AICC 2024–2025 CHAIRMAN

Taking flight in his new role, the Association’s board leader embraces the path ahead

OFFICERS

Chairman: Gary Brewer, Package Crafters, High Point, North Carolina

First Vice Chair: Terri-Lynn Levesque, Royal Containers Ltd., Brampton, Ontario, Canada

Vice Chairs: Joseph Morelli, Huston Patterson/Lewisburg Printing Co., Decatur, Illinois

Mike Schaefer, Tavens Packaging & Display Solutions, Bedford Heights, Ohio

Eric Elgin, Oklahoma Interpack, Muscogee, Oklahoma

Immediate Past Chair: Matt Davis, Packaging Express, Colorado Springs, Colorado

Chair, Past Chairmen’s Council: Jana Harris, Harris

Packaging/American Carton, Haltom City, Texas

President: Michael D’Angelo, AICC, The Independent Packaging Association, Alexandria, Virginia

Secretary/General Counsel: David Goch, Webster, Chamberlain & Bean, Washington, D.C.

Administrator, AICC México: Veronica Reyes

DIRECTORS

West: Sahar Mehrabzadeh-Garcia, Bay Cities, Pico Rivera, Califormia

Southwest: Jenise Cox, Harris Packaging/American Carton, Haltom City, Texas

Southeast: Chad Wagner, Peachtree Packaging & Display, Lawrenceville, Georgia

Midwest: Cassi Malone, Corrugated Supplies Co., Bedford Park, Illinois

Great Lakes: Josh Sobel, Jamestown Container Cos., Macedonia, Ohio

Northeast: Larry Grossbard, President Container Group, Moonachie, New Jersey

AICC México: Sergio Menchaca, EKO Empaques de Cartón S.A. de C.V., Cortazar, Mexico

OVERSEAS DIRECTOR

Kim Nelson, Royal Containers Ltd., Brampton, Ontario, Canada

DIRECTORS AT LARGE

Finn MacDonald, Independent II/Hood Container, Louisville, Kentucky

Kevin Ausburn, SMC Packaging Group/Green Bay

Packaging , Springfield, Missouri

Casey Shaw, Batavia Container, Batavia, Illinois

Stuart Fenkel, McLean Packaging , Pennsauken Township, New Jersey

Josh Sobel, Jamestown Container Cos., Cleveland, Ohio

Jack Fiterman, Liberty Diversified International, Minneapolis, Minnesota

EMERGING LEADER DELEGATES

Jordan Dawson, Harris Packaging , Haltom City, Texas

Evan Clary, National Corrugated Machinery, Hunt Valley, Maryland

Cody Brant, A.G. Stacker Inc., Weyers Cave, Virginia

ASSOCIATE MEMBER DIRECTORS

Chairman: John Burgess, Pamarco/Absolute, Roselle Park, New Jersey

Vice Chairman: Jeff Dietz, Kolbus America Inc., Cleveland, Ohio

Secretary: Mike Butler, Domtar Packaging , Fort Mill, South Carolina

Director: Brian Foley, Bobst, Phoenix, Arizona

Immediate Past Chair Associate Members: Tim Connell, A.G. Stacker Inc., Weyers Cave, Virginia

ADVISORS TO THE CHAIR

Matt Davis, Packaging Express, Colorado Springs, Colorado

Joe Palmeri, Jamestown Container Cos., Cleveland, Ohio

John Burgess, Pamarco/Absolute, Roselle Park, New Jersey

PUBLICATION STAFF

Publisher: Michael D’Angelo • mdangelo@AICCbox.org

Editor: Virginia Humphrey • vhumphrey@AICCbox.org

EDITORIAL/DESIGN SERVICES

The YGS Group • www.theYGSgroup.com

Vice President, Association Solutions: Craig Lauer

Creative Director: Mike Vucic

Managing Editor: Therese Umerlik

Senior Editor: Sam Hoffmeister

Copy Editor: Steve Kennedy

Art Director: Alex Straughan

Account Manager: Jillian Mengel

SUBMIT EDITORIAL IDEAS, NEWS, AND LETTERS TO: BoxScore@theYGSgroup.com

CONTRIBUTORS

Cindy Huber, Director of Conventions and Meetings

Chelsea May, Meeting Manager

Laura Mihalick, Senior Meeting Manager

Patrick Moore, Membership Manager

Taryn Pyle Director of Training, Education, and Professional Development

Rebecca Rendon, Senior Manager, Education and Training

Alyce Ryan Membership Marketing Senior Manager

ADVERTISING

Taryn Pyle

703-535-1391 • tpyle@AICCbox.org

Patrick Moore 703-535-1394 • pmoore@AICCbox.org

AICC PO Box 25708

Alexandria, VA 22313

Phone 703-836-2422

Toll-free 877-836-2422

Fax 703-836-2795 www.AICCbox.org

PROVIDING BOXMAKERS WITH THE KNOWLEDGE NEEDED TO THRIVE IN THE PAPER-BASED PACKAGING INDUSTRY SINCE 1974

We are a growing membership association that serves independent corrugated, folding carton, and rigid box manufacturers and suppliers with education and information in print, in person, and online. AICC membership is for the full company, and employees at all locations have access to member benefits. AICC offers free online education to all members to help the individual maximize their potential and the member company maximize its profit.

WHEN YOU INVEST AND ENGAGE, AICC DELIVERS SUCCESS.

My name is Gary Brewer, and it is my honor to have been elected as your 2024–2025 AICC chairman. I am president of Package Crafters in High Point, North Carolina, and Creative Packaging in Savannah, Georgia.

My path over the past 21 years has resulted in a two-facility sheet plant operation that has been supported tremendously by my AICC membership. My career began with degrees in paper science and chemical engineering from North Carolina State University and an MBA from Wake Forest University in North Carolina. I started out as a process engineer in a paper mill and then transitioned to various roles in a corrugator plant.

Many times, as I pursued my MBA at night while working full time, I saw classmates leave the stability and security of the company they worked for to chase an idea or a dream. It proved contagious and caused me to make the decision to break out on my own. I started my company with my father and four other team members; we bought an empty building and installed a flexo folder-gluer, rotary die cutter, and printer slotter. Then, it was time to get to work because we had no customers. Here I am now, proudly representing our industry.

I am a believer in AICC, its mission, and the many benefits of membership. The educational resources, peer group offerings, and networking opportunities are the bedrock for me and those I work with, not only early on but through today.

The theme of my chairmanship for this year is “Fly the Plane.” I have been a licensed pilot since my 21st birthday. Entrepreneurs and business leaders, like pilots, face many distractions and diversions on a daily basis. Your priorities, safety, customers, team members, sales, and family are always there, but so are many other circumstances, influences, demands, and interruptions. Everyone is counting on you.

Pilots have extensive education and training as well as their crew, manuals, checklists, and air traffic controllers to help them on their way. You have AICC, your colleagues, friends, family, suppliers, and experiences to help you on your way. Like a pilot, you log hours at your business and become more proficient as you build time honing your skills and embracing new ideas and technologies.

But you must fly the plane. Always. You must run your business.

We’ll develop this theme as the year progresses. I very much look forward to meeting with as many of you as I can and building the dialogue for continued successful flights.

Thank you for the opportunity to serve the Association.

President, Package Crafters and Creative Packaging

BY RYAN FOX

The fundamental landscape of corrugated boxmaking has changed since the COVID-19 pandemic, with demand bolstered by an e-commerce boom. From Q1 2020 to Q1 2024, corrugated manufacturers increased their number of employees by 4.7%, while total wages rose 26%, according to U.S. Bureau of Labor Statistics data (see table at top right).

Despite the past few years of industry growth, the longer-term trend has been more muted. In 1994, corrugated box shipments totaled 374.8 billion square feet (BSF) and were valued at about $18.7 billion, Fibre Box Association data shows. Almost three decades later, box shipments in 2023 were up just 1% at 380 BSF, and 2024 didn’t look much better through the first nine months. Last year’s shipments were valued at $39.9 billion, roughly the same as in 1994 adjusted for inflation.

Thirty years ago, 1,467 box plants in the U.S. employed about 131,100 people (see chart at bottom right). Those numbers have shrunk since to 1,150 plants and 103,000 workers, down 22% and 27%, respectively. Today’s smaller workforce faces the increasing demand for graphics, on-time deliveries, and perfect quality. That’s a tall order, but the industry has kept up so far, shipping more product with fewer plants and people while generating similar revenue.

Employment and Wages in Corrugated Manufacturing (Q1 2020 vs. Q1 2024)

Source: U.S. Bureau of Labor Statistics

Employment in NAICS* 322111 Corrugated & Solid Fiber Box Manufacturing in the U.S.

* North American Industry Classification System

Source: U.S. Bureau of Labor Statistics

Technology has made that possible. Sheet plants in 1994 largely used handme-downs and old equipment. Converted letter presses or similar basic printer slotter

machines from the 1960s were popular. Many required a second pass to glue the boxes. Conveyance, automation, and elaborate workflows were absent from the

average plant. Almost every machine was manual and required wrenches and tape measures, and the typical press operator might have had 20 years of experience. It wasn’t uncommon for family members to work together on a machine.

If a sheet plant had a conveyor system, it was likely manual. When boxes came off the printer slotter, they were stacked on a cart (basically, a big pallet with four swivel wheels) and pushed by employees through the plant to the next machine. Finding employees was easier than today, and they were the answer to most problems.

The cost to replace old equipment has outrun the ability to generate sufficient profits compared with 1994. New machine prices today are up 30%–130% in inflation-adjusted terms. That’s largely because they’re asked to do far more than they did 30 years ago.

Customer needs have dictated that producers buy new equipment with the ability to print more colors inside and outside of the box. To keep up with orders, machines are highly automated and store box specifications internally. This produces faster setups without the need to turn wrenches. To meet productivity goals and mitigate employee shortfalls, box plants have opted to buy pre-feeders, conveyance, robots, stackers, bundlers, and more.

These advancements and productivity gains have a downside for profitability. The industry’s expanded capacity has prompted some boxmakers to lower box prices to levels that were previously unprofitable to fill up their machines. That widens the gap between prices of containerboard and boxes—and fuels a need for bigger moves in containerboard.

Ryan Fox is a corrugated market analyst at Green Markets, a Bloomberg company.

We’ve combined power, precision, and performance into a robust and technically advanced machine.

Designed & manufactured in Germany

Robust cast-iron construction

Hybrid-design: gear driven + servo technology

Up to 8 print units

Slot score section

Top print available

BY ERIC ELGIN

AICC’s Government Affairs subcommittee and AICC staff members oversee AICC’s participation in efforts to support legislation and administrative rules in Washington, D.C., that would be favorable overall to AICC members. Here is an example of the issues that AICC touches, through the topics of letters signed on to by AICC during fiscal year 2024 (July 1, 2023, through June 30, 2024) starting with the most recent:

• June 12 to U.S. Department of Labor (DOL) Administrator Jessica Looman requesting a stay in the effective date of the new overtime rules.

• May 9 to Looman requesting a delay in the implementation of new salary guidelines for overtime.

• April 29 to U.S. Sen. Tommy Tuberville (R-Ala.) and U.S. Rep. Warren Davidson (R-Ohio) supporting the repeal of the Corporate Transparency Act.

• March 19 to the U.S. Senate Banking Committee leadership requesting a delay of one year in the implementation of the Corporate Transparency Act.

• March 5 to U.S. House members in support of the Overtime Pay Flexibility Act to protect workers and employers from specific changes to overtime pay by DOL.

• January 19 to U.S. House Speaker Mike Johnson (R-La.) and U.S. Senate Majority Leader Charles “Chuck” Schumer (D-N.Y.) urging passage of the Tax Relief for American Families and Workers Act.

• January 16 in support of National Association of Manufacturers

(NAM) letter to the U.S. House Ways & Means and U.S. Senate Finance committees in support of a retroactive earnings before interest, taxes, depreciation, and amortization standard for deductibility going back to 2022 and extending through 2025.

• December 11 to Johnson and U.S. Rep. Randall “Randy” Feenstra (R-Iowa) in support of the Death Tax Repeal Act.

• November 8 to U.S. Senate and U.S. House leadership in support of delaying the Corporate Transparency Act.

• November 7 to DOL in support of the Partnership to Protect Workplace Opportunity efforts to table or defeat the increase in minimum salary definitions for white-collar workers and the resulting increase in potential overtime pay.

• October 4, 2023, in support of the NAM’s letter to U.S. Senate and U.S. House leadership advocating for full research and development expenses to be deductible in the year in which they are incurred.

• September 28, 2023, in support of the Coalition for Tomorrow’s Workforce’s letter to U.S. House Ways & Means and U.S. Senate Finance committees advocating for adoption of the Invest for Tomorrow’s Workforce Act. This act would allow 529 education savings plan funds to be used for technical and trade schools.

• July 6, 2023, to the U.S. Senate and U.S. House authors in support of the Main Street Tax Certainty Act of 2023 to make permanent the 20% deduction for small and individually owned businesses (Section 199A).

In addition, AICC regularly shares information with members on many of these same issues:

• From the Small Business Legislative Council, AICC shares monthly alerts about what is going on in Congress that may be of interest to small businesses.

• From the S-Corporation of America, whenever they issue a communication, AICC sends to members.

• From the Council of Manufacturing Associations, a division of NAM, whenever they issue a communication, AICC sends to members.

AICC also liaises with related industry advocates:

• Corrugated Packaging Alliance: life cycle analysis and sustainability actions.

• Paper & Packaging Board: Sustainability toolkit and promotion of the Box to Nature program.

• American Forest and Paper Association: monthly extended producer responsibility (EPR) update Zoom meetings to stay abreast of state-by-state developments on EPR.

While AICC’s advocacy is not always successful, the voice of the independent is always heard.

Eric Elgin is owner of Oklahoma Interpak and chairman of AICC’s Government Affairs subcommittee. He can be reached at 918-687-1681 or eric@okinterpak.com

NEWW PACKAGING & DISPLAY

DAVID URQUHART

President/Owner 205 School St., Suite 201 Gardner, MA 01440 978-632-3600 www.newwpkg.com

AXIS CORRUGATED CONTAINER E.A. CASSON CEO

201 Industrial Dr. Butner, NC 27509 919-575-0500 www.accbox.com

DONECK USA

BILLY PRIEST

Chief Sales Officer

110 Ramsey Pl. Lynchburg, VA 24501 770-238-2151 www.doneck.com

KING PAPER LIMITED

LARRY MILLER

Chief Financial Officer 4800 N. Federal Hwy. Building D, Suite 302 Boca Raton, FL 33431 561-279-3232 www.kingpaper.com

WALLA WALLA ENVIRONMENTAL

CASSIE ROTHSTROM

President and CEO 4 W. Rees Ave. Walla Walla, WA 99362 509-522-0490 www.w2ecares.com

BOX+FOAM

ANN McCANN CEO

10100 S.W. Allen Blvd. Beaverton, OR 97005 503-449-5811 www.boxandfoam.com

SuperCorrExpo® 2024 electrified the corrugated packaging industry, drawing nearly 4,000 professionals to Orlando for a dynamic week of innovation and collaboration in September. With 276 exhibiting companies spanning 143,600 square feet of floor space, attendees were immersed in cutting-edge technologies, networking opportunities, and forward-thinking ideas.

The event’s stellar lineup of keynote speakers, interactive workshops, and expert panels offered invaluable insights

into the future of packaging. From artificial intelligence (AI)-driven production innovations to maximizing operational efficiency, SuperCorrExpo® provided a unique platform for learning, connecting, and pushing the boundaries of the industry’s potential.

SuperCorrExpo® 2024 delivered a robust educational experience with three impactful keynote presentations featuring NFL Hall-of-Famer Cris Carter, futurist Sean DuBravac, and “The Manufacturing Millennial” Jake Hall.

The event also included executive panel discussions with industry leaders. Attendees benefited from specialized sessions about AI on the production floor, in marketing, and applying AI in a box plant. Effective Methods to Maximize Die Cutting Productivity and Paper, Testing, and Profitability as well as sessions about automation, building expansion, capital expenditures, and cybersecurity offered insights into innovation, technology, and operational efficiency.

SuperCorrExpo ® 2024 opening keynote speaker Jake Hall, The Manufacturing Millennial, shares ways to engage current employees and build excitement in the next generation for manufacturing careers.

Nearly 4,000 people come together to see the latest innovations in the industry at SuperCorrExpo ® 2024.

®

and educational

Matt Davis, Packaging Express, passes the gavel to Gary Brewer, Package Crafters and Creative Packaging, the 2024–2025 AICC chairman.

Back by popular demand, the Technical Association of the Pulp and Paper Industry’s CorrPak Competition and AICC’s Package Design Competition join forces once again for the 2024 Box Manufacturing Olympics at SuperCorrExpo ® 2024.

Finn MacDonald of Independent II and Hood Container was awarded the highly esteemed AICC Champion Award during this year’s SuperCorrExpo®. As a long-serving and dedicated Membership committee chair, MacDonald has played a pivotal role in recruiting new members, retaining those needing support to continue their membership, and fostering greater engagement among AICC member companies. His unwavering commitment and leadership have significantly contributed to the Association’s growth and vitality.

This year, students were challenged to create an innovative, 360-degree shoppable, freestanding point-of-purchase floor display for their small-format retail stores. The project came from a real-life corrugated display buyer, Rocky Mountain Chocolate. Jerry Frisch of Wasatch Container helped to bring this real-world opportunity to AICC and the students.

All winning teams were from California Polytechnic State University. Winning teams included:

Structure Category

• Isabel Mendoza

• Alex Nishida

• Crystal Quan

• Andrew Reitz

• Jessica Wong

Graphics Category

• Julianne Hom

• Abigail Yee

• Evy Nguyen

• Lara Daghlian

• Christian Angulo

Back by popular demand, the Technical Association of the Pulp and Paper Industry’s (TAPPI’s) CorrPak Competition and AICC’s Packaging Design Competition joined forces once again for the 2024 Box Manufacturing Olympics (BMO). The competition was open to all TAPPI and AICC members from around the globe who produce corrugated, rigid box, and folding cartons, as well as their suppliers.

All entries were prominently displayed during SuperCorrExpo® in Orlando. Entries were evaluated by BMO judges based on various criteria, including design, quality, graphic excellence, technical difficulty, and innovative application.

Best of the Industry Corrugated Printing Vanguard Companies: PopSockets Grip & Go Target EndCap

Best of the Industry Corrugated Structure

Peachtree Packaging & Display: Bodyarmor Stadium

2024 Attendees’ Choice

Arvco Container: Custom Food Trays

See all winners at www.SuperCorrExpo.org

Geo. M. Martin earned the top accolade for its innovative SmartShingle system, which effectively minimizes or eliminates feed interrupts during stack or bundle discharges, addressing a significant operational challenge in die cutting.

SUN Automation Group won second place for the SUN 625HD, a revolutionary heavy-duty 66-inch rotary die cutter. Bahmüller took third place for Unique Turn, a high-speed turning module for specialty folder-gluers.

• Kongsberg: Ultimate Precision Cutting System

• JB Machinery: AutoDryer Control

• EAM Mosca: Max-Core Unitizer

• Durst: Digital White

• EFI: Nozomi 14000AQ

• EFI: Packsize X5 Nozomi

Attendees of SuperCorrExpo® witnessed videos showcasing all finalist innovations and cast their votes, selecting Geo. M. Martin as the 2024 Innovator of the Year. Open exclusively to AICC Associate members, this year’s competition focused on machinery.

Learn more at www.AICCbox.org/innovator

SHINKO Super Alpha OC Open & Close Flexo Folder Gluer

BY RALPH YOUNG

Your Association constantly receives news from subscription sources, regular public news services, members, and Associates on local and regional issues, other associations, investment firms, and publicly traded events. We view our Association’s responsibility as staying immersed in these issues, and when we do not have answers for questions you ask, we connect with our network and look to other news sources.

A cover feature article in the July 22, 2024, issue of Board Converting News was on Premier Packaging and included mention of a 22-page sustainability report. This document is available to view or download from the company’s website, www.prempack.com

One year ago, we partnered with the Packaging School, associated with Clemson University in South Carolina, on an eight-hour online course on carbon neutrality—one piece of the total sustainability puzzle. AICC members who chose to participate were able to make significant reductions in their sustainability footprint and enjoyed the exercise. This was just one more educational benefit of AICC membership.

In August, it was reported that BlackRock rebranded the very negative phrase “environmental, social, and governance” as “transitional investing.” For those of you who are not familiar, BlackRock is the world’s largest asset management company, with over $10 trillion under management. So, what’s the big deal?

The company is the elephant in the room and is able to tell public companies

where they own stocks or bonds and how they are to run their business in regard to the issues listed above.

The opposition was so loud that BlackRock needed to rebrand its tactics. This is important to you because this can have a trickle-down effect. Your packaging clients could start asking about your way of doing business. A copy of the report titled BlackRock Investment Steward: Climate and Decarbonization Stewardship Guidelines is at bit.ly/3T9xrlh

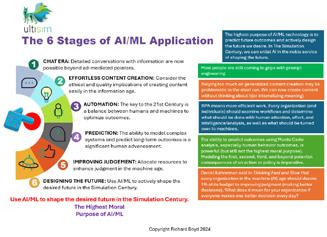

In May, AICC held a very wellattended and successful AI Xperience. We continue to be out front on these issues. Thanks again to all the knowledgeable presenters. Keep up the good work.

Against this, we observed that Dole is moving as fast as it can to paper-based packaging and away from plastic for certain ready-to-eat consumer foods. Its claim is that the new packaging design eliminates 97% of plastic usage across an entire product lineup. I assume more paper-based wine bottles are on their way!

Deutsche Bank published a research paper on July 11, 2024. In the survey of consumers regarding the biggest economic risks in the next few years, the five that may have the biggest impact on us as boxmakers are as follows:

• High inflation

• Climate change

• Slow economic growth

• Rise of artificial intelligence (AI)

• Collapse of global supply chains

The Institute of Packaging Professionals’ new Sustainable Packaging

Technical committee is just beginning. We belong to the Chemical Packaging committee in which we monitor movements in the United Nations’ hazardous materials regulations for corrugated packaging.

The Paper and Paperboard Packaging Environmental Council in Canada has been commenting to provincial governments about the Ontario Blue Dot program, which has not accomplished what lawmakers originally envisioned.

Now, their efforts are being applied to being industry experts on extended producer responsibly (EPR), especially to British Columbia lawmakers. Remember that five states in the United States have passed various forms of EPR legislation, all with varying levels of success.

SuperCorrExpo® had two sessions on these issues in September 2024, and at FastMarkets’ International Containerboard Conference in October 2023, AICC moderated a panel discussion on AI. The sustainability session at SuperCorrExpo® featured discussion on life analysis and packaging-to-product weight ratios.

Don’t go it alone. We are here to support and guide you.

Ralph Young is the principal of Alternative Paper Solutions and is AICC’s technical advisor. Contact Ralph directly about technical issues that impact our industry at askralph@AICCbox.org

With 2024 nearing its end, it’s a great time to pause and take stock of what’s going on in the consumables space, including offset printing plates, paper and paperboard, printing inks, and everything else needed to actually produce printed packaging materials.

Although we have certainly rebounded a fair amount from the shortages and price hikes that defined the COVID-19 pandemic years, that doesn’t mean consumables in general aren’t still getting pressure from a number of sources. Depending on the types of consumables you use, you might feel like everything has more or less returned to pre-2020 situations, or you might still be feeling the squeeze.

With that in mind, let’s take a look at a few key material supply trends still impacting the print and packaging space today.

Paper and Paperboard Are Still Under Pressure

While it certainly isn’t nearly as bad as it was a few years ago, the paper and paperboard markets are still under considerable pressure. Demand is still shifting, with many paper mills either closing entirely or moving to other grades of paper and paperboard, particularly packaging grades or consumer products— think toilet paper or paper towels.

“Like all businesses, the challenges paper manufacturers face are input costs—energy, raw materials (pulp costs), and finding labor [like printing press operators]. It is an aging workforce that is challenged to attract younger workers,” says Jill Crossley, director of operations at industry association Two Sides North

America. “An overall decline in demand plus the cost of inflation have led to consolidation, closure, and the transition of many North American paper mills to manufacture other more profitable and desirable marketplace grades.”

I recently saw some data pulled from RISI that showed printing and writing paper capacity has decreased from 65% to 85% since 2000 depending on the paper type. The numbers are similar in Europe, where a strong contraction of capacity has occurred in recent years, as well.

Overall demand for coated paper and paperboard was slightly up in the first half of 2024. The conversions by paper manufacturers and cost pressures have caused printers and end users to look at other paper options, often getting creative and downgrading to a lesser quality or lighter paperboard to help with increasing costs. I would think packaging printers will continue to do this for the foreseeable future because those cost pressures don’t

seem to be going away in the second half of this year or through 2025, as well. What’s next for the rest of this year and into next? There most likely will be some additional short-term shortages or shuffling of supply locations as mill closures and consolidations continue to occur.

The grades of paperboard availability will vary fairly significantly in terms of how much demand and cost increase are seen, so no one trend or prediction will apply to all package printers. Rather, you should continue to work closely with your preferred paperboard mills and merchants to ensure you have what you need, when you need it, and for a price that doesn’t cut into your cost structure.

Another area experiencing significant challenges right now is the aluminum lithographic printing plate market, with a battle going on over whether the United States will impose tariffs on imported

plates. Right now, Kodak is the only manufacturer still producing aluminum offset plates in the United States at a facility in Columbus, Georgia, with the rest of the U.S. being supplied with products from Japan or China.

Kodak and the U.S. Department of Commerce have been pushing for tariffs that could soar into the triple digits, if passed. This will force manufacturers such as Fujifilm to raise prices significantly to offset those costs. Not surprisingly, they have been strong opponents of the proposed tariffs, with a statement from Fujifilm noting it will “explain and defend our position to the International Trade Commission.”

Further muddying those waters, Fujifilm has also filed a patent infringement suit against Kodak, saying the company’s Sonora processless plates are infringing on Fujifilm’s patents.

The basis for the tariffs revolves around claims that companies that manufacture aluminum litho plates in Japan and China have an unfair advantage, claiming they are “dumping” plates in the U.S. market for significantly less than they charge in those countries, creating anticompetitive markets. Kodak claims these companies are selling plates for significantly less than the cost of production to capture more market share.

However, Fujifilm noted in a statement, “The preliminary antidumping duties from the U.S. Department of Commerce are predicated in part on the higher market prices of our aluminum printing plates in Japan, which creates the misguided perception of Fujifilm unfairly lowering U.S. prices by comparison. The antidumping law allows Eastman Kodak to claim that the existence of higher prices in Japan somehow makes the lower prices offered to U.S. customers ‘unfair.’ But this is just not true. Fujifilm’s prices to its U.S. customers are not unfair to anyone.”

Recently, 12 regional trade association groups threw their own weight into the

debate, with a formal joint statement against the proposed tariffs. It reads in part, “We are writing on behalf of the U.S. printing and graphic communications industries to urge the International Trade Commission (ITC) to reject antidumping and countervailing duties on imports of aluminum lithographic printing plates from Japan and China. Additional duties on printing plates will lead to increased costs for printers and the businesses they serve, reduce competition in the printing plate market, and threaten the availability of quality printed materials for businesses and consumers alike. … Although the entire printing, packaging, and graphic communications industries and the customers they serve will feel the burden of increased costs—from the largest-scale packaging printers to the smallest mom-and-pop printers—we are particularly concerned that small printers and the thousands of small businesses served by printers in this country will disproportionately shoulder the burden.”

The final hearing was to be held September 12, 2024, which is also when ITC was expected to issue its final ruling on the matter, so stay tuned.

In contrast to paper and plates, inks in general aren’t seeing as much volatility right now. There have been hiccups in the past year such as the fight to prevent state legislatures from banning carbon black in inks, which would have significant impacts if passed, but for the products themselves, the market has stabilized into a fairly healthy supply and demand.

A few trends impacting the space include ever-increasing demands for more eco-friendly inks to match with growing sustainability concerns across all types of businesses and industries; a growing demand for more specialty inks, particularly in the digital space—think fluorescents or metallic inks—and the continuing trend for printers to demand

inks that can dry faster and also produce higher-quality pieces, since consumer brands aren’t interested in compromising quality or marketing.

Packaging ink demand is rising rapidly as more commercial printers look to enter the space with short-run or prototype work to complement work they are doing with large and small brands. That trend will likely continue to drive innovation in that space.

On the flip side, the costs of the raw materials needed to produce these inks and the supply chains necessary to move those materials are seeing costs rise, which is impacting the price of the final product. To date—barring the COVID-19 pandemic years—the costs of ink have remained relatively stable, without any major spikes, but more of a steady increase over time. Expect that to continue for at least the short term, although a lot of factors could cause that to change rapidly.

All in all, the consumables market has stabilized in the past few years, but that doesn’t mean the challenges created by the COVID-19 pandemic have simply evaporated overnight. We are still seeing the impacts linger, even as newer challenges such as the imported offset plate tariff controversy come along.

In general, most package printers don’t need to be hoarding paper or supplies anymore for fear of running out and not being able to get more, but they should be paying close attention to what the market is doing and continue to work closely with their chosen vendors to make sure they are prepared for whatever might come down the line during the remainder of this year, in 2025, and beyond.

Tom Weber is president of WeberSource LLC and is AICC’s folding carton and rigid box technical advisor.

Contact Tom directly at asktom@AICCbox.org

BY TODD M. ZIELINSKI AND LISA BENSON

So far in 2024, raw materials, energy, labor, and transportation costs have risen significantly, leading packaging manufacturers to raise prices or reduce profit margins. Simultaneously, while cooling, inflation is still straining consumer spending, prompting consumers to scale back on nonessentials, leading to a decline in certain categories. The U.S. government revised its job growth report, decreasing the number significantly. This may indicate the job market is weaker than initially reported, leading some analysts to believe the feds have waited too long to cut interest rates, and the economy could be slowing sharply. We are living with a significant degree of economic uncertainty. In this challenging environment, having the right type of salespeople is more critical than ever.

A skilled and well-suited sales team can be the difference between maintaining profitability and falling behind during uncertain times. Well suited means they have the skills and personality for the specific sales job—whether that be to prospect and develop new business (e.g., a business development representative [BDR], sales development representative, new business sales executive) or nurture and grow existing customers (e.g., an account manager [AM], account representative, customer service representative). Sustainable company growth requires a sales team made up of both types. Each job requires specific skills and personality traits. Skills are generally acquired through practice, education, or experience and can often be assessed and evaluated. Personality traits are inherent characteristics that shape how a person

feels, thinks, and behaves. Personality traits can be gauged by personality and sales aptitude tests. We use Behavioral Sciences Research Press’ SPQ*Gold sales assessment, which tests for sales call reluctance, sales skills, aptitude, and prospecting behavior, and Inscape Solutions’ Everything DiSC sales assessment, which evaluates dominance, influence, steadiness, and conscientiousness.

Since both jobs have multiple titles associated with them, to simplify, we will refer to those who develop new business as BDRs and those who nurture and grow existing accounts as AMs.

Finding new business opportunities and converting them into customers require skills different from those of an AM. A BDR, the “hunter” archetype, must prospect, cold-call, negotiate, and close the deal—activities requiring a distinct skill set. The individual will have the skills to understand the intricacies of the market, identify and seek out new opportunities that fit the business goals, build genuine relationships with strangers, and understand the importance of listening and reading social cues to adapt to different sales situations and personalities.

Persuasion is another vital skill— having a deep understanding of their company’s value proposition and how current economic situations impact it provides an advantage to a BDR. Additional skills found in successful BDRs are that they can prioritize leads and manage time efficiently to maximize sales opportunities. They are also adept at adjusting strategies and tactics quickly in

response to new information or changing circumstances.

Like the skill sets, the personality traits of a successful BDR align closely with the job’s demands. They are typically aggressive in pursuing new business, driven by a sense of urgency and a desire to close deals quickly. This aggressiveness is balanced by resilience; a BDR must be able to handle rejection and bounce back quickly, ready to move on to the next opportunity.

Confidence and a competitive spirit are other defining traits of a successful BDR. They believe in their ability to win over clients because they often find themselves in situations where they must beat out other companies vying for the same business. Having a solid value proposition ties back in here.

BDRs are generally independent workers, thriving on autonomy and taking the initiative without needing constant supervision. Lastly, successful BDRs are willing to take risks, understanding that the potential rewards of securing new business often outweigh the risks involved.

In contrast to the BDR, an AM is often seen as a “farmer” dedicated to nurturing and growing existing client relationships. Their primary focus is on maintaining customer satisfaction, fostering long-term loyalty, and identifying opportunities to expand the business within these existing accounts.

The skills required to be a successful AM differ significantly from those needed by a BDR. At the heart of the AM’s role

is relationship-building. They excel at developing strong long-term relationships with their customers, understand their needs, and ensure they are consistently met over time.

Account management skills are crucial for AMs because the primary focus is on identifying opportunities to grow the account. This could mean introducing the client to new products or services, cross-selling within the existing portfolio, or upselling to a more comprehensive solution.

Customer service is another key skill for AMs, ensuring their clients are satisfied with the products or services they receive and addressing any issues or concerns that arise quickly and effectively. This level of service is critical for maintaining client loyalty and preventing churn.

One skill that gets used quite often is problem-solving. Clients will inevitably face challenges, and it’s the AM’s responsibility to address these challenges in a way that strengthens the relationship. This could involve coordinating with other departments within the company to ensure the client’s needs are met, or coming up with creative solutions to unique problems.

Finally, communication skills are indispensable for AMs. Successful AMs keep their clients well informed and engaged, ensuring there is always a clear and open line of communication. They are diligent in following up with customers and addressing their inquiries.

When we look at the personality traits of a successful AM, patience is perhaps the most important trait because building and nurturing long-term relationships take time and effort. AMs need to be willing to invest this time to see the relationship grow and flourish. Nurturing an account requires some level of empathy.

Understanding and caring about the client’s needs and concerns are essential for building trust and ensuring long-term

loyalty. Trustworthiness is closely linked to empathy; clients need to feel confident that their AM has their best interests at heart and will act with integrity.

AMs are detail-oriented, paying close attention to the specifics of each client’s account to ensure nothing is overlooked. This attention to detail helps prevent issues from arising and ensures the client receives consistent and reliable service.

Finally, collaboration is also a critical trait for AMs. They often need to work closely with other departments within the company to meet the client’s needs. This requires a collaborative spirit and the ability to work well with others.

While the roles of BDRs and AMs are distinct, they are also complementary. A successful sales strategy involves hunting and farming; new business needs to be brought in, but existing business must also be maintained and grown.

BDRs and AMs often work closely together, with BDRs bringing in new clients and AMs taking over to ensure those clients are satisfied and the relationship continues to grow. This cooperation and division of labor are essential for the company’s longterm success.

Packaging customers seek partners who are not only knowledgeable but also reliable and supportive, particularly during uncertain times. Sales teams that are a blend of farmers and hunters with the right skills and personality traits are better equipped to maintain strong client

relationships, even when budgets are tight. BDRs and AMs can identify new opportunities for new accounts and existing customers within shifting markets. They are not just selling products; they are offering stability, support, and strategic insights to help their customers navigate uncertain times.

Ultimately, in a year when every dollar counts, having a sales team that combines the right skills with the right personality is not just beneficial—it’s essential. Investing in the right people could be one of the most important decisions packaging manufacturers make this year as they work to stay ahead in an increasingly complex economic landscape.

Todd M. Zielinski is managing director and CEO at Athena SWC LLC. He can be reached at 716-250-5547 or tzielinski@athenaswc.com

Lisa Benson is senior marketing content consultant at Athena SWC LLC. She can be reached at lbenson@athenaswc.com

BY JULIE RICE SUGGS, PH.D., AND ALLI KEIGLEY

For packaging professionals, the trends in corrugated materials are more than just a passing fascination—they’re like discovering a hidden treasure chest full of new possibilities! Imagine this: You’re at the helm of a packaging design project, and instead of reaching for the same old materials, you’re exploring cutting-edge corrugated solutions that are as ecofriendly as they are innovative.

Picture a small, ambitious startup that makes artisanal chocolates. Its goal is to deliver not just a delicious treat but also an unforgettable unboxing experience that aligns with its commitment to sustainability. The company is in search of packaging that’s stylish and environmentally friendly. Enter the world of advanced corrugated materials. By opting for custom-designed, sustainable corrugated boxes that feature stunning print designs and protective layers made from recycled fibers, the startup is able to captivate its customers while reducing its environmental footprint.

In this article, we take a deep dive into how the trends in corrugated materials are revolutionizing the packaging industry. From optimizing packaging solutions to enhancing sustainability and adapting to ever-evolving market demands, we explore how packaging professionals can harness these innovations to stay ahead.

Let’s kick things off with a key topic in today’s world—sustainability and eco-friendly innovations in the packaging industry. This includes using recycled materials and compostable coatings and reducing overall waste. Professionals need to create packaging solutions that align with sustainability objectives. One way is by examining the United Nations’ sustainable packaging goals, which can provide a foundation for developing

effective strategies. A suggested approach might involve designing corrugated packaging that features a greater proportion of recycled fibers or adopting construction techniques that facilitate easier recycling. For example, you could use corrugated materials made from post-consumer recycled content of old corrugated containers or opt for designs that minimize the use of adhesives and coatings, which can complicate the recycling process.

Education is key here; staying informed on the evolving regulations and standards for sustainable packaging helps ensure compliance and positions companies as leaders in eco-friendly practices. Our partners at the Sustainable Packaging Coalition offer valuable resources on this subject, including its comprehensive guide on the recyclability of paper packaging.

With an increasing focus on regulations related to packaging, encompassing recyclability, food safety, and labeling, packaging professionals must prioritize compliance management to ensure their designs meet all relevant standards. This requires up-to-date information on all pertinent legislation and incorporating necessary features into packaging. Sustainability reporting is also becoming crucial because it involves providing transparency in sustainability efforts and packaging practices, including reporting on material sourcing, recycling rates, and overall environmental impact. The Packaging School can support professionals in this area through its sustainability reporting module, which offers comprehensive guidance on navigating regulatory requirements and effectively communicating sustainability achievements.

Another trend becoming increasingly popular is the customization of

corrugated packaging for branding and unique consumer experiences. Creating custom designs in which printing occurs directly on the corrugated packaging not only strengthens brand identity but also enhances consumer appeal. This could include incorporating high-quality graphics, developing unique structural designs, or adding special finishes that make the packaging stand out on the shelf to create a memorable impression. Designing packaging that provides a more engaging or interactive experience for consumers—such as incorporating custom shapes or designs that enhance the unboxing experience—can boost customer satisfaction and brand loyalty. There is an ongoing push for costeffective packaging solutions that maintain high-quality and performance standards. For packaging professionals, this trend means diving into thorough cost analysis and optimizing packaging designs to balance cost with functionality. This includes evaluating the total cost

Scan the QR code below to access the Packaging School’s sustainable reporting module:

And don’t hesitate to check out AICC’s Packaging University at learning.AICCbox.org for tons of courses that boost your knowledge about sustainability throughout the packaging process.

of ownership—factoring in production, transportation, and disposal. Moreover, streamlining production processes to reduce waste and lower costs is essential. By implementing more efficient manufacturing techniques or enhancing material utilization, you can boost cost-effectiveness without compromising quality. Incorporating education into your team culture can further amplify these efforts, ensuring everyone is equipped with the latest knowledge and skills to innovate and excel in this dynamic field.

Lastly, the integration of technology into corrugated packaging is a growing trend, encompassing innovations such as smart packaging solutions and advanced printing techniques. For packaging professionals, this means exploring the use of quick response (QR) codes, near-field communication (NFC) tags,

or sensors embedded in corrugated packaging to offer additional information or improve traceability.

In summary, corrugated packaging pros need to keep their finger on the pulse of the latest trends to stay ahead in the game and meet the ever-changing demands of consumers and regulators. By diving into the latest advancements in corrugated materials and embracing cutting-edge, sustainable, and cost-effective design practices, you can supercharge your packaging solutions and shine in the marketplace.

Continued education plays a crucial role in this journey, ensuring you stay current with emerging trends and technologies. By committing to ongoing learning, you’ll be better equipped to innovate and adapt, keeping your packaging solutions at the forefront of the

industry and giving you a competitive edge. Think of it as leveling up your packaging game—where every trend is a new power-up to boost your success and keep your creations on the cutting edge of innovation.

Julie Rice Suggs, Ph.D., is academic director at the Packaging School. She can be reached at 330-774-8542 or julie@ packagingschool.com.

Alli Keigley, who contributed to this article, is production coordinator at the Packaging School. She can be reached at alli@packagingschool.com.

BY SCOTT ELLIS, ED.D.

“MacGyvering” refers to the process of solving a problem or creating something in a resourceful and inventive way, typically by using whatever materials are readily available, often in unconventional or unexpected ways. The term comes from the 1980s television series MacGyver in which the main character, Angus “Mac” MacGyver, was known for his ability to craft solutions to complex problems using everyday items and without the need for advanced technology or tools.

I recently read Unstoppable Brain , in which the author uses MacGyver as a model for failure immunity—not that MacGyvers never fail, just that they don’t let it stop them. Neuroscientist and Unstoppable Brain author Kyra Bobinet is convinced that iteration is the key—we try, we fail, we try something different, we succeed in part, we figure out what is working, we do something better.

Examples of failed change initiatives are easy to find. So many companies have launched initiatives fueled by force of management will, only to return to old habits in a few weeks. Then, the tool or methodology is blamed. In truth, the reason the company did not follow through was due to relying on a tool rather than changing the mindset.

A mindset leads to a way of doing things. The way we do things is our culture. There is no tool, and there isn’t one to be developed that will work for long without a culture of continuous improvement. Such a culture has iteration as its foundation. We don’t usually call it iteration; we call it kaizen or plan-docheck-act. It also has other aliases.

The key to this culture is we never quit because failure just shows us another way that doesn’t work. Iteration brings an attitude that “problems are just opportunities

in work clothes.” In this culture, we never settle because when we succeed, we know that we can build on that success.

This culture is absorbed by everyday doing. Any classroom time should be invested in those who will facilitate the use of tools and methods to involve the people closest to the process in continuous improvement. If you are interested in the theory behind this hard-won opinion, you can reference the earlier books in my intentional culture series. Here is the short version: “Don’t take me back to school.” Just identify a problem and engage me with a tool that will help me approach it differently. Use a variety of tools situationally, and soon, I will be fluent in problem-solving.

One of the fastest ways to develop the habits of a continuous improvement culture is to have physical reminders of the tools in the workplace, particularly where work group meetings are held. This helps because it reminds the meeting leader and those present of the tools available. Here is my expanded plan-do-check-act cycle with examples of planning and critical thinking tools that are easy to use with work groups.

1.

This is the habit of looking for trouble, a proactive approach to improvement. We want to be surprised by as few problems as possible. This is practiced by showing people how to use the “five whys” or searching for waste by using the TIMWOOD tool (an anagram for wastes in transportation, inventory, motion, waiting, overproduction, overprocessing, and defects).

2. PROBLEM EXPLORATION

We explore many possible causes so our solutions will decrease or eliminate the actual root cause. Examples of tools to accomplish this include use of a fishbone diagram or a value stream map.

3. SOLUTION BUILDING

Problem exploration data points you to the priority root cause candidates. Those contenders will be the subject of focused attention by an individual or group. Tools such as A3 reports and mission-aligned people and processes (MAPPs) are used in this stage. A3 involves a clear definition of a problem, the current conditions, well-defined goals, thorough analysis, proposed solutions, a plan, and follow-up to test the plan’s effectiveness. MAPP is

a series of questions to be answered by a group to ensure success by matching the project goal with goals of the company.

The success of the solution you implement requires involvement of the team will for longevity of the improvement. To achieve lasting change, we will need to build in communication and accountability. Tools to help here include action plans and team charters to keep everyone focused and on task.

Performance measures specific to the task expose levels of progress and provide motivation. Posted key performance measures are essential.

We may fail, make partial gains, or attain stellar success. We must adapt or iterate to keep moving up. Tools that can assist here include the lessons learned review and regular process audits. The key is to never give up or settle for good enough.

Recently, I was asked if line workers should be paid more to problem-solve. In truth, those who use critical thinking are paid more because they advance to levels of higher responsibility.

An important ancillary benefit is that they take those skills home, where they model MacGyvering for their family. Your continuous improvement culture can influence whole communities.

Scott Ellis, Ed.D., is a culture tech working for leadership and process improvement. This article is an excerpt from the book of the same name that will be volume three in the Intentional Culture series, available on Amazon.

BY BEN DOLEZAL

As a professor of packaging design in the University of Texas at Arlington’s (UTA’s) Art and Art History Department, I have the distinct privilege of shaping future packaging professionals—though some are surprised by how much math goes into designing even a simple box. But don’t worry, it’s not all geometry and glue guns. We dive deep into the world of graphic design, a field that’s as much about storytelling as it is about looking good on a shelf.

One of the first lessons I stress (other than “don’t use Papyrus font”) is packaging design is more than making something pretty—it’s a brand’s handshake with the consumer. Every color, font, and graphic works overtime to tell a story before you even realize you’ve picked up that same box of cereal for the third time this week.

In our program, students quickly learn that design choices can make or break consumer engagement. Through hands-on projects, they tackle real-world challenges like “How do we make this look cool and affordable?” Spoiler alert: Many sticky notes are involved. But by the time they graduate, they’ve developed the skills to create not only beautiful packaging but also practical, cost-effective solutions. And that’s no small feat.

Let’s be real, nobody likes plastic anymore, except maybe some vintage

Tupperware from the 1990s. Enter paper-based packaging, the eco-friendly hero we’ve all been waiting for. However, designing sustainable packaging is like playing Tetris: How do we make it ecofriendly, durable, and still good-looking without breaking the planet (or the budget)?

In our program, students experiment with various paper substrates, custom printing techniques, and structural design. They learn how to solve challenges like balancing cost, production efficiency, and sustainability, all while keeping aesthetics in mind. The goal is to leave with portfolios full of innovative designs that are visually appealing and

environmentally responsible. In other words, they’re learning to save the world—one recyclable box at a time.

Packaging is often the first time a consumer interacts with a brand, so it’s like the product’s “first date” with the buyer— awkward moments included. That’s why it’s essential to get the branding right from the get-go. I teach my students how to use color schemes, typography, and logos to make a strong first impression, creating a brand experience that keeps customers coming back.

Students work on real-world branding challenges, creating packaging that not

only tells the product’s story but makes you feel something—like the overwhelming need to buy another bag of chips you didn’t plan on getting.

Ah, the creative mind! Artists love to push boundaries, and in packaging design, that can be a blessing and a logistical nightmare. Teaching artists to consider cost, production processes, and material limitations can sometimes feel like telling a cat to walk on a leash— possible, but tricky. Yet, watching them balance beauty and practicality is one of the most rewarding parts of my job. Through hands-on projects, our students learn how to take their out-ofthis-world creative ideas and translate them into designs that actually work in the real world. (Yes, your triangular milk carton is cool, but let’s think about how that’s going to stack in a fridge, shall we?)

Despite the challenges, students from artistic backgrounds bring fresh, unconventional ideas to the table—

sometimes literally. Whether it’s handdrawn illustrations or bold color palettes that defy the norms, their creativity shines through in their designs. And sometimes, the most unexpected ideas lead to innovative solutions.

Since 2013, my students have won more than 50 national and international awards for their packaging designs, including several awards from the annual AICC Student Design Competition. From a pingpong paddle box shaped like a cannon to a floor stand display resembling a circus big top, their work has been recognized for pushing creative boundaries in all of the best ways.

One of the biggest joys of teaching is seeing my students go out into the world and land impressive jobs—often at companies such as Frito-Lay and Mary Kay. They use their newfound skills to make consumers buy things they didn’t know they needed.

Our program prepares students to thrive in the competitive world of packaging design. With professional

portfolios packed (pun intended) with their work, many of our graduates have secured roles at major companies, applying what they’ve learned to create the next big thing in packaging. After all, we know it’s not just about the product—it’s about how it’s wrapped. In the world of consumer products, graphic design is the heartbeat of successful packaging. The UTA program equips students with the tools to balance creativity, sustainability, and practicality. Whether it’s winning international awards or landing top jobs, our graduates prove that packaging design is about more than just wrapping a product—it’s about shaping an experience.

And remember, if you ever need advice on picking out the perfect font for your packaging, I’m always here—just don’t use Papyrus.

Ben Dolezal is an associate professor at UTA.

It’s time to unbox the latest model in the Ultima machine family –EMBA 295 QS Ultima ™. Delivering outstanding productivity and quality as well as material efficiency to large box operations. That’s what we call big news.

By introducing the EMBA 295 QS Ultima ™, we now offer a complete machine range to fit any customer need. It comes loaded with all the

benefits you’d expect and like all our Ultima machines it features our unique Non-Crush Converting ™ and Quick-Set ™ technologies.

The 295 QS Ultima ™ offers true DualBox ™ production through TwinFeed ™ and XL slotter, as well as complex internal box die-cutting and creasing with the bottom diecutter. Several available options, like for example HighBox ™ and the award winning LiquidCreaser ™ , further enhance its true flexibility and top-class performance.

BYLINE

AICC is excited to offer its members an insightful new webinar titled Death of Traditional Sales Model: The New Sales Process for Corrugated and Protective Packaging on Wednesday, December 4, 2024. This educational session, available for free to AICC members in good standing, will explore how the evolution of buyer behavior is reshaping the sales landscape for packaging professionals.

As sales and marketing continue to evolve, traditional methods of connecting with potential buyers have become increasingly challenging. Buyers now take a more independent approach to their sales journey, and the salesperson’s role is undergoing significant transformation. This shift is a response to new buyer habits and a recognition that the conventional sales model has proven inefficient for complex sales environments such as corrugated and protective packaging.

Leading the discussion will be Todd Zielinski, managing director and CEO of Athena SWC, an expert with over 20 years of experience in sales, lead generation, tactical marketing, and business development. As a co-founder of Athena,

Zielinski was instrumental in creating Athena’s outsourced business model and has consistently helped companies optimize their sales strategies for better results.

This webinar presents a unique opportunity for AICC members to gain critical insights into the modern sales process

and adapt to the shifting dynamics of the packaging industry.

Remember, the webinar is available free of charge to AICC members in good standing. To register or learn more about this valuable opportunity, please visit www.AICCbox.org/calendar

BY STEVE YOUNG

Menasha’s corporate headquarters in Neenah, Wisconsin.

Anyone who’s been in the corrugated industry for 20, 30 years, or more can be forgiven for thinking of Menasha Corp. as an “integrated” forest-products company. After all, it did own paper mill assets and timberlands during much of its long history.

But Mike Riegsecker, president of Menasha Packaging, is quick to set the record straight. “We’re a 175-year-old private company that’s owned by the same family that founded it,” he says. “We’re now in the seventh generation of family ownership.”

Menasha Corp., based in Neenah, Wisconsin, this year celebrated its 175th anniversary as an independent. Riegsecker recalls the company’s legacy of entrepreneurial innovation and commitment to customers, employees, and their communities. “The industries we serve continue to evolve, and that has evolved the expectations our customers have with their packaging and supply chain

requirement,” he says. “These evolutions have taken place for 175 years, and as they do, we have remained focused and committed to growing and investing in the solutions we offer—always focused on helping our customers solve the challenges they are facing today while remaining out front and in tune with the challenges that are on the horizon where new solutions will be required.”

The company was founded in 1849 in Menasha, Wisconsin, as the Pail Factory, a maker of wooden buckets, barrels, and kegs. It floundered in its early years, however, and in 1852, a young transplant from Woonsocket, Rhode Island, Elisha D. Smith, seeing an opportunity to exploit the growing volume of trade in the newly admitted state of Wisconsin, acquired it for $1,200—money borrowed from his father-in-law in Rhode Island. In 1872, the firm reorganized under the name Menasha Wooden Ware Co.

Company: Menasha Corp.

Established: 1849

Joined AICC: 2023

Phone: 920-751-1000

Website: www.menasha.com

Headquarters: Menasha, Wisconsin

President: Mike Riegsecker

Though the privately held Menasha of today lacks vertical integration in timber resources and paper mill assets, its founder recognized the need to secure his sources of raw material supply. In the early days of the Wisconsin territory, canal and rail transportation made possible the bulk-shipment of products such as vinegar, sauerkraut, beer, and sausage from the interior of the territory to the Great Lakes ports of Green Bay and Milwaukee. Abundant timber resources there provided the hardwoods needed to produce the barrels and kegs to support this trade, so Smith acquired timberlands in Wisconsin, Michigan, and Minnesota to supply the company. Later, after these sources grew thin—reforestation was little practiced at that time—he bought lands in Washington, Oregon, and northern Idaho. Downstream timber processing facilities such as lumber mills, stave-making plants, cooper shops, and

painting facilities completed Menasha Wooden Ware’s supply chain and drove much of the company’s success in the last decades of the 19th century.

With the passing of Smith in 1899, his son Charles Robinson Smith took the reins of the company. But it was his son Mowry Smith Sr. who, as a new member of the company’s board of directors in the 1920s, recognized the value of a new, nascent industry: corrugated paper.

By the late 19th and early 20th centuries, the development of corrugated paper and fiberboard shipping boxes provided an alternative to heavy wooden crates. Shippers, impressed with the lightweight durability of corrugated paper, saw it as a viable alternative. Gina Shaw, writing in Living Our Values: The Story of Menasha Corporation , named the Lawrence Paper Co. in Lawrence, Kansas, and Fort Wayne Corrugated Paper Co., as two of the earliest entrants into this market, calling them “the first mass corrugated box producers in the United States.” However, the railroads, the predominant carriers of freight in that era, objected to the introduction of paper-based packaging and began charging a tariff on products packaged in it. A landmark decision for the future of the corrugated box as a shipping container came in 1914 with the Pridham case in which the Interstate Commerce Commission ruled that there were no differences between the movement of commodities in fiber and wood boxes and thereby removed the added tariff. This decision paved the way for the young corrugated box industry to compete with its wooden counterparts. It was thus, in 1927, that Menasha Wooden Ware, seeing shrinking demand for its wood-based packaging, converted a four-story butter-tub warehouse into its first corrugated box plant. The corrugator installed was from the Samuel M. Langston Co., and its principal linerboard supplier at the time was the John Strange Paper Co. of Menasha.

According to author Shaw, the company struggled in its early years but recovered even as the Great Depression gripped the nation. Although the company grew into profitability, Menasha was dependent on outside suppliers of linerboard and corrugating medium. Lacking the capital to build its own mill but seeking more control over its sources of supply, Menasha in 1939 acquired a stake in the Otsego Falls Paper Mill, a manufacturer of linerboard and medium located in Otsego, Michigan. Then, beginning in the 1940s, the company expanded its converting capacity through box plant acquisition, starting with Durham Container Co. in North Carolina. And in what could have been the prototype for today’s sheet-supplier or joint mill-ownership consortia, Menasha and four local box companies in 1946 purchased the John Strange Paper Co., the original supplier to its flagship plant in Menasha. The corrugated box industry was propelled by a post-war economic boom, and vertical integration was a principal driver of the industry’s capital investment decisions. Shaw, in Living Our Values, writes that during this time, Menasha expanded west, with the 1954 construction of a greenfield corrugated box plant in Anaheim, California. Concurrently, the company parleyed its timberland holdings in the Pacific Northwest into lumber and building products for the postwar housing boom as well as constructing a corrugating medium mill in North Bend, Oregon, to serve the expanding West Coast box market. The company still operated under the name Menasha Wooden Ware Corp., until 1957, when Menasha shipped its last wooden product and closed its wooden products arm. In 1962, the company changed its name to Menasha Corp.

Today, Menasha Corp. consists of two principal divisions: Menasha Packaging and ORBIS (see sidebar on p. 34). Overall, it has nine corrugated

printing and converting sites across North America. Each of these sites receives graphic packaging preprinted rolls or top sheets from Menasha’s North American Preprint Hub in Neenah, its litho-printing facilities in Neenah and York, Pennsylvania, and a litho-lamination plant in Richmond, Indiana. Menasha also maintains a network of 32 packaging service sites across North America. These sites perform co-packing, display assembly, and kitting services, which round out the company’s focus on supply chain efficiency for its diverse customer base. Menasha’s contemporary focus on graphics has deep roots, as well, going back to founder Elisha D. Smith, who once said, “A good-looking package is worth more money.” That philosophy was translated into action during the company’s acquisition spree between 1969 and 1980, when it acquired several plants, including Wisconsin Container Corp., Crown Corrugated Containers in Greensburg, Pennsylvania, and Hartford Container Co. in Hartford, Wisconsin. Hartford became Menasha’s color division, maturing now over 40 years and enhanced by further acquisitions of independents, including Triangle Container Corp. in Philadelphia, the Strive Group (formerly Pride Container) in Chicago, and Pearce-Wellwood in Brampton, Ontario. The company’s 2022 purchase of

Georgia-Pacific’s color box division put an exclamation point on Menasha’s graphic emphasis and broadened the company’s reach not only in the Midwest but also in the South and Northern California.

Riegsecker, now with Menasha for 31 years, witnessed the company’s growth, especially its graphics services and capabilities. An Indiana native and graduate of Purdue University in Indiana, he joined the Menasha color division out of school. “I spent the first eight years or so in manufacturing operations before I got into technical sales roles,” he recalls. “I ran sales for our whole company and had different regional jobs along the way. So, I’ve done a lot of different things over the 31 years before coming into this job in 2018.”

In the past 25 years, the corrugated industry has shifted its marketing and sales focus as the North American manufacturing base shifted to lower-cost manufacturing environments. “We really started with what was going to stay in the U.S., and we decided that we were going to focus on food, personal care, and household products in a big way as our core market segments,” he says.

The company has engineered a finely tuned system of printing and graphics application, from direct print, litho-lamination, preprinted linerboard, and sheet-fed digital—what Riegsecker calls “integrated services and vertical integration of the way we apply graphics to corrugated or other material.” From its graphics houses to its finishing operations, product is shipped to one of its 32 service facilities for final packing and delivery to retailers.

Menasha considers the customer’s entire supply chain, and its introduction of automated systems drives costs out of the chain for their direct customers and their customers’ customers. Says Riegsecker, “We asked ourselves, ‘Could we become part of a revenue conversation with our customers versus just a cost conversation?’ And we started to develop relationships,

and we now have offices next to the major retailers all over the U.S.”

Menasha’s commitment to its customers and their retail customers began in earnest in the early 2000s. The company, under the newly minted leadership of President Mike Waite, was still seen as a commodity brown-box supplier. To counter this, writes Shaw in Living Our Values, “Waite and his team established the Retail Integration Institute (RII), a strategic merchandising consultancy housed within Menasha Packaging.

“The intent behind RII was to create a mechanism for co-developing merchandising solutions with customers, wiring packaging’s value proposition more tightly to its customers’ needs and goals.”

Visitors to Menasha Corp.’s Neenah headquarters will find their way to the RII showroom, where the company’s retail promotion expertise is on full display for primary market segments such as food and beverage, personal care, pharmaceutical, and automotive aftermarkets, among many others. According to Shaw in Living Our Values, Menasha’s first

successful project in RII was with the H.J. Heinz Company (now Kraft-Heinz). Ketchup and mustard were profitable for Heinz, but pickle relish was not. “On RII’s advice,” Shaw writes, “Heinz created the now-familiar ‘picnic pack,’ a bundle of ready-to-go ketchup, mustard, and relish sold at chains like Walmart, Sam’s Club, and Costco. The solution increased the package’s appeal, saved Heinz about $500,000, and generated record sales.”

While a success for Heinz, it was a significant learning experience for Menasha. Riegsecker, recalling the case, says, “We didn’t understand all the cost drivers, what the costs were of holding the merchandise, and how to price it.”

All these, he now says, are at the heart of Menasha’s continuous effort to improve efficiencies by enlisting automation to streamline the process for their customers.

“It’s almost like we’re providing packaging systems, not just displays. And so, how do you do that efficiently? How do you look at the total cost through that lens?

“Menasha’s original strategy of evolving with the industries we serve as they grow

“Well, I can see that plastics are becoming a threat to paper packaging. We ought to have a foot in the door.”

With that quip, Mowry Smith Sr., grandson of Menasha founder Elisha D. Smith, in 1957 set the stage for what is today Menasha Corp.’s other principal division: ORBIS. Menasha had already identified a need for industrial companies to transport parts in-plant and from warehouses to production lines—and for bakeries to deliver to retail stores. The company thus acquired a majority stake in a pioneer closed-loop plastics packaging manufacturer, G.B. Lewis, and thus diversified its product offerings for a growing customer base. Over the years and with several acquisitions, Menasha’s plastics division became a vehicle for balancing the cyclicality of the corrugated packaging business. In 1996, these several entities were combined to form ORBIS.

Today, ORBIS supplies reusable totes, pallets, containers, dunnage, and racks to a wide range of global manufacturing, distribution, and assembly industries. Headquartered in Oconomowoc, Wisconsin, ORBIS has 3,300 employees working in 12 North American manufacturing and 34 service-center sites. Operating under the banner of ORBIS Reusable Packaging Management, ORBIS service centers sort, inspect, clean, refurbish, and repair all types of reusable packaging.

An award-winning printing line for corrugated

A multi-award-winning modular printing solution Up to 3 flexo units + single pass inkjet + rotary die cutter

The low-capex option to step into single-pass hybrid

With Kento Hybrid’s award-winning modular approach, you get the power to decide how and when to scale up your corrugated printing operation, starting with a price tag similar to a multi-pass digital printer.

Flexo printing for solid backgrounds, white ink, special colors

Digital printing for high-quality images and personalization

With 4 installed machines in EMEA and North America

We are corrugated

Rotary die cutting for increased overall equipment efficiency

download a brochure ask for a live demo

has driven many investment decisions around the expansion of our footprint, state-of-the-art assets, automation, robotics, and new products and services. This continued network modernization is critical to the longevity and success with customers.”

From the start, Smith was a man of integrity who considered the well-being of his employees as a cardinal virtue of his company. Even as the former woodenware business was drying up, no employees were laid off. Writes Shaw, “It probably would have made more business sense for Menasha to lay off many of its longtime employees when the [corrugated] box plant opened [in 1927], but true to its values as a people-first company, Menasha wasn’t about to turn loyal workers out in the cold.”

These values hold true today, seven generations later. “It’s interesting,” Riegsecker notes. “Everybody’s got the same equipment in this industry, right? So, it’s people who are the differentiating force, and you know, I’m proud of our people in Menasha. There’s just a tremendous longevity in the company, and our people really have a passion for our customers and our communities. It’s one of the reasons I’ve stayed here for 31 years.”

Menasha has engraved this ethos within its very name, declaring with each first letter of the following values its peopleand value-centric culture:

• Meet our commitments.

• E xcellence in serving our customers.

• Neighborhood involvement and improvement.

• A bility to see and embrace change to continually improve.

• Sincerity, candor, and teamwork in everything we do.

• Honesty, integrity, and respect at the highest level.

• A ccountability to customers, employees, communities, and shareholders.