NORTHLAND

NORTHLAND

$874,000$900,000$826,000 2.9%5.8%3992

FARNORTH $792,000$799,000$714,000 0.9%10.9%1312

AHIPARA

CABLEBAY

$674,000$654,000$573,0003.1%17.6%31

$871,000$858,000$752,0001.5%15.8%50

COOPERSBEACH $906,000$907,000$783,000 0.1%15.7%30

HARURU

$881,000$867,000$777,0001.6%13.4%41

KAEO $823,000$844,000$706,000 2.5%16.6%38

KAIKOHE $388,000$389,000$346,000 0.3%12.1%60

KAITAIA $451,000$464,000$400,000 2.8%12.8%130

KARIKARIPENINSULA

KAWAKAWA

$787,000$810,000$669,000 2.8%17.6%77

$495,000$513,000$472,000 3.5%4.9%33

KERIKERI $1,140,000$1,140,000$1,032,0000.0%10.5%301

MANGONUI $839,000$826,000$714,0001.6%17.5%37

OKAIHAU $787,000$784,000$683,0000.4%15.2%23

$560,000$563,000$498,000 0.5%12.4%27

OPONONI

PAIHIA $837,000$820,000$725,0002.1%15.4%62

RUSSELL $1,455,000$1,537,000$1,355,000 5.3%7.4%41

TAIPA $774,000$765,000$660,0001.2%17.3%20

WAIPAPA

4.7% 5.5%27265

AUCKLANDCITY$1,583,000$1,658,000$1,693,000 4.5% 6.5%6966

AUCKLANDCENTRAL $612,000$618,000$665,000 1.0% 8.0%840

AVONDALE $1,069,000$1,111,000$1,193,000 3.8% 10.4%253

BLOCKHOUSEBAY $1,237,000$1,293,000$1,343,000 4.3% 7.9%183

EDENTERRACE $854,000$877,000$887,000 2.6% 3.7%102

ELLERSLIE

$1,354,000$1,428,000$1,464,000 5.2% 7.5%153

EPSOM $2,277,000$2,419,000$2,366,000 5.9% 3.8%217

FREEMANSBAY $1,798,000$1,859,000$1,816,000 3.3% 1.0%84

GLENINNES $1,233,000$1,315,000$1,400,000 6.2% 11.9%129

GLENDOWIE $2,438,000$2,568,000$2,546,000 5.1% 4.2%113

GRAFTON $704,000$723,000$778,000 2.6% 9.5%72

GREAT BARRIERISLAND (AOTEA) $835,000$836,000$754,000 0.1%10.7%51

GREENLANE $1,963,000$2,072,000$2,069,000 5.3% 5.1%75

GREYLYNN $1,937,000$2,048,000$2,028,000 5.4% 4.5%194

HERNEBAY $3,816,000$3,880,000$3,907,000 1.6% 2.3%64

HILLSBOROUGH $1,390,000$1,470,000$1,515,000 5.4% 8.3%81

KINGSLAND $1,507,000$1,545,000$1,608,000 2.5% 6.3%60

KOHIMARAMA $2,328,000$2,410,000$2,475,000 3.4% 5.9%75

LYNFIELD $1,414,000$1,502,000$1,505,000 5.9% 6.0%45

MEADOWBANK $1,798,000$1,840,000$1,937,000 2.3% 7.2%78

MISSIONBAY $2,346,000$2,448,000$2,430,000 4.2% 3.5%83

MORNINGSIDE $1,379,000$1,453,000$1,486,000 5.1% 7.2%67

MOUNTALBERT $1,470,000$1,534,000$1,574,000 4.2% 6.6%235

MOUNTEDEN $1,924,000$2,011,000$2,018,000 4.3% 4.7%307

MOUNT ROSKILL $1,229,000$1,310,000$1,318,000 6.2% 6.8%276

MOUNTWELLINGTON $1,060,000$1,130,000$1,087,000 6.2% 2.5%344

NEWWINDSOR $1,344,000$1,411,000$1,419,000 4.7% 5.3%52

NEWMARKET $963,000$998,000$1,031,000 3.5% 6.6%31

ONETREEHILL $1,439,000$1,523,000$1,546,000 5.5% 6.9%56

ONEHUNGA $1,220,000$1,277,000$1,330,000 4.5% 8.3%290

ORAKEI $2,526,000$2,642,000$2,612,000 4.4% 3.3%91

OTAHUHU $846,000$899,000$886,000 5.9% 4.5%175

PANMURE $1,102,000$1,163,000$1,206,000 5.2% 8.6%107

PARNELL $2,211,000$2,238,000$2,240,000 1.2% 1.3%155

POINTCHEVALIER $2,038,000$2,131,000$2,209,000 4.4% 7.7%140

POINTENGLAND $1,169,000$1,243,000$1,384,000 6.0% 15.5%42

PONSONBY $2,558,000$2,645,000$2,631,000 3.3% 2.8%87

REMUERA $2,949,000$3,047,000$2,995,000 3.2% 1.5%395

ROYALOAK $1,501,000$1,615,000$1,580,000 7.1% 5.0%60

SAINTJOHNS $1,579,000$1,705,000$1,710,000 7.4% 7.7%91

SAINTMARYSBAY $3,091,000$3,212,000$3,111,000 3.8% 0.6%32

SANDRINGHAM $1,530,000$1,583,000$1,583,000 3.3% 3.3%172

ST HELIERS $2,406,000$2,606,000$2,512,000 7.7% 4.2%222

STONEFIELDS $1,675,000$1,753,000$1,726,000 4.4% 3.0%74

THREEKINGS $1,246,000$1,303,000$1,326,000 4.4% 6.0%45

WAIOTAIKIBAY $1,629,000$1,701,000$1,804,000 4.2% 9.7%32

4.9% 9.1%40

WATERVIEW

5.1%0.2%40 MAUNU $1,060,000$1,119,000$1,044,000 5.3%1.5%78

MORNINGSIDE $608,000$643,000$609,000 5.4% 0.2%46

NGUNGURU $1,088,000$1,188,000$1,066,000 8.4%2.1%32

ONETREEPOINT $1,155,000$1,222,000$1,114,000 5.5%3.7%173

ONERAHI $686,000$715,000$690,000 4.1% 0.6%139

PARAHAKI $812,000$856,000$800,000 5.1%1.5%26

PARUABAY $1,177,000$1,257,000$1,146,000 6.4%2.7%39

RAUMANGA $540,000$577,000$537,000 6.4%0.6%61

REGENT $720,000$784,000$737,000 8.2% 2.3%33

RIVERSIDE $779,000$828,000$789,000 5.9% 1.3%20

RUAKAKA

$986,000$1,051,000$937,000 6.2%5.2%89

RUATANGATAWEST $1,079,000$1,144,000$1,031,000 5.7%4.7%22

TAMATERAU $1,158,000$1,279,000$1,182,000 9.5% 2.0%24

TIKIPUNGA $649,000$697,000$652,000 6.9% 0.5%189

TUTUKAKA $1,397,000$1,431,000$1,254,000 2.4%11.4%39

WAIPU $1,213,000$1,302,000$1,141,000 6.8%6.3%103

WAIHEKEISLAND $3,520,000$3,610,000$3,423,000 2.5%2.8%31

FRANKLIN

$1,174,000$1,226,000$1,119,000 4.2%4.9%1246

BOMBAY $1,778,000$1,862,000$1,681,000 4.5%5.8%22

CLARKSBEACH $1,279,000$1,358,000$1,255,000 5.8%1.9%52

GLENBROOK $1,251,000$1,367,000$1,261,000 8.5% 0.8%58

HUNUA

PAERATA

PATUMAHOE

PUKEKOHE

RAMARAMA

WAIUKU

$1,562,000$1,654,000$1,496,000 5.6%4.4%31

$1,419,000$1,509,000$1,399,000 6.0%1.4%38

$1,338,000$1,408,000$1,313,000 5.0%1.9%31

$989,000$1,044,000$995,000 5.3% 0.6%605

$1,764,000$1,871,000$1,744,000 5.7%1.1%42

$959,000$1,025,000$945,000 6.4%1.5%261

$785,000$801,000$727,000

PAPAROA $769,000$784,000$720,000

$1,128,000$1,122,000$992,0000.5%13.7%53 KAIPARA$981,000$974,000$891,0000.7%10.1%610 DARGAVILLE $574,000$569,000$542,0000.9%5.9%97 KAIWAKA $1,022,000$1,052,000$943,000 2.9%8.4%64 MANGAWHAI $1,401,000$1,431,000$1,263,000 2.1%10.9%123 MANGAWHAIHEADS $1,529,000$1,475,000$1,302,0003.7%17.4%101 MAUNGATUROTO

2.0%8.0%44

1.9%6.8%20 TINOPAI $672,000$673,000$622,000 0.1%8.0%20 WHANGAREI $899,000$950,000$883,000 5.4%1.8%2070 AVENUES $581,000$614,000$614,000 5.4% 5.4%35 GLENBERVIE $1,300,000$1,380,000$1,200,000 5.8%8.3%28 HIKURANGI $629,000$673,000$618,000 6.5%1.8%41 HORAHORA $707,000$744,000$736,000 5.0% 3.9%24 KAMO $817,000$853,000$785,000 4.2%4.1%278 KAURI $1,225,000$1,277,000$1,117,000 4.1%9.7%21 KENSINGTON $683,000$729,000$673,000 6.3%1.5%101 MAUNGATAPERE $1,147,000$1,209,000$1,145,000

LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS GREATERAUCKLAND $1,398,000$1,467,000$1,480,000

WHANGAREIHEADS $1,142,000$1,228,000$1,126,000 7.0%1.4%36 WHAUVALLEY $740,000$777,000$733,000 4.8%1.0%48 WOODHILL $626,000$670,000$647,000 6.6% 3.2%42

$1,114,000$1,171,000$1,226,000

WESLEY $1,194,000$1,286,000$1,369,000 7.2% 12.8%28 WESTMERE $2,699,000$2,751,000$2,782,000 1.9% 3.0%70 WAIHEKEISLAND $2,087,000$2,192,000$1,951,000 4.8%7.0%286 OMIHA $1,169,000$1,206,000$1,263,000 3.1% 7.4%20 ONEROA $2,300,000$2,388,000$2,246,000 3.7%2.4%72 ONETANGI $2,071,000$2,124,000$2,062,000 2.5%0.4%40 OSTEND $1,522,000$1,568,000$1,520,000 2.9%0.1%53 PALMBEACH $2,080,000$2,134,000$2,048,000 2.5%1.6%20 SURFDALE $1,502,000$1,556,000$1,487,000 3.5%1.0%50

CURRENT

THREE

AGO 12

QoQ

YoY

SETTLED SALES LAST12 MONTHS

LOCATION

AVERAGE PROPERTY VALUE

MONTHS

MONTHS AGO

CHANGE

CHANGE

$874,000 5.8% AVERAGEPROPERTY VALUEYEARONYEARCHANGE

$1,398,000 5.5% AVERAGEPROPERTY VALUEYEARONYEARCHANGE OneRoof.co.nz 29

GREATER AUCKLAND

MANUREWA $893,000$923,000$945,000 3.3% 5.5%678

MANUREWAEAST $771,000$809,000$907,000 4.7% 15.0%94

MARAETAI $1,613,000$1,684,000$1,731,000 4.2% 6.8%37

MELLONSBAY $2,191,000$2,292,000$2,394,000 4.4% 8.5%47

NORTHPARK $1,472,000$1,563,000$1,631,000 5.8% 9.7%53

OTARA $832,000$892,000$860,000 6.7% 3.3%116

PAKURANGA $1,269,000$1,338,000$1,336,000 5.2% 5.0%137

PAKURANGAHEIGHTS $1,258,000$1,307,000$1,304,000 3.7% 3.5%127

PAPATOETOE $885,000$959,000$937,000 7.7% 5.5%755

RANDWICK PARK $816,000$855,000$893,000 4.6% 8.6%96

SHELLYPARK $1,628,000$1,729,000$1,784,000 5.8% 8.7%31

SOMERVILLE $1,550,000$1,657,000$1,730,000 6.5% 10.4%52

SUNNYHILLS $1,792,000$1,869,000$1,841,000 4.1% 2.7%53

THE GARDENS $1,357,000$1,443,000$1,421,000 6.0% 4.5%49

TOTARA HEIGHTS $1,084,000$1,147,000$1,165,000 5.5% 7.0%29

TOTARA PARK $2,262,000$2,446,000$2,332,000 7.5% 3.0%31

WATTLEDOWNS $1,107,000$1,189,000$1,146,000 6.9% 3.4%117

WEYMOUTH $860,000$901,000$897,000 4.6% 4.1%197

ONEROOF VALOCITYHOUSE VALUEINDEX

WIRI

NORTHSHORE $1,541,000$1,607,000$1,606,000 4.1% 4.0%3986 ALBANY $1,178,000$1,232,000$1,159,000 4.4%1.6%164 ALBANYHEIGHTS $1,444,000$1,510,000$1,494,000 4.4% 3.3%109 BAYSWATER $1,810,000$1,926,000$1,971,000 6.0% 8.2%33 MANUKAU $1,281,000$1,344,000$1,300,000 4.7% 1.5%5857 BEACHLANDS $1,670,000$1,769,000$1,671,000 5.6% 0.1%128 BOTANYDOWNS $1,332,000$1,402,000$1,443,000 5.0% 7.7%121 BUCKLANDSBEACH $1,810,000$1,885,000$1,839,000 4.0% 1.6%171 CLENDON PARK $782,000$818,000$853,000 4.4% 8.3%167 CLEVEDON $2,189,000$2,322,000$2,170,000 5.7%0.9%40 CLOVER PARK $894,000$954,000$954,000

WHITFORD $3,611,000$3,726,000$3,526,000 3.1%2.4%36

$734,000$777,000$803,000 5.5% 8.6%41

6.3% 6.3%82 COCKLEBAY $1,695,000$1,759,000$1,767,000 3.6% 4.1%77 DANNEMORA $1,693,000$1,768,000$1,856,000 4.2% 8.8%29 EAST TAMAKI $1,178,000$1,233,000$1,235,000 4.5% 4.6%88 EAST TAMAKIHEIGHTS $1,787,000$1,910,000$1,961,000 6.4% 8.9%55 EASTERNBEACH $1,965,000$2,097,000$2,126,000 6.3% 7.6%22 FARMCOVE $1,853,000$1,893,000$1,962,000 2.1% 5.6%33 FAVONA $919,000$968,000$927,000 5.1% 0.9%64 FLAT BUSH $1,436,000$1,490,000$1,500,000 3.6% 4.3%739 GOLFLANDS $1,348,000$1,418,000$1,515,000 4.9% 11.0%43

HILLPARK $992,000$1,039,000$1,072,000

HOWICK $1,257,000$1,353,000$1,395,000

MANGERE $955,000$1,037,000$973,000 7.9%

MANGEREBRIDGE $1,347,000$1,447,000$1,381,000 6.9% 2.5%129 MANGERE EAST $936,000$1,015,000$947,000 7.8% 1.2%233 MANUKAU $662,000$688,000$732,000 3.8% 9.6%89 LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS

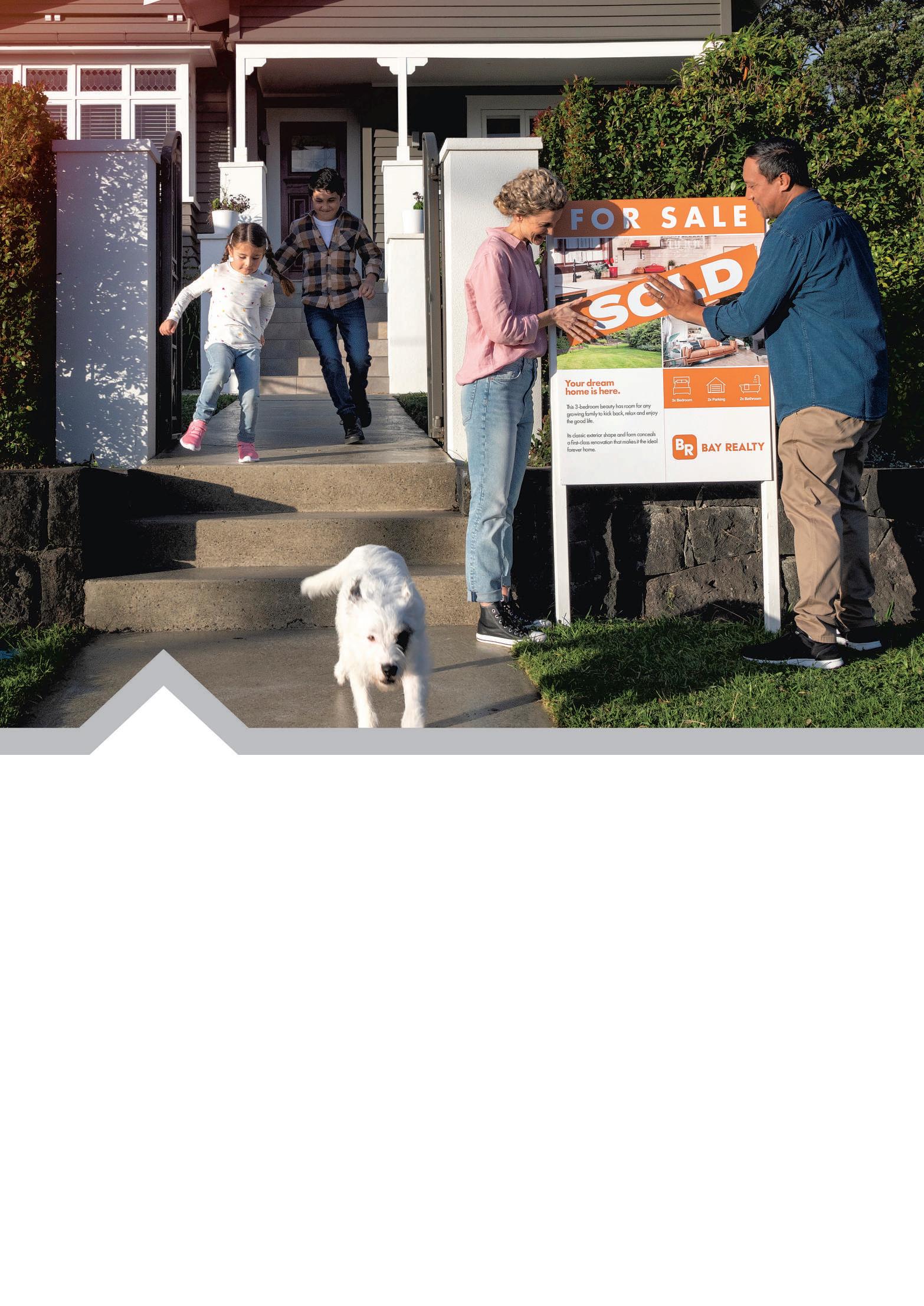

AUCKLAND.THESUBURB'S AVERAGEPROPERTY VALUEHASDROPPED2.8%INTHE

30 OneRoof.co.nz

GOODWOODHEIGHTS $1,144,000$1,227,000$1,238,000 6.8% 7.6%53 HALFMOONBAY $1,709,000$1,793,000$1,749,000 4.7% 2.3%94 HIGHLAND PARK $1,222,000$1,289,000$1,299,000 5.2% 5.9%69

4.5% 7.5%81

7.1% 9.9%231

1.8%174

HOUSESINPONSONBY,

LAST12MONTHS.PHOTO /FIONAGOODALL

LOCATION

BAYVIEW

CURRENT

$1,047,000$1,130,000$1,164,000 7.3% 10.1%121

BEACHHAVEN $1,111,000$1,206,000$1,261,000 7.9% 11.9%218

BELMONT $1,667,000$1,725,000$1,720,000 3.4% 3.1%48

BIRKDALE $999,000$1,059,000$1,082,000 5.7% 7.7%175

BIRKENHEAD $1,401,000$1,462,000$1,430,000 4.2% 2.0%190

BROWNSBAY $1,291,000$1,377,000$1,370,000 6.2% 5.8%223

CAMPBELLSBAY $2,401,000$2,486,000$2,591,000 3.4% 7.3%44

CASTORBAY $1,999,000$2,075,000$2,179,000 3.7% 8.3%64

CHATSWOOD $1,561,000$1,630,000$1,733,000 4.2% 9.9%43

DEVONPORT $2,240,000$2,324,000$2,374,000 3.6% 5.6%103

FAIRVIEWHEIGHTS $1,650,000$1,732,000$1,771,000 4.7% 6.8%41

FORRESTHILL $1,461,000$1,522,000$1,605,000 4.0% 9.0%134

GLENFIELD $1,125,000$1,175,000$1,184,000 4.3% 5.0%275

GREENHITHE $1,810,000$1,913,000$1,881,000 5.4% 3.8%126

HAURAKI $2,111,000$2,229,000$2,165,000 5.3% 2.5%80

HILLCREST $1,302,000$1,381,000$1,405,000 5.7% 7.3%147

LONGBAY $1,731,000$1,801,000$1,815,000 3.9% 4.6%93

MAIRANGIBAY $1,827,000$1,904,000$2,012,000 4.0% 9.2%91

MILFORD $1,850,000$1,974,000$1,980,000 6.3% 6.6%148

MURRAYSBAY $1,827,000$1,889,000$1,991,000 3.3% 8.2%70

NARROW NECK $2,055,000$2,163,000$2,237,000 5.0% 8.1%31

NORTHCOTE $1,352,000$1,383,000$1,363,000 2.2% 0.8%130

NORTHCOTEPOINT $1,781,000$1,837,000$1,938,000 3.0% 8.1%46

NORTHCROSS $1,360,000$1,417,000$1,458,000 4.0% 6.7%48

OTEHA $1,196,000$1,234,000$1,267,000 3.1% 5.6%78

PAREMOREMO $1,939,000$2,066,000$2,057,000 6.1% 5.7%28

PINEHILL $1,724,000$1,814,000$1,842,000 5.0% 6.4%37

ROTHESAYBAY $1,647,000$1,716,000$1,876,000 4.0% 12.2%53

SCHNAPPER ROCK $1,662,000$1,749,000$1,796,000 5.0% 7.5%54

STANLEYPOINT

$2,530,000$2,665,000$2,788,000 5.1% 9.3%20

SUNNYNOOK $1,279,000$1,355,000$1,384,000 5.6% 7.6%64

TAKAPUNA $2,331,000$2,421,000$2,356,000 3.7% 1.1%157

TORBAY $1,322,000$1,370,000$1,398,000 3.5% 5.4%264

TOTARA VALE $1,086,000$1,148,000$1,164,000 5.4% 6.7%93

UNSWORTHHEIGHTS $1,210,000$1,280,000$1,316,000 5.5% 8.1%61

WAIAKE $1,659,000$1,710,000$1,809,000 3.0% 8.3%25

WINDSOR PARK $1,446,000$1,525,000$1,537,000 5.2% 5.9%25

PAPAKURA $1,118,000$1,161,000$1,092,000 3.7%2.4%1957

CONIFERGROVE $1,105,000$1,147,000$1,157,000 3.7% 4.5%86

DRURY $1,463,000$1,512,000$1,392,000 3.2%5.1%26

KARAKA $1,803,000$1,922,000$1,830,000 6.2% 1.5%238

OPAHEKE $1,161,000$1,206,000$1,170,000 3.7% 0.8%136

PAHUREHURE $1,069,000$1,129,000$1,130,000 5.3% 5.4%86

PAPAKURA $930,000$951,000$932,000 2.2% 0.2%831

REDHILL $890,000$940,000$877,000 5.3%1.5%64

ROSEHILL $988,000$1,032,000$976,000 4.3%1.2%90

TAKANINI $997,000$1,040,000$1,011,000 4.1% 1.4%390

RODNEY$1,497,000$1,559,000$1,470,000 4.0%1.8%2998

ALGIESBAY $1,426,000$1,496,000$1,501,000 4.7% 5.0%20

ARMYBAY $1,193,000$1,259,000$1,303,000 5.2% 8.4%28

COATESVILLE $3,752,000$3,737,000$3,311,0000.4%13.3%48

DAIRYFLAT $2,417,000$2,547,000$2,349,000 5.1%2.9%64

GULFHARBOUR $1,158,000$1,223,000$1,127,000 5.3%2.8%180

HATFIELDSBEACH $1,170,000$1,215,000$1,261,000 3.7% 7.2%25

HELENSVILLE $1,263,000$1,323,000$1,277,000 4.5% 1.1%119

HUAPAI $1,342,000$1,435,000$1,355,000 6.5% 1.0%62

KAUKAPAKAPA $1,488,000$1,554,000$1,486,000 4.2%0.1%50

KUMEU

$1,664,000$1,797,000$1,727,000 7.4% 3.6%169

LEIGH $1,547,000$1,635,000$1,478,000 5.4%4.7%23

MAKARAU $1,257,000$1,334,000$1,246,000 5.8%0.9%22

MANLY $1,308,000$1,388,000$1,366,000 5.8% 4.2%112

MATAKANA

$2,024,000$2,058,000$1,893,000 1.7%6.9%36

MURIWAI $1,520,000$1,597,000$1,652,000 4.8% 8.0%28

OMAHA $2,683,000$2,780,000$2,675,000 3.5%0.3%32

OREWA $1,321,000$1,386,000$1,302,000 4.7%1.5%361

POINTWELLS $2,299,000$2,358,000$2,160,000 2.5%6.4%27

REDBEACH $1,301,000$1,381,000$1,345,000 5.8% 3.3%122

RIVERHEAD $1,992,000$2,063,000$1,907,000 3.4%4.5%107

SILVERDALE $1,478,000$1,536,000$1,474,000 3.8%0.3%180

SNELLSBEACH $1,145,000$1,202,000$1,177,000 4.7% 2.7%88

STANMOREBAY

$1,139,000$1,252,000$1,159,000 9.0% 1.7%252

STILLWATER $1,681,000$1,739,000$1,670,000 3.3%0.7%26

WAIMAUKU $1,700,000$1,791,000$1,699,000 5.1%0.1%63

WAINUI $1,582,000$1,693,000$1,677,000 6.6% 5.7%167

WAITOKI $2,113,000$2,218,000$2,121,000 4.7% 0.4%21

WARKWORTH $1,267,000$1,314,000$1,238,000 3.6%2.3%192

WELLSFORD $859,000$921,000$878,000 6.7% 2.2%54

WAITAKERE

$1,140,000$1,192,000$1,164,000 4.4% 2.1%4255

GLENEDEN $952,000$1,021,000$1,023,000 6.8% 6.9%373

GLENDENE $1,024,000$1,104,000$1,085,000 7.2% 5.6%82

GREENBAY $1,273,000$1,370,000$1,378,000 7.1% 7.6%55

HENDERSON $1,072,000$1,111,000$1,094,000 3.5% 2.0%611

HENDERSON VALLEY $1,428,000$1,508,000$1,464,000 5.3% 2.5%46

HOBSONVILLE $1,240,000$1,270,000$1,228,000 2.4%1.0%511

KELSTON $988,000$1,038,000$1,055,000 4.8% 6.4%64

LAINGHOLM $1,099,000$1,173,000$1,175,000 6.3% 6.5%45

MASSEY $1,096,000$1,113,000$1,105,000 1.5% 0.8%498

NEW LYNN $940,000$976,000$1,023,000 3.7% 8.1%317

ORATIA $1,632,000$1,726,000$1,708,000 5.4% 4.4%21

RANUI $937,000$985,000$996,000 4.9% 5.9%202

SUNNYVALE $983,000$1,028,000$1,020,000 4.4% 3.6%94

SWANSON $1,262,000$1,324,000$1,249,000 4.7%1.0%109

TE ATATUPENINSULA $1,234,000$1,324,000$1,384,000 6.8% 10.8%264

TE ATATUSOUTH $1,050,000$1,108,000$1,098,000 5.2% 4.4%248

TITIRANGI $1,284,000$1,401,000$1,377,000 8.4% 6.8%237

WAITAKERE $1,563,000$1,642,000$1,512,000 4.8%3.4%32

WESTHARBOUR $1,366,000$1,476,000$1,436,000 7.5% 4.9%151

WESTGATE $1,022,000$1,092,000$1,121,000 6.4% 8.8%63

WHENUAPAI $1,359,000$1,432,000$1,451,000 5.1% 6.3%162

$744,000$775,000$758,000 4.0% 1.8%46

FITZROY $813,000$855,000$817,000 4.9% 0.5%39

FLAGSTAFF $1,192,000$1,221,000$1,209,000 2.4% 1.4%244

FORESTLAKE $773,000$800,000$764,000 3.4%1.2%55

FRANKTON $683,000$697,000$698,000 2.0% 2.1%157

GLENVIEW $793,000$815,000$810,000 2.7% 2.1%146

GRANDVIEWHEIGHTS $931,000$956,000$938,000 2.6% 0.7%25

HAMILTONCENTRAL $796,000$817,000$805,000 2.6% 1.1%52

HAMILTONEAST $750,000$766,000$779,000 2.1% 3.7%258

HAMILTONLAKE $934,000$977,000$1,010,000 4.4% 7.5%45

HILLCREST $819,000$833,000$840,000 1.7% 2.5%121

HUNTINGTON $1,115,000$1,150,000$1,128,000 3.0% 1.2%139

MAEROA $752,000$780,000$752,000 3.6%0.0%52

MELVILLE $677,000$700,000$690,000 3.3% 1.9%126

NAWTON $694,000$714,000$710,000 2.8% 2.3%200

PUKETE $852,000$885,000$875,000 3.7% 2.6%88

QUEENWOOD $1,071,000$1,104,000$1,008,000 3.0%6.3%63

RIVERLEA

$896,000$935,000$917,000 4.2% 2.3%23

ROTOTUNA $1,038,000$1,085,000$1,054,000 4.3% 1.5%66

ROTOTUNANORTH $1,077,000$1,119,000$1,150,000 3.8% 6.3%133

SAINTANDREWS $870,000$908,000$882,000 4.2% 1.4%133

SILVERDALE $761,000$791,000$777,000 3.8% 2.1%34

WHITIORA $696,000$712,000$667,000 2.2%4.3%39

AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS LOCATION

CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS

WAIKATO$960,000$981,000$927,000 2.1%3.6%9901 HAMILTON$854,000$875,000$878,000 2.4% 2.7%3195 BADER $611,000$622,000$632,000 1.8% 3.3%47 BEERESCOURT $1,027,000$1,070,000$998,000 4.0%2.9%53 CHARTWELL $901,000$912,000$881,000 1.2%2.3%261 CHEDWORTH $953,000$992,000$952,000

CLAUDELANDS

DINSDALE

ENDERLEY

FAIRFIELD

FAIRVIEWDOWNS

3.9%0.1%28

$801,000$825,000$796,000 2.9%0.6%53

$755,000$768,000$778,000 1.7% 3.0%172

$632,000$647,000$639,000 2.3% 1.1%74

$798,000$848,000$823,000 5.9% 3.0%138

3.6% AVERAGEPROPERTY VALUEYEARONYEARCHANGE OneRoof.co.nz 31

WAIKATO $960,000

HILLTOP $917,000$977,000$908,000 6.1%1.0%56

KINLOCH $1,384,000$1,413,000$1,260,000 2.1%9.8%77

MANGAKINO $496,000$541,000$474,000 8.3%4.6%39

MOTUOAPA $790,000$825,000$793,000 4.2% 0.4%33

NUKUHAU $894,000$951,000$886,000 6.0%0.9%103

OMORI $796,000$839,000$789,000 5.1%0.9%23

RANGATIRAPARK

RICHMONDHEIGHTS

TAUHARA

$1,064,000$1,079,000$994,000 1.4%7.0%42

$807,000$847,000$808,000 4.7% 0.1%59

$613,000$630,000$603,000 2.7%1.7%35

TAUPO $765,000$800,000$746,000 4.4%2.5%203

TURANGI $492,000$514,000$481,000 4.3%2.3%93

TWOMILEBAY

$961,000$977,000$947,000 1.6%1.5%29

WAIPAHIHI $1,115,000$1,132,000$1,079,000 1.5%3.3%38

WAIRAKEI $1,131,000$1,168,000$1,029,000 3.2%9.9%22

WHAREWAKA $1,346,000$1,432,000$1,336,000 6.0%0.7%80

THAMES COROMANDEL$1,296,000$1,276,000$1,198,0001.6%8.2%1050

COOKSBEACH

COROMANDEL

$1,568,000$1,457,000$1,399,0007.6%12.1%24

$912,000$921,000$872,000 1.0%4.6%36

MATARANGI $1,238,000$1,186,000$1,129,0004.4%9.7%75

PAUANUI $1,662,000$1,574,000$1,438,0005.6%15.6%94

TAIRUA $1,266,000$1,237,000$1,164,0002.3%8.8%66

THAMES

$806,000$804,000$748,0000.2%7.8%113

WHANGAMATA $1,548,000$1,518,000$1,418,0002.0%9.2%183

WHITIANGA $1,153,000$1,161,000$1,050,000 0.7%9.8%231

WAIKATO$1,158,000$1,188,000$1,073,000 -2.5%7.9%1514

BUCKLAND $1,442,000$1,457,000$1,354,000 1.0%6.5%31

HUNTLY $581,000$584,000$560,000 0.5%3.8%126

MANGATAWHIRI

$1,384,000$1,394,000$1,237,000 0.7%11.9%24

MATANGI $1,836,000$1,912,000$1,647,000 4.0%11.5%38

MEREMERE $545,000$523,000$505,0004.2%7.9%23

NGARUAWAHIA $813,000$826,000$786,000 1.6%3.4%193

POKENO $1,115,000$1,163,000$1,057,000 4.1%5.5%192

PORTWAIKATO $663,000$657,000$647,0000.9%2.5%22

PUKEKAWA $1,232,000$1,236,000$1,110,000 0.3%11.0%23

RAGLAN $1,276,000$1,286,000$1,193,000 0.8%7.0%153

TAMAHERE $2,194,000$2,219,000$1,955,000 1.1%12.2%70

OPOTIKI $494,000$455,000$471,0008.6%4.9%59 WAIOTAHE $1,109,000$974,000$1,048,00013.9%5.8%21

ROTORUA$752,000$782,000$755,000 3.8% 0.4%993

FAIRYSPRINGS $574,000$625,000$588,000 8.2% 2.4%33

FORDLANDS $393,000$421,000$386,000 6.7%1.8%20

GLENHOLME $691,000$703,000$704,000 1.7% 1.8%80

HAMURANA $1,347,000$1,379,000$1,202,000 2.3%12.1%29

HILLCREST $628,000$657,000$640,000 4.4% 1.9%26

KAWAHAPOINT $806,000$816,000$812,000 1.2% 0.7%37

KOUTU $525,000$542,000$543,000 3.1% 3.3%21

LYNMORE $957,000$980,000$936,000 2.3%2.2%60

MAMAKU $582,000$611,000$557,000 4.7%4.5%23

MANGAKAKAHI $541,000$571,000$554,000 5.3% 2.3%54

NGONGOTAHA $734,000$743,000$721,000 1.2%1.8%67

OWHATA $691,000$712,000$687,000 2.9%0.6%104

POMARE $765,000$785,000$757,000 2.5%1.1%20

PUKEHANGI $643,000$673,000$659,000 4.5% 2.4%67

SPRINGFIELD $834,000$843,000$836,000 1.1% 0.2%50

SUNNYBROOK $739,000$760,000$739,000 2.8%0.0%33

VICTORIA $556,000$571,000$560,000 2.6% 0.7%33

WESTERNHEIGHTS $538,000$563,000$545,000 4.4% 1.3%50

TAURANGA$1,126,000$1,184,000$1,163,000 4.9% 3.2%3019

BELLEVUE $822,000$869,000$855,000 5.4% 3.9%66

BETHLEHEM $1,198,000$1,250,000$1,187,000 4.2%0.9%159

BROOKFIELD $838,000$886,000$858,000 5.4% 2.3%113

GATE PA $697,000$743,000$722,000 6.2% 3.5%128

GREERTON $759,000$802,000$770,000 5.4% 1.4%67

HAIRINI $819,000$861,000$840,000 4.9% 2.5%45

JUDEA $761,000$809,000$809,000 5.9% 5.9%69

MATUA $1,256,000$1,296,000$1,288,000 3.1% 2.5%89

MAUNGATAPU $945,000$1,000,000$985,000 5.5% 4.1%49

MOUNTMAUNGANUI $1,538,000$1,609,000$1,562,000 4.4% 1.5%445

OHAUITI $1,157,000$1,210,000$1,158,000 4.4% 0.1%122

OTUMOETAI $1,107,000$1,152,000$1,158,000 3.9% 4.4%149

PAPAMOA $969,000$1,052,000$990,000 7.9% 2.1%143

PAPAMOABEACH $1,163,000$1,238,000$1,162,000 6.1%0.1%621

PARKVALE $692,000$719,000$712,000 3.8% 2.8%59

POIKE $720,000$744,000$735,000 3.2% 2.0%24

PYESPA $1,158,000$1,230,000$1,191,000 5.9% 2.8%292

TAURANGA $1,056,000$1,121,000$1,074,000 5.8% 1.7%51

TAURANGASOUTH $962,000$1,038,000$938,000 7.3%2.6%110

WELCOMEBAY $959,000$1,017,000$940,000 5.7%2.0%205

0.9%5.6%30 KATIKATI $850,000$882,000$804,000 3.6%5.7%139 MINDEN $1,667,000$1,789,000$1,624,000 6.8%2.6%28 OMANAWA $1,407,000$1,568,000$1,369,000 10.3%2.8%29 OMOKOROA $1,182,000$1,212,000$1,142,000 2.5%3.5%177

OROPI $1,556,000$1,719,000$1,500,000 9.5%3.7%24

PAENGAROA $1,119,000$1,158,000$1,031,000 3.4%8.5%33

PUKEHINA $1,278,000$1,336,000$1,145,000 4.3%11.6%37

TAHAWAI $1,313,000$1,394,000$1,238,000 5.8%6.1%26

TEPUKE $854,000$895,000$832,000 4.6%2.6%157 TEPUNA $1,912,000$2,041,000$1,819,000 6.3%5.1%24

WAIHIBEACH $1,469,000$1,545,000$1,379,000 4.9%6.5%67

ONEROOF VALOCITYHOUSE VALUEINDEX HAURAKI $771,000$812,000$662,000 5.0%16.5%370 NGATEA $744,000$867,000$661,000 14.2%12.6%32 PAEROA $603,000$665,000$530,000 9.3%13.8%86 WAIHI $760,000$829,000$632,000 8.3%20.3%149 MATAMATA PIAKO$840,000$875,000$796,000 4.0%5.5%657 MATAMATA $860,000$880,000$782,000 2.3%10.0%235 MORRINSVILLE $839,000$883,000$790,000 5.0%6.2%237 TEAROHA $755,000$769,000$684,000 1.8%10.4%94 OTOROHANGA$698,000$681,000$691,0002.5%1.0%126 KAWHIA $620,000$612,000$589,0001.3%5.3%21 OTOROHANGA $656,000$668,000$666,000 1.8% 1.5%76 SOUTH WAIKATO$546,000$548,000$516,000 0.4%5.8%417

TIRAU

PUTARURU $580,000$592,000$550,000 2.0%5.5%91

$713,000$728,000$697,000 2.1%2.3%37 TOKOROA $470,000$468,000$425,0000.4%10.6%265 TAUPO $924,000$963,000$903,000 4.0%2.3%1074 ACACIABAY $1,464,000$1,498,000$1,351,000 2.3%8.4%56

CAMBRIDGE

4.5%1.1%326 KARAPIRO $1,536,000$1,637,000$1,463,000 6.2%5.0%22 KIHIKIHI $809,000$841,000$756,000 3.8%7.0%119 LEAMINGTON $997,000$1,031,000$960,000 3.3%3.9%251 MAUNGATAUTARI $1,629,000$1,751,000$1,550,000 7.0%5.1%20 NGAHINAPOURI $1,461,000$1,554,000$1,375,000 6.0%6.3%55 OHAUPO $1,374,000$1,406,000$1,281,000 2.3%7.3%44 PIRONGIA $1,074,000$1,130,000$1,051,000 5.0%2.2%46 TE AWAMUTU $813,000$862,000$761,000 5.7%6.8%361 WAITOMO $467,000$462,000$405,0001.1%15.3%167 TE KUITI $478,000$470,000$395,0001.7%21.0%109 BAYOFPLENTY$1,002,000$1,044,000$1,004,000

KAWERAU $435,000$436,000$420,000

OPOTIKI

TAUPIRI $1,177,000$1,207,000$1,092,000 2.5%7.8%29 TE KAUWHATA $907,000$907,000$839,0000.0%8.1%114 TE KOWHAI $1,432,000$1,395,000$1,333,0002.7%7.4%33 TUAKAU $902,000$910,000$848,000 0.9%6.4%147 WHATAWHATA $1,313,000$1,348,000$1,229,000 2.6%6.8%32 WAIPA$1,068,000$1,115,000$1,053,000 4.2%1.4%1331

$1,236,000$1,294,000$1,223,000

4.0% 0.2%5676

0.2%3.6%132

$666,000$607,000$623,0009.7%6.9%99

WESTERN BAYOFPLENTY $1,216,000$1,282,000$1,179,000

AONGATETE $1,330,000$1,423,000$1,279,000

ATHENREE $1,124,000$1,134,000$1,064,000

5.1%3.1%896

6.5%4.0%28

WHAKATANE $790,000$809,000$759,000 2.3%4.1%537 COASTLANDS $1,030,000$1,033,000$951,000 0.3%8.3%45 EDGECUMBE $660,000$664,000$619,000 0.6%6.6%36 MATATA $856,000$875,000$815,000 2.2%5.0%22 OHOPE $1,231,000$1,277,000$1,177,000 3.6%4.6%86 WHAKATANE $707,000$736,000$685,000 3.9%3.2%251 LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS BAYOF PLENTY $1,002,000 0.2% AVERAGEPROPERTY VALUEYEARONYEARCHANGE 32 OneRoof.co.nz

WHAKAMARAMA $1,571,000$1,703,000$1,567,000 7.8%0.3%44

$940,000$994,000$945,000 5.4% 0.5%39

CLIVE

ESKDALE $1,354,000$1,423,000$1,352,000 4.8%0.1%23

FLAXMERE $493,000$511,000$504,000 3.5% 2.2%108

FRIMLEY $909,000$978,000$928,000 7.1% 2.0%71

HASTINGS $633,000$670,000$668,000 5.5% 5.2%63

HAVELOCKNORTH $1,263,000$1,311,000$1,291,000 3.7% 2.2%257

MAHORA $730,000$789,000$787,000 7.5% 7.2%67

MAYFAIR $631,000$676,000$674,000 6.7% 6.4%77

PARKVALE $707,000$741,000$750,000 4.6% 5.7%81

RAUREKA $642,000$706,000$701,000 9.1% 8.4%63

SAINTLEONARDS $639,000$681,000$703,000 6.2% 9.1%39 NAPIER $829,000$887,000$903,000 -6.5% -8.2%1124

$1,076,000$1,151,000$1,107,000 6.5% 2.8%33 AWATOTO $970,000$1,050,000$1,012,000 7.6% 4.2%34 BAYVIEW $1,088,000$1,174,000$1,152,000 7.3% 5.6%37 BLUFFHILL $1,086,000$1,144,000$1,144,000 5.1% 5.1%52 GREENMEADOWS $847,000$935,000$905,000 9.4% 6.4%118 HOSPITALHILL

GISBORNE $701,000$710,000$683,000 1.3%2.6%622 ELGIN $505,000$530,000$502,000 4.7%0.6%33 GISBORNE $586,000$592,000$580,000 1.0%1.0%35 INNER KAITI $733,000$752,000$742,000 2.5% 1.2%33 KAITI $505,000$544,000$495,000 7.2%2.0%37 LYTTONWEST $936,000$924,000$925,0001.3%1.2%25 MANGAPAPA $664,000$672,000$653,000 1.2%1.7%90 OUTER KAITI $501,000$531,000$482,000 5.6%3.9%45 RIVERDALE $812,000$820,000$822,000 1.0% 1.2%23 TEHAPARA $595,000$619,000$600,000 3.9% 0.8%96 WHATAUPOKO $889,000$901,000$875,000 1.3%1.6%70 HAWKE'S BAY$833,000$876,000$868,000 4.9% 4.0%2750 CENTRALHAWKE'S BAY$704,000$738,000$664,000 4.6%6.0%357 OTANE $814,000$859,000$773,000 5.2%5.3%43 WAIPAWA $674,000$710,000$627,000 5.1%7.5%81 WAIPUKURAU $682,000$710,000$620,000 3.9%10.0%137 HASTINGS$910,000$948,000$934,000 4.0% 2.6%1156 AKINA $646,000$705,000$689,000 8.4% 6.2%78

MARAENUI

MAREWA

NAPIER

ONEKAWA

7.3% 8.6%107 PIRIMAI $656,000$715,000$733,000 8.3% 10.5%60 PORAITI $1,302,000$1,378,000$1,308,000 5.5% 0.5%51 TAMATEA $653,000$706,000$727,000 7.5% 10.2%88 TARADALE $874,000$946,000$947,000 7.6% 7.7%228 TE AWA $852,000$907,000$910,000 6.1% 6.4%21 WESTSHORE $1,127,000$1,169,000$1,193,000 3.6% 5.5%34 WAIROA$467,000$467,000$402,0000.0%16.2%113 WAIROA $336,000$336,000$286,0000.0%17.5%71 MANAWATU WHANGANUI $633,000$668,000$663,000 5.2% 4.5%4615 HOROWHENUA$664,000$699,000$684,000 5.0% 2.9%757 FOXTON $547,000$553,000$568,000 1.1% 3.7%65 FOXTONBEACH $647,000$692,000$678,000 6.5% 4.6%63 LEVIN $633,000$676,000$665,000 6.4% 4.8%415 OHAU $1,037,000$1,075,000$985,000 3.5%5.3%38 SHANNON $532,000$560,000$558,000 5.0% 4.7%45 TAURANGA'S AVERAGE PROPERTY VALUEIS3.2%YEARONYEAR. PHOTO/GETTYIMAGES LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS CENTRAL NORTH ISLAND GISBORNE$701,000 2.6% HAWKE'S BAY$833,000 4% MANAWATU-WHANGANUI $633,000 4.5% TARANAKI$716,000 8.2% AVERAGE PROPERTY VALUE YEARONYEAR CHANGE OneRoof.co.nz 33

AHURIRI

$1,046,000$1,138,000$1,095,000 8.1% 4.5%41

$542,000$554,000$584,000 2.2% 7.2%46

$618,000$651,000$675,000 5.1% 8.4%75

SOUTH $717,000$775,000$782,000 7.5% 8.3%86

$631,000$681,000$690,000

TOKOMARU

SOUTH TARANAKI

$727,000$764,000$736,000 4.8% 1.2%20

WAITAREREBEACH $699,000$734,000$730,000 4.8% 4.2%40

MANAWATU

FEILDING

HALCOMBE

$713,000$734,000$730,000 2.9% 2.3%609

$686,000$714,000$707,000 3.9% 3.0%406

$828,000$851,000$784,000 2.7%5.6%37

HIMATANGIBEACH $553,000$563,000$571,000 1.8% 3.2%20

RONGOTEA $719,000$749,000$725,000 4.0% 0.8%41

PALMERSTONNORTH$713,000$765,000$778,000 6.8% 8.4%1513

AOKAUTERE

ASHHURST

$1,162,000$1,298,000$1,170,000 10.5% 0.7%26

$750,000$798,000$781,000 6.0% 4.0%72

AWAPUNI $660,000$711,000$711,000 7.2% 7.2%148

BUNNYTHORPE

CLOVERLEA

FITZHERBERT

HIGHBURY

HOKOWHITU

KELVINGROVE

$943,000$1,009,000$927,000 6.5%1.7%32

$584,000$632,000$664,000 7.6% 12.0%31

$969,000$1,088,000$1,070,000 10.9% 9.4%91

$567,000$602,000$605,000 5.8% 6.3%96

$851,000$907,000$907,000 6.2% 6.2%181

$842,000$899,000$892,000 6.3% 5.6%161

MILSON $671,000$705,000$716,000 4.8% 6.3%131

PALMERSTONNORTH

ROSLYN

TAKARO

$661,000$724,000$712,000 8.7% 7.2%116

$580,000$626,000$634,000 7.3% 8.5%109

$509,000$513,000$458,000 0.8%11.1%563

ELTHAM $439,000$439,000$415,0000.0%5.8%44

HAWERA $563,000$567,000$503,000 0.7%11.9%298

MANAIA $397,000$396,000$351,0000.3%13.1%23

NORMANBY $521,000$531,000$496,000 1.9%5.0%24

OPUNAKE

$497,000$499,000$467,000 0.4%6.4%55

PATEA $339,000$331,000$278,0002.4%21.9%24

WAVERLEY $449,000$442,000$374,0001.6%20.1%30

STRATFORD $562,000$573,000$539,000 1.9%4.3%198

STRATFORD $545,000$561,000$510,000 2.9%6.9%150

PAEKAKARIKI $1,026,000$1,080,000$1,118,000 5.0% 8.2%25

PARAPARAUMU $871,000$909,000$933,000 4.2% 6.6%152

PARAPARAUMUBEACH $940,000$1,009,000$1,006,000 6.8% 6.6%174

RAUMATIBEACH $945,000$1,012,000$1,007,000 6.6% 6.2%72

RAUMATI SOUTH $939,000$997,000$1,043,000 5.8% 10.0%75

WAIKANAE $992,000$1,060,000$1,052,000 6.4% 5.7%193

WAIKANAEBEACH $1,018,000$1,072,000$1,137,000 5.0% 10.5%78

LOWERHUTT$835,000$902,000$1,002,000 7.4% 16.7%1466

ALICETOWN $853,000$923,000$1,045,000 7.6% 18.4%23

AVALON $763,000$851,000$912,000 10.3% 16.3%63

BELMONT $991,000$1,077,000$1,127,000 8.0% 12.1%51

BOULCOTT $932,000$1,012,000$1,155,000 7.9% 19.3%39

EASTBOURNE $1,226,000$1,277,000$1,361,000 4.0% 9.9%44

EPUNI $859,000$921,000$1,025,000 6.7% 16.2%35

FAIRFIELD $809,000$888,000$997,000 8.9% 18.9%37

HUTTCENTRAL $1,148,000$1,252,000$1,325,000 8.3% 13.4%47

KELSON $866,000$944,000$1,022,000 8.3% 15.3%45

MAUNGARAKI $910,000$1,011,000$1,092,000 10.0% 16.7%40

NAENAE $666,000$737,000$800,000 9.6% 16.8%94

NORMANDALE $957,000$1,030,000$1,105,000 7.1% 13.4%25

PETONE $930,000$994,000$1,083,000 6.4% 14.1%104

STOKES VALLEY $684,000$751,000$795,000 8.9% 14.0%149

TAITA $647,000$726,000$776,000 10.9% 16.6%89

WAINUIOMATA $678,000$737,000$797,000 8.0% 14.9%303

WAIWHETU $783,000$879,000$975,000 10.9% 19.7%67

WATERLOO $889,000$1,010,000$1,095,000 12.0% 18.8%63 WOBURN $1,283,000$1,365,000$1,471,000 6.0% 12.8%44 MASTERTON $704,000$777,000$748,000 9.4% 5.9%600

KURIPUNI $580,000$637,000$630,000 8.9% 7.9%50 LANSDOWNE $675,000$737,000$718,000 8.4% 6.0%100 MASTERTON $588,000$650,000$631,000 9.5% 6.8%205

LOWER VOGELTOWN $743,000$762,000$685,000 2.5%8.5%36

LYNMOUTH $706,000$724,000$666,000 2.5%6.0%26

MARFELL $493,000$489,000$432,0000.8%14.1%28

MERRILANDS $816,000$828,000$754,000 1.4%8.2%66

MOTUROA $778,000$795,000$700,000 2.1%11.1%45

NEWPLYMOUTH $889,000$898,000$839,000 1.0%6.0%94 OKATO $693,000$708,000$622,000 2.1%11.4%36

SPOTSWOOD $571,000$600,000$538,000 4.8%6.1%41

STRANDON $1,017,000$1,001,000$911,0001.6%11.6%55

UPPER

ONEROOF VALOCITYHOUSE VALUEINDEX

WESTEND

WESTBROOK

RANGITIKEI $530,000$554,000$527,000 4.3%0.6%271 BULLS $584,000$621,000$586,000 6.0% 0.3%40 MARTON $572,000$603,000$552,000 5.1%3.6%144 TAIHAPE $401,000$409,000$412,000 2.0% 2.7%45 RUAPEHU $459,000$458,000$422,0000.2%8.8%234 OHAKUNE $581,000$572,000$545,0001.6%6.6%71 RAETIHI $406,000$424,000$362,000 4.2%12.2%25 TAUMARUNUI $375,000$380,000$347,000 1.3%8.1%58 TARARUA$479,000$533,000$520,000 10.1% 7.9%404 DANNEVIRKE $493,000$534,000$511,000 7.7% 3.5%155 EKETAHUNA $435,000$494,000$472,000 11.9% 7.8%32 PAHIATUA $504,000$562,000$534,000 10.3% 5.6%93 WOODVILLE $454,000$498,000$478,000 8.8% 5.0%65 WHANGANUI $559,000$585,000$571,000 4.4% 2.1%827 ARAMOHO $488,000$521,000$485,000 6.3%0.6%69 CASTLECLIFF $438,000$453,000$432,000 3.3%1.4%109 DURIEHILL $609,000$646,000$630,000

WHANGANUI

WHANGANUI

TARANAKI $716,000$727,000$662,000

$585,000$630,000$631,000 7.1% 7.3%96 TERRACEEND $671,000$726,000$730,000 7.6% 8.1%84

$633,000$684,000$699,000 7.5% 9.4%76

$594,000$642,000$648,000 7.5% 8.3%35

5.7% 3.3%36 GONVILLE $435,000$461,000$451,000 5.6% 3.5%109 OTAMATEA $888,000$952,000$906,000 6.7% 2.0%24 SAINTJOHNSHILL $688,000$731,000$716,000 5.9% 3.9%31 SPRINGVALE $601,000$640,000$611,000 6.1% 1.6%84 TAWHERO $548,000$562,000$562,000 2.5% 2.5%54 WESTMERE $1,006,000$1,106,000$995,000 9.0%1.1%26

$419,000$425,000$438,000 1.4% 4.3%81

EAST $472,000$485,000$483,000 2.7% 2.3%112

1.5%8.2%2249 NEWPLYMOUTH $792,000$804,000$733,000 1.5%8.0%1488 BELLBLOCK $762,000$791,000$689,000 3.7%10.6%123 BLAGDON $594,000$624,000$568,000 4.8%4.6%31 BROOKLANDS $716,000$736,000$652,000 2.7%9.8%20 FITZROY $946,000$951,000$883,000 0.5%7.1%33 FRANKLEIGH PARK $733,000$752,000$672,000 2.5%9.1%53 HIGHLANDS PARK $957,000$963,000$874,000 0.6%9.5%40 HURWORTH $1,205,000$1,208,000$1,078,000 0.2%11.8%26 INGLEWOOD $656,000$688,000$613,000 4.7%7.0%98

VOGELTOWN $708,000$725,000$651,000 2.3%8.8%21 VOGELTOWN $649,000$665,000$606,000 2.4%7.1%41 WAITARA $501,000$524,000$483,000 4.4%3.7%102 WAIWHAKAIHO $1,184,000$1,149,000$1,032,0003.0%14.7%24 WELBOURN $723,000$748,000$691,000 3.3%4.6%35 WESTOWN $657,000$672,000$622,000 2.2%5.6%126 WHALERS GATE $800,000$810,000$716,000 1.2%11.7%44

LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS GREATER WELLINGTON $940,000 13.1% AVERAGEPROPERTY VALUEYEARONYEARCHANGE GREATERWELLINGTON$940,000$1,023,000$1,082,000 8.1% 13.1%7783 CARTERTON $817,000$861,000$828,000 5.1% 1.3%225 CARTERTON $702,000$742,000$730,000 5.4% 3.8%153 KAPITICOAST $944,000$1,006,000$1,027,000

6.2% 8.1%1051 HAUTERE $1,465,000$1,488,000$1,395,000 1.5%5.0%22 OTAKI $764,000$826,000$813,000 7.5% 6.0%133 OTAKIBEACH $693,000$737,000$746,000 6.0% 7.1%62

SOLWAY

PORIRUA$900,000$958,000$1,034,000 6.1% 13.0%706 AOTEA $1,275,000$1,366,000$1,423,000 6.7% 10.4%101 ASCOT PARK $694,000$749,000$806,000 7.3% 13.9%28 CAMBORNE

4.9%

CANNONSCREEK

KENEPURU

PAPAKOWHAI

PAREMATA

PLIMMERTON

PUKERUABAY

TITAHIBAY

WHITBY

34 OneRoof.co.nz

$654,000$719,000$689,000 9.0% 5.1%148

$976,000$1,026,000$1,105,000

11.7%28

$601,000$626,000$681,000 4.0% 11.7%29

$906,000$973,000$1,031,000 6.9% 12.1%28

$934,000$981,000$1,116,000 4.8% 16.3%32

$1,020,000$1,097,000$1,144,000 7.0% 10.8%30

$1,116,000$1,157,000$1,192,000 3.5% 6.4%27

$947,000$994,000$1,076,000 4.7% 12.0%23 RANUI $661,000$733,000$766,000 9.8% 13.7%38

$758,000$830,000$893,000 8.7% 15.1%95

$1,024,000$1,092,000$1,135,000 6.2% 9.8%202

SOUTH WAIRARAPA$947,000$1,030,000$996,000 8.1% 4.9%316

FEATHERSTON $646,000$717,000$699,000 9.9% 7.6%66

GREYTOWN $1,032,000$1,119,000$1,065,000 7.8% 3.1%98

MARTINBOROUGH $1,077,000$1,166,000$1,114,000 7.6% 3.3%66

UPPERHUTT$829,000$885,000$988,000 6.3% 16.1%692

BIRCHVILLE $749,000$810,000$891,000 7.5% 15.9%40

BROWNOWL $805,000$871,000$993,000 7.6% 18.9%30

CLOUSTONPARK $703,000$768,000$867,000 8.5% 18.9%26

EBDENTOWN $715,000$779,000$872,000 8.2% 18.0%50

ELDERSLEA

$767,000$836,000$924,000 8.3% 17.0%32

PINEHAVEN $807,000$871,000$952,000 7.3% 15.2%30

RIVERSTONETERRACES

$1,102,000$1,170,000$1,256,000 5.8% 12.3%28

SILVERSTREAM $942,000$991,000$1,091,000 4.9% 13.7%59

TIMBERLEA $819,000$859,000$978,000 4.7% 16.3%32

TOTARA PARK $709,000$765,000$863,000 7.3% 17.8%35

TRENTHAM $727,000$807,000$849,000 9.9% 14.4%137

WALLACEVILLE $789,000$853,000$941,000 7.5% 16.2%91

WELLINGTON$1,070,000$1,180,000$1,244,000 9.3% 14.0%2727

$1,017,000$1,150,000$1,233,000 11.6% 17.5%32

AROVALLEY

BERHAMPORE $900,000$993,000$1,092,000 9.4% 17.6%69

BROADMEADOWS $936,000$1,062,000$1,105,000 11.9% 15.3%20

BROOKLYN $1,134,000$1,269,000$1,292,000 10.6% 12.2%84

CHURTONPARK $1,128,000$1,248,000$1,309,000 9.6% 13.8%104

CROFTONDOWNS $1,089,000$1,226,000$1,256,000 11.2% 13.3%26

GRENADAVILLAGE $1,065,000$1,214,000$1,236,000 12.3% 13.8%38

HATAITAI $1,246,000$1,355,000$1,422,000 8.0% 12.4%81

ISLANDBAY $1,223,000$1,344,000$1,386,000 9.0% 11.8%93

JOHNSONVILLE $909,000$980,000$1,025,000 7.2% 11.3%148

KARORI $1,203,000$1,316,000$1,367,000 8.6% 12.0%205

KELBURN $1,590,000$1,708,000$1,776,000 6.9% 10.5%43

KHANDALLAH $1,385,000$1,575,000$1,575,000 12.1% 12.1%126

KILBIRNIE $954,000$1,053,000$1,112,000 9.4% 14.2%42

LYALLBAY $1,030,000$1,163,000$1,220,000 11.4% 15.6%46

MAUPUIA $1,001,000$1,126,000$1,092,000 11.1% 8.3%25

MELROSE $1,086,000$1,229,000$1,328,000 11.6% 18.2%28

MIRAMAR $1,109,000$1,222,000$1,239,000 9.2% 10.5%114

MOUNTCOOK $829,000$920,000$987,000 9.9% 16.0%54

MOUNTVICTORIA $1,294,000$1,402,000$1,500,000 7.7% 13.7%63

NEWLANDS $875,000$1,005,000$1,037,000 12.9% 15.6%100

NEWTOWN $1,041,000$1,122,000$1,187,000 7.2% 12.3%94

NGAIO $1,152,000$1,281,000$1,307,000 10.1% 11.9%74

NORTHLAND $1,170,000$1,283,000$1,361,000 8.8% 14.0%56

PAPARANGI $889,000$1,006,000$1,040,000 11.6% 14.5%35

ROSENEATH $1,593,000$1,732,000$1,936,000 8.0% 17.7%22

SEATOUN $1,848,000$2,077,000$2,009,000 11.0% 8.0%36

STRATHMORE PARK $1,111,000$1,250,000$1,226,000 11.1% 9.4%38

TAWA $931,000$1,020,000$1,027,000 8.7% 9.3%185

TEARO $767,000$848,000$830,000 9.6% 7.6%223

THORNDON $1,044,000$1,151,000$1,199,000 9.3% 12.9%78

WADESTOWN $1,339,000$1,462,000$1,580,000 8.4% 15.3%48

WELLINGTONCENTRAL

$576,000$642,000$634,000 10.3% 9.1%59

WILTON $1,022,000$1,143,000$1,187,000 10.6% 13.9%30

WOODRIDGE $985,000$1,101,000$1,151,000 10.5% 14.4%26

MARLBOROUGH $783,000$799,000$757,000 2.0%3.4%1094

BLENHEIM $627,000$641,000$629,000 2.2% 0.3%176

BURLEIGH $1,039,000$1,069,000$981,000 2.8%5.9%21

HAVELOCK $708,000$719,000$631,000 1.5%12.2%24

MAYFIELD $590,000$608,000$601,000 3.0% 1.8%35

PICTON $669,000$683,000$635,000 2.0%5.4%85

REDWOODTOWN $623,000$635,000$622,000 1.9%0.2%135

RENWICK $786,000$798,000$762,000 1.5%3.1%41

RIVERSDALE $568,000$585,000$584,000 2.9% 2.7%26

SPRINGLANDS $851,000$873,000$820,000 2.5%3.8%130

WAIKAWA $954,000$960,000$900,000 0.6%6.0%35

WITHERLEA $784,000$809,000$761,000 3.1%3.0%137

NELSON $832,000$867,000$857,000 4.0% 2.9%953

ATAWHAI $954,000$987,000$973,000 3.3% 2.0%57

BISHOPDALE $781,000$802,000$775,000 2.6%0.8%23

ENNERGLYNN $904,000$963,000$906,000 6.1% 0.2%31

MARYBANK $953,000$1,000,000$939,000 4.7%1.5%24

MONACO $709,000$737,000$742,000 3.8% 4.4%25

NELSON $1,137,000$1,205,000$1,162,000 5.6% 2.2%32

NELSON SOUTH $793,000$825,000$805,000 3.9% 1.5%69

STOKE $772,000$813,000$775,000 5.0% 0.4%322

TAHUNANUI $718,000$764,000$703,000 6.0%2.1%79

THEBROOK $734,000$768,000$740,000 4.4% 0.8%33

THE WOOD $817,000$853,000$853,000 4.2% 4.2%59

TOITOI $563,000$583,000$598,000 3.4% 5.9%42

WASHINGTONVALLEY $638,000$659,000$676,000 3.2% 5.6%44

TASMAN $982,000$1,011,000$959,000 -2.9%2.4%1193

APPLEBY $1,207,000$1,240,000$1,251,000 2.7% 3.5%109

BRIGHTWATER $990,000$1,037,000$963,000 4.5%2.8%62

HOPE $1,378,000$1,408,000$1,244,000 2.1%10.8%23

KAITERITERI $1,469,000$1,496,000$1,367,000 1.8%7.5%25

MAPUA $1,162,000$1,206,000$1,083,000 3.6%7.3%44

MOTUEKA $778,000$814,000$775,000 4.4%0.4%135

REDWOOD VALLEY $1,636,000$1,689,000$1,514,000 3.1%8.1%27

RICHMOND $903,000$927,000$882,000 2.6%2.4%422

RUBYBAY $1,544,000$1,590,000$1,459,000 2.9%5.8%25

TAKAKA $701,000$719,000$694,000 2.5%1.0%32

UPPERMOUTERE $1,339,000$1,366,000$1,256,000 2.0%6.6%29

WAKEFIELD $940,000$990,000$911,000 5.1%3.2%66

LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS

THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS

LOCATION CURRENT AVERAGE PROPERTY VALUE

WESTCOAST $414,000$403,000$367,0002.7%12.8%1003 BULLER $385,000$372,000$333,0003.5%15.6%318 REEFTON $338,000$320,000$272,0005.6%24.3%29 WESTPORT $381,000$376,000$332,0001.3%14.8%156 GREY$411,000$404,000$360,0001.7%14.2%378 BLAKETOWN $280,000$278,000$240,0000.7%16.7%24 COBDEN $262,000$261,000$225,0000.4%16.4%47 GREYMOUTH $397,000$401,000$347,000 1.0%14.4%93 PAROA $627,000$610,000$563,0002.8%11.4%20 RUNANGA $247,000$239,000$211,0003.3%17.1%25 WESTLAND $458,000$441,000$421,0003.9%8.8%307 ARAHURAVALLEY $629,000$615,000$558,0002.3%12.7%21 FRANZJOSEFGLACIER $488,000$489,000$448,000 0.2%8.9%30 HOKITIKA $409,000$401,000$379,0002.0%7.9%92 RUATAPU $569,000$548,000$499,0003.8%14.0%23 UPPER SOUTH ISLAND MARLBOROUGH $783,000 3.4% NELSON$832,000 2.9% TASMAN$982,000 2.4% WESTCOAST $414,000 12.8% AVERAGE PROPERTY VALUE YEARONYEAR CHANGE OneRoof.co.nz 35

AKAROA $964,000$959,000$918,0000.5%5.0%36

ARANUI $446,000$469,000$429,000 4.9%4.0%114

AVONDALE $537,000$545,000$491,000 1.5%9.4%75

AVONHEAD $825,000$840,000$757,000 1.8%9.0%167

AVONSIDE $533,000$545,000$497,000 2.2%7.2%28

BECKENHAM $818,000$846,000$786,000 3.3%4.1%28

BELFAST $688,000$700,000$638,000 1.7%7.8%80

BISHOPDALE

$665,000$696,000$644,000 4.5%3.3%163

BROMLEY $501,000$529,000$476,000 5.3%5.3%53

BROOMFIELD $705,000$715,000$664,000 1.4%6.2%67

BRYNDWR $785,000$803,000$746,000 2.2%5.2%107

BURNSIDE $894,000$902,000$849,000 0.9%5.3%179

BURWOOD $686,000$694,000$613,000 1.2%11.9%177

CASEBROOK $834,000$846,000$758,000 1.4%10.0%90

CASHMERE $1,106,000$1,135,000$1,034,000 2.6%7.0%138

CHRISTCHURCHCENTRAL $695,000$719,000$645,000 3.3%7.8%327

DALLINGTON $573,000$570,000$546,0000.5%4.9%37

DIAMONDHARBOUR $814,000$864,000$735,000 5.8%10.7%30

EDGEWARE $534,000$558,000$493,000 4.3%8.3%119

FENDALTON $1,679,000$1,829,000$1,723,000 8.2% 2.6%87

HALSWELL $864,000$903,000$814,000 4.3%6.1%403

HAREWOOD $1,091,000$1,119,000$993,000 2.5%9.9%35

HEATHCOTE VALLEY

$807,000$809,000$741,000 0.2%8.9%35

HEIHEI $601,000$614,000$562,000 2.1%6.9%87

HILLMORTON $678,000$700,000$634,000 3.1%6.9%60

HILLSBOROUGH $791,000$794,000$737,000 0.4%7.3%55

HOONHAY $656,000$700,000$624,000 6.3%5.1%159

HORNBY $593,000$616,000$550,000 3.7%7.8%137

HUNTSBURY $1,101,000$1,126,000$1,039,000 2.2%6.0%59

ILAM $946,000$978,000$898,000 3.3%5.3%168

ISLINGTON

$571,000$582,000$526,000 1.9%8.6%43

LINWOOD $485,000$498,000$460,000 2.6%5.4%241

LYTTELTON

1.6%7.8%43

1.4%5.6%183

2.9%10.8%95

SPREYDON $627,000$663,000$612,000 5.4%2.5%196

ST ALBANS $861,000$874,000$829,000 1.5%3.9%395

STROWAN $1,173,000$1,271,000$1,126,000 7.7%4.2%71

SUMNER $1,103,000$1,149,000$1,069,000 4.0%3.2%48

SYDENHAM $554,000$578,000$531,000 4.2%4.3%179

TEMPLETON $806,000$864,000$730,000 6.7%10.4%49

UPPERRICCARTON $690,000$729,000$641,000 5.3%7.6%96

WAIMAIRIBEACH $942,000$952,000$885,000 1.1%6.4%26

WAINONI $494,000$493,000$462,0000.2%6.9%56

WALTHAM $498,000$510,000$460,000 2.4%8.3%106

WESTMORLAND $1,139,000$1,166,000$1,024,000 2.3%11.2%37

WIGRAM $876,000$903,000$805,000 3.0%8.8%147

WOOLSTON $546,000$551,000$492,000 0.9%11.0%271

YALDHURST $1,056,000$1,074,000$951,000 1.7%11.0%44

ONEROOF VALOCITYHOUSE VALUEINDEX

CHRISTCHURCH'S AVERAGEPROPERTY VALUEISUP4.1%ON LASTYEAR.PHOTO /PETERMEECHAM

HURUNUI $700,000$662,000$613,0005.7%14.2%382 AMBERLEY $733,000$710,000$632,0003.2%16.0%117 HANMERSPRINGS $800,000$756,000$716,0005.8%11.7%91 LEITHFIELD $690,000$670,000$590,0003.0%16.9%33 KAIKOURA$733,000$740,000$668,000 0.9%9.7%106 KAIKOURA $684,000$660,000$607,0003.6%12.7%52 KAIKOURAFLAT $850,000$807,000$745,0005.3%14.1%27 MACKENZIE $794,000$798,000$745,000 0.5%6.6%230 FAIRLIE $530,000$546,000$475,000 2.9%11.6%45 LAKETEKAPO $1,126,000$1,098,000$1,089,0002.6%3.4%51 TWIZEL $748,000$739,000$684,0001.2%9.4%98 SELWYN$965,000$1,000,000$921,000 3.5%4.8%1918 DARFIELD $833,000$874,000$751,000 4.7%10.9%108 DUNSANDEL $812,000$872,000$759,000 6.9%7.0%24 KIRWEE $1,036,000$1,104,000$898,000 6.2%15.4%39 LEESTON $776,000$811,000$702,000 4.3%10.5%80 LINCOLN $1,019,000$1,055,000$912,000 3.4%11.7%316 PREBBLETON $1,321,000$1,381,000$1,176,000 4.3%12.3%122 ROLLESTON $876,000$906,000$863,000 3.3%1.5%904 SOUTHBRIDGE

TIMARU $578,000$581,000$543,000

GERALDINE $587,000$582,000$527,0000.9%11.4%90 CANTERBURY$770,000$789,000$727,000 2.4%5.9%14451 ASHBURTON $613,000$612,000$559,0000.2%9.7%868 ALLENTON $628,000$624,000$549,0000.6%14.4%210 ASHBURTON $508,000$509,000$459,000 0.2%10.7%104 HAMPSTEAD $445,000$448,000$396,000 0.7%12.4%83 HUNTINGDON $1,067,000$1,083,000$1,005,000 1.5%6.2%45 METHVEN $687,000$693,000$616,000 0.9%11.5%91 MOUNT SOMERS $559,000$573,000$534,000 2.4%4.7%23 NETHERBY $552,000$560,000$502,000

RAKAIA $556,000$567,000$515,000

TINWALD $607,000$606,000$545,0000.2%11.4%115 CHRISTCHURCH $765,000$794,000$735,000 3.7%4.1%8276 ADDINGTON $531,000$551,000$513,000 3.6%3.5%128 AIDANFIELD $943,000$942,000$865,0000.1%9.0%68

$653,000$679,000$602,000 3.8%8.5%38 SPRINGSTON $1,005,000$1,064,000$944,000 5.5%6.5%32 TAITAPU $1,466,000$1,562,000$1,314,000 6.1%11.6%38 WESTMELTON $1,370,000$1,445,000$1,221,000 5.2%12.2%89

0.5%6.4%987

1.4%10.0%63

1.9%8.0%67

NORTHWOOD

PAPANUI $752,000$781,000$737,000

PARKLANDS $750,000$760,000$692,000

PHILLIPSTOWN $439,000$458,000$428,000 4.1%2.6%122 REDCLIFFS $1,141,000$1,169,000$1,121,000

REDWOOD $665,000$685,000$620,000

RICCARTON $725,000$775,000$699,000 6.5%3.7%172 RICHMOND $533,000$554,000$503,000 3.8%6.0%120 RUSSLEY $716,000$729,000$671,000 1.8%6.7%49 SAINTMARTINS $727,000$752,000$682,000 3.3%6.6%52 SHIRLEY $641,000$672,000$600,000 4.6%6.8%152 SOCKBURN $619,000$655,000$600,000 5.5%3.2%103 SOMERFIELD $725,000$766,000$697,000 5.4%4.0%146 SOUTHNEWBRIGHTON $589,000$609,000$547,000 3.3%7.7%55 SOUTHSHORE $680,000$704,000$631,000 3.4%7.8%21 LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS CANTERBURY $770,000 5.9% AVERAGEPROPERTY VALUEYEARONYEARCHANGE 36 OneRoof.co.nz

$757,000$769,000$702,000

MAIREHAU $636,000$645,000$602,000

MARSHLAND $1,076,000$1,120,000$962,000 3.9%11.9%100 MERIVALE $1,484,000$1,549,000$1,473,000 4.2%0.7%127 MOUNTPLEASANT $1,129,000$1,163,000$1,019,000

NEWBRIGHTON $520,000$543,000$481,000 4.2%8.1%170 NORTHNEWBRIGHTON $555,000$568,000$515,000 2.3%7.8%92 NORTHCOTE $582,000$609,000$548,000 4.4%6.2%63

$1,112,000$1,160,000$1,011,000 4.1%10.0%96 OPAWA $781,000$759,000$714,0002.9%9.4%26

3.7%2.0%143

1.3%8.4%179

2.4%1.8%51

2.9%7.3%161

GLENITI

$823,000$806,000$743,0002.1%10.8%72

GLENWOOD $549,000$546,000$509,0000.5%7.9%45

HIGHFIELD $607,000$606,000$550,0000.2%10.4%80

KENSINGTON $441,000$457,000$423,000 3.5%4.3%27

MAORIHILL $567,000$574,000$551,000 1.2%2.9%27

MARCHWIEL

PARKSIDE

PLEASANTPOINT

$514,000$522,000$485,000 1.5%6.0%75

$440,000$446,000$425,000 1.3%3.5%71

$580,000$581,000$527,000 0.2%10.1%36

SEAVIEW $457,000$469,000$443,000 2.6%3.2%47

TEMUKA

WAIMATAITAI

$484,000$496,000$462,000 2.4%4.8%111

$491,000$507,000$472,000 3.2%4.0%44

WATLINGTON $448,000$462,000$444,000 3.0%0.9%28

WESTEND $487,000$488,000$452,000 0.2%7.7%65

WAIMAKARIRI

ASHLEY

$856,000$837,000$762,0002.3%12.3%1523

$1,011,000$985,000$857,0002.6%18.0%20

BURNTHILL $956,000$921,000$819,0003.8%16.7%23

EYREWELL $1,052,000$1,045,000$895,0000.7%17.5%24

FERNSIDE $1,304,000$1,265,000$1,122,0003.1%16.2%30

KAIAPOI $699,000$685,000$633,0002.0%10.4%299

LOBURN

OHOKA

OXFORD

$1,141,000$1,124,000$959,0001.5%19.0%47

$1,508,000$1,465,000$1,264,0002.9%19.3%45

KINMONT PARK $760,000$815,000$829,000 6.7% 8.3%24

MAORIHILL $1,073,000$1,132,000$1,082,000 5.2% 0.8%50

MARYHILL $596,000$638,000$670,000 6.6% 11.0%20

MORNINGTON $575,000$619,000$650,000 7.1% 11.5%59

MOSGIEL $734,000$771,000$768,000 4.8% 4.4%312

MUSSELBURGH $652,000$696,000$700,000 6.3% 6.9%33

NORTHDUNEDIN $756,000$798,000$804,000 5.3% 6.0%48

NORTH EAST VALLEY $552,000$585,000$600,000 5.6% 8.0%71

PORTCHALMERS $555,000$567,000$594,000 2.1% 6.6%22

RAVENSBOURNE $548,000$566,000$575,000 3.2% 4.7%20

ROSLYN $904,000$940,000$938,000 3.8% 3.6%38

SAINTCLAIR $915,000$968,000$933,000 5.5% 1.9%49

SAINTKILDA $512,000$538,000$553,000 4.8% 7.4%119

SAWYERSBAY $659,000$724,000$673,000 9.0% 2.1%32

SHIELHILL $776,000$865,000$850,000 10.3% 8.7%22

SOUTHDUNEDIN $412,000$438,000$455,000 5.9% 9.5%96

TAINUI $612,000$650,000$669,000 5.8% 8.5%23

WAIKOUAITI $506,000$539,000$530,000 6.1% 4.5%36

WAKARI $610,000$643,000$667,000 5.1% 8.5%38

WAVERLEY $780,000$856,000$854,000 8.9% 8.7%36

QUEENSTOWN LAKES$1,884,000$1,883,000$1,651,0000.1%14.1%1287

ALBERTTOWN $1,537,000$1,507,000$1,303,0002.0%18.0%72

ARROWTOWN $2,396,000$2,427,000$2,025,000 1.3%18.3%86

ARTHURSPOINT $1,580,000$1,595,000$1,415,000 0.9%11.7%30

FERNHILL $1,202,000$1,207,000$1,169,000 0.4%2.8%48

FRANKTON $1,130,000$1,129,000$1,084,0000.1%4.2%82

GLENORCHY $1,446,000$1,423,000$1,122,0001.6%28.9%21

JACKS POINT $1,909,000$1,909,000$1,582,0000.0%20.7%134

KELVINHEIGHTS $2,556,000$2,593,000$2,257,000 1.4%13.2%22

KINGSTON $802,000$793,000$697,0001.1%15.1%23

LAKEHAWEA $1,261,000$1,212,000$1,019,0004.0%23.7%47

LAKEHAYES $2,424,000$2,435,000$1,952,000 0.5%24.2%57

LOWERSHOTOVER $1,620,000$1,627,000$1,403,000 0.4%15.5%78

QUEENSTOWN $1,599,000$1,587,000$1,484,0000.8%7.7%139

WANAKA $1,997,000$1,984,000$1,728,0000.7%15.6%341

WAITAKI

$551,000$570,000$514,000 3.3%7.2%561

HAMPDEN $452,000$459,000$417,000 1.5%8.4%22 HOLMESHILL $587,000$606,000$538,000 3.1%9.1%45 KAKANUI $606,000$625,000$563,000 3.0%7.6%27 OAMARU $449,000$462,000$414,000 2.8%8.5%64 OAMARUNORTH $494,000$503,000$458,000 1.8%7.9%131 OTEMATATA $557,000$575,000$513,000 3.1%8.6%21 PALMERSTON $431,000$440,000$405,000 2.0%6.4%42

$426,000$438,000$424,000 2.7%0.5%81 GRASMERE $471,000$484,000$461,000 2.7%2.2%62 HARGEST $534,000$535,000$500,000 0.2%6.8%23

HAWTHORNDALE $477,000$481,000$468,000 0.8%1.9%26 HEIDELBERG $408,000$419,000$396,000 2.6%3.0%52

KINGSWELL $398,000$405,000$387,000 1.7%2.8%60

NEWFIELD $438,000$445,000$433,000 1.6%1.2%55

OTATARA $759,000$753,000$708,0000.8%7.2%80

RICHMOND $487,000$501,000$478,000 2.8%1.9%50

ROCKDALE $431,000$439,000$425,000 1.8%1.4%20

ROSEDALE $714,000$728,000$670,000 1.9%6.6%28

SEAWARDBUSH $933,000$953,000$869,000 2.1%7.4%22

STRATHERN $366,000$380,000$367,000 3.7% 0.3%77

WAIKIWI

$618,000$622,000$590,000 0.6%4.7%80

WAVERLEY $564,000$572,000$545,000 1.4%3.5%40

WINDSOR

WOODEND

WAIMATE $512,000$514,000$462,000 0.4%10.8%161 WAIMATE $498,000$497,000$438,0000.2%13.7%132

$705,000$693,000$625,0001.7%12.8%73 PEGASUS $878,000$851,000$758,0003.2%15.8%175 RANGIORA $724,000$729,000$656,000 0.7%10.4%419 SEFTON $1,017,000$1,008,000$858,0000.9%18.5%24 SWANNANOA $1,260,000$1,251,000$1,070,0000.7%17.8%47 WAIKUKUBEACH $692,000$674,000$608,0002.7%13.8%24

$753,000$759,000$688,000 0.8%9.4%164

SOUTHHILL

WESTON

SOUTHLAND $520,000$525,000$492,000 1.0%5.7%2155 GORE $448,000$460,000$432,000 2.6%3.7%278 EAST GORE $396,000$391,000$346,0001.3%14.5%29 GORE $457,000$479,000$446,000

MATAURA $254,000$249,000$241,0002.0%5.4%47 INVERCARGILL $509,000$518,000$497,000

APPLEBY $323,000$334,000$321,000

AVENAL $495,000$505,000$484,000

BLUFF

CLIFTON

GEORGETOWN

GLADSTONE

GLENGARRY

$537,000$551,000$495,000 2.5%8.5%75

$734,000$748,000$634,000 1.9%15.8%27

4.6%2.5%169

1.7%2.4%1284

3.3%0.6%84

2.0%2.3%25

$324,000$329,000$321,000 1.5%0.9%50

$377,000$381,000$370,000 1.0%1.9%35

$374,000$385,000$369,000 2.9%1.4%40

$617,000$640,000$598,000 3.6%3.2%61

WINTON $603,000$612,000$539,000

LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS LOCATION CURRENT AVERAGE PROPERTY VALUE THREE MONTHS AGO 12 MONTHS AGO QoQ CHANGE YoY CHANGE SETTLED SALES LAST12 MONTHS OTAGO$935,000$958,000$887,000 2.4%5.4%4985 CENTRAL OTAGO$883,000$905,000$801,000 2.4%10.2%601 ALEXANDRA $747,000$763,000$686,000 2.1%8.9%128 BRIDGEHILL $867,000$915,000$824,000 5.2%5.2%38 CLYDE $941,000$973,000$804,000 3.3%17.0%32 CROMWELL $943,000$959,000$845,000 1.7%11.6%190 MOUNTPISA $1,300,000$1,328,000$1,150,000 2.1%13.0%29 CLUTHA $447,000$441,000$427,0001.4%4.7%328 BALCLUTHA $443,000$442,000$426,0000.2%4.0%87 KAITANGATA $298,000$285,000$263,0004.6%13.3%21 MILTON $441,000$443,000$432,000 0.5%2.1%56 WAIHOLA $677,000$650,000$658,0004.2%2.9%20 DUNEDIN $679,000$717,000$723,000 5.3% 6.1%2208 ABBOTSFORD $630,000$667,000$695,000 5.5% 9.4%37 ANDERSONSBAY $677,000$724,000$750,000 6.5% 9.7%45 BELLEKNOWES $799,000$856,000$846,000 6.7% 5.6%40 BROCKVILLE $515,000$546,000$567,000 5.7% 9.2%20 CALTONHILL $482,000$510,000$532,000 5.5% 9.4%32 CAVERSHAM $461,000$487,000$511,000 5.3% 9.8%45 CONCORD $585,000$622,000$644,000 5.9% 9.2%27 CORSTORPHINE $610,000$660,000$646,000 7.6% 5.6%35 DUNEDINCENTRAL $717,000$762,000$756,000 5.9% 5.2%55 FAIRFIELD $774,000$809,000$782,000 4.3% 1.0%43 FORBURY $463,000$491,000$513,000 5.7% 9.7%25 GREENISLAND $601,000$635,000$658,000 5.4% 8.7%62 HALFWAYBUSH $647,000$687,000$680,000 5.8% 4.9%34 HELENSBURGH $725,000$771,000$766,000 6.0% 5.4%29 KAIKORAI $587,000$631,000$645,000 7.0% 9.0%39 KARITANE $685,000$751,000$676,000 8.8%1.3%22 KENMURE $624,000$668,000$674,000 6.6% 7.4%41 LOWER SOUTH ISLAND OTAGO$935,000 5.4% SOUTHLAND$520,000 5.7% AVERAGE PROPERTY VALUE YEARONYEAR CHANGE OneRoof.co.nz 37

$576,000$592,000$567,000 2.7%1.6%102 SOUTHLAND $576,000$572,000$509,0000.7%13.2%593 LUMSDEN $368,000$368,000$324,0000.0%13.6%29 MAKAREWA $730,000$730,000$677,0000.0%7.8%21 RIVERTON $653,000$660,000$564,000 1.1%15.8%56 TEANAU $729,000$718,000$645,0001.5%13.0%142

1.5%11.9%90