Production set to Pass the 1 mln Mark Soon

The slowdown in electric vehicle sales is temporary, and stakeholders are ready to embrace competition. However, collaboration among the entire local automotive ecosystem will be needed for long-term success. 10

Automotive in CEE Regional Conference

The Automotive Business in CEE Regional Conference 2024, held in Budapest, provided attendees with a comprehensive overview of the current trends and challenges facing this vital industry across Central and Eastern Europe. 12

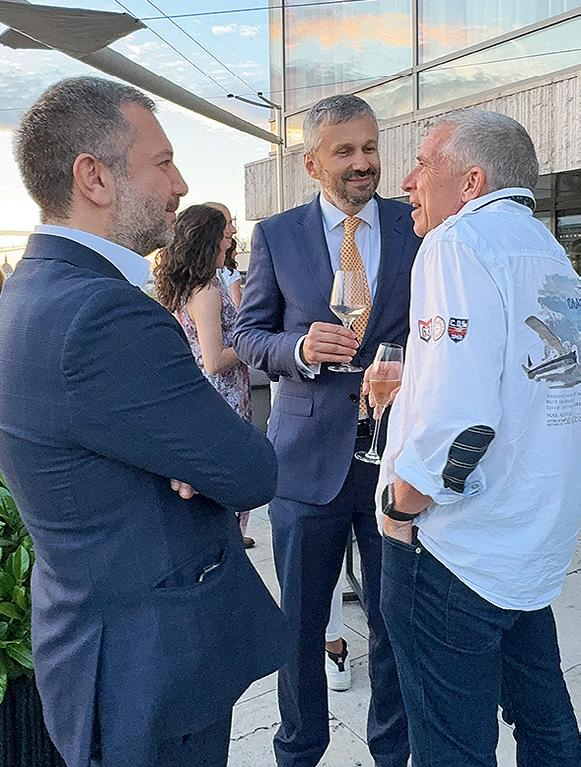

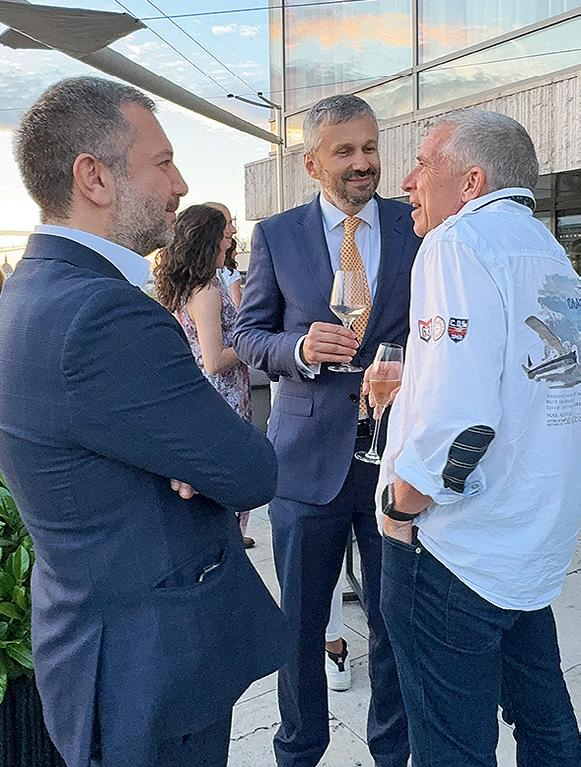

AmCham Marks 35 Years in Hungary

The American Chamber of Commerce in Hungary celebrated its 35th anniversary at a gala event, welcoming more than 400 guests: AmCham members and partners from top investors and government leaders, U.S. Embassy reps, think tanks and academia. 21

Magyar Movies

Best Supporting Actor Role?

Inflation in Hungary on the Rise Again

Although prices fell by 0.1% in May from April, the 12-month inflation index rose to 4%. This means that the annual price index grew for the second month. Analysts expect further upward movement in the following months. 3

Csaba Káel, Government Commissioner for Developing the Hungarian Film Industry, talks about this countryʼs remarkable success in the global movie market industry, backed by generous state support. 20

Craft Conference Celebrates 10th Anniversary

The 10th anniversary of Central Europe’s largest professional IT event, was held at the Hungarian Railway Museum:, exploring the future of AI engineering, productivity enhancements, and industry trends . 9

SOCIALITE

ʼ

NEWS YOUR INDISPENSABLE EVERYDAY COMPANION FOR BUDAPEST BUSINESS NEWS AND VIEWS SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM

BUSINESS ITʼs

VOL. 32. NUMBER 12 | JUNE 14 – JUNE 27, 2024 HUF 2,100 | EUR 5 | USD 6 | GBP 4

Automotive SPECIAL REPORT INSIDE THIS ISSUE

SOCIALITE

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Luca Albert, Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Gary J. Morrell, Nicholas Pongratz, Gergő Rácz.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

COVER PHOTO: Márton Pesthy; LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center

1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

THE EDITOR SAYS

IN PRAISE OF SUMMER SUNDOWNERS

BBJ-PARTNERS

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making. For more information visit budapestbusinessjournal.com

It’s been a busy few days, what with AmCham and GE Hungary celebrating their joint 35th anniversary (see page 21), the European Parliament and Hungarian municipality elections (page six), and the headlong rush toward the Hungarian presidency of the Council of the European Union, which starts on July 1. And among all that, we held our latest Budapest Business Journal Boardroom Meeting in the morning and BBJ Business Mixer on the evening of the same day (page 22). For those of you who don’t know, the Boardroom Meeting grew out of our Expat CEO of the Year Gala as a means of keeping in touch with leading members of the business and diplomatic community in Budapest on a more regular basis and providing a value-added platform through which to share knowledge, news and views. A vital part of what makes it work has been our roundtable discussions of current events examined from a commerce point of view.

This time, our guest speakers were the Belgian Ambassador to Hungary Jeroen Vergeylen, making his debut, and Tamás Lőcsei, country managing partner for PwC Hungary. Our discussion was framed by those elections, that Presidency of the Council of the EU, and, of course, the latest macroeconomic outlooks. Issues covered included how the EP elections might influence power dynamics in Hungary and the EU, whether Péter Magyar and his Tisza party are likely to be a lasting force in Hungarian politics, and some of the fallout from the election, such as French President

Emmanuel Macron’s decision to call a snap general election, and its potential economic impact.

Other topics included highlights of the Belgian presidency, the likely priorities of the Hungarian presidency, and Belgian-Hungarian relations ahead of the handover. On the Hungarian macroeconomic front, we touched on inflation and GDP growth this year and next, as well as whether growing real wages might benefit or threaten the economy.

It really is a privilege for me to moderate these conversations, picking the brains of some very knowledgeable people, and I learned a lot on Tuesday morning, but my BBJ highlight of the week was undoubtedly our Summer Sundowner at the Marriott’s Liz & Chain rooftop bar. The Business Mixers have been building nicely since we made a more conscious effort, post-COVID, to bring back something that had always been a BBJ hallmark. We are getting to that stage where we are very close to needing to limit numbers. Guests want to return because they know the venues are great, the tombola prizes are enticing, and the mix of people is intriguing. They are, as I like to say at these events, a place to meet old friends, meet new acquaintances, and do some business. I know all three were happening on Tuesday evening, and personally, I can’t wait for the next event. I hope I’ll get to see you there.

Robin Marshall Editor-in-chief

THEN & NOW

In the black-and-white photo from the Fortepan public archive, a woman carrying her child casts her vote at a polling station in Nyáregyháza primary school (54 km southeast of Budapest by road) during what passed for national general (parliamentary and local council) elections in 1971. In the present-day picture from the state news agency MTI, a man posts his vote in a ballot box in the European Parliament and municipal elections at a polling station in the Erzsébetváros Bilingual Primary and Secondary School in the capital’s District VII on June 9, 2024.

2 | 1 News www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

The Budapest Business Journal, HU ISSN

is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved. What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential. VISIT US ONLINE: WWW.BBJ.HU

1216-7304,

IMPRESSUM

Photo by István Péterffy / Fortepan

Photo by Zoltán Balogh / MTI

1News • macroscope

Inflation in Hungary on the Rise Again

Although prices fell by 0.1% in May from April, the 12-month inflation index rose to 4%. This means that the annual price index grew for the second month. Analysts expect further upward movement in the following months.

Industrial Production in Hungary, 2002-2024 (January-April)

Source:

In May, consumer prices were 4% higher on average in May 2024 than a year earlier. Compared to April, prices decreased by 0.1% on average, according to the latest figures released by the Central Statistical Office (KSH). In April, the annual inflation was 3.7%.

On a year-on-year basis, a price increase of 1% was recorded for food, within which there was a 29.6% rise for sugar, chocolate and cocoa was up 9.8%, fruit and vegetable juices rose by 9.5%, buffet products were up 8.8%, with rises of 8.6% for pork, 8.1% for meals at restaurants and 5.6% for non-alcoholic beverages.

There was better news within the product group: egg prices decreased by 22%, the cost of flour by 19.6%, that of milk products by 11.6%, pasta product prices by 10.6%, the prices of milk and bread by 9% each, cheese by 7.4% and poultry meat prices by 6%.

Services became 9.5% more expensive, and Alcoholic beverages and tobacco prices rose by 3.5%, within which tobacco went up by 3.8%. The price of pharmaceutical products grew by 6.4%, while electricity, gas and other fuels became 2.4% cheaper. Motor fuels, however, became 9.2% more expensive.

Consumer prices decreased by 0.1% on average compared to the previous month. The highest price increase of 0.9% was measured for services, while electricity, gas and other fuels fell by 0.9%. Consumers had to pay 1.7% less for natural and manufactured gas. Motor fuel prices fell by 4.4%.

Low Tide in March

The 12-month inflation data reached its lowest point in March at 3.6%. However, according to the Portfolio analyst survey, the 4% annual pace in May is a good

figure, even compared to the fact that analysts expected an average 12-month monetary deterioration of 4.2% for May. On a monthly basis, prices last decreased in December last year, when the KSH measured a 0.3% one-month price decrease.

“As for the monthly price changes, overall food prices increased minimally compared to April, but at the same time, ‘core’ food products continue to show a decrease and mainly the prices of service-related segments (such as catering, buffet products, and home delivery) pulled the index positive,” Erste Bank analyst János Nagy said.

He added that the 0.9% monthly services price increase was still remarkable. In addition to wage dynamics, repricing with retrospective inflation was again the most significant factor here.

Nagy said the main inflation index reached the edge of the

tolerance band of the National Bank of Hungary (MNB) in May. In the short term, the biggest question is how much room there is for further price increases in the second half of the year after an 18-month recessionary period.

Erste expects inflation to be over 4% in the next few months. For the year as a whole, he predicts fluctuating annual inflation figures of 4-5% without a definite trend. According to Nagy, the disinflation process could start again next year and inflation return to the central bank’s target band then.

Disinflation Broken

“The disinflation process was already broken in April, and the annual inflation index could also be expected to rise in May. By the end of the year, inflation will be substantially higher than the May level, but it seems less likely that the inflation index will rise above 5% by the end of the year,” MBH Bank’s senior analyst Márta Balog-Béki said.

According to her, the increase in the price of services will slow in the coming months, as it is less and less justifiable to use last year’s inflation as the basis for pricing decisions. Balog-Béki believes the stable and sustainable achievement of the central bank’s inflation target of 3%

can be expected in 2025 at the earliest, but even then, the average annual inflation may exceed 3%.

Naturally enough, the MNB also monitors inflation processes closely. MNB deputy governor Barnabás Virág told a recent central bank conference in Budapest, “We cannot sit back because of inflation in the service sector and high wage dynamics; inflation may rise in the coming months, so this justifies a patient and cautious monetary policy even more.”

Despite the rising trend, Minister for National Economy Márton Nagy claimed in a press release that, due to the government’s targeted measures, such as mandatory sales and online price monitoring, inflation has collapsed and remained at a low level due to price competition generated by government actions.

Among the May data, it is noteworthy that, within the food product group, the

price of eggs decreased by 22%, that of flour by 19.6%, dairy products by 11.6%, and dry pasta by 10.6% compared to the same period of last year. Nagy also noted that household energy prices fell by 2.4% on a year-on-year basis, within which the cost of piped gas dropped by 4.7% and electricity prices by 2.9%.

The drop in basic foodstuff and household energy is a major help for Hungarian families, the press release of the Ministry for National Economy says.

Battling industry

Hungarian industry continued its battles in April. While the volume of industrial production grew in April by 6.4% year-on-year, based on working-day adjusted data, production declined by 2.4%. Compared to the crude data, the significant difference is due to the fact that there were three more working days in April 2024 than in April 2023, KSH noted. However, production also declined on a monthly basis: according to seasonally and working-day adjusted data, industrial output was 0.7% lower than in March 2024. However, it is important to note that industrial production in Germany, considered Hungary’s most important trade partner, also shrank in April: production was 3.9% lower than last year.

2-4%

www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

ZSÓFIA CZIFRA

Hungarian State Completes Majority Purchase of Budapest Airport Real Estate Matters

The purchase by the state of an 80% stake in Budapest Airport

Zrt., the operator of Budapest Ferenc Liszt International Airport, has been positively welcomed by analysts in the tourism and hospitality industries. The Hungarian state is now back in the position of majority ownership after 20 years and following a two-year negotiation period.

With a purchase price of EUR 3.1 billion, this is regarded as a record transaction of its type in the Central and Eastern European region in the view of many commentators. Buying back was extremely complex, while selling it had been easy, according to the government. The hotel and hospitality sector is once again regarded as an attractive development and investment option. Hungary is seen as a popular tourist destination, with guest nights for Budapest rising towards the record highs of pre-pandemic levels.

“Notably, in 2023, the RevPAR [revenue per available room] in Budapest was higher than in Prague. According to forecasts, passenger traffic at Ferenc Liszt International Airport will return to pre-pandemic levels in 2024,” comments Robert Székely, hospitality and leisure expert at the consultancy Newmark HTL.

“The city is ranked among the top conference destinations, has a rich history, stunning architecture, and unparalleled cultural attractions. It has also consistently demonstrated its ability to host successful largescale sporting events and is home to one of the largest summer festivals. With these strong fundamentals, the sentiment about Budapest’s tourism outlook is very positive,” he says.

Investment Market Remains Slow in H1

“The investment market is quiet as investors adopt a wait-andsee position; nobody wants to take a risk and justify an investment deal to a board or colleagues. A fall in interest rates could mark a turnaround in the markets,” comments Benjamin PerezEllischewitz, principal at Avison Young Hungary.

Avison Young estimates Hungary yields at 6% for prime office, with prime industrial at 7% and retail (essentially strip malls with tenants with long leases) at 7%. Further yield movement is anticipated.

With investment activity for the first half of 2024 limited to around EUR 150 million, Perez-Ellischewitz anticipates a total investment value for the year to be up to

EUR 400 mln. Several large deals under negotiation could slip into 2025.

“The market bottleneck is, as always, liquidity, the lack and cost of debt, the cautiousness and the fears on the global macro-economic and political fronts. I think that vendors’ expectations and valuation levels in Hungary are becoming more realistic,” Perez-Ellischewitz says.

“This is a plus, compared to some other locations, and will help restart the market cycle as soon as debt is coming back. More robust investment volumes will only come at the end of the year when market sentiment should improve more broadly and debt markets should re-open,” he concludes.

Meanwhile, investment activity is picking up in Poland, where Skanska has sold the Leed “Platinum” and Well-

A biweekly look at real estate issues in Hungary and the region

“The largest impact on tourism in Budapest could come from the state’s purchase of Ferenc Liszt International Airport. This acquisition could lead to infrastructural redevelopments at the airport, as well as the longawaited railway connection between the airport and the city center.”

says. “This acquisition could lead to infrastructural redevelopments at the airport, as well as the long-awaited railway connection between the airport and the city center,” he notes.

With regard to infrastructure projects, the expansion and improvement of Budapest Airport and ongoing developments in the Castle District will improve the attractiveness of the tourism sector in Hungary.

Over the long term, Budapest is likely to see sustained growth due to continuous investments in tourism infrastructure, increasing international connectivity, and the city’s strategic marketing initiatives, says Attila Radvánszki, director of the hospitality consultants Horwath HTL Hungary. Altogether, approximately 3,000 hotel rooms are in the pipeline for the next five years from more than 22 hotel projects.

“The largest impact on tourism in Budapest could come from the state’s purchase of Ferenc Liszt International Airport,” Székely

accredited Studio B office building in Warsaw to Stena Real Estate, part of the privately-owned Swedish Stena Group. This is the third transaction between the two parties in CEE.

“The transaction of the Studio B project stands as a testimony to the interest in high-quality and sustainable real estate products in fast-paced, vibrant locations. This is proof of a positive shift in demand in the investment market,” comments Katarzyna Zawodna-Bijoch, president and CEO at Skanska’s commercial development business unit in CEE.

Studio B is part of an office complex designed by Danish Arrow Architects and Polish Grupa 5 Architekci. It has 17,600 sqm of sustainable and innovative space. The office space was already fully leased before it gained its occupancy permit.

“Meanwhile, hotel supply development is continuing: hotel brands such as Kimpton, St. Regis, Radisson Collection, voco, Vignette Collection, Moxy, Mandarin Oriental, So, and Swissotel – just to name a few – are entering the market, resulting in a differentiated supply,” Székely adds.

Futureal

Sells 2 Buildings at Lipowy Office Park

Futureal Investment Partners, a member of the Futureal Group, and 1 Asset Management, an investment management company backed by the developer Hanner, have announced a transaction involving the division and sale of two buildings at Lipowy Office Park in Warsaw.

The buyer, CEE Student Housing Fund, managed by 1 Asset Management, intends to convert the property into a modern co-living and purpose-built student accommodation (PBSA) for students and young professionals.

“This is a fine example of a redevelopment project, where the previous 21,000 sqm of office space will be repurposed into a modern rental living area with over 650 units, and will certainly rejuvenate the surrounding area. There is an immense scarcity of affordable and modern housing in Warsaw due to an existing undersupply and a constantly growing demand from the youth,” said Matas Mockeliunas, a fund partner from 1 Asset Management. The deal reflects the growing attractiveness of the residential real estate sector for investors. It is an emerging sector in CEE, although it is yet to be established in Hungary.

4 | 1 News www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

GARY J. MORRELL

Photo by BUD Zrt.

Ukraine

Could B9 Become B8 Over Hungary’s Actions on Ukraine, Russia? Roundup Crisis

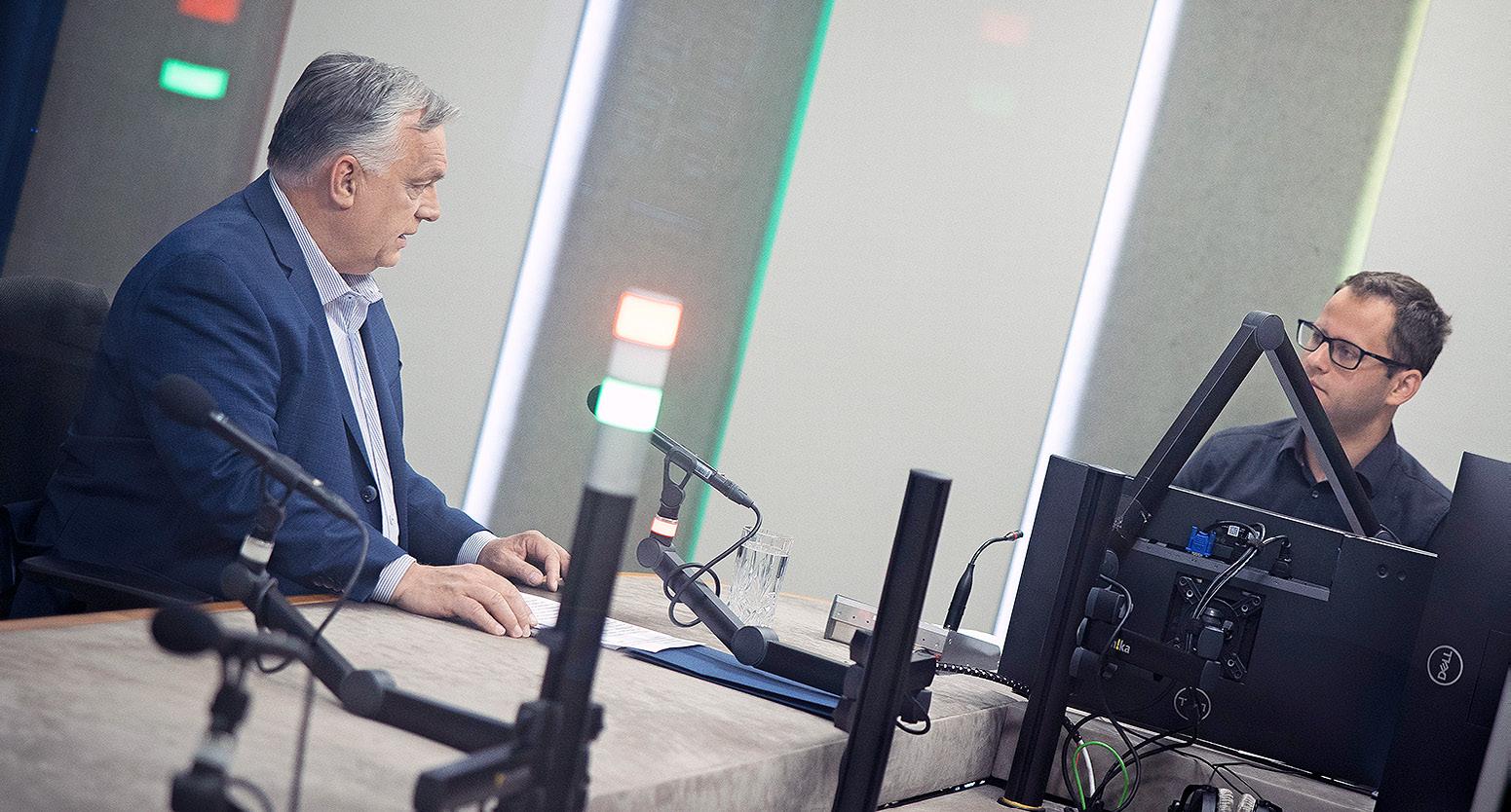

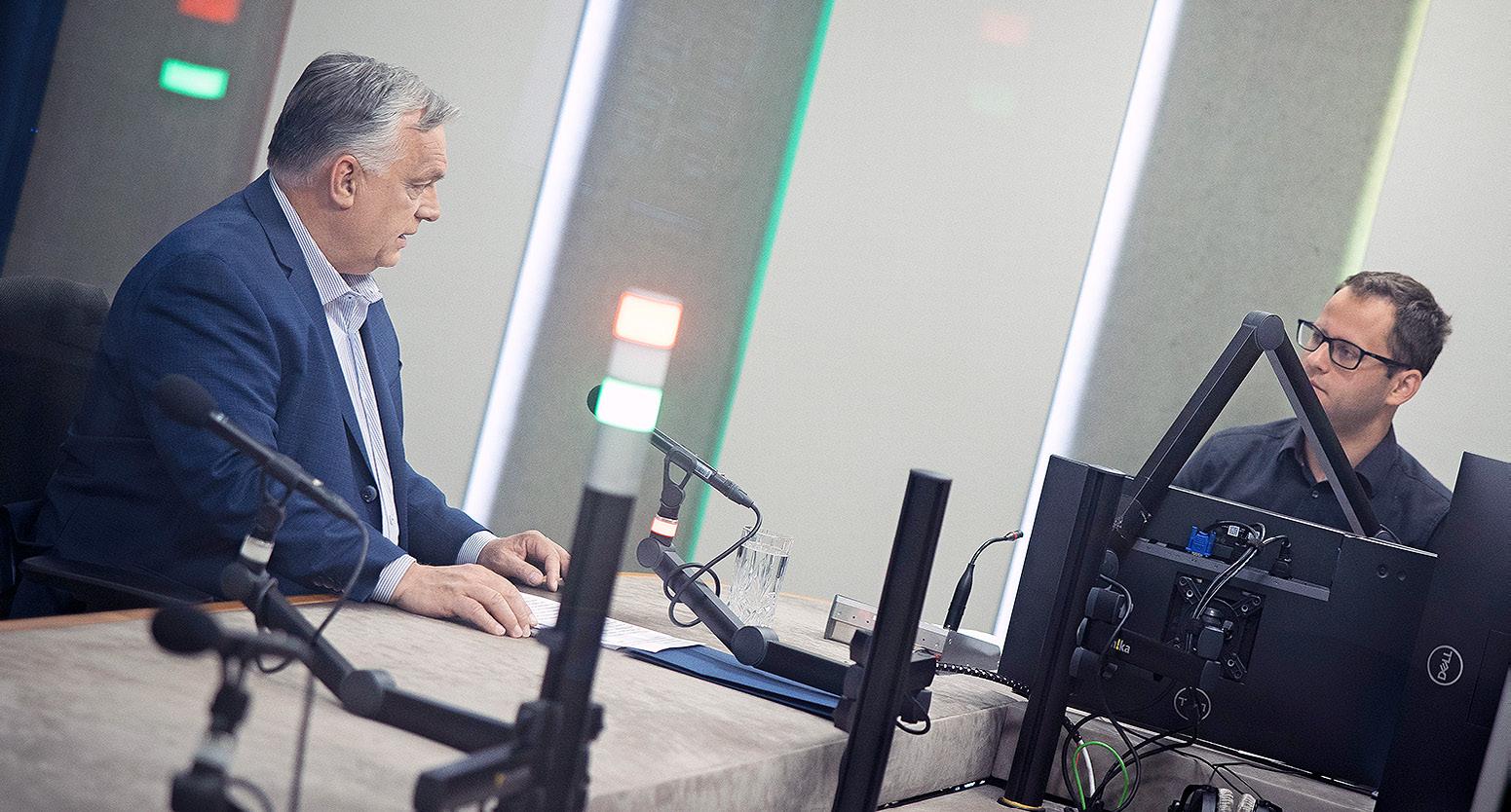

Prime Minister Viktor Orbán claimed a victory for “advocates for peace” following the European Parliament elections held in Hungary on Sunday, June 9, in which the FideszKDNP (Christian Democrat) alliance won 44.6% of the vote. The PM had touted the election as a “chance” to stop the war during an interview with Kossuth Rádió two days before the election on Friday, June 7.

Due to what he perceived as “war psychosis” in Europe, Orbán had warned of an “advance towards conflict at a faster pace,” adding that it had come “very close” to the “point of no return.” Following Sunday’s results, Orbán said that the EP elections had been an opportunity to slow the “drift toward war. If we see it this way, then we got what we wanted,” he added.

“Hungary’s addiction to Russian energy is dangerous and unnecessary,” Pressman said. “Minister Szijjártó is right: energy diversification is not a matter of ideology but physics. The laws of physics in Hungary are no different from the laws of physics in any of Hungary’s EU partners who have chosen to reduce their dependence on Putin,” the U.S. diplomat added.

“The Hungarian government says it is on the side of peace, but it is actually on the side of war led by Putin,” Pressman claimed.

In this file photo, released by the Press Office of the Prime Minister, Viktor Orbán (left) is interviewed by Zsolt Törőcsik on “Good Morning, Hungary!” at the Óbuda studio of Kossuth Rádió.

Orbán pointed out that support for “pro-peace” parties had been so great in France that it persuaded President Emmanuel Macron to dissolve the National Assembly and call for snap elections scheduled for June 30 and July 7. Macron’s Renaissance party had garnered just half of the share of the vote secured by Marine Le Pen’s right-wing populist party, National Rally (RN), in the EP elections.

In light of his diminished mandate at home, Macron hopes to coalesce other moderate parties into a “republican front” against the burgeoning RN with the two-round election. Gleefully, Orbán reflected that a “transatlantic peace coalition” could take shape if Donald Trump returns to the White House in November.

“Now we’re waiting for President Donald Trump to bring victory in the United States in the second half, and then there will be peace,” Orbán added.

Driven by the country’s “absolute position on the side of peace,” Minister of Foreign Affairs and Trade Péter Szijjártó said at the St. Petersburg International Economic Forum on June 6 that Hungary would

in Brief News

Scope Affirms Hungary’s ‘BBB’ Rating

Scope Ratings completed a biannual monitoring review for Hungary on June 7. The periodic review resulted in no rating action. Scope rated Hungary “BBB” with a stable outlook. Scope said the rating is supported by robust growth, bolstered by substantial foreign investments and significant European Union funding, and by the structure of Hungary’s external and public

liabilities and an improved external position, enhancing the country’s resilience to external shocks.

CEU Closing Hungarian University Entity

Central European University (CEU) informed its former students that the university council will initiate the revocation of the CEU’s license, according to a post on its Facebook page. “CEU has not accepted students into its Hungarian-

participate at a foreign ministerial level in a Ukraine peace summit due to be hosted by Switzerland on June 15.

He added that the Hungarian government regretted that both warring parties would not be present at the conference, as Russia would not be attending.

“We believe that if everyone were at the negotiating table, real results could be expected,” the foreign minister said.

Russian Energy Ties

Szijjártó had attended the economic forum in St. Petersburg to affirm energy ties with the Kremlin. Hungary remained satisfied with its cooperation with Russia on gas supplies and had no plans to curtail purchasing gas from Moscow despite external pressure, the minister said. He added that the issue of energy supply had been “taken hostage by political and ideological debates,” while Hungary viewed the matter as a “purely practical one,” a function of mathematics and physics. This perspective drew critical remarks from the U.S. Ambassador to Hungary, David Pressman.

accredited degree programs for several years, and the last students enrolled in such programs will graduate in July 2024. Therefore, CEU does not meet the conditions of a university in Budapest, and as such, our Board of Trustees has decided to initiate the closing of our Hungarian university entity, Közép-európai Egyetem, at the end of the academic year,” the post stated. It also mentioned that the Orbán government’s efforts to expel the university from Budapest have succeeded, as CEU will cease its higher education activities in Hungary. However, the research institutes in Budapest will remain, and non-degree programs will be maintained.

Similarly frustrated with Hungary’s continued cultivation of close ties to Russia and reluctance to provide support to Ukraine, the Bucharest Nine (B9), a group of European countries on the eastern edge of NATO, said that it had discussed the possibility of excluding Hungary from future meetings.

The discussions on excluding Budapest are “very serious,” said one B9 diplomat, adding, “We are likely meeting in this format for the last time.” President Tamás Sulyok chose not to attend the recent meeting in Riga on June 11

(Hungary was represented by its ambassador to Latvia), which Latvian President Edgars Rinkevics said allowed the group a “more coordinated approach” towards supporting Ukraine. That said, the summit ended without a joint declaration of the nine countries for the first time since the format was established in 2015, Rinkevics’ office added. Instead, a statement was issued in the name of the presidents of Latvia, Romania, and Poland, who jointly hosted the Riga gathering. The group currently includes Bulgaria, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania and Slovakia, all former members of the Soviet Union or the Warsaw Pact and now NATO and EU states.

Hungary’s EU Presidency to Draft new European Competitiveness Pact

Hungary’s presidency of the Council of the European Union will draft a new European competitiveness pact, Minister of EU Affairs János Bóka said at a conference in Budapest on June 6, according to hirado. hu. Bóka said an informal meeting of the council in Hungary slated for November could affirm the pact and designate the direction for the EU in the coming five-year institutional cycle. Hungary will organize 230 events during its halfyear EU presidency, which starts on July 1. The detailed program will be announced on June 18.

1 News | 5 www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

NICHOLAS PONGRATZ

Fischer / Prime Minister’s Press Office MTI

Photo by Zoltán

Orbán Claims’ Double Election Victory,’ Magyar

Prime Minister Viktor Orbán declared victory for his Fidesz-led coalition in “the two elections held today” in his speech following the counting of votes in Sunday’s ballots for representatives in the European Parliament (EP) and Hungarian municipalities.

With a record 2.04 million votes, some 200,000 more than in the previous 2019 EP election, Fidesz won 11 of Hungary’s 21 seats in the Brussels parliament. And an unprecedented voter turnout just short of 60% enabled Orbán to boast that Hungarian democracy is alive and well despite what he termed “a wartime situation.”

However, despite these successes, the Fidesz vote share was 45% of the total, down from 52.6% in 2019, and the new Fidesz MEP contingent is two short of the 13 achieved in the previous cycle.

This aspect of the news (inevitably played down by state media) is the result of the unprecedented emergence of former Fidesz insider Péter Magyar and his Tisza (Respect and Freedom) Party, a combination that achieved just short of 30%

of the vote to garner seven MEP seats.

“Today is the Orbán government’s Waterloo, the beginning of the end […] Tonight, many have regained their faith in the possibility of building a different kind of Hungary, which is not based on division and lies, but on peace, unity and love,” the ex-husband of former Minister of Justice Judit Varga declared.

Becomes Principal Opposition Leader The results of

can organize and manage a party machine or find the money to finance the overheads needed to sustain a large party’s activities is unclear.

“At this point, we have absolutely no idea,” because there is no evidence as to whether Magyar possesses these qualities, the analyst argues. “I think this is why it’s practically impossible to tell what to expect from him because these sort of political skills are going to be the ones that are decisive,” he says.

Karácsony Fights off Intense Vitézy Attack to Retain Budapest. For Now

Regardless of his questionable analogies regarding Napoleonic history, Magyar’s whirlwind success, coming from a virtually unknown Fidesz bureaucrat to claim leadership of the opposition in just four months of feverish nationwide campaigning, cost the traditional Hungarian opposition parties dearly.

Support Slashed

The Democratic Coalition-SocialistsDialogue alliance, which earlier had hopes of winning at least four seats this year, saw its support slashed, garnering just 8% of the vote and gaining only two seats in Brussels (down from five in 2019).

The Momentum Movement, whose two female MEPs had proved remarkably active in the past five years, also saw support collapse as the Magyar campaign developed, leaving the liberal party short of the 5% threshold in the final votes.

Likewise, the alternative Two-Tailed Dog Party, which held real hopes of winning an MEP seat as late as early June, achieved just 3.6%

of the vote, while both the JobbikConservatives (with one MEP in 2019) and the green LMP (Politics can be Different) virtually sank without trace.

This left only Our Homeland on the EP score sheet, its 6.7% share of the vote yielding the radical-right party one MEP.

“I believe that there is really a new political era that has begun in Hungary on Sunday,” Zoltán Ranschburg, senior analyst at the Republikon Institute, told foreign media on June 11.

“The sort of dichotomy between Fidesz and the left-wing opposition, which is more or less circulating around the person of Ferenc Gyurcsany, and the Democratic Coalition being the sun of this microsolar system of this opposition, that’s practically over,” he added.

Extraordinary Result

For Magyar to begin from nowhere and reach nearly 30% of the EP vote in such a short period, with no real party or formal support, and having to overcome a massive Fidesz smear campaign en route, was nothing short of extraordinary, Ranschburg said.

“This is the best result that a single opposition party has achieved against Fidesz in the 21st century. I mean, this is really a big, big thing,” he added.

Naturally, the question now is whether Magyar can build on his platform to pose a serious threat to the Orbán administration in the 2026

general elections. A 30% slice of the vote is impressive but insufficient to defeat the incumbent government, barring some political catastrophe, and the wave of euphoria among his supporters cannot alone carry him to victory during the next two years.

“This sort of momentum, I think, is not going to last very long,” opines Ranschburg. While Magyar has energy and charisma, whether he

In what proved to be the most exciting battle in the entire election mix, incumbent Gergely Karácsony fought back to overturn a significant deficit in the early vote count to defeat challenger Dávid Vitézy for the position of Lord Mayor of Budapest by the thinnest of margins. At the final count, Karácsony, a Dialogue-Green party member within the Democratic Coalitionled alliance, polled 47.53% of the vote, with Vitezy on 47.49%, trailing by a mere 324 votes in a total count of 807,000. The turnout was 60.51%.

The late withdrawal of Alexandra Szentkirályi, the Fidesz candidate for the post, spiced up the contest with the former government spokeswoman urging her supporters to vote for Vitézy. He had once served as the head of the Budapest Transport Office in the former Fidesz Mayor István Tarlós. This resulted in election administrators crossing out Szentkirályi’s name by hand on 1.4 million ballot papers and has given Vitézy grounds to call for a recount. Pointing to 24,592 invalid votes, he claimed that the tiny margin of victory justified a recount on fundamental democratic principles. According to Hungarian electoral law, a recount can only be justified on grounds of specific voter fraud and not merely on the closeness of the vote.

On Wednesday, June 12, as this edition of the Budapest Business Journal went to press, Vitézy personally delivered his appeal to the Budapest Election Office. The body automatically forwards the appeal to the National Election Committee, which has three days to decide on a recount.

6 | 1 News www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

KESTER EDDY

List Valid votes cast for the list Percentage of valid votes cast for the list Acquired MEP seats FIDESZ-KDNP 2,042,232 44.90% 11 TISZA 1,343,029 29.53% 7 MSZP, DK, ZÖLDEK 366,413 8.06% 2 Mi Hazánk 305,870 6.73% 1

the European Parliament election

Péter Magyar

/ Shutterstock.com

Photo by csikiphoto

2 Business

Delta 1 Esports Café: Hungary’s

Latest Esports Hub Opens

Budapest has inaugurated its latest electronic gaming venue, the Delta 1 Esports Café. The hub offers a comprehensive environment for amateur and professional esports enthusiasts alike, including coaches, player management, mentorship programs, and training camps. It also provides AI training courses. Its mission is to nurture talent and support individuals aiming to grow and succeed in the field.

for esports in the region, attracting both local and international attention.

The Delta 1 Esports Café includes sections for PC, PlayStation, and virtual reality gaming, VIP rooms, and spaces suitable for team boot camp training within its

Esports has seen significant growth in Hungary over the past few years, with increasing participation and recognition nationally and internationally. The country has produced several notable esports players who have competed globally.

Hungarian esports organizations and events are gaining momentum, and there is a growing community of gamers and enthusiasts. This burgeoning industry is supported by various initiatives to foster talent and provide resources for aspiring esports professionals.

The establishment of dedicated esports facilities and training programs has contributed to the professionalization of the sport in Hungary. The government and private sector are also investing in esports, recognizing its potential for economic growth and youth engagement. As a result, Hungary is becoming an emerging hub

square meters. It also features a dedicated classroom for educational purposes. What sets the venue apart is its comprehensive support system, offering dedicated coaches for various games, career management services, and professional mentoring covering legal, financial, and competitive aspects.

Elite Club

“We felt there was a need for an elite esports club where the next generation of esports players could seek advice, expertise, and support,” Attila Jakab, founder and CEO of Delta 1 Esports Café, said at the opening.

“Here, they can meet coaches and teams, and integrate into the scene. Our mission is to elevate local talent who will further enhance the reputation of esports as players, streamers, or commentators,” Jakab added. “Delta 1 aims to initiate dialogues on important topics such as mental health, gamer culture, and strengthening women’s presence in esports,” he continued.

The founders emphasize the importance of local expertise development, drawing on their

significant experience teaching esports fundamentals as a standalone subject at Óbuda University. Delta 1 also collaborates closely with the Hungarian Esports Federation (Hunesz).

“At the Hungarian Esports Federation, we work to promote and support the growth of esports nationwide. A key pillar of our work is connecting and supporting local esports communities.

Delta 1 is a prime example of the strength found in local esports initiatives. We believe such endeavors offer opportunities for talents to flourish,” stated Balázs György Biró, secretary general of Hunesz.

The Delta 1 Esports Café is located at Lechner Ödön Fasor 1 and is open

to all enthusiasts. The hub also offers unique group local area network (LAN) experiences. Visitors can bring teams of 3-5 people to enjoy uninterrupted gaming sessions in exclusive bootcamp rooms equipped with the latest hardware. These sessions can include additional features such as pizza and beverages, making for a complete gaming day. Furthermore, the café can provide coaches for enhanced esports training, contributing to a professional and immersive gaming experience.

Educational Background

Delta 1’s founders are not new to the academic aspect of esports, with established programs at Óbuda University. This expertise is now channeled into Delta 1, aiming to support the community’s gaming and educational needs. The collaboration with Hunesz further strengthens the initiative, providing a robust framework for developing esports in Hungary. Jakab highlighted the café’s broader mission beyond just gaming.

“We want to address crucial issues like mental health and the representation of women in esports. By creating an inclusive environment, we hope to foster a positive and supportive community for all players,” he said.

In an interview, Jakab discussed the potential number of esports players in Hungary and their proportion among regular gamers. He noted that, while exact figures are unavailable, only about 1%

of gamers

become professional esports players. Jakab also elaborated on the significant earnings of professional esports players abroad, highlighting that they receive comprehensive preparation, including training, nutrition from dedicated chefs, and participation in physical exercise regimes.

The Delta 1 Esports Café is, therefore, not just a gaming venue but a comprehensive support system for aspiring esports professionals. It aims to bridge the gap between amateur and professional levels by offering targeted training and development programs. With a focus on mental health and community support, Delta 1 says it is setting a new standard in the esports industry.

270

www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

GERGELY HERPAI

Esports gamers welcome.

Attila Jakab, founder and CEO of Delta 1 Esports Café, outside the venue.

Startup Genome, Hungarian Innovation Agency Feature Startup Ecosystem

The 2024 Global Startup Ecosystem Report (GSER) by Startup Genome and the Global Entrepreneurship Network was launched on June 10 at the start of London Tech Week. The Hungarian Innovation Agency teamed up with the report’s creators to give insight into Budapest’s entrepreneurial ecosystem.

BENCE GAÁL

The report analyzes data from more than 4.5 million companies across 300-plus entrepreneurial innovation ecosystems. It aims to provide new insights and deep knowledge about

worldwide startup trends and features a ranking of the Top 40 global ecosystems, emerging ecosystems, and an expanded regional ranking.

Budapest performed remarkably well, according to GSER, with the city’s ecosystem experiencing 41% growth (USD 2.4 billion) in ecosystem value in the period between July 1, 2021, and Dec. 31, 2023, when compared with the period between July 1, 2019, and Dec. 31, 2021. Ecosystem value measures economic impact, which is calculated as the value of exits and startup valuations, Startup Genome explains.

The report highlights the Hungarian Innovation Agency, a subsidiary of the National Research, Development,

News Company

Liberty Dunaújváros Shuts Down Coke Ovens

Hungarian steelmaker Liberty Dunaújváros has started shutting down its two coke ovens, Indian owner Liberty Steel said on June 10. The coke ovens, which are inefficient and difficult to maintain, are being shut down as Liberty Dunaújváros prepares to make the switch to green steel. Liberty Steel noted that it had recently signed a contract with China’s CISDI Engineering on the delivery of an electric arc furnace that would cut carbon emissions by around 80%. In the meantime, Liberty Dunaújváros is working to ensure employees affected by the measure are retrained and transferred to other areas within the company. Liberty Steel acquired the assets of troubled steelmaker Dunaferr for about HUF 20 billion in a liquidation procedure in the summer of 2023.

Szállás Group Acquires 80% Stake in Litoralulromanesc

Szállás Group, which owns booking site operators in Hungary as well as Croatia, the Czech Republic, Poland, and Romania, has acquired an 80% stake in the operator of Romania’s litoralulromanesc.ro for EUR 16.8 million, the company said in a press release on June 11. Last year, travelers booked accommodation worth more than EUR 45 mln on Litoralulromanesc, which focuses on hotels and resorts along the Black Sea Coast, the Szállás Group said. The acquisition dovetails with the earlier purchase of Romanian online travel agency travelminit.ro, which had bookings of EUR 30 mln in 2023, it added. The Szállás Group was acquired by Polish media company Wirtualna Polska for EUR 82 mln in 2022.

regulatory obstacles faced by startups and investors, ensure early-stage financing, and increase the international visibility of the ecosystem,” says Deputy State Secretary László Bódis of the Ministry for Innovation and Culture.

J.F. Gauthier, founder & CEO of Startup Genome, adds, “Budapest’s startups, investors, and ecosystem leaders are innovating at an accelerated rate, producing an impressive 41%

growth in ecosystem value. We are thrilled to work with the Hungarian Innovation Agency to foster economic growth through entrepreneurial innovation.”

and Innovation Office (NKFIH), which advances innovation by aiding businesses in development and global market entry. The 2023 edition of the Startup Factory program, launched by NKFIH, offered a total budget of USD 15.9 million for technology incubators. Projects can receive between USD 415,000 and USD 2.5 mln for 24-42 months to develop earlystage startups, foster innovation, commercialize technology-based products, and secure further funding.

Increasing Visibility

“The Hungarian Innovation Agency works closely with key players in the startup ecosystem to break down the

Hungarian Richter to Acquire Belgian Peer Mithra Assets

Hungarian pharmaceutical company Gedeon Richter announced that it has agreed to purchase certain assets from Belgian peer Mithra Pharmaceuticals, state news agency MTI reports. Richter said that the transaction included acquiring 100% of Estetra Srl and Neuralis SA and some assets of Mithra R&D. The enterprise value implied by the transaction is EUR 175 million, including assumed net debt. The transaction aims to acquire exclusive rights of Estetrol, a unique, native estrogen developed by Mithra, for multiple indications and several synthetic approaches, as well as worldwide rights attached to the linked product and product candidates.

EC Blocks State Aid for GKN Investment in Hungary

The European Commission said it found Hungary’s plans to grant EUR 43.8 million in state aid for a vehicle parts plant in the underdeveloped north of the country were not in line with European Union rules on June 11. “Hungary failed

GSER is driven by a consortium of representatives from more than 40 countries and looks at the current state of startup activity and related investment, providing insights and guidance to public and private leaders on how to foster thriving startup communities, Startup Genome tells the Budapest Business Journal

The full report is available at startupgenome.com/gser2024

to prove that the aid was decisive for the beneficiary to locate its investment in Hungary,” the EC said. It explained that available evidence showed that GKN Automotive Hungary had already decided to invest in Hungary without considering the state support. As the state aid had no real “incentive effect,” the EC said it was incompatible with state aid rules and could not be granted.

Motherson Group Expanding Bases for EUR 33 mln

Indian automotive industry supplier Motherson Group (SMG) will plow EUR 33 million into capacity expansions at its bases in Győr (120 km northwest of Budapest), Mosonmagyaróvár (165 km northwest), Mosonszolnok (170 km northwest) and Túrkeve (155 km southeast), Minister of Foreign Affairs and Trade Péter Szijjártó said, according to origo.hu. The government is supporting the investment, which will focus on supplying the factories of BMW and Mercedes, with EUR 6.6 mln, Szijjártó said. He added that SMG, which employs more than 3,000 people locally, decided to invest in Hungary based on its favorable experiences.

8 | 2 Business www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

STARTUP SPOTLIGHT

Craft Conference Celebrates 10th Anniversary with Leading Tech Giants

The 10th anniversary of the Craft Conference, Central Europe’s largest professional IT event, was held at the Hungarian Railway Museum in Budapest on May 30-31. Discussions included the future of artificial intelligence engineering, productivity enhancements through AI tools, and industry trends amidst economic challenges. The Pragmatic Engineer Gergely Orosz headlined the event.

Spotify, Microsoft, OpenAI, and eBay. Since its inception in 2014, the conference has welcomed over 15,000 participants, with more than 2,000 attending last year alone.

Relaxed but Inspiring

The organizers attribute the event’s success to its relaxed yet inspiring atmosphere, offering valuable insights for novice and seasoned developers alike, as well as business leaders and managers.

“We have become the go-to developer event in the region,” said co-founder Médea Baccifava.

With a new generation of developers often lacking knowledge that was commonplace 10-20 years ago, Craft offered sessions to bridge this gap. The event also covered new industry advancements and their effective integration into existing tech stacks. Soft skills were emphasized as essential for coders, who need to solve increasingly complex problems daily. Craft provided guidance on embarking on self-improvement to elevate one’s career.

70 Speakers

The Craft Conference, which began in 2014, was the brainchild of Medea Baccifava and Gergely Hodicska, intending to create a hub for tech enthusiasts to learn and network. Initially a small local event, it quickly grew into an international symposium, becoming a staple in the tech industry calendar.

The conference’s unique venues, like this year’s Hungarian Railway Museum, offer a blend of historical ambiance and modern innovation. The event stands out for its diverse topics, from foundational software development to cutting-edge AI technologies, ensuring it remains at the forefront of tech innovation.

This year Budapest hosted the 10th anniversary of the summit, which has become Central Europe’s largest IT professional event. Known for its significant contributions to software development discussions, the Craft Conference attracted thousands of professionals from around the world.

The 2024 event featured keynote speakers from major tech companies, including Google, Tesla,

“The community loves Craft because it showcases the diverse directions the industry is heading. Attendees leave with practical tips and thought-provoking ideas, making it a unique networking opportunity.”

Craft Conference extends far beyond typical conference rooms, resembling a festival where technology, knowledge, networking, and entertainment converge. The unique venue of the Hungarian Railway Museum provides a historical backdrop, with participants navigating through old train carriages and even taking rides on mini trains during breaks.

While the setting is captivating, the focus remains on pivotal trends in software development, especially the role of artificial intelligence.

Speakers discussed transforming developer tasks, the potential of AI engineering as a future profession, and enhancing productivity with digital labor. This topic is particularly crucial as many companies face reduced development budgets, making productivity a key factor.

The conference also revisited foundational topics to aid junior and novice professionals in honing their skills.

The 10th Craft Conference featured 70 speakers across seven stages, including Mark Thompson from Google, Kelly Shortridge from Fastly, Randy Shoup from eBay, and Samantha Coffman from Spotify. However, one of the biggest highlights was Orosz, the author behind the toprated tech newsletter The Pragmatic

Engineer, which he bills as the number one paid-for technology newsletter on Substack. It has more than half a million subscribers, and Orosz has 250,000 followers on one of the major social media platforms.

This year, Orosz offered a unique opportunity for attendees to meet him and get signed copies of his book “The Software Engineer’s Guidebook.”

“From the perspective of the presenters, they return to Craft because the audience is very open, curious, and eager to learn and ask questions. Active discussions take place even between presentations,” said Károly Varga, the head of event organizer CraftHub.

“We have become the go-to developer event in the region. The community loves Craft because it showcases the diverse directions the industry is heading. Attendees leave with practical tips and thought-provoking ideas, making it a unique networking opportunity.”

“We aimed to invite inspiring speakers with global experience who can provide a comprehensive overview of current happenings in the IT industry. It’s an interesting time; while the market seems to be in a wait-and-see mode, the field has also split,” Varga explained.

“Despite economic challenges, many companies are prospering and growing, while others face tougher conditions, focusing on retaining their best-performing employees and supporting them with new technologies and training,” he added.

The Craft Conference continues to serve as a vital platform for professional development in the tech industry by emphasizing the importance of foundational knowledge, current trends, and networking opportunities.

2 Business | 9 www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

GERGELY HERPAI

The event featured a broad cross-section of speakers.

Many top tech firms had booths at the conference.

3 Special Report

Automotive

Hungary’s Automobile Production Set to Surpass the One Million Mark Soon

The slowdown in electric vehicle sales is temporary, and stakeholders are ready to embrace competition. However, collaboration among the entire local automotive ecosystem is needed for long-term success in the wake of the transition, experts concluded at the flagship automotive event of the Hungarian Investment Promotion Agency.

output of the domestic automotive industry could increase from the current

500,000

to one million units, a capacity that only five countries in Europe are currently capable of delivering. He added that this is partly because of the connectivity approach, a vital element of the Hungarian investment promotion strategy, which will make the industry more resilient in the long term.

Sigrid de Vries, general director of the European Automobile Manufacturers’ Association (ACEA), agreed with Joó’s to-do list, noting that customers need more affordable autos and that European automotive can only thrive if more collaboration exists.

“Against the backdrop of geopolitical tensions and political uncertainty due to elections all over the world, it is also essential to stay flexible,” Jens Bühler, CEO of Mercedes-Benz Manufacturing Hungary Kft., said.

As showcased by a series of examples, the “Local for locals” principle is widely followed when sourcing material. The OEMs’ overall impression of local suppliers is positive, although there is still a need to take their operations to the next level in digitization, among other things.

Easing Burdens

Issuing digital invoices is still an issue, for example. On the other hand, automakers could use help, particularly in easing administrative burdens such as the duplication of reporting obligations, Olívia Mesics, managing director of Opel Szentgotthárd Ltd., part of Stellantis, noted.

Attila Vári, partner at IFUA Horváth & Partners Ltd., stressed that Hungary stands a chance to profit from the automotive transition away from fossil fuels if it assumes the role of being an integration hub, hosting flagship players from all around the world and further develops its strong position in R&D, mainly in EV and advanced driver-assistance systems (ADAS) ecosystem building.

The Hipa Automotive Conference 2024 gathered the most renowned representatives of the sector to discuss the latest trends. For example, the industry hasn’t been recovering consistently in the wake of the COVID-induced economic slowdown.

According to the latest survey by the International Organization of Motor Vehicle Manufacturers (OICA), the French, Polish and American car manufacturers reached production volumes in 2023 of around 60-70% of 2019 levels, while the Japanese or Czechs managed 85-98%. By contrast, Hungary’s performance last year was already above pre-pandemic levels.

“All this would not have been possible without strong automotive hubs such as Esztergom, Szentgotthárd, Győr and Kecskemét,” said Hipa CEO István Joó in his opening keynote speech.

Thanks to the developments of recent years, the annual production

Electrification has created a new competitive environment where Asian players have had a head start, but this will only force European companies to produce better vehicles. Above all, the battery range must be further extended and production costs reduced.

“But to make a real breakthrough, we need to work a lot not only on the quality of vehicles but also on the development of the electromobility infrastructure for which the European Union must also allocate additional resources. Most of all, the charging point network needs to be expanded, and the conditions for related subsidies need to be eased,” Joó pointed out.

2025 Bounce-back

The temporary slowdown in demand for electric vehicles is also partly due to this lack of charging infrastructure, but experts expect a strong bounceback by 2025.

“The success of the automotive industry sends a very clear message to manufacturers and investors that keeping production in Hungary is an economically rational choice,” concluded the Hipa CEO.

“To make a real breakthrough, we need to work a lot not only on the quality of vehicles but also on the development of the electromobility infrastructure for which the European Union must also allocate additional resources. Most of all, the charging point network needs to be expanded, and the conditions for related subsidies need to be eased.”

Top executives of Hungary-based OEMs also expressed their readiness to embrace competition that “pushes them to make better products.” The importance of training was emphasized as the sector needs to be made more attractive for the young. The existing dual education system, imported from Germany, could provide an excellent basis to reach that goal.

“Innovation in Hungary is driven by FDI,” Hipa deputy CEO Rita Szép-Tüske said. She highlighted that the agency’s extensive R&D incentive scheme offers plenty of opportunities for investors to benefit. Since 2017, HIPA has guided 33 projects worth EUR 500 million, two-thirds of which were linked to automotive.

Although the number of researchers in Hungary doubled between 2010 and 2021, nobody can sit back and relax. As István Szászi, representative of the Bosch Group in Hungary and the Adriatic region, pointed out, the availability of talent alone won’t cut it; all those involved need to understand all aspects of the business to prevail.

“Business models are changing all the time, which requires stakeholders to remain flexible,” he said. This includes suppliers that should embrace a whole new mindset by turning their B2B approach into B2C by incorporating client feedback into their development plans.

“Players from the industry, research and academia are ‘gently forced’ by incentives to work together. This collaboration may not bear fruit right away, but with time, great things are bound to happen as we learn to create value,” Zsolt Szalay, head of department at the Budapest University of Technology and Economics, concluded.

www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

BBJ STAFF

PRESENTED CONTENT

The OEM roundtable discussion at the Hipa Automotive Conference 2024

‘In

Automotive Projects, Only Change is Permanent.’

Two of the leading architects and project managers from Óbuda Group talk exclusively with the Budapest Business Journal about what sets the firm apart in serving the automotive field.

If you are a highly competent Hungarian architectural and engineering firm looking to cash in on the international FDI wave sweeping Hungary right now, the number one attribute is probably not only your technical expertise, but the ability to communicate and navigate cultural differences.

“I tell my colleagues the key to success in a project is communication because it’s really not enough that you just know the language, and that is what makes a difference,” explains Sándor Benkei, technical director of Óbuda Group’s project management firm. “If I say ‘design concept,’ it means something different in Germany than in Poland, for example. And if you don’t have experience with foreign clients, then it will be challenging working with them,” he adds.

It is a sentiment that the architectural studio’s managing director, Géza Germán, fully endorses. The two men have the better part of six decades of experience between them, including time spent abroad and working for foreign companies.

“We are very open-minded and have international experience in all aspects of a real estate project. You are talking with two engineers capable of adapting to any situation. I think this is our strongest point in the market,” says Germán.

Put another way, they have seen a lot of different international approaches to architectural engineering problems. That knowledge is stored away, ready to be called upon, but they have also distilled it into one fundamental lesson.

“If a client is bringing some very special solution that does not fit the European requirements, we do not say ‘No.’ We offer solutions for how they can adapt the new technology, system or equipment to Hungary and European norms,” Germán explains.

“Already with European and American partners, a lot of adaptability and attention was needed, but with Asia, it is different again,” Benkei agrees.

Understanding the Mindset

“We Europeans have to learn. We need to understand a different mindset. That’s why we hold regular events with international clients, where we try to show

how to do it better based on the experience of previous investments,” he says.

“My favorite example is how the Chinese [visually] count to 10 on one hand. When we show ‘two’ [with thumb and index finger], it means ‘eight’ to a [mainland] Chinese person. Such misunderstandings must be dealt with somehow,” Benkei adds.

The two experts recall when Hungary began to open up and the first wave of Japanese and, most especially, German automotive OEMs started to arrive.

Germán called it a “golden time” when new technologies, knowledge, and culture were imported into the country. Some may see today’s wave of Chinese and Korean investors as offering an easy repeat run; after all, the fundamentals of a factory are still four walls and a roof.

But the Hungary of 1989 and 2024 aren’t just separated by time (“Do you remember before

1990?

You could choose from five different models of car, and that was it!”), but also by technology. The insulation and cladding on those four walls must meet completely different standards. The buildings’ roof will probably need to accommodate solar panels. And today’s buildings, their construction and surroundings face increasing ESG regulation.

That would be true for pretty much any factory, of course. What separates the automotive industry from most others is the scope of tasks expected to be completed on one site.

“They have to stamp the body, then they have the welding shop, the paint shop, the bumper shop where they make molded plastic, and after that they have assembly. These five shops all have different types of machines

and technologies. So, if we are designing a car manufacturing plant, this is a very complex project,” says Germán. It doesn’t stop there. Depending on location, there could be a requirement for rail, road or river connections, even a private landing strip, plus logistics facilities, health and safety sections that may include fire-fighting facilities or a medical clinic, and so on.

“We

are very open-minded and have international experience in all aspects of a project. You are talking about two engineers capable of adapting to any situation. I think this is our strongest point in the market.”

With the original wave of combustion engine-powered cars being replaced with EVs, Benkei makes the point that automotive plants are expected to evolve much more than standard industrial units.

The Only Constant

“I was visiting the Pick factory in Szeged not so long ago. The whole value of the brand is that it has been made in the same way for 100 years,” he says. “In automotive projects, only change is permanent.”

He gives a recent example. When the car body shell is brought to the chassis section for the two to be “married up,” it is transported via an overhead conveyor belt. The shell is lowered over

the chassis, the two attached, and the combined unit is lifted back up and moved on to the next stage. The same system was used with conventionally powered cars, but today’s EVs have the battery already in place in the chassis.

“Because of this battery, which is

200-300 kgs, the load on the conveyors was so significantly changed that we had to put additional support and stiffening in the roof; we virtually had to rebuild the roof,” Benkei explains.

The extra weight of those batteries is not their only drawback. “Range anxiety,” the worry about how far you can go on a single charge, remains a genuine concern for some, and the relatively high inflation environment has led many would-be buyers to postpone new vehicle purchases.

Germán says that improvements will come. German manufacturers are still keen on driving innovation, if you will pardon the pun, while Chinese manufacturers seem pretty happy to add new technologies almost as soon as they appear.

“Personally, I am very much looking forward to the arrival of the Hydrogen Fuel Cell Electric Vehicles (FCEV). If the issue of safe storage is resolved, then I think it could lead to an interesting competition against EVs with the rapid transformation of charging networks,” Germán says.

“It’s like the battle between Betamax and VHS tapes,” he adds.

One thing is certain: whichever technology wins out, Óbuda Group will be ready to help design, consult, manage and supervise the realization of the factories that will help make it happen, wherever they are based and whoever the investor.

3 Special Report | 11 www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

ROBIN MARSHALL

PRESENTED CONTENT

Géza Germán

Sándor Benkei

Automotive in CEE Regional Conference 2024: Navigating the Future of the Industry

The Automotive Business in CEE Regional Conference 2024, held in Budapest, provided attendees with a comprehensive overview of the current trends and challenges facing this vital industry across Central and Eastern Europe.

The conference highlighted the increasing presence of Chinese car manufacturers in the region, the electrification of the automotive sector, and the evolving sales models, all of which have significant implications for the Hungarian market and beyond.

Zsolt Müllner, Chairman of the Board of AutoWallis Group, opened the conference with a presentation on the automotive market’s challenges and prospects in Hungary and the CEE region. He noted that many industry trends are progressing more slowly than anticipated, with significant changes occurring behind the scenes, particularly in infrastructure.

“The emergence of competing powertrain technologies is a critical trend. However, the adoption of electric vehicles is slower than expected, with less than 40%

of new car sales in our region involving electrification,” Müllner said. He attributed this to the underdeveloped charging infrastructure in Eastern Europe despite recent government measures supporting electrification.

Müllner also emphasized the growing influence of Chinese automakers in Europe, noting frequent announcements of new market entries or factories.

“The competition will intensify, affecting EV prices. Major markets will protect their manufacturers, as seen with significant tariffs on Chinese vehicles in the U.S.,” he warned. Müllner added that an omnichannel sales approach, combining online and showroom experiences, is becoming essential, with the direct sales model shifting the dealer’s role to a commission-based system.

Diversify and Expand

Gábor Ormosy, CEO of AutoWallis Group, highlighted the company’s strategic focus on diversification and expansion.

“Our revenue from foreign markets consistently constitutes 60% of our total, with significant growth opportunities through acquiring new brands and expanding our market coverage,” he said.

Petr Knap, a senior advisor at EY Consulting, discussed the rapid changes in the industry, including the rise of new manufacturers and the increasing footprint of Chinese automakers.

“Sustainable value creation requires strong, cooperative partnerships and a customer-centric approach,” he asserted.

The first panel discussion explored the restructuring of the import and dealership systems. Tibor Együd, managing director of Mazda Motor Hungary, pointed out that consumer demands drive market dynamics, necessitating a multichannel sales model and expanded financing options.

Richard László, country director of Toyota Central Europe – Hungary, highlighted the shift in corporate fleet demands towards sustainability, which influences the market significantly.

Andrew John Prest, international business development vice president at AutoWallis Group, noted a generational shift in driving habits.

“Young people are obtaining their licenses later, typically in their

mid-20s,

reflecting broader changes in consumer behavior,” he said.

The conference also delved into the impact of digital transformation on the automotive industry. Zmak Kreso, vice president of product development at omnichannel market platform Infobip, highlighted the importance of data-driven marketing and the rise of communication via mobile apps.

“AI-driven customer service, including chatbots, and the use of messaging apps like Messenger, Viber, and WhatsApp, are revolutionizing how we engage with customers,” he noted.

Péter Antal, retail division director at AutoWallis Group, discussed the implications of the agent-based sales model versus traditional dealership models.

“The choice between [retail] models largely depends on the manufacturer, with German premium brands leading the way towards the agent model,” he argued.

ESG Significance

The significance of environmental, social, and governance (ESG) considerations in fleet management was another key topic. Péter Farkas, managing director of Nelson Flotta, emphasized the importance of sustainability in customer services and aligning European ESG standards with global practices.

Deputy State Secretary for Economic Development Bence Gerlaki of the Ministry of National Economy provided a global perspective on electric mobility trends. He highlighted the fluctuating market conditions, noting a drop in EV sales at the beginning of 2024, which later stabilized.

“China is leading in EV sales, while Germany anticipates a 14% drop

due to the end of subsidies,” he said. Gerlaki stressed the importance of competitive electric vehicle production in Hungary and outlined governmental support programs to enhance EV competitiveness, including subsidies for new and used EVs, private and public investment in charging infrastructure and standardizing battery conditions and market values.

Zoltán Vígh, CEO of Jedlik Ányos Cluster, discussed the integration of

energy and mobility sectors and the need for extensive network development to support charging infrastructure. He highlighted the demand for fast chargers on public networks and the need for a comprehensive development plan involving multiple industries.

“The emergence of competing powertrain technologies is a critical trend. However, the adoption of electric vehicles is slower than expected, with less than 40% of new car sales in our region involving electrification.”

The conference concluded with discussions on sustainable urban mobility. Orsolya Hartyányi, managing director of Wolt Hungary, emphasized the goal of reducing delivery times while addressing sustainability by increasing bicycle deliveries.

Gergely Kofrán, head of mobility Strategy at Budapest Transport Center, stressed the importance of multifunctional public spaces and efficient organization of mobility services to cater to growing demands.

Péter Ujváry, managing director of Avis Hungary, envisioned a platform that plans and recommends transportation modes based on personal preferences. He noted that carsharing and rental services complement each other, addressing different needs.

12 | 3 Special Report www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

GERGELY HERPAI

Roundtable on the market in Hungary and CEE, from left: Moderator Petr Knap (EY); Tibor Együd (Mazda); Richard László (Toyota); Norber Nagy (Kia); Andrew John Prest (AutWallis); and Tamás Wachtler (Porsche Hungaria).

Continental Veszprém Plant Manager Looks to Transform Challenges Into Opportunities

Starting as a trainee at Continental in 2008, András Mészáros has risen through the ranks and become the plant manager in Veszprém this year. He talks with the Budapest Business Journal about his career path, industry challenges, sustainability, and more.

BBJ: Can you share your journey within Continental, from your initial role in 2008 to your current position? What were some key milestones along the way?

András Mészáros: I am an electrical engineer who studied at the Technical University of Budapest. In 2008, during my studies, I applied for a trainee position in surface mounting technology at Continental. Fortunately, I was hired fulltime after a year, and eventually, I led the team until 2014. Later, I transitioned to electrification technologies, working on serial development, and then becoming a “focus factory” manager. It was a valuable experience to work with highly mature, well-organized production processes for brake control units while also being involved in evolving hybrid control units for new electric and hybrid vehicles. My career has been marked by continuous change and new tasks, albeit all at the same place. In 2016, I shifted to steering control unit production as head of the focus factory, which later expanded to include software-heavy telematic control, display, and high-performance computer production, often utilizing full automation. After more than a decade of working in Budapest, I had the opportunity to expand my responsibilities further as the European operations manager for a business area, overseeing 11 additional locations. This experience provided crucial insights into various products, production lines, and technologies, as well as exposure to different plants and teams, which was essential to understanding our business. This role eventually led me to my current position as plant manager in Veszprém.

BBJ: What specific goals and plans do you have for the Veszprém factory in your new role? What are you aiming to achieve with your team here?

AM: The European industry is facing significant competitiveness challenges. We can improve efficiency, speed, and quality by leveraging an innovative and resilient team. Numerous digital

and AI-based tools are currently available, and more are being developed, so we need to identify the most suitable ones for our plant. Our primary objective is to become a globally competitive and innovative location.

On the other hand, last year, we continued to develop the attractiveness of our location from the R&D perspective. We highlighted with several campaigns for software developers that Continental is in a truly unique position in the region: we are not only an employer in the city of Veszprém, but anyone in the Balaton region can join us for a thrilling career and great atmosphere. I want to keep building this image and showcase that we are more than a simple manufacturing location. We are a 360-degree site as we work on innovative ideas with our R&D teams, test these ideas and other solutions on our own test track, and manufacture state-of-the-art automotive parts.

BBJ: The European automotive industry has faced significant challenges in recent years. How do you plan to address these and ensure that the Veszprém plant remains competitive and innovative?

AM: I am an engineer, and I believe that engineers are best suited to understand which tools are the most appropriate for the problems we encounter. I strive to lead by example and actively seek to understand the purpose of different tools. I am also eager to be innovative, collaborate with colleagues in addressing challenges, and bring in fresh ideas from sources such as other plants, colleagues, and articles. Having the right mindset is crucial in fostering a highly innovative environment. If a perfect existing digital tool is available, I would advocate using it. This, in itself, is a form of innovation for our plant. We don’t always need to create everything from scratch. Sometimes, adopting an existing tool to solve a problem within our plant’s specific environment efficiently is also a form of innovation.

BBJ: Can you elaborate on the role of the Veszprém plant in developing and producing high-tech, future-proof products? How does this align with Continental’s overall strategic goals?

AM: Plant Veszprém employs several hundred development engineers who work on sensors and brake control units, which have been critical competencies for decades and are required in every newly sold car. However, our development processes and speed must evolve with the same mindset, being open to change, striving for innovation, and choosing the most effective solutions. Our focus is on efficiency when pursuing innovation rather than doing it for the sake of fun.

BBJ: With ESG and CSR aspects gaining importance in the industry, what steps are you taking to ensure the sustainable operation of the plant and the satisfaction of its employees?

AM: We have a roadmap to become a gold-labeled green plant by purchasing 100% renewable electricity and actively working to reduce and recycle our waste in production and supply chain processes. I work with my team to look to the future, considering options like solar or wind energy or energy storage solutions. For example, if solar energy is the solution, perhaps optimizing for lower levels of sunlight in the winter would be beneficial in 5-10 years. Keeping up with the latest trends and solutions will help us make good decisions for our sustainability. We also make a conscious effort to plant trees wherever possible. Regarding well-being and CSR, we recently organized a Quality and Health Days initiative, consisting of more than 50 presentations over three weeks. Additionally, we actively support sports and theater and identify areas where we can have the most significant impact on our society. I have taught four courses at the university and am involved in partnerships with schools and universities.

Being future-proof isn’t just about having an excellent product and highly digitalized R&D and production. We also need to understand our complete waste and CO2 footprint and take measures to minimize it. Furthermore, we prioritize the well-being of our employees by providing regular checkups, promoting healthier diets, and demonstrating care for future generations. We also aim to be a responsible player in the local community.

3 Special Report | 13 www.bbj.hu Budapest Business Journal | June 14 – June 27, 2024

BENCE GAÁL

PRESENTED CONTENT

András Mészáros, Continental Veszprém plant manager.

EV Market and Hungary: Fancy a Roller-Coaster Ride? Automotive Matters