CHANGE IS THE ONLY CONSTANT

SEEING YOURSELF AS A FIXER-UPPER

CHANGE IS THE ONLY CONSTANT

SEEING YOURSELF AS A FIXER-UPPER

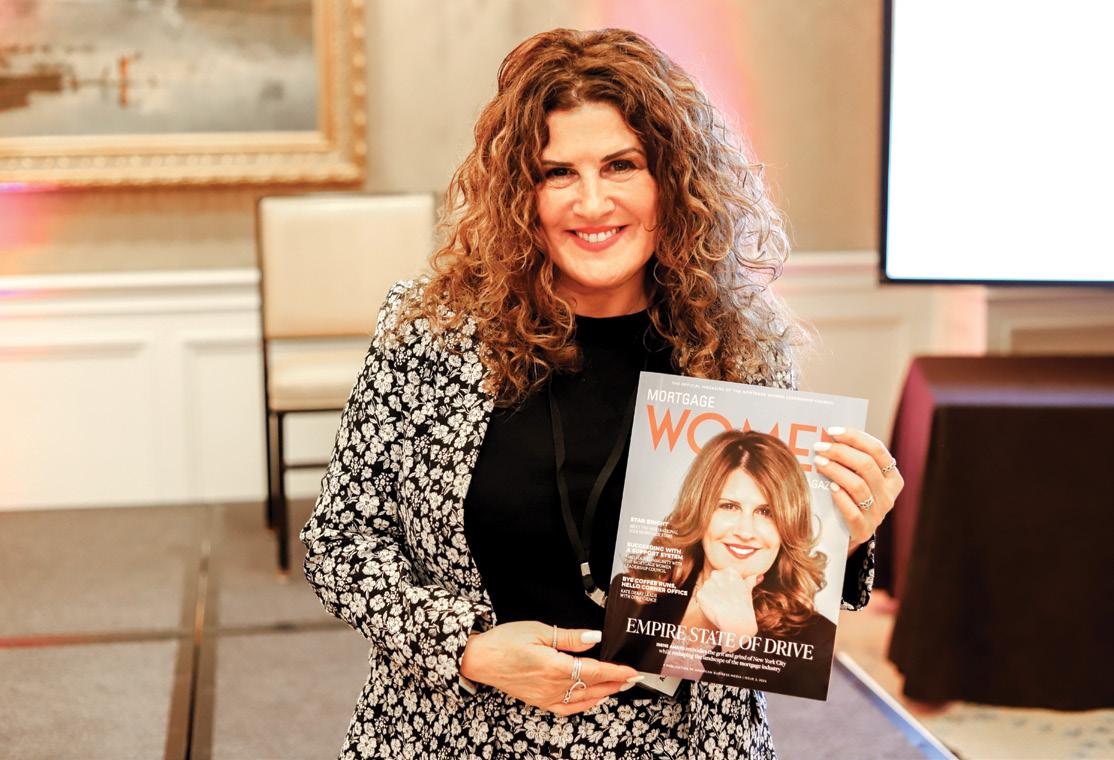

Chasing impact, not just income: how VANESSA MONTAÑEZ redefined success in mortgage lending

We hope you've enjoyed recieving complimentary editions of Mortgage Women Magazine. Beginning in 2025, new issues will be exclusive to members of the Mortgage Women Leadership Council.

Mortgage Women Magazine is now the official magazine of the Mortgage Women Leadership Council. Membership not only guarantees your subscription to the digital magazine but also provides you with a wealth of benefits designed to empower and elevate women in the mortgage industry. These include access to a dynamic network, editorial opportunities, awards, community support, and much more.

Join us in this exciting next chapter by becoming a member of the Mortgage Women Leadership Council and ensure you stay connected and informed.

Can you feel it? Fall is in the air, bringing the unmistakable crispness of change and a renewed sense of optimism throughout the mortgage industry. As the leaves turn, so too do the opportunities around us. After an inspiring and empowering Mortgage Star conference, we find ourselves invigorated, ready to seize the moment, and eager to push the boundaries of what’s possible.

In this season of transformation, the industry is showing promising signs of growth and innovation. Now is the time to harness that momentum. Whether it’s lending with empathy and understanding, standing out in an increasingly crowded market, or mastering the delicate art of delivering difficult messages with poise and power, we are poised to excel.

This issue of Mortgage Women Magazine is your roadmap to navigate this season’s unique challenges and opportunities. It’s about refining your approach, amplifying your voice, and

embracing the evolving landscape of mortgage lending. We’re all about sharing strategies to thrive — because it’s not just about surviving; it’s about making a lasting impact.

As you dive into these pages, we also invite you to something greater: Join the Mortgage Women Leadership Council (MWLC), a community dedicated to empowering and connecting women leaders in the mortgage industry. By joining, you’ll connect with a network of forward-thinking professionals, all committed to growing, supporting one another, and leading with confidence. Don’t miss out — visit mwlcouncil.com/join and use the exclusive code MWM2024 for your free membership.

Together, let’s continue to grow, uplift, and reshape our industry — one leader at a time. Let’s embrace the change, breathe new life into mortgage lending, and drive excellence in everything we do.

Kelly Hendricks Managing Editor, Mortgage Women Magazine

VINCENT M. VALVO CEO, PUBLISHER, EDITOR-IN-CHIEF

BEVERLY BOLNICK ASSOCIATE PUBLISHER

KELLY HENDRICKS MANAGING EDITOR

ERICA DRZEWIECKI, KATIE JENSEN, RYAN KINGSLEY, SARAH WOLAK STAFF WRITERS

TINA ASHER, MICHELE BODDA, LAURA BRANDAO, JANINE CASCIO, LINDA S. CONNER, MARY MARGARET HOGAN, MATT JONES & DANIELLA CASSERES CONTRIBUTING WRITERS

ALISON VALVO DIRECTOR OF STRATEGIC GROWTH

NICOLE COUGHLIN

ADVERTISING ASSOCIATE

JULIE CARMICHAEL PROJECT MANAGER

MEGHAN HOGAN DESIGN MANAGER

STACY MURRAY, CHRISTOPHER WALLACE GRAPHIC DESIGN MANAGERS

NAVINDRA PERSAUD DIRECTOR OF EVENTS

WILLIAM VALVO UX DESIGN DIRECTOR

ANDREW BERMAN HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

KRYSTINA COFFEY, MATTHEW MULLINS MULTIMEDIA SPECIALIST

MELISSA PIANIN

MARKETING & EVENTS ASSOCIATE

KRISTIE WOODS-LINDIG ONLINE ENGAGEMENT SPECIALIST

Dr. Vanessa Montañez says she can help build the path to

BY SARAH WOLAK

Promote Like a Pro

Captivate an audience, generate excitement, secure attendance.

16 The New Homebuyer Playbook

Guiding the next generation of homebuyers means understanding their needs and challenges. 12

Simplify, scale, and succeed with Events-In-A-Box. 10 Strike The Right Tone

Why saying the tough stuff pays off. 24 Innovation Meets Integrity

Embrace The Ebbs And Flows

Guaranteed Rate’s Kate Amor embraces industry change with open arms.

See who the movers and shakers are in the mortgage industry. 28

Plan Ahead, Don’t Delay

Equitable pricing practices keep opportunity alive for borrowers. 32 What Energy Do You Bring To The Workplace?

Crafting confidence outside work bleeds into your day-to-day.

38 Fair Lending Is Getting A Face Lift

Recent court rulings will significantly impact fair lending laws. 06

Catch the highlights from the 2024 Mortgage Star Conference. 20 On The Move

52 Championing The Industry’s Resilient Women

▶ KATE AMOR, SENIOR VICE PRESIDENT AND HEAD OF ENTERPRISE PRODUCTS, GUARANTEED RATE

BY LAURA BRANDAO, CONTRIBUTING WRITER, MORTGAGE WOMEN MAGAZINE

This month I had the pleasure of speaking with Kate Amor. Kate is the Senior Vice President and Head of Enterprise Products at Guaranteed Rate. She is the executive responsible for product strategy, development, and management for Guaranteed Rate’s loan products.

Kate has been married to her best friend, Chad, for 18 years and they have a furry family of two dogs and two cats.

Kate grew up in Cleveland, Ohio and obtained a double major in Business Management and Eco-

nomics from Bellarmine University in Louisville, Kentucky.

She currently lives and works in Cincinnati, Ohio.

How did you get your start in the mortgage industry?

KA: My first job right out of college was as a mortgage loan officer. I went on to roles in operations, risk, credit, and I am currently in capital markets. I really enjoy developing leaders, the creativity of product, and believe housing finance is an important and meaningful way to contribute to the lives of the clients we work with.

What does being a trailblazer mean to you?

KA: A trailblazer is someone who has the courage to show up authentically as a change agent, embracing new ideas and circumstances.

Trailblazing is not only about being bold, but also about being resilient and the best version of yourself. It means overcoming fears and courageously stepping past them to achieve your goals.

Where do you see yourself, and women in general, in the industry over the next 5 years?

KA: I see myself empowering excellence in others and embodying my highest self-mastery. I believe we are in a time when women have the opportunity to grow and thrive in our work and lives like never before. I see this amplifying over the upcoming years. We are able to have our perspective added to every conversation at every level.

What is your professional superpower?

KA: Hands down, my superpower is my energy. I think of myself as the bright spark that can rally our organization around executing a vision of what could be.

When I come to the table, I want everyone to match my energy and channel it into forward momentum for whatever initiative we are taking on. I want them to know that my enthusiasm is genuine and that their contributions will be met with respect and gratitude for their efforts.

ing that to inspire others to exceed their own expectations.

Tell us something about your career in the mortgage industry that was pivotal to your achievements today.

KA: Understanding who I am, my strengths, and developing the confidence to step out into the world

KA: There are three pivotal actions you can take to empower yourself.

First, take the time to get to know yourself. Learn what is important to you and follow that inner compass rather than letting the environment and those in it influence who you are and where you want to go.

Success means empowering others to improve their lives, our communities, and [the] larger ecosystems we serve.

I also have a unique ability to turn obstacles into opportunities. For myself and for the people around me. I love bringing an air of excitement and fun to the table and us-

as my authentic self has been pivotal to my success. I have learned to ride the wave of industry and business cycles to create resilience and opportunity in my life. Lastly, I intentionally use my mindset to create future opportunities.

What advice would you give to a woman entering or trying to move up in their mortgage career?

The only constant is change. If you are true to yourself, you can remain balanced and centered despite chaos or upheavals. Success comes from outside of your comfort zone and knowing who you are gives you the courage to push past fears and let go of limiting beliefs.

Second, find your tribe. Work and life are always more fun when you share it with others. Find a group

or line of work that you feel is important and makes a difference in the world and contribute to it. Contributing to a group working together towards a common goal is satisfying and empowering.

Curate an inner circle of women who lift each other up and provide the support and encouragement needed to push each other forward. Find an accountability partner in that group who can keep you on track and give you honest feedback when you need it. Trust them to give you a reality check when required.

Third, to take inspired action. Don’t wait for opportunities to knock at your door. Volunteer to be a part of projects that you find interesting and important to you.

Look for ways to contribute to team problem solving or volunteer for stretch projects. Establishing a reputation as a team player and someone willing to step up is valuable as you move through your career. Don’t confuse this with taking on all of the team admin work.

Always keep moving in the direction of your true North with every action you take. Looking within yourself for the answers to what motivates and inspires you can only lead in the right direction and keep you from getting sidetracked.

What does success mean to you?

KA: Success means empowering others to improve their lives, our communities, and [the] larger ecosystems we serve. It means making a meaningful and lasting difference through conscious leadership as we redefine how businesses interact with employees and communities while evolving how humans contribute value to society. Success really is about showing up and participating in change while also paving the way for future leaders to flourish.

How do you recommend navigating change in an industry that is always changing and growing?

KA: My philosophy is to embrace change as the only constant. When you accept change as the natural flow within any industry, it becomes easier to lean in and see it as a challenge rather than an obstacle to success. Knowing the power of your perspective allows you to stay grounded and focused.

Actively choosing to see the potential in any set of circumstances offers you options, that dwelling on the negative takes away. Letting fear dictate your actions limits your opportunities and can drag you into a space where you feel powerless. When you see things as happening for your benefit, each moment is a new opportunity to learn something about yourself and make choices aligned with

your desired outcome!

What do you like to do outside of your working life?

KA: My husband and I are property investors and business partners; we specialize in urban restoration projects. We buy dilapidated property in historic neighborhoods and bring them back to life. We also love to travel, attend the orchestra, and scuba dive together!

I really enjoy meditation, journaling gratitude practice, and positive affirmations. Additional parts of my selfcare routine also includes, getting enough sleep and exercise with a fast-paced Vinyasa Flow, Zumba class, or any other fun movement I enjoy. Walking in my favorite park and out in nature also keeps me balanced and feeling good. I also enjoy sci-fi and EDM.

What one takeaway would you like our readers to hold and create in their lives?

KA: Your mindset is your most powerful resource. The easiest way to dial into a great mindset? Get a journal and set aside five minutes a day to write positive affirmations and what you are grateful for. It is amazing what you can create from a place of gratitude and intention, and it only takes five minutes a day. What we think, speak, and write has a profound impact on our lives. ■

Speaking up is like exercising: each time you do it, you grow stronger

BY TINA ASHER, CONTIBUTING WRITER, MORTGAGE WOMEN MAGAZINE

What is your biggest pet peeve?”

That was a question I asked a CEO during an interview I had a while back. He was a bit stunned by the question and replied, “that’s a great question, I’ve never been asked that before,” and then he proceeded with his answer. My point in asking the question was to find out what bugs him. If I’m doing something that is irritating to someone and they don’t address it, how will I know?

Saying the hard thing can be one of the most difficult things we ever do. And for many of us, just thinking about doing it can cause worry, fear, and stress. The good news is that getting these

conversations right has more to do with planning and practice than saying “just the right thing.” And when we dare to broach these hard topics with other people, there are often hidden rewards.

Difficult conversations have the power to get you what you really want from life. They can clear the air between you and someone else. And they can give your self-esteem a real boost.

Revealing how you really feel and what you really want is a life-long practice that sets you up for more good things to come. Regardless of what happens or how the other person responds, making your true self visible will only make you stronger, healthier and more at peace with yourself.

1. Bring it up. It’s wishful thinking to hope that the other person will broach a hard topic. In some cases, he or she may not even be aware of the need. That means, like it or not, it’s up to you.

2. Be clear on your intention. Are you discussing a sensitive topic to make a decision, reveal what you’ve already decided, make a request, or something else? Being clear about why you are having the conversation — and what you hope to get out of it — will help you frame what you’re about to say.

3. Be mindful of your mindset. Sidestep the tendency to blame and assume you know exactly what is going on. Leave room in your frame of mind for discovery and revelation. Stay curious. Remember how much you care for the person and envision how you’d like your relationship to be after the conversation.

4. Rehearse. It can be helpful to practice your conversation by writing in a journal or talking it through with a trusted friend or therapist. This will help you become more familiar with your feelings and point of view, and help you relax before you say the hard thing.

5. Set the tone: Use “I” messages. “You” statements tend to assign blame. For example, rather than saying, “You hurt my feelings,” it is better to use an “I” message and say, “I feel hurt.” If you’re afraid, say what you’re afraid of at the beginning of the conversation. For instance, “I’m scared that you won’t like me anymore, or that you’ll go away, or that we won’t be friends anymore after this conversation.” Then take a deep breath and begin.

Saying the hard thing is like any other exercise: every time you do it, you’re building muscle … and your hard work will unquestionably pay off in more meaningful relationships in the end.

In case you wondered, the pet peeve for that CEO was that he hated receiving emails addressed to him and were also copied to a string of additional employees, and yes, I did get the job!

Here’s to your success, in your next difficult conversation. ■

Tina Asher is a coach and founder of Build U Up Consulting.

Whether you’re traveling to a conference or hosting one your-

self, there is one major factor that could make or break your investment of time, money, and energy: an attentive audience. As one approaches an event, there is immense pressure to advertise the occasion and entice potential attendees. If not handled care-

present in front of an eerie room with few attendees who are unengaged, and understandably, uninterested in learning more. Sounds terrifying, right?

In any industry, it is crucial to avoid this horror scene entirely. No people, no connection, no sales. Luckily for us, the digital world has transformed into part billboard, part classroom, with social media serving as a playground for promotion and education. Follow these tips below to create buzz for your up

coming events, capture the attention and excitement of audiences well in advance, and secure their attendance.

The rollout for event promotion is central to achieving a successful audience in attendance. Deciding when to post about an upcoming event can be tricky, and you may find yourself grappling with questions like: Am I posting too much or too little? Too fre

quently or too sporadically? How can I educate my audience without turning them away?

These are all valid concerns. While it may feel like there’s no harm in constant promotion, there are some potential consequences. Various algorithms hide repetitive content, and many online users can become irritated by spam-adjacent advertisements. There is a real risk involved in oversaturating your feeds with untargeted and unvaried posts.

Although there is no universal answer to posting timelines, you can start by testing out monthly markers beginning six months prior to the event. Analyze and note the success of these posts across socials, then you can determine how frequently to promote the event you’re attending and/or hosting. As the event nears, the content can become more specific and frequent, and shouldn’t come across as excessive. Overall, if the content is diverse and educational during the lead-up, the more likely it is that you will captivate, educate, and retain audiences for your upcoming event.

Diving into the content itself, naturally each post should be equipped with the standard event information of “where,” “when,” “why,” and “who,” but the real challenge is crafting promotions that are enticing enough to create buzz and unique enough to hold the intrigue of any viewer.

Crafting promotions that highlight the unique qualities of the event itself is primarily where audiences will be captured. What aspects of this upcoming event are the most alluring?

Does it reside in its prestigious speakers, exclusive networking opportunities, or sought-after experiences? All these event experiences are prime examples of where to focus when marketing.

If you find that your event is missing these unique qualities, then it’s time to tailor it. Perhaps your event does not stand out on its own; here is a great opportunity to commit to a theme that pleasantly incorporates your existing brand while creating a distinctive vision for the gathering. Adopting a theme is a playful way to make your event easily recognizable on social feeds and informs the audience how engaging it may be. For example, incorporating elements of a circus, rodeo, or casino pitches a playful image to potential attendees — showing that not only are they going to make some serious professional advancements, but will also have a fun experience.

Highlighting the unparalleled happenings of your event will set it apart from the rest and encourage audiences online that this is something they cannot experience anywhere else. By teasing these unique elements of your event, the excitement will be tangible through your promotional strategies and far more successful in capturing attendees.

Another effective method to enhance variation in your posts is sharing them from a different perspective: Your employees! Adding a personal flair and “putting a face” to marketing has become all the rage in promotional strategies.

You may notice an increase in popu-

larity with brands adopting “ambassadors” and employee “takeovers” to advocate publicly on their behalf. In terms of event promotion rollout, adding a personal flair could be displayed in various ways.

Creating content for individuals to share their involvement and excitement about the upcoming event can be a great place to start. This provides an opportunity to humanize the staff attending and organically make a connection with potential audience members before they even arrive onsite. When they arrive, they will find comfort in seeing a familiar face from the interweb and naturally, remember the face more likely than the company.

Furthermore, collecting testimonials about similar events in the past can be a huge advantage to event promotion. From featuring quotes from previous attendees to sharing throwback videos of the environment from the year prior, adding these touches to event promotion can transport potential attendees to the world of possibilities of their future attendance.

Incorporating these personal touches not only serves as another platform for event promotion but also paints the event as a desirable occasion filled with trustworthy figures.

To ensure your upcoming event is well attended, you must showcase the value of it well in advance. Creating buzz on a timely schedule and showing audiences what they will miss if they don’t attend is the sweet spot of event marketing. Try these tips the next time you’re promoting your upcoming event! ■

By Mary Margaret Hogan, Event Marketing Specialist at RCN Capital.

Creating a space for the next generation in NMLS education.

Introducing Maximum Acceleration, your new premier provider of continuing education.

We’re not just bringing you a lecture. We’re bringing you the fuel to spark your competitive fire, the plan to win the game on the merits, the confidence to know the rules and master them.

We’re Maximum Acceleration, and we’re where loan originators go to put their career in high gear.

— LaDonna Lockard, CEO

Homeownership is a cherished milestone, symbolizing stability, investment, and dreams fulfilled. When I think

back on my own journey towards homeownership, I’m reminded of the significance it held in shaping my family’s future. As the housing market evolves, so do the aspirations of first-time buyers.

Much of the current commentary focuses on the (very real) affordability challenges caused by persistently higher interest rates and home prices. This commentary can overshadow both the aspiration of first-time

BY MICHELE BODDA, CONTIBUTING WRITER, MORTGAGE WOMEN MAGAZINE

homebuyers and the opportunity this cohort represents to mortgage lenders. Experian’s latest research sheds light on crucial trends, and we’re here to guide lenders toward serving this vibrant community.

Our research shows that 80% of Gen Zers and 68% of Millennials say they aspire to own a home someday. A remarkable 31% of Gen Zers and 30% of Millennials plan to purchase a home within the next two years.

Although consumer optimism may clash in some cases with current affordability, we see geographic regions where first-time homebuyers are already achieving greater success. With

for sale inventory higher in May 2024 than it has been in years, and home prices easing in certain markets, we are encouraged about the expansion of opportunities for homebuyers.

To serve younger Americans and firsttime homebuyers effectively, we must understand their needs, preferences, and challenges. Here are five strategies to assist mortgage professionals:

Bridge the knowledge gap: While many young consumers aspire to own a home, many don’t know where to begin. Our research shows 30% of Gen Zers and 21% of Millennials say they have a poor or no understanding of the steps one needs to take to purchase a

home. Don’t want to build education materials from scratch? Many industry participants (such as Experian) offer consumer education data and tools you can incorporate in your own portals.

Find them what they want, where they want it: We are seeing a higher proportion of first-time homebuyers in more affordable locations, most no-

bands, recent trends signal a growing presence in the near-prime score band. Additionally, the income landscape for first-time homebuyers shows over one-third of these buyers have an annual household income of less than $90k, and 11% meet the FHFA low-to moderate income requirements. By knowing as much as possible about a

drive effective omnichannel presence.

Create the seamless digital experiences they expect: Gen Zers and Millennials expect a streamlined, tech-savvy mortgage lending process that aligns with their digital lifestyles. They expect access to tools such as automated employment and income verification to manage their mortgage

To serve

and first-time homebuyers effectively, we must understand their needs, preferences, and challenges.

tably in west and mid-western states. Additionally, our research shows an overwhelming majority (86%) of firsttime homebuyers purchase single-family homes with 76% preferring newer construction. Tailoring your outreach to prospective buyers can set you apart from more generic marketing.

Understand their financial profile:

A comprehensive understanding of the financial habits and profiles of firsttime homebuyers is paramount for developing effective lending strategies. While most first-time homebuyers fall into the prime and super-prime score

prospect’s situation, lenders can design mortgage products that empower consumer financial success.

Meet them where they are: In today’s digital age, younger generations rely heavily on social media, online platforms, and mobile apps for research and communication. It’s tempting to assume “digital natives” are averse to other channels, but Experian research shows that 14% of home buyers still engage with direct mail and 19% with television. Knowing the engagement and conversion preferences of individual consumers can

journey. Investing in online tools enhances the borrower experience and improves pull-through.

Lenders, investors, and regulators all play a pivotal role in shaping the homeownership journey. By understanding these trends and tailoring our approach, we can empower the next generation of homeowners and turn aspirations into keys and houses into homes. ■

Michele Bodda is president of

Experian housing, verification solutions and employer services at Experian PLC

Percy.ai, a leader in data intelligence and fintech marketing for the real estate and mortgage sectors, announced the appointment of Lisa Larson as its new Chief Strategy Officer. With over two decades of expertise in real estate property technology across North America, Larson will spearhead the development of AI and Machine Learning strategies and manage the advancement of business and product initiatives at Percy.ai.

“Lisa’s deep knowledge and experience with AI perfectly complement Percy’s current goals. She has consistently proven her ability to launch exceptional real estate products and her recent achievements in AI integration technology highlight her adaptable skills and visionary mindset,” said Charles Williams, founder and CEO Percy. “Lisa is a transformative leader whose strategies have significantly contributed to scaling businesses effectively and we’re thrilled to have her join our team.”

Larson’s prior role as Managing Director at Restb.ai saw her at the forefront of integrating cutting-edge AI and computer vision technology for prominent real estate brands including

CoreLogic, Blackstone, RE/MAX, and ICE. Her leadership has consistently paved the way for innovative, AI-driven solutions in the industry, earning her the title of 2024 Futurist by RIS Media for her contributions in AI and computer vision.

Xactus recently announced its appointment of Danielle Walker to senior vice president of business development. Previously, Walker served as the vice president of product development.

Per a release from the company, Walker oversees business development and operations for Xactus’ property valuation solutions division, which includes Appraisal FirewallX, Appraisal ScorecardX, and VerisiteX, as well as its proprietary appraisal/ property valuation technology. Walker also coordinates clients’ enhancement requests, vendor and product integrations, and software updates between Xactus’ Development and QA departments, while she maintains constant communication among the company’s business team, sales team, and clients.

“We are thrilled to have Danielle take on greater responsibility as she has been instrumental in our ongoing growth

and success,” said the Chief Operating Officer at Xactus, Michael Crockett. “She has made key contributions that have had a significant, positive impact on our business. Danielle will continue to play a pivotal role in helping Xactus advance the modern mortgage.”

Walker has nearly 20 years of mortgage industry experience helping lenders mitigate risk. Prior to becoming Xactus’ SVP of business development, she also served as sales and product manager for one of Xactus’ divisions, Appraisal Firewall.

InterLinc Mortgage welcomed Erin Dee to the organization as its new Chief Operating Officer in early May. Widely-known for her contribution to the mortgage industry, Dee holds the position of Secretary/Treasurer with TMBA, the Texas Mortgage Bankers Association, and has made guest appearances on multiple podcasts, including The Mortgage Collaborative, Lykken on Lending, and The Connect with TSAHC.

Before joining InterLinc, Dee served as Chief Operating Officer at LoanPeople, Chief Strategy Officer at Thrive Mortgage, and Chief Operating Of-

ficer at Infinity Mortgage Holdings, managing multiple organizational departments and boosting success. In her new role, Dee will leverage her extensive industry knowledge and leadership skills to drive operational excellence, streamline processes, and enhance customer experiences.

“We are thrilled to welcome Erin Dee to the InterLinc Mortgage team,” said James Durham, Senior Vice President at InterLinc. “Her proven track record of driving operational excellence and her deep understanding of the mortgage industry make her the ideal candidate to lead our operations. We are confident that Erin’s leadership will play a key role in driving our continued success and growth!”

Dee expressed her excitement about joining InterLinc Mortgage, stating, “I am honored to join the InterLinc family and contribute to its continued success. I am eager to work alongside the talented team to drive efficiency in operations and deliver outstanding results for our clients.”

Equifax announced that Barbara Larson, former Chief Financial Officer for Workday, has been elected to its board of directors.

“I’m energized to welcome Barbara as a new independent director on our board,” said Mark W. Begor, CEO of Equifax. “Her more than two decades of financial leadership and extensive experience in both human capital management and enterprise technology will

be a tremendous asset to Equifax as we execute against our EFX2026 strategic priorities — continuing to grow our non-mortgage business through Equifax Cloud-based new product and EFX.AI innovation.”

Larson will serve on the board’s Audit Committee. With this appointment, the Equifax board now consists of ten directors, including nine independent directors.

“Barbara is a strong business leader and seasoned finance professional,” said Mark L. Feidler, non-executive chairman of Equifax. “I am pleased to welcome her to the Equifax board of directors and am confident that her background will be invaluable to the board in its continued oversight of the company’s strategic growth.”

Fannie Mae announced the appointment of Dr. Diane N. Lye to its Board of Directors. Lye brings over 30 years of technology and finan cial services expertise to the board.

Lye’s latest post was at Rivian Automotive, Inc., an electric vehicle manufacturer, as its Chief Information Officer from October 2022 to December 2023.

“We are very pleased to welcome Diane to the Fannie Mae Board of Directors,” said Michael J. Heid, chairman of the board. “Her deep data science and technology expertise will provide rich insights as the company continues to advance the mortgage experience for housing market participants.”

Previously, Lye was at Capital One, Na-

tional Association, where she served as Executive Vice President and Chief Information Officer for Card Technology, from May 2019 to September 2022, and as Senior Vice President of Enterprise Data, Machine Learning, Risk and Finance Technology, from October 2016 to May 2019.

“Diane brings extensive technology and financial services knowledge to our talented and diverse Fannie Mae Board of Directors,” said Fannie Mae’s President and Chief Executive Officer, Priscilla Almodovar. “We will benefit from her broad technology experience as we continue to strengthen systems that support our risk management efforts, while identifying and developing emerging technology opportunities to support sustainable access to mortgage credit.”

Kind Lending announced the appointment of Tammy Richards as Chief Operating Officer. The announcement, made via the company’s LinkedIn, touted Richards’ 35 years in the industry.

“We are excited to announce the addition of Tammy Richards as the Chief Operating Officer at Kind Lending, LLC. With over 35 years of experience in the mortgage industry, Tammy brings expertise and a proven track record of success to oversee all operational aspects at Kind. Together, we’re excited to reach new heights and continue to deliver kindness in lending. Welcome aboard, Tammy!” the post read.

Richards formerly held executive roles

at loanDepot, Caliber Home Loans, Bank of America, and Wells Fargo. Richards will retain her role as CEO of LendArch, a consultancy and mortgage technology solutions provider she founded in 2021.

In a subsequent press release announcing the hire, Kind Lending’s President, Yvonne Ketchum, said, “Her experience and dedication to enhancing operational efficiency will be instrumental as we continue to grow and innovate. Tammy’s vision and leadership will undoubtedly help us to better serve our customers.”

Philadelphia-based Incenter Lender Services has promoted Sara Parrish to chief operating officer amid a plan to attract independent mortgage banks (IMBs) with variable-cost services. Parrish will remain as president of CampusDoor, an Incenter subsidiary that focuses on student loans.

“I am thrilled to be working closely with Sara at this key point in Incenter’s lifecycle,” said Incenter President Bruno Pasceri. “As we plan for additional expansion, Sara’s vision, problem-solving talents, discipline, and natural leadership skills will be invaluable.”

Parrish joined CampusDoor in 2016 and is responsible for the growth of the company, which has processed $36 billion in private student loan applications. Before joining CampusDoor, she held various operational and portfolio management roles at the

“As we plan for additional expansion, Sara’s vision, problemsolving talents, discipline, and natural leadership skills will be invaluable.”

Bruno Pasceri, President, Incenter Lender Services

Pennsylvania Higher Education Assistance Agency.

Parrish also serves on the board of the New Cumberland Federal Credit Union and the York County Economic Alliance in her home state of Pennsylvania. Ms. Parrish holds an M.S. from Duquesne University and a B.A. from Ursinus College.

“It is a privilege to help steward the future of Incenter,” said Ms. Parrish. “We enjoy many opportunities to leverage our unique intellectual property, services, and expertise, and accelerate new solutions into the market at scale to help our clients.”

JMAC Lending brought on mortgage-industry veteran Sabrina Lopez as Regional Vice President — TPO

WEST. Lopez brings 20+ years of strategic leadership experience in the TPO mortgage industry. Per JMAC, Lopez will grow and scale a team of Sr. Account Executives in JMAC’s Western Region.

Lopez has held senior executive roles at several mortgage banking lenders, including Homepoint and Caliber Home Loans. She is a member of the National Diversity Council (NDCCDP) and the Black Homeownership Council, and resides with her family in Arizona.

Rocket Companies has appointed Heather Lovier as the company’s chief operating officer as of June 20, per a recent 8-K filing with the Securities and Exchange Commission (SEC). Lovier will replace Bill Emerson, but Emerson will remain Rocket’s president.

Lovier joined Rocket Mortgage, the company’s lending arm, in 2003. Her most recent position was chief client experience officer.

“During the past 21 years, Mrs. Lovier has focused on driving operational excellence and enhancing the client experience. Mrs. Lovier will continue her role as Chief Operating Officer of Holdings. Any changes to Mrs. Lovier’s compensation for her new appointment will be determined at a later date,” Rocket’s comment read in the SEC filing. ■

Registration management

Simplify & speed up check-in

Track attendance

Unlimited attendees

Priced for your specific needs

Up to 15 custom fields

Create custom badges

Cloud-based software

Personalized support

visit expotrac.com or scan this code

ExpoTrac was developed and tested by event producers, creating a tailored product that does exactly what it needs to: check people in quickly, and make it easy to manage. We traveled the country, using ExpoTrac at more than 60 of our own events so that we could design a system that not only works for us, but that we know will work for you, too.

No more hauling around large trays of name badges. No more hiding badges that haven’t been claimed. No more cumbersome last-minute changes to someone’s title, company or name. Our cloud-based system makes it all easy, simple and fast. And even better, you can run this system with one small printer and one laptop – and then add more users instantaneously as demand picks up at various times of the day.

There is simply no other faster, simpler, agile and economical badge printing system on the market today. We stand behind it, because we use it every day.

BY LINDA S. CONNER, SPECIAL TO MORTGAGE WOMEN MAGAZINE

In a recent CFPB Supervisory Highlights1, “Pricing Discrimination” has been identified as a fair lending issue. In a highly competitive mortgage market, it has become increasing more important for mortgage originators to be able to offer pricing exceptions. With the low volume of loans, it is extremely imperative to keep current clients and work to gain new clients, by being assertive when it comes to pricing. Many mortgage companies are advertising “bring me your LE, and we will meet it or beat it.” Expressly, stating they are willing to offer a pricing exception. However, the analysis of the data reflects that more favorable pric-

ing options are being offered to some but not to all. The data also reflects that there is a “significant” disparity in these rate adjustments, especially when it comes to certain protected characteristics of consumers, therefore, leading to pricing discrimination.

“The CFPB again found that mortgage lenders violated ECOA and Regulation B by discriminating in the incidence of granting pricing exceptions across a range of ECOA-protected characteristics, including race, national origin, sex, or age.”

The CFPB clearly states they will be examining lender’s practices on pricing exceptions to determine if they meet the minimum fair lending standards. This may include a review of how the overall process works within your organization. How will your company fair, when asked these questions:

• Do you have policies and procedures on how pricing adjustments are evaluated, determined and granted?

• Do you provide oversight and controls over mortgage loan officer’s discretion when making price exceptions?

• Does management take corrective action when disparities occur in the pricing adjustment process?

• Are there legitimate, nondiscriminatory decision-making practices consistently applied to all mortgage loan applicants?

• Are there weaknesses in training programs on fair lending and specifically pricing exceptions?

• How does your record retention, support the

decision, documenting the reasons, and how the decision was derived, when allowing for the price exception?

V What is the source of the initiation request (borrowers request v. loan officer offering)?

V Are your loan originators coaching some clients v. neglecting to share the same information with other clients on how to get best price?

V Do you require documentation from competitors demonstrating the need for price exception to gain or retain the mortgage transaction?

When it comes to fair lending, mortgage professionals need to make sure all aspects of the business practices incorporate factors that protect consumers, and that all practices are equally applied to all mortgage clients.

“Finally, examiners concluded that management and board oversight at lenders was not sufficient to identify and address the risk of harm to consumers from the lender’s pricing exceptions practices.” – CFPB

The CFPB required these lenders that were found to be in violation, to take corrective action and implement chang-

The CFPB again found that mortgage lenders violated ECOA and Regulation B by discriminating … across a range of ECOA-protected characteristics, including race, national origin, sex, or age.

es to ensure fair lending standards and practices were included in all pricing exceptions. Some of the requirements included, but not limited to:

• Must have pricing exceptions policies and procedures that incorporate fair lending standards, and identify how a mortgage originator must apply those standards.

• Develop a list of documentation required in order to get a price exception approval.

• Create detailed criterion for pricing exceptions with determining factors for approval.

• Identify those within your organization who will have the authority to

process2. Pricing discrimination is just one aspect that is currently being highlighted by regulatory authorities. It’s being exasperated by a tremendously competitive mortgage market partly because of the existence of a significantly high interest rate environment. This is the perfect storm for fair lending risks and pricing discrimination to occur.

As mortgage professionals, providing the best customer service and best deals to all our clients is the goal and certainly a priority. However, think about how you can accomplish this and still protect yourself and the mortgage company. Meaning, put it all down in writing, continually train, and then monitor your success.

Remember, examiners can only see the documentation that is in the mortgage file, not what you intended. If the documentation does not support your efforts, it did not happen or it happened in a way that may have been a fair lending violation. So, create a culture of compliance that shares knowledge, experience, and documents how much you “like” your clients (all of them) by helping them achieve their goal of homeownership. Providing all of your clients the opportunity to build wealth through investing in themselves and their homes. Just like having kids, you can’t really have a favorite, you must love them all equally! Clients and kids, treating them all fairly and equally will provide you with the best results at work and at home. ■

Amplify Credit Union specializes in helping first-time homebuyers achieve their dreams of home ownership.

Want to keep reading Mortgage Women Magazine?

Become a member of the Mortgage Women Leadership Council today.

Membership not only guarantees your subscription to the digital magazine but also provides you with a wealth of benefits designed to empower and elevate women in the mortgage industry.

Linda S. Conner is Vice President at Mortgage Education Institute.

Achieve effortless event with a pre-packaged toolkit

BY KATRINA ORLANDO, SPECIAL TO MORTGAGE WOMEN MAGAZINE

They’re the epitome of pre-planning. Events-InA-Box are pre-defined, prepackaged toolkits that provide everything a mortgage professional needs to promote and host an event efficiently, effectively, and in strict compliance with the mortgage industry’s high regulation standards.

Most mortgage professionals recognize that in-person events are invaluable marketing experiences. They improve a mortgage professional’s perception as a trusted industry expert, build prospect and customer relationships, and bolster industry networking.

Events-In-A-Box reduce the time and stress involved in hosting an event, making it more possible to leverage event value — and easier to hold more of them. This approach also allows scalability, ensuring that events of any type and size maintain the same high standard of quality and brand representation. And by reducing preparation time and effort, Events-In-A-Box give staff more time to focus on engaging with clients.

Typical Events-In-A-Box include everything needed to host educational seminars, industry networking collaborations, client appreciation events, internal

training sessions, and more:

• Physical supplies, such as branded signage, professional name tags, and informational brochures.

• Digital assets include PowerPoint presentations, email templates for event invitations, social media graphics, event registration tracking platforms, and event check-in sites that track attendee information.

• Guidelines and checklists are an absolute must to ensure nothing is overlooked. They should include detailed set-up instructions, schedules of events, and even industry compliance standards.

For example, a “Home Financing 101” event toolkit might include these tactics:

• A predesigned invitation to “popby” invitees’ offices, including a mini calculator and the message: “Calculate your success at our Home Financing 101 Event!”

• Email invitations to attend the event.

• Social media marketing assets with pre-defined messaging and a call-to-action with the event registration link.

• Flyers overviewing mortgage products, dos & don’ts, and mortgage terms.

• An interactive PowerPoint presentation covering mortgage types, advantages, real-life scenarios, and testimonials.

• Branded Swag such as pens and notebooks.

• An event set-up plan that outlines venue booking, online registration, and on-site signage.

• Post-event marketing plans to post

a summary video on social media, send thank you emails that share additional resources, and requests for feedback.

Establishing a robust Events-In-A-Box strategy starts with creating an annual calendar. Determine the number of events for the year. Plan topics that align with business goals and schedule them to coordinate with national events. For example, hold home-buying events in June, National Homeownership Month. Add marketing timing to the calendar, typically starting two weeks out from the event date. Once the event calendar is established, proceed to tactically develop the overarching Events-In-A-Box toolkit. You can then easily supplement it with specific toolkits tailored for each event, like the detailed one for Home Financing 101.

1. Understand the target audience and address their needs and preferences. For example, an event designed for first-time homebuyers should focus on the basics and include educational materials.

2. Pay strict attention to brand standards to elevate the professional tone of the event, enable brand recognition, and foster trust. Include brand-appropriate colors, fonts, logos, and taglines in all materials.

3. Tailor content to current industry and market trends, ensuring discussion guides, presentations, and informational brochures are relevant and valuable to attendees.

4. Integrate events with other marketing strategies, using events to cross-promote other services such

as future webinars. Market the event across all digital marketing tactics. Leverage event data, including feedback, preferences, and engagement levels to optimize overall marketing plans.

5. Apply a continuous improvement strategy by implementing postevent surveys and holding post-mortem team reviews to identify successes and opportunities for change. Encourage experimentation in smaller settings to test new ideas, such as trying digital engagement tools.

6. Tap advanced technology such as artificial intelligence (AI) to further streamline toolkit development. For example, AI tools can be prompted with a topic and, in under a minute, can provide a detailed outline of an event presentation, recommendations for handouts, ongoing education, follow-up consultations, and much more.

Events-In-A-Box toolkits allow mortgage professionals to transform their event management processes, making them more engaging, professional, and successful, all with the goal of driving growth and enhancing client relationships in a competitive market. ■

Katrina Orlando is Vice President of Sales Engagement at Incenter Marketing, a full-service marketing firm that helps organizations build strong brands that are better able to transcend market fluctuations. With a career spanning over two decades in the mortgage industry, she is a fervent advocate for integrating digital technology to strengthen customer relationships. She specializes in utilizing video messaging, social media and AI-driven tools to elevate the customer experience in mortgage lending. Contact her at Katrina.orlando@incenterls.com

BY JANINE CASCIO, SPECIAL TO MORTGAGE WOMEN MAGAZINE

As the founder and president of Simplending, I aim to equip women with a four-step method for achieving diverse goals. This comprehensive guide, using excerpts from my e-book, “She Thinks, She Believes, She Acts, She Receives: A Guide to Empowerment for Women” will dive into the specific

strategies, mindsets, and actionable steps necessary to employ this fourstep method. Having personally utilized this method, I’ve experienced rapid growth in my businesses, fostered nurturing relationships, familial harmony, and realized substantial personal growth.

Readers will likely find value in learning how to implement this approach

in their own endeavors, be it in professional growth, enhancing personal relationships, or venturing into financial growth. When women are empowered through their thoughts, beliefs, and actions, the impact extends far beyond individual growth. Empowered women contribute diverse perspectives, innovative solutions, and leadership in various fields. They become catalysts for societal change, advocating for equality, inclusivity, and social justice, shaping a more equitable world for future generations.

Imagine driving a car without a destination in mind — It’s like wandering aimlessly! Even if you asked for help, no one would be able to guide you in the right direction if you don’t know where you want to go. This leads us to the initial step — which is GET CLEAR! My journey toward cultivating intuition and self-awareness involved embracing the art of slowing down. For me, practices like meditation and yin yoga have been instrumental. These activities provide the space to slow down, fostering genuine clarity about my aspirations. Mindfulness, a mental practice rooted in being fully present, facilitates a deeper connection with your inner

desires, infusing your journey with purpose and fulfillment. Additional techniques to master clarity include gratitude exercises and journaling. Journaling serves as a reliable tool to assess your emotions, heightening awareness as you reflect on various experiences.

The thoughts a woman holds about herself form the foundation of her self-perception. Positive thoughts reinforce self-esteem, leading to a healthy self-image and confidence in abilities.

adopting practices that encourage optimism, resilience, and self-empowerment. Techniques such as affirmations, visualization, and reframing negative thoughts into positive ones empower women to redirect their mental focus and beliefs. Building an empowering mindset involves embracing challenges as opportunities for growth, celebrating achievements, and maintaining a forward-looking perspective.

The thoughts a woman holds about herself form the foundation of her self-perception. Positive thoughts reinforce self-esteem, leading to a healthy self-image and confidence in abilities. Conversely, negative thoughts can erode self-worth and create barriers to personal growth. Recognizing these patterns allows women to consciously shift their thought processes toward more empowering and constructive narratives.

Strategies for fostering a positive and empowering mindset are integral to personal development. This involves

In the journey of self-discovery and personal growth, having a positive belief system is the secret! This belief system serves as a cornerstone for developing confidence and empowers you to face life challenges with resilience and determination The first step toward building a positive belief system is acknowledging negative thought patterns. Identify self-limiting beliefs that hinder progress and replace them with empowering ones. For instance, shifting from “I can’t” to “I’ll learn how to.” Accept yourself for who you are, embracing both strengths and weaknesses. Understand that imperfections are part of being human and offer growth op-

portunities. Introduce positive affirmations into daily routines. Practice constructive self-talk, consciously replacing self-criticism with encouragement and praise.

Here are a few techniques you can develop to work on building self-confidence. Set achievable goals — break down large goals into smaller, achievable steps. Each accomplishment builds confidence, creating momentum for further progress.

fostering self-esteem and confidence is an ongoing journey. It requires dedication, patience, and self-compassion. Embrace the process, celebrate progress, and remember that each step taken towards self-improvement contributes to

formidable obstacles. Fear of failure, judgment, or even success itself, can impede our advancement.

Identify self-limiting beliefs that hinder progress and replace them with empowering ones. For instance, shifting from “I can’t” to “I’ll learn how to.”

Embrace continuous learning by acquiring new skills and knowledge to bolster confidence. Seek opportunities for learning and personal development. Practice visualization by mentally rehearsing scenarios in your mind. This mental condition can enhance confidence when facing real-life events. Don’t forget to surround yourself with a supportive network. Aligning with people who are also positive and growth-oriented while encouraging your personal growth.

Instead of seeing setbacks as failures, view them as opportunities to learn and grow stronger. Cultivate adaptability in the face of change. Flexibility allows for a more resilient response to life’s uncertainties. Prioritize selfcare — physical exercise, healthy eating, adequate rest, and mindfulness practices. A healthy body and mind contribute to emotional resilience.

Developing a positive belief system and

a stronger, more confident you. As you cultivate these qualities, you’ll find yourself more resilient and better equipped to navigate life’s diverse experiences. Believe in yourself — you are capable of remarkable growth and success.

In chasing our dreams and ambitions, a crucial factor is the readiness to act. Dreams stay intangible unless we actively pursue them. However, taking action is frequently hindered by obstacles, both external and internal, which manifest as fears and barriers. Before seeking remedies, it’s vital to recognize these hurdles. External obstacles could stem from scarce resources, societal restrictions, or unexpected hurdles. Internally, fears and self-doubt often pose as the most

Create a plan that lists every step needed to achieve your goal. A detailed plan can help calm worries and give you a clearer view. Check what resources you have and think of clever ways to use them. Sometimes, when you have limits, you can find new and smart solutions. Be flexible with your plans. Being able to change when things don’t go as expected helps you keep moving forward. Find someone who’s done what you want to do and ask for their help. Their advice and experiences can show you the right path.

Taking action necessitates a leap of faith. It involves confronting discomfort, acknowledging fears, and yet, persisting despite them. It’s a testament to resilience and determination.

Remember, progress isn’t always linear. There might be setbacks, moments of self-doubt, and unexpected challenges. But the commitment to your dreams and the resilience to face obstacles head-on will propel you forward.

Receiving extends beyond mere acceptance; it encompasses embracing life’s richness. It involves welcoming positivity, opportunities, and blessings. Often overlooked, receiving is deeply tied to

Instead of seeing setbacks as failures, view them as opportunities to learn and grow stronger.

the energy we emit. Gratitude functions as a force that attracts positive outcomes. When we express gratitude for the present and cherish what we have, we create space for more blessings. It’s the catalyst for abundance and goodness.

To be open to receiving, start by acknowledging your own worthiness. Embrace compliments, support, and opportunities with openness. Sometimes, we unknowingly deflect kindness by minimizing compliments or refusing help. Embrace these gifts without hesitation. Recognizing even small achievements amplifies the abundance around us. Gratitude intensifies the joy of receiving. Set intentions to invite positivity deliberately. Envision the outcomes you desire, remaining open to various paths they may take.

Acknowledging achievements is crucial in the receiving process. Celebrating milestones and successes strengthens a positive cycle, reinforcing the belief in one’s deservingness to receive more. Gratitude serves as a bridge between what we have and what we aspire to achieve. Appreciating the present lays the groundwork for future abundance. By being grateful for the little things, we create an environment that attracts greater blessings.

Receiving is an integral part of the abundance cycle. Embracing gratitude, openness, and acceptance allows the universe to shower us with its blessings. The more open and thankful

we are, the more positivity and abundance we attract. Practice gratitude, celebrate achievements, and remain open to receiving life’s countless gifts.

In traversing the paths of self-discovery and personal growth, it’s essential to acknowledge the transformational journey you’ve undertaken. Along this path, you’ve encountered concepts that hold the power to shape your life positively.

1. Positive Belief Systems: Cultivate empowering beliefs and replace self-limiting thoughts with affirmations that foster growth.

2. Action & Overcoming Obstacles: Break down goals, adapt plans, and seek guidance to navigate barriers on your path.

3. Gratitude & Receiving: Embrace gratitude as a magnet for positivity, and remain open to receiving life’s abundance.

The journey towards personal empowerment isn’t a sprint; it’s a marathon filled with continuous growth and discovery. Commitment is the cornerstone of this expedition. Embrace each step, celebrate progress, and learn from set-

backs. Remember, empowerment isn’t a destination; it’s a way of life. Embrace the challenges, knowing that they are growth opportunities. Embrace change and adaptation as they pave the way for resilience.

As you continue your journey, keep nurturing a positive mindset. Believe in your capabilities and celebrate your uniqueness. Surround yourself with a supportive network that fuels your growth.

Embrace curiosity and continual learning. Seek experiences that challenge you and expand your horizons. Be gentle with yourself, allowing room for self-compassion and understanding.

Above all, remember that every moment is an opportunity to evolve, learn, and thrive. Your journey towards personal empowerment is a testament to your strength and resilience. Keep moving forward, embracing the unknown, and uncovering the incredible potential that resides within you.

As you commit to your ongoing personal development, envision the empowered individual you strive to become and take each step with courage and determination. The power to shape your destiny lies within you. Embrace it, cherish it, and continue on this empowering journey towards a brighter and more fulfilled you. ■

Janine Cascio is the founder and president of Simplending Financial.

Picture your dream home. Now look down. There’s a bright red line keeping you out. Join host Katie Jensen as we dive into redlining and the legacy of discrimination. You’ll hear first-hand accounts from those who’ve had to fight back to achieve their dreams. And we’ll challenge industry leaders on how to rewrite this legacy.

Listen by following the link or by subscribing wherever you get your podcasts. Available

Two recent federal court opinions from the Supreme Court and one from the 7th Circuit Court of Appeals will likely have significant impacts on the future of fair lending regulation, enforcement, and litigation. As a result of these decisions, historical deference to agencies’ interpretation of laws is diminished while redlining enforcement may be emboldened.

The decision in Loper Bright Enterprises, et al. v. Raimond, largely eradicates the perceived authority and credibility of federal agency interpretations of vague or ambiguous laws. On June 28, 2024, the United States Supreme Court overturned longstanding precedent (widely known as “Chevron”) that for 40 years had required courts to defer to agency interpretations when a statute was silent or ambiguous concern-

ing the specific issue at hand. Chevron previously required courts to engage in a two-step process when analyzing an agency’s interpretation of law. The first step of Chevron required a court to determine whether Congress had spoken directly to the precise question at issue. If Congress had spoken to the precise question in an unambiguous manner, then the agency and courts were bound by what Congress wrote. However, if Congress had not spoken clearly to the precise question at issue, then Chevron required courts to move on to step two, which required courts to defer to an agency’s reasonable interpretation of the statute at issue.

In overturning Chevron, the Loper Bright Court replaced the Chevron two-step framework with an “independent judgment” standard. Specifically, under Loper Bright, courts now “must exercise their independent judgment in deciding whether an agency has acted

within its statutory authority … [and] under the APA may not defer to an agency interpretation of the law simply because a statute is ambiguous.” In other words, under Loper Bright, courts cannot defer to an agency’s interpretation of the law, whatsoever — even if the interpretation is reasonable.

The Loper Bright decision may result in more industry challenges to controversial agency interpretations because it theoretically levels the playing field between regulatory agencies and industry players that wish to go to court over an agency’s interpretation of an ambiguous law. The increased prospect that an agency interpretation of law will be struck and rendered unenforceable could also motivate agencies to settle matters more frequently. Nonetheless, excitement around Loper Bright should be tempered. There will be many occasions in which a court’s independent exercise of judg-

BY MATT JONES & DANIELLA CASSERES, SPECIAL TO MORTGAGE WOMEN MAGAZINE

ment will be consistent with the agency’s interpretation of law. The Townstone 7th Circuit Court of Appeals decision is a perfect example.

On July 11, 2024, just two weeks after the Loper Bright decision was issued by the Supreme Court, the 7th Circuit Court of Appeals sided with the CFPB and reversed the federal district judge’s decision in the Townstone Financial nonbank redlining case concerning allegations of ECOA violations. Applying Loper Bright, the 7th Circuit panel exercised its own independent judgment in lieu of the two-step Chevron framework. The Court held that Congress intended for agencies to prevent “circumvention or evasion” of the Equal Credit Opportunity Act (ECOA) and permitting discouragement of prospective applicants would thwart that intention. Further, the Court pointed to the law that requires agencies to refer “pattern or practice” discrimination cases

to DOJ, including cases where a creditor “engaged in a patten or practice of discouraging … applications for credit.” According to the 7th Circuit, this law demonstrates that ECOA was intended to regulate conduct relating to prospective applicants.

In the near term, the 7th Circuit decision in Townstone will likely embolden the CFPB to continue its pursuit of redlining actions; however, this decision may be less consequential in the long term. Importantly, the 7th Circuit decision does not address whether Townstone actually engaged in redlining or violated ECOA. This issue has been remanded to the District Court for further proceedings. Townstone may also appeal the 7th Circuit’s decision, which could be overturned. Moreover, lenders facing redlining allegations outside of the 7th Circuit are not bound by this decision and courts in other jurisdictions are free to interpret

ECOA differently in redlining cases.

The CFPB’s theory of modern-day redlining has not been tested in court after the Supreme Court’s recent decision in Students for Fair Admissions, Inc. v. President & Fellows of Harvard Coll. The admissions process that was found to violate the Equal Protection Clause in Harvard bears many similarities to the redlining remediation efforts currently required by agencies. Racial quotas and targets designed to achieve racial balancing for underrepresented racial groups present serious constitutional concerns, particularly when efforts to achieve that balancing are done at the expense of other racial groups. The Harvard decision could render the agencies’ theory of modern-day redlining unconstitutional, which would limit the significance of the 7th Circuit Townstone ruling.

In the end, Loper Bright may better insulate the mortgage industry from agency enforcement trends that ebb and flow with the political leanings of the executive branch of government. However, even with courts no longer deferring to agency interpretations of law, a court’s independent judgment may be consistent with an agency’s interpretation, as was the case in Townstone. While the Loper Bright decision is expected to result in more successful challenges to agency interpretations of law, the Townstone decision illustrates why Loper Bright will not always rescue regulated industries from aggressive agency enforcement. ■

Daniella Casseres and Matt Jones are both Partners at Mitchell Sandler, a certified women-managed, majority-womenowned boutique financial services and financial technology-focused law firm based out of Washington, D.C.

Do you have what it takes to be the best?

The New England Mortgage Expo returns to the fabulous Mohegan Sun Resort & Casino this January! With over 2,000 attendees, you won’t want to miss this opportunity to be a part of New England’s largest and most exciting mortgage event — the largest regional mortgage show in the nation. Join your peers for an exiting day of networking, product showcases, educational sessions, motivational speakers, and so much more!

Originators attend for FREE using code MWM

BY SARAH WOLAK, STAFF WRITER, MORTGAGE WOMEN MAGAZINE

DD r. Vanessa Montañez, D.E.L, says that her now 28-yearlong career in mortgage lending didn’t start glamorously. After attending San Diego-based National University with big business executive dreams, Montañez was plucked by a recruiter and shuffled into a call center role at Beneficial Home Loans. To put it bluntly, it wasn’t the career she had been dreaming of.

Montañez had taken her father’s advice to “chase the money and stability” in a business degree. Upon graduating and briefly working for Beneficial, the post-grad eventually moved to Countrywide Home Loans. But Montañez messed up. A lot. She mixed up different loans and wasn’t quite sure how to approach customers behind the phone. After being told

to essentially get her act together, she described doing what she called “killing a lot of trees,” printing out all the information she could about different loan programs, and studying to keep her job. Amid countless hours pouring over guidelines, Montañez discovered that there was a whole other world out there of just affordable lending. “I knew there was free money out there, and I was determined to help my clients take part of that,” she said.

Montañez’s early roots are an extreme juxtaposition from where she is today. With almost three decades of experience in residential lending and sales and business development management tucked under her belt, Montañez’s latest adventure in lending is her role at Los Angeles-based City National Bank, working as the bank’s first community lending national sales manager.

Montañez’s father was right about chasing the money, but he wasn’t necessarily spot-on about the money Montañez would be chasing. Montañez’s mission is to focus on diverse segments and expand education about down payment assistance programs, not just in her native California, but nationwide.

Montañez is now one year into her career at City National Bank, but the sentiment behind her career

isn’t new. Montañez’s prior position was U.S. Bank’s vice president for the national strategic markets and diverse segments, in which she was responsible for tailoring market tactics to boost sales volume and market share for accessible lending solutions in the West.

to work for Bank of America and Alterra Home Loans as a mortgage manager for the LA metro and as a sales manager, respectively. “There’s a whole other world out there in affordable lending. I started researching state DPA funds as well as funds that the city of Los

“I knew there was out there, and I was help my clients take

Montañez’s mentality has always been “What’s next?” After eventually securing a role at Countrywide Home Loans as a branch manager for San Fernando Valley, Montañez started working with primarily Hispanic buyers. She eventually went

Angeles had to offer, as well as nonprofits, grants … There’s a formula that I saw not as a roadblock, but as a solution,” she said. “This was back in the 1990s when prices and costs were much different, but I felt it was a privilege to help a first-time

homebuyer, especially those who weren’t aware of special programs.”

Now, those special programs have shaped Montañez’s career and led

inantly Black and Latino communities. Montañez said that before her position, she hadn’t considered City National as a place to work because “they didn’t have an affordable lending program.”

Montañez started working with a

her to City National. The heavy investment in community lending comes in the wake of City National’s payment of $31 million in a redlining settlement — the DOJ’s largest ever — after refusing to underwrite mortgages in predom-

recruiter, who advised her to create a business plan to present to the bank. Montañez wrote a 14-page plan with an appendix, including the exact partnerships she would want, as well as procedures for sales, marketing, and third-party

plans. When she presented her plan at the interview, she learned that she created exactly what City National Bank had in mind. She was hired immediately, becoming the Bank’s first-ever community lending national sales manager in the bank’s 70-year history.

Today, Montañez is the face behind City National Bank’s “Ladder Up” Program, a grant program for specific and qualifying geographies in Southern California, New Jersey, and New York, and works closely with the bank’s Community Reinvestment Act team. Per Montañez and Adrian Oliver, City National’s VP of community lending manager residential, Ladder Up provides borrowers with grant assistance, a mortgage program, and credit education to help them ascend the ladder of financial success and wealth-building. The Ladder Up program offers “a grant up to $20,000 or 3% of the loan amount that may be used for a down payment, closing costs, or buying down the rate. In addition, no mortgage insurance is required regardless of the down payment amount,” per a release from City National Bank.

“Vanessa built the program and pulled knowledge from her experience in the industry and in community lending, and she knew what other places were doing and was able to take inspiration from [those products] and fine-tune it,” Oliver said. “And it allows us to be competitive on rate, cuts out the mort-

“During our mentoring sessions, Vanessa heard me and helped me outline the execution of my goals. She reminds me that all things are possible with a plan, a vision, and a supportive network.”

ADRIAN OLIVER

gage insurance, and lets us better help those underserved communities.”

Now that the bank is repairing its damages, Montañez is offering a fresh approach to serving the underserved. “Education is forefront. In any community, you have to educate. And the best plan for me is teaming up with nonprofits that

are well known in the community that are already doing the great work, that have workforce development, and are doing educational workshops on financial literacy and providing classes on how to buy a home,” she said. “As we’re creating projects and programs, I look to research and data to validate why we’re doing this. I look to the Urban Institute, Fannie and Freddie,

McKinsey Institute, and HUD to validate why we create programs and why we have a high affordability cost … As a professional in any industry, it’s so important to understand the ‘why’ and the semantics of how something works so you can defend it.”

Even though creating a program from scratch wasn’t in Montañez’s wheelhouse, leadership was something she was familiar with. After a colleague suggested she reach for more management positions, Montañez opened Mi Casa Financial Services and operated as a broker shop, continuing to cater to Hispanic people for several years. “Eventually, we opened an insurance company with Farmers Insurance so we could be a one-stop shop,” Montañez explained. “Then, the mortgage meltdown hit and I closed up shop … so many of the lenders I worked with went under and I had no choice.”

After six years of being self-employed and, frankly, tired after the meltdown, Montañez pursued her MBA from Pepperdine University in Malibu, Calif., eventually graduating in 2014 from the program. In the meantime, she served on the National Association of Hispanic Real Estate Professionals (NAHREP) as a national board member and a board director for the LA chapter between 2008 and

2010. This was Montañez’s definition of taking it easy. “What I discovered is that you want to be surrounded by like-minded professional individuals who believe in the mission of sustainable Hispanic homeownership,” she said. “Trade organizations who support your initiatives are also important.

During her MBA program, Montañez went on to work for JPMorgan Chase as its Vice President and California Regional Business Development Manager but faced a layoff at the end of 2014. “In a career advancement, nobody thinks about the day they get laid off,” Montañez shared candidly. “It doesn't matter if you exceed expectations … the company I was at eliminated my position … it was a humbling experience after being on top of the world. I learned that everyone’s replaceable, and it’s hard to find the same position. The more you advance in your career the [fewer] opportunities you can come across.”

Montañez was given a choice: the opportunity to stay at Chase in a lower-paid position or take the severance package and bid adieu. Montañez took it as a sign to leave Chase and finish her MBA program. But following graduation, the positions Montañez desired weren’t coming around. She shuffled around between a job as East West Bank’s National Mortgage Business

Development Manager and as an outside consultant with On Q Financial, Inc., a position she said was “short-lived.” After facing a layoff from East West Bank, Montañez decided to complete her academic accolades with a doctorate.

“I thought to myself, ‘How can I stay relevant but do something different?’,” she asked. “The severance package allowed me to take time and think of what I truly wanted to do.”

In 2017, Montañez enrolled in the Doctorate of Executive Leadership program at West Virginia-based University of Charleston. “I wanted to focus on what good executive leadership is because I remember how the mortgage meltdown cast the blame on the salespeople and loan officers,” she said. “In reality, it was the leaders who created derivatives, it’s not the low-hanging fruit that created these programs.”

Montañez graduated with honors and a 4.0 GPA in 2021, all while working at U.S. Bank as its Sales and Business Development Manager before landing her job at City National Bank.

But the buck doesn’t stop after Montañez’s 12-hour days working for the bank. Outside of the office, Montañez hosts LeadHER Talks, a podcast that she and her sister, Chantal Camarillo, created as “an

There’s a quote that says if you see her, you can be her. And that’s my approach to everything I do.

DR. VANESSA MONTAÑEZ

open forum for women and those who support women to exchange ideas, network, empower, enrich, and educate the growth and development of women in business across all industries.” Montañez describes it as a passion project.