8 minute read

Teranga Gold

Advertisement

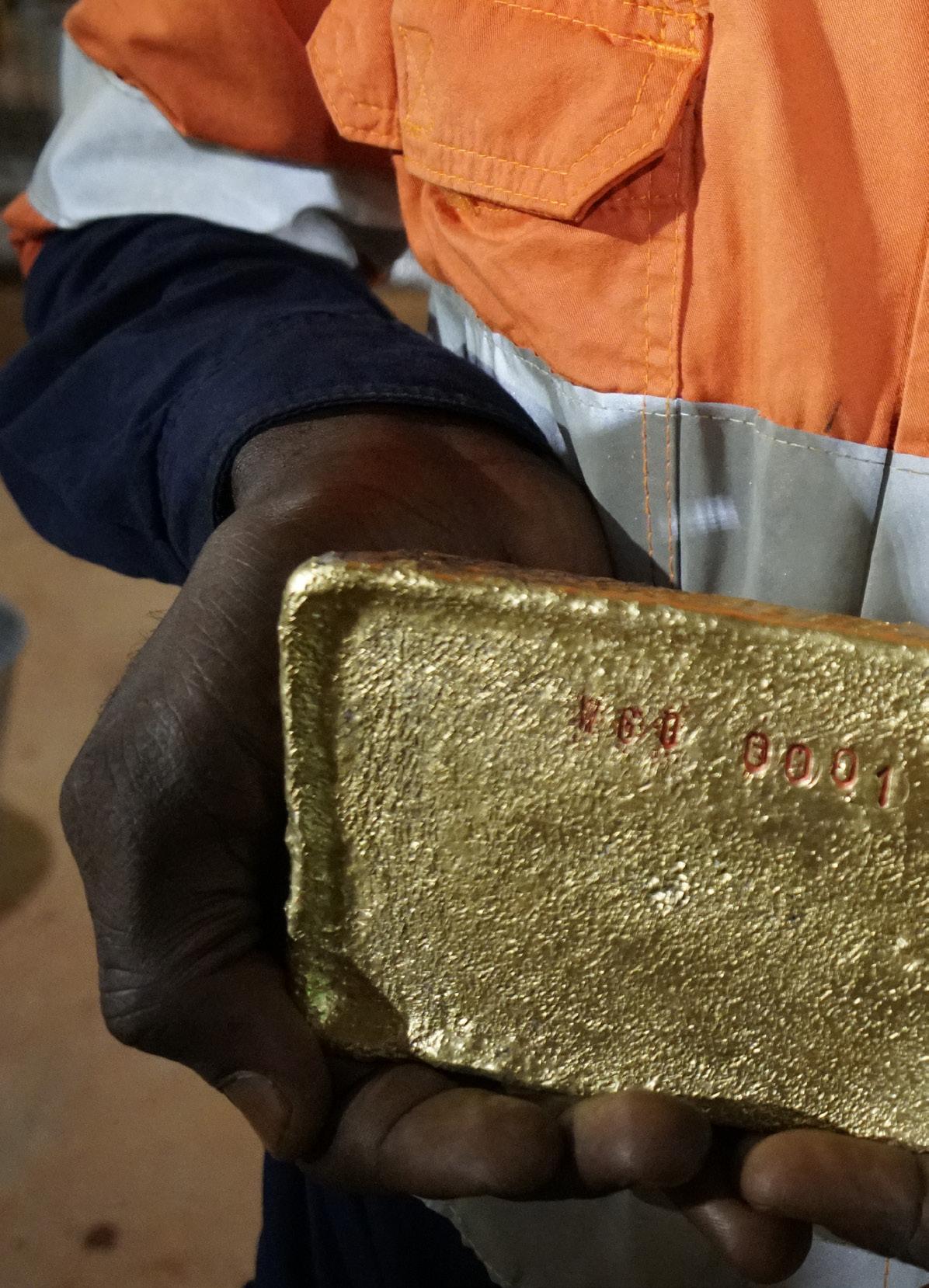

In the third quarter of 2019, TSXlisted Teranga Gold achieved first gold pour at its Wahgnion Project in Southwestern Burkina Faso two months ahead of schedule. The commissioning of Wahgnion (Teranga’s second operating mine in West Africa) is a major company milestone, not just because it will boost consolidated production by approximately 50% commencing in 2020, but also because it creates asset diversification across multiple jurisdictions, which can serve to increase the overall valuation of listed mining companies. “Over the last decade, investors have moved away from single-asset companies,” says Richard Young, president and CEO of Teranga Gold. “Having multiple assets reduces risk, and becoming a multi-mine, multi-jurisdictional company can make a positive difference in our valuation.”

After acquiring the project from Gryphon Minerals in 2016, the Teranga team took Wahgnion from exploration to production in less than three years, without a lost time injury during the construction phase.

improved in the following year when an updated study estimated a measured and indicated mineral resource of 2.4 million ounces (Moz) at 1.6 g/t Au for a 13-year mine life.

The mine is expected to produce 132,000 ounces (oz) of gold annually in the first five years of its life at an all-in sustaining cost of $761 per oz and with a total free cash flow of $311 million. Meanwhile, there is strong potential to increase the mine life further through reserve development programmes.

Ramping up at Wahgnion Teranga will continue to ramp up to commercial production at Wahgnion through the fourth quarter of 2019 and expects to declare commercial production by the end of the quarter. The company is set to produce 30,000-40,000 oz of gold from the operation in 2019.

Teranga has also continued to balance operational achievement with a responsible approach to development in the communities touched by its activities, evident in its handling of a progressive resettlement programme for local families living near the site at Wahgnion.

The phased programme has already resettled around 100 families over the past year, with a further 250 families set to be moved over the next 15 months beginning January 2020, for a total of nearly 500 by 2023.

“We’ve done a lot of work on the structure and compensation for resettlement and earned the trust of our local stakeholders,” Young explains. “We focus on improving the fundamentals such as healthcare, clean water accessibility and food security to these communities.”

In addition, Teranga has hired 30% of its Wahgnion workforce from local communities and in 2018, 92% of Wahgnion’s employees were Burkina Faso nationals. This is another way Teranga mitigates the impact of the mine on the area – a policy characteristic of a company that puts responsible development at the core of its business proposal.

The flagship mine Teranga’s first and flagship mine is Sabodala in Southeastern Senegal. Sabodala is the largest operating gold mine in Senegal, producing approximately 1.8 Moz of gold since the company’s initial public offering in 2010.

“In each of the last two years alone, we’ve mined about 25% more gold than we anticipated at a higher grade and more tonnes. That’s led to higher production from Sabodala, which is a credit to the grade control measures that we’ve implemented,” says Young.

Teranga has a proven track record of consistently replacing the reserves it has mined at Sabodala and the company is currently working through a significant opportunity for reserve growth after it implements a village relocation programme.

The local Sabodala village sits on top of Niakafiri – the largest gold deposit within Sabodala’s mine licence, and so Teranga is in the process of resettling around 600 households using IFC performance standards and international best practices as the benchmark.

“Once the village is relocated in 2020, we will complete the drill programme on the Niakafiri deposit,” says Young. “In parallel, we will commence reserve development programmes elsewhere on the mine licence and regional land package.”

In addition to a strong sustainability mandate considering the needs of all stakeholders, Teranga brought in Environmental Resources Management, a global firm with over 30 years of experience in relocations across Africa, to manage the Sabodala resettlement programme.

“We wanted to bring in a firm with a high level of expertise to complete the relocation in the best way,” notes Young. “We’ve got a board that has instructed us to work with the communities to make sure that these resettlement sites are sustainable and something that our management group, employees and shareholders can be proud of.”

Advancing exploration at Golden Hill Returning to the subject of Burkina Faso, Young and the Teranga board are highly encouraged by the initial resource estimate

at Golden Hill – the company’s most advanced exploration stage asset located on the highly prospective Houndé greenstone belt.

The initial resource estimate provides a solid base from which to grow Golden Hill with 415,000 oz at 2.02 g/t Au in the indicated category and 644,000 oz at 1.68 g/t Au in inferred. As well, the company’s ongoing drilling programme has produced excellent gold mineralisation continuity along trend and to depth.

The company has completed metallurgical test work and preliminary engineering, has a flowsheet locked in and has cemented its sustainability strategy ahead of its expected mine licence application for Golden Hill in 2020.

The company also commenced a 27,000 metres RC and DD drilling and exploration programme at Golden Hill in July 2019.

“The results we’ve seen at Golden Hill to date are very encouraging, and we are optimistic that we’ll continue to make positive exploration findings. We believe that Golden Hill has the makings to become our third gold mine,” Young continues.

Exploring Côte d’Ivoire Teranga recently moved into Côte d’Ivoire, its third jurisdiction in West Africa, as it expands its portfolio and builds its reputation as a leader in West African gold mining.

“Having multiple assets reduces risk, and becoming a multi-mine, multijurisdictional company can make a positive difference in our valuation” Richard Young, Teranga Gold CEO and president

Côte d’Ivoire is the largest economy in West Africa and it makes up the greatest proportion of any country within the Birimian greenstone belt – the enormous geological formation underpinning the region’s gold abundance – at 35%.

What’s more, Côte d’Ivoire is relatively underexplored compared to neighbouring countries like Ghana, Burkina Faso and Mali as a result of the successive civil wars that rocked the country between 2002 and 2007 and again from 2010 to 2011.

After a sustained period of peace and relative political stability, Côte d’Ivoire is becoming increasingly receptive to foreign investment in the gold industry. Barrick Gold CEO Mark Bristow even hailed Côte d’Ivoire as the number one jurisdiction in Africa for gold exploration.

“We entered Côte d’Ivoire through two joint ventures, the first with Miminvest – a company controlled by our largest shareholder David Mimran. The second joint venture relates to the Afema property. Through these joint ventures, we have three early-stage exploration projects that look very attractive.”

The most advanced of the three projects is called Guitry, which yielded encouraging results from its maiden drill programme conducted last year. Drilling is set to continue in 2020 across all three prospects.

and three exploration permits, providing a significant opportunity for scale that is rarely seen in West Africa aside from the shared systems in Ghana and Mali.

“We are very encouraged by the Afema land package and certainly expect to recommence our drill programmes when the rainy season ends,” says Young.

A true regional player Young also highlights the ease at which Teranga has expanded from one jurisdiction to three in West Africa, owing to much of the region’s close alignment along linguistic, judicial and business lines.

“We have focused on French West Africa and countries that are part of the West African Monetary Union. Countries in this organisation have very similar legal systems, labour and environmental laws and similar mining codes.

“As a result, we’ve been able to move over 50 employees from Sabodala to Wahgnion across several key departments. Part of the reason we chose Senegal, Burkina Faso and Côte d’Ivoire is because of the easy movement of people through the three

jurisdictions, allowing us to leverage our skilled team and infrastructure already in place in West Africa.”

With the Wahgnion Project up and running, Teranga will now turn its attention to reserve development programmes at Sabodala and Wahgnion and exploration programmes at Golden Hill and in Côte d’Ivoire, all while maintaining its status as the model for responsible gold development in West Africa.