Texas is one big state, and it takes a big reach to keep its mortgage origination pros in the game. Only Lone Star LO gets the job done. We round up the data, insight and products that let Texans win the mortgage rodeo.

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

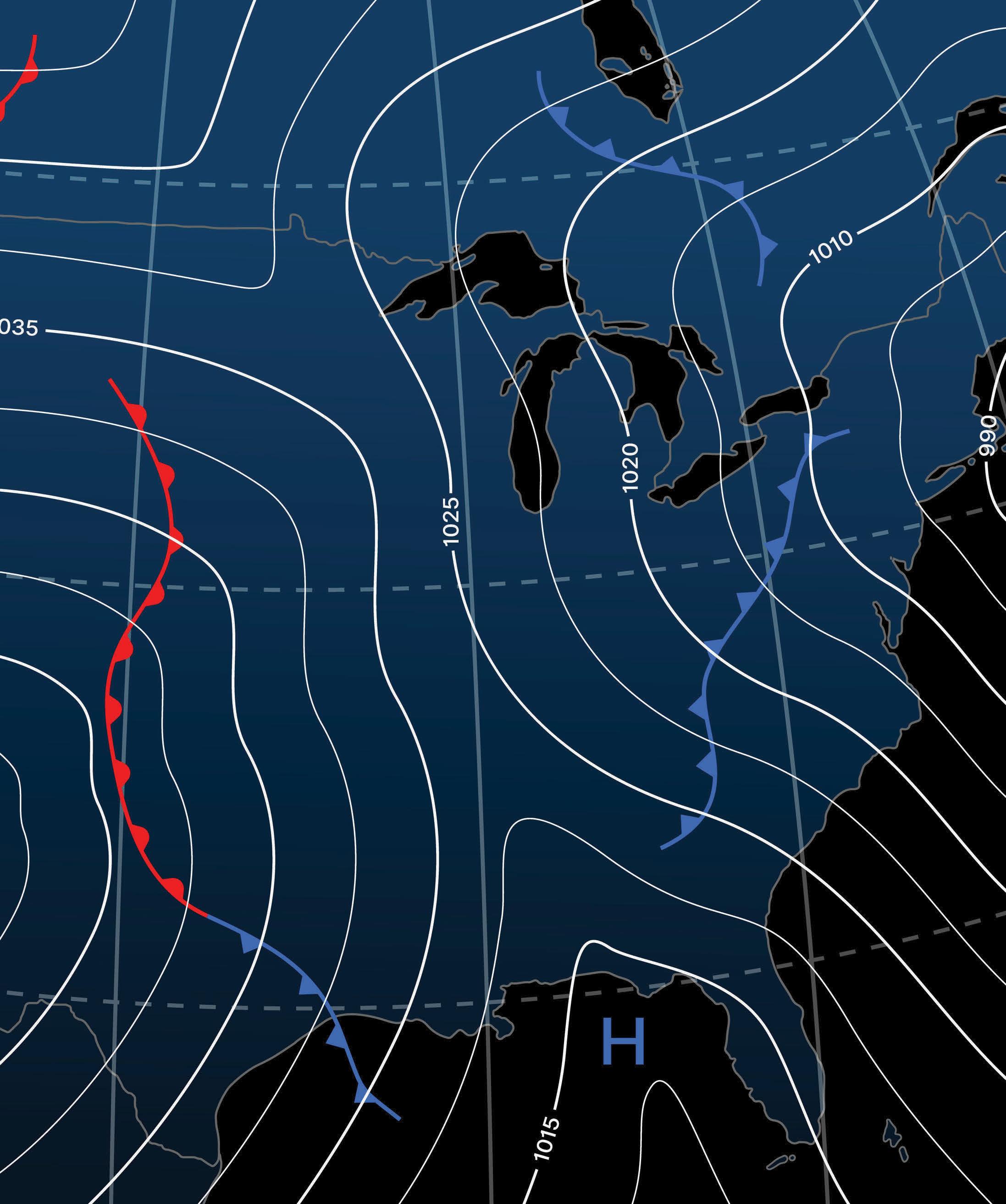

FEATURING SARAH WOLAK, STAFF WRITER FOR NMP TUNE IN EVERY FRIDAY FOR YOUR WEEKLY FORECAST.

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Christine Stuart

NEWS DIRECTOR

Keith Griffin SENIOR EDITOR

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley STAFF WRITERS

Gary Rogo

SPECIAL SECTIONS EDITOR

Alison Valvo DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Mary Quinn MULTIMEDIA PRODUCER

Matthew Mullins

MULTIMEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Regina Morgan ADVERTISING SALES EXECUTIVE

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Lydia Griffin MARKETING INTERN

Submit your news to editors@ambizmedia.com

If you would like additional copies of Lone Star LO magazine Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Lone Star LO magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC

88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991

info@ambizmedia.com

ore than 30 years ago, I was standing next to the guy who owned the company I was working at. I was in charge of one of his businesses, and he had a visitor he was showing around. They came up to me, and my boss introduced me to his guest. And then he said something that has stuck with me ever since. "This guy," he said, pointing at me, "is pretty good at what he does. But when things get tough, that's when he gets even better."

I hadn't realized what he had seen, but after he said that, I went back and thought about it. He was right, but the reasons weren't as complimentary as one might hope (although I know he meant this as a compliment).

When things are going swimmingly, if you're basically competent, it's easy to do well. After all, everything's on your side. The market is good, the rates are good, and everyone's hopeful and confident, so business is easy to come by. Some folks maybe capitalize on good times more so than others, but it's not a great achievement to bask in economic sunshine.

When business gets tighter, harder, and darker, it's critical to start thinking about how to be innovative, to look at markets in a different light, and to consider what other ways you can generate revenue and sustain income. My boss was saying I was good at that, and I think I still am: I like keeping an open view of what might be coming a year or two out. But I realized that if I were really a good business leader, I would have been thinking about all those things when the market was going great. Instead, I was coasting on easy wins and only turned to a more thoughtful approach when I was forced to. If I'd been better at this earlier, I wouldn't have had to scramble.

For loan originators now scrambling, we know there are techniques, tactics, and tricks to help secure those loan deals, fewer though they may be. We are glad to tell the stories of LOs who have successfully pivoted. But we're also impressed by -- and delighted to tell the stories of -- local originators who laid the groundwork for their success now by being thoughtful and focused two years ago. Many of these success stories share the same characteristics: the LO didn't just grab the easy money (refinances) but made sure to keep a solid footing with purchase partners, despite that being more time-consuming. Those relationships built then are a bank of profit now.

For many LOs, that's a lesson to be learned for the next market turndown. For now, the imperative is to know every winning strategy, trend, and insight that can set you up for success. And then to think about what the market will also look like two years from now. The compliment shouldn't be that we get innovative when we have to but that we never have to scramble in the first place.

VINCENT M. VALVO CEO, Publisher, Editor-in-Chief

A look at the news that’s important for the mortgage industry across the state of Texas. A

Originators need a new playbook to fight high prices and rates.

Decades after departing, major bank is backing in the mortgage business.

There are new rules on the books for closing mortgages legally.

Kristin Stark has built a successful career with her winning skills.

The Lone Star State breaks a major milestone to become second in U.S.

This is one instance where it’s not good to be tough in Texas.

The New Austin 2.0

The state capital is popular once again by returning to its roots.

A Roundup of Texans landing new jobs or being awarded promotions.

Zero-Interest Mortgage Program

Habitat For Humanity’s Empowering Lending Initiative

The LO Down

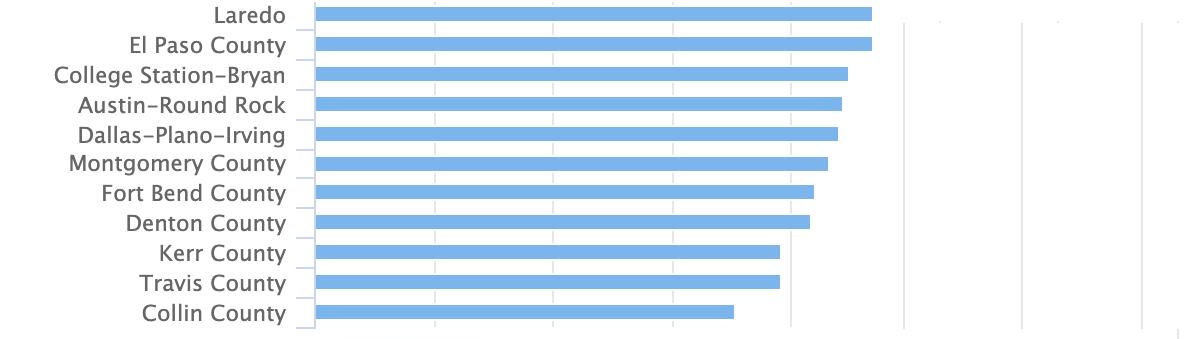

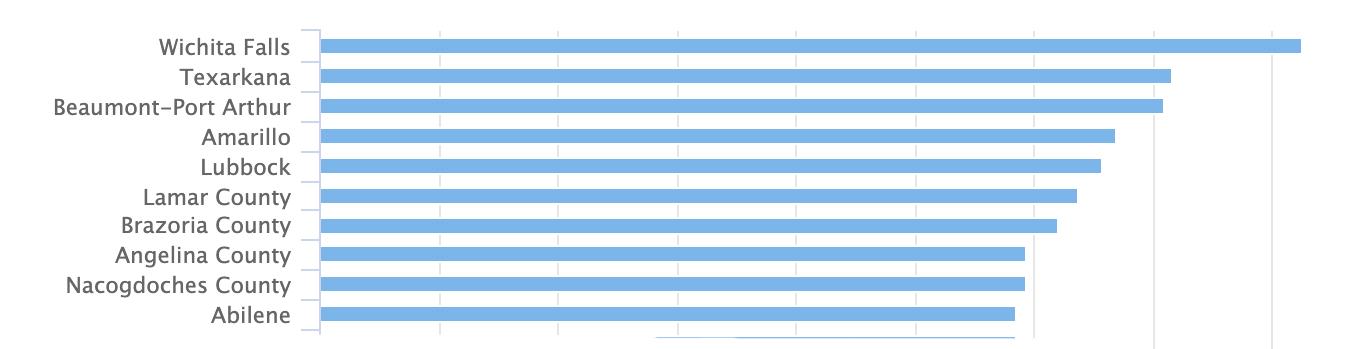

Learn some facts about the leading real estate markets in Texas.

Wednesday, September 6, 2023

DoubleTree by Hilton Dallas Galleria

Tuesday, November 14, 2023

Sheraton North Houston

February 20, 2024

Austin Marriott South

Despite higher interest rates, Texas’ residential mortgage industry expressed an improved outlook, according to the latest Texas Residential Mortgage Survey. The bright spot for current conditions was the stable increase in pre-approved customers looking for homes.

“Respondents to the TRMS have consistently reported monthly improvements in their company outlook this year,” said Wes Miller, senior research associate at the Texas Real Estate Research Center at Texas A&M (TRERC). “They’ve maintained that position amid a recent rebound in mortgage interest rates that has hindered both origination volumes and average values.”

The TRMS business-activity index notched five consecutive positive readings to start the year but stalled in June and July. Activity pulled back in the home-purchase segment of the market, but the refinance segment has yet to find its footing in the postpandemic economy.

"The persistently high-interest rate environment has continued to suppress the refinance market,” according to Erin Dee, chief operating officer with LoanPeople LLC. “Over 90% of all homeowners have interest rates below 6%. With current 30year fixed mortgage rates averaging 6.81% (Freddie Mac), there are very few incentives for homeowners to refinance their existing-home loans outside of opportunities to draw on their equity.”

The average value of refinance originations is expected to fall further during the second half of the year, but TRMS respondents anticipate a stabilization in rate-and-term

origination volumes if mortgage rates tick downward.

“The Mortgage Bankers Association, however, expects interest rates to remain at elevated levels through 2023, keeping mortgage origination volumes dampened through spring 2024," Dee said.

The monthly survey is a collaborative effort between the Texas Mortgage Bankers Association and TRERC to provide a contemporaneous analysis of changes and conditions in the residential mortgage industry.

High-income earners are moving, and the data on where exactly they're going provides eye-opening insights into the current lifestyle trends of the wealthy. In this analysis, MyElisting. com dives into the dynamics of wealth migration within the United States, shedding light on the states attracting high-income earners and witnessing an outflow of such wealth.

$10.7 Billion

factors, including tax laws, economic prospects, and lifestyle offerings, that collectively sway where high-income earners reside.

Texas was second with a net income migration of $10.7 billion. The other top 5 states were Florida, 1, at $12.4 billion; Arizona, 3, at $9.4 billion; Colorado, 4, at $8.6 billion; and, North Carolina, 5, at $7.8 billion.

The states losing the most are California, 1, at -$343.2 million; New York, 2, -$299.6 million; Illinois, 3, -$141.7 million; New Jersey, 4, -$135 million; and, Massachusetts, 5, -$129 million.

According to MyEListing.com, “Various unique benefits draw these high net-worth individuals to the Lone Star State. Texas, like Florida, also boasts the absence of personal income tax, a significant lure for those with hefty incomes.”

A first-time homebuyer must earn roughly $64,500 per year to afford the typical U.S. “starter” home, up 13% ($7,200) from a year ago, according to a new report from Redfin, the technology-powered real estate brokerage. That’s due to the one-two punch of higher mortgage rates and higher home prices.

However, Austin is one of three markets in the U.S. where a first-time homebuyer needs to earn less, but the numbers are different than U.S. averages.

It ranked U.S. states based on their net income migration, a critical economic indicator reflecting the movement of high-income earners. This measure culminates several

A homebuyer in Austin must earn $92,000 to afford the typical "starter" home, down 3.3% (from a year earlier. Austin is also among the metros where prices of starter homes have declined the most, with median sale prices down 12.2% to $347,300 in Austin. Starter-home prices are

falling in Austin, where prices went wild because of the influx of remote workers moving into the area.

Now that mortgage rates have more than doubled, the initial surge of remote-work relocations has passed, and new listings are scarce due to homeowners locked in by low rates, the housing market in Austin has fallen back down to earth.

Overall, though, sales rose in Texas. Sales increased from a year earlier in San Antonio (11.6%), Dallas (2.5%), and Fort Worth, TX (0.6%).

top origin was Los Angeles. Houston had a net inflow of 3,600, down from 4,500 a year earlier. The top origin was New York City.

A record one-quarter (25.5%) of Redfin.com users nationwide looked to move to a different metro area in the second quarter, up from roughly 23% a year earlier and about 19% before the pandemic.

Even though a record portion of homebuyers are relocating, there are fewer relocators than there were a year ago as high mortgage rates cool the overall housing market. The number of Redfin.com users moving to a different metro is down 7.5% year over year, a record decline but much smaller than the 18% decline for those staying within their current metro area.

Motto Mortgage has a new office in Copperas Cove, Texas. Motto Mortgage Homestead is now open serving the Copperas Cove, Waco, Temple, Belton, Killeen, and Austin markets.

Motto Mortgage Homestead is a full-service mortgage brokerage established by Rick Ott. He brings over 18 years of industry experience to the brokerage and has spent decades learning the local market. He moved to the Greater Fort Hood area in 1994 while serving on active duty and spent his free time learning the real estate market and building his

> two Texas cities are in top 10 most popular destintations for people moving in to metro areas.

Dallas is ranked eighth and Houston 10th as the most popular destinations for Redfin.com users moving to a different metro area, according to a Redfin report on the second quarter of 2023.

Popularity is determined by net inflow, a measure of how many more Redfin.com users looked to move into an area than leave.

Dallas had a net inflow of 4,100, down from 6,200 a year earlier. The

network. When his service ended, Ott jumped into real estate full-time and founded RE/MAX Homestead.

Patrick McGrath will serve as the Senior Loan Officer for the office. McGrath is a mortgage professional with seven years of real estate and lending experience who takes great pride in serving his community and helping individuals achieve their homeownership dreams.

Foreign buyers purchased $53.3 billion worth of U.S. existing homes from April 2022 through March 2023, slipping 9.6% from the previous 12-month period, according to a new report from the National Association of Realtors.

For the 15th consecutive year, Florida remained the top destination for foreign buyers, accounting for 23% of all international purchases. California and Texas tied for second (12% each), followed by North Carolina, Arizona and Illinois (4% each).

“Florida, Texas, and Arizona continue to attract foreign buyers despite the hot weather conditions during the summer and the significant spike in home prices that began a few years ago,” Lawrence Yun, NAR chief economist, said.

Across the U.S., foreign buyers purchased 84,600 properties, down 14.2% from the prior year and the fewest number of homes bought since 2009, when NAR began tracking this data. Overall, U.S. existing-home sales totaled 5.03 million in 2022, down 17.8% from 2021.

Despite a modest decline in sales volume, the San Antonio housing market has maintained its average

> Foreign buyers purchased $53.3 billion worth of U.S. existing homes from April 2022 through March 2023

of days on the market, which rose by 121% to reach 64 days. This suggests a more deliberate decision-making process among buyers, potentially due to increased scrutiny or the need for a more thorough evaluation of available options.”

price, indicating the robustness of the real estate sector in the region, according to a Multiple Listing Service (MLS) report from San Antonio Board of Realtors. Other areas of Texas have seen year-over-year declines.

According to the report, there were a total of 3,354 home sales in San Antonio, representing a 9% decrease compared to a year ago. However, the average price of homes sold remained steady at $395,524, signifying a stable market overall. The median price experienced a 6% decrease from 2022, settling at $320,950. The price per square foot declined by 4% to $183, providing additional affordability for prospective homeowners.

“The inventory situation in San Antonio remains relatively stable, with 3.7 months of inventory available,” said Sara Briseño Gerrish, SABOR's 2023 board chair. “This balance signifies a market that is conducive to both buyers and sellers, creating a fair playing field for negotiations. Additionally, 95% of sales closed close to the original listing price, indicating that sellers are achieving their desired outcomes in most transactions. Another noteworthy trend observed is the significant increase in the number

During the latest period, Bexar County recorded a total of 2,288 home sales, representing a 10.2% decrease compared to June 2022. However, the average price of homes sold demonstrated stability, experiencing only a slight decline of 1.5% to reach $363,157, indicating a robust market overall. The median price of homes in Bexar County settled at $305,000, showing a 4.7% decrease. The other three major counties in the stateTravis, Harris and Dallas - reported median home prices of $580,000, $335,000 and $390,000, respectively.

85,022

Across Texas, despite a 9.7% decrease in total sales, with 31,689 homes sold, the housing market has maintained its stability across the state. Homes stayed on the market for 50 days, with 3.2 months of inventory and 96.3% closing for their original list price. The state closed the month with 46,042 new listings, 85,022 active listings and 29,959 pending sales.

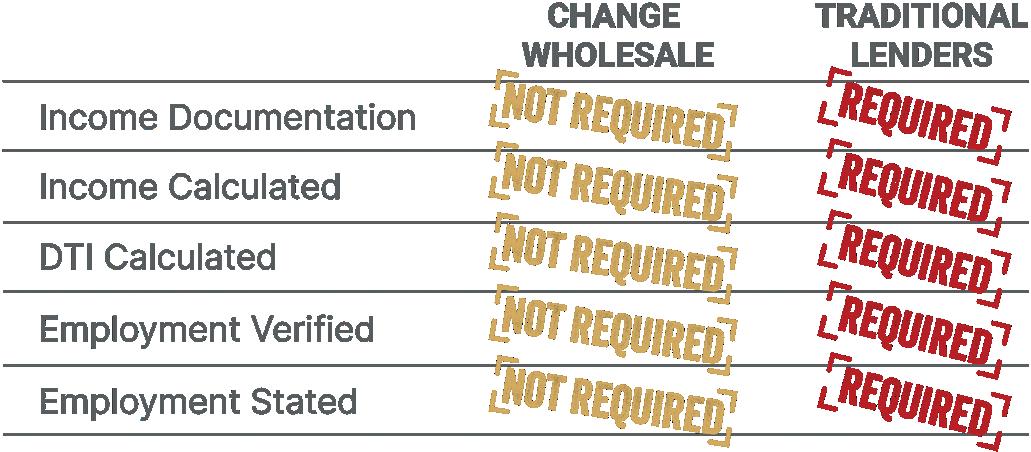

As a CDFI, Change Wholesale creates our own portfolio of products and guidelines that are exempt from complex underwriting rules and regulatory restrictions. Instead, we make smart credit decisions and use leading-edge technology to increase the number of loans you can close.

Our innovative, market-leading Community Mortgage is the only owner-occupied loan that doesn’t require income or employment on the application to help brokers and originators serve more people. Fewer requirements. More closings. That’s the Change Wholesale unfair advantage.

Even though 2023 started with a bang, Texas’ home sales still diminished by over 20% compared with last year’s numbers. But high-interest rates and rising mortgage rates are threatening the housing market in the Lonestar state, causing LOs to change their strategies.

The year began with a false start: the market seemed promising– inventory began to correct and homes spent more days on the market, causing anxious wouldbe buyers to come off the sidelines. Although home prices in the state are trickling downward overall, the unexpectedly cool industry is compelling LOs to revisit the fundamentals and devise innovative strategies to stir up business.

Aaron Canales is experiencing a market downturn for the first time in his short career as a mortgage loan officer. Canales, based out of Austin, decided to make a career shift and obtained his license in May 2022. He started originating at CrossCountry

Mortgage but, two months later when the market shifted, he was promptly laid off with minimal contacts and practically zero business. “It was a tough time for me,” he said. “My wife and I just had our second child and I was unemployed. Although we had prepared for my career shift and saved up money, I was left on my own to build leads and get my name out there.”

Canales has been weathering the storm on his own. Previously, Canales held a sales position at a tech firm and wasn’t used to a commission-based career.

“As time has gone on, it’s been a blessing [to work on commission and be on my own] because in this industry it takes a while to start making headway in a commission position,” he reflected. “Bouncing around between companies after being laid off gave me time to make relationships with people.”

Now, Canales is originating at Geneva Financial and is finally completing his first loans nearly a year into the business. “I’m in my 40’s and I feel like a high school freshman,” Canales quipped. “Luckily now I’m at a company that coaches me. I have a lot of help, but I’ve also been able to

“I’m in farming mode: planting seeds and expanding my reach for when the market comes back.”

> Aaron Canales, loan originator Geneva Financial

pave my own way.”

So how did he do it? Canales says that he relied a lot on his personal network, especially agent friends. “At the beginning, I had one agent that I was working with,” he admitted. “But compared to six months ago it’s been a huge difference, now I’m working with seven agents instead of just one.”

Canales described the period of unemployment as a dark time and a lot of “boots on the ground” work. He had a house-flipping project on the side that he was relying on for money while he spent time making phone calls, shaking hands, and trying to reinforce connections with real estate agents. “I had to learn how to market myself and reach out to people through my network or referrals. I even met a financial planner that is going to send me referrals,” he said. “I’m in farming mode: planting seeds and expanding my reach for when the market comes back.”

Canales also added that he’s focusing on making himself an educational resource to borrowers. “I’m making myself available to do refinances down the line and trying to offer tips to customers who need an extra step to compete in the Austin and Central Texas markets,” he said.

For industry veteran Jennifer Wolf, the Texas market has seen higher points. Wolf originates for 1st Alliance Mortgage, which is based out of College Station – just a hop and a skip away from Texas A&M University. She’s been in the business for over 21 years and says that 2023 is far from the ideal market that she saw in 2021. “2021 was perfect because… the market was hot. However, 2022 was much tougher and 2023 is bouncing back a little bit but is nowhere where it was two years

ago,” she said. “A lot of people are looking for homes and questioning purchasing, but a lot of applications haven’t quite turned into contracts.” Wolf cited slow inventory as a contributor to the tight market. “We’re not seeing people want to refinance from the 2% or 3% rates that they got a few years back,” she explained. “Even investment properties, which is what I see a lot of in College Station, are slowing down.”

Wolf says that right now, her main customers are primary residences between $325,000 and $350,000. She also described working with a lot of first-time buyers in the market –more than she’s worked with before. But Wolf’s bread and butter around the springtime is usually parents purchasing investment properties for

their kids going to a Texas university. This year, however, she’s seeing less of those investments due to high-interest rates.

“I’m hearing that prices all over are coming down. But it’s tough to generalize what the Texas market is going through because each city and geographic area is its own ecosystem,” Wolf explained. “Right now, the real estate agents dictate the activity. They have to work a lot harder to solicit the buyers out there, especially pulling first-time buyers out of the weeds and incentivizing those loan products designed for first-timers.”

Toni Shopp tells a different story, even though she and Canales work for the same company. Shopp, who has been an LO since 2019, says she personally isn’t seeing first-time buyers pursue homeownership. “The rates are scaring them because they expect to get the same rates that COVID-19 shoppers did,” she said. “I tell them that you marry the house and date the rate. Rates historically go up and down, and you can refinance down the road.”

Shopp is licensed in five states but does most of her business outside of Austin. She says that the influx of tech companies – Tesla, Dell, etc – is impacting homebuying, albeit to an extent. It’s been a tough market for her to be resilient in, but Shopp has a different angle. Prior to originating, Shopp held a real estate license and says she’s kept in touch with the renters. “I’m trying to sway them into homebuying and keep up with their journeys,” she said. “I tell them that when you rent, you’re paying 100% interest. They have to think of real estate as an investment, not just a place to stay.”

Jennifer Wolf 1st Alliance MortgageAdapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

Inquire about our NMLS Data Licensing and LO Contact Database options.

Twenty years ago, Frost Bank froze its mortgage operations in the Lone Star State. Now, it’s back in the mortgage business in an aggressive way.

By the end of 2023, players in the Texas mortgage industry are going to feel the heat.

The San Antonio-based bank, seventh largest by assets in Texas, is currently ramping up its mortgage operations. It has hired 80 loan officers and formed a partnership with Infosys to create a digital lending platform.

It’s running a pilot program with only employees being offered mortgages initially. Later this year, it will market mortgages to existing clients and then open the market up to any mortgage seeker.

One Texas mortgage industry expert thinks there’s both good and bad news in Frost’s return. “Both banks and nonbanks will potentially be impacted by Frost’s entry into the mortgage space,” says Marty Green, a Dallas-based partner with Polunsky Beitel Green. “Because mortgage companies expanded to meet the increased demand during the pandemic, Texas already had a very competitive mortgage environment. Frost Bank entering the residential mortgage market will only make it more competitive. But Texas mortgage companies are no strangers to intense competition and will adapt. The good news is that the anticipated growth in Texas will provide ample opportunity for existing market participants, as well as for new participants like Frost Bank.”

When Frost Bank pulled the plug on its mortgage origination business, it stepped

away from what was 10% of its loan portfolio at the time. Chairman and CEO Phil Green said he hopes the bank returns to those levels within the next five years. “The way I hope it turns out is, if you look five years out, it'd be the 10-ish percent of the portfolio back when we used to have them on the book before, I think we're around that area, 10%, 12% of the portfolio. So I just think directionally, we'd be in that same level. If you kind of took what would that be and what kind of volumes would that be, you could sort of pencil out how much that might add to growth.”

As of the end of 2022, Frost had a loan portfolio of $17.03 billion. The target for mortgages would be at least $1.7 billion in five years.

When the housing market collapsed in 2008, some folks thought the bank’s execs knew something everyone else didn’t. “It made us look like geniuses,” said Bill Day, Frost Bank’s senior vice president of communications. “It wasn’t falling in with our model of building relationships with customers. The whole business was commoditized. It wasn’t a business decision. It was an institutional decision.” Frost Bank’s Green told the San Antonio Express that it basically came down to too much emphasis on rate shopping.

Now some might question the bank’s return to mortgages. The Mortgage Bankers Association reported, on average, independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks lost money on loans they originated in 2022: the first time that’s happened in the 14-year history of the MBA’s annual report on the industry. IMBs and mortgage subsidiaries of chartered banks lost an average of $301 on each loan they originated in 2022. That was down dramatically from an average profit of $2,339 per loan in 2021, the report states.

As the bank rapidly expands its branch presence across Texas, Frost execs say it made sense to return. “Around 2020 we started talking about the gap - customers were asking for it and we thought if we could offer the same kind of customer service,” Day said. “It is the most significant purchase people make in their lifetime and we weren’t there.”

Day said the company started the process from the ground up beginning in the fall of 2021, but did not want to team up with an existing lender. The bank would

“Both banks and nonbanks will potentially be impacted by Frost’s entry into the mortgage space.”

> Marty Green, Partner Polunsky Beitel Green

not divulge what is investing in the return to mortgages.

Frost Bank has hired about 80 salaried loan officers, Day said, with no plans currently to add more. “We have a good group of mortgage loan officers now, and we probably will add more as we increase our mortgage lending going forward, but that will depend on the volume of loans. We will be flexible as we grow, so there isn’t a specific target number or timetable for that growth,” he said.

Day said the bank will focus on home purchases and not refinancing and they won’t be selling the servicing rights. “We want to hang onto that loan,” he said.

That could be the silver lining in the cloudy mortgage industry. The same MBA report that painted the bleak view on originations in 2022 was more celebratory of servicing. On the servicing side of the business, net financial income more than doubled in 2022, the report said. Higher loan balances pushed per-loan servicing fees higher, while servicing expenses dropped as serious delinquencies fell. In addition, valuation markups on mortgage servicing rights and slower prepayment activity contributed to servicing profitability, the report states. Net servicing financial income, which includes net servicing operational income, as well as mortgage servicing right (MSR) amortization and gains and losses on MSR valuations, was at a gain of $586 per loan in 2022, up from a gain of $261 per loan in 2021.

One Texas loan originator thinks Frost might be looking in the wrong direction. “They should be focusing on wholesale and [the non-delegated] channel, instead of loan origination,” says Aslam Mansoor, a loan originator with Liberty Home Mortgage in Plano, 20 miles northeast of Dallas.

Marty Green thinks Frost is making a move at the right time. He deems them a “formidable competitor in an already crowded marketplace.”

He explained, “Frost has been in Texas for over 150 years and currently has over [170] branch locations, so they are a name that Texans will know and be familiar with. They also have a fairly large deposit base and those customers may very well prefer to obtain a residential mortgage directly from their banking institution.

“So the existing footprint, combined with an aggressive plan to expand its banking operations in the state, could provide Frost with an exceptional launching pad for its mortgage operation. It also coincides with some other large banks reducing their mortgage operations in Texas, which provides available mortgage talent in the state from which Frost can staff its mortgage team. So from a timing perspective, Frost may be poised to see fairly immediate success in growing their home mortgage division.”

be fully up and running to offer mortgages to the public by the end of the year.

“We’re moving slow and steady,” Day said. “The main thing is we wanted to build it our way.”

Frost Bank has the wherewithal to wait. Frost is the banking, investments and insurance subsidiary of Cullen/Frost Bankers Inc., a financial holding company with $52.9 billion in assets on Dec. 31, 2022. According to the Texas Department of Banking, Frost is the seventh largest bank in the Lone Star State by asset size and is one of the 50th largest banks in the U.S. Its 172 branches are in Austin, Corpus Christi, Dallas, Fort Worth, Houston, Permian Basin, Rio Grande Valley and San Antonio regions.

However, the move back to mortgages doesn’t come without significant increase in noninterest expenses. “Looking at our projection of full year 2023 total noninterest expenses, we expect total noninterest expense for the full year 2023 to increase at a percentage rate in the midteens over our 2022 reported level,” said Green on the earnings call. “Our continued expansion in Houston and Dallas and the introduction of our mortgage product accounts for about 2.5% of that projected growth.

The bank is also not rushing into the new offering as it sees what works best and what doesn’t. Mortgages to employees are first as part of the pilot program.

“Our team has created a new mortgage loan process from the ground up to originate and service mortgage loans and keeping with the Frost philosophy, and we've created a great digital and mobile experience around it. Once we complete this pilot program, we'll roll out mortgage lending to customers on a limited basis with the goal of opening it up to everyone later this year,” Phil Green said in the earnings call.

As of the end of February, they have closed two mortgages and they are with bank employees. The goal is to scale up and

“Also impacting the projected growth rate is significant investments that we will be making in information technology for both people and infrastructure. Investments in marketing in both advertising and people as we focus on expanding the communication of our value proposition and expense growth is also impacted by costs associated with continued support of our staff.”

The decision to return to mortgage lending comes at a time when the bank, which has been in business for more than 150 years, is also growing. They are wrapping up an expansion in the Houston area that will more than double their presence from about 32 to 55 branches, which they call financial centers. They are also beginning an expansion in the Dallas area that will see Frost grow from 14 to 27 branches. Altogether Frost has 172 locations across Texas.

Day attributed the growth to Frost CEO Phil Green who is known to say “if a business isn’t growing, it’s dying.”

It’s time to let your skills shine. Find resources for breaking through barriers like degree screens and stereotypes. It’s time to tear the paper ceiling limiting STARs: workers Skilled Through Alternative Routes rather than a bachelor’s degree.

I am more than who I am on paper.

It has been a busy time for the Texas Legislature, and multiple bills passed that may affect Texas Home Equity Lenders.

One statute specifically affects mortgage servicers and mortgagees. The statute (House Bill 219) adds Section 343.108 to the Texas Finance Code, which requires a mortgage servicer or mortgagee to deliver a release of lien within 60 days after a loan is paid in full. The release should be delivered to the mortgagor or filed in the appropriate real property records of the county where the property is located.

However, the bill requires an expedited release if the mortgagor requests the release on or before the 20th day after the loan is paid in full. If the mortgagor makes the request, the mortgagee or mortgage servicer must

deliver or file the release within 30 days of receiving the written request. A mortgage servicer only is required to comply with these requirements if it has the authority to deliver or file a release of lien for the loan. Further, if there is a conflict between the new requirements and a home loan agreement entered into before its effective date of Sept. 1, 2023, the provision of the home loan agreement controls.

Lenders and servicers are likely to benefit from a new law that protects businesses from conflicting or inconsistent local laws and regulations. Such local laws could affect land use (beyond zoning), environmental requirements, architectural and esthetic standards, evictions, foreclosures, and many other aspects of

mortgage lending.

House Bill 2127, known as the Texas Regulatory Consistency Act, passed in the Legislature and is waiting for the Governor’s signature. The act seeks to remove local regulations in specific areas that have led to a patchwork of regulations across the state. The act will amend seven different Texas Codes, including the Texas Finance Code, by adding Section 1.0004.

The amendment will preclude municipalities or counties from adopting or enforcing ordinances that are not explicitly authorized by state statute. The amendment would allow any person adversely affected by an ordinance to bring an action against the city, county, or official enforcing the ordinance. However, there is an exception for credit services organizations if the municipality adopted the ordinance before Jan. 1, 2023. The expectation is that

consistency of laws and regulations will remove uncertainty and risk and decrease the cost of doing business across the state.

Lenders and servicers also may be affected by a new law that shortens the time period for a company to report a security breach to the state attorney general. Under the existing law, companies had 60 days to notify the state attorney general of the breach. Effective Sept. 1, 2023, Senate Bill 768 amends the timeframe to “as soon as practicable” but no later than the 30th day after a breach has been determined. It will only apply to a breach that involves at least 250 residents in the state.

To facilitate reporting, the attorney general’s office is directed to post an electronic form on its website for companies to report breaches. The law does not affect other existing data breach reporting obligations, such as the obligations to notify consumers, consumer reporting agency, and data owners in certain circumstances.

Consistent with current law, companies must provide a detailed description of the nature and circumstances of the breach, as well as the number of affected individuals and the number of people already notified of the breach. Additionally, companies are required to address what steps they are taking to resolve the breach. These breach notifications will also be made available to the public on the attorney general’s website.

Finally, Senate Bill 1568 passed in the legislature and is waiting for the governor’s signature. If signed, it will expand the definition of “trustee” and “substitute trustee” to clarify what parties are authorized to be a trustee and take action under a Deed of Trust with Power of Sale. The bill specifies that a trustee or substitute trustee may be an individual, corporation, organization, government or governmental subdivision or agency, business trust, estate, trust, partnership, association, or other legal entity. This amendment gives clarity and certainty to the process of selecting a trustee and substitute trustee.

Notably, a bill proposing a constitutional amendment to loosen the restrictions on where a home equity loan or HELOC can close did not make it out of the Senate. The current law for home equity loans requires the borrower to close the loan at the office of the lender, an attorney’s office, or the office of the title company. House Bill No. 264 was trying to change that requirement for borrowers located outside of Texas because they, or their spouse, are on active duty with the United States Military, an officer of the Commissioned Corps of the United States Public Health Service, or members of the reserve components of the armed forces of the United States. The exemption would have also applied to civilian employees of the federal government connected to the armed forces if the employee is assigned to a foreign country or vessel.

Non-military members would have enjoyed the relaxed signing requirements if they had a disability that prohibits travel, were unable to leave their homes for medical reasons, and had a physician verify their condition. The bill would have extended this privilege to individuals who were incarcerated or under house arrest. It would have allowed qualified borrowers to close the loan from a remote location using online notarization. While this bill did not make it to the Governor’s desk, additional efforts to streamline the closing process will probably arise in future sessions of the Legislature.

Although House Bill 219 and Senate Bill 768 will not take effect until Sept. 1, lenders and servicers should begin their compliance efforts now to avoid potential issues. Compliance guidelines may need to be created or amended to ensure the necessary actions will be taken within the required timelines.

Paul Kellogg is of counsel in the Houston office of McGlinchey law firm; David Tallman is a member of the firm in the Houston and Dallas offices; and, Louis Rossitto is an associate in the Houston office.

Compliance guidelines may need to be created or amended to ensure the necessary actions will be taken within the required timelines.Paul Kellogg McGlinchey, Houston David Tallman McGlinchey, Houston/Dallas

Texas is now one of only two U.S. states with a population of 30 million or more: the nation’s second-most-populous state reached a population milestone by passing the 30-million threshold.

Texas’s population in 2022 was 30,029,572, second only to California (39,029,342), not surprising given its consistent place in recent years among the nation’s fastest-growing, largest-gaining states.

From 2000 to 2022, the population of 11 of Texas’s 254 counties more than doubled, according to July 1, 2022 population estimates released.

The population of Texas, the largest in land area among the Lower 48 states, increased by 470,708 in 2022, continuing a steady uptick. From 2000 to 2022, the state gained 9,085,073 residents, more than any other state and almost 3 million more than Florida, the next largest-gaining state.

That’s a 43% jump, which made Texas the fourth fastest-growing state in the country, behind Nevada, Utah, and Idaho.

Rockwall County was not only the fastestgrowing county in Texas but also the secondfastest growing county in the nation.

Unlike Florida, where growth stemmed mainly from domestic migration, Texas experienced moderate increases across all components of population change.

About half of Texas's population gain since 2000 resulted from natural increase (more births than deaths); around 29% from net domestic migration gains; and 22% from net international migration gains.

Harris County, home to Houston, was Texas’s largestgaining county, adding a net 1,366,674 people during the 22-year period. And the population of Rockwall, the state's fastest-growing county, nearly tripled (182% growth).

Harris County added the most residents but several counties within the Dallas-Fort Worth-Arlington metro area had significant gains, too. Most notably Tarrant, Kaufman, Collin, and Denton counties:

Tarrant County gained the second-largest number of people in the state (almost 700,000).

Kaufman County’s population rose by 139%, making it the state’s fifth fastest-growing county.

Collin County grew by 132% or 659,578 residents, while Denton added a net 538,490 people — a 123% increase — making these counties two of the fastestgrowing, largest-gaining counties in Texas from 2000 to 2022.

Texas counties led the nation in growth.

Rockwall County was not only the fastest-growing county in Texas but also the second-fastest growing county in the nation, behind Lincoln County, South Dakota.

Eight other Texas counties (Hays, Williamson, Fort Bend, Kaufman, Comal, Collin, Montgomery and Denton) ranked among the nation’s 25 fastest-growing counties between 2000 and 2022, when all saw their populations double.

Ten Texas counties (Harris, Tarrant, Bexar, Collin, Denton, Fort Bend, Travis, Williamson, Montgomery, and Dallas) were also top gainers nationally during this period.

Harris County was the nation’s second largestgaining county after Maricopa County, Arizona.

Texas gained an average 412,958 residents annually between 2000 and 2022.

In 2010, the population of Texas was just two-thirds that of California. By 2022, it was more than threefourths that of California. In 1930, Texas had more people than California — and the 2030 Census will show where both states stand a century later.

The population estimates release provides growth data for all U.S. counties.

BY DAVID KRECHEVSKY , EDITOR LONE STAR LO MAGAZINE

BY DAVID KRECHEVSKY , EDITOR LONE STAR LO MAGAZINE

Call it a cultural thing.

That was one reason cited by loan originator

JoAnna Camposano for why Texas was the toughest state in which to close a mortgage in 2022.

The Lone Star State ranked No. 1 based on an analysis of 2022 Housing Mortgage Disclosure Act (HMDA) data conducted on behalf of Lone Star LO magazine by Richey May, a Denver-based financial services firm.

The analysis, which included reviewing first- and second-lien loans, determined that Texas ranked as the toughest place to close a loan, with just 46.33% of mortgage applications being funded. Louisiana ranked second, at 46.75% of applications

funded, followed by Florida at 46.98%, Mississippi at 47.75%, and Georgia at 48.13%.

That compares to a rate of 52.8% of loans funded nationwide. The analysis included data from the 50 U.S. states and the District of Columbia along with combined data for the U.S. territories of Guam, Puerto Rico, and the Virgin Islands.

According to the analysis, 21 of the 52 states and territories funded loans at rates below the U.S. average.

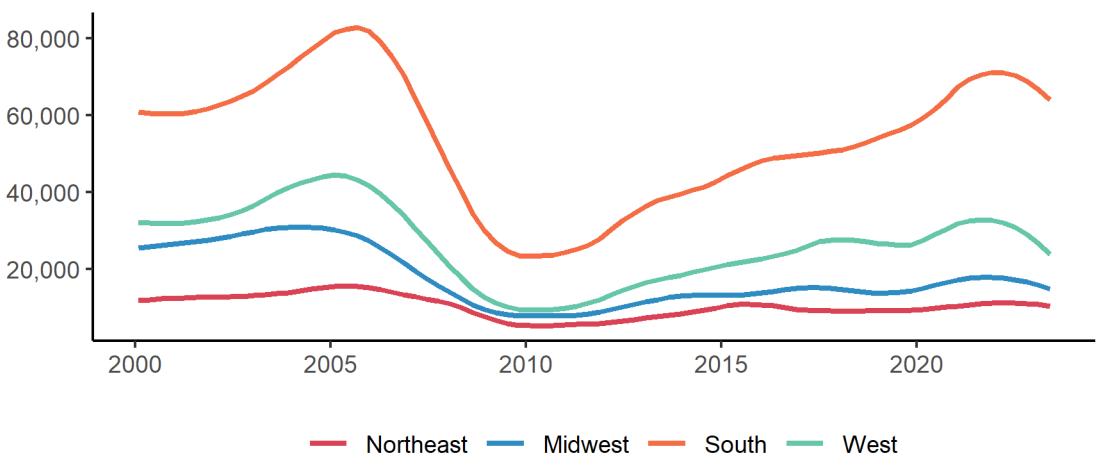

It’s no coincidence that the top five toughest places in which to close a loan were all located in the South. That was by far the toughest of the four U.S. regions to close a mortgage in, with just 49.38% of loans funded. The three other regions — the Midwest (57.62%), Northeast (55.44%), and West (53.41%) — all had

“We see that a lot in our industry, or at least on the border, with the Hispanic culture. We struggle with them having to establish credit. They don’t want to do that.”

> JoAnna Camposano Senior Loan Officer Fairway Independent Mortgage Corp.

funded-loan rates above the U.S. average. Based on HMDA data, there were six reasons for a mortgage to not be funded:

• The application was denied;

• The application was approved but not accepted by the borrower;

• The pre-approval request was denied;

• The pre-approval request was approved but not accepted;

• The file was closed for incompleteness; or

• The application was withdrawn.

According to the analysis, in 2022 nearly 2.5 million applications nationwide were recorded as denied and another 2.2 million were withdrawn, compared to 1.25 million for the other four reasons combined.

Talk to loan originators, though, and they offer a frontline perspective for why so many mortgage applications failed to close in the Lone Star state.

You might have noticed that none of the six reasons for loans to fail mention anything about cultural differences.

That brings us back to Camposano, a senior loan officer with Fairway Independent Mortgage Corp. and Team Camposano in Eagle Pass. Located southwest of San Antonio, Eagle Pass is on the border with Mexico.

“There’s a lot of Hispanics,” Camposano said. “And we see a lot of people who don’t trust the banks.” She said it is a cultural thing, with Hispanics preferring to pay in cash and refusing to open bank accounts.

“We see that a lot in our industry, or at least on the border, with the Hispanic culture,” Camposano said. “We struggle with them having to establish credit. They don’t want to do that.”

Which, not surprisingly, can make completing applications for pre-approval of mortgages a challenge. That, and some other issues, she said.

“We do have a lot of people also that

change jobs a lot,” Camposano said. “So it makes it harder for us to get an approval.

… We have people that have, like, eight or nine jobs. So it just makes it more difficult tracking down the employers, getting the verifications of employment filled out.”

While pre-approvals do happen, she said, “what normally would take maybe 24 to 48 hours …, we’re seeing it sometimes take three weeks, four weeks, just to actually get them pre-approved.”

Because of that, she added, “people get discouraged.”

Camposano also noted that a majority of the people she works with, “like 90%,” are first-time homebuyers, “They’re kind of nervous, … but that’s where I, as a mortgage professional, will walk them through the whole process to where they feel comfortable.”

Because so many of her clients are first-time buyers, Camposano says educating them on the process is key to helping them eventually close their loan.

“We do a lot of the first-time homebuyer programs that the state of Texas offers,” she said. “And one of the requirements is that they do take a home-buying course.”

Camposano said that helps “a little bit,” but she and her team supplement that education to make sure clients know “the steps that they’ll be going through on the whole home-buying process, … which usually takes about 30 to 45 days in our market to close.”

Linda Davidson agrees that buyer education is often a key to getting loans closed. Davidson, area leader, branch manager, and senior loan officer for Fairway’s Heritage Group in Garland estimates that two out of every five of her clients need a “get mortgage ready” action plan. Garland is about 20 miles northeast of Dallas.

“So they are not, at that point, prepared to purchase, or we would be setting them up for failure to even try,” Davidson

“We get the documentation upfront, we review it upfront — whether it’s alternative credit letters, whether it’s funds to close — whatever it is, we do it upfront so we make sure that we don’t close late or ugly at that point ...”

> Linda Davidson Branch Manager and Senior Loan Officer Fairway Independent Mortgage Corp.

said. “So we give them a written outline on exactly what they need to do to get mortgage ready. Sometimes it’s to put them in a credit repair. Sometimes it’s just building credit. Sometimes it’s just education — ‘these are the things you need to do.’ Sometimes it’s saving money.”

Even if a client uses a down payment assistance program, she said, “it’s not paying for everything. So every situation’s different. And I love when clients call us and say, ‘I’m not buying for a year from now, but can you tell me what I need to do?’”

And despite all of that education, some clients just don’t follow the advice, Davidson said.

“Sometimes … circumstances are just so much out of their control,” she said. “Life, you know, happened. And sometimes it’s just … the desire to be a homeowner is not as strong as the desire to not break the bad habits that are already there. So it really depends on the person.”

Davidson said she also was told early in her career that the best thing she could learn “is to be better than an underwriter. And I can truthfully say that I’ve never had a loan turned down that we’ve sent to underwriting.”

That’s because she tries to gather everything before it’s sent, she said.

“We get the documentation upfront, we review it upfront — whether it’s alternative credit letters, whether it’s funds to close — whatever it is, we do it upfront so we make sure that we don’t close late or ugly at that point,” Davidson said. “I think that’s one of the big keys of closing.”

As in many places, homebuyers in Texas face affordability issues. With interest rates hovering between 6% and 7% and prices still elevated, it’s even tougher these days to afford a home, especially for first-timers.

“It’s kind of hard when it’s just one income and you’re having to pay a $2,000 mortgage payment,” Camposano said. “People want to have a comfortable payment, but with the prices for houses, it’s just not likely.”

That means loan originators have to be creative, “whether we do a two-one buydown or buy points just to get them to feel comfortable with the payment,” she said. “Like we say, ‘you’re only going to date the rate. You can always refinance later.’”

The flip side of affordability, she added, is when potential homebuyers get preapproved for a loan, but then can’t find a house within their budget.

“We really don’t see any denials in our market,” she said. “It’s really more that the client was not able to find a house, or something changed in their job history that put the application on hold temporarily.”

Davidson says the hot housing market during the pandemic made it especially difficult for first-time buyers.

“It was almost impossible to get your contract accepted because there were multiple, multiple, multiple offers with 20% and 30% and 40% down, and then paying over with no contingency on anything,” she said. “So it was really, really hard for our first-time homebuyers.”

“Then that shifted around May of 2022,” she continued, “And then we started

seeing our seller willing to take those government loans, those low down loans, that kind of thing.”

Davidson said the Dallas-Forth Worth area does have “a major shortage of inventory, which is bringing back the multiple-offer market, and making buyers reluctant to accept buyers with government loans.

“It’s not a weak file, it’s a good file, it just has a family that is looking for homeownership,” she said. “But I get it, on the seller’s side,” she said. “If you are being offered 60 grand over on a strong conventional mortgage, then I get it.”

Camposano also defended buyers

using government loans, such as FHA or VA loans. “There’s not really a difference between an FHA and a conventional loan,” she said. “I know some people say, ‘well, the appraisers are really picky.’ In my opinion, I think that’s a myth.”

In general, she said, “our sellers have no objections” to borrowers with government loans.

For both Camposano and Davidson, the bottom line for homebuyers is to work with a loan originator who knows the area and can best prepare them in advance for the process.

“So I think, first and foremost, go to a trusted mortgage professional that knows the market, knows the

area, and that knows their guidelines,” she said. “That is, to me, one of the most important things. Listen to the education that they’re giving you.”

For Camposano, the most important thing for a buyer is to not do anything that could alter their financial or credit situation.

“Don’t do any major purchases, any major changes without consulting with us first,” she said. “Anything that you’re going to do, consult with us before anything because we definitely do not want any hiccups down the road. We want to get you into that house within 30 to 45 days, and everybody’s happy.”

EXCLUSIVELY ON PRODUCED BY NMP FOR THE INTEREST FEATURING STEVE RICHMAN

TUNE IN EVERY FRIDAY FOR YOUR MONEY-MAKING TIPS.

The capital city is being revamped into a premier place for young tech workers

BY SARAH WOLAK , STAFF WRITER, LONE STAR LO MAGAZINE

BY SARAH WOLAK , STAFF WRITER, LONE STAR LO MAGAZINE

There’s no such thing as a perfect housing market, but Austin is trying to check off all the boxes for wouldbe buyers. Young and savvy tech professionals are flocking to the funky metro known for its music scene to scoop up jobs and take the plunge into homeownership.

Since Austin is attracting new buyers and transforming long-term renters into prospective homeowners, LOs aren’t having trouble wrangling customers to buy loans. And it helps that 25.8% of homes in Austin have lower estimated monthly housing payments than they would have if they had been for sale a year ago, according to Redfin. Year-to-date home sales price data from the Austin Board of Realtors show a 12.6% decline in the median price for homes in the fivecounty Austin region compared to the first four months of last year. The market is balancing out, and buyers are ready to move from the sidelines into the playing field.

It helps that prices are falling, too, even though most buyers in the Austin area are able to afford those heftier purchases. Zeke Alvarez, an Austinbased loan officer at SecurityNational Mortgage Company, says originations have been easier to write due to a sophisticated buying pool. “These buyers – especially those moving with their tech companies – are highly educated and have high credit,” he said. “They’re more likely to buy homes in the $500,000 range. It’s a completely different buying experience from that of first-time homebuyers.”

Alvarez also says that because these sophisticated buyers are flocking to a brand new area, they’re easier to market to and are more likely to willingly engage with an LO. “I’ve seen that when I host professional networking happy hours, people are

more likely to show up and mingle,” he said. “Everyone at these events is from everywhere else, so even while they’re going to the event to meet a mortgage professional, they’re also going to meet people from the area.”

Erin Dee offers a unique perspective from her perch as chief operating officer at LoanPeople, a member of Texas Mortgage Bankers Association board of directors, and a recent homeowner. She says that Austin caters to singles looking for an urban living area and nightlife and families looking for sizeable yards. “Austin is a vibrant area with the best of both

expatriates looking for jobs in the tech industry. “Now we’re up to about three months worth of inventory, and buyers are starting to get some of their negotiation power back,” she added. “For example, I just bought a home and was able to offer below the asking price and still get what I wanted. Home prices have started to decline, too, which makes it easier to purchase.”

Alvarez has only worked in the Austin market for just over two years, but he’s quickly seen how Austin has transformed into a tech hub. Big tech firms like 8VC and QuestionPro relocated to Austin as early as 2020, and companies like Tesla and Samsung are building factories in the Austin area, earning it the nickname “Silicon Hills.” And people looking to break into Austin are even flocking towards cities on the outskirts like Georgetown and Kyle, which were both listed on the U.S. Census Bureau’s Vintage 2022 Population Estimates’ list of fastest growing cities.

worlds: tech and the outdoors,” Dee said. “The job market is favorable, too, and there’s a lot of building happening which makes for new neighborhoods and places to live.” Alvarez shared a similar outlook; since Austin offers a variety of living styles from suburban subdivisions to lofty apartments, it’s easy to find buyers because there’s something for everyone.

Dee said that last year, Austin had less than one month’s worth of inventory, and buyers were ousted by higher bidders – mainly California

Alvarez says that the largest draw for tech firm relocations have been housing prices, high taxes, strict building regulations, and the overall cost of living. Employees – especially first-time homebuyers – are eager to make the move to buy homes that, to them, are more affordable than what they’ve seen. To boot, the median family income soared to $110,300 in 2022, up 45% from a decade earlier, according to the U.S. Census Bureau. Despite current market conditions, Alvarez says the majority of his customers right now are first-time homebuyers and demand is hot. “The largest buying pool is millennials down here. The average age in Austin is between 33 and 35 years old, which means they’re usually buying for the first time, which makes them a bit skittish,” he said. “A lot of buyers that I work with come from California. But

“Austin is a vibrant area with the best of both worlds: tech and the outdoors.”

> Erin Dee, COO, Loan People

even a lot of the Realtors I’m working with are from California or the West Coast. There’s definitely a trend of people coming here from that area.”

Alvarez pointed out that a lot of people moving to Austin usually move with the trends, not because Austin is the most affordable market. “Because Austin is becoming its own Silicon Valley, you’re not just not seeing the

techies come over,” he said. “It’s now people from places like Seattle, the East Coast, and Portland, Oregon.. It’s a mass exodus not just because it’s a good place to buy a home, but it’s becoming one of the hottest job markets.”

Even though Alvarez praises Austin’s offerings, he also knows that Austin has its own set of challenges. “It’s not a perfect place to buy a home, Austin has its own issues like gentrification and infrastructure,” he explained. “But

there are a lot of pluses to living in Austin. The appreciation rate [here] is high. There’s also a lot of culture and education.”

Bankrate’s Ostrowski, like Alvarez, also stressed that no job market is perfect. “There’s no perfect metro, and no metro [we analyzed] scored well in every category,” he said. “[Austin] may be the ‘least’ bad market for first-time homebuyers.”

Dee offered advice for newcomers to Austin, especially first-time buyers:

“Find a local lender and Realtor who really knows Austin in and out. Keep it local. People here will have your best interest and homeownership goals in mind.”

The view from the ground is backed up by stats from Bankrate, a consumer financial services company, that found Austin and Texas’ Round Rock metropolitan area are the best metro markets for first-time buyers.

Jeff Ostrowski, an analyst with Bankrate and principal mortgage writer, said, “It was the strength of the job market that pushed Austin to the top.” Bankrate analyzed four categories to determine the best aggregate metro. For example, Ostrowski explained that Austin scored first in having a healthy job market, second place in market tightness – meaning days on market and inventory count – and sixth place in wellness and culture. Austin placed 35th place in affordability. Bankrate also used U.S. census data, diversity indices, and U.S. Labor Department data to evaluate each metro.

“We looked at unemployment, which is very low in the Austin area, and we looked at job growth. Tech jobs are a big driver for Austin. We also weighed commute times in that category.”

But it’s not just the youngins taking advantage of Austin’s housing scene. Steve Ferguson, branch manager and national director of home ownership initiatives at Thrive Mortgage, says despite the majority of his customers are young, long-term renters ready to plunge into homeownership, retirees are also flocking to the sunny metro.

“Especially in Austin’s suburbs, people are seizing the opportunity to buy,” Ferguson said. “Other factors like education and strong economic opportunities, and even tech-focused jobs, are drawing people in. Austin

itself is a melting pot of economic opportunity.” Ferguson also said that the Austin market can be daunting to first-time buyers who have long put up with high rent costs. “They’re nervous about affordability in Austin, but they’re realizing that rent costs aren’t getting cheaper anytime soon,” he said.

And, overall housing in Texas is depreciating. According to Veros Real Estate Solutions, the Austin and

Round Rock markets are expected to depreciate -6.4%. Eric Fox, chief economist at Veros, seems to think Austin has reshaped. “It appears that we have turned the corner from overall slight annual forecast depreciation one quarter ago to an overall flat forecast now,” she commented. “This suggests that we are now seeing a halt to the continually declining annual forecasts which started a year ago to one that is ticking back up, albeit slightly.”

“It’s a mass [influx] not just because it’s a good place to buy a home, but it’s becoming one of the hottest job markets.”

> Zeke Alvarez, loan officer, SecurityNational Mortgage Company

Kristin Stark isn’t just a loan officer. She was a world traveler – an Army brat who graduated high school in Germany. Now she’s a mother, a leader of an all-female loan team, and a solutionist.

But Stark’s most prominent attribute – one that she doesn’t brag to you about – is that she’s a tough cookie. The mother of two children with special needs, Stark can tell you what it’s like in and out of the office to have patience, attentiveness, and strength. She’s had intense encounters like when a customer threatened to find her and kill her and her children – all over a change in property taxes. She’s dealt with colleagues making fun of her appearance, and she once held a job where she cried daily in the parking lot before going in.

Stark hasn’t given up through it all. And now she can add overachiever to her list of attributes, being within the top 1% of women loan originators. Stark and her team closed just over $40 million last year, and in the first six months of 2023 has $24.01 million under her belt. “I don’t have a niche,” Stark affirms. “I say yes to whoever needs me; I say yes to $67,000 loans as much as I do with $3 million contracts.”

Ashley Watson, Stark’s business partner, has worked alongside Stark for just over three years. She paints Stark as being an underdog who continued to focus on the purchase market during the big refi boom of 2020 and 2021. She was pregnant, on bed rest, and still finding a way to crank out loans or harness a referral relationship.

“She had just become an independent loan officer and had a poor pipeline, so she just focused on forming good relationships and narrowing in on purchase while everyone else made it big off of refinances,” Watson explained. “Now her business has absolutely taken off. We’re thriving from

word of mouth and agent relationships … we put the hard work in [during the boom] to get the business that won’t ever die.”

But it took a long time for Stark to branch off and become independent in her business. Following her graduation from West Texas A&M University with a degree in public relations and advertising, Stark picked up and moved to Oregon. What she had assumed would be a state flush with new job opportunities turned out to be

a job at American General, a subsidiary of American International Group (AIG), which hired her to do loans. But her life got flipped upside down when 2008 happened. Stark was told to handle foreclosures and got her title as a senior LO ripped away.

When the market picked back up she took on being an LO again – this time, in Lubbock, Texas. “I started at Prosperity Bank as an LOA and worked for only men,” Stark said. “I was very belittled and felt like a servant and paid terribly … In a primarily male industry, jokes are thrown about how you look and about other women. I felt inadequate. As much as I hated their behavior, I learned a lot about strategy and

Stark experienced a Stockholm syndrome-esque feeling while at Prosperity. Through therapy and realizing her self-worth beneath the guise of who she tried to be at the bank – accommodating, selfless, and present – Stark was able to move on to Movement Mortgage and work as an LOA. “Therapy helped me realize that I was a good person and could do business the way that I wanted,” Stark said.

But Stark’s work ethic was noticeable beyond her assisting five loan officers at the same time. Customers liked her, and she was approached about the opportunity to become a preferred lender for a real estate company. Her team initially told her that she would fail; Stark responded by switching to work for CMG Financial. “I knew that now I had the opportunity to be my own business, and my first goal was to build an all-female team,” Stark said. “I narrowed in on females because we’re slinging loans while making it happen at home for our families and kids. We are dedicated and passionate moms! And I noticed with females that stuff is always going to go wrong but we have a completely transparent dialogue about those issues.”

That was back in 2019 – Stark’s first time working completely on commission.

At

“I was scared to leave my W2 safety net,” she admitted. “But I started building my business on trust. I think I was born to do this. I’m a solutionist, I wanted a team that helped and harnessed each other, not compete.”

Even though Stark’s first goal at CMG was to build a team of powerhouse women to do loans alongside, this was an adverse environment for her. Stark says she spent a lot of time alone as a kid. Her earliest roots were planted in Amarillo, Texas, living with her mom. But Stark took the opportunity to live with her father who was in the army. Stark went to Albuquerque, New Mexico for middle school and her first year of high school.

Colorado Springs claimed the next two years of high school – what Stark says was the longest time she spent at a school –and finally, she graduated high school in Germany. “It was so hard to nail down relationships. But it conditioned me for what I do now. When you move so much, you have to become a chameleon. I really didn't know who I was until I was in my

“We can all do a good job, but it’s about how you do the job. Kristin’s business has grown because of how she treats people. It’s not just a transaction, it’s our brothers and sisters who we’re helping.”

> Ashley Watson

30s,” Stark admitted. “When you go to all these schools you don’t want the other kids to know that you’re lonely and depressed and haven’t laid down one root. I never decorated my walls. By the time I would start to have a friend, I would have to move. I struggled to have roots.”

But Stark says she’s changing that by putting roots down in Texas – both for her and for her clients. “I swear every town has my signature on it,” Stark joked.

Stark doesn’t make it sound easy. In fact, she’s open about the stress that comes with being a full-time mom and an even more full-time LO. “This job is stressful … You will have highs where you’re celebrating and five minutes later someone is slapping you back to reality. I’ve wanted to quit mortgage more times than anyone knows. The highs are high and the lows are low,” she said. “You can’t have it all either. I’m lucky to have a phenomenal nanny. I want to be around my kids but I also love working. When I was an LOA I hardly saw my daughter, so now I work from home so I can see my children but someone can help me with taking them to therapy and things like that.”

And Stark’s motivation for being a workaholic is for her children to live comfortably. “You can’t teach hunger. Hunger is something that you have to find within yourself. What drives me is that I was raised and lived my life very poor,” Stark explained. “The sacrifice to me is

worth that. I never want to live like that again.”

Even though Stark has a bootstrapping attitude, she’s conscious of how she can help her team strike a balance in their professional lives and with their families, because she went without balance for so long. “I used to be scared to take off work for doctors appointments,” she said. “Everything that I wish I had when I was on the operations side I try to provide for my team.”

And Watson says that Stark’s understanding attitude comes through in every part of her job. “She’s always making sure that she doesn't push us too far,” Watson said. “Kristin puts everyone else above herself in a good way: colleagues, borrowers… she treats everyone like family.”

For Stark, old lending practices aren’t her forte. Stark – and Texas– are welcoming a new era of homebuyers: millennials. “Mortgage lending is historically known as boring old men,” Stark joked. “Even look at marketing: I’m always fighting with my compliance department about putting out things that don't look like a 70-year-old

man is going to read it.”

Stark says that her technique, or what she calls her playbook, involves lessons that she learned from her day-to-day life. Stark’s daughter has frequent outbursts, and her stress level is similar to some of the reactions Stark has seen from customers. “These people are emotionally charged and you are the path to least resistance for an emotional outlet,” Stark explained. “I use lessons from my parenting classes and help to validate their emotions. You’re frustrated, tell me more about that. How can I make you feel better about this? If something is bothering them it should bother me.

But the playbook doesn’t stop there. “ I focus on customer service and above and beyond communication,” Stark said, citing that she sends out videos every week and gives real estate agents a marketing booklet she designed. She also wants to start a podcast alongside other successful women in the industry.

Kinta Wendt, another Austin-based loan officer for CMG, is a close colleague of Stark’s and a top-producing officer. And even though they are essentially competitors, Wendt says that Stark has become her soundboard. “If Kristin can’t give you the answer she will find someone for you,” Wendt said. “[We have] the commonality of being women in the industry. There’s not a lot of very smart women in the industry or those you can bond with who are in it to win it like we are.”

Wendt says that Stark’s knowledge of the business is what drew her to her. “She isn’t just great at one task, she knows the “why” of the business,” Wendt said. “She’s worked in what I call cradle to grave, meaning that she’s worked at the beginning and end of the loan, which makes her a better LO. I call her the blonde version of me.”

For Watson, it’s no surprise that Stark’s methods have earned her recognition and respect. “We can all do a good job, but it’s about how you do the job. Kristin’s business has grown because of how she treats people. It’s not just a transaction, it’s our brothers and sisters who we’re helping,” Watson said. “Her and I are the dream team because we excel in what the other doesn’t, and vice versa. She’s trustworthy, honest, and open to her clients. And she’s creative, which balances out my analytical side.”

“You can’t teach hunger. Hunger is something that you have to find within yourself. What drives me is that I was raised and lived my life very poor.”

> Kristin Stark

Kinta Wendt CMG Loan Officer

FirstClose Inc., a fintech provider of data and workflow solutions for mortgage and home-equity lenders, said Dan Kellett has joined the Austin company as chief technology officer.

Austin-based Calque, which helps established lenders offer noncontingent mortgages, recently announced the appointment of mortgage industry veteran Dan Mugge as chief operating officer.

BSI Financial Services, an Irvingbased mortgage operating platform, has named Harold Lewis as its president and chief operating officer.

First Mortgage welcomed an experienced loan officer back to the team. The McKinney-based lender announced that Erich Cosio, a long-time Fort Worth resident, rejoined the company to continue serving his local communities.

Hillary Bryand has joined the staff of Texas Bank and Trust as vice president and mortgage loan originator in the bank’s Tyler Grande location.

The Federal Home Loan Bank of Dallas announced the appointment of David Long to its Affordable Housing Advisory Council. During the past 18 years, he has served as president of Austin-based Texas State Affordable Housing Corp.

Colliers Mortgage, the debt financing arm of Colliers | U.S., announced the hiring of Greg Young as senior vice president, production manager based out of Houston.

BY STEVE GOODE , STAFF WRITER, LONE STAR LO MAGAZINE

BY STEVE GOODE , STAFF WRITER, LONE STAR LO MAGAZINE

When Jennifer Evans had a personal crisis in 2005, she decided to leave California and move back to her central Texas hometown of Waco to be closer to her parents.

After several years of sharing their 700-squarefoot home, Evans started looking for some space of her own while working a job that paid her little more than $10 an hour as a recreational director at a local retirement community.

“I would not have been able to own a home at that time,” said Evans, who also had spent time working as a substitute teacher, city bus driver and barista after moving back to Waco. “I probably would have moved on to another city.”

But then Evans found out about a zero-interest mortgage program from a couple who lived in the retirement community where she worked.

As luck would have it, the couple she spoke to were the parents of John Alexander, the executive director of the Waco Habitat for Humanity, where the zero-interest rate mortgage program had been in existence for decades to the benefit of scores of people who wouldn’t otherwise be able to realize the dream of home ownership.

An empowering community-focused lending initiative helps a relentless texas woman transform her life

Alexander, who is still in that position, said recently that the Waco organization has completed and handed over more than 180 zerointerest mortgage homes to grateful owners since 1986, and three more are expected to be completed in 2023.

“The zero-interest mortgage is key to Habitat’s model. It is what makes the home affordable to the lowincome households we work with,” Alexander said. “Without the zerointerest mortgage, the families would not be able to purchase their homes and build wealth as they pay off their mortgages.”

The mortgage may be interestfree, but applicants don’t get a free-ride to approval.

According to the Waco Habitat for Humanity website, applicants must: be legal residents of the U.S.; either be living in overcrowded or bad conditions, paying 30% or more of their income for housing or be unable to secure decent housing through traditional means; must have a stable income 35% to 60% of the county’s median income; be able to pay all monthly bills; work at a current place of employment for at least a year; save $1,500 by closing to cover the cost of two months of utilities and insurance; and volunteer for 300 hours of sweat equity to the home they are qualified for or the home of another applicant.

The process usually takes 18 to 24 months.

Of the sweat equity, Evans said the heat during the summer was oppressive at times nearing 114. The cold was also a factor she said, but everyone soldiered through.

Evans said she worked on siding, painting, a little roofing, fascia, window installs, flooring, caulking, and helped hang doors, build porch railings, raise trusses and frame, and

assisted with roughing in plumbing.

“Some of the work was quite easy and some tasks were quite difficult. Oftentimes I worked with one or two other staff members and a few volunteers,” she said. “As my time volunteering went on, I had the opportunity to take the lead and lead a group of volunteers. I mainly got folks going on painting siding and trim or putting up Hardie board siding. I enjoyed empowering others. I also volunteered as a photographer for the affiliate.”