MAR/APR 2019

> WHOLE LATTE

BANKING Capital One Cafés Are Stirring Things Up For Millennials

> STELLAR YEAR FOR PROFITS 2018 Will Be Hard To Match

SPECIAL SECTION

BankHorizons | April 15-16 PAGE 16

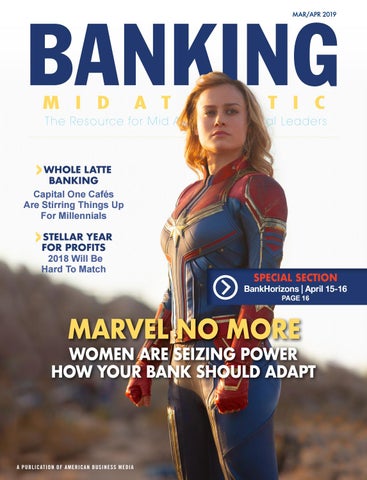

MARVEL NO MORE

WOMEN ARE SEIZING POWER HOW YOUR BANK SHOULD ADAPT

A PUBLICATI O N O F A M E R I C AN B U S IN ES S M ED IA

Our 100 years means that wherever you are going, we can guide you there.

WILLIAM J. NOWIK, PRINCIPAL IT ASSURANCE SERVICES

At Wolf & Company, we pride ourselves on insightful guidance and responsive service. As a leading regional firm, our dedicated professionals and tenured leaders provide Assurance, Tax, Risk Management and Business Consulting services that help you achieve your goals. Visit wolfandco.com to find out more.

MAR/APR 2019

Leadership

CONTENTS

14 Women and

The gender gap problem

21 Did You See? BankHorizons | April 15-16

RESORTS HOTEL & CASINO, ATLANTIC CITY, NJ

16 BankHorizons

18 BankHorizons

20 BankHorizons

Plan your days at the conference

2019 Exhibitors Stop by and learn

Thanks to all

Agenda

Event Floor Plan

Sponsors

DON’T MISS THIS YEAR’S DYNAMIC SPEAKERS

Highlights from recent Banking Mid Atlantic newsletters

23 Talking Banking

Jerome Powell, Stanley Marcus, Jamie Dimon, Gary Vaynerchuk

24 Out and About

Photos from the Northern New Jersey Community Bankers annual St. Patrick’s day luncheon

26 Bank Profits

Mid Atlantic banks and credit unions did very well in 2018 DON MANN

AMANDA BEARD

BRUCE PAUL

4 Letter From

5

12

Who Will Win Banking’s Game Of Thrones?

Loans and lattes?

10 News

Women are better bank customers than men

The Publisher

Opinion

Statistics

30 Anything But Banking

Carlo Oropesa, Executive Vice President, Freedom Bank

People on the move

www.ambizmedia.com

LE T T E R F RO M T H E P U B LIS H E R

Who Will Win Banking’s Game Of Thrones? It was a strange winter in the Mid Atlantic region. Except when “bomb cyclones” had their way, there’s been a lot less snow than usual, a bit more rain, and temperatures that were certainly more moderate than the prior year’s bone-rattling single digits. Given the return of HBO’s survivalist blockbuster, it makes it a lot harder to use the lazy writing trope that “Winter Is Coming” for banking. Winter wasn’t that difficult, was it? But maybe this is the wrong way to look at it. Every month, the Northern New Jersey Community Bankers Association hosts a luncheon. Bankers and vendors alike come together in camaraderie and commiseration. Each month, scores of bank industry pros have a chance to network and get real-time peer validation on what’s happening in the local market. It’s an Every-30-Day checkup to see what tech or economic dragons might be winging their way to make things hot and dangerous in the financial services world. But the talk, and buzz, hasn’t been dread, it hasn’t been a dive into a winter of discontent. It was rooms packed with people looking for possibility. What new tech is available to grow community banks and credit unions? What new strategies are critical? Figuratively, the folks who run the region’s banks and CUs weren’t looking at the snow. They were looking at the sun. A New Season For Bankers We know that banking is changing again. It’s not a question of pillars and marble, but pixels and mobile apps. New generations see banks as askew, forcing financiers to come to them on their tech terms. And the savviest bankers aren’t bemoaning the changes, they’re exhilarated by the possibilities of creating something new. They may be aghast at the price, but they realize that there is little choice but to adapt. Evolution, eventually, takes us all. New players on the financial tech stage – the fintech competition – are ubiquitous. These guys are developing products and strategies daily, trying them, pressing them out to new generations of consumers, seeing what works. When it doesn’t, they embrace the Silicon Valley credo to “fail fast,” and move on to the next experiment. It’s a whole new way of approaching financial innovation. It’s the opposite of doom and gloom recalcitrance. It’s all about firing up new ways of thinking, new ways of approaching banking, new technology tools to deliver a faster, friendlier, warmer experience to consumers. It’s one reason that AmBiz is launching several new initiatives this year. One of the most exciting is our conference lineup, including two editions of BankHorizons in New Jersey, a community banking event in White Plains, NY, and at the end of June, a new super-regional event. As the warmth spreads, we’ll be unveiling the new Best Bank Expo (www.bestbankexpo.com), a one-day think tank of best practices, benchmarked data, and best-of-breed products to make your bank or credit union the best it can be. Every speaker, every product demo is vetted to show that it’s either going to be immediately actionable, or it won’t be on the agenda. That makes, we hope, for a hot event. And maybe a new paradigm of embracing, rather than fearing, the changes on the way. Which could make for stronger credit unions, more robust community banks, and a fertile financial industry. After all, Summer Is Coming.

STAFF PUBLISHER Vincent M. Valvo ASSOCIATE PUBLISHER Barb Dimauro EXECUTIVE EDITOR John Hassan MANAGING EDITOR Keith Griffin OPERATIONS MANAGER Kurt Schenher ONLINE CONTENT DIRECTOR Navindra Persaud GRAPHIC DESIGN MANAGER Stacy Murray GRAPHIC DESIGNER Scott Ellison If you would like additional copies of Banking Mid Atlantic Call (860) 719-1991 or email kschenher@ambizmedia.com

Cover photo: Contributed

www.ambizmedia.com © 2019 American Business Media LLC All rights reserved. Banking Mid Atlantic magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 345 North Main St., Suite 313 West Hartford, CT 06117

VINC E N T M. VALVO

Publisher & CEO

4

BANKING MID ATLANTIC

w a r l let fee? u o y in cof

pat rick

What’s

OP I N I O N

el By Micha arm: Capital One’s desire to “unbank” the brand by launching several café model branches, designed to be warm and inviting environments without any highpressure sales, is an interesting idea. However, having visited one recently, I didn’t exactly know what to make of it. When Capital One bought ING Direct in 2012, the deal included ING’s Orange Cafés. 18 years ago, ING opened its first café in the United States in New York City, after successes in Canada, Australia, France, Italy, and Spain, as an attempt to create a new experience with customers. With that history as a backdrop, it’s interesting to see the buzz these days around Capital One. Coffee and its service is provided by Peets, Wi-Fi is free, and pastries are from local purveyors, a nod to Millennials who like to support their neighbors. Though it’s not required for purchase, Capital One cardholders get a 50% discount on drinks. And they have steadily expanded on the idea over the years with 30 café branches in the United States now, including Rittenhouse Square in Philadelphia, Pennsylvania, after inheriting 11 total in the US and

rk i K S.

Canada in the purchase. Clearly, there is something about the bank/café model that is working for Capital One. It certainly is time to retool the branch if not outright question its existence. The bank branch experience hasn’t changed very much over the years and feels as outdated as a fax machine. And this is in an era where retail giants like Apple have raised the bar for in-store experiences. While the comparison is a little unfair, we can look to the retail sector for some insight into consumer behaviors in understanding what the branch experience should be and if Capital One’s café strategy is in sync with the approach of leading retailers. One factor retailers acknowledge and design for is the evolution of the shopper’s journey. Nowadays the shopper’s path to purchase increasingly crosses between physical and digital worlds. Retailers are working to devise seamless omnichannel experiences to best serve these changing behaviors. Today’s shoppers are looking for a stress-free shopping experience that supports an increasing desire to visit the physical store to “test drive” products firsthand and prior to price-comparing and purchasing – behaviors which are moving increasingly online. With packaged goods, this makes a lot of sense but with products like mortgages, loans and other financial products it’s a little more complicated. Because these products are intangible and complicated, having human beings standing by to help simplify things and to answer questions is a winning strategy that nicely aligns

BANKING MID ATLANTIC

5

from Google offering , App l a i c n le, a n P i f a

75% of millennials say ...

e over their nation Squar w i d eb a

uthey

venue… There’s more space and more tables here – Starbucks is further away and always too crowded.” When asked if this felt like a reinvented bank, he chuckled slightly, “I have no idea. Sort of… If I needed help with bank stuff I guess I would ask…” motioning to a CapitalOne expert nearby. The relaxed atmosphere and aesthetic is the draw and the banking is an afterthought or not a thought at all for those camped out with headphones and laptops. It’s an alternative to Starbucks or Café Nero and that feels like what Capital One is going for – but is it sustainable as a business investment I wonder? “It’s a good concept… Coffee is an everyday ritual”, I overheard an equally intrigued visitor mention to one of the Capital One folks standing by. To me it’s reminiscent of the old digital strategy from the early 2000’s: get people to your website and the

r al, o ayP

’d be more e xcite db y

with consumer preferences. So, what do the people that visit these cafes think? I asked an appropriately scruffy young man sitting at a beautiful (walnut?) table sipping coffee out of a ceramic mug while flicking the trackpad of his Apple laptop. “I come here to do some work as a change of

nk. 6

BANKING MID ATLANTIC

economics will work themselves out. Another key success factor for Capital One to contend with on something billed as “reinvention” is their reputation as a reinventor. I have no doubt consumers want a reinvented relationship with banking and financial services. That’s been proven by the scores of successful fintech companies across wealth management, lending and payment sectors. Payment companies Paypal and Venmo have had great success delivering a reinvented way to pay and share money and others have since followed by rethinking savings, checking, bill paying and various other components of the banking experience. It’s not surprising that many of the innovators that provided new and reinvented solutions to the market were not incumbents like Bank of America, Citi, JPMorgan or others. Generally, consumers are more open to invention from a fresh new company that can authentically claim they’ve looked at the situation in an entirely new way. These disruptors can step into an industry and say to the market leaders We’ll take it from here without a legacy

“Capital One is to be commended for doing something so odd and courageous (and not at all inexpensive).” of brand perception to overcome. In a recent banking survey of millennials, 75% say they’d be more excited by a financial offering from Google, Apple, PayPal, or Square over their nationwide bank. Capital One’s success at reinvention of the branch goes beyond just convincing people to “bank differently”. In some ways, they’re also asking customers to believe Capital One, in its 31st year, is a company with the perspective required to truly reinvent the branch. Few established brands or companies succeed at convincing consumers to believe in a new ethos without a long campaign of demonstrated successes that earn incremental trust while demonstrating a true commitment to change. Apple could never have released the iPad – a device about which David Pogue said “I don’t know what I need this for but I’m buying it anyway.” without the prior wins with consumers (Mac, iPod, iTunes). Consumers are savvy, and these announcements are often met with skepticism. Skepticism drives behavior and can be a wet blanket on even the strongest of ideas. So Capital One’s claim at reinventing the branch is brave but I’m not sure they’ve earned that opportunity in the hearts and minds of consumers which may impact how much actual commerce happens over the piping hot cups of Peet’s. Incumbent brands should not give up and stick to the status quo. They need to account for the brand perception they have cultivated when developing innovation strategies. This perception of “steady sameness” and lack of innovation and change is a real barrier to success. If you’re going to earn the right to be different, that will take time and investment and you need to give consumers what branding experts call a “reason to believe” – that is, why is now different? What’s changed? In other words, why is Capital One uniquely positioned to do these cafes and why are they a strong idea for banking? I don’t see this incorporated into Capital One’s strategy and that may hamstring

adoption of this model especially if Amazon, a company with a solid trackrecord of innovation, decides to enter the market with a physical presence. And with 500 Whole Foods stores, this is a rumored and real possibility. The final and perhaps most challenging issue I see here is something that’s been a scourge for the banking industry for years: a lack of transparency. Let’s get real - most banks (especially the big boys) are seen as untrustworthy by the public. There is an inherent “You’re screwing me, I just can’t figure out how” sentiment amongst most consumers that has led many - especially millennials - to explore new ways to move, lend and manage their money. Digital upstarts have emerged such as Ally, Moven and Aspiration and a slew of many others to serve this appetite to defect. I spoke to one of the Capital One employees on a return visit. He had the kind of pleasant nature and friendliness that is clearly recruited for, “Sometimes when people come in and I’m up front, I will say hi and…” (holding up his hand) “They’ll say ‘I’m all set’. They think I’m trying to sell them when I’m really just saying hi!” Looking at the Capital One café through a filter of trust and transparency, customers might interpret cafés as a dishonest misdirect. It could appear like a tactic of plying customers with coffee while masking the real intentions. “Are

they watching what websites I visit on the free wifi?” Because the strategy is so unconventional – and the reputation of banking is so poor - it could be seen as a trick, even if it isn’t. Customer perception is a real and serious challenge. I paid for my coffee and sat for a while surveying the beautifully appointed surroundings. Lots of wood, leather fabrics and just the right level of designer lighting all created a mood that absolutely had me wanting to spend time here. As I sat contemplating “Where are we going with this?” I couldn’t help but root for this to work. Capital One is to be commended for doing something so odd and courageous (and not at all inexpensive). They must do something to stay relevant and compete as do the all large, national banks. Behaviors are changing. They may be ahead of the market here and we will all soon discover how natural this marriage of lattes and loans is. If these cafes truly do create a new experience paradigm that customers love, they will have earned the right with consumers to try many more innovative moves in the future.

_________________________ Michael S. Kirkpatrick is Senior Vice President, Client Experience & Strategy and leads the Financial Services Practices at Mad*Pow, an Experience Design agency.

BANKING MID ATLANTIC

7

NEWS

TRY TO KEEP UP LOCAL PROFESSIONALS MAKING THEIR MARK IN MID ATLANTIC BANKING

NEW JERSEY

TD Bank Welcomes Michael Innis-Thompson as Senior Vice President, Head of National Community Lending

TD Bank announced the appointment of Michael Innis-Thompson to senior vice president, head of national community lending for the bank’s residential lending businesses. InnisThompson will oversee strategy and development of the community mortgage sales process and expansion of enhanced product offerings catering to the diverse TD Bank client base, as well as ensure compliance with regulation in the mortgage lending space. Michael Innis-Thompson As a 25-year mortgage banking professional, Innis-Thompson will leverage his expertise in the development of community lending programs to support TD Bank’s multicultural lending strategy. He will also use his experience to build sales distribution and strategic partnerships, apply advanced market analytics and support regulatory compliance to benefit the bank across business lines. He will be based in TD Bank’s Mt. Laurel, NJ office and report to Rick Bechtel, EVP and head of U.S. Residential Lending. Before joining TD Bank, Innis-Thompson served as Managing Director of Community Lending and Investor Relations for MUFG Union Bank. He has also held senior roles in compliance, business development and product marketing for Wells Fargo, Bank of America, Fannie Mae and Freddie Mac. In addition to his professional experience, Innis-Thompson also serves organizations including the Asian Real Estate Association of America (AREAA), the National Association of Hispanic Real Estate Professionals (NAHREP), the National Association of Real Estate Brokers (NAREB) and the National Community Reinvestment Coalition (NCRC). He also serves on the Bankers Council and was Chairman of Community HousingWorks board from 2013 – 2017.

Peapack-Gladstone Financial Corporation Announces Appointment of Two New Directors

Peapack-Gladstone Financial Corporation has appointed Peter D. Horst and Patrick J. Mullen to the board of directors of the company and of Peapack-Gladstone Bank. Horst is a Fortune 500 chief marketing officer with 30 years of marketing leadership experience across diverse industries in consumer and business products, services and technology for market leaders such as Capital One, General Mills, US West (Century Link), Hershey and Ameritrade. He is the founder of CMO, Inc., and serves as a consultant, author, speaker, board member and advisor to senior executives on marketing strategy, messaging and growth planning. He is a Forbes contributor and author of the book, “Marketing in the #FakeNews Era.”

8

BANKING MID ATLANTIC

Mullen is an experienced financial services professional who recently retired as the director of banking, State of New Jersey, for the New Jersey Department of Banking and Insurance, for which he worked over the past eight years. There, among other things, he was responsible for the examination and supervision of all state-chartered banks and credit unions and state-licensed non-bank financial institutions. His career in financial services included time spent at Chemical Bank, A.G.Becker, Inc., Kidder Peabody, Inc., Barclays Capital/BZW Securities, ABN AMRO, Inc., Alliance Capital and Sound Securities, LLC, before landing at the New Jersey Department of Banking and Insurance. Peapack-Gladstone Financial Corporation is a New Jersey bank holding company with total assets of $4.62 billion and assets under management and/or administration of $5.8 billion as of December 31, 2018.

DELAWARE

The Bancorp Expands Executive Leadership Team to Drive Innovation and Performance

The Bancorp Inc. has made key additions to its executive leadership team. Additionally, transitions were implemented among two current members of the team. John Leto, who joined the company in July 2016 as chief administrative officer, now serves as executive vice president and head of institutional banking. Prior to joining The Bancorp, Leto served as president and CEO of Standard Chartered Private Bank for the Americas, as well as head of national sales of wealth management at TD Bank in the US. Jeff Nager has expanded his role and is now executive vice president and head of commercial lending. In his new role, Nager will continue to lead the small business lending division but will also oversee the commercial fleet leasing division. With more than 25 years of experience in Small Business Administration (SBA)/Small Business Lending, Nager most recently led the SBA Lending team at SunTrust Bank. Previously, he held SBA-focused leadership positions at Wells Fargo, Community South Bank, and several other national SBA Lenders throughout his career. Erika Caesar was recently appointed to serve as chief diversity officer where she leads the development and implementation of initiatives that advance the company’s commitment to maintaining a talented, diverse workforce and inclusive culture. Caesar joined the bank in October 2017 as managing director, assistant general counsel. Gregor Garry, the company’s chief risk officer, has been appointed deputy chief operating officer. As deputy COO, Garry assists the company’s COO in leading several key divisions of the company, including operations, financial crimes risk management and consumer compliance. Previously, he served as The Bancorp’s chief audit executive where Erika Caesar

he played a lead role in the remediation of regulatory issues and transitioning the company to a predominantly in-house internal audit operation. Jennifer F. Terry has been named managing director, chief human resources officer of the company. Working out of the company’s Wilmington, DE headquarters, she is responsible for the development and implementation of the strategic plan for all human resource operations. Terry has more than 20 years of human resources experience. She most recently served as TD Bank’s vice president, senior manager of human resource operations and delivery. Maria Wainwright, who joined the company in 2013, was recently named managing director, chief marketing officer. In her role, Wainwright leads the strategic planning, development, and execution of all marketing, internal and external communications, branding and investor relations functions of the organization. Previously, Wainwright had various marketing roles in the financial industry, including Lincoln Financial Group, where she worked for 12 years.

PENNSYLVANIA

Philadelphia Fed Appoints New Members to Community Bank Advisory Council

The Federal Reserve Bank of Philadelphia announced the appointments of Eric Hoerner, CEO of MidCoast Community Bancorp, Inc., based in Wilmington, Delaware, and Brian W. Jones, president/CEO and director of The First National Bank of Elmer in New Jersey, to its Community Depository Institutions Advisory Council. Hoerner and Jones began their three-year terms in March 2019. Hoerner brings more than 38 years of financial services industry experience as the current CEO of MidCoast Community Bancorp. He serves on the American Bankers Association’s Community Bankers Council, the board of directors of the Delaware Bankers Association, and the boards

of MidCoast Community Bancorp, Nantahala Bank & Trust Co., Greenleaf Financial Group, and Lancaster Theological Seminary. As president/ CEO and director Brian W. Jones Eric Hoerner of The First National Bank of Elmer, Jones provides leadership for all bankwide initiatives, programs, and activities. He serves on the Board of Trustees and the Finance Committee for Friends School Mullica Hill, the Executive Advisory Council for Rohrer College of Business at Rowan University, and the Risk Management Association’s National Community Bank Council. The 12-member council is composed of representatives from commercial banks, thrift institutions, and credit unions. The group convenes twice a year with officials from the Federal Reserve Bank of Philadelphia to share insights about economic and business trends facing community depository institutions in their local markets.

Baronick Joins NexTier As SVP, Commercial Lending

Privately-held NexTier Bank has hired a senior vice president of commercial lending from S&T Bancorp as its north central Pennsylvania market manager. Daniel Baronick will focus on developing NexTier’s business in DuBois, Brookville, Marion Center and Punxsutawney, as well as Indiana, Pa. Baronick worked at S&T for almost 12 years. NexTier is a $1.3 billion bank holding company that was established in 1892. It includes 28 branches and ranks 14th in the 10-country Pittsburgh metro by deposit market share.

ARE YOU MEETING CUSTOMER EXPECTATIONS IN THE BRANCH and ONLINE? Talk to Jack Henry about a solution to your unique needs and engage customers everywhere. Visit RedefineCore.com or email RedefineCore@jackhenry.com to learn more.

BANKING MID ATLANTIC

9

STAT I ST I C S

WOMEN AND BANKING:

THE FORCE IS WITH THEM WHY XX SHOULD MARK THE SPOT OF YOUR BANKING OUTREACH BY BRUCE PAUL

T

he latest Banking Benchmarks for Pennsylvania and New Jersey are out and we have conducted an exclusive analysis for Banking Mid Atlantic into the gender differences in banking across the region. We analyzed 546,695 reviews from both women and men to tease out the differences. Some of the results may surprise you. THE TECHNOLOGY DIVIDE In a reversal of roles in years past, women are now more likely than men to use the online and mobile tools their bank offers to do their banking. Almost 72 percent said they prefer the electronic tools (mobile and online) over personal contact (in-branch and phone). By comparison, just under 67% of men prefer electronic banking. The number one reason women cited for preferring banking electronically was because they are too busy to go into a branch or call on the phone, and they prefer the speed and ease of online and mobile tools. Not exactly breaking news. What might surprise some is that women are also significantly more capable than their male counterparts at using the technology: 16% more capable according to the respondents themselves (and that is with the built-in overclaim we see with men).

10

BANKING MID ATLANTIC

This capability gap is different by age group: Millennials have about the same technological competence regardless of gender, but male Baby Boomers are significantly worse at figuring out the tools compared to their female counterparts. Not only is the technology gap significant, but it is growing. Women are more likely than men to say that they will actually increase their use of electronic banking this year. So, the technology gap is only going to widen in the foreseeable future. Given this gender discrepancy, how many banks are thinking of gender when they roll out new managed services? Our Benchmarks cover 1854 banks across the Northeast US but I only know of 3 institutions that have ever considered gender differences in their approach to technology roll out. DOES THE PERSONAL TOUCH MATTER? Some Community Bank CEOs I have talked with have wondered if women are using branches less because they don’t have a good experience in the branch—kind of like the stereotypical car repair shop where women might feel less respected. We analyzed the data to see if this is the case, and actually the opposite is true. Women are 20% less likely to get treated with disrespect than men, according to the men and women’s own experiences.

Stop the presses and contact your State lobbying organization! Banking is an industry where women get treated better than their male counterparts! Women also report 27% lower levels of pushy staff, while getting the same level of proactivity from their bank as the men do. They seem to get the best of both worlds. This is especially true around Philadelphia (in both Pennsylvania and New Jersey suburbs) and Dauphin County markets as women get significantly better service than men there. (Bergen County in New Jersey and Montogomery County in Pennsylvania have the lowest gender discrepancy, by the way). ARE WOMEN BETTER CUSTOMERS? Women might be happier than men with the electronic banking tools and with the service they get from their banks, but do banks get rewarded for that performance? The Benchmarks show a clear answer: yes. Overall, women are 6% more likely to consolidate their business with one institution. And they are also 9% more likely to remain with a bank long term than men. This is exactly what all banks want: greater cross sell to current customers and lower attrition of those customers over time. As a matter of fact, you can take that to the bank: the average lifetime value of a female customer is actually $335 higher than a

male customer. So meeting their needs is clearly a good investment. ARE WOMEN ATTRACTED TO DIFFERENT BANKS THAN MEN? The answer to this is mixed and really depends upon the market. But not all banks are created equal. Some banks in Pennsylvania and New Jersey do a better job for their female customers than others. In some of the larger metropolitan areas, like Philadelphia, Newark and Pittsburgh there is a big difference between the banks that women will consider vs the ones men will consider. This difference narrows in many of the more rural areas. The table below and on page 12 shows the top-rated banks in New Jersey and Pennsylvania as rated by women, in each of the main areas of the two States. In some of the cases, these banks are also top performers for male customers, but in more than half they are not. If you would like to see the ratings and/ or rankings for a specific bank, whether by women only, or for all customers, just email info@cescx.com.

Bruce Paul is president and CEO of Customer Experience Solutions, which produces NJ and PA Banking Benchmarks.

THE TOP BANKS ACCORDING TO WOMEN IN NEW JERSEY Gateway New Jersey (Bergen,

Northern New Jersey (Essex,

Central New Jersey (Monmouth,

Southern New Jersey (Burlington,

1

Columbia Bank

Fulton Bank of New Jersey

Manasquan Bank

First National Bank of Absecon

2

Spencer Savings Bank

SB One Bank

Two River Community Bank

Haddon Savings Bank

3

Atlantic Stewardship Bank

ConnectOne Bank

Magyar Bank

Republic Bank

4

TD Bank

First Hope Bank

Bank of Princeton

Franklin Savings

5

Chase Bank

Chase Bank

Fulton Bank of New Jersey

Columbia Bank

Rank Among Women

Passaic, Hudson)

Union, Morris, Sussex, Warren counties)

Middlesex, Somerset, Hunterdon, Mercer, Ocean counties)

Camden, Gloucester, Salem, Cumberland, Atlantic, Cape May counties)

BANKING MID ATLANTIC

11

THE TOP BANKS ACCORDING TO WOMEN IN PENNSYLVANIA Western PA (PA Bankers Group 1):

Southeast PA (PA Bankers Group 2): City of

Northeast PA (PA Bankers Group 3): Carbon,

North Central (PA Bankers Group 4):

South Central (PA Bankers Group 5): Adams,

Central (PA Bankers Group 6):

1

Woodforest National Bank

Firstrust Savings Bank

People’s Security B&T

Woodlands Bank

ACNB Bank

1st Summit Bank

2

Marquette Savings Bank

Univest B&T

The Honesdale National Bank

Jersey Shore State Bank

Ephrata National Bank

Reliance Savings Bank

3

S&T Bank

DNB First

NBT Bank

Swineford National Bank

PeoplesBank

Ameriserv Bank

4

PNC Bank

Harleysville Bank

Wells Fargo Bank

First Citizens Community Bank

Orrstown Bank

CNB Bank

5

Somerset Trust

QNB Bank

Community Bank

The Northumberland National Bank

PNC Bank

Bank of Orbisonia

Rank Among Women

Allegheny, Armstrong, Beaver, Butler, Clarion, Erie, Fayette, Greene, Indiana, Lawrence, McKeen, Mercer, Somerset, Venango, Warren, Westmoreland Counties

Philadelphia, Berks, Bucks, Chester, Delaware, Lehigh, Northampton, Montgomery, Schuylkill Counties

Lackawanna, Luzerne, Monroe, Susquehanna, Wayne, Wyoming Counties

Bradford, Columbia, Lycoming, Montour, Northumberland, Potter, Snyder, Tioga, Union Counties

Cumberland, Dauphin, Franklin, Fulton, Juniata, Lancaster, Lebanon, Mifflin, Perry, York Counties

Bedford, Blair, Cambria, Centre, Clearfield, Huntingdon Counties)

Source: Customer Experience Solutions

Simply Better Security.

Better security is the result of experience not always new technology. Call 1-866-433-4474 or email talk@isgsecurity.com or visit www. isgsecurity.com/contact to begin a conversation on how we may help you improve your existing security, camera/video, monitoring, access control & fire alarm systems, lower costs, and experience service as it should be. Integrated Security Group (ISG) has been providing alarm services for nearly thirty years beginning as a consulting agency and now one of the largest service & installation providers in the northeast to financial institutions and high-risk retail corporations. As one of the only Underwriters Laboratory (UL) Listed installers of Bank, Safe & Vault electronic security in the entire region, we guarantee your systems will perform better, cost less and give you the peace-of-mind that only a partner at your side can.

License 181726

SECURITY I FIRE I VIDEO I ACCESS CONTROL I KNOW HOW TO BE SECURESM Integrated Security Group tel 866.433.4474 I isgsecurity.com

12

BANKING MID ATLANTIC

WO MEN & LE A DE R S HIP

Rising Through The Ranks At Banks

HOW TO CLOSE THE LEADERSHIP GENDER GAP By KAREN KIRCHNER, ELLEN KEITHLINE BYRNE, and DENISE D’AGOSTINO

T ONLY

here is undeniable evidence that a diverse leadership team and workforce leads to better business results. The Credit Suisse Gender 3000 report states, “where women account for the majority in top management, businesses show superior sales growth, high cash flow returns on investments and lower leverage.” “However, despite this clear advantage, many companies, including financial institutions, are making slow progress in addressing the gender gap in leadership. While women make up 44% of the S&P 500 labor force, only 26% of executive and senior level managers are women and only 4.8% of CEOs.

42%

WHAT’S GETTING IN THE WAY?

There are myriad factors at play, both individual and systemic. Women themselves can improve in areas such as quieting their inner critic, taking more risks, and unabashedly owning the true value they bring. Yet they will still face significant external barriers, such as unconscious bias, unfair promotion practices, and maledominated corporate cultures. For both individual women and banks, there are five steps that should be part of any effort to confront the gender gap problem. Start at the executive level. It makes a huge difference when those at the top move beyond lip service and actively promote initiatives that help women advance.

OF COMPANIES HOLD SENIOR LEADERS ACCOUNTABLE FOR MAKING PROGRESS TOWARD GENDER PARITY. BANKING MID ATLANTIC

13

Only 42% of companies hold senior leaders accountable for making progress toward gender parity. Yet it’s hard to imagine a groundswell of change when leaders aren’t formally expected to drive it. The Women in the Workforce 2018 report by McKinsey&Co., sponsored by LeanIn.org, recommends setting annual targets for promoting women and holding executives accountable for achieving them. If results are being tracked, managers are more likely to scrutinize their decisions and question their assumptions, leading to more women getting a seat at the table. Women need senior level sponsors who see their potential, introduce them to key contacts and recommend them for opportunities. Companies need to enable the key relationships that make a difference. Nine in ten women do not feel confident in asking for sponsors; and eight out of ten lack the confidence to seek mentors, according the 2015 KPMG Women’s Leadership Study. And yet, we know that these relationships are key. Kelly Watson, KPMG Partner and Board Member, explains that “Relationships are the building blocks of anyone’s life or career, and making those connections has been the single most critical thing for my career advancement.” Both women and their companies need to proactively connect high-potential women with senior leaders who can share lessons learned, help navigate politics and open doors. Networking opportunities that encourage employees to mingle, regardless of level, are also key. Our clients often ask us, “How can I build a relationship with someone I never see?”

of adding women’s voices to the conversation as well as giving men valuable feedback on unacceptable behavior. An inclusive culture also encourages women to use the benefits designed to help them manage their lives outside of work. One female leader at a major investment bank explained that while her company has a flextime policy, it’s not considered culturally appropriate to use it. Another described the stress of balancing two kids, leading a team and keeping up the façade that she has it all together. For women to rise through the ranks, they need acknowledgement and support for the complications they face on the home and work fronts.

FOSTER AN INCLUSIVE AND RESPECTFUL CULTURE

GIVE WOMEN THE FEEDBACK THEY NEED TO SUCCEED

This starts with making the expectation clear that managers at banks and credit unions should demonstrate zero tolerance for biased behavior and language when they observe it at any level of the organization. But fostering an inclusive environment requires going a step further. In the Harvard Business Review article “Women, Find Your Voice” from 2014 authors Kathryn Heath, Jill Flynn and Mary Davis Holt found that women feel unsupported and frustrated in many high-level meetings, often unable to get a word in edgewise and are frequently interrupted. Having leaders at the table who regularly solicit the views of those less vocal is important. Former Chairman and CEO of Pepsi, Indra Nooyi has discussed how she would regularly call men out who interrupted women in meetings. This has the double benefit

BUILD AWARENESS OF UNCONSCIOUS BIAS

It’s critical to pay attention to whether women and men are evaluated differently. Are you categorizing strong, assertive behavior in a woman as abrasive, while that same behavior is viewed as leader-like in a man? Training in unconscious bias helps to build awareness of the thinking patterns that lead to discrimination. This awareness results in evaluations based more on merit and less on comfort level. A senior manager may lean towards a candidate who has a similar background to his, but when he learns to question his biases, he looks for more objective data to use in a hiring decision. Research also suggests that mandating a diverse slate of candidates helps companies make better hiring and promotion decisions. Thinking about candidates in groups helped managers compare individuals by performance, while evaluating them individually led to gender-biased decisions.

Robyn Ely, faculty chair of the Harvard Business School Gender Initiative, explains that women get qualitative feedback that is more positive than men, but it’s also more vague. According to Ely’s research, men tend to get more specific, developmental feedback, which helps them correct behaviors that are getting in their way. By handling women with kid gloves, managers are slowing their development, because they don’t know what to work on to improve. Training managers in the importance of giving specific, developmental feedback to both men and women is key. Helping women develop the behaviors and skills that position them for leadership success at your bank is critical. Combining those development efforts with organizational initiatives provides the catalyst for real and lasting change, helping women to shatter that glass ceiling once and for all.

Moxie Leaders was founded by (from left to right) Denise D’Agostino, Karen Kirchner and Ellen Keithline Byrne, a team of organizational leaders, executive coaches and a PhD, who create programs specifically for women leaders –– to help them rise up in today’s competitive world and make their mark. For additional information visit www.moxie-leaders.com.

14

BANKING MID ATLANTIC

Learn where your competition is strong and where it is vulnerable.

Over 1 million independent, unbiased reviews by your own customers and your competitors’ customers that can help you discover where you have a competitive advantage, and where you are vulnerable. To learn more about our subscriptions or to get your Customer Experience Benchmark Report, visit cescx.com/benchmarks or email info@cescx.com.

Presented by

BankHorizons Schedule at a Glance: APRIL 15, 2019 5:00 p.m. – 6:00 p.m. Welcome Reception With Exhibitors 6:00 p.m. – 8:30 p.m. BANKING CHOICE AWARDS 6:30 p.m. – 7:15 p.m. Special Keynote Presentation

APRIL 16, 2019 8:00 a.m. Exhibit Hall Opens 8:00 a.m. – 10:00 a.m. SBA Training Session 8:00 a.m. – 8:45 a.m. Breakfast, Networking & Exhibits 8:30 a.m. – 10:00 a.m. Early Morning Sessions 10:00 – 10:45 a.m. EXHIBIT HALL BREAK 10:45 a.m. — 12:15 p.m. Mid Morning Sessions 12:00 – 1:00 p.m. Buffet Lunch With Exhibitors 1:00 p.m. – 2:30 p.m. Afternoon Sessions 2:30 p.m. – 3:00 p.m. EXHIBIT HALL BREAK RAFFLE PRIZES CONCLUSION

16

BANKING MID ATLANTIC

CONFERENCE AGENDA MONDAY, APRIL 15 5:00 p.m. — 6:00 p.m. WELCOME RECEPTION WITH EXHIBITORS

Banking Choice Awards Sponsored by

6:00 p.m. — 8:30 p.m.

BANKING CHOICE AWARDS SEPARATELY-TICKETED EVENT

The Banking Choice Awards celebrate the financial institutions that regularly go above and beyond to serve their customers. There are countless ways to gauge outstanding performance, but who better to ask than the customers themselves? The Banking Choice Awards recognize banks and credit unions that receive high marks from their customers and members in four categories: Customer Service, Technology, Contribution to the Community, and Overall Quality. More than 30,000 individuals were surveyed, yielding more than 2.5 million data points. The Banking Choice Awards will honor the top three institutions in each category from multiple regions of the Mid Atlantic region. Your customers can choose to bank wherever they want. Find out who does it best at The Banking Choice Awards. 6:30 p.m. – 7:15 p.m. SPECIAL BANKING CHOICE AWARDS KEYNOTE IN THE WATER, THEY CAN’T SEE YOU CRY Amanda Beard, Seven-Time Olympic Swimming Medalist, Model, Author, Entrepreneur Amanda Beard made her first Olympic swimming appearance in 1996 at the age of 14. Beard won one gold and two silver medals at that first Olympic Games and has been a strong competitor since. She went on to win a gold medal, two silvers and a bronze at the next two Olympic Games. Beard is the winner of eight national titles and is a former world record holder. Amanda has also made her mark outside of the pool, becoming much more than the 14-year-old Olympic gold medalist that carried her teddy bear around wherever she went. But despite a career that has encompassed being a successful entrepreneur, a best-selling author, and a top model, Amanda Beard hasn’t always felt like a winner. Anyone who has ever succeeded once, and then wondered if they will ever do so again, will appreciate her story of being told that she would never compete again. In April 2012, Amanda released her first book, New York Times Best Seller In The Water They Can’t See You Cry, a riveting memoir revealing the truth behind the Olympic spotlight, the battles that she fought along the way and her new found happiness in love and motherhood. Touring coast to coast, Amanda stays busy talking about her book, hosting swim clinics, endorsing products, speaking at events and making appearances in top national media like the “Today Show,” “Dr. Phil,” “Access Hollywood,” CNN, USA Today, FOX Sports and more.

TUESDAY, APRIL 16 8:00 a.m. Exhibit Hall Opens BREAKFAST BEFORE BUSINESS NETWORKING EVENT WITH EXHIBITORS 8:00 a.m. – 10:00 a.m. SPECIAL TRAINING SESSION U.S. SMALL BUSINESS ADMINISTRATION LENDER UPDATE We welcome the U.S. Small Business Administration as it presents an update and forum for banks and credit unions working to improve access to capital to our region’s growing small business economy. 8:30 a.m. – 9:15 a.m. OPENING KEYNOTE THE COMMUNITY BANK’S GUIDE TO EATING A BIG BANK’S LUNCH Bruce A. Paul, President & CEO, Customer Experience Solutions Clearly, big isn’t always better. But are you ready to capitalize on that? Right now, benchmarks show that 14% of Big Bank customers in the mid-Atlantic region are currently looking to leave their Big Bank. Come find out why, what they want in a new bank, and whether they think your bank or credit union has what they want. And gain far more than your share of the market in play. 9:15 a.m. – 10:00 a.m. THE DIGITAL IMPERATIVE: HOW YOUR BANK CAN LEVEL THE PLAYING FIELD, AND BEAT THE COMPETITION With consumer preferences shifting from physical to digital, many banks and credit unions have been left at a disadvantage when trying to compete with larger banks and innovative fintechs. Because they’re often saddled with outdated, complex legacy systems, smaller financial institutions often struggle with their ability to offer a digital banking platform that provides an exceptional customer experience, as well as seamless operations across their services and channels. In this session, presented by Jeff Bender, VP of Digital Solutions at Diebold Nixdorf, we’ll explore how a next-generation digital banking platform and application suite are no longer “nice to have” items, but rather mission-critical competitive necessities that can help banks and credit unions cost-effectively accelerate their digital strategy. 10:00 a.m. – 10:45 a.m. EXHIBIT HALL BREAK 10:45 a.m. – 11:30 a.m. EXPLORING CHANGES IN THE RISK UNIVERSE The risk universe that we knew earlier in our careers is being overtaken by emerging threats at the fastest pace we have ever witnessed, and we are responding with new tools and business practices just as quickly. Can we be sure, though, that we are moving fast enough and in the right direction? A risk-aware workforce that effectively identifies and responds early to new threats will attract the most talented employees and profitable customers. Get a glimpse into the ways the financial industry’s mechanisms are changing as we delve into the industries top trends for 2018-2019, and what we can expect in the years leading up to 2020 and beyond.

11:30 a.m. – 12:15 p.m. WHY BRANCH TRANSFORMATIONS MAY TRANSFORM YOUR BOTTOM LINE The delivery channels for bank products are getting more complex as DIVERSIFIED GROUP, INC. consumers increasingly look for multiple ways to access bank products. While digital systems are one avenue, consumers continue to make their way to physical branches at credit unions and banks. It’s critical for banking institutions to look carefully at how their branches are designed. This session will look at multiple real-world examples of branch transformations that changed an institution’s bottom line for the better. As senior management looks at increasing returns on investment, maintaining the same old branch network should be high on the “review and revamp” list.

PHOENIX

12:15 p.m. – 1 p.m. LUNCH WITH EXHIBITORS 1:00 p.m. – 1:45 p.m. FINTECH OBSTRUCTION OF THE CORE IT DISRUPTION Alex Lopatine, Managing Director of Paladin’s Fintech Advantage Alex Lopatine will deliver a formidable one-two punch for community banks who must face off against the Core IT supplier oligopoly when adopting future fintech alternatives. He’ll provide deep insights on how to profitably explore ways to build the bank of the future without being beholden to the onerous contractual, financial and technology barriers of legacy suppliers. Gain an understanding of the business and economic defects hidden deep inside supplier agreements preventing fintech adoption, and leave with a implementable strategy for gaining the upper hand in their next contract renewal negotiation. During this session, bankers are encouraged to share experiences and ask tough questions about their unique technology hurdles. 1:45 p.m. – 2:30 p.m. AFTERNOON KEYNOTE HOW TO RUN YOUR BANK LIKE YOU’RE SEAL TEAM SIX Don Mann, Navy SEAL, author, “Inside SEAL Team Six.” When it comes to Navy SEALs, Don Mann is the real deal. As a member of SEAL Team Six for more than eight years and a SEAL for more than 17 years, he worked in countless covert operations, operating from land, sea, and air, and facing shootings, decapitations, and stabbings. He was captured by the enemy and lived to tell the tale, and he participated in highly classified missions all over the globe, including Somalia, Panama, El Salvador, Colombia, Afghanistan, and Iraq. Mann will talk about goal setting, achieving against impossible odds, and building the fortitude it takes to succeed when it seems like everything is against you. 2:30 p.m. – 3 p.m. EXHIBITOR HALL BREAK RAFFLE PRIZES CONCLUSION BANKING MID ATLANTIC

17

BALL ROOM FLOOR PLAN

BUFFET

SBA

590 BHG

570

AM BIZ

500

ASCEND ANT FX

580

SCAN DIEBOLD TRON NIXDORF

190

200

CLASSIC EQUIP

ISG

270

280

COCC PHOENIX DIVS

STAGE

210

UWM NES GROUP

RED HAWK

320

220

CFT

420

290

EXIT

360

MTS SOFT WARE

300

WOLF

400

Abacus IT

500

AM BIZ Media

220

Atlantic Technology Systems Inc.

570

Bankers Healthcare Group

360 BranchServ 420

Center For Financial Training

270

Classic Equipment Services

210 COCC 380

Customer Experience Solutions

200

Diebold Nixdorf

FDIC

310

SEC. PRO WOLF SYST. 401 BRANCH SERV

250

CES

380

240

580 AscendantFX BONADIO

370

230

ATL TECH

EXIT

2019 EXHIBITORS

BUFFET

ABACUS IT

240

SPECIALIZED DATA

390

JACK HENRY

370

280

ISG Security

370

Jack Henry & Associates

300

MTS Software Solutions

320

NES Group

Paladin fs

370

Phoenix Diversified Group

310

Red Hawk Fire & Security

190 Scantron 290

Security Product Systems

390

Specialized Data Systems, Inc.

250

The Bonadio Group

230

United Wholesale Mortgage

590

US Small Business Administration

400/401 Wolf & Company

18

BANKING MID ATLANTIC

TRANSFORM. ATTRACT. ENGAGE. A full service company for all of your financial/building requirements Transform today and get ready for the future. Let your brand’s personality break through. Build connections that create experiences. RedHawkUS.com |

800-540-2703

FULL SERVICE

SECURITY SOLUTIONS

• ATMs – NCR partner • Branch Transformation – Interactive Teller Machines • Windows 10 Upgrades • Safes, Vaults, & SD Boxes • Drive-up Systems & Deal Drawers • Undercounter Steel • After Hours Depositories

• • • •

Electronic Security Systems Closed Circuit Television Access Control Systems Temperature Monitoring

LIFE SAFETY SOLUTIONS • • • •

Fire Alarm Systems Closed Circuit Television Sound Systems Personal Medical Emergency Devices

MONITORING, SERVICE, & INSPECTION SOLUTIONS • Monitoring Systems (cellular available as well) • Fire Extinguisher Inspections • Emergency Lighting Inspections • Fire & Smoke Damper Inspections • Managed Video Monitoring • Sprinkler Inspections • Preventative Maintenance Programs • Managed Access Programs

Visit us at BOOTH 310 the power of experience

®

©2018 Red Hawk Fire & Security | info@RedHawkUS.com

BANKING MID ATLANTIC

19

2019 EVENT SPONSORS DIAMOND SPONSOR Wolf & Company is one of the top regional certified public accounting firms in the Northeast. Building on a tradition of unparalleled guidance, the firm provides clients with audit and assurance, tax, business consulting, risk management services, and WolfPAC Integrated Risk ManagementÂŽ.

PHOENIX DIVERSIFIED GROUP, INC.

PLATINUM SPONSORS Phoenix Diversified Group is a full-service provider of bank equipment, branch transformation solutions, design, construction, and facilities maintenance, with over 45 years of experience. Utilizing the most accurate and expansive national database in the market, Paladin fs specializes in assisting community financial institutions through incumbent vendor Core and IT banking contract renewals, smart vendor selection and preparing agreements for future M&A strategies. SILVER SPONSOR (LUNCH) AscendantFX is a Payment Solution Provider that combines tailor-made technology, dedicated customer support and seamless accounting integration to deliver speed, comprehensive reporting and clear ROI. In business since 2011, our success is attributed to our ability to successfully marry the world of technology with international payments. Our business is backed by over 250 years of combined experience in foreign exchange and international payments. We strive to establish a partnership and a long lasting relationship with you and your company. Along with protecting your bottom line we are committed to customer service. BRONZE SPONSOR (COFFEE) Founded in 1978, The Bonadio Group is a nationally ranked Top 40 CPA firm offering accounting, tax, and consulting services to clients of all sizes. The firm’s professionals deliver practical, proactive, and innovative solutions to help clients reach their financial, compliance, management, and personal goals. EVENT PARTNER The Northern New Jersey Community Bankers Association is an organization dedicated to promoting the interests of community banks. Its membership is composed of banks and vendor associates from throughout New Jersey, southern New York, Connecticut and eastern Pennsylvania.

20

BANKING MID ATLANTIC

DI D YOU SEE?

Banking Mid Atlantic publishes a weekly digital newsletter that rounds up the latest news and information about, you guessed it, banking in Delaware, New Jersey and Pennsylvania. Here are a few stories from recent editions of that newsletter. If you would like to subscribe to or advertise in the Banking Mid Atlantic newsletter, contact us at info@ambizmedia.com. insured financial institution. The order also does not refer to the 2014 loan fraud scheme that was uncovered after an FBI investigation.

NCUA BANS FORMER CEO OF PA CREDIT UNION Deborah N. Peters has been banned by the NCUA after a short tenure as CEO of Wilkes-Barre City Employees Federal Credit Union in 2014. The CU was once under investigation for internal fraud prior to Peters becoming president and CEO. She was listed by the NCUA as the president/CEO in the first quarter and second quarter of 2014. Peters was replaced by Joseph Gimble who was listed by the NCUA as president/CEO in the third quarter of 2014. By the end of the second quarter of 2014, WilkesBarre City Employees FCU posted a net income loss of nearly $180,000, and a net income loss of $228,000 in the third quarter. By the end of 2014, the credit union recorded a net income loss of $1,014,792, according to NCUA financial performance reports. The NCUA’s prohibition order does not provide any information that explained why Peters was banned from ever participating in the affairs of a federally

OCEANFIRST FINANCIAL CORP. TO DELAY ANNUAL REPORT OceanFirst Financial Corp. filed a Notification of Late Filing with the Securities and Exchange Commission for an extension to file its annual report for the year ended Dec. 31, 2018. In the fourth quarter of 2018, OceanFirst identified an internal control issue related to ineffective information controls in the areas of user access and the accuracy of critical file maintenance reports that support the company’s financial reporting processes. Some of business process controls (automated and manual) were also deemed ineffective because they could have been adversely impacted. According to its filing, management has determined that this issue is a material weakness in internal control. OceanFirst in its filing says the material weakness has not resulted in any identified misstatements to the financial statements, and there have been no changes to previously released financial results. The company believes that the control deficiencies were a result of system access that enabled certain

BANKING MID ATLANTIC

21

employees to serve in multiple capacities in order to best serve customers. While certain compensating and process level controls were in place, validation procedures surrounding the completeness and accuracy of critical file maintenance reports proved insufficient to fully mitigate the risks that resulted from the manner in which access was granted

JPMORGAN CHASE, BANK OF AMERICA & MORE SUED BY PHILADELPHIA FOR COLLUSION JPMorgan Chase & Co. and Bank of America Corp. are two of seven banks facing a lawsuit that is accusing them of costing local governments billions of dollars. The suit states that the banks colluded to fix prices on floating-rate bonds issued to finance public works. The City of Philadelphia alleges the banks conspired to inflate the interest rates on the bonds from as early as 2008, according to a class action filed in federal court in Manhattan Wednesday. According to the complaint, the Justice Department opened a preliminary criminal investigation into the banks’ practices after meetings with a whistle-blower in 2015 and 2016. The Securities and Exchange Commission has contacted at least four banks “regarding their conduct in the VRDO market.” Citigroup Inc., Goldman Sachs Group Inc., Wells Fargo & Co., RBC Capital Markets and Barclays were the other banks named in the suit. Bill Halldin, a spokesman for Bank of America, declined to comment. Scott Helfman, a spokesman at Citigroup, declined to comment, while representatives at the other banks were not available for comment. The lawsuit appears similar to several filed by Edelweiss Fund on behalf of California, Illinois, Massachusetts and New York that center around the pricing of variable-rate demand obligations, a type of long-dated bond that carries low interest rates because buyers have the option to sell them back to banks periodically. Edelweiss, which is backed by an anonymous principal with experience in the municipal-bond industry, is seeking at least $3.6 billion in damages and penalties as part of three of the suits.

PA-BASED CREDIT UNION SUCCESSFULLY LEADS $50M LAWSUIT AGAINST WENDY’S Pennsylvania-based First Choice Federal Credit Union was the lead plaintiff in a 2016 class-action lawsuit against Wendy’s, after a breach revealed a failure to secure its systems and failing to notify consumers. The lawsuit sought to have Wendy’s compensate affected card issuers for breach-related losses and expenses, such as the cost of reissuing cards and

22

BANKING MID ATLANTIC

compensating cardholders for fraud losses. It also asked that the court ensure that Wendy’s shores up its information security practices and procedures. The lawsuit was joined by numerous other organizations, including the Federal Deposit Insurance Corporation. The plaintiffs estimate that 18 million payment cards issued by approximately 7,500 financial institutions were compromised in the data breach. In February, Wendy’s reached a proposed settlement with financial institutions, including attorneys’ fees and costs, that would pay out $50 million. Of that, Wendy’s says it expects to pay about $27.5 million, while the rest will be covered by insurance. The fastfood giant notes that the settlement agreement must still be approved by the court. After that, the payment would not be made until late in 2019.

BEST WORLD BANKS LIST INCLUDES 6 FROM MID ATLANTIC REGION Six banks headquartered in New Jersey and Pennsylvania have been named to Forbes first-ever look at what it deems the World’s Best Banks. In conjunction with market research firm Statista, more than 40,000 banking customers around the globe were surveyed for their opinions on current and former banking relationships. S&T Bank, based in Indiana, Pennsylvania, takes home the top spot in the region and is ranked third overall in the nation. It has $7.3 billion in assets and 1,535 employees. Fulton Bank finished just three spots behind at sixth best in the U.S. It has $20.7 billion in assets and 1,286 employees. Northwest Bank, headquartered in Warren, Pennsylvania, is the nation’s 17th best bank, according to Forbes. Northwest Bank employs 2,133 and has $9.6 billion in assets. First Commonwealth Bank, also headquartered in Indiana, Pennsylania, came in 25th place for the best banks in the U.S. It has $7.8 billion in assets and 1,417 employees. It was closely followed by Dollar Bank, based in Pittsburgh, which ranked 27th. It employs 1,377 and has $8.4 billion in assets. TD Bank, headquartered in Cherry Hills, was the sole New Jersey bank to crack the list of best banks in the United States. TD Bank has 27,000 employees and $380.6 billion in assets. No banks from Delaware were included on the Forbes list.

TA LK I N G B A N K ING

A regular roundup of quotations, old and new, from and about the world of finance. SPREAD THE WEALTH

In a talk on January 30, 2019, Federal Reserve Chairman Jerome H. Powell acknowledged that the United States’ economy is strong but also noted that income inequality and a decline in mobility, the opportunity for people to move up in economic class, are of concern.

WHAT DID YOU SAY, GARY?

Gary Vaynerchuk is the chairman of VaynerX, a media and communications “We want prosperity to be widely shared,” said Powell. holding company, “We need policies to make that happen.” He later noted and the CEO that “The U.S. now lags in mobility. And that’s not our of VaynerMedia, self-image as a country nor is it where we want to be.” an advertising agency. He is a sought-after speaker and recently hosted an event in Miami called “Agent ITTY BITTY BITCOIN 2021” aimed at helping In recent years, mortgage and real estate JP Morgan Chase professionals. The THE PERSONAL TOUCH CEO Jamie Dimon following remarks, has spoken “The dollar bills the customer gets made after that harshly about conference, are from the tellers in four banks are cryptocurrencies, from the Cannonball the same. What is different is the going so far as to Mindset podcast from tellers.” tell Bloomberg in February 2, 2019. – Stanley Marcus August 2018 that Bitcoin is a “scam” “I do not think the American that he had “no interest” in. He also dream should be buying a “suggested governments may move home anymore. It’s a bad use to shut down the currencies because of upfront capital, and it ties of an inability to control them.” He you up and it’s just not smart. softened his stance over time and …it’s 2019. Why do you need regretted calling Bitcoin a “fraud” in to own a home? To leave it to 2017. Finally, in the July/August 2018 your kids? They can rent too… issue of the Harvard Business Review I think the whole thing is going Dimon said “I probably shouldn’t say to go. In the next 50 years, it any more about cryptocurrency.” takes time to rebrand.” Of course, everyone can let their opinions evolve on any topic as more information comes in. So, it was noted with great interest when CNBC reported in February 2019 that JP Morgan would be the first U.S. bank to test a digital currency, JPM Coin, to be used for payments between large institutions using blockchain, a technology Dimon/JPMorgan has consistently said they see as having strong potential.

BANKING MID ATLANTIC

23

Corned Beef And Cash

From left, Amy Coiro, vice president, Statewide Reports Inc.; Lorraine Medici and Joe Medici, president, Medici Real Estate Group.

On Friday March 15, 2019, the Northern New Jersey Community Bankers held its monthly meeting at the Stony Hill Inn in Hackensack, New Jersey. The March meeting always features a St. Patrick’s Day theme and attendees enjoyed corned beef and cabbage, Irish music, and Irish step dancers. Here are some photos from the festivities.

24

BANKING MID ATLANTIC

David Yanagisawa, executive vice president, Lakeland Bank, and Chris Van Der Stad, P&G Associates.

From left, Kurt Breitenstein, executive vice president, chief lending officer, Oritani Bank; Rich Bengal, D.A. Davidson; Walter E. Loeffler, board of directors, SB One Bank; Steven M. Fusco, executive vice president and CFO, Spencer Savings; and Robert Pabst, senior vice president, D.A. Davidson.

From left, Joseph Romanello, director, The Bonadio Group; Dan Daly, WolfPAC Thomas J. Kemly, president of the Northern New Integrated Risk Management; and, Will Nowik, WolfPAC Integrated Risk Management. Jersey Community Bankers, and Brian McAllister, executive director, lead the march into lunch at the Saint Patrick’s Day celebration.

Matthew Carcich, president/CEO Freedom Bank, vice-president of the Northern New Jersey Community Bankers, and Kelly Carcich, vice president business development, Oritani Bank.

BANKING MID ATLANTIC

25

P R OF I T S

Mid Atlantic Banks See Big Profits In 2018 But what lies ahead for 2019?

Both banks and credit unions in New Jersey, Pennsylvania and Delaware enjoyed strong years in 2018. Bank net income grew $3.51 billion in 2018 over 2017 and credit unions saw year-toyear growth of $441 million over the same period. Banking Mid Atlantic takes a look inside those numbers to see what drove such success in 2018 and what lies ahead for 2019. 26

BANKING MID ATLANTIC

C

ommercial banks and saving institutions in New Jersey, Pennsylvania and Delaware saw their net income grow by $7.3 billion from $11.72 billion in 2017 to $19.02 billion in 2018. That reflects a 62 percent growth in net income from year to year, according to numbers released by the FDIC. Nationally, FDIC-insured commercial banks and savings institutions reported aggregate net income of $59.1 billion in the fourth quarter of 2018, up $33.8 billion (133.4 percent) from a year ago. The improvement in net income was led by higher net operating revenue, lower income tax expenses and onetime accounting changes driven by the new tax law that forced banks to log significant losses at the end of 2017. In general, it was a good year for the Mid Atlantic banks with 88 percent reporting earnings gains compared with 48 percent in 2017. The number of unprofitable institutions was 4.7 percent in Pennsylvania, 6.6 percent in New Jersey, and 0 percent in Delaware. Peter Ostrowski, managing director of Ostrowski & Company Inc. in Cranford, N.J., said tax cuts were the biggest driver of the net income growth in 2018, but even without that, it was a good year for bank profitability with doubledigit grow in net income even when the tax cut is factored out. “Earnings were still strong aided by a strong economy,” he said in a phone interview.

banks should look very strong,” he added. “It should be a fairly strong year. [Banks] are positioned to weather any squalls in the economy.” That sentiment was echoed on the national level as well. “The banking industry continued to report strong results, and the FDIC is actively monitoring economic conditions to ensure banks remain resilient,” FDIC Chairman Jelena McWilliams said at a Washington, D.C. press conference. She added, “Growth in net income was attributable to higher net operating revenue and a lower effective tax rate. Loan balances expanded, net interest margins improved and the number of ‘problem banks’ continued to decline. Community banks also had a strong quarter, with annual loan growth and a net interest margin that exceeded the overall industry.” Here is a state-by-state look at the combined net income of FDIC-insured financial institutions in the Mid Atlantic region, according to government statistics.

Delaware Delaware ended 2018 with $14.79 billion in net income compared with $8.72 billion in 2017 for a 69 percent increase: the largest percentage increase among the Mid Atlantic states. Delaware had 22 institutions reporting quarterly results to the FDIC at the end of 2018. Delaware reported $1.07 trillion in total assets. Total deposits reported were $767 billion.

percent increase. There were 156 institutions reporting quarterly results in Pennsylvania to the FDIC at the end of 2018. Pennsylvania reported total assets of $260.6 billion and total deposits of $205.9 billion.

CREDIT UNIONS The National Credit Union Association (NCUA) reports net income grew 25 percent at the country’s 5,375 credit unions in 2018. In the Mid Atlantic region, the numbers were more dramatic with NCUA figures showing year-over-year net income increasing from $386.8 million to $515.4 million for a 33.2 percent increase. Financial information released by the NCUA shows net income rose nationally from $10.35 billion in 2017 to $13.02 billion in 2018 for a 25.8 percent increase. Interest income rose $6.6 billion, or 13.8 percent, over the year to $54.0 billion, and non-interest income increased $1.7 billion, or 9.3 percent, to $19.8 billion. Sam Taft, assistant vice president for analytics and business development, at Callahan & Associates, which tracks credit unions, said, “There are a couple of factors at play here which contributed to the strong credit union results we saw in 2018. Robust loan demand from members continued throughout 2018. Interest income, both from loans and investments, benefitted from the rate hikes throughout 2018 and the resulting asset repricing that occurred.”

He added, “Member engagement and growing product penetration helped New Jersey push non-interest income higher in 2018 as credit union members increasingly New Jersey ended 2018 with $1.47 choose credit unions for their financial billion in net income compared with service needs. This income segment $1.01 billion in 2017 for a 45 percent rose 9.4 percent in 2018, driven in large increase. New Jersey had 75 institutions part by gains in other operating income Also, bankers should be following reporting quarterly results to the FDIC factors like an increase in nonwhich includes interchange income as at the end of 2018. New Jersey reported well as gains from mortgage sales to the performing assets from personal credit total assets of $161.1 billion and $122.3 card debt and other indicators. The secondary market.” numbers are the lowest they have been billion in total deposits. Credit union income also got a boost since before the recession, but an uptick Pennsylvania from a one-time payment from the could signal concerns. NCUA, according to Taft. He said, “In At the end of 2018 Pennsylvania had Ostrowski said banks are currently in a 2018 the NCUA approved an equity $2.76 billion in net income compared good place with their strong reserve and distribution related to the share with $1.99 billion in 2017 for a 38 capital positions. “Given the economy, insurance fund which was captured in Economists, Ostrowski added, are cautious about the rate of growth in 2019 with expectations it will soften. He said concerns about trade issues and the global economy could impact New England bank income.

BANKING MID ATLANTIC

27

other operating income, which helped push this higher. The collective interest and non-interest income gains were more than enough to offset the 8.1 percent growth in operating expenses, resulting in annual net income growth of 25.2 percent in 2018.” That one-time payment means net income growth could level off a bit in part because of the equity distribution being a non-recurring event. Also, as Fed rate hikes slow in 2019, some of the interest income repricing will also slow. Despite the drop in the number of credit unions, membership is growing. Mid Atlanic membership numbers rose from 5.33 million to 5.48 million from 2017 to 2018 for a 2.7 percent increase. The NCUA reported that federally insured credit unions added 4.9 million members over the year, and credit union membership in these institutions reached 116.2 million in the fourth quarter of 2018. Full-time employment is growing at Pennsylvania credit unions year over year at a 3.9 percent rate (compared

with a 15 percent growth nationally). New Jersey and Delaware full-time employment numbers were relatively flat year to year. The NCUA reported a total of 15,055 full- and part-time employees in New York with all of the increase coming in full-time workers. Employee compensation costs rose 4.1 percent from 2017 to 2018. The Mid Atlantic’s shares and deposits were $55.19 billion: a 3.8 percent hike. Total shares and deposits nationally in 2018 were $1.2 trillion, up $60.2 billion from 2017’s $1.1 billion for a 5.2 percent increase. The loans-to-shares ratio for 2018 was 85.56 percent compared with the 10-year average of 75.59 percent nationally. The NCUA reports national assets and total investments also dropped. Cash and equivalents fell 6.1 percent to $92.6 billion. Credit unions total investments declined from $261.8 billion in 2017 to $253.2 billion in 2018, or 3.3 percent less. Nationally, according to the NCUA, total credit union loans reached $1.04 trillion:

up $86.29 billion, or 9 percent, from 2017. First mortgage real estate loans continued to dominate the category at 40.85 percent, followed by used vehicle loans at 20.9 percent and new vehicle loans at 14.1 percent. Those percentages are largely consistent with 2017. Interest expense totaled $9.8 billion annualized in the fourth quarter of 2018, up $2.2 billion, or 29.4 percent, from one year earlier. Non-interest expenses grew $3.3 billion, or 8 percent, over the year to $44.5 billion in the fourth quarter. Rising labor expenses, which were up $1.6 billion, or 7.5 percent, accounted for roughly half of the increase in non-interest expenses. Nationwide, credit unions also had their best year since 2014 for yields vs. cost of funds. NCUA data shows the yield on average loans was 4.7 percent compared with 4.56 percent in 2017. The cost of funds did increase from 0.57 percent up to 0.69 percent in 2018 while the yield on average investments grew from 1.66 percent to 2.04 percent.

Is your organization effectively managing third-party risk? The three most common challenges facing organizations today when it comes to managing third-party risk are... Tracking vendor documentation on a timely basis Inefficient processes because vendor documentation is not centralized Preparing for third-party risk assessment audits

The RemoteComply Risk Management Suite addresses all these challenges since it stores vendor data & sensitive documents in a centralized repository. RemoteComply also includes an audit-ready risk assessment questionnaire for critical and non critical vendors. To learn more about RemoteComply, visit our website at www.banksoftware.com or call us at (888) 408-4335.

28

BANKING MID ATLANTIC

THE CONSUMER EXPERIENCE

APRIL 19, 2018

A

Best

THE IN NEW JERSEY BANKING t American Business Media, we cover the banking industry. But we also celebrate it.

Amanda Beard, seven-time Olympic medalist, model, author, and entrepreneur will be the keynote speaker.

B A N K I N G C H O I CThe E A WA RDS.C O M Awards are based upon the results Together with Customer Experience Banking Choice Solutions, we have found a way to do both. of the Banking Benchmarks, the largest and most Twenty-four banks from across New Jersey comprehensive measure of banking customer experience are finalists for the prestigious Banking Choice Awards. in the world. The Benchmarks are independent of any financial institution and conducted by Customer The Banking Choice Awards recognize the banks that Experience Solutions LLC, the recognized leader in receive the highest ratings from their customers in four measuring and tracking customer experience for banking categories: Customer Service, Technology, Community institutions. Contribution, and Overall Quality. The Banking Choice Awards honor the top three institutions in those four In New Jersey, more than 250,000 reviews were categories from each region of New Jersey. An overall conducted in a double-blind survey. Customer Experience statewide winner will be named in each group. These Solutions did not know which banks consumers statewide awards are the highest honor any bank in New use before conducting the interview and recruited Jersey can achieve. respondents were not told the subject of the survey was about banking. This double-blind method minimizes bias The honors will be awarded April 15 at American and provides the most objective results. Business Media’s BankHorizons conference as part of a gala evening sponsored by Wolf & Company at the In advance of awards ceremony, we salute the finalists Resorts Casino and Hotel, in Atlantic City, New Jersey. listed below and congratulate them on their great work.

Gateway, which includes Bergen, Hudson, and Passaic counties: Atlantic Stewardship BCB Community Chase Columbia ConnectOne Spencer TD Bank

Northern New Jersey, which covers Essex, Morris, Sussex, Union, and Warren counties: Capital One Chase ConnectOne First Hope Regal SB One (Sussex) TD Bank

Central New Jersey, which covers Hunterdon, Mercer, Middlesex, Monmouth, Ocean, and Somerset counties: Capital One Chase Fulton Manasquan Peapack-Gladstone Princeton TD Bank Two River

Southern New Jersey, which encompasses Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, and Salem counties: Century Savings Bank Citizens Crest Franklin Federal Fulton PNC Republic Sturdy TD Bank BANKING MID ATLANTIC

29

A N YTH I N G B UT B A N K I NG

| By John Hassan

Carlo Oropesa

Executive Vice President Freedom Bank Maywood, New Jersey

Carlo Oropesa started his own mortgage company when he was 19 years old. He joined Freedom Bank in 2011. Banking Mid Atlantic spoke with him about his life outside work.

“Don’t leave for tomorrow what you can do today.” FAVORITE SPORT: Skiing. I go up to Killington, Vermont as often as I can. I go to Windham Mountain Resort in New York state as well. My skis are Rossignols.

BINGED TV SHOWS: Oh, yes. The Sopranos. The Umbrella Academy on Netflix. And I spent a weekend watching Breaking Bad.

FAVORITE SPORTS TEAM: New York Giants.