FINANCIAL FUTURE IS

New women’s bank focuses on entrepreneurs

Foresight leaving community bankers leery

UNDERSTANDING FAILURE

FDIC chair opines on lessons learned from bank closures

Foresight leaving community bankers leery

FDIC chair opines on lessons learned from bank closures

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

BENEFITS

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

Inquire about our NMLS Data Licensing and LO Contact Database options.

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

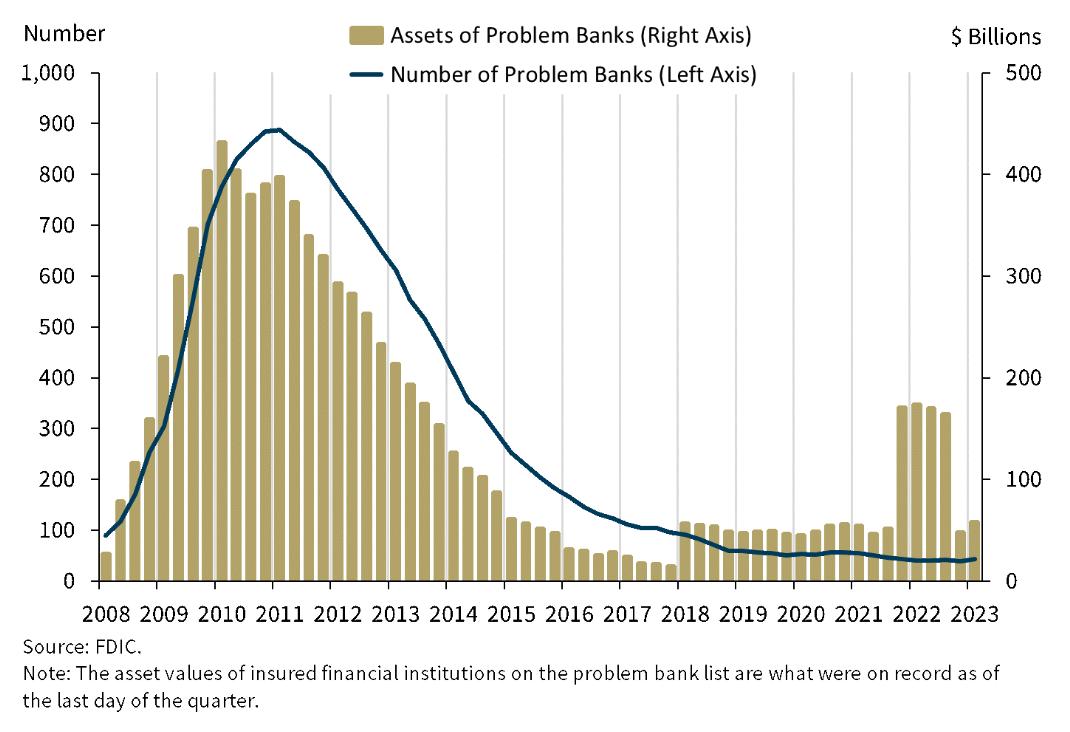

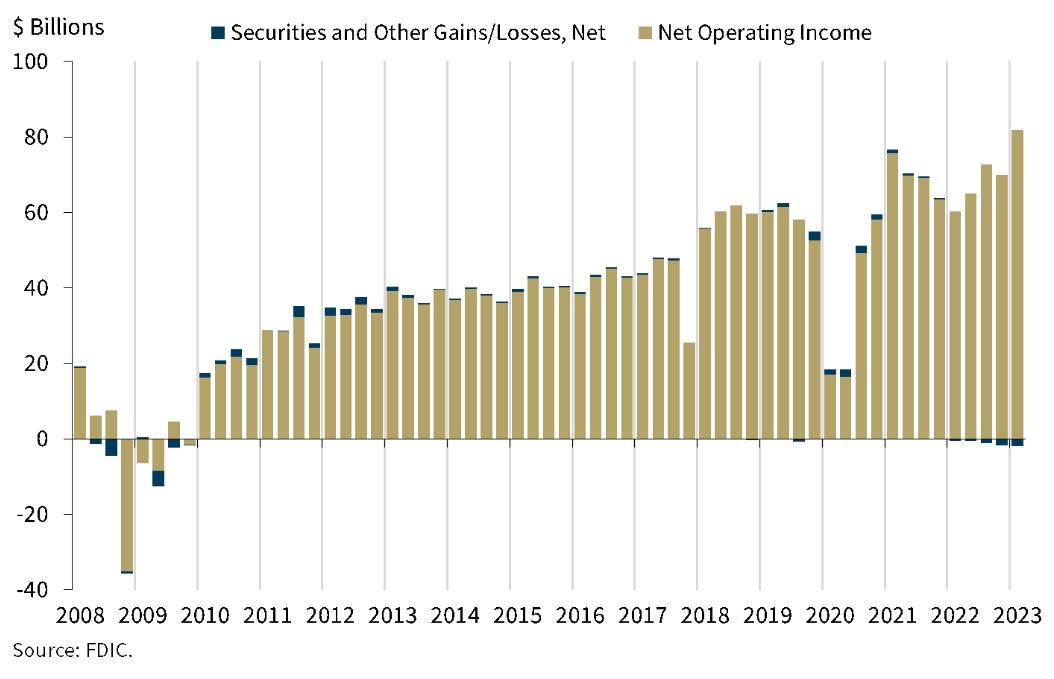

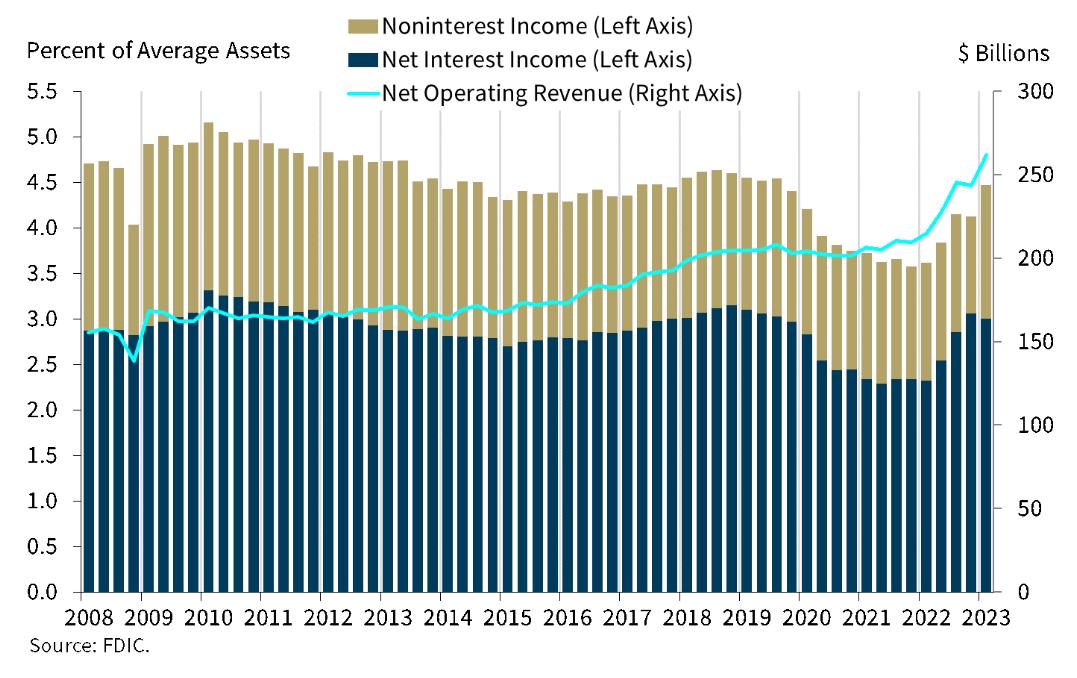

The FDIC’s 2023 Risk Review provides a comprehensive summary of key developments and risks in the U.S. banking system, as in prior reports, and includes a new section focused on crypto-asset risk. This year's report incorporates data for 2022 through first quarter 2023, with insights related to the stress to the banking sector that emerged in March 2023.

Credit Risks: Asset quality remained generally favorable as of first quarter 2023 despite modest deterioration. Weaker economic conditions and higher interest rates may challenge bank loan portfolios, including credit card, commercial and industrial, residential real estate, and commercial real estate (CRE) loans.

Agriculture: The agricultural sector had another strong year with record profits despite widespread drought conditions. Loan growth and higher loan yields boosted farm bank earnings in first quarter 2023 following a down year in 2022. Stronger farm sector financial conditions led to improved farm bank asset quality through first quarter 2023, but higher interest rates and production costs pose challenges in 2023.

Commercial Real Estate: Banks have substantial exposure to CRE lending as CRE loans comprised a quarter of total loans held by the banking industry as of first quarter 2023. CRE loans as a share of total industry assets have grown and approached their 2009 peak. Most CRE property types performed well in 2022, but some challenges continued into

2023, particularly among office properties. With a structural decline in office demand and weak rent growth, some borrowers may have difficulty refinancing. Longer-term leases, which are prevalent in the office sector, helped to insulate office properties from reduced occupancy earlier in the pandemic, but more office leases are scheduled to expire over the next three years in some large markets. While aggregate banking industry CRE asset quality metrics remained favorable in first quarter 2023, challenges to loan performance include higher interest rates, difficulty refinancing particularly for loans secured by some office properties, and economic uncertainty.

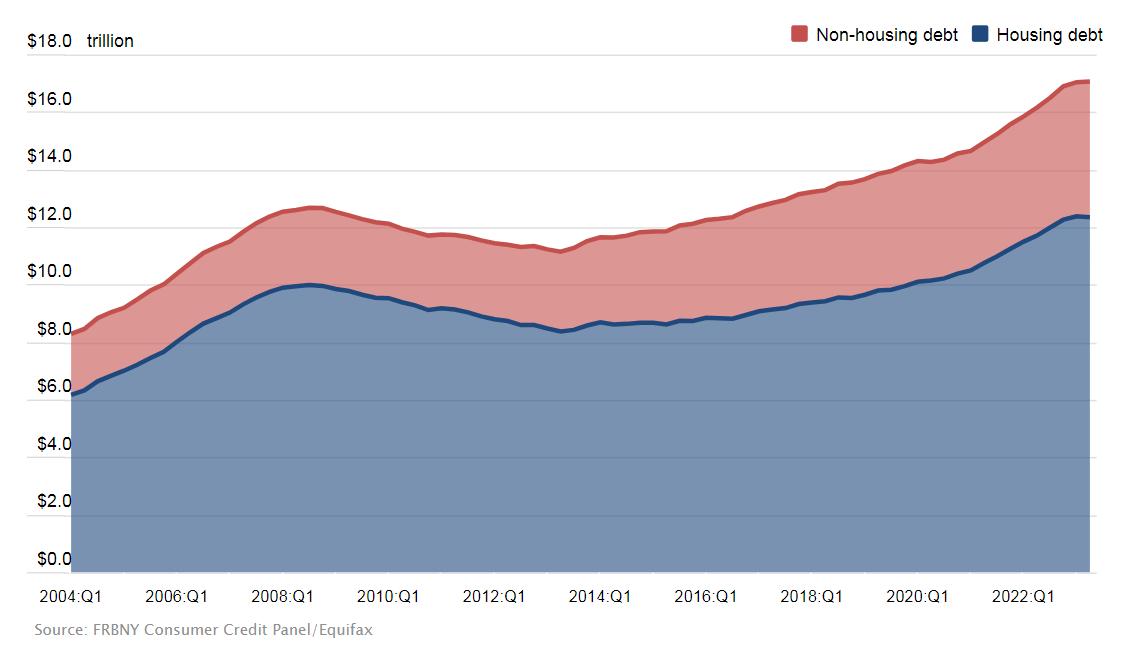

Consumer Lending: Consumer debt increased, owing primarily to strong growth in credit card balances. While a strong labor market supported consumer incomes, consumers faced higher inflation that constrained budgets. Consumer savings declined, and declines in equity prices pressured some consumer balance sheets. Potential signs of consumer loan problems emerged at banks as the total past-due rate on credit cards and auto loans rose. While asset quality remained generally favorable, trends in consumer loan performance could deteriorate in 2023 if the labor market or economic growth weakens. Auto loans, in particular, showed concerning asset quality trends that may worsen if auto prices normalize from high levels.

Energy: Energy prices softened during the second half of 2022 as oil prices receded from earlier highs and were more stable through

home prices and increased mortgage rates continued to reduce the affordability of homes, particularly for first-time home buyers. With the sharp rise in long-term mortgage rates, mortgage originations declined last year and through first quarter 2023, but banks reported higher residential mortgage loan balances and increased residential construction and development lending. Asset quality metrics for residential mortgage loans remained favorable, but early signs of potential credit deterioration have emerged.

The full risk review is available at: https:// www.fdic.gov/analysis/risk-review/2023-riskreview/2023-risk-review-full.pdf

OUR MISSION

Banking Northeast magazine is dedicated to providing quality informational/educational content that betters the banking process at every step. The content is oriented to help professionals progress their understanding of the banking business and develop their skills at improving efficiency and profitability at all levels.

CEO, PUBLISHER, EDITOR-IN-CHIEF

Vincent M. Valvo vvalvo@ambizmedia.com

ASSOCIATE PUBLISHER

Beverly Bolnick bbolnick@ambizmedia.com

NEWS DIRECTOR

Christine Stuart

SENIOR EDITOR

Keith Griffin

STAFF WRITERS

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley

SPECIAL SECTIONS EDITOR

Gary Rogo

DIRECTOR OF STRATEGIC GROWTH

Alison Valvo

DESIGN MANAGER

Meghan Hogan

GRAPHIC DESIGN MANAGERS

Christopher Wallace, Stacy Murray

DIRECTOR OF EVENTS

Navindra Persaud

UX DESIGN DIRECTOR

William Valvo

MULTIMEDIA PRODUCER

Mary Quinn

MULTIMEDIA SPECIALIST

Matthew Mullins

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Andrew Berman

www.ambizmedia.com

PROJECT MANAGER

Julie Carmichael

MARKETING & EVENTS ASSOCIATE

Melissa Pianin

ONLINE ENGAGEMENT SPECIALIST

Kristie Woods-Lindig

ADVERTISING SALES EXECUTIVE

Regina Morgan

ADVERTISING ASSOCIATE

Nicole Coughlin

INTERN

Lydia Griffin

© 2023 American Business Media LLC All rights reserved. Banking Northeast magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media | LLC 88 Hopmeadow Street | Simsbury, CT 06089 | Phone: (860) 719-1991 | info@ambizmedia.com

The past year has created significant liquidity challenges for community banks and credit unions. As interest rates maintain the rise, the greatest risk for community financial institutions face is deposits’ volatility. Rates rise, deposit specials and deposit migration become common affecting margins greatly. However, community lenders can still maintain growth tactics assuming member, asset and loan portfolio growth is a key business outcome.

The high interest rate environment has forced community lenders to reconsider certain aspects of their business including balancing the cost of deposits, access to lendable capital, earnings and asset quality. Parallel to the challenges, this creates tremendous opportunities for banks and credit unions to double down on their growth strategies. Take Home Equity and HELOC lending as an example. As lendable equity maintains its strength, driven primarily by the lack of inventory, consumers’ appetite for consolidation of debt that’s cash flow restrictive becomes greater.At a time when community lenders are confronting lower levels of liquidity than many are comfortable with, it’s easy to slip into a short-term, transactional mindset that looks more like damage control than long-term strategic thinking. This is a tremendous mistake, as the lenders

that lock in high-yield interest rates and expand their TAM today will have major competitive advantages tomorrow.

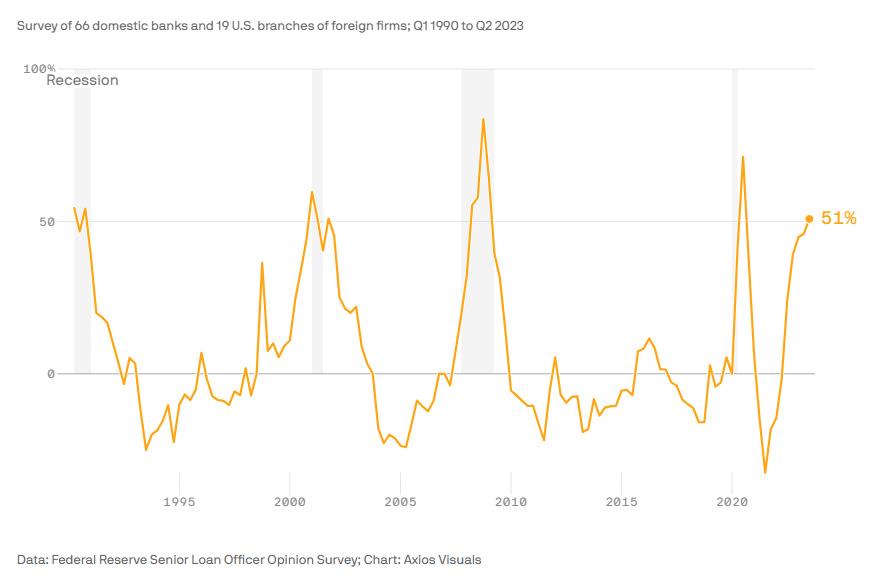

There’s no denying the difficult situation community lenders face. According to the 2023 AFP Liquidity Survey, cash and short-term allocation to bank deposits has plummeted to 47% – a four-year low. Deposits are depleted and the cost of funds is higher than we have seen in many years. These circumstances (along with

fears of another banking crisis like the one at the start of 2023) have led lenders to move their short-term investments into treasury bills, while 63% say safety is their “most valued short-term investment objective.”

Of course, community lenders have to take the liquidity crunch seriously, but this is no time for panic. Banks and credit unions have been here before, and industry leaders have emerged from similar episodes with more efficient and innovative businesses. There are several ways community lenders can simultaneously serve their customers and protect their interests: by prioritizing operational efficiency and leverage, de-risking their portfolios while seizing business opportunities, and fighting margin compression.

Community lenders have a responsibility to be cautious, but this doesn’t mean giving in to a retrenchment mindset and letting fear dictate their decision-making processes. Lenders have a wide array of resources at their disposal to mitigate risk, help customers make the most of their financial resources, and strengthen their businesses.

While large financial institutions have certain advantages when it comes to maintaining liquidity, community banks and credit unions are in a much better

Community lenders have a responsibility to be cautious, but this doesn’t mean giving in to a retrenchment mindset and letting fear dictate their decisionmaking processes.

position than they used to be. For example, powerful and accessible digital tools are available to improve the borrower experience and drastically reduce the lending cycle, decreasing origination cost. These tools increase customer retention and engagement while opening up new lines of business –crucial advantages as lenders work to increase liquidity and position themselves for sustainable growth.

One of the most common misconceptions about the home loan approval process is the idea that borrowers will have to wait weeks or even longer for a decision. This deters borrowers from exploring their financial options and wastes valuable resources that community banks and credit unions can’t afford to spare right now. It’s no surprise that banks are making relationships with fintechs a core priority – particularly smaller institutions like credit unions. Community lenders want to offer the digital services borrowers are demanding without burning capital on research and development or costly installations and maintenance.

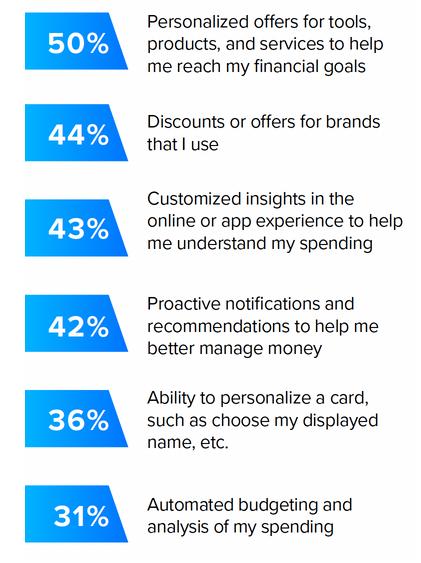

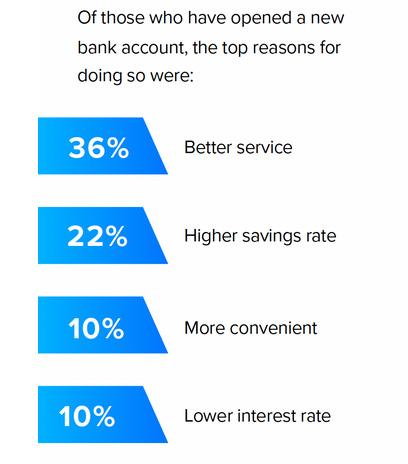

A recent Accenture survey of 49,000 banking customers found that banks could increase revenue from their primary customers by 20% if they focus on relationship-building. Community lenders specialize in personalization and customer service, but they need the digital services to meet borrowers where they are today. It’s an added bonus that these services will reduce waste, improve efficiency, and ultimately cut costs as well.

It’s understandable for community lenders to be focused on immediate liquidity concerns, but they must avoid falling into the

trap of short-term thinking. For example, far too many lenders are preoccupied with the cost of funds issues – a fixation that is causing them to overlook lucrative business opportunities and paths toward long-term revenue growth. Now is the time for community lenders to leverage available credit lines – by borrowing from the FHLB and wholesale lenders, banks and credit unions can continue serving their customers.

Community lenders should also be expanding their TAM and securing loans with high-yield fixed interest rates while they still can. Banks and credit unions can’t allow a period of illiquidity to interrupt their strategic goals – the lenders that stay focused on long-term growth right now will eventually emerge as industry leaders.

Beyond the fact that lenders have plenty of resources for navigating liquidity challenges, they also have access to digital tools that can help them meet customers’ diverse financial needs and process much higher loan volumes. This is particularly valuable when interest rates remain in the stratosphere.

Despite the high cost of funds, depleted deposits, and other liquidity problems, community banks and credit unions can still take huge strides toward their lending goals. Community lenders have faced liquidity issues many times throughout history, but there’s a critical difference today – they have never had more ways to address these issues and work toward a more prosperous future. While community banks and, specifically, credit unions are in place to serve their member base, let’s not forget that the next generation of members have redefined what “service” means. And it’s primarily driven by the digital user experience.

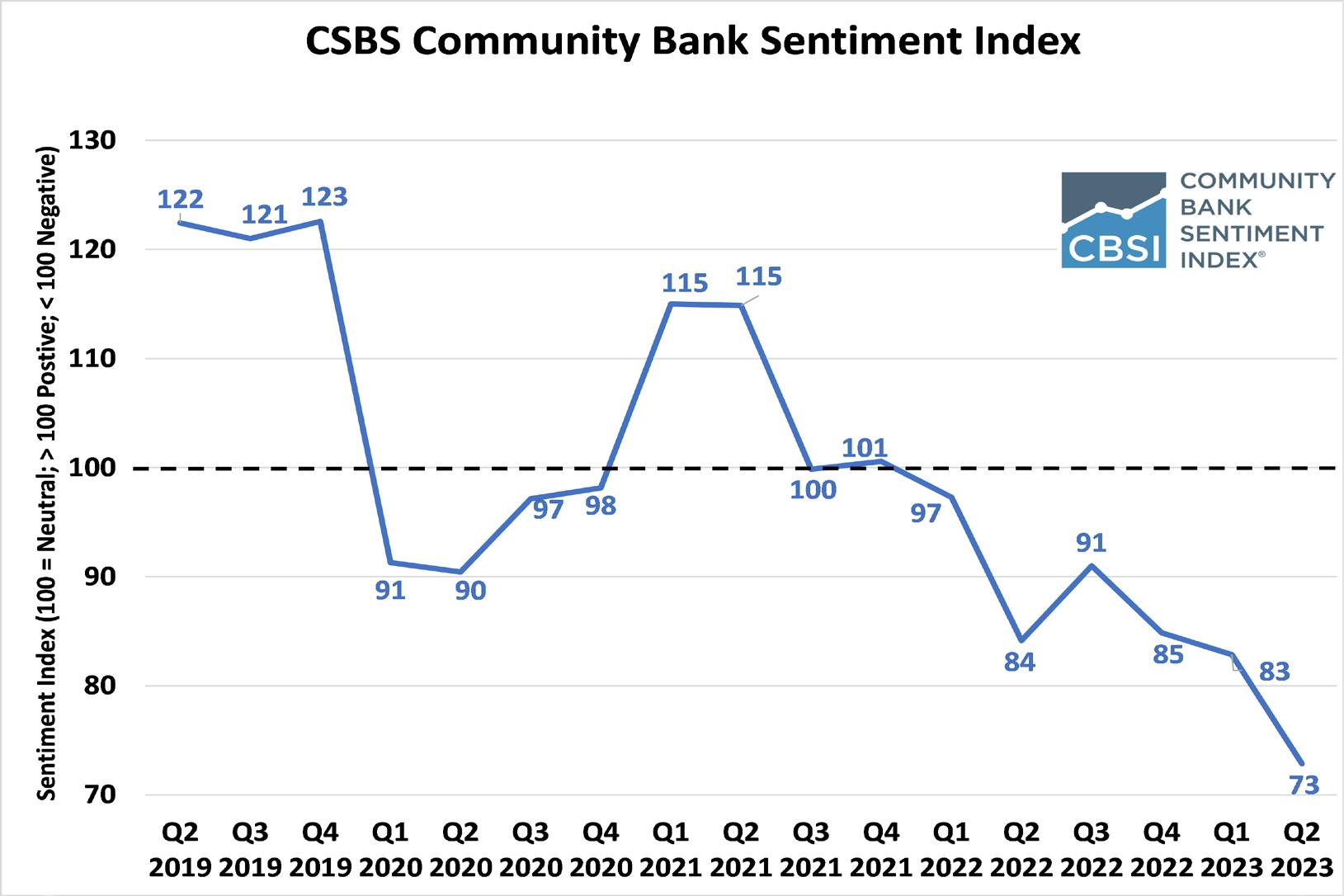

Chief Economist Tom Siems answered questions from Banking Northeast Senior Editor Keith Griffin on the fact that community banker sentiment is at an all-time low.

Q: There probably is no simple answer to this complex question. Why is the Community Banker Sentiment at another record low?

Tom Siems: The CSBS Community Bank Sentiment Index, or CBSI, has been generally declining for the past two years, falling from 115 two years ago to 73 today, where 100 is considered the neutral level. While all seven components that comprise the CBSI fell during this time span, the indicator that measures expectations for future business conditions dropped the most, falling from 143 to 43.

BY KEITH GRIFFIN , SENIOR EDITOR, BANKING NORTHEAST MAGAZINE Chief

Chief

I think it’s worth noting that the decline in the CBSI is consistent with the falloff in The Conference Board’s Leading Economic Index (LEI), which has fallen for 15 straight months and peaked 18 months ago. Moreover, one of the components in the LEI that has declined the most is consumer expectations for business and economic conditions, which has fallen for 24 months.

Community bankers know their customers and know their markets. Community bankers have foresight into what future conditions might look like because they know when businesses are hiring and firing, when customers plan to expand or contract and when borrowers might have greater difficulty repaying loans. And they know all this before any economic statistics are collected or published.

Community banker sentiment driven, in part, by foresight. They are afraid of what’s coming

Q: What are some of the factors driving that ennui?

TS: Of the seven components that comprise the CBSI, four factors are currently pulling the index below the neutral level of 100: regulatory burden, monetary policy, business conditions and profitability. These first two components are a significant drag on the CBSI. While community bankers often complain that regulations for community banks are more burdensome than for other institutions, the regulatory burden indicator has been below 30 since the beginning of 2021, and the monetary policy indicator has been below 40 since the Federal Reserve began its current tightening cycle in March 2022.

Q: Why were things so good during the pandemic and so bad afterwards?

TS: The CBSI was in the 90s for the first four quarters following the start of the pandemic, whereas any value below 100 indicates a pessimistic outlook. So, things were not “good” during the pandemic, although it’s true that most of the quarterly readings of the CBSI over the past year and a half have been lower than during the pandemic.

It’s worth noting that during the pandemic, community banks played a big

role in administering the government’s Paycheck Protection Program and were able to maintain profitability during this time because of the added fiscal stimulus. Those funds and protections have largely

gone away, and we are now left with an economic environment characterized by slower growth, substantially higher interest rates, and higher inflation.

Q: The future profitability indicator saw a large decline from the previous quarter. What happens in situations like this? Do community bankers look for white knights in the form of mergers for increased profitability? One-fifth of bankers, though, seems to have a bright outlook. Are they the larger community banks looking to acquire smaller banks?

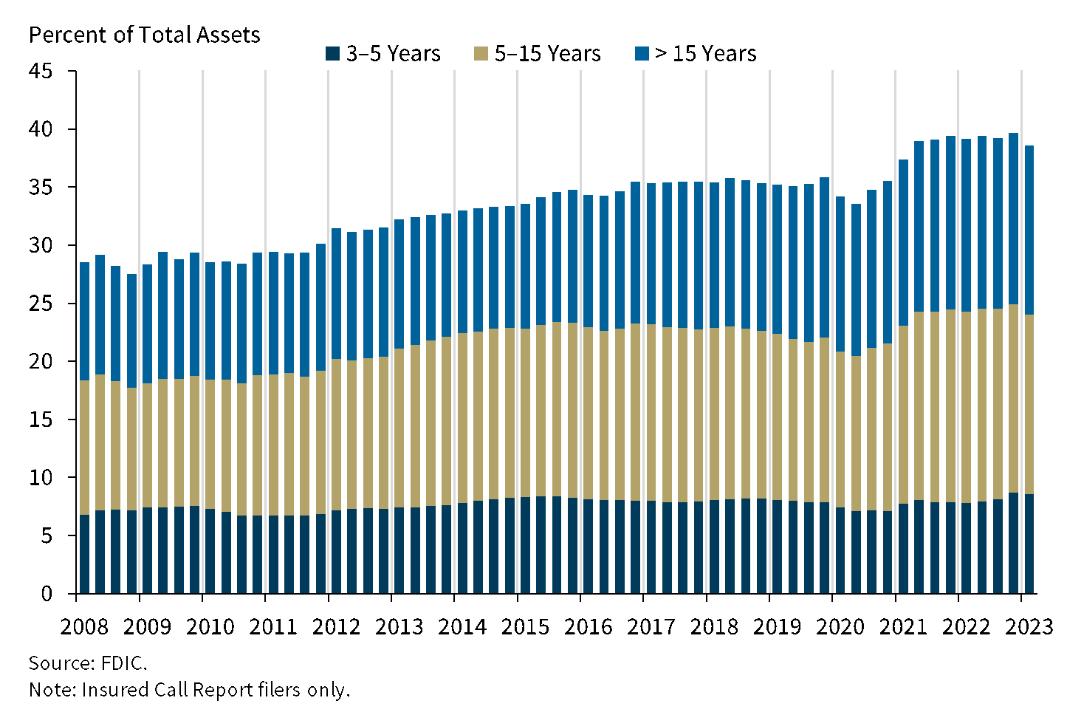

TS: The CBSI profitability expectations indicator seems to be an important driver of the overall index. When profitability expectations improve, the overall index often rises, and vice versa. Most likely, the profitability component has recently experienced large declines as a result of the large shock to their securities and loan portfolios following the rapid rise in interest rates.

Q: One of the comments said we are “in a period of stagflation which may persist for a few years.” What is stagflation and how does it differ from inflation? Are we in a period of stagflation?

Most likely, the profitability component has recently experienced large declines as a result of the large shock to their securities and loan portfolios following the rapid rise in interest rates.

TS. Stagflation is a period of slow (or stagnant) economic growth, high unemployment, and high inflation, created by combining the words “stagnant” and “inflation.” During the 1970s, the U.S. economy experienced severe stagflation when economic growth declined, inflation rates hit double-digits, and the unemployment rate rose to around 9%. While those metrics of the economy today are nowhere near those levels, it is important for policymakers to be proactive now in preventing stagflation. This helps explain why the Fed has been so aggressive in raising interest rates to combat inflation.

Q: According to an article you wrote, some good news from the current survey is that community bankers continue to maintain or escalate capital spending plans. How can they be pessimistic yet so willing to invest in the future with capital spending? Community bankers continue to value the importance of furthering technological initiatives despite their pessimism? Why is that?

TS: Despite declining profit expectations, community bankers tend to take a long view on the economy and therefore continue to invest in ways to better serve their customers. Community bankers understand that to remain competitive and relevant, they need to continually invest in technology and cybersecurity solutions that add value for their customers and to their franchise.

If we had any doubts about the challenges in resolving regional banks – and the potential for significant adverse impact on the financial system – they were dispelled by the failure this spring of three large regional banks - Silicon Valley Bank (SVB), Signature Bank (Signature), and First Republic Bank (First Republic). While the FDIC resolved all three institutions in a manner that mitigated systemic risk, that outcome was by no means certain.

In particular, the resolution of SVB and Signature required the use of extraordinary authority by the FDIC, the Federal Reserve, and the Secretary of the Treasury -- the systemic risk exception under the Federal Deposit Insurance Act (FDI Act) -- to protect uninsured depositors at those institutions, setting aside the least cost requirement to the Deposit Insurance Fund.

That experience should focus our attention on the need for meaningful action to improve the likelihood of an orderly resolution of large regional banks under the FDI Act, without the expectation of invoking the systemic risk exception.

I would like to revisit the issue of the resolution of large regional banks in the United States in light of our recent experience. In particular, I believe there are important changes to capital regulation, resolution planning

requirements including long-term debt, bank supervision, and deposit insurance pricing that would make a repetition of what occurred much less likely.

Just to provide context, it may be worth recounting the events of earlier this year.

When SVB failed overnight on Friday, March 10, the FDIC initially established a Deposit Insurance National Bank (DINB), under FDIC control, so that depositors would have access to their insured funds on the Monday after failure. Uninsured depositors would have access to a substantial portion of their funds through the payment of an advance dividend. A portion of the uninsured deposits would be held back in the receivership and would experience losses depending on the losses to the Deposit Insurance Fund.

As it turned out, the prospect that uninsured depositors at SVB would possibly experience losses alarmed uninsured depositors at other similarly situated banks, and they began to withdraw funds. Signature and First Republic also experienced heavy withdrawals. A contagion effect became apparent at these and other banks. There was clear evidence that the failure of a regional bank in which uninsured depositors faced losses could cause

systemic disruption.

In response, on Sunday the U.S. authorities invoked the systemic risk exception to the least-cost test. This allowed the FDIC to fully protect all depositors at SVB and Signature. They were placed into separate bridge banks under FDIC control. Signature was sold a week later to Flagstar Bank, a subsidiary of New York Community Bank, and Silicon Valley Bank was sold two weeks later to First Citizens Bank of North Carolina.

First Republic Bank also experienced large deposit outflows that weekend but managed to survive. The bank spent the next few weeks trying to raise capital, but was unsuccessful. On May 1, the state of California closed the bank. The FDIC had time before the bank was closed to conduct a competitive bidding processs, which resulted in JPMorgan Chase submitting the least-cost bid and purchasing all of the assets and assuming all of the deposits of First Republic. The winning bid covered all uninsured depositors under the leastcost test and did not require a systemic risk exception.

So what are the lessons to take away from this experience?

The three banks that failed this spring shared common characteristics that

on the failures of SVB and Signature, respectively, found they were poorly managed and not responsive to supervisory feedback

The bank failures earlier this year highlighted the vulnerabilities that can result when banks have a heavy reliance on uninsured deposits for funding.

made them more vulnerable to a run.

Reports from the Federal Reserve and the FDIC on the failures of SVB and Signature, respectively, found that they were poorly managed and not responsive to supervisory feedback, and their supervisors were not forceful enough in requiring them to take corrective measures.

In addition, the three banks grew rapidly and relied heavily on uninsured deposits for funding. Two of them had uninsured deposits approximating 90% of their funding, and the third approached 70%.

Further, two of them had unrealized losses on securities or low yield loan portfolios that were large relative to their capital base. All three had little or no long-term debt outstanding.

These characteristics proved to be a toxic combination when each bank faced stress. In addition, the resolution plans that had been received from two of the three banks were limited in content.

There are some obvious lessons here that we now have an opportunity to address.

In late July, the three federal banking agencies issued a Notice of Proposed Rulemaking to implement the Basel III capital rule. There are many aspects to this proposal, but one in particular is a step toward addressing one of the key vulnerabilities of the recent failures. Under the proposal, unrealized losses on available for sale securities would flow through regulatory capital for all banks with more than $100 billion in assets. This means that these banks, in order to maintain their capital levels, would need to retain or raise more capital as these unrealized losses occur.

It is worth noting that, although SVB’s failure was caused by a liquidity run, the loss of market confidence that precipitated the run was prompted by the sale of available for sale securities at a substantial loss that raised questions about the capital adequacy of the bank. This loss of confidence followed the announced self-liquidation of another local institution, Silvergate, a day earlier. That institution had announced its sale of available for sale securities at a substantial loss and planned capital raise

just a week earlier.

Had SVB been required to hold capital against the unrealized losses on its available for sale securities, as the proposed Basel III framework would require, the bank might have averted the loss of market confidence and the liquidity run. That is because there would have been more capital held against these assets.

underscored this spring. While SVB and First Republic had been required to file resolution plans which provided basic information that was useful, far more robust plans would have been helpful in dealing with the failure of these institutions. Signature failed before it would have been required to file its first resolution plan in June.

For example, some of the elements that would have been helpful this spring include the bank’s:

capability to promptly establish a virtual due diligence data room, and populate it with enough information for interested parties to bid on the bank or certain of its assets or operations;

maintenance of information necessary for operational continuity of the bank, including a more thorough description of key personnel and retention plans, critical third party and shared services, and payments and trading activities; and ability to describe communications systems and strategies for reaching internal and external key stakeholders in the event of a resolution.

While each of the three bank failures this spring ultimately concluded in a sale to a single acquirer, it is also clear that a sale to a single acquirer may not always be possible. Therefore the proposed rule will seek to expand the options available to the FDIC.

An important complement to a longterm debt requirement is meaningful resolution plans for these large regional banks. There is currently a requirement for these banks to file plans that address the resolution of the insured depository institution under the FDI Act.

The IDI Plan Rule, first adopted in 2011, requires banks with over $50 billion in total assets to periodically submit resolution plans to provide the FDIC with information about the bank that is essential to effective resolution planning, and to support the execution of a resolution if necessary. The rule requires covered banks to “develop and submit detailed plans demonstrating how [they] could be resolved in an orderly and timely manner in the event of receivership.”

Over the years, the FDIC has given banks feedback and guidance with respect to their plans and has considered different approaches to the planning requirements.

The importance of this work was

The proposed rule would require a bank to provide a strategy that is not dependent on an over-the-weekend sale. It would require a bank to explain how it could be placed into a bridge, how operations could continue while separating itself from its parent and affiliates, and the actions that would be needed to stabilize a bridge.

The rule would also require banks to identify franchise components, such as asset portfolios or lines of business that could be separated and sold, in order to provide additional options for exiting from resolution by disposing of parts of the bank to reduce the size of a remaining bank and expand the universe of possible acquirers.

A stronger resolution planning requirement for large regional banks, combined with a long-term debt requirement, would provide a much stronger foundation for the orderly resolution of these institutions.

CONTINUED ON PAGE 14

Liquidity runs on uninsured deposits can be amplified and exacerbated through social media.

Heavy reliance on uninsured deposits for funding carries a number of liquidity risks. First, large uninsured depositors, such as businesses, non-profit organizations, and wealthy depositors, are likely to be more sophisticated and more attuned to market developments than retail depositors, and thus may be more likely to withdraw funds quickly. Second, such deposit accounts are often concentrated in a relatively small number of depositors, also making them more susceptible to runs. Third, electronic banking services allow for the instantaneous withdrawal of large uninsured deposits. Finally, liquidity runs on uninsured deposits can be amplified and exacerbated through social media.

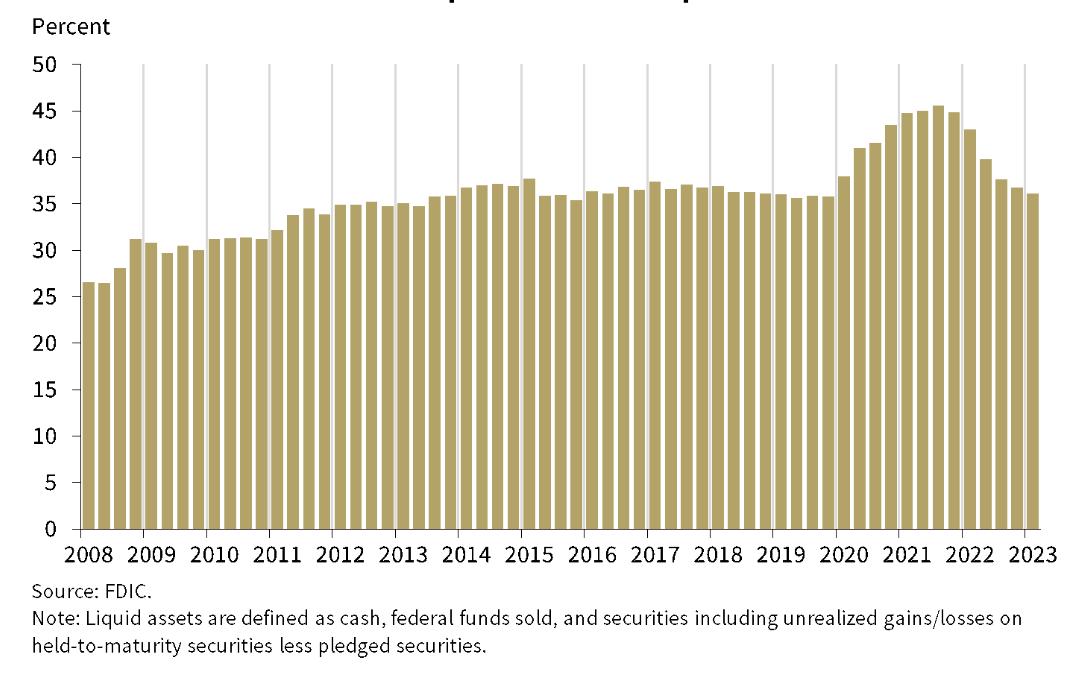

For the banking industry as a whole, reliance on uninsured deposit funding has been increasing. The FDIC’s report, Options for Deposit Insurance Reform, notes that in the aggregate, uninsured deposits rose from about 18% of domestic deposits in 1991 to nearly 47% at their peak in 2021, higher than at any time since 1949. The aggregate concentration of uninsured deposit funding has since come down slightly from 2021 but still remains high.

Concentrations of uninsured deposit funding are more common among large banks. At year-end 2022, banks with more than $50 billion in assets were approximately 1% of banks but held nearly 80% of all uninsured deposits. And, the majority of domestic deposits were uninsured for more than 40% of those banks. Although reliance on

uninsured deposits is a more common issue for larger banks, it is not exclusively a large bank issue. Uninsured deposits comprised the majority of domestic deposits for about 15% of banks between $1 billion and $50 billion in assets.

As noted previously, uninsured deposit funding tends to come from a relatively small number of depositors. At the end of 2022, less than 1% of all deposit accounts had balances above the deposit insurance limit of $250,000 but accounted for over 40% of banking industry deposits. At the time of its failure, Silicon Valley Bank’s 10 largest deposit accounts collectively held $13.3 billion in deposits.

More forward-leaning supervision of large regional banks is certainly a key lesson from the events earlier this year. In particular, the FDIC is reviewing whether its supervisory instructions on funding concentrations should be bolstered to better capture risks related to high levels of uninsured deposits generally or types of deposits more specifically, such as business operating account deposits. For example, FDIC examiner instructions could establish a specific threshold for concentrations of uninsured deposits, which would require examiners to devote supervisory attention to the concentration. Regulators and other stakeholders may also benefit from more granular, and more frequent, reporting of deposits. These are matters of priority attention for the FDIC.

In addition, risk-based deposit insurance pricing can deter banks from relying too heavily on less stable forms of funding such as uninsured deposits and can maintain fairness by charging banks with unstable funding sources for the risk they pose to the Deposit Insurance Fund. For this reason, it is worth reexamining the ways in which deposit insurance pricing captures the risks of uninsured deposits.

However, calibrating precisely the risk of uninsured deposits is a challenge. Therefore, while deposit insurance pricing may be a useful tool, it is best seen as a complement to other tools that mitigate the risk of over-reliance on uninsured deposits.

It’s a new day for women leaders at banks, mortgage companies & credit unions. Come share this one-day conference where women take the lead on Friday, October 27, 2023. The conference will take place LIVE at the oceanfront Wyndham Newport Hotel. You’ll see a stellar array of accomplished women leaders from throughout the region, as well as special keynote presenters. This is the only event specifically designed for all women in the banking, credit union, and mortgage professions throughout New England, and you don’t want to miss this amazing opportunity.

The amazing BankWorld 2024 is back for its 29th year, and once again, this is your can’t-miss opportunity to learn about the future of banking at the Northeast’s largest and most exciting banking show. This expansive conference will provide you with essential educational sessions, interactive panels, cutting-edge exhibits, countless networking opportunities, raffles, and so much more – all with an eye to giving you an edge against the competition.

BankWorld is the opportunity to get your hands on the latest products and technology that are revolutionizing the future of banking. If you’re an executive, senior management, or staff member involved in operations, technology, lending, retail banking, marketing and sales, human resources, security, or compliance and risk management, BankWorld is for you.

BankWorld is your must-attend event!

Impressia Bank, a new, full-service banking division of CNB Bank, is dedicated to the professional and financial development and advancement of women business owners and leaders. Built by a steering committee of women in business and banking, CNB Bank has tapped financial leader Mary Kate Loftus to lead the charge as the first president of Impressia Bank.

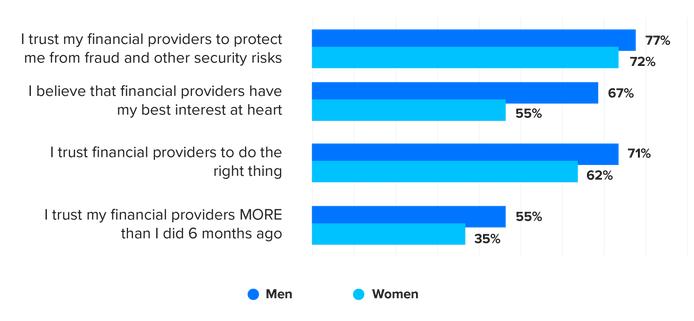

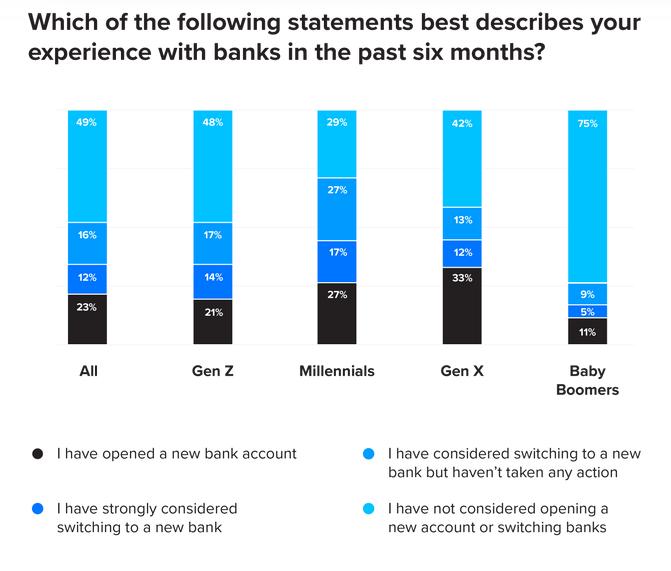

Loftus said a bank specializing on women is needed when trends are explored, especially the rate of pace of women who have become entrepreneurs, following COVID. “The bank had done quite a bit of (consumer experience) studies to understand how do women feel that they’re being served by their bank? The qualitative plus the data indicated there’s a real opportunity here. And when you look at that, it just seemed that, especially in the markets that we’re currently serving, there was a tremendous opportunity where there’s economic growth and by being able to focus on it and create an environment that women felt welcomed and they felt like it

was designed for them, that we would be able to better meet their needs and address the issues, particularly regarding gaps in funding and access to credit.”

Angie Wilcoxson, executive vice president and chief commercial banking officer for CNB Bank, added,

“The original idea actually came from our CEO Michael Peduzzi. And when he first started, he really went on a listening tour around our different divisions. And one of the things that he noticed was that we had a lot of women leaders within the bank. And that’s what prompted the idea of having a bank that was solely focused on women-owned business, women-led businesses, and really really wanting to create something specifically for that, for that target market.

“Because as Mary Kate said, the statistics show that there definitely is an opportunity out there. And really thinking through what specifically does that target market need in terms of banking, the

“By being able to ... create an environment that women felt welcomed and they felt like it was designed for them ... we would be able to better meet their needs.”

> Mary Kate LoftusAngie Wilcoxson Executive Vice President and Chief Commercial Banking Officer CNB Bank

way that you bank them, the relationship that you build with them, and what are those other things that they need that are beyond just traditional banking services? So is it education, is it networking? What are some of those other things that they need that that is different than other businesses that are out there? So that was one of the reasons why we looked at doing it and really focusing on that market because the needs are different.”

What sets Impressia apart from other banks serving women is its focus. Wilcoxson said an eightmember steering committee was formed after Peduzzi’s idea. Seven came from the bank and the eighth was a woman entrepreneur. They looked at other banks that offered services for women but the employees weren’t entirely devoted to them.

“What we really felt that was needed was that as we looked at the need, was really be able to curate an entire bank with employees that were dedicated a 100% of their time towards women owned and women led businesses,” she said.

“And that’s

“Based on statistics that we saw ... women owned businesses weren’t actually walking into the bank for funding for their business.”

> Angie Wilcoxson

one of the big things that makes us very different, as opposed to just a program amongst a lot of programs that a bank would be able to offer. We’ve got people that will be in the markets that can actually participate in women organizations and go out and meet those clients and they become their dedicated relationship manager for all of their needs. And that’s their only focus as opposed to some other banks will do it.”

Marty Griffith, CNB senior executive vice president, chief banking officer, said, “When you look at us as a community bank and, and we’re almost like a regional community bank at five and a half billion dollars in size, we certainly focus on small business lending. And of course, you know, you read articles and literature and you look at demographics and, you know, 90% of the economy is fueled by small business. But I think what we recognize too is that an awful lot of those small businesses were women led or women owned enterprises. And we kind of thrive ourselves on providing almost like a boutique or a niche style of delivery where it’s a very personal, compassionate delivery … where we really want to add value to relationships. And what I think what we were finding is that as we really looked inside of ourselves, other banks, some regionals and some larger banks may have attempted to check that box, for

Marty Griffith Senior Executive Vice President Cheif Banking Officer CNB

lack of a better way to put it.

“But I don’t think we found anybody in our footprint that was really committing to this and providing the value add to women-owned enterprise that they deserve. And it’s kind of ironic in that many, many of these small businesses in our environment are in fact women owned. So we identified a gap the further we looked, the wider the gap got and, and really convinced us to take these steps.”

Impressia Bank was able to launch as a standalone because it wasn’t started from scratch. “Honestly, when you think of funding, if you’re talking about starting a bank just from scratch, you have to

go out and raise capital to be able to do that. Whereas with us, the ability to be able to utilize the capital of CNB because we have the organization that we do, it gives us that ability to be able to progress faster than someone that was just going to start it just from scratch. There are some women-owned banks out there. So it’s not as if there aren’t some out there, there’s just not a lot of them because other banks have chose to do it as a program as opposed to a standalone bank,” said Wilcoxson.

First Women’s Bank in Chicago appears to have been the first bank launched for women from scratch. At its grand opening in September 2021 opening, Marianne Markowitz, president and CEO, said in an announcement, “Small business owners support their families, their employees and their communities—we’ve formed First Women’s Bank to support them.”

In addition to providing innovative capital solutions for small businesses, First Women’s Bank has created the FWB Collective, a community of resources, support and inspiration for small businesses and a platform through which individuals and organizations can provide tangible support for the women’s economy. “The potential for First Women’s Bank to drive social change and to help bridge the gender and racial lending gaps is enormous,” said

Markowitz. “We will draw significant strength in that effort from our partners.”

Wilcoxson says Impressia was formed because the bank looked at its numbers and saw the need to serve more women.

Griffiths added, “If you look at our numbers, we’re certainly a very growth oriented bank. But the numbers, just like when you search for a new employee and, and you look at the data pool that you get for your search, we weren’t getting enough opportunities or at bats with women-owned enterprise.”

“One of the things that we found is that based on statistics that we saw that women owned businesses weren’t actually walking into the bank for funding for their business. There was a very low percentage, I think it was about 16, 17% or so with the number that actually seek funding, I believe. But the one thing that was just very interesting that a lot of times they will fund their business through credit cards or their savings accounts or just any of their personal funds and not go to the bank for capital. And so what’s happening with that is that these businesses aren’t growing as fast because they’re not accessing that capital that could be available to them to help them grow faster,” said Wilcoxson.

She added that the bank is targeting and going to where women are as opposed to waiting for them to walk through the bank’s front doors. “And really sort of finding out where do, where do we get

access to women-owned businesses? There’s lots of organizations that provide support and we’re really looking to partner with them to, to really have access and really talk about what we can offer, not even just from a banking perspective, but also from a connection and from an education perspective.”

Loftus said her role in the new bank is similar to that of any bank president but with more of a salesperson/educator role. “What we want to do is educate by bringing together speakers and just really high quality content. So engagement and education is where it shifts a bit. And as a result, that’s how you build the relationship. So it is that hyperlocal, you know, knowing somebody and then that being able to build trust so that you can build your business out.”

Part of Impressia’s growth will come from women wanting to support other women. Loftus said, “We’ve heard stories where people say, actually, ‘I’ve had an awesome banker and I’ve been well served, and I love this, this person, I’ve worked with them for years. But I’m interested in supporting other women and being part of this community.’ We’ve also had some people that have shared that they find the bank isn’t conducive to their time schedule. So it’s the same thing, you

know, we’ve talked about for years about branch transformation and how banks have evolved to do that.

“And then lastly, for some women, it is like an intimidation and comfort factor where we’ve had stories where people say, I worked on my business plan, but I’m so scared to go and talk to someone and have someone say, you, you’re not ready. And that’s, for them. They feel more comfortable having that conversation in a different way than traditionally. “

“I do feel like sometimes some businesses could think that they’re too small and there really isn’t a business that’s too small for us to look at it. But sometimes people have that misconception that they have to get to a certain scale before they look at bank financing,” added Wilcoxson.

Griffith further explained. “Quite frankly, if a women owned enterprise approached us and we felt that another bank could service their needs for some reason we’d send them that way. We want this to be very consultative, and if we cannot add the value, we’ll send them in a direction that they can. We happen to think we can answer all those questions, but, you know, that’s the whole scope of this is not just loan growth in womenowned enterprise. It’s really adding value. And if we add value over a period of time, it’s like my mother used to say, good things happen to good people. Right. So if we can add value, I think that these

opportunities, whether we are the direct lender on day one or not, will come back to us.”

Impressia is starting off small with a staff of five. Loftus explained that’s due to the ability to tap into CNB’s centralized operations. There also isn’t a brick and mortar branch either. “We really aren’t looking to develop that strategy. However, what we have is a really unique advantage because we have the branch network of the entire CNB family of banks. So, for example, in Erie, Penn., right now, any client that is an Impressa client can go to an Erie branch office and be able to fully transact because everybody, everything is under the same routing and transit number. So the beauty of it is we have distribution without having to really build that out.”

It may seem as this is just a bank for women entrepreneurs, but Loftus said

it is full service and open to men, of course. “We do know our mission is to improve the financial lives of women, right? We do have a real focus on the business side of it, but what we’re finding is we have conversations with women who own businesses. It naturally flows over into their personal life. So that’s where we are focused on helping and helping them with their professional life. But then we’re having the conversations as well on the personal side.”

By the way, the name Impressia is contrived much like Häagen-Dazs ice cream, which sounds foreign but is crafted in New Jersey. As Angie Wilcoxson, Executive Vice President and Chief Commercial Banking Officer for CNB Bank explained, the name is a hybrid of the Italian word impresa, which means business and victory. “It really just spoke to what we were trying to accomplish with the division. So that’s why we ended up going with it. It really made a lot of sense,” she said.

“If we can add value, I think that these opportunities, whether we are the direct lender on day one or not, will come back to us.”

> Marty Griffith

Dime Community Bancshares

Inc., the parent company of Dime Community Bank, announced Friday that that Kevin M. O’Connor stepped down as CEO effective Aug. 31, 2023, and that Stuart H. Lubow, the company’s current president and chief operating officer, stepped into the CEO role.

O’Connor has been CEO of the Long Island-based company since Bridge Bancorp, Inc. (“Bridge”) and Dime Community Bancshares, Inc. (“Dime”) merged on Feb. 1, 2021. Before the merger, O’Connor was president and CEO of Bridge. Lubow has been president and chief operating officer of the company since the merger. Before, Lubow served as president of Dime. Before joining Dime in 2017, Lubow was a founder, chairman, president, and CEO of each of Community National Bank and Community State Bank. Lubow has prior community bank CEO experience of over 17 years.

Dime Bank Executive Chairman Kenneth J. Mahon said, “We are grateful for Kevin’s strong leadership and are very excited to promote Stu Lubow to CEO. (His promotion) has been under consideration since the beginning of the year and is the culmination of a thoughtful and well-planned succession process. Stu has a proven track record throughout his career of delivering value for customers and shareholders alike. Most recently, he was instrumental in the hiring and onboarding of seven deposit-focused groups that are already contributing to significant customer growth.”

“I am thankful for the opportunity the Board has granted me to lead Dime and would also like to express my gratitude to Kevin for his leadership and support over the years,” said Lubow. “Dime has a proud history of being rooted in the communities we serve, and I look forward to working with all of our dedicated employees to add value to our customers and our shareholders. I will draw upon my prior CEO experience to lead Dime into the next chapter of our growth as the preeminent com munity bank in our footprint.”

O’Connor will continue to serve on the board until Dec. 31, 2023. Lubow will be added to the board simultaneously with his appoint ment as CEO.

Provident Bank, a New Jersey-based financial institution, announced the addition of two experienced leaders to the orga nization.

Diane Gigliotti has joined the bank as senior vice president, controller. Mary Brown has been appointed to the position of senior vice president, chief compliance officer.

Gigliotti has more than 20 years of experience in accounting and finance in leadership positions of increasing responsibility. Prior to joining Provident, she was chief financial officer & managing director with the BBVA New York Branch. Before that, she

was responsible for regulatory reporting, financial statements, and coordination with auditors as the CFO of BBVA Securities Inc., a subsidiary of BBVA.

Gigliotti is responsible for managing the accounting, controls, and financial operations as required by accounting and

risk stewardship while building, leading, assessing, and enhancing risk management programs. Most recently, she served as managing director and chief compliance officer for HSBC, where she provided strategic leadership for regulatory and financial crime compliance, risk stewardship, and

Brown is responsible for developing and implementing a comprehensive compliance program to ensure effective compliance risk management across all areas of the bank while providing regular reporting to the management governance committees and the board of directors, as necessary.

Providence-based Citizens Financial Group Inc. announced the appointment of Taira Hall as head of enterprise payments. Hall will report to Beth Johnson, vice chair and chief experience officer at Citizens.

Hall most recently served as senior vice president of embedded finance, B2B & strategic innovation executive at FIS. Previously Hall held executive leadership roles at Visa and Citigroup focused on developing and deploying market-leading global solutions. She has a track record of building new business lines in high-growth areas and has expertise in fintech, embedded finance, and B2B payments. Throughout her career, she has focused on digital transformation, enhancing payments and collections capabilities while expanding delivery.

“We are very pleased that Taira is joining Citizens,” said Johnson. “Payments presents a real opportunity for Citizens, and her extensive work in digital transformation will serve us well as she pursues opportunities for the bank to differentiate itself while serving the needs

of our customers. In particular, we see exciting opportunities in real-time and emerging payments.”

Citizens partners with Zelle for person-to-person payments and was one of the first financial institutions to begin using the real-time payments rail developed by The Clearing House to offer customers faster payments. A strong collaboration with FIS WorldPay, one of the world’s largest and best-known merchant processors, and direct merchant relationships with some of the world’s most recognizable brands for point-of-sale financing through Citizens Pay, have helped position Citizens as an innovator in the payments space.

Tompkins Financial Corp., based in Ithaca, announced that Matthew Tomazin has been promoted to executive vice president, chief financial officer (CFO) and treasurer of Tompkins Financial effective Oct. 1, 2023. Tomazin is currently senior vice president and treasurer of the company. Prior to joining Tompkins, Tomazin spent more than a decade in bank financial management gaining expertise in financial modeling, asset and liability (ALCO) management, profitability modeling, governance and controls and strategic planning and execution.

In his new role, Tomazin will serve as the senior executive responsible for managing the

financial activities and strategies of the company by providing strategic financial guidance, overseeing financial operations, and making informed decisions to drive the company’s growth and profitability. He will report to Steve Romaine, president and CEO of Tompkins Financial.

“It is rewarding, and a testament to our succession planning process, to be able to identify such an outstanding talent from within our organization to assume this role. I’ve had the pleasure to engage with Matt, often directly, over the past four years and have been impressed with his financial acumen and thoughtful, thorough approach to financial issues. In addition, Matt has demonstrated his ability to contribute more broadly to strategic matters and I welcome him as a member of my senior leadership team,” said Romaine.

Tomazin is active in his community and has served as a board member for a number of local organizations, including Town and County Planning and Tioga County Rural Economic Area Partnership Board. He is an Eagle Scout in Boy Scouts of America and a youth soccer coach. He is a 2007 graduate of Binghamton University and 2014 graduate of Darden/SNL Executive Program in Bank Financial Leadership.

Tompkins Financial Corporation is a banking and financial services company serving the Central, Western and Hudson Valley regions of New York and the Southeastern region of Pennsylvania. It is parent to Tompkins Community Bank.

Machias Savings Bank, based in Machias, Maine, announced that Ben Jordan has joined the bank as chief operating officer.

Jordan has spent nearly three decades navigating technological advancements in the industry, streamlining operations, and supporting the implementation of digital banking solutions. Most recently, he worked as chief information officer at Synergent, where he focused on delivering holistic support to diverse financial institutions, managing vendor ecosystem integrations, and supporting corporate infrastructure investments. He also contributes to industry advancements throughout the state as a board member of the Maine Technology Institute. Jordan lives in Windham.

Jordan’s expertise will be critical as the bank transitions to the Jack Henry technology modernization strategy to continue delivering high-level customer service as the bank grows.

“Ben has extensive knowledge of the Jack Henry ecosystem that will be invaluable as Machias Savings Bank moves toward modernizing, operating more efficiently into the future, and evolving to meet the needs of our customers as technology continues to advance,” said Larry Barker, President & CEO of Machias Savings Bank.

At Banking Northeast Magazine, we honor the growing impact that women are having on the banking industry.

This special feature shines a light on the many trailblazers who are leading the ways for others in this once male-dominated business.

The three women being honored truly stand out among their peers. Anne Tangen, president & CEO of BankFive, based in Fall River, Mass., took the reins at her bank during the height of COVID-19 and built true success. Claude M. Rousseau, senior managing director, culture & colleague experience at Webster Bank, did outstanding work on a merger of equals, while Lizette Nigro, chief product officer at Owners Bank, a division of Liberty Bank, received accolades for leading Liberty Bank, an $8 billion bank in Connecticut, through a digital transformation and being vital in the recent launch of neo challenger bank, Owners Bank, which focuses on serving small businesses.

The women being honored were selected thanks to readers’ nominations. They let us know who makes significant contributions in the financial institutions across the Northeast. Reader contributions help to make Banking Northeast Magazine the publication that it is. You are part of making our magazine provide quality information that betters the banking process at every step.

Lizette Nigro serves as senior vice president of digital engagement for Liberty Bank and chief product officer of Owners Bank, a division of Liberty Bank. In early 2023, she led Liberty Bank, an $8 billion bank in Connecticut, through a digital transformation including new digital account opening, digital banking, credit monitoring, money movement tools, upgraded card controls, and bill pay experiences, creating a new digital ecosystem for over 140,000 customers.

She was vital in the recent launch of neo challenger bank, Owners Bank, which focuses on serving small businesses. Nigro’s leadership helped design the bank’s ability to help small businesses manage invoicing, bill payment, cash flow, accounting functions, and offering business interest checking and savings accounts. She also plays an integral role in developing Owners Bank’s credit card and loan products.

Her belief is that being great at what you do requires getting to know your customers and understanding their pain points and passions. As chief product officer of Owners Bank, Lizette uses her experiences and experiences from family members running small businesses to shape product roadmaps. As she sees pain points from small businesses firsthand, she creates a product strategy that is responsive to small business owners’ needs.

Lizette Nigro answered questions from Banking Northeast Magazine.

Why do you feel it is important for women to be represented in the banking industry?

All industry leaders should represent their market. Women are often the primary financial providers for their families, which is why it’s no surprise that the growth of new women-led businesses is higher than their male counterparts. In fact, in my home state of Connecticut, women-led businesses contribute more than $16 billion each year to the state’s gross state product! Women offer much-needed diversity in thought, vision, and leadership styles that will help the banking industry be more successful.

What contributions to the banking industry are you most proud of?

After years in community banking, I moved to Fintech where I spent the next 20 years. During this time, I identified, created, and delivered technology that made banks more successful. I spent thousands of hours at hundreds of financial institutions listening, observing, and providing guidance. Seeing banks use your technology to benefit their customer base and/or their bottom line was very fulfilling. Now at Liberty Bank, I am able to use that experience and best practices to help meet digital leadership goals. I’m most proud of the creation of a new digital banking brand. Identifying an

underserved market that would benefit from a tailored digital experience and seeing that become reality is extremely exciting. Owners Bank’s journey has just begun.

What significant changes would you like to see from the banking indutry in the upcoming year?

I believe that banking needs to double down in two areas. First, we need to focus on the needs of individual market segments. The financial needs of an attorney firm vs. a small contractor are a world apart. We have to understand their workday, the language they use, and what keeps them up at night. If banks don’t tailor financial services to individual segment needs, someone else will (and are). Second is to fully get on the digital train. We need to understand that people are used to, prefer, and want access to self-service wherever and whenever they want it. Amazon, VRBO, and Uber are all perfect examples.

Which sector of the baking industry do you believe women make the most significant impact?

I’ve seen strong, talented, stand-out women in all sectors of banking: technology, finance, lending, retail, marketing, you name it. But, I see women as great drivers of change. We tend to be more willing to break the status quo and try new things. Maybe women are willing to try new things because we are a bit less fearful of making mistakes - or at least I hope so.

Claude M. Rousseau is senior managing director, culture and colleague experience at Webster Bank where she is responsible for leading and driving culture strategy and colleague engagement programs for the $70 billion commercial bank. The Culture and Colleague Experience strategy and resulting immersive program was designed to facilitate the company’s strategic imperative to build an even higher performing, more agile and innovative company to drive our business goals.

Prior to her role at Webster, Rousseau was the vice president of human resource, strategic management and developed the company’s overall human resource strategy and led company-wide strategic initiatives with Sterling National Bank. In addition, she was the enterprise strategic solutions partner executing the company-wide initiatives including the human resources integration activities of multiple merger and acquisitions.

Company culture is central to a bank’s success after a merger because differing cultures from the legacy banks can create obstacles that thwart success. After the merger of equals between Webster Bank and Sterling National Bank was announced in April 2021, Rousseau met the challenge, significantly contributing to bringing the new organization’s culture to life, building on a new set of core values defined by a common language and guiding behaviors.

She recognized that, unlike a takeover in which the dominant company’s culture prevails, this merger of equals presented an exceptionally more difficult challenge to develop a new set of values and gain buy-in from all colleagues.

Claude Rousseau answered questions from Banking Northeast Magazine.

Why do you feel it is important for women to be represented in the banking industry?

Women should be represented in banking because they bring diverse perspectives, skills and experiences that can benefit the financial sector and society at large. Women are half of the world's population and potential customers, so having more women in banking can help understand and serve their needs better. Women also tend to have different risk preferences, leadership styles which can enhance the performance, innovation, and sustainability of banks. Moreover, women's representation in banking can empower other women to pursue careers in finance, create role models and mentors, and foster a more inclusive and equitable culture in the industry.

What contributions to the banking industry are you most proud of?

I am most proud of the way my colleagues at Webster engaged with what we were trying to accomplish in creating a new corporate culture after the merger of equals with Sterling National Bank. The program my team designed to ensure

everyone uses a common culture language went from initially being something employees had to do, to something they looked forward to with excitement, encouraging others to so sign on. Ninety percent of the nearly 4,000 participants rated the sessions “excellent” or “very good,” and 95 percent came away with a “very strong” or “strong” understanding of the bank’s new values and desired culture. It also was rewarding that other banks and organizations have taken notice with positive feedback on our efforts.

Which sector of the banking industry do you believe women make the most significant impact?

Women have been playing a vital role in shaping the banking culture for decades by driving innovation and customer-centricity. Women are often more attuned to the needs and preferences of diverse customer segments, especially those that are traditionally underserved or marginalized by the financial system. Women are also more likely to demand products and services that cater to their specific life stages and goals. By understanding and addressing these needs, women can help banks create more value for their customers and differentiate themselves from their competitors.

Women also advocate for policies and practices that foster a more inclusive and respectful work environment, such as flexible work arrangements, parental leave, pay equity, and anti-harassment measures. By doing so, women can enhance the performance, reputation, and sustainability of the banking sector.

Anne P. Tangen is a highly accomplished financial leader and the 16th president of BankFive. With extensive experience in prestigious financial institutions, she brings a wealth of expertise to her role. Tangen spent 14 years at Fidelity Investments, empowering diverse populations to seize economic opportunities. As executive vice president at State Street Bank, she oversaw the growth of the global cash management division and successfully launched the wealth management business. Later, as COO and CIO at The Cooperative Bank of Cape Cod, Tengen revolutionized the institution’s technology strategy to compete with larger banks.

Joining BankFive in April 2020 during the pandemic, she achieved remarkable success with historic earnings, market expansion, and impressive profitability.

Tangen has overcome gender barriers and actively promotes diversity by assembling a leadership team that includes prominent women. Her expertise spans wealth management, institutional asset management, and cash management.

As a leader, she possesses exceptional business acumen, information technology proficiency, and a range of valuable skills, including negotiation, facilitation, relationship-building, and effective problem-solving.

BankFive, under her leadership, supports several charitable organizations including Peoples, Inc., EforAll, and the Fall River Historical Society. In 2022, the bank established a $1.2 million college scholarship fund for local students.

Tangen also founded the Alden Pettengill Foundation and serves on the boards of Argosy Collegiate Charter School, the Savings Banks Employees Retirement Association (SBERA), and the Endowment Committee for the Fall River Historical Society. Recently, she joined the boards

Anne P. Tangen President & CEO, BankFive

Anne P. Tangen President & CEO, BankFive

of the Massachusetts Bankers Association and the Federal Reserve Deposit Council.

Her strength lies in her ability to relate to people, demonstrating empathy and understanding. This has contributed to BankFive being recognized as one of 2022’s “Top 100 Women-Led Businesses” in Massachusetts and one of the Most Charitable Companies in Massachusetts at Boston Business Journal’s 2022 Corporate Citizenship Awards. The bank has also received a 5-Star rating from Bauer Financial.

Anne Tangen answered questions from Banking Northeast Magazine.

Why do you feel it is important for women to be represented in the banking industry?

It’s a proven fact that a diversity of opinions, experiences, and backgrounds improve business results. Women’s talents, knowledge, and experience can be key differentiators to a bank’s success. Women are natural collaborators and can be extremely effective leaders. Because many women understand household finances, they also naturally understand the needs of their banking customers.

Historically, women in banking started as tellers, where hours were flexible and suited to “mothers’ hours.” Women were recognized for their talents and given opportunities for advancement only if progressive men were in positions of power and enabled the opportunity. With more women in leadership positions, successes are mounting. My hope is more women are speaking up for the jobs we want and not afraid to ask for the next learning opportunity.

What contributions to the banking industry are you most proud of?

I was given the opportunity to lead a new business within a large corporation. I am proud of the team we built. Proud that we were given the resources we needed to be successful.

I’m also proud to be a role model for others that success as a working mother and now grandmother is possible.

What significant changes would you like to see from the banking indutry in the upcoming year?

I would like to see cryptocurrencies be regulated by OCC or Federal Reserve. Without regulation, it creates risk in the banking system by allowing untraceable ransomware payouts, distrust in the financial systems, and supports money laundering..

Which sector of the baking industry do you believe women make the most significant impact?

I think confidence in banking is critical. Women should be more vocal and visible about the stability of our financial system. We also should broadcast our contributions to the communities we serve. Without our capital, small businesses would not thrive, and community resources would be limited.

Bangor Bancorp MHC, the parent company of Bangor Savings Bank, and fintech innovations developer PayWith Worldwide Inc. have worked closely together to form IncumbentFI Inc., a joint venture company to provide innovative programmable payments technology to current bank cardholders.

With IncumbentFI’s new programmable payment technology, known as the Fintech Switch, customers can link their various payment sources to their existing debit or credit card of choice and determine which approved funding source to use for a singular transaction. This solution will provide customers with a unique and differentiated one-card experience and flexible and personalized features. It will help them better manage their financial lives more conveniently without needing to remember which funding source to choose when initiating a transaction. For example, a tap of their debit card at a local restaurant could be paid from the customer’s rewards account, while the technology could be configured to permit a similar swipe at the pharmacy to be funded from their health savings account.

Bangor Savings Bank devised the concept to support its Buoy Local® program, collaborated with PayWith to develop the proprietary Fintech Switch technology, and worked with Fiserv to implement it. Of note, Bangor Savings Bank received the 2023 Celent Model Bank Award for Payments Innovation for expanding its debit card capabilities with programmable payments technology. The Fintech Switch redirects payments after authorization and before the payments are processed via a dynamic processing engine (DPE) to the account selected by the cardholder pre- or post-transaction. It then funnels the payment to that funding source for settlement. The Fintech Switch will be brought to market through IncumbentFI.

Cambridge Savings Bank (CSB), a full-service mutual bank with more than $6 billion in assets, announced its recent approval of a $100,000 grant in support of the Cambridge Equity Fund. The fund will offer essential resources that seek to support and uplift minority-owned businesses in the local community.

Launched in August 2020, CSBBN serves as a platform for Black entrepreneurs to come together, identifying targeted programs that support their success in a postpandemic landscape. This most recent initiative collaborates with Blackowned businesses in Cambridge and Somerville, supporting those in the start-up, expansion, or recovery phase following the COVID-19 pandemic. CSB's commitment to this grant reinforces its customer-first approach and dedication to fostering a thriving and inclusive business ecosystem.

Out of the total funds granted, $80,000 has been allocated to extend technical assistance grants ranging from $5,000 to $10,000 to chosen businesses. The expert team will assume a crucial role in supervising the grant application process, ensuring that the capital reaches the 10 to 15 small businesses that are in greatest need of financing to fuel their growth. Furthermore, the staff at SBN has established a regular and systematic follow-up process with the grant winners to ensure that the funds are appropriately administered and utilized to sustain growth.

The remaining $20,000 that CSB has contributed to the Cambridge Equity Fund will be directed to program administration, marketing campaigns, necessary office materials, and general overhead costs associated with running the initiative.

In addition to the grants, CSB will provide mentorship to minority entrepreneurs. Moreover, CSB will prioritize providing comprehensive small business underwriting training to members of the Cambridge Equity Fund task force, ensuring a fair assessment of risks and informed decision-making.

Connecticut Gov. Ned Lamont has signed into law Substitute Senate Bill No. 1033 which makes significant changes to the state’s Small Loan Act. The new law takes effect on Oct. 1, 2023.

The primary changes are as follows: New APR calculation: Under the current law, the APR is calculated under the provisions of the federal Truth-in-Lending Act and associated regulations. Under the new law, the APR is to be calculated under the provisions of the federal Military Lending Act and associated regulations.

The new law also specifies certain charges that shall be deemed to be a finance charge for purposes of calculating the APR:

• A charge set forth in 32 C.F.R. Sec. 232.4(c)(1);

• A charge for any ancillary product, membership or service sold in connection with or concurrent with a small loan;

• Any amount offered or agreed to by a borrower in furtherance of obtaining credit or as compensation for the use of money; and

• Any fee, voluntarily or otherwise, charged, agreed to or paid by a borrower in connection with or concurrent with a small loan.

Reorganized and expanded small loan definition: The new law reorganizes the definition of small loan, and more importantly, expands the definition to increase is coverage from loans in an amount or value of $15,000 or less to loans in an amount or value of $50,000 or less (where the APR is greater than 12%).

New licensing requirement for persons acting as an agent, service provider or in another capacity for persons who are exempt from licensure (e.g., a bank) if:

• Such person holds, acquires or maintains an economic interest in a small loan;

• Such person markets, brokers, arranges or facilitates the loan and holds the right, requirement or right of first refusal to purchase the small loans, receivables or interests in the

small loans; or

• The totality of the circumstances indicate that such person is the lender and the transaction is structured to evade the requirements of the Small Loan Act.

Circumstances weighing in favor of deeming a person a lender who must be licensed as a small loan lender include but are not limited to the person (A) indemnifying, insuring or protecting an exempt person for any costs or risks related to a small loan; (B) predominantly designing, controlling or operating a small loan program; (C) purporting to act as an agent, service provider or in another capacity for an exempt person in this state while acting as a lender in another state.

NBT Bancorp Inc. announced that it completed the merger of Salisbury Bancorp Inc. with and into NBT on Aug. 11, 2023. The merger added 13 banking offices to the NBT franchise in complementary markets, including northwestern Connecticut, the Hudson Valley region of New York, and southwestern Massachusetts. Following a core systems conversion, NBT Bank now has 153 banking offices across its seven-state footprint.

“We are honored to build on the relationships Salisbury has cultivated with its customers, communities and shareholders for 175 years,” said NBT President and CEO John H. Watt Jr. “We are also pleased to welcome the dedicated professionals joining NBT in customer-facing positions in our retail, commercial and wealth management businesses along with many in key support roles in our new Lakeville Operations Center. With the integration of our two high-quality community banks, we are focused on continuing to support all stakeholders with a smooth transition and to the opportunity to grow our combined company together.”

In connection with the closing of the Merger, NBT has appointed former President and CEO of Salisbury, Richard J. Cantele Jr., to its board of directors. He will also join the executive management team at NBT.

NBT Bancorp is a financial holding company headquartered in Norwich, N.Y, with total assets of $11.89 billion at

June 30, 2023. The company primarily operates through NBT Bank, N.A., a fullservice community bank, and through two financial services subsidiaries. NBT Bank, N.A. has banking locations in New York, Pennsylvania, Vermont, Massachusetts, New Hampshire, Maine and Connecticut.

Detectives from the Ulster County (NY) Sheriff's Office report the arrest of a 34-year-old man of Bronx, N.Y., following an investigation involving wire fraud and bank scams.

Recently, detectives from the Ulster County Sheriff's Office and special agents from the U.S. Department of Homeland Security Investigations responded to Trustco Bank in the Town of Ulster after receiving information Justice Amoh, 34, was at the bank withdrawing United States currency from a fraudulent account linked to illegal wire fraud, money scams, and bank scams.

The defendant presented a false identification card and other forged documents to bank employees during his transaction. When he exited the bank with the currency, he was approached by detectives and special agents and falsely identified himself.

The defendant was arrested and charged with the felonies of forgery in the second degree (two counts), criminal possession of a forged instrument in the second degree, and the misdemeanor of criminal impersonation in the second degree.

The currency illegally obtained was seized as the investigation remains open and ongoing. The defendant was released with an appearance ticket returnable to the Town of Ulster Justice Court for a future date and time.

The New York State Department of Financial Services (DFS) has set forth a revised proposed second amendment to 11 NYCRR Part 500, the regulation regarding cybersecurity requirements for financial services companies (the Second Amendment). The requirements affect all “covered entities,” which are any persons

“operating under or required to operate under a license, registration, charter, certificate, permit, accreditation or similar authorization under the Banking Law, the Insurance Law or the Financial Services Law.”