Interview: Succession Implementation in

Partial Replacement of Artemia with Dry Feeds

Focus on

MRF

Interview: Succession Implementation in

Partial Replacement of Artemia with Dry Feeds

Focus on

MRF

SHENG LONG BIO-TECH INTERNATIONAL CO., LTD

Add: Block A5, Duc Hoa 1 Industrial Park, Duc Hoa District, Long An Province

Tel: (84-272) 3761358 - 3779741 Fax: (84-272) 3761359

Email: thanglong@shenglongbt.com Website: www.shenglongbt.com

SHENG LONG BIO-TECH (INDIA) PVT LTD

Add: Plot No. A-11/1, Part-A, SIPCOT Industrial Park, Thervoykandigai Village, Gummidipoondi Taluk, Thiruvallur District, Tamil Nadu 601202, India.

Tel: 91-44-6790 1001 Fax: 91-44-6790 1017

Email: info@shenglongindia.com Website: www.shenglongindia.com , a complete range of quality fish feeds are formulated by our experienced aquatic animal nutritionists covers freshwater and marine species. The quality diets will maximize feed intake and improving feed conversion ratio, promotes performance by supplying a specific amino acid balance to deliver excellent growth and reducing environmental impacts.

The Red Tilapia in Vietnam

From the editor

2 Shrimp prices: Lower for longer

Industry News

3 A renaissance and an inclusive shrimp farming industry

5 Unfounded: Accusations about shrimp farming’s role in widespread, continuous mangrove destruction in India. Commentary by Willem van der Pijl

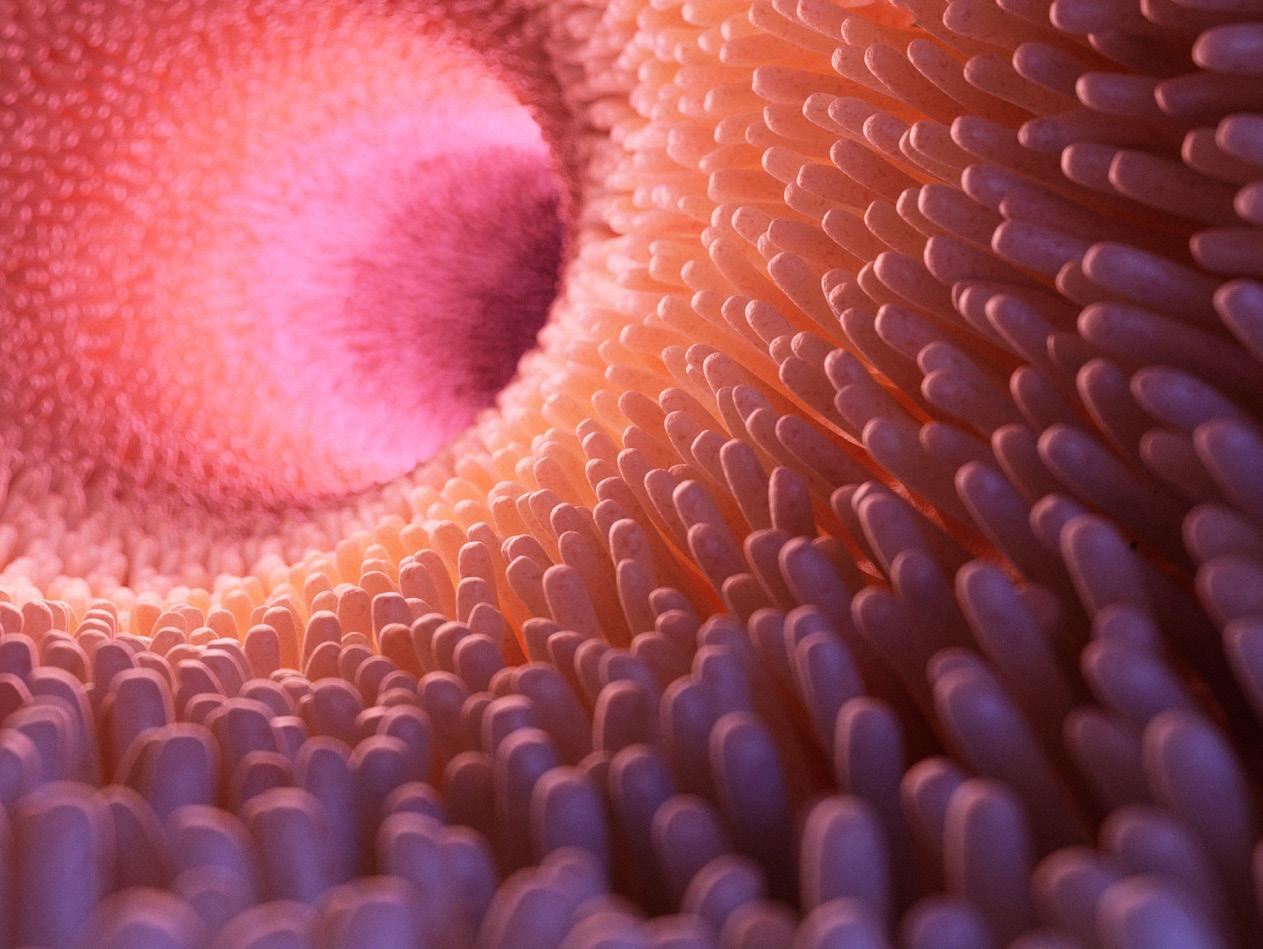

21-day old red tilapia fry. Page 42

Editor/Publisher

Zuridah Merican, PhD

Tel: +6012 205 3130

Email: zuridah@aquaasiapac.com

Editorial Coordination

Corporate Media Services P L

Tel: +65 6327 8825/6327 8824

Fax: +65 6223 7314

Email: irene@corpmediapl.com Web: www.corpmediapl.com

Design and Layout

Words Worth Media

Management Pte Ltd

Email: sales@wordsworth.com.sg Web: www.wordsworth.com.sg

AQUA Culture Asia Pacific is published bimonthly by

Aqua Research Pte Ltd

3 Pickering Street, #02-36 Nankin Row, Singapore 048660

Web: www.aquaasiapac.com Tel: +65 9151 2420

Printed in Singapore by Times Printers Private Limited 18 Tuas Avenue 5 Singapore 639342

Subscriptions

Subscribe via the website at www.aquaasiapac.com

Subscriptions can begin at any time.

Subscriptions rate/year (6 issues): SGD 70, Email: subscribe@aquaasiapac.com Tel: +65 9151 2420 Fax: +65 6223 7314

Copyright © 2024 Aqua Research Pte Ltd.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior permission of the copyright owners.

Aqua Culture Asia Pacific is a print and digital magazine. View E-magazine & Download PDF of past issues for free www.aquaasiapac.com

Shrimp Aquaculture

8 Four models and one farm

How the commercial application of four farming models is working well for the team at PT Delta Marine farm in Sumbawa. By Zuridah Merican

13 Effects and economics of partial replacement of Artemia with dry feeds in post larvae production

Babu Rathinam, Grace Angel and Victor Suresh showed no negative effects on the hatchery productivity and post larvae quality and yielded 10% savings in feed input costs.

Feed Technology

16 The search for sustainable and nutrient-rich shrimp feed leads to krill

The future of the shrimp aquaculture industry depends on cost efficient and more sustainable feed ingredients.

19 Sustainable aquafeed takes centre stage

A panel at Seafood Expo Global 2024 discusses commitments to responsible feed sourcing

21 Growth of aquaculture requires alternative and sustainable feed ingredients

At the USGC international aquaculture conference post- SEG, Barcelona

Interview

26 Succession Implementation

The route of PT Delta Marine from trading to shrimp farming and passing the baton. By Zuridah Merican

Feed Technology

30 The power of mannan rich fraction to address parasitic disease challenges

It is the production method which determines MOS’ prebiotic activity, immune stimulatory effects, and pathogen-binding capabilities, say Yufan Zhang and Henry Wong

34 Harmonising sustainability with profitable fish and shrimp farming

The Sustainable Seafood Event by Adisseo looks at managing health and feed efficiency for better productivity

Industry Review - Tilapia

40 Saline tilapia in Indonesia

The centre in Karawang is preparing to revitalise shrimp ponds in coastal areas

42 Full steam ahead with tilapia fry throughout Vietnam

Selection for fast-growing broodstock is leading development and fry production

45 A red tilapia cage farming business in the Mekong Delta

How demand vs supply cycles affect small-scale farmers

Demand & Supply Equilibrium

48 Responsible aquaculture supply chains

Traceability, legal compliance and shedding light on strategies to enhance responsible practices within Europe

50 Marketing Asian seafood at Seafood Expo Global

55 Company News

Zuridah Merican

Global economists had a tag line when describing US interest rates. It was called ‘higher for longer’ indicating the Federal Reserve was not cutting interest rates anytime soon. The shrimp industry now has a similar tag line for shrimp prices i.e. ‘lower for longer’. Shrimp is a global commodity, and prices are mainly determined by demand and supply with government tariffs and supply chain woes thrown in. A review from various vantage points will give a clearer picture.

US shrimp wholesale prices have fallen below pre-Covid levels and to 20-year lows. During the 2020 lockdown, restaurants were forced to close temporarily, and prices tumbled but when restaurants re-opened in 2021, there was revenge dining increasing prices. Concurrently, incountry inventory was low due to minimal replenishment of shrimp as shipping was curtailed and later traffic jams at Los Angeles Port slowed supply to warehouses. When supply normalised in 2022, prices fell and continues until present day. The ‘cost of living’ crisis has affected the US but when compared to a basket of other proteins (beef, pork

We strive to be the beacon for the regional aquaculture industry.

We will be the window to the world for Asia-Pacific aquaculture producers and a door to the market for international suppliers.

We strive to be the forum for the development of self-regulation in the Industry.

and chicken), Rabobank’s average protein index has shown that shrimp is relatively cheaper today than in 2020. Shrimp is touted as a price elastic product i.e. when price decreases, consumption increases so why have we not seen this shrimp consumption increase? Very simply – this is based on wholesale prices which has not cascaded down to retail prices.

Demand comes from the largest markets which are China, the US and the EU+UK. China was the biggest driver with record imports of 987,601 tonnes in 2023 but China’s shrimp imports were down by 4.2% in value and up by 12.4% in volume so there was deflationary pressure. Ecuador led with 72% market share followed by India at 13%. For YTD April 2024, China’s imports reached 290,031 tonnes (-5% Y-o-Y) with 75% coming from Ecuador at lower prices. Will China’s increasing demand continue? This is unlikely due to the continued fall in property prices which poses a huge risk to consumer confidence.

The supply side has been the key disruptor and Ecuador has doubled production over the past 5 years. The Global Seafood Marketing Conference reported that global vannamei shrimp production reached 5.15 million tonnes in 2023. Ecuador led with an estimated 1.45 million tonnes. The industry expects single digit growth due to slower demand and lower prices in 2024. The US antidumping (AD) and countervailing duties (CVD) rates will hurt sales and there is still a big concern with insecurity in the country. India produced an estimated 850,000 tonnes and YTD 1st crop 2024 has shown stocking to be 20% lower with stocking densities unchanged at 20-30PL/m2. Failure rates remain as farmers live with WSSV and EHP but harvest ABW have increased to >20g, thus increasing biomass.

The US Dept of Commerce has published its preliminary rates for AD & CVD. Apart from some specific companies, the general combined

rates are 13.47% for Ecuador; 4.36% for India; 6.3% for Indonesia and 2.84% for Vietnam. This will change the trade landscape for matching the export country to the import country and prompt Ecuador to focus on China, with which it has a FTA, instead of the US.

The Suez Canal, a major waterway for ships has seen traffic fall 80% due to Houthi rebel attacks, diverting ships around the Cape of Good Hope requiring 15 extra shipping days. Together with reduced traffic along the Panama Canal, this has increased container shipping prices 5-fold to USD8,000 per 40-foot container for China exporting to EU. Although less than during the Covid period, it does mean fewer available containers and ships due to longer shipping routes. This will increase prices along the supply chain such that high market prices will not translate to high farmgate prices.

So, what does the crystal ball show for 2024? Will the demand vs. supply equilibrium change or are low prices the new normal? Demand may improve slightly over 2023, based on growth in US which is highly dependent on passing lower prices to the retail segment, but the AD and CVD rates will be counterintuitive. China’s economy cannot lift demand further. Supply will not contract despite Ecuador’s growth slowing. India’s production will maintain. Hence low prices will remain as domestic demand growth will take time. Today, while better cost of production is expected due to cheaper feed, labour costs are rising. Productivity and efficiency will be the key to our success.

If you have any comments, please email: zuridah@aquaasiapac.com

The second Shrimp Aquaculture Conference (SAC), held in June in Bali, was organised by the Young Shrimp Farmers of Indonesia with the acronym PMI (Petambak Muda Indonesia). The theme was “Aquaculture Renaissance”. This 2024 edition captured the interests of stakeholders outside of Indonesia with 40% international participants, notably from Thailand, the Philippines and Vietnam. In his opening address, PMI President Rizky Darmawan, CEO Delta Marine group, emphasised, “At PMI, we are first and foremost shrimp farmers. We organise SAC for the good of the industry, to ensure its sustainability. As we take over from our predecessors, we want to create a sustainable industry for the next generation.

“We want more people to see the wonderful world of shrimp and what it can bring to the country’s economy. The industry needs a revival to have more entrants. By renaissance we mean rebirth with inclusivity, using technology, data and science to bring up shrimp aquaculture. I quote in Latin; Veni, Vidi, Vici which means we “came, saw, conquered”. This is through sheer hard work and innovations.”

Shrimp and hatchery owners at SAC commented how farming continues to be challenged by poor biosecurity practices, management, and diseases. Small scale hatcheries use local polychaetes from areas where shrimp farms discharge water. Diseases include Enterocytozoon hepatopenaei (EHP) in combination with white faeces disease (WFD), and infectious myonecrosis virus (IMNV). Currently, an estimated 40% of farms in West Jawa are not operating.

In disease management, a reactive approach is common. Dr Melony Sellars, Genics, Australia suggested early detection of diseases such as when 1,000 copies of WSSV are present, it is an early warning of not to stock. “Fitness for purpose tests is important for this industry,” said Sellars. Based on the work carried out at Viet Uc, a large hatchery and farming group in Vietnam, Sellars showed how biosecurity planning and improvements can be implemented leading to better profitability. Early detection of pathogens in a farm in Ecuador led to 50% increase in nauplii production and 10-15% increase in production. Maxime Hugonin, MixScience Asia, presented on the development of a blend of short chain and medium chain fatty acids which works to disrupt the infectivity of the polar tubule of EHP. A field trial in Vietnam using the blend as top coating, increased shrimp resistance against EHP and control of EHP in the gut.

Rishita Changede, Teora is working to develop next generation solutions. “With fast spread of pathogens, solutions available for disease management are difficult to sustain. In the case of white spot syndrome virus (WSSV), the virus is changing and rapid solutions are needed to block or reduce the viral load. Rishita described the application of nanopeptides, delivered orally to manage pathogens by blocking multiplication.

Chiow-Yen Liew, dsm-firmenich approached the dynamics of ponds aging by documenting the whole process in the shrimp ponds: from nutrient built up in ponds and decomposition of organic matter to changes in biodiversity of plankton and fluctuations in water quality. Liew also described the effects of feed containing different levels of crude protein on the pond environment in terms of phosphorus and nitrogen loadings. Kamaru Budianto from Yuki Water Treatment spoke on the climatic effects on water quality, such as changing seawater temperatures. He went on to discuss water disinfection with UV to address different pathogen loads.

Shrimp farmers are under pressure with low farmgate prices and the added burden of increasing feed prices. Dr Daranee Seguin said options include using alternative ingredients to reduce feed costs, moving from marine meals to cheaper plant-based protein meals such as DDGS and improving overall efficiency with functional feeds. Indonesia is a leader with the use of feed with low crude protein (30%) which other than reducing feed costs, also reduces the impact of feeds on the pond environment.

Dr Albert Tacon presented a holistic approach to shrimp nutrition and health. He said, “In Indonesia, labels on feed bags give no indication of the dietary nutrient levels within the feed. Most feeds have the same proximate composition; feed quality and performance are currently determined by the farmers.” As more plant meals are being used in shrimp feeds, approximately 50%, he cautioned on risks of poor feed intake and FCR with the presence of antinutritional factors and mycotoxins. Use of feed additives with health benefits are common but these are not always a panacea against diseases. Finally, Tacon said, “A weak link is top dressing. The feed miller’s job is to provide the farmer with good feed and that of the farmer is to grow the shrimp.”

Since feed is a significant cost component in the farming process, efficient feed management practices are crucial for all farms. At AQ1, Keone Dodd has led research on feed management using acoustic systems. She presented real time feeding data from AQ1, derived from some case studies, such as the transition from feeding with blowers to sensor-based feeding. Dodd said that farmers must find the best way to deliver the feed to shrimp in the most effective way, minimising feed wastes while maximising shrimp growth.

The low shrimp prices and the anti-dumping (AD) and countervailing duties (CVD) imposed on imports of frozen shrimp to the US, affect all players. While presenting on navigating current markets and beyond, Lie Ce Yung, PT Central Pertiwi, said that the demand for certified products is increasing; Japan is asking for BAP and ASC certifications, while demanding small size shrimp. Indonesia exported 209,065 tonnes in 2023, mainly raw frozen vannamei shrimp. “Some 85% of Indonesia’s shrimp goes to the US. We need to export to the EU and we need our government to help.”

A panel moderated by Ronnie Tan, US Grains Council discussed several issues on marketing shrimp. Panellists were Chingling Tanco, Mida Trade Ventures, Philippines; Aris Utama, Bumi Menara Internusa, Indonesia; and Van Vu, Otanics Technology, JSC, Vietnam.

Caleb

Latest trends in the global shrimp market

Tanco noted that although Ecuador and India have increased production and there is an oversupply situation, Indonesia is shielded as farmgate prices remain high. But, being highly dependent on the US market with easy peeled products, the risk is high. Aris commented that consumers’ focus on shrimp welfare has added pressure on the sustainability issue. BMI is part of the new Global Shrimp Council which aims to increase shrimp consumption via nutrition, good taste, easy to cook and better targeted marketing. As prices of large size shrimp remain resilient, Van expects Vietnam to maintain its share in this segment.

Changing consumer demand over the past 5 years

While Tanco said the change has been towards quality and premium products in the retail sector e.g. without phosphate treatment, Aris said that with the US AD and CVD, there is a need to build up domestic and regional demand. On dealing with AD and CVD, Aris suggested to focus on premium products and selling live shrimp locally. China could be a target market.

Elephant in the room

As Ecuador continues to increase production, will any increase in consumption just benefit Ecuador and not Asian producers? Due to logistics and high freight cost, Tanco suggested that Asian producers target the China market and allow Ecuador to focus on the US, which Ecuador benefits due to proximity. But the focus is on flavour and quality. Aris said that China wants HOSO and for Indonesia, the US market is less demanding, and Indonesia can cater to this demand. Tanco added that Asian producers may find it difficult to compete with Ecuador’s extensive culture system producing shrimp of HOSO quality, especially to prevent burst hepatopancreas. An alternative is to do live cooked HOSO.

According to Aris, Indonesia has been aligned for so long with the US market and may find it difficult to compete with Ecuador and India because their offer prices are so much lower. Since Indonesia’s market share has decreased, it is time for Indonesia to think of new approaches.

Van said that EU buyers demand sustainability credentials but who should pay for this? “What is happening is that certification bodies assumed this responsibility on behalf of buyers and supermarkets in the US,” commented Tanco. The EU is more serious with more audits. In Vietnam, large companies like Minh Phu help small farmers attain certification.

Commentary by Willem van der Pijl, Shrimp Insights, released

on July 15 2024

Recent reports have accused India of continuous, widespread mangrove destruction through its expansion of shrimp farming on the country’s east coast. But is this claim a fair one?

Unfounded: Accusations about shrimp farming’s role in widespread, continuous mangrove destruction in India

Commentary by Willem van der Pijl, Shrimp Insights, released on July 15 2024

Recent reports have accused India of continuous, widespread mangrove destruction through its expansion of shrimp farming on the country’s east coast. But is this claim a fair one?

Satellite imagery analysis by Indian space tech start-up GalaxEye Space using its own aquaculture pond database and Clark Labs’ mangrove database (see Image 1) prove these accusations to be unfounded. Their analyses show that from 1999 to 2022, only 0.3% of the total land covered with mangroves was converted into fish and shrimp ponds. What’s more, the total net area covered by mangroves has actually increased by 8%.

Satellite imagery analysis by Indian space tech start-up GalaxEye Space using its own aquaculture pond database and Clark Labs’ mangrove database (Figure 1) prove these accusations to be unfounded. Their analyses show that from 1999 to 2022, only 0.3% of the total ltand covered with mangroves was converted into fish and shrimp ponds. What’s more, the total net area covered by mangroves has actually increased by 8%.

In this commentary, I will debunk the myth that the recent expansion of shrimp farming operations has led to “continuous” and “widespread” mangrove destruction. I will back this up with evidence.

along the coastline and in salt pan lands, wherever feasible. Some funds that the new program draws from were allocated for afforestation efforts to compensate for diverting forests for non-forest use. Successful conservation and afforestation efforts depend greatly on cooperation and the co-management of mangrove habitats with local communities, civil society, and other actors in the coastal ecosystem, such as the shrimp industry.

In this commentary, I will debunk the myth that the recent expansion of shrimp farming operations has led to “continuous” and “widespread” mangrove destruction. I will back this up with evidence.

Figure 1. An illustration of the different sources and steps used in the analysis presented in this commentary

Strengthened conservation efforts by India’s government that started in the early part of the 21st century with a strengthened forest act and the implementation of the Coastal Aquaculture Act, combined with the overall public awareness on the significance of mangrove forests for the country’s ecological health mean that rather than declining, the total area covered by mangroves on the eastern coast has actually increased by 8%. So how did this happen?

India strongly supports the Ramsar Convention on Wetlands and has the most significant number of Ramsar sites in South and Southeast Asia. The Indian government has made the protection of wetlands in general, and the protection of mangroves in particular, a priority. India’s finance minister announced two major programs for mangrove plantation and wetlands conservation in the country’s latest annual budget for 2023-24. One initiative, “Building on India’s Success in Afforestation, Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI),” will entirely focus on mangrove plantation

One of the organisations working on mangrove conservation and afforestation is the Swaminathan Foundation. This organisation has been working on this task from 1993 onwards and claims to have restored 2025 ha of mangroves. On the eastern coast, the organisation has been working in Tamil Nadu between 1993-2018 and has restored 900 ha of mangroves. In Andhra Pradesh, it worked on mangrove conservation between 1999-2002 and 2017-2021 and restored 860 ha of mangroves. In Odisha, its activities took place between 1996-2004, and it restored 240 ha of mangroves. Read more about the organization’s work in its report on “Restoring mangroves ecosystems saves the coastline and community”.

The majority of India’s shrimp farms and mangroves are concentrated on the east coast. For this reason, GalaxEye Space has limited its analysis to the east coast.

The primary mangrove forests on the east coast are the Sundarbans (West Bengal), the Bhitarkanika Mangroves (Odisha), the Godavari-Krishna Mangroves (Andhra Pradesh), and the Pichavaram Mangroves (Tamil Nadu). Smaller patches are also found in other parts of the east coast’s deltas and river estuaries. Shrimp farming is concentrated in Andhra Pradesh, with significant farming activities also being present (in order of significance) in West Bengal, Odisha, and Tamil Nadu (Figure 2).

It’s

Figure 3. An illustration of some of the geographies where mangrove forests expanded between 1999-2022. As 9,550 ha of land was lost during the same period, the gross increase of mangroves was even close to 30,000 ha.

Credit: GalaxEye Space

It’s true to say that India’s east-coast shrimp farms and mangroves compete for scarce land along the coastal creek- and riversides. Data on mangroves from Clark Labs and analysis using GalaxEye Space’s proprietary pond database show that between 1999 and 2022, the land covered by fish and shrimp ponds expanded by 87%, and that the total area covered by mangroves increased by 8% (Figure 3). In 2022, around 385,000 ha on the east coast was covered by fish and shrimp ponds, and around 260,000 ha was covered by mangroves.

While the total area under mangroves increased, also some mangroves were lost. The majority of mangroves during this 23 year period was lost for a variety of reasons: because of climate change, tropical storms, industry expansion, and other agricultural activities to name a few. These reasons, according to GalaxEye Space’s analysis, resulted in a loss of around 8,800 ha of mangrove forests.

Over the same 23-year period, mangrove to fish or shrimp pond conversion was limited to an area of 750 ha. This figure represents just 0.3% of the total land covered by mangroves and only 0.2% of the total fish and shrimp pond area. Placing these figures in context makes claims accusing India’s shrimp industry of continuous and widespread mangrove destruction not only unfair and misrepresentative, but also unfounded.

Let us take a closer look at two of the major states where mangroves and shrimp- farming exist side-byside. Andhra Pradesh, is home to some major rivers: The Godavari, The Krishna, The Pennar, and The Vamsadhara. Most of the region’s mangrove forests are found in the estuaries of these rivers, but they also occur in smaller patches along the coastline.

Despite the rapid expansion of the shrimp industry, and around 450 ha of mangroves that despite forest conservation regulations were converted to fish and shrimp ponds, the area covered by mangroves in Andhra Pradesh grew from 32,047 ha in 1999 to 42,493 ha in 2022, an increase of 33%. This increase is a strong confirmation of conservation and aggressive afforestation efforts of federal and state level authorities.

West Bengal is home to the majority of India’s mangrove, around 192,665 ha of mangroves and a portion of one of the most famous and largest mangrove forests in the world: the Sundarbans. Traditional shrimp farms have been active since the 1980s around the Sundarbans. These are large, multi-hectare ponds where farmers grow shrimp at low densities. The Sundarbans are now well preserved, and no significant destruction of mangroves due to shrimp farming expansion has occurred between 1999 and 2022. This is slightly different in other coastal districts in West Bengal, where more intensive shrimp farming has expanded recently, and, despite local regulations, some mangrove conversion has occurred. The total land covered by mangroves in West Bengal slightly increased from 189,555 ha to 192,665 ha. This, again, illustrates the success of India’s mangrove conservation and afforestation efforts.

Industry coexisting with vital ecosystems

India is one of the world’s largest shrimp producers and is home to some of the world’s most significant mangrove habitats. While the shrimp industry is vital for India because of its economic significance and the number of jobs it creates, mangroves are essential for coastal protection, biodiversity, and carbon sinking. It’s in the interest of the industry and the wider Indian society that the shrimp industry and the country’s mangrove habitats not only coexist but also flourish.

If we take a moment to consider the market challenges the Indian industry faces in the wake of these claims, committing itself to supporting increased mangrove conservation and afforestation projects could significantly enhance its market image and consumer perception. According to Indian legislation, companies must spend a 3% of their three-year trailing average net profit on corporate social responsibility (CSR) activities; mangrove conservation projects would be a good place to start for some of the country’s shrimp exporters in light of this situation.

While some deforestation has indeed happened over the past 25 years, contrary to common belief the numbers show that the scale of conversion does not justify the accusations being put on the Indian shrimp industry: as proved in this analysis, the industry’s impact has been quite limited. In my view, these claims are, therefore, unfounded, unfair and unjust. Even more, while the shrimp industry expanded rapidly during this period, the land covered by mangroves increased significantly, by more than 20,000 ha.

It’s essential to spread this message within the industry, to retailers, and to consumers worldwide: accusations like this don’t only damage the Indian shrimp industry but the global shrimp industry more broadly.

Disclaimer: As part of the analysis, Galaxeye Space has compared its results with the data from India’s forest department. Although there are slight differences in the absolute figures, both sources confirm the trend of growth of the total area under mangroves.

Contact the author at willem@shrimpinsights.com for more information on this analysis?

SPECIFIC FOR YOUR SUCCESS

Animals robustness and resilience comes from within. We believe that’s never been more true than today.

Our passion is harnessing the natural power of yeast and bacteria to support health, well-being and performance of all farmed aquatic species.

We help our industry partners and farmers sustainably feeding and farming shrimp with a complete range of microbial solutions for: gut health, immune support, antioxidant balance and micro-nutrition pond water and soil quality.

How the commercial application of four farming models is working well for the team at PT Delta Marine farm in Sumbawa

By Zuridah Merican

W

hen Rizky Darmawan took over the management of the PT Delta Marine farm in 2014, the 70ha farm in Sumbawa, West Nusa Tenggara, Indonesia had 33 cement ponds. In 2018, expansion was with 20 ponds of 0.25ha in two new sections and 3 treatment ponds of 0.4ha each.

Today, the farm is operating 55 concrete and lined ponds, 18 round tanks and 3 raceways. Rizky and farm manager Joseph Santoso, both in their 30s, share the ambition of constantly innovating to find the best way to increase productivity in shrimp grow-out. A strong feature is the more than 600m intake pipe into the ocean and waste settling ponds with lush mangroves. There are 13 treatment and reservoir ponds.

“We want to be more future focus. I am paranoid for the future and do not want to keep to my comfort zone. We must keep looking for innovative ideas such as round tanks and raceways to always be better. That is how we can set ourselves apart from other players. I realise that the majority of shrimp farmers are often contented and keep to the same structure and do not try to change,” said Rizky.

Among the four models at the farm, Rizky’s favourite is the 50m long and 20m wide, 1000m2 raceways. The depth at the shallow end is 1.5m. “Before, the hype was to construct round tanks to utilise space. However, compared to the land area used for round tanks, I find that raceways are the most efficient in terms of the use of land. They are straight and long, and they don’t need much gap between them, maximising space. We stock at 300 PL/m2 now, and we can continue to stock more,” said Rizky.

“We started in 2021 and have gone through more than four cycles successfully. We have not had a bad crop with this raceway design, and I am tempted to expand with more raceways. The production was 5.2 tonnes/1,000m2 A cost and space advantage is that raceways can share a wall.”

Both Rizky and Joseph are proud of the raceway design and now want to incorporate HDPE liners onto these raceways.

Currently, there are three of these raceway systems, one is 50m long x 20m wide, and two, 50m long x 10m wide. The raceway is designed to keep sloping down towards one of its corners where the drain/shrimp toilet is located. Paddlewheels and diffusers aerate the water.

A discussion was whether they should place solar panels across the concrete raceways. One might say that solar panels will shield away the sunlight but for Rizky, there is not much need for plankton in intensive culture systems. With solar energy he has calculated savings of 5-10% versus electricity from the grid.

“My only concern is the wastage of solar energy during the shutdown period as we practise an all-in all-out process for each site. Solar energy is very useful if we adopt a staggered production protocol,” said Rizky.

Bringing in the aspect of staff welfare, Joseph explained that during the shutdown period, which is around 40 days and includes pond drying, staff will visit families. “This is important for them. For all models and throughout the farm, we have a thorough clean-up process after each cycle.”

There are now two super large round tanks of 1,000m2 with 37m diameter, in addition to 16 smaller tanks with

314m2 area. In the large tanks, in one cycle, the stocking density of PL10 was 300 PL/m2 and over days of culture (DOC) 115, shrimp reached size 31/kg.

Joseph said, “There was partial harvesting bringing the total harvest to 7.2 tonnes/cycle or 72 tonnes/ha. Aeration is from blowers and paddlewheels. We use one HP per 200m2 of water. These large tanks have a new shrimp toilet system, and we manage just by pulling the cord to release the waste.”

All in all, there are 91 ponds including reservoir ponds, occupying 30ha of the total land area of 70ha. Additionally, there are 18 ponds used for trials with sizes ranging from 314m2 to 1,000m2. Concrete ponds followed a design from the 1980s.

Stocking density ranges from 150-180 PL/m2. Partial harvesting starts at DOC 70 and each partial harvest is 5-10 tonnes. It is all-in all-out for each section.

Partial harvesting at DOC 90 and packing for the long journey to the processing plant, alternately layering 300kg ice and 300kg shrimp and finally adding more ice.

At the farm, there have been outbreaks of white faeces disease (WFD) and infectious myonecrosis virus (IMNV). In the case of WFD, the strategy is to use probiotics to address the Vibrio population.

Recently, the success rate has been 90% and the survival rate was 95% with FCR of 1.2. Harvest sizes are around size 30/kg. Each cycle is 120 days. Rizky explained that success rate means that ponds have gone through a full 120 days in the pond. “Our SOP is that once we see a problem with the crop, we harvest.”

On the best FCR at this farm, Joseph said, “This was 1.02 at DOC77 size 57/kg in the round tank model. In a discussion on prices versus size and cost of production, two young farmers from Thailand said that for them prices reach a plateau such that it is THB 180/kg for size 3035/kg and THB210/kg for size 25-29/kg. While costs of production continue to increase mainly due to higher FCR, the differential in prices are small which does not merit growing larger shrimp. In contrast, in Indonesia, prices continue to rise with size which encourage farmers to produce larger shrimp.

The average cost of production (COP) for concrete and lined ponds are around IDR35,000/kg (USD2.16/kg) for size 30/kg. In a comparison of COP for his four culture models, Rizky said that the round tanks are newer models, and the COP is lower because of higher stocking density. Nevertheless, it is difficult to compare with other farms as here, COP is also spread over an area such as 1,000m2 with sharing of lab services etc. COP is affected when the survival rate is low and while the same energy needs are applied.

The general understanding is that real time monitoring of ponds has its merits. “In the perfect world, it should work but the accuracy is still not there yet. Finally, the decision has to be done by humans which means that automation helps to draw out a problem but solving it requires experience. In some cases, we need one equipment for each pond, which is expensive for large farms like this with 76 ponds. Effectiveness also depends on the worker’s level of training and skill,” said Rizky.

“In Indonesia, labour is cheap. We have the responsibility to give employment to the local community. There is a social sustainability aspect and the more we employ, the more the community benefits. In our opinion, it is good enough to monitor using our YSL probes for the daily checks, and test several other parameters, once or twice a week.”

“My next move is to try to run a nursery. This will increase our number of cycles/year. Now we have 2.5 cycles/year and produce 2,000 tonnes/year. With a nursery, we may increase to produce 3,000 tonnes/year. With a nursery, production will be like clockwork.

However, this may mean that the staff may not have their usual and important break cycle holidays. “We really need to understand the consequences and outcomes before making a decision about this.”

“We want to be more future focus. We must keep looking for innovative ideas such as round tanks and raceways to always be better. That is how we can set ourselves apart from other players.” - Rizky

of

only

Replacement showed no negative effects on the hatchery productivity and post larvae quality, and yielded 10% savings in feed input costs

By Babu Rathinam, Grace Angel and Victor Suresh

and appeared to be healthy and stress-free.

PL12 harvested at the end of the trial. Shrimp were actively swimming against the water current and appeared to be healthy and stress-free.

of the rectangular cement tanks used in hatcheries and has a volume of 140L. The tanks received constant aeration via a 25mm PVC pipe laid at the bottom of the tank and connected to a 1HP ring blower. Seawater flowing through an ultra-filter (<0.5µm) was used in the tanks.

A single batch of specific pathogen free (SPF) Litopenaeus vannamei post larvae (PL3) was transferred from the commercial production unit to GSHFTC. Post larvae were stocked at either 8,000 or 11,500 PL/tank resulting in stocking densities of 60 PL/L and 80 PL/L respectively. Post larvae were fed six times a day, every four hours and each meal consisted of live Artemia nauplii and the Growel Origin hatchery feed.

Within each stocking density, two feeding protocols were tested (Table 1):

• A standard feeding protocol adopted in most hatcheries;

• A test feeding protocol in which Artemia feeding was reduced by 25% and Growel Origin® shrimp hatchery feed was increased by 25%.

Effects and economics of partial replacement of Artemia with dry feeds in post larvae production

Replacement showed no negative effects on the hatchery productivity and post larvae quality, and yielded 10% savings in feed input costs

By Babu Rathinam, Grace Angel and Victor Suresh

Feed inputs constitute a major cost component in shrimp hatchery operations. Approximately, 3.4kg of Artemia cysts and 8kg of dry feeds are required to produce one million vannamei shrimp post larvae. Together these two feed components cost about USD480-520 per million of post larvae production. Artemia cysts cost 350% more than dry feeds and involve additional costs to hatch them into live nauplii. So, a replacement of Artemia with dry feeds will reduce the cost of post larvae production provided that such replacement will have no negative effect on the hatchery productivity and post larvae quality.

Two sizes of Growel Origin feed were used. Particles with an average size of 150µm were fed to post larvae of 1-7 days (PL1-7) and 300µm for post larvae more than 5 days (PL5). Five randomly chosen tanks were assigned for each dietary treatment at each stocking density in a 2x2 design.

Feed inputs constitute a major cost component in shrimp hatchery operations. Approximately, 3.4kg of Artemia cysts and 8kg of dry feeds are required to produce one million vannamei shrimp post larvae. Together these two feed components cost about USD480post larvae production. Artemia cysts cost 350% more than dry feeds and involve additional costs to hatch them into live nauplii. So, replacement of Artemia with dry feeds will reduce the cost of post larvae production provided that such replacement will have no negative effect on the hatchery productivity and post larvae quality.

In this article, we report the results of a feeding trial where Artemia usage was reduced by 25% and compensated by an increase in the dry diet by 25%. The test was done at two different stocking densities of post larvae (PL) in the tanks: 60 PL/L and 80 PL/L - the lower and upper ends of stocking densities used in commercial hatcheries. Growel Origin® shrimp hatchery feed, an extruded, crumbled, micro coated feed produced in India (Growel Feeds Private Limited) was used exclusively throughout the trial.

Trial methodology

The feeding trial was conducted at the Growel Shrimp Hatchery Feed Trial Center (GSHFTC) which is located within the premises of a commercial hatchery near Ongole, Andhra Pradesh, India. The centre has 25 ‘U’ shaped tanks made of fiber reinforced plastic. Each tank is a miniature

Table 1. Standard and test feeding protocols, and Artemia nauplii per PL/feeding administered in the trial. Feed/day/tank was divided into 6 rations/day.

Water exchange was 30-50% per day according to post larval age. Salinity was gradually decreased every day by 3ppt from 30 to 5ppt on the day of final harvest to acclimate the PL to the low salinity at which they will be stocked in the ponds. An average of 20 post larvae were collected daily to assess rostral development, average total body length, and muscle gut ratio.

When post larvae reached the PL12 stage, the tanks were completely harvested to assess survival (%), mean PL length (mm), and biomass harvested (g) from each tank. Additionally, 20 post larvae were taken from each tank to perform two stress tolerance tests. Post larvae from each treatment were packed in plastic bags with oxygen in the same manner as for packing for transportation and left for 12 hours. Post larvae were then counted to assess survival. In the second test, post larvae in 5ppt water were transferred to 30ppt water for 30 minutes and then transferred back to fresh water for 30 minutes. Post larval swimming activity, colour changes and mortality were observed during the stress tests.

“The strategy of reducing live Artemia by 25% and increasing the dry diet by 25% can give cost savings of USD 24-25/million PL production which represents 10% savings in feed inputs cost.”

Over the 11-day experimental period, water quality parameters remained within the optimal range for the post larvae, with no significant difference among the treatments (temperature 30-32oC; pH 8.1 and total ammonia nitrogen 2-3mg/L).

Survival, post larvae length and weight were consistently high among all treatments (Table 2). Within post larvae in

the standard feeding protocol group, higher survival was observed in the tanks stocked at 60 PL/L and slightly lower survival was observed in the tanks stocked at 80 PL/L.

The average total length of the post larvae was higher when stocked at 60 PL/L as compared to those stocked at 80 PL/L. The highest mean body weight of 8.95mg/PL was achieved in post larvae stocked at 60 PL/L and with the treatment protocol in which Artemia was reduced and dry feed quantity was increased. The post larvae body weights of other treatments were nearly similar (Table 2).

Table 2. Effects of PL density and feeding protocol on growth and survival of white shrimp Litpenaeus vannamei. Each value is the mean±SD of five replicates.

Results from the stress tests revealed post larvae survival at more than 95% in both tests. No signs of stress were evident when post larvae were transferred from 5 ppt to 30ppt and then to freshwater. There was no noticeable difference in post larval swimming behaviour among the treatments. Shrimp were actively swimming against the water current and were observed to be healthy and stress-free.

Protocols

Table 3. Cost comparison between the different feeding protocols.

This is shown in Table 3. Reducing the use of Artemia by 25% and concurrently increasing dry feed by the same percentage resulted in consistent savings of about USD24-25/million PL production which represented about 10% savings in feed input costs.

Although the post larvae stocked at 60 PL/L, performed slightly superior to those stocked at 80 PL/L, the latter group showed acceptable performance under the standard feeding protocol and exceptional performance when live Artemia was reduced and Growel Origin® dry feed was increased.

More importantly, the cost of feed inputs to produce a million PL was lower when the post larvae were stocked at a higher density because the feed or Artemia nauplii must be at a sufficiently high density in water to enable the post larvae to find the feed easily before consuming them. Most other hatchery operating costs per unit of post larvae production would also be lower at the higher stocking density provided that the productivity per tank (mainly driven by survival) or post larvae quality were not adversely affected.

We believe that the higher stocking density of 80 PL/L can be easily supported by the use of a good dry feed and management, and there is no need to rely more on live Artemia feeding in the higher densities.

Reducing the use of live Artemia by 25% and compensating for the reduction by increasing dry feed usage by 25% did not result in any major negative impacts on water quality, survival, growth or stress tolerance of vannamei post larvae between PL3 and PL12 even when the post larvae were stocked at a density of 80 PL/L. Growel Origin shrimp hatchery feed was used as the only dry feed in the trial and found to support consistently high survival and growth of vannamei post larvae.

If a good quality dry feed is used and the tanks are well managed, stocking density can be maintained at 80 PL/L without any discernible adverse impacts on the hatchery productivity or post larvae quality. This strategy of reducing live Artemia and increasing the equivalent with dry diet can give about 10% savings in the cost of feed inputs.

Grace Angel is Manager, Nutrition & Feeds R&D

Dr Victor Suresh is Technical Director.

All authors are with Growel Feeds Private Limited, India. Email: nutrition@growelfeeds.com

The future of the shrimp aquaculture industry depends on cost efficient and more sustainable feed ingredients. Through years of study, krill has proven to be a well-managed marine resource that can fill nutritional gaps and stimulate strong growth performance.

Shrimp aquaculture is a growing industry, with a rising consumer demand focusing on sustainable operations. At the same time, pressure on marine wild stocks is increasing. Commercially farmed shrimp accounts for 83.7% of the world’s shrimp consumption today. Presently, this industry faces challenges stemming from oversupply in the market, which has led to falling prices in recent years.

The mission of the modern shrimp farmer has become a delicate balancing act of securing sustainable operations, while taking the right measures to achieve production and economic efficiency. The combined goal of sustainability and efficiency in shrimp aquaculture has put the spotlight on shrimp feed which has emerged as a key factor in terms of balancing costs and reducing impacts to support sustainable growth in the industry.

The challenge of costly shrimp feed

“Feed can represent over 50% of shrimp production costs. When attempting to reduce these costs by removing expensive ingredients, there is a risk of eliminating nutrients that are essential for the shrimp’s growth and health,’’ says Lena Burri, Director R&D Animal Nutrition and Health at Aker BioMarine.

The question for the industry and for the aquaculture scientific community has become: how do we secure nutrient-rich feeds with effective ingredients that are both sustainable and cost-efficient?

The search for new, sustainable and costefficient marine ingredients

Marine ingredients are at the heart of an effective shrimp feed. They are rich in protein and essential amino acids that are key to strong growth performance. In essence, they play an important role in ensuring good production outcomes. However, many marine ingredients can be costly, especially when included at high levels, and they are increasingly scarce resources due to overfishing of some marine species.

“It’s not a question of whether to include marine ingredients in the feed, but rather, which marine ingredients to include and at what inclusion levels. Over the course of many years and multiple scientific studies, we see that krill stands out amongst its marine peers as a well-managed and sustainable resource that has proven effective in stimulating growth of shrimp when put to the test, side-by-side, with other marine ingredients,” says Dr Alberto J.P. Nunes, Professor at Federal University of Ceará’s Institute of Marine Sciences – LABOMAR.

Krill’s effectiveness in shrimp feed formulations

Much of the scientific study around shrimp feed formulation has been dedicated to evaluating the effectiveness of diets with low amounts of marine ingredients, testing whether minimising the inclusion of marine ingredients in the right combination can still contribute to performance. In one such review study developed in 2022 (Nunes et al., 2022) by LABOMAR and Aker BioMarine, the authors asserted that Antarctic krill, in its krill meal form, is a viable option to fill the nutritional gaps created by the reduced inclusion of other, less sustainable, and potentially higher cost marine ingredients.

In a typical feed formulation, more than half of the formula consists of protein raw materials and crystalline amino acids derived from marine ingredients. These nutrients amount to more than two-thirds of the cost – which makes them the most expensive part of the shrimp feed. To reduce this cost, the typical course of action is to replace the marine source of the protein and amino acids with plant-based sources, such as soybean or canola meal, or animal by-products.

“The downside of using plant-based ingredients or animal by-products in the feed is the lower nutritional value and reduced effectiveness when it comes to stimulating growth performance. When we look at krill meal in comparison, we see a sustainable and nutrientrich ingredient that has proven effective in multiple

Dr Lena Burri says, “ When attempting to reduce these costs by removing expensive ingredients, there is a risk of eliminating nutrients that are essential for the shrimp’s growth and health.”

Krill was ranked as the best feeding effector and growth enhancer for Pacific whiteleg shrimp in comparison to six other marine ingredients (Nunes et al., 2019).

Krill is a sustainable and functional feed ingredient. It is certified by MSC.

aquaculture feed trials – with results showing that it stimulates appetite and enhances growth even at lower inclusion levels,” explains Nunes.

In a 2019 scientific review article (Nunes et al., 2019) also conducted by LABOMAR and Aker BioMarine, the scientists ranked krill meal as the best feeding effector and growth enhancer for Pacific whiteleg shrimp in comparison to six other marine ingredients. In a new study published in 2024, it was demonstrated that an inclusion as low as 1.5% of krill meal was enough to increase feed intake and enhance growth, yield, and feed conversion ratio (FCR). In this study, other ingredients were optimised and resulted in good performance with low marine ingredient inclusions, reducing as much as 75% of less sustainable marine ingredients. The authors asserted that the strong growth results were likely due to krill’s feed attractiveness along with the dietary nutrients it delivers.

Krill meal serves as a nutritional powerhouse in shrimp feeds

To understand the unique qualities of krill, it’s important to look to its origins. Antarctic krill is found in the pristine waters of the Southern Ocean, where it feeds on microscopic algae – consuming up to 20% of its own body weight each day. Krill’s nutrition-rich profile has put it in the ‘super ingredient’ category – high in protein, peptides, essential amino acids, micronutrients, and phospholipids that carry fatty acids, including the all-important omega-3s. Peptides and amino acids in krill also happen to be feed attractants, which help to increase the attractability and palatability of the feed. The result is that more feed is consumed by the shrimp and less is wasted, leading to greater growth due to high intake and overall improved efficiency combined with a lower feed loss.

“The combination of krill’s rich protein and lipid profile, with the phospholipids, vitamins, chitin, and astaxanthin it contains, makes it an ideal feeding component for shrimp feeds. The bonus is that it is also a sustainable ingredient - a merit that is increasingly important to shrimp producers who seek to reduce their environmental impact,” says Ragnhild Dragøy, VP Product Management and Sustainability for Feed Ingredients, Aker BioMarine.

The growing importance of sustainable ingredients in shrimp feed Norway-based Aker BioMarine accounts for the majority (65-70%) of the global catch of krill. Krill catch limits are set at less than 1% of the total estimated biomass in Area 48, a measure that is strictly regulated by the Commission for Conservation of Antarctic Marine Living

For Dr Alberto J.P. Nunes, the question is, “which marine ingredients to include and at what inclusion levels.”

Low marine ingredient inclusions, reducing as much as 75% of less sustainable marine ingredients increase feed intake and enhance growth, yield, and feed conversion ratio (Nunes et al, 2022)

“..a merit that is increasingly important to shrimp producers who seek to reduce their environmental impact,” says Ragnhild Dragøy.

Resources (CCAMLR). The krill biomass has been closely monitored for decades, and according to a recent 10-year monitoring study (Skaret et al., 2022), the Antarctic population has held steady and has even exhibited growth in the last two decades.

“What’s notable about Aker BioMarine’s krill operation is our strict management and underutilisation of the krill resource. We aim for zero by-catch, low emissions, and full transparency across the entire value chain, which means that every batch of krill can be traced all the way back to where it was caught. This precautionary approach has resulted in a healthy and plentiful krill biomass, making it a sustainable and well-supplied ingredient for shrimp feed,” says Pål Einar Skogrand, VP Policy and Impact, Aker BioMarine.

“The need to reduce shrimp feed costs is growing more urgent in this challenging industry. However, reducing costs cannot come at the expense of nutrition and sustainability of the operation,” he adds.

In the quest to find an ingredient that balances these requirements, krill stands out amongst its fellow feed ingredients. Its combination of proteins, nutrients and feed attractants is enabling the reduction of other marine ingredients that may be scarce in supply, costly or unsustainably fished. Krill meal opens the door to improving the cost efficiency and nutritional intake of shrimp, without sacrificing sustainability. It’s a win-winwin for shrimp aquaculture.

References

Nunes AJP, Dalen LL, Leonardi G, Burri L (2022). Developing sustainable, cost-effective and high-performance shrimp feed formulations containing low fish meal levels. Aquacult Reports; 27, 101422. https://doi.org/10.1016/j.aqrep.2022.101422

Nunes AJP, Sabry-Neto H, Oliveira-Neto S, Burri L. (2019). Feed preference and growth response of juvenile Litopenaeus vannamei to supplementation of marine chemoattractants in a fishmeal-challenged diet. J World Aquacult Soc. 2019; 50: 1048–1063. https://doi.org/10.1111/jwas.12648

Skaret G, Macaulay GJJ, Pedersen R, Wang X, Klevjer TA, Krag LA, Krafft BA (2023). Distribution and biomass estimation of Antarctic krill (Euphausia superba) off the South Orkney Islands during 2011–2020, ICES Journal of Marine Science, 80(5), 1472, https://doi.org/10.1093/icesjms/fsad076

This year’s Seafood Expo in Barcelona was a huge success for the Aquaculture Stewardship Council (ASC), as the organisation garnered attention for its efforts in promoting responsible aquafeed production. The three-day Seafood Expo event, which attracted over 35,000 seafood professionals, saw ASC’s distinctive branded booth becoming a focal point for seafood enthusiasts, experts, retailers, buyers, and processors alike.

One of the highlights of the expo was ASC’s panel event, which centred on the importance of responsibly produced aquafeed. The panel, featuring key industry players, drew a crowd of 120 attendees eager to learn more about the ASC Feed Standard and its implications for the aquaculture industry.

With the theme ‘Feed Responsibly: Why Responsible Aquaculture Needs Responsible Feed’, key industry players shared how they are adopting the ASC Feed Standard to drive transparency, social and environmental improvements in feed supply chains. The panel included representatives from Skretting, Thai Union, and New England Seafood, each offering unique perspectives on their journey towards responsible feed production.

Esther Luiten, ASC’s Commercial Director kicked off the event with a warm welcome, acknowledging the impressive turnout. The focus of the day was on responsible feed production—an essential component of sustainable aquaculture. Luiten proudly announced the certification achievements of three feed companies, highlighting their commitments to meeting the rigorous standards set by ASC. She emphasised the global reach of this initiative, with certified sites spanning from Mexico to Thailand, Chile, and Ecuador, and exciting prospects in the pipeline for further expansion.

The significance of responsible feed cannot be overstated, given its pivotal role in shaping the future of aquaculture. Luiten underscored the challenges inherent in achieving this goal, setting the stage for a panel discussion on the difficulties in driving impactful change. Before delving into the dialogue, a brief video provided insight into the ASC standard, setting the tone for an engaging exploration of responsible feed practices.

Ruth Hoban, Head of Sustainability at New England Seafood emphasised the importance of transparency and traceability in feed sourcing for her company. Hoban spoke about the increasing scrutiny from UK retailers and NGOs regarding these demands. She emphasised the need for standards like the ASC Feed Standard to guide companies on their journey towards responsible feed sourcing. The dialogue delved into the broader implications of the ASC Feed Standard beyond marine ingredients, with Hoban shedding light on the evolving landscape of feed production. She highlighted the importance of due diligence and assurance in sourcing raw materials, emphasising the role of the ASC standard in providing greater transparency and confidence to processors and retailers.

pro Autolyzed brewers’ yeast

Rich in nutrients and active ingredients

High bioavailability of the same

Stimulates the metabolism

Promotes feed intake and performance

Adam Brennan, Chief Sustainability Officer, Thai Union Group elaborated on the group’s ambitious sustainability strategy, which includes commitments to responsible feed sourcing aligned with climate change and biodiversity goals. He emphasised on the role of the ASC Feed Standard in helping the company deliver on its commitments.

He elucidated the tangible benefits of the ASC Feed Standard for his company’s sustainability goals. He emphasised how the standard aligns with Thai Union’s commitments to climate responsibility and sustainable aquaculture, providing a robust framework for addressing material risks within the supply chain. Brennan stressed on the credibility and scalability of the standard, underlining its role in driving impact at scale while instilling consumer confidence through the ASC label.

Jorge Diaz, Global Sustainability Manager, Skretting shared insights from his company’s journey in embracing the ASC Feed Standard, reflecting on the initial apprehension, daunting challenges and subsequent determination to forge ahead on the journey towards certification. Diaz highlighted the subsequent benefit of adopting responsible feed practices and spoke about the transformative potential of the standard in reshaping relationships with suppliers. With a commitment towards understanding these standards, he explained that taking a collaborative approach is necessary for risk mitigation and industry advancement.

Alexandra Warrington, Feed Standard Senior Coordinator, ASC concluded the panel session by emphasising on the collaborative efforts needed to drive positive impacts on both people and the planet through responsible feed production. Warrington set the stage by expressing her delight at the growing awareness among stakeholders regarding the pivotal role of feed in fostering responsible aquaculture.

She emphasised that responsible culture is inseparable from responsible feed, noting the critical need to

address the wide-ranging impacts of feed production throughout the supply chain. Warrington lauded the introduction of the ASC Feed Standard as a pivotal step towards scrutinising these impacts and driving meaningful change.

Discussing the initial reactions from feed companies, she highlighted a spectrum of responses, ranging from eagerness to apprehension. She elucidated on the complexity of the ASC Feed Standard, which was crafted in consultation with diverse stakeholders to address the multifaceted nature of supply chain risks. Warrington reiterated ASC’s commitment to supporting feed mills in navigating the requirements of the standard.

The positive reception and continuous support from stakeholders across the aquaculture supply chain reaffirmed ASC’s commitment to promoting responsible feed practices.

As the dialogue ended, it became evident that while challenges remain, the ASC Feed Standard represents an important step forward in fostering sustainability and responsible practices within the aquaculture industry. With continued collaboration and support, stakeholders might be able to navigate the complexities of feed production, paving the way for a more sustainable future. With more feed companies undergoing the certification process, the momentum towards environmentally and socially responsible feed production continues to grow.

The Seafood Expo Global served as a platform for meaningful dialogue and collaboration towards a more sustainable future for aquaculture. As the demand for responsibly sourced seafood continues to rise, initiatives like the ASC Feed Standard play a vital role in driving positive change across the aquaculture supply chain.

ASC certified farms have until October 2025 to switch to sourcing compliant feed produced under the ASC Feed Standard. Feed mills that get certified in 2024 will not have to pay licence fees on the volume of compliant feed they produce this calendar year.

The USGC international aquaculture conference’s topics range from demand and supply, feed sustainability to DDGS and corn fermented protein for aquafeeds

The ecosystem for aquafeeds continues to change. It is now the era of Aquafeeds V3 where the focus is on traceability and sustainability, according to IFFO’s Director of Research, Dr Brett Glencross. By October 2025, Aquaculture Stewardship Council (ASC)’s certified farms must use feeds certified to its new feed standards. A new challenge from 2025 is the EU’s Deforestation Regulation affecting the entire supply chain for soy complex (soybeans, soy oils and soy meals etc).“While aquafeed millers constantly seek sustainable feed ingredients, a demand is out there for sustainable feed ingredients, but this comes at a cost,” said Ronnie Tan, Aquaculture Consultant, USGC.

“The US Grains Council promotes two corn co-products, Distiller’s Dried Grains with Solubles (DDGS) and corn fermented protein (CFP); both can play a larger role in aquafeed production, particularly with regards to sustainability,” said Carlos Suarez, USGC’s Sustainability Manager. Sustainability in aquaculture is more complex and different from that for livestock production.

Taking advantage of the presence of the global seafood and aquaculture stakeholders attending Seafood Expo Global in Barcelona, USGC held a half day International Aquaculture Conference. Ramy H. Taieb, Regional Director, US Grains Council - Middle East, Africa and Europe and Karisha Kuypers, Agricultural Attaché, USDA FAS Madrid welcomed over 40 aquafeed producers, together with shrimp and fish farmers.

Rabobank’s Novel Sharma, Analyst-Seafood, said that 2024 is seeing the lowest shrimp prices. At the retail level, they do not reflect those at wholesale prices and the hope is that retail prices will go down leading to increase in demand.

China’s domestic supply is expected to affect future demand, but the macroeconomics of the country does not favour the population spending a lot on buying shrimp. “We need the demand and supply to close up to have better prices,” said Sharma.

Growth in supply from Ecuador is expected to slow down to 5% in 2024. Ecuador is pushed by its technification process in the farming level and investment in processing. Ecuador’s industry can pivot to any product, as its exporters did in 2021 to quickly match market demands. After years of growth, Southeast Asia’s production is expected to drop, led by Vietnam and Indonesia.

Despite low prices, Rabobank does not expect supply to contract in 2024. It expects India and Indonesia to be encouraged by US demand expectations. “Low prices will remain and become the new normal. Even in an optimistic

scenario of a faster demand recovery, globally there is sufficient supply growth potential to prevent a strong price recovery.”

El Niño is tapering off which will help feed producers. Fish meal volumes will recover to the 5 million tonnes mark. “The fishmeal/soy meal price ratio is expected to continue a gradual decline after hitting its peak in Q3 2023. The five-year average was 4.2,” said Sharma.

Ragnar Nystøyl, Chief Analyst, Kontali discussed trends in the global supply of tilapia and merged these into aquafeed demand. Tilapia and catfish fit into the lower end of the seafood ladder, with prices around USD1.60/ kg and USD1.20/kg. In comparison, salmonids are at USD9.50/kg. In terms of supply, global volumes of the tilapia reached 6.5 million tonnes at a 5-year compound annual growth rate (CAGR) of 1.8% while for the catfish, mainly pangasius from Vietnam, volumes reached 5.2 million tonnes at a CAGR of 3.2%.

In 2023, aquafeed volumes were expected to decline in the order of 4% for tilapia feed and 5% for catfish feed. Overall aquafeed volumes have been on the decline in 2023 according to the data from Alltech. The decline was led by China and Southeast Asia.

Kontali adopts the weighed raw material index for salmon feeds and using this, Nystøyl demonstrated that inflation and squeezing margins led to slow growth. Tough feed logistics have affected the trade of tilapia and catfish from China and Southeast Asia to the EU, Africa and America. “In mid-December 2023, the Red Sea crisis had a significant impact on trade and imports to the EU; the total volume during that period was only 99,113 tonnes”.

Growth in tilapia supply levelled off in 2023. The US was no longer driving growth of the tilapia market. US volumes declined from 700,000 to 450,000 tonnes but the US remained the reference for the tilapia trade. In terms of prices, those for fresh tilapia have increased while frozen tilapia declined to USD4.00/kg in 2023 and frozen whole fish price hovered around USD2.00/kg. For the catfish, the major markets were China, USA and the EU.

2024 and beyond

The volume growth for the tilapia is uncertain because of feed costs but price levels may improve with international trade of frozen tilapia. Issues on feed, price and inconvenient logistics are expected to hamper growth for both tilapia and catfish. Kontali expects growth of both pangasius and hybrid/local catfish in Latin America for local and regional consumption.

According to Tan, the Alltech Global Feed Survey showed aquafeed production in 2023 at 52.09 million tonnes, down 4% from the previous year. Shrimp feed volume was over 8 million tonnes mainly from Latin America and Asia, but with growth in the former and stagnation in the latter.

Global tilapia feed production was over 9 million tonnes led by China, Egypt, Indonesia, Brazil and Bangladesh. Global production of pangasius catfish feed was over 4.5 million tonnes (excluding China) and if farmgate prices of the fish do not improve, the industry will continue with economical feeds.

The outlook for 2024 sees new challenges. “Will inflation, looming recession and gloom in the US, EU and China respectively, dent seafood demand?” asked Tan. While salmon prices will remain high, securing feed volumes, low shrimp prices will cause shrimp feed volumes to shrink. Notwithstanding, feed insecurity is on the rise. Fishmeal prices are expected to soften but current inventory is still low.

Tan echoed Nystøyl, that bottlenecks at Suez and Panama Canals will tighten the supply chain. Alternative protein ingredients are in the feed companies’ radar, but utilisation will depend on price and scalability. Tan gave a 2H 2024 outlook on grain supply, forecasting lower soybean meal prices and range-bound prices for corn and DDGS with supporting fundamentals.

Glencross showed how the use of ingredients is changing. As aquaculture grew, formulation became much clearer,

but the need was to control cost. With regards to fishmeal, aquaculture is using fishmeal more than before. It continues to be used as a strategic ingredient. Grains will underpin all feeds going forward. Growth in grain consumption by 2032 will be 465 million tonnes and feed will consume 106 million tonnes.

Glencross discussed how diet formulations are designed, stressing that formulations are based on nutrients, Increasingly, industry is looking at formulations based on digestible levels such as digestible energy and protein. Using the example of a modern formulation for the Asian seabass, Glencross demonstrated how specifications change for different stages. Eight different specifications can be applied over the production cycle of this fish (from first feeding to 5kg harvest size).

Secondly, digestible levels are fixed but crude or gross levels vary. Thirdly, as the animal’s size changes, there is a different pellet size and the protein: energy dynamics will also change. He discussed the regulation of feed intake and how the fish reacts to feed. Fish have the same five senses as humans do, plus the ability to sense vibrations in water via their lateral line and in some cases electrical currents. Fish have a higher sensory capacity than mammals and marine meals stimulate feed intake.

“All feed ingredients have SWOT - strengths and weaknesses, opportunities, and threats. There is no such thing as the perfect ingredient,” said Glencross. He added that all ingredients have risks and formulators need to be aware of the ramifications and impact they create on formulations. But with an understanding of the strengths of an ingredient, and the weaknesses of another,

complementarity is possible. Marine ingredients are complementary to increasing grain use in feeds, providing cost effective nutrients.

“Managing diet palatability is becoming critical and control of palatability will empower formulation,” said Glencross. Palatants tend to be enzymatic or acid hydrolysates of fishery products with key chemical stimuli such as peptides and free amino acids. The typical inclusion rates are 0.5-5% but Glencross reminded that responses are variable depending on hydrolysis, between species but overall, still gives good palatability.

Seabass and seabream in the Mediterranean Kantham Papanna, Consultant on Fish Pathology & Aquaculture, formerly Head, Fish Pathology, Nireus Aquaculture (now Avramar) said that together Greece and Turkey produced 70% of European production, with a total volume of 363,000 tonnes in 2022. Species wise, volumes were 28% gilthead bream and seabass at 25%. Economic sustainability is a concern for players in Greece and Turkey and a common challenge is high feed and energy costs. Turkey also faces currency devaluation and high inflation.

Major markets are local as well as Italy, Spain, and France. The supply chain is limited to chilled fish which needs a cold chain supply line from harvest point to final markets. Turkey has the advantage of selling to Russia while there is an embargo for EU producers. Tracking prices, Kantham showed that these have been quite unstable over the past two decades. March 2024 prices were €6/kg for the seabass and €5.5/kg for the seabream. In Greece, 300 companies in Greece are integrated from hatchery to sale and logistics and a few have retail outlets.

There is a two-phase grow-out in open sea cages over a 2-year cycle. In year 1, small 60-80m diameter cages hold 2-60g fish and in year 2, large cages (100-200m diameter) and 15-20m deep, hold more than 60g fish to harvest. Genetically improved juveniles reach harvest sizes of 350-450g fish in 13-18 months with over-wintering when water temperatures are 16°C.

The hatchery segment is well organised. With technological advancement, survival to 2g fry has improved tremendously over 35 years to the present 45% for seabream and 25% for seabass. Some 70% of the juveniles produced are from genetically improved stock. In Greece, Avramar, the largest producer in the Mediterranean works with Benchmark Genetics and Scotland’s Xelect. Japanese and Scandinavian breeding companies are working in Turkey. Their output has seen improvements in harvest weight, fillet yield, body shape, robustness, deformity reduction and disease resistance against Vibrio, viral nervous necrosis (VNN) and parasites.

Vaccinations against several pathogens are in place starting with 20g fish, better nutrition with functional feed ingredients for parasite control, fallowing of the sites and year class separation, with priority on stocking with robust juveniles.

“In the pursuit of sustainable shrimp production, feed is important,” said Michiel Fransen, Standards and Science Director, ASC. There is the importance of quantifying the footprint of feed ingredients through life cycle assessments (LCAs), focussing not only on environmental impacts but also resource management and scalability.

ASC has two types of certification programs: one for aquaculture farms and a recent certification for feed. Fransen, discussed the ASC Feed Standard, outlining sustainability challenges and principles for feed used in aquaculture, focussing on responsible ingredient sourcing and transitioning to deforestation-free supply chains. He explained the challenges encountered with feed: up to 80% of carbon footprint of aquaculture is in feed; deforestation and land conversion are the biggest drivers. Sustainability credentials of marine ingredients and feed supply chains are long and complex, making traceability difficult. Responsible sourcing of ingredients - marine and plant ingredients are included in its five principles. Fransen reflected on how the role of the supply chain has shifted from business to business towards business to consumer, with concerns on origin of supply chain and trust built in.

Controls fungi, protozoa, and pathogenic bacteria Quickly troubleshoots Red Head events Does

www.megasupply.com orders@megasupply.net

“We basically are asking that the feed miller undertakes due diligence on their ingredient sources to demonstrate low risk on key factors (legal, environmental and social).”

He added that as transparency is key, similar to the farm standard, ASC publishes on its website what the feed mill reports on water consumption and disposal, effluent discharge, energy consumption, GHG emissions and ASC feed volumes sold.

DDGS in aquafeeds

“DDGS and CFP do not compete for the same space. Regular DDGS is for lower protein feed of less than 33% crude protein and CFP for higher protein feeds of more than 33%CP,” said Tan. The strengths of DDGS in aquafeeds include the protein component, energy, available phosphorous, yeast, beta-glucans and xanthophyll, and for CFPs, the highly digestible amino acids. (Table 1).

Shrimp feed 32-40%CP Tilapia feed 28-32%CP Pangasius feed 26-28%CP Marine Fish feed 40-50%CP DDGS Indonesia Thailand Vietnam

Table 1. Opportunities for DDGS for freshwater fish and shrimp and CFP for marine fish & shrimp in Asia. Source: Ronnie Tan, 2024.

Turkey produced 876,000 tonnes of feeds for an aquaculture production of 575,000 tonnes. But with prices of fish feed increasing and volatility in the soy market, Professor Deniz Coban, Agriculture Faculty, Aydın Adnan Menderes University, Turkey, has conducted laboratory trials with DDGS, adding it in feeds at three inclusion rates, 10%, 20% and 30%.

He concluded that feed conversion ratio (FCR) was lower, weight gain and specific growth rate (SGR) were higher in the 20% inclusion group. It was observed that the use of DDGS up to 30% in rainbow trout feeds had no negative effect on skin and fillet colour. Digestibility trials also showed no negative effect on digestibility rates. It was observed that the feed cost decreased significantly due to the increase in DDGS protein source in the trial feeds.

For Dr Kevin Herrick, Director of Nutritional Technical Services, POET Bioproducts, USA, CFP represents the next evolution of the distiller’s industry. Its nutrient profile makes it ideal for aquaculture formulations and provides an alternative ingredient in most formulations but there are still a lot more to learn on the benefits. Using the AquaOp formulation software which captures requirements for regional species and ingredient specifics, CFP replaced some soybean meal and wheat gluten meal with 3.1% reduction in feed costs in a formulation for steelhead trout in Turkey. It replaced some soybean meal, gluten meal, and blood meal with a 2.7% reduction in feed costs, in a formulation for gilthead bream. A formulation for the

seabass with a replacement of soy protein concentrate with CFP and added fishmeal, gave a 2.9% reduction in feed costs.

Herrick also debunked some perceptions such as effects on fillet colour. CFP has little to no effect on fillet colour at typical inclusions as shown in a 30-day digestibility study with CFP at 30% inclusion.

The growth in aquaculture feeds requires complementary feed ingredients. Fishmeal and marine ingredients will remain as strategic ingredients. The industry looks for alternative ingredients with availability, price and sustainability attributes. DDGS and CFP meet all the criteria.