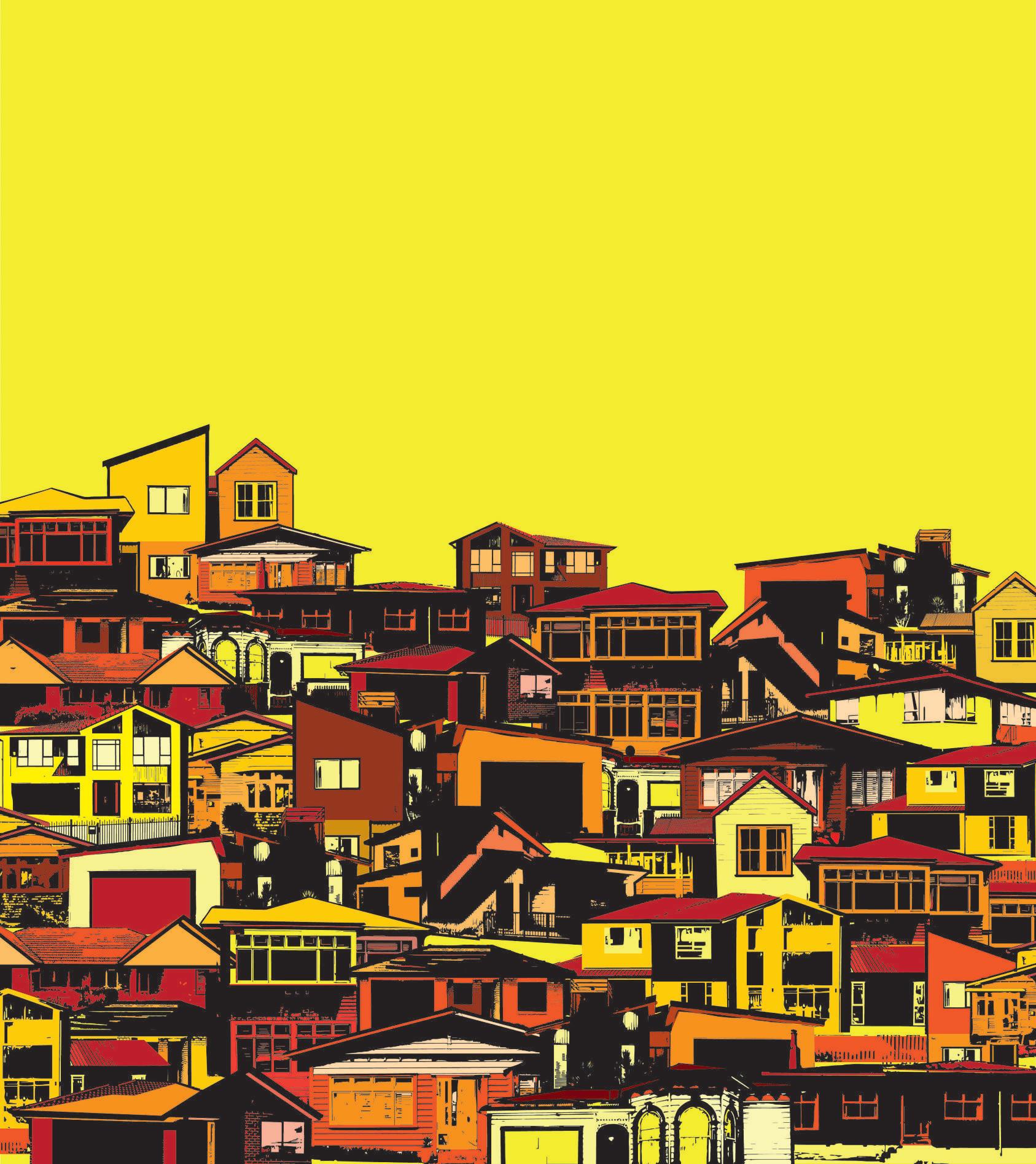

REVEALED: Theneighbourhoods withthemostpotential

ThelargestnetworkofbuyersinAuckland. Ifyou’rethinkingofselling,we’reheretohelpyouconnectwiththerightbuyers,andplentyof them.With1,800salespeopleacross87branches,wecangiveyourpropertytheexposure itdeserves,moreeyesonyourpropertymeansmorecompetition,whichcanmakeallthe differencebetweenagoodsaleandagreatone.Bookanappraisalatoneofourbranches today,andbeconfidentinknowingyouhaveAuckland’sleadingteambehindyou.

There’sareasonwhyKiwisarewatching AAInsuranceLocation,Location,Location NZ.Findingtherightsuburbinacountry withmorethan2000tochoosefromisahardask. Unfortunately,wecan’tcallonourownpersonal PaulandJaynetohelpuswhenwe’reoutlooking forhouses.Yes,ifwehadmillionsstashedinthe bank,mostofuswouldbeinourprivatenirvana,be itbythebeach,nexttothebestrestaurants,orinthe mountains.

ButifQueenstown,HerneBay,andOmahaareoff thecards,whereshouldyousetyoursights?

Weallwanttobuyatanaffordablepriceandto liveinasuburbthat’sontherise.Andwhileprices havesoftenedafter2023’sminipost-slumpsurge, therearelocationsaroundthecountrythatare primedforgrowthwhenthemarketpicksup.

Buyersneedtodotheirresearchtounderstand whatdrivesalocalmarketandhowitislikelyto evolveoverthecomingyears.OneRoof’sHot100 listisaninvaluableaidforthoseunsureaboutthe market.Itpinpointsthe100NewZealandsuburbs thatofferthebestvaluetobuyersandholdthebest long-termgrowthprospectsforowners.Theseare thesuburbstowatch.

Inflationwoes easingbutdon’tbet Andwhyit’stimetoditchunhelpfullanguagearoundcutsizes.

HeadingintotheSeptemberquarter inflationrelease,somepeoplehadbeen gettingquiteexcitedwiththeirpushfor theReserveBanktocuttheOfficialCash Rate75basispointsonNovember27.Werethis tohappen,itwouldbeanextrapositiveboostfor growthintheeconomythrough2025andofcourse thestrengthoftheupturnnowunderwayinthereal estatesector.

So,waslastmonth’sConsumersPriceIndex outcomeenoughofasurprisetojustifyafurther accelerationinthepaceofpolicyeasing?

Theannualrateofinflationdroppedto2.2%from 3.3%,whichiswithintheReserveBank’s1-3%target bandandaboutaverageforthepastthreedecades. Sofar,sogood.

The2.2%resultisalsolessthanthe2.3%expected bytheReserveBanksothereisnoproblemthere. Butthedifferenceissmallandwhenwelookat someofthedetailsthereisnoreasonforbelieving thatNZinflationrisksfallingbelow1%.

Inparticular,weneedtolookatthedifference betweentradeablesandnon-tradeables.About40% oftheCPIbasketofalmost650thingsaretraded acrosstheborderorhavetheirpricesheavily affectedbypricesoverseas.Thesetradeablesprices fell0.2%intheSeptemberquarterand1.6%forthe year.Weareimportingdeflation.

“Barringsomefresh 26-29

30-46

│ Designandartwork BethWalsh│Subeditor AkanisiTaumoepeau│ │ Photos FionaGoodall,GeorgeHeard,AlexBurton,GettyImages│ │DatasuppliedbyValocity│

horriblenewsforthe localorworldeconomy, wecanstillreasonably expectanother50basis pointcuttotheOfficial CashRateinNovember.”

Butthemoreimportantmeasureisnon-tradeables forwhichthequarterlypricechangeonaveragewas ariseof1.3%followinga0.9%increaseintheJune quarterand1.7%riseintheMarchquarter.This measureofwhatishappeninginNewZealandto thepricesofthingsmonetarypolicycaneventually influencerose4.9%thispastyear.Thisistoohigh andaneasychallengetothosewhomightsaythe

economyissomuntedlocalinflationhasdied.Ithas notanditremainstoostrong.

So,barringsomefreshhorriblenewsforthelocal orworldeconomy,wecanstillreasonablyexpect another50basispointcuttotheOfficialCashRatein November,takingitto4.25%.Afterall,inNovember 2022theReserveBankincreasedthecashrateby75 basispoints,followingtheCPIfortheSeptember quartercomingin0.6%higherthanitexpected.This latestresultisonly0.1%lowerthanincludedinthe mostrecentMonetaryPolicyStatement.

Butconsiderthis.Whenthe50basispointcut happensoneimaginespeoplewillusethesame terminologythatwasusedrecentlytodescribethe October9.Namely,“slashed”and“massive”. Thosewordswerewronglastweekandtheywill bewrongagainlateinNovember.SincetheOfficial CashRatewasintroducedinApril1999, ithasbeencut28times.Twoofthesecutsreached 150basispoints,buttheaveragecuthasbeen46 basispoints.

Therefore,October’swasonlyaverage–not massive. • •TonyAlexanderisanindependenteconomics commentator.Additionalcommentaryfromhim canbefoundatwww.tonyalexander.nz

GENTRIFICATIONissweepingthrough manyofNewZealand’smoreaffordable andsometimesunderratedsuburbs,some ofwhichdeservetobereassessedandold preconceptionsdiscarded,agentsandexpertssay. Inspiredbysimilarresearchbyrealestate.com. auinAustralia,OneRoofanditsdatapartner Valocitycarriedoutamajoranalysistofindthe country’s“hottest100”up-and-comingsuburbs. Arangeofmeasureswasused,includingaheavy emphasisonaffordability,resilienceovertherecent downturnandfactorslikethenumberofbuilding andrenovationconsentsissuedinrecentyears, mortgagedata,amenities,employmentproximity, andpropertypriceandpopulationgrowth.

Atthetopofthelistwastheunassuming industrial/business/residentialsuburbofEast Tamaki,totheeastofAuckland,followedbyMt Wellington,about10kmsouthoftheCBD,withits backdropofscaffoldingandcranesasthebuilding ofhomesmarcheson.

10,asdidWhanganuiandMasterton.

Theresultsreflectthechangingbuiltenvironment notjustinAucklandbutaroundthecountry–nearlyaquarterofsuburbswereinAuckland, butthesewerefollowedhardbyCanterbury,the Waikato,WellingtonandtheManawatu-Whanganui regions,thenascatteringinOtago,Hawke’sBay, theWestCoast,TaranakiandNorthland.

Acrossthecountry,therehasbeenrenewalanda movementofpeople,especiallypost-Covidwhich openedthedoortopeoplemovingoutofcitiesto moreaffordableregionsbecausetheycanwork fromhomeusingtechnologylikeZoom.

STEPPING-STONESUBURBS INAUCKLAND,suburbshaveseenmuch intensification.Wheretherewerebackyardsthere areterracehouses,andbigsquareapartment buildingsarebecomingamorecommonfeatureof suburbcentres.

andexploreMtWellingtoninstead.

Shumsaysakeymessageoftheanalysisisthat peopleneedtoreassessthesemoreaffordable neighbouringsuburbsbecausewhiletheymight notprovideaforeverhome,theycanprovidea goodmeanwhilehome:“Itmayfulfilalotofyour needsinthereasonablemedium-term.”

Whilesuburbsareseparatedbyalineonamap, sometimesthetransitionsbetweenthemarenot distinctandshopping,parksoremployment,and sometimesschooling,nextdoorareeasilyaccessed.

OtarablendsintoEastTamaki,forexample, butagentssaywhereOtaraisfirst-homebuyer territory,EastTamakiispopularwithsecond-home buyers.Thecountry’s“hottest”suburbhasbecome anaspirationaloneforthosewantingtogetintothe likesofHowick,MellonsBayandCocklesBay,says agentRichardWhite,whoheadsHarcourtsbranch officeinEastTamaki,andsomeareeyeingup gettingtheirchildrenintoMacleansCollegeoverin BucklandsBeach.

HOTINTHE CITIES Wherewillhousepricestakeoffnext?That’stheperennialquestioninrealestate.Thoseabouttotakethatfirststepontheproperty ladderwantanaffordablehomeinasuburbthatwillgrowinvalue.Iftheycan’tlandahomeinthemostpopularneighbourhoods, they’llwantthenextbestthing.OneRoofanditsdatapartnerValocityhaveidentifiedthe100hottestup-and-comingsuburbsaround NewZealand.Therankingsmaybeasurprisetohomeowners,butonethingisforsure:NewZealand’shousingmarketischanging-fast.

OtherSouthAucklandsuburbswereprominent, connectedalongmotorways,arterialroutesand railwaytracks–Otahuhu,Onehunga,Papatoetoe, Wiri,Mangere,Otara,Takanini,Papakuraand Pukekohe.

AsnapshotasofAprilshowedtheaverage propertyvalueinEastTamakiwasover$1million withaveragevaluesintheothersuburbsranging fromthehigh$700,000s.

WestAucklandwasrepresented,too,with Henderson,NewLynn,Avondale,Westgateand Hobsonvilleinthemix.

Notablyabsentwereposhersuburbswhichoften top“hot”arealists,likeRemueraorthewealthy northAucklandbeachplaygroundofOmaha, butWayneShum,seniorresearchanalystfor Valocity,saysthisanalysiswasforthemajorityof homeowners,notthetop10%ofthedemographic. Inner-citysuburbsinChristchurchmadethetop

Thesuburbsreflectthediverseethnicmix ofAuckland’sneighbourhoods.Throughout aredozensanddozensofsportsandreligious organisations,fromtheplentifulSamoanand TonganchurchestoSikhandBuddhisttemples.

MostofthehotAucklandsuburbswere southofEllerslie.That’snottosaythereare noaffordableup-and-comingpocketsonthe NorthShore,butShumsaystheresultsdo reflectthehigherpricebandstheotherside oftheharbourbridge.

ManyoftheAucklandsuburbsthatfeatureare stepping-stonesuburbs,hesays,wherepeople aspiretothesuburbnextdoorbutcan’taffordto gothereasyet.Theymayhaveaneyeonthe schoolzonesacrosstheboundaryandhaveaview tobuyingtherewhentheyhaveaccumulated enoughequitytodoso.

Peoplewhocan’taffordEllerslie,forexample, mighttakethebusyEllersliePanmureHighway

CATHERINEMASTERS reports

WhereOtaraends,theindustrialsprawl ofEastTamakibeginswithitsmanufacturing andwarehousingalongtheflat,alongwith bigHighbrookBusinessParkwithitshundreds ofcompaniesandjobs.Theindustrialzone giveswaytowardstheeastofthesuburbwhere single-levelbrickhomesbegin,turningintomore substantialhomesatEastTamakiHeightswhere thereareviewsoftheindustrialsprawlbelow. AlotofChineseandIndianpeoplelivein EastTamaki,andWhitesaysheseesbuyers comingfromfurthersouth,fromthelikesof TakaniniandPapakura,ontheirwaytothe eastofthecity,whichhesaysisunderrated. Thebuyerswanttheschooling–BotanyDowns SecondarySchoolisalsohighlyregarded,for instance–andtheylikethemotorwayaccessto thecityoneway,theairporttheotherway,or southtoHamilton.

toletgoofoldstigmaaboutplaces.

Therearesometimesshootingsorgangactivity inthenewsbutRawsonsayslookbeneaththe surfacetothechurches,communityorganisations andsportsfacilitieswhicharethebackboneof placeslikeOtara,MangereandOtahuhu.

Shumagrees,sayingsuburbseverywheremight haveoneortwostreetstoavoidbutpeopleshould notwriteoffthewholesuburb,andRawsonpoints outevenposhsuburbshavetheirshareoftrouble.

“There’sbeenamethlabonParitaiDrive[one ofAuckland’smostexpensivestreets].Therehave beenshootingsalloverAuckland.”

Placeschangeasnewpeoplemoveintoareas,he says,bringingnewenergy.“Youjustgiveitabitof timeandeverythingchanges.”

ToRawson,anup-and-comingsuburbisonethat stillhasgreenspaces,wherelandwillonlyincrease invalue,andsuburbsthathavebeenundervalued foronereasonoranother.

“Theonesthathavegotstigmasoutthere, maybe,thathavebeencheapbuttheyare neighbouringamoreexpensivesuburb.”

Otarais“massively”undervalued,forexample, hesays:“ItsneighboursareliterallyHighbrook, EastTamakiandBotany.”

DrivedownwideandleafyBairdsRoadinOtara andtherearerowsofnicely-keptstatehousing. Peopleareashouseproudhereasanywhere, Rawsonsays.Heknowsofagentswhorefuse

“Therearedefinitely moretradieUtes headinginto thesuburbsand rejuvenatingthe housingstockand buildingmorehomes.” TomRawson,RayWhiteManukau todrivethroughtheareabutsayshecuthisreal estateteethinthesesuburbswhileoutdoorknocking.Heencounteredlovelypeoplewhowere mortgage-freeandnotinterestedinselling.

“Alotoftheconversationswere,‘oh,no,we’re goingtohandthishousedowntothekids,we don’teverplanonselling’.”

It’snotlikeRemuerawherehomescanbe trophies.“Yourrootsarehere.Thereisn’tthis aspirationtogoanywhereelse.”

THENEXT20YEARS…

ONAGREYAucklanddayatthePanmureBasin, atidalestuaryadjacenttoMtWellingtonand

Inthesamepark,aEuropeanmansayshebases hisbusinessinMtWellingtonbecauseofitsgreat locationclosetoarterialroutes–andwhatstood outaboutthetopsuburbsinthehot100listtoChris Farhi,Bayleysheadofinsights,wasnotjustthe affordabilityfactorbutthetransportconnectivity. “They’reextremelyconvenientplaces.”

Whenlocationshavestrongpublictransport, thattendstoenablemoreintensivezoningfor housing,hesays.MtWellington,forexample,has thetrainandisamixofindustryandhousing. IthastheSylviaParkshoppingcentreandKiwi Propertyisbuildingitsbignewbuild-to-rent developmentthere.

Farhisayssomeofthesesuburbshavealready shakenanystigmatheymighthavehadand havegreathousingofferings.Otahuhuhasolder characterhomestoberenovatedandOnehunga, wherethereisatrainstation,hasalreadybecomea “very,verycool”placetolivewiththePonsonbystyletransformationandrenovationofitscharacter villas.

Hethinksabigdriverofthehotsuburbsisthat peoplecanbuymorefortheirbuck.Theamount ofmoneytobuyaterracehouseinEllerslieor Greenlanemightbuyastandalonehousedownthe roadinMtWellingtonorOtahuhu.

Thenext20yearswilllikelyseesignificant furtherchangeinthesesortsoflocations, Farhisays,andthatisinpartbecauseasareas

gentrifyandbecomemorepopular,peoplewith higherincomesmovein,whichleadstofurther gentrification.

Rawson,too,thinksinanother10years,places likeOtahuhuwillbeevenmoredenselypopulated, sayingthereisstillspacetobuildinthesuburb. Foreveryhousealreadytakenawayanditssite developed,thereareanother10propertiesholding ontobigparcelsofland.Developmentlandhere ismoreexpensivethanfurthersouthbecause OtahuhuisseenasthenorthernendofSouth Auckland,whilenextdoorMtWellingtonisseen moreasthesouthernendofthecity.

“TherearedefinitelymoretradieUtesandvans headingintothesuburbsandrejuvenatingthe housingstockandbuildingmorehomes.”

Infact,Rawsonsays,infillhousinghasalready virtuallyconnectedsuburbsup.“Youcanalmost jumpfromrooftoroofbetweenPapatoetoeall thewaythroughthesuburbstogettoBotany Heights.”

“We’venowgottrainsin moreplacesandpeople arelessinclinedtohave tobeintheofficeso we’recertainlyseeinga bitmoreofaspreadof wherepeoplearebuying theirfirsthome.” LesleyHarris,FirstHomeBuyersClub

AgePapakura/Takanini,saysthereusedtobe alotofhorseracinginTakaninibutit’shousing now.Thesuburbwasanearlyadopterofterrace housingandatthetimeeveryonewasworriedit

AUCKLANDCENTRAL,whichencompassesthe CBD,alsofeaturedinthetop10,largelydrivenby affordabilityofapartmentliving.Whenshoebox apartmentswerebuiltinthe1990sand2000s,the centregainedareputationforhousinginternational studentsbutbiggerapartmentshaveandarebeing builtwhicharepopularwithmigrantfamiliesmore usedtoapartmentliving.Farhisaysasurprising numberoffamiliesandchildrenliveintheCBDthese days.

AnumberofsuburbsfromCanterburyfeatured inthetop100,withinner-cityChristchurchsuburbs Sydenham(averagepropertyvalue$572,700)and Waltham($516,500)inthetop10.Farhisaysthese suburbsarewalkabletotownbutifcomparedto characterhomesasimilardistancefromAuckland’s CBD,likeinPonsonbyorGreyLynn,theyareonlya thirdoftheprice.HesaysbuyersfromAucklandhave reportedit’slikeshoppinginthesales.

“Thatmakesyouthinktheareaaroundtheedge oftheCBDinChristchurchisundervaluedatthe moment.”

TonyJenkins,managingdirectorforHarcourts Holmwood,saysalotofpropertydevelopersare renovatingandflipping:“Thesesuburbswiththeir proximitytoournewcitycentrehavethepotentialto betheMtEdensandPonsonbysofChristchurchin10 years.”

AFFORDABILITYVAMENITY SOMEmoreexpensivesuburbsmadeittothehot 100list,aswell,suchasMtEden,wheretheaverage propertyvaluewas$1.79matthetimeoftheanalysis, aswellasMtMaunganui($1.4736m)andQueenstown ($1.7519m).Shumsaysthesearenotanomaliesbut reflectiveofthesolidityofthesuburbs,thehousing mixandthefacttherearemoreaffordablehomesthan youmightthinkintheseareas.

FarhiisnotsurprisedtoseeCromwell($1.002m) onthelist,too,describingthecentralOtagotownas a“halo”locationontheedgeofQueenstownand Wanakawherevalueshaverisenfastsopeoplewho can’taffordthepriciertownslooktoCromwell.

LESLEYHARRIS,spokespersonfortheFirstHome BuyersClub,urgesabitofcaution,sayingfirsthomebuyersshouldnotpackupandgoand buyinoneofthehotsuburbssimplyforthe priceofhousing.Affordabilityisonlya quarterofwhatcanbeacomplexhome ownershipjourneyforthosestartingout. Youngbuyersneedtoconsiderschools, family,lifestyle,andcareerandincome opportunities–there’snopointbuying inHuntly(averagepropertyprice $544,600)ifoncetherethebuyercan’t progressintheircareer.

Havingsaidthat,workhas changedsinceCovidandthe advanceoftechnologygivesmore flexibilityaroundwherepeople buy.

Bettertransport,too,means peoplecanbuyfurtheroutfrom thecitycentre.

“We’venowgottrainsinmore placesandpeoplearelessinclined tohavetobeintheofficesowe’re certainlyseeingabitmoreofa spreadofwherepeoplearebuying theirfirsthome.”

Harrisspokeofabuilder whorelocatedhisfamilytoNew Plymouth($894,400averageproperty value)recently,inpartbecause housingislessexpensive,butshesays themovemadesenseinmoreways thanonebecausethechildrenareingood schoolsandhehasasimilarwagetopayfor amoreaffordablehouse.

“There’ssomuchmorethatgoesinto thisequationandit’snotjustaboutthe financialaspects.” •

Bigambitions? Ourpurposeistohelpothersachievesuccess.Whenyoujoinour team,yourgrowthisourpriority.Ifyou’relookingforahometo unlockyourpotential,we’dlovetotalktoyou.

WHYTHESE100SUBURBS ARETHEONESTOWATCH Inacountrywithmorethan2000 suburbs,choosingwhichonehasthe bestprospectscanbechallenging forbuyers.Weallwanttoliveina neighbourhoodwithabrightfuture.We allwanttobuyatanaffordableprice.We allwanttoseeourhomesgrowinvalue becausethecommunitiesaroundthemare vibrantandprovideaqualityoflifethat’s secondtonone.

Inspiredbyhousingmarketanalysis carriedoutbyAustralia’stwobiggestreal estateportals,OneRoofanditsdatapartner ValocityhavecreatedalistofNewZealand’s “hottest”100suburbs-thelocationsthat havethegreatestpotentialtoshine,the locationsfirst-homebuyersandinvestors shouldhavetopofmindwhendrawingup theirwatchlists.

Wehavestartedwithsuburbswith500or moreresidentialandlifestylesuburbsacross thecountryandassignedscoresbasedonthe criteriabelow.Aweightedscoreiscalculated foreachsuburbandranked ValocityseniorresearchanalystWayne Shumsaidthepurposeoftheanalysiswas nottoshowthetopgrowthsuburbsofthis yearorlastyear,buttoidentifythe“upand coming”suburbsthatwillrewardbuyersin yearstocome.

SuburbsmadetheOneRoof-Valocitylist basedonthefollowingcriteria:

PRICEGROWTH: Wemeasuredthe growthintheValocityValueIndexofthe individualsuburbbetweenJanuary2020and thepeakvalueduringthe2021-2022boom. Ascorewasassignedbasedonthevalue growthoverthisperiod

RESILIENCETOSHOCKS: Wemeasured thedeclineintheValocityValueIndex betweenthepeakofthemarketin20212022totoday.Ahigherscorewasassigned forsuburbsmostresilienttothemarket downturn

SUBURBTURNOVER: Calculatedbased onthenumberofsalesin2023and2024 andtheoverallstocklevelofthesuburb. Ahigherscorewasassignedtosuburbs withfewersales,assumingthatamore stablepopulationismoreattractiveto first-homebuyers

BUILDINGCONSENTS:Ascorecalculated fromthenumberofbuildingconsentsissued asaproportionofstockinthesuburb. Ahighernumberofconsentsindicates confidenceandgrowthinthesuburb,from developerslookingtobuildnewhomesto existingownerswhoarerenovatingand wishtostayput.

AMENITIES: Scoresareallocatedto suburbssurroundingcommutertrain stationsinAucklandandWellington, astheyprovideanalternative transportmethodforresidents. Proximitytocommercial hubsandemployment opportunitiesarealso calculatedaspartofthe amenitiesscore,basedon thenumberofcommercial andindustrialpropertiesin thesuburbandsurrounding suburbs,asaproxyfor employmentandopportunities.

AFFORDABILITY: Basedon mortgagerepayment,thelowerthe repayment,thehigherthescoreassigned.

HOT100 BYREGION DEVELOPMENTLANDAVAILABLE: Higherscoresareassignedtosuburbs withfewerdevelopmentsitesavailable, asthisencouragesgreatergentrification andwithoutthesupplysuppressingfuture valuegrowth

NEWLYCREATEDSTOCK: Calculated usingthetotalnumberofnewbuilds (constructedin2023and2024)aspartofthe stockmix,FirstHomeBuyersareattracted tothenewstockfortherelaxedLVR requirement,fixedpricemarketing,andlow maintenance

OWNERSHIPMIX: Measuresthecurrent ownershipmixofthesuburbandhowit deviatesfromthenationalaverageFirst HomeBuyerownership.Higherscoresare assignedtoareascloselyalignedwiththe nationaltrend.

RENTALGROWTH: Wehavecompared themedianrentalforeachsuburbbetween April2023andApril2024,withhigher scoresassignedtoareaswithstronger growth.Rentalgrowthisanindicationof thesuburb’sdesirability.

POPULATIONGROWTH: Calculated usingtheregionalpopulationgrowthdata fromthe2023Census.Strongpopulation growthisassociatedwithstrongeconomic growthactivity.

No.1

EASTTAMAKI, AUCKLAND

Averagepropertyvalue: $1,097,000

Scoredhighlyon: Turnover,OwnershipMix, Amenities,Employment, DevelopmentLand

No.2

MOUNTWELLINGTON, AUCKLAND

Averagepropertyvalue: $958,000

Scoredhighlyon: Amenities,Employment, NewStock

No.3

OTAHUHU, AUCKLAND

Averagepropertyvalue: $746,000

Scoredhighlyon: OwnershipMix,Amenities, Employment,Rental Growth,NewStock

No.4

THE HOT 100 No.7

AUCKLANDCENTRAL, AUCKLAND

Averagepropertyvalue: $573,000

Scoredhighlyon: Amenities,Employment, Affordability

No.8

TAKANINI,AUCKLAND

Averagepropertyvalue:

$901,000

Scoredhighlyon: BuildingConsents, Affordability

No.9

WHANGANUI, WHANGANUI

Averagepropertyvalue: $419,000

Scoredhighlyon: OwnershipMix, Affordability,Development Land RentalGrowth

No.10

MASTERTON, WELLINGTON Averagepropertyvalue:

No.13

PAPAKURA, AUCKLAND

Averagepropertyvalue: $810,000

Scoredhighlyon: Amenities,Employment, NewStock

No.14

ROLLESTON,SELWYN

Averagepropertyvalue: $867,000

Scoredhighlyon: BuildingConsents, OwnershipMix,Population Growth,NewStock

No.15

WIRI,AUCKLAND

Averagepropertyvalue: $671,000

Scoredhighlyon: Amenities,Employment, NewStock

No.16

FRANKTON, HAMILTON

Averagepropertyvalue:

No.20

KAIKOHE,FARNORTH

Averagepropertyvalue: $402,000

Scoredhighlyon:Price Growth Resilience toShocks,Turnover, Affordability,Population Growth

No.21

GREYMOUTH,GREY

Averagepropertyvalue: $480,000

Scoredhighlyon:Price Growth Affordability RentalGrowth

No.22

TAIHAPE,RANGITIKEI

Averagepropertyvalue: $400,000

Scoredhighlyon: ResiliencetoShocks, Turnover Affordability

No.23 TEARO,WELLINGTON

Averagepropertyvalue: $690,000

No.27 CHRISTCHURCH CENTRAL, CHRISTCHURCH

Averagepropertyvalue: $693,000

Scoredhighlyon: ResiliencetoShocks, Amenities,Employment NewStock

No.28

HAWERA, SOUTHTARANAKI

Averagepropertyvalue: $539,000

Scoredhighlyon: Amenities,Employment, Affordability

No.29

ASHBURTON, CANTERBURY

Averagepropertyvalue: $523,000

Scoredhighlyon: ResiliencetoShocks, Affordability,Rental Growth

No.30 No.33 DANNEVIRKE, TARARUA

Averagepropertyvalue: $484,000

Scoredhighlyon:Price Growth,Affordability, RentalGrowth

No.34 OAMARU,WAITAKI

Averagepropertyvalue: $449,000

Scoredhighlyon: Affordability Rental Growth

No.35

WAIROA, HAWKE’SBAY

Averagepropertyvalue: $318,000

Scoredhighlyon: PriceGrowth,Turnover, Affordability

No.36

NEWPLYMOUTH, TARANAKI

Averagepropertyvalue:

No.1 EASTTAMAKI EASTTAMAKI isanentry-levelpathwayintoeast Auckland.Ithasavastindustrialareaontheflat whichprovidesjobswithresidentialhomesmore totheeast.WayneShum,fromValocity,describes thesuburbasamoreaffordableonenestled amongexpensivesuburbs–neighboursare Burswood,Dannemora,FlatBush,Huntington ParkandNorthpark.

Thehousingmixissomewhatuniformwitha lotof1990sstockandalotofculdesacs,which Shumsaysareconsideredaquintessentialsuburban benchmark.OverinBotany,hesaysonemighthave fourculdesacscomingoffit.Standalonehouses alongtheflatinEastTamakigivewaytomore substantialhomesonthehill.

Harcourtsagent RichardWhitesayshe seespropertyownersmove fromsouthAucklandintothe eastofAucklandandsaysEast Tamakihasbecomeaspirationaland asteppingstoneintothelikesofHowick,Cockle BayandMellonsBayinthe“underrated”eastof Auckland.

Oneoftheattractionsisthegoodschooling. Valocitynotespartsofthesuburbareinzone for15schools,fromBotanyDownsCollegeto HowickIntermediateandSantaMariaCollegein neighbouringFlatBush.

TheFoGuangShanBuddhisttemple,located

SPOTLIGHTON SOUTHAUCKLAND THESOUTHAUCKLAND suburbsonthelistare rapidlygrowingandgentrifyingasevidencednot justbythenewandvariedhousingtypesandnew buildconsentsissued,butbythecombinedhundreds ofconsentsissuedforrenovationsandadditions.

Shumsaysrenovationsshowthedesirabilityof anareabecausetheyindicatepeoplearestayingput, preferringtodouptheirpropertiesovermoving. Thesesuburbsareconnectedbymotorwaysand mainarterialroutes–inthevicinityisthesouthern andsouthwesternmotorways,theEllersliePanmure Highway,GreatSouthRoad,MaseyRoad.

Theyarepredominantlyworkingclassbut theydohavepocketsofmoreexpensivehomes, oftenconcentratedaroundwater.Thesuburbs havedozensofsportsgroundsandfacilities,and therearemanydozensofchurchesandreligious organisationswhichshowsthediversityofthe peoplelivingthere,fromthemanySamoanand TonganchurchestoBuddhistandSikhtemples,as wellasplentifulCatholicandotherdenominations represented.

MtWellingtonoffersschoolingoptionswhilenot beingtoofarfromSouthAucklandforfamilieswith strongrootsthere.SylviaParkandarterialroutes makeitreallyconvenient.Theareaisamixofolder styleNewZealandhomestonewterracehousing, andKiwiPropertyiscompletingalargebuild-torentbuildingatSylviaPark,thehubofcommercial andretailforthearea.

Otahuhuboastsgoodtransportlinks,but residentsalsolovethecharacterofthehomesand area.It’sonthefringeofthesouthandcentralpart ofthecity,andbecauseit’swater-lockedthereare

betweenEastTamakiandFlatBush,isan attraction,andnextdoorisWhitfordandthe countryside.Whitesayspeoplecanjumpin thecarandbeatHowickHistoricalVillagein 15minutesorgotothebeachesandCockles BayReservewhicharenicethingstodoatthe weekend. •

somegoodviewstobehad.

Likeothersuburbs,the diversityofthesuburbisrevealed throughalargerangeofreligious establishments,fromIndian BaptiststoVietnameseBuddhists andSamoan,Tonganandother churches.

MangerehasabigPasifikacommunity, hasnumerousschoolingoptionsandiscloseto strongemploymentcentres(theairportisnotfar away).It’smoreaffordablethanPapatoetoeand Otahuhujustnextdoor,andtherearelargersites stillwithgooddemandforinfillhousing.

Otahuhu,Auckland

Manurewa,Auckland

OtarasitsbetweenOtahuhu,EastTamaki, MangereandPapatoetoe.RayWhiteManukau directorTomRawsonsaysthereisroomfor developmentonbigsites,andratestheconvenience factorofthelocation.Thesuburbhasdeep communityrootsandfeelwithgenerationalfamily historiesandplentifulchurches.

NeighbouringPapatoetoehasabigIndian communityandastrongreligiousnetwork. MiddlemoreHospitalishandyandthereisethnic shoppingtosuittheneedsofthecommunity. RawsonsaysPapatoetoeishistoricallydesirable–it waspopularwhenhisparentsboughtthere40years agoandisstillpopularnow.

FurthersouthisTakaniniwherepeopleoftenwant tobuyclosetoschoolsandtemples.Thepropertiesare newerandoftenowner-occupied,andRawsonsays somepocketshavecovenantsagainststatehousingso thereiscertaintyaroundwhatisgoingupnextdoorin thisheavilydevelopedarea.•

No.40

WESTGATE, AUCKLAND

Averagepropertyvalue: $882,000

Scoredhighlyon: BuildingConsents,New Stock

No.41

RANGIORA, WAIMAKARIRI

Averagepropertyvalue: $714,000

Scoredhighlyon: ResiliencetoShocks, OwnershipMix,Population Growth

No.42 REEFTON,BULLER

Averagepropertyvalue: $374,000

Scoredhighlyon:Price Growth,Resilienceto Shocks,OwnershipMix, Affordability Population Growth

No.43 BELFAST, CHRISTCHURCH

Averagepropertyvalue: $697,000

Scoredhighlyon: ResiliencetoShocks, BuildingConsents,Rental Growth,NewStock

No.47

MANUREWA, AUCKLAND

Averagepropertyvalue: $787,000

Scoredhighlyon: Amenities,Employment

No.48

PALMERSTONNORTH, WHANGANUI

Averagepropertyvalue: $614,000

Scoredhighlyon: Amenities,Employment, DevelopmentLand

No.49

ADDINGTON, CHRISTCHURCH

Averagepropertyvalue: $553,000

Scoredhighlyon: ResiliencetoShocks

Affordability,Rental Growth,NewStock

No.50 PARAPARAUMU, KAPITICOAST

Averagepropertyvalue: $803,000

Scoredhighlyon: Amenities,Employment, DevelopmentLand

No.51

WAIMATE,

No.54 LEVIN,HOROWHENUA

Averagepropertyvalue: $569,000

Scoredhighlyon: OwnershipMix,Affordability, PopulationGrowth

No.55

NAPIERSOUTH, NAPIER

Averagepropertyvalue: $648,000

Scoredhighlyon: OwnershipMix

No.56

WIGRAM, CHRISTCHURCH

Averagepropertyvalue:

$867,000

Scoredhighlyon: Amenities,Employment RentalGrowth

No.57 MANGAKAKAHI, ROTORUA

Averagepropertyvalue: $512,000

Scoredhighlyon: Turnover,Affordability, DevelopmentLand

No.58 THAMES,THAMES COROMANDEL

Averagepropertyvalue:

No.62 DARFIELD,SELWYN

Averagepropertyvalue: $842,000

Scoredhighlyon:$$xxx BuildingConsents, OwnershipMix,Population Growth NewStock

No.63 NAENAE, LOWERHUTT

Averagepropertyvalue: $623,000

Scoredhighlyon: DevelopmentLand

No.64 RAETIHI,RUAPEHU

Averagepropertyvalue: $364,000

Scoredhighlyon: PriceGrowth Turnover Affordability Rental Growth

No.65 HAMILTONCENTRAL, HAMILTON

Averagepropertyvalue: $740,000

Scoredhighlyon: Turnover Development Land,PopulationGrowth

No.66

TAUPO,WAIKTO

Averagepropertyvalue:

No.70

NEWBRIGHTON, CHRISTCHURCH

Averagepropertyvalue: $549,000

Scoredhighlyon: ResiliencetoShocks BuildingConsents, Affordability,Rental Growth,NewStock

No.71

HALSWELL, CHRISTCHURCH

Averagepropertyvalue: $856,000

Scoredhighlyon:Building Consents,NewStock

No.72 BLENHEIM, MARLBOROUGH

Averagepropertyvalue: $604,000

Scoredhighlyon: OwnershipMix, DevelopmentLand

No.73

DUNEDINCENTRAL, DUNEDIN

Averagepropertyvalue: $704,000

Scoredhighlyon: Turnover,Amenities, Employment

No.74

No.78

BELLBLOCK, NEWPLYMOUTH

Averagepropertyvalue: $756,000

Scoredhighlyon: PopulationGrowth

No.79

TEAWAMUTU, WAIPA

Averagepropertyvalue: $773,000

Scoredhighlyon: PopulationGrowth

No.80 SOUTHDUNEDIN, DUNEDIN

Averagepropertyvalue: $419,000

Scoredhighlyon: Affordability Development Land

No.81

TAITA,LOWERHUTT

Averagepropertyvalue: $625,000

Scoredhighlyon: DevelopmentLand,New Stock

No.82

PAHIATUA,TARARUA

Averagepropertyvalue: $488,000

Scoredhighlyon:Price

SPOTLIGHTON AUCKLAND CENTRAL AUCKLANDCENTRAL isdifferenttoother suburbsbecauseof thepredominance ofapartmentsinthe CBD.Whiletheshoebox apartmentserectedfrom the1990sweretiny,there arenowlarger,family-friendly apartmentsandyouwillfindnotjuststudents butnewmigrantslivinginthecitycentreand raisingchildrenthere.

Migrantstendtocomefromdenserliving andareusedtoit,whereasmanyKiwisstill preferthesuburbs.

Shumsayswhenhelivedinthecity,hesaw migrantscomeoutoftheSugarTreeapartment complexonNelsonStreetinthemornings andwalktheirchildrendowntoFreemans BayPrimarySchool,sayingcitylivinghasthe advantageofgoodschoolzones.Partsofthe cityareintheprizeddoublegrammarzoneand thereareotherpartsinzoneforschoolssuchas KowhaiIntermediateinKingsland,Newmarket SchoolandNewtonSchool,aswellasPonsonby IntermediateSchoolandWesternSpringsCollege. AndrewMurray,directorofApartment Specialists,sayspeopleoftenmisunderstand theCBDmarketbecauseit’snotonemarketbut many.“Wehavealmost3000leaseholdunits, whichchangesaveragepricesandeverything andalltheCVsareout–noneofthestatistics anybodyeverprovidesarecorrectorevenclose tocorrect.”

Thecityhasamixoffirst-timebuyerstock, investorstockandhigh-endstock,which rangesfromtiny,totwoorthreebedrooms,to penthousesuitesinthehigh-riseresidential towers.Theriseofapartmentshaschanged thecitylandscape.Whilemigrantsmovein torentthecheaperapartments,andmakeup thelargestnumberofCBDresidents,Murray saystheyoftenmoveoutagainbecausesmall apartmentsizeisanissue.

Whilethecitycentrehadthe“worstPR” sufferedfromtheCovidera,whichsawthe internationalstudentmarketdryupand workersstayawayfromoffices,itisthebest placetobuy“handsdown”,Murraysays.

That’sbecausesomevaluesaredown around2013levels.“I’mbuyingasmany apartmentsasIcan–Icouldn’treallysay anythingmorepowerful.”

Farhi,too,saysthecitycentrewillalways havegoodprospectsbecauseoftheamountof investmentthatgoesintothelikesoftransport andgreenspaces.Hesaysthenetincreasein migrationisbeingdrivenbypeoplefromIndia, ChinaandthePhilippines,whoarenotonly usedtomoreintensivelivingbutaresubjectto theforeignbuyerbanwhentheycomeinsoby defaulthavetorent.

“Ithinkthere’sasurprisingnumberof familieslivinginthecity,especiallyinsomeof thelargerapartments.” •

SPOTLIGHTON WESTAUCKLAND SEVERALWESTAUCKLAND suburbsfeature inthetop100,includingHenderson,NewLynn, Avondale,WestgateandHobsonville.Harcourts NorthwestagentDiegoTragliasaysthesuburbsare distinctandinquiriesarealwaysstrong.

Aswithotherpartsofthecity,peoplewantgood schoolzonesandarewillingtomovetogetthem.

Hendersonitselfhastwosides,withHenderson Heightsthemoreexpensiveofthetwo(West Harbourissimilar).Tragliaboughthisfirsthome onthecheaperMasseysideandsaysheloved itthere.Again,therearegreatschoolsandgood demandforproperties.

Westgatehasalotofbrand-newproperties andsubdivisions.Tragliathinksthesuburbhas notdroppedinpriceasmuchasotherlocations becauseofthequalityofthepropertiesandits proximitytothenewCostco,Westgateshopping complexandthemotorway.

NewLynnisanoldersuburbbutinrecentyears ithasseenalotofhigh-densitydevelopment.The suburbrateshighlywithfirst-homebuyersbecause it’soneofthemostcentralinWestAuckland-the motorwayisclose,anditboastsatrainstationand goodretailhub.

SPOTLIGHTON WHANGANUI WHANGANUI,onthewestcoastoftheNorth Island,Whanganui,onthewestcoastoftheNorth Island,hasgainedinpopularityinrecentyearsand itscentralsuburbfeaturesatnineontheHot100list.

WayneShum,ofValocity,saysthepopularityhas beendrivenbyaffordability,withentry-levelhomes costingthesameamountofmoneyasthedepositon anAucklandhouse.

RachelThompson,regionalgeneralmanager forBayleysWhanganui,saysabout30%ofowneroccupierbuyersarefromoutoftown,butpointsout peoplearealsorelocatingtorent.That’sbecauseof

thegoodschoolsandlifestyle.

“We’vegotbeaches,weare closetomountains,we’vegot theriverflowingthroughus.But Iwouldsayit’s[mainly]justcostof living–weareaffordable.”

Tragliathinksalot ofthefirst-homebuyers whogotheremight notbeintendingtostay forever,perhapshankering fornearbyAvondale,which hasgoodpublictransportlinks, includingtrains,busesandbikelanes.Avondaleis “justgettingbetterandbetter”,hesays,withhouses rangingfromentrylevelone-bedroomapartments bytheracecourseto$2mhousesintheheights.

“Cool”Hobsonvilleisasafesuburb,and thekindofplacepeoplemightgotoforthe communityvibeandschoolzones,sobuytheir firsthomeonlytoliketheareasomuchtheybuy theirsecondandthirdhomesthereaswell.

Hobsonvillealsohasmotorwaysnorthand central,andaferry.TragliathinksallAuckland suburbsaregentrifyingbutsayswhatgivesone theedgeoveranotherisproximitytotransport,as wellasamenities.

NoneoftheWestAucklandsuburbswerelikely tolosevalueandwhenmakingdecisionsonwhere theywanttolive,peopleshouldlookatthequality ofthehousingstock. •

Thetowncentreisattractivewithalotofheritage buildings,andit’seasytogetaround.Therearea lotofsportsgroundstoo,withthetownhosting theNewZealandMastersGameseverytwoyears where30differentsportsareplayed.

Asfarasthehousingstockgoes,there’ssomething

foreveryone,Thompsonsays.Thereare townhouses,standalonecharactervillas andnewdevelopments.

ToAucklandersfearfulofmissingout ontheircoffeeculture,shesaysfearnotas therearetonsofcafesalongtheWhanganui Riverandout inCastlecliff. There’splentytodoonthedoorstep,aswell, withresidentsinThompson’spatchhitting RuapehuNationalParkfortheskiing,biketrails andwalkingtracks. •

Hobsonville

Avondale

Westgate

SPOTLIGHTON MASTERTON NUMBERTENonthelistisMasterton,north ofWellingtoncityandthebiggesttowninthe Wairarapa.Shumsaysthepopularityhereisdue inparttoWellington’sunprecedentedCovidboom whichdrovealotofpeopleoutofthecity.

There’satrainstationanddecentsectionsizes stilltobebought.LJHookermanagingpartnerBen Moorcocksaysit’sjustagreatplacetolive.“We’ve gotbeaches,we’vegotbush.There’severything weneedhereyetwe’reanoffshootofWellington withatrainridethat’sjustoveranhouraway.”

Moorcockagreespeoplemovedoutof WellingtonintheCovideraandsayssome commutetoworkafewdaysaweek.Theycould buysomethingnear-to-newinMastertonfor $300,000-$400,000lessthanwhattheywouldpay inWellington-andlivenearlymortgage-freewith alovelylifestyletoboot.

TheMartinboroughwineregionisdownthe roadandtheboutiquetownofGreytownisa 20-minutedrive.

andthere’sgood, reliablehousingthat first-homebuyersstill haveashotataffording.

Therehasbeenalotof buildingintheareabuton alesserscalethansomeother areas,andpriceshaveriseninthelast10years. In2015,apieceoflandcouldbeboughtfor $100,000butthatwouldcostthreeorfourtimes asmuchnow.

Moorcockpredictsthetownwillbethehubof thelowerNorthIslandinthenextfiveor10years, sayingtheWellingtonFreeAmbulanceService isbuildingitsnewhubtherefortheentirelower NorthIsland.

Still,Moorcockpredictsthetownwillbethe hubofthelowerNorthIslandinthenextfiveor 10years,sayingtheWellingtonFreeAmbulance Serviceisbuildingitsnewhubthereforthe entirelowerNorthIslandbecauseinanational

No.86

HOKITIKA, WESTLAND

Averagepropertyvalue: $466,000

Scoredhighlyon:Price, Growth,Resilienceto Shocks,Affordability

No.87

TOLAGABAY, GISBORNE

Averagepropertyvalue: $399,000

Scoredhighlyon: Turnover,OwnershipMix, Affordability

No.88

FEILDING, MANAWATU

Averagepropertyvalue: $650,000

Scoredhighlyon: BuildingConsents

No.89

ALICETOWN, LOWERHUTT

Averagepropertyvalue: $794,000

Scoredhighlyon: PriceGrowth,Turnover, DevelopmentLand,Rental Growth

No.90

WINTON, SOUTHLAND

No.94

MATAMATA, MATAMATA PIAKO

Averagepropertyvalue: $803,000

Scoredhighlyon: Affordability,Population Growth

No.95

GLENEDEN, AUCKLAND

Averagepropertyvalue: $836,000

Scoredhighlyon: Amenities,Employment, NewStock

No.96

MANAIA, SOUTHTARANAKI

Averagepropertyvalue: $378,000

Scoredhighlyon: PriceGrowth,Turnover, Affordability,Rental Growth

No.97

OPOTIKI, BAYOFPLENTY

Averagepropertyvalue: $456,000

Scoredhighlyon: Affordability,Population Growth

No.98 BURNSIDE,

Rolleston,Canterbury CentralChristchurch

SPOTLIGHTON CANTERBURY

SNAPBACK 2024startedwithafloodoflistingsandhopesofrisingpropertyvalues,butmarketconfidencequicklyevaporatedinthefaceofhigh interestratesandeconomicuncertainty.Withthecostofmortgagesnowtumbling,expertsarepredictingabettertimeforhomeowners. CATHERINEMASTERS reports

Itwasatoughyearinrealestate. Itstartedwellbutflaggedin themiddle,earningavarietyof adjectivesfromtheexperts,from soggytounderwhelming.

Theyearbeganwithaslightupturninlistingsandmarketconfidence-but joblossesandlowconfidenceremained partofthepictureformuchof2024.

Buyerswerepresentedwithalotof choicewithasurplusofstockupfor grabs,someofitfrompeopleselling upbecausetheywerenotcopingwith thehighinterestrates,andotherswho wereuppingsticksandleavingfor Australia.

Insomepricebrackets,housessaton themarketformonthsonendasbuyers waitedfortheinterestratestodrop, whichtheyfinallydidbutnotbymuch.

Bytheyearend,therewasalittlemore cheeraroundinterestrates,andagents andeconomistsinterviewedbyOneRoof thoughtnextyearwouldbebetter.

Therewasonestandoutbuyer groupduringtheyear,however.

KelvinDavidson,chiefeconomistfor CoreLogicNZ,called2024theYearof theFirst-HomeBuyer.

“Certainly,theirmarketshareatour numbershasbeenatrecordhighs–27%,that’sarecord.Atsomepointsin thepast,it’sbeenbelow20%.”

ButDavidsonsaidtheyearoverall wasunderwhelming.Therewere acoupleofpercentagepointsof growthinthefirstfewmonthsbutby Septemberitwasaround-4%.

Joblossesstartedtocomethrough inFebruaryandMarch,thehoped-for interestratecutsdidnotcome,and activitylevelswerelow.

“Iguessrealitykindofhitagain. Propertieshaven’treallybeenchanging hands,sincesalesvolumesarereally low.Inalowturnoverenvironment, youdon’ttendtoseebigboomsin houseprices.”

Mortgageratesfallingwaskey torecovery,withDavidsonsaying thatwouldbethemainreasonthe downturnwouldlikelyendsoon.

“Interestratescanhaveapretty strongimpact,andaprettysudden impact.”

Thatdidnotmeantherewouldbe anewboom,though.Peoplewere stilllosingjobs,therewasstretched affordabilityandtherewerealotof listingstopickandchoosefrom.

WhileDavidsonexpectednextyear tobebetterforthehousingmarket,the introductionofDebt-to-IncomeRatios (DTIs)couldlimithousepricegrowth.

TURNINGPOINT ASBchiefeconomistNickTuffley’s adjectiveofchoicefortheyearwassoggy, sayinganymomentumfromlate2023 soonfizzledout.

Populationgrowthhadbeenstronglast year,andtheReserveBankhadsignaled itwasdonewithinterestraterisesbuta short-termflurryearlyin2024quickly diedawayandtalkturnedinsteadtothe possibilityofinterestratesgoinghigher again.

Salesturnoverflattenedwithmore listingscomingonthemarketleadingto “soggy”pricesthroughthemiddlepartof theyear,andstocksataroundforlonger thanusual.

However,withtheReserveBanksince signalingthestartofaneasingcycle, confidenceshouldbegintopickup,as wellassales,hesaid.

Tuffleyexpectedpricestobestronger nextyearwiththeASBpickingaround 10%growth.

KiwibankchiefeconomistJarrodKerr alsosaidfallinginterestrateswouldbe thegamechanger.

“That’stheturningpoint.Wecansort ofputtheflaginthegroundandsay‘hey, thisisthebottom’.”

Investors,whohadbeen“huntedby policymakers”,shouldbegintorecover. KerrsaidKiwibank’slendingtoinvestors thisyearwaslessthantofirst-home buyersandthatwas“extraordinary”.

“Normallyinvestorsarethree,four timesthesizeoffirst-homebuyersso that’sabigshift.”

“Interest ratescanhave aprettystrong impact,anda prettysudden impact.” CoreLogicchiefeconomist KelvinDavidson

Inthecomingmonthsthereshouldbe alotmoresignsoflifeacrosstheboard, hesaid.

“We’restillforecasting5%to7% growthinhousepricesnextyear.After a20%fall,that’sarecoveryofsome description.”

HOUSINGCRISIS Joblosses,however,didnothelpthat pictureandonaregionalbasisWellington wastheworstperformingregion.

“Theyarerecordingtwooutof10on theKiwibankeconomicscorewhichis prettymiserable,andthat’sfollowinga miserabletwooutof10lastyear.”

Aucklandscoredthreeoutof10atthe timeofwriting,andtheSouthIsland wasmostlyfours.

Thistimenextyear,however,Kerr expectedimprovements,fromthrees andfourstopotentiallyfivesandsixes.

Futureimprovementsaside,the housingcrisiswasstillalongway frombeingsolvedandmayhave gonebackwardsthisyearbecause fallsinhousepricesmadeithardfor developerstodevelop,hesaid.

Theunderlyingproblemwaslackof infrastructurespendingstillrestricting building:“Thereisachronicshortageof housingbecausewehaveunderinvested fordecades–thatstoryhasn’tchanged.” Kerrsaidasolutionwouldbetotake infrastructureoutofGovernmenthands andintoaninfrastructurefundsowork couldbeconsistentandoutsidethreeyearelectioncycles.

Photo/FionaGoodall

TOREALITY NEWZEALAND’SAVERAGE PROPERTYVALUESINCE2018 ThenewlistingvolumesintheninemonthstotheendofSeptember2024 wereup24%onthesameperiodlastyear–anextra17,390homesforsale.

$1,100,000

$1,000,000

$900,000

$800,000

NewZealand’saverage propertyvaluehita peakof$1.097min February2022–60% higherthanitwasat thestrartof2018

Frompeaktotrough, theaveragevalue fell14%to$943,600 From troughtoOctober 2024,thevalue hasgrown1.4% to$957,141

2018 2024 Thenewlistingvolumesintheninemonthstotheendof September2024wereup24%onthesameperiodlastyear–anextra17,390homesforsale.

Thechartshowstherolling12-monthchangeinresidential salesvolumessince2007comparedtothelong-termaverage

“Weneedpeoplewiththeabilityto thinklong-termanddeliverlong-term. Theyshouldbethinkingin15/30-year chunks,notthree-yearbites.”

WayneShum,seniorresearch analystforValocity,OneRoof’sdata partner,saidtheyearhadbeen subduedwithearlyoptimismnot panningout.

TheReserveBank’stalkabout keepingtheOCRhighforlongerto combatinflationmeantthebankskept interestrateshigh,keepingthemarket flat,however,he,too,saidnextyear shouldbebetter.

Shumexpectedtransactionnumbers toimprove,althoughsaidthatmightnot translatetoimmediatepriceincreases.

“We’restillalongwayawayfrom thosefixedoffers-on-the-table-by-thefirst-weekendsituationsthatwesaw in2021.”

Andpeoplemaystillholdofftheir housingplansastheinterestrate loweringcyclehadonlyreallybegun.

“Theyknowit’sgoingtocome downfurther,there’snourgencyat themoment,there’splentyofsupply outthere.There’snourgencyfor anyonetoactjustyet.”

FIRST-HOMEBUYERS DOMINATE Shumsaidlastyear’schangeof Governmenthadnothadmuchimpact onthemarket.Thepromisedchange totheforeignbuyerbandidnot happenandwhilethebright-linetest wasbroughtbacktotwoyearsatthe endofJuneitdidnotleadtoinvestorownedhousesfloodingthemarket.

InSeptembercamenewstheGDP wasdown2%,andredundanciesand joblosseshadflow-oneffects,such ashospitalitynotdoingwelland restaurantsandcafesclosing.

SanjeevJangra,anadvisorwith LoanMarketwhodealsmainlyin SouthAuckland,saidhisyearwas abusyoneregardlessofmarket conditionsandthatwaslargelydown tofirst-homebuyers.

HehadgoneoverseasaroundNew Year’sEve,hopingthingswouldbe quietbuthisphonestartedringing withpeoplewantingloans.

HeputthatdownpartlytoNew Year’sresolutions,andpartlydownto hope,becauseatthestartoftheyear peoplethoughtthebottomhadbeen reachedandtherewashypeinterest ratescouldfall.

ButthemarketwentflatbyMarch andAprilwhenpeoplerealisedthat wasnothappening,Jangrasaida lotofpeopleputtheirhomesonthe marketaheadoftheirmortgages comingupforrenewalonlytofind fewbuyers.

Healsohadtodealwithclientswho hadalreadybeenapprovedforloans losingtheirjobs,manyoftheminthe

Governmentsector,sonotbeingableto proceedwiththeirhouse-buyingdream.

“Governmentcontractorshavebeen contractingfor10-plusyearsandon areallydecentincomeandallofa suddenhavenothing.”

Pocketstightenedacrossthesector –JangrasaidFacebookmarketplaces hadbuilderssellingtheirtools becausetheywereoutofwork.

BySeptember,though,investors wereback,lookingforabargain,and propertyflipperswereactive.

MOREPAINTOCOME InfometricsprincipaleconomistBrad Olsensaidtheyearsawalotmore stressandpressureonmortgagors, asevidencedbythehigherlevelsof propertiesforsale.

Peoplecouldseetheywould strugglesoadjustedtheirown positionbeforeitwasforcedonthem, hesaid.

And,whiletechnicallyabuyer’s market,therewerealimitednumber ofpeopleabletogetamortgageto buyahouse.

Evenwithlendingeasingtherewere stillplentyofconcernsaroundjob securityandtheeconomiclandscape intheyearahead.Olsensaid Infometricsexpectedthe unemploymentratetoclimbto5.3% nextyearsofurtherpainwastocome.

“Alotofthinkingthisyearhasbeen whenisthepickupgoingtobegin andwethinkthepickupisstillalittle bitmorelimited,oratleastalittlebit morerestrained,thanothersseemto beexpecting.”

Thatwasbecauseasinterestrates starttocomedown,debttoincome limitswouldstarttobite.

Populationgrowthhadalsoslowed comparedtolastyear,butalotof housesbuiltinthelastcoupleofyears werecomingonline,sounlessthere wasamassivejumpinbuyernumbers therecoverywaslikelytobesoft.

“It’sasoftmarket–it’sbeenasoft sortofyear.”

Agentsalsoreportedachallenging yearofblood,sweatandtears,evenat thehigherbrackets.

LindaGalbraith,fromBarfoot& ThompsonParnell,saidthegeneral consensuswasithadbeenaninteresting buthardyearwithsomeagentsshe knewdescribingitas“diabolical”.

Thecountrywouldcrawloutofthe doldrumsbutvendorswouldneedto berealisticaboutprices,shesaid.

Everyonewasholdingoutforthe OCRtocomedownanother50basis pointssobuyerscouldborrowmore, andfortheforeignbuyerbanto beoverturned,whichshesaidhad beenapersistentrumourthroughout theyear–ifbothofthosethings happenedthemarketmightstartto moveagain.

againsthousepricefalls,whileDTIs wereputinplacetoprotectborrowers: “That’saboutsaying,‘Youmightthink youmightbeabletoaffordyourloanat currentinterestrates,butwhatiftheygo upinthefuture?Wewanttolimityour loansize.’”

DavidsondescribedtheDTIsas “aprettybiglandscapeshift”and couldtakeeffectsoonerthanhad beenexpected.

“Thewaythingsaregoingit lookslikewecouldgobelow 5.5%forarangeofmortgagerates prettysoon.”

ButwhileDTIscouldmake borrowingtrickier,theyarenot allbadnewsbecausewhilethey wouldlimittheamountpeoplecould borrow,theyshouldalsolimitthe extentofhousepricegrowth, whichmeanspeopleshould notneedtoborrowasmuch.

WHAT’S NEXTFOR Davidsonsaidtheoutlook fornextyearwaspositive, butnotedthatworldevents couldupendforecasts, suchasanescalationinthe MiddleEastconflict,rising oilpricesandtheoutcome oftheUSelection:“There’s alwaysrisks.Nothing isguaranteed.”

HANGINGOUTFORRELIEF pricesandwar,the2%levelgavethe ReserveBankalotmoreroomtolook throughvolatility.

“Ifinflationisrunningatfiveand thensomethingsuddenlydisruptsyour inflationforecastforsixmonthsit’sharder tosay,‘don’tworryaboutit’–yousortof havetoworryaboutit–whereasinnext yeartheyshouldbemorerelaxed.”

ANZwasalsoexpectingmortgagerates tobeinthefiveto5.5%range.Economist HenryRussellsaidtheriskwasthehousing marketbouncingbackmoreaggressively thanexpected,addingthehousingmarket hadmanydifferentdrivers,whichwere pointingindifferentdirections.

TheloosenedLVRsalongwithother policychanges,suchasthereinstatement ofinterestdeductibilityandreductionof thebright-linetest,supporteddemandbut Russellsaidtheeconomywasweakand unemploymentwasrising.

DTIswouldcomeintoeffectifhouse pricesdidincreaserapidlyandthatwould tempertheincrease:“Ithinkthebestwayto describethatpolicyisit’stryingtoreduce theboom/bustcycleofthehousingmarket, whichIthinkisagoodthing.”

BUSYYEARAHEAD MortgageadviserCampbellHastie,of HastieMortgages,expectsnextyeartobea busyoneforhisprofession.

ExpertspredicttheReserveBankwillkeepcuttingin2025 -andthatdebt-to-incomeratioswillputthebrakeson runawayhousepricegrowth. CATHERINEMASTERS reports

Decliningmortgagerates arewelcomerelieffor homeownersbutsomeexperts saybuyersshouldnowwatch outfortheimpactofdebt-to-income ratios,whichwilllikelybegintobind nextyear.

Higherinterestratesformostof 2024havelimitedhowmuchpeople canborrowbutwithratesnowwidely forecasttofalltobelow6%-oreven below5%-inthenext12months,the newDTIruleswilltakeoverlimiting howmuchpeoplecanborrow.

Ingeneral,owner-occupierswillbe abletoborrowamaximumofsixtimes theirincomewhileinvestorswillbeable toborrowamaximumofseventimes theirincome,withsomeexceptions,such asfornewbuilds.

TheReserveBankintroducedthe DTIsthisyearonJuly1,thesameday itloosenedloan-to-valuerestrictions ondeposits,butthoseinterviewedby OneRoofsaythemeasuretowatchis theDTIswhich–technically,atleast–shouldpreventrunawayhouseprices, whichcanhappenwithfallinginterest rates,asseenafterCovid.

TheReserveBank’sOctoberdecision tocuttheOCRby50basispoints to4.75%wasprecededbyandthen followedbybankscuttingmortgage rates,andmoremortgageratecutsare expectediftheReserveBankagaincuts theOCRinNovember.

CoreLogicchiefeconomistKelvin DavidsonsaidtheJulychangestoLVRs, whichgavebanksmoreleewaytolend tomorepeoplewithlowerdeposits,had nothadmuchimpactbuthethoughtthe DTIswouldalterthemarket.

LVRsweretheretoprotectbanks

“The windowfor goodbuying willclose relatively quicklyand competition forhousing willbegin toincrease sothose lookingto buyshould actquickly.” TellaCEOAndrew Chambers JarrodKerr,Kiwibank’schiefeconomist, saidinterestratesremainedthebiggest driverofthehousingmarketandthe recentOCRcutswereaffectingmarket sentiment.

Thecurrentfrontloadingofcutsmeant theOCRwaslikelytoreacharound 2.5%soonerthananticipated,andKerr expectedmortgageratestobearoundthe lowfives,withsomepossiblyinthehigh fours,bythistimenextyear.

“Whichissignificantreliefforpeople whowerefacing7%-plusnotthatlong ago.That’sthepowerofmonetarypolicy, socuttingthoserates,peoplearekindof hangingoutforit,andthere’sgoingtobe alotofreliefoutthere.”

DTIswouldmakepeoplemoreaware ofhowmuchleveragetheycouldtakeon, butmortgagetestrateswouldalsocome down,whichhadbeenaninhibitorfor sometogetloans.

KerrsaidDTIsshouldtempercrazy housepriceincreases.“Itwon’tenable thesamesortoflendingthatwegotafew yearsago.”

Westpac’schiefeconomist,Kelly Eckhold,saidmortgageratescouldget closeto4%nextyear,includingtheshorter one-yearandsix-monthrates.

“Youmightseeamorenormallysloping mortgagecurvewheretheshorterrates areslightlylowerthanthelongerrates.”

Thatwasamaterialimprovementin budgetingforfirst-homebuyersand madethemetricsforinvestorslook morepositive.

GLOBALVOLATILITY EckholdexpectsDTIstobiteifhouse pricesrunaheadofincomegrowth.

Westpac’shousepriceforecastwasfora 6.25%risenextyearbutEckholdsaidwith wagegrowthlikelytosettlecloserto4%in nominaltermstherewasnotahugegap betweenincomegrowthandhouseprice growthintheforecast.

Theinflationratewasontracktoreach 2%andflattenoutaroundthatlevel, whichwaswhattheReserveBankwanted.

Evenwith“plenty”ofsourcesof volatilityintheworld,suchaspetrol

HeexpectedtheReserveBankwould keepcuttingtheOCRthroughtonext winteruntilmortgagerateswerein thefives,sayingtherateitselfwasless importanttopeopleasthedownward trend,whichgaveconfidence,butpeople alsoneededjobsecurity.

“Ifthere’smorecashflowingthroughthe economyit’smorelikelypeoplewillkeep theirjobsand,therefore,morelikelythey willtakeonamortgageobligation.”

TellaMortgagesCEOAndrewChambers expectstheOCRtobeinthe4%snextyear andinthe3%sin2026–headvisedfirsthomebuyerstogetintothemarketnow becauseitwouldonlybecomeharderfrom hereonin.

“Thewindowforgoodbuyingwill closerelativelyquicklyandcompetition forhousingwillbegintoincreasesothose lookingtobuyshouldactquickly.”

Fallingrateswoulddriveborrowers toshorterrateperiodswithmorepeople goingbacktoone-yearfixedrates,hesaid.

“Aswecomeoutofthedowncycleand intogreaterjobsecurity,activitywillpick up–inflationimproving,ratesfalling,tax adjustmentsalladduptomorefinancial securityandthatwilldriveactivity.” •

NZ’scashrateiscurrently4.75%. Thenextratedecisionwillbeannouncedat 2pminWednesdayNovember27,2024

RETURN OF THE New Zealand s top 60 real estate agents kept setting records despite a return to the downturn CATHERINE MASTERS reports on a topsy-turvy 12 months in the housing market

ONEROOF’S top listings agents report the year has been challenging but one to relish because in a tough market they get to put their skills to work

While some of the names at the top are familiar, the noticeable change is a meteoric rise of agents who had been sitting on 30 or 40 listings in the previous 12-month period who this time listed sometimes well over 100 properties

Many were marketing a flood of townhouses which have hit the market, especially inAuckland where hardpressed developers have been keen to get rid of stock – 19 agents were new to the top 60, most of them inAuckland

The OneRoof data tells the story of a rush to sell at the start of the year which ended what felt like a year-long listings drought for many agents

New listings for the first four months of 2024 were up 31% on the first four months of 2023 (although still 5% below the 20-year average) It was enough to give the market a boost – albeit a temporary one

OneRoof analysed the 12 months to July 31 to ascertain the country’s top listings agents, a period which covers more than 117,000 residential listings

Overall, the average number of listings per agent was 11, down from 14 in the previous rankings – but the average search price per listing was just over $1 million, up 25%

Just over 10% of the 10,699 active agents had only one listing, down from 1246 in the previous 12-month period, while 585 agents managed to list 50 or more properties, up 49% on the previous period

Seventy-eight salespeople – 0.7% of the total working in New Zealand –managed to sign up 100 or more listings over the 12-month period, almost double the number in the previous 12 months. Of those, 10 managed to list more than 200 properties.

The super-listers were also reaping big rewards for their efforts The total

value of the stock brought to market by the top 60 listing agents was $9 3 billion –more than $1bn above the previous tally

WORKING HARDER The number one agent by volume of listings has not changed Cameron Bailey, of Harcourts Gold in Christchurch, listed just over $365m worth of real estate in the 12-month period – up 21% on the previous period His 263 listings had an average search price of $1 39m Scott McGoun, from Bayleys Wanaka, listed fewer properties (126), but his average search price topped the tables at $1 925m

“We’ve got to be better at what we do. I’m finishing work most nights at 9pm, it’s some long days at the moment. I’m in the office every day at eight in the morning.” CameronBailey,Harcourts While the OneRoof rankings didn’t take into account sales and sales prices – only listings volumes and search prices – it did show the super-listers were getting results, with much of the stock attached to their names selling, although getting deals over the line in a market overflowing with listings has not always been easy Average days to sell has blown in many cases Bailey says like every agent in the country, he and his team has had to work harder

“We’ve got to be better at what we

do I’m finishing work most nights at 9pm, it’s some long days at the moment I’m in the office every day at eight in the morning,” he says

“The work is there but it doesn’t fall on your lap like it used to, so you have to go and hunt for it ”

But that’s the measure of a good agent – not so good agents have been leaving and switching companies Bailey puts the success of his team this way: “In these sorts of markets when the tide goes out you can see who’s wearing togs ” He still orchestrates18 open homes on busy weekends, saying he does so not because he’s chasing the sale these days but because he loves the job and feels privileged to be a part of people’s journeys One of his clients is going through a cancer scare and it’s rewarding to help such clients

“Sometimes the best parts are not even the real estate side I’m sitting down with someone and hearing their life lessons and things like that Real estate is so emotional ”

CHALLENGING MARKET While most of his business is repeat or by referral, his listings are up partly as a reflection of the market, in that there are just more listings available But Christchurch has survived a bit better than other areas, too, as it did not have the highs that Auckland and Wellington had, which meant neither did it have the lows

“We’ve certainly had prices come back and it’s still challenging. I still think we’re going to have a challenging market for the next one or two years.”

Bailey’s biggest sale this year was $8m for a mansion in Fendalton, but he says his bread-and-butter range is more around the $1m mark, and he also recently sold a unit for $550,000 in Ilam

Those high-end sales stand out more but he says everyone gets the same treatment and service

Second on the list is Eddie Zhao, from Barfoot & Thompson’s West Harbour branch inAuckland. Zhao has moved up from the number 20 slot last year He had 255 listings for the period measured – that’s an 84.8% increase. The average value of his listings was over $1.33m and the total value was $340,898,000.

Zhao says a lot of townhouses have come onto the market but also says a lot of people left forAustralia which contributed to a sudden oversupply of

stock, leading to “slow motion” in the market

Properties were selling but were taking longer: “People just need a bit of persistence if they want to sell ”

The big change he noticed is that in a tough market people were preferring to buy the ready product for less money as opposed to buying off the plan

Zhao also sells top-end product but says that market is flatter because where he used to sell $5m or $10m homes regularly, that rate had fallen to only one or two

Demand is much higher in the firsthome buyer and downsizer market with locations like West Harbour popular because properties are not overpriced and Costco and the Mall appeal to buyers

BACK TO BASICS In Hamilton,YvennaYue of Harcourts took out the third highest spot, overtaken this year one place by Zhao Yue sells with partner CraigAnnandale, who is number 15

They are pulling out the stops to get sales across the line andYue says launch parties are a new selling technique the couple has been employing, resulting in some strong sales The whole team is involved, and she ropes in her children to help out

“If you have any agent saying they are not doing well, they are probably not doing the basics.” YvennaYue,Harcourts “You dress up nice and have proper champagne and canapes ”

Alot of rich people come along and at one launch party this year a VIC (Very Important Client) turned up in an $800,000 car This kind of turnout gives confidence to buyers who see people are still doing well in Hamilton, “so it’s not like the economy is going to crash. It just brings a fresh way to market the highend ones.”

Not all launch party attendees have $4 85m to spend, which is the amount fetched for a Chartwell Property, but they might have $2m, $3m or $4m to spend on

another property

Yue prides herself on getting listings across price ranges and says the majority of her listings are in the $700,000s

She also says an agent’s true talents come out in a tough market, which is why her team had been in demand, and consistency is everything

“You have to do the basics, to follow up the buyer, follow up the vendor, get the good photos, good marketing, good presentation, all these kinds of things

“If you have any agent saying they are not doing well, they are probably not doing the basics ”

Atop agent for Harcourts JK Realty in MtAlbert,Aman Gulia, sells across market price bands but has a strong reputation in developments, in part because he understands the ins and outs of the Unitary Plan

Number 14 on the list, Gulia says a lot of development sites that were sold in 2021 either came back on the market to be resold over the year or arrived in the market as completed townhouses

While hard work is important to success - Gulia was working 60 to 70 hours a week at the time of writing –reading the market is also important and two years ago his team decided not to sign any more off-plan sales because they saw the market was heading down

They also only list properties with realistic vendors, because pricing is what sells a property, Gulia says

“If you do the pricing right it will sell, even if it’s a brand-new townhouse in centralAuckland or WestAuckland, or it’s a really, really nice house or it’s a big development site - if it’s priced right it will sell ”

DEVELOPMENT SURGE The year has also been a good one for Garry Singh and the team he has built over 11 years The top agent for Ray White Takanini and Karaka sells across property types, from standalone houses and lifestyle properties to townhouses and developments

Singh was 21 on the list with 143 listings – a whopping 101 4% increase

The average value of his listings was $904,755 and the total value was $129,380,000

Singh puts his success down to a lot of hard work and long hours, and also working closely with mortgage brokers, banks, buyers and sellers and staying on top of the market

He,too,saysalotofpropertieshave cometomarketfrompeoplerelocating toAustralia,butthebuyingtendstostay stronginSouthAucklandbecausethere isalotofemploymentaround,suchasat theairportandatHighbrook.

Alotofsaleshavegonetofirst-home buyersinterestedinanythingfrom quarteracrepropertiestotownhouses, andsitesthatcanaccommodatemultiple dwellingswerealsosold.

Singhwasalsoputtinginlonghours –hehadjustfinished36hoursinthree days.Heworkssixdaysaweekand creditshisteamwhichhesaysperform multipletasksandis“tenoutoften” acrossallformatsandplatforms.

“Therealityiswe’rejustdoingthe samethingagainandagainandbeing thereforpeopleinthetoughtimes.”

AnewentrantonthelistwasRocky Liuatnumber26.TheBarfoot& ThompsonagentisbasedinAlbanybut sellsacrosstheNorthShoreandinWest Auckland.Hislistingswereup88.9%on thesameperiodlastyear.

Alotofhisstockisbrand-new townhousesaswellasdevelopments andsubdivisions,buthealsosells standalonehouses.

Liusayssomeofthetownhouses hehaslistedareveryhighspecand

architecturally-designedinareaslike TakapunaandMilford.Somehavelifts whichappealstodownsizers.

Heisnoticingatrendofdevelopers hiringarchitectstoincorporateoutdoor spacesfortownhouses,becausesome peoplestillwantthat,butsomebuyers, especiallyyoungpeople,likethatthereis suchlittlemaintenance.

“Becausemostofyoungpeople,young family,theydon’twanttodoanygarden. Theyaretoobusyduringthedayand afterwork.Theyjustwanttogohome,sit onsofaandhavedinnerandmaybehave somefamilytimeandthat’sit.”

InWanaka,ScottMcGoun,ofBayleys, wasatnumber36andwhilehehad droppedalittlehesaysthat’sprobably moretodowithhisteamrestructuring becauselistingsareupandtheteam hasexpanded.

McGoun’saveragesearchprice toppedthetablesat$1.925mandhesays Wanakapriceshaverisenandtherehave beenmoremulti-million-dollarsales takingplace.

Wanakahasalotofabsenteeowners andthechangestothebright-linetest hadfreeduppeopletosellwithout beingtaxed,whichalsoboostedlistings numbers,ashadthelittlebitofreliefseen oninterestrates. •

ONEROOFPOWERRANKINGS2024 ThenewOneRoofPowerLististhedefinitiveguidetothesuperagentssellingthemostrealestateinNewZealand. Therankingsshowthe60agentswhohavelistedthemostresidentialpropertiesonOneRoofinthe12monthstoAugust2024. Alsogivenforeachagentaretheannualchangeintheirlistingsvolumes,theestimatedworthoftheirlistings,basedon OneRoofsearchpricedata,andtheaveragevalueofthehomestheyareselling.

9 5 2 3 8 4 12 11 10

CAMERONBAILEY HARCOURTS,

EDDIEZHAO BARFOOT&THOMPSON,

Photo/FionaGoodall

FINDING BUYERS Findingtheperfectbuyerforyourpropertycan bearealchallengeinanymarketconditions. However,there’sonenamethatconsistently deliversresults–Bayleys.

AsNewZealand’slargest,full-servicerealestateagency, ourextensivelocal,nationalandglobalnetworkscombined withtheuseofanexclusivesuiteofmarketingproducts,

enableustolocateandengageprospectivebuyers anywhereinNewZealand,andaroundtheworld.

Tounlockyourhome’sfullpotentialbyreaching moreoftherightbuyers,talktoustoday.

034500200 I otago.bayleys.co.nz LICENSEDUNDERTHEREAACT2008

SHARONDONNELLY

SANDYWANG

SABRINAZHANG

SHANEBROCKELBANK +17.9%

BARFOOT&THOMPSON, +37.5% TOTALVALUE: $151,000,800

MICHELLEFU HARCOURTS, CHRISTCHURCH

MEGANBAILEY

LOWERHUTT

EMMAYOUNG

WELLINGTON

CHELSEALIU BARFOOT&THOMPSON, AUCKLAND

Stars INTHEIREYES Kiwislovetakingapeekinsidethehomesoftherichandfamous,withcelebrityproperties dominatingOneRoof’slistofmostviewedhomesfor2024.Butasthenumberonespot makesclear,buyerslovebargainmore. CATHERINEMASTERS reports

Ahumbletwo-bedroomhouseinHamilton trumpedmansionsandcelebrity-owned stunnerstotakeoutthemost-viewed listingspotonOneRoofthisyear.

Whileaffordablehomeswereamongthose attractingplentyofeyeballs,fancyhousesstill gottheirfairshareofviews,especiallythose beingsoldbynamesKiwiswillrecognise–like fashioniconDameTreliseCooperandformerTux WonderDoghostMarkLeishman,bothofwhose propertiesfeaturedinthetop10.

AnanalysisofsearchesonOneRooffor2024 showsprice,location,andstocknumberswerethe biggestinfluencingfactorsinthemarket.

Thesuburbswiththemostsearchestended tohavegoodamenitiesandthelargestrangeof “affordable”homes.

Ofthetop10most-viewedlistings,eightwere inAuckland–butmanyhomesinthetop100 werebeachhomesinholidaydestinationslike Coromandel.

Themediansearchpriceforthoselookingin Aucklandwasjustunder$1m,withhomesin Papatoetoe,NewLynn,andMountWellington popularwithhousehunters.

Attractivelypricedsuburbsdominatedbuyer searchesinCanterbury,Wellington,andWaikato.

Exceptionsincludedthewealthyenclavesof Remuera,MountMaunganui,Queenstown,and FlagstaffinHamilton,whichallfeaturedhighly inbuyersearchesandshowedthestrengthof establishedblue-chipsuburbs.

NZ'SMOSTPOPULAR HOMESOF2024: inquiryhadbeenconsistent,especiallyamongthe first-homebuyermarket.

“Itwouldprobablybethebesttwo-bedroom weatherboardpropertyonthemarketacrossHamilton.

“PuketeisgreatproximitytoTheBase(shopping centre),it’sgotgreatproximitytotheexpressway.”

Therehadbeenoffersonthepropertybutnotatthe rightlevel,Willissaid,andwhileshecouldnotreveal whatthatlevelwas,OneRoofrecordsshowthe2021 RVis$640,000.

FordRoad,HikurangiRd2,Whangarei WithdrawninJune

Listingagent:AlexSmits,RayWhite

95PuketeRoad,Pukete,Hamilton Stillonthemarketforsale

Listingagents:ChristineWillis andRayMitchell,Harcourts

No.1 Thenumberonespotwenttoaspacious100sqmtwobedroomhousewithtimberfloorsinPukete,tothe northofHamilton’sCBD.

Thepropertywasstillonthemarketatthetimeof writingwithChristineWillisfromHarcourtssaying

OneRoofasfarasheknewthehapuwasnolonger occupyingthebuildingbutwasunawareifanyprogress hadbeenmadebetweenNgatiHauandtheCrown. Whenthepropertywasfirstlisted,therehadbeen plentyofinterest,hesaid,witharound20ormore peoplelookingatsubmittingatender,includingpeople wantingtousethesiteasananimalrescuethroughto peoplelookingatcommunalliving.

TheCrossing,WaihekeIsland SoldinAprilfor$12m

Listingagents:JacksonHawkesby-Lyne andRichardLyne,RayWhite

No.2 Thenextmost-viewedlistingwasapropertyatthe otherendofthepricespectrum.Thevineyardhome ofbroadcasterJohnHawkesbyonWaihekeIsland, whichoverlooksChurchBay,soldfor$12m,morethan doubletheproperty’s2021CVandtheisland’shighest salefortheyearatthetimeofwriting.

HawkesbysaidinJunethepropertywasboughtby thefirstpeopletoinspectit:“Wewantedthepeople whoboughtittoloveitlikewehaveandwe’reover themoonit’shappenedthatway.”

GrandsonJacksonHawkesby-Lyne,ofRayWhite, whowassellingalongwithhisfatherRichardLyne, said:“Ihadarealsenseofresponsibilitytogetthis rightformygrandparents.”

No.3 Thethirdmost-viewedwasupinWhangarei,inthe northofthecountry,andthiswasamongthemost controversiallistingsoftheyear.

AnabandonedschoolinHikurangi,complete withemptyswimmingpool,wasputupforsale butultimatelywithdrawnafterbeingoccupiedby NgatiHau.

AOneRoofstoryfromJunesaidthehapuhad wantedtheCrowntopurchasethepropertybutwere declinedsomovedintothesiteattheendofMarch, vowingtostaythereuntiltherewasaresolution.

Thelistingagent,AlexSmits,fromRayWhite,told

301/20DevoreStreet,StHeliers,Auckland Stillonthemarketforsale

Listingagent:AaronFoss,Barfoot&Thompson

No.4 Anothercelebrityhomewasthebarelylived-in apartmentoffashioniconDameTreliseCooperinthe SonatabuildingonDevoreStreet,StHeliers.

Atthetimeofwriting,theproperty,whichoccupies thethirdfloorofthebuilding,wasstillonthemarket, havingpassedinatauctioninMay.

DameTreliseandhusbandJackboughttheapartment offtheplaninlate2022for$10.5mbutwantedtospend moretimeoverseaswiththeirfamily.

Barfoot&ThompsonagentAaronFosstoldProperty Reporttheapartmentwasinthe$8mrangeandwhile therehadbeenoffers,sometimesdealsatthatlevel couldbecomplicatedtogetacrosstheline.

Hismarketingdescribes“breath-takingexpansive views”ofRangitotoIslandandthesparkling WaitemataHarbour.

Buyersoftheproperty,whichfeaturedabeautifullycraftedbespokeinterior,wouldbebuyingDame Trelise’sstyleandtaste,hetoldOneRoof.

TRELISE COOPER

JOHN HAWKESBY

ofagrand900metresolidconcrete villaspanningacrossa2688metre doublesectiononHerneBay’smost prestigiousstreet.”

MARKLEISHMAN &JORAYMOND

WimbledonWay,Remuera,Auckland SoldinJulyforanundisclosedamount

Listingagent:BenRyken,RayWhite

No.5 Alowerkeypropertyinanupmarketsuburbtook outthefifthmost-viewedslot.An“affordable”threebedroomhouseinWimbledonWaysoldfastwiththe turnoutsuchthatRayWhiteagentBenRykentold OneRoofinJulythatFOMO(fearofmissingout)was onitswaybackintothehousingmarket.

Thepropertyhadbeeninitiallymarketedfor around$1.1mwithnotakersbutwhenRyken relauncheditwithadeclaredreserveof$950,000 thenewtacticresultedinasaletofirst-homebuyers withindaysforunder$1m.

Thehousehasfivebedroomsincludingguest house,6.5bathrooms,atenniscourtandpavilion, gym,pool,winecellar,extensivegaragingand completeprivacy.

Gibbonswouldnotrevealthecostofthebuild,

KingStreet,GreyLynn,Auckland SoldinJulyforanundisclosedamount

Listingagents:RyanTeeceandReubenPayn,Whitefox

No.6 Theformerhomeofdragqueenswhohaveappeared onRuPaulDragRaceDownUndercaughttheeyeof plentyofsearchersthisyear.

AnitaWigl’itandIvannaDrink,akaNickHalland ShameelKennedy,soldtheirGreyLynnproperty inAucklandforanundisclosedsumnorthofthe property’s$1.575mCV.

Thepairputthethree-bedroomvillaonthemarket aftertheirmarriagebrokeuplastyearwithHalltelling OneRooftheyhadpouredtheirheartintothehouse.

Theformercouplehadtransformedthevilla insideandoutandhadturnedtheirshedintoalarge wardrobefortheircostumes,wigsandshoes.

No.7 SearcherswerealsodrawntoamansioninHerneBay, oneofAuckland’smostsalubriouswaterfrontsuburbs.

TheCVontherenovated-to-luxurypropertyisa cool$23.5mandthehouse,ownedbyKiwiproperty developerKurtGibbonsandhiswifeMakere,wasstill onthemarketatthetimeofwriting.

WallRealEstatekeptthelistingcopyshortand sweet:“JustcompletedFearonHaytransformation

OceanbeachRoad,MountMaunganui,Tauranga SoldinFebruaryfor$5.6m

27MarineParade,HerneBay,Auckland Stillonthemarketforsale

Listingagents:GrahamandOllieWall,WallRealEstate

whichincludedearthworksontheclifffronttomake alevelsurfaceforatenniscourt,buttoldOneRoof earlieritwaswelloverthe$8mhehadinitially plannedtospend–“these[builds]costafortune.I’m intheindustryandevenIcouldn’tsticktobudget.”

No.8 Alsostillforsaleatthetimeofwritingwasthe lifestylehomeofacelebritycanine-owner.

MarkLeishman,starofthe1990sTVhitTux WonderDogs,puthis1.1hapropertyinMatakanaon themarketafterthedeathofmuch-lovedlabradors MickeyandBuddylastyear.Thelabscameafterthe 2000deathofDexter,themostfamousoftheTux WonderDogs.

7RosemountRoad,Matakana Stillonthemarketforsale

Listingagent:KellieBissett,Bayleys

Leishman,whoseshowoutrankedOprahandMr Beaninitsday,boughtthehousewithhiswifeJo RaymondafterCovidbrokeout,tellingOneRoofthe deathofthedogshadbeenablow.

“It’stheendofquiteanerareally.I’vehaddogsfor 42years.Therewasneveradaywherewedidn’thave adoginthehouse.”

ThepropertyisbetweenWarkworthandMatakana andhasbushandtrackstoastreamwitha180-yearoldkauritree.

Listingagent:CalebPaterson,PatersonLuxury

No.9 Avintage1960sbrickandtilebeachfrontbachwith abigpricetagputaMountMaunganuiproperty,in Tauranga,intothetop10most-viewedlistings.

Thepropertyfetchedwellunderits$9.67mCV, sellingfor$5.6m,butwasoneofthelastoftheoldschoolbeachhomesalongOceanbeachRoadand MarineParadewheremanysuchpropertiesarebeing renovated,rebuiltorredeveloped.

AgentCalebPaterson,ofTelosGroup,tookonthe listingafterotheragentshadhaditforawhile,telling PropertyReportthebuyerswereexpatsfromSydney whowereoriginallyfromtheareaandplannedon renovatingandusingthehouseastheirfamilybach.

Interesthadbeenstrongfromdevelopersbutthe sitehadsomeconsiderationswhichlimitedtheusable landareaforbuildingandthepricefetchedwasafair one,Patersonsaid.

BeachRoad,Waiake,Auckland SoldinMayfor$2.37m

Listingagents:ShaneCooteand MichelleCampbell,RayWhite

No.10 Squeakingintothetop10wasapropertywhich offeredupafreeTesla.Whilethatmayhaveaccounted forsomeoftheviews,https://www.oneroof.co.nz/ news/free-tesla-house-returning-expats-buy-thehome-but-pass-on-the-car-45474theeventualbuyers passedontheflashcar.

Therenovatedfive-bedroompropertyonBeach RoadinWaiake,onAuckland’sNorthShore, hadcomewithaneye-catchinglistingsayingthe ownerswerepreparedtoselleverythingbefore headingoverseas.

WhiletheTeslahadhelpedthepropertystandout fromthecrowd,RayWhiteagentShaneCootetold OneRooftheclincherwasthatthehousewas“pretty damncool”.OneRoofrecordsshowthesalewas madeinMayfor$2.37m. •

Note:Propertiesmarkedasstilllistedforsalewere liveonOneRoofatthetimeofwriting.Streetnumbers havebeenleftoffofsoldlistingsforprivacyreasons.

THE RICH LIST feelssqueeze the the Wealthybuyerswerespoiledforchoicein2024,withafloodoftrophyhomeshittingthemarketatthestartoftheyear. However,$10m-plussaleswerethinontheground, CATHERINEMASTERS reports

THETOPEND ofthehousing marketfeltthecrunchthisyear. OneRoof’sanalysisofsettled salesdatashowsjustfivehomes –allinAuckland-soldfor$10million andaboveintheninemonthstotheend September.Threetimesasmanyhomes fetchedeight-figuresumsoverthesame periodlastyear.

Thebig-ticketpurchasescentred aroundthetraditionalwealthyAuckland suburbsofRemuera,Orakei,Parnelland SaintMarysBay.

Wealthybuyerswerespoiledforchoice, withplentyoftrophyhomeshittingthe marketinthefirstthreemonthsofthe year.Buttheliftinlistingsdidn’tturninto aliftinhouseprices.Manyoftheprestige homeslistedthisyearwerequietly withdrawnfrommarketorhadtheir pricescut.

Somearelikelytoberelistednextyear, whenthemarketismorefavourable.

AgentsspokentobyOneRoofhad differenttheoriesastowhysalesatthetop levelweredown,thoughmostindicated thepeoplewhobuyandsellinthe “rarefiedair”atthetopoftherealestate chainwerenotparticularlyimpactedby theeconomy,norbywhattherestofthe marketwasdoing.

Thehighestpricepaidwasacool $21.84mforanItalian-stylestone mansiononParitaiDrive,Orakei–one ofAuckland’swealthieststreetsandone oftwopropertiesinthetop10onthe trophystreet.

Alocalfamilyclaimedthe813sqm five-bedroomhomeamidstronginterest frominternationalbuyers,including Singaporeans,whoareexcludedfrom theforeignbuyerban.

Whilethelocalspaidaheftysum, thepriceisstillsomewayoffthesuburb recordof$38.5mpaidfortheformer Hotchinmansion11yearsago.

NOMESSINGAROUND

ThedealwascompletedbyPauland JonathanSissons,ofNewZealand Sotheby’sInternationalRealty.Paultold OneRoofhewasawareofothersalesin theworksthatcouldstillbeathisrecord –buthewasprettysureheandJonathan heldoneofthebesttenderprocessesfor theyear,sayingthesix-weekcampaign closedat4pmonMarch16withthedeal doneby8.30pm.

That’spartlybecausevendorsatthat levelknowwhattheywant,havedone theirresearchandaregoodtodealwith. “Theygetwheretheyarebybeinggood, solid,cleverbusinesspeoplewhoknowthe valueofadollarandtheyknowwhenthey

seetherightpropertyandfallinlove withitandtheydon’tmessaround.”

Thehousestoodoutforkeyreasons, onebeingthe“todiefor”180-degreeview fromthecitytoWaihekeIsland.Another wasthe“magnificence”ofthehouseitself, andanotherwasthegarage–thiswasno ordinaryoil-stainedgaragebutonewith tiledfloorsandroomforalotofcars.

“Peoplehavealotofbeautifulcarsand wehadgaragingforatleastseven,possibly eight,anditwasabeautifulgarage.”

Pauldidnotthinkthelowernumber ofhighpricebracketsalesthisyearhad anythingtodowithmarketconditions. Rather,abusyyearatthetopendoneyear probablyjustmeantfewerqualityhomes incirculationthenextyear.

Peoplestayedinsuchhomesin generationalcycles,waitingforthe childrentogrowupandleaveforgood beforedownsizing,hesaid.

Cominginatnumbersevenonthelist wastheotherParitaiDriveproperty,which soldfornearly$10m.