LEAD LOCKDOWN

FCC’S NEW CONSENT RULES PUT LEAD BUYERS ON NOTICE

FOLLOW THE YELLOW BRICK LOAN NO PLACE LIKE YOUR OWN BROKERAGE

DECODING THE DATA HOW TO SCORE TOP TALENT IN A TIGHT MARKET

LEAD LOCKDOWN

FCC’S NEW CONSENT RULES PUT LEAD BUYERS ON NOTICE

FOLLOW THE YELLOW BRICK LOAN NO PLACE LIKE YOUR OWN BROKERAGE

DECODING THE DATA HOW TO SCORE TOP TALENT IN A TIGHT MARKET

With Florida’s rising fees turning the tide, ADAM COHN navigates new markets and fresh opportunities up the coast

LEAD LOCKDOWN

FCC’S NEW CONSENT RULES PUT LEAD BUYERS ON NOTICE

FOLLOW THE YELLOW BRICK LOAN NO PLACE LIKE YOUR OWN BROKERAGE

DECODING THE DATA HOW TO SCORE TOP TALENT IN A TIGHT MARKET

With Florida’s rising fees turning the tide, ADAM COHN navigates new markets and fresh opportunities up the coast

COVER STORY PAGE 58

With HOA fees climbing higher than the Florida sun, Adam Cohn is shifting his business from the sandy shores of the Sunshine State to the more affordable landscapes of the Carolinas, helping New Yorkers find a new southern sanctuary. CONTENTS

6

A Rate Cut Rhapsody

Join us as we toast to the first rate cut in over two years! Raise a glass to progress, but remember: the future’s melody is yet to be composed.

8 Commission Confusion

As the NAR settlement sends ripples through the mortgage and real estate landscape, seasoned professionals reflect on a history of adapting to change.

Recognition That Resonates

Discover how winning awards can elevate your brand, boost employee morale, and attract top talent. In a crowded market, accolades are more than just trophies — they’re a ticket to greater recognition and success.

Chevron Showdown

In a landmark decision, the Supreme Court has overturned nearly 40 years of Chevron deference, leaving the mortgage and housing industries in a tailspin.

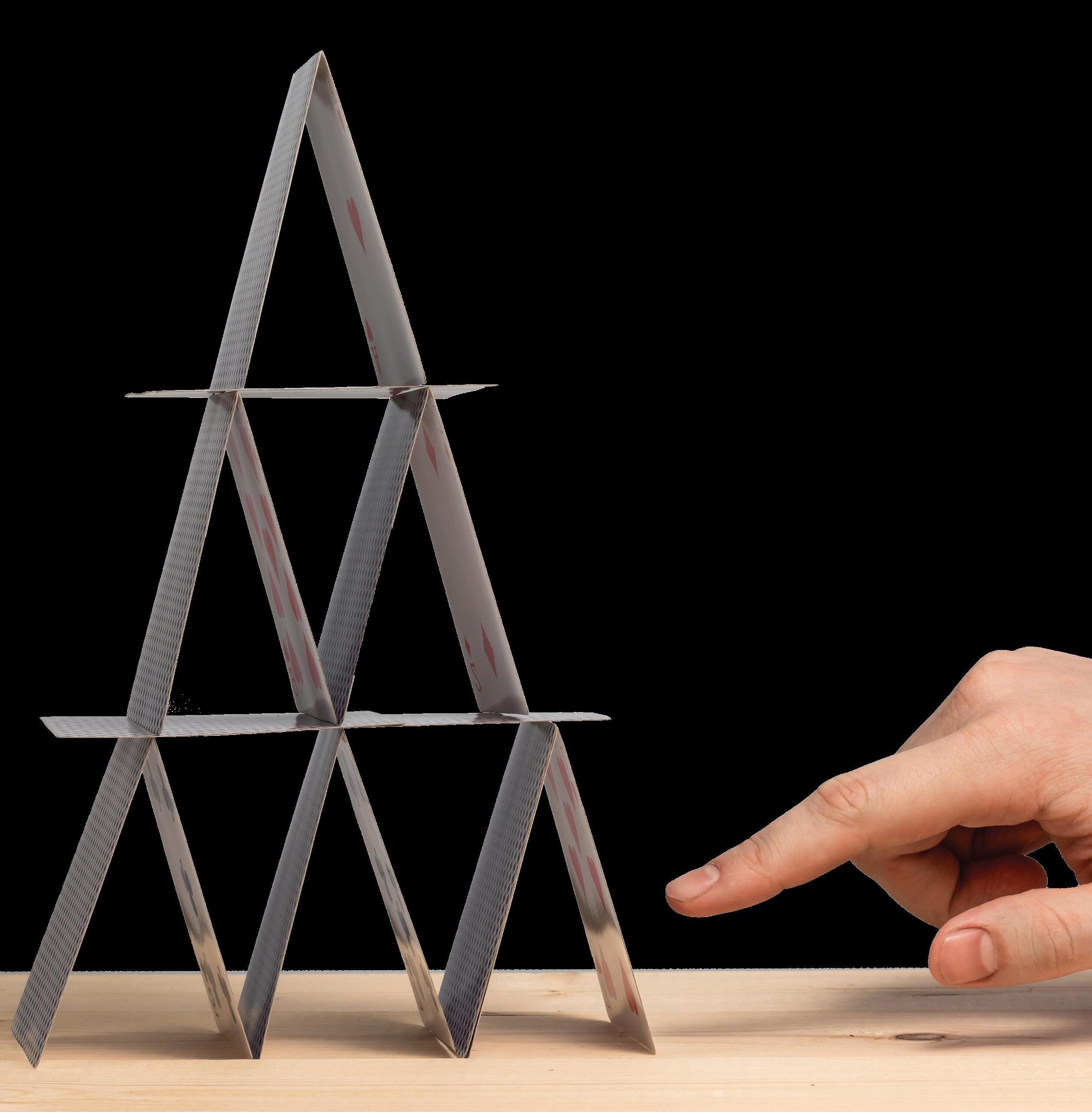

DIALING IT DOWN: FCC REWRITES THE RULES FOR LEAD GEN CALLS

As new FCC rules reshape the lead generation landscape, gone are the days of easy internet leads, with one-to-one consent taking over the game. How will lenders and borrowers adapt to this seismic shift? Find out how the changes might silence more than just your phone.

People on the Move

See who the movers and shakers are in the mortgage industry. 24

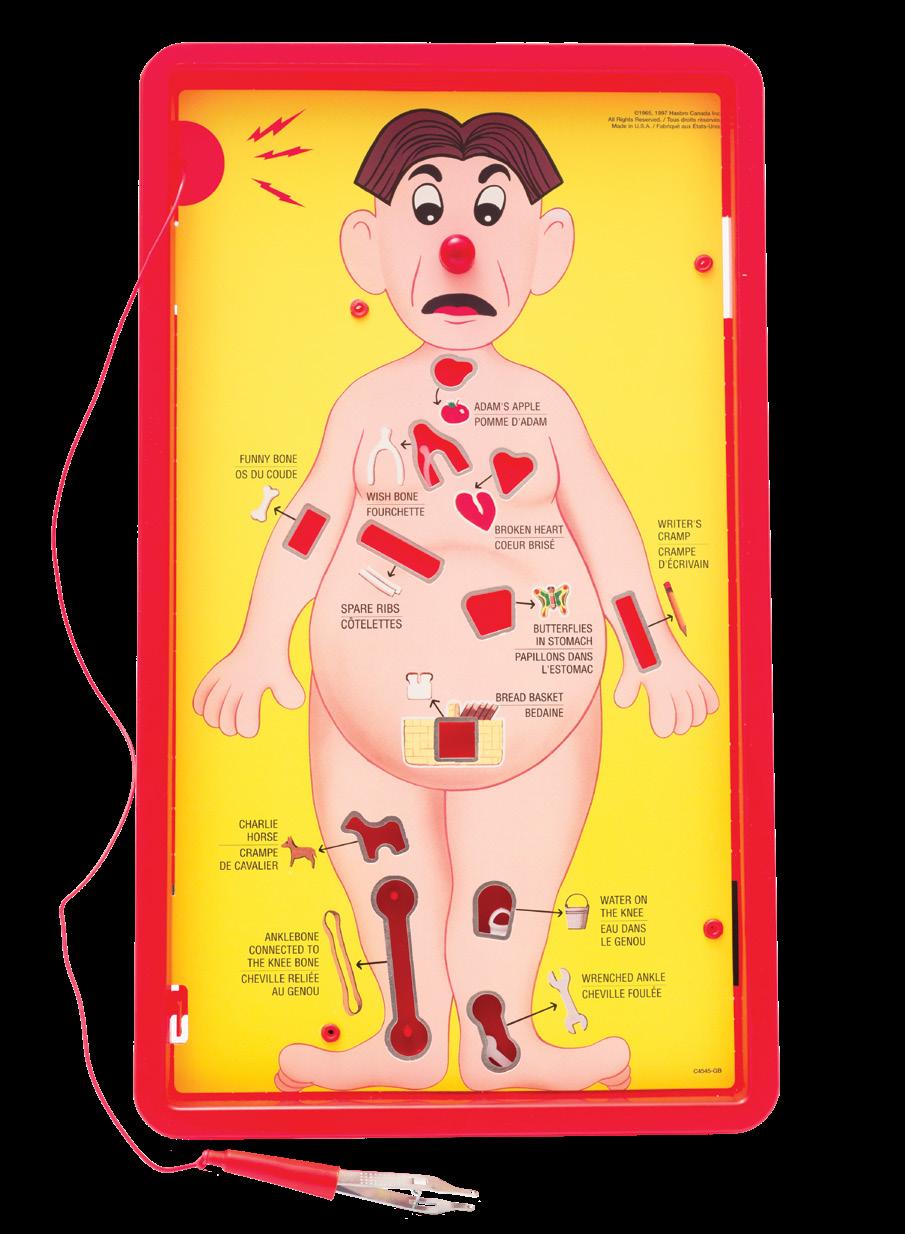

Your First Million Dollars: From Butterflies To Boldness

Dive into the world of public speaking, where nerves can become your greatest ally. Discover how countless red-faced, white-knuckled speakers have transformed into confident orators.

28

Benchmarks And Best Practices: Fraud, Fear, And Financial Foresight

As technology advances, so too do the tactics of fraudsters — stay informed and protect your borrowers from falling victim to deception.

Originator Tech Resource Guide

Wholesale Lender Resource Guide

32

Maximum Conversations: Cutting Through The Noise

Navigating the twists and turns of the lending landscape with clarity and confidence.

Mortgage Meteorology Report

44

A Tiered Talent Approach

With competition fierce and the talent pool shrinking, recruiting top loan officers requires more than luck — it’s all about the numbers. Discover how data-driven strategies are reshaping recruitment in the mortgage industry, helping companies reach the top one percent.

50 Click Your Heels, Start Your Shop

Aspiring brokers don’t need a wizard, just a solid plan. From ready-made compliance solutions to “just add water” brokerage models, discover how mortgage pros are building independent shops with ease—and a little help from technology.

Vincent M. Valvo CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak STAFF WRITERS

Dave Hershman, Erica LaCentra, Harvey Mackay, Lew Sichelman, Mary Kay Scully CONTRIBUTING WRITERS

Alison Valvo DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Navindra Persaud DIRECTOR OF EVENTS

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

William Valvo UX DESIGN DIRECTOR

Krystina Coffey, Matthew Mullins MULTIMEDIA SPECIALIST

Andrew Berman HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Nicole Coughlin ADVERTISING ASSOCIATE

Joel Berman FOUNDING PUBLISHER

One of our more popular video segments at www.nationalmortgageprofessional.com is Poetic Moments In Mortgage. Here then is a little ditty of celebration (and caution) for the first rate cut in more than two years.

In boardrooms bright, with graphs aglow, Mortgage originators hum a vibrant show, For Jerome Powell, with measured decree, Has eased high rates, set them free.

Once, the weight of eight percent bore down, A heavy crown on a weary town, But now, with six or less, hope takes flight, As dreams of homeownership shimmer in light.

Champagne flows, a clink of glass, Each deal signed feels like a pass, To greener pastures, to doors anew, Where families gather, dreams born anew.

Yet, as the confetti dances on air, Wisdom whispers — “Proceed with care.” For markets shift like the turning tide, And questions linger just outside.

Will rates dip further, or rise once more?

A dance of numbers on a fickle floor, The Fed’s hand steady, yet uncertain still, What follows the jubilation? What’s the next thrill?

The markets swirl with a tempest of doubt, Will more cuts follow, or will they run out?

A delicate dance on the edge of a knife, Balancing hope with the pulse of life.

So let the revelry echo and swell, But hold close the caution — do tell, For in every celebration, there’s a tether, Between dreams fulfilled and the stormy weather.

Mortgage originators, revel and cheer, In this moment of ease, the future is near, But temper your joy with the wisdom of old, For tomorrow’s rates may still unfold.

So raise up your glasses, both bold and sincere, To the promise of loans, and the warmth that draws near, Yet hold tight to wisdom, let patience be known, For the future’s a canvas that’s still being sewn.

VINCENT M. VALVO Publisher, Editor-in-Chief

Submit your news to: editors@ambizmedia.com

If you would like additional copies of National Mortgage Professional, call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

TBY DAVE HERSHMAN, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

he NAR settlement has cast a pall over the industry as we start dealing with another great unknown. I have been in this industry for over 40 years (of course, I started when I was ten). Every time there is a major change, we tend to adjust. There have been so many that I have lost count: licensing, the pandemic, loan officer commission rules, the subprime boom, the subprime bust, TRID and more. Each of these came with predictions of Armageddon (with apologies to Bruce Willis — a great movie, by the way).

But we adjusted each time. Though I cannot predict the future, I would guess that we will adjust this time as well. This does not mean we may not have to adjust our business. As a matter of fact, each agency has already had to adjust or reiterate their “buyer-paid commission” rules. This was one of the more obvious needs. In this article I will not try to predict the future. But I will point out a few important factors that we should consider.

• First, let’s talk about the concept of buyer-paid real estate commissions. Ever since I wrote the Book of Home

Finance 40 years ago, I have been teaching in this industry. When it came to real estate commissions, I have always stated that the seller does not pay the real estate commission. And everyone looked at me like I had two heads. This is false, by the way, as I barely have one. But let me explain this statement. The buyer of the property is the only one buying something in the transaction. Therefore, they are the only entity that can pay. It is simple economics. Let’s take a simple fictitious example — closing costs. The seller does not pay them — ever.

1. $400,000 Sales Price, $10,000 in closing costs.

2. The buyer submits an offer for the seller to “pay” the $10,000 in closing costs.

3. The contract is accepted.

4. One month later the buyer decides that paying the closing costs would be more beneficial to their financial situation.

5. The buyer asks the seller to lower the price to $390,000 with the buyer paying the closing costs.

6. The agent explains to the seller that their net will be exactly the same, so they accept.

7. Thus, you can see that the buyer is clearly paying for the closing costs through the price of the house. This does not mean that an agent commission does not benefit the seller — because it has been shown that homes comparable which are listed in the MLS sell for a higher price than FSBO’s. Agent commissions are generally worth the value they deliver. It is just that the buyer pays them — albeit indirectly.

• Second, let’s talk about the latest craze. Real estate agents, desperate for more income, will now become loan officers as well. This is already a common practice in a few states. However, major companies have always discouraged this practice because FHA did not allow it. Thus, the practice was more common among non-FHA approved brokers. However, FHA recently revised their conflict-of -interest rules to open the door for this practice. I am not an attorney, but I am not aware of state licensing rules being changed in any way, nor RESPA. Thus, I believe agents would have to be licensed to be paid and they must provide a service worthy of that payment. Regardless of my amateur assumptions, I have heard stories of companies jumping the gun and claiming that they can pay agents under certain guidelines. Keep in mind that the agents who are inclined to take those companies up on this offer are the ones having trouble

The buyer of the property is the only one buying something in the transaction. Therefore, they are the only entity that can pay. It is simple economics.

Top agents don’t have time to conquer the expertise needed for two jobs. They are too busy selling homes.

making a living, which is not exactly the best target for loan officers. Top agents don’t have time to conquer the expertise needed for two jobs. They are too busy selling homes. Plus, if an agent is serious about becoming a loan officer also — do you think other agents will refer them business? These agents are competitors and can sell a next home to those referrals — perhaps not now, but sometime in the future. One exception might be a larger team of agents appointing one of their lower producers as a loan officer — but again, the head of that team likely could not take a cut without licensing and providing a service. I will let the attorneys ferret that one out.

• Finally, will the role of the loan officer change? You bet it will! The loan offi-

cer will become more important. Why is that? Every time there is a complicated change in the industry, it opens the door for education. The agents need to learn about what is allowable and what is not. All the questions have not been answered and this is likely to be an evolving situation. Thus, it is incumbent upon the loan officer to keep up with what is taking place. Even more importantly, the loan officer will need to read the contracts much more carefully to determine if the contract meets current requirements for contributions and more. These contracts are likely to become more complex and we will see a slew of variations. Going back to the previous point — the real estate/mortgage interaction world is going to become more complex. How many agents are qualified to traverse this path, let

alone become competent loan officers?

This is another major change for the industry. Again, I predict that we will adjust. Those that don’t adjust are the ones that are in jeopardy, not the industry in general. Every challenge begets opportunities and this one will be no exception. ■

Dave Hershman is the top author in this industry with six books published as well as the founder of the OriginationPro Marketing System and the OriginationPro’s on-line comprehensive mortgage school. His site is www.OriginationPro.com and he can be reached at dave@hershmangroup.com

Creating a space for the next generation in NMLS education.

Introducing Maximum Acceleration, your new premier provider of continuing education.

We’re not just bringing you a lecture. We’re bringing you the fuel to spark your competitive fire, the plan to win the game on the merits, the confidence to know the rules and master them.

We’re Maximum Acceleration, and we’re where loan originators go to put their career in high gear.

— LaDonna Lockard, CEO

Why awards are important for the success of your business

TBY ERICA LACENTRA, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

hroughout the year you may see numerous award rankings and award announcements from publications and media outlets throughout the mortgage industry. Awards like “Top Originator”, “Best [Insert Type of Lender Here] of the Year”, “Top Mortgage Workplace”, and other flashy accolades tend to be highly touted by their recipients and certainly draw additional attention to these winning individuals or companies. However, you may be thinking, with the sheer number of awards that exist in this industry do they really have that much of an impact on a business? Simply put, yes, winning awards and being able to promote them can be extremely beneficial to your business. Let’s dive into the significant effect that applying for, and winning, awards can have on your business.

In the mortgage industry, trying to differentiate yourself from competitors and increasing brand recognition are typically some of the biggest challenges your company will face. What better way to stay top of mind with potential clients and also stand out from others than by winning an industry award? Whether your company is just starting out or is more established, winning

awards can go a long way toward increasing brand awareness and greater brand awareness translates directly into more business. “According to Best Business Awards, award-winning small businesses can see a 63% increase in income and a 39% growth in sales. Large companies also benefit, seeing a 48% increase in income and a 37% growth in sales.”

In addition to increasing brand awareness which can translate directly into more business, winning awards can also boost your credibility in the industry. Clients want to work with brands they recognize and trust, and winning awards helps to establish and increase that trust in your company. Apply for awards that are decided by impartial judges or data-based factors, like annual origination volume. If your company wins based on its merit or service rather than just paying to play, this will help to increase the legitimacy of the business and build trust with current and future clients.

Would you rather work for a no-name run-of-the-mill company or be part of an “award-winning” business? It’s human nature to want to be proud of the company you work for and businesses that win awards are more likely to instill

that sense of pride with their employees. Receiving recognition through external awards can help employees feel a greater sense of loyalty to your company and want to stay with your business because they feel like they are making a noticeable difference in the industry. When your company wins awards, it can also be a great opportunity to encourage your employees to showcase these successes and take pride in a win they were a part of. This can lead to even greater brand awareness and exposure for your business.

Winning and highlighting awards can also be a great recruitment strategy. If you are looking to bring in top talent, being able to point to the awards your company has won can make all the difference in whether a candidate accepts your offer or an offer from a competitor. If you have won awards, make sure they are showcased on the recruitment page for your company, or at a minimum, mentioned during the recruiting process. It will show candidates exactly what your business is made of and why they want to work at your company.

Rarely will you have a chance to get free (good) publicity or free marketing for your business. When your company wins or is simply nominated for an award, you will have the opportunity to garner free exposure, and it is guaranteed to be positive. In addition to any marketing efforts you plan to showcase these prestigious honors, your company will also benefit from any promotions or marketing that the award issuer is running. When you win or are nominated for an award, you essentially become an extension of the media outlet or publication that is hosting the award and get additional exposure to their audience. In addition to reaching these new audiences, make sure to lean into their efforts and share their marketing and content with your own current and prospective clients. Every award

What mortgage leaders want to see revised in the wake of

NBY LEW SICHELMAN, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

early 40 years ago, the Supreme Court ruled in what is popularly known as the Chevron decision that courts needed to defer to federal agencies’ interpretations of ambiguous statutes. But in June, after more than 18,000 judicial opinions in which the Chevron deference decision was applied, the High Court overturned that case, handing off the responsibility to interpret federal laws to the judiciary.

That ruling has discombobulated practically everyone who is regulated by Uncle Sam — particularly the heavily regulated mortgage and housing businesses — into a proverbial tizzy, all wondering what comes next. One “possible outcome,” suggest Charles Lowery of the National Housing Conference, could be a jump in legal challenges to Uncle Sam’s rules of the road.

Other possibilities, the NHC’s Senior Policy Director offers, include a slower regulatory process because the role of the courts add more time to the process and increased compliance costs and investment in legal counsel to

understand and anticipate the courts’ decisions. “The coming months will, hopefully, provide more clarity into the implications of the end of Chevron deference and the future of the new relationship between administrative law and the courts,” Lowery says.

For now, though, the NHC executive notes that in Texas, new amendments to the Community Reinvestment Act are already being challenged by the banking business on various grounds. And proposed guidance under the Fair Housing Act and rules promulgated by the Consumer Financial Protection Bureau and the Federal Trade Commission concerning supposed junk fees, among other things, also could come under “higher scrutiny.”

On Capitol Hill, meanwhile, lawmakers “strongly disagreed” about the impact of the Court’s ruling, according to a Mortgage Bankers Association synopsis of hearings held in the House to examine the future of congressional policymaking. “While GOP lawmakers on the panel felt the decision will re-establish Congress’s primary role in the statutory construction of new

law — and subsequent regulation,” the MBA said, “Democrats countered that it will instead unintentionally decrease the power of the legislative branch by empowering courts at the expense of Congress.”

Republicans and Democrats in the U.S. Senate also have introduced competing legislation. Bill Cassidy, R-La., introduced a measure that would require the head of a federal agency signing a major rule to testify about the rule before the committee of jurisdiction within 30 days of the rule being published. Cassidy’s bill also would require agencies to conduct cost-benefit analyses and reviews for major rule makings within five years of each rule’s effective date.

“The intent of the ruling might have been to protect the government and other junior lien holders, ensuring they don’t miss out on claims. However, it inadvertently complicates and delays the foreclosure process, frustrating many in the industry.”

> Dax Junker, CEO, Title Clearing & Escrow

On the other side of the aisle, Elizabeth Warren, D-Mass., joined by 10 of her Democratic colleagues, introduced a bill that would give agencies more power to proceed with rulemaking in line with a “reasonable interpretation” of statutes. Their legislation also would allow agencies to reinstate rules that were overturned by the Congressional Review Act and would strengthen the public’s ability to comment on rules.

With this background in mind, I asked several industry players what one, single rule they would like to see overturned. Specifically, I queried, “if you had to pick one regulation above all others that you would like to see overturned, what would it be and why?” Here are their answers:

If Jay Crowell, senior vice president of Cornerstone Home Lending, could change one thing, it would be the QM and Dodd-Frank in-

come requirements. The rules eliminated stated income and no-income programs, Crowell reports, replacing them with “cumbersome and poorly priced” non-QM programs.

Originally, these programs were designed for high net-worth individuals with significant equity in their homes, being that equity is the main predictor of a loan’s performance. They were not meant for borrowers who put little to nothing down, and who ended up underwater when markets shifted.

The problem: High net-worth individuals with complex finances and numerous investments struggle to get competitive rates. They face excessive paperwork and questions about the minutiae of their financials, despite many being capable of paying for their homes in cash. Meanwhile, first-time home buyers with a salaried job and a small down payment gift from their parents often find the process easier. Crowell would like to see

the process simplified “for those who have earned it” by offering an A-paper product that has reduced documentation for high net-worth borrowers with substantial home equity. “While guardrails are necessary to prevent ‘liar loans,’ the current situation doesn’t make sense,” he told me. “Some bank statement programs exist, but their rates are terrible.”

It’s not a regulation that Dax Junker, CEO of Title Clearing & Escrow in Tulsa, Okla., would like to see overturned, but rather a court ruling that he says has “significant and potentially problematic implications” for the title business.

In that case (Show Me State Premi Homes v, McDonnell), Junker says, the decision by the U.S. Court of Appeals for the Eighth Circuit “significantly altered” the practice of nonjudicial foreclosures in the United States. “The ruling mandates that when the United States holds a subordinate lien,

the senior lien holder must pursue foreclosure through judicial action to extinguish the subordinate interest.”

As Junker sees it, the decision has a profound impact on foreclosure processes nationwide. It “has essentially nullified the ability to conduct nonjudicial foreclosures when the U.S. government has any interest in the property, making it a lengthy and cumbersome process,” the title business executive told me.

does more harm than good. Reversing this ruling would streamline the foreclosure process, reduce delays and provide much-needed clarity and efficiency in real estate transactions.”

Sebastian Jania, who owns Ontario Property Buyers, a company that focuses on flipping and renovating houses in Kitchener, ON, would like to squelch the need for lenders to know a borrower’s credit score.

a little, but it would also free up lenders to concentrate on other crucial aspects of determining a borrower’s mortgage eligibility.”

“This has created significant hurdles for REO managers and servicers, halting many REO transactions across the country. The intent of the ruling might have been to protect the government and other junior lien holders, ensuring they don’t miss out on claims. However, it inadvertently complicates and delays the foreclosure process, frustrating many in the industry.”

The Eighth Circuit ruling also has led major underwriters, like First American, to change their underwriting guidelines, effectively prohibiting nonjudicial foreclosures when a government interest is involved. This adds risk to mortgage loans and can alter the way lenders approach these situations.

Says Junker: “By shifting the matter from a state to a federal level, this case has muddied the waters and increased the complexity and duration of foreclosure proceedings. It’s a decision that many in the servicing industry view as detrimental to the economy. While it aims to protect junior lien holders, its broader impact on the foreclosure market potentially

That requirement, says Jania, places undue stress on borrowers, who already are under much tension and anxiety and might just make snap decisions or bail entirely. In addition, the need to see credit scores could lead to unequal treatment among borrowers. “Given that not all borrowers have the same credit score,” he told me, “some borrowers may benefit more than others from disclosure of this information” and unfair practices and discrimination may result.

But most significantly, Jania says, a borrower’s complete financial situation and how it may impact their mortgage approval are not fully revealed by only knowing their credit score.

“Lenders take a number of things into account before approving a mortgage, including credit scores,” he points out. “The debt-to-income ratio, employment history and income are some additional important variables that are also very important.”

He concludes: “Not only would getting rid of this rule help borrowers

While Peter Idziak of the Polunsky Beitel Green law firm in Dallas believes there should be some restrictions on how loan officers are compensated, he tells me the Loan Originator Compensation Rule “has failed to create a compensation regime that truly benefits consumers and appropriately compensates loan originators for the time and effort that they put into working and winning loans.”

The rule’s prohibition against paying loan officers differently based on the loan product prohibits lenders from compensating their officers appropriately, Idziak says. For example, construction loans require more time. “Although intended to prevent steering, this prohibition could in and of itself encourage steering borrowers into products that require less work for a loan officer,” he says.

Furthermore, under the rule, the originator cannot lower his fee in order to offer consumers a more competitively priced loan, which harms both the borrower and the loan officer.

“Consumers may lose out on a better deal when LOs cannot freely compete on price,” the attorney says. “The loan officer may lose out entirely on a commission with a prospective borrower when he would otherwise be happy to lower their compensation to match the fees of a competing offer.”

“We could usher in a wave of innovative mortgage products tailored to a wider array of financial circumstances. Lenders would be able to come up with new ideas, providing loans that take into account a broader perspective of a borrower’s financial situation rather than just focusing on their income at a specific moment.”

> Kris Mullins, chief marketing officer, Capital Max

Abhinav Asthana, prod uct business and growth leader at Tavant, an information technology company based in Brunswick, N.J., would like to see changes in the new banking regulators’ requirements, including a combination of risk assessment and categorization based on weights.

make it more difficult for large banks to make mortgages available to consumers — limiting the choices consumers have when seeking a mortgage, especially when consumers rely on their banking relationships to help them with their mortgage needs.”

Asthana explains it this way: “Based on the Basel III proposals from 2023, the Federal Reserve Board, Federal Deposit Insurance Corp., and the Office of the Comptroller of the Currency proposed new riskweighted capital requirements for banks that would increase the amount of capital that banks with over $100 billion in assets must hold.

“The banks would be required to make changes to adhere with the guidelines between 2025 and 2028. This would

As chief marketing officer at Capital Max, an investment, advisory and fund placement firm in Boca Raton, Fla., Kris Mullins oversees the company’s strategic positioning in the alternative space. As such, that gives him a front row seat to the regulatory impacts on the financial markets and mortgage lending. And he believes the QM Rule “would benefit from a fresh perspective.”

Originally designed to safeguard consumers, the qualified mortgage regulation now seems to stifle

innovation within the mortgage industry, Mullins says. “It’s high time we reconsidered viewing regulations like QM as inflexible doctrines and started acknowledging their real-world effects on both lenders and borrowers.”

With its strict debt-to-income ratios and narrow definitions, the rule “often acts as a barrier that prevents individuals from achieving home ownership,” he complains. “It feels like we’ve constructed a fortress around the mortgage market, unintentionally excluding those who could benefit most.”

As Mullins sees it, the rule’s rigidity is especially challenging in today’s ever-evolving economy, where nontraditional income sources and gig work are increasingly prevalent. “People are more than just figures on a financial spreadsheet,” he told me. “Our regulations should adapt to this truth.”

If the rule was modified or abolished altogether, Mullins says, “we could

usher in a wave of innovative mortgage products tailored to a wider array of financial circumstances.

Lenders would be able to come up with new ideas, providing loans that take into account a broader perspective of a borrower’s financial situation rather than just focusing on their income at a specific moment.”

“This isn’t about removing consumer protections. Quite the opposite,” he offers. “It’s about adjusting them to find a better equilibrium between preventing reckless lending practices and promoting an inclusive and dynamic mortgage market.

Donna Schmidt, managing director of DLS Servicing in Grand Rapids, would dump two regulations: First would be the current CFPB rule that requires full loss mitigation applications whenever a streamlined option results in a higher monthly payment. And a close second would be the CFPB’s proposed servicing rule that installs a foreclosure safeguard when a borrower is unresponsive for at least 90 days, unless there are no other loss mitigation options available.

The first CFPB dictum had a “particularly adverse impact” on VA borrowers during the COVID pandemic. “When interest rates began to increase,” Schmidt explains, “many streamlined options would have led to slightly higher monthly payments. However, unlike the standard, full package (of) loss mitigation options, the VA’s streamlined Refund

Modification program had a principal reduction component.”

That, in turn, meant that the full package loss mitigation modification “always resulted in an even higher monthly payment than the streamlined Refund Modification, which had the benefits of a claim for arrears and partial principal reduction,” she told me.

At the same time, the proposed servicing rule does not have a denial component. That means all loans can be modified as a last resort to keep borrowers in their homes, even though the final modified payment may be unaffordable. And lengthening the time frame from 45 to 90 days means all calculations must be updated, creating what Schmidt says is an “endless cycle of reissuing loss mit options and engaging and re-engaging borrowers” and leaving servicers without the option of starting the foreclosure process on borrowers who do not act quickly enough.

“Doing away with both rules would not only make a servicer’s loss mitigation efforts more effective,” she argues. “but ensure that every borrower has a fair shot at keeping their home without any unnecessary hurdles.■

PCV Murcor Pomona, CA

AREA OF FOCUS: Nationwide Real Estate Valuations Management — An Appraisal Management Company

DESCRIPTION OF PRODUCTS OR SERVICES: Licensed in all 50 states, plus D.C., PCV Murcor provides nationwide appraisal management and valuation advisory for residential and commercial real estate. With a foundation built on 43 years of experience, PCV Murcor brings a deep understanding of our clients’ goals that complements appraisal modernization. Our use of stateof-the-art AI technology ensures precision and efficiency in every aspect of our service. Experience innovation-powered recision and time-tested excellence with unparalleled service and cuttingedge products.

pcvmurcor.com sales@pcvmurcor.com (855) 819-2828

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country. Find the full AMC list on page 69

Guaynabo, PR angelai.com love@angelai.com (855) 711-1770

AREA OF FOCUS:

Empathetic Ai Assistant for Fair, Efficient Home Financing Solutions.

DESCRIPTION OF PRODUCTS OR SERVICES:

Angel Ai is an empathetic personal assistant who offers unparalleled support in home financing. With 100% trusted answers* to financial questions, it eliminates delays and stress in home purchases or refinances. It connects users to licensed mortgage companies for mortgage products and empowers real estate professionals with lead prospecting, SEO-Boosted listings, 24/7 financing support, and TRU approvals® for strong offers.

*Visit angelai.com/warranty for terms and limitations of the 100% Trusted Warranty.

Hazlet, NJ

appraisallinks-amc.com

mshrout@ appraisallinks-amc.com (732) 696-2905

AREA OF FOCUS: Appraisal Management

DESCRIPTION OF PRODUCTS OR SERVICES: Appraisal Management services with cutting edge technology. Every report is initially scanned by our order processing platform and further scrubbed for compliance requirements. Then all reports are additionally QC’d by our appraisal professionals. The results are reports you can count on to be fully compliant, technically correct, and follow best industry practices. Our Account Manager and CSRs are the best in the business. Call us to discuss your appraisal management needs.

Baltimore, MD

creditxpert.com marketing@ creditxpert.com (410) 938-8690

AREA OF FOCUS: Credit Optimization for all borrowers

DESCRIPTION OF PRODUCTS OR SERVICES:

CreditXpert, the predictive credit score insight platform, helps mortgage lenders leverage credit to extend better, more compelling financing options to every applicant while it helps them improve profitability in their lending operations. With its enterprise-ready SaaS platform, CreditXpert helps lenders identify an applicant’s near-term credit score potential, generate detailed improvement plans, and improve margins.

Founded in 2001, CreditXpert is used by more than 60,000 mortgage professionals annually at many of today’s most innovative lenders. CreditXpert is redefining the way leading mortgage lenders use credit optimization to make homeownership more accessible and affordable for all.

San Diego, CA

ijungo.com

erics@ijungo.com (619) 727-4600

AREA OF FOCUS:

Mortgage CRM built on Salesforce

DESCRIPTION OF PRODUCTS OR SERVICES: Jungo is a customer relationship management (CRM) platform designed specifically for mortgage professionals. It offers a suite of tools and features tailored to help mortgage brokers, loan officers, and other professionals in the mortgage industry manage their relationships with clients, streamline their workflows, and improve their overall efficiency.

McLean, VA lendingpad.com customersuccess @lendingpad.com (800) 900-2823

AREA OF FOCUS: Loan Origination System

DESCRIPTION OF PRODUCTS OR SERVICES: LendingPad is a modern LOS serving lenders, brokers, bankers, and credit unions; offering centralized and compliant automated technology to the mortgage industry. Providing solutions spanning the entire mortgage lending process, and lowering your cost of business. LendingPad is here to revolutionize lending. For a demo, visit www.lendingpad.com.

San Jose, CA loanfactory.com

thuan@loanfactory.com (408) 877-8000

AREA OF FOCUS: Marketplace, Wholesale, FinTech, Consumer Direct, Technology, Disrupt

DESCRIPTION OF PRODUCTS OR SERVICES:

Loan Factory is a rapidly growing mortgage fintech that brings together loan officers, consumers, and lenders on a unified platform. By developing proprietary technology, Loan Factory tackles two major challenges in the mortgage industry: trust and complexity. Loan Factory is the most trusted company, with over 6,000 5-star Google Reviews. It is the best mortgage platform for loan officers, offering a flat fee per loan model with no monthly or technology fees.

Boca Raton, FL wemlo.io

info@wemlo.io (866) 523-3876

AREA OF FOCUS: Loan Processing

DESCRIPTION OF PRODUCTS OR SERVICES: We are wemlo® — visionaries in the mortgage loan processing industry. We offer mortgage professionals the flexibility to scale when necessary and a highly qualified processing team that they can trust. Our process is fully transparent for tech-empowered control. We provide attentive service to every borrower for business-building customer satisfaction. NMLS ID 1853218

Stockton, CA 1smtg.com

info@1smtg.com (888) 458-0650

AREA OF FOCUS: Software

DESCRIPTION OF PRODUCTS OR SERVICES:

1Solution Mortgage allow you to Originate, price a loan scenario with proposal, CRM, Marketing, and more …

(And

> loanDepot recently appointed Bryan Bergjans as its first National Director of Military Growth and Strategy.

> CMG Home Loans announced the appointment of Kari Van Kleef to the position of reverse mortgage operations manager.

> Industry veteran Diana Reid was named CEO of Freddie Mac by the governmentsponsored enterprise’s (GSE) Board of Directors, to replace interim CEO Michael Hutchins, who will remain President.

> Hector Amendola, CMB, recently took the post of President at Panorama Mortgage Group (PMG). Amendola served as PMG’s Executive Vice President of Finance & Retail.

ABY HARVEY MCKAY, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

political candidate’s wife dropped heavily into an easy chair at home, kicked off her shoes and sighed, “Boy, what a day. I’ve never been so tired in my life.”

> Ally Financial has appointed a legal expert to lead its newly created Legal & Corporate Affairs Office. The Detroit-based bank welcomes Hope Mehlman as Chief Legal and Corporate Affairs Officer, effective Dec. 2.

> Houstonbased Stewart Title recently welcomed a longtime title insurance executive

Heather Bland as its new Senior Vice President, Chief Underwriting Counsel for Direct Operations.

“Why should you be tired? growled her husband. “Think of me making seven speeches to voters. You didn’t have to do that.”

“That’s right,” agreed the weary wife, “but remember, I had to listen to them.”

> Brendan Mulvey joins Treliant as a Senior Managing Director in its Regulatory Compliance, Mortgage, and Operational and Enterprise Risk Management Solutions practice.

> Cornerstone Capital Bank welcomed Paul Woo as its new Chief Financial Officer.

Public speaking is one of my favorite pastimes — and it should be, considering all the speeches I’ve given over my lifetime. I’m often asked for advice on making effective and interesting presentations. Seems a lot of folks out there are fairly terrified at just the thought of speaking in public. Let me share a little secret: It wasn’t always easy for me either.

The day after I graduated from the University of Minnesota, my father Jack Mackay pushed me to join King Boreas Toastmasters in St. Paul, the oldest Toastmasters club in the United States.

This October, Toastmasters International will celebrate its 100th anniversary and now boasts a membership of

more than 364,000 in 16,600 clubs in 143 countries. Many formerly red-faced, white-knuckled speakers owe a debt of gratitude to Toastmasters, a club whose main purpose is to help members hone their public-speaking skills.

Along with that, members learn about preparation, appearance, self-confidence, self-esteem, and thinking on their feet … or how to be interesting. Toastmasters can help anyone in any profession since those skills are in universal demand. And with surveys showing that public speaking ranks at the top of the list of fears — even above death — a little refresher course is in order. You can reach Toastmasters at www.toastmasters.org.

> Chris Behrns, Rocket Pro TPO’s former Vice President, joined Better. com as its Senior Sales Manager/Site Leader.

> Huntington National Bank tapped Mike Maeser as regional president in Minnesota.

> Regulatory and compliance authority Ronald Chillemi was appointed CLO and Corporate Secretary at fintech platform Figure Technology Solutions.

HAVE A NEW HIRE OR PROMOTION TO SHARE?

Submit the information to editors@ambizmedia.com for possible publication. Announcements should include a headshot.

Many of my good friends on the knife and fork circuit in the National Speakers Association tell me they are asked the same question over and over again: How can you stand up there and do that?

We all know the secret: Practice.

You don’t start at the top and work your way up in public speaking. Has anyone pulled on a pair of ice skates for the first time and the next day won Olympic gold? Of course not. But I want to drive home a point: Great speakers are made, not born.

Public speaking is a performance. All performances generate angst and trepidation. Every actor, writer, comedian, musician, athlete, lecturer, and magician can tell you all about performance anxiety.

The idea is not to get rid of your nerves. The idea is to convert them into energy.

Here are some of the most important points.

The most important are the first three:

Room size.

Room size.

Room size!

If 100 people are going to attend, the room should seat 75. If 500 people are expected, the room should hold 400. You want the excitement of a standing room only, bumper-tobumper crowd to build chemistry.

You don’t start at the top and work your way up in public speaking. But I want to drive home a point: Great speakers are made, not born.

How do you do this? You practice. You start small. You stand up and lead a discussion group for your department. You take speaking engagements with industry groups, civic associations, community groups, and charity organizations. You oblige teachers if they ask you to discuss your profession in their classrooms.

Here’s another secret: If you do become an accomplished speaker and no longer feel butterflies before you speak, get out of the game. You’ve lost your edge. You won’t be any good at it anymore.

I have a very useful tool to make speech-making easier. It’s called the Mackay 35 to Stay Alive. It’s one of many handouts that are available free on my website, www.harveymackay.com.

Another hint: Set the podium back a few feet from the audience so you can walk in front of it. You want to create intimacy with the group at critical moments.

Ask your introducer to request politely that the people with their backs to the stage stand up and turn their chairs forward so they can see you better without distractions. Introducers are critical. Always try to have a real pro introduce you. Be wary of someone who is a poor speaker being given the honor.

Outside noise from the adjoining rooms and hallways is the #1 killer of meetings. If you can’t hear a pin drop, you’re in the wrong room.

And finally, make sure you have a spectacular ending. Summarize with a memorable phrase or two to wrap it up. As P. T. Barnum said, “Always leave them wanting more!”

Mackay’s Moral: The person who rises to the occasion should know when to sit down. n

Harvey Mackay is a seven-time New York Times bestselling author with 15 books.

PASADENA, CA NOV. 5, 2024

WBY MARY KAY SCULLY, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

hen it comes to a mortgage loan, borrowers have a lot to gain and a lot to lose. When stakes are high, it’s easy for misrepresentation to occur, whether intentional or not.

Regardless of anyone’s intentions, misrepresentation in the mortgage process is a crime, and it’s your responsibility to be on the lookout for red flags. As technology continues to advance, borrower fraud and misrepresentation will advance, also.

Let’s talk about mortgage fraud, the repercussions, and how you can help spot it and stop fraud in its tracks.

Mortgage fraud is a more common problem than you’d like to think — and it is on the rise. In their quarterly mortgage fraud report, CoreLogic found a 2.7% increase in mortgage fraud quarter over quarter in Q4 ‘23.

Mortgage fraud comes in many different forms, but there are some common misrepresentations listed by the FHFA . Examples include:

• Providing false information regarding employment status, income level, or employer;

• Misrepresenting the source of funds for a borrower’s down payment;

• Falsifying a borrower’s credit score and/or outstanding debts and liabilities;

• Misrepresenting a borrower’s intent to occupy the property;

• Providing false information concerning a borrower’s identity;

• Using inaccurate appraisal figures to misrepresent the true value of a property;

• Obtaining multiple loans on a single property based on false information;

• Providing false property information to secure or modify a loan; and

• Misrepresenting income, hardship, or related information to halt foreclosure or influence a short-sale decision.

Whether intentional or unintentional, providing inaccurate information on a mortgage application is a crime. Be clear about this with your borrowers. They may think small inaccuracies are immaterial, but borrowers should be careful to ensure they provide the most accurate information. No matter how big or small (or unintentional), misrepresentation of a material fact is still a felony — and, depending on the circumstances, sentences for offenders may include years in prison and fines.

Of course, there are financial repercussions for fraud as well. In their 2024 The True Cost of Fraud report, LexisNexis reported that for every dollar of fraud loss, financial institutions lose $4.41. Mortgage fraud is costly for lenders, and your keen eye can help prevent fraudulent transactions.

In order to prevent fraud, you have to be aware of potential red flags. Red flags on a file can range from misspellings and math errors on a pay statement to a questionable watermark on an asset statement. Read through all your documents carefully and do additional verification when something appears suspicious.

Other red flags may not be as easy to spot. Technology is making it easier for bad actors to get away with fraud. AI and deepfakes add another complicated layer to verifying your borrower really is who they say they are, and they earn what they say they earn. Fake IDs and other documents are easily available online and many of these can look incredibly convincing.

To stay ahead of fraud, take some time to brush up on common tactics so you can help stop misrepresentation in its tracks. There is an abundance of resources on fraud, including:

• Consumer Financial Protection Bureau — Fraud and Scams

• Federal Bureau of Investigation — Financial Institution/Mortgage Fraud

• Federal Trade Commission — Home Loans

• Fannie Mae — Beware of Scams or 1-800-2FANNIE

Freddie Mac — Avoiding Fraud or

more sophisticated and more difficult to detect. Regardless of difficulty, it is not impossible, and it’s your responsibility to be paying attention and staying up to date on the latest fraud trends. ■

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education

Whether intentional or unintentional, providing inaccurate information on a mortgage application is a crime.

Wholesale Loan Features:

Up to 90%1 CLTV for loans up to $3.5 million

Fixed-rate loans, ARMs and HELOCs available

No seasoning period or limits for cash-outs2

Available to LLCs and Revocable Trusts

FICO ® sco re only required for PM I loans

Only one apprai sa l report regardless of loan size

Contact Our Experienced Wholesale Lenders Tod ay :

Joseph Noviello (718) 240-4780

jnoviello@ridg ewoodbank.com

NMLS ID# 625762

Bijan Farassat (917) 731-4870

bfaras sat@ridgewoodbank.com NMLS ID# 646654

ORIGINATOR TECH RESOURCE GUIDE

wemlo

Boca Raton, FL

Area of Focus: Loan Processing

Third-party processing service, wemlo, empowers mortgage professionals through transparent, flexible, and efficient loan processing. To better serve our customers and their borrowers, wemlo proudly offers processing support in 47 states (plus Washington DC) for more than a dozen loan products including Conventional, FHA, Jumbo, VA, and Non-QM.

wemlo.io (866) 523-3876 info@wemlo.io

Licensed In: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, VT, VA, WA, WV, WI, WY

Zero 1 Solution LLC

Stockton, CA

Area of Focus: Software

1Solution Mortgage allows you to Originate, price a loan scenario with proposal, CRM, Marketing and more …

• Scenario

• Communication

• CRM

• LOS

• Essentials

• Marketing

• HR

1smtg.com (888) 458-0650

info@1smtg.com

Licensed In: All U.S. States, U.S. Virgin Islands

Find the full Originator Tech list on page 69

LENDER RESOURCE GUIDE

ACC Mortgage

Rockville, MD

ACC Mortgage is the oldest NonQM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Find the full Wholesale Lenders list on page 69

In this episode of Maximum Conversations, LaDonna Lockard, CEO of Maximum Acceleration sits down with Brandon Christensen, Director of Education and National Instructor at Maximum Acceleration. With an extensive background in originations, and expert on compliance, Brandon shares his insights on what’s impacting the markets right now, and what challenges originators face in the months ahead.

LADONNA LOCKARD: I'm here today with my favorite guest, Brandon Christensen, director of education and national instructor here at Maximum Acceleration. It's good to have you back as always. How are you, my friend?

BRANDON CHRISTENSEN: I'm doing really well. It's always a dream to be here with you.

LD: We've been on the road a ton, and we've been chatting with different loan officers in markets across the country. What are you seeing right now with the market as a whole, and what are LOs talking about right now?

BC: I'm seeing a lot of what I would interpret as misinformation out there. And I think that's a natural reaction to a change in the market, coming from where we've been, in a high interest rate environment to potentially a lower rate environment, and there's a lot of excitement and desire to get people interested in doing loans again.

LD: We know the Federal Reserve cut its benchmark interest rate by 50 basis points in mid-September. So what does that really mean for mortgage rates?

BC: The reality of the situation is the bond markets have already baked in the Fed's cut to the Fed funds rate. And if you look back over the last year, I want to say rates peaked in October of 2023, at right around 8%. We're already almost a full two percentage points lower than that peak. So rates had already, in large part, come down. So I don't anticipate that the Fed funds decrease is going to dramatically impact or influence mortgage rates. I don't think it's going to do a lot in the market.

LD: Why do you think we have been seeing some ups and downs in rates and the market as a whole recently?

BC: Well, there are a lot of factors at play right now. LaDonna, you told everybody that I'm a nerd, and I certainly

am. I will research just about anything. It doesn't have to be just mortgage-related, and there are some things happening overseas in Japan and Korea, specifically, where their economies are facing some unique challenges. And because of that, because of their low interest rate environment, people have been borrowing money from the banks in Japan and then taking those funds and investing them in other markets. And because of the nature of the global economy that we live in, when an economy the size of Japan's faces some challenges, it's going to be felt by everybody around the world.

LD: With the rate cut, there’s a lot of chatter going on about potential refinances. What is the type of conversation that you would be having with your borrowers right now?

BC: We're in a really good position to have conversations with our borrowers about potentially refinancing, or at least taking a look at their current

mortgage situation and seeing if the decrease in interest rates will make sense for them from a financial perspective.

But, you know me, Ladonna. I think the conversation I would be having is one that's centered on education. And that requires us as loan officers to educate ourselves so that we can educate our partners and our clients, so that everybody wins. Education always wins because you can bring value through it, and education helps everybody make better decisions. What I would encourage loan officers to be learning about and then educating their sphere about are the opportunities that exist in the market right now.

However, I'll be the first to tell you, I'm not doom and gloom, but even if interest rates continue to come down, I think we're facing a challenge as loan officers.

LD: Tell me, what is the challenge you think lies ahead for LOs?

BC: There's something going on behind the scenes right now that I don't think a lot of us realize, and it’s happening with the mortgage servicers of the world. There are some big ones out there like Mr. Cooper and loanDepot. Even Rocket Mortgage holds a pretty healthy mortgage servicing portfolio. And what we're noticing is that the recapture rates, as have been recently reported by these large servicers, are approaching 80%. That's dramatically higher than we've seen previously. His-

torically, you're typically somewhere in the 20% range.

So as loan originators in this market where we might see some potential refinance opportunities, our biggest competitor is going to be the servicer. And the servicer knows how to get directly to the consumer. They know how to stay in front of the consumer. They know how to remind the consumer who they are. They're sending them a monthly invoice, and the consumer is logging on to their website to make payments and interact with them. And you better believe that these servicers are spending money on technology to get in front of these borrowers on their CRMs — they're using AI, they're communicating better, they're leveraging credit monitoring to see where the consumers are at with their credit scores. So my message to loan officers today would be, find a way to be relevant to your consumer right now at this moment.

Even though you're advertising to your client that rates are going to come down and that there will be an opportunity, my challenge to you would be, how do you create that opportunity today? I think there's actually a lot of opportunities in the current market that we're just not paying attention to.

LD: I cannot think of another expert in this industry who stays so on top of things. Thank you so much for your insights, and I can’t wait to have you back for more updates. ■

Enjoy more conversations like this one, watch Maximum Conversations in Minimal Time with host LaDonna Lockard, exclusively for NMP.

BY KATIE JENSEN, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Change is in the air; mortgage professionals are nearing the end of their efforts to stop the relentless phone calls from scammers and competitors, which they have been advocating against on behalf of their borrowers. Yet, it might not be the end they were hoping for. Gone are the days when a consumer could hop on a comparison shopping website, fill out their information, and get multiple lenders to compete for their

business with a single click of a button. Lenders can wave internet leads goodbye thanks to a new ruling from the Federal Communications Commission (FCC) that is expected to reshape the lead generation industry and permanently alter the business models of lead buyers and lead publishers. Starting January 27, 2025, the FCC will attempt to halt the rapid spread of consumer information by redefining “prior express written consent” in the Telephone Consumer Protection Act (TCPA).

The new TCPA rules state, “Texters and callers must obtain a consumer’s prior express written consent from a single seller at a time on the comparison shopping websites that often are the source of lead generation, thus closing the lead generator loophole.”

generation, and TCPA compliance are concerned that the new rules will disrupt lead economics in a major way. In anticipation that consumers won’t spend the extra time consenting to many lenders, the experts are forecasting a significant reduction

be “logically and topically” related to the transaction that prompted consent. Also, lead buyers are required to maintain documentation of the consumer’s consent and cannot rely on lead publishers to maintain it, adding to their compliance burden.

“Even when everything was done in a completely compliant way, it created this kind of cottage industry of plaintiffs’ attorneys who were looking for ways to sue lenders and try to generate TCPA lawsuits … ”

> Eli Schwarz, chief strategy officer, Verisk Marketing Solutions.

Under the new one-to-one consent rule, consumers cannot consent to multiple lenders at once; instead, they must consent to each lender individually.

The FCC rules apply to all lead publishers, like LendingTree, Credit Karma, Money.com, and other comparison shopping sites. They also apply to all lead-buying businesses using auto-dialers for robo texts or robocalls. However, the new rules are not applicable to trigger leads sold by the major credit bureaus, Experian, Transunion, and Equifax. Still, trigger leads are threatened with extinction if Congress passes the final version of the National Defense Authorization Act (NDAA), which contains a bill to ban their use.

Experts in digital marketing, lead

in lead supply as an inevitable consequence of one-to-one consent.

Michael Eshelman, founder of Next Percent, a mortgage consulting company, said “When [consumers] have to select which individual lenders they wanna speak with, we’ll find out, are they going to select lenders that they have heard of before? Are they going to decide not to select anyone? Because now it’s just another hurdle that they have to cross.”

Not only must consumer consent be given individually, but exclusively, too. That means the lead buyer cannot resell a lead to any other person or company — a common practice in the industry.

Other requirements under one-toone consent are that all calls between the lead buyers and consumers must

To boot, the new rules extend the Federal Do Not Call (DNC) registry protections to text messages.

“This is a big deal and is going to have a major impact on mortgage lending and advertising,” wrote Josh Friend, founder and CEO of InSellerate, in a LinkedIn post. “A lot of lenders don’t yet understand the impact but they will when the rates drop and they want leads. Or their online purchase leads go away.”

The famous Ricky Bobby quote from Talladega Nights, “If you’re not first, you’re last,” is, essentially, the golden rule to buying leads off the internet, considering 88% of homebuyers either go with the first or second lender that calls. It was the same 20 years ago

when Eshelman was a loan officer calling on leads that were fed to him by his company, but the competition has gotten a lot stiffer since many lenders now use auto dialers to get ahead.

“Part of marketing operations is being able to configure a dialer to place phone calls as quickly as possible, or the follow-up calls as strategically as possible to maximize your performance,” Eshelman said. “Using an autodialer [and] being able to schedule exactly when to place phone calls when a lead comes in would move the needle on conversion rates.”

Grand View Research, a market research company, reports that auto dialers can generally increase talk times by 200%, make up to 200 calls per hour, and increase contact rates by 20-50% compared to manual dialing.

Since it’s nearly impossible to compete without an auto-dialer, many companies in the lead-buying market use them, Eshelman explained, and must abide by the new rules.

However, companies that do not use auto dialers are still likely to be impacted by the new consent rules. Because those companies have a weaker conversion rate on internet leads, Eshelman said some will try to make a profit by reselling the lead to businesses offering different services, such as home insurers, attorneys, travel agents, and more. But, since consent is exclusive, lenders won’t be able to resell those leads without the consumer’s one-to-one consent.

Then again, Eshelman said those companies that manually dial leads might end up doing better if the new TCPA rules restrict auto dialers to oblivion.

loan officers or mortgage companies who are buying leads that don’t use automated dialing technology. My understanding is they won’t need oneto-one consent, which is an interesting dynamic,” Eshelman said. “It could change some originations dynamics where … a growing percentage of originations move towards the wholesale channel.”

Friend, in the midst of preparing InSellerate clients for the big adjustment, said that many CEOs aren’t aware that the FCC rules apply to their business or to what extent.

“A lot of lenders still rely on the originator to get their own business. And so they’re not really paying attention to how they’re getting that business,” Friend said.

As an example, Friend said that many Customer Relationship Management (CRM) software systems don’t support text messaging, so lenders tell originators that the company doesn’t use text to engage with customers.

“Well, but they do,” Friend said. “It’s just their loan officers use their cell phones instead. And then that becomes really non-compliant because you’re not managing opt-in at all. How you text, how you opt-in for text messaging, [and] having the ability to opt-in for text separate from email [and] from call — that’s all gonna be really important.”

Although the changes are expected to have a dire impact on small lenders, Friend said the biggest consumers of online leads are among the nation’s top 10 lenders — some of which

“You have a lot of smaller independent

“It’s going to weed out the weak. Is that a sad thing? I think it’s a fantastic thing.”

> Joseph Shalaby, founder & CEO, EMortgage Capital

are on the Insellerate platform. He explained that one particular client of InSellerate, a big retail lender, must reconfigure the core functionality of their point-of-sale (POS) solution. The company’s current POS solution has the customer opt-in for calls, texts, and emails altogether. But, because the FCC extended DNC protections to texts, the opt-in for text must be separate from the opt-in for calls and the opt-in for emails.

“Because we have a text platform, we’re having phone carriers say, ‘Hey, that lender of yours is no longer compliant. We can’t text for them because they don’t have a separate opt-out. It’s a singular opt-out [for texts, calls, and emails all together] and that’s noncompliant.’ So it’s already causing some issues,” Friend said.

For that reason, Friend recommends

that lenders with a POS solution use a 2-factor authentication method where the consumers can opt in or out of texts, emails, and calls separately.

“Tech providers are gonna have to really start looking at this,” Friend warned. “Because what’s gonna happen is their lenders will potentially start getting sued.”

As chief strategy officer at Verisk Marketing Solutions, Eli Schwarz helps lenders comply with TCPA regulations with their technology and data solutions. Still, throughout his 10-year career, Schwarz has witnessed many lenders get dragged to court by consumers claiming they’ve been contacted without proper consent. Typically, he sees a surge in those lawsuits after there’s a change to TCPA rules.

Previously, leads were generated and distributed with “implied consent,” meaning consumers who submitted their phone numbers with their information on the lead publisher’s website implied their consent to be contacted. In 2013, the FCC began requiring consumers “expressed written consent,” so lead publishers implemented a disclaimer that stated consumers are agreeing to receive telemarketing phone calls from multiple lenders by submitting their information.

“Those calls may come from up to five different mortgage lenders or any of their marketing partners and mortgage lenders with a hyperlink that would link out to a list of dozens of companies,” Schwarz said.

But, Schwarz explained that if a thirdparty lead provider did not include the disclaimer and sold that lead to dozens

of companies, it’s the mortgage lender that’s more at risk, not the lead provider.

“Even when everything was done in a completely compliant way, it created this kind of cottage industry of plaintiffs’ attorneys who were looking for ways to sue lenders and try to

insurers, attorneys, and other entities not related to mortgage.

“A lot of lenders don’t yet understand the impact but they will when the rates drop and they want leads. Or their

online purchase leads go away.”

> Josh Friend, founder & CEO, InSellerate

generate TCPA lawsuits or get lenders to settle with them before a lawsuit ever came forward,” Schwarz said.

Schwarz believes the likely reason consumers file suit even after consenting to the disclaimer is that they don’t notice or click on the hyperlink that contains a long list of additional advertisers, such as home

“They’re expecting a couple of lenders to contact them. But what often happens is those couple of lenders are gonna contact them a lot,” Schwarz said. “Also, their information or that lead might be sold to multiple other lead aggregators or marketing partners who are also gonna try to contact the consumer and turn it into another lead that they can sell to another lender.”

Although disclaimers with hyperlinks are currently considered TCPA compliant, Schwarz said lenders have continuously been dragged to court over it, despite having no control over the website or consumer experience.

Now Schwarz is expecting the same slew of lawsuits to come in 2025, saying “Any consumer or plaintiff could say to a mortgage lender, ‘You made telemarketing calls to my mobile phone, but you don’t have consent to do that. So you’re liable for $500 to $1,500 in penalties per call.’”

As the founder of a marketing consulting firm that centers around digital marketing, lead generation, and mortgage technology, Eshelman admits that the current business model of lead publishers and buyers “creates a terrible customer experience.” But, he acknowledges that limiting the spread of consumer information or internet leads among companies will disrupt the entire business model of lead publishers, reducing the faucet of lead supply to a mere trickle.

In current agreements between lead publishers and lead buyers, it stipulates that the publisher can sell the same

lead up to four times — four being the industry standard, Eshelman explained. So, if it costs $50 for a lead seller to generate a lead, and it sells that lead four times for $20, making $80 in revenue, that creates a decent profit margin.

“That’s their business model,” Eshelman said. “[But] if the consumer is in charge of selecting who they’re gonna get matched up with, what’s gonna happen to pricing? What if the consumer only selects one? What if they don’t select any? That’s gonna change the economics to where now maybe lead sellers are gonna have to start charging more for when a consumer does select them.”

Yet, Eshelman also said that limiting the supply of those leads makes them more exclusive and, therefore, higher quality. If consumers only give consent to one or two lenders, on average, then those lenders no longer have to compete against dozens of companies and increase their chances of converting that lead to a funded loan. Some lead publishers, like Bankrate, already have a business model in which it only sells exclusive leads, but for a higher price.

Though that may not be an issue for big lenders, the words ‘exclusive’ and ‘expensive’ are alarming for smaller lenders and most brokers that lack the capital and brand recognition of their larger competitors. Not only would those companies be priced out from buying leads, but if most consumers choose lenders they’re familiar with, as Eshelman suggested, smaller companies will have a hard time winning the consumer’s consent.

Additionally, a lot of smaller lead publishers that exclusively participate in lead arbitrage would be directly

impacted by the new consent rule. That’s when a smaller company generates a lead, but instead of selling that same lead to four different lenders, it sells it to one lender and the other three are sold to a larger lead publisher/ seller. The larger lead seller may buy

center dials the consumer, gets them on the phone, asks them a couple of questions, and then transfers them to a loan officer at a different company, Eshelman explained.

“That will probably go away because the consumer didn’t give consent to

“[But] if the consumer is in charge of selecting who they’re gonna get matched up with, what’s gonna happen to pricing? … now maybe lead sellers are gonna have to start charging more for when a consumer does select them.”

> Michael Eshelman, founder & CEO, Next Percent

those leads for $30 and sell them to three lenders for $60. However, the consumer and original company that generated the lead have no idea who the other buyers are going to be.

“So lead arbitrage, which historically has been a decent part of the industry, goes away,” Eshelman predicted.

The same fate may be true for warm transfer leads, where the lender doesn’t buy the consumer lead, but buys a call that gets transferred to their loan officers. Essentially, an outside call

that telemarketing company that’s auto dialing them [and] will then sell it to another lender,” Eshelman said.

Smaller businesses and brokers that buy or sell leads are expected to face the brunt of the impact from the new rules. For that reason, the FCC reluctantly accepted the Small Business Administration’s request to seek commentary on the new rules to mitigate the potential economic

impact. Among those that responded was LendGo, a comparison shopping site and mortgage lead publisher, which stated that not every lender will survive the new rules, and any that do will pass down the higher costs to the consumer.

services, said the new rules would “significantly disrupt” her business model and force her to close down.

“Requiring one-to-one consent would mean contacts would have to actively

“A lot of lenders still rely on the originator to get their own business. And so they’re not really paying attention to how they’re getting that business.”

> Josh Friend

In its letter to the FCC, the company said that the new rules will lead to at least a 25% reduction in consumer journey completions. In turn, the company anticipates cost increases of more than 25% for businesses that rely on comparison sites for lead acquisition. But, consumers will ultimately pay the price by taking on higher costs and having fewer options available due to companies going out of business.

“Closing the ‘lead generator’ loophole and asking consumers for one-on-one consent will greatly affect the online user journey and user experience of legitimate comparison websites,” LendGo stated. “In addition, it will adversely affect the performance metrics of these user journeys which will likely wipe out several small- and mid-tier businesses.”

Karen Lawes, owner of Burst Marketing, a lead publisher connecting homeowners and businesses with home improvement

opt-in for each vendor,” Lawes said. “This extra friction means fewer leads and significant revenue loss. This would also significantly increase my operating expenses.”

Other small lead publishers responded in a similar vein. The Astoria Company, which sells home insurance, mortgage, and auto leads, told the FCC that it does not have the marketing budget to cover the significant expenses of implementation.

The Astoria Company also stated in its comment to the FCC that, “The bigger companies immediately gain market share dominance, while small companies, individual agents, and minority businesses will lose and suffer big time.”

Given the implications that sources have mentioned, including more

compliance, more legal risks, and more cost burdens, the FCC’s new rules sound like all-around bad news for smaller lenders and brokers that rely on internet leads. But, one broker-owner pointed out, any company that relies on just one method of lead generation was in trouble from the start.

Joseph Shalaby, founder and CEO of EMortgage Capital says marketing is a table, and if you only have one leg or one strategy for acquiring leads, how stable is your table?

“If you’re doing social media, and you’re buying leads, and you have trigger campaigns, and you have automation campaigns, and you’re building relationships with realtors … your table becomes unshakeable,” Shalaby said.

At InSellerate, Friend is helping his lender clients that rely on internet leads explore possible alternatives, with the expectation that buying internet leads will become more scarce and costly next year. One client, for example, is doing their own digital marketing through Google.

Friend explained that lead publishers have historically dominated Google

search results, so anytime a consumer went shopping for a mortgage online, typing “mortgage purchase rates” into the search bar, they were drawn to a lead publisher’s website. But once lead publishers can no longer sell to multiple lenders, Friend believes less lenders pay for their service, which creates an opportunity for lenders to try their own digital marketing.

“We have lenders that are doing that [and] they’re being effective,” Friend said. “If they’re marketing to local areas, it’ll do that more effectively because they’re not gonna have these out-of-market providers trying to come in and market to their customers.”

Friend also said lenders typically use lead publishers once rates have dropped to find customers looking to refinance. In the event that rates drop next year, Friend warned, “If you don’t already have digital channels set up, you may not be able to go out and easily go buy leads.”

Any size lender can set up a digital marketing channel, Friend said. But, for those not ready to abandon internet leads completely, they must adjust to the changes in compliance and be prepared to stay on top of consent documentation per the FCC’s requirement.

“If you’re a big company, you’re gonna spend money because you’re gonna have to manage it across organizations,” Friend said. “If you’re small, you’re gonna want to talk to an attorney and make sure what you’re doing is right. They’ll also have to manage it across their organization.”

While leaning into more digital advertising could be a cheaper

alternative to generate leads, is it realistic that every company will be able to match the success they had with internet leads? Sometimes the truth is too hard to swallow, but Shalaby can be blunt.

“It’s going to weed out the weak. Is that a sad thing? I think it’s a fantastic thing,” Shalaby said. “I try to weed out the weak from our organization every single day. We have 900 loan officers, I’d like to get down to 500. I know that sounds shrewd, but it’s like, there’s just no time for the weak right now.”

EMortgage Capital, a national brokerage, is a big lead buyer as well as aggregator, Shalaby said. The company primarily buys leads from LendingTree and Bankrate to help branch managers across the country scale their business. But, as a larger company or “mega brokerage,” he’s not that concerned over the new FCC rules. In fact, he thinks having higher-quality and more exclusive leads in the marketplace will be a boon to his business.

“The long and short of it is the lead cost is gonna increase,” Shalaby said. “But short-sighted loan officers — loan officers who don’t have a lot of money [and] are just going for the cheapest lead — they’re gonna be phased out because the cost per acquisition is gonna go down.”

As Eshelman previously explained, making a shared lead exclusive makes it higher-quality and thereby more expensive. So a $15 shared lead that gets sold and resold becomes an $80 exclusive lead. But that’s not all.

“If you’re looking at the cost of leads, you’re looking at it all wrong,” Shalaby said. “You should be looking at the cost of acquisition, which is probably

gonna decrease significantly.”