MortgageBanker MAGAZINE

‘JUNK FEE’ CRACKDOWN

CFPB ignites a cleaning spree

THE GSE ALERT

Understand Freddie Mac & Fannie Mae’s aggressive moves

CLOSE FOR LESS

Strategies to reduce loan process expenses

THE BLOCKCHAIN REVOLUTION

Experts point out what’s right, what’s wrong

SETTING SAIL

Off-Shoring Dilemma Balancing the Rewards with Perils

DATABANK MARKETS OCTOBER 2023 | $ 20

INNOVATION

A PUBLICATION OF AMERICAN BUSINESS MEDIA

Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward.

©2022 First Horizon Bank. Member FDIC. Let’s find a way. firsthorizon.com/capital Commercial & Specialty Lending Commercial Real Estate Treasury

Know-how that wastes you forward. no time moving

Management

REGULATORY CORNER

FHFA ANNOUNCES NEXT PHASE OF PUBLIC ENGAGEMENT PROCESS FOR UPDATED CREDIT SCORE REQUIREMENTS

The Federal Housing Finance Agency (FHFA) announced additional opportunities for ongoing public engagement to facilitate the transition to updated credit score models and credit report requirements for loans acquired by Fannie Mae and Freddie Mac (the government-sponsored enterprises). This engagement, which will include stakeholder forums and listening sessions, will allow for the identification of a wide variety of issues, opportunities, and challenges related to the successful implementation of the new requirements, including potential refinements to the timeline for adoption.

“This engagement process represents the next logical step in our efforts to ensure robust public input as we work towards implementing the new credit score requirements at the Enterprises,” said FHFA Director Sandra L. Thompson. “We want to hear from market participants and impacted stakeholders to ensure a smooth transition that minimizes costs and complexity.”

In October 2022, FHFA announced the validation and approval of both the FICO 10T and VantageScore 4.0 credit score models for use by the GSEs. The announcement followed a lengthy process of reviewing potential updates to the enterprises’ credit score requirements, as required by statute and regulation. During this time, the GSEs undertook rigorous testing of the models for which an application was received. Both of the newly approved models exceed the required thresholds for accuracy, reliability, and integrity. Following an extensive implementation process, the enterprises will require scores from both models, when available, on all single-family loans they acquire.

In October 2022, FHFA also announced that the GSEs would transition from a tri-merge requirement, in which credit reports are required from all three nationwide consumer reporting agencies, to a bi-merge requirement, in which credit reports are required from at least two of these agencies. FHFA expects this update will promote competition in the market while maintaining the information needed to support robust risk management. FHFA further expects that the implementation date for this bi-merge requirement will occur later than the first quarter of 2024, as was initially proposed.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

NEWS DIRECTOR

Keith Griffin

SENIOR EDITOR

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley

STAFF WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Christopher Wallace, Stacy Murray

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Mary Quinn

MULTIMEDIA PRODUCER

Matthew Mullins

MULTIMEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Regina Morgan ADVERTISING SALES EXECUTIVE

Nicole Coughlin

ADVERTISING ASSOCIATE

Lydia Griffin

MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com

Submit your news to editors@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991

info@ambizmedia.com

Before Selling To Fannie And Freddie: Be Alert

GAIN THE EXPERTISE AND EXPERIENCE TO ANALYZE BASIC DECISIONS

BY ROB CHRISMAN , CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

As we’ve moved through 2023, lenders everywhere are reporting increased buyback requests from Fannie and Freddie, who have become more aggressive. The general feeling is that lenders, who have been consistently losing money or breaking even this year, believe the government-sponsored enterprises (GSEs) are not being consistent with commitments made in recent years about materiality and options for remediation and have changed their quality control and sampling methodology. Lenders, which obviously include independent mortgage banks, are using staff time and resources, thus adding costs to a lender’s bottom line.

But for the last several years, Fannie & Freddie’s end-run around the large aggregators and marketing directly to the small and mid-sized lenders is well known in the industry.

Smaller lenders may not have the expertise or experience (yet) to analyze some basic decisions between selling loans directly to the GSEs (through the cash window) or securitizing loans themselves. It is helpful to have a primer on what that means and know what might be going on behind the scenes influencing decisions.

A PRIMER

ROB CHRISMAN

Freddie and Fannie’s more aggressive posture may be because they are concerned about the potential failures of some of their lender customers during these difficult times, and therefore, they would lose their counterparty to warranty defects on loans should they go to default.

In selling directly to the GSEs, lenders have the option to sell for “cash” or to “swap.” If you work in secondary marketing, you no doubt have been asked, at some point, whether it is more profitable to trade agency products for securities or for cash. Approved lenders have the business luxury of either swapping closed loans they originate for mortgagebacked securities or selling these loans directly to FNMA/FHLMC in exchange for cash (known as “cash window” sales).

There are some common misconceptions about cash window transactions and the collateral and prepay differences, if any, between pools securitized through the cash window and the MBS swap programs. It’s important to understand who uses the cash window option, why, and whether or not there are differences in pool characteristics.

When originators sell loans via the cash window, the GSEs aggregate the loans from a large pool of lenders and securitize them as an MBS; the cash window option allows both Fannie and Freddie to make shortterm use of their balance sheet without interfering with their current mandate of continued reduction in their retained mortgage investment portfolio.

Secondary marketing departments choose to sell in this fashion for speed and efficiency. The agency cash window typically alleviates warehouse line concerns, a problem that plagues many small originators, by way of faster fundings. Borrower retention is maintained as well.

MODEL CONTRIBUTORS

In the fast and furious days of 2020 and 2021, getting loans out the door and paying off a warehouse line was of paramount

4 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

MARKETS

importance. Quality and QC checks may have taken a backseat to volume and keeping up with locks. Typically, smaller lenders selling their loans to larger lender aggregators sell servicing rights as well. The cash window allows smaller lenders to retain their customer base while allowing them to continue to originate new loans. Historically, smaller lenders had two options: sell their loans to FNMA/ FHLMC or sell to a large aggregator. As large aggregators have been closing the correspondent channel, small originators have become central contributors in the cash window securitization model.

Unfortunately, selling loans directly to Freddie or Fannie is a “two-edged sword.” The original price is probably better than selling to an aggregator (middleman), and the speed at which the purchase happens is often faster. In addition, a lender can retain the servicing. But lenders may want the cash from the servicing value (mortgage servicing rights), and dealing

directly with Freddie and Fannie eliminates a buffer in terms of buybacks. They go back to the entity that sold them the loan, in this case, an aggregator, who may have more success in rebutting the repurchase request.

I expect smaller lenders to continue to sell to FNMA/FHLMC cash-window desks given that larger lenders like Wells Fargo have scaled back on their role as aggregators. Consequently, it is likely that the percentage of pools securitized through the cash window will continue to increase if not stay at current elevated levels. Given the comparable collateral characteristics and increased oversight by the GSEs on participating lenders, we can add caveat venditor (seller beware) to caveat emptor (buyer beware).

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 5

It’s important to understand who uses the cash window option, why, and whether or not there are differences in pool characteristics.

How To Do A Brand Audit

EVALUATE YOUR BRAND’S POSITION, STRENGTHS, AND WEAKNESSES IN THE MARKETPLACE

BY SCORE SPECIAL TO MORTGAGE BANKER MAGAZINE

Your brand is your business’s biggest asset — one whose health must be cultivated and monitored.

A brand audit is a checkup that evaluates your brand’s position in the marketplace, its strengths and weaknesses, and how to strengthen it. A brand audit should cover three areas:

1. Internal branding — your brand values, mission, and company culture

2. External branding — your business logo, print and online advertising and marketing materials, public relations, website, social media presence, email marketing, and content marketing

3. Customer experience — your sales process, customer support, and customer service policies

INTERNAL BRANDING

Your brand values, mission, and company culture

EXTERNAL BRANDING

Your business logo, print and online advertising and marketing materials, public relations, website, social media, email and content marketing

CUSTOMER EXPERIENCE

Your sales process, customer support, and customer service policies

MARKETING

“Clarify what you think your brand is before evaluating what others think.”

6 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

You can hire an outside marketing company to conduct abrand audit for you, but you can also do much of it yourself. Follow these 10 steps for a successful brand audit.

STEP 1.

Know what you’re measuring. Refer to your marketing plan, and identify your business’s mission, vision, unique selling proposition, and positioning. Who are your target customers, and what does your brand promise them? Clarify what you think your brand is before evaluating what others think.

STEP 2.

Assess your external marketing materials. Review your business logo, brochures, sales sheets, product packaging, letterhead, business cards, and print advertisements. Compare them to your online presence, including your business website, email marketing messages and newsletters, social media profiles, and content marketing pieces. Are all of these elements consistent in terms of design, color, and tone of voice? How effectively does each piece target your intended market?

STEP 3.

Review your business website. Using website analytics, assess:

• Where is web traffic coming from? If all your traffic comes from one or two sources, you’re vulnerable to any changes to those sources; try to diversify.

• Is your website attracting your target market? More traffic is only valuable if it’s the right kind of customer.

• What is your bounce rate? If most visitors leave your site leave right away, it’s not as effective as it should be.

• What is your conversion rate? Is it rising or falling?

STEP 4.

Review your social media data. Use your social media analytics to examine how well your social media marketing is working. What types of customers engage with your brand on social media? Are they customers you want? What are they saying about your brand?

STEP 5.

Survey your customers.

Use a combination of customer focus groups, email surveys, social media polls, phone surveys, and online surveys to get customer feedback on questions such as:

• What words would you use to describe this brand?

• What problem does this brand solve?

• How does this brand make you feel?

• Would you recommend this brand to your friends and family?

• What does the brand’s logo make you think of?

• How good is this brand’s customer service?

• How could this brand improve customer service?

STEP 6.

Survey people in your target demographic who aren’t customers. This will measure your brand awareness. Using the survey methods above, ask questions such as:

• Have you ever heard of this brand?

• Have you ever used this brand?

• What do you know about this brand?

• How would you describe this brand to others?

• What problem does this brand solve for you?

• How does this brand make you feel?

STEP 7.

Survey your employees.

Your employees create the customer experience that is essential to your brand. If they don’t understand your brand, they can’t convey it properly. Use anonymous surveys to ask questions such as:

• How would you describe our brand?

• What is the brand’s vision?

• What problem does our brand solve for customers?

• How do you deliver on our brand’s promise? What keeps you from delivering on that promise?

• What one thing would you do to improve our brand?

STEP 8.

Evaluate your competitors’ brands.

Assess your biggest competitors’ marketing and advertising materials, websites, social media presence, and customer service. You can also ask customers, members of your target market, and even your employees the same questions about your competitors’ brands as you asked about yours.

STEP 9. Review your results.

Using the information you’ve gathered, document what aspects of your brand work, which need some finetuning, and which are missing the mark entirely. Then create an action plan for updating your brand to bring it in line with your business’s mission and vision.

STEP 10.

Monitor your progress.

As you complete each element of your brand update, review the results to ensure the changes are having the desired effect. Brands naturally become a bit stale over time. Repeating your brand audit every few years will keep your brand fresh.

This article was provided by SCORE, the Service Corps of Retired Executives. More information is available at SCORE.org.

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 7

Don’t Get Blown Away By Climate Change

ASSESSING NATURAL DISASTER RISK DATA WILL BEST POSITION MORTGAGE SERVICERS

BY DONA DEZUBE SPECIAL TO MORTGAGE BANKER MAGAZINE

Lenders who focus on assessing natural disaster risk data and helping homeowners and homebuilders improve property resiliency will be in the best position to respond to climate change, according to a panel at the Mortgage Bankers Association Compliance and Risk Management conference in Washington, D.C.

What do we currently know about the influence of climate on residential housing? Rising temperatures drive different natural perils in different geographies, said panelist Kingsley Greenland, director, mortgage risk analytics practice at Verisk Extreme Event Solutions.

In Florida and the Gulf, rising water temperatures are a key ingredient in hurricane severity, though not frequency. In coastal areas, a rise in sea level has been observed and is expected to continue. On the West Coast,

increased evaporation has made the climate drier, a condition under which wildfires thrive.

Recent record natural catastrophe losses are as much due to population and property valuation growth as they are to peril severity, Greenland added.

HEADING INTO THE STORM

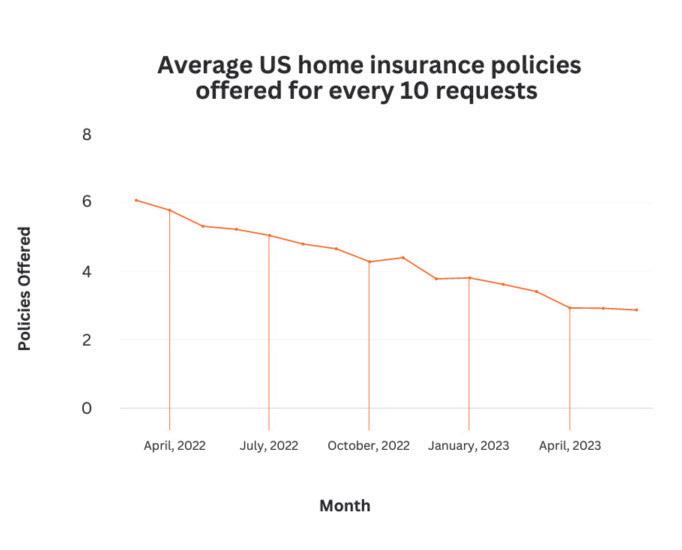

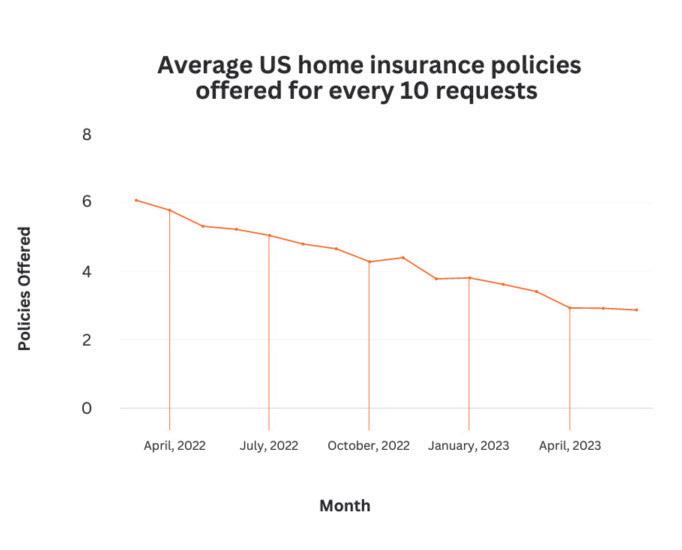

Interestingly, the U.S. is experiencing counterintuitive migration patterns with people continuing to move toward areas at higher risk of natural disasters, said Federal Housing Finance Agency (FHFA) Senior Policy Analyst Joe Weisbord. Homebuilders responding to that demand are increasing the number of homes in higher-risk areas. Meanwhile, regulatory-driven consumer protections have led to reduced insurance availability. If insurers can’t price the risk in an actuarily fair way, they’ll exit,

Greenland explained.

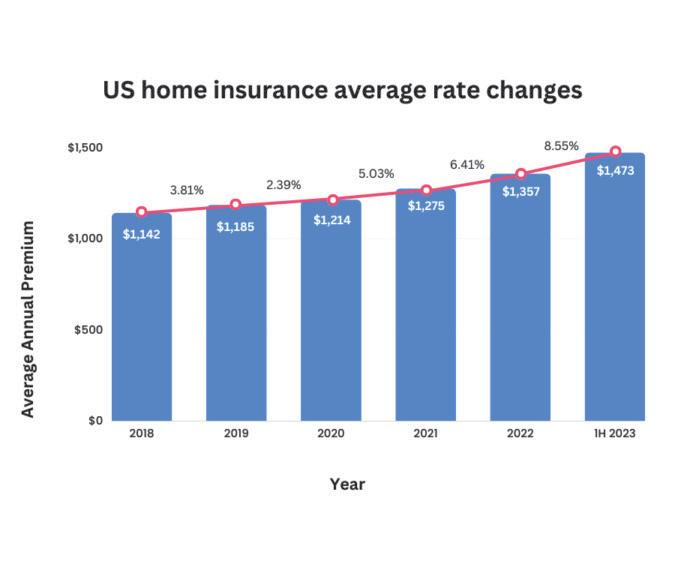

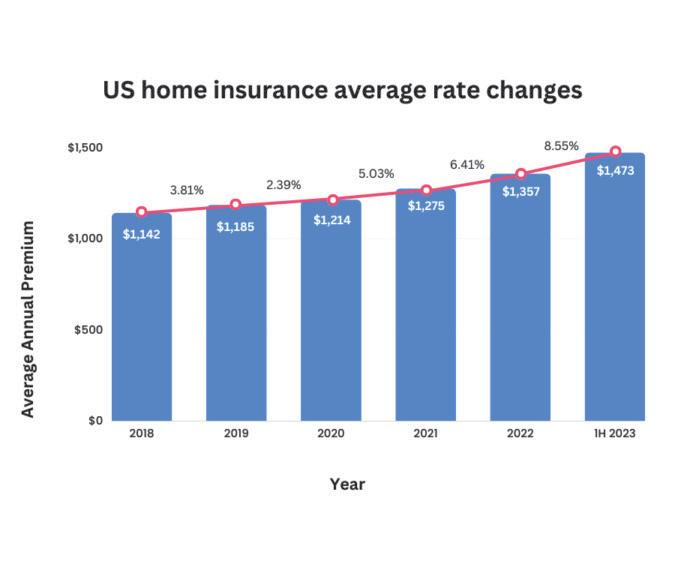

Taken together, these factors have all led to rising natural disaster costs, which in turn have caused insurance companies to raise premiums, pull out of markets, or implement coverage exclusions.

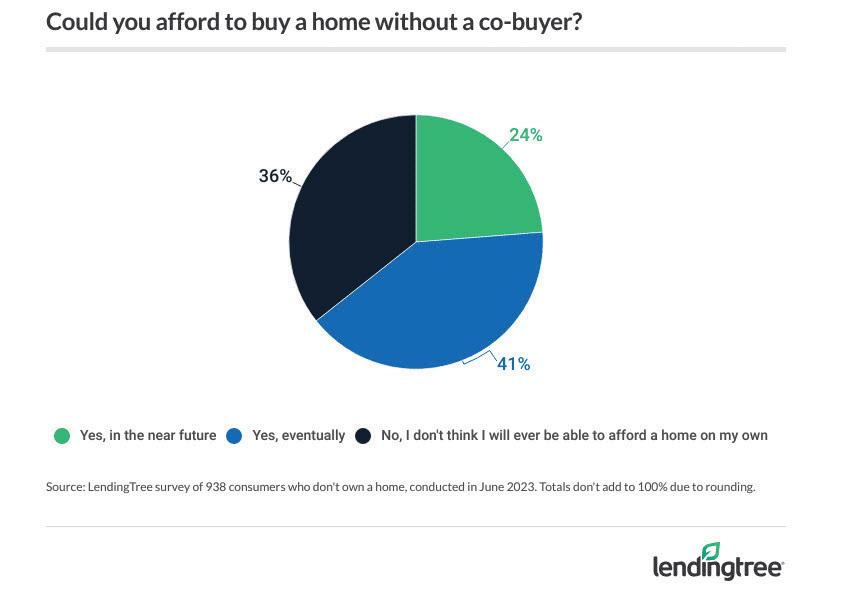

Increases in climate risks put lenders and servicers at risk in several ways. Originators can no longer assume borrowers will have modest homeowner’s insurance payments, while servicers may find borrowers unable to afford rising premiums. Natural disasters can lead to increased modification requests. A lack of insurance availability has overburdened state insurance funds of last resort, the panelists observed.

At the same time risks are increasing, lenders and servicers may soon be required to disclose more about catastrophe risks of the assets they hold.

8 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

ANALYSIS & DATA

“The United States has imported the European regulatory structure, [Task Force on Climate-related Financial Disclosures] TCFD, which more or less requires financial institutions to measure and disclose their climate risk, which in residential real estate is natural catastrophe risk,” Greenland said. “Expect to have to measure this through a catastrophe model and disclose it to auditors or the public market, if you’re a publicly traded entity.”

An FHFA working paper released last month examined research on the interplay between climate change and residential real estate highlighting key research findings, Weisbord explained.

There’s a lot of uncertainty right now. Information asymmetries, differences in state insurance regulations, and federal disaster assistance all influence how consumers perceive risk and the value of

insurance, as well as how the market prices insurance, he explained.

“For example, research suggests many people may overvalue the amenities of being in a coastal area versus the risk of a hurricane or

flooding,” Weisbord said. “Climate risks are an agencywide concern and a top priority for [FHFA] Director [Sandra] Thompson.”

MONITORING MODS

Panelist Christopher Joles, senior vice president of enterprise and credit risk at Planet Home Lending, said his company closely monitors modification rates following natural disasters both in its own servicing portfolio, as well as for the loans it sub-services and assets it manages. While there’s often a postdisaster spike caused by homeowners waiting for insurance reimbursement or having difficulty finding a contractor to complete repairs, the increase should resolve. If it doesn’t, that’s a risk red flag.

Joles also predicted that we’re on the leading edge of having homeowners in high-risk areas facing large premium increases as they go through the

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 9

“The U.S. is experiencing counterintuitive migration patterns with people continuing to move toward areas at higher risk of natural disasters.”

> Joe Weisbord Senior Policy Analyst, FHFA

annual insurance renewal process. “Premium sticker shock is going to come out of that,” he predicted.

As insurance companies pull out due to increased risk, an unexpectedly high number of people are being pushed to state insurers of last resort, including Citizens Property in Florida and the California FAIR Plan.

“Those companies are having to absorb unexpectedly high inflow of policyholders,” said moderator Andrew Hellard, vice president of product management, Matic Insurance. “Because those are taxpayer-backed companies, now you’re turning what was a market problem into a political problem. So, we’re going to see a lot of action in state houses in the next few months,” he predicted.

SERVICERS ON THE FRONTLINE

At a time when relatively high interest rates and low housing inventory put affordability under tremendous pressure, adding rising insurance costs makes homeownership harder to achieve for first-time homebuy-

ers, especially low- and moderateincome buyers, Hellard said.

The same risks are driving homeowner’s insurance policy exclusions. That’s an issue the industry will need to watch carefully to ensure the policies selected by homeowners continue to meet agency and government lending guidelines, he added.

“Servicers are on the front line of this issue,” Hellard said. “They’re responsible for monitoring that coverages are in place and working with homeowners who are unable to find coverage. We’re starting to see exclusions in homeowner policies. Those can be in direct odds with Fannie and Freddie requirements. It’s very easy to get out of compliance.”

Insurance company downgrades due to losses, while not related directly to climate, also have the potential to be disruptive.

In the final analysis, climate risk is likely to continue changing the real estate insurance environment drastically and swiftly. Lenders can best manage risk by staying abreast of key impacts such as the rising cost of coverage, changing risk profiles, increased frequency and intensity of natural disasters, availability of coverage, and adaptation of mitigation efforts to reduce exposure to climate risk.

10 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

Dona DeZube is vice president, communications for Planet Home Lending.

“Servicers are on the front line of this issue. They’re responsible for monitoring that coverages are in place and working with homeowners who are unable to find coverage.”

> Andrew Hellard Vice President of Product Management, Matic Insurance

Andrew Hellard, vice president of product management, Matic Insurance (left) and Chris Joles, senior vice president of enterprise and credit risk at Planet Home Lending discussed how climate risk is changing the real estate insurance environment at the Mortgage Bankers Association Compliance and Risk Management conference in Washington, D.C.

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 11 Join the Originator Connect Network for a fun and welcoming holiday party to celebrate the season, and celebrating the accomplishments of the mortgage origination community. Let’s all toast to good cheer, and to continued success! ORIGINATORCONNECTNETWORK.COM OCN Mortgage Holiday Party Dec. 15, 2023 | Irvine, CA Irvine Marriott Register FREE at: originatorconnectnetwork.com/ events/ocn-mortgage-holiday-party Use promo code NMPFREE style . Celebrate the season in *Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

Cracking The Crackdown

HOW TO ELIMINATE AND PREVENT ‘JUNK’ FEES TO AVOID PENALTIES

BY ERICA DRZEWIECKI , STAFF WRITER , MORTGAGE BANKER MAGAZINE

It’s high time to get clean. Earlier this year, industry watchdog the Consumer Financial Protection Bureau (CFPB) clamped down on unnecessary, incorrect and illegal fees charged to consumers by mortgage servicers and banks. If they haven’t already, those that wish to avoid a bite and then a festering wound must review servicing portfolios and tidy up operations. Non-compliance, after all, can lead to monetary penalties, disciplinary action and distrust by partners and borrowers.

A cautionary bark, indeed.

FOUR WAYS TO GO WRONG

fees being targeted by this CFPB initiative and ways in which mortgage professionals can ensure they are following the rules.

To summarize broadly, the CFPB is now flagging (one) late fees higher than permissible by loan agreements, (two) extraneous payments stemming from unnecessary property inspections, (three) Private Mortgage Insurance (PMI) overcharges and (four) failure to honor CARES Act forbearances.

“This provides us with yet another opportunity to continue to assist our customer base with compliance through thought leadership and a variety of technologies to monitor and automate related processes,” Federspiel says of the ‘junk fees’ crackdown, adding, “What the CFPB is really targeting here is compliance more than intent.”

So whether they snuck in an extra payment or simply miscalculated the charge is irrelevant.

HOW TO COME CLEAN

Lenders should make sure their Loan Origination System (LOS) is set to the correct rate-fee cap within a loan agreement to avoid issuing inaccurate late fees.

Black Knight

Senior Vice President of Servicing Technologies and

Product Innovation Dana Federspiel identifies the four main

As a top provider of high-performance software, data and analytics solutions for the mortgage industry, Black Knight continually monitors regulatory technology and industry updates for their potential impact. Staff also meet with regulatory bodies like the CFPB to gather insights and share feedback with clients.

Ongoing property inspections to delinquent borrowers are often handled by third-party servicers, who charge the borrower. In certain cases the CFPB has found that servicers repeatedly sent property inspectors to the wrong address, charging the

REGULATORY

12 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

Dana Federspiel Senior Vice President Black Knight

borrower in each instance.

Federspiel recommends companies perform a data quality check in their system for addresses that require regular inspection.

“In real estate there’s a saying - the number one rule is location, location, location,” she says. “For servicing portfolios and the management of these I would say the number one rule is data, data, data. The volume of data in this industry and access to it just grows exponentially each year. In order to review servicing portfolios, originators and servicers alike really need to have a trusted technology partner to provide best-inclass integrated solutions and more importantly, intelligent analytics. That allows them to spend their time focusing on the customer.”

Lenders typically require borrowers who put less than 20% down on a loan to purchase PMI, which can be dropped while the loan is still current and the principal balance reaches 78% of the property’s original value.

“This should happen automatically but in some cases it doesn’t,” Federspiel says.

To avoid PMI overcharges lenders should ensure their servicing system tracks loan activities and has the ability to determine when PMI should be terminated, then updating portfolios accordingly.

Finally, the federal CARES Act put into place during the covid-19 pandemic required servicers to waive specific fees and penalties for borrowers facing

a pandemic-related financial hardship. Those that received a waiver under the CARES Act are not required to pay back missed payments in a lump sum post-forbearance, no matter what they hear.

Federspiel encouraged servicers to set stops in their system to prevent fees from being charged in these instances and when evaluating for loss mitigation in arrearage.

FUEL TO THE FIRE

The CFPB received around 29,000 complaints related to mortgages last year, enough to provoke a crackdown.

One servicer identified in this year’s undertaking faced a $5.25 million penalty for misleading customers who requested forbearance about CARES Act repayment options.

Aside from an official retribution, servicers in violation can face retention and referral losses.

Staying apprised of developments like the CFPB initiative and looking out for the best interests of lenders are trade associations like the Florida Association of Mortgage Professionals (FAMP).

“We’re keeping a careful eye on making sure things are meeting compliance and regulations,” FAMP President Nathaniel Bittman says. “We’re educating a tremendous amount of licensed loan originators

and even some non-licensed LOs in the area of how to manage compliance, make sure they’re up to date with the right vendors, lenders, resources and tools so that they can advance forward in an ever changing technological association as well.”

Black Knight’s flagship product, MSP, manages loans after they’ve been turned over to servicers.

“We really do make sure we provide the flexibility and monitoring tools for our customers to stay compliant with the requirements coming down from the CFPB and other regulating bodies,” Federspiel says. “Some examples that can be put into play are monitoring solutions to identify anomalies or exceptions and potentially have automation for immediate correction of those exceptions that have been identified. Another recommendation would be to perform internal audit and data quality checks on a regular basis to ensure accuracy of the data you have inside the application itself, especially given that this industry tends to have movement of data.”

When servicing transfers between different providers, for example.

Performing regular internal audits can position companies within the confinements the CFPB has recommended with respect to fee management.

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 13

Nathaniel Bittman President FAMP

“Having accurate data is what’s going to keep you from having any potential compliance issues associated with the fee management side.”

> Dana Federspiel Senior Vice President, Black Knight

“Originators and servicers need to work together,” Federspiel says.

It’s important to ensure that the terms reviewed by the customer in the contract have been automated so a system goes on to calculate fees accordingly.

“Having accurate data is what’s going to keep you from having any potential compliance issues associated with the fee management side,” she adds.

ANOTHER COMPLICATION

It’s no secret that times have been tough for LOs and mortgage companies, and introducing another zone for potential pitfalls doesn’t make anyone gleeful.

Linda Davidson, senior loan officer with Fairway Independent Mortgage, understands the challenge industry professionals can have getting their systems in line, necessary as it may be.

“We’ve never been big on junk fees…

but I can see where mortgage companies would have been using those fees just to basically shore up the bottom line,” Davidson points out. “And if they’re not charging those fees coupled with everything else that’s costing more I can certainly see where it would affect the bottom line and even viability of that mortgage company to stay in business. We’re seeing Freddie and Fannie be very strict; they’re kicking back more loans than we’ve ever seen them kick back.”

Maybe a slow-moving portfolio lends itself well to a checkup. So when better times shine down (and they will) systems will be set for takeoff.

14 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

Linda Davidson Senior Loan Officer Fairway Independent Mortgage

“We’re seeing Freddie and Fannie be very strict; they’re kicking back more loans than we’ve ever seen them kick back.”

> Linda Davidson

Senior Loan Officer Fairway Independent Mortgage

HOME OF THE MOST POWERFUL WOMEN

THOMPSON KIM CALLAS TARA PETTERSEN

IN MORTGAGE

Financial proudly has more Powerful Women in Mortgage winners than any other company this year. Congrats to Tara, Kim, and Courtney!

60%

worked

to

WWW.CMGFI.COM

Risk & Compliance Officer EVP, Chief Operating Officer EVP, Head of Servicing CMG Mortgage, Inc. dba CMG Home Loans, NMLS# 1820, is an equal housing lender. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025. To verify our complete list of state licenses, please visit www.cmgfi.com/corporate/licensing and www.nmlsconsumeraccess.org. 3 WINNERS IN 2023

COURTNEY

CMG

All three women are members of executive leadership. We’ve worked hard to cultivate a culture that’s over

women. We’ve

harder

make sure these women reach the highest levels of success.

Chief

OCT 26

Hear From Industry Leaders As We Peek Under The Hood Of Non-QM.

UP NEXT:

The State of Non-QM

Non-QM has seen its share of ups and downs over the past several years. But one thing is certain. As one of the only growing niches in the mortgage business, keeping up to date on this space is more important than ever. Serving the underserved community, non-QM is an essential part of the mortgage ecosystem. And with the number of borrowers non-QM serves continuing to rise, now is the time to learn more about these products.

NMP is launching a monthly series called “Non-QM Townhall – A Monthly Report”. We will cover different topics each month with a panel of experts in non-QM. They will share their knowledge and experience so you too can become a non-QM expert.

COMING SOON:

November 16

The State of Non-QM (current state of the sector, where are the biggest opportunities)

Finding These Borrowers

December 14

Prospects for 2024 programs, state of nonQM, what’s coming, how to prepare

16 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

ROBERT SENKO ACC MORTGAGE

TOM DAVIS DEEPHAVEN

JOHN WISE NEWFI WHOLESALE

the webinar schedule and register to attend: nmplink.com/NQMTownhall

Check

Fewer Dollars To Close

IMBs WEIGH IN ON FINDING SAVINGS IN THE LOAN PROCESS

To enjoy the expense of turtle soup occasionally, one often has to work on a beans-and-rice budget. Especially when production and volume are down, costcutting can be necessary to perpetuate success in business and fulfill obligations - or personal tastes.

Mortgage professionals know this all too well.

Loan volume declined for nine consecutive quarters as of Q1 2023, right alongside four consecutive quarters of production losses, according to the Mortgage Bankers Association. Independent mortgage banks (IMBs) reported a pre-tax net loss of $534 on each loan they originated during Q2 2023, an improvement from Q1, when losses hit $1,972 per loan.

This information comes by way of the MBA’s newly released Quarterly Mortgage Bankers Performance Report. The findings also indicate that 58% of companies were profitable in Q2, up from 32% in Q1 and 25% in Q4 2022. However, Fannie Mae reported in August that single-family mortgage

origination volumes in the overall market were about 35% lower than the same time last year.

IMBs and mortgage subsidiaries of chartered banks are now finding ways to cut costs in places they never have before.

58% > Percentage of companies profitable in Q2 according to the MBA’s newly released Quarterly Mortgage Bankers Performance Report.

‘CRAZY EXPENSIVE’

Times were good. “When you’re making money and business is flowing, you don’t really look at it as clearly as you could,” says Linda Davidson, senior loan originator at Fairway Independent Mortgage. “When the market shifts,

that is when leadership should rise to make those decisions. What can we do better to manage expenses?”

The National Credit Reporting Association (NCRA) announced the pricing structure of credit reports would rise up to 400% this year. While borrowers are typically responsible for the cost of a credit pull, it’s up to the lender to absorb when applications are canceled or denied.

The cost to verify an applicant’s employment in order to issue a preapproval also has risen.

“Just those two things alone have been crazy expensive,” Davidson points out.

“Your verifications can be $100-$150 depending on how difficult that file is, and you may or may not ever close that loan.”

High interest rates, simultaneously low inventory, and “hairy” loans have become commonplace.

“Right now it seems like every single loan has hair on it,” Davidson says. “There’s not a lot of perfect 20%-down, 820-credit score borrowers. Those do not exist right now, and if they do

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 17

BOTTOM LINE

BY ERICA DRZEWIECKI , STAFF WRITER MORTGAGE BANKER MAGAZINE

they’re rare and far between. So you’re spending a lot of man hours on those (hairy) loans, and that’s another cost you have.”

Then with inflation, there have been increases in payroll, rent, and utilities for lenders running offices, retail branches, mortgage banks, and brokerages.

“Everything we do has gone up, but our revenue has gone down, so that’s why you’re seeing the mergings, the shutdowns,” Davidson says. “If companies have not set money aside and prepared for this type of season, they’re not going to be able to sustain until the market shifts.”

As a top-producing branch manager and LO for almost 28 years, a large part of her focus is mentoring other industry leaders through professional development workshops.

“I get the wonderful benefit

of being able to talk to a lot of people from lots of different companies. Everyone is struggling right now, whether it’s an IMB, a broker, or a depository,” Davidson says.

She counsels fellow executives to pull from their experience and, when necessary, reserves.

“There’s no manual someone picks up in leadership. You look at your reserves versus what is needed. What is the best next right thing? That’s what you do.”

ONE NEXT RIGHT THING

Snapdocs Vice President of Customer Success Todd Maki has identified significant savings in closings through fintech.

“We’ve conducted a deep dive with over 25 of our lender customers and have identified a hybrid closing can save customers on average over $110 per loan due to operational and secondary market efficiencies,” Maki explains. “That savings increases to over $290 per loan when the hybrid closing has the addition of an eNote.”

In mortgages, an eNote is essentially an electronic promissory note detailing repayment terms, which serves as a binding agreement between lender and borrower.

Other closing documents, such as a certificate of title, deed, and bill of sale, can also be signed remotely. The “hybrid” model involves a combination of digital and ink signatures.

Lenders store eNotes in eVaults, secure electronic systems in digital lending. There are a lot of eVault providers registered with the Mortgage Electronic Registration System (MERS) that tracks the owners and servicers of U.S. loans. Vendors also should be compliant with the Mortgage Industry Standards Maintenance Organization (MISMO) and

the government-sponsored enterprises (GSEs).

Between the real estate agent, borrowers, lender, third-party servicers, attorneys, and others, many parties are involved in a loan transaction from start to finish. And all of them must sign off.

“The closing process requires a lot of coordination across dozens of different parties,” says Maki, who manages the team that directly serves SnapDocs’ lender-customers. “We’re focused on multiparty defragmentation.”

Specialized software allows documents to be created, reviewed, signed by multiple parties and stored in a secure, remote network. This translates to an immediate savings of ink, fuel, time, hassles, and money.

“Tech is a line item in a lender’s business, but where we see the value of tech is driving efficiency in terms of how lenders do business,” Maki says. “Even with technology being more and more pervasive every year in the mortgage industry, there remains significant opportunity for efficiency and cost reduction because many of the technologies in the space serve a point purpose. It’s the fragmentation across the different entities and people involved that creates inefficiency.”

CONTROL OVER EXPENSES

But tech isn’t the only place to find savings. People also can find savings on their own.

“There are still going to be costs no matter what you do,” Davidson says. “Every smart mortgage lender has gone in and said, ‘OK, let’s identify what things we can do to help keep costs down.’ We have five things that we call expenses we can control. We’ve identified those, and we talk about them every single month. This is what we spent, this is what we spent last year … that way you’re seeing the savings.”

Small changes can add up over time -- pennies in a jar transforming into dividends.

Among Davidson’s suggestions for controlling expenses is an alternative to ordering Verifications Of Employment (VOE) during the pre-approval. Instead, she says, ask applicants for pay stubs representing each of the last

etc., but they are cheaper for a glance upfront before you go into the other expenses you need for underwriting,” Davidson says.

While the phrase “a reduction in force” is not one anybody wants to hear, this is a primary way companies cut costs during hard times.

When staff positions are eliminated, appropriate delegating of resources and staff can mean the difference between stamina and shutdown.

“A lot of companies are sharing processors between branches,” Davidson says. “Maybe one branch had to do a force reduction and a different branch has the capacity to handle another 15 files. They can pay a fee per loan versus hiring someone else.”

THE BIG PICTURE

Every industry has seasons and markets. Putting away savings in reserve funds during better times ensures an industry professional doesn’t crash and burn, at least right away.

few years to find out what they made, broken down over time. Then at least the official VOE is only an endgame before closing.

Additionally, some companies are employing soft versus hard credit pulls, a cheaper, though limited, option.

“You can’t run automation approvals,

“As we say in the South, we’re buckling down and honing on what we can, but being really wise on how we share resources with each other, looking at the big picture and what can be done,” Davidson says. “Even in biblical days, Joseph was a leader and he knew there was a famine coming, so he stocked away the grain so that they could have it during lean times. It’s the same concept. Whether it’s back 2000 years ago or today, good leadership has the foresight to say, ‘What can we do right now to hold us off when the market shifts?’”

While the fingers of mortgage lenders have been crossed for a more lucrative market in Q4, some might still depart 2023 empty-handed.

As Davidson predicts, “It will be next year before we see the righting of the ships again.”

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 19

“Tech is a line item in a lender’s business, but where we see the value of tech is driving efficiency in terms of how lenders do business.”

> Todd Maki Vice President of Customer Success, Snapdocs

20 MORTGAGE BANKER MAGAZINE | OCTOBER 2023 Get what it takes to JAN 12 UNCASVILLE, CT Mohegan Sun Resort & Casino nemortgageexpo.com Attend for free by using the code MBMFREE

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 21 Find a mortgage event near you. For mortgage brokers, originators, processors, underwriters, and anyone looking to grow within the industry. originatorconnectnetwork.com/events

2000 attendees in 2023, you won’t want to miss this opportunity to be a part of New England’s largest and most exciting mortgage event — the New England Mortage Expo. Join your peers for an exiting day of networking, product showcases, educational sessions, motivational speakers, and so much more!

The nation’s largest regional event is back. With over

A Quest For The ConfoundedDigitally

BLOCKCHAIN MIGHT HAVE A TRANSFORMATIVE POTENTIAL FOR THE FUTURE

BY ERICA DRZEWIECKI , STAFF WRITER MORTGAGE BANKER MAGAZINE

BY ERICA DRZEWIECKI , STAFF WRITER MORTGAGE BANKER MAGAZINE

TECHNOLOGY

Nearly 300 years after potters began using the wheel in 3500 B.C. it was fashioned into a perpetual motion device to carry chariots, eventually evolving into the mechanism of transportation that it is today.

It’s only been 15 years since a mysterious faction known as Satoshi Nakamoto introduced the cryptocurrency Bitcoin and the concept of blockchain to the world, allowing individuals to reclaim financial power from the elite by participating in a decentralized public banking system.

This ledger-type technology is linked via a peer-to-peer network of computers, preventing a digital coin from being spent more than once. Some say this stops fraud, others aren’t so sure.

The most popular use case of blockchain has been cryptocurrency. There are now more than 22,000 crypto projects in existence, according to a June 2023 report by Forbes. The top cryptocurrency based on market capitalization (the total value of coins mined) is still the original Bitcoin, at $570.2 million.

Even with this rapid growth, blockchain technology hasn’t yet had the profound impact on our financial system that analysts predicted it would. Mortgage Banker spoke with mortgage and banking system experts, who have mixed thoughts on the future of cryptocurrency as a tool of

TITLE INSURANCE

The question of whether or not blockchain will eliminate the need for title insurance began surfacing in housing and money media at least six years ago. Financial analysts had high expectations for blockchain to revolutionize the industry and this was an area of particular interest.

But all that hasn’t quite happened yet and the experts aren’t even so sure it will anymore.

“I’ve seen over the years how blockchain could disrupt the industry,” says Jeremy Yohe, vice president of communications for the American Land Title Association (ALTA). “Blockchain is, to simplify it, a different way to store data. But any way you store it, there’s still gonna be that threat that it could be hacked, it could be altered, it could be stolen, it could be changed, it could be fraud.”

Since its founding in Washington, D.C. in 1907, ALTA has been a resource for title and settlement companies. The organization now represents more than 6,000, and ALTA title insurance remains the industry standard for lenders and homeowners.

“At the end of the day, you still need a backstop to protect your property rights. And title insurance is the best option to protect these rights,” Yohe says. “Without it lenders would be taking on a lot more risk and they would have to price their products accordingly.”

A homeowner’s title insurance policy is optional, but also the only product that protects borrowers’ property rights for a one-time fee. In an ownership dispute, for example, the title company representing the policyholder covers all court costs, attorney fees, and a settlement, if applicable.

Borrowers can fall in love with a property and secure financing, but then it takes some

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 23

“Blockchain is, to simplify it, a different way to store data. But any way you store it, there’s still gonna be that threat that it could be hacked, it could be altered, it could be stolen, it could be changed, it could be fraud.”

> Jeremy Yohe, ALTA

Communication s, A L AT

detective work before the title or proof of ownership is effectively transferred to their hands.

“That’s when our people step in,” Yohe explains. “The title agent is searching the public records to see if there’s any red flags that need to be addressed before the transaction can proceed. There’s a lot of strange things across this country that give people access to properties.”

A century-old easement for a portion of the front yard, for example, or a utility line preventing the property owner from digging the summer oasis of their dreams.

Much of that information is still in paper form - in government buildings, library archives and elsewhere. What and where is it not? A block on a chain. That’s not to say this facet of the industry has not progressed with the times.

“Not everything can be done in a day, but the title industry has made significant strides to use technology to expedite the process,” Yohe says. “It’s modified products over the years to provide lenders the type of efficiency and coverage they may need on a mortgage, on a refinance, on a HELOC, on a home equity. And at the end of the day, it gives the lender peace of mind that they’re protected, that they have first lien priority.”

This past spring ALTA modified its industry best practices to include risk mitigation driven by modern contrivances like digital payments and blockchain. For example, it is now recommended that title companies use a wire verification service to ensure funds found their place in the correct account.

ALTA is also backing federal legislation to permit remote online notarization nationwide.

“We really think the government should provide a pathway to continue to allow the industry to use technology that maintains a standard of safety and security for con-

sumers and service providers,” Yohe says. “A lot of situations may make it difficult to have the flexibility to sign documents. Not to say that it’s going to replace the entire process, but it’s an option to give consumers if they want it.”

In 2023, there are 43 states that have adopted some degree of permanent Remote Online Notarization (RON) laws.

AMERICA ONLINE

Norman Roos, partner at Robinson+Cole Finance Group in Connecticut, has been working in the mortgage industry for the last 50 years. In that time he’s gained extensive experience in electronic contracts, digital signatures and online servicing. Around the turn of the last century, he convened a task force to consider the adoption of electronic recording in Connecticut. To this day, the Puritan-settled New England state still has not permitted remote notarization.

“There’s a difference between blockchain and digitization of services,” Roos points out. “When you look at the technological impact on the mortgage industry so far, largely blockchain hasn’t played a role. It was a brilliant idea and it has had a number of successful use cases. I don’t think blockchain is going to transform the mortgage industry anytime soon.”

He means residential lending specifically, the most heavily regulated sector.

“A home is probably the biggest purchase you’ll ever make. It’s a very large, very important transaction. And it’s highly regulated because the potential for abuse or for problems if things don’t go well is enormous.”

Just like when many people thought they understood collateralized debt obligations before the 2008 financial crisis, Roos recalls, only to find out they were duped by the complex asset-backed security (ABS).

“This tool, which was thought to be a very efficient tool, turned out to be terribly misused. I think with blockchain, while it’s not the same … I don’t know anybody who really understands it.”

Those who have delved into the intricacies of this still-unregulated arena may have also heard the term stablecoin. It is a digital currency that obligates its issuer

24 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

Cole Financ ia l G r uo p

anRoos, Partner at Robin

to convert each unit of token into $1 upon demand.

“Unlike bank deposits, stablecoins are not regulated, and the way they report the assets backing their liabilities is very different from that of a bank,” said economist Daniel Sanches in a report for the Philadelphia Federal Reserve.

REGULATORY HURDLES

The fact that there is no centralized hub for blockchain is perhaps its most valuable asset as well as the highest hurdle to wider use by mortgage industry professionals.

“When you go to a bank, you see this big building with pillars in front of it. And presumably the money would be there because it’s a trusted institution. There were regulators who made sure it acted in a safe and sound manner,” Roos says. “The idea with this distributed-ledger system is that there is no central authority to whom you can look if something goes wrong. I think for reasons of lack of transparency, lack of accountability … there’s going to be a reluctance to use blockchain widely or immediately in a lot of different applications. I may be proven wrong, but that’s my suspicion.”

Insurance and mortgage are highly regulated industries. The Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), known together as TRID, is a series of rules enforced by the Consumer Financial Protection Bureau (CFPB). Lots of time, money and resources were invested by financial companies to ensure compliance and good business practices with the passage of these and other laws.

“If a mortgage company decided they want to create their own blockchain and operate their origination or servicing system using blockchain, I think they would get a quick visit from their regulator, be it the Department of Banking or some other regulatory agency,” Roos points out.

Most people don’t know the inner workings of the car they drive, but trust its basic safety after obtaining insurance and registration, and have some idea of where to go if it needs repairing.

“Who’s gonna perform that role for blockchain? It takes care of itself, right?” says Roos. “I’m very interested to see if it

can be applied in a broader manner, but I’m not confident that will happen anytime soon.”

THE WAY IT’S ALWAYS BEEN

As a regulatory lawyer in financial services for most of his career, Roos has watched tech evolve and knows industry changes are inevitable.

“I just don’t know that blockchain, which is one technological tool essentially, is going to be driving that change,” he says. “I think technology can be very helpful to streamline the processes, cut costs, and provide better services. But I think we just have to be careful about it. There are some limitations of blockchain and it’s a little opaque to most people.”

As long as public records were kept, real estate transactions, property transfers and deeds have been recorded in local government offices, with times stamped and fees paid. Homeowners owe taxes to the county or municipality in which they reside, after all.

Thousands of these recording offices exist across the U.S. and each has its own processes and practices. However, even as technology progresses, the manner in which a homeowner registers their property has not changed.

“In this day and age, they still continue to do things the way they did it many years ago,” Roos says. “And everybody likes to do it their own way.”

Instituting a single recording office for say - the entire U.S - might eventually prove more efficient, but it would also be quite an undertaking.

With that said, energy efficiency is one of the world’s top priorities right now and the blockchain mining process demands high energy consumption. Bitcoin alone is estimated to consume 127 terawatt-hours (TWh) per year, which is more energy, electricity and heat than many countries.

While technological advancements continue to deliver new solutions to the mort-

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 25

P

Mortg a g e S o l u t i sno

ampbell, Founder of Equil

gage industry, will blockchain be a gamechanger?

“I don’t consider it up there with the invention of fire or the wheel,” Roos says.

Equilibrium Mortgage Solutions founder Paul Campbell has higher expectations.

25%

“Blockchain represents the ability to omit specific pieces of data and still have a grasp on the entire flow of a loan,” says Campbell, who is also executive vice president of lending at Kwik Mortgage. “It gives individuals the ability to work on separate pieces and then holistically allows the system to put it all together, which I think in the long run is going to create efficiencies and reduce fraud, identity theft and things of that nature. I see blockchain as it continues to mature, to be a tremendous tool to the financial services industry and that includes home mortgage.”

THE STUDIES

Only one-quarter of lenders surveyed in 2022 by Fannie Mae told the enterprise they were familiar

with blockchain technology and its possible applications in the mortgage business. Of the 20% of lenders that said they have looked into blockchain, 41% plan to adopt it within four years. Although familiarity with blockchain still seems low among industry professionals, about 40% of study respondents said they believe decentralized finance - what defines blockchain - has high to very high potential to disrupt incumbent financial institutions.

Whether or not blockchain will cause a small rift in the mortgage industry or a collision equivalent to the impact of a large asteroid appears to be up to lawmakers and regulators.

Congress is now working to expand its crypto industry oversight by defining the jurisdiction of the Commodity Futures Trading Commission and Securities and Exchange Commission.

The SEC has stated that most cryptocurrencies are securities and subject to investor protection rules, a claim disputed by most crypto companies.

26 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

Amount of lenders in survey familiar with blockchain technology.

Appraiser Independence Update: What You Need to Know

In August 2023 Fannie Mae and Freddie Mac released an update to their Appraiser Independence Requirements (AIR) and FAQs. These updates provided significant clarity to the requirements for selecting appraisal vendors during the loan origination process. The most important updates were:

1. Appraisal Management Companies (AMCs) were included in the definition of “Independent Party.”

This is an important distinction. It has been largely held that AMCs could provide the layer of separation between the sales and mortgage production functions from the appraisal functions. However, with this clarification and inclusion there must now be a clear separation between the parties involved and originators cannot directly engage the AMC of their choice. This is likely to cause some operational issues within many mortgage companies.

2. Lists of approved Independent Parties can only be created by non “Restricted Parties”

It has largely been held that it is okay to recommend a panel or list of appraisers or AMCs that can be rotated through and that those parties aren’t guaranteed a specific assignment. The updates however clarify that while lists can still be kept, the lists must originate from outside the mortgage sales and production staff or the “restricted parties.” This is a significant change and one that will require compliance departments to get a handle on what lists are out there and how they came into existence.

3. Compliance with AIR will be audited as part of each GSE’s operational review. AIR will be validated and looked at during upcoming audits. Lenders must have in place a process that can be validated and

tracked for complete AIR compliance. Additionally, lenders are responsible for ensuring that their third parties are also compliant with the AIR requirements.

These Changes Are Good for the Appraisal Industry

Appraisals have long been the bane of the loan process and for some realtors the greatest fear in a residential transaction. However, truly allowing the industry to move to the independence it needs will allow for the industry to transform to deliver a better, quality, and faster product.

Speed: Preferred lists create inconsistency in speed in the appraisal process. Lenders with preferred lists see on average a 4-8 business hour delay in getting their orders accepted by an appraiser due to the inefficiencies with being limited to which appraisers you can assign the order. By allowing appraisal desks and appraisal management companies more flexibility to find the right appraiser, we can bring more consistent turn times to everyone.

Quality: Preferred lists have a place when it comes to quality. However, the preferred lists should be transferred over to a “verified” list where the selection of an appraiser considers the skills of the appraiser and their ability to complete a given assignment.

In a recent analysis we performed on SSR data returned by the GSEs as a part of the appraisal review process, we identified preferred appraisers that were 4 times more likely to receive a warning for overvaluation and twice as likely to receive warning for appraisal quality. These preferred appraisers were also half as likely to

come in below purchase price as their counterparts. Removing preferred lists also allows appraisers to develop special niches within the appraisal world to differentiate themselves and build a better business. Not every home is a cookie cutter appraisal and by eliminating this aspect appraisers can find ways to work with lenders to become their experts in tough conditions and markets.

Accountability: The existing marketplace for appraisal doesn’t allow for much accountability with the vendors participating in the space. Given that much of the selection of the appraiser has largely been driving by the production teams, it has been easy to pass off blame to the limitations set forth by those teams. As the appraisal industry moves to improve these processes and force those selecting the appraiser to become better vendor managers, we will see much more accountability in the processes developed around quality, measurement, and continued assignments of appraisers.

Recommendations

Embrace the change that should accompany these updates. Understand that the best thing you can do moving forward in the appraisal space is hold your vendors accountability for delivering quality and speedy appraisals. Partner with the companies that are doing the best in these areas and understand that there is a lot more to appraisals than getting it returned ASAP.

Better yet, visit us at tryjaro.com and see how our platform can help you manage all these aspects of the process and more at any point in the appraisal journey.

SPONSORED EDITORIAL

Gareth Borcherds Managing Director at Ascent Software Group

Arc Home LLC

Mount Laurel, NJ

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions. When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com

(844) 851-3600

sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

NON-QM LENDER RESOURCE GUIDE

We’re invested in your growth.

Carrington Wholesale

Dallas, TX

The Carrington Advantage Series is a full suite of Non-QM Loan solutions that “Delivers More” for you and your borrowers. Ideal for borrowers, like the self-employed, that don’t fit Agency or Government Qualified Mortgage standards based on credit quality, property type, documentation type, income documentation, or other borrower situations.

• FICOs 550+

• Primary wage earners FICO

• DTIs up to 50%

• Bank Statements (personal or business) accepted

• We don’t require disputed tradelines to be removed

With the Carrington Investor Advantage (DCR)

• DCR down to .75

• First-time investors are ok

• Only 48 months seasoning for major credit events

• 1x30x12 mortgage history ok

(866) 453-2400

carringtonwholesale.com

LICENSED IN: 47 States (excluding NH, MA & ND.)

Directory Listings

Be available when your clients go looking. Directory listings ensure your company is accessible when your clients are looking for you. Your listing includes:

• 6 or 12 month options

• Your active listing highlighted in the monthly special feature

28 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

MORTGAGE

MAGAZINE

BANKER

RESOURCE GUIDE

WAREHOUSE LENDING RESOURCE GUIDE

APPRAISER & AMC RESOURCE GUIDE

PRIVATE LENDER RESOURCE GUIDE

FirstFunding, Inc. Dallas, TX

Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors.

*Ease of use (Support staff, technology an other tools to support mortgage bankers)

FirstFunding’s FlexClose Funding program allows our clients to fund outside the Fed wire restrictions. Same day and afterhours funding. Browser-based proprietary platform, customized reporting tools, and a dedicated customer service team.

Conventional Conforming, Jumbo, FHA, VA, USDA, Non-QM

(214) 8217800

firstfundingusa.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Clear Capital Reno, NV

Clear Capital is a national real estate valuation technology company with a simple purpose: build confidence in real estate decisions to strengthen communities and improve lives. Our commitment to excellence is embodied by nearly 800 team members and has remained steadfast since our first order in 2001.

clearcapital.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

Alpha Tech Lending West Hempstead, NY

DSCR Rental NO DOC Loans

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owner-occupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com

(888) 276-6565

info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Your listing comes with an enhanced online profile, which includes:

• Company name, logo, & description

• Contact phone, email, social accounts, & location

• All directories your company is listed in

• Latest 3 mentions in articles on our site

• Latest 3 webinars hosted by your company (if applicable)

Prices are subject to change. Pricing is not guaranteed until a contract is formed.

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 29

ambizmedia.com/resource-guides

Sailing New Seas

WEIGHING THE BENEFITS AND RISKS OF OFF-SHORING

BY ERICA DRZEWIECKI , STAFF WRITER , MORTGAGE BANKER MAGAZINE

When British sailors set sail to dominate the world, they carefully planned and prepared. However, they

discovered that challenges could unfurl –- a sudden dark, cold mist could befall their ship or pirates could attack at a moment’s notice.

Bravely departing their homeland for new soil, mortgage companies are following suit, educating themselves on foreign doctrine and tying up loose ends before planting roots overseas. Like the sailors, they face unknown challenges, too.

WHERE AND WHAT

Statistics indicate that most of the top 25 lenders and top 50 servicers are currently handling some if not all business overseas. In many cases this is

limited to specific servicing functions.

“Our world is becoming more interconnected, and I only see that continuing,” says James Brody, senior partner at Garris Horn LLP in Irvine, Calif., regulatory compliance counsel for depositories, independent mortgage banks (IMBs) and credit unions.

“When we get involved generally with outsourcing-related issues on the legal end, it’s trying to help our clientele build up safeguards, whether through contractual issues or contractual agreements, navigating what the risks are in the legal environment of the outsourced country, how easy is it or how difficult would it be to address these problems,” Brody says.

Much of the mortgage industry’s servicing now takes place in countries like India, Malaysia and the Philippines. That includes the functions of lending that don’t directly involve communication with the borrower, such as pre-underwriting, onboarding, processing and certain parts of closing.

COVER STORY

30 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

“We represent the company, but we don’t want to represent the company to the borrower,” says Executive Vice President of lending at Kwik Mortgage Corp. Paul Campbell, founder of Equilibrium Mortgage Solutions and a lender board member of The Mortgage Collaborative (TMC).

“You’ll never see any one of our employees – and no other company for that matter from a fulfillment platform -- communicating directly with the borrower. And I think that’s very important because the borrower needs to know that they’re in a solid position. So communicating with their key point of contact, which is potentially head of processing in the organization in the United States or their loan officer is always preferred.”

Campbell co-founded outsourcing firm Equilibrium Solutions in 2018 to support IMBs alongside Nishith Parikh, the owner of Kwik Mortgage. Offices are in Mumbai, Pune and Ahmedabad, India. Team members have direct access to a customer’s loan origination system (LOS) to support loan flow as prescribed.

Lessons learned during the pandemic have made operations more efficient today.

“We really had to hone in our skillset because employees had to be remote just as they are in the United States to help curtail the spread of COVID,” Campbell explains. “We installed critical accountability technology that allows us to manage our employee base remotely, and lets us know their productivity during the day. But what became apparent was productivity jumped. What we saw is because the fulfillment is performed basically during the nighttime in the U.S., that ability gave our customers the ability to have pretty much instantaneous results.”

Loans could be set up within 24 hours. With that speed to market, what was initially a challenge proved to be a reward.

Campbell and Parikh chose to open Equilibrium Mortgage in India for several reasons.

“The familiarity with our products and process and our management style,” Campbell says. “It’s fully understood. And there’s a lot of folks that are from India that live in the United States as well. So, communicating is really not a challenge. The Indian population is very well educated, has a strong command of English and understands process and flow really well. So you can take a process out in India and replicate it at a pretty high rate with a pretty sound, quality return.”

Other companies have gone to places such as the Philippines, where they’ve found communication to also be strong.

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 31

“You’ll find more of those upfront type functions especially ramping up in the Philippines,” Campbell says. “There’s groups in Malaysia as well that do a really good job of understanding the processes with regard to processing pre-underwriting and closing.”

This includes smaller companies that don’t have the funds or resources to insource functions, according to Brody, who represents many of them.

“A lot of what we do is really on the risk management and prevention side of trying to help them insulate their companies against any liabilities,” he says. “There’s no perfect solution. There’s no one agreement that will address these issues in full. And I think that the regulators are having a difficult time with that as well. Trying to come up with a landscape that will adequately protect people, yet allow businesses to have some ability, because if there’s too much risk, there’s too much liability associated with it, then it makes outsourcing less attractive. And then that results in maybe higher costs and fees to consumers one way or another.”

WHY NOT?

Not every company has jumped onboard to set their windy sails.

One example is Universal Component Lender Services, a vendor based in Connecticut.

“When I’m talking to people about outsourcing services to us, it comes up all the time. Is this offshore servicing? Do you do business out of the country?” says Joseph Amoroso, vice president of business strategy and development. “Just by virtue of the amount of times I’m asked that question, it clearly is something that’s important to people, but we do not outsource anything overseas. I think that there’s a certain element of reputational risk that a lender may have by saying, yes, we outsource overseas. Some Americans take it very seriously and I think that a lot of borrowers take it very seriously.”

Amoroso acknowledges, however, that there is a place for offshoring mortgage

services. Oftentimes it’s the most surefire way to cut costs. And that’s important when there are countless other companies providing the same service.

“In the mortgage world, it’s crazy competitive right now,” he says. “Everybody is looking to be a little bit better than the next guy or to offer something a little better than the next guy.”

His customers value the fact that all functions are performed on American soil. Those that do choose to venture offshore should know that there are risks.

Access to information, audits, different regulations and language barriers are just a few.

“You also have kind of a systemic risk that if too many people put too many of their important functions in outsourced companies and they have a problem,” Brody, the regulatory compliance attorney, points out. “It could be something unique to that country, the political regime, it could just be the fact that they have a bad business or something goes wrong. How do you

32 MORTGAGE BANKER MAGAZINE | OCTOBER 2023

James Brody Senior Partner Garris Horn LLP

Paul Campbell Founder Equilibrium Mortgage Solutions

Joseph Amoroso Vice President of Business Strategy and Development, Universal Component Lender Services

deal with that when the laws, the political environment and the economic conditions of a different country are much less within your control? Concerns with data privacy and cyber security are associated with outsourcing issues.”

In an industry like mortgage banking, where many regulations govern business, it can be challenging to transfer operations overseas.

“Try to balance that,” Brody says. “The cost savings and the efficiencies against what your risks are, because one big problem could be a challenge that some companies may find insurmountable.”

One of the common issues his firm handles are data breaches. “If there’s a malware attack, normally the first thing you want to do is segregate off the databases and do an audit to figure out how that breach happened, what information was released and who it could have gone to.”

Countries have differing regulations pertaining to who needs to be notified in

these cases.

“At the end of the day, I think it’s going to be more about how better to manage those risks internationally from the political side, making it easier to work with other countries and have set standards to allow, for instance, the regulators who have concerns about access to third-party vendors, to oversee them, to run those audits,” Brody says.

IT COMES DOWN TO THE SAME ISSUES

Areputation for poor service can be devastating no matter the locale.

“It’s a time when loan officers and companies are searching for ever-creative ways to bring in the dollars and more competition,” Brody says. “Hopefully that would be a race to the top with quality of service, better handling of consumers’ concerns. But when you also

have this type of competitive environment and problems, you also have a lot of people come out of the woodwork who don’t care about you.”

When he’s speaking to lenders at conferences about risk management, the reception is cautiously appreciative. “When you have a room of people who have competitors sitting next to them, they don’t always want to share their stories or ask the questions that would belie the problems that they’re facing. But in this industry, everyone’s facing the same challenges in one form or another.”

Groups like The Mortgage Collaborative provide places for mortgage pros to network, problem-solve and trade industry secrets.

“The more that people share, the more you realize that they’re all having the same issues somehow, in some way,” Brody points out. “Just some companies are better able to address those from a financial capital investment perspective.”

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 33

“There’s a certain element of reputational risk that a lender may have by saying, yes, we outsource overseas. Some Americans take it very seriously and I think that a lot of borrowers take it very seriously.”

> Joseph Amoroso

34 MORTGAGE BANKER MAGAZINE | OCTOBER 2023 MortgageBanker MAGAZINE

MORTGAGE BANKER MAGAZINE | OCTOBER 2023 35 DATABANK

MORTGAGE BANKING of

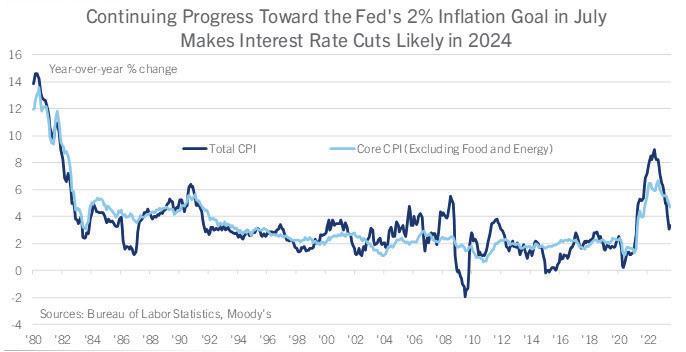

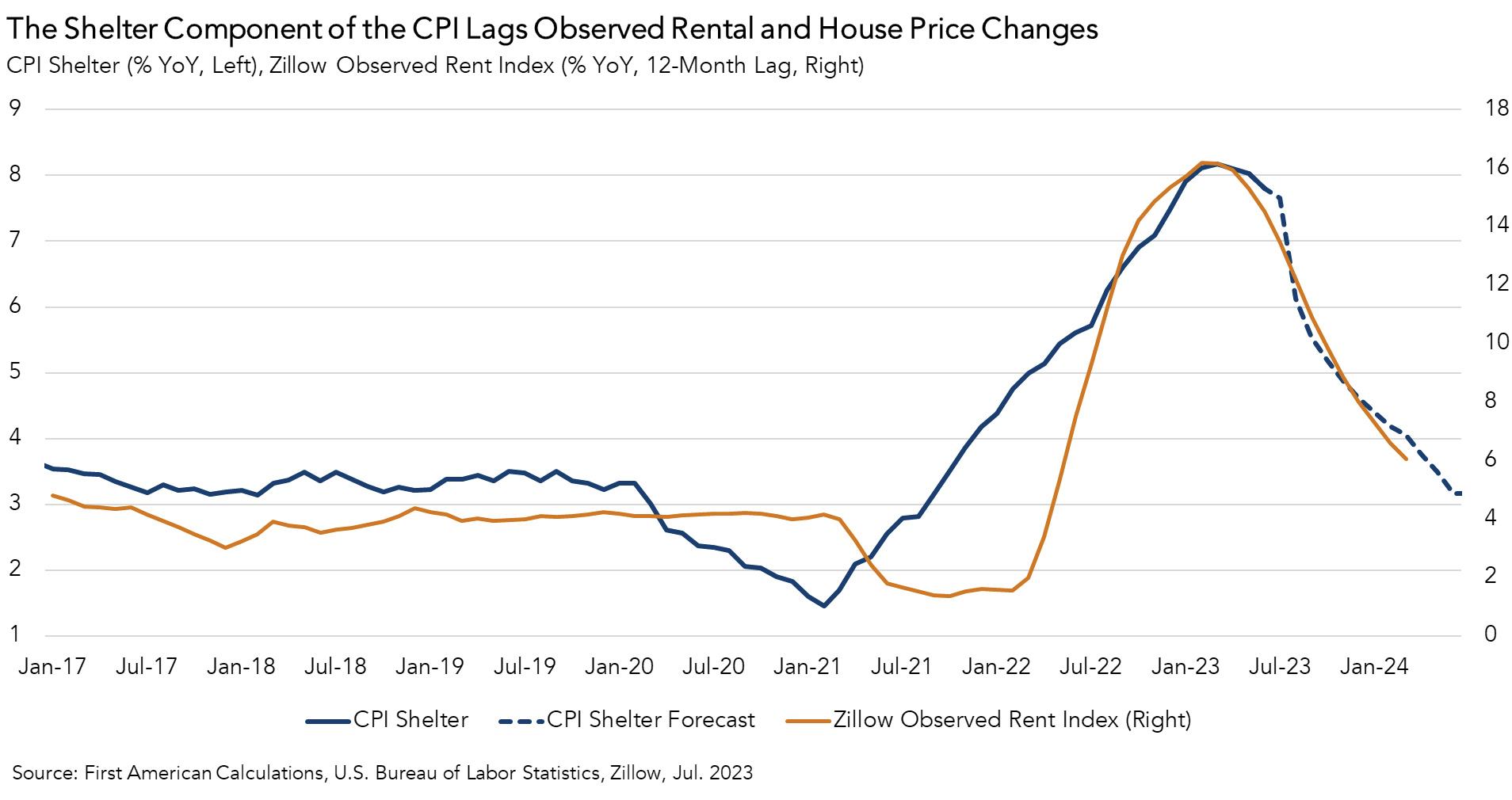

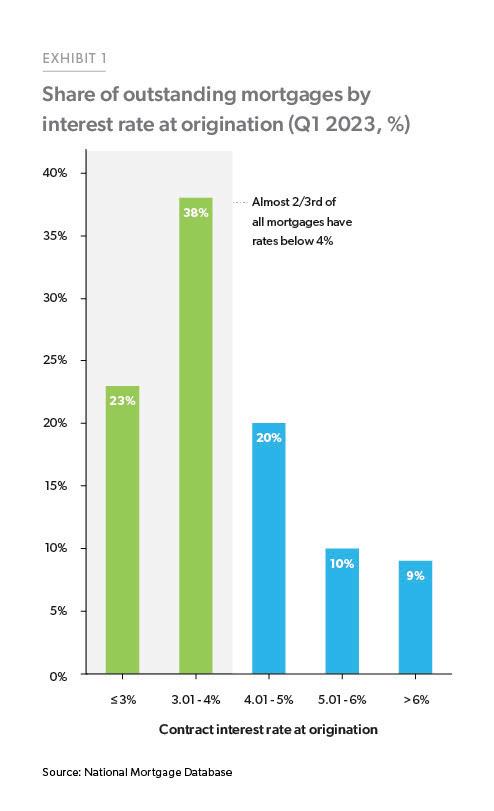

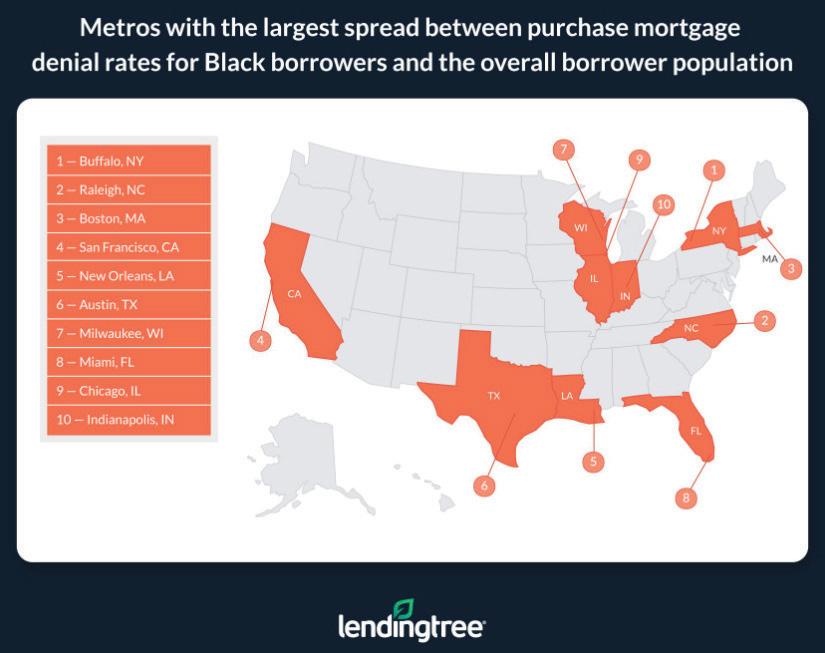

In this issue, Mortgage Banker Magazine highlights the women who are making an impact. We recognize and honor the Powerful Women of Mortgage Banking — it’s important for women to see women leaders within the industry, especially in areas where they may not expect to see them in great numbers, such as technology, finance and the c-suite.