8 minute read

Prospect Resources

Advertisement

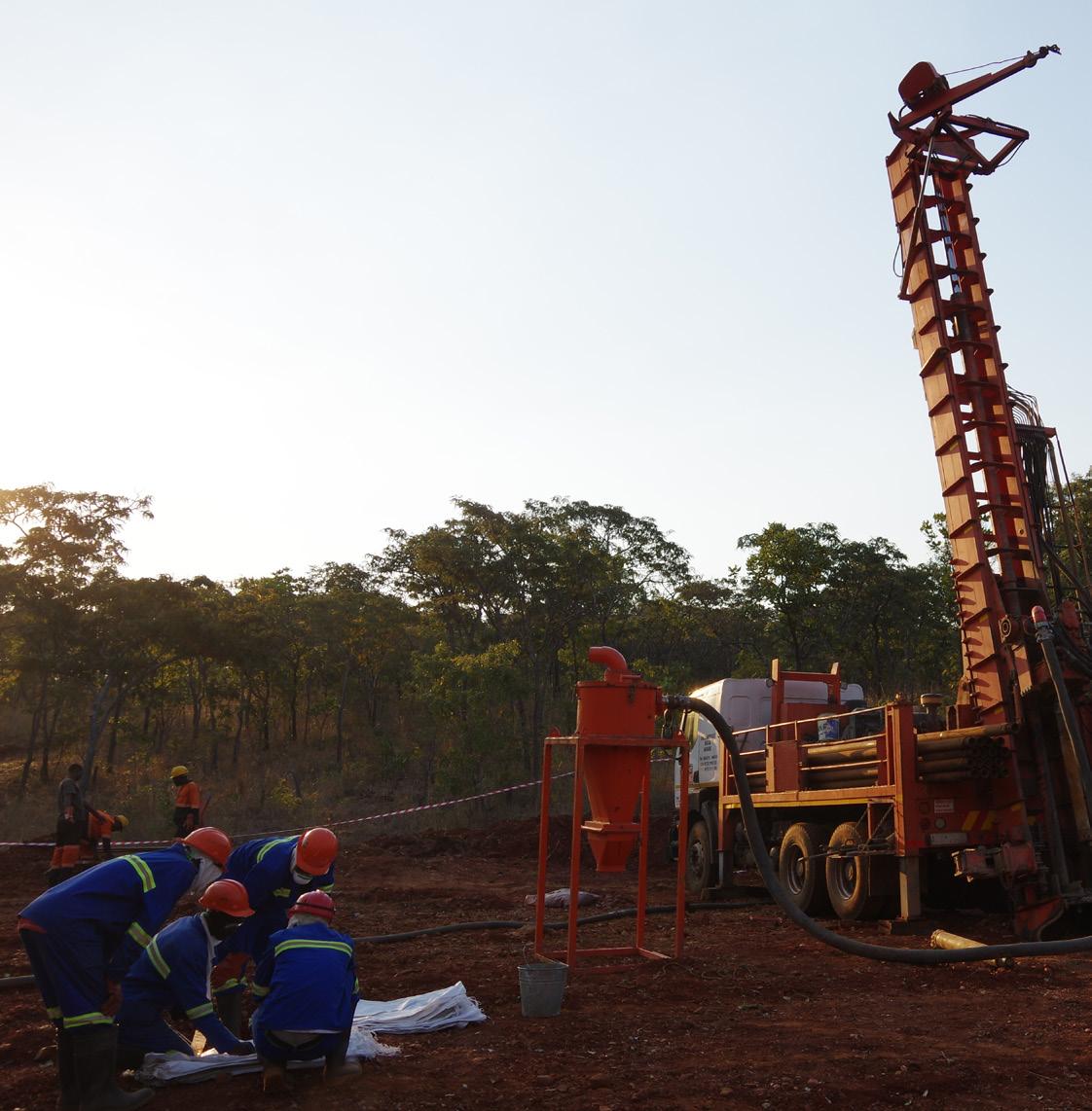

Prospect Resources’ flagship venture is the 87%-owned Arcadia Lithium Project in Zimbabwe, which has been progressed from first discoveries to an updated definitive feasibility study (DFS) in less than three years. The Arcadia deposit, located on the outskirts of capital city Harare, is comprised of low iron spodumene and ultra-low iron petalite ore, and is the 7th largest hard rock lithium project in the world after the ore reserve was recently increased by 39% to 37.4 million tonnes (Mt) at 1.22% lithium and 121 ppm tantalum. Driving the project forward is a strong management team with a wealth of experience in lithium project development in Africa. The internal team is also supported by tier 1 EPCM partner Lycopodium/ADP and a host of other specialist companies. SEZ status 2019 was a year of consistent news flow for ASX-listed Prospect, starting with the announcement that Special Economic Zone (SEZ) status had been granted for the Arcadia project by the Zimbabwe government in February. from tax relief and exemptions (including 0% corporate income tax for the first five years), the ability to hold and operate foreign currency accounts and exemptions from the requirement to obtain permits for the trading of goods in and out of Zimbabwe. “The financial and non-financial benefits to Prospect Resources in achieving SEZ status at Arcadia will greatly assist in the financing, development and operation of the mine,” said Prospect managing director Sam Hosack following the approval of the 10-year licence. After decades of decline under the previous regime, Zimbabwe is starting on the long road to economic recovery, with mining set to play a crucial role. In 2018 Zimbabwe’s mining sector contributed 60% of the country’s national exports and 13% of government revenue. The government is therefore acutely aware of the importance of the sector to the economy and has taken upmost care to attract foreign investors in the mining sector in recent years, as evidenced by its designation of a SEZ for the Arcadia project. “Mining is fundamental to Zimbabwe’s economic recovery, so we feel we are in the right sector and worked hard to obtain full government backing. We maintain a very good relationship with the government and in particular the mining ministry.”

TECHNICAL EXCELLENCE & SURETY IN DELIVERY

BATTERY METALS

Lycopodium is an internationally recognised engineering and project delivery group servicing global mineral resource projects and associated mine infrastructure.

Lycopodium’s capabilities extend worldwide and across project size, process complexity and commodity.

Coupled with our reputation in precious and base metals, we have now grown to be a widely recognised services provider to the iron ore, battery metals and industrial minerals industries.

INDUSTRIAL MINERALS

Our demonstrated commitment and proven ability to safely deliver projects on schedule and on budget, quickly ramping up to meet project performance targets, is the cornerstone of our success and repeat client base.

Lycopodium has a diverse team of Industry experts spanning a network of global offices, delivering fit-forpurpose and innovative solutions across all commodity types.

PRECIOUS METALS

BASE METALS

IRON ORE

The petalite market In Q3 Prospect made a secondary listing on the Frankfurt Stock Exchange, a move designed to gain greater exposure to the European market for petalite products and sophisticated European investors seeking exposure to the battery and the automotive sector.

Zimbabwe team, Prospect Resources

Throughout the first half of the year, the firm focused on enhancing its understanding of the petalite it will produce alongside spodumene at Arcadia, as well as the markets that consume the mineral.

iron lithium concentrate producer in the global market, which has a long history of being supply constrained.

grade ultra-low iron petalite to the glass and ceramics market - the primary consumer of petalite products worldwide.

Prospect then announced that Arcadia’s petalite product had passed the stringent product specification requirements of the glass and ceramics market in November and confirmed it would be the largest ultra-low

“We anticipate Arcadia becoming one of only two mines in the world capable of producing ultra-low iron petalite and we expect to be the largest player in this natural oligopoly,” Hosack tells RGN.

This newfound understanding of Arcadia’s high quality petalite ore led to a shift in commercial focus towards exposure to the European glass and ceramics market, which compelled Prospect to revisit its original DFS that was published in November 2018.

The DFS was subsequently updated and published in December 2019, taking into account changes to the mine plan and design in order to maximise production of ultralow iron petalite, alongside the spodumene destined for the battery minerals markets.

“We were able to integrate a stronger market-driven approach into our mine plan, changing the mine design scheduling and upgrading our JORC resource to reflect the ultra-low iron petalite content for the glass and ceramics market.”

An optimised DFS The December DFS for the 2.4 million tonnes per annum (Mtpa) base case reinforced the Arcadia project’s geological and financial merits, positioning Prospect as leading lithium producer to both the chemical and technical markets.

Improved financial outcomes from the DFS included a 39% increase to the pre-tax NPV10, which now stands at US$710 million, average annual EBITDA of $168 million for the first 5 years of operation, a $162 million capex estimate, $3.42 billion LOM revenue (excluding tantalum credits) and a pre-tax IRR of 71%. Meanwhile, the Arcadia mine life was extended by three and a half years to 15.5 years, further increasing Arcadia’s exposure to long term demand from growing sections of the lithium battery industry, including the electric vehicle (EV) sector. While Prospect has chosen to focus on petalite production for the glass and ceramics market in the short term, it maintains the view that the battery chemicals sector will be a key driver of lithium demand growth in the long term. “We now have two target markets: the mature glass and ceramics market in Europe and the emerging battery chemicals and energy storage industries in China. We were able to leverage the mine plan to reflect these markets in the DFS,” says Hosack. “I think we are now identified as Africa’s leading lithium project. We believe that 2020 and 2021 will be the major turning point in the lithium demand cycle underpinned by growth in electric vehicle (EV) sales, with the

market moving into deficit. We think it will be very beneficial to our shareholders to have maximum upside exposure to the EV story whilst benefitting from the security of the European glass and ceramics sector.”

Offtake ambitions Soon to be one of the largest and highest quality producers of ultra-low iron petalite, Prospect sees itself as a very strong contender for supply in the glass and ceramics market and has received a lot of interest from European customers already.

Commencing negotiations with potential future customers was another key focus for Prospect in 2019, building on the offtake agreement signed in 2018 with Chinese lithium chemical converter Sinomine Resources Group. In December, the company announced it had entered into a Memorandum of Understanding (MoU) with leading energy group Uranium One Group, part of the Rosatom business. The MoU affords Uranium One a 90-day exclusivity period in which the companies can negotiate equity investment terms and an offtake deal for at least 51% of Prospect’s future lithium production.

“The offtake discussions with Uranium One are progressing and we see them as being particularly determined to not miss an opportunity like this to secure the volumes and quantity of product they seek to secure for the strategic model,” declares Hosack.

Later in the month, Prospect announced the appointment of African Export-Import Bank (Afreximbank) to arrange and manage the primary syndication of a $143 million project finance debt facility.

significant experience financing projects in Zimbabwe, so the securing of a project finance debt facility with the organisation was a major coup for Prospect and provides a strong foundation for full project financing.

Africa’s most advanced lithium project After a year of substantial progress in the geological, technical and financial development of the fully permitted Arcadia project, Prospect has reached a crucial phase in the project’s life cycle.

With an updated DFS to reflect Prospect’s dual focus on the glass and ceramics and battery chemicals markets and a clear pathway to funding laid out, this serves as the catalyst for Prospect’s globally significant Arcadia project.

“I think our management has done an excellent job establishing a clear pathway towards financial close and from financial close to first production. We are an advanced development story having de-risked the project throughout 2019, and we have a clear plan to increase our offtake, progress our project finance and deliver our goals as the most advanced lithium project in Africa,” concludes Hosack.

and validation of the strategic importance of our asset, and its credentials as one of the top 10 lithium projects in the world.

ASX:PSC FRA:5E8

a j