ISSUE#26 FINTECH GOES HOLLYWOOD! THE FF WALK OF FAME 2022: LIGHTS, CAMERA, ACTION... BUT WHO WERE THE WINNERS? Intix ● Adjoin Homes ● Revolut ● SmartStream ● Feedzai ● SAP Fioneer Mobiquity ● Adyen ● FINCAD ● UL Solutions ● Kani Payments ● Trulioo ● Oxbury Bank INSIGHTS FROM

A COLLECTION OF EXCLUSIVE EVENTS & DIGITAL CONTENT THROUGHOUT THE YEAR parisfintechforum.com PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PAR TICIPANTS 4 0 COUNTRIES PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PAR TICIPANTS 4 0 COUNTRIES PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PAR TICIPANTS 4 0 COUNTRIES PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PAR TICIPANTS 4 0 COUNTRIES PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PAR TICIPANTS 4 0 COUNTRIES

FINTECH FOCUS

20 The Fintech Finance Awards

The best of the guests and the winners who wowed us in 2022 RESILIENCE &

SUSTAINABILITY

6 Going to X-tremes

Financial institutions have long been required to monitor transaction data. But now both regulators and stakeholders are demanding insight on a wider range of issues, the volume of information and analysis demands a new approach, says André Casterman from Intix

8 Mutual benefits

Financial institutions, by and large, face the same challenges: talent, time, cost and, increasingly, pressure not to contribute to environmental damage. Haytham Kaddoura, CEO of SmartStream, argues they’re four good reasons to let it share the load

10 The SAP is rising

Dirk Kruse, CEO of SAP Fioneer, on how this ambitious joint venture is focussed on helping financial services tackle one of the most pressing problems of our time… the thorny issue of ESG data management

13 Moving on Alex King explores how mobility as a service could be morphing into a broader embedded concept

NEOS & CHALLENGERS

16 Which way now for Generation Rent?

Adjoin Homes is among the newest of the proptechs trying to solve the dilemma facing thousands of tenants who'd like to buy their own home, but can’t. Founders Marios Tsatsos and Kostas Zachariadis know how it feels

THEFINTECHVIEW

ISSUE #26 2023

Five hundred guests; 18 worthy winners: three men in kilts; one 80s girl band… and a col-our-ful form-er MP. If you hummed that to the tune of Partridge In A Pear Tree, well done and apologies for planting the earworm.

We make no apologies, though, for celebrating the awesome creativity of the industry at our second pre-Christmas ‘Oscars’, the FF Wow Moment Awards, of which you’ll find full coverage, beginning on page 20 of this issue.

When Editorial Director Ali Paterson (pictured below) launched the Wows, they were very much intended to be an antidote to the sometimes yawningly dull ceremonies that he’d attended over the years – an excuse to layer on the movie glitz and for guests to be put in the hall of fame, courtesy of our talented filmmaking team.

No-one pays to submit their video entries (of which there were 350 this year) and no-one knows in advance if

they've won (which perhaps explains the lack of acceptance speeches!).

The Wows recognise creativity in building solutions to a huge diversity of challenges facing financial services and their users, not least in the overlapping areas of Trust & Security and Resilience & Sustainability – both of which we explore in detail in this issue.

We ended the year with news of the first co-ordinated APP fraud sting, resulting in more than 140 arrests (page 57), and Brussels agreeing a controversial world-first carbon border tax as it doubles down on climate change action. So, there’s both a promise of progress but clearly also of more complexities for fintech to address in 2023. We look forward to being ‘wowed’!

Our last issue’s spine tingler, “Perhaps we make too much of what is wrong and too little of what is right”, was a quote from HRH Queen Elizabeth II

Sue Scott, Editor

CONTENTS

Issue 26 | TheFintechMagazine 3

6 16

18 Growing smarter

Oxbury Bank is alone among UK agritechs in having a full banking licence. Co-founder Nick Evans told us how it’s ploughing its own furrow

WINNING STRATEGIES

26 Taking a different route

As competition hots up in cross-border payments and the correspondent banking network hits back, we ask three players from different sides of the tracks, how the explosion of new services will play out for customers

30 Scaling fintech

Revolut and Kani Payments are both UK-based fintechs with their sights set on expansion. Here, André Silva and Aaron Holmes discuss how the neobank and the PSP respectively are scaling up in an environment where trust and compliance can define your success

34 Lighting up the radar

Mobiquity offers advice on how to differentiate your banking app in a sea of sameness

TRADING

38

A new normal?

Technology and regulation have moved on since the last global recession, giving investors better tools to navigate what looks likely to be a year of extreme uncertainty – one in which none of the old rules about economic performance seem to apply. We asked two leading providers to the market – Christian Kahl PhD, President of FINCAD, the capital markets division of Zafin, and Gennadiy Friedman, MD of Enfusion – for their analysis

43 Changing the menu

Ian Manocha, CEO of Gresham Technologies plc, on why automating data management is fundamental to reducing risk and improving customer experience

TRUST & SECURITY

46 Embedded trust

Adyen has recently expanded into financial services on the back of a full banking licence, with a workforce that puts security at the heart of

every task, says CTO Alexander Matthey. Here, he discusses its approach alongside Mark Phillips, Senior Consultant at cybersecurity consultancy Dionach

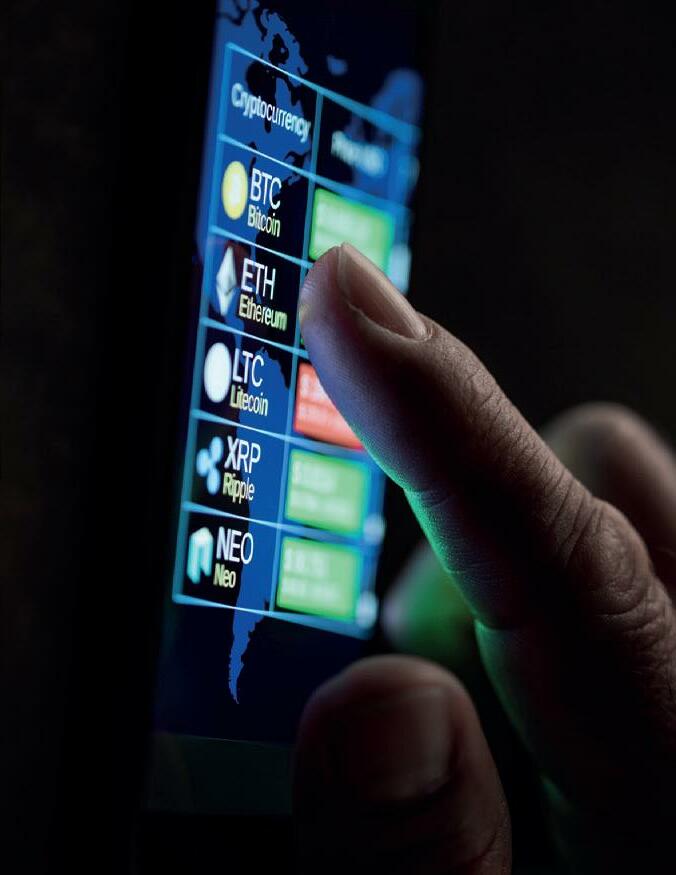

51 How to build confidence in crypto

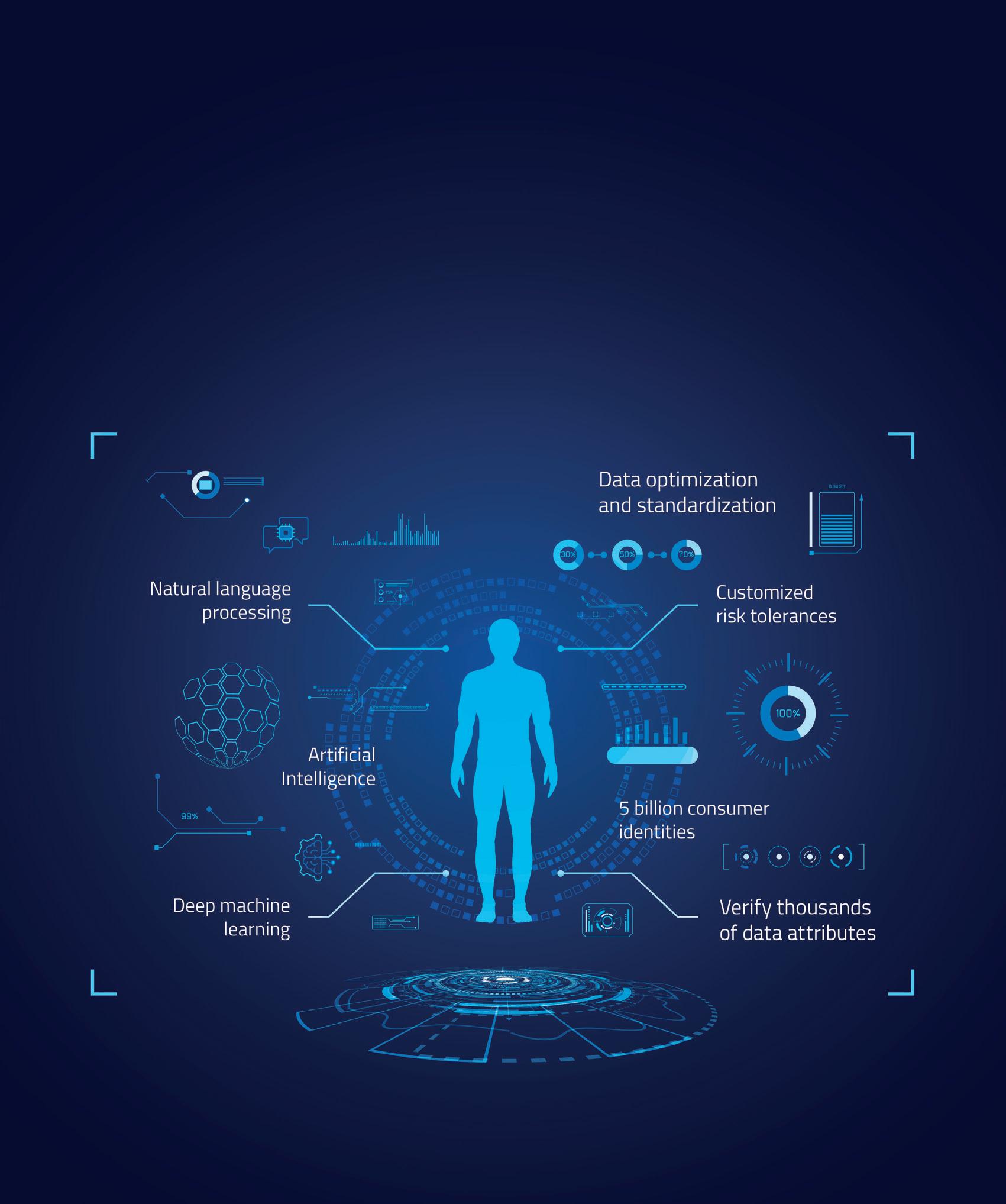

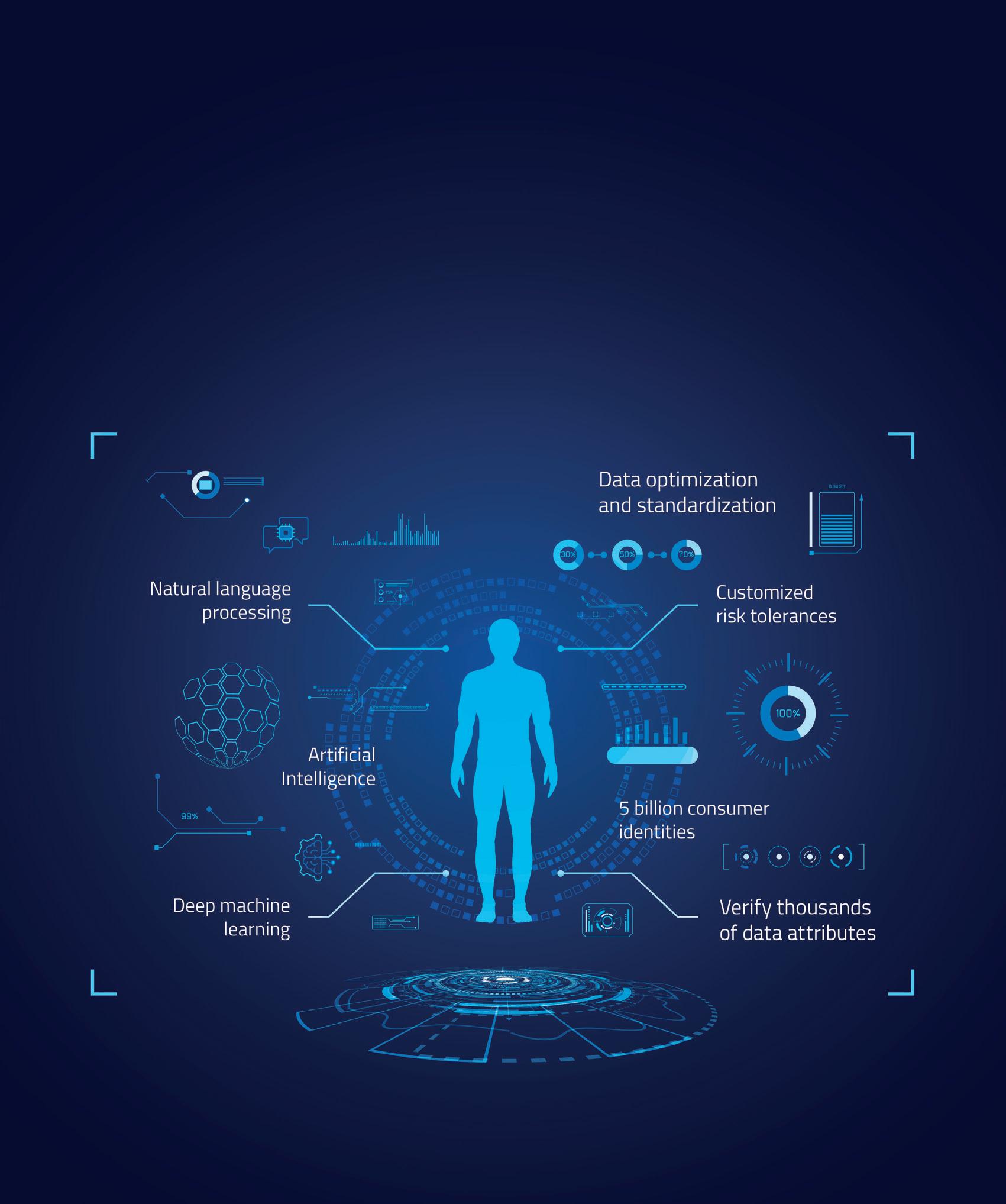

Michael Ramsbacker, Chief Product Officer at Trulioo, the global identity verification specialist, considers what exchanges can do now to restore faith in the industry

54 Change of tune

The US payments landscape is fundamentally changing, with ISO 20022 helping to bring harmony to a discordant environment.

Ravi Sharma from global leader in applied safety science UL Solutions gives his perspective on the impact

57 The big sting

Could the UK-led purge of the iSpoof site and subsequent arrests across multiple jurisdictions mark a turning point in the detection and enforcement of APP and other fraud? asks Alex King

4 CONTENTS THEFINTECHMAGAZINE 2023 ISSUE #26 4 18

51 30

All Rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner. While every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions. The products and services advertised are those of individual authors and are not necessarily endorsed by or connected with the publisher. The opinions expressed in the articles within this publication are those of individual authors and not necessarily those of the publisher. EXECUTIVE EDITOR Ali Paterson GENERAL MANAGER Chloe Butler EDITOR Tracy Fletcher PRODUCTION Taylor Griffin HEAD OF CONTENT Douglas Mackenzie CONTENT TEAM Aniqah Majid HEAD OF MARKETING Ben McKenna CONTACT US ffnews.com DESIGN & PRODUCTION www.yorkshire creativemedia.co.uk ART DIRECTOR Chris Swales PHOTOGRAPHER Jordan “Dusty” Drew ONLINE EDITOR Lauren Towner ONLINE TEAM Lewis Johnson-Pitt FEATURE WRITERS Hannah Duncan David Firth ● Tim Goodfellow Martin Heminway Alex King ● Natalie Marchant Sean Martin ● Sue Scott Frank Tennyson Fintech Finance is published by ADVERTAINMENT MEDIA LTD. Pantiles Chambers 85 High Street Tunbridge Wells, TN1 1XP SALES TEAM Tom Dickinson Nicole Efthymiou VIDEO TEAM Lewis Averillo-Singh Alexander Craddock Max Burton IMAGES BY www.istock.com PRINTED BY LA Printers Ltd "PROUDLY NOT ABC AUDITED" TheFintechMagazine | Issue 26 ffnews.com

banking

payments

out

our low-code payments

visit

valantic FSA Passionate about payments. Digitize. Augment. Evolve.

valantic FSA is at the heart of the evolving

and

landscape –delivering powerful applications through X-Gen, our low-code/no-code platform. To find

more about

solution,

www.valantic.com/fsa

Financial institutions have long been required to monitor transaction data. But now both regulators and stakeholders are demanding insight on a wider range of issues, the volume of information and analysis demands a new approach, says André Casterman from Intix

Legislation typically lags innovation in the digital age and that assertion is clearly true in the case of environmental, social and governance (ESG) investing.

By 2020, global ‘sustainable’ funds that sat under the ESG umbrella totalled $35.3trillion, accounting for a third of the value of all professionally managed assets, according to investment research group Morningstar. While many of these complied with voluntary codes of reporting, such as that laid out by Global Reporting Initiative, it’s only recently that we’ve seen mandatory rules around ESG reporting being introduced.

For instance, in March 2021, the Sustainable Finance Disclosure Regulation (SFDR) went live in the EU to improve transparency in the market for sustainable investment products, to prevent greenwashing and to increase transparency around sustainability claims made by financial market participants.

The UK government’s first wave of Climate-related Financial Disclosure Regulations came into effect for publicly quoted companies, banks, insurers and large private companies in April 2022.

The UK is expected to adopt the International Sustainability Standards Board requirements for disclosures over climate and general ESG reporting by 2025, which must be linked to financial statements. And, in the US, the Securities and Exchange Commission released its consultation in March 2022 on a requirement for companies filing there, (including private foreign companies) to report direct and indirect emissions.

ESG is huge, complex and highly political – and it’s about to drop a vast regulatory burden on businesses around the world.

“ESG is going to be as important as the compliance trend that we witnessed following the financial crisis of 2008,” says André Casterman, chief marking officer of data-tracking software group Intix, which has a client portfolio consisting of Tier 1 banks across the world.

“It’s nascent – it hasn’t impacted all the bank systems yet – but, at the same time, climate change is a priority for the world. And it’s a priority for the regulators who are creating many new obligations on banks to handle ESG data.

“Whether this is related to an ESG scoring at a company level, or an ESG scoring at a transaction level, all of this data has to be stored, kept, archived, and be part of the decision-making within the banks.”

While some of the latest regulation is specifically concerned with understanding the size of the risk and protecting systemically important institutions from financial shocks caused by climate change, more broadly, the environmental component of ESG means a financial institution must consider how its actions – and, indeed, those of its suppliers and customers – impact the natural world, and come up with a strategy to mitigate it.

When it comes to meeting social responsibility obligations, a company needs to look at how its own, and potentially others’ management of relationships up and down the supply chain, affects individuals and communities. Governance, meanwhile, is something most companies have paid closer attention to following the Cadbury report in the 1990s; it requires them to demonstrate probity in leadership, auditing and internal controls.

The data needed to demonstrate regulatory compliance and satisfy internal reporting to stakeholders on the ‘E’ and ‘S’ in ESG requires institutions to gather information from disparate internal and external sources. That data is often hidden in a long-tail supply chain and often it will be qualitative by nature.

As Casterman points out, environmental reporting is comparatively new and has already sparked huge criticism by both supporters and detractors. There have been claims of ineffectiveness and greenwashing from environmental activists, while recently, during the US Congress mid-term elections, some Republicans went so far as to allege that ESG was part of a woke agenda by left-wingers.

In October it was reported that US investment giant BlackRock had lost more than $1billion in asset management business in Republican-run states where treasurers were opposing its green investment policies.

6 RESILIENCE & SUSTAINABILITY: REPORTING

TheFintechMagazine | Issue 26 ffnews.com

Environmental reporting is particularly fraught because there is as yet no universally agreed rating system against which to peg a company’s performance. Industry giants such as MSCI, Standard & Poor’s, Moody’s, Institutional Shareholder Services and Bloomberg provide ESG metrics but so do scores of others.

Whatever the protocol, the importance of these metrics is not lost on financial institutions: KPMG said recently that many in the UK were already transitioning their ESG data and reporting teams into finance ‘so that the same rigour can be applied to these metrics as to the reporting of financial information and disclosures‘.

The big data exchange

The sustainable investment revolution could transform businesses for the better, and demand for such products seemingly outstrips supply. A PwC study in October 2022 claimed nearly nine in 10 institutional investors believe asset managers should be more proactive in developing new ESG products, yet only 45 per cent of asset managers had new ESG fund launches in the pipeline. The UK investment market has already noted and is acting upon the unmet opportunity: London aims to become the world’s first net zero-aligned financial centre.

For Casterman, all this points to one truth: “Across multiple streams –securities, payments, trade, and so on – more and more data will have to be exchanged for organisations to be ESG compliant.”

Intix was acquired in March 2022 by Summa Equity, which invests in companies that are solving global challenges and creating positive ESG outcomes. Superior automated data gathering and analysis, such as that offered by Intix xTRAIL and xTRACE data tracking solutions and now xCOMPLY will go a long way to helping them achieve that.

xTrace and xTrail already allow firms to view all their transaction data in a unified graphic user interface as well as in machine-readable APIs. But xCOMPLY combines that transaction data with many

more data sets to deliver contextual insights that support compliance with a wider range of regulatory obligations and financial forensics. That includes ESG reporting.

“Whether it’s an ESG dataset, an anti-money laundering dataset or another type such as a master dataset, with xCOMPLY we can correlate them. Compliance officers will benefit, but it has other uses in the organisation, such as business or client support functions.”

Pointing to the growing complexity around data management, Casterman adds: “More and more internal systems within banks are being added, one next to the other. Different screening systems are run for payments, for securities, for trade, and all the requirements are different. The challenge for banks is to navigate through datasets that are scattered across these systems, and that’s what we enable – we provide a single window into the internal systems of the bank.

“We can add additional datasets as needs evolve without having to change our

ESG is going to be as important as the compliance trend that we witnessed following the financial crisis of 2008

platform. Being adaptable, configurable, to address additional needs from regulators, or as the market evolves, is a key aspect of our technology.”

Casterman believes the current fragmentation of payment systems will only add to the volume of data held by any one institution, which makes the case for automation even harder to resist.

“There are not only new entrants competing on cross-border payments but also we see the world dividing,” he says. “This year, we saw Swift disconnecting countries due to political decisions, which means there will be more systems used to process payments. So, banks have to connect to a number of channels, whether they like it or not. And they will have to

internalise as much data as possible because whereas, in the past, they could let some data be handled by those channels, such as analytics and reporting, they can no longer rely on this.

“At Intix, whatever channel the bank is using, we are always focussed on the payment, securities or trade transaction data, and we process it independent of the formatting of the instruction – MT or ISO 20022, or any other standard.

“We can provide the data for both automated and manual processes, but the key is for the bank to automate as much as possible to avoid compliance officers having to do all their linking manually because we know that leads to operational risks and errors.”

Intix has been advising clients on how to get their data in order for years, and now that regulators have a better understanding of the datasets available and their demands are becoming more specific, that advice is coming home to roost – not least because when it goes wrong for financial institutions, the fines and potential reputational damage can be severe.

“The way banks need to report transactions for regulators is undoubtedly becoming more complex,” says Casterman. “Regulators also want faster reporting –it’s no longer end-of-month. Everything has to be real-time.

“When it comes to conducting forensic investigation, every piece of data counts. You want to know everything around the parties involved, around the transaction, its origin – is it coming from a securities settlement, or a trade settlement or just a regular payment?”

Those are the questions that clients will, he hopes, come to rely on xCOMPLY to answer. But whether it’s information required under the ‘single EU rule book’ for anti-money laundering/countering terrorist financing – as is currently being discussed – or gathering the data to justify investment in a company that may or may not be greenwashing, Casterman says: “Our technology is ready for any change that the banks will have to go through.”

A changing landscape: Going forward, global warming will have greater impact on regulatory reporting

7

ffnews.com Issue 26 | TheFintechMagazine

Good for business, good for the planet: A single solution to a shared problem

Mutual benefits

Financial institutions, by and large, face the same challenges: talent, time, cost and, increasingly, pressure not to contribute to environmental damage. Haytham Kaddoura CEO of SmartStream, argues they’re four good reasons to let it share the load

ISO 20022 has become a preoccupation of the majority of players in the financial world, such is the transformative nature of the payment messaging standard imminently coming into play for many of them for the first time.

The protocol has already replaced existing domestic legacy payment standards in more than 70 countries and, says the UK’s NatWest bank, within five years we can expect to see around 80 per

cent of high-value payments by volume, and 90 per cent by value, using ISO 20022.

The benefits of adoption are obvious: a new global standard for payments messaging between financial institutions, enabling faster processing and improved reconciliation. Richer and better data, increased transparency, and automation of digitisation of payments, should help counter the malignancy of failed payments that currently costs the global economy $118.5billion in

fees, labour and lost business a year, according to Accuity data.

So, by any reckoning, ISO 20022 represents a positive move in the payments space, connecting the financial world with less friction and much more efficiency. However, with all these growing and increasingly complex volumes of data – 10 times more data per ISO 20022 message, according to EY – there is a downside: the processing capacity needed to handle not just the nominal increase in

8 RESILIENCE & SUSTAINABILITY: RECONCILIATIONS

TheFintechMagazine | Issue 26 ffnews.com

information, but the associated regulatory reporting, including ESG (environmental, social and governance) reporting, not to mention the environmental impact of all that additional processing.

“Regulation has been a wake-up call for banks,” says Haytham Kaddoura, CEO of global financial software and managed services provider SmartStream. “They would be fooling themselves if they weren’t expecting it, because everyone has seen the trend towards greater transparency.

“But the financial ecosystem is coming together – regulators, individuals, clients – to really help address some of the gaps that were in the financial sector, and still persist in certain areas. We have a long way to go to address all the challenges, but we continue to work very closely with some of the top institutions in the world, helping them to address these challenges, building their transparency, building the checkpoints in their business, to ensure that they are as compliant as possible.”

In order to handle the huge volumes of information now at play, financial institutions require technology – chiefly Cloud-native solutions. Among them, SmartStream AIR is capable of processing millions, or even billions, of lines of data per second.

This artificial intelligence (AI) reconciliation and exceptions management system learns from user behaviour, populating fields automatically, setting labels, running out of office hours.

It can provide suggestions to users, or fully automate the process, significantly improving straight-through processing (STP) rates. SmartStream AIR requires no training or configuration and is easy to onboard. Users simply upload raw data to the application, in any structured format. The application then matches the information using unsupervised AI.

AIR is just one of the cost-efficient solutions to come out of SmartStream’s innovation strategy to help data-rich, time-poor banks meet every-day challenges. In Kaddoura’s view, banks save significantly when partnering with a fintech like this, compared to developing or building upon a product themselves.

“I think there should be a neutral, fundamental look by institutions at what they need to do internally, from a

technology perspective,” he says. “The infrastructure costs for an institution today of doing everything itself is going to be phenomenal, and I don’t think, with the current economic challenges we are facing globally, it makes any business sense. I mean, it’s defeating the purpose. Banks and other institutions spend millions of dollars, only to realise, one or two years down the line, that they should have done it through somebody who actually does it for a living. There are many small and large companies like ourselves, that are profoundly proficient at what we do. We are the experts.”

The logic of using SmartStream AIR specifically is that it can be deployed within hours – not through the IT department, but by onboarding users directly to the Cloud-native platform, which picked up an award this year for its intuitive user interface (UI). The prestigious Red Dot Design Award was the first to be given for a financial reconciliation solution, beating off 20,000 entries submitted worldwide. Previous winners include the likes of Apple, IBM,

Banks

Samsung, ING and BMW.

In November, SmartStream also won a Fintech Finance ‘Wow Moment’ Award for Data Insights.

By combining human and artificial intelligence, organisations can better manage their workforce, says Kaddoura.

“People are increasingly work-from-home orientated, skills can leave an organisation with the churn of staff and there is a very real need to free up the people you do have, to carry out higher-value tasks. A more innovative approach is required.”

Such a Cloud-based service comes with efficiencies built in. No longer do you need a warehouse full of people in order to handle the huge volumes of

information being generated by data-rich payments that must be screened and reconciled; delivery is streamlined, more accurate, cheaper and, importantly, achieved with less impact on the environment, according to Kaddoura.

“Environmental efficiencies within the industry are not a matter of ‘if’ anymore. I think we’re all heading in that direction,” he says. “Multi-tenanted centres, moving to the Cloud, all helps in conserving and reducing the impact we leave on the environment.

“By unifying clients’ requirements, we are already moving towards greater, more efficient processing and some of the new processes and physical technology infrastructure changes will, I think, help us reduce our own footprint even further, and help our clients see the value, from an environmental impact perspective.”

AIR is testament to the work conducted by SmartStream’s Innovation Lab, which is based in Vienna and staffed by a cadre of research and data scientists, and technologists, who work alongside clients to drill down into their evolving priorities, then apply AI to solve them.

“With the advances in digital payments, the volume is just exploding globally. Institutions in unconventional markets are demanding the ability to handle 100 million transactions a day,” says Kaddoura.

“Our innovation team looks at enhancing our value proposition for clients, building that efficiency, the ability to handle masses of transactions. The focus going forward will be on reducing the cost of infrastructure for those institutions: the ability to upgrade, move quickly, lowering the cost of ownership for our clients; helping them with their regulatory compliance, as much as possible.”

The SmartStream approach, he says, is a pragmatic response to a long-standing problem; a way to reduce costs through mutualisation, albeit it through an external supplier.

“Many of the clients we see seem to have a similar problem, yet the basic notion of cooperating together to solve it appears not to be feasible,” says Kaddoura. “Therefore, it has to come through a third party like us. We look at our research offering in the reference data space and offer it to those that need it.”

That’s got to be good for business – and the environment.

9 ffnews.com Issue 26 | TheFintechMagazine

and institutions spend millions of dollars, only to realise, one or two years down the line, that they should have done it through somebody who actually does it for a living

The Fioneer spirit

The launch of SAP Fioneer in 2021 was a milestone in the long and distinguished history of SAP, the multinational, cross-industry technology leader that for 50 years has been at the forefront of developing enterprise application software.

Conflating the words ‘finance’ and ‘pioneer’, it’s a joint venture between SAP and Dediq, an entrepreneurial investor that focusses on digital businesses and information technology, and the aim is to accelerate the transformation across core banking, insurance and other members of the financial services (FS) industry.

The new company, which can be seen as both an extension to and a refinement of SAP’s existing business, was launched during a time of rapid change for FS. Due to the pandemic there has been an acceleration in the adoption of digital-first strategies and an increase in the demand for Cloud and platform-based businesses.

The banking and insurance industries have also recognised the need to quickly adapt and modernise in order to remain relevant in the digital economy and meet the expectations of consumers.

“We’ve built the SAP financial services business over more than 20 years,” says Dirk Kruse, SAP Fioneer’s CEO. “However, the marketplace has been unsettled by rapid changes and the amount of investment and capacity to go into products and portfolios. At SAP, we saw the need for change and wondered how we should organise our business, so that we can be the best innovation and transformation partner for our clients.”

In 2021 that thought process led to the creation of SAP Fioneer. “We took all the products, all the IP, all the experts, and much capital, and we invested it in a joint venture,” says Kruse. “SAP Fioneer is a carve-out, or ‘speedboat’, to drive innovation with energy and purpose. It’s a well-considered response to an industry challenge.”

While SAP’s technology and pedigree were unquestioned, the founders of SAP Fioneer knew that it would require a different type of enterprise – a leaner and more specialist organisation – to deliver the creative solutions being demanded by a rapidly changing financial industry. So while it carries the SAP name and is backed by all the resources of SAP’s global brand, SAP Fioneer is a standalone business. Or, to use Kruse’s phrase, separate but integrated. Underpinned by an ecosystem of handpicked, curated partners who help pull together collaborative solutions for financial services clients, it’s similar at first glance to pure-play FS providers Temenos’ and Finastra’s Cloud-based marketplaces.

But the big difference is that it draws on SAP’s experience in handholding clients in other sectors through digital transformation. Its USP comes from understanding how to transform enterprise business processes, not just the technology.

social and governance (ESG) principles and to demonstrate the highest standards in their operations. But, as global temperatures rise, so does the regulatory and stakeholder pressure on larger financial services companies to demonstrate corporate responsibility.

“ESG is a growing concern for our banking and insurance clients,” confirms Kruse, “and it’s a key element in our platform. From our conversations with clients and partners, we know there is a big demand for regulatory reporting from an ESG point of view. Data feeds, data providers and different data sources are all big discussion topics. In addition, most of our clients are concerned about data management – although they are collecting all the information, they don’t know how to manage it and build a single source of truth for ESG.”

So, SAP Fioneer has devised a way to deliver it through Sustainable Finance Data Hub: an integrated data pool that connects and harmonises external data sourced through partners in an ESG data marketplace with a bank’s internal ESG data. This ‘reliable, regulation-compliant single source of ESG truth within the bank’, will, ultimately, give rise to the SAP Fioneer Sustainable Finance Platform, which FIs can use for internal auditing and external reporting of climate-related metrics, satisfying both stakeholder and regulator demands for transparency.

System integration is a key part of the proposition – to bring everything together neatly in one place – and Kruse stresses that engagement and a close partnership with customers are crucial so that solutions always answer demand – at scale and at speed.

An excellent example of it rising to a topical challenge faced by FS providers, is how it’s helping them make the transition to ‘sustainable finance’.

Every company today is under scrutiny to embrace good environment,

With a global ratcheting up of climate-related reporting requirements –and countries shamed at the recent COP27 climate summit to make good on previous pledges to do even more – getting to grips with the ‘E’ in ESG is inescapable for

10 RESILIENCE & SUSTAINABILITY: DATA MANAGEMENT

TheFintechMagazine | Issue 26 ffnews.com

Going green: Missing or inconsistent data needs to be addressed

SAP Fioneer is a carve-out, or ‘speedboat’, to drive innovation with energy and purpose. It’s a well-considered response to an industry challenge

Dirk Kruse, CEO of SAP Fioneer, explains how this ambitious joint venture is focussed on helping financial services tackle one of the most pressing problems of our time… the thorny issue of ESG data management

financial institutions. But, speaking at Sibos 2022 in October, Ravi Menon, managing director of the Monetary Authority of Singapore, singled out the gathering of robust and trusted ESG data as one of the top two challenges for the financial services industry as it enters 2023.

“Sustainable finance is a powerful enabler for the net zero transition. High-quality, trusted ESG data is critical for comparable climate-related disclosures, management of environmental risks, and green and transition finance flows,” he said.

However, while quality data is foundational in the fight against greenwashing and in enabling relevant stakeholders to make effective ESG investment decisions, there was a significant gap between ESG data needs and the ESG data available, Menon added.

“We need good data on firms’ carbon footprint, historical carbon emission trends, and compliance with their respective transition targets. We also need data on the climate-related risks their physical assets are vulnerable to. But the ESG data acquisition process is often manual, tedious and costly. ESG data verification is at a nascent stage. This impacts the credibility of reporting. Fintech can be a key enabler in addressing these ESG data challenges.”

Kruse would like to think that SAP Fioneer’s Sustainable Finance Data Hub fits that description. It enables banks to handle their end-to-end ESG challenges centrally

across their business units. In addition, it includes a Sustainable Finance Workplace, which consolidates bank-integrated ESG applications, such as climate risk stress testing, ESG advisory, and emissions management and steering.

“The Sustainable Finance Data Hub is a platform solution we would like to offer to all our banking and insurance clients,” says Kruse. “To have this single source of ESG truth, and to be open to all the reporting providers, with SAP integration, is a versatile and powerful tool. We also want to be open, so that other reporting solutions can sit on top.”

What makes the hub unique, he says, is that it does more than simply connect to data feeds – it also informs decisions and opens conversations.

“It’s essential in financial services, especially the banking industry, to collect a diverse range of data, particularly in the credit and lending process,” he says. “In order to provide sustainable finance data on environmental, social and governance (EDG) issues, you will need to offer a user interface and integrate it into your loan origination process. This is because there will be no data provider that offers specific information on, for example, a wind park in the North Atlantic. “You have to capture that information yourself. So we’re building a user interface that allows you to incorporate your data and data feeds.”

That external data is sourced through SAP’s

ESG marketplace, and a clear audit trail is embedded in all banking processes. Notably, the solution also allows banks to collect client ESG data, which, according to a recent SAP Fioneer white paper

The Challenge Of Sustainable Sustainability: Accelerating The ESG Transformation In Banking is ‘a pressing use case at the moment for banks’ because ‘data availability from public and proprietary sources alone is insufficient in coverage and reliability in order to fulfil a bank’s ESG requirements’.

Client data collection consists of an easy-to-navigate frontend, pre-filled with existing internal and external ESG client data. This minimises manual input and, in particular, the time a bank might need for a corporate customer to provide ESG data.

Any bank currently employed in the task of compiling a carbon dossier on its clients in line with risk exposure audits or net zero alignment pledges will tell you that it’s an all-consuming task. But SAP Fioneer’s solution goes further by using ESG-trigger points to create an ESG advisory dialogue, which will help banks and their customers to accelerate ESG business transformation together.

A data collection and advisory workbench analyses client data and will alert relationship managers to the potential advisory needs of corporate clients, enabling bank sales teams to identify opportunities for ESG support.

SAP Fioneer’s ESG project is an early example of how it understands the pressures and competing demands that financial services companies face today and can focus the skills and energy of itself and its partners in a highly targeted way to support them.

In addition, the team is building a strong ecosystem of co-developers that will allow it to undertake many similar projects, says Kruse. “We’re building an inclusive, open, future-fit platform for our customers, prospects and partners,” he adds.

“The future is about ecosystems and platforms as a service, and SAP Fioneer is showing the way forward.”

11 ffnews.com Issue 26 | TheFintechMagazine

Evolve without fear of cyber attacks REAL SECURITY IN A VIRTUAL WORLD Mitigate risks and continually improve your organisation’s resilience with Dionach’s breadth of cyber security services. Dionach help you to understand your cyber security risks as a strategic cyber security partner. Schedule a free 30-minute consultation with us hello@dionach.com +44 1865 877830 dionach.com Penetration Testing Red Teaming PCI QSA Services ISO 27001 Consultancy Incident Response (CSIR) Security Auditing Security Consulting

Back in 2007, the revamped Eurostar line between London and Paris was unveiled. The £6 billion project, which included the revival of London’s St Pancreas terminus, would shave 40 minutes off the journey time between the European capitals.

This was money well spent, according to the organising stakeholders, who anticipated a 25 per cent increase in traveller numbers before the end of the decade. But when that boost failed to materialise, the project’s value for money was called into question. As behavioural economist Rory Sutherland has noted, for a tenth of the project’s budget, Eurostar could have hired all the world’s top male and female supermodels to patrol the train handing out free Château Pétrus, and people would have demanded the trains be slowed down.

Here, Sutherland hits on the key issue that has always plagued the mobility sector. People don’t choose their mode of transport based soley on each journey’s cost and duration, but on a litany of factors

which, in today’s world, include COVID security, relative emissions, and even how the journey makes them feel.

That’s a truth well understood by MaaS Global, a developer of mobility software that launched its app, Whim, in 2016. The Whim app connects users with every option in a city transportation network – including trains, trams, buses, taxis, bikes and e-scooters – via a pay-as-you-go model or a monthly subscription. The stated aim of the app is to ‘create a world where you don’t have to own a car to live a fulfilling life’, in recognition that easy, omniplatform access to the full spectrum of a city’s mobility options is enough to nudge users away from their private vehicles.

It’s little wonder that the concept of ‘mobility-as-a-service’ (MaaS) was forged in Finland, where there are an estimated nine cars in use for every 10 people. The EU average is closer to five cars per 10 people. Whether informed by Helsinki’s traffic hell or not, Whim has ambitions to take a million cars off the roads by 2030, finding in a 2021 poll that 12.5 per cent of its Finnish users had already got rid of their car, or avoided purchasing one, thanks to the app.

Whim launched in Birmingham in 2018, and has since expanded to several other European cities. It’s also present in Japan and Singapore, being hailed as ‘the

Netflix of public transport’ by Singapore’s press on the eve of its launch in the city-state. Like Netflix, Whim’s service is all about providing choice, on demand. And like streaming services, Whim relies on tech partners to make its offering as attractive and practical as possible, including when it comes to ease of payment.

In 2020, Whim set its sights on issuing a card that could be used alongside its app. The MaaS pioneer found a natural partner in Enfuce, the Helsinki-based card-as-a-service (CaaS) fintech, also founded in 2016. Both firms are confident that friction-free services, offered with friction-free payments, could be the incentive consumers need to finally drop their private vehicles.

Underpinning the entire MaaS movement is the understanding that a true shift in our mobility habits will only take place when public transport becomes a genuine alternative to cars – not just in terms of price and journey duration, but in terms of simplicity, ease, and reliability. No one understands this better than David Hensher, founding director of the Institute of Transport and Logistics Studies at the University of Sydney and a pioneering MaaS scholar.

13 RESILIENCE & SUSTAINABILITY: MOBILITY-AS-A-SERVICE

on ffnews.com Issue 26 | TheFintechMagazine

Moving

Alex King explores how mobility as a service could be morphing into a broader embedded concept

“MaaS will only have a future if it changes the travel behaviour of a sufficient number of people,” he told Mobility Payments. Having worked closely with MaaS Global, monitoring the adoption of the Whim app in different jurisdictions, he believes MaaS approaches should now shift onto a new track to appeal to more people. “At the moment, we are not seeing anywhere in the world at all that [MaaS] products are getting people out of their cars in any significant way,” he said.

Sampo Hietanen, founder and CEO at MaaS Global, recently charted the evolution in his thinking in a LinkedIn post. “We tend to be a bit arrogant in this industry, thinking that things will integrate to us. It just might be that it works better if mobility is embedded into all other services.

“If you think of mobility from the perspective of the user, it is there to support the real things of value. Those things are at the destinations. So it's obvious to make mobility a part of every offering out there.” What he’s getting at is the need for services like Whim to not just be a Pandora’s box of travel options, but to wrap themselves around experiences – such as going on a city break, or travelling to a wedding – in such a way as to make those experiences more satisfying.

This ‘second generation’ MaaS approach was recently explored in a report from consultancy firm BearingPoint. Hearteningly for Hietanen and Whim, their Destination 2030 study found that 81 per cent of those surveyed believe they will prefer to use a single app or platform for ordering and billing all their mobility-related services by 2030.

Echoing Hietanen’s thoughts, the report’s headline prediction is that, by 2030, every journey will be a personalised experience. “The time people spend travelling will increasingly be used as productive time for other activities that can be accessed online – shopping, entertainment, household

administration – enabling multiple service providers from different sectors to earn revenues.” Notice that these are activities one cannot perform when behind the wheel of a car.

So, the MaaS market is in a state of flux about the future. On the one hand, two ‘black swan’ events have arrived like London buses this decade: the COVID pandemic and the ongoing energy crisis created by the war in Ukraine. They’ve upended the market. On the other hand, MaaS is a fledgling, active research area. Despite early successes, it is still finding its feet, its business model, and its customers.

Only in July 2022, a study by BIS Research estimated that the MaaS market would generate $379.66billion in revenue by 2031, at a CAGR of 25.7 per cent. That’s nearly a

proposes a role for energy companies and the automotive industry, too.

All this is to say that there are many moving pieces, but they appear destined to come together. MaaS Global, meanwhile, is not waiting on the platform, staring longingly down the tracks. Whim, and its founder, are busy building the platform, scaling up the ticket office, and exploring partnerships that touch on that sentiment from Rory Sutherland: that we’re irrational creatures and that we make decisions based as much on our feelings as on the facts.

Eurostar would eventually meet its traveller number aspirations in 2019, hosting 11 million passengers between London and Paris. In a cruel blow, the following year would see a 95 per cent reduction in traffic due to pandemic travel restrictions. The service remains far from a full recovery, with its future hanging in the balance.

BearingPoint’s Destination 30 report

tenfold increase from the $39.23billion in revenue the market generated in 2021. These projections take into account increased urbanisation, soaring costs, environmental concerns, and planned infrastructure projects.

The Destination 2030 report offers a glimpse of the facilitators that will take us from these global mega trends to global habit changes. It acknowledges that policy and legislation will play a part, for instance in the phasing out of domestic flights. It hints at new insurance models and novel integrated payments services, and

Yet Eurostar, alongside Europe’s Interrail ticket, is symbolic of successful collaboration across borders, systems, and services, making mobility simpler for European travellers. A mammoth undertaking with a lofty ambition, it too shrugged off the naysayers to prove that, in mobility, what really counts is the connection. What Eurostar achieved on the continental scale is now taking place on the metropolitan one, with trailblazers like Whim positioned to drive this growth market.

All trends point to a future in which MaaS conquers global transport, spreading between cities, then countries, then continents. It’s a future in which every door-to-door journey can be planned and purchased through a single app. In this future, you’d expect, Eurostar will cement its role as a simple, seamless and sustainable way to journey between the British Isles and the European continent.

14 RESILIENCE & SUSTAINABILITY: MOBILITY-AS-A-SERVICE TheFintechMagazine | Issue 26 ffnews.com

81 per cent of those surveyed believe they will prefer to use a single app or platform for ordering and billing all their mobility-related services. By 2030, every journey will be a personalised experience

www.intix.eu Want to mitigate the impact of incidents before clients come back to chase you? Need to get a 360-degree view on payments and their context? Want to enjoy instant access to transaction details? Know your transaction (KYT) as deeply as possible Find the needle in your transaction haystack Fix the friction in your transaction flow Smart, contextual and real time. ING, ING & ING YOUR TRANSACTIONS

Which way now for Generation Rent?

Adjoin Homes is among the newest of the proptechs trying valiently to solve the dilemma facing thousands who’d like to buy their own home, but can’t. Founders Marios Tsatsos and Kostas Zachariadis know exactly how that feels

You need a big brain to make sense of – and more so to predict – the current UK housing market.

Even those closest to it have been serially wrong-footed over the past two years: properties flying off the books, unseen, during lockdown when agents anticipated sales would stall; forecasts of a post-pandemic cooling that’s only now beginning to materialise; landlords cashing in their chips (13 per cent sold up between July and October 2022, according to Propertymark) when you might have expected them to be adding to portfolios as rents hit record highs. In London, they even crossed the average-£2k-a-month pain barrier for the first time.

Whether you’re an active first-time buyer – most likely in your mid-30s – who’s finally saved, or sadly inherited, a minimum five per cent deposit and is now miserably failing affordability tests as lenders move the goalposts, or (more likely) you’re resigned to being a lifelong member of Generation Rent and in a bidding war with another 12 prospective tenants for your next home, you probably feel cheated, even resentful, that others are profiting from property at your expense. There must be a solution, but you can’t figure it out.

Enter not one but two big brains, who think they can. The first is a doctor of atomic science and quantum physicist who, in 2020, had just started a company applying deep learning to data in commercial real estate. The other is a professor of financial economics with a particular interest in market design using game theory – a branch of mathematics that can be, and has been, used in real estate to analyse the impact all the

interactions between various actors have on the way that market behaves.

“In 2020, I had a really good job at a university and a stable income, but still could not buy a home in central London after 12 years of renting,” says Professor Kostas Zachariadis.

Given his background, he couldn’t help but think there must be a way for him and thousands of others renting in the city to get something back from their investment (there would be no rental market without them, after all) and perhaps even bring them closer to owning a home of their own. He just needed to harness the right data and hitch it to a pricing model that worked.

The vehicle for that was Adjoin Homes, the proptech he co-founded in 2022 with Dr Marios Tsatsos.

It’s what’s been referred to as Real Estate 3.0. The first wave used technology and the internet to give the public access to data on real estate that only the industry had been privy to, and to provide matchmaking platforms for buyers and sellers, landlords and renters. The second wave digitised and accelerated the transaction process, making it a lot more transparent and cheaper to rent and buy. The latest innovations, which include but are not limited, to fractional ownership, could potentially allow millions to share in property wealth in a myriad of ways, in both the domestic and commercial space.

There’s less evidence of Real Estate 3.0 happening in the UK than there is in the US; it’s where, for example, former WeWork founder Adam Neumann is now directing his attention with his latest startup, Flow. But Adjoin is typical of them in that it breaks with convention. It believes the question ‘do I rent or buy?’ is academic when you could do both, simultaneously.

Many would argue that the current dysfunctional state of the UK, and, indeed, US housing markets, is a due to an imbalance between supply and demand that could be corrected in the UK by building 145,000 new affordable homes each year to 2031, according to the National Housing Federation and national homelessness charity Crisis, while America is short of five million.

While that’s true, Adjoin is among an emerging category of startups in the foothills of what others say is another answer: a home ownership revolution.

Its flexible product is not, say Tsatsos and Zachariadis, a digitally rehashed version of traditional rent-to-buy schemes. Instead, the tenant shares in the property price appreciation, relative to a minimum pre-agreed price, as if they had owned part of the home to begin with. Their share is stored in the ‘Adjoin Wallet’, which is used as a discount against the purchase.

“If the value of the property falls, they still have the right to buy, but at the minimum pre-agreed price,” says Zachariadis. “Meanwhile, the landlord enjoys a higher rental income, a tenant with skin in the

16 NEOS & CHALLENGERS: PROPTECH

TheFintechMagazine | Issue 26 ffnews.com

Ultimately, the aim is to help people on both sides – the tenant and the landlord

Dr Marios Tsatsos

Moving on:

Real Estate 3.0 broadens the concept of home ownership

past 30 years, according to the Resolution Foundation. Before the pandemic, in London, it was taking them an average of nearly 16 years to save a deposit. While the problem is most acute in the capital, half of the enquiries Adjoin has received are from other major cities where the startup’s price forecasting model could be adapted to cater for specific micro property markets.

Unlike Divvy or HALO in the US, which are built on a similar wealth-sharing premise but are aimed at a less affluent demographic, Adjoin does not currently invest in property itself. Instead, it works with existing private landlords and institutional property investors.

“It’s actually a good time to put up such a value proposition,” says Tsatsos. “As we enter a recession, we see bigger landlords, institutional developers, who have stocks of flats, interested in our product because it allows them to hedge against a downside. We’ve also seen big London developers switching to rental rather than selling because they think it’s the right time to diversify.”

game, and a potential buyer in place, without having to pay extra commissions or face lengthy negotiations.”

The challenge is to strike the right balance between incentivising the tenant and protecting the landlord. That’s where Adjoin’s proprietary AI and data-assisted expertise in selecting properties that are likely to make incremental gains, and forecasting their valuation years hence, is key.

The model is still evolving as Adjoin works towards launching a platform, but the team says it will deliver superior yields to landlords while giving tenants security of tenure at a fixed rent while they build up equity. “If I’d used Adjoin when I started renting my apartment in London in 2009, I’d have £100k in my Adjoin wallet now,” says Zachariadis.

No wonder it’s attracted a waiting list, the majority of whom are high-earning, professional couples with no kids.

“If they hadn’t joined Adjoin, they’d have rented for another 10 years. For them, like me, it’s a 100 per cent loss,” he adds.

Home ownership among young people in the UK has fallen by nearly half over the

Given the squeeze on yields and the prospect for many of coming out of fixed buy-to-let mortgage deals into a high-interest environment, many individual landlords are also unsure whether to sell or hold. Adjoin allows them to optimise their strategy and buys them some time.

The value is all in the data and the AI property inspections.

“We are not looking for black swan properties,” says Tsatsos, “rather ones that will perform for landlords and tenants who want to sell or buy any time between two and eight years and which will, at least, keep pace with inflation. We have a very specific data model that supports that.

“It’s a new paradigm in home ownership,” Tsatsos maintains. “While we give people the option to buy, it’s more than that – it’s the ability to share in housing wealth.”

And that, for Generation Rent, would be a quantum leap.

17

ffnews.com Issue 26 | TheFintechMagazine

If I’d use Adjoin when I started renting in 2009, I’d have £100k in my Adjoin Wallet now

Prof Kostas Zachariadis

Growing smarter

Two-year-old Oxbury Bank is alone among UK agtechs in having a full banking licence, allowing it to finance digitally literate and data-rich businesses, based on a unique set of environmental metrics. It's a lonely furrow, but it looks set to be a profitable one

To all appearances, it doesn’t seem like a propitious moment to be the UK’s first agtech bank.

The soaring cost of fertiliser, feed and fuel combined with a messy divorce from the EU that has seen up to £60billion of

produce left to rot this year for want of foreign hands to pick it, is hammering farm businesses.

But you reap what you sow… and even before its launch on January 29, 2021, Oxbury Bank had been intensively

cultivating the technology that would make its lonely furrow highly productive.

As it closes its books on only a second full year of trading, signs are that it’s already broken even. In 2023, Oxbury is forecast to turn a profit.

18 NEOS & CHALLENGERS: AGRICULTURE

Circular economy: Oxbury's use of data is helping clients with the transition to net zero

TheFintechMagazine | Issue 26 ffnews.com

That’s possibly the fastest route to being in the black since OakNorth –also a retail savings and business lending bank – which hit its goal in a remarkable six months. Both were born of a frustration with legacy bank’s attitudes to funding growth businesses, and both have taken a tech-enabled, peopledriven approach to breaking the mould.

Oxbury puts muddy feet on the ground, while its Cloud-based, API-ready system is busy winning awards. The latest was a British Banking Tech Award for Best Use of IT for SME Lending with Oxbury Farm Credit. Described as a ‘unique input finance facility’, it’s a flexible working capital product that allows farmers and growers to buy essential materials through an approved list of suppliers as they need them and settle up when it suits their cash flow. Invoices are automatically uploaded to the bank’s online platform, which is integrated with its suppliers, so customers can review their account in real time, query and pay bills, make repayments on their credit and monitor monthly outgoings.

While that’s key to keeping the tractor wheels turning, it’s also important in helping the sector reach another, important, goal – achieving net zero.

According to a survey published by NatWest in August, 99 per cent of UK farmers were hit with above-inflation input costs last year that had forced them to put climate action on hold. At the same time, an overwhelming majority (88 per cent) were at least somewhat worried about the impact climate change was having on their industry. That led NatWest to announce a £1.25billion lending package for the sector while also ramping up its support around sustainability.

Virgin Money, meanwhile, has also launched a £200million fund to help farmers decarbonise. In its own survey, 72 per cent of businesses wanted banking products tailored towards sustainability; 22 per cent said they’d been asked by customers to provide evidence of emissions.

Farmers are right to be worried, says Oxbury Bank MD Nick Evans, because how they manage their business today will materially impact their profitability in the future as customer demands, lenders’ attitudes and environmental regulation becomes stricter around their impact on the planet.

Oxbury itself voluntarily published its first disclosure report under the Taskforce for Climate-Related Financial Disclosures (TCFD) framework in late December.

In it, it revealed that the closing 2021 loan portfolio of £102,476,672 saw 70 per cent of lending by value directed at climate-related opportunities.

As high street banks in the UK struggle to get to grips with interrogating their legacy loan books in order to meet climate-related financial disclosures, Oxbury set out from the beginning to automatically collect granular data from Cloud-based farm management and other apps, bring that information to the core banking system and attach it to the farm record. Once there, it’s used to not only improve the bank’s risk assessment process but also assist clients in their transition to net zero. The National Farmers Union has said the industry will achieve that goal in 2040 – 10 years ahead of the government’s ambition.

While agriculture itself is responsible for 10 per cent of total greenhouse gas emissions in the UK – mostly nitrous oxide

to make sure we’re happy with its performance now and that we’re going to be happy with it in 15 years’ time, because, if a farm is not on the right [sustainable] trajectory, there’s a danger that it will not be able to sell its produce in the future.”

Speaking at the Altfi Green Lending Event in November, where he shared a platform with Funding Options and Tandem bank, Oxbury co-founder and chief customer and regulatory officer Tim Coates, said it was important that the bank incentivised its current and future customer base to share data because ‘better information means lower risk’. “And this is where fintech, I think, is really involved, because that is about quality information data transmission between customer and lender,” he added.

For the forward-thinking bosses that Evans says the bank is managing to attract, data-driven farming is not an alien concept and they are willing to exchange one valuable commodity for another: information for access to cash – increasingly so as agriculture moves towards Industry 4.0.

A record £1.3billion in agritech deals were signed in the UK in 2021, supporting technologies such as drones and vertical growing systems, that offered solutions to rising input costs, food security and the transition to nature-positive farming.

Farming is, in all respects, a growth industry, says Evans: “I thought that in 2018 when we started looking at Oxbury Bank and I’m even more sure now of the opportunities for farmers and growers.”

and methane while only accounting for about 1.7 per cent of total CO2 – it’s the farmed landscape’s ability to lock in carbon through soil and woodland sequestration that makes the industry a key warrior in the fight against global warming. According to a 2019 report from the Intergovernmental Panel on Climate Change, global farmland can capture and store the equivalent of up to 8.6 gigatons of CO2 a year, and the world released around nine gigatons of it in 2020.

Soil carbon is one of a number of indices that Oxbury Bank captures from its client farms.

“We’re in the process of putting together metrics to benchmark each,” says Evans. “We use the data to risk assess the farm

Most recently, the bank launched Oxbury New Gen specifically to support startups in the agricultural sector whose founders are aged between 18 and 40, addressing what is historically, one of the biggest barriers for new entrants to climb. The bank funds successful applicants at up to 100 per cent of their cash flow requirements.

These new founders will be drilled with the mantra ‘if you can’t measure it, you can’t manage it’ and will, of necessity, become accustomed to collecting and sharing the environmental data on which Oxbury will base its future lending decisions.

In that way, says Evans, the bank will ensure that there are not just enough farmers for it to keep ploughing its particular furrow, but that it will also be among the greenest.

19

ffnews.com Issue 26 | TheFintechMagazine

If a farm isn‘t on the right [sustainable] trajectory, there’s a real risk it will not be able to sell its produce in the future

Nick Evans, Co-founder & MD

Fintech Hollywood

Hannah Duncan relives what’s now established as the glitziest night of the fintech year

Stepping into the FF Awards at the historic Old Billingsgate building was a welcome contrast to the wintery London streets. Guests were bedazzled by paparazzi cameras, ushered towards deep red carpets and welcomed with sparkling flutes of bubbly. YES! From the swoosh of ball gowns to the jangle of jewels, the vibe was invigorating. Lights, camera… fintech!

Naturally, I asked a few attendees the obvious question. If the FF Awards ceremony was a drink, what would it be?

“A soupe de champagne with curaçao,” shrugs Zumo’s Amelie Arras like it’s the most obvious thing in the world. God, how we love her. “Why? Because the finalists are champagne calibre, the curaçao is a twist… and, besides, blue is the colour of trust,” she finishes.

“An American red wine,” proclaims FF’s Doug McKenzie in his kilt. “Because there’s lots of it about, plus it’s loud and fruity!” Doug and the rest of the FF crew had painstakingly set up the entire event – it was the second time Fintech Finance had handed out the Wow Moment awards and more than 500 people were there to enjoy it.

RED CARPETS AND FINTECH ROYALTY

Jacket of the night surely had to go to Kevin Emery, gobal cybersecurity director for UL Solutions. He sported a card-themed look which was anything but undercover. I caught up with him to ask what Hollywood genre would match his outfit and Kevin did not disappoint. “It would be for sure an action

movie. I actually think Hollywood should make a movie about my life. Happy to have Jason Statham or Tom Hardy play me.”

Gabriella Trow, head of marketing and demand generation at Vitesse, also stood out in a turquoise gown with The Little Mermaid meets Morticia Addams vibes. Impossibly elegant. Fintech royalty floated past like grand ships. We ogled at the iconic Jim Marous in his red hot bow tie and glittery trainers (legend). We peeked over shoulders at the illustrious Chris Skinner – who also had fabulous shoes… did we miss a trend here? And we were drawn to the magnetic Leda Glyptis who never fails to light up the room.

At one point my guest and brother, Toby – who is a junior doctor and not a fintech person – commented, “John Bercow is standing behind you.” Obviously, I ignored him the way all big sisters should. But sure enough, when I swiped a look later, there he was. The man best known for bringing MPs in line as Leader of the House by bellowing “ORRRRRDEEERRRRRRRR!!!!” was now calmly enjoying a duck appetiser with Fintech Finance founder and host Ali Paterson. Ali had that slight look of “What if he shouts at me to behave?” Totally understandable.

As the night got underway, we swished over to our tables for some juicy fintech chat over a lovely meal. I sat next to Hokodo’s Lucy Heavens who looked like a Chanel advert in a floaty black ball gown. Serene.

Modulr kindly provided a tote bag of treats (thank you, Modulr).The toothbrush, socks and laptop cover proved surprisingly useful and have since become remarkably integrated in my daily life. Nice one!

20 THE FINTECH FINANCE AWARDS 2022

TheFintechMagazine | Issue 26 ffnews.com

AND THE AWARD GOES TO…

Before we knew it, excited hushes and shhhes filled the room. Ali took to the stage, looking fierce in his kilt (has anyone ever seen Ali wear trousers at these events?) to launch the awards and introduce the HILARIOUS Channel 4 presenter and comedian Alex Brooker to lead proceedings and introduce a roster of special guest presenters. Among them, Frank Abagnale, the original ‘social engineer’ and conman, author of Catch Me If You Can, was beamed into the room from his home in the US – as was Ghela Boskovich – you could just see the back of my head in her video. I swelled with pride.

I n an industry where so many innovations are changing the way people and businesses do banking, the event was an exceptional way to recognise the firms that are delivering solutions at speed and scale Jim Marous

We clapped, whooped and raised our glasses for the winners, none of whom had been prepped for their award – and were, genuinely speechless, as in they had no speeches. I managed to quiz one, Jinesh Vohra founder of Sprive, which helps homeowners in the UK be mortgage-free faster, about how he felt. “Surprised but proud!” he replied. “Going on stage was a bit of a blur – it happened so quickly! I just went through such a range of emotions from ‘is this really happening?’ to ‘what am I going to say?’.” We’re proud of you guys, too Jinesh!

Tall order: Fintech podcaster and reviewer, the lofty Stuart Thomas

DANCING THE NIGHT AWAY

The sparkling surprises and jaw-dropping royalty kept on coming. Like a conveyer belt of Marvel heroes. Noughties mega group, Liberty X, strode onstage decked out in leather and heels. As that infamous beat started up, I grabbed my guests and we hit the dance floor. All around us, cameras twinkled and spotlights whooshed as the girlband belted out their top-10s. Across the venue, guests’ faces lit up as they chattered about the night’s events. I caught up with some of fintech’s finest to ask more. “The FF Awards are an antidote to the established awards system”, elaborated Modulr’s bombastic Sergei Miller-Pomphrey, with his iconic Glaswegian cadence.

“They’ve got something brewing at FF that you don’t often see - it’s the people, the team, the spirit, the creativity, and Ali, the leadership. Sometimes heroes just need to tear everything down to build it all back up again!”

Sergei – if you don’t already know him – is kind of a ledge. He dances like there’s no tomorrow and once let me stand on his shoulders in some mud.

“The FF Awards was an amazing opportunity to see more than 500 of the brightest and best minds in financial services in one place,” fintech icon Jim Marous later told me. “It was also a great way to celebrate the best-of-the-best in 18 different categories.” Couldn’t agree more!

Award ceremonies can sometimes blend drearily into one, mulched down into a squishy memory. But not this time. Despite the free bar, the FF Awards truly were unforgettable. And made us all feel like stars. Now turn the page to to meet our fabulous winners.

21 ffnews.com Issue 26 | TheFintechMagazine

The FF Awards is an awards programme like no other. What’s not to love about celebrating WOW moments? Lucy Heavens

Brand icon : Top-to-toe style finfluencer Jim Marous

A moment to celebrate: Fintech author and thought leader Chris Skinner

It was THIS big!: We believe you, Leda

Glyptis

WOW MOMENT IN... CONSUMER BANKING

Starling Bank flew to the top for putting contactless control back into the hands of customers. When the contactless card use limit automatically increased from £30 to £100, not everyone was comfortable with the idea. This thoughtful fintech gave people the chance to change it back, or adjust the limit to whatever they wanted. Nice! It earned a ping of approval from customers and a WOW from our judges.

WOW MOMENT IN... BUSINESS BANKING

Nothing quite kills the buzz of going international with your business like cross-border payments. From start to finish, the whole palaver can be a major headache, especially for medium-sized businesses. Stepping in to give these guys a break is MultiPass. Our judges were impressed with the way the platform found a slick solution to a major problem and had rapidly expanded over the past year. Now let’s pop another champers and crank up the party anthems.

WOW MOMENT IN... EMBEDDED FINANCE

We love a fintech that gives power to the people… and so do our judges! This year it was the partnership between PPS and Sprive that made us go WOW. Together, these two techy tycoons created a service to help everyday homeowners pay off their mortgage faster. By putting just a few pounds a day towards their property, ordinary people can ditch debt faster and cheaper than ever before… where do we sign up?

WOW MOMENT IN... OPEN BANKING

We asked for a video. We asked for a WOW moment. And, oh Lordy, did we get it. Hearty congrats to Neonomics for their epic submission. It had everything. Lumberjack vest? Check. A kid rapping about fintech? Check. Dollar sign sunnies and office floor dancing? Double check. Neonomics have done some banging new things this year, boosting experiences for customers and streamlining processes. For the second year running, they are the Open Banking winners.

Special shout out to nine-year-old Penelope Matilde Fazlic who stole the show with her awesome rap skills. We love you!

WOW MOMENT IN... CROSS-BORDER PAYMENTS

Ahhh…. Partnerships. There’s nothing like a good collaboration to get things moving. And when it comes to cross-border payments, there’s one nifty fintech we can’t get enough of. This year, our judges were WOWed by Wise, whose partnerships in Turkey and Israel are the first of their kind. The submission won by a landslide. Nice one, Wise!

WOW MOMENT IN... ID VERIFICATION & KYC

OCR Labs came in with a very authentic video. Just two minutes of honest chat about democratising onboarding, beating fraudsters and the importance of facial recognition. This refreshingly different approach went down a storm with the judges. Many congratulations to OCR Labs for their plain and simple winning formula.

22 THE FINTECH FINANCE AWARDS 2022 TheFintechMagazine | Issue 26 ffnews.com

WOW MOMENT IN... DATA INSIGHTS

All jaws dropped when the UL Solutions team strolled up the stage. Kevin Emery’s jacket, described by Alex Brooker as ‘confident’, drew every eye in the room. Despite the garment’s casino vibes, the video entry by UL Solutions was all about conquering risk. The video had a surprising but welcome groovy background beat. We challenge you not to shimmy your shoulders as you watch it! Many congrats to the UL Solutions team on the memorable submission and jazzy wardrobe choice.

WOW MOMENT IN... AUTHENTIC ESG

Hand in hand with Parley for the Oceans, G+D created a unique payments card this year. Their new recycled plastic cards help to protect oceans and raise awareness of plastic pollution. But according to the team, it’s just the beginning. As well as putting forward this clever and thought-provoking idea, the team also delivered a Hollywood quality video. Surely, there’s only one word to describe this moment… WOW.

WOW MOMENT IN... WEALTH MANAGEMENT

Well, Temenos got straight to the point. No messing around here! Judges were plunged head-first into a product demo, and they loved it. The slick and seamless features – with a special focus on filtering options – stuck a chord with investors. Sometimes you just have to let the product speak for itself and that’s exactly what Temenos did. From time to time, we could all be a little more Temenos. Congrats to the team!

WOW MOMENT IN... BLOCKCHAIN

When the Nuvei team say they move fast, they mean it! Their memorable video lasted just 14 seconds! Filled with a rigorous clapping beat throughout – the kind that makes you want to get up and do an aggressive jig – the submission was powerful and to the point. With a video so very professional and Apple-esque and a proposition like no other, the judges were blown away. Go, Nuvei!

WOW MOMENT IN... INVISIBLE PAYMENTS

Bottomline presented a sleek submission about how its software protects users from ‘bad actors’… Was that a cheeky Hollywood pun? We hope so! The video was comprehensive and suitably geeky enough to grab the winning spot. The category may have been ‘invisible’, but Bottomline were the clear winners. The team sashayed on stage in leopard print, sequins and tuxedos… Looking every bit the legends they are.

WOW MOMENT IN...

ARTIFICIAL INTELLIGENCE

Shout out to the production team behind this silky smooth entry. SmartStream’s video was hypnotic to watch and informative to read. Like a gentle meditation video with educational qualities. Popping with facts and stats, the team explained why their ‘data-rich, information-poor’ campaign was a serious WOW moment of the year. Representatives came onstage to collect their award decked out in glistening gold. What a team and what a theme!

23 ffnews.com Issue 26 | TheFintechMagazine

WOW MOMENT IN... LENDING

Mambu went in strong, presenting its WOW moment as banking platform to startup Scroll Finance with a lot of serious detail. They’re serious about the benefits this new lending service will bring to people, and are looking to democratise home equity. The judges went crazy for it, and votes poured in. Nice one!

WOW MOMENT IN... INNOVATIVE INSURTECH

Presented by the white-tuxedoed Ron Rock from Jobs Ohio, this was a fiercely contested category. Hearty congratulations to INSTANDA and MLTPLY, who’s partnership over the past year was a real WOW moment. Magic happens when seed companies and startups are given a chance to thrive. That’s exactly that INSTANDA and MLTPLY are doing in the insurance world. Their ultimate WOW moment was developing a new fully-fledged insurance product in just six weeks – a record time. Go team!

WOW MOMENT IN... MOBILE PAYMENTS

Judges were WOWed with Enfuce’s video entry, which showcased how they create payments cards in a matter of weeks – whatever kind of card you need. The submission was smooth, cool and weirdly 80s reminiscent. With animations of rockets and astronauts, what’s not to love?

WOW MOMENT IN... PARTNERSHIPS

G+D again took to the stage, this time for its winning partnership with Netcetera. As soon the judges they pressed ‘play’, they were transported to a fiery video with motivational vibes. The content went on to provide a detailed overview of the magic partnership, that unlocks new security possibilities for customers.

WOW MOMENT IN... REAL-TIME PAYMENTS

Looking suitably festive in red and green, ACI Worldwide proudly picked up their trophy for Real-Time Payments. As their video explains, the planet has hurtled a million miles an hour towards instant transactions over the past years. Post-COVID, nobody has time to wait days for funds to clear. Pah! ACI Worldwide have been at the heart of this much-needed transition and are racing ahead to give us the real-time tech we need.

WOW MOMENT IN... BANK BUILDER

What do Revolut, Wagestream and Sage all have in common? They all use Modulr for their embedded payments. The team dazzled the judges with more of their stellar performance. Presenting the award was none other than former Leader of the House of Commons John Bercow! Join us in warmly congratulating Modulr – that’s an ORDEERRRRRR!!!

THE FINTECH FINANCE AWARDS 2022 TheFintechMagazine | Issue 26 ffnews.com

As competition hots up in cross-border payments and the correspondent banking network hits back, we ask three players from different sides of the tracks, how the explosion of new services will play out for customers

The cross-border payments and remittance marketplace has become increasingly crowded over time and that means that customers have a lot more options – in terms of both speed and costs – than they did 10 years ago.

As a result, the sluggish correspondent banking system has had to up its game in response to alternative payment service providers using different routes to speed up payments. One obvious example of this is Swift’s introduction of gpi for high-value international transfers through the correspondent banking network. There is also the now-mandatory adoption (since November this year) of the ISO 20022 messaging standard