Promoting African dignity & opportunities globally SPECIAL EDITION Minister of Economy & Planning MARIO AUGUSTO CAETANO JOAO LEADING ANGOLA’S DIVERSIFICATION & TRANSFORMATION AGENDA

11. IFAL New York 2022 - Profile His Excellency Dr Mohamed Irfaan Ali President of The Co-operative Republic Of Guyana

12. IFAL New York 2022 - Profile of H.E. Gaston Browne Prime Minister of Antigua

. IFAL New York 2022 - Profile of Hon. Dr. Terrance M. Dew Prime Minister, St. Kitts and Nevis

IFAL New York 2022 - Profile of HE Hon Philip Joseph Pierre Prime Minister of St Lucia

15. IFAL New York 2022 - Profile of HE Adama Barrow, President of The Gambia

16. IFAL New York 2022 - Profile of Hon. Mario Augusto Caetano Joao Minister of Economy & Planning

30. Mrs. Victoria Irabor & Depowa Uplifting the Wives of Fallen Heroes' By Extending a Helping Hand

Contents AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk 64. 5 Actions to Prepare African Countries Better for the Next Pandemic 53. Trade-driven Industrialization In Africa 41. Nafco: Sustaining Government's Legacy Through The Free School Feeding Program In Ghana 62. Africa Youth Leadership: Building Local Leaders To Solve Global Challenges 67. Nigeria Pitches Debt Forgiveness for Climate-Change Funding Plan 69. Statement By H.E. Cyril Ramaphosa, President of The Republic of South Africa on Climate Change 45. Spearheading Pipeline Transportation of Petroleum Products & Storage In Zimbabwe 56. Mastercard: Promoting African Innovation & The Digital Economy 23 18 38

13

14.

49 04 P A G E

Afric n Leadership

...A Publication of

Ken Giami

Founder & Executive Chairman

Group Managing Editor - Kingsley Okeke editor@africanleadership.co.uk

Editor - Kembet Bolton kembet@africanleadeship.co.uk

Head of Creatives - Joseph Akuboh A.

Editorial Board

Peter Burdin, London UK - Chair Nwandi Lawson, Atlanta USA - Member

Simon Kolawole, Lagos Nigeria - Member

Peter Ndoro, SABC EditorJohannesburg - Member

Frenny Jowi, Nairobi Kenya - Member

Brig. Gen. SK Usman Rtd., Abuja Nigeria - Member David Morgan, Washington DC USA - Member

Furo Giami - Chief Operating Officer / Executive Director

Boma Benjy - Iwuoha - Group Head, Finance & Administration

Sasha Caton - Manager, UK & European Operations

Ehis Ayere - Group Head, Sales & Business Development

Izuchukwu Samuel Ukandu - Manager, Client Relations & Partnerships

Amana Alkali - Executive Assistant to the Chairman

Samuel M. Elaikwu - Manager, Sales & Business Developments

Happy Benson - Director of Operations North America

Christy Ebong - Head, Research & Admin - North America

Stanley Emeruem - Business Development Managers

Muna Jallow - West African Rep for The Gambia and Senegal

Oluwatoyin Oyekanmi - Head, South African Bureau

Bernard Adeka - Head, Nigeria SS/SE

CORPORATE HEADQUARTERS

Portsmouth Technopole, Kingston Crescent, Portsmouth PO2 8FA, United Kingdom; t: 44 23 9265 8276 | fax: +44 (0)23 9265 8201 | e: info@africanleadership.co.uk w | www.africanleadershipmagazine.co.uk

AFRICA & REGIONAL REPRESENTATIVES

Abuja Accra Atlanta Banjul Bujumbura Freetown Johannesburg London Monrovia Nairobi Washington DC

ISSN 2006 - 9332

While great care has been taken in the receipt and handling of materials, production and accuracy of content in the magazine, the publishers will not take responsibility for views expressed by the writer

JOIN THE CONVERSATION www.africanleadershipmagazine.co.uk

FOLLOW US ON SOCIAL MEDIA

Facebook: African Leadership Magazine

Twitter: @AfricanLM

Instagram: @africanleadershipmag

LinkedIn: African Leadership Magazine

YouTube: African Leadership Magazine

...Identifying, Celebrating & Enabling Excellence in Africa

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

Magazine

The African Leadership Organization 05 P A G E

H. E. JOHN MAHAMA FMR. PRESIDENT OF GHANA H.E. MRS AMEEN GURIB-FAKIM FMR. PRESIDENT OF MAURITIUS

“It is always an honour to be in the companyofsuchdistinguishedfellow Africans, that the African Leadership Magazine events bring togetherAfricans who have committed their lives to changing the negative narrativeaboutourcontinent.”

“It is very gratifying that we now have an organization like African Leadership Magazine, which endeavors to promote good governance and impactful leadership in Africa - bring the best of Africa to theglobalstages.”

DR GOODLUCK JONATHAN FMR. PRESIDENT OF NIGERIA

“African Leadership Magazine has become a brand for Africa and I am pleased to be associated with it especially because of the caliber of AfricanLeadersonitʼsboard.”

H.E. JOHN KUFOUR FMR. PRESIDENT OF GHANA

“I believe people are more important than power and anything that promotes good people and leadership is what we need in Africa, and that is what African Leadership Magazineisdoing.”

H.E. JAMES A MICHEL FMR. PRESIDENT OF SEYCHELLES

“I wish to express my sincere thanks and deep appreciation to the African Leadership Magazine for the work that it is doing on the continent, and especially in advancing the cause of small Islands Developing states, Any effort aimed at increasing the visibility of the good workbeing done by leadership in Africa does positively impact on the continent and that is what the African Leadership Magazineisdoing.”

H.E. ERNEST BAI KOROMA FMR. PRESIDENT OF SIERRA LEONE

“I am delighted to be associated with the sterling work that the African Leadership Magazine is doing on the continent. Democratic governance is the elephant in the room, and the continent needs to reaccess its governance systems. The agenda on global sustainable development shows that Africans are lagging behind. Africa will need to reinvent its governance system with its youth growingpopulation.”

WHAT NOTABLE LEADERS ARE SAYING ABOUT AFRICAN LEADERSHIP MAGAZINE AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk 06 P A G E

P A G E

“I feel deeply honored to be associated with the African Leadership Magazine as it is a veritable platform to honor true service in Africa. I commend your efforts and assure you of my continued support and the support ofthegoodpeopleofLiberia.”

“African Leadership Magazine is doing a wonderful job of speaking for Africa and Africans. The magazine remain a good example of what young people in Africa can do in the world. Best wishes in keeping the Africandreamalive.”

“It is an honour to participate at this African Leadership Magazine's 2020 Ceremony, and I commend the magazine's focus to reshape positively, the dominant narratives about the African continent, especially towards the pursuit of peace-building and democracy on thecontinent”

“I thank you so much, African Leadership Magazine for the great work that you are doing for the continent. Your tradition of awarding excellence as I have seen in the line up of African Leaders who have received the African Leadership Awards, is something ver y commendable”

“The future of African people and improving the quality of Leadership on the African continent is my vision and I find in African Leadership Magazine - a true partner I am also happy that the African Leadership Awards is doing at a lower level, what I intend to achieve at the Head of State level. That is why I flew to Paris just to be a part of what you are doing here at the African Leadership Magazine”

“The African Leadership Awards truly captures the essence of my message which is that, success shouldnʼt be solely defined by wealth. It should be about the positive impact and influence that one has had in his community”

WHAT NOTABLE LEADERS ARE SAYING ABOUT AFRICAN LEADERSHIP MAGAZINE

DR. MO IBRAHIM Founder, Mo Ibrahim Foundation

MRS. ELLEN JOHNSON - SIRLEAF Nobel Peace Prize Winner & Fmr. President, Republic Of Liberia

MO DEWJI Tanzania Businessman & Philanthropist

H.E JAKAYA KIKWETE Fmr. President Of Tanzania

H.E DAVID MABUZA Deputy President Republic Of South Africa

AFRICANLMAGAZINE EADERSHIP

DR. AKINWUMI ADESINA President, African Development Bank

www africanleadershipmagazine co uk 07

African Leadership Magazine (ALM) has concluded its first-ever International Forum on African-Caribbean Leadership (IFAL) with five Heads of states from Africa and the Caribbean region attending and calling for greater cooperation among the nations and peoples of both regions. The forum, which took place on the margins of the 77th United Nations General Assembly (UNGA) at the iconic Harvard Club of New York City, also brought together over 250 business, political and social justice leaders to debate issues ranging from climate action, reparations, food security, trade and defence, among others.

The five heads of states who also addresses the forum included H.E. Dr Mohamed Irfaan Ali, President of Guyana; H.E. Gaston Browne, Prime Minister of Antigua and Barbuda; H.E. Dr. Terrance M. Dew, Prime Minister, St. Kitts And Nevis, HE Philip J. Pierre, Prime Minister of St. Lucia and HE Adama Barrow, President of The Gambia, ably represented by the Gambia Minister of Foreign Affairs. The event was therefore truly an opportunity for the regional leaders to build strategic partnerships, bilateral cooperation, as well as increase engagements in trade and investments, innovation and technology transfer, culture and tourism, and other sectors. The theme of the programme was - Redefining Trans-regional Cooperation for Sustainable Peace and Development.

The forum, which also featured two high-level panel sessions on the current state of governmental and economic policies impacting social institutions in Africa and the Caribbean countries, with three experts as panellists, namely- Van McCormick, Executive Director, International Economic Alliance (Havard); Hon Marlo Oaks, Treasurer- State of Utah; and Mr. Nathan Estruth, Former Vice President, Procter & Gamble. The second panel session took a different turn with focus on “Viewing the World from the Lens of Regional/Domestic National Security with Gen (rtd) William “Kip” Ward, Former Commander of US AFRICOM and US Colonel Sergio Do La Pena (fmr0 Deputy Assistant Secretary for Western Hemisphere, US Department of Defence as expert panellists.

The events also had a special awards presentation ceremony to honour and recognise African leaders who have distinguished themselves excellently in business and public service, as well as contributed immensely to the socio-economic development of their communities. The honourees during the International Forum on African-Caribbean Leadership (IFAL) included Mr.

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

IFAL NEW YORK 2022 09 P A G E

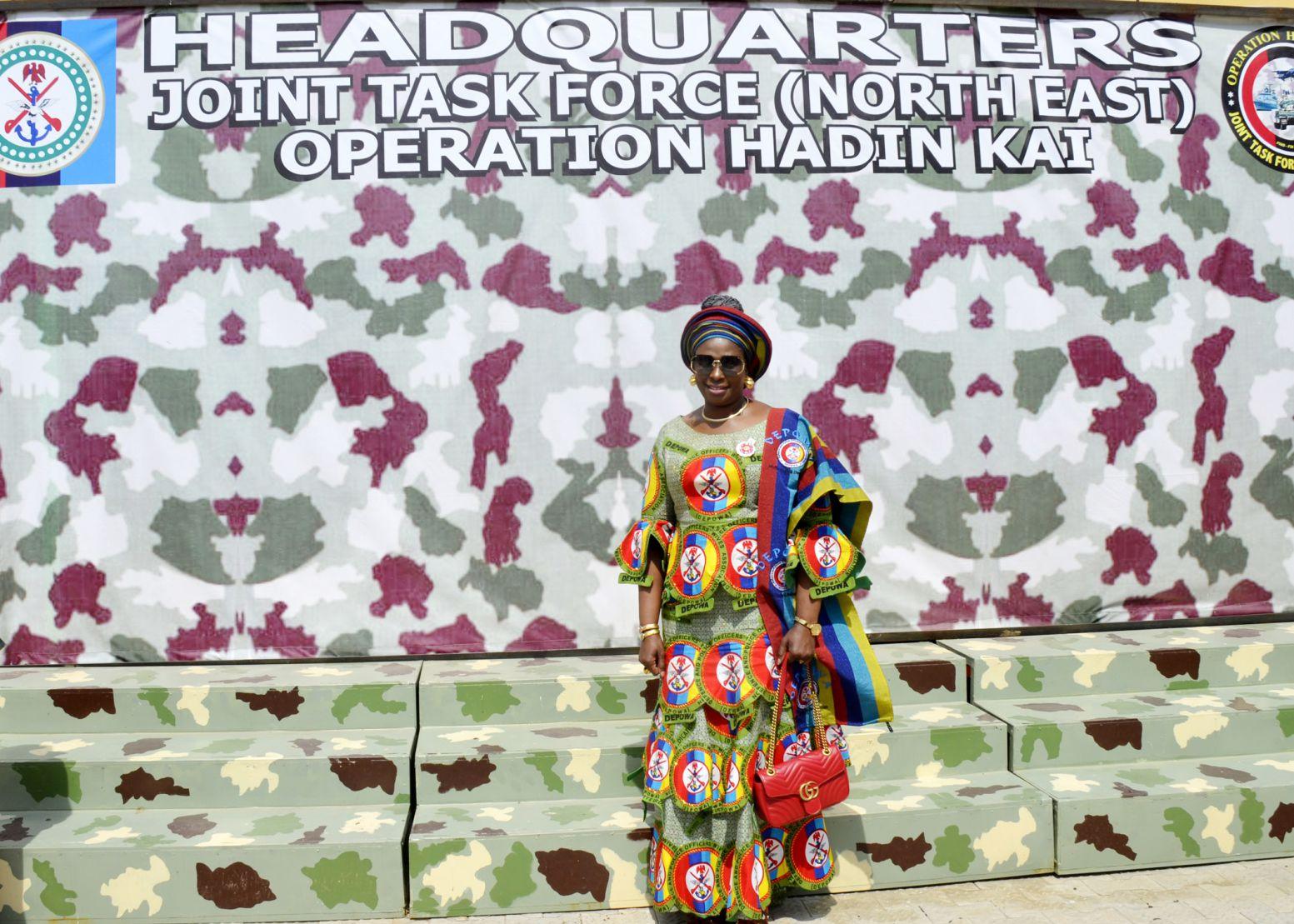

Hanan Abdul-Wahab, CEO, National Food Buffer Stock Company Limited (NAFCO) Ghana who received the African Business Leadership Commendation Award in Food Security; H.E. Mário Augusto Caetano João, Minister of Economy and Planning, Angola who received the African Public Service Excellence Award; and Barr. Mrs Vickie Anwuli Irabor, President of the Defense and Police Officers' Wives Association (DEPOWA) who received the SDG Advocacy & Mental Health Leadership Award. The other honorees included Mr Wilfred Matukeni, CEO, National Oil Infrastructure Company, Zimbabwe who received the African Business Leadership Excellence Award; and Mr José de Lima Massano, Governor, National Bank of Angola who received the African Public Service Leadership Excellence Award.

The International Forum on African-Caribbean Leadership (IFAL) is an ALM flagship event held annually on the sidelines of the United Nations General Assembly to bring leaders together in setting policy direction and as a peer review mechanism. Over the years, the event has become a platform that connects world leaders, especially from Africa, policymakers and private sector players with focus on the challenges and the progress of the African people. This forum which has been running for eight years and primarily focused on African leaders was expanded in scope for the first time to include Caribbean nations in a bid to strengthen trans-regional cooperation between Africa and the Caribbean nations.

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk IFAL NEW YORK 2022 10 P A G E

His Excellency

Dr Mohamed Irfaan Ali

President of the Co-operative Republic of Guyana

President of the Co-operative Republic of Guyana and Commander-in-Chief of the Armed Forces, His Excellency, Dr Mohamed Irfaan Ali, was sworn in as Guyana's Ninth Executive President on August 2, 2020.

Dr Ali is one of two sons of his parents, who are both educators. He was born on April 25, 1980, into a Muslim, Indo-Guyanese family at Leonora, West Coast Demarara,

His early education started at Leonora Nursery and Primary schools and progressed to the Cornelia Ida Primary School, while he completed his secondary education at the St Stanislaus College in Georgetown.

Dr Ali is the holder of a Doctorate in Urban and Regional Planning from the University of the West Indies, a Master of Arts Degree in Manpower Planning, a Post Graduate Diploma in International Business, a Post- Graduate Certificate in Finance from Anglia Ruskin University, an LLM Degree in International Commercial Law at the University of Salford and a Bachelor of Arts Degree (Hons.) in Business Management from the University of Sunderland.

He was also a member of the Canadian Institute of Management (up to 2017) and Project Management Professional-PMP (2006).

He previously served as Project Manager of the Caribbean Development Bank's Project

Implementation Unit in the Ministry of Finance and Senior Planner in the State Planning Secretariat. He became a member of the National Assembly of Guyana in 2006 and was subsequently appointed to the portfolios of Minister of Housing and Water and Minister of Tourism Industry and Commerce. During his time at the Ministry of Housing, he implemented the most extensive endowment campaign in the history of the country, backed by a massive distribution of lots to citizens of all social strata and geographic regions.

In the National Assembly, Dr Ali was also a leading spokesperson on the economy and finance. He served as chair of one of the most important committees, the Public Accounts Committee, and co-chair of the Economic Services Committee of the Parliament of Guyana.

Dr Ali is married and is a father

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

IFAL NEW YORK 2022 - PROFILE 11 P A G E

H.E. Gaston Browne

Gaston Browne is the Prime Minister and Minister of Finance, Corporate Governance and Public Private Partnerships. He is a graduate of the University of Manchester, United Kingdom with a Master of Business Administration (MBA), majoring in Banking and Finance. He served as Commercial Banking Manager for a major banking consortium in Antigua and Barbuda, comprising offshore and onshore banks and trust companies, managing in excess of US $400 million dollars in assets.

He became an elected member of Parliament in 1999 representing the constituency of St. John's City West and has been re-elected in four subsequent general elections.

PM Gaston Browne is well known for his philanthropic work which is seen through his contributions to the empowerment of the Point and Villa areas within his Constituency

In 2012, he was elected as Leader of the Antigua and Barbuda Labour Party which he steered to

victory in General Elections in 2014, becoming Prime Minister, and then again in March 2018, increasing its representation in Parliament.

Between 1999 and 2004, he served as Minister of Planning, Trade, Industry, Commerce and Public Service Affairs. While in opposition in Parliament between 2004 and 2014, P.M. Browne returned to the private sector as a businessman and launched several successful ventures to include Real Estate Development and Real Estate Management.

On becoming Prime Minister, the Caribbean Heads of Government appointed him to have lead responsibility for financial matters, cricket, aviation and derisking in the quasi Cabinet of CARICOM.

Prime Minister Browne is married Member of Parliament, Mrs. Maria Bird Browne and is the father of three children. He has special interest in soccer, crick and yachting.

IFAL NEW YORK 2022 - PROFILE AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

Prime Minister of Antigua

12 P A G E

Hon. Dr. Terrance M. Dew

Prime Minister, St. Kitts and Nevis

The Honourable Dr. Terrance M. Drew is the 4th Prime Minister of the twin-island Federation of St. Kitts and Nevis following General Elections on August 5th, 2022, in which he led the St. Kitts – Nevis Labour Party to secure an outright majority in Parliament, winning 6 of the 11 seats in the National Assembly

Prime Minister Drew also currently holds the portfolios of Minister of Finance, National Security, Immigration, Health, and Social Security

Dr. Drew is serving his first term as the elected Member of Parliament for the constituency of St. Christopher 8.

Prime Minister Drew serves as the Lead Head of Government within CARICOM bearing responsibility for Health.

A medical doctor, Prime Minister Drew has provided health care as a General Practitioner at the Joseph Nathaniel France General Hospital as well as via private practice in St. Kitts, following his studies at Instituto Superior de Ciencias Médicas in Santa Clara, in Cuba (from 1998), and has specialized in Internal Medicine in St. Kitts, following his studies at the Paul Foster School of Medicine in Texas (2010-2013)

Prime Minister Drew is a Diplomate of the American Board of Internal Medicine (ABIM).

Prime Minister grew up in the community of Upper Monkey Hill located in the parish of St. Peter and is the son of Ras Gerzel Pet Mills and Michael 'Mic Stokes' Heyliger

Prime Minister Drew founded the C.A.R.E. Foundation in February 2021, a non-profit, non-partisan organization that aims to provide assistance to citizens nationally, across both islands of St. Kitts and Nevis.

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

13 P A G E

His Excellency Honorable Philip Joseph Pierre has served as Prime Minister of St Lucia, an island nation since July 28, 2021. Pierre is the Minister of Finance, Economic Development and Youth Economy and has been the leader of the Saint Lucia Labour Party (SLLP) since June 18, 2016.

Pierre was born and raised in Waterworks, Castries East on Saint Lucia. The exact date of his birth is unclear and it was estimated to be sometime between 1954 and 1955. Pierre's mother, Evelyn, was a teacher, and his father, Auguste, was a policeman. He studied at Saint Mary's University and completed a BA (hons) in Economics and a Master of Business Administration at the University of the West Indies.

After graduating, Pierre began his career as a lecturer at St. Mary's

HE Hon Philip Joseph Pierre

Prime Minister of St Lucia

University serving there from September 1972 to September 1973. He was then a manager at J.Q. Charles Limited (1976-1978), Audit Clerk at Coopers and Lybrand (1978-1984), Audit Senior at Panell Kerr Forster (1984-1988), and Financial Controller at Stanthur Company Limited (1988-1990). He was also a Director of the National Research and Development Corporation (NRDF) from 1985 to 1994. From 1990 to 1997 he was Managing Director of Philip J. Pierre Business Services Limited (Saint Lucia).

Pierre joined the Saint Lucia Labour Party (SLP) in 1985 and served as the party's treasurer from 1986 to 1992. In 1992, he stood for the first time in the Castries East general election but did not win. Pierre stood again in 1997 and won. In the subsequent Kenny Anthony-led SLP government, Pierre served as Minister of Tourism, Civil Aviation, and International Financial Services from 1997 to 2000.

Pierre was re-elected as MP for Castries East in the 2001, 2006 and 2011 general elections. In 2011, he was sworn in as Deputy Prime Minister and Minister of Infrastructure, Port Services, and Transport. In the 2016 general election, Pierre retained his seat but the SLP lost the election. Kenny Anthony resigned as party leader and Pierre was then elected as his successor on June 18, 2016. He also became parliamentary leader of the opposition.

Philip J. Pierre National Address Announcement (Caribbean News Global)

Pierre is a member of the Commonwealth Parliamentary Association (CPA). He is also a member of the Caribbean Community Parliamentary Assembly and attended its inaugural session in Barbados in 1996. He led the SLP in the 2021 general elections, where the party won a majority of seats. He was sworn in as Prime Minister of Saint Lucia on July 28, 2021.

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

IFAL NEW YORK 2022 - PROFILE 14 P A G E

HE Adama Barrow

His Excellency President Adama Barrow was until he election as president, a real estate developer. The is the 3rd and current president of The Gambia. Barrow defeated Yahya Jammeh in the 2016 Gambian presidential election, but because the incumbent president initially refused to recognize the victory, Barrow was inaugurated at the Gambian embassy in Senegal on January 19, 2017. He returned to Gambia on January 27, 2017.

Barrow was born on February 16, 1965, in Mankamang Kunda, British Gambia (Gambia), in a small village near Basse Santa Su to Mamudu Barrow and Kaddijatou Jallow, two days before Gambia achieved independence from the United Kingdom. Barrow attended Koba Kunda primary school, Crab Island secondary school, and then received a scholarship to the Muslim High School located in Banjul, the capital of Gambia.

After graduation, Barrow worked for Alhagie Musa and Sons, a Gambian energy company where he became a sales manager. Barrow moved to London, England, in the early 2000s, where he studied for a degree in real estate while working as a security guard to help finance his education. Barrow returned to Gambia in 2006 and founded Majum

Real Estate. He remained CEO of the company until 2016.

On October 30, 2016, Barrow was chosen by a coalition of seven opposition parties as their endorsed candidate for the 2016 Gambian Presidential Election. Before being a presidential candidate, Barrow had not previously held any elected office, but he had served as treasurer of the United Democratic Party (UDP). He resigned from the UDP on November 3, 2016, to run as an independent with the backing of Coalition 2016. During his first campaign, he promised to return Gambia to its membership in the Commonwealth of Nations and the jurisdiction of the International Criminal Court. He also promised to reform security forces, suggesting that they should be “distanced from politics.” Barrow won the election held on December 1, 2016, with 43.34 percent of the vote, Yahya Jammeh won 39.6 percent of the vote, and a third-party candidate Mama Kandeh won 17.1 percent of the vote.

He also won reelection in 2022, to serve for his second and final term.

Barrow is a devout Muslim who follows Sunni Islam.

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

IFAL NEW YORK 2022 - PROFILE 15 P A G E

Hon. Mario Augusto Caetano Joao

Minister of Economy & Planning

Mário A. Caetano João was born in 1978 in Luanda, Angola, where he attended primary and secondary school (1983-1995), with a pause from 1990-1992 when he moved to Bonn, Germany. He then went to the Czech Republic where he completed high school and college (1995-2007). He holds a Masters in Agricultural Economics (MSc) from the Faculty of Economics and Management of the University of Agriculture in Prague (2006), a Masters and PhD in African Studies from the Faculty of Arts of the Charles University of Prague, Czech Republic (2007 and 2009) and is a PhD candidate at the Faculty of Economics and Management at the Prague University of Agriculture (since 2018).

Within his professional journey, he has beena trade and investment manager at the Portuguese Agency for Investment and Foreign Trade (AICEP), Commercial Section of the Portuguese Embassy in Prague (20042007) and Head of Liaison and Cooperation Section at the Angolan Customs (2008-2012). At the same time, he was a member of the Multisectoral Technical Group for the implementation of the SADC Protocol on Trade

(2008-2010) and the Angolan Negotiating Group for the Negotiation of Economic Partnership Agreements with the European Union (2007-2012). In 2011,he livedin Gaborone, Botswana, where he worked as a trade expert in the SADC Directorate of Trade, Industry, Finance and Investment (TIFI).

In 2012, he was transferred to the Studies and International RelationsDirectorate of the Angola Ministry of Finance, having held the position of Head ofDepartment for Macroeconomic Policy and Management (2013-2015) and Head of Department for International Relations (20152016). From 2016 to 2019, he served as Advisor to the Executive Director of the 25th Constituency at the World Bank Group (WBG) in Washington, DC, United States of America and in 2019 he was nominated Executive Director and CFO of the Angola Debt and Stock Exchange (BODIVA).

In 2020, he was appointed Secretary of State for Economy and later, in 2021, as Minister of Economy and Planning.

IFAL NEW YORK 2022 - PROFILE AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

16 P A G E

The Angolan economy has recorded an impressive macroeconomic progress in the last two years, marked by the government’s commitment towards economic diversification and transformation agenda. In this exclusive interview with the African Leadership Magazine UK, the Minister of Economy & Planning, Hon. Mario Augusto Caetano Joao, talks about the government’s effort to place Angola on a sure foot and sustained economic growth. Excerpts:

Leading Angola’s Diversification & Transformation Agenda

Some analysts have hailed Angolaʼs macroeconomic improvements, recorded in the last two years. Can you share some of these successes with us?

Our country was coming out of a 5-year recessive cycle of economic activity and a scenario of profound macroeconomic imbalances, whose removal forced the adoption of a Macroeconomic Stabilization Program, supported by the International Monetary Fund:

Ÿ

Fiscal sector: Between 2014 and 2017, there was a period of successive deficits in the fiscal accounts that was reversed in 2018, as a result of a comprehensive fiscal consolidation process. However, in 2020, due to the negative effects of COVID-19, the country returned to a deficit of 1.9%. In 2021, fiscal surplus balances resumed, with the global of 3.8% and the primary of 7.7%, in relation to GDP. For 2022, the forecasts point to a fiscal surplus with an overall 6.6% and a primary surplus of 9.7%, in relation to the GDP.

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

COVER

18

Ÿ

For the coming years, the Government will remain committed to controlling the non-oil primary deficit, in line with the Public Finance Sustainability Law

Regarding Government Debt: The stock of public debt denominated in foreign currency decreased from US$ 80.84 billion in 2017 to US$ 70.43 billion in 2021. The stock of domestic debt denominated in foreign currency followed the same trend, falling from US$ 36.09 billion in 2017 to US$ 19.79 billion in 2021. In relative terms, the stock of public debt went from 129% of GDP in 2020 to 77% of GDP in 2021, signaling the downward trajectory of debt ratio.

Ÿ External sector: In 2018, a process of reforms in the foreign exchange market was initiated, including changing the exchange rate regime from fixed to floating exchange rate, in order to provide an effective buffer against shocks, restore balance, ensure efficient allocation of scarce foreign exchange resources, improve the competitiveness of the economy, and support economic diversification.

The exchange rate adjustment had a positive impact on International Reserves, with a smaller contraction between 2018-2021, by approximately 7%, compared to the drop of almost 49% recorded in the period 20142017. Since November 2020, the country's foreign exchange transactions have become more secure and predictable and the foreign exchange market is functioning normally. The national currency has remained stable against major international currencies. In 2021, the national currency appreciated against the US dollar on the primary market by 18.24%, standing at US$/Kz 554.98. At the end of the first Semester of 2022, the national currency settled at US$/Kz 428.20 highlighting the remarkable stability of the foreign exchange rate, with the gap between the official and informal foreign exchange rate having reduced significantly, from 150% at the end of 2017, to less than 10% currently.

Ÿ Additionally, there was a reversal of the deficit trajectory of thecurrent account on the balance of payments from 2014 to 2017 (US$ 4.43 billion on average) to consistent surpluses in the period 2018 to 2021 (US$ 4.78 billion on average), as a result of policy measures aimed at reducing import levels by about 45% in order to stimulate domestic production. In the first quarter of 2022, the current account balance recorded again a surplus ofUS$ 4.7 billion.

Ÿ The improvement in the terms of trade, as well as the reforms made to the foreign exchange market, allowed the countryʼs International Reserves to be maintained at adequate levels. In the period 2014 to 2017,

International Reserves fell by US$ 14.1 billion, as they fell from US$ 27.7 billion in 2014 to US$ 13.6 billion in 2017. In the period from 2018 to 2021, International Reserves fell by only US$ 1.2 billion, due to the new exchange rate regime adopted. In the first half of 2022, Gross International Reserves stood at around US$ 15.5 billion.

Ÿ

Real sector: The macroeconomic stability that the country is experiencing has allowed for a gradual recovery of our economy and, in 2021, the country emerged from the situation of economic recession that it had been in since 2016, with GDP growing by 0.7%, as a result of the macroeconomic reforms initiated in 2018, with non-oil GDP growing by 6.2%, which offset the strong contraction of 11.6% in the oil sector

Ÿ

The first Quarter 2022 saw year-on-year GDP growth of 2.6%, with the oil sector including gas growing 1.9% and the non-oil sector growing 2.8%.

Ÿ

After inflation peaked at around 42% in 2016, there was a downward trend, settling at 17.1% in 2019, as a result of better coordination between monetary and fiscal policy, as well as increased domestic production, especially agricultural production. However, the downward trend was reversed in 2020, with inflation settling at 22.4%, due to the negative effects of COVID19, remaining at high levels in 2021 (27.03%), as a result of disruptions in global distribution chains that have caused food commodity prices to rise in international markets. However, since January 2022 a downward trend incinflation has been registered, standing at 21.4% (YoY) in Julycthis year

Ÿ

The increase in domestic production brought more employment. In the period between 2018 and the first half of 2022, there were 490,769 new formal jobs, an average of 108,855 jobs per year, with 2019 recording the most jobs, close to 153,034 jobs. In 2021, due to COVID 19 Pandemic, only 45,689 jobs were created. This job creation trend is a result of the implementation of a set of programs and initiatives of the Government,

COVER AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk 19 P A G E

Ÿ

of which we highlight the Action Plan to Promote Employability (PAPE).

During the 2017-2022 period, in order to diversify the economy, the Government is implementing programs such as the PREI (Program for the Requalification of the Informal Economy), the Program for Production Support, Export Diversification and Import Substitution (PRODESI) and the Privatization Program (PROPRIV).

Angolaʼs flagship Programmeto Formalize the Informal Economy (PREI), has yielded tremendous results for MSMEs sector. Can you tell us more about this programme?.

The Programme to Formalize the Informal Economy (PREI, www.prei.ao) is part of the Government's various initiatives to accelerate the process of diversifying the economy. The program is developed within the framework of a Transition Strategy from the Informal to the Formal Economy and its Action Plan.

On November 16, 2021, the Campaign for the Formalization of Economic Activities was officially launched. It soonbecame one of the main instruments for a broad approach of proximity services for the formalization of economic activities, including organization of municipality markets and street vending activities. By June 30,the Campaign had reached all 18 provinces and formalized more than 200,000 economic operators, of which 74% are women.

Additionally, PREI has generated more than 3 thousand new jobs, through the availability of 2 thousand microcredits in the amount of more than US$ 6 million.

Angola has just joined the Africa Finance Corporation as a shareholder and its 35th Member state. How would this partnership help to Advance the countryʼs development agenda?

The partnership with Africa Finance Corporation (AFC) will help drive the countryʼs growth and development, as this institutionʼs investment approach is aligned with Governmentʼs priorities through its focus on financing infrastructure projects that promote economic diversification and resource-based industrialization.

As matter of fact, we have recently approved PLANAGRÃO (National Plan to Promote the Production of Grains –Presidential Decree 200/22),to boost the production of grains, namely corn, beans, rice and wheat with the vision to position Angola as one of the largest grainsʼ producers in Africa. The financial resources needed for the next 5 years to implement PLANAGRÃO is approximately US$ 5 billion and as AFC provides financing to infrastructure and agro-processing projects,it is expected that this partnership would support Angolaʼs transition from a state-led and oil-financed economic model to a private sector-led growth model.

Angola is currently managing a strategic transition from Oil-led economy to a private-sector-led growth model in the country. While this is a long-term plan, can you share

We are strongly engaged in an economic transition process to change the current economic model, to a growth model based on the dynamics of the private sector, aiming at the resilience of the economy and the generation of employment.

some of the progress this far?

Yes, we are strongly engaged in an economic transition process to change the current economic model, to a growth model based on the dynamics of the private sector, aiming at the resilience of the economy and the generation of employment.

Since 2018, the Government has implemented various programs in this regard, namely:

Ÿ Program to Support Production, Export Diversification and Import Substitution (PRODESI, prodesi.ao), which has already enabled the creation of more than 60,000 jobs, through the financing of 1,300projects, until the first half of 2022, mainly in the agribusiness sector. Additionally, more than 63,000 producers hadbeen registered in the National Production Portal (PPN, ppn.gov.ao), which has allowed for the signing of more than 2,700 future purchase contracts and the holding of more than 170 fairs promoting national production.

Ÿ

The Privatization Program (PROPRIV) is also being implemented and has already allowed for the privatization of 84 assets out of a total of 132 to be privatized and processes are underway for the privatization of other relevant assets in the financial, telecommunications and industry sectors, having already begun the process of initial public offering (IPO)that wouldallow for the spreading of the capital of these assets, also to small investors.

To accelerate the economic and social development of municipalities, we are implementing the Integrated Program for Intervention in the Municipalities. With this program, a total of 2,730 projects are being developed, 630 of which are already completed.

To attract more investments, we continue to implement actions aimed at improving the business environment. An Action Plan for the Improvement of the

Business Environment has been developed for the 2021-2022 period, in line with the World Bankʼs new approach, without, however, refrainingthe initiatives in implementationthat are seen as vital for the countryʼs development.

These reforms have triggeredthe economic activity, led

COVER AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk 20 P A G E

by the non-oil sector, which has proven capable of counterbalancing the systematic decline in the oil sector.

The weight of the non-oil sector in the GDP structure registered a substantial increase, rising from 57% in 2011to 72% in 2021, signaling a clear trend of the diversification of our economy. Our goal is to reach 85% by 2027 and I have no doubts that it is achievable.

Economic growth of any economy is, to a large extend, dependent on performances of micro businesses within the country. Can you share with us your ministryʼs economic policy for SMEs and start-up

Our Government recognizes the fundamental role that SMEs play in the process of economic diversification. In this regard a set of financial instruments hasbeen designed and are in operation to support small and median enterprises, associations and cooperatives, namely:

In order to strengthen the technical capacities of entrepreneurs, 8 training packages have been designed, and more than 5,000 producers and owners had been trained;

For instance, “Envolver” is a project funded by the European Union which has a partnership between INAPEM (Angolan SME Institute), IAPMEI(Portuguese SME Institute) and IPS (Polytechnic Institute of Setúbal in Portugal), with the aim of training officers from commercial banks, courts specialized in commercial, industrial and intellectual property matters, as well as entrepreneurs and INAPEM officersin matters related to financial literacy and business management;

The project Envolver is based on four fundamental pillars of capacity building, namely (i) strengthening INAPEMʼs capacity to encourage and expand MSME access to banking and financial services; (ii) Increasing financial literacy and capacity to develop projects; (iii) Improving the capacity of banks to diversify financial services, including the use of innovative financial instruments; and (iv) Improving legal capacity in commercial litigation.

In addition to the above mentioned initiatives, INAPEMhasthe online platformNosso Saber(port.: Our Knowledge) which has available online courses for the training of entrepreneurs.

Ÿ

BNAʼs notice 10/2022, provided by commercial banks, 371 projects approved, US$ 1.5 billion;

Ÿ

Credit Support Project (PAC), provided by our National Development Bank for SMEs,1120 projects approved, US$ 105 million; and

Having financial resources and capacity building initiatives, we want to support the proliferation of start-up incubators oriented not only from the supply side, but also from the demand side of the economy, that is, companies would present their challenges, we would provide financing they would develop the sollutions.

Ÿ

Economic Relief Measures (COVID-19 credit response window), provided by our National Development Bank for SMEs,237 projects approved, US$ 84 million;

For the next five-year period, we plan tosecure financing to up to 300 start-ups designed within the framework of fostering entrepreneurship;

Besides the availability of these financial instruments, other actions have been developed to facilitate access to the internal market (formalization of more than 3000 contracts and organization of more than 150 fairs) and access to the external market (export support);

The governmentʼs diversification agenda, anchored in the Privatization Program 2019-22 (PROPRIV), has moved forward, although slowly, due to global disruptions, caused by the COVID-19 pandemic. How is this program performing now?

The Privatization Program (PROPRIV) represents one of the most ambitious initiatives of the Government in terms of liberalizing the economy and promoting private economic initiative. In its original formulation, this program contemplated 195 assets and companies, and with the necessary updates, highlighting the exclusion of 33 assets

COVER AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

21 P A G E

and the subsequent inclusion of 16 assets, giving us a current number of 178 assets/companies, of which it has already been possible to privatize 91. The remaining 87 assets/companies to be privatized are in progress.

The privatization of these 91 assets/companies allowed the signing of contracts whose value amounts to more than US$ 2 billion.

Itʼs been over two years since you came on board as the Minister of Economic Planning of Angola. What are some of the high points of your leadership?

It has been an almost 3 yearsʼ journey at the Ministry of Economy and Planning.

First as Secretary of State for the Economy (Jan 2020) and then as Minister of Economy and Planning (Sep 2021). As Secretary of State for the Economy, our focus was to support the Minister to implement and deliver on PRODESI, our economic diversification programme as mentioned above.

As Minister, we managed to fuel this economic diversification trend by restructuring one of our financial instruments operationalized by our National Development Bank specifically for scale up projects. We visited all crops and animal production small and middle-sized projects in all 164 municipalities in the whole country and provided tailor-made financial resources, looking for quick wins. In 5 months, more than 1,100 projects were financed by our National development Bank. We also restructured our venture capital state company (FACRA, facra.ao) to support SMEs with risk capital when accessing the financial market. Last, but not least, we restructured our service Feitoem Angola (made in Angola, feitoemangola.gov.ao) to give dignity and identity to our local products. Our seal Feitoem Angola has an innovative feature embodying a QR code to provide the right information to consumers and to track the destiny goods.

On the other hand, our first task as a Minister was to design and implement the campaign to formalize the informal economy (PREI). We managed to launch it in all 18 provinces and formalize more than 200,000 economic operators. PREI was supposed to be implemented in 2013 but was never implemented. We are now transforming this programme into a permanent service, focusing on sustainability to broaden the tax base and provide better working conditions.

Besides PRODESI and PREI, our biggest responsibilities under National Development Plan, we managed to improve working conditions at the Ministry, capacitate and promote officers stacked due to lack of vacancies to grow in their professional career

Can you share with us and the world your leadership journey thus far to the present leadership role as it contributes

to the socioeconomic growth and wealth creation of Angola and by extension Africa?

We had to make shock in our market. The way market was structured in the last 30 years in Angola, it was nothing else than a logistical operation. Goods were imported and distributed to industrial units or commercial centers to be consumed.

We needed to change it as most of our foreign exchange reserves were used to import goods where Angola had comparative advantages. We needed to bring a new “elephant” in the room, which is the local production and slowly but surely unlock our economy We needed to transform the potential wealth of Angola into real wealth. Our approach was to ease the doing business environment and to create financial instruments and products to develop the agribusiness sector we managed to make this change. In 2019 less than 50 projects were financed in our economy and from 2020 to 2022, more than 1,700 projects mostly in the agribusiness sector were approved in the amount of US$1.7 billion. The agribusiness sector, including fisheries, is now the main engine of our economy and is growing more than 5% a year. Last year we grew 0.7% after 5 years of negative growth and this year (2022) we believe we can grow close to 3%. We can now feel the “train” moving and increasing its pace in the right direction. We are now creating market where the main engine is the local production.

We are focused in helping creating market in Angola and strengthen its institutions to follow the trend. We are even more excited as the Government has decided to invest more than US$ 1 billion a year in the agribusiness sectorand be an important player in the free trade areas of regional economic communities, where Angola belongs, including AfCFTA.

COVER AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

22 P A G E

ACCIDENTAL BANKING CZAR

THE

23 P A G E

BancABC's rich history of supporting Zimbabwe's productive sector and traditionally strong Corporate Banking services, has positioned the Bank as a leader in financial services in the country and the continent. The CEO's towering status as one of the continent's finest bankers, having led about 5 Banks as CEO, has also added to the Bank's growth prospects in the continent. In this exclusive interview with African Leadership Magazine, Dr Lance Mambondiani, CEO, BancABC, tells us about the Bank's efforts towards redefining banking in Zimambwe and beyond. He also shares his experience as a veteran banker, as he discusses the ABC of Banking, Excerpts:

You have held the position of CEO in about five institutions. You have done exceptionally well in these roles; I read somewhere you were quoted saying you have never applied to be CEO; you have mostly been invited. What have you done and continue to do that has kept you at the top of the financial sector chain?

Firstly, let me start by expressing my gratitude to everyone at African Leadership magazine for choosing to have me on this platform, it`s truly a humbling experience. To your questions, I will admit that to be called into any position of leadership is an incredible honor and privilege which I do not take lightly. I have often described myself as “The accidental CEO”. My main desire is to serve and make a difference in the small ways I can, in whatever assignment I am gifted to lead, and anyone can do that without a title.

I am not afraid to take bold risks and also make mistakes, because I believe that is the only way you can succeed at producing groundbreaking initiatives!

My formula, if you will call it that, has always been to bring the most authentic version of myself. It allows me to connect with the people and that's why I continue to tell my story as it is. I am not any smarter than my peers but extremely driven and equally enjoy being a part of a driven team. I am not afraid to take bold risks and also make mistakes, because I believe that is the only way you can succeed at producing groundbreaking initiatives! I am committed to change, and I am committed to legacy building as a core principle of any leadership position. It has been proven that Entrepreneurship is what stimulates development in any nation or state; what are you doing as a financial institution to promote Entrepreneurship among the Zimbabweans, especially women and youths?

24 P A G E

Entrepreneurship is definitely at the heart of stimulating development, and this is essentially true for any African economy. In Zimbabwe, as in most countries, SMEs are the biggest employers, playing a critical role in spurring economic activity and sustaining value chains. BancABC has been quite involved in supporting SMEs through their growth phases. Our popular iGnite SME initiative provides lending, training, and access to markets for small businesses. One of my favourites is our flagship Annual SME summit where we bring together SMEs and young entrepreneurs from across Africa, to share their stories and debate common challenges faced by small businesses and how they can overcome these challenges. We often conclude the Summit with a pitching competition where startups can win funding from various investors. We have started making preparations for the 3rd edition of the SME Summit later on this year and I`m looking forward to engaging with entrepreneurs from all over Africa.

Financial inclusion is one area we must mention when we discuss banking in Africa. Going by the number of unbanked people in the continent, do you think it is getting

the attention it deserves from financial institutions, and what are you doing to address the situation not just as a bank but as a CEO?

There has been a lot of progress made in addressing financial inclusion in Africa largely because of the fintech revolution and the significant penetration of mobile phones across the continent. Well known examples are of course M -Pesa in Kenya and Ecocash in Zimbabwe which are mobile wallet services, that allow previously unbanked people to access financial services using the USSD Mobile Platforms for transactional purposes. While much of this has been through necessity, the convergence of financial services and the mobile phone has been hugely significant in addressing financial inclusion.

Financial inclusion is at the core of our mandate as BancABC and also my personal approach to banking. I firmly believe that banking should be accessible to everyone, and this has been my mission in the banks I have been privileged to lead. At BancABC, our low cost KYC lite account product offering is accessible to all Zimbabweans. We also have one of the biggest footprints in the country through our Instore banking

partnership with Pick n Pay where we provide limited banking services in 52 kiosks in almost all major cities and towns.

Because of the Covid-19 disruptions, you recently asserted that "Banking will never be the same again; more and more, we are going to see banking being moved onto platforms that were inconceivable a couple of years ago – platforms that are accessible in real-time, anytime, anyplace". What innovations have you introduced to accelerate this transformation in your bank?

Despite the intolerable human suffering, the pandemic was also a catalyst for digital adoption and transformation for all industries and Banking is no different. During the first lockdown, we saw an opportunity to introduce our hugely popular virtual branch – Branch X, which allows our customers to transact virtually without ever visiting the branch. We also launched a WhatsApp Banking Service we call Ally, which allows our customers to enjoy all our banking services on the popular social media platform. Looking ahead, we are aware that our clients are adapted to doing banking anywhere but never at a Bank. Our agenda is to accelerate our digital

25 P A G E

transformation agenda to meet this new expectation.

From what we know about you, I think it is safe to say you are an IT-driven banker. However, implementing IT policies is not always a smooth ride as many people think. What strategy have you adopted over time to achieve successful implementation and operation of IT?

I am passionate about the digital transformation of the financial sector. The traditional banking model is antiquated and does not address the mutating demands of a new type of tech-savvy clientele. To survive in the new environment, Banks have to provide service that is frictionless for the customer in real time, anytime anywhere. Innovation and tech platforms can aid this process and make Banking simpler, more adaptive and relevant to modern demands. We live in a fast-changing social media, generation, the bank of the present and the future has to be as intelligent as Google, as Easy to use as Apple and as engaging as WhatsApp.

In Zimbabwe, 80–90% of transactions are conducted by informal traders or small- and medium-sized enterprises (SMEs); what services and products do BancABC currently employ to cater for these categories of people?

We certainly have the SME clientele at heart, and we have created an SME account (The Ignite Account) that is tailored to cater for the numerous needs of this important segment. We have a dedicated business banking unit for our SME clients, to ensure once the account is opened the SMEs are provided with all the necessary support they need to succeed. We like being a part of our clients' growth stories.

Any partnerships or plans to increase BancABC accessibility across Africa?

BancABC as a group has a rich history as a true Pan-African Bank. Whilst the Group is currently scaling back and in the middle of divesture transactions which are a matter of public record, we have had operations in Botswana, Mozambique, Rwanda, Zambia, Tanzania and of course in Zimbabwe. We have always been an African Bank and proud to have done banking in many African communities.

We also have ambitious plans to extend our product range across the continent where possible. Following the huge success of our local remittance service, “City Hopper”, in December 2021 we launched a cross border remittance service which we have called “Border Hopper”.

In partnership with Mama Money and TM Pick n Pay we are processing cross-border remittances between Zimbabwe and South Africa. Any of our clients in SA can walk into a Mama Money agent (including in PnP stores) and send money to

Zimbabwe for collection in any one of our 41 kiosks in TM Pick n Pay stores across the country. Our aim is to offer banking services to everybody who needs it. We speak African, we understand Africa and we have become a part of many stories across the continent.

In the post-COVID-19 era, with the emergence and growth of FinTech and the digitalization of banks, what would be the concerns or challenges of the banking industry?

Cybersecurity risk is a serious threat of an accelerated digital transformation drive. The goal is to identify risks and assess whether the rewards outweigh these risks. If we can find ways to mitigate risks we then move at break-neck speed to design, execute and launch to market. Nonetheless, change is the only constant.

One of the biggest threats to banks is the accelerated growth of fintench players that are more agile and can offer some services that are traditionally offered by banks such as lending, savings and payment options without the need for a banking license. To survive in this fast-changing environment banks will need to partner with fintech players for agility rather than attempt to compete.

As an individual, you have constantly maintained that you want to make bigger contributions to the country and with your track records; you have contributed amazingly to society. What

26 P A G E

do you plan to do differently from what you have done in the past and currently?

I would like to be a part of a generation that stands for something and would like to leave the business or my country better than I found it. We owe it to our children and our children's children to do better than those who precede us, generating value not only for ourselves but also for those we are privileged to lead and serve. I strongly believe that losing yourself in the service of others is the only way we can overcome and build a better tomorrow

For us to play our role effectively as financial service providers, we need to be an institution that is always looking to be part of projects that are nation building, that contribute to the country`s economic growth. In whatever assignments or transactions we do, we need to be relevant.

You must have faced a lot of battles to get to where you are right now. Which experience is your most memorable, and would you say made you stronger?

Challenges create an opportunity for success, and I have had many, too numerous to mention. I have fallen many times, been fired a couple of times. Every decision we made in the past inevitably shapes our future and I am happy to have learnt from my past. I don't always get it right, but I am conscious of the fact that when in a position of leadership, we are sometimes living our lives as an example for others. I live by the old adage that 'life itself is a battle, its either you are in one, going into one, or coming out of one'.

Your slogan is "you can outsmart me but never outwork me" What will you say to the young people who look up to you and still do not understand this slogan?

You don't always have to be the smartest person in the room, but you must show up everyday and put that extra effort if you are to succeed. I believe strongly in good old-fashioned hard work, passion and pouring one's heart and soul into every assignment! True success often happens to those individuals willing to pay a price to achieve it.

Success is embracing failure as an option and learning from it. You have to be bold, courageous and take calculated risks if you are to achieve your goals. Lastly, the burden of leadership is to give each other Hope, inspiring each other to do better and acknowledging that someone doesn't have to fail for you to succeed. We can all succeed together

'Do good by you and when done, Please Do good by others.'.

I believe strongly in good old-fashioned hard work, passion and pouring one's heart and soul into every assignment! True success often happens to those individuals willing to pay a price to achieve it.

27 P A G E

28 P A G E

P A G E

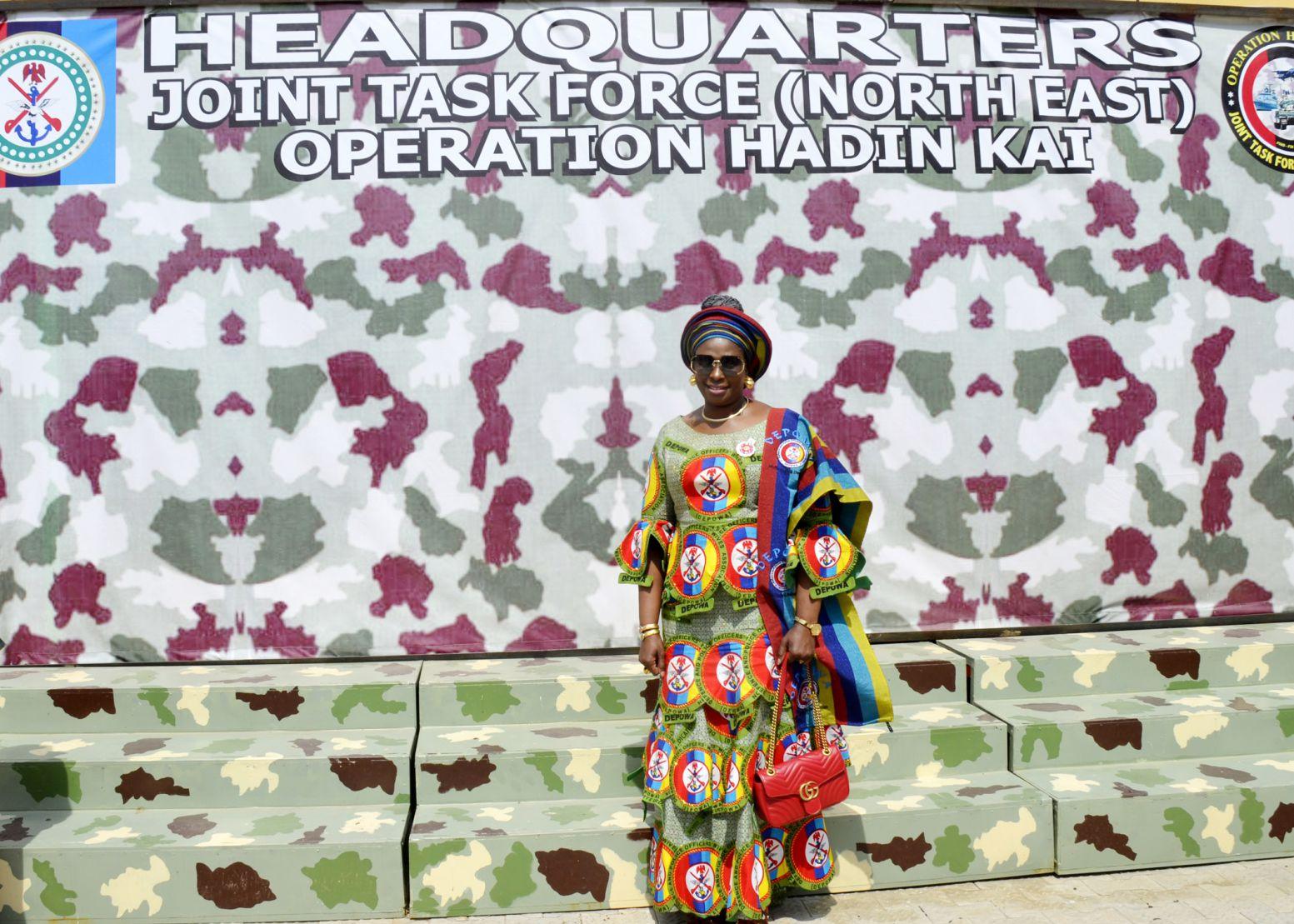

Mrs. Victoria Irabor & Depowa

P A G E

Mrs. Victoria Irabor & Depowa

Uplifting the Wives of Fallen Heroes' By Extending a Helping Hand

Barrister (Mrs.) Victoria Irabor, President, Defence, and Police Officers' Wives Association (DEPOWA), a vast and well-read professional in the fields of law, conflict, security, development as well as corporate management and finance law has decided to use her indepth knowledge and experience to take on the challenge of changing the narrative of the lives of widows in Nigeria, with special focus to the wives of fallen heroes in Nigeria. In her role as the DEPOWA president, she has not only led by example but has gone further to make sure that the military widows of the nation benefit and succeed.

She believes in fulfilling the African dream by harnessing the power of the skilled woman and has gone over and beyond to see to the social inclusion of these women via relevant skill acquisition. The wives of our fallen heroes are heroes in themselves and we must recognize them. They must be equipped to re-join society. Irabor has come in with a fresh pair of eyes for innovation and expansion with projects that goes beyond helping the widows of fallen heroes of Nigeria to helping the heroes themselves.

Women have always played an essential role in the development and growth of any society and Barrister (Mrs.) Victoria Irabor through the office of the president of DEPOWA has made it her mission to make sure that Nigerian widows lead better lives through skill acquisition projects, social inclusion, and establishment of PTSD Rehabilitation centres for their husbands. She has shown tenacity, resilience, compassion, and a strong drive for excellence in the course of her service to Nigeria.

A team of editors caught up with her recently where she talked about her passion and motivation in helping widows.

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

30

We would be thrilled to know a little more about the woman behind such great works.

I am Mrs. Victoria Irabor, fondly called Vicky by my friends and family I am married to Major General Lucky Eluonye Onyenuchea Irabor. We believe in the grace of God and Jesus Christ, our Saviour. I am who I am today because God has made me so. My marriage is blessed with two beautiful children, a son and daughter

My parents were civil servants. My father was a teacher and principal of schools and my mother was a nurse, so they were exposed to education.

This afforded me the opportunity to start school. I was exposed to a good education because my parents were educated. Today I am a lawyer and married to a military officer. I would relate who I am to date to the experiences I had as a child. With benefit of hindsight, I recall that as a child, my mother would look at me and she would praise me. She would say, “you see you're so tall. I can imagine you reading law. “When you stand in court to speak, your presence will intimidate the judge”. With this nudge from her, fell in love with the profession after I researched. Later I came back to my mom and told her that I wanted to be a lawyer but I wanted to work with the police so that I'll be able to fight crime and investigate crime. At the end of the day, I could not join the police but I married the military officer. So I think that my dream did come true, only in a different way than.

I graduated from the University of Benin where I obtained an LLB. I also proceeded to the Nigeria law school where I obtained my BL and was called to the Nigerian bar. After that I acquired three masters, first from the legal state university, where I obtained a masters in corporate management and finance law, then a Masters of law from the Lawton University Bangladesh, and finally a Masters in conflict, security, and development from the Nigerian defence academia. I actually did my Masters in conflict, security, and development to support my husband

in his job as a military officer

You have a vision for DEPOWA as it were. Where did you meet it and where do you intend to leave?

When I met DEPOWA it was a very comfortable place to start off work The past DEPOWA Presidents have done wonderfully well. DEPOWA as an association is the coordinating body for the army officers' wives' association, Naval officers' wives' association, air force officers' wives' association and the police officer's wives' association.

As the president my position allows me to relate with women across the services. My vision for the association is broken down into parts. We have our traditional objective which is coming together as women and relating with one another Sharing the same challenges with someone is usually reassuring. Another one of our traditional goals is to not leave the widow isolated. I have a goal to go beyond just support, I want to give skills to those that do not have and then also sharpen their skills by organizing pieces of training. I intend to go beyond the traditional objectives and goals.

I have found a project that I think would launch DEPOWA to greater heights and that is looking beyond ourselves, not just what we can offer to the officer's wives but to see what we can do for our husbands, because our husbands today have a huge problem that is plaguing them and that is the issue of Post-Traumatic Stress Disorder, PTSD

For the past decade, Nigeria has gone through conflict and when the men come back home, they return with so many issues. At the end of the day, the women and children in their lives are the first to receive the impact of these negative outcomes. Women watch their husbands go to the conflict zone and change.

Some of these women have complained that their husbands cry at night, they scream in their dreams and some become very violent and take it out on the wives and children. As a soldier or officer, you cannot go

to the war zone, return and go straight back to your family. But in Nigeria, we do not have the system where these men are evaluated and if the problem of PTSD becomes existent in their lives, they don't have a chance to be rehabilitated. We need that type of centre and that is why I am proposing that DEPOWA works towards establishing a rehab PTSD evaluation and rehabilitation centre for the armed forces. That is my big project and goal. I believe one of the effective ways to help women is to give them a peaceful and safe home, to do this we must make sure that their husbands are sane and without any form of post-war trauma.

In some of your works you have partnered with migration and refugee organizations, how did that assist and benefit your goals?

Yes, I partnered with them but right now we're trying to reach out to the downtrodden in the society. The widows, the sick in the hospital, especially victims of conflict we are paying specific attention to the northwest zone because of the grave levels of insurgency. This is the Zero Hunger Project.

Hunger is not just about food. Anything that makes you deprived is hunger and if we say zero, the kind of hunger we are talking about is ending hunger for food, shelter, love, and health. We want to reduce any problem that is plaguing the society We are prepared to meet these needs no matter how little thus the name of the program; Zero hunger. I am sure when people see that they expect food but we go beyond that, they will appreciate it. Last month we were at 44 hospitals where we donated 13 motorized wheelchairs and some assistance for the patients.

Looking at DEPOWA and your skill acquisition programs that you organize, a lot of people have come to question how you organize and departmentalize it. How do you decide which skills gap you want to breach?

For DEPOWA our skills acquisition and target audience are different from other skills acquisition done by

INTERVIEW AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

31 P A G E

other organizations in the sense that we focus primarily on widows, the orphans, and the less privileged in our military community. As I mentioned earlier, Nigeria has gone through a lot of insecurity and insurgency in the last decade, hence more men of the force have been deployed to protect our country. This would mean that the number of widows in the military community has increased. We have so many of them in the barracks and there's no way DEPOWA can turn a blind eye to what is the current reality.

That's the reason why we have taken this very seriously It is not enough to just pay their debt, and the debt benefits of their husbands as saved out of the barracks. Where do we go from there? So, we ask these women if they have any skills and quite a number of them do not. We then concentrate on exposing these women to skills that can improve their standards of living by giving them a stream of income. These skills could range from catering, tailoring, ICT, bead making, and so on. And we don't just stop at the training when they graduate, we set them up with start-up capital. We buy the tools and equipment's they would need to start and pay their rent for one year Then we monitor them for some time. When they are established, we can let them stand on their own. This scheme nurtures these women from beginner levels up until they are grounded in their craft and can sustain a cashflow system independently

To keep track we have a database of the women whose husbands are deceased under our scheme. Every time a soldier dies in the war zone, we update our data. We follow up on the women to know the ones that would require our support. What we are doing is limited to the military community and we do it with passion not just because we want to go into skills acquisition, but because our community needs this. We are cantered on remembering the wives of our heroes, the men who put their lives on the line for our great country

COVID-19 disrupted a lot of livelihoods, disrupting businesses and many people lost jobs just like most organizations. DEPOWA also has some kind of intervention relief for this set of people. Could you tell us more about what DEPOWA is doing regarding this?

Yeah. From time to time, we gather the widows in the military community and we give them relief materials. It is something we do on a regular basis, and we're still prepared to do this in the coming years. We also incorporate an inclusive approach when planning our programs for these widows. For example, we had a general meeting two months ago and we found opportunity to gather the widows again, we do this to stay in touch and make these women have a sense of belonging.

Every day as we eat, as we dress up and put on makeup, we must recognize that we have these women amongst us for the sake of love for the nation, their husbands died. We must never forget them. They are part and parcel of DEPOWA and will always be remembered. If we don't remember them or reach out to them who will? society does not know them. We cannot abandon them!

Losing a loved one is difficult, but losing a loved one who fought to protect the nation is difficult yet prestigious and that is why we must regard these women.

For a big organization like DEPOWA one of the major challenges a leader can face is finding a work-life balance. A lot of people look up to you and most of them are also professionals. How are you able to maintain that delicate balance between work, family, as well as also ensure that you stay on top of your project and programs at DEPOWA.

To start with I would like you to know that I still have my professional career outside DEPOWA. I have the choice to take a leave of absence to focus on DEPOWA but I deliberately decided to continue and when my MD called me and asked if I was sure I said, why not! The reason is I intend to teach the women not by saying it, but by example. As a woman, you must be gainfully employed not just provide civil service but you must be actively engaged in a business or career that earns you a living. You can't be married to an officer and be idle.

In fact, in the current age and time we live in, idleness is not an option. Women from advanced countries work 23 jobs, I don't see a reason why I shouldn't be able to hold down my various responsibilities provided I manage my time and resources effectively. If you are not working in an office, you should work from home or have your business and that is the only way you can earn your respect and be useful to the society

We must decide to be useful to our husbands, children, and ourselves. Our husbands need a lot of support from us. The idle brain is the devil's workshop. We don't want women to be a liability. We want them to be useful, useful to their families and the society. How am I able to manage? I have always worked long before I married my husband so it comes naturally to me. I have worked long enough both as a single woman and as a married woman.

Over the years I've learned how to juggle and combine both family and work-life to coexist. It became natural to play this role as the DEPOWA president and work in my office. My office is in Kaduna but they've allowed me to work from home. So sometimes I'm here with my laptop. And if I don't have time to work in the daytime, at night I sit up to work here when they need me.

My close team members all work elsewhere and I encourage it. No woman around me is idle. To thrive in the Nigeria of today you must bring something to the table. I don't want a DEPOWA where we are gathering to clap hands. You need to be versatile. You need to be current. You need to know the issues in your community, our community, the military community. If you don't know what the issues are, you would not be able to deliver anything. Every woman has got a brain, so every woman here is thinking and that is what I want to see in DEPOWA.

INTERVIEW AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

32 P A G E

Mr José de Lima Massano Governor of Bank of Angola

Mr José de Lima Massano Governor of Bank of Angola

From stabilizing the nation's currency, to keeping unemployment at bay, Central Banks across the world are perfecting the art of staying the course amidst global economic crunch.

The Angolan Central Bank have particularly become adept in managing the country's monetary policy and making the currency surge ahead of the rest.

In this exclusive interview with José de Lima Massano, Governor of the National Bank of Angola, we discussed the performance of the Angolan economy and other issues. Excerpts;

Staying The Course Amidst Troubled Economy

AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

38 P A G E

You have had an impressive career Please tell us briefly about your professional background and how that has supported you in your current role?

I have spent most of my working life in the financial sector, having completed a Master's degree at the City University in London.

I was on the board of directors of the state-owned commercial bank for 6 years, and thereafter was the CEO of the largest private commercial bank in Angola for another 6 years, with a break in between of 4.5 years during which time I served as the Governor of the Central Bank. This experience gave me an in-depth knowledge of the workings of the financial sector and of the economy, and was invaluable for my current role.

At a Conference in Carcavelos, you stated that the main objective of the institution's monetary policy is to ensure that inflation falls to single digits by 2024, adding that you are migrating to an inflation targeting regime. Please, can you talk more about this strategy, and what policies you plan to introduce bearing in mind the rising cases of inflation globally?

At the end of 2017, we transitioned from an exchange rate objective in controlling inflation to a monetary objective, with money aggregates being the operational variable of the monetary policy, whilst at the same time preparing the ground for the implementation of a free-floating exchange rate regime, which was achieved in October of 2019. This policy has served us well up to now, however, our objective for the future is to progress to an inflation targeting regime that will see the Central Bank establishing a numerical target for medium term inflation, which will be publicly disclosed.

In the meantime, from an organizational point of view, the reforms we have implemented, which, amongst others, include formalizing the independence of the Central Bank and strengthening its accountability, as well as establishing price stability as its primary objective, have

contributed towards creating the internal conditions for the implementation of the inflation targeting regime.

As for the rising cases of inflation globally, we are obviously monitoring those movements, taking note of the strong measures being applied by Central Banks worldwide to bring inflation back to their target levels. In our monetary policy decisions, whilst we define our policy in line with our particular circumstances, we also consider the inflation levels of our trading partners and the extent to which they may impact on our internal inflation.

Angola's national currency, the kwanza, has seen an appreciation in recent months and is now worth around 430 kwanzas per dollar, appreciating about 30% against the dollar. What would you say is responsible for this achievement?

Angola depends on oil sales for its foreign currency, and therefore the significant drop in the oil price which started around mid-2014 significantly reduced the availability of foreign currency. The reluctance at the time in devaluing the domestic currency due to the country's dependance on imports, exacerbated the shortage of foreign currency and led to a significant overvaluation of the domestic currency. This resulted in the complete malfunction of the foreign exchange market.

At the end of 2017 we established a new foreign exchange policy focusing on normalizing the functioning of the foreign exchange market through the elimination of administrative controls and the implementation of a free-floating foreign exchange regime. Initially we had a regime of “managed depreciation” and in October 2019 we transitioned to a free-floating exchange rate regime.

As expected, immediately after freely floating the currency, there was an overshooting of the exchange rate as the banks adjusted to this new regime. In addition, shortly thereafter, we were confronted with the Covid 19 pandemic, and a crash of the oil price,

linked to uncertainty on all levels, which caused some disturbance in the functioning of the foreign exchange market. However, as the Covid 19 was brough under control, the functioning of the foreign exchange market started returning to normal, and we saw the exchange rate move back to more sustainable levels, which explains the appreciation in the first half of the year.

From your perspective as the Governor of the National Bank, how do you rate the performance of the Angola economy?

The quarterly national accounts released by National Statistics Institute indicate a quarterly growth of real GDP of around 1.60% (+1.1pp) in the fourth quarter of 2021, resulting in a growth of 2.2% (+1.30pp) year on year, which determined a slight annual expansion in 2021 of 0.7%, after 5 consecutive years of economic recession. The favorable evolution of the GDP is in line with the positive sentiment of business people about the economy

Of course, there is still a lot of work to be done, but we are on the right path.

Are there any plans to regulate financial technology (fintech) firms in the same way as banks are regulated in Angola?

The provision of financial services in Angola, including payment services, is regulated by the Central Bank. We have specific payment systems regulations which cover all payment service providers, whether they be banks or not. Fintech firms that are payment service providers are therefore regulated by the Central Bank according to the nature of their business model.

One issue that is attracting a lot of interest currently around the world is crypto currencies. While some countries are adopting crypto, some are also banning them. What is the banks position in relation to crypto adoption?

Only two countries have so far adopted crypto currencies as official legal tender, making their acceptance

INTERVIEW AFRICANLMAGAZINEwEADERSHIP ww africanleadershipmagazine co uk

39 P A G E

mandatory. We have no plans whatsoever to do this. We are closely following international developments on the use of crypto “currencies”, including the discussions within the Central Bank space with respect to regulation and supervision, and will take a view in due time as to the course of action to follow in respect of these “currencies”