GOLDEN GIVING

GSFA Celebrates Another Trip Around The Sun

IMBs THREATENED BY STATE CRA LAWS CONVERT CLICKS TO LEADS

Influencer Stars

Share Their

For

GOLDEN GIVING

GSFA Celebrates Another Trip Around The Sun

IMBs THREATENED BY STATE CRA LAWS CONVERT CLICKS TO LEADS

Influencer Stars

Share Their

For

California is large and in charge. That’s why there’s California Broker magazine. We cover the nation’s biggest mortgage market, and the state with more originators than anywhere else in the country. It’s the industry leader, and so is California Broker magazine.

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Katie Jensen EDITOR

Ryan Kingsley, Sarah Wolak, Erica Drzewiecki STAFF WRITERS

Alison Valvo DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Matthew Mullins, Krystina Coffey MULTIMEDIA SPECIALIST

Alan Nero MEDIA SPECIALIST

Melissa Pianin MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Regina Morgan ADVERTISING SALES EXECUTIVE

Nicole Coughlin ADVERTISING ASSOCIATE

Lydia Griffin MARKETING INTERN

Submit your news to editors@ambizmedia.com

If you would like additional copies of California Broker magazine Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

© 2024 American Business Media LLC. All rights reserved. California Broker magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

These days in the mortgage industry, a lot of "F" words are getting tossed around. "Frantic" is one. "Frenetic" follows suit. "Frightful" keeps reappearing. And, too many times, "failed" is the word of the day.

But there's another "F" word that also keeps flexing its muscle: Fighter.

Think of the frigates of old, where storms were an inevitability and crews had to brave through severe conditions to keep their ships afloat. Lashed by wind and water -- the very elements that propelled them to fortune -- the hands on deck would work furiously to trim sails, secure the holds and keep the vessel from flailing uncontrollably through the seas. That's not unlike what's been happening in the mortgage world. The interest rate ocean, once calm and comforting, has become an undulating menace, while gusts of buyers who once gave speed to the market now are in the doldrums.

It's enough to make anyone fearful.

The promise of substantial interest rate reduction seems continually out of reach. The real estate sales market was already in a dread state before the National Association of Realtors agreed to a legal settlement that will upend how consumers purchase homes. The government seems helpless to institute programs or policies to buttress the residential real estate market in its time of need. Where once home financing was a feast, it's now famine.

And yet....

When we look around, we see those in the industry who are fighting these elemental forces and winning. There are rookies putting up substantial sales numbers because they never got stuck in the old ways. There are mavens who are making bank because they've been through stormy markets before and are confident in the skills they've learned to succeed.

Here, we tell those stories. We feature those whose fortitude inspires and motivates. In our work life, these are our friends and family, the ones we can lean on and learn from, the ones who help us find the way.

Eventually, all storms ebb, and the one tossing the mortgage market will, too. Together, we will stay ready as this market finds its footing. And when it does, the future will no longer look quite so forbidding. It won't be long, frankly, before the "F" word we're using is "fantastic."

VINCENT M. VALVO CEO, Publisher, Editor-in-Chief vvalvo@ambizmedia.com6

36

Kelly Rivas shares her story behind her royal appearance.

A look at news of interest to mortgage originators across California

10

16 Golden State News Nuggets Golden State Finance Authority Celebrates Another Trip Around the Sun Mortgage Influencers Rise to Power

The GSFA reaches peak homebuying age as it turns 30

Influencer stars, known by their handles @whatsamortgage and @mortgagemandy, share their tips for success

26 State CRA Laws Undermine IMB Progress

IMBs say consumers will pay the cost of added compliance regulations

32

A look at those people in the California mortgage industry who are seizing new employment opportunities or promotions.

Our Data Bank whittles down the important stats about the California housing market.

A look at the news that’s important for the mortgage industry across the state of California.

The Connecticut Banking Department issued a cease and desist order earlier this month to a San Francisco-based lender, LoanSnap, for allowing individuals without a mortgage license to negotiate and take residential mortgage loans over the phone.

The cease and desist against LoanSnap alleges that it employed a business model from at least August 29, 2022, to December 2, 2022, in which most of its origination work in Connecticut was performed by unlicensed mortgage loan originators.

The charges brought against LoanSnap, Inc. include alleged violations of the Truth in Lending Act and the Fair Credit Reporting Act. However, the central focus of Commissioner Jorge Perez's findings revolves around unlicensed mortgage origination activities.

LoanSnap did not immediately respond to requests for comment on the allegations.

Perez directed LoanSnap to halt specific activities and notified the company of the impending revocation of its state mortgage lender license. Additionally, LoanSnap faces up to a $100,000 civil money penalty per violation as a result of the order.

The company had 14 days to request a hearing or their license would be revoked. The Banking Department said LoanSnap did request a hearing.

According to the cease and desist, LoanSnap employed individuals who were not licensed as mortgage loan originators in Connecticut. Despite their lack of proper licensing, these individuals acted as mortgage loan originators by taking residential mortgage loan applications, soliciting Connecticut borrowers for residential mortgage loans, and even negotiating terms for these loans. Most of the unlicensed mortgage originators worked in out-of-state call centers and

the company relied on this unlicensed workforce for its origination work in Connecticut.

The order states, that once an unlicensed MLO deemed a potential borrower qualified for one of the respondent’s loan products based on the information gathered (via text, electronic mail, telephone call and additional verification documentation he or she required the potential borrower to submit), the unlicensed MLO would then send the file to a licensed mortgage loan originator."

Additionally, it says, if the borrower didn't qualify for one of the products then the unlicensed MLO "would end the call without allowing the potential borrower the opportunity to speak with a licensed mortgage loan originator."

The order also refers to one nonlicensed employee maintaining a LinkedIn profile that identified her as a "mortgage loan officer." Furthermore, other non-licensed employees' LinkedIn profiles included statements indicating their involvement in activities directly related to mortgage loan origination.

Those misrepresentations played a significant role in the examination and subsequent order against LoanSnap, because Connecticut law states that an individual is considered to be engaged in the business of a mortgage loan originator if they represent themselves as such to the public through advertising or other forms of communication.

Additionally, the commissioner alleged that LoanSnap's conduct triggered provisions of the Connecticut SAFE Act related to character, general fitness, and operating with honesty, fairness, and efficiency.

Wildfires, droughts, food shortages, and pollution levels are projected to intensify this year, according to the 2023 National Climate Assessment, making it too risky for even homeowner insurers to stick

around. Meanwhile, mortgage lenders are left to deal with the consequences.

Over the past few years, many homeowner insurance carriers have decided to no longer insure homes in certain parts of the state, while others have left the home insurance market altogether. The most recent move is by smaller insurers, including Merastar Insurance Company, Unitrin Auto and Home Insurance Company, Unitrin Direct Property and Casualty Company, and Kemper Independence Insurance Company, which all plan to non-renew policies.

That comes after the state’s leading insurers, Allstate, State Farm, Farmers, and USAA, announced their withdrawals in 2022 and 2023.

Industry giants State Farm and Allstate stopped issuing new home insurance policies altogether in 2023, but still back existing policies for some residents. Meanwhile, Farmers and USAA announced in 2023 it will begin to limit California home insurance coverage in 2024. Combined, the four insurers made up 24% of the state’s home insurance market.

The companies cited increased construction costs alongside inflation, and exposure to catastrophes as reasons to taper off in the Golden State. It became increasingly expensive for State Farm, Allstate, Farmers, and USAA to take on new home insurance policies since state legislation requires rate hikes to be approved by the California Department of Insurance. The slow pace by which rates are approved slows down the rate-raising process, essentially freezing home insurance rates at an unsustainable rate.

In 2024, many California residents are left with little to no options for homeowners insurance, adding further stress on mortgage lenders that are already struggling to cope with today’s market challenges, like low inventory and affordability.

Irvine-based loanDepot President Jeff Walsh commented on the matter, saying as more companies leave, insurance

premiums will become more expensive, impacting debt-to-income ratios for borrowers. Though most buyers and industry professionals have been quiet on this issue, Walsh expects to hear many complaints about it this year.

However, the state has a last resort option, the FAIR Plan, which provides coverage of up to $3 million for singlefamily homes and up to $20 million for commercial properties.

The California Housing Finance Agency (CalHFA) has announced that it will be administering an additional round of applications for the California Dream For All Shared Appreciation Loan Program, a loan application for first-time home buyers. Last year the program was so popular that it exhausted all its funding, $300 million in total, within just 11 days

According to the 2023-24 State Budget, an additional $220 million has been allocated for the Dream for All program and will now focus first-generation homebuyers as well as buyers in the lower tiers of income eligibility.

The program provides first-time homebuyers with up to 20% of the home purchase price to be used as a down payment and/or closing costs assistance, up to $150,000. The state will repay the loan plus a share of the home’s appreciation when the home is sold again, and the repayment would go into a revolving fund to allow other future homebuyers to take advantage of the program.

Despite the program’s wild popularity, it failed to reach its intended demographic target, said Adam Briones, the CEO of California Community Builders, a nonprofit housing research and advocacy organization. The Dream For All program was designed by Briones and his team in an effort to close the racial homeownership gap in the state. Yet, only 3% of the grantees were Black,

according to CalHFA, compared to 35% of white recipients, 33% Latino, and 19% Asian American and Pacific Islander.

However, Briones ensures that new changes to the 2024 California Dream for All program are meant to address those disparities.

State approved lenders should prepare for buyers to start calling in April when the application period opens. They only have a month to submit their applications.

CalHFA will use a lottery to allocate a number of vouchers for each region of the state based on its share of the state’s households. An estimated 1,700 to 2,000 vouchers will be distributed and must be used within 90 days.

Eligibility Criteria:

• Each borrower must be a first-time homebuyer and least one borrower must be a first-generation home-buyer, defined as someone who has never owned a home and whose parents did not own a home, or someone who grew up in foster care.

• All borrowers must occupy the property as their primary residence within 60 days of closing.

• Income must be less than or equal to 120% of the area median income.

• Borrowers must be U.S. citizens or a Qualified Alien, and at least one borrower must be a California resident

Home builders, developers and investors now have access to a newly-formed, comprehensive suite of loan products through private direct lender Anchor Loans.

The fix-and-flip company, based in Cerritos, just announced the launch of its new Third-Party Originator (TPO) channel, serving brokers, banks, private and Non-QM lenders and other referral partners that work directly with these parties.

Accelerating company growth with channel expansion represents the vision of Anchor Loans’ new CEO Rayman Mathoda, who came on board last year.

“The launch of Anchor Loans’ new TPO Channel marks an exciting step forward for our company and further supports our ability to expand our national footprint with improved and enhanced financing offerings,” Mathoda said. “We are at a moment in time when regional banks and private lenders are pulling back on financing options while the American housing market is in desperate need of millions more move-in ready homes than exist today. Our team remains deeply committed to expanding housing opportunities for America’s buyers and renters by providing investors with the capital necessary to refurbish our nation’s aging homes, and build new ones.”

Loan products available in the new channel include bridge, fix and flip, ground-up construction, and rental investor loans with debt service coverage ratio (DSCR), company officials said.

Anchor Loans Co-Chief Revenue Officer Tim Landwehr led the program’s design and launch.

“Our new TPO program is designed to support and protect the strong relationships that exist between loan originators and their clients,” Landwehr said. “At Anchor Loans we are obsessed with delivering exceptional customer value, and our TPO Channel is an expansion of that ideal. We look forward

to working with TPOs to help build longterm partnerships between them and their clients.”

A federal court has issued an order banning the operators of the Home Matters USA mortgage relief scam from the telemarketing and debt relief businesses and requiring them to turn over $19 million as a result of a lawsuit by the Federal Trade Commission (FTC) and the California Department of Financial Protection and Innovation (DFPI).

The FTC and DFPI sued companies doing business as Home Matters USA, Academy Home Services, Atlantic Pacific Service Group, and Golden Home Services America and the owners of the companies, Michael R. Nabati, Armando Solis Barron, Dominic Ahiga (also known as Michael D. Grinnell), and Roger S. Dyer in September 2022, charging them with taking millions of dollars from thousands of struggling homeowners seeking mortgage relief.

The court found that the defendants falsely promised to reduce homeowners’ mortgage payments and prevent foreclosures, defrauding distressed homeowners out of millions of dollars. The scheme harmed more than 3,000 people nationwide, particularly elders and veterans.

“Our win in this case sends a clear message to scammers who target consumers facing financial hardship: the FTC and our law enforcement partners are focused on fighting fraud and halting it,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection. “We look forward to more opportunities to partner with the California DFPI on behalf of consumers.”

“This case also demonstrates the value of the California Consumer Financial Protection Law as a tool to combat deceptive and predatory financial schemes. Fraudsters everywhere should take note – DFPI will find you, expose you, and hold you accountable. Victims of fraud should likewise take heart.

The DFPI has your back,” said DFPI Commissioner Clothilde Hewlett.

The court’s orders bar the individuals

and their companies from directly or indirectly engaging in telemarketing, debt relief services, and making any misrepresentations or unsubstantiated claims about any product or service.

“Our win in this case sends a clear message to scammers who target consumers facing financial hardship: the FTC and our law enforcement partners are focused on fighting fraud and halting it.”> Samuel Levine Director of the FTC’s Bureau of Consumer Protection

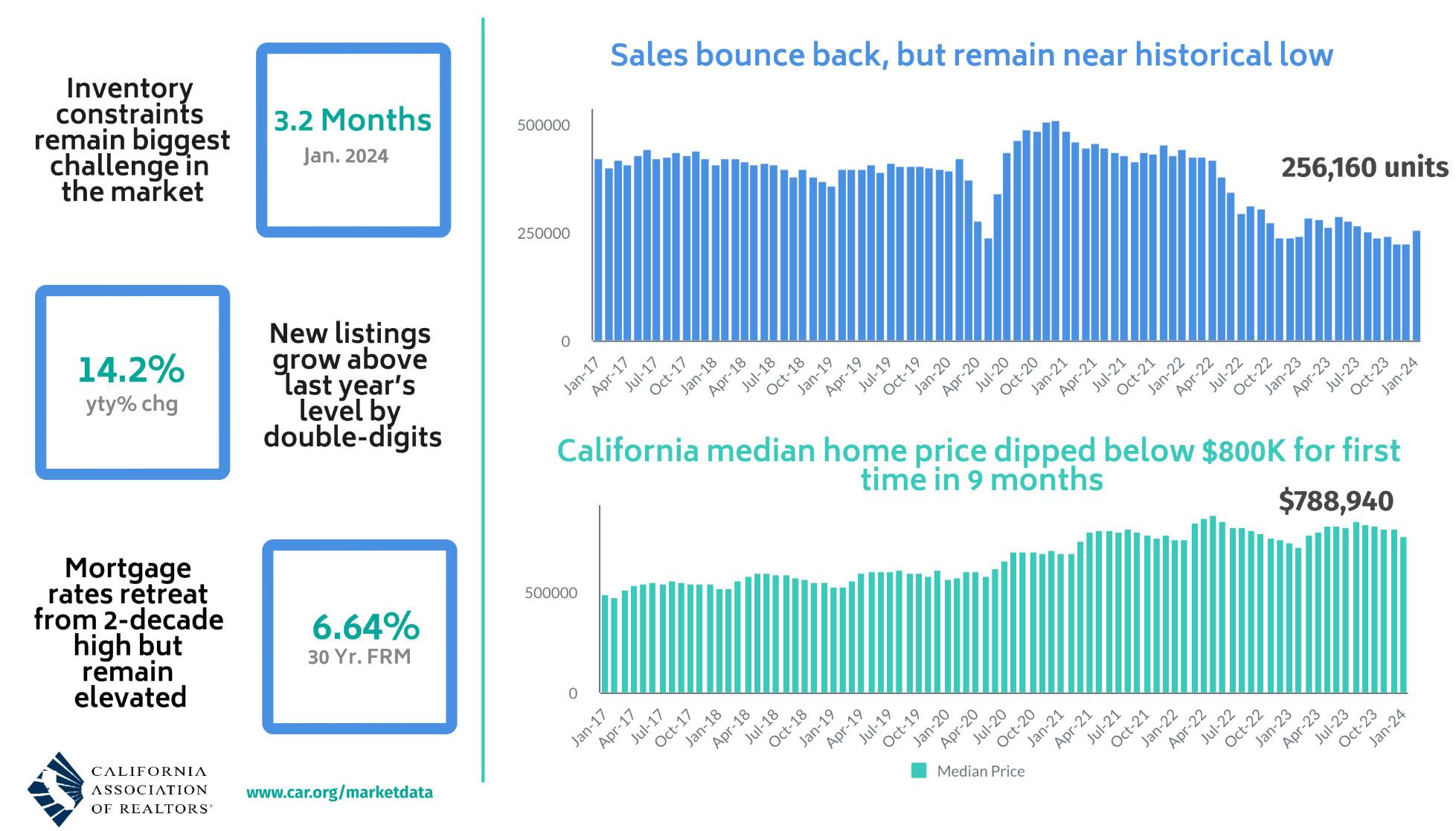

Elevated borrowing costs and a shortage of available homes for sale in the fourth quarter of 2023 kept California housing affordability suppressed at the lowest level in 16 years, according to the California Association of Realtors (C.A.R.).

While unchanged from third-quarter 2023, only 15% of home buyers could afford to purchase a median-priced, existing single-family home in California in fourth-quarter 2023. The fourth quarter 2023 figure was down from 17 percent a year ago, according to C.A.R.’s Traditional Housing Affordability Index (HAI). The fourth-quarter 2023 figure is less than a third of the affordability index peak high of 56 percent in the first quarter of 2012.

C.A.R.’s HAI measures the percentage of all households that can afford to purchase a median-priced, singlefamily home in California. C.A.R. also reports affordability indices for regions and select counties within the state.

The index is considered the most fundamental measure of housing wellbeing for home buyers in the state.

A minimum annual income of $222,800 was needed to qualify for the purchase of a $833,170 statewide median-priced, existing single-family home in the fourth quarter of 2023. The monthly payment, including taxes and insurance (PITI) on a 30-year, fixed-rate loan, would be $5,570, assuming a 20 percent down payment and an effective composite interest rate of 7.39 percent. This marked the second consecutive quarter that the effective interest rate rose above 7 percent in more than two decades. The effective composite interest rate was 7.14 percent in thirdquarter 2023 and 6.8 percent in fourthquarter 2022.

While interest rates have trended downward for most of fourth-quarter 2023, dropping about 100 basis points from the peak recorded in mid-October, they have leveled off in recent weeks and remained elevated since the start of 2024. Moreover, as recent economic data continues to defy expectations of a slowing economy, the Federal Reserve could hold off on rate cutting at their upcoming March meeting. As such, rates are expected to remain elevated through the first half of the year and will continue to put downward pressure on affordability.

The median price of condominiums and townhomes in California held up better than single-family homes from both the previous quarter and a year ago. As a result, the share of households that could afford a typical condo/townhome in fourth-quarter 2023 dipped to 22 percent from the 23 percent recorded in the previous quarter and was down from the 26 percent recorded in the fourth quarter of 2022. An annual income of $174,000 was required to make the monthly payment of $4,350 on the $650,000 median-priced condo/ townhome in the fourth quarter of 2023.

Compared with California, more than a third of the nation’s households could afford to purchase a $391,700 median-priced home, which required a minimum annual income of $104,800 to make monthly payments of $2,620. Nationwide affordability was down from 38 percent a year ago.

California has extended the requirements for the California Mortgage Relief Program to provide additional assistance to eligible homeowners.

As part of the Homeowner Assistance Fund authorized by the American Rescue Plan Act, California was awarded $1 billion to put toward the program, which provides homeowners with up to $80,000 in assistance.

The program aims to help those with missed property taxes, late mortgage payments, reverse mortgages and partial claims or loan deferrals taken during the COVID-19 pandemic.

As of Monday, only about $776 million has been distributed.

To continue aiding more Californians, the program has repeatedly extended the requirements to assist low-income and moderate-income homeowners.

So who is eligible to receive assistance?

With the latest extension, homeowners who’ve missed at least two mortgage payments or at least one property tax payment by Feb. 1 are eligible to receive assistance.

According to the program’s website, California homeowners may be eligible if they meet one of the following requirements:

• Missed at least two mortgage payments and are currently past due.

• Missed at least one payment for property taxes.

• Have a partial claim or loan deferral.

• Have a reverse mortgage; and owe a past-due property tax and/or insurance payment.

President and CEO of Valley Agricultural Federal Credit Union (FCU) in Santa Paula, Tina Louise Torres, will be sentenced in April for embezzling more than a quarter million dollars, KTVA reported. The $5-million credit union has approximately 628 members.

According to prosecutors, Torres

stole more than $250,000 from Valley Agricultural FCU, previously known as Limoneira FCU, while she was President and CEO between 2016 and 2019. Prosecutors also say she altered or forged documents to hide her thefts from the board of directors. According to the credit union’s profile reports filed with the NCUA, Torres served as the board’s treasurer. After discovering her crimes in August 2019, Torres was fired and later arrested in June of 2023 in Ojai, Calif.

Torres pleaded guilty to four counts of grand theft, two counts of forgery, and four counts of grand theft-embezzlement, according to prosecutors.

“The legislature is essentially now pro-housing. Pretty unequivocally and objectively, you can say that the legislature wants to solve the housing crisis.”

> Matthew Lewis Spokesman for California YIMBY

In addition, Torres admitted to nearly four-dozen special allegations that were filed by the Ventura County District Attorney's Office in a charging document that is 14 pages long.

An audit detected suspicious wire transfer schemes, which allegedly enabled Torres to siphon credit union funds. She allegedly used the money to pay her personal debts, police investigators said.

Torres was booked into the Ventura County Jail with bail set at $40,000, prosecutors said. She posted bail and was released the same day. As of February 2024, Torres remains free on bail and is due back in court on April 3, 2024, to face sentencing.

Lawmakers have finally broken the state’s long-standing anti-housing sentiment last year after 56 housing bills were signed into law during the 2023 legislative session. Has the tide finally turned from NIMBY to YIMBY? What is certain is that lawmakers are serious about increasing home affordability in the state.

Matthew Lewis, spokesman for California YIMBY, which advocates for building more housing, told KQED, a San Francisco-based digital media company, the lack of controversy is due to there being more legislators from all the parts of the state carrying housing bills.

“The legislature is essentially now prohousing,” he said. “Pretty unequivocally and objectively, you can say that the legislature wants to solve the housing crisis.”

More than 100 housing production laws have gone into effect since 2017, and new construction has increased with nearly 114,000 homes and apartment units permitted, on average, since 2018, up roughly 17% compared to the five-year average between 2013–2017, according to the Construction Industry Research Board.

Laws to increase granny flats and backyard cottages have also been successful. Accessory dwelling units now account for more than 10% of all housing units built since 2018 and 18% of all completed units in 2022.

But despite this success, it hasn’t been enough to move the needle on affordability, which remains at historic lows. According to the California Association of Realtors (CAR), just 15% of Californians could afford the medianpriced single-family home in 2023, down from 27% in 2018. And more than half of all tenants spent over a third of their income on rent, indicating housing insecurity.

Homelessness also increased nearly 40% since 2018, compared to an 18% rise nationally, according to the federal Department of Housing and Urban Development (HUD). And while California more than tripled the number of homes built for low-income renters between 2019 and 2022, it is still building only around 20% of its goals.

When wildfires blew through Butte and Shasta counties in 2018, destroying almost 19,000 structures and displacing thousands, it donated over $1 million to help residents rebuild. When the Census indicated Black homeownership rates were the lowest in the nation, it launched a three-year educational outreach initiative.

When data revealed that only one out of six California residents can afford the average home in the Golden State, its down payment assistance programs stepped up to bat. Last year, Cali’s housing authority came out with a Dream For All DPA program available to first-time buyers and they exhausted their budget very quickly -- $300 million in 11 days.

Having celebrated its 30th anniversary in 2023, the Golden State Finance Authority (GSFA) models what a housing agency can be. Not only for the least fortunate of borrowers, but also the loan officers who make it their mission to serve them.

The GSFA’s history traces back to the Rural County Representatives of California, which first formed the California Rural Home Mortgage Finance Authority in 1993 as a joint powers authority representing 18 counties.

organization that continues to innovate and evolve to improve the lives of so many.”

Thirtieth anniversary events took place throughout 2023.

Over the last three decades the GSFA has expanded from single- and multi-family financing to offer energy efficiency financing. Since 2010 it has financed over $1 billion among 36,200 residential and commercial energy efficiency projects. Ongoing economic development outreach has included $3.5 million in emergency disaster assistance to wildfire survivors, to fund temporary housing and rebuild projects.

“All of these investments are designed to help rural California thrive,” says Patrick Blacklock, executive director. “These milestone achievements would not be possible without the direction of our Board and the dedication of our amazing staff. I congratulate them all for their expertise and long-term commitment that has been integral to GSFA’s success.”

“We have a strong network of loan officers that truly want to make a difference in people’s lives. Working with the clients who don’t have cash resources takes a lot of commitment and dedication.”> Carolyn Sunseri, director of marketing and stakeholder relations, GSFA

This organization grew and became the GSFA in 2015, and today represents more than 200 lenders across 56 counties. Each individual lender determines which branches or loan officers participate in the GSFA’s programs.

“Providing the best products and services possible while developing strong relationships with business partners that make our endeavors viable is the heart of our organization,” GSFA Deputy Director Craig Ferguson said in a statement. “At times this means juggling challenging financial markets and shifting priorities as the real estate market fluctuates. I am proud to be a part of an

By working directly with investors, the organization has been able to generate funds for its programs through the sale of mortgage backed securities.

In the last 30 years, 85,400 Calif. residents have benefited from more than $660 million in down payment and closing cost assistance from the GSFA. At the same time the organization participated in over $15.6 billion in loan financing for first and second mortgages.

But no dollar amount can make up for the dedication by the lenders and loan originators that execute the GSFA’s programs, according to staff.

“Our most important business relationship is the one we have with our lending partners,” Carolyn Sunseri, director of marketing and stakeholder relations, explains. “We have a strong network of loan officers that truly want to make a difference in people’s lives. Working with the clients who don’t have cash resources takes a lot of commitment and dedication.”

Keeping in contact with them postclose often means a GSFA client is a return client.

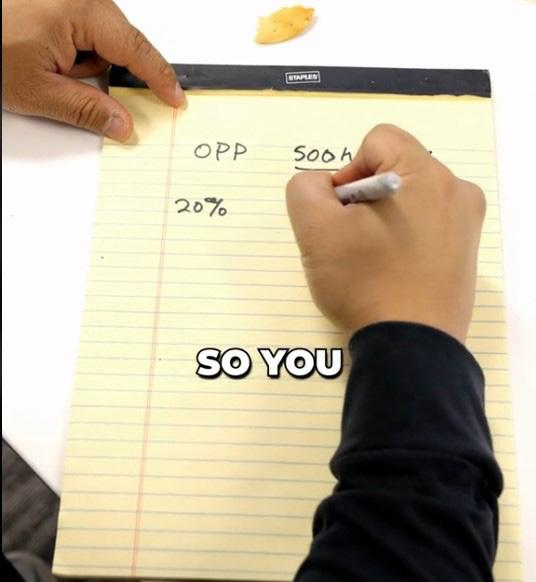

“They know that you did your best by them and showed them the way. And guess what? Those people a couple of years from now become the 800 credit scores with the 20% to put down once they sell the first house that you help them get into,” says Will Patterson, a mortgage loan originator with Academy Mortgage in Modesto, Calif. “It’s all about the trajectory up. You kind of get the best of both worlds where you’re helping people accomplish a major life goal and you can make a nice living doing it as well.”

There are fewer ‘perfect’ borrowers with excellent credit and enough cash for a 20% down payment browsing through Zillow and Redfin these days. Instead, it’s just a bunch of Janes and Joes scrolling through the few listings available in their budget and praying for the market to ease up. Some say LOs who make their money off of wealthy clients and milliondollar homes have no business being in today’s market.

“If that’s the client base you’re relying on, those people aren’t buying homes right now, or if they are, it’s a very, very select few,” Patterson says. “If you’re gonna make your career out of that type of client base, great. So be it. But guess what? These files aren’t as hard as people think they are. We finish them in 15 to 17 days routinely.”

It’s not just a seat in Heaven that propels LOs to get involved with the GSFA. Or other finance authorities across America, for that matter.

“Whether it’s the GSFA or another program, take a look at them because there’s a lot that it can do to help your client base which in turn, will also help your business,” Patterson says.

A family he recently closed a loan with came to Patterson through a

lender and real estate agent that didn’t have the resources to help them given that their credit score was so low. The GSFA’s Golden Opportunities program was able to accommodate their needs.

“They called a realtor that I work with and he said, ‘Hey, talk to my lender. He might have something for you.’ The fact that we had access to that program, we both got a transaction out of nowhere that we didn’t know was coming. That’s always a nice win in this industry. And if that was an agent I didn’t do a lot of business with, that would have bridged an opportunity to do more business together.”

Too often homebuyer-hopefuls go to a lender and leave empty-handed. Another set of Patterson’s clients needed the higher backend debt-to-

income ratio Golden Opportunities provides.

“We gave them buying power to at least be at a realistic price point. I love having those kinds of tools in my tool belt for my clients,” he explains. “It’s pretty cool to get somebody preapproved within three or four days. And then 25 days later, you’re already getting paid on it.”

The GSFA hears stories like this all the time. In fact, impossible dreams are their specialty.

“What I have seen in my 17 years with the organization is that homebuyers who are able to purchase a home sooner than they thought was possible tell family and friends,” Sunseri says. “Loan officers can build their own referral network just through clients they help. They become the go-to resource in their office for assistance programs. It’s a great way to build a business.”

Celebrating her 25th year in the mortgage business is Sondra Yates, originating branch manager with CrossCountry Mortgage in Modesto, Calif. Looking out for those borrowers who need a little help is her priority.

“We’ve all heard of clients that didn’t love their home buying experience, and we definitely want to be the ones that are contributing to all the favorable, positive, we’re there for you - not just from start to finish in a transaction - but after closing as well,” says Yates. “We want to be those advocates for people that don’t always have a voice depending on the market conditions. That’s our responsibility.”

She got involved with the GSFA and started offering borrowers its assistance programs about three years ago.

“We’re all looking for ways to stand apart. What’s our unique value add? What does our program mix look like? The more programs that you can offer to help buyers be competitive is super important. Then once you’ve established trust with them, they tell

their friends, they tell their fellow coworkers; they want to have that experience duplicated for other people they know.”

LOs interested in doing loans with the GSFA can visit its website at GSFAhome.org to find out if their company has been approved.

About 15% of the loans Patterson closed this year were GSFA loans.

“A few of those files we would not have been able to do without whichever GSFA program we used for them,” he says. “It’s funny because now I think back to earlier in my career and I’m like, oh man, how much business did I not capture because I didn’t have access to down payment assistance programs. As the market has shifted there’s been a huge necessity for it.”

The organization offers free weekly training workshops for those new to this niche market, to familiarize them with the programs, eligibility and loan processing guidelines.

Generally the GSFA offers FHA,

“It’s funny because now I think back to earlier in my career and I’m like, oh man, how much business did I not capture because I didn’t have access to down payment assistance programs.”

> Will Patterson Mortgage Loan Originator Academy Mortgage

USDA and VA government financing in conventional, 30-year fixed rate loans.

“The actual application and processing of our mortgage loans through our programs is the same as the loan process an officer normally goes through to offer their products, but the difference is when they lock in

the rate they’re doing it through us as a housing financing agency,” Sunseri says. “At the same time they are getting the commitment of the down payment assistance funds they need for their borrowers.”

While other agencies require additional compliance review steps, there are none here.

“We delegate the underwriting directly to our lenders so it doesn’t slow down the escrow process,” Sunseri adds. “It’s practically seamless.”

The GSFA also welcomes more borrowers than other down payment assistance programs, according to the LOs who have their tools at ready.

“You don’t have to be a first time home buyer; you can have nonoccupying co-signers or things like that,” Patterson points out. “Sometimes as loan officers, we’re used to one down payment assistance program and we get something that doesn’t quite fit in that box, so we might be in the mindset to say no, we can’t do it.”

He encourages LOs to educate themselves on as many different loan products as they can in order to do right by the most borrowers.

“I think that the more that you can add to what you can do for your clients is always going to benefit you as a loan officer, as well as your agents that you work with.”

Yates commends the GSFA for a stellar 30 years of making homeownership possible for people who thought it was impossible.

“They’ve obviously had a long history of doing a great job and helping so many home buyers,” she says. “It’s a fantastic organization to align yourself with in terms of their product mix and what they truly offer to clients. I would highly recommend that you join them because you will have clients that benefit from this program over some of the other down payment assistance programs.

Advertising has become monumentally easier with the invention of social media – no need to pay for an ad section in a newspaper, put up a billboard, or set up shops across town when posting on Facebook, Instagram, and TikTok is free. And keeping customer acquisition costs low is the name of the game this year.

Data from recent studies via Market Splash show that marketing on social media can be especially lucrative. In fact, 78% of salespeople engaged in social selling outperform their peers who don’t use social media. Companies with sales teams using social selling have 51% higher revenue growth than non-users. Companies that use social selling generate 50% more leads, and 93% of salespeople using social selling report an increase in their sales.

but according to an originator survey by Loan Officer Hub, only 31% of originators find marketing on social media to be successful. That answer varies depending on the originator’s level of experience, too.

78% of salespeople engaged in social selling outperform their peers who don’t use social media.

Experienced originators have established a reputation with previous clients, so most of their marketing is word-of-mouth. Many originators with 5 years experience or less, however, are still building their reputations, and doing so through social media. That’s why 43% of newer originators find success with social media advertising compared to 26% of experienced originators with 20+ years in the industry.

Yet, in recent years, more mortgage companies and originators have begun to embrace the rise of social selling, seeing it as a way to connect with younger homebuyers.

With everyone’s eyes glued to their phones, why wouldn’t an originator be using social media to advertise their business or services? Many do,

NFM Lending launched a one-of-akind influencer division due to the success of originator Scott Betley (@thatmortgageguy), who has 872K followers on TikTok, and is now vice

president of the influencer division.

Some lenders or brokers may find they have a star in their midst and encourage their own staff to become an influencer, like what happened to Mandy Philips (@ mortgagemandy) when she worked as an originator for Vista Real Estate, based in the Redding-Red Bluff Area. Since then, she has become branch manager for Omega Mortgage Group, expanding her reach nationally. Though Phillips initially didn’t have any experience or much comfortability in front of the camera, she continued posting consistently and eventually gained 123K followers on her main platform, TikTok.

“I don’t ever try to sell them on anything. I just offer help and value, and I’ve been able to turn that into business consistently.”

- Mandy Phillips, Omega Mortgage Group Branch Manager

Mandy Philips

But for any companies that don’t have that kind of talent on staff, they can partner with a separate company of influencers to make content, like Irvine-based What’s A Mortgage (WAM). That’s what brokerage West Capital Lending did in 2023, partnering with the 15 member team of LO influencers at WAM as an experimental way of generating leads. West Capital Lending CEO Daniel

Iskander said he believes it’ll be a boon to growing leads since WAM’s previous partnership with loanDepot led to about $70 million in closed production in just one month.

“My plan was to be a mortgage educator, to inform consumers on what a mortgage is. That’s how we came up with a name,” said WAM co-founder Minh Nguyen. “When I started making content and putting the consumer first without thinking about getting something back, is when it started working.”

Still, the industry has only just begun to skim the surface of social selling.

Nguyen, Orange County-based originator and co-founder of WAM, said he started expanding his presence on social media to minimize his dependence on real estate agents and go direct to consumers. Or, in his case, going directly to his consumer’s “For You” page.

“I can get to the consumer quicker than waiting for the Realtor to do it,” Nguyen said. “We went to US Bank, loanDepot, and after that we went to sell leads to other mortgage companies for a season. And, of course, as the market shifted, we became a mortgage broker in August of last year.”

Nguyen estimates his team of loan officers averages $22 million a month in funded loans. At the company’s peak during 2020 and 2021, they were funding $50 million to $70 million loans per month for loanDepot.

Phillips was initially surprised she found success through TikTok, since she never considered herself a natural in front of the camera.

“Probably about half of my business now actually is just from social media,” Phillips said. “Because of my success with TikTok, I decided to get licensed in multiple states… in addition to California, now I have a license in Texas, Tennessee, Florida, and South Carolina, because I noticed that I was getting a good amount of leads from those

states as well.”

People from these states would reach out to her through the comment section, direct messages, or through her email which is shown on her account page.

“I don’t ever try to sell them on anything. I just offer help and value, and I’ve been able to turn that into business consistently,” Phillips said.

WAM was not Nguyen’s first attempt at starting his own company, though. In 2016, he started Vision One Mortgage, a small direct lending company, but just one year later, he lost everything due to his staff being poached by other lenders, bringing their Realtor partners along with him. To make matters worse, one of his loan officers left him in debt from his bad loans.

“I had to liquidate all my assets to pay back all the bad loans that my loan officer stuck me with, and we had to scratch and dent a bunch of loans,” Nguyen said.

“Everything was sold off. I owed about $600,000 in just money to the collectors or warehouse lines and all that. I was losing everything.”

Nguyen’s surmounting debt caused him to lose his mortgage company, his house, and even his marriage, in one fell swoop.

“Everyone left me,” Nguyen said. “But as they were leaving me, that’s when I built my social [presence] in 2017.”

In the aftermath of his downfall, Nguyen began leaning on social media to build up his advertising and catch as much business as quickly as possible. With the help of some social media advertising for his mortgage and credit repair business, he did. From March to November in 2018, Nguyen was able to pay off the $600,000 he owed through the leads he generated on social media.

“I saw it change my life and it made me go all in on it,” Nguyen said.

Phillips, on the other hand, began her career as a Realtor before transitioning to be a mortgage originator. Her husband owned the real estate brokerage, Vista Home Loans, and had been wanting to add lending to their business for some time.

“Your first 10 or 15 videos are going to be awkward and a little bit painful to go back and rewatch. But, the more you do, the easier it gets.”

Mandy Phillips

“As realtors, we’re in the dark,” Phillips said. “We’d get these very inconsistent updates from the lender after trying to track them down for days. We would need to draft extensions [and] everybody would get frustrated. So I decided I will go ahead

and get licensed.”

As for her influencer career, Phillips’s story is similar to Nguyen’s in which she got her start because she was tired of answering the same questions posed by consumers, and saw the need for more financial education.

Phillips made a list of her borrowers’ frequently asked questions and

short videos that provided in-depth responses. When her clients would reach out with these frequently asked questions, she’d include the video in her email response.

“People have responded really well to it,” Phillips said. “They like it and it’s more digestible for them.”

Phillips’s strategy of answering frequently asked questions is a great way to get started with making content. Taking on the role of financial educator is a generally successful approach, especially for originators targeting first-time homebuyers.

When Nguyen worked as a loan officer for his previous employers, he realized many consumers don’t know what a mortgage is or how to qualify for one, hence the company name What’s A Mortgage.

But financial education is helpful to all homebuyers, especially when it comes to different loan options, Nguyen said. Move-up buyers may be newly self-employed and need a Non-QM loan, or considering down payment assistance, or want to be updated on the latest government programs and affordability products.

Accordingly, the first thing mortgage influencers, Nguyen and Phillips, did was identify their target audience and what they want to learn. In the same way originators learn their market in order to decide which products to offer, social sellers need to make targeted, market-based choices on content.

For underserved, low-income, or first-time borrowers, content

explaining affordability programs and products are helpful, as well as news impacting home prices and mortgage rates. Basic educational content about the mortgage process or loan types also works, or explaining terms like FHA, VA, USDA, conventional, mortgage insurance, and down payment assistance.

However, Phillips warns content creators to not dwell too much into their niche. They need to cast a wide net to draw a substantial audience. An originator specializing in divorce lending may gear most of their content in that direction, but attracting a broader following requires a broader content offering.

“I just do the basic loans myself,” Phillips said. “I think that that type

of video content is going to bring in the clients and the leads that you’re looking for.”

Nguyen also warns originators to ensure they actually offer the products and programs they talk about. That way the content creator has a better chance of converting clicks to leads, because it’s all about building trust and accountability with the borrower.

“When you start mixing the content together, you’re sending the wrong signal to social media,” Nguyen said. “If I told you, ‘Hey, I love hamburgers, I love meat,’ [and] then you bring me a burger. But I’m like, ‘Why? Why did you bring me a burger? I like tofu.’ It’s just so confusing. So just tell me one thing and let’s stick to that one thing.”

“I saw it change my life and it made me go all in.”

- Minh Nguyen What’s A Mortgage Co-founder & Partner

Converting clicks to leads and leads to funded loans is the entire point of social selling, but sources say it takes more than good content to get borrowers across the finish line. If an originator has been consistently putting out content but not generating leads, they need to take a step back and ask themselves what problems need to be addressed.

Content needs to reach an originator’s target borrowers. If the originator is licensed in multiple states, it’s wise to make content involving those specific states so that borrowers in those states are directed to those videos, Nguyen said. Using hashtags and keywords in the video description – #California if that’s where the originator is licensed, or #FHA if that’s the borrower demographic – also helps refine content.

The creator’s choice of platform may be another reason for not building enough leads.

“TikTok is where you find all your content because they build out like more of a Google version of finding

content. Instagram’s more hashtags,” Nguyen said. And, stop using LinkedIn for consumer-targeted content, he added. “LinkedIn’s more for brand building… but you’re not gonna get the business that you want to get out of it.”

Many people assume to know what the audience demographic is for each app, like Gen Z uses TikTok, millennials like Instagram, and older generations prefer Facebook. Those user trends are generally true, but it’s not the whole picture. Faulty assumptions mean missed opportunities, as Phillips learned when she first started posting content. Originally, she thought TikTok was for kids.

“I’ve had borrowers in their, you know, fifties, sixties — I think even one in her seventies — that found me through TikTok. So, you know, I was totally wrong,” Phillips said. “I was really surprised at the range of ages that I ended up attracting.”

Informing Phillip’s assumptions now is the fact that, since the pandemic, TikTok has expanded its footprint to reach a much broader audience of consumers.

Am I making magnet content and anchor content?

Magnet content, Nguyen explained, attracts people to influencers’ videos and channels. Anchor content, meanwhile, gets the audience to stay and interact with your page for a while. Without a balance between the two, originators may see their social strategy stagnate.

“They’re all doing anchoring content,” Nguyen said. “So the platform is not finding them a new audience.”

Overall, mortgage is not a sexy topic. And yet, originators’ videos compete for views with every other video on their chosen platform, including funny cat videos, celebrity gossip, and breaking news from around the world. How can mortgage videos be equally magnetic?

Nguyen recommends making short form content — 15 or 20 second long videos. Do memes, duets, or stitches (see graphic) about anything mortgage and real estate related.

“Unless you are this amazing presenter, like the real Wayne Turner or the mortgage kitchen, you’re not

God’s gift to real estate mortgage. So do trends,” Nguyen said. “Don’t do all these talking videos… Do all the easy content that doesn’t even require you even being in the video.”

Anchor content is where the real substance lies, though. For this type of content, creators may discuss industry insights and provide advice to homebuyers. Creators may answer questions like: Should I use a broker? What’s an FHA 203K loan? What is The Fed doing? How do I get a lower mortgage payment in today’s market?

Duet:

Duet allows you to post your video sideby-side with a video from another creator on TikTok. You must have a public account to allow others to Duet with your videos.

Meme:

Most people know what image memes are, but what are audio memes?

Essentially, they are trending sounds on TikTok that people add their own video to, like the “It’s Corn” song or the “Oh no” song to signal something bad is about to happen.

Stitch:

This is a creation tool that allows you to combine another video on TikTok with one you’re creating. If you allow another person to Stitch with your video, they can use a part of your video as a part of their own video.

In most cases, people don’t become originators to become social media influencers. The thought of talking excitedly to an audience of potentially thousands of people can feel uncomfortable.

But, no one is a natural-born star, and as Nguyen says, it’s okay to be bad at it when first getting started. Just keep posting consistently!

“I didn’t have a good editor, so our clips weren’t amazing. Transitions were horrible. The lighting was bad, everything was horrible,” Nguyen said. “But I posted twice a day and I went live twice a week. It was crappy going live because I only had five people watching me, my mom, my dad, my brother, my business partner, and my business partner’s parents.”

Are my videos aesthetically pleasing?

Mortgage professionals know that when they’re meeting a client or associate, they need to look nice. The same rule applies for video content. Some creators dress and act more casually online than they do in-person, which is okay, but the video should have some aesthetic appeal.

The location where the video is recorded should have good lighting and a pleasant-looking background. Avoid having anything in the video that may distract the audience. Don’t get too fancy with your editing, warned Phillips.

“I see a handful of loan officers or mortgage brokers put out content that is super edited to where it looks really aesthetically pleasing, but it is not connecting with the viewer because it looks too overproduced,” Phillips said.

Phillips said she’s made a few videos like that herself, but they didn’t get a lot of engagement. So, what’s the point of putting in all that effort?

Having great visuals is especially important when posting to Instagram, Nguyen said, whereas TikTok is more audio based.

Visuals also include captions, which can help users find your video if they identify or show interest with those key terms, such as FHA, DPAs, or first time homebuyers.

“So when you talk on TikTok and on Instagram too, if you put it in the captions and then the description, you’re telling Instagram and TikTok what you want,” Nguyen said.

It took Nguyen a while to build up an audience, going from five viewers in June 2017 to 100 or 200 per video in February 2018. All it took was one video going viral – his V-O-E video, where he sings, “Gimme a V, I got your V, I got your V! Gimme an O, I got your O, I got your O!” with a cheerleader-type dance to teach viewers about verification of employment.

It initially got 2,000 views, and after liquidating his house in March to pay off his debts, Nguyen used some of the remaining money to run the video as a YouTube ad in May. He was able to fund nine loans off the proceeds. The rest is history, he said, and he kept building his business from there.

Phillips also often made herself cringe before she developed her showmanship. Although she doesn’t recommend posting a bad video for the sake of creating content, she does advise beginners to go easy on themselves in the beginning.

“Your first 10 or 15 videos are going to be awkward and a little bit painful to go back and rewatch,” Phillips said. “But, the more you do, the easier it gets. And you just got to start doing it, and you just got to be consistent. The biggest thing is consistency.”

As his last piece of advice, Nguyen says all newbie content creators should remain patient. Generally, leads don’t flood in overnight. “But when you do get a deal,” he said, “I’m sure it’s gonna be a whale of a deal.”

The mortgage industry is going through a significant change. For mortgage origination professionals, it’s a struggle to keep on top of all the changes, and to keep your sales strategies and marketing initiatives at their peak. You need to keep your pipeline filled, and you need the tools and directions to stay profitable, efficient, and effective. We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros.

California Broker Magazine readers like you can attend for free by using the code CBMFREE.

www.camortgageexpo.com

You’ve seen it in your neighborhood. The marquee grocery store has closed. Varying by city, a Dollar General, Dollar Tree, or Family Dollar opens in its place. The message that Safeway or Albertsons sends by closing is clear: profitability exists elsewhere.

This scenario has been mirrored in the mortgage business since the Great Recession began 15 years ago. Nationally, banks have executed a strategic retreat from residential lending and Main Street. In their stead, independent mortgage banks (IMBs) have expanded access to mortgage credit for many low- and moderate-

income (LMI) and majority-minority communities.

Last April, the Housing Finance Policy Center of the Urban Institute, a Washington, D.C.–based think tank that conducts economic and social policy research, released, “An Assessment of Lending to LMI and Minority Neighborhoods and Borrowers.” This report cataloged how in the context of a widening homeownership gap and proposed reforms to the federal Community Reinvestment Act (CRA), IMBs dramatically outperform banks in residential lending to LMI and minority borrowers.

In an addendum to the national study the authors

analyzed data for five states where state-level CRA frameworks covering nonbanks have either been adopted or proposed, including: Massachusetts, New York, Illinois, Maryland, and California. The authors found that the national trend of IMB dominance holds true in California, the largest and most expensive housing market in the country.

All of which, surprisingly, has even the Urban Institute questioning the groundswell movement to subject IMBs to the strictures of the Community Reinvestment Act, or state-level mandates such as the one being proposed in California. Ultimately, more compliance means more costs – costs that are always passed through to consumers, like those an expanded CRA would seek to help.

For the years the Urban Institute examined in its report, 22.5% of all IMB lending in California was in LMI neighborhoods compared to 13.9% for banks. Furthermore, 22% of all IMB lending was in predominantly minority neighborhoods compared to 16.1% for banks. The report was commissioned by the Mortgage Bankers Association (MBA) to compare the lending patterns of entities subject to CRA requirements, like banks and thrifts, with those of lenders not subject to the statute, like IMBs and credit unions.

The MBA, for its part, believes the Urban Institute’s research serves as a caution to federal and state

“I’m not sure nonbanks should be subject to CRA because they’re already doing more, they’re in one line of business. It seems like it’s a solution in search of a problem.”

> Laurie Goodman, an Urban Institute fellow

policymakers who think shrinking the IMB market share is a good policy objective on its own and provides more solid evidence that IMBs already lead the mortgage market in sustainable lending to LMI borrowers and communities. The MBA said in a statement that proposals that apply CRA mandates to IMBs are “ineffective and misguided, as IMBs do not have deposits to reinvest and do not have access to direct government support.”

Laurie Goodman, an Urban Institute fellow, founder of the Housing Finance Policy Center, and one of the assessment’s authors, says this performance gap stems in part from banks originating a lower volume of Federal Housing Administration (FHA) loans, which disproportionately go to LMI neighborhoods and borrowers.

Furthermore, while banks view mortgages as an auxiliary business that complements their front-and-center retail offerings, IMBs are wholly in the mortgage banking business, she says. “I’m not sure nonbanks should be subject to CRA because they’re already doing more, they’re in one line of business. It seems like it’s a solution in search of a problem.”

Banks, she added, aren’t looking for the same challenges IMBs are. “They basically make loans to anyone that fits within the box. By contrast, the banks are in a lot of different businesses. … The result of that is if there’s one hint of reputational risk, the banks run,” she says. Reputational risk because, Goodman points out, the banks aren’t really bearing the credit risk for government-insured loans – the government is. Banks moderate this risk by raising their lending threshold with tighter credit overlays. Functionally, these overlays act like cat flaps that let in the cat but keep out the dog, erecting barriers to homeownership that disproportionately impact

“Continuing to add cost or complexity is going to add cost. Ultimately, that gets passed on to the consumer ... I think the very consumers you’re trying to serve with a CRA requirement. I don’t think anybody’s trying to harm these consumers, but the consumers that they’re trying to serve would ultimately be hurt. It would have a reverse effect on them.”

> Bill Lowman, vice chairman, American Pacific Mortgage

When it comes to individual borrowers, IMBs still hold the lending edge in California, with 13.4% of their total lending going to LMI borrowers compared to banks’ 7.2%. The gap is slightly narrower with minority borrowers – 57.9% for IMBs and 53.9% for banks. Yet, IMBs are twice as active than their bank counterparts in lending to borrowers who are both LMI and minority, with 8.8% and 4.4% of mortgage lending going to those borrowers, respectively.

Given the elevated costs of homeownership in the state, more than one-third of all existing homeowners in California fall under the LMI threshold, per the Institute’s analysis. One-fifth of all homeowners in California live in LMI neighborhoods and one-quarter of homeowners live in predominantly minority neighborhoods.

Though the Urban Institute did not include market-level data for California, a review of 2022 HMDA data compiled by Richie May, a data and business services advisor, shows the lending disparities between banks and nonbanks continuing into 2022, with IMBs originating 51% of all residential mortgages in California compared to banks’ 42% and credit unions’ 7%.

Government-insured FHA loans that typically go to LMI and minority borrowers comprised 14% of all IMB lending in California in 2022. Though FHA lending comprised only 7% of mortgages originated in the state in 2022, IMBs accounted for 93% of these mortgages – nearly 87,000 loans worth nearly $37 billion, according to Richie May’s data.

The average FHA loan amount was $425,000, which speaks to the extremely high cost of housing in the state, given the national average for FHA loan amounts in 2022 was $270,000.

The debate over implementing state-level CRA frameworks hinges on whether increased regulation and oversight will actually result in increased lending to LMI and/or minority borrowers.

Sen. Monique Limón introduced Senate Bill 1176, California Community Reinvestment Act, to the California Legislature in 2022 in an effort to fold nonbank lenders into a state-level, CRA-style mandate. The bill passed the California Senate in mid-2022, but was later amended by the state assembly’s Banking and Finance Committee to remove the community reinvestment mandate and add language to explore whether other states that have enacted laws modeled after the federal CRA statute actually experienced an increase in lending to underserved communities, as compared with states that have not enacted similar laws.

Paulina Gonzalez-Brito, chief executive officer of Rise Economy (formerly the California Reinvestment Coalition), a statewide coalition of housing and community development organizations, says a state-level mandate will add transparency to

a historically opaque process for borrowers. “Nonbank mortgage lenders really obscure, or don’t provide as much data on race in terms of who they’re lending to under HMDA. So, it’s really problematic and doesn’t give us a clear picture of how they’re doing in terms of lending to black, indigenous, and people of color, and whether there’s any disparities or any fair lending concerns.”

The revised bill did not pass the California Legislature during the 2022 legislative session, but Gonzalez-Brito and advocates of a state-level CRA for nonbank lenders are planning on bringing the measure before the legislature in 2024.

Member organizations of Rise Economy are particularly concerned about the prevalence of “steering” –the practice of ushering borrowers into a particular loan product or program that may be more advantageous for the lender than the borrower. Rise Economy released its own report in spring 2023, “Exploring Mortgage Trends In California,” which tracked state-wide lending patterns of banks and nonbanks using the National Community Reinvestment Coalition’s

For the most part, Rise Economy’s report affirms many of the Urban Institute’s findings, but the report did find that black borrowers in California more often received governmentinsured loans from mortgage companies, regardless of income. The fact that government-insured loans are associated with higher costs for borrowers and higher profit margins for lenders raises the question of potential steering of conventional loan-qualifying borrowers of color into higher-cost, government-insured loans.

“As they do their housing counseling, for instance, they see people come in who would have qualified for a conventional loan, but were in a government-backed loan,” Gonzalez-Brito says.

Jamie Buell, a research analyst for Rise Economy and the report’s author, says just because mortgage companies are stepping up to serve LMI borrowers and borrowers of color doesn’t mean these companies are better serving these communities. “Independent mortgage companies,

state-chartered banks, if they are well-serving these communities, then they should have no problem with at least being evaluated as a first step of their provisions and service of these communities,” Buell says.

But, IMBs are heavily regulated already, says Bill Lowman, vice chairman at the Rosevillebased American Pacific Mortgage. He worries that a CRA mandate for IMBs could reverse the progress IMBs have made in expanding credit to LMI and minority borrowers. American Pacific Mortgage, which is licensed in 49 states, gets audited separately by all 49 states, he says – in addition to auditing by the FHA, USDA, VA, and CFPB.

Contrary to Buell, it’s not being evaluated that worries Lowman, but the added compliance expenses that continue to drive up the cost of origination. These costs are passed straight to borrowers in the form of increased mortgage rates

Paulina Gonzalez-Brito Chief executive officer Rise Economy

IMBs’ general revenue model.

“The actual content of what they’re calling CRA is not what the federal CRA laws actually created and represent. The federal laws were created in the 70s in order to address certain inequities, but specifically to ensure that when a depository institution took deposits from one community, that they cycled those deposits back into the same community via loans,” Stork points out. “That was fundamentally the purpose … to make sure that the dollars that came out of the Bronx went back into the Bronx. The dollars that came out of Compton went back into Compton. The dollars that came out of Houston went back into Houston.”

“IMBs are by far and away the first lender and the lender of choice for the very borrowers that a new CRA program is intended to support in the first place.”

> Taylor Stork President, Community Home Lenders of America

“I think the very consumers you’re trying to serve with a CRA requirement,” Lowman explains, “I don’t think anybody’s trying to harm these consumers, but the consumers that they’re trying to serve would ultimately be hurt. It would have a reverse effect on

What states are calling “CRA” for nonbanks doesn’t actually track with what the federal statute requires of banks, says Taylor Stork, chief operating officer of Developer’s Mortgage Company and president of the Community Home Lenders of America, a national association of small and mid-sized communitybased mortgage lenders. A CRA-like mandate for IMBs is a conflict in terms given

IMBs, of course, don’t take deposits. Most IMBs are privately owned and generate loans using privately-raised capital. Selling their loans to depositors and investors provides IMBs with the liquidity they need to continue originating. “The monies that mortgage companies utilize are their own monies that are used,” he continues. “It’s their own capital – that is then used as collateral in some cases – that is used to then borrow monies from depositories to make the loans.”

A CRA-like mandate for IMBs could also conflict with IMBs’ licensing requirements, creating an undue burden for businesses and borrowers. While banks face heavier federal regulations, IMBs are regulated on a state-bystate basis. This means, Stork says, “whether it’s Illinois or New York or somewhere else, IMBs tend to operate in the communities where they serve the borrowers. We do loans where we live and where we work. It’s just the nature of the model.”

Adding operational complexity with layers of redundant regulation only increases origination costs that are passed on to borrowers, says Stork. Besides, he continues, “When you add new legislation or regulatory controls on top of that – particularly when you add regulatory controls to an industry

that is already outpacing the controls that are meant to manage them in the first place –when you add those regulatory controls what you’re actually doing is making it more difficult for the IMBs to operate.”

IMBs’ business model isn’t just built on a profit motive, but what Stork calls an “existence motive.” IMBs help any borrower they can, even higher risk borrowers, because they have to hit production volumes. Imperiling the operations of IMBs also imperils the communities they serve.

“We know that the vast majority of loans to disadvantaged borrowers are done through the FHA loan program through the Department of HUD. We know that factually, we know it mathematically, and we know it statistically,” he says. “We also know that 90% of those loans are made by IMBs. IMBs are by far and away the first lender and the lender of choice for the very borrowers that a new CRA (Community Reinvestment Act) program is intended to support in the first place.”

The reasons banks have retreated from mortgage lending, especially FHA programs, mostly stem from the 2007-2008 financial crisis, says Clifford Rossi, director of the Smith Enterprise Risk Consortium at the University of Maryland and a former banking industry executive.

Many banks no longer had an appetite for volatile assets such as mortgage servicing rights, he says. Banks were also getting burned on the origination side through non-traditional mortgages, such as alt-A and subprime loans. But, regulators’ lack of guidance also played a role.

“Another big reason the banks got out,” says Rossi, “particularly around FHA lending, but even more broadly, in the years following

the financial crisis there was an awful lot of uproar by banks in terms of the lack of transparency of repurchase demands that were being made by the GSEs [Government Sponsored Enterprises], private mortgage insurance companies, and also by the FHA.”

Mortgage repurchases occur when buyers of mortgagebacked securities, such as Fannie Mae or Freddie Mac, determine there are defects in how a loan was made, leading them to demand a repurchase by the lender. After such hefty penalties were levied, Rossi noticed a prevailing attitude among banks – that there was a lack of consistency in the way FHA and the agencies audit for defects in the way banks underwrite or value loans from a collateral standpoint.

Goodman echoes Rossi’s assessment, saying that “banks feel like a lot of them received fines as a result of bad lending during the financial crisis, and that the rules of engagement aren’t as clear as they could be, particularly for servicing loans.”

For those lenders that do have an appetite – and an incentive – to lend within LMI and majority-minority communities, Stork says support and structure need to be created for borrowers instead of for loans.

“I believe that we need to focus on the people instead of the package,” he says. “When we talk about lending to people, we’re talking about lending in a community and helping build the American Dream. When we look at loans, we’re talking about assets. Assets can be problematic on a bank’s balance sheet when they have basis risk and the assets don’t match the deposits and things like Silicon Valley Bank happen.”

Aubrey Gilmore

Samuel Bjelac

Thomas Yoon

Eric Wu

Bret Rathwick

Kevin Bender

Michael Anthony

Aubrey Gilmore

Samuel Bjelac

Thomas Yoon

Eric Wu

Bret Rathwick

Kevin Bender

Michael Anthony

A San Diego-based provider of hazard insurance claims management for the mortgage industry announced a promotion among its executive leadership this week.

Rutledge Claims Management (RCM) promoted its chief operations officer Aubrey Gilmore to president. In this new role Gilmore oversees the company’s core services, driving strategic decisions, and ensuring client satisfaction, officials said in a statement.

“The decision to promote Aubrey to president was a very simple one,” RCM CEO Allison Rutledge said. “As COO, she managed our internal operations to near perfection, while her hard work and unwavering commitment to our clients solidified our status as a proven leader in the hazard claims market. I am confident Aubrey’s extraordinary leadership will guide RCM to new heights and continue to drive successful outcomes for our clients.”

RCM founder and former president Tom Rutledge is taking on the newly-created position of chief financial officer, managing the company’s fiscal operations and growth.

“I’m honored to lead RCM in this crucial moment for the housing industry,” Gilmore said. “As servicers and investors seek innovative solutions for operational efficiency amid evolving challenges like climate risk, I plan to expand our services to help clients navigate these changes while delivering exceptional results.”

The graduate of Rutgers University, who joined RCM in 2008, said she is prepared to tackle the complex challenges of the hazards claim market into the future.

“The combined impact of inflation and increased disasters is driving up home insurance costs,” Gilmore pointed out. “Insurers are raising rates, pulling back from key markets, and cutting costs. In today’s climate, It’s imperative for servicers and investors to establish stringent controls, ensuring continuous monitoring of insurance coverage to protect assets. Because insurance carriers may cut corners, our work at RCM becomes pivotal,” she continued. “We not only help recover every dollar rightfully due under the policy, but also serve as a crucial partner in efficiently filing claims. Our comprehensive support helps maximize returns and protect our clients’ interests.”

Summit Funding is looking to redefine Non-QM lending, starting with the appointment of Thomas Yoon in a new leadership role.

The Sacramentobased mortgage company announced that Yoon has been appointed head of Lead+ Wholesale Lending in its Non-QM division. Under Yoon’s direction, the division will introduce a new broker development program, employing advanced marketing and sales strategies to enhance their pipelines and market presence within NonQM, company officials said.

Yoon will be accompanied in this venture by a team of colleagues with expertise in the Non-QM lending sector. Company officials said their collective experience,

particularly in nuanced underwriting practices, “promises mortgage brokers a level of support and understanding unmatched in the industry.”

Yoon, whose LinkedIn profile lists him as president of EQA Mortgage and Brokers Advantage Mortgage, also spent eight years in various leadership roles at Excelerate Capital.

“It’s not just about offering Non-QM loans; it’s about providing a foundation for brokers to confidently navigate this complex market,” Yoon said. “Our team’s depth of experience ensures that every loan we handle is approached with the insight and precision it deserves. Our commitment extends beyond transactions. We’re here to build a community of highly skilled, knowledgeable brokers who are equipped to meet the evolving needs of today’s diverse borrowers.”

The California-based Carrington Mortgage Services is bringing Samuel Bjelac back to lead its third-party origination lending teams. Bjelac

previously served as divisional vice president of Carrington Mortgage Services’ wholesale lending team. Prior to his return Bjelac honed his non-QM expertise as EVP of national sales at Sprout Mortgage, while also leading the third-party origination teams at CoreVest Finance and LendingOne.

“Samuel brings more than 20 years of mortgage experience to Carrington,” said Greg Austin, EVP of lending for CMS. “Combining a deep understanding of the non-QM business, along with his sales leadership experience, I am very excited about the future of wholesale and correspondent at CMS.”

Bjelac will report to Austin and his primary areas of responsibility include aligning the wholesale and correspondent sales organizations.

“I am blessed and humbled at the opportunity to come back to a company I called home for so many years; and I’m thrilled to continue building, growing and serving a high-performance sales team that can excel in any market,” Bjelac said. “Our incredible loan programs, advanced technology and enviable operations teams are solidly committed to providing unwavering support to our mortgage industry partners.”

Residential real estate ecommerce platform Opendoor Technologies Inc. will bid farewell to its founder at the start of the New Year, according to a document filed with the Securities and Exchange Commission Dec. 14.

President of Marketplace Eric Wu announced he would be resigning from the firm and its board of directors effective Jan. 1, 2024.

“Eric has taken the radical idea of simplifying life’s biggest and most complex transaction – buying and selling a home – and transformed it into a fully digital, streamlined experience on a world-class technology platform,” Opendoor CEO Carrie Wheeler said in a statement. “Together, and with his leadership over the years, we’ve built something impactful that’s helped over 250,000 people move with simplicity and certainty. I want to thank Eric for his courage, innovation, and grit over the years. Opendoor would not be here without him and his unwavering commitment to our customers.”