Old-Fashioned Banking Meets

Pennsylvania bank is growing through its relationship with the Amish

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

BENEFITS

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning Visit

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Inquire about our NMLS Data Licensing and LO Contact Database options.

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

At the onset of the pandemic in 2020, U.S. consumers dramatically changed how they purchased goods and services, favoring credit cards by a significant margin and increasing their use of online payments. With the country emerging from the pandemic and economic conditions characterized by high inflation, Federal Reserve researchers were interested to see if this trend would continue.

Analyzing the 2022 survey data that informs the Diary of Consumer Payment Choice, they found that 2020’s shift away from cash and toward credit card payments has continued. Consumers continued to reach for credit cards at a higher rate in 2022. Their use of online payments also remained elevated compared to pre-pandemic payment habits. By contrast, consumer use of debit cards and cash held steady at 2020 levels.

Although consumers are making fewer cash payments when compared to prepandemic, both on-person and storeof-value cash holdings remained above pre-pandemic levels in 2022, signifying 1) consumers’ demand for cash remains and 2) there may be a long-term impact from

the onset of the pandemic on consumer cash holdings.

The key diary findings are:

• The share of payments made using cash declined slightly from 2020 and 2021 to 18% of all payments, driven by an increase in non-cash payments and not a decrease in cash payments.

• The share of in-person purchases and person-to-person (P2P) payments remained steady since 2020 at 81%.

• On-person cash holdings increased by $5 from 2021, averaging $73.

• Average store-of-value holdings remained elevated compared to prepandemic holdings and increased slightly to $418.

The consistency across these cash data points since the start of the pandemic revealed what may be a new normal level of cash payments and holdings.

Another key takeaway from 2022 payment trends was the leveling-off of mobile app payments. Although consumers rapidly shifted toward online and remote

• Fewer consumers reported that they preferred cash when making in-person payments.

• The number of in-person payments at retailers where consumers make most payments returned to pre-pandemic levels; however, cash payments at these retailers did not.

• The change in consumer shopping habits resulted in fewer payments of less than $25 compared to 2019. Historically, cash has been used more often for such payments.

CEO, PUBLISHER, EDITOR-IN-CHIEF

Vincent M. Valvo vvalvo@ambizmedia.com

ASSOCIATE PUBLISHER

Beverly Bolnick bbolnick@ambizmedia.com

EDITORIAL DIRECTOR

Christine Stuart

EDITOR

David Krechevsky

SENIOR EDITOR

Keith Griffin

MULTIMEDIA PRODUCER

Mary Quinn

STAFF WRITERS

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley

SPECIAL SECTIONS EDITOR

Gary Rogo

DIRECTOR OF STRATEGIC GROWTH

Alison Valvo

CHIEF MARKETING OFFICER

Steven Winokur

DESIGN MANAGER

Meghan Hogan

GRAPHIC DESIGN MANAGERS

Christopher Wallace, Stacy Murray

DIRECTOR OF EVENTS

Navindra Persaud

UX DESIGN DIRECTOR

William Valvo

MULTIMEDIA SPECIALISTS

Tigi Kuttamperoor, Matthew Mullins

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Andrew Berman

PROJECT MANAGER

Julie Carmichael

MARKETING & EVENTS ASSOCIATE

Melissa Pianin

ONLINE ENGAGEMENT SPECIALIST

Kristie Woods-Lindig

ADVERTISING ASSOCIATES

Nicole Coughlin, Nichole Cakirca

INTERN

Lydia Griffin

BY MAGGIE DAVIS, SPECIAL TO BANKING NORTHEAST MAGAZINE

BY MAGGIE DAVIS, SPECIAL TO BANKING NORTHEAST MAGAZINE

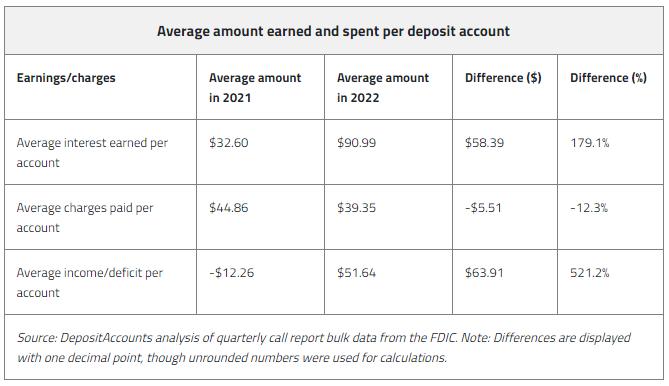

Two major U.S. banks — Silicon Valley Bank and Signature Bank — closed in March 2023 and First Republic Bank was forcibly sold on May 1. But while the shutdowns came as a shock to the general public, there is some positive news for the average bank account holder: Over the last two years, banking has shifted to favor the depositor. Not only have the amount of banking fees dropped, but consumers’ interest earnings have risen dramatically — with interest rates seeing particularly notable increases in the third and fourth quarters of 2022.

For this study, DepositAccounts.com,

trasts sharply with the $24.3 billion paid out in 2021, for a year-over-year increase of 223%.

• Banks collected $33.1 billion in fees on these same accounts in 2022, down from $34.0 billion in 2021, a drop of 2.6%. Combined, this represented a net gain for depositors of $45.6 billion in 2022, compared to a net loss of $9.6 billion in 2021.

• This translates to average interest earnings of $90.99 per deposit account in 2022,

compared to $32.60 in 2021, a gain of 179% for depositors. Deposit accounts include demand deposit accounts, such as checking accounts; savings deposit accounts; time deposits, such as certificates of deposit; and certain retirement savings accounts.

• Meanwhile, the typical account was charged $39.35 in bank fees in 2022, down 12% from $44.86 in 2021. Overall, this left depositors with a surplus of $51.64, compared with a deficit of $12.26 a year earlier.

• Looking at the quarterly progression, the average account basically broke even in the second quarter of 2022, earning an average of $10.71 that quarter in interest while paying $10.63 in fees. By the fourth quarter of 2022, the accounts earned an average of $47.16 in interest and only paid $8.47 in bank charges.

• In fact, banks paid out $23.0 billion and $41.6 billion in interest on deposit accounts in the third and fourth quarters of 2022, re spectively. This compares to a total payout of

$38.4 billion in the preceding six quarters combined.

• Banks also ended 2022 with 882.3 million individual deposit accounts, an increase of 68.1 million (8.4%) compared to the end of 2021.

Money talks, and in 2022, banks had a lot to say. In fact, they paid out a whopping $78.7 billion in interest to domestic deposit accounts, a stark contrast to the mere $24.3 billion they paid out the year prior. That’s a staggering year-over-year increase of 223%.

What’s driving this surge in payouts? According to DepositAccounts founder Ken Tumin, rising interest rates are largely to blame here.

“The Fed increased its benchmark rate in 2022 at the fastest pace in decades,” he says. “Even though banks were slow to pass on these rate increases to their deposit accounts, over the past year, consumers were still able to see a widespread positive impact on deposit rates.”

What’s also clear is that banks are ramping up their efforts to attract and retain customers — especially with deposit accounts (which include checking accounts, savings accounts, certificates of deposit (CDs) and certain retirement savings). One way they’re doing so is by charging less in fees: In 2022, banks collected $33.1 billion in fees from domestic

deposit accounts, a decrease of 2.6% from the $34.0 billion collected in the previous year.

According to Tumin, overdraft fees — which make up the bulk of fees that depositors pay — are likely the single largest contributor to this drop. That’s because in the last year, many banks either revised their overdraft fee policies to be more consumer-friendly or eliminated those fees altogether.

When you add it all up, depositors walked away with a net gain of $45.6 billion in 2022, a stark contrast to the net loss of $9.6 billion in 2021.

What does that mean for the average depositor, though? More green. The average interest earnings per deposit account were $90.99, a massive 179% increase from the previous year’s average of $32.60. This surge in interest earnings tells just one part of the story, as bank fees were down too: The typical deposit account was charged $39.35 in bank fees in 2022, down 12% from $44.86 in 2021. Overall, these increasing earnings and decreasing fees left depositors with a surplus of $51.64 — that compares with a deficit of $12.26 a year earlier.

Maggie Davis is a writer for DepositAccounts, where this article first appeared.

High inflation hurts everyone, but it’s hardest on those who can least afford to pay more for groceries, rent, and gas. Persistently high inflation also undermines the ability of our economy to reach its full potential.

Today, I’m going to talk about inflation, which remains a top concern. I’ll also give my views on the economic outlook and monetary policy.

Before I go any further, I need to give the standard Fed disclaimer that the views I express today are mine alone and do not necessarily reflect those of the Federal Open Market Committee—what we call the “FOMC”—or others in the Federal Reserve System.

Over the past three years, our economy has endured a remarkable series of events that have added to economic uncertainty. First came the pandemic, which caused huge and prolonged imbalances between demand and supply that are still with us today. Then Russia’s war on Ukraine fueled higher global energy and food prices.

More recently, stresses in parts of the banking system are likely to result in a tightening of credit conditions that will in turn reduce spending by businesses and households. The magnitude and duration of these effects, however, are still uncertain.

The FOMC is responsible for setting

monetary policy. We are mandated by Congress to promote maximum employment and price stability. On the employment side, the U.S. labor market has been extremely resilient. Job growth has been strong, job vacancies are plentiful, and at 3.6%, the national unemployment rate is near halfcentury lows. I should also note that Connecticut’s unemployment rate has fallen to a low level of 4%.

Inflation is another story. The FOMC defines price stability as 2% inflation, as measured by the personal consumption expenditures (PCE) price index. Our

commitment to 2% inflation is an important bedrock principle, providing a “North Star” for policy decisions and helping to improve the public’s understanding of our goals and actions.

Inflation reached a 40-year high of 7% this past June. While it has since moderated to 5%, it is still well above our longer-run goal. Without price stability, we cannot achieve maximum employment on a sustained basis. That is why it’s so important for the FOMC to use its monetary policy tools to bring inflation down.

Our most important policy tool is the setting of the target range for the federal funds rate, which influences demand for goods and services by affecting borrowing costs.

To show how this is helping to reduce inflation, I’ve been using an analogy of a mechanism, such as a watch, that is powered by gears.

The watch represents the economy, and its gears are different sectors. To keep time accurately, the gears need to turn at the right speed. But the ones that drive inflation have been spinning at different rates.

The first inflation gear relates to globally traded commodities, such as lumber, steel, and grains. Thanks in part to tighter monetary policy here and abroad, demand has eased, and commodity prices have moderated.

The second gear, which represents

goods such as cars, appliances, and furniture, is turning nearer where it needs to be, as higher interest rates have helped curb demand. Supply-chain bottlenecks that plagued the economy earlier in the pandemic have receded, which is also helping bring goods price inflation down.

The gear that’s having the most trouble turning represents non-energy services excluding housing. It’s influenced by the balance of overall supply and demand for these services and labor, and it will likely take the longest to bring inflation in this sector down fully.

One aspect of inflation that’s important for achieving and sustaining price stability is the anchoring of inflation expectations. Various measures of longer-run inflation expectations have remained well anchored at levels consistent with our 2% goal.

Inflation expectations for the next few years, which increased as inflation was rising, have come down in recent months. The New York Fed’s monthly Survey of Consumer Expectations showed that three-year-ahead inflation expectations are back to where they were in early 2021, and one-year-ahead expectations have

decreased sharply.

With all this in mind, last week, the FOMC raised the target range for the federal funds rate to 4-3/4 to 5%, its ninth consecutive increase. The FOMC said it “will closely monitor incoming information and assess the implications for monetary policy.” It also said it “anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.”

I will be particularly focused on assessing the evolution of credit conditions and their effects on the

outlook for growth, employment, and inflation.

While the FOMC has taken decisive steps to bring inflation down, lags exist between policy actions and their effects. It will take time for all of our inflation gears to move at a pace that takes us to our 2% target. I expect inflation to decline to around 3-1/4% this year, before moving closer to our longer-run goal in the next two years. I expect real GDP to grow modestly this year and for growth to pick up somewhat next year. Slower growth and tighter monetary policy will likely lead to some softening in the labor market. So, I anticipate unemployment gradually rising to about 4-1/2% over the next year.

The economic outlook is uncertain, and our policy decisions will be driven by the data and the achievement of our maximum employment and price stability mandates. I am confident that our actions will bring inflation down to our 2% longer-run goal.

John C. Williams is president and CEO of the Federal Reserve Bank of New York.

One aspect of inflation that’s important for achieving and sustaining price stability is the anchoring of inflation expectations.

The GELT bus is like a focus group for a brick-and-mortar branch.

KEITH GRIFFIN, SENIOR EDITOR, BANKING NORTHEAST MAGAZINE

The clip clops of the hooves of Amish horses are a modern market research tool for Bank of Bird-in-Hand in Pennsylvania.The Bank of Bird-in-Hand promoted its mobile banking with a traditional Amish horse and buggy.

Lori A. Maley, the bank’s president and CEO, said where the old-fashioned buggies sidle up to the bank’s mobile branches, called the GELT (Money) Bus, are helping determine where brickand-mortar locations will be built. The bank operates four mobile bank branches serving 17 total locations.

When the GELT buses were launched, the bank went where the Amish are. “We looked for places that they frequent, such as the hardware store right next to our brick and mortar, Bird-in-Hand branches, Bird in Hand hardware. And then, we started to look for the hardware store in other com-

munities like Honey Brook and Chester County, the shoe store, we look for the hay sales. So places that the Amish frequent, we try to do that,” Maley said.

She further explained, “One good thing about the bus is it kind of tells us where we're supposed to go. Like where do we put the permanent branches?”

Both the Amish and Mennonite communities have reached out to the Bank of Bird-in-Hand after bank mergers left them with no branch. “They actually invited us to come to lunch. So we said, look, we'll have lunch for you. And we had 30 Amish men and a couple Mennonite guys show up. That's telling you there's a need. So we've launched the bus up there, but now we're

looking. We had some really great reception up there, but we're looking to put a permanent location and they're doing some renovations (in) a farmer's market. They're expanding the farmer's market and they're gonna put a Bird-in-Hand Bank office on the end of it,” Maley said.

Another effective marketing strategy is word-of-mouth, said Maley. “This is just an example. We have neighbors here and there's five brothers, two sisters. And so what you get is you get the brothers, and then you get the brothers' children. So one relationship might be 50 people. And, and that's kind of a little bit of word of mouth with the Amish. The church services are Sunday and they do have social meetings

and they talk about it. And, that's how the bank really gained such success is the positive results that we've given them. And then they communicate back to other Amish.

Bird-in-Hand Bank runs four GELT buses. Maley said they’re intended to be more than rolling billboards with an ATM. At the time the first bus was launched, Bird-inHand Bank was relatively new: the first de novo bank in the nation after the 2008 financial crisis. The bank had limited capital, but a desire to reach out to an underbanked community.

“So, we started talking about it and said, you know, this could have great value for the Amish community. A lot of credit unions out in the western part of the country use them and some banks in rural areas.

So, we came up with, well, why don't we try this? What we could do is we could take one bus, our original bus and pretty much service 10 locations a week. So each location is considered a branch. We would go to one location in the morning, then travel to the next location and be there for the afternoon,” Maley said.

With the bank’s limited capital for investment, the bank executives knew this was a better solution for growth than attempting to build brick-and-mortar locations. “This actually worked out incredibly well,” Maley said.

Now the bank has more access to capital.

As of Dec. 31, 2022, Bank of Bird-in-Hand had total assets of approximately $1.132 billion, total deposits of approximately $894 million, total net loans of approximately $975 million, and total shareholders’ equity of approximately $115 million.

“You know, [the Amish] want a community bank, and I think that's really what's funded and really enhanced our growth because to go from a startup bank, now just over nine years old, we are over a billion dollars. It's all organic. None of it is acquisition. It's just pure organic growth,” Maley said.

Jim Caliendo, president & CEO of PWCampbell, a full-service firm offering design-build, branch experience, and consulting services to the financial industry, thinks Maley and her bank are on the right track.

“I think of it as an advantage,” Caliendo said about the market research. “It’s a mobile focus group. Banks used to build branches depending on where their board lives. Now its demographic studies. She’s getting research right then and there, so kudos. It’s a good thing.”

Caliendo offered practical advice for Bird-in-Hand Bank when it comes time to build a branch. “The buildability is critical in limiting risk. When buying land and a building with strict environmental laws and local authorities being so strict, you must do due diligence. Banks will [buy] 1.5 acres, do an investigation, and by the time they look at restrictions, it's a quarter acre and can’t use it.”

Of course, there’s more to dealing with the Amish than putting up hitching posts for the horses. A lot of the Amish are involved in agriculture and operate as small businesses. That in and of itself is not so complicated. Where issues arise are their reliance on self-insurance paid for out of collective Amish funds.

“When we opened the bank, the FDIC

“... there’s more to dealing with the Amish than putting up hitching posts for the horses.”

“It’s written in the loan documents that there are certain things that are really specific to them and their businesses.”

allowed us to put into our credit policy special purpose credit for this particular group of people,” Maley said. “Bill O'Brien, our chief lending officer, has been working with them for over 30 years. He understands what they need as far as a line of credit. You know, they need an agricultural loan. For example, dairy farmers and some of the tobacco farmers, the checks they get for selling tobacco are timed. So, there are times when they may want to pay down more of the loan. It’s written in the loan documents that there are certain things that are really specific to them and their businesses.”

Maley concedes this is a unique challenge. “You have to call the bishop and … make sure that they're a member of the church. And so there's a little bit of legwork. I mean, we've been doing it for so long, it's really not an issue for us. But, you know, you have [an outside bank] move into the area and it's completely foreign to them. They don't really want to deal with it. It's a couple extra steps. We've been able to jump in there and help those people and provide the loans that they need. In some of these families, Bill O’Brien knows the grandfather, the father and now, the next generation son. So, what you find with the Amish, it's almost exponential.”

Maley added, “It's fascinating that the people would not necessarily think of them as an underbanked community, but of course they are because they're difficult. I don't mean it in a negative way, but they're difficult customers. They need a little more hand holding.”

Originally, Bird-in-Hand Bank thought the Amish’s greatest needs would be commercial lending. What Maley said the bank discovered was a need for mortgages it hadn’t anticipated. “They could not get a mortgage in most places, so we fill that gap and we do mortgages. We’re kind of the only stop for them when they want a traditional mortgage. We do adjustable rate mortgages. And, we put them on the balance sheet,” Maley said.

Interestingly, the bank has to service the mortgages because the Amish properties are nonconforming and otherwise couldn’t qualify. The reason? They may not necessarily have electricity.

We’re kind of the only stop for them when they want a traditional mortgage. We do adjustable rate mortgages. And, we put them on the balance sheet.Lori A. Maley, CEO and president. Bank of Bird-inHand in Pennsylvania.

A new bank, designed to support the financial development and advancement of women business owners and women leaders, will have its headquarters in Buffalo. Western New York banking veteran Mary Kate Loftus has been appointed as president.

Impressia Bank, the newest sister division of BankOnBuffalo, will focus exclusively on meeting the financial needs of women – chief among them, access to capital, which continues to be the biggest barrier to market entry and success of female founders. To solve this problem, Impressia Bank will go beyond traditional banking by offering women solutions that are often not provided by banks today. Impressia Bank is the sixth division of Pennsylvania-based parent company, CNB Bank.

With nearly 25 years of banking experience, Loftus brings her passion for supporting women as well as her expertise in customer experience, strategic growth, and community banking to her role as president of Impressia Bank. In this role, she will focus on developing leaders and successfully investing in women entrepreneurs to level the gender gap in funding.

Loftus served in leadership positions at Fortune 500 financial institutions with responsibility for transformational change, strategy, and customer engagement through digital banking, branch management, and contact centers. Among her career achievements, Loftus was identified by Forbes as one of “6 Women Changing the Face of Leadership

in Banking and Finance.”

“At Impressia Bank, the future is female. This is a new way to bank, inspired by women in business and designed to meet clients where they are. Our ambition is to not just be our customer’s bank, but to be the trusted partner and friend they need on this journey to grow their business,” said Loftus. “As a lifelong resident of Buffalo, I’m grateful for this opportunity and thrilled that Buffalo has been selected for the headquarters of Impressia Bank.”

Avidia Bank has named Robert D. Cozzone as its new president and CEO. He replaces Mark O’Connell, who will retire in May.

Cozzone joins Hudson, Mass.based Avidia from Rockland Trust, a $20 billion community bank, where he enjoyed a successful 24-year career. Most recently, he served as Rockland’s executive vice president and chief operating officer reporting to the CEO. In that role, he was responsible for overseeing management of all consumer and small business banking activity as well as finance, treasury, and corporate services. Prior to that, he served as Rockland’s chief financial officer and retail executive.

In his former role as COO, he was responsible for some 1,000 employees and 123 retail branches.

“I’m grateful to be selected by the board to join a capable and dedicated team, and I look forward to building lasting relationships with them,” Cozzone said. “Avidia’s genuine commitment to the community and its tradi-

tion of innovation and excellence in customer service is admirable.

The bank has enjoyed tremendous growth and success under Mark’s leadership, and I’m committed to continuing that legacy.”

Cozzone serves on a number of boards and committees, including Massachusetts Business Roundtable, Thompson Island Outward Bound, Plimoth Patuxet Finance Committee, and the Bridgewater State University Riccardi School of Business Advisory Board.

O’Connell will retire after 35 years of service and helping steward Avidia from a $120 million bank with two branches to a $2.5 billion full-service financial institution with nine branches.

OceanFirst Bank, the wholly owned subsidiary of OceanFirst Financial Corp., appointed Stephen Adamo as president of residential and consumer lending.

Adamo will lead the residential and consumer lending divisions at OceanFirst, which is headquartered in Red Bank, N.J. His responsibilities include the growth and expansion of all residential home lending products, consumer lending products and sales, services, loan officers, and delivery channels.

With almost three decades of experience in mortgage banking, Adamo most recently was president of national retail production at Embrace Home Loans in Middletown, R.I. Previously, he was head of mortgage, home equity, consumer loan operations, and consumer underwriting at Santander Bank, and held executive leadership positions at Weichert Financial Services and Citi-

zens Financial Group.

Joseph J. Lebel III, OceanFirst president and chief operating officer, said, “Steve is a seasoned mortgage and banking professional with an impressive record of significantly growing residential mortgage teams and driving results throughout his career. We are pleased to welcome Steve to OceanFirst.”

Tompkins Community Bank announced the appointment of two new market presidents across its New York State footprint. Diane Torcello has been appointed to president of the bank’s Western New York (WNY) market, and Johanna Anderson has been appointed to president of the bank’s Central New York (CNY) market.

The dual announcement also marks a significant milestone in the bank’s executive leadership history. The appointments of Torcello and Anderson come nearly one year after the appointment of Ginger Kunkel, president of Tompkins’ Pennsylvania market, marking the first time that three of the bank’s four market president roles have been filled by women leaders.

In their new roles, Torcello and Anderson will be responsible for the bank’s growth, community and client engagement and stakeholder relations throughout their respective markets, as well as fostering relationships with clients of Tompkins insurance and wealth affiliates.

A veteran of the banking industry, Torcello is well-known throughout the community for her expertise in retail, commercial, operations, and branch man-

agement. She began her 18-year tenure with Tompkins as vice president and branch manager before being elevated to senior vice president and community banking manager in 2013, a position she has held for the past decade. In this role, she is responsible for the leadership of all staff and operations of the Western New York branch network, as well as the direct involvement and management of the largest deposit relationships. She also interacts routinely with the Tompkins WNY bank board on business development and strategy..

A three-year member of Tompkins’ CNY board, Anderson is known for her expertise in residential and consumer lending, commercial real estate management and affordable housing development work, as well as her advocacy for financial education. In her more than five years as executive director of INHS, Anderson has actively led the mission to build affordable housing developments, as well as support homeowners and renters with financial and maintenance services. In her prior position, she served as the chief credit officer of Home HeadQuarters, Inc., where she managed the process and production of all lending products and oversaw the development of credit approval processes.

Citizens Financial Group announced that Richard Stein will assume the role of chief risk officer upon the retirement of Malcolm Griggs in the first quarter of 2024. Upon assuming the CRO

role, Stein will report to Bruce Van Saun, chairman and CEO, and serve on the bank’s executive committee.

Stein will join Citizens from Fifth Third Bancorp, where he most recently served as executive vice president and chief credit officer with responsibility for enterprise-wide credit risk management. In that role, he oversaw consumer credit, special assets, middle market credit, commercial credit, capital markets credit, and commercial real estate credit while managing all regulatory and governance stakeholder relationships. He also held increasingly responsible risk management roles at Comerica and Bank of America over the course of his more than 25-year career.

A 34-year banking industry veteran, Griggs has been with Citizens since 2014, helping guide the bank through dramatic transformation and growth since becoming an independent public company. He was appointed chief risk officer in 2016, previously serving as chief credit officer. He joined Citizens from Citigroup, and over the course of more than 30 years, he has also served in senior risk management leadership roles at Morgan Stanley, Bank of America, Wachovia Corp., and Fifth Third Bancorp.

“Richard is a highly experienced risk management executive whose deep experience, drive, and sharp strategic insights will enable him to provide strong and effective leadership for our risk organization as we continue our efforts to become a top-performing bank,” said Van Saun. “We have designed a thoughtful transition process that will further strengthen our risk management capabilities while ensuring strong continuity.”

Not every financial institution will find itself presented with the same challenges.

BY TIM KEITH, SPECIAL TO BANKING NORTHEAST MAGAZINE

BY TIM KEITH, SPECIAL TO BANKING NORTHEAST MAGAZINE

The prolonged period of taking deposit gathering for granted seems to be nearing an end. Financial institutions have been awash in deposits for years, flush with liquidity. According to data from the Federal Deposit Insurance Corp, deposit balances at banks have risen by 35% in the past two years alone.

The bigger challenge has been finding ways to put those deposits to use in profitable ways.

Everything has a life cycle, and it appears that financial institutions will soon need to be more competitive in recruiting and retaining depositor relationships. The Wall Street Journal recently noted a growing belief among bank analysts that deposits at the biggest U.S. banks could decline by 6% this year.

Competition is coming from all angles. In addition to banks and credit unions, notable deposit outflows have been linked to cryptocurrency exchanges as more people embrace digital asset investments.

For the first time in two years, bankers are declaring that they’re “in the market for CDs.” With that in mind, banks and credit unions must prepare for a shift in mindset and take steps to protect their liquidity.

With the economy entering its third rising rate cycle in the last 20 years, we can look to recent history for clues to the road ahead. However, several twists in the landscape make the crystal ball blurry. Rarely have financial institutions begun a cycle so well-funded, which may portend a delay in heightened deposit competition. At the same time, banks and credit unions are holding onto more mortgages – fueling a greater appetite for deposits.

There’s a unique commercial lending component to this turn in the cycle. Demand for traditional business loans has mainly been subdued – primarily reflecting the success of the Paycheck Protection Program (PPP). It’s a matter of time before appetite for these loans returns, putting more pressure on financial institutions to hold onto their deposits.

Not every financial institution will find itself presented with the same challenges. Markets are different, and it only takes one or two competitors promoting aggressive rates to reset consumer expectations and start a deposit battle.

The ascent of digital banking is another element. Depositors are less likely to see a rate card at the branch or speak with a banker before moving their funds – making silent attrition a much greater risk. As stated earlier, large sums are quietly leaving FIs to go to crypto exchanges.

Banks and credit unions shouldn’t solely monitor their loan-to-deposit ratios to assess their liquidity position – each deposit account has a client attached to it. Even if an financial institution doesn’t currently need the funds, is it willing to jeopardize the associated relationship? Any institution taking on deposits

is sure to follow up with a checking account offer to secure primary financial institution status.

This points to the “sleeper risk” conundrum bankers perpetually encounter. There’s great temptation to pursue “new money,” enticing noncustomers with attractive offers when courting deposits. The irony is that these funds cost more than the rate bump required to convince an existing customer or member to stay (while at the same time, current customers are receiving similar higher offers from competitors).

Although many banks live in fear of sleeper risk, the reality is that true sleepers stay asleep. If an financial institution’s marketing strategy woke them up, chances are good a similar effort by a competitor would have done so anyway.

Financial institutions can tackle deposit gathering with an approach akin to what we propose for finding overlooked lending opportunities within an existing client base. It is incumbent on the institution to proactively initiate conversations that make it easier for customers to self-identify as being “inmarket” when it is right for them.

In the short run, most banks and credit unions can afford a little runoff of deposits – some might even welcome it. However, the rules of engagement can change rapidly, much as they have with inflation, and FIs certainly don’t want to lose client relationships in the process.

While it is essential to attract a prospective depositor’s attention while they’re in the market, building familiarity through prior exposure also has value. The key is to be proactive and holistic in setting a deposit strategy –and hoping depositors don’t wake up as rates rise is not a strategy. SRM has the tools and know-how to help you build such a strategy and effectively execute it to keep liquidity levels robust enough to support future lending opportunities.

For the first time in two years, bankers are declaring that they’re “in the market for CDs.”

The National Credit Union Administration issued three prohibition notices in April 2023. Among them is Tara Kewalis, a former president and CEO of Skyline Financial Federal Credit Union, Waterbury, Conn., who was permanently prohibited from participating in the affairs of any federally insured depository institution.

According to court documents and statements made in court, the Department of Justice said from approximately September 2016 until her employment was terminated in March 2021, Kewalis used her position to access the credit union’s accounting system to create fraudulent accounts and make fraudulent entries, and steal $254,532 in credit union funds.

Kewalis pleaded guilty to one count of embezzlement by a credit union officer or employee. She served as president and CEO from September 2016 until her termination. She began her employment at Skyline Financial in or about May 1993.

The Office of the Comptroller of the Currency initiated cease-and-desist proceedings against Dunkirk, N.Y.-based Lake Shore Savings Bank for noncompliance with the July 13, 2022, formal agreement, including for unsafe or unsound practices relating to information technology security and controls, and board of directors and management oversight of corporate risk governance.

The OCC also found deficiencies, unsafe or unsound practices, and violations of law, rule, or regulation related to Bank Secrecy Act/Anti-Money Laundering risk management.

The Comptroller, in an order dated March 17, instructed the bank’s board of directors to maintain a compliance committee of at least three members of which a majority should not be employees or officers of the bank or any of its subsidiaries or affiliates.

By March 31, and thereafter within 10 days after the end of each month, the compliance committee must submit to the board of directors a written progress report including a detailed description of the corrective actions needed to

achieve compliance with each article of the OCC’s order; the specific corrective actions undertaken; and the results and status of the corrective actions.

Lake Shore, which has 11 branches in Chautauqua and Erie counties, reported net income of $5.7 million in 2022, down 8% from the year before.

Money tainted with an unknown substance led to several employees at a Newark, New Jersey, bank ending up hospitalized after falling ill, according to the city's Public Safety Director Fritz Fragé.

NBC New York reported the strange events unfolded shortly after 12 p.m. at a Wells Fargo Bank located on Lyons Avenue. It was at that time that Newark Police was reporting to the bank for a possible hazmat incident, according to Fragé.

Allegedly a man entered the bank and handed a bank teller cash tainted with the unknown substance. The bank was subsequently evacuated after at least three workers reported feeling sick, Fragé said.

Three employees were rushed to Newark Beth Israel Medical Center for evaluation. The victims were said to be in stable condition.

Police in Central Massachusetts quickly caught an alleged bank robber thanks partly to his love of the New England Patriots, authorities said.

Todd Mitchell, age 46, of Northbridge, faces a single charge of unarmed robbery from the April 11 heist of a Santander Bank, Northbridge police said.

A customer at the 1234 Providence Road bank called 911 just after 9 a.m. to report a robbery, authorities said. The caller gave police a detailed description of the suspect and told officers where he ran when he left the building.

Within minutes, police found Mitchell nearby in front of Shaw's Supermarket. He matched the caller's description of the robber and had nearly $2,000 in cash in his pockets, authorities said. Officers arrested him without incident.

Though, he wasn't wearing what the 911 caller had described. After a short search, detectives found the mask,

gloves, and distinctive Patriots hoodie tossed in a nearby dumpster, police said.

According to the Daily Voice Worcester, it's unclear if he was allegedly trying to hide evidence or making a statement about the team's struggles in recent seasons.

The Nation Credit Union Administration liquidated the Inter-American Federal Credit Union in Brooklyn, N.Y., after determining it was not operating in a safe and sound manner.

Inter-American, with assets of $727,157, posted a net income loss of $21,905 at the end of the fourth quarter. The credit union also recorded a delinquent loans plus net charge-offs ratio of 21.89%, which was substantially higher than the peer average of 3.87%, according to NCUA financial performance reports.

In June, the federal agency publicly released a cease-and-desist order against the credit union, which served 460 members.

According to a report on cutimes.com, the order required the credit union to take eight actions such as resolving the out-of-balance conditions with loans, shares, cash and undivided earnings, obtaining an AIRES share and loan download and reconciling the download to the general ledger, and providing written, supporting documentation for the resolution of all out-of-balance conditions.

Provident Bank, a leading New Jersey-based financial institution, has announced the donation of one of its former branches to New City Kids, a Jersey City-based nonprofit organization that offers after-school programming for local youth from traditionally under-resourced urban areas. The 5,472-squarefoot building, located at 533 Bergen Ave., Jersey City, will be known as the New City Kids Rubingh Center for Youth Development, and will serve as the organization’s fourth Jersey City location.

“Our commitment to this community runs deep,” said Chris Martin, Executive Chairman, Provident Bank. “Lending a helping hand in the communities we serve and making a positive impact is fundamental at Provident. It’s extremely gratifying to give back to the community

where Provident was founded in 1839.”

In addition to the bank’s donation of the building, The Provident Bank Foundation has pledged a multi-year commitment of $100,000 to New City Kids. The funds will be disbursed over a 4-year period and will be used for building upgrades, operational support, and programming at the New City Kids Rubingh Center for Youth Development.

Following the donation of this branch to New City Kids, Provident Bank will operate five locations in Jersey City.

Police are searching for a crew of con artists crisscrossing New York City, targeting unsuspecting seniors at cash machines.

They are wanted for stealing debit cards and pin numbers and have struck at least 15 times, getting away with nearly $77,000.

One victim, who goes by 'Joe,' asked Eyewitness News not to reveal his real name or show his face but wanted viewers to hear about what happened to him last month as he withdrew cash at his local Citibank, in Riverdale.

"I felt a tap on my left shoulder, and I turned around to see who it was, and it was a lady," Joe said. "She pointed to the floor and said, 'sir you dropped some money,' so I bent down to pick it up and that was my mistake. There was a man standing next to her, reached around in that split second and palmed my card."

A new survey from WSFS Bank found Americans are confident managing their money, including 91% of respondents in the Greater Philadelphia and Delaware region (89% nationally), but 34% in the region were not confident they could weather an economic downturn or recession (41% nationally).

The study found 34% of regional respondents (39% nationally) were not confident they could afford rising costs of living, and many are making changes to their spending habits as a result.

Nearly two-thirds (61%) of total regional respondents said they are cutting back on non-essential spending, compared to 69% nationally, while 42% of regional re-

spondents said they are delaying a large purchase like a home, car or furniture. Thirty-eight percent of regional respondents are focusing more on paying down debt because of rising costs, while 33% are tapping into their savings to help pay for everyday items.

Rising costs and interest rates have also resulted in 25% of regional respondents saying they have more debt now than a year ago. Among regional respondents, Black (71%) and White (74%) respondents were more likely to cite higher prices and cost of living due to inflation as a reason for their increased debt than Hispanic or Latino (57%) respondents.

Half (52%) of regional residents said if faced with an emergency expense of $1,000 or more, they would have to borrow money, take out a loan or pay it off with a credit card over time. Sixty-one percent of regional Hispanic or Latino respondents would need to do this compared to 50% of White and 46% of Black respondents.

The Conference of State Bank Supervisors encourages community banks to participate in its 10th annual National Community Bank Survey, open now through June 30.

This is an opportunity for community banks to share their perspectives on community banking, the economy, regulation and supervision with state and federal policymakers. This year’s questions focus on current bank conditions and emerging issues, including inflation, product service design and offerings, banking expenses and the future of community banking.

The survey takes approximately 20-30 minutes to complete, and responses may be entered during multiple sessions now through June 30. Participating community banks will need to provide their FDIC certificate number, but all information collected is for research purposes only and will not be linked to any institution.

Survey results will be released at the annual Community Banking Research Conference, sponsored by CSBS, the Federal Reserve and the FDIC. Last year’s survey of nearly 500 community banks showed that economic conditions and net interest margins rank as the top external risk while cybersecurity is the top internal risk for community banks.

For more on CSBS, go to www.csbs.org.