MANHATTAN REAL ESTATE MARKET REPORT

Lower Manhattan’s recovery from the COVID-19 pandemic continued in the third quarter with office leasing rebounding and several exciting new retailers opening their doors. Leasing activity increased 40% over the second quarter representing Lower Manhattan’s third best quarter since the start of the pandemic. That good news is offset by other indicators that represent a mixed picture overall. Lower Manhattan’s recovery continues to lag behind the other Manhattan office markets. While leasing in Midtown and Midtown South was sufficiently robust to surpass their fiveyear quarterly leasing averages, leasing in Lower Manhattan is still significantly below the five-year average. Vacancy rates remained stubbornly high in all three Manhattan office markets, which were over 20% for the second quarter in a row. While tenants have continued to show an interest in newer Class A properties, high availability and increasing economic uncertainty continue to present serious headwinds for Lower Manhattan’s office market.

Lower Manhattan continued to enjoy steady momentum in the retail market, with 34 new openings helping to fill vacancies created during the pandemic. In fact Lower Manhattan is now home to as many retailers as in 2019. Roughly half of these openings were food and beverage businesses, including the Tin Building by Jean-Georges, an exciting new neighborhood attraction featuring 53,000 sq. ft. of markets, full-service restaurants, bars and fast-casual eateries. Lower Manhattan’s residential market remained strong but is beginning to show the effects of broader macroeconomic headwinds with median sale prices dipping below $1 million for the first time since 2019.

Source: CBRE

Source: CBRE

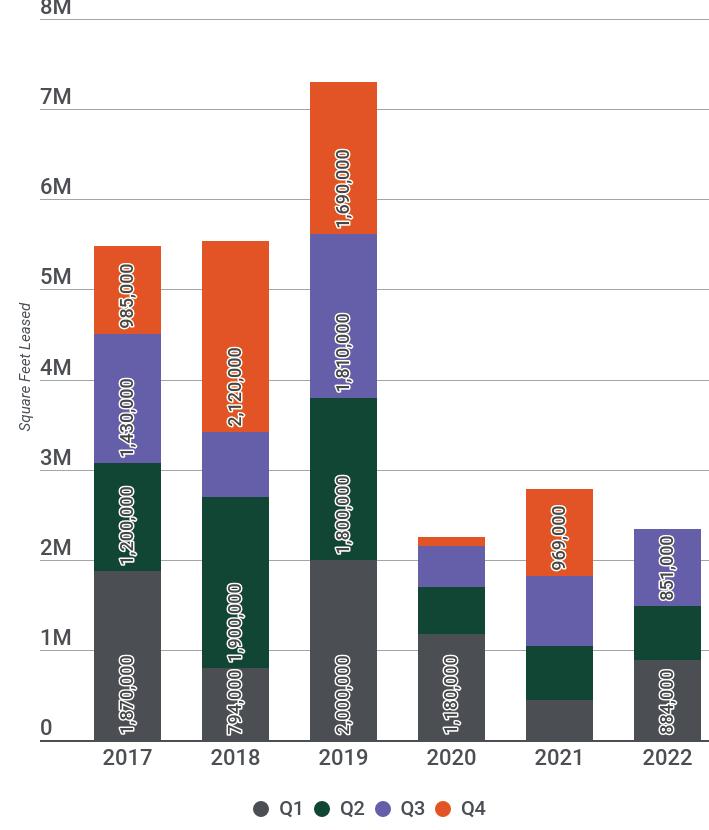

Square Feet Of New Leasing In the Second Quarter, 17% Below the Five-Year Quarterly Average

The third quarter saw Lower Manhattan record 851,000 sq. ft. of office leasing, according to CBRE. Leasing activity rose 40% over the second quarter and 10% over the third quarter of last year. While this reverses two quarters of decline in leasing activity, third quarter leasing remains 17% lower than the five-year quarterly leasing average. Legal services and government tenants fueled the surge in activity, executing three large leases over 100,000 sq. ft.

Midtown Manhattan saw 4.62 million sq. ft. of leasing activity in the third quarter, 40% higher than the square footage signed from the third quarter of last year, and 27% above the five-year quarterly average. This is the second highest quarterly total since Q4 2019 and the second consecutive quarter with over 4 million sq. ft. of leasing. Flight-to-quality continues to drive leasing in Midtown, with the largest lease of the quarter and the year signed at 2 Manhattan West.

Midtown South saw the highest quarterly increase in leasing among Manhattan’s submarkets. At 1.7 million sq. ft., leasing activity in Midtown South rose 55% above the second quarter, and 37% above the five-year quarterly average. This figure remained slightly below 2021’s robust third quarter leasing activity of 1.8 million sq. ft, representing a 6% decline year over year. Financial services led Midtown South’s leasing activity for the second consecutive quarter, accounting for 43% of leasing. Financial firms drove demand for Midtown South’s boutique office space, while technology companies drove demand for sublease space.

Freshfields Bruckhaus Deringer signed the largest deal of the quarter, relocating to Lower Manhattan from Midtown. The law firm signed a 180,000-sq. ft. new lease at 3 World Trade Center. Freshfields’ 15-year lease represents a 70,000 sq. ft. expansion from its previous 110,000 sq. ft. footprint at 601 Lexington Avenue.

The Manhattan District Attorney’s Office renewed its 112,526 sq. ft. lease at 250 Vesey Street in Brookfield Place. Other government tenants to sign notable leases include: the New York City Housing Development Corporation, which signed a 109,234 sq. ft. lease at 120 Broadway; and the US General Services Administration, which signed a 48,211 sq. ft. lease at 123 William Street.

Tenant Name Location SF Leased Transaction Sector

1 Freshfields Bruckhaus Deringer 3 World Trade Center

180,000 Relocation

Professional Services, Law

2 Manhattan District Attorney’s Office 250 Vesey Street 112,526 Renewal Government

3 NYC Housing Development Corporation 120 Broadway

109,234 Move Within LM Government

4 Ideal School 5 Hanover Square 62,969 Relocation Education

5 AXA Equitable 225 Liberty Street 56,043 Renewal FIRE

6 US General Services Administration 123 William Street

48,211 New Lease Government

7 New York Life One World Trade Center 47,355 Move Within LM FIRE

8 Asana 3 World Trade Center 44,100 Expansion TAMI, Technology

9 Jay Suites 40 Wall St 43,489 New Lease Flex. Office Provider

10 Gilbane Building Company 88 Pine Street

30,866 Renewal & Expansion

Professional Services, Other

11 Professional Staff Congress 25 Broadway 29,912 New Lease Nonprofit

12 Simon-Kucher & Partners 225 Liberty Street 27,465 Move Within LM Professional Services, Consulting

13 TB Alliance 80 Pine Street 21,561 Move Within LM Healthcare

FIRE tenants that signed significant leases during the third quarter include AXA Equitable, a financial services and insurance company, which renewed its 56,043 sq. ft. lease at 225 Liberty Street in Brookfield Place; and New York Life, which took 47,355 sq. ft. of sublet space from Condé Nast at One World Trade Center. New York Life’s sublease brings One World Trade Center to 95 percent leased. New York Life is relocating within Lower Manhattan and downsizing from its current 54,000 sq. ft. at 120 Broadway.

Other notable transactions include the Ideal School of Manhattan, a private K-12 school based on the Upper West Side, which signed a 62,969 sq. ft. lease to relocate to 5 Hanover square; Asana, a project-management software company, expanded its lease at 3 World Trade Center by 44,100 sq. ft., bringing its total footprint to 61,100 sq. ft. Asana originally signed a 17,000 sq. ft. lease in 2019; Jay Suites, a flexible-space provider, signed a 12-year lease for 43,489 sq. ft. at 40 Wall Street, taking over space once operated by a different flexible-space provider called WorkBetter; Gilbane Building Company, a construction and facility management firm, renewed its lease at 88 Pine Street and expanded by 30,866 sq. ft; the Professional Staff Congress (CUNY labor union), signed a lease for 29,912 sq. ft. at 25 Broadway; Simon-Kucher & Partners, a management-consulting company, signed a lease for 27,465 sq. ft. moving within Lower Manhattan from 17 State Street; and TB Alliance a tuberculosis-treatment healthcare company, signed a lease for 21,561 sq. ft. at 80 Pine Street, moving within Lower Manhattan from 40 Wall Street.

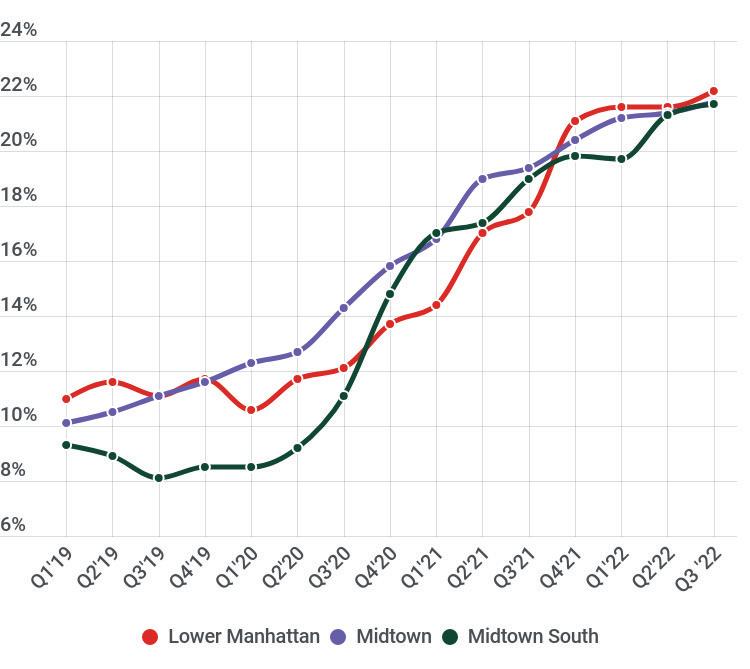

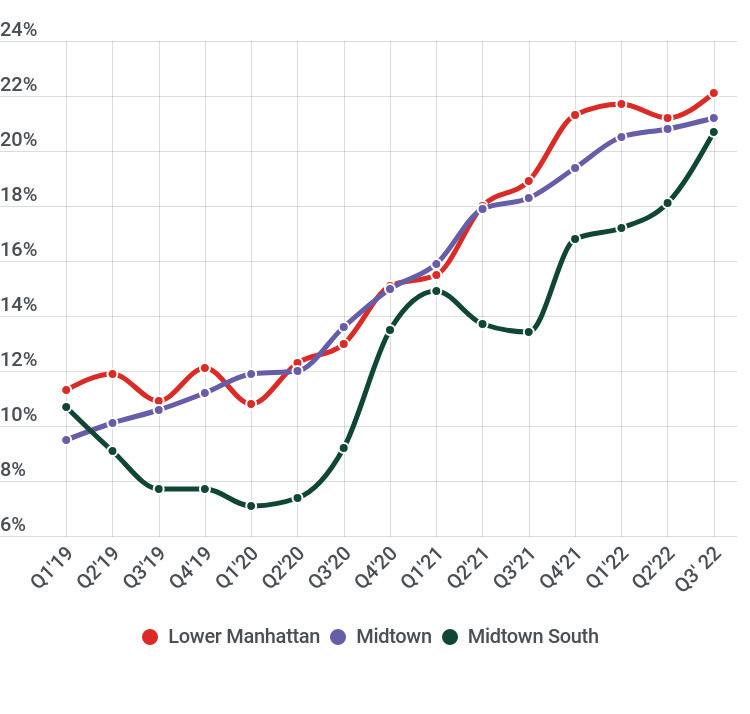

Despite the 40% increase in leasing activity from the last quarter, Lower Manhattan’s overall vacancy rate inched up to 22.2%, a record high, according to Cushman & Wakefield. Since the onset of the pandemic in the second quarter of 2020, the overall vacancy rate has grown 10.5%. For the second quarter in a row, around 30% of the vacant space in Lower Manhattan is made up of sublet space. This included the largest space addition of the quarter, a 137,274 sq. ft. sublease at 55 Water Street. The total office space available for sublet in Lower Manhattan came to nearly 5.86 million sq. ft. in the third quarter.

Class B space had the highest vacancy rate this quarter, increasing to 24.4%, an uptick of 0.4% over last quarter.

Similar to last quarter, Class B space’s year-over-year increase remained significant at nearly 8%. Class A space had a larger quarter-over-quarter increase (0.9%), but a total vacancy rate of 22.1%. This quarter, Class C office space recorded a lower vacancy rate than in the second quarter and lowest overall at 16.9% vacant. The Insurance District (roughly east of Broadway, north of Maiden Lane) continued to show a high year-over-year increase in vacancy rates of 10 percentage points. The Financial West District (roughly west of Broadway, south of Albany Street) had the highest vacancy rate of the six downtown subdistricts in the third quarter (34.6%). The year-over-year vacancy rate increase in the Financial West District was similar to the Insurance District at 9.4%.

Vacancy rates in all three Manhattan office markets were up over last quarter, and reached over 20% for the second quarter in a row. Similar to Lower Manhattan, vacancy rates in Manhattan as a whole increased despite the strength of third quarter leasing activity. Midtown South experienced the largest quarter-over-quarter increase in vacancy rates, up 2.6% to reach a new high of 20.7% in the third quarter — as large blocks became available for direct leasing in Hudson Square/West Village and Soho. Class A office space vacancy is up 7.3% year-over-year in Midtown South, more than double the increases seen in Midtown (2.9%) or Downtown (3.2%).

This is the second quarter during which the overall vacancy for all three Manhattan office markets was over 20%.

Source: Cushman & Wakefield

Source: Cushman & Wakefield

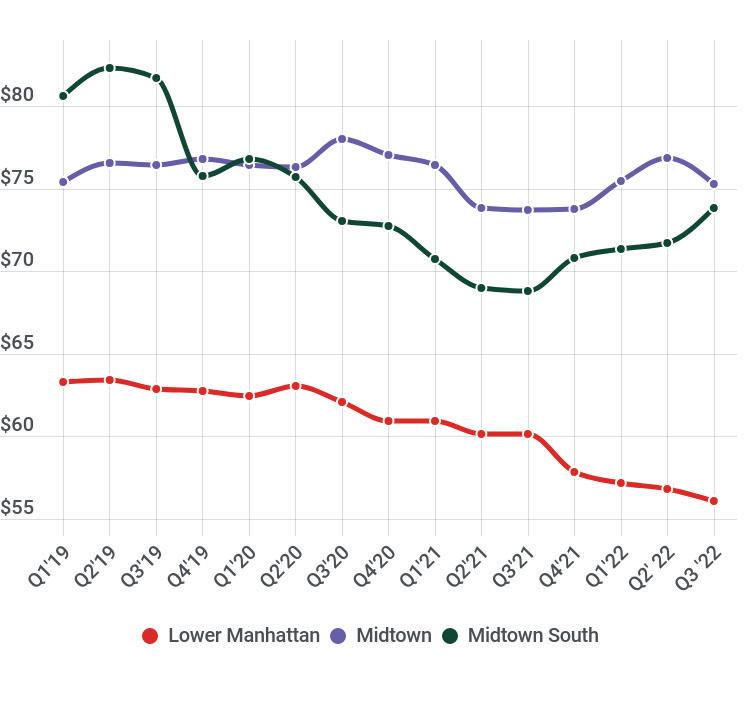

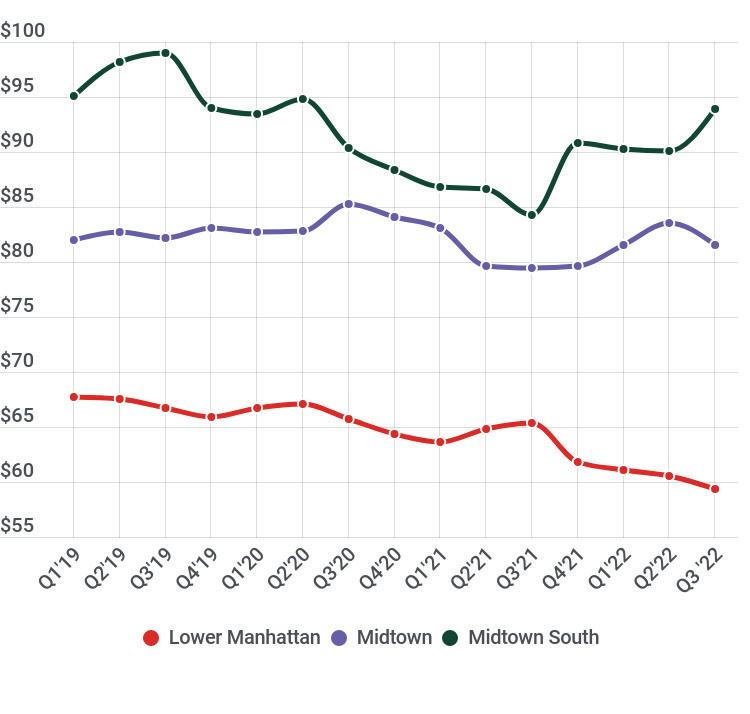

Asking rents in Lower Manhattan have recently lagged behind the growing prices seen in Manhattan’s other office submarkets. Both overall and Class A asking rents continued to inch down for the fourth consecutive quarter in Lower Manhattan. Though rents in Midtown dipped slightly after recording increases for the past three quarters, they remain high, and rents in Midtown South have steadily increased over the last four quarters. Tenants have continued to show a preference for amenity-rich space in newly built or recently renovated Class A properties.

According to Cushman & Wakefield, Lower Manhattan’s overall average asking rent fell slightly from the last quarter to $56.09 per sq. ft. — down 6.7% year over year and over 11% below the highs seen in early 2019. This is the fourth consecutive quarter below $60 per sq. ft. Class A asking rents fell 2% over the quarter and 9.3% over the year to $59.33 per sq. ft., due to large sublease additions and higher-priced space being taken off the market at the World Trade Center. Class B average asking rents were essentially flat over the past quarter and down 1.1% over the past year, standing at $52.17 per sq. ft.

Rents in Midtown fell slightly in the third quarter. Overall rents inched down by 2% over the past quarter and Class A office rents in Midtown declined 2.3% over the past year to $75.27 and $81.59 per sq. ft., respectively,

driven mostly by the absorption of large blocks around Penn Station and Sixth Ave/Rockefeller Center. In Midtown South, overall asking rents grew by 3% over the quarter and 7.3% over the past year to $73.81 per sq. ft. Class A rents in Midtown South increased a substantial 11.5% over the past year, growing to $93.91 per sq. ft. due to large blocks of higher-priced space coming onto the market. This is the fourth consecutive quarter with Class A rents in Midtown South being above $90 per sq. ft., returning to a norm seen prior to the pandemic.

Source: Cushman & Wakefield

$59.33

According to Kastle Systems, September 2022 showed New York City office occupancy rates reaching their highest levels in the post-pandemic era. In the last two weeks of September, New York reached 46.1% occupancy. From August 31 to September 7, there was a 3.5% jump in office occupancy, the biggest increase of the 10 cities Kastle tracks.

Partnership for New York City surveyed more than 160 major Manhattan office employers, finding the share of fully remote workers dropped from 28% in April to 16% as of mid-September. The survey results indicated that 77% of employers plan to maintain a hybrid office schedule and that 55% of employees are in the office at least three days a week. The survey projects office occupancy to climb to 54% by January 2023. While many remain remote or hybrid, several Lower Manhattan office tenants have committed to a five-day return to office schedule. Goldman Sachs announced that it would bring back employees five days a week to their 200 West Street offices after Labor Day.

Recent pedestrian counts in Lower Manhattan have also increased. By the end of September, total monthly foot traffic was up 3% from the end of the second quarter. Growing tourism, warmer weather and increased office occupancy, particularly midweek, are driving weekday traffic and contributing to the busier feel on the streets.

40 Fulton Street: Vornado Realty Trust entered into contract to sell 40 Fulton Street to investor David Werner for a figure between $105 million and $110 million. Vornado initially began marketing the building in May, then reportedly seeking between $130 million and $140 million for the 234,553 sq. ft. building. Vornado reportedly lowered its asking price to make it easier for a potential buyer to complete the deal amid rising interest rates. Although fully leased, 40 Fulton is speculated to be converted to residential use, given its smaller floor plates and good light access.

19 Dutch Street: At the end of September, Pontegadea Group, a real estate firm owned by ZARA founder Amancio Ortega, closed on the purchase of the 64-story, 483-unit apartment building for a reported $487.5 million from Carmel Partners. The building, which opened in 2019, traded for roughly $1 million per unit.

175 Water Street: In mid-October 99c LLC, a boutique UKbased real estate investment firm with ties to the Brooklynbased developer Bushwack Capital, purchased 175 Water Street from Vanbarton Group for a reported $252 million.

The 684,000 sq. ft. building served as the headquarters of AIG until 2019, when AIG vacated the building and sold it for $270 million. Previous plans for the building called for conversion to a 400 unit residential property, but conversion plans have since been halted.

Thirty-four retailers opened in the third quarter, holding at the same number of retail openings from the second quarter. These recent openings continued to help fill vacancies created during the pandemic, with a few exceptions. Roughly half of retail openings were food and beverage businesses, including:

• The Tin Building by Jean-Georges opened in late summer featuring two gourmet grocery stores, 12 restaurants and four bars offering a variety of cuisines and service types ranging from full-service to fastcasual dining.

• Famed Brooklyn-based pizzeria Di Fara opened a new location in the Seaport at 108 South Street.

• Highwater Rooftop bar opened at the Hotel Indigo NYC Downtown - Wall Street at 120 Water Street.

• Smyth Tavern opened at 85 West Broadway, replacing Little Park in the Smyth Tribeca hotel.

In addition, five new retailers opened in Westfield WTC, including:

• Geek Store, offering toys and gifts from sci-fi and fantasy brands;

• Karma and Luck, a jewelry store;

• Repair & Shop, a phone repair service;

• Art to Ware, an upcycled fashion store; and

• The Canvas, a boutique featuring independent fashion brands, opened in the former REISS space. The Canvas announced plans to open an events and gallery space in the former Lacoste and Victoria’s Secret spaces.

• Life Time Fitness, a high-end gym, opened a 74,000-sq.-ft. sq. ft location at One Wall Street. Life Time Fitness also operates a 12,000 sq. ft. gym at 1 West Street.

Sadly, 13 retailers closed during the third quarter, including Homemade by Miriam, a popular Brooklynbased Mediterranean restaurant that opened at 74 Warren Street during the height of the pandemic, and longtime favorite Bobby Van’s, which closed after 16 years at 25 Broad Street.

Two notable sports and fitness centers opened in the third quarter:

• Trinity Boxing Club opened a 4,500 sq. ft. flagship venue at 20 Vesey Street in the space once temporarily occupied by The National September 11 Memorial Museum. Trinity Boxing first opened at 110 Greenwich Street in 2004 and moved to Duane Street in Tribeca in 2014.

The Tin Building by Jean-Georges Brings a New Culinary Destination to the Seaport

The Howard Hughes Corporation and world-renowned chef JeanGeorges Vongerichten teamed up to rehabilitate the historic Tin Building into a 53,000 sq. ft. culinary marketplace as part of the revitalization of the South Street Seaport. The original Tin Building was constructed on this site in 1907 to host the Fulton Fish Market, which relocated to the Bronx in 2005. The marketplace features six new full-service restaurants, five fast-casual counters, multiple bars and three specialty retail markets across two levels. The second floor dining space also features a broadcast studio for cooking segments and recording a daily podcast. The Tin Building by Jean Georges reinforces the neighborhood’s growing appeal as a culinary destination, where new food and beverage businesses have driven a rebound in retail openings.

Hall des Lumiéres Opens at Landmarked Emigrant Savings Bank Building

Hall des Lumiéres, an immersive digital arts center, opened in the landmarked Beaux-Arts building that formerly housed the Emigrant Industrial Savings Bank hall at 49 Chambers Street. The 28,000 sq. ft. space is filled with historic details, including marble columns, statues, bank tellers and stained glass windows, that add to the experience of seeing classic works by great masters in a new, immersive way. Hall des Lumiéres originated in Paris in 2018, where it attracted more than 2.6 million visitors to view digitized works by Da Vinci, Van Gogh and Klimt. This space is a partnership between Culturespaces, a museum and art center operator, and IMG, which manages fashion and media events.

Printemps Announces First US Store at One Wall Street Luxury French department store Printemps announced in September that it will open its first US location at One Wall Street in spring 2024. The store will span 54,365 sq. ft. over two levels with a 346 linear foot facade on Broadway at the corner of Wall Street. This space includes the landmarked Red Room, one of only 50 interior landmarks in New York City. There are 20 Printemps department stores in France. The ownership group behind Printemps also operates in the lifestyle and e-commerce spaces. The new opening in Lower Manhattan will be key to the company’s international development strategy, offering a high visibility location and a local customer base for e-commerce.

Lower Manhattan welcomed 5.7 million tourists in 2021 as domestic travel began to resume and international travel restrictions eased. While still far below 2019’s 14 million visitors, 2021’s tourism number was nearly double the visitation seen in 2020. The share of international visitors steadily increased to 28% and is anticipated to rise higher throughout 2022. Traditional western European markets and Canada have rebounded significantly in 2022 after travel restrictions were lifted in late 2021.

Nearly 33 million visitors came to New York City in 2021, less than half the record total for 2019, but still up from 22.3 million in 2020. Looking forward, NYC & Company forecasts that international travel will triple its 2021 volume in 2023 and domestic travel will exceed pre-pandemic levels by 2023.

The current hotel inventory in Lower Manhattan stands at 8,713 rooms across 41 hotels, including the 289-room Radisson Wall Street at 52 William Street, which reopened in August after operating as a temporary homeless shelter. There are nearly 1,600 hotel rooms across 8 hotels under construction or in development in Lower Manhattan. Nearly 470 rooms across two hotel developments are anticipated to open later in 2022. They include:

• The Fidi Hotel at 11 Stone Street with 143 rooms; and

• Motel One at 133 Greenwich Street with 326 rooms. The property was formerly a Courtyard that closed in 2021 and will be rebranded.

1 The Fidi Hotel 11 Stone Street

Premier Emerald LLC 143 2022

2 Motel One 133 Greenwich Street Union Investment Real Estate 326 2022

3 Hotel Indigo 50 Trinity Place Fit Investment Group 173 2023

4 The Warren Street Hotel 86 Warren Street Solil Mgmt/ Firmdale 70 2023

5

The Ned Hotel at American Stock Exchange 123 Greenwich Street

Yucaipa Companies 174 2023

6 AC Hotel 112 Liberty Street Hidrock Realty 230 TBD

7 Tempo by Hilton 140-142 Fulton Street Hidrock Realty 296 TBD

8 TBD Hotel 7 Platt Street

The Moinian Group 172 TBD

Another three hotels containing over 1,000 rooms are expected to open in the coming years:

• Hotel Indigo World Trade Center NYC at 50 Trinity Place, opening next year with 173 rooms;

• The Warren Street Hotel at 86 Warren Street, opening next year with 70 rooms; and

• The Ned Hotel at American Stock Exchange at 123 Greenwich Street, opening in2024 with 174 rooms.

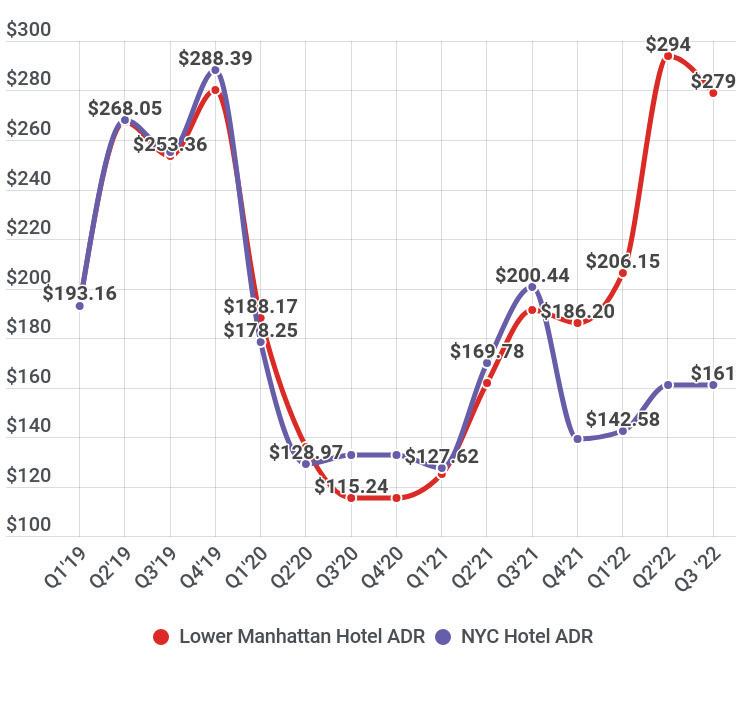

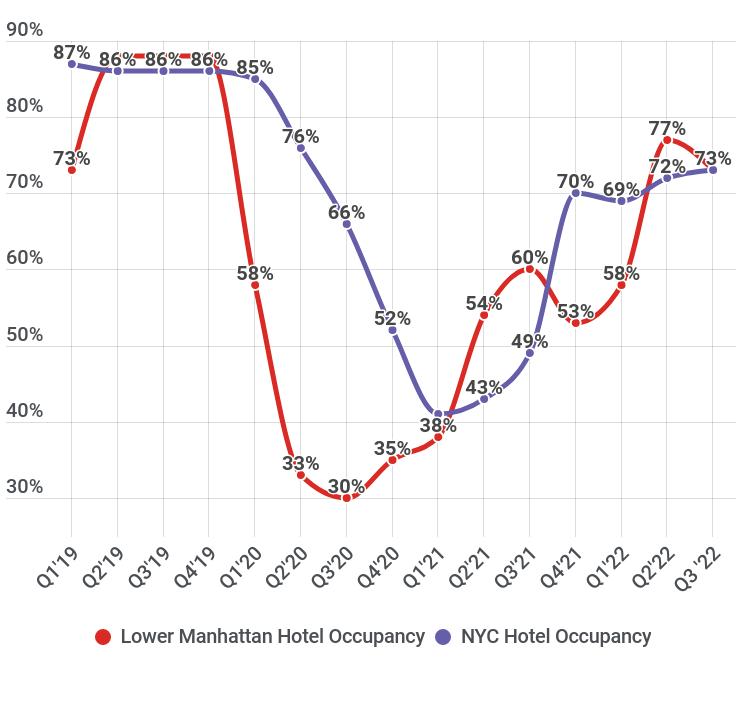

Though citywide hotel occupancy metrics remain below pre-pandemic levels, occupancy has improved markedly over the last year as business travelers and tourists continue to return to New York. Lower Manhattan recorded hotel occupancy at 73% in the third quarter, 13% higher than last year and only 15% lower than the same period in 2019. Throughout the summer, Lower Manhattan’s occupancy rates averaged in the low-to-mid 70s. Lower Manhattan saw average daily room rates rise to $279 per night in the third quarter, 10% above summer 2019 rates and a substantial 46% above those seen in the third quarter of 2021. Though Lower Manhattan’s hotel performance metrics continue to indicate ongoing improvement from pandemic lows, it must be noted that both occupancy and room rates across the city fell slightly from the previous quarter as rising inflation limited some leisure travel.

Source: STR

Lower Manhattan has 33,677 units in 343 residential buildings. There are an additional 4,925 units in 15 buildings under construction or planned for development, with about 74% currently planned as rental units and 26% as condos/co-ops.

Later this year, construction is expected to wrap up on One Wall Street. Macklowe Properties is finalizing work on the conversion of the landmarked office tower into 566 condominiums. The building will offer 157,000 sq. ft. of retail, including a 44,000-sq.-ft. Whole Foods expected to open later this year, a 74,000-sq.-ft. Lifetime Fitness, which opened in late September, and Printemps’s 54,365 sq. ft. debut US store, which will open in 2024.

Construction work continues at three ongoing residential developments in Lower Manhattan:

• One Park Row: Foundation work is continuing on the new development at One Park Row. Circle F Capital is developing a 23-story, 103,000-sq.-ft. tower with 58 condos and 19,000 sq. ft. of commercial space. Construction is expected to wrap in late 2023;

• 160 Water Street: Vanbarton Group filed plans and began construction to convert the 24 story, 482,000 sq. ft. office building into a 586-unit market rate rental building. Vanbarton partnered with Metro Loft to convert a similar building at 180 Water Street in 2017. The conversion plan calls for the addition of five new floors and the building will be reclad with glass curtain walls. Construction is scheduled for completion by late 2025; and

• 7 Platt Street: Foundation work is also ongoing at Moinian’s 38-story, 250 rental unit tower. The existing five story structure was demolished last year and construction is scheduled for completion in 2025.

Source: Downtown Alliance

Address Lease / Building Type Units Open Date

Condo + Rental Units

Under Construction Total 2,533

1 One Wall Street Condo New Construction 566 2022

2 1 Park Row Condo New Construction 58 2023

3 7 Platt Street Rental New Construction 250 2025

4 8 Carlisle Street Rental New Construction 400 2025

5 160 Water Street Rental Conversion 586 2025

6 250 Water Street Rental New Construction 270 TBD

7 161 Maiden Lane Condo New Construction 80 TBD

8 45 Park Place Condo New Construction 50 TBD

9 125 Greenwich Street Condo New Construction 273 TBD

10 55 Broad Street Rental Conversion 571 2026

11 130 Liberty Street Rental New Construction 1,325 2028

12 75-83 Nassau Street Rental New Construction 229 TBD

According to residential statistics published by Miller Samuel/Douglas Elliman, the median rent in Lower Manhattan rose to a record high of $4,500, up over 12% from last quarter and nearly 10% higher than in the third quarter of 2021. Median rents are now nearly 13% higher than they were in 2019. Rental prices in the neighborhood have spiked amidst limited supply, a lack of concessions, and high demand, including from would-be homebuyers pushed back into the rental market by increasing interest rates.

Likewise, Manhattan’s overall median rent rose to a record $4,100 — up 2.5% from the previous quarter and nearly 26% year-over-year. Overall rents in Manhattan have hit record highs for three consecutive quarters, though the pace of increases seems to be slowing.

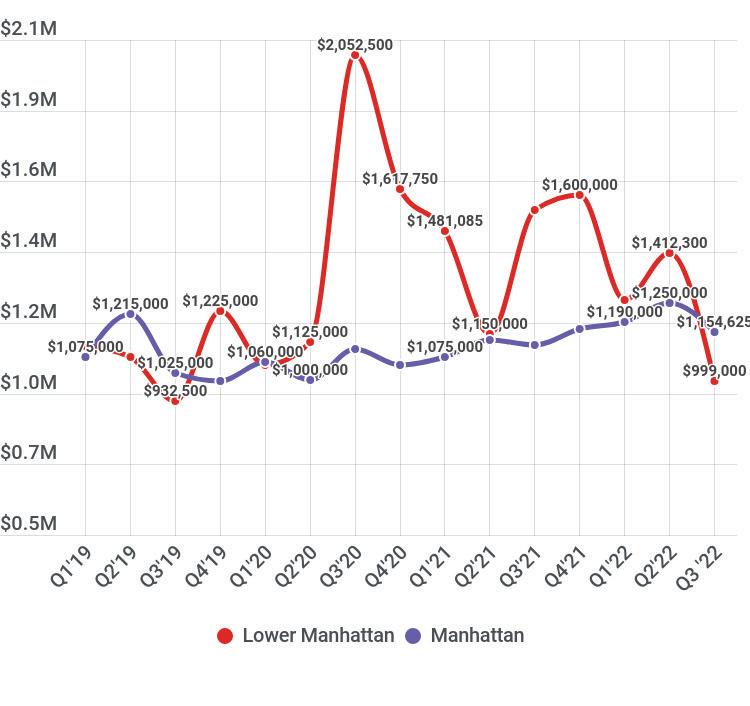

The sales market cooled considerably in the third quarter as median sales prices were impacted by increased interest rates. The median sales price for co-ops and condos in Lower Manhattan fell to $999,000, down over 37% yearover-year. This is the first time since the third quarter of 2019 to see median prices fall below $1 million. Sales volume also declined significantly, falling nearly 25% quarter-over-quarter and nearly 45% year-over-year. Though the decline in the Lower Manhattan sales market may signal tightening conditions at the high end of the market, median sales prices across Manhattan were up 3.6% yearover-year at $1,154,625.

Median

Manhattan

Up

Construction on the Ronald O. Perelman Performing Arts Center topped out in the spring of 2021. Exterior facade work on the 4,900 marble panels wrapped in early 2022. The approximately 110,000-sq.-ft. cube-shaped building will feature three theaters of varying sizes which can be combined in different seating configurations and formats for an array of unique performance environments. The project is anticipated to open in 2023, with Khady Kamara recently announced as the inaugural executive director.

The Santiago Calatrava-designed St. Nicholas Greek Orthodox Church and National Shrine, located atop Liberty Park, officially reopened with a consecration ceremony on July 4, 2022. The original church was destroyed on September 11, 2001 and construction was underway for more than 20 years as a result of funding delays.

The 9/11 Tribute Museum closed at 92 Greenwich Street in mid-August due to low visitation following the pandemic. The Museum, which originally opened in 2006, will continue to offer educational programming online, and artifacts will be transferred to the New York State Museum in Albany.

A partnership between Brookfield and Silverstein Properties received approval from the Port Authority and Lower Manhattan Development Corporation (LMDC) to develop Site 5 at the World Trade Center, also known as 130 Liberty Street. The site recently served as a Port Authority police depot and the southernmost area continues to serve as a temporary public plaza.

The proposed 1.56 million-sq.-ft. tower is expected to include approximately 1,300 rental apartments, of which at least 25% will be affordable. LMDC approved an override to city zoning rules in order to build a tower larger than local regulations allow. Construction may commence in 2023.

NY Waterway is slated to add a new ferry route in the coming months connecting South Amboy, NJ to Brookfield Place in Lower Manhattan, with a further stop at Pier 79 in Midtown. The trip is anticipated to take 40 minutes.

Reconstruction of Front Street between Old Slip and John Street began in January 2020 and is scheduled for completion in Fall 2023. Greenwich Street reconstruction, between Barclay and Chambers Streets, began in early 2022 and will be completed in November 2024; the adjacent sidewalks at 240 Greenwich Street will also be redone in tandem. Vesey Street reconstruction, between Church Street and Broadway, began in September 2022 and will be completed in September 2024. Nassau Street reconstruction, between Pine Street and Maiden Lane, will begin later in 2022. These projects, each lasting two years, will replace all underground infrastructure, including water mains, sewers, electric, gas and other utilities, as well as construct new streets and curbs.

The city began work on the streetscape and public-realm enhancement project along the Water Street corridor in May 2021 which is estimated to be completed in 2024. The $22.8 million project will transform two temporary public plazas at Coenties Slip and Whitehall Street into permanent public spaces, featuring new landscaping, seating and concessions. The project will also plant street trees, rebuild sidewalks and enhance pedestrian safety from Whitehall Street to Old Slip.

The Urban Assembly Harbor School, located on Governors Island, announced plans to expand by two new buildings, doubling its total footprint to approximately 160,000 SF across four buildings. The expansion will allow enrollment to grow from approximately 520 students to nearly 900. The expanded space will include the newly renovated historic Building 555 and a newly constructed building affiliated with the Center for Climate Solutions. The expansion will add classrooms, a competition-sized pool, a gymnasium and lab space.

Trinity Place Learning Center (fka PS 150) opened Sep. 7 at 77 Greenwich Street. The 3K - fifth grade school has capacity for up to 420 students and spans eight floors.

Developer SomeraRoad completed its $19 million renovation and conversion of the landmarked commercial condo at One Hanover Square into 20,000 sq. ft. of boutique office space. The renovation includes 5,000 sq. ft. of high-end amenity and conference space. The developer began marketing One Hanover for lease in midOctober. SomeraRoad purchased the building, the former home of private membership club India House, for $6 million in March. Harry’s will continue to own and operate its restaurant out of the basement space.

October 29, 2022 marked the 10-year anniversary of Hurricane Sandy’s landfall in New York City. The storm caused unprecedented damage to the city’s infrastructure and resulted in the deaths of 44 residents and more than $19 billion in damages and lost economic activity. Lower Manhattan experienced 14 feet of storm surge and severe flooding in the low lying areas near the waterfront. Nearly 40% of commercial buildings in Lower Manhattan were affected by the storm, over 5,900 residential units were inaccessible and around 30% of the neighborhood’s retailers were closed for more than a week.

Despite the extraordinary challenges, economic recovery from the storm was swift and Lower Manhattan has continued to evolve over the past 10 years. Lower Manhattan’s east side, including the Water Street corridor and Seaport District, exemplify changes in the neighborhood since Sandy. In 2016 the Department of City Planning approved a zoning text amendment for the numerous privately owned public spaces (POPS) along the Water Street corridor, facilitating the infill of arcade spaces for retail use. Since approval, notable POPS improvements have included 100 Pearl Street, where the 16-vendor Urbanspace food hall opened in summer 2022, and a fully approved plaza improvement plan at 200 Water Street. Other Water Street property owners are considering upgrade projects as well. Water Street has also been transformed by a major $24.5 million streetscape improvement project that will create two new permanent public plazas as well as new street trees, landscaping, and other pedestrian amenities. And at the southern end of the Water Street corridor the historic Battery Maritime Building has been fully renovated and transformed into a boutique luxury hotel, private club and event space owned and operated by Cirpriani. The new space includes a two story south-facing glass addition

and maintains access to three ferry slips at the base of the building.

Since Sandy, the South Street Seaport has also gone through a major revitalization, dramatically reshaping the neighborhood’s retail landscape and transforming a dated and poorly performing mall into one of New York City’s most exciting dining and entertainment venues. A rebuilt Pier 17 elevated out of the 100 year floodplain opened in 2018, adding eight new restaurants, 76,361 sq. ft. of office space and new rooftop amenities. Adjacent to the Pier 17 development is the recently opened Tin Building by Jean-Georges, a food hall with six full service restaurants, five fast-casual eateries, two bars as well as retail and grocery. These developments have become attractions for residents and visitors alike, helping to make Lower Manhattan a destination. In addition, the Tin Building alone adds 700 new jobs to the neighborhood and revitalizes a derelict historic property built in 1907 to house the Fulton Fish Market.

The Seaport’s improvements are part of a larger movement in the neighborhood. Since Superstorm Sandy, Lower Manhattan’s retail offerings have increased and diversified. Eightyseven percent of the 320 retailers closed by Sandy reopened by the end of 2012. Between 2012 and 2019, the number of retailers in the district grew year over year before the onset of the Covid-19 pandemic. Today, more than two and a half years into the pandemic, there are a greater number of retailers in Lower Manhattan than there were in 2012 or in 2019. In the first two quarters of 2022, retail openings outpaced those of 2019, demonstrating a strong rebound as the city emerges from Covid-related challenges. Many of the neighborhood’s new openings over the past 10 years have been food and beverage related. Since Sandy hit, the number of restaurants and bars has increased 27%, changing the makeup of Lower Manhattan’s offerings.

Lower Manhattan property owners have also responded to the challenges posed by climate

change. More than 25 commercial properties including 32 Old Slip, 77 Water Street, 110 and 111 Wall Street have installed flood barriers and moved electrical equipment to higher floors. 4 New York Plaza implemented long-term stormproofing measures, including moving chillers onto steel frames. 180 Maiden Lane spent $40 million to renovate their lobby, add a fitness center in the basement and a new cafeteria. In addition the city and state governments have financed more than $ 1 billion in resiliency projects across the district, helping to protect critical infrastructure from future flooding. The city is currently working on an extensive and comprehensive plan to protect the entire Lower Manhattan community from both storm surge and sea level rise for generations to come.

Lower Manhattan has proven capable of weathering crises and hardship, emerging from each event with increased flexibility and demonstrated resilience. Sandy’s impact highlights the willingness to invest in the neighborhood’s ability to adapt and survive. These qualities are more important than ever as the city emerges from more than two years of the Covid-19 pandemic into a new and uncertain economic landscape.

Alliance for Downtown New York 120 Broadway, Suite 3340 New York, New York 10271

The mission of the Alliance for Downtown New York is to provide service, advocacy, research and information to advance Lower Manhattan as a global model of a 21st century central business district for businesses, residents and visitors.

downtownny.com/business/research-statistics