Subscribe today to receive four print issues of the magazine that builds Texas’s broker business.

Subscribe today to receive four print issues of the magazine that builds Texas’s broker business.

Texas is one big state, and it takes a big reach to keep its mortgage origination pros in the game. Only Lone Star LO gets the job done. We roundup the data, insight and products that let Texans win the mortgage rodeo.

Vincent

M. ValvoCEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Douglas Page, Sarah Wolak

STAFF WRITERS

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael

PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise

MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Submit your news to editors@ambizmedia.com

If you would like additional copies of Lone Star LO magazine Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Lone Star LO magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991 info@ambizmedia.com

It was just about a decade ago that our company launched the Texas Mortgage Roundup. Our first production was in San Antonio, followed by new editions over the years in Dallas, then Houston and now Austin. This amazing show for the state's origination community now reaches more than 1,500 live registrants each year, and we deliver free NMLS license renewal classes to more than 500.

Of course, we love Texas. And so does the mortgage world, which counts the Lone Star State as one of the nation's top three markets for home lending.

That's why we decided it was time to go above and beyond. Our conferences deliver great education to the attendees, including information on new products and services to expand your lending opportunities, as well as insight into regulations and economics that will change the way you make a living.

But only so many folks can make it out in person. We want to be sure that all originators and mortgage pros in the region have a chance to keep fully informed, and to get access to stories of your compatriots who are conquering the market.

That's why we launched Lonestar LO, the only magazine looking at the mortgage origination market in Texas. You'll get stories on interesting industry participants, details on alternative lending products that can keep you in the game, and regulations that will affect your business practices. We'll have hands-on practical advice on how to manage your business and your career, and all focused specifically on Texas.

This quarterly magazine is brought to you by the same people who produce National Mortgage Professional magazine, Mortgage Banker Magazine and Mortgage Women Magazine. These publications are created, written and edited independent of any association or sponsor, so the only allegiance is to our readers. Complimentary digital editions are provided to every active NMLS licensee in the state, and hard copy editions are available at our Texas Mortgage Roundup shows and via subscription. We're looking forward to having the eyes of Texas on us. As always, we're here to write the story of your success.

VINCENT M. VALVO CEO, Publisher, Editor-in-Chief vvalvo@ambizmedia.com

TitleEase, a title and settlement services franchise business based in Dallas, has announced it is now licensed as a title agency with the Texas Department of Insurance.

"We are thrilled to announce that TitleEase is licensed in the State of Texas and can provide title services and offer title franchises in that state," said Joseph D'Urso, CEO of TitleEase. "Texas is a great market for us to be in. According to Zillow, the Texas Home Values index increased 14.6% from 2021 to 2022. Zillow is also predicting in 2023 an increase in midwestern markets (inclusive of Texas). We have received high interest for franchises in the State of Texas and are excited we can now service those individuals."

In 2022, its licensing footprint has expanded exponentially. In addition to Texas, TitleEase has obtained title agency licenses in Colorado, Delaware, Florida, Georgia, Indiana, Maine, Michigan, Minnesota, Nebraska, New Jersey, New York, Rhode Island, Tennessee, Virginia and West Virginia. We will continue to add additional state licenses and expand our national footprint in the new year.

TitleEase provides a simplified, streamlined and fully compliant path for mortgage originators, servicers, real estate professionals and entrepreneurs to own and operate a title agency without the burden and expense of building a platform from scratch. Franchisees own a tangible asset with its own terminal value.

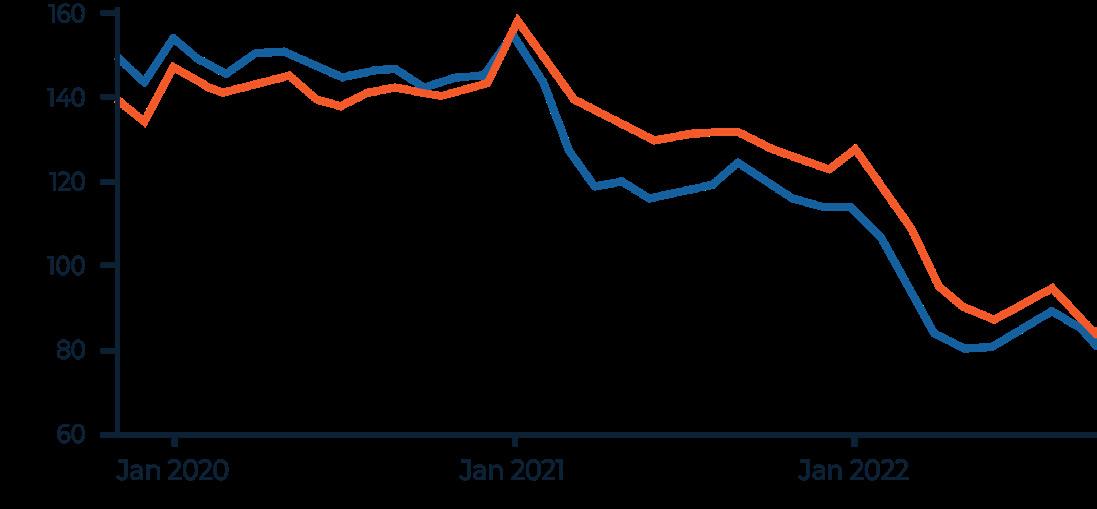

Existing single-family rent and price growth will moderate with the potential to turn negative on a

year-over-year basis, The Texas Real Estate Research Center says. The rapid pace of rent and purchase price appreciation over the last two years was never sustainable and would have been forecast to slow even in the absence of other headwinds.

Existing-home sales will likely be lower in 2023 than they were in 2022. Elevated mortgage rates combined with elevated asking prices will slow sales even as price growth moderates.

The TRERC research team has made its economic forecast, including on housing, for 2023, given current conditions. TRERC forecasts that

> percentage of fixed-rate mortgages in Texas had interest rates lower than 3.0% in 2021.

the mortgage interest rate's annual average will likely be higher in 2023 than it was in 2022. The recent increase in mortgage interest rates has been in response to both high levels of inflation and increases in interest rates from the Federal Reserve to combat inflation. Interest rates will largely follow a similar path as inflation with similar forecast risk factors.

Home price growth was largely supported by the fall in interest rates from 2019 through 2021. An increase in the 30-year mortgage interest rate to 7% from the January 2021 low of 2.65% decreases the purchasing power of principle and interest payments by 40 percent. The same increase to 7% from

January 2020's 3.65% represents a 30 percent loss of purchasing power.

Texas builders and developers have faced similar supply constraints as the rest of the economy over the last few years. This has led to a backlog of under-construction homes that will continue to come to market.

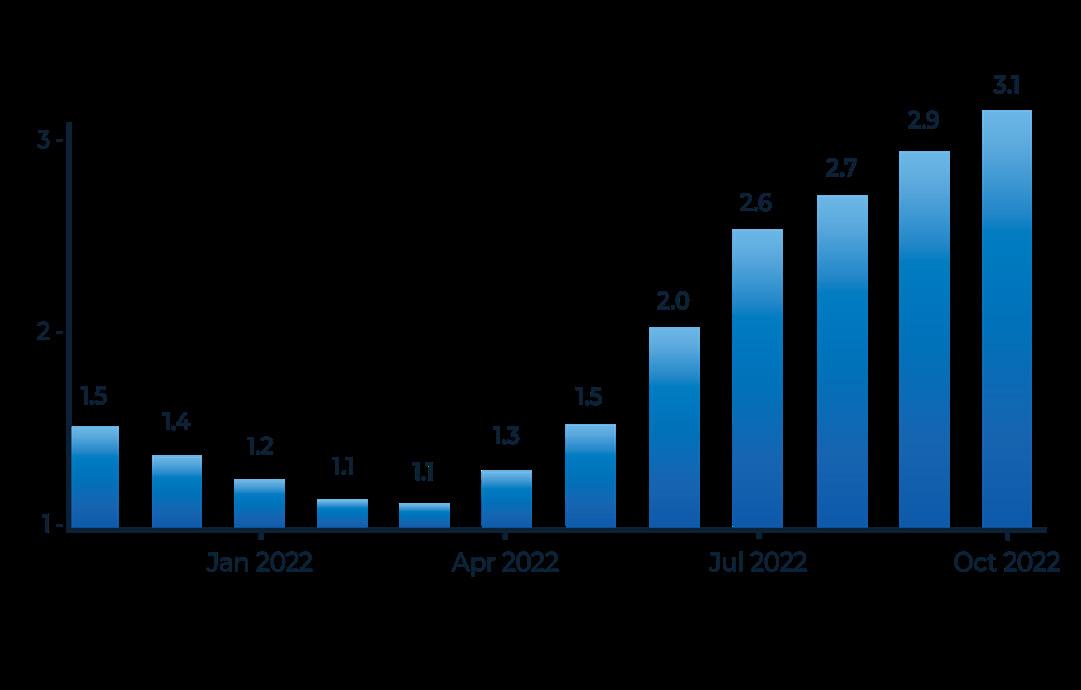

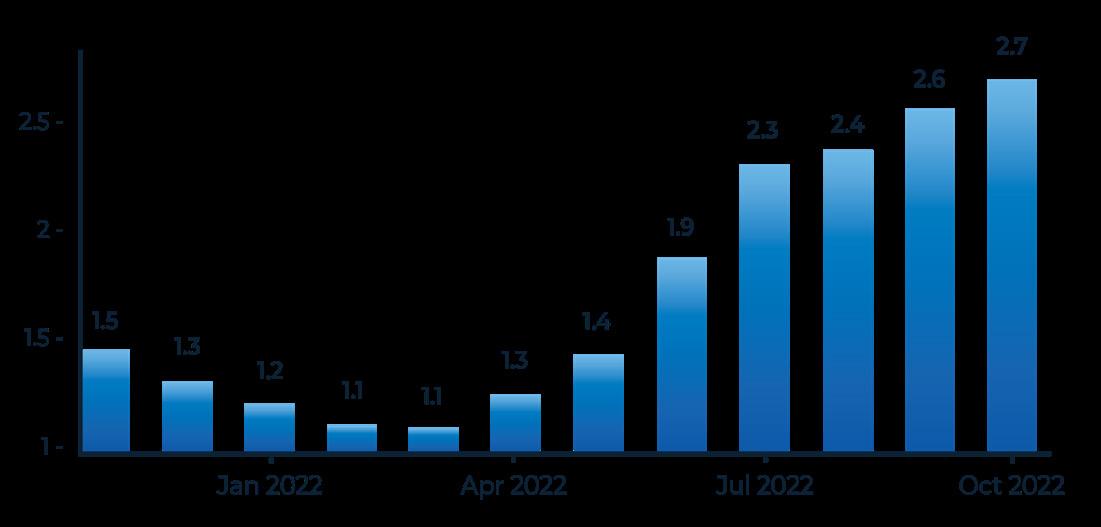

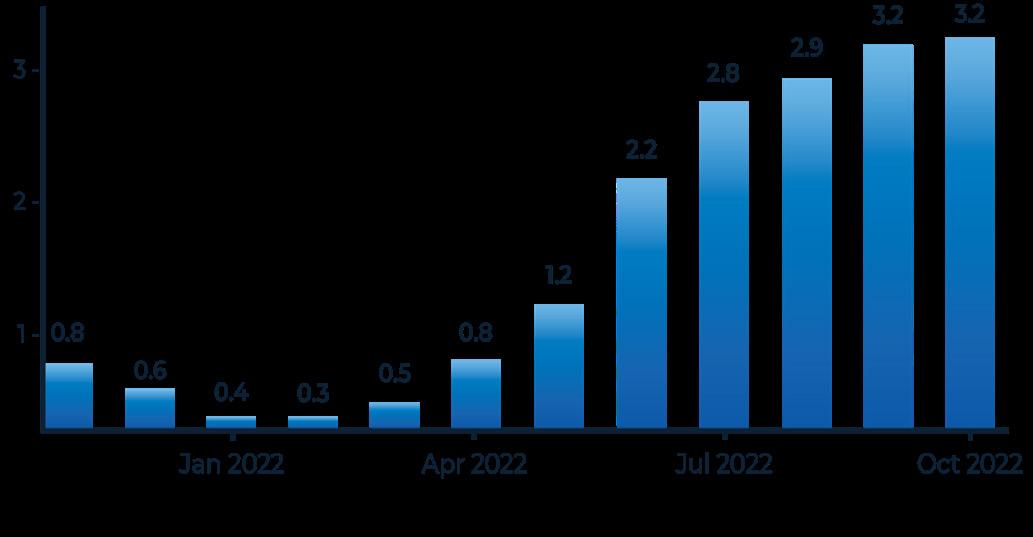

Mortgage rates soared in 2022. Corporate headquarters relocations to Dallas-Fort Worth and statewide dropped precipitously from their record levels in 2021.

Are the two related? Steve Triolet, research director for Dallas-based commercial real estate firm Younger Partners, is sure they are. He sees a definitive correlation between the plunge in corporate relocations in the wake of higher interest rates. He expects that to continue in 2023, Triolet said in an interview on the topic with the Dallas Business Journal.

The explanation is logical. Employees who own homes in another state are hesitant to move because of the higher costs of buying a new home in a new market, causing C-suite executives to stay put for now, Triolet said.told the Dallas Business Journal.

According to the “Relo Tracker” from YTexas — the Austin-based business network that connects executives who have recently moved to Texas or are considering a move — at least 24 businesses moved to the state in 2022. That’s down more than 60% from a record 62 that made the move in 2021.

To determine the U.S. states that get the best mortgage interest rates,

researchers at Construction Coverage analyzed the latest data from the 2021 Home Mortgage Disclosure Act, according to Inforney.com. The researchers ranked states according to the share of all fixed-rate mortgages with less than a 3.0% interest rate. Researchers also calculated the share of 30-year and 15-year mortgages with less than a 3.0% rate, and the median interest rate across all fixed-rate mortgages.

The analysis found that 39.4% of fixed-rate mortgages in Texas had interest rates lower than 3.0% in 2021, compared to 41.6% in the entire U.S. Further, the analysis found that 38.9% of 30-year mortgages had less than a 3.0% rate (40.5% nationally), 71.0% of 15-year mortgages had less than a 3% rate (80.2% nationally) and 3.1% had the median interest rate across all fixed-rate mortgages, matching the national average.

On Nov. 23, 2022, HomeTrust Mortgage reported a data breach with the Attorney General of Montana after hackers carried out a successful ransomware attack against the company, compromising consumer data stored on the company’s computer system, according to jdsupra.com.

According to HomeTrust, which has its corporate offices in Houston and branch locations across Texas, the breach resulted in the names, addresses and Social Security numbers of certain customers being compromised. Recently, HomeTrust Mortgage sent out data breach letters to all affected parties, informing them of the incident and what they can do to protect themselves from identity theft and other frauds.

The available information regarding the Home Mortgage of

America breach comes from the company’s filing with the Attorney General of Montana. According to this source, on July 15, 2022, HomeTrust Mortgage was made aware of suspicious activity within its computer system. In response, the company began working with third-party data security experts to better understand the incident and whether any consumer information was compromised as a result.

Home prices may have decreased for the first time in nearly a year, but fewer than half of first-time homebuyers in the Houston-The Woodlands-Sugar Land market can afford the median-priced home,

> fewer than half of first-time homebuyers in the HoustonThe Woodlands-Sugar Land market can afford the median-priced home

according to communityimpact.com

A study from Texas A&M's Texas Real Estate Research Center published on Nov. 4 compared data from 2011 through the third quarter of 2022. The study, completed by Reece Neathery, Harold Hunt and Losey, found several key factors in determining housing

affordability have risen dramatically over the past decade, including the 30year fixed mortgage rate.

According to the study, first-time homebuyers must factor in a monthly mortgage payment that is nearly three times as high as it was a decade ago. In 2011, the average mortgage interest rate of 5.62% equated to a monthly payment of $865. First-time homebuyers in 2022 pay an average of $2,379 per month for that same interest rate. Moreover, the actual mortgage rate has increased considerably over the past year.

The chairman for the Greater Tyler Association of Realtors said the housing market at this time last year looked completely different, as interest rates and the price of homes continue to climb.

“Last year we had barely any inventory at all. Interest rates were low,” John Wampler told KLTV. “So, tons of buyers were in the pool ready to attack any house that hits the market. Right now with interest rates going up and up and up, we basically see that buyer pool has diminished.”

The November 2022 Smith County housing report compares data to November 2021. It shows the average sales price is $48,000 more than last year. That average sales price is at $358,000.

And according to Freddie Mac, the interest rate on a 30-year fixed

mortgage is at 6.3%. Wampler said higher interest rates allow for more inventory to grow back.

Home prices in North Texas remained higher in the third quarter compared to last September, but the pace of price growth continues to slow, according to the Dallas Morning News in a report provided by Allie Beth Allman & Associates on its website alliebeth.com

The S&P CoreLogic Case-Shiller Index reports that Dallas-Fort Worth home prices rose more than 16% in September, compared with September 2021. But that’s also a drop from a 31% increase from April 2021 to April 2022.

Home prices across the country were up 10.6% in September, compared to September 2021, but down 1% from August. The September figures indicated three consecutive months of annual price growth decreases in DFW.

Houston home sales took their biggest hit of 2022, falling nearly 30% in November because of a combination of factors, including high mortgage rates and not enough inventory, Houston Public Media reported.

A new Houston Association of Realtors report shows sales in every housing segment suffered in November, including a nearly 45% decrease in homes priced between $150,000 and $250,000. Homes priced between $250,000 and $500,000 fell 27% last month.

A perfect storm of market conditions has led to a rough 2022 for home sales in Houston and across the nation, according to Houston Public Media. Mortgage rates have more than doubled since last year and home prices are still relatively high, which has kept more potential homebuyers on the sidelines waiting for better deals.

It's the latest sign the Houston

housing market is normalizing after last year's record sales.

Houston renters earned 69% of the income they would need to afford a starter home in October, according to an analysis by real estate website Point2Homes.

Researchers considered "starter homes" properties valued in the lower third of all available homes for sale.

It matters, Axios says, because higher mortgage rates and housing costs are keeping homeownership out of the reach of many first-time buyers.

By the numbers: Renters in Houston earned a household income of $41,364 on average, while the income needed to cover a mortgage was $60,186, according to the study.

In September, a typical Houston starter home cost $196,661, the study found, analyzing Zillow data.

Home prices in the Dallas-Fort Worth Metroplex have plummeted, with median prices down six figures in some cities, as buying slows amidst interest rate hikes, wfaa.com reports. With mortgage rates hovering between 6 and 7 percent, buyers are gawking after 2-to-3 percent rates that set the market on fire.

DFW homebuyers who've purchased homes in the past couple of months have seen a stark contrast from this time last year or even eight months ago.

Cathy DeWitt Dunn, president and CEO of DeWitt & Dunn Financial Services, said this cooler market offers different opportunities for buyers.

"We were paying perhaps 30 to 40 percent more on a house, we're having constant bids," DeWitt Dunn said. "People were writing letters with their family's intent and explaining that they're going to stay there forever and just hoping to get selected."

Now, buyers are able to navigate the market without the pressure to outbid dozens of other buyers, and houses are staying on the market for longer.

The year 2022 saw the US enter into a recession, as property prices rose drastically as a result of inflation. The financial experts at IBRinfo.org have revealed their property inflation predictions for 2023 in Texas. They also identified two Texas cities as among the top 10 nationwide for diminishing purchasing power. The financial website experts say before analyzing the data, it’s important to establish the relationship between

inflation and property prices. Inflation refers to the rate at which purchasing power drops and prices for goods and services rise to the point that they are no longer affordable for the majority of people. This ultimately has a knock-on effect for the property market as house prices increase and mortgage interest rates climb in an attempt to bring inflation back down to more manageable levels. Nationwide in 2022, home prices increased by over 6% compared to figures from 2021, according to Forbes. This led to far fewer homes being sold, as the majority

of people are unable to afford these higher prices. This has resulted in the supply of homes for sale being far greater than the demand for homes to buy.

IBRinfo.org expects to see things remain relatively the same throughout 2023 as inflation is gradually reduced. Although the rate of inflation is being brought down slowly over time, there is unlikely to be any major financial relief to come to the housing market in the next year. Nationally, mortgage rates will remain almost twice as high as those in 2021, with the typical payment increasing to $2,430 – up 28% (Realtor.com).

Across the U.S., home prices will rise another 5.4% in 2023 – with a few select areas seeing prices reduce from those in 2022.

The housing market is predicted to grow in Texas in 2023. In the year between 2021 and 2022, house prices across the state rose an average of 19.8% (Zillow) in response to inflation, which saw house sales decrease as a result. IBRinfo.org predicts that housing prices across Texas will reduce in 2023 to combat lower house sales, with property prices already slowly starting to fall at year’s end.

In particular, the Dallas-Fort-Worth area has seen the median home price fall from $393,000 in July 2022

to $390,000 in September 2022 – seeing a decrease of $3,000 in just two months (Zillow). Meanwhile, IBRinfo.org predicts that Austin will see a drop in house sales, with the volume of sales decreasing 6.6% in 2023 (Realtor.com).

However, IBRinfo’s research into house prices found that properties in Arlington and Fort Worth have risen from just over $65 per square foot in 2012 to over $180 in 2022 – falling just short of tripling in the span of a decade.

Across the U.S., IBRinfo.org’s team of experts expects to see inflation remain high throughout the entirety of 2023, with a very gradual decrease as the year comes to a close. House prices will steadily decline in some areas, while mortgage rates will remain high overall. Despite some states seeing house prices starting to fall, purchasing power will continue to decline in 2023 due to increased interest rates, leaving the demand for housing at a similar rate to 2022.

The website also conducted research to establish the difference between property values in 2012 and 2022. To do this, they compiled a list of the biggest cities

in each of the 50 US states by both size and population. They then used property price data per square foot for these cities, taken from both Zillow and Redfin, spanning the first eight months of both 2012 and 2022. They then calculated how many square feet of property you could buy with $1 million dollars in each city.

The research aimed to identify how much property $1 million dollars was worth in 2012 and 2022. Despite being only 10 years between the two sets of price data collected, the differences between the figures were fascinating.

Two Texas cities made the list.

In Arlington in 2012, one million dollars could purchase 15,385 sq. ft. of real estate. That number has plunged to 5,521: a drop of 9,864 sq. ft. Among the Top 10 most populous cities in the U.S., Arlington was ranked fourth.

Fort Worth came in fifth. In 2012, one million dollars would purchase 15,152 sq. ft. on average. For the same amount in 2022, 5,450 sq. ft. could be purchased: a decline of 9,702.

Among the Top 10 most populous cities in the U.S., Arlington was ranked fourth. Fort Worth came in fifth.

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

Inquire about our NMLS Data Licensing and LO Contact Database options.

It’s not a hot take to say that the second half of 2022 was tough on loan originators around the country and in the Lone Star State. Last year mortgage rates and inflation jumped to four-decade highs, causing affordability for prospective homebuyers to drop as typical families were forced to spend more on goods, services and rent and save less for down payments on a mortgage. Housing prices were still elevated though as demand continued to surpass supply, further pricing potential buyers out of the market.

As a result, existing home sales experienced slumped to 2011 levels at about 4.4 million, compared to 6.1 million in 2021 and the share of first-time home buyers shrunk to an all-time low of 26%, compared to 34% the previous year, according to the National Association of Realtors.

In their On The Horizon: Markets to Watch in 2023 and Beyond report, the folks at NAR are calling for a slow turn around this year due to a variety of factors. The country’s largest trade association’s experts are forecasting that existing-home sales will rebound slightly even as the median price of those homes will increase slightly from 2022.

Their forecast is also for the 30-year, fixed-rate mortgage to hang around 5.7%, which could bring first-time home buyers back into the market. However, higher mortgage rates will dissuade current homeowners, who bought at much lower rates, from considering a move resulting in a continued limited supply and higher

prices. Single family housing starts are also expected to be down, according to NAR researchers. Oh, and don’t expect 3% rates again anytime soon.

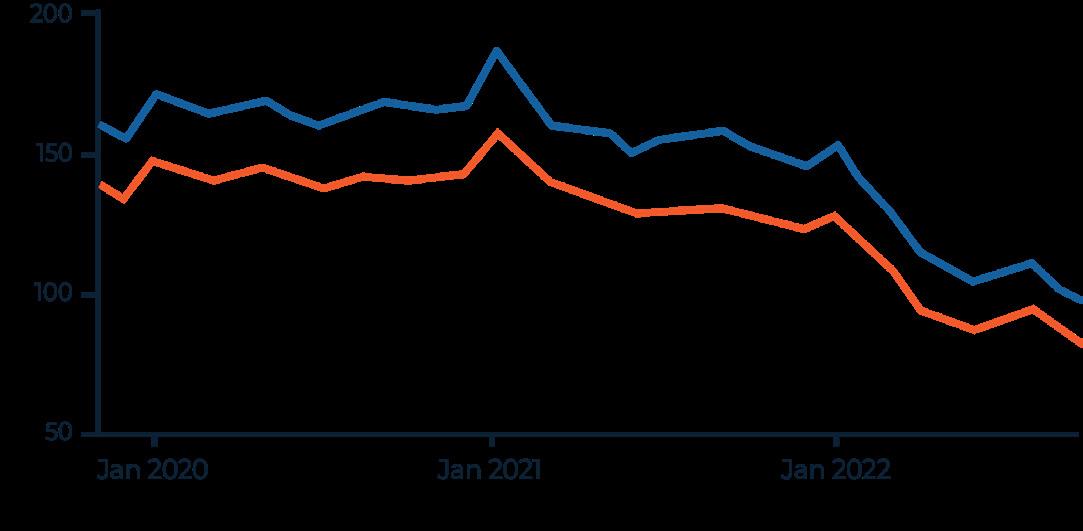

The researchers at NAR believe that, like politics, all real estate is local. With that in mind the association compiled a list of the top ten markets in 179 metro areas that it believes will outperform the industry in general. To determine which markets would make the list, they used data from NAR, the U.S. Census Bureau, the U.S. Bureau of Labor Statistics, the Bureau of Economic Analysis, the USPS and realtor.com.

Researchers tracked 10 indicators, including: NAR’s Housing Affordability Index, which shows how much above or below the qualifying income the typical family earns. An HAI higher than 100 shows that the typical family earns more than the qualifying income. An HAI higher than the national average also indicates more affordability; the share of renters who can afford to buy the typical home; job growth; growth of information jobs, whose workers are paid about 50% more than the average employee; share of information industry in the local GDP; population change; share of inbound moves from January to

September 2022; change of active listings October 2022 to October 2021; share of workers working from home; and the NAR housing shortage tracker.

The Atlanta metro market came out on top of the list followed by Raleigh, but DallasFort-Worth-Arlington landed the third spot and San Antonio-New Braunfels cracked the top 10, coming in at 9th, just behind Jacksonville and ahead of Knoxville.

Of Dallas, which ranked ahead of the national average on every indicator except for growth of information jobs, researchers said the area is experiencing a growth of tech workers with many startups moving to the area. Housing was also more affordable than nationally and there are more options available.

Regarding the San Antonio-New Braunfels market, researchers noted that while Texas is comparatively tax-friendly, the home of the Alamo is more affordable than other areas statewide.

“The qualifying income for a medianpriced home here is about $85,000 compared to $130,000 in Austin,” researchers said. “With a growing influx of tech workers, this is another area that is expected to outperform in 2023.”

There will be a real estate slump, but the big cities are coming out much better

NexBank, the largest privately held bank based in Texas, announced that Brian Ralston has been promoted to Executive Vice President, Chief Mortgage Banking Officer.

Stronghill Capital in Austin announced that it launched a new residential lending division with the appointment of industry veteran leader Dustin Wells as co-president.

Houston-based Stewart Information Services Corporation announced that Elizabeth Giddens has assumed the role of chief legal officer & corporate secretary.

FirstClose, Inc. announced that industry veteran Carol Crawford has joined the company as chief marketing officer.

NexBank announced it has appointed Scott Studenko as market president of DallasFort Worth.

Open Lending Corporation, which specializes in lending enablement and risk analysis solutions for financial institutions, announced the appointments of Simona Fillarini as the company’s first chief human resources officer, Thinh Nguyen as the company's chief information officer, and Jill Tyson as senior vice president of operations.

It’s time to let your skills shine. Find resources for breaking through barriers like degree screens and stereotypes. It’s time to tear the paper ceiling limiting STARs: workers Skilled Through Alternative Routes rather than a bachelor’s degree.

team and see the enormous amount of opportunity not only to buy a house, but to get a great deal on the price, get some closing costs, even cosmetic upgrades.

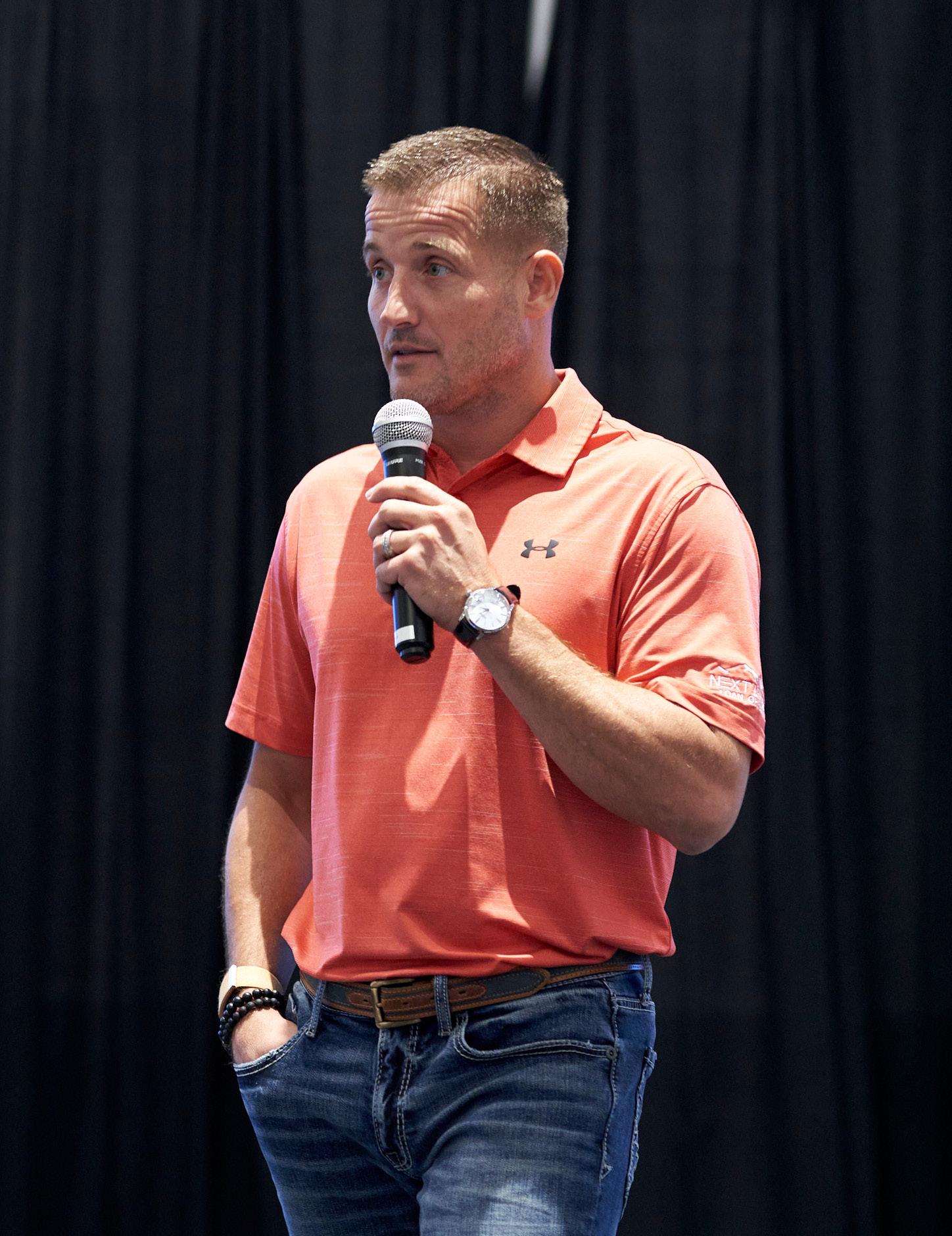

Q: What’s it going to take for MLOs in Texas to thrive in the coming six months?

Q: What are interest rates doing to the Texas market? Are the effects different than what is being seen nationally?

Rising interest rates affect everyone. However, geographically strong markets like the state of Texas are positioned well and will be able to absorb the changes a lot better. Texas is constantly growing and business-friendly, so the amount of people and companies continuing to come here bodes well during challenging times like these.

Q: Are some parts of the state doing better than others when it comes to the effect of interest rates?

I think the big cities handle things the best. There is just more economic growth and capital in the big markets, so the resources give bigger cities the ability to make adjustments and also take advantage of opportunities.

Q: How are they affecting home prices?

Home prices are starting to drop, but it really is specific to the price points.

Anything under $500,000 still has a lot of demand, $500,000- $800,000 has cooled off but still has interest and anything $1 million or over seems to be cooling off the fastest and most open to negotiating.

Q: Overall, are certain parts of Texas doing better than others?

I think Dallas is still doing the best overall because of its economic diversity. Dallas is well balanced amongst multiple industries, so it doesn’t suffer as badly during times like these. Austin is great, but they had the biggest price spike in the country, and now they are cooling off the fastest. Austin is also heavy in the tech stock world, and that industry isn’t doing so well which has caused buyers to press pause. Houston is doing OK but it’s an oil-driven economy, so they are up or down based on that alone.

Q: Who is winning in this market? How can more Texas mortgage professionals do better?

Smart Realtors, smart mortgage advisors and smart buyers are winning in this market. Collectively, they all work as a

I think the loan officers that are hard workers, highly skilled, and have valuable partnerships and relationships are the ones who will not only make it through these tough times but will probably pick up even more market share and thrive. The market isn’t giving any free deals right now, so it all comes down to massive work ethic, financial literacy and relationship-building, six to seven days a week until this storm calms.

Q: How bad is it going to get before things get better? Or are we seeing signs of recovery already?

It’s hard to say how bad things will get and when we will see a recovery. I believe we should know after Q1 of 2023, as I think massive unemployment is the next shoe to drop. The only positive thing about a deepening recession is historically mortgage rates come down. If things get worse, we may see some much-needed rate relief which would help incentivize more buyers to make a move. One thing is for sure. Tough times don’t last; tough people do.

Q: Let’s look at Austin and Houston. How can mortgage originators in those markets smooth out their book of business? Does it come by focusing on low-end loans?

In today's market “smoothing” your business begins fishing with a wider net. Right now, that is the name of the game. “Smooth” is ideal but “anything” is helpful. We have to market and be open to every opportunity that presents itself. People, price points and property. We can’t be choosers in this market so the more the merrier. Any person or family we can help is a win for everyone. We also need to expand our search parameters on business partners. The perfect Realtor isn’t the bullseye anymore. The bullseye is now the entire dartboard.

Q: You raise a good point that Texas MLOs will thrive with financial literacy. Does that mean more comprehensive knowledge of what the market has to offer or better preparing consumers to understand the mortgage process?

One of my favorite sayings has always been “ knowledge is power”. You have to learn beyond traditional loan guidelines. Financial literacy is everything right now. Financial freedom, how to create a wealth accumulator, how to run a personal budget, tax incentives, ROI, ect. Right now you have to be more of an “advisor” vs just an application taker. There are so many variables when it comes to becoming a “smart homeowner” and articulating this in today's economic environment is crucial. It’s what will make or break you and separate you from your competitors. The days of the easy refinance are gone. Todays market requires a fully committed, educated and caring mortgage officer. The standard has been raised, quickly. You can’t be a pretender anymore.

“The days of the easy refinance are gone. Today's market requires a fully committed, educated and caring mortgage officer.”

–Brian McAuley

Texas-based Next Level LO co-founders say to ride this market, originators need a tight grip on work, faith, and family

The line from an old George Bernard Shaw play goes “Those who can, do; those who can’t, teach.”

The late, great Irish playwright might not have ever introduced the world to that long-popular phrase had he met the team at Next Level Loan Officers.

That’s because they do both.

Next Level LO’s principals are busy in the lending business, and they teach others how to be as successful as they want to be, whether that means closing enough loans a month to be able to make a living and spend time coaching their kids’ ball teams or making enough money to buy a yacht and travel the high seas.

“Success in our world comes in many different forms,” said co-founder Kellen Vaughan.

Next Level LO has its roots in a meeting between Vaughan and Kenneth Travis (two native Texans) in 2015. They were relatively new to the mortgage business and got involved in some coaching. They quickly realized that some of their teammates hadn’t been directly involved in origination in a decade or more and decided that there had to be a better way.

“We wanted to make it relevant,” said Vaughan, and their company was born in December 2017.

“It’s always been a fundamental belief that we make better coaches and mentors when we’re actively in the business,” said Vaughan, who like his three fellow founders is a licensed loan officer. He currently works as a non-producing manager in Keller, Texas, just north of Fort Worth.

Initially, they coached other lenders one-onone and had a clientele of about two dozen loan officers at a cost of $1,800 a month for two onehour calls per month.

Then, in July 2022 they made the decision to expand their reach by making it more financially accessible and more private. Vaughan and

Travis - who also have fellow co-founders Shane Kidwell and Sean Zalmanoff on their team, launched their own website - leaving Facebook- and introduced their current model. It features Next Level Community, where for $197 a year, loan officers get access to learn from and network with top industry professionals, up to the minute notifications and agency and market updates, donefor-you scripts and marketing, Next Level training camp, access to in-person events and push notifications. They can also sign up for one-on-one coaching for a separate fee if they feel they need it. The next level up, which Vaughan said is the most popular, is Community Pro. For $197 a month, members have access to everything Next Level Community has to offer, plus private accountability groups, on-demand training, access to exclusive events and daily live-stream calls. LO’s in that plan can still get one-on-one coaching for a separate fee. Finally, there is Pro-Plus, which includes everything in Community Pro with coaching included, for $997 a month.

“We’re here for 95% of the LOs out there,” Vaughan said. “The other 5% are superstars and that’s not our customer-base.”

Next Level LO has more than 800 members and Alysha Boles is among them. Boles, a branch manager and mortgage advisor at Navigate Lending, has been in real estate investment and ownership for 20 years and in mortgage origination for seven years.

“I learned about Next Level as a result of looking for seminars and resources as a retail loan officer who wanted to expand her knowledge and abilities. Although provided in-house support and training, I knew there had to be more to actually originating at a more competent and higher standard,” Boles said. “That was something no company at the time was providing. I attended a

“It’s always been a fundamental belief that we make better coaches and mentors when we’re actively in the business.”

–Kellen Vaughan

two-day “LIVE” in Las Vegas and was re-energized, excited and blown away. They were teaching what no one else was and with different strategies in how you wanted to run your business.”

Boles, who is based in Texas, participates in both the on-line and in-person sessions - she prefers the latter - and has recommended NLLO to her colleagues many times.

“Next Level has changed over the years to accommodate need and growth, but continues to be a leader and innovator in the mortgage coaching community space,” she said. “For me, my recommendation is based around knowing the value of the people in the Next Level Community and the commitment to relevance and excellence in the leaders. There are endless resources, only those who choose not to act won’t find them.”

For Boles though, there is a downside to the online focus.

“Honestly, I miss our huddle coaching calls. Being in a smaller group with a coach and regular structured time was something that worked very well for me,” she said. “Some of my closest friends came from that and are resources I still use for questions and help with clients and loans. I am now part of two coaching groups because the other group has that more intimate connection with frequent in person opportunities. However, that is still possible at Next Level if you have a group who wants to coordinate and pay for private coaching sessions.”

Co-founder Travis, who grew up in Dallas but now calls Longview in East Texas home, said the money they bring in from coaching is a motivator. He said that their hope is to have several thousand people paying smaller amounts for coaching in the next five years with a goal of reaching a $55 million valuation.

Even with that goal, Travis, a Marine Corps veteran, said the company is leaving money on the table.

“Without a question we are leaving money on the table,” Travis said. “We’re going to give you more than we take.”

And that’s by design too because they want to teach LOs to work smarter, not harder.

“If people knew how little I work (on mortgages) they wouldn’t believe it. That’s what we teach people,” he said, adding that the number one challenge is getting people to let go of things that aren’t worth their time.

Travis estimates that he still makes between $50,000 and $150,000 a month on the lending side, which takes care of his family.

Family is paramount in Travis’s life. If you get his voicemail it lets you know that he’s available Monday to Saturday, but Sunday is set aside for family and faith. It wasn’t always that way though, especially before the creation of Next Level LOs, which Travis calls one of the best decisions of his life.

“One night I came home and my wife was packing her bags. She said ‘Kenneth, I didn’t sign up for this,’” Travis recalled of his days working non-stop.

“Here I am thinking this was what I was supposed to do,” he said. “I

learned how to scale my business and help people change the trajectory of their business and their personal life.”

Travis, who now works as a mortgage broker, said if he had to choose between that and coaching the choice is easy.

“Coaching,” he said. “I’m 100% geared towards helping LOs gain confidence and live a better home life with their spouse and kids..”

Travis said that when he shares his story with other LOs inevitably there’s one who says “Kenneth, that’s me.”

Vaughan said he hopes to maintain his current mix of teaching and doing indefinitely though.

“I will probably always have a foot in lending because I think it’s an amazing business that can provide crazy opportunities for people that are willing to work it,” he said. “But I also love coaching and if the stars align, I would love to expand my capacity to do more of that.”

“Without a question we are leaving money on the table. We’re going to give you more than we take.”

–Kenneth Travis

“Mortgage malfeasance” vs. fraud

Mendrygal, a partner at Locke Lord LLP in Dallas. Here is an edited version of their discussion.

Q: There are some stats showing increases in property fraud, which ultimately leads to mortgage fraud. Are you seeing increases in mortgage fraud in Texas?

Not yet, but it is only a matter of time. The fraud I see tends to be complex, and often involves sophisticated fraud rings and/or industry insiders. These cases generally take longer to bubble to the surface because they are hard for lenders and law enforcement to detect and unravel. In addition, because of the various forbearance programs that have been in place for the past few years, we have not had the opportunity to see some of the tell-tale signs of fraud, such as early payment defaults. Over the past few years, and up until a few months ago, the conditions were ripe for fraud. We had a hot housing market in many parts of the country, involving a combination of high demand and moderate supply, low interest rates, rapidly increasing housing prices, and bidding wars. As a result of those conditions, some buyers and sellers had the opportunity to play some games.

Now that the forbearance programs are being lifted, payment defaults and foreclosures are going to start to occur. Lenders and regulators are going to begin studying those loans to understand what happened, and some fraud is going to be detected. Everything was frozen in time for a while. Now comes the thaw.

Q: Is mortgage fraud driven by a bad economy? With a recession of some scope predicted for 2023, will there be increases in mortgage fraud?

People who study financial fraud believe there are two major categories - crimes of opportunity and crimes of desperation. The hot housing market prior to and during the pandemic meant that a lot of houses were in circulation, which created plenty of opportunity. If we enter a recession, particularly if interest rates remain high and housing transactions low down, we could see a shift away from crimes of opportunity and see more crimes of desperation.

Crimes of desperation can come in different flavors. I see it on the lender side when people who are paid on volume or commission get

themselves into financial trouble. That boat payment they agreed to during the hot market weighs heavily when the market goes cold. Thus, some insiders start to do bad loans. On the borrower side, a recession combined with high interest rates makes it much more expensive to get into that house that they have had their eye on. Some borrowers will end up saying whatever they need to say to get into that house (or stay in their existing home). In the end, I’m not sure if the total volume of fraud will increase year-over-year in 2023, but we might see a different flavor of fraud.

Q: Where is fraud a more prevalent issue? The borrower or the lender?

Statistically speaking, there is much more fraud on the borrower side. But it is often way more serious on the lender side. Fraud by lenders and other industry insiders can be incredibly difficult to detect because they know how these deals work. They know what the certain borrower documents should look like to minimize scrutiny. They know which underwriters and processors are more diligent. They know the loan amount thresholds that trigger different treatment in the pipeline. And they know that they can put their reputation on the line with their co-workers to push certain deals through the pipeline before the fraud is detected. As a result, insider fraud can last a long time and, once it is detected, can result in law enforcement scrutiny on the entire company, not just the co-conspirators.

A majority of lenders are honest, hard-working people, obviously. But how does one spot the bad actors among fellow lenders who might be taking shortcuts?

There is no perfect solution, but

Lone Star Loan Originator Senior Editor Keith Griffin discussed the potential for increased mortgage fraud as housing economics change with KipKip Mendrygal Locke Lord LLP

my best trick is data analytics and, specifically, inward-facing data analytics. I see companies with robust and smart outward-facing analytics that they use to assess risk and detect fraud by borrowers. But many of these companies spend much less time studying what is happening within their castle walls. In nearly every insider fraud case that I deal with, there was a clue in the data. Often, the biggest red flag is some significant change in a loan officer’s business patterns. For instance, how did that loan officer go from eight to 48 loans in a single month? Or, why did that loan officer go from working exclusively in these zip codes and go exclusively to a new zip code? Or, why did that loan officer shift from single-family homes to multi-family properties? Is there a good explanation for what happened? There might be, but someone needs to ask and decide whether the answer makes sense.

I should be clear about something – I appreciate that trends are much more difficult to detect in real time than they are after the fact. But inward-facing data analytics will often help you notice aberrational shifts in the quantity, quality, location, or types of loans being originated by your loan officers.

particularly when it comes to foreign nationals attempting to move funds to the United States to invest in real estate and using straw borrowers to do so.

using those outward-facing analytics that we just talked about. In the company’s files, is the employer’s address or phone number associated with any other loans? Does the same bank account number appear in any other loan files? Do we have other loans on the same street with similar employers or bank accounts?

I originally got involved with mortgage sector fraud cases back in 2005, when I was a brand-new lawyer. Back then, the fraud was heavily slanted toward traditional borrower fraud – falsified bank statements, verifications of employment, etc. In the past 18 years, not a lot has changed. I do see more occupancy fraud these days,

The biggest difference is that the same borrower fraud schemes have become more sophisticated. Whereas fraudsters used to create amateurish fake bank statements and have their friend pretend to be a supervisor at work, the false documentation has become far more sophisticated and difficult to detect. The documents look authentic. In a few days’ time, you can set up a faux website for a faux business.

So how do you detect fake documents? I encourage lenders to try to talk to the borrower at least once during the process. Don’t read a script – have a real conversation.

If your Spidey sense starts to tingle, there is probably a reason for that. That’s usually a good time to start

In legalese, “design and implement an effective compliance program.” In plain English, “hire smart people and give them the budget and resources to aggressively detect and prevent fraud, which might have the ancillary benefit of saving the company’s bacon.” There are a lot of great compliance products out there, but be careful about buying something off the shelf and assuming that it will work for every business. Someone needs to sit down and assess where your particular risks are and then hire a knowledgeable and adequately-resourced compliance and fraud prevention team that is empowered by senior management to do the job.

This department is your corporate life insurance policy. They’ll catch a lot of fraud, and even if something slips by, it shows that the company is trying to be a good corporate citizen. Most companies are wise to this, but I still see quite a few companies in the mortgage sector that hasn’t invested in any personnel who are tasked with doing the types of fraud detection activities that I talked about above. In a worst-case scenario of insider fraud, those are the companies that have to sweat bullets.

Q: What are some common things originators can look for when it comes to borrower fraud?

Q:

... Inward-facing data analytics will often help you notice aberrational shifts in the quantity, quality, location, or types of loans being originated by your loan officers.

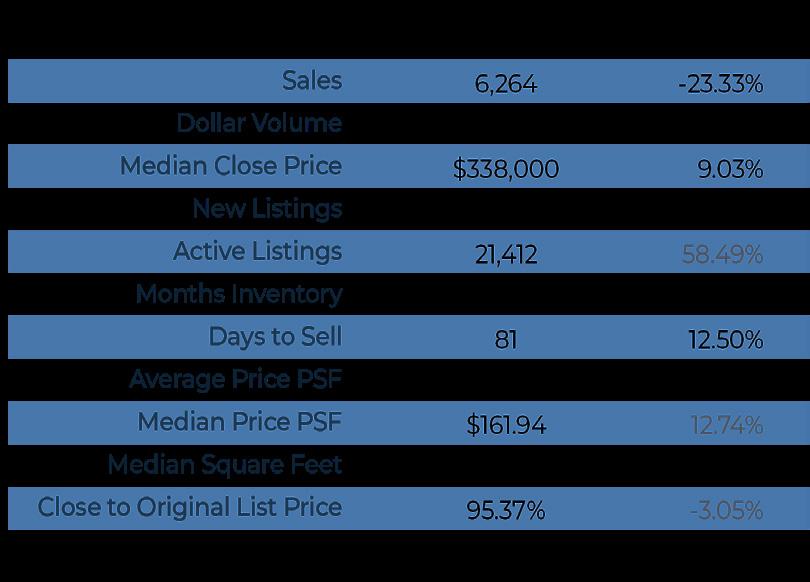

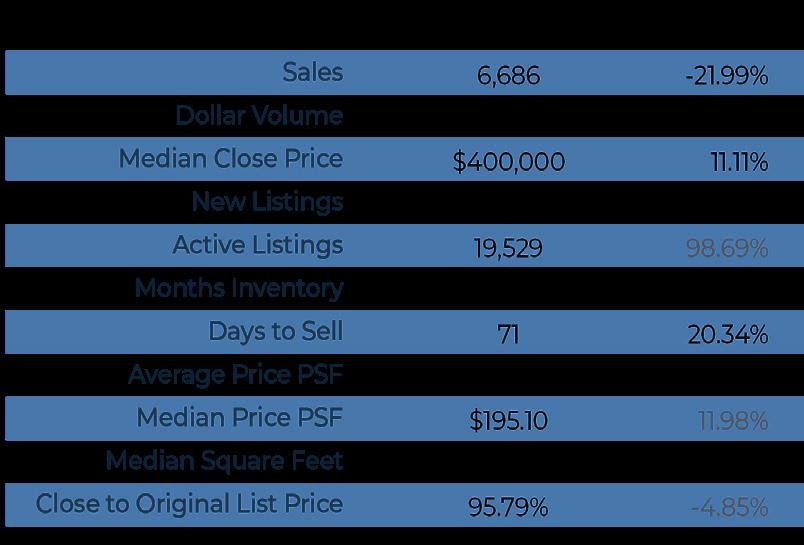

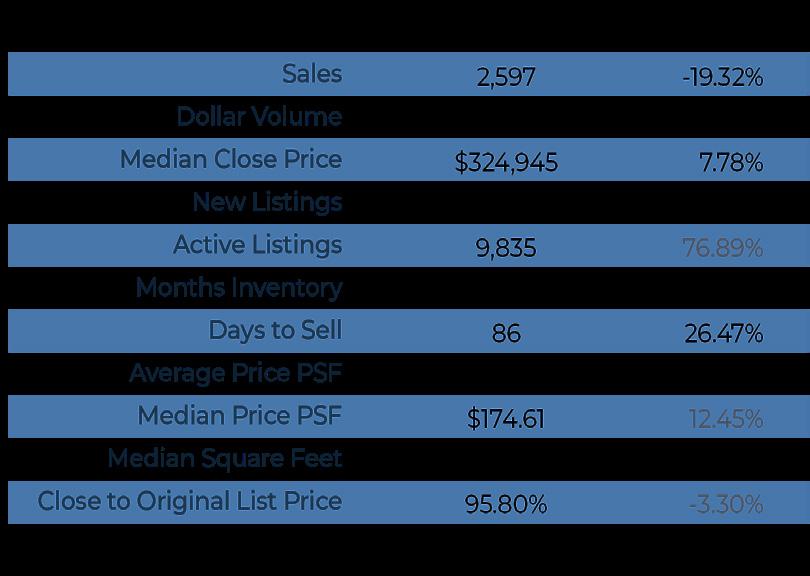

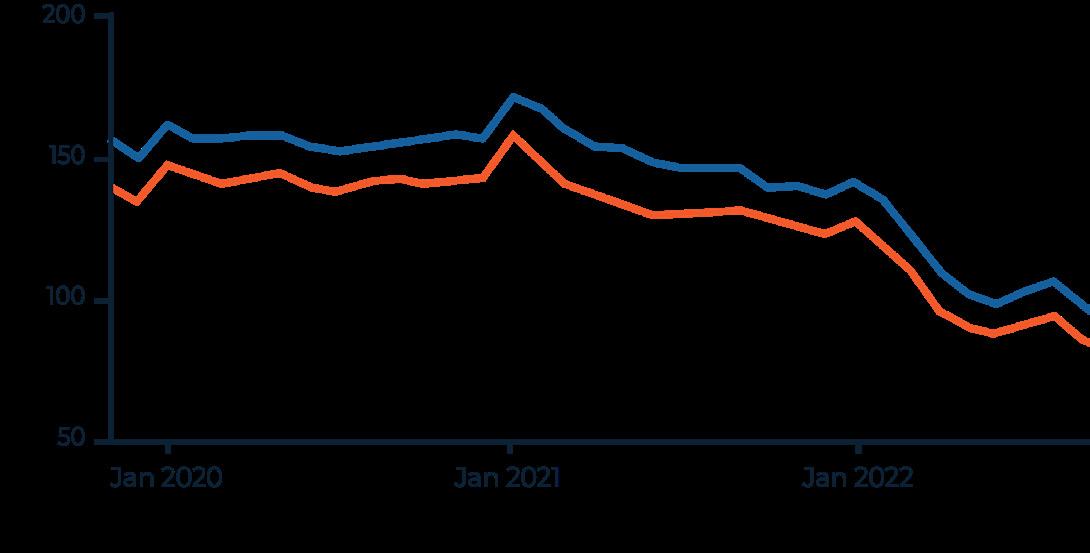

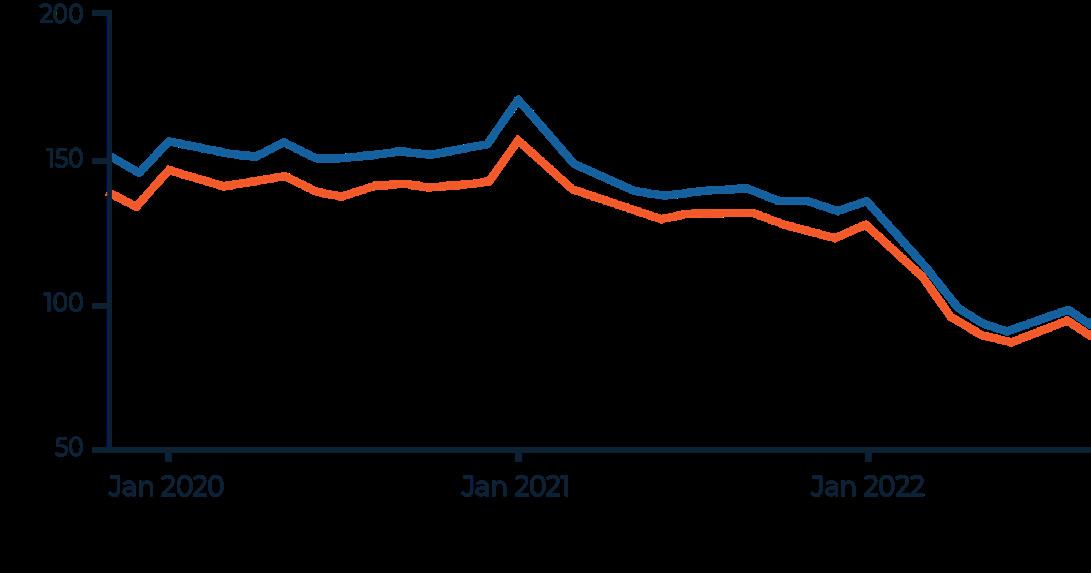

Texas experienced its ups and downs throughout 2022 when it comes to the real estate market. As this data from Texas Real Estate Research Center shows, sales volume is down over 20% across the Lone Star State with Austin showing the biggest drop in sales volume at 26.59%.

The Houston market was the most active in closed listings at 85,720. In October, the Houston market remained vibrant with 21,412 listings. It’s part of a U.S. Census metropolitan statistical area with a population of 7.1 million.

San Antonio is the most affordable of the top four markets in Texas with a median closing price of $321,000. Austin’s affordable housing may have improved in part due to much larger inventory. It saw an increase of 226.87% from October 2021 to October 2022.

Connect and learn from the very best in the business. Upcoming Originator Connect Network events you don't want to miss.

MARCH 22 — MARCH 23

Las Vegas, NV | www.originatortech.live

This event connects customer experience-obsessed executives and originators with best-inbreed tech vendors and lenders helping to dominate or disrupt their markets. The winners of the next booms will be sharing and mapping out their tech stack upgrades at this event.

JUNE

JUNE 27, 2023

San Antonio, TX | www.txmortgageroundup.com

Join your community of mortgage professionals at the Lone Star State’s largest mortgage event, The Texas Mortgage Roundup. Don’t miss out on our lineup of engaging events centered around networking, skill-building, and having a great time with your peers at our mid-year edition in San Antonio.

AUGUST

AUGUST 18 — AUGUST 20, 2023

Las Vegas, NV | www.originatorconnect.com

Be part of the nation’s largest and most innovative mortgage conference focused solely on the origination community at brokerages, banks and credit unions. A three-day weekend event that motivates originators, drives your business forward with new tools, and energizes and educates on ways to propel volume to new heights.

SEPTEMBER

SEPTEMBER 6, 2023

Texas Mortgage Roundup

Dallas, TX | www.txmortgageroundup.com

The Lone Star State’s top gathering for mortgage pros. The lineup of engaging events centered around networking, skill-building and having a great time with your peers. The Roundup is so big, we have to do it twice! Join us for the Dallas edition as we gather the best in the business from north Texas.

NOVEMBER

NOVEMBER 14, 2023

Houston, TX | www.txmortgageroundup.com

The Lone Star State’s top gathering for mortgage pros. The lineup of engaging events centered around networking, skill-building and having a great time with your peers.

Join us for the newest edition in Houston as we gather the best in the business from southeast Texas.