A PUBLICATION OF AMERICAN BUSINESS MEDIA POWER SHIFTS BACK TO EMPLOYERS TINY DWELLINGS — BIG POTENTIAL CHICKEN OR THE EGG? DID INVESTORS AFFECT AFFORDABILITY OR DID HIGH PRICES? THE ART OF THE OCTOBER 2022 Vol. 14, Issue 10 $20.00 SPECIAL SECTION >PAGE51

©Angel Oak Mortgage Solutions LLC NMLS #1160240, Corporate office, 980 Hammond Drive, Suite 850, Atlanta, GA, 30328. This communication is sent only by Angel Oak Mortgage Solutions LLC and is not intended to imply that any of our loan products will be offered by or in conjunction with HUD, FHA, VA, the U.S. government or any federal, state or local governmental body. This is a business-tobusiness communication and is intended for licensed mortgage professionals only and is not intended to be distributed to the consumer or the general public. Each application is reviewed independently for approval and not all applicants will qualify for the program. Angel Oak Mortgage Solutions LLC is an Equal Opportunity Lender and does not discriminate against individuals on the basis of race, gender, color, religion, national origin, age, disability, other classifications protected under Fair Housing Act of 1968. MS_A723_1221 The Leader in Non-QM Visit AngelOakMS.com | 855.631.9943

A PUBLICATION OF AMERICAN BUSINESS MEDIA POWER SHIFTS BACK TO EMPLOYERS TINY DWELLINGS — BIG POTENTIAL CHICKEN OR THE EGG? DID INVESTORS AFFECT AFFORDABILITY OR DID HIGH PRICES? THE ART OF THE OCTOBER 2022 Vol. 14, Issue 10 $20.00 SPECIAL SECTION >PAGE51

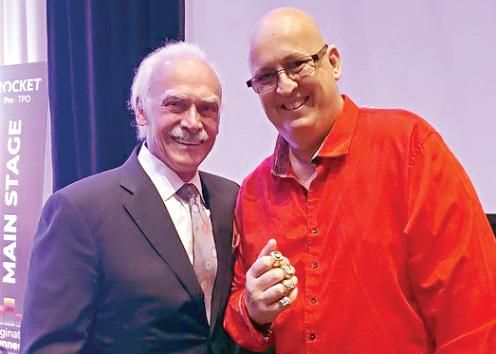

Success Advice

your day-to-day

well pays off in accolades and, more importantly, keeps the lights on and your business

in difficult times.

Upfront With New Hires

expectations to keep employees working for

Office Post-COVID

are gaining the upper hand again.

ADU Solution

houses may solve big problem of supply with right financing.

Tech Showcase

on the Move

who the movers

the

COVER STORY

Relationships

local to build up your business during

& Affordability

investors cause high prices or did high prices

Build-A-Broker:

Risks

from home increases cloud security risks.

First Million Dollars:

Dream Team

and

team

& Best

Go Digital

housing

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 3 4 Simple

Treating

staff

succeeding

6 Be

Set

you. 8 The

Employers

10 The

Little

15 Originator

19 People

See

and shakers are in

mortgage industry. 20 Build-A-Broker: Bolster

Look

quiet times. 22 Build-A-Broker: Investors

Did

attract investors? 24

Two-Fold

Working

26 Your

The

Respect

commitment help all

members succeed. 28 Benchmarks

Practices: Start Planning The time to set goals is now, not on New Year’s Eve. 30 Non-QM Lender Resource Guide 33 Private Lender Resource Guide 34 Fear Of The Future Appraisers are being set back by not embracing modern technology. 36 Wholesale Lender Guide 37 GSEs

Federal

agencies are finally entering the 21st century. 40 DataBank 66 Non-QM Lender Directory 68 Wholesale Lender Directory Originator Tech Directory Private Lender Directory 70 Facebook Thoughts: Curing Sadness With Swedish Fish

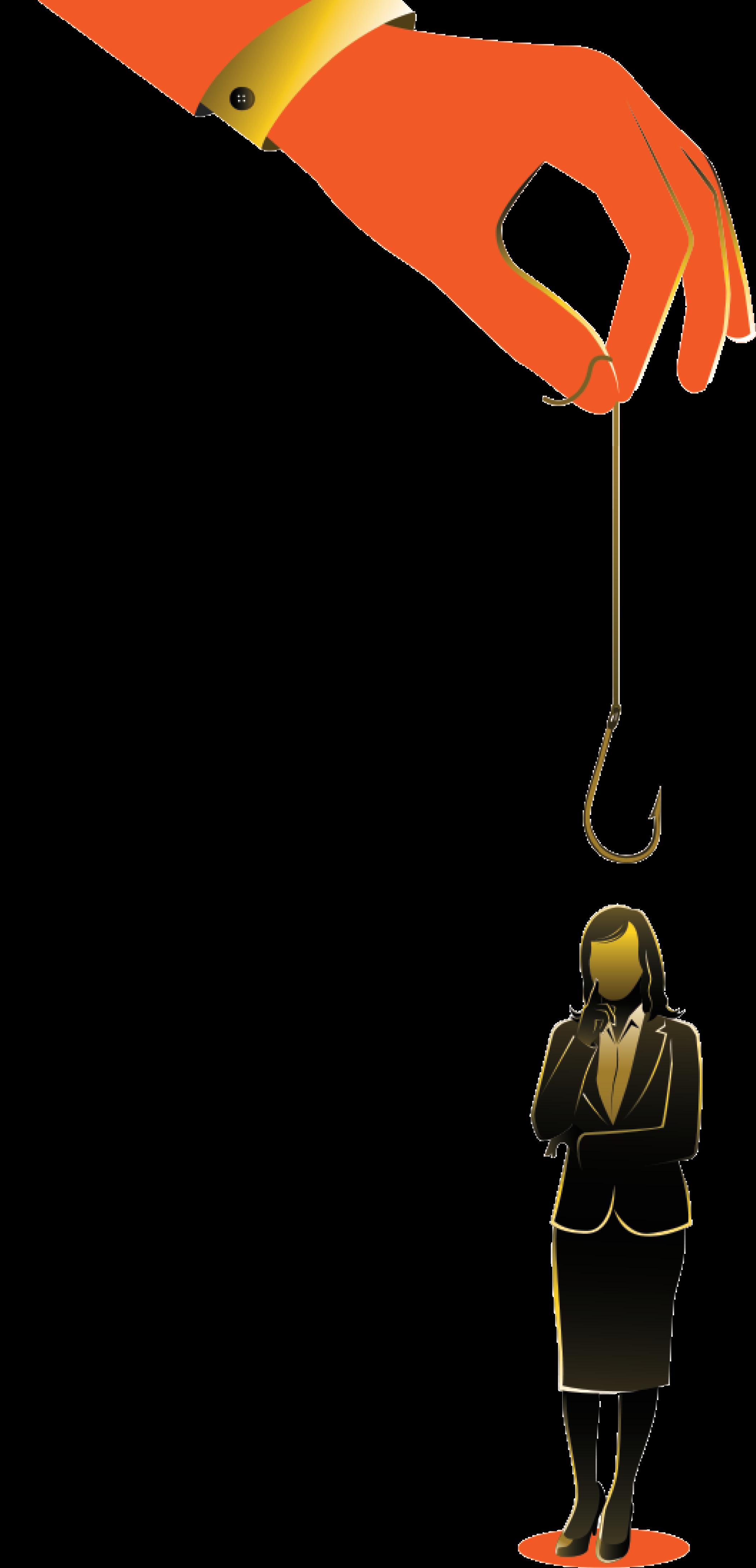

PAGE 42 POACH vs. STEAL There’s a right way and a wrong way to hire and be hired. Don’t be on the wrong end of a lawsuit. nationalmortgageprofessional.com OCTOBER 2022 Volume 14 Issue 10 CONTENTS nationalmortgageprofessional.com PAGE 51 The employees have spoken! The annual collection of the most loved employers in the mortgage industry. SPECIAL AWARDS SECTION

The Gravity Of It All It

is, we swear, only serendipity that a special feature on Most Loved Mortgage Employers is in the same issue whose cover story is about how to (legally) steal a sales team. That said, it’s also axiomatic that sales teams, or anyone, who’s working at a company they love are going to be a lot harder to steal away than ones who are feeling unappreciated and underutilized.

Right now, there are a lot of nervous mortgage industry workers. Companies are shutting down with only hours’ notice. Whole divisions are disappearing overnight, and the landscape of companies who are hiring is looking barren.

But it’s also true that companies thrive — including, and maybe especially, during tough times — when their employees are passionate, thoughtful and motivated. There are few organizations that can scale and survive without the buy-in and direct business experience of the people doing the day-to-day work. So it’s smart leadership, and good policy, to build companies that respect staff, reward exceptional work, and recognize the human value that workers can bring.

A few years ago, a small credit card processor based in Seattle, called Gravity Payments, made headlines when its CEO voluntarily cut his own pay in order to set a baseline $70,000 minimum annual salary for every worker. The company and its leader were pilloried in much of the business press for not understanding how capitalism works, and that such actions were sure to doom the small business.

But the opposite happened. The employees set about bringing in more clients, and it set revenue records. When COVID hit, disaster seemed imminent, as restaurants were a huge base of business for the company, and restaurants were shut down. Its own cash flow was reduced to about a quarter of what it was, and the company leader started talking about having to make painful layoffs.

But then the workers rallied. They told him they would each take pay cuts in order to keep funding available for everyone, so no one would have to be let go. Because of that, and things like Payroll Protection Program loans, the company made it through — and then it grew again to record revenues. And the company then, astonishingly, made whole every employee who had given up pay to secure their co-workers.

How easy do you think it would be to steal someone from that firm? It’s why mortgage lenders want to be among the most loved. It’s not just a great honor, it’s great business.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Douglas Page, Sarah Wolak

STAFF WRITERS

Rob Chrisman, Dave Hershman, Erica LaCentra, Nick Roberson, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

Submit your news to editorial@ambizmedia.com

If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email info@ambizmedia.com www.ambizmedia.com

VINCENT M. VALVO Publisher, Editor-in-Chief

© 2022 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991 info@ambizmedia.com

4 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 OCTOBER 2022

Volume 14, Issue 10

LETTER FROM THE PUBLISHER

Defining Responsibilities Up-Front — The Bane of Turnover

Doing so creates the correct expectations on both sides

BY DAVE HERSHMAN, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL

The mortgage industry is plagued with rampant turnover, especially on the sales side of the industry. While there are many causes for this condition, I have found that a pretty consistent violation of a basic premise of management and leadership contributes significantly to this turnover. Simply put, it is the lack of specific definition of the responsibilities of the “job.” This dearth of vital communication is essential for

successful leadership, yet we rarely see it practiced the way it should be.

When the loan officer’s expectations do not meet the expectations of the manager and/or the company, it is no wonder that a disconnect occurs which many times puts us on a different page from those who work for us. From there it can escalate into mistrust and more. How do we rectify this situation? Here are a few guidelines: Responsibilities must be defined upfront! Actually, the process should have started during the selection process

6 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 RECRUITING, TRAINING, AND MENTORING CORNER DAVE HERSHMAN

by accomplishing thorough interviews. When you know your candidates well, you can devote most of your meetings to discussing their feedback regarding the responsibilities that are expected and making sure they are consistent with the candidate’s expectations.

Before the salesperson starts. You must sit down with them and arrive at an agreement regarding what that position is to entail. This is your building block to determine some very important information:

• What support will they need to fulfill their responsibilities? Are you ready to commit to that level of support?

• What benchmarks are we going to use in evaluating their performance? It is important to note that goals must be broader than “how many loans and when.” What actions are they committing to produce these loans What is the quality of loan applications — including meeting company qualification standards?

• How can this be accomplished in such a way that it will facilitate the achievement of the company’s objectives? We must align the objectives of each individual with the goals of the company.

• What misunderstandings might occur if a loan officer is not in agreement of what is expected?

Poor or inconsistent attendance at staff meetings and other functions

Lack of support for their processor and other operations staff

An unsatisfactory level of customer service given to their clients

Completeness of loan applications and packages

Quantity vs. quality of pipeline

Types of products originated.

Are we talking about a job description? It does not have to be as formal as a job description. A job description typically has general statements such as “process loans.” An agreement might more actually depict the size of the pipeline and expected turnaround. But the expectations should be in writing, perhaps as part of the commission plan document.

Expectations. What we are doing here is creating the correct expectations — on both sides. I have seen so many job situations fall apart because the employer and employee have had

• An originator is promised help with marketing. To them, this means the company is going to give them leads. To the manager, this means that they will split the cost of some advertising, IF they produce.

• An originator starts part-time and hopes to move full-time if they can support themselves. The manager expects a transition within 90 days. The loan officer does not expect that timeframe at all.

• The manager expects ethical behavior and for the originator “staying on the right side of the line” is not getting caught.

• Two completely different definitions of excellent customer service and complete loan applications.

differing expectations with regard to job responsibilities. Here are just a few of the areas I have reserved:

• An originator takes a position. The manager says he expects the originator to work hard. For the originator, the definition of working hard is 30 hours each week. For the manager it is 60.

• The originator is promised training. For the manager, this is following him around and observing and making comments. The originator was expecting a training program with classes, role-playing and more.

I could go on and on with the examples, but certainly the point is easy to see. I would like to advance one other important point. You will note that I put the word “job” in parentheses earlier. That is because, while we are talking about a W-2 employee, a key to a successful loan officer career is being an entrepreneur and not treating the position as a job. That is a topic for another day! n

Senior Vice-President of Sales for Weichert Financial Services, Dave Hershman is the top author in this industry with seven books published as well as the founder of the OriginationPro Marketing System and the OriginationPro Mortgage School — the online choice for mortgage learning and marketing content. His site is www. OriginationPro.com and he can be reached at dave@hershmangroup.com

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 7

I have seen so many job situations fall apart because the employer and employee have had differing expectations with regard to job responsibilities.

A Shift In Power And A Return To Office

Popular employee benefits may wither in face of a possible recession

CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL

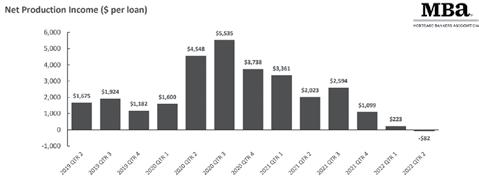

here is an unfortunate reality happening in the mortgage industry right now. Layoffs are rampant, whole divisions of companies are closing and some mortgage companies are even shuttering due to volatile market conditions. This means that there is now a growing pool of talent looking for jobs in an industry that is rapidly shrinking. And suddenly, in a market where employees have held the upper hand for a significant amount of time, employers may suddenly find themselves able to take back the power.

With the tides turning from an employees’ market to an employers’ market, this will certainly lead to employees losing some of the perks they came to expect like higher wages, better benefits, and for many companies, the much contested, work-from-home flexibility. So, with a potential recession looming, is fully remote work about to become a thing of the past?

CALLING LOYALTY INTO QUESTION

There is no doubt that employers have been doing a delicate dance with their employees regarding coaxing them back into the office post-covid. Some companies even found that when they tried to mandate a return to the office and call their employees’ bluff that folks were more than willing to walk away because work-fromhome or hybrid work opportunities were in abundance. But especially in the mortgage industry as more and more challenges arise, and employees see that their job may potentially be in jeopardy, they no longer have the choice to walk away or draw a hard line in the sand.

And it seems that employers are recognizing that they

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 ERICA LACENTRA RECRUITING, TRAINING, AND MENTORING CORNER

may finally have the upper hand and are starting to at least push for more of a hybrid work situation, with at least a few days required in the office. “According to The Society for Human Resource Management, before the pandemic, about 10% of the U.S. workforce worked fully remotely and by the end of 2024, they believe the number of fully remote workers will go to about 20%” (https:// cnb.cx/3RwpN1p). While a minimal increase, this means that 80% of workers will still be in the office in some capacity, maybe to the chagrin of employees.

The data is already showing significant trends indicating this push for the return to the office. “As of midApril, 38% of Manhattan office workers were at a physical workplace on an average weekday, but only 8% were in the office five days a week” according to The Partnership for New York City. “Even without taking into account the prospect of a recession and less plentiful jobs, it is forecasting that return to office rates will increase after Labor Day, with nearly half (49%) of workers in the office on an average weekday in September” (https://bit.ly/3BaDso2).

This is essentially a push from employers requesting their employees to meet them halfway and show greater loyalty and buy-in to the organization simply by showing up. What that looks like seems to vary from organization to organization based on how many days employees need to be in office, if certain days are mandated, and how much flexibility is allocated, but it will be interesting to see how the dynamic continues to shift as the industry deals with ongoing volatility, increasing layoffs, and more mortgage companies running into financial issues.

DOES BEING IN OFFICE EQUAL GREATER PRODUCTIVITY?

It’s strange to think that after years of successfully working remotely an employee’s work ethic or loyalty to a company could be called into question because they don’t want to go into the office full-time or even part-time

maybe, simply because they enjoy the balance that work-from-home grants them, but that is the situation that many employees now face. Especially for those in the mortgage industry

way of thinking, but employers do need to consider how life has changed since the pandemic hit and what employees have become accustomed to, and that it isn’t as simple as snapping their fingers or setting a date and simply going back into the office full time. Strides have been made with technology that has made it significantly easier for employees to be successful working from home and employees have truly appreciated the work-life balance that

that have very active roles and find themselves on the road or outside of their offices anyways, it’s strange to think that being in the office equates to being productive or being a good employee.

It may be a lingering antiquated

comes with working from home, even if that is with a hybrid schedule.

Also, employers should consider how their ability to find talented candidates has expanded by being able to hire remote workers rather than being limited to hiring employees that must be in the office five days a week. Especially for companies in the mortgage industry that are in the unique position to be looking to hire right now, there is probably no better time to try and find some top talent because of the layoffs that have occurred. If companies are willing to also consider remote working options, they could truly have the cream of the crop to choose from. If there is anything the pandemic should have taught companies, it’s that being in office didn’t equal being productive, and that being at home didn’t equal laziness.

As we go into this next economic cycle, it will be interesting to see how both employers and employees navigate the hybrid work situation and ultimately figure out how to strike an appropriate balance. n

Erica LaCentra is chief marketing officer for RCN Capital.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 9

It may be a lingering antiquated way of thinking, but employers do need to consider how life has changed since the pandemic hit and what employees have become accustomed to.

SICHELMAN

Better Financing Options For ADUs — But …

They’re affordable but they are still not inexpensive

BY LEW SICHELMAN, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL

The first accessory dwelling unit (ADU) New Avenue designed was a scant 280 square feet. The occupants were a young family with a newborn, but they made it work.

Fast forward a dozen years and the Berkeley, Calif., design-build firm is now putting up backyard houses as large as 1,200 square feet with up to three bedrooms. In some cases, says founder Kevin Casey, the new units live larger than the older homes that sit in front of them.

“Today’s ADUs work for entire families with work-from-home careers, kids, parents and extended family visitors. They’re real homes for 21st-century people living 21st-century lives,” says Casey.

Over the past 12 years, ADUs, sometimes known as granny flats or in-law suites, also moved beyond a niche market into the mainstream.

According to one report, less than 2% of the active for-sale listings in 2000 had an accessory unit. But by 2019, that figure had grown to almost 7%.

They’re “a burning hot topic,”

Shannon Faries of Land Gorilla, a technology firm which focuses on helping lenders manage their construction loans, told me. “They’re on everyone’s tongue. And it’s all related to the housing crisis. There’s

which argues that improved financing options, in combination with state and local zoning reforms, could lead to the creation of more than a million new ADUs over the next five years.

Compared to a typical house, ADUs

not enough houses, and there’s not going to be enough in our lifetimes.”

Now, though, perhaps the two most important mortgage market players have given ADUs a proverbial shot in the arm, just as proponents say these mini-houses could go a long way to solving the shortfall of some 4-5 million dwelling units.

Most recently, Freddie Mac has joined cross-town rival Fannie Mae in saying it, too, will boost its investments in mortgages on houses owned by people who want to build an accessory dwelling on their properties or in loans on houses that already have an ADU.

Housing advocates have long argued that accessory dwelling units are necessary to ease the housing shortage. Some people see them as opportunity to generate rental income, while others use them to keep their elders or their newly graduated children nearby. They also are a part of the Biden Administration’s plan to boost affordable housing,

are affordable. But they still aren’t inexpensive, not by a long shot. According to Maxable, which offers help in planning, hiring and managing an ADU project, a “legal” unit with a kitchen and bathroom typically starts at $80,000 and shoots up from there. “For a stand-alone accessory dwelling unit, expect the cost to start at $150,000.” (Casey’s New Avenue has built more than 100 ADUs, mostly in Northern California, at prices ranging from $130,000 to $750,000.)

And that’s just for construction costs. Add the cost of permitting and impact fees and you’re starting to run into some real money.

Despite the cost obstacle, a number of jurisdictions have loosened their rules to permit the construction of accessory units, with more and more doing the same every month. California has been in the forefront of the movement, but states like Arizona, Florida and Texas, where interest has been the keenest, also are working on eliminating zoning roadblocks.

10 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 LEW

RECRUITING, TRAINING, AND MENTORING CORNER

‘They’re on everyone’s tongue. And it’s all related to the housing crisis. There’s not enough houses, and there’s not going to be enough in our lifetimes.’

– Shannon Faries, Land Gorilla

In 2017, California required all cities and counties to allow ADUs as long as the property owner secured a building permit. Two years later, it eliminated occupancy requirements; made it easier to add not one but two ADUs as long as they contain at least 800 square feet of floor space and created a tiered permit structure based on the size of the unit and its location.

Many communities throughout the country also have been relaxing their restrictions against ADUs, and some states have been encouraging their local jurisdictions to allow them. According to AARP, the cities of Atlanta, Austin, Denver, Houston, Philadelphia, Phoenix and Seattle now allow accessory units. Oregon requires cities and counties of a certain size to allow them in singlefamily neighborhoods, New Hampshire says they must be allowed in nearly every single-family neighborhood.

But financing has lagged. “Financing has been one of the top barriers to production,” Wells Fargo’s Amy Anderson said at a UC Berkeley conference this summer. “A critical

aspect of ADU financing … is how to change those federal agency programs that can really play a central role in unleashing more private lending.”

Currently, most people who build an ADU either pay cash, tap into their home’s equity or take out a construction loan that converts to permanent financing when the project is finished. All are expensive options.

Jett Miller, a loan officer with Cherry Creek Mortgage in Las Vegas, hasn’t been bombarded with requests to finance ADUs. But he suspects there’s far more activity than he knows about because he’s doing a lot of business in cash-out refinancings and home equity lines of credit. In those cases, borrowers are not required to reveal how they intend to use the proceeds, and most don’t, Miller told me. “We don’t get into conversations about intended use.”

Now Fannie and Freddie have stepped up with more financing options. The two government-sponsored enterprises are key mortgage market players who together put their stamp on roughly half of all home loans.

They don’t make loans directly to borrowers. Rather, they purchase loans on the secondary market from main street lenders, package them into securities and sell them to investors worldwide. In so doing, the GSEs keep money flowing into the mortgage market by allowing the direct lenders, the ones you and I deal with, to replenish their supply of funds.

Fannie and Freddie still won’t purchase loans used to finance an ADU. But they will buy loans on primary residences that include accessory units, either in the house itself — a basement apartment, for example, an attic in-law suite, or a granny suite over the garage — or somewhere on the property.

Under Freddie’s recent “ADU Expansion,” for example, accessory units are not just limited to singlefamily homes. Now, two and threeunit properties are eligible as long as they have just one ADU. Also, any rental income can be used to qualify for funding, whereas it used to be limited to borrowers who have a disability and the income came from a live-in aide. At the same time, though, rental income cannot exceed 30 percent of the borrower’s total “stable monthly income.”

Despite these and other improvements, though, some believe Fannie and Freddie have fallen short of the ADU trend. “Freddie, in my view, God bless them, it’s awesome, but it’s a baby step,” Meredith Stowers, branch business development manager at CrossCountry Mortgage in Brecksville, Ohio, said at the

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 11

CONTINUED ON PAGE 12

ADU OPTIONS

Berkeley conference.

More specifically, Faries of Land Gorilla says a rule that the square footage of the ADU cannot exceed that of the primary residence is outdated.

“It’s not in line with the current trend” toward larger accessary units, he says, explaining that many property owners want to move into the accessory unit and rent out their main residence. “I suspect (Fannie and Freddie) will catch up because most consumers want larger units,” Fairies told me. But right now, he added, they’re “not in line with the current movement.”

Faries also laments the “conservative approach” Freddie Mac is taking concerning who the borrower uses as his contractor. He understands the need to protect both the lender and the borrower from hooking up with a fly-by-night builder, or even one who just has a lousy track record of not showing up for

weeks or not being on time. But he says the rigorous vetting requirements are “one of the biggest drawbacks.”

Another issue, of course, is the need to refinance, especially for owners who currently hold low-rate mortgages and are loathe to give them up. In that regard, the Land Gorilla executive thinks ADUs should be underwritten as a second livable unit with its own separate mortgage, whether the unit is a separate, detached dwelling or an area over the garage or in the basement.

“I’m sure there’s going to be a lot of changes coming,” he told me. “But we’ve got to stop thinking of these as accessory dwellings and starting thinking about them as another livable dwelling unit where grandma is going to live.”

Meanwhile, while some are waiting for the mortgage business to catch up, others are waiting for state and local jurisdictions to come aboard. In 2000, Washington was the first state to ban localities within its borders from outlawing ADUs, according to AARP.

Since then, perhaps a half-dozen other states have done the same. But others are dragging their feet.

Massachusetts, for instance, failed to pass a measure this summer that would have allowed ADUs “by right” statewide without prohibitions, restrictions or cumbersome permitting requirements that are on the books in some cities and towns. The measure would have precluded local governments from preventing accessory units up to 950 square feet on a lot of more than 5,000 square feet. n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country. He also has been real estate editor at two major Washington, D.C., dailies and spent 30 years on the staff of National Mortgage News, formerly National Thrift News.

RECRUITING, TRAINING, AND MENTORING CORNER

CONTINUED FROM PAGE 11

Visit JoinAPM.com or contact DUSTIN BLOCK at 303.378.3166 ©2022 American Pacific Mortgage Corporation | NMLS #1850. All information contained herein is intended for mortgage professionals only and not for public distribution. YOU WANT TO PARTNER WITH A COMPANY THAT’S ROCK-SOLID CHANGING MARKET IN A IS IN OUR DNAGrowth WHAT ABOUT YOURS? Discover why APM is experiencing record expansion in a changing market.

2022 CE IS NOWIS NOW AVAILABLE AMBIZDISCOUNT USE CODEWould you like to know more about our corporate programs? Or are you a branch manager? Contact Us. VISIT : MORTGAGEEDUCATION.COM (317) 625-3287 TRAIN YOUR COMPANY CALL OR

Calyx

Dallas, TX

Calyx® is an established provider of mortgage software solutions used by banks, credit unions, mortgage lenders, and brokerages nationwide. Our easy-touse software features an online borrower interview integration, secure electronic signature functionality, and access to wholesale lenders from within your system. End-to-end processing and reporting have never been easier. Our complete LOS solutions have been trusted by industryleading brokers, bankers, and financial institutions for decades because they’re proven to deliver superior accuracy and reliability. The Calyx suite of products include our flagship product Point® and PointCentral®, Path®, Zenly® and Zip®. Point is the choice for mortgage brokers and includes all the features, forms, and reports you need for loan marketing, prequalification, origination, and processing. PointCentral is everything you love about Point and more. This is the end-to-end solution you need to ensure quality and accuracy, and prevent unauthorized changes, across multiple locations. Path is our enterprise level solution designed for financial institutions and mortgage bankers. This cloud-based, fully configurable, datadriven, and role-based system features builtin compliance that gives you the insights and capabilities you need for seamless, effective operations. Zenly is our newest cloud-based solution that is designed for the busy loan originator. It is a mortgage platform and a point of sale all in one. Zenly includes the tools you need to unlock better customer relationships, grow your business, and decrease time to close! Lastly, Zip is our point of sale solution that can be integrated with any of our products or used in conjunction with another software.

calyxsoftware.com

(800) 362-2599 sales@calyxsoftware.com

LICENSED

U.S. States

Capacity

St. Louis, MO

Capacity is an AI-powered mortgage support automation platform that connects your entire tech stack to answer questions, automate repetitive support tasks, and build solutions to any business challenge.

Mortgage professionals use Capacity to effortlessly tap into key systems like ICE Mortgage Technology’s Encompass, and AllRegs to provide real-time access throughout the entire loan life cycle. Your clients will benefit from a superior customer experience with 24/7 tier-0 support. Capacity connects apps, mines documents, captures tacit knowledge, and automates processes — all through a mobile-friendly chat interface. Capacity’s conversational interface is easily embedded right on your website.

Answer more than 90% of your FAQs 24/7/365 without human involvement through an all-in-one helpdesk, and free up your team’s time for relationship building and revenue generating activities.

Automate monotonous processes and tasks with low-code workflows to increase productivity in cross functional teams.

Build solutions to empower your loan officers and support staff with access to information via a user-friendly knowledge base, suite of app integrations, and conversational interface.

Go live within 30 days!

Capacity is an industry leader in support automation. Mortgage clients leverage Capacity to automate 90% of the manual, repetitive questions hitting their operational teams like scenarios, processing, underwriting, lock desk, compliance and customer support. We help our clients defect low value tasks from their high value resources.

capacity.com (314) 502-9412 contact@capacity.com

LICENSED IN: All U.S. States

FileInvite: Document Collection on Autopilot Denver, CO

FileInvite is the gold standard for information and document collection, trusted by thousands of customers worldwide.

By automating information collection in document-heavy workflows, FileInvite helps you create a seamless digital experience for your clients — with time to close improved by as much as 50%.

With FileInvite, you can request documents using a secure, branded customer portal that’s easy for clients to use — no passwords or downloads are required. Clients digitally complete, sign and upload files. And automated text and email follow-ups — with constant tracking and visibility — mean your team saves significant admin time.

FileInvite delivers operational efficiency and is easily integrated with existing software using open APIs, so you can extend the capabilities of your CRM, legacy databases, workflows and email systems.

What do top mortgage professionals say about using FileInvite?

“It gives you back valuable time for another deal.” – Hamish P.

“I keep files out of my inbox and easily managed with FileInvite. It sets autoreminders for my clients and I can customise the list of items I’m asking for to simplify the process. It also links to my other software like Box, Dropbox and Google Drive.” – Mark M.

“Clients have given me nothing but positive feedback on the ease of use from the enduser experience.” – Renee G.

“FileInvite has been a vital tool empowering our clients to easily provide us with the documents and information we need.” – Michele M.

fileinvite.com (628) 201-0083 info@fileinvite.com

LICENSED IN: All U.S. States

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 15

IN: All

SPECIAL ADVERTISING SECTIONORIGINATOR TECH SHOWCASE CONTINUED ON PAGE 16

Lender Price

Pasadena, CA

Lender Price is the most accurate and dynamic mortgage product pricing & eligibility engine (PPE) with advanced business intelligence & analytics. Lender Price’s versatility allows correspondent lenders, banks, and credit unions to manage product pricing for all mortgage types (conforming, non-conforming, NonQM, and specialty loans). Built using the latest technologies, Lender Price provides powerful performance, more innovative features (e.g. built-in compliance checks, capital market tools, margin management, lock desk, customized workflows) with full mobile functionality.

lenderprice.com (626) 486-0171 contact@lenderprice.com

LICENSED IN: CA

MonitorBase

Salt Lake City, UT

The MonitorBase platform prompts originators who to call, sends originators a prescreen credit profile for each client and sends the client an email and a letter prompting them to call their originator. MonitorBase informs originators when those in their database: show preshopping behavior, apply for a loan with a competitor, have improved their credit, or listed their home for sale.

monitorbase.com (888) 795-6575 sales@monitorbase.com

LICENSED IN: All U.S. States

wemlo

Boca Raton, FL

Third-party processing service, wemlo, empowers mortgage professionals through transparent, flexible, and efficient loan processing. To better serve our customers and their borrowers, wemlo proudly offers processing support in 47 states (plus Washington DC) for more than a dozen loan products including Conventional, FHA, Jumbo, VA, and Non-QM.

wemlo.io (866) 523-3876 info@wemlo.io

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, , ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, , NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, , VT, VA, WA, WV, WI, WY, DC

ORIGINATOR TECH SHOWCASE 16 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 CONTINUED FROM PAGE 15

EXPAND YOUR FOOTPRINT WITH ACRA LENDING’S BUSINESS PURPOSE LOAN PROGRAM

Real

estate investing, like most things in life, is not without its difficulties. Finding available and affordable funding options, as well as assessing

the right deals, are all challenges that all real estate investors face at some time.

Acra Lending has an option built specifically for first time and seasoned realty Investors. The business purpose program offers the ability for borrowers to qualify with rent rather than their income in addition to closing in a Corporation (LLC). The program allows lending options on Condotels, Airbnb and Daily Rentals.

Visit www.acralending.com or call (888) 800-7661 to learn more about Acra Lending’s business purpose program

Zero 1 Solution LLC Stockton, CA 1Solution Mortgage allows you to Originate, price a loan scenario with proposal, CRM, Marketing and more … Scenario Communication CRM LOS Essentials Marketing • HR 1smtg.com (888) 458-0650 omar@1smtg.com LICENSED IN: All U.S. States, U.S. Virgin Islands SPECIAL ADVERTISING SECTION

OCTOBER 2022 | 17

Chasing Non-QM business is

Deephaven Mortgage LLC. All rights reserved. This material is intended solely for the use of licensed mortgage professionals. Distribution to consumers is strictly prohibited. Program and rates are subject to change without notice. Not available in all states. Terms subject to qualification. deephavenmortgage.com NMLSConsumerAccess.org MLS #958425 Disclosures & Licenses https://deephavenmortgage.com/disclosures-and-licenses/ deephavenmortgage.com The experts at Deephaven are leading the way. Top-performing Non-QM loan officers and brokers from coast-to-coast started with Deephaven’s phenomenal training and DIWY (Do it With You) application support services. It’s all you need to get out in front of the pack and stay there. To sign up for training or to learn more contact: info@deephavenmortgage.com

easier when you’re at the head of the pack. SCAN HERE TO CONTACT US TODAY!

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 19 > Mortgage Network Inc. announced Chance McQueen has joined the company’s East Berlin, Conn., office as a loan officer. > Birchwood Credit Services announced the promotion of Barret Elliot to chief operating officer. > Planet Home Lending, a national mortgage lender and servicer, has a new team in Minneapolis led by branch manager Robert “Bob” Clausen > Matt Hansen has been named chief product officer of nCino, overseeing the company’s product development & engineering organization globally. PEOPLE ON THE MOVE // SPONSORED BY BUILD A BROKER Refocus Relationships! Investors & High Prices Securing The Cloud From Home YOUR FIRST MILLION DOLLARS Make The Dream Work! BENCHMARKS & BEST PRACTICES Setting SMART Goals For 2023 CAREER TICKER: People On The Move HOW NMP’S MONTHLY SECTION OF HANDS-ON PRACTICAL ADVICE

Refocusing Loan Officers On Relationships

Also, focus on your local markets and not national trends for success

BY A.W. PICKELL, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL

The last few years have been really good for the mortgage lending industry. Anyone who got into the business in 2018 or 2019 found it to be a great time to be a mortgage loan officer. Rates were low, homes were selling like crazy, and the phones didn’t stop ringing. The new people who entered the business this

PEOPLE ON THE MOVE //

year are finding a much different market.

In 2020 and 2021, it was about how much business could you close how quickly? Today, it’s about relationships. How new LOs manage their relationships will determine whether they succeed or fail.

UNDERSTANDING

THE POTENTIAL

I was working with a couple of the loan officers I mentor and helping

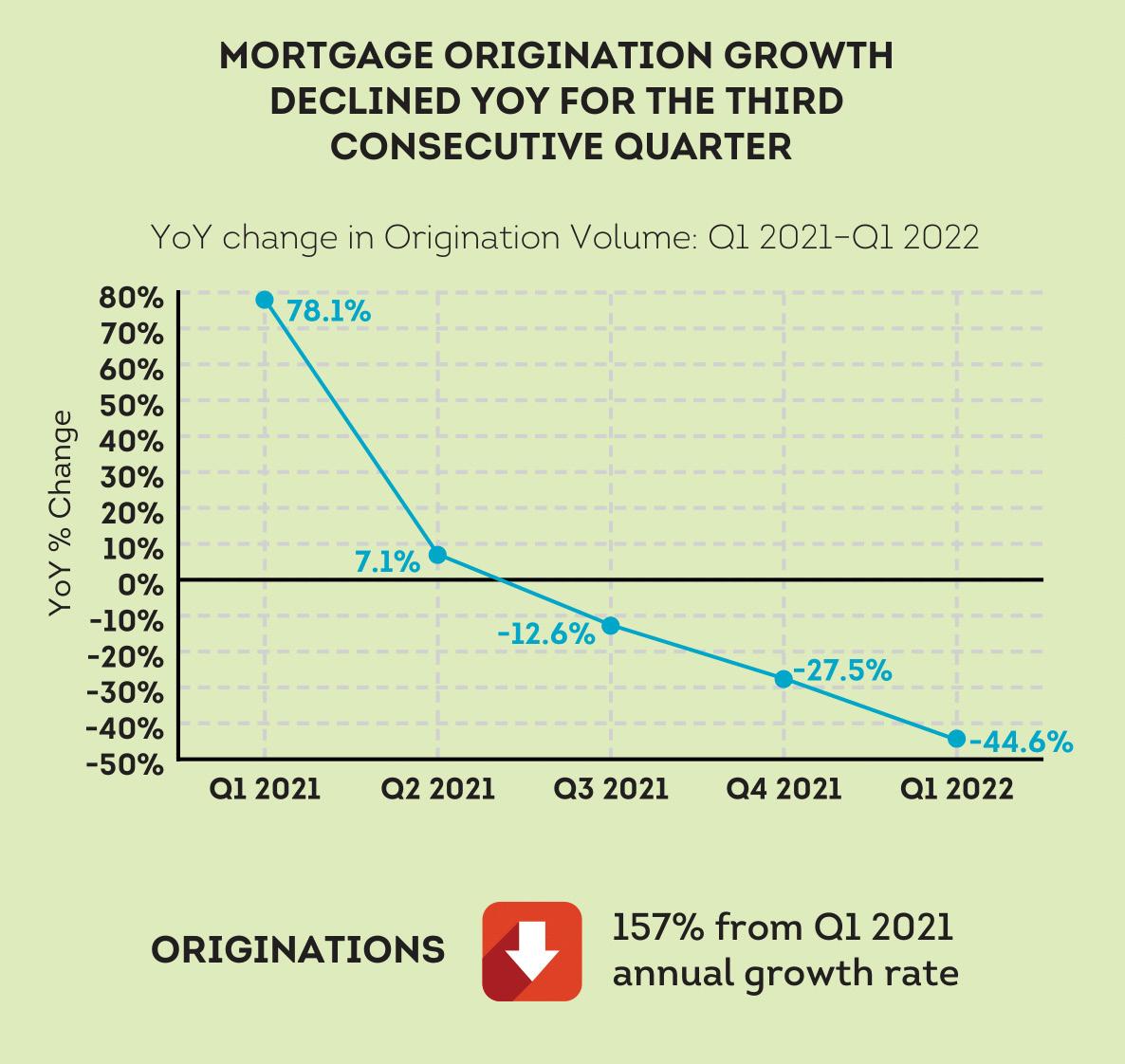

put their plans together for the next quarter and there was some concern that loan volumes would be falling so much from last year.

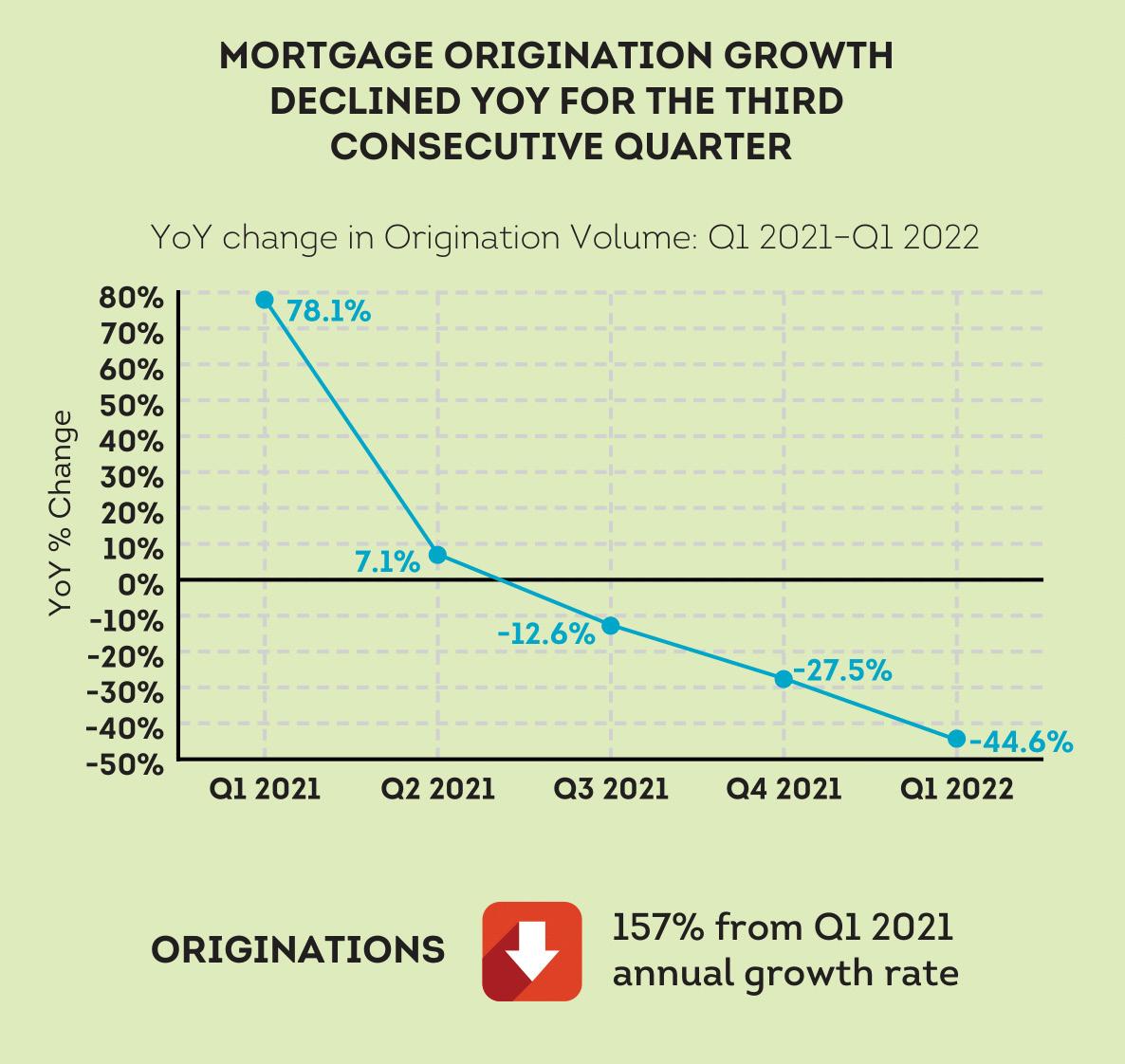

So, I asked if they knew how many loans were originated last year. They weren’t sure, but they knew volume would be down almost 50% this year. I asked if they knew that this year’s number would be. Again, uncertainty.

This is very common in the industry. Loan officers read the headlines, see how much the business is changing

He comes from Lionbridge, a translation and localization co., where he served as CMO for five years.

20 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 BUILD-A-BROKER

> Jaime Punishill has been named chief market officer of nCino.

> Cenlar FSB announced Dave Applegate has been appointed chairman of the board of directors.

> Robert “Rob” Lux has been named co-CEO of Cenlar FSB, a leading mortgage loan subservicer and federally chartered wholesale bank.

> Centric Bank in Harrisburg, Pa., has promoted Maura E. Cohen to vice president, director of mortgage services and consumer lending.

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

A.W.

PICKELL

and immediately translate that into difficulties for their own businesses. The details get lost, but the fear, uncertainty and doubt remain.

I explained that we were still going to see about $2.5 trillion worth of business this year. They only needed to close five or six loans a month to be successful. That’s just 60 over the next 12 months.

applications did they get into the system? How many did they close? So, it’s natural for them to think about relationships the same way and try to build them with everyone.

The truth is you don’t have to work with everyone to be a success in this business. Of course, it’s hard to think this way when you see loan volumes falling industry wide.

When I work with loan officers and talk to them about building the right relationships, I always advise them to seek out people they like, people who are like them. The way to find them is to be involved in things you like. That’s where you meet other people who are like you, who like the same things you do.

Number one is real estate agents. The loan officer and the real estate agent should have one of the most symbiotic relationships there is out there. We are both trying to help people get into new homes.

But beyond that there are attorneys, accountants, insurance agents and financial planners. These professionals have all earned the trust of the people our industry serves, so it makes sense to build relationships with them. The business will continue to come through these partners for years to come.

Suddenly, it didn’t seem so difficult to them, and it isn’t.

If the loan officer can focus on their own business and not the national trends, they’ll see that there is plenty of business in the market to allow them to be as successful as they want. As long as they have the right relationships, that is.

THE RELATIONSHIPS

YOU NEED AND DON’T

Professional salespeople are managed by their numbers. How many prospects did they find? How many

This could be almost any organization. It could be Rotary or a wine club. What my wife and I have recently picked up is Pickle Ball, of all things. It’s actually fun and we’re meeting people who like to have fun like we do. Who would these people go to if they needed a new home loan?

Loan officers often underestimate how effective these relationships are at bringing in new business.

BUSINESS REFERRAL RELATIONSHIPS

In addition to this, there are people in the neighborhood who work in a handful of occupations that every loan officer should know.

I don’t originate today, spending my time consulting, but I still get calls from people I worked with five or even six years ago, who are asking for a new loan. Any loan officer getting into the business today can do the same thing.

Refocusing the loan officer’s attention on the relationships that matter to their business is the best way to overcome the fear, uncertainty and doubt that always come with a down market so they can achieve success in the year ahead. n

A.W. Pickel III is a mortgage industry veteran who started as a broker and ultimately became CEO of a number of mortgage lending enterprises and past president of the NAMB. Today he is a coach and mentor and serves as an expert witness in court and to Congress.

> Ben Miller has been named CEO of SimpleNexus, an nCino Company.

> Embrace Home Loans said James “Jace”

Stirling has been named regional sales manager for the company’s Southeast region.

> Angel Oak Home Loans, a full-service mortgage lender, has hired Daniel Sheehy as a senior correspondent account manager.

> Fannie Mae has appointed Cissy Yang as senior vice president and chief audit executive. She was previously at Credit Suisse.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 21

SPONSORED BY

The truth is you don’t have to work with everyone to be a success in this business.

Are Investors Fueling The Rapid Decline In Housing Affordability?

It might be a case, instead, of higher prices attracting investors

BY ZANDER SNYDER, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL

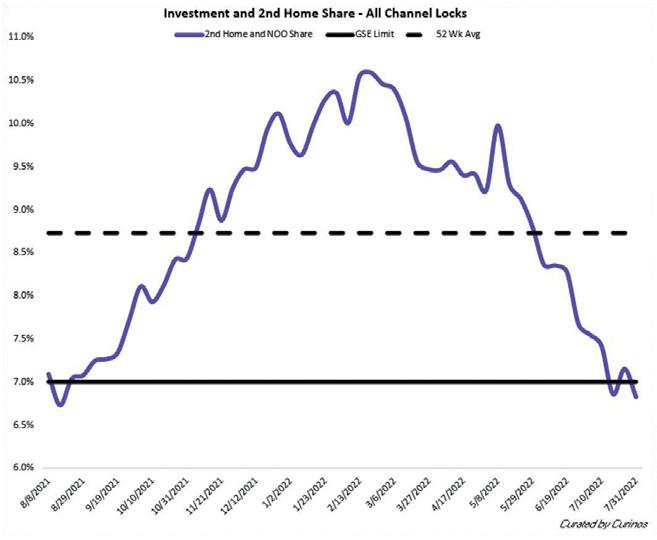

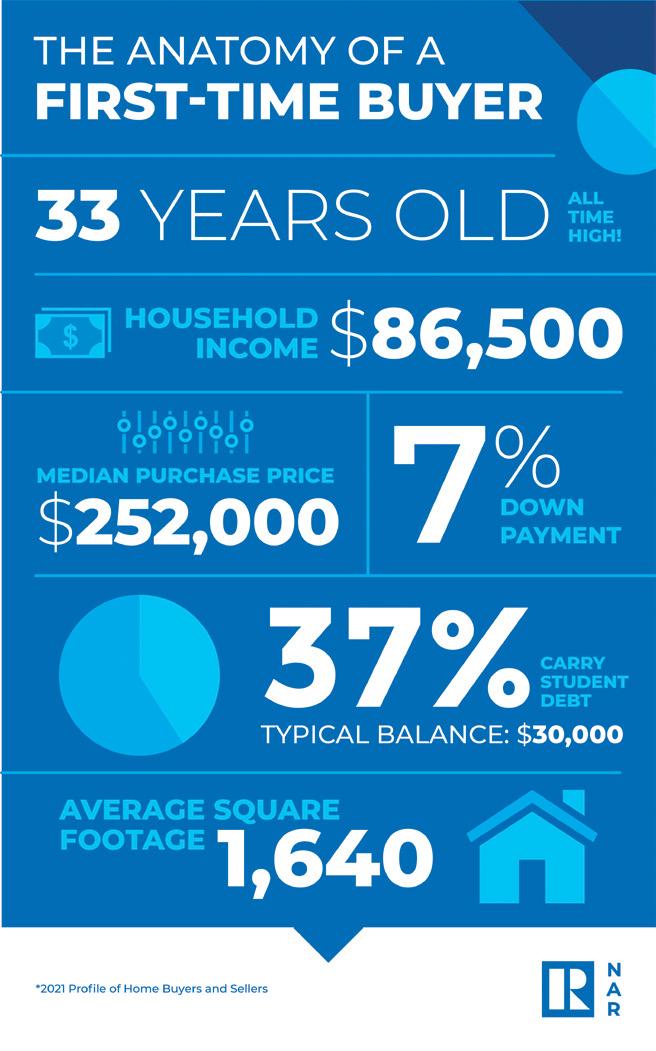

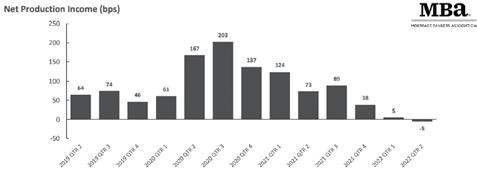

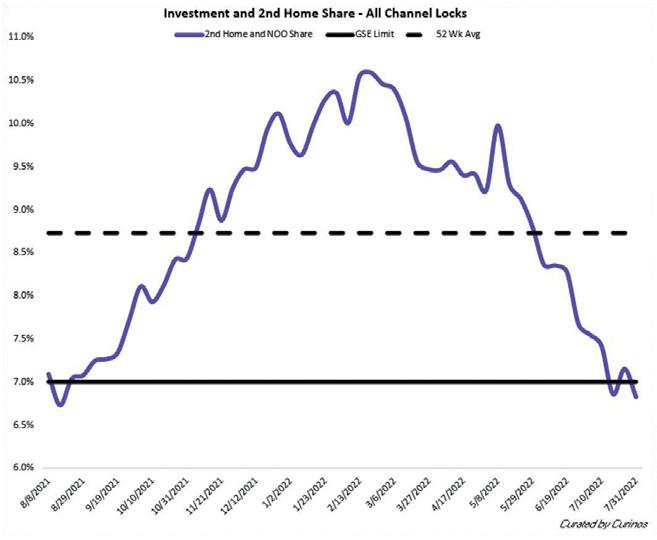

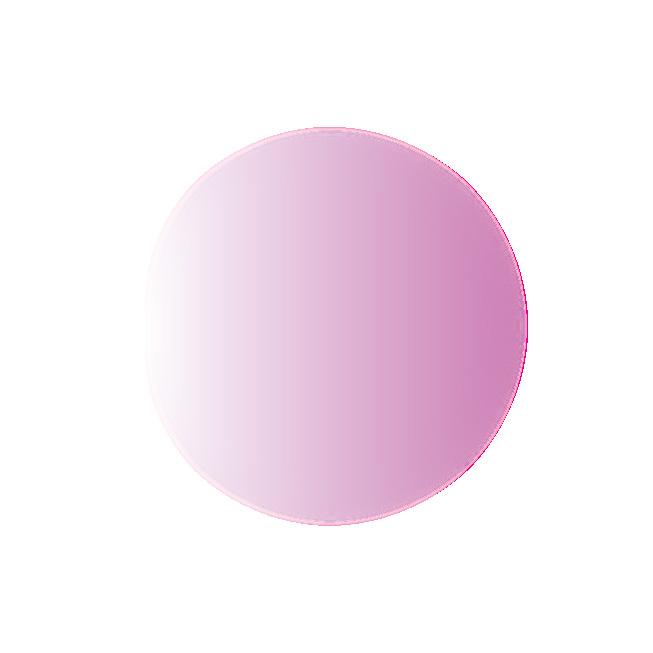

According to data from First American Data & Analytics, investor purchases of residential homes as rental properties as a share of all residential home sales, have increased sharply in the last year, rising from 10.5% in May 2021 to nearly 18% in May 2022. That’s based on the investor share identified as the share of all residential sales to buyers whose name includes keywords such as Corp, Inc, LLC, Trust, or other identifiable business names.

Increasing investor participation in the residential housing market has coincided with remarkable growth in house prices, leading some to attribute the worsening housing affordability crisis to the increase in investor participation.

However, an equally plausible explanation is that rapid house price appreciation enticed greater investor participation in the market. Given

the ongoing affordability crisis, understanding this dynamic can provide helpful insight into what we can expect as the market transitions.

SO, WHICH CAME FIRST?

It turns out, as one might expect, that house price growth and investor participation are positively correlated. While there is substantial variation from city to city, we found cities with a larger investor share of sales generally experienced greater house price growth over the last year. For example, Phoenix, Atlanta and Jacksonville had the largest investor share in May as well as some of the fastest year-over-year house price growth rates in the country.

The top five cities by investor share

in May 2022 were:

• Phoenix

Investor share: 32%

Annual house price growth: 28%

• Memphis, Tenn.

Investor share: 31%

Annual house price growth: 18%

• Atlanta Investor share: 30%

Annual house price growth: 27%

• Jacksonville, Fla.

Investor share: 29%

Annual house price growth: 31%

• Las Vegas

Investor share: 28%

Annual house price growth: 28%

However, as the adage goes, correlation is not causation. Investor purchases could be driving price

SHARE CAREER

22 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 BUILD-A-BROKER

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE > Scott Bristol, a former president of PrimeLending, has joined Fairway as senior vice president, sales and recruiting. > Nations Lending hired industry veteran Greg Griffin as vice president, Central Regional Manager. > SWBC Mortgage Corporation announced that Paul Gorske has been appointed chief technology officer.

NEWS WITH NMP™ Have news of a major new hire or promotion in the mortgage industry? Submit the information to Senior Editor Keith Griffin at kgriffin@ambizmedia.com for possible publication. Announcements should include a headshot. NMP™ has the final determination on which items are published. 0 5 10 15 20 25 30 35 PHOENIX MEMPHIS, TN ATLANTALAS VEGASJACKSONVILLE, FL

Investor

shareAnnual house price growth

Top

five cities by investor share in May 2022

Zander

Snyder PEOPLE ON THE MOVE //

appreciation, or it could be the other way around, or both. There could also be a third factor driving both the growing investor share of purchases and house price appreciation simultaneously — a pandemic-driven surge in housing demand against a limited supply of homes for sale. It’s

to be made that house price growth was influential in driving up the investor share.

Rising investor participation in the residential housing market created additional competition for the alreadylimited number of homes available for purchase, compounding the alreadyrapid pace of price growth. One estimate for the current national shortage in housing units is 3.8 million units. This preexisting shortage made house prices highly responsive to the increased demand from investors.

PERMANENT PHENOMENON OR PASSING PHASE?

difficult to know with a high degree of certainty, but recent history provides some insight.

PANDEMIC-PRICED PROPERTIES

The recent growth in demand to own residential properties is, in part, a consequence of a pandemic-induced flight away from densely populated cities and corresponding increase in demand for remote working space. This migration to more suburban cities and the search for more space accelerated demand in key markets, contributing to record house price appreciation.

As people became priced out of the purchase market, they turned to the rental market, which in addition to ongoing new rental household formation, contributed to rents growing at a record pace. The combination of rapid rent growth and house price appreciation attracted even more investors flush with capital. This explanation is compelling in part because annual house price growth was already in the double digits before the investor share picked up in the second half of last year. In other words, there’s a strong case

If greater investor participation continues to contribute to elevated demand relative to limited supply, then house prices are likely to remain positive despite rising interest rates. If house price growth is enticing greater investor participation, then we would expect to see declining investor

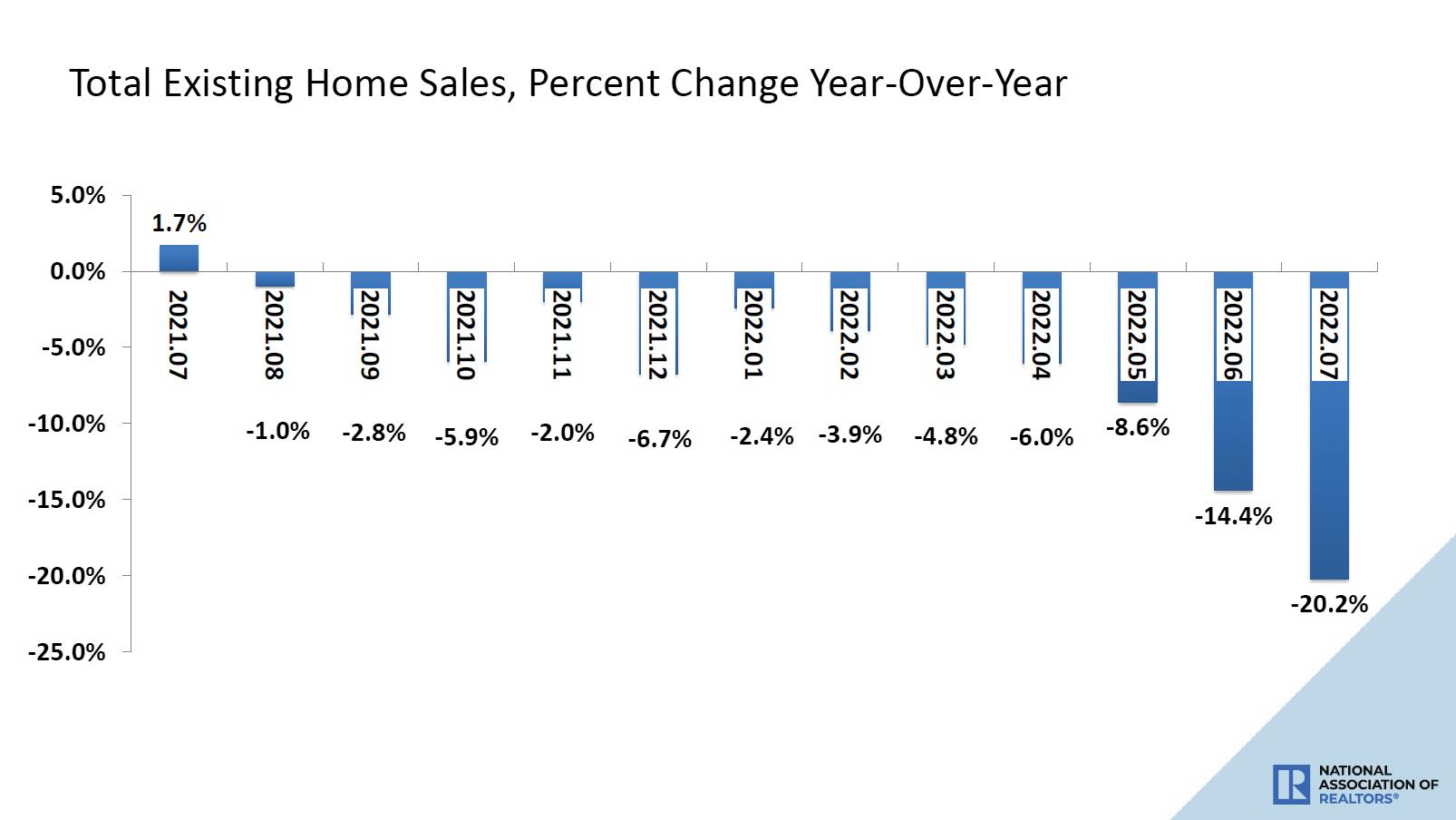

participation in the residential housing market as house prices decelerate. Currently, investor participation remains near alltime highs, but mortgage purchase applications were down 16% year-overyear in a late-July report, indicating a declining buyer pool for potential homes that may translate to slower price growth in the near term.

However, the ongoing housing shortage will continue to make home prices particularly responsive to changes in demand. So, which came first, greater investor participation or faster house price growth? Perhaps, neither. It seems that both were predated by pandemicaccelerated demand amid a historic supply shortage.

Xander Snyder is a senior economist at First American.

n

SPONSORED BY

Investor purchases could be driving price appreciation, or it could be the other way around, or both.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 23

Overcome The Many Challenges Of Digital Transformation

While convenient, working remotely has two-fold risks. SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL

While digital transformation offers many benefits, it also comes with many challenges.

For instance, investing in technology also increases cybersecurity risks. AI and machine learning have been known to potentially increase the attack surface for hackers, while big data and the cloud hold lots of information, which can pose a considerable risk in the wrong hands.

Investing in technology to support your business growth and gain a competitive edge is highly advisable as a small business owner. However, you must monitor cybersecurity trends to protect your business from potential breaches and attacks while harnessing the full potential of digital

transformation. Here are trends you should pay attention to:

1. ATTACKS ARE GETTING SOPHISTICATED

As noted, advancement in technology also increases cybersecurity risk. Like businesses, hackers are also constantly searching for the best technologies and techniques to leverage in their craft. Cyberhacking is a multibillion-dollar enterprise, complete with R&D budgets; thus, hackers invest in advanced tools and processes to penetrate systems.

Today, hackers use machine learning, AI, and other technologies to launch sophisticated attacks. These technologies enable them to expedite attacks — from weeks to days. For example, Emotet, a malware program that targets banks, is believed to be capable of changing the nature of

attacks. It can leverage AI and machine learning to automate attacks and send out contextualized phishing emails.

Other capabilities and technologies have also advanced over the years. For example, ransomware attacks have doubled since 2019, thanks to factors like ransomware as a service (RaaS) and cryptocurrencies, which have reduced the cost of launching attacks.

These attacks are a growing pain for more than 50% of cyber leaders, and 80% believe that ransomware attacks are a significant threat to public safety.

The number of Remote Desktop Protocol and internet attacks has also grown, and 2022 already has record numbers of attacks.

2. MOBILE IS THE NEW TARGET

The increased use of smartphones and tablets has made them potential

24 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE BUILD-A-BROKER

prospects for hackers. Today, mobile devices hold lots of information and can be connected to your company’s network at any time — this makes them prime targets for attackers.

Since mobile devices have software and internet access, they have security threats, such as data leakage, unsecured Wi-Fi, phishing or smishing attacks, spyware, spoofing, and SPAM. For instance, in 2020, every organization experienced at least one mobile malware attack, according to a report by Check Point.

Also, about 46% of organizations had at least one employee download a mobile app that threatened their systems and networks. Mobile devices are desirable to APT groups and actors, such as Rampant Kitten, which has previously targeted mobile users using an elaborate and sophisticated campaign.

3. CLOUD IS POTENTIALLY VULNERABLE

Cloud computing is quite effective and efficient in delivering different services via the internet. It facilitates the ondemand availability of resources, such as servers, files, and applications, to support business operations in various ways.

cybersecurity protection tools and robust access control such as multifactor authentication.

Between 2018 and 2019, up to 33 billion business records were exposed due to poor cloud security implementation. Also, up to 68% of organizations believe that cloud account takeovers pose a considerable risk to their operations. While the cloud has different benefits, its success hinges on secure implementation and use.

4. MISINFORMATION/SCAM IS STILL RAMPANT

In 2021, the Federal Trade Commission received fraud reports from over 2.8 million consumers. Imposter scams accounted for the majority of cases, and consumers lost $5.8 billion to fraud that year, representing a 70-percent increase from 2020.

This information highlights the prevalence of scams and how attackers can use them to exploit unsuspecting users to share valuable information or send money to bad actors. For example, an attacker can email or call your employee in the disguise of tech support, gov’t agency, or bank support. They can then use the information to access your system and accounts.

and systems are used with employees working from home. Other factors, such as unattended computers and unsecured Wi-Fi connections, aggravate the risk when working remotely.

A survey by OpenVPN revealed that up to 90% of IT professionals believe that remote workers are not secure. Also, about 70% believe remote workers pose a higher security risk than onsite workers. This assertion shouldn’t be taken lightly today, given that the lines between home and work are increasingly blurred.

A report by HP showed that about 30% of workers admitted to sharing their work devices, while 70% noted that they used the devices for personal tasks, too. Such behaviors pose a huge risk, particularly when roughly 71% of employees say they access company data more frequently while working at home.

Remote working has benefits and can be quite effective in improving employee productivity. However, hackers are taking note of these shifting patterns to improve their phishing and spam campaigns.

6. SOCIAL ENGINEERING, HUMAN FACTOR

However, the cloud can be vulnerable to flaws or weaknesses in a cloud environment, which attackers can exploit. The impact can even be worse for companies that count on a single cloud deployment for their business needs. Multi-cloud environments also add security and complexity challenges due to a lack of visibility and control. Therefore, businesses must now consider additional cloud

In 2020, businesses filed 241,342 complaints of phishing scams, which cost them $54 million in losses. Scams targeting small businesses take different forms, including fake invoices, unordered office supplies or other products, directory listing scams, utility company imposters, business coaching scams, and counterfeit checks.

5. REMOTE WORKING HAS ITS RISKS

Working remotely is convenient, but the risk posed by employees is two-fold. Companies cannot control how their files

Social engineering is the preferred method for soliciting information by attackers — it’s effective, and that’s why up to 98% of cyber attacks rely on social engineering to penetrate systems. It’s an effective strategy that can manipulate an elementary school student, a company’s CEO, or even a seasoned IT professional.

It has even become relatively easy for attackers to implement this technique with increased social media platforms. To target users, they use blended attacks, such as spear-phishing, business email compromise, and deepfake. Other attacks include quid pro quo, tailgating, pretexting, and baiting. n

This article comes courtesy of the Senior Corps of Retired Executives (SCORE.org). Read the rest of this article at: www.score. org/resource/securing-your-small-business.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 25 SPONSORED BY

Between 2018 and 2019, up to 33 billion business records were exposed due to poor cloud security implementation.

Teamwork Makes The Dream Work

Embracing it won’t make you invisible on the job

BY HARVEY MACKAY, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL

Once upon a time there was an enterprising businessman who had a fantastic idea. He thought he had figured out a way to build the perfect automobile.

He hired a team of young engineers and told them to buy one of every model car in the world and dismantle them, picking out the best part of every car and placing it in a special room. Soon the room was filled with parts judged by the group to be the best engineered in the world — the best carburetor, the best brakes, the best steering wheel, transmission and so on. It was an impressive collection — more than 5,000 parts in all.

Then he had all the parts assembled into one automobile. There was only one problem. The car would not function — the parts would not work together.

The moral of the story: you can have a team of superior individualistic “all stars” but they are no match for a group of people with a common objective and harmony.

My definition of teamwork is a collection of diverse individuals who respect each other and are committed to each other’s successes.

PLAY LESS GLAMOROUS ROLES

Teamwork sometimes requires people to play roles that aren’t as glamorous as they’d like. As former baseball player and manager Billy Martin once said: “No one can play whatever position they choose. If that happened in baseball, there would be nine pitchers.”

Then there’s the story of the symphony conductor who was asked which instrument was the most difficult to play. Without missing a beat, the conductor replied: “Second fiddle. I can get plenty of first violinists. But finding someone who can play second fiddle with enthusiasm is a real problem. When we have no second fiddle, we have no harmony.”

You just can’t win without teamwork. You have no harmony.

Teamwork is consciously promoted but unwittingly shunned by most people in business because they are afraid of it. They think it will render them anonymous or invisible.

Nothing could be further from the truth.

That’s why in sports the team with the most superstars usually doesn’t win championships. The Boston Celtics won 13 NBA championships and never had the leading scorer in the league. They accomplished it with phenomenal teamwork. The leader of those teams was Bill Russell who recently passed away. Russell was a team-first player, yet in 1980 he was voted the greatest player in NBA history by basketball writers.

The player many consider the GOAT (Greatest Of All time), Michael Jordan, said: “Talent wins games, but teamwork and intelligence wins championships.”

26 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE YOUR FIRST MILLION DOLLARS

Harvey Mackay

Magic Johnson, retired Los Angeles Lakers superstar, said: “Ask not what your teammates can do for you. Ask what you can do for your teammates.” (Does that sound a little familiar?) Finding good players is easy. Getting

them to play as a team is another story. This advice extends far beyond the sports arena. Your company either functions as a team or it’s headed for the showers.

Teams have shaped American history throughout the centuries: the voyage of the Nina, Pinta, and Santa Maria; the wagon trains that carried pioneers into new frontiers; and the soldiers who fought in every sort of environment in every corner of the world to cite a few examples. American industry became the world leader when it came up with the assembly line, a concept that still works, combining human and robotic capabilities. Working together is critical for success, and that hasn’t changed over the years.

There is no greater example of teamwork than a good marriage. Many years ago in Austria there was a custom

that helped villagers size up the future happiness of a newly married couple. After the marriage ceremony in a local church, the villagers would escort the bride and groom to a nearby forest and stand them before a large tree where they would hand the couple a twohandled saw and ask that they use it to cut the tree down. With the bride on one end of the saw, and the groom on the other, the villagers watched as the young couple sawed through the tree.

The closer the cooperation between the husband and wife, the shorter the time it took for the tree to come down. And the older villagers wisely reasoned that, the shorter the time, the happier the young couple would be — because they had learned that most valuable of marital lessons — teamwork!

Mackay’s Moral: Don’t aspire to be the best ON the team. Aspire to be the best FOR the team. n

No ad d-ons to pricing

on property type, credi t score, LTV

r transact io n

o limits o

cash-outs1

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 27

Your Clients Deserve Options, Not Obstacles.

based

o

type N

n

(no seasoning) U p to 90%2 CLTV for loans up to $3.5 mill io n No FICO ® score (unless PM I loan) Available to LLCs Joseph Novi ello (718) 240-4780 jnoviello@ridgewoodbank.com NMLS ID# 625762 As a trusted wholesale lender, we help independent mortgage brokers give borrowers more flexibilit y while minimizing costs. 1. On primary residences. (LTVs apply). | 2. 1–2 family and condo purchases and rate and term refinances – primary residences Terms and conditions subject to change without notice. Loans subject to credit approval. | © 2022 Ridgewood Savings Bank. All rights reserved. Learn more at ridgewoodbank.com Bijan Farassat (917) 731-4870 bfaras sat@ridg ewoodbank.com NMLS ID# 646654 My definition of teamwork is a collection of diverse individuals who respect each other and are committed to each other’s successes. SPONSORED BY

Start Setting Your Goals For 2023

Make them SMART: Specific, Measurable, Attainable, Relevant and Time-bound

BY MARY KAY SCULLY, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL

This year is not what anyone thought. Who could have predicted such swift rate increases or the supply chain issues that are holding up new construction? Just because 2022’s conditions weren’t ideal doesn’t mean you can simply rewrite your goals.

It’s hard to be successful today —

it takes hard work and determination. As we enter Q4 — it’s time for a goal setting check-in.

WHY ARE GOALS SO IMPORTANT?

I know, we talk about goals a lot, but there’s a reason for that. Setting goals is a key element of success. Don’t believe me? Listen to the facts: According to Hive, a lack of clear goals is the most common cause of a project’s failure — 37%, in fact. And a study by Dominican University in California says you are 42% more likely to achieve your goals if you write them down.

You can’t just start doing anything and everything and expect to be successful. Setting goals helps keep you focused and organized, which contributes to greater success. It also keeps your mind focused on something positive and distracts it from the negative that may be happening around you.

WHERE ARE YOU WITH 2022 GOALS?

Are there any goals you have achieved this year? Celebrate them! One positive outcome can motivate you to reach your next goal. If there are goals you haven’t reached, ask yourself why. Did you give up because the market got challenging? Was the goal achievable to begin with? Do you have the knowledge and tools required to succeed? Have you made good progress toward it? If not, how can you course correct?

Not meeting goals does not mean you are a failure. Sometimes goals are unachievable to begin with. Maybe it’s the timeline that makes it feel impossible or maybe the goal is too aspirational for where you are in your life or career. Dig in and break down what made you want to set that goal in the first place. Many times, you can break that goal down into different, more achievable parts.

Any progress toward meeting your goals is a success. Celebrate the small wins you see along the way to your big

BENCHMARKS & BEST PRACTICES MARY KAY SCULLY 28 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE SPONSORED BY

“Obstacles are those frightful things you see when you take your eyes off your goal.”

– Henry Ford

goals. Just because you cannot check them off the list yet does not mean you haven’t made significant

SET GOALS FOR 2023

Now that it’s Q4, start setting your goals for 2023. Don’t wait until January. Need help setting goals? Make sure they are SMART: Specific, Measurable, Attainable, Relevant and Time-bound.

Make your goals specific by being clear about what you want to accomplish. A measurable goal is one where you are able to track your progress. We’ve already touched on this, but it is so important to make sure your goals are attainable. You can shoot for the moon, but it needs to be possible to get there. Having unattainable goals will only discourage you and possibly burn you out in your mission to achieve them. Relevant goals must be beneficial for you personally or professionally — don’t just set goals for the sake of achieving something, make sure your goals have value. You also have a responsibility as a corporate citizen, so consider if you’re meeting your company’s expectations of you. Finally, think about how your goals are time-bound. Short-term and long-term goals are both great. Give yourself a timeline to work toward to keep you accountable and motivated.

While the market may not change in 2023, there is much you can change. Take some time to reflect and determine what you can and should be working toward and then take action. Take a class to expand your knowledge on a new product offering, listen to a podcast on time management tips, investigate a customer relationship management (CRM) software to enhance productivity, develop a new business channel, expand your social media footprint or enhance your technology skills. Whatever your goals are, don’t leave them on a to-do list and hope that they achieve themselves.

When setting goals, it’s also important to have an accountability partner. Sharing your goals with a coworker, mentor, a family member or even your social media following can help keep you on track. A study published in the Journal of Applied Psychology determined that who you share your goals with matters. Those who share their goals with people they view as “higher status” (maybe a friend or manager) demonstrated more goal commitment and better performance. Sharing your goals makes you more accountable, but sharing with your cat doesn’t. Think about who will actually help motivate you and how you may motivate others to set and achieve their own goals, too.

It’s clear that having thoughtful and achievable goals is a critical part of success — and your success means your borrowers’ success, too. With 2023 coming down the line, take the time to assess where you are with this year’s goals and find aims you can work toward in the new year. n

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum. The statements in this article are solely the opinions of Mary Kay Scully and do not necessarily reflect the views of Enact or its management.

We Have Mortgage

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | OCTOBER 2022 | 29

Jobs. • Branch Manager • Business Development Manager • Client Relationship Manager • Client Relationship Specialist • Collateral Asset Manager • Commercial Loan Officer • Credit Analyst • Licensing Assistant • Loan Officer • Loan Mitigation • Post Closing QC Expert • Loan Administration Manager • Processor • Regional Vice President • REO Closer • Retail Branch Manager • Reverse Mortgage Specialist • Sales Manager • Underwriter • Wholesale Account Exec • And MORE! Resposes are from highly-qualified candidates. Your ad can also be [osted on Indeed and SimplyHired as a FEATURED JOB, on Craigslist in most cities, Googlebase, Oodle, Juju, CareerMetaSearch, TopUSAJobs, Jobalot and MORE! Pay-per-use RESUME BANK. findmortgagejobs.com

achievements.

SPONSORED BY

LENDER RESOURCE GUIDE

Acra Lending

Lake Forest, CA

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com (888) 800-7661 sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Angel Oak Mortgage Solutions

Atlanta, GA

We offer alternative mortgage solutions for originators throughout the country helping borrowers who don’t fit Agency guidelines. We are pioneering a fresh approach to today’s mortgage lending challenges helping partners to grow their business.

angeloakms.com (855) 631-9943 info@angeloakms.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, DC and the District of Columbia

Arc Home LLC

Mount Laurel, NJ

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions.

When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com (844) 851-3600 sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

And …

Mortgage

power of video and

inform, educate,

most

while

NON-QM

News Network’s mission is to use the

podcasts to compliment the written word and

enable and empower mortgage professionals with the

relevant, up-to-date information and advances in the mortgage industry. It is our goal to offer worthwhile information to our viewers

delivering it with the utmost professionalism. MORTGAGENEWSNETWORK.COM

Action!

Civic Financial Services

Redondo Beach, CA

CIVIC delivers fast, honest, simple lending for real estate investors. Description of your products or services.

CIVIC Financial Services is a private money lender, specializing in the financing of non-owner occupied residential investment properties. CIVIC provides Mortgage Brokers and Real Estate Investors with a fast and cost effective funding source for their real estate investment needs.

civicfs.com (877) 472-4842 info@civicfs.com

LICENSED IN: AZ, CA, CO, FL, GA, HI, ID, IL, IN, LA, MD, MA, MI, MN, NV, NJ, NC, OH, OK, OR, PA, SC, TN, TX, UT, VA, WA, WI

NON-QM LENDER RESOURCE GUIDE

Deephaven Mortgage

Charlotte, NC

Founded in 2012, Deephaven is a national, Non-Agency/Non-QM mortgage provider.

A full-service innovator in the NonAgency/Non-QM mortgage space helping millions of Americans unable to qualify for a traditional, government-backed mortgage to achieve their dreams of homeownership. Available through both wholesale and correspondent channels, our differentiator is our borrower-centric culture and service delivery model. Particular strengths include our own in-house underwriting and collaborative teams that directly support our national network of independent mortgage brokers and loan officers.

deephavenmortgage.com (800) 983-0457 info@deephavenmortgage.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WI, WY

First National Bank of America

East Lansing, MI

With over 65 years of lending experience, First National Bank of America specializes in Non-QM loans, nationwide.

• Alternative Income Documentation

Options

• 12 months only of income history

• Self-Employed/1099

• ITIN or SSN

• Recent Credit Events

Our alternative mortgage solutions are designed to help people turn homeownership dreams into a reality in the Retail, Wholesale or Correspondent space

Visit: www.fnba.com/wholesale www.fnba.com/correspondent www.fnba.com/mortgage

Equal Housing Lender

fnba.com/wholesale (800) 400-5451 requests@fnba.com

LICENSED IN: Continental U.S.

Non-QM Lender Resource Guide cont’d. next pg. PRODUCTIONS OF AMERICAN BUSINESS MEDIA nationalmortgageprofessional.com/video nationalmortgageprofessional.com/ podcasts/principal nationalmortgageprofessional.com/ podcasts/gated-communities

Global Integrity Finance LLC

McKinney, Texas

DSCR Rental NO DOC Loans

As a direct, private lender, Global Integrity Finance takes a commonsense approach to underwriting, with all approvals made in-house. We are dedicated to providing quick responses to time-sensitive loans, often times with the ability to close in as few as 3 business days. At Global Integrity Finance, we value referrals and our brokers are protected. We are committed to the highest level of customer service, because our success thrives in building relationships.

globalintegrityfinance.com (214) 548-5190 toby@globalintegrityfinance.com

LICENSED IN: AL, AR, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NH, NJ, NM, NY, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VT, VA, WA, WV, WI

NON-QM LENDER RESOURCE GUIDE

Luxury Mortgage Corp. Stamford, CT

Non-QM, Wholesale, Delegated Correspondent, Non Delegated Correspondent