Marketing,

Marketing,

Sheng Long, your professional and trusted aquaculture partner. We are committed to supporting our valuable customers’ success by providing innovation programs with high-performance feeds, healthy shrimp larvae, aquatic probiotics & healthy products and new farming models & technology.

Add: Block A5, Duc Hoa 1 Industrial Park,Duc Hoa District, Long An Province

Tel: (84-272) 3761358 - 3779741 Fax: (84-272) 3761359

Email: thanglong@shenglongbt.com Website: www.shenglongbt.com

Add: Plot No. A-11/1, Part-A, SIPCOT Industrial Park, Thervoykandigai Village, Gummidipoondi Taluk, Thiruvallur District, Tamil Nadu 601202, India.

Tel: 91-44-6790 1001 Fax: 91-44-6790 1017

Email: info@shenglongindia.com Website: www.shenglongindia.com

Marine Shrimp: Supply Dynamics & China

From the editor

2 Still lacking Disaster Risk Management

Industry News

4 TARS 2024: Steering Asia’s finfish aquaculture into focus

6 EAS honours Bjørn Myrseth for contributions to European and global aquaculture

Shrimp Aquaculture

8 Indonesia Shrimp Farmers Day

A need for a fresh marketing strategy and matching feeds to location and farm conditions

Feed Technology

Editor/Publisher

Zuridah Merican, PhD

Tel: +6012 205 3130

Email: zuridah@aquaasiapac.com

Editorial Coordination

Corporate Media Services P L

Tel: +65 6327 8825/6327 8824

Fax: +65 6223 7314

Email: irene@corpmediapl.com Web: www.corpmediapl.com

Design and Layout

Words Worth Media

Management Pte Ltd

Email: sales@wordsworth.com.sg Web: www.wordsworth.com.sg

AQUA Culture Asia Pacific is published bimonthly by

Aqua Research Pte Ltd

3 Pickering Street, #02-36 Nankin Row, Singapore 048660

Web: www.aquaasiapac.com Tel: +65 9151 2420

Printed in Singapore by Times Printers Private Limited 18 Tuas Avenue 5 Singapore 639342

Subscriptions

Subscribe via the website at www.aquaasiapac.com

Subscriptions can begin at any time. Subscriptions rate/year (6 issues): SGD 70, Email: subscribe@aquaasiapac.com Tel: +65 9151 2420

Fax: +65 6223 7314

Copyright © 2024 Aqua Research Pte Ltd.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior permission of the copyright owners.

Aqua Culture Asia Pacific is a print and digital magazine.

View E-magazine & Download

PDF of past issues for free www.aquaasiapac.com

15 Health functionalities in shrimp feeds: Connecting science with field reality

By Jean-Benoît Darodes de Tailly and Thomas Denis

19 New circular economy venture in Vietnam with hydrolysates

Interview with Thomas Levallois on the commitment to upcycle seafood waste in a facility designed with sustainability at its core

22 Growth performance and digestibility in Nile tilapia fed plant diets supplemented with a new generation phytase

Growth performance of tilapia with increased phosphorus, calcium and ash accumulation levels in the whole body, bones, and scales. By Nguyen Van Nguyen, Le Hoang, Pham Duy Hai, Tran Van Khanh and David Bal

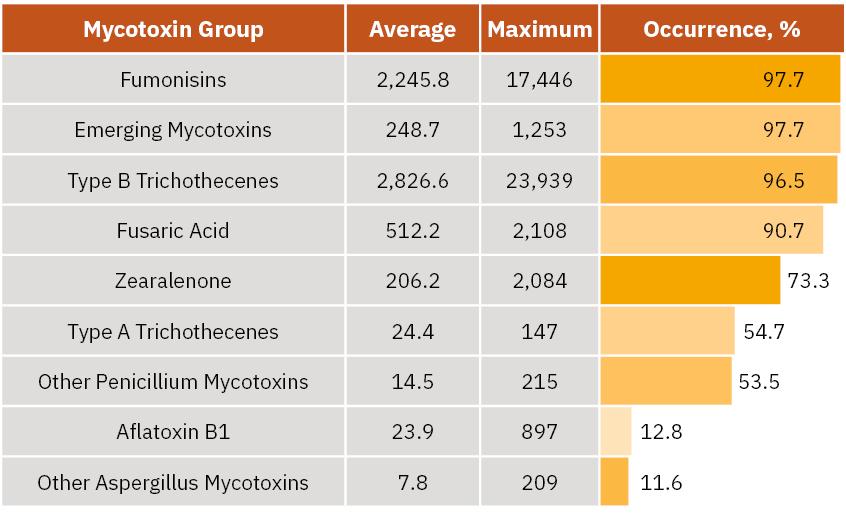

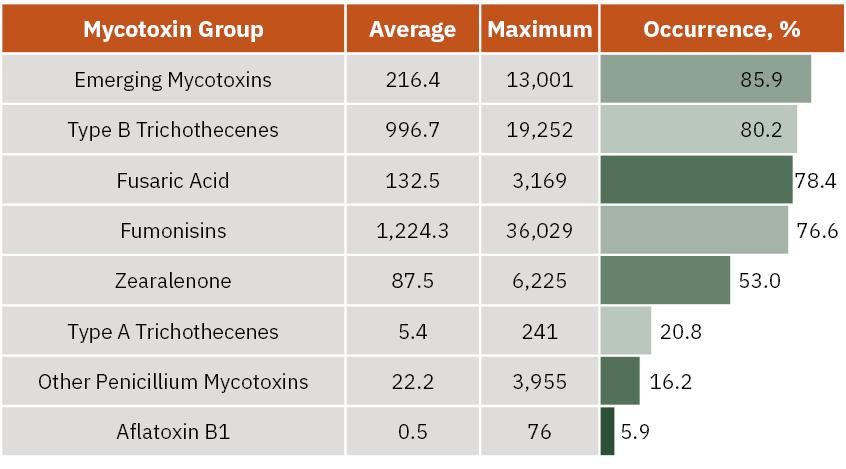

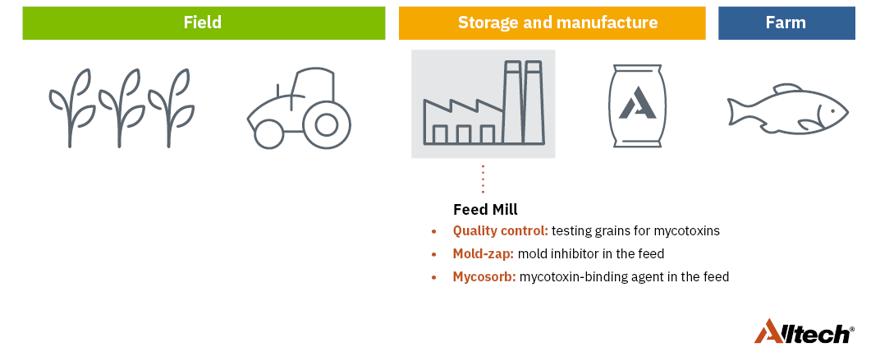

26 Understanding and mitigating the mycotoxin risks for aquaculture farmers in Asia-Pacific

Vivi Koletsi reviews occurrence of mycotoxins in feedstuffs for aquafeeds and effects on carp and whiteleg shrimp

30 Comparison between mineral-amino acid complexes and inorganic mineral supplementation on performance and health of pangasius catfish during the nursery phase

By Le Thanh Hung, Huynh Khanh Duy, Vo Thi Thanh Binh, Mihai Sun and Sutep Luengyotluechakul

Fish Aquaculture

34 Navigating the dynamics of finfish aquaculture in Asia

At TARS 2024, discussions on how the lower demand for frozen tilapia fillet affects producers in Asia and how consumers are influencing which marine fish is on the dining table

40 Marketing, branding, and sustainability of Asia’s farmed finfish

A global exchange by industry leaders at TARS Hard Talk 2024 on marketing the pangasius, tilapia and Asian seabass

Industry Review-Marine Shrimp

44 Vannamei shrimp supply outlook to May 2024

At Shrimp Summit 2024, Kontali estimated production to reach 5.7 million tonnes in 2024 and grow further to 6.1 million tonnes in 2025

46 A deep dive into China’s shrimp production

Focus on the strengths and weaknesses of the small greenhouse model at GSF 2024

Show Review

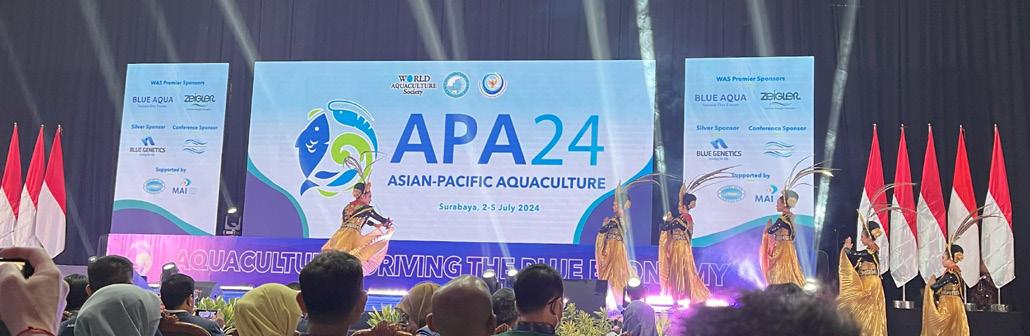

50 Asian Pacific Aquaculture 2024 in Surabaya, Indonesia

Company and Event

56 INVE Aquaculture celebrates 40 years of innovation and growth at larvi 2024

58 Customised research for alternative proteins in Wales and Singapore

60 Aqua seminar breaks down phytase and feed costs

Zuridah Merican

It is just pure coincidence that during the week of The Aquaculture Roundtable Series 2024 on Finfish Aquaculture – Steering an Industry into Focus, that the New York Times published on their front page ‘Wild West of Fish Farming’ in Chile. In 2023, farmed salmon was the second largest export of Chile generating US$6.5 billion in revenue. Chile’s National Fisheries Agency reported that 338 tonnes of antibiotics were used that year and that is detrimental to its image and to aquaculture in general.

My takeaway message from TARS 2024 was that we are still lacking a Disaster Risk Management (DRM) Protocol. We cannot speak for Chile, but we can certainly speak for AsiaPacific. The pangasius sector in Vietnam boomed in the early-2000s and there was negative publicity of pangasius fish farmed intensively in cages in the Mekong River deemed to be one of the most polluted. Tilapia gained prominence in the US market in the late 2000s and there was negative publicity that tilapia was described as an unhealthy fish

We strive to be the beacon for the regional aquaculture industry. We will be the window to the world for Asia-Pacific aquaculture producers and a door to the market for international suppliers. We strive to be the forum for the development of self-regulation in the Industry.

for human consumption. Nearly two decades later and we still hear this circulating in social media which hurts the growth and per capita consumption of both species. The problem is that this narrative has never been corrected on an unbiased and balanced scale. DRM involves prevention, preparedness, response, and recovery actions that address natural and man-made hazards.

Similarly, we do not sufficiently tell our success stories of finfish aquaculture in Asia. Leading the list for pangasius, tilapia and marine fish are Vinh Hoan, Regal Springs and Australis, respectively. Although culturing very different species, they share common traits contributing to their success. The first being that they are all integrated and control many segments of their value chain. Vinh Hoan started as a pangasius processor and exporter but today they have gone into hatchery, nursery, farming, and feed but they are also careful not to be 100% self-reliant. This allows them to benchmark against third parties to ensure there is no complacency. Vinh Hoan’s fish production only supplies 75% of their processing needs. They buy commercial feed and sell their own feed to optimise the equilibrium and ensure quality is maintained.

Regal Springs focuses on fish production to ensure cash is used in the right places. Integrating into feed production is always tempting but when there are feed companies willing to provide good quality feed with credit terms, it may be better to ‘stick to the knitting’ while only stepping into feed production for the juvenile phase. When the founder of Australis – Josh Goldman started barramundi aquaculture 15 years ago, he was adamant that he wanted to be integrated. Although, this meant a dilution of investment into the various segments of the value chain, it meant ‘keeping promises’ and allowed for control of quality all the way to the consumer, thus contributing to their tagline: ‘Better Fish, Better World’

Integration in all the above three companies allowed for traceability, transparency and sustainability which differentiated them from the competition. Freezing and processing are key to the export markets as it allows for long term storage and handling of the fish product. Francisco Murillo of Tropo Farms (ex-Regal Springs and Rain Forest) clearly stated that the tilapia took-off in the US market when it was packaged into a ready to cook, filleted and skinless product.

Nguyen Ngo Vi Tam, CEO of Vinh Hoan tells us that their current strategy is to maximise the fish value in the farmed fish complex i.e. skins for collagen, frames for fish meal and oil for the feed and biofuel industries. Efficiency is key to profitability so off-cuts are transformed, from byproducts into surimi co-products.

The call for sustainability came in the early 2000s and it started off as a ‘box to tick’ but when buyers and retailers used certifications to ensure sustainability criteria were met, Lukas Manomaitis, Aquaculture Lead at USSEC said that ‘they suddenly had teeth’ and the aquaculture value chain had to pay attention. Then over the Covid period, the process matured and now consumers are demanding sustainability.

Hard Talk in TARS 2024 has clearly shown that all our successful aquaculture companies share Marketing, Branding & Sustainability (MBS) as their narrative. If Disaster Risk management (DRM) is to be our industry’s defensive strategy, MBS should be our offensive strategy.

If you have any comments, please email: zuridah@aquaasiapac.com

Enhancing

In its 13th year, The Aquaculture Roundtable Series (TARS 2024) returned to finfish aquaculture. Asia stands as the world’s largest producer of farmed finfish, contributing nearly 58 million tonnes to the global fish supply. As global demand is projected to double by 2050, producers in Asia are central to meeting this challenge. However, economic sustainability remains a key obstacle, with low farmgate prices and rising input costs squeezing margins. The market demand for quality, sustainability, and traceability adds further pressure on producers, who must balance these expectations without compromising on price.

Asia’s tilapia and pangasius face significant pricing challenges, hindering their climb up the whitefish value chain. Although Asia is a leading supplier of tilapia to the US, led by China and Indonesia, both species struggle with cyclic lows in farmgate prices, while retail prices for whitefish from Asia remain at the low and medium range. These issues present headwinds to the industry’s growth and market positioning.

In the marine segment, the industry is marked by large volumes of low-value milkfish and small volumes of high-value species like groupers. This fragmentation complicates efforts to achieve economies of scale and slows research and development in areas such as genetics, feed development, and vaccines. The contrast with Europe, where focus is placed on a few key species such as the European seabass and salmonids, amplifies the challenges posed by Asia’s multispecies culture.

Held in Bangkok, Thailand, on August 14-15, the meeting attracted 210 participants, with 72 of them from Thailand. This year’s program featured 40 speakers, tasked with navigating the multiple facets of Asia’s farmed fish industry, mainly production and supply chains for tilapia, pangasius and marine fish. TARS 2024 was organised by Aqua Culture Asia Pacific and Corporate Media Services, Singapore and this year, industry sponsors were dsmfirminech, US Grains Council, Jefo Nutrition, Alltech, BASF and Lucta.

Although Thailand is a small producer of the tilapia, it is a leader in exporting tilapia fry to 46 countries. Tilapia genetics is pursued by the private sector and the Department of Fisheries (DOF). However, farmers

At the Interactive Breakout Roundtable session, Group Leader, for “A Better Tilapia”, Dr Krishna R Salin, Asian Institute of Technology, Thailand (standing right) with table leaders, from left, Dr Roberto Cascione, Virbac Asia Pacific, Thailand; Dr Morten Rye, Benchmark Genetics, Norway; Abung Simanjuntak, dsm-firmenich, Indonesia; Hervé Lucien-Brun, Jefo Nutrition, Inc., Canada; Antonios Chalaris, Devenish, Scotland; Dr Ei Lin Ooi, Adisseo Asia Pacific, Singapore; Cameron Maclean, eFishery, Indonesia and Dr KP Chan, BASF Animal Nutrition, Asia Pacific, Singapore.

constantly face cyclic highs and lows in demand, affecting prices and margins. In his welcome message, Praphan Leepayakhun, Deputy Director-General, DOF, said, “Fish farmers are mostly small-scale. They are the backbone of our fish aquaculture industry and helping them to combat diseases, increase productivity and achieve consistent harvests is our responsibility.” He added that Thailand is strong in pond farming of the Asian seabass, producing almost 50,000 tonnes in 2022. “However, we need to focus on genetics, in the same way as we are doing for the tilapia.”

Praphan Leepayakhun, Deputy DirectorGeneral, Department of Fisheries Thailand (DOF) gave the welcome address.

While most of Asia’s finfish aquaculture is fragmented, there are a few integrated enterprises making waves globally. At the Hard Talk panel were business leaders, Nguyen Ngo Vi Tam , CEO at Vinh Hoan and Josh Goldman, Founder/CEO of Australis Aquaculture to discuss branding, marketing, and sustainability. Supporting them were Francisco Murillo of Tropo Farms, Ghana and USSEC’s Lukas Manomaitis, who offered a helicopter view on tilapia and the finfish aquaculture landscape, respectively (see pages 40-43).

The conference began with the State of Industry session, focusing on an analysis of the tilapia trade in the US, followed by directions for marine fish production in China, pangasius in Vietnam, and tilapia in Thailand (see pages 34-39).

A constant feature of the TARS program is the Interactive Breakout Roundtable session. This year, the task for participants was to build ‘de facto’ integrated enterprises for tilapia, pangasius, and marine fish. They addressed common industry issues from genetics, nursery, feed, productivity and efficiency, disease mitigation and

traceability, with the goal of driving the industry towards greater coherence and effectiveness. Some takeaways are listed below:

Retailers’ influence on consumer preferences: Retailers play a significant role in shaping consumer perceptions and demands, as seen with the promotion of salmon in Europe. This influence can extend to other species, but it also raises concerns about retailers imposing costly practices on farmers.

Need for industry pushback: While retailers can drive positive change, like promoting sustainable practices, there is a need for the industry to push back when retailers’ demands lead to increased costs or unfair burdens on small-scale farmers.

Quality and perception: Those for the pangasius and tilapia are influenced by factors like quality control and marketing. Poor practices can lead to a negative image, making it difficult to market these species, especially in regions where they are viewed as cheap or low-quality.

Importance of branding and negotiation power: Branding is crucial for improving the market position of less popular species. Only producers with strong negotiation power, can command higher prices and better market positions. Smaller producers in Asia have an unfair disadvantage.

Collaboration among stakeholders: More supply chain coordination, and collaboration among farmers, regulators, academia, and retailers is essential for improving standards, supporting small-scale producers, and enhancing the overall quality and marketability of fish species.

Education and support for small farmers: Educating small farmers on good practices is critical for preventing issues like disease and maintaining the quality of fish. Associations and cooperatives can help provide stability and fair pricing for these farmers.

Market adaptation and versatility: Species like pangasius can be marketed based on their versatility in flavour, catering to various consumer preferences. Adapting marketing strategies to emphasise these qualities can help improve their market appeal.

Changing consumer perceptions: There is a need for collective industry efforts to change negative perceptions of certain fish species, especially in regions where species like tilapia may have a poor image.

Product diversification through co-development: Better utilisation of the whole fish, improves profitability. Various products such as fish skin chips, can help diversify food options.

Importance of training farm workers: Better training of the farm workforce to ensure good farming practices, and better biosecurity, can improve fish health and performance throughout the production cycle.

Marine fish feed production: Feed millers are reluctant to produce feed for marine fish due to the continued use of trash fish, which lowers their volumes and profitability. Government intervention may be necessary to address this issue.

Low quantities hinder feed production for specific species: Low demand for feed for certain marine species, like for the grouper, makes it unprofitable for feed millers to produce specialised feeds, leading them to instead create a one-size-fits-all product.

Genetics and long-term investment concerns: On genetic improvement for the Asian seabass, once genetics selection is settled for the first founder stocks, the cycle time for the next selection is manageable. Similar to salmon, the adoption of strategies to prioritise genetic selection, despite the initial delay, was suggested.

Market development and branding for marine fish: There is difficulty in developing a premium market for marine fish due to the need for significant investment in branding and marketing. This is particularly challenging when the top species keep changing frequently.

Consumer demand vs production capability: The moot point for discussion was whether the industry should focus on producing what the consumers demand, or dictate what they should consume, especially when dealing with multiple species of fish.

Cultural preferences and market expansion: There is a cultural preference for marine fish among coastal populations in China and the need to change consumer perceptions in inland areas to expand the marine fish market. It was suggested that promoting the benefits of marine fish, similar to how chicken breast became popular for its protein content, could help achieve this.

At the opening ceremony of the AQUA 2024 event in Copenhagen, Denmark, the European Aquaculture Society (EAS) gave its highest award - Honorary Life Membership - to Bjørn Myrseth. A pioneer of fish farming in Europe and beyond, a role model for aquaculture and one of the founding members of EAS in 1976, Bjørn is the 16th recipient of this distinguished award.

Bente Torstensen, EAS President 2022-2024 presents the EAS Honorary Life Membership Award to Bjørn Myrseth at the AQUA 2024 Opening Plenary session.

AQUA 2024 was co-organised by the European and World Aquaculture Societies and attended by 3,600 participants from more than 80 countries. Bente Torstensen, EAS President 2022-2024 introduced and presented the award.

Bjørn Myrseth graduated with a master’s degree from the University of Bergen in 1971. After graduation, he became a founder of Stolt Sea Farm, specialised in the production of salmon smolts in Norway and later in Scotland, USA and Canada. Bjørn was the key driver of the company’s involvement in sturgeon farming in California.

He then looked to diversify his interests and, through Marine Farms AS, where he was CEO, made investments in Greece, Spain, UK and Chile. This was the start of Galaxidi Marine Farm in Greece and Culmarex in Spain. Marine Farms was listed on the Oslo Stock Exchange in 2006, having operations in the UK (salmon), Belize (cobia), Vietnam (cobia) and in Spain (seabass and seabream). In 2012, he was named as the Chairman of the salmon processor, Morpol, after their acquisition of Marine Farms.

Bjørn was presented with the Federation of European Aquaculture Producers “Award of Excellence” in 2011 for his “exceptional contribution to European aquaculture”. In 2013, he was presented with a lifetime achievement award by the Global Aquaculture Alliance. These are just two of his many recognitions.

Bjørn’s commitment and dedication to EAS goes back to its founding, as the European Mariculture Society in 1976, where he was a founding member and member of the Bureau. He was also the National Representative for Norway from 1976 to 1985, before coming back to the Board and becoming EAS President from 1992-1994 and then again from 2016-2018. This is the first time that EAS has had the same president for two non-consecutive terms.

Bjørn was chair of the 1993 EAS WAS World Aquaculture event in Torremolinos, Spain, and he was again the chair of the AQUA 2024 Steering Committee, 31 years later. Like all pioneers, he does not sit back on his laurels, but keeps active, keeps leading and keeps learning. He continues to be a Board member of companies across the globe and provides consulting services through his own Vitamar company.

His contribution to aquaculture is global, as described previously, and so the EAS Board considered that this EAS WAS AQUA 2024 event was the right time to honour Bjørn. He is a role model for aquaculture.

Honorary Life Membership of EAS is an award given to someone that has made a significant impact on the development of European aquaculture. Since 1981, EAS has given this award to very few persons, including Eric Edwards, Peter Hjul, Colin Nash, Courtney Hough, Pascal Divanach, Patrick Sorgeloos, Michael New, Sachi Kaushik, Stefano Cataudella and László Varadi.

ROBUSTNESS AND DIGESTIVE SYSTEM INTEGRITY +

PERFORMANCE

Partnering in microbial solutions for a changing world. Using sound science, proven results and knowledge from experience, Lallemand Animal Nutrition helps our customers and industry partners be more successful – and animals lead healthier lives.

Lallemand Animal Nutrition provides a full range of speci c, natural microbial products, services and solutions that improve animal well-being and performance while respecting animals, people and the environment.

A need for a fresh marketing strategy and matching feeds to location and farm conditions

There was a special program for Indonesian shrimp farmers during Asian Pacific Aquaculture (APA 2024) in Surabaya on July 4. This was organised by Shrimp Club Indonesia (SCI) for its members as well as other conference and trade visitors. The aim was to provide updates on the latest on the global demand and supply for vannamei shrimp and on shrimp feed technology and farm management.

Established in 2005, SCI aims to keep its members informed about the latest developments in the shrimp industry both locally and globally. The organisation provides a platform for shrimp farmers to exchange knowledge, discuss challenges, and collaborate on solutions. They also host events such as national meetings, seminars, and symposiums to promote sustainable shrimp farming practices. It was formed by a merger of two regional shrimp farming communities, the Lampung Shrimp Club (SC Lampung) and the East Indonesia Shrimp Club (SC Intim). Currently SCI has more than 15 representatives in various regions from western to eastern parts of Indonesia and continues to grow.

In 2023, SCI President, Haris Muhtadi estimated that Indonesia’s vannamei shrimp production was 265-275,000 tonnes. Exports in 2023 was estimated at 209,065 tonnes (GSF, 2024). “The challenging US market is a pain point for our shrimp farming industry since >70% of production goes to the US. With demand low in both the US and EU, market access is an issue our farmers are beginning to be aware of. For several years, we have been contented with the US market, a market which our processors are so familiar with. The US market merely demands low prices and does not focus on quality. Change is required if we need to seek alternative markets.”

Farmgate shrimp prices have fallen below pre-Covid levels and to two-decade lows. This is the biggest worry on the minds of all shrimp farmers. Ronnie Tan , Aquaculture Consultant, US Grains Council provided a summary of the demand, supply and price outlook. He set the scene for this session with an outlook on the global shrimp situation and outlined some positives and negatives in the current situation with shrimp markets. Noting the aim of the meeting, Tan gave tips on how the Indonesia’s shrimp industry could move forward.

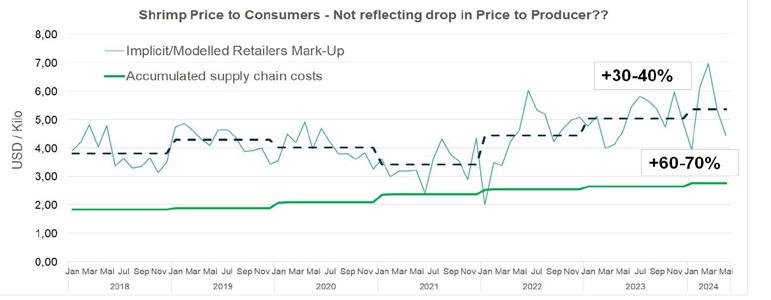

Rabobank compared the relative prices of shrimp against a basket of animal proteins between January 2020 and January 2024. They found that shrimp prices were relatively cheaper at the wholesale level, but this was not reflected in the retail market yet and may have a lag time of 9-12 months. The largest markets are China, the US, EU+UK and Japan and shrimp is a very price elastic product. “China recorded nearly one million tonnes of shrimp imports in 2023 but with lower aggregate prices and Ecuador supplied 72%. YTD May 2024, volumes have eased 5% compared to the previous year. China’s secondary home prices fell again in May, and this dents consumer confidence. The US imported nearly 800,000 tonnes in 2023 and in May 2024, although seafood prices have eased 6.3% (Y-o-Y), general affordability remains a key issue,” said Tan.

The supply side has been the key disruptor as Ecuador has doubled production over the past 5 years. Global shrimp production in 2023 reached 5.15 million tonnes (Global Seafood Marketing Conference 2024) led by Ecuador, China, India, Vietnam and Indonesia. Ecuador expects single digit growth in 2024 due to slow demand and lower prices. China’s demand remains the big question while the US antidumping (AD) and countervailing duties (CVD) rates will hurt sales. There is also a big concern with national insecurity.

So, what is Indonesia’s challenge? Indonesia’s major exports are to the US at 70% and to Japan at 16% demanding mainly PD (peeled deveined) and HLSO (headless shell on) respectively but the US has recently imposed AD and CVD rates on most companies at a combined rate of 6.3%. The China, EU+UK markets are relatively untapped by Indonesia but the EU+UK demand strict certification. While China is a closer proximity market requiring less certification, the demand is for head on shell on (HOSO) product.

“However, Indonesia’s ‘soaking’ practice will not meet EU+UK and China’s specifications. Hence, of the four major markets totalling 2.6 million tonnes, Indonesia can only play in two i.e. a limited 38% of global market. To create a new marketing strategy, the farmers and processors will have to work together to find the right product for the new markets,” said Tan.

“The forecast for demand shows some US growth dependant on lower retail prices but China’s economy cannot lift demand further. Supply will not contract despite low prices. Ecuador’s growth is slowing but from a large base. Hence low prices will remain as domestic demand growth will take time. For Indonesia to remain competitive, productivity and efficiency will also be key.”.

Anwar Hasan , General Sales Manager, Shrimp Feed, West Area at CJ Feeds gave some perspectives on the current concerns with shrimp farming in Indonesia and on the role of feed millers to optimise shrimp growth performance and efficiency. “Within this industry, we need to understand why farms are not performing. In Indonesia, particularly in Sumatera and Java, only 3040% of farms are operating,” said Anwar.

Starting with the concerns of the industry in Indonesia, Anwar related this to global trends. In the 2021 Goal survey, market prices were the key concern for 2022. In contrast, in the 2022 survey for 2023, aquafeed costs rose to be the main concern. “However, we are in 2024, and we know that for today, the concern is low shrimp prices which are expected to remain stagnant for the next few years.” In Indonesia, July prices for size 50 have hovered around IDR65,000/kg (US$4.21). Anwar added, “For us in Indonesia, we focus on the US market which is now very difficult with India and Ecuador as competitors. For the EU markets, access is difficult.”

Some 2-3 years ago, acute hepatopancreatic necrosis disease (AHPND) began to affect farms. But although survival rates were 50-60%, with higher prices, margins were good for farms. In Indonesia, when compared to 2022, when the price was still acceptable, shrimp prices in 2024 declined to US$1-1.5/kg for size 50.

Anwar described the approach at CJ Feeds in feed development. Sustainability is important and using renewable plant protein meals and alternative protein and oil products is the new direction. Nevertheless, for any ingredient, the considerations are cost, availability, supply, consistency, palatability, digestibility, nutritional value and anti-nutritional factors. “At CJ, we focus on nutrient balance to promote growth. There is the amino acids balance and palatability and when plant meals are used, protein hydrolysates and krill meal come into the formulation. Other considerations are digestibility, health care with nucleotides, and organic acids for intestinal immunity.

The optimal requirement for protein in the feed of vannamei shrimp depends on shrimp stage and the size of the shrimp. Anwar emphasised the difference between a good protein composition with the right balance of amino acids versus just high crude protein with free nitrogen with consequential effects on the pond environment.

Common ingredients in shrimp feeds in Indonesia are fish meal, soybean meal, squid liver powder, fish oil, squid oil, lecithin, protein hydrolysate, vitamin and minerals, acidifier, antioxidant and toxin binders.

Disease may change the feed strategy. “We need to heed global warming and rising sea water temperatures. The increase in disease outbreaks caused by Vibrio harveyi reflects not higher cell fitness of the Vibrio bacteria, but rather an increase in virulence with toxin release to escape from adverse environments to nutrient rich host pathogen environment.

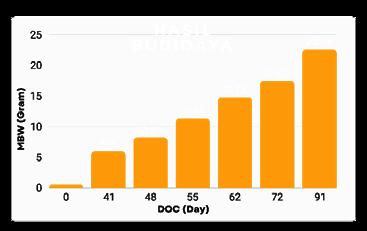

“We know that feeds with 38% crude protein (CP) give good results with good pond and feed management. In 90 days of culture, we get size 27 at a survival rate of 87% at a stocking density of 147 post larvae (PL)/m2. However, in East Java, a feed with 32% CP can produce size 40/kg after 89 days with a feed conversion ratio (FCR) of 1.2 at stocking density of 132 (PL)/m2. In Situbondo, where farmers are challenged with diseases, even 30-32% CP feed are working well to produce size 44/kg at FCR of 1.2, at a stocking density of 115 PL/m2.” The message is that matching feeds to location and farm conditions is crucial.

Figure 1. Shrimp growth performance by feeding CJ’s Super Innovative feeds with 30-32% CP in Situbondo, East Java. Extracted from the presentation by Anwar Hasan on Role of feed mill to optimise shrimp growth performance and efficiency.

Anwar Hasan said that “ improvement in feed efficiency is not only to reduce production costs but also to reduce environmental impact of feeds and improve animal performance and its health status.”

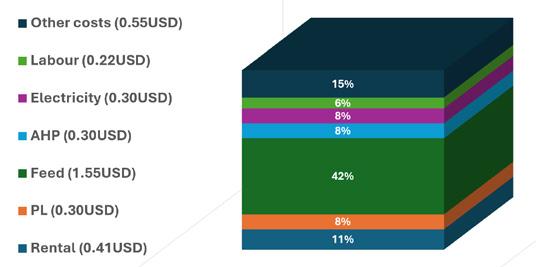

Feeds account for 60% of the costs of production and when this increases to 70%, there should be a cause for concern. According to Anwar, improvement in feed efficiency is not only to reduce production costs but also to reduce environmental impact of feeds and improve animal performance and its health status.

“We need an assessment along the supply chain, from broodstock to health care. We know that for most farms in Indonesia, it is challenging to find solutions when facing disease outbreaks. However, some have been farming since 1990’s and they have survived.

“Furthermore, these farmers have made large investments and therefore, the feed miller has the critical role to support them to achieve success, including improving or changing husbandry practices, using functional additives in feeds as well as other interactions such as with the environment and broodstock. With current field situations, feed formulae, type of feeds and feeding strategies must be based on farm conditions including season, and disease challenges.”

Shrimp prices are low globally and this is also affecting shrimp farmers in Ecuador. “In 2024, Ecuador vannamei shrimp production is projected to grow 4-6% to 1.275 million tonnes, although values may fall to 5.5% and profits plummet. With low prices, how are farmers managing the cost of production via feeds and feed management? For certain, we know that the approach is entirely different than that in Asia and in Indonesia,” said Dr Aberto Nunes, Professor at Labomar in Brazil in his presentation titled “Cost effective and sustainable shrimp feeds with low levels of krill meal”.

Nunes cited that the cost of production (COP) for size 30/40 per kg shrimp in Ecuador varies between two categories. COP in small and medium size farms is US$3.09-3.30/kg and for large farms and integrators, it is US$2.87/kg. In April, the farmgate prices by two of the 10 major exporters ranged from US$3.40-3.60/kg for size 30-40/kg shrimp and US$3.10-3.30/kg for size 4050/kg shrimp. Therefore, for smaller farms, shrimp is a loss-making operation. Large companies which are able to absorb the low prices are taking over the small/medium size farms. But those in operation have taken some steps. “The smaller farms addressed low prices by changing to focus on larger shrimp, 28-33g shrimp instead of producing 20-25g shrimp to leverage on better prices. They have also reduced stocking density to 11-12 PL/m2 to have faster growth, in excess of 0.43 g/day.”

Economy and low protein feeds

These feeds contain 22,25,28,30,32 or 35% CP. In Ecuador, there are both pelleted and extruded feed, and the latter can support more than 50% soybean meal which can bring more than 15% reduction in prices when compared to an equivalent % CP feed. “By reducing % CP from 35 to 28, the price reduction is almost 8%. Generally, we see that farmers start with 42-35% CP feeds from PL10 to 3g shrimp. Then it is 35% CP feeds for 3 to 8g and then economy feeds from 8g to harvest.”

Extruded feeds and auto feeders

Nunes deliberated on why industry in Ecuador favours extruded feeds. “Firstly, major feed millers have vast knowledge on extrusion based on experiences with salmon feeds. There is vast experience with mechanical feeders such as timed and acoustic devices, and the extruded feeds have resistance to physical stress caused by such feeders.”

A study by Molina et al., in 2021 showed that the feed conversion ratio (FCR) was better with extruded feeds, at 1.67 versus 1.96 with pelleted feeds. Production of shrimp/ lb using acoustic technology to feed shrimp was US$1.58 with pelleted feeds and US$1.30 with extruded feeds as compared to US$1.61 for manual feeding of extruded or pelleted feeds.

It was changing needs that prompted a change to mechanical feeding. “Farms moved from feeding two times a day to 24-hour feeding and auto feeders became the tool among large and medium size operations. Our estimate is 25-30% of the 220,000ha of ponds use auto feeders.” Other benefits of this change include reduced leaching of feed and labour costs. There is a drastic improvement on FCR and yields such as from 1.3 tonnes/ha to 4.5 tonnes/ha with 3-4 crops a year.

Nunes discussed the benefits of acoustic feeding technology, supplied by three companies in Ecuador. These include real time feeding responses to dissolved oxygen levels and water temperature in ponds. “Prior to using these devices, farmers have guessed that they have been underfeeding their shrimp and this might have been one of the reasons for previous slower shrimp growth rates. Acoustic feeding systems are viable when stocking density is more than 20 PL/m expensive for lower yields. The system can detect shrimp chewing feed when they are more than 3g sizes, but recent research has shown that shrimp sounds are detectable even at post larvae sizes.”

Alberto Nunes said that “ the use of high levels of soy protein sources in shrimp feeds can be cost competitive. The beauty of using plant protein meals is its predictability and consistency, but formulation must be on a digestible basis for all nutrients.”

While feeding management has made an impact on production growth, the other development is in feed formulation.

Iwan Sutanto, Past President of SCI (second left) and Dr Yuni Puji Hastuti, IPB University-Bogor (second right) with some shrimp farmers, from right, Soewando Basoeki, Abu Jasin Sutanto, Ricky Li (Sumatra SCI) and Edbert Thomas.

Today, commercial feeds in Ecuador contain fish meal at levels not exceeding 6%. Local fish meal is used and contains 48-60% CP, derived mainly from byproducts (trimmings) where the concerns are freshness, biogenic amines and consistency in quality such as amino acids which drive shrimp growth. Imported fish meal from Peru and Chile has 62-68% CP. “Soy based feeds are just popular. The 35% CP feeds may have less than 4% marine proteins, including fish meal, and almost 80% plant meals or almost 6% marine proteins and 72% plant protein meals. For farmers, economics matters and it is more on knowing that fish meal can be replaced with cheaper protein sources with no compromise on shrimp performance.”

Unfortunately, plant protein diets with low levels of fish meal and 1.5% fish oil require good sources of attractants. The inclusion of methionine, a crystalline amino acid works but a recent study showed its leaching rates were proportionate to its inclusion levels in feeds. Thus, feed attractants and palatants are essential to increase speed of feed consumption.

Nunes highlighted the requirement of krill meal in low fish meal feeds. “Much of the previous work done on the effectiveness of krill meal was carried out with diets deprived of or with very low levels of fish meal. Many studies showed that krill meal acts as a strong feed and growth enhancer at 3% dietary inclusion for juvenile shrimp. However, when combined with higher inclusion levels of fish meal, beyond 6%, our recent work has found that even 1.5% krill meal can be as effective as higher levels. This is partly explained by the fact that fish meal, like krill meal, also carries critical nutrients and chemical drivers for shrimp feeding stimulation and shrimp growth. This corresponds with the industry’s ongoing trend to achieve cost efficiency through the reduced utilisation of critical resources.

“The use of high levels of soy protein sources in shrimp feeds can be cost competitive. The beauty of using plant protein meals is its predictability and consistency, but formulation must be on a digestible basis for all nutrients.”

Other presentations in feed management included a mini review on functional feeds and additives by Professor Kyeong-Jun Lee, Jeju National University, South Korea. Lee also provided recommended levels for vitamin C and E at 60-90mg/kg and 60-80mg/kg, respectively. Others were Bacillus species of probiotics at 105-109 CFU/g, prebiotics and synbiotics. The recommended doses for organic acids were given for succinic acid at 0.5% and malic acids at 0.2%. For ß-glucans, it was around 0.2% and nucleotides at 0.1-0.4%.

Dr Matthew Briggs, Ridley Feeds, Australia introduce the product NovaqproTM, a novel sterilised microbial biomass developed by CSIRO and now marketed by Ridley AgriProducts for global markets except for China and Vietnam.

Haris said, “It is not easy for Indonesia to maintain status quo with the US markets. Today, we have to think differently, put more emphasis on quality and move to non-traditional markets like China. All shrimp farms need Indonesia’s good aquaculture management practices (CBIB) and for Europe, we need to strive for Aquaculture Stewardship Council (ASC) Furthermore, getting EU certification is an industrypublic task. We still have hope for the future but need to acknowledge that competition is strife.”

By Jean-Benoît Darodes de Tailly and Thomas Denis

The progressive intensification of shrimp production systems, driven by a growing market demand and land constraints, has inadvertently created ideal conditions for pathogens to thrive. The shrimp industry contends with a wide range of pathogens, including bacteria, viruses, fungi, and parasites which are often associated with intricate disease dynamics and symptoms, making diagnosis complex and treatment costly.

There are also no effective treatments against some of the most important shrimp pathogens such as the white spot syndrome virus and Enterocytozoon hepatopenaei (EHP) which can lead to unpredictable harvests and significant financial losses. Given these challenges, there is growing interest in preventive strategies that enhance shrimp’s natural defense mechanisms and improve their ability to cope with the conditions that may promote disease outbreaks.

fiction?

The reality often shows that despite investments in high-quality feed, disease-free post larvae (PL), water disinfection, and other biosecurity measures, pathogens continue to infiltrate shrimp farming systems through various means. Once pathogens enter a farm, their rapid spread can be exacerbated by the warm temperatures required for shrimp farming and the aqueous environment, which is an ideal medium for pathogen transmission and multiplication.

together with adverse conditions exacerbated by the e=ects of climate change, can be important vectors of stress and compromised immunity further adding to the susceptibility of shrimp. Jiang et al. (2005) demonstrated that suboptimal oxygen concentrations could lead to notable decrease in haemocytes, the shrimp’s primary immune cells. Similarly, Wang and Cheng (2005) found that abrupt salinity shifts could also compromise shrimp immune defenses within hours, favouring Vibrio alginolyticus infection (Figure 1). Once infected, shrimp have limited adaptive immune responses, and no commercial vaccines are currently available to protect them against future infections.

Shrimp sensitivity to pathogens stems from a variety of inherent characteristics. For instance, shrimp naturally inhabit the pond bottom, constantly coming into contact with substrates and potentially pathogenic microorganisms. Regular moulting also makes shrimp more susceptible to infections and parasites during this critical period. Additionally, and unlike mammals and some fish species, shrimp lack an acidic stomach barrier that could offer protection against pathogen entry.

Concurrently, the shrimp industry has gradually shifted towards more intensive practices. The higher densities and frequent variations of water quality encountered in such systems, together with adverse conditions exacerbated by the effects of climate change, can be important vectors of stress and compromised immunity further adding to the susceptibility of shrimp. Jiang et al. (2005) demonstrated that suboptimal oxygen concentrations could lead to notable decrease in haemocytes, the shrimp’s primary immune cells. Similarly, Wang and Cheng (2005) found that abrupt salinity shifts could also compromise shrimp immune defenses within hours, favouring Vibrio alginolyticus infection (Figure 1). Once infected, shrimp have limited adaptive immune responses, and no commercial vaccines are currently available to protect them against future infections.

This situation has led farmers to increasingly rely on functional additives by manually top coating them onto commercial feeds during their culture cycles. While

Time elapsed (h) 5 ppt 15 ppt 25 ppt

Figure 1. Impact of salinity on total haemocyte count of whiteleg shrimp Litopenaeus vannamei (adapted from Wang and Cheng, 2025).

this method has been effective in managing disease outbreaks, directly incorporating additives into the feed formulation offers a more reliable solution. It ensures precise dosage, consistent mixing and minimises the risk of water leaching of additives allowing for lower inclusion rates with the same effectiveness. Additionally, this approach simplifies administration, reduces the risk of fraudulent or low-quality additives entering the farm, and provides feed manufacturers with an opportunity to convert farmers into consistent users of functional feeds. With the professionalisation of farm management practices over the past decade, there is now greater potential for developing advanced, measurable functional feed concepts, provided there is a solid understanding of the physiological mechanisms required to achieve the desired outcomes.

Unlike many other farmed animals, our understanding of the shrimp immune system remains rudimentary. The existing knowledge is scattered across a wide range of literature, which can be confusing and present limitations for developing effective functional feed concepts.

In practical terms, shrimp natural defenses comprise three main barriers, each of which can be actionable with the right approach. The first barrier is the overall physiological and antioxidant status, which involves maintaining cellular health and mitigating oxidative stress caused by reactive oxygen species. This ensures robustness and less susceptibility to an infectious event. The second barrier is the epithelial layer, which serves as a physical barrier.

This barrier includes the shrimp’s cuticle, gills, gut lining, mucus, and microbiota. Maintaining the integrity of the epithelial layer effectively prevents pathogens from entering the body cavity and spreading within the shrimp. If pathogens evade these initial defenses, the immune system forms the third and final barrier. The immune system of shrimp relies on innate responses mediated by haemocytes - the shrimp’s immune cells. These cells coordinate and execute various humoral and cellular defense mechanisms that work together to control and eliminate pathogens.

Strategic interventions can be implemented to support and optimise these three barriers. Antioxidants are regularly used to block oxidative chains and the excessive production of free radicals. Bioactive compounds and probiotics can be added into feeds to improve gut health and integrity by acting against pathogens and reinforcing the barrier it forms with

the external environment. Immunostimulants are also commonly used to boost the production and activation of immune cells, enhancing immunity by fortifying both its cellular and humoral components.

While these strategic interventions are not silver bullets against pathogens in shrimp farming, they remain an important part of an integrated management approach that helps mitigate infection risks and severity. They should be viewed as complementary tools within a broader strategy that includes good farming practices, biosecurity measures, and regular monitoring, as described in Figure 2.

Developing a shrimp diet is a complex process that involves considering the nutritional needs of shrimp at different life stages, selecting appropriate raw materials, and optimising the physical parameters of the pellets. The goal is to create effective diets at minimal cost while ensuring consistent performance.

The industry typically evaluates diet efficiency using parameters such as feed intake, growth, feed conversion ratio (FCR), and cumulative mortality. However, moving forward, it is essential to also consider the other benefits of specific diets on a broader range of parameters, particularly those related to health. This is crucial because, while achieving low FCR through highquality feed is important, disease outbreaks can have a much more severe impact on farm economics at harvest.

The concept of balancing performance with health can be compared to recent advancements in salmon and shrimp genetics. While selection for rapid growth has its limitations, incorporating more parameters into genetic selection has led to lines that perform better under challenging conditions. A similar multi-parameter approach could now be applied to shrimp feed.

E>ectiveness of tailored functional feeds

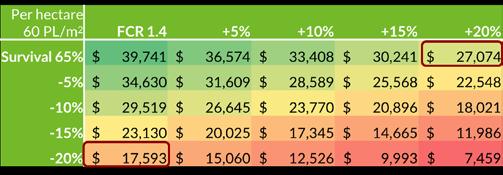

Table 1 illustrates this by modelling the effects of changing FCR and/or survival rates on an average Litopenaeus vannamei farm in Vietnam. Unfortunately, assessing diet performance is often constrained by limited resources, and health considerations are not always prioritised. However, these can often be addressed cost-effectively with the right functional approach.

To illustrate the value of this approach, Phileo by Lesa=re conducted a large-scale commercial trial to evaluate the e=ectiveness of tailored functional feed concepts. These concepts, developed and validated under laboratory conditions, were tested to determine their impact on economic performance in real farming conditions. The trial was conducted in a cluster of corporate farms near Guayaquil, Ecuador, covering 101 hectares of commercial shrimp ponds and compared the performance of shrimp fed with a functional diet against those fed with a conventional diet over a full culture cycle.

The functional feed included Safmannan®, a yeast postbiotic from Phileo by Lesa=re, rich in beta 1.3 – 1.6 glucans and mannans, and Selsaf®, Phileo’s organic selenium-enriched yeast. These components were blended synergistically to support the three primary health barriers previously discussed in this article. Both solutions were incorporated into the feed at dosages of 0.5kg (Safmannan®) and 0.1kg (Selsaf ®) per tonne of feed, to mitigate the potential negative e=ects of pathogenic threats and oxidative stress.

Phileo’s probiotics and active yeast fractions are designed for hatcheries and growing farms to support health, feed efficiency and growth performance . Our sustainable solutions bring innovative responses to fishmeal reduction stakes and environmental challenges. Act with nature for animal care.

Figure 3. Enhanced shrimp performance with supplementation of Safmannan® and Selsaf®, compared to the control as indicated by (A) survival, (B) feed conversion ratio (FCR) (mean ± S.E.).

The concept of balancing performance with health can be compared to recent advancements in salmon and shrimp genetics. While selection for rapid growth has its limitations, incorporating more parameters into genetic selection has led to lines that perform better under challenging conditions. A similar multi-parameter approach could now be applied to shrimp feed.

Figure 3. Enhanced shrimp performance with supplementation of Safmannan® compared to the control as indicated by (A) survival, (B) feed conversion ratio ± S.E.).

cost reduction resulted in an increased profit margin of US$409/ha. The proposed solution hence yielded US$100 of returns per tonne of feed, for an initial investment of US$4/tonne of feed for both functional additives, equivalent to an ROI of 1:25.

improvements in survival could be expected. Nonetheless, FCR improved from an average of 1.78 in the control group to 1.60 in the supplemented group (Figure 3B).

Although no specific health parameters were recorded during production, this improvement in FCR is likely due to an overall enhancement in the health status and gut health of the shrimp throughout the production cycle. Consequently, production costs decreased from an average of USD 4 per kilogram of shrimp in the control group to USD 3.6 per kilogram of shrimp in the supplemented group. This cost reduction resulted in an increased profit margin of USD 409 per hectare. The proposed solution hence yielded USD 100 of returns per tonne of feed, for an initial investment of USD 4 per tonne of feed for both functional additives, equivalent to an ROI of 1:25

The inclusion of Safmannan® and Selsaf® resulted in an increase in survival rates average of 50.3% in the control group to 54.3% in the supplemented group (Figure Given the absence of any clear infectious events during the culture cycle, moderate

A guide on functional additives

These results highlight the substantial performance gains achievable through functional feed concepts, even in the absence of clear pathogenic threats. They also demonstrate how improved health can enhance the nutritional performance of conventional diets under commercial conditions with minimal investment in the formulation.

These results highlight the substantial performance gains achievable through functional feed concepts, even in the absence of clear pathogenic threats. They also demonstrate how improved health can enhance the nutritional performance of conventional diets under commercial conditions with minimal investment in the formulation.

Figure 3. Enhanced shrimp performance with supplementation of Safmannan® and Selsaf®, compared to the control as indicated by (A) survival, (B) feed conversion ratio (FCR) (mean ± S.E.).

To support shrimp producers in implementing functional solutions, Phileo by Lesa=re developed Aquasaf Shrimp, a comprehensive program o=ering practical guidance on using fermentation solutions to improve health mechanisms and performance of shrimp.

The inclusion of Safmannan® and Selsaf® resulted in an increase in survival rates from an average of 50.3% in the control group to 54.3% in the supplemented group (Figure 3A).

To illustrate the value of this approach, Phileo by Lesaffre conducted a large-scale commercial trial to evaluate the effectiveness of tailored functional feed concepts. These concepts, developed and validated under laboratory conditions, were tested to determine their impact on economic performance in real farming conditions. The trial was conducted in a cluster of corporate farms near Guayaquil, Ecuador, covering 101 hectares of commercial shrimp ponds and compared the performance of shrimp fed with a functional diet against those fed with a conventional diet over a full culture cycle.

Given the absence of any clear infectious events during the culture cycle, moderate

This program is built from a decade of research and development in yeast and bacteria, probiotics, and postbiotics.

The functional feed included Safmannan®, a yeast postbiotic from Phileo by Lesaffre, rich in beta 1.3-1.6 glucans and mannans, and Selsaf®, Phileo’s organic selenium-enriched yeast. These components were blended synergistically to support the three primary health barriers previously discussed in this article. Both solutions were incorporated into the feed at dosages of 0.5kg (Safmannan®) and 0.1kg (Selsaf®) per tonne of feed, to mitigate the potential negative effects of pathogenic threats and oxidative stress.

To support shrimp producers in implementing functional solutions, Phileo by Lesaffre developed Aquasaf Shrimp, a comprehensive program offering practical guidance on using fermentation solutions to improve health mechanisms and performance of shrimp.

It features case studies conducted with numerous institutes and commercial partners around the globe and integrates results from relevant published papers A detailed user manual accompanies the program, and can be downloaded using the QR code or https://phileo -lesa=re.com/en/program-aquasaf-shrimp/

References are available on request.

This program is built from a decade of research and development in yeast and bacteria, probiotics, and postbiotics. It features case studies conducted with numerous institutes and commercial partners around the globe and integrates results from relevant published papers. A detailed user manual accompanies the program, and can be downloaded using the QR code or https://phileo-lesaffre.com/en/programaquasaf-shrimp/

The inclusion of Safmannan® and Selsaf® resulted in an increase in survival rates from an average of 50.3% in the control group to 54.3% in the supplemented group (Figure 3A). Given the absence of any clear infectious events during the culture cycle, moderate improvements in survival could be expected. Nonetheless, FCR improved from an average of 1.78 in the control group to 1.60 in the supplemented group (Figure 3B).

Although no specific health parameters were recorded during production, this improvement in FCR is likely due to an overall enhancement in the health status and gut health of the shrimp throughout the production cycle. Consequently, production costs decreased from an average of US$4/kg of shrimp in the control group to US$3.6/kg of shrimp in the supplemented group. This

References are available on request.

Jean-Benoît Darodes de Tailly is Global Program Manager for Aquaculture – Phileo by Lesaffre Email: j.darodesdetailly@phileo.lesaffre.com

Thomas Denis is Technical & Feed Formulation Services Manager – Phileo by Lesaffre

A conversation with Thomas Levallois on the commitment to upcycle seafood waste in a facility designed with sustainability at its core, featuring the latest innovations and green technology solutions

There are two buzzwords in the aquaculture industry today - circular economy and sustainability. Aquaproducts Pte Ltd, is committed to transforming the seafood industry’s byproducts into valuable resources through cutting-edge innovations and green technology solutions. Its mission is to establish a robust, eco-friendly supply chain for marine functional proteins in Southeast Asia.

A decade ago, Thomas Levallois and François Dupuis, two French agrifood engineers co-founded Aquaproducts to use their expertise in enzymatic hydrolysis to maximise the use of local resources and support the circular economy. Aquaproducts has accumulated a decade of experience in marine bioextracts to manufacture functional peptides extracted from seafood byproducts, providing a sustainable source of alternative proteins for the feed industry. It is claimed that this reduces dependency on imported ingredients, strengthens regional supply chains, and creates new market opportunities.

Furthermore, the team has built strong partnerships with industry leaders, such as Scanbio SAS Norway and Maqpro Biotech Indonesia, reinforcing their sector position. Additionally, Aquaproducts is pursuing collaborations with European biotech firms to develop biopolymers from shrimp shells

The green field facility in Long Anh province in Vietnam’s Mekong Delta, is a major milestone after years of commitment. The opening event on June 11 also highlighted its role in promoting high-quality, locally-made ingredients. It is contributing significantly to the local economy with a promise to create hundreds of jobs. (see issue July/August page 61 https://bit. ly/47vq0KQ)

The new state-of-the-art facility is said to be designed with sustainability at its core, featuring solutions to ensure efficiency and environmental responsibility. The factory aims to produce 10,000 tonnes of powder and upcycle over 50,000 tonnes of seafood waste annually. The 2,500m2 site is close to raw material sources, clients, and major exportation ports. The facility incorporates innovative drying technology, a zero-waste policy, water recycling systems, advanced 3-stage odour treatment, and a comprehensive wastewater facility. Dupuis emphasised that the goal is not just to recycle waste and produce great products, but to do so responsibly without creating new sources of pollution.

Leiber ® Beta-S

Highly purified ß-glucans | Immunity booster | Increased resilience | Improved vaccinations

Leiber ® Beta-S Plus

The ß-glucan alternative | Synergistic blend of pure ß-glucans and MOS

In an email conversation, Thomas Levallois elaborated on the company’s journey, its products and plans for the future. Levallois, with a master’s in aquaculture and a BSC in agro-economics has more than 15 years of experience in sales and marketing of marine functional ingredients for the feed industry, with a few partnership (joint ventures) set-ups.

Thomas Levallois is now Director at Aquaproducts Pte Ltd. Previously, he was the Director of Sales at Diana Aqua, now a branch of the Symrise group. In 2014, he co-founded Aquaproducts Ltd, a consulting and trading company and later in 2016, he set up Maqpro Biotech Indonesia, a factory producing marine hydrolysate and chitin.

Tell us more about your journey with the circular economy project?

Thomas Levallois: Francois Dupuis and I started with consulting and trading services to promote alternative proteins produced from marine byproducts. Our first industrial project in Indonesia in 2016 set the stage for what was to come next. By 2020, we had valued over 20,000 tonnes of seafood waste, producing 5,000 tonnes of protein hydrolysate annually for the domestic market.

In 2021, the company welcomed two seed investors, Jean-Yves Chow and Marc Le Poul, who brought a wealth of expertise, network and support. This partnership enabled AquaProducts to raise US$4 million with the Sustainable Ocean Fund from Mirova, thus marking the launch of our venture in Vietnam. The following year in 2022, we created MBV, the manufacturing arm of AquaProducts. Today, the site we have in Vietnam is ready for operation. This hydrolysate factory focuses on producing dry hydrolysate protein powder for the Asian feed and pet food markets.

is

TL: We specialise in upcycling marine protein, particularly from seafood byproducts like shrimp heads. Our extraction process uses natural enzymes to break down protein molecules into small peptides and free amino acids. The resulting marine functional proteins are particularly beneficial for improving palatability, health, and immunity in aquaculture species, especially during juvenile stages, or when used in low fish meal diets.

We prioritise quality by sourcing raw materials exclusively from human-grade processing units and trusted suppliers. Each element undergoes analysis in our laboratory to meet quality standards, supported by HACCP and GMP certifications.

Aquaproducts’ expertise lies in the enzymatic hydrolysis of marine byproducts to extract proteins and other valuable compounds such as oils, chitin, and chitosan. This method ensures sustainable valorisation of byproducts, transforming them into marine functional proteins for the animal feed and pet food markets.

“The primary goal is to enhance performance and sustainability by reducing the use of traditional ingredients like whole fish, fish meal and squid paste.”

TL: MBV offers a range of marine functional proteins, including shrimp hydrolysate powder, salmon hydrolysate powder, and pelagic hydrolysate powder. These products are used as feed supplements in aquafeed, typically at a 1-5% inclusion rate. The primary goal is to enhance performance and sustainability by reducing the use of traditional ingredients like whole fish, fish meal and squid paste.

TL: These new ingredients provide solutions for antibiotic replacement, productivity improvement, and sustainability in the feed industry. Our model of using local, undervalued byproducts and transforming them with lowenergy processes enables us to offer competitive prices for the Southeast Asian region.

The competitive advantages of these products lie in their 100% sustainable sourcing and stable supply, which ensures consistent prices. As mentioned above, they are natural solutions for reducing antibiotic use, a significant concern in aquaculture. Our primary targets include all true marine animals, carnivores and generally all species during juvenile stages when quality nutrients are crucial.

Beyond its core purpose, what are AquaProducts’ sustainability credentials and functional benefits?

TL: AquaProducts operates with a circular approach, processing 100% byproducts from the seafood industry, primarily sourced from local farms and, to some extent, sustainable fishing (cannery byproducts). We aim to sell over 90% of our output to local and regional markets in Southeast Asia. This supports local economies while promoting sustainability by utilising underused resources and minimising waste.

Using local byproducts and enzymatic reactions, we create valuable products with zero waste and ecofriendly processes. Our focus on developing unique products without harsh chemicals or harmful thermal processes aligns with our mission to provide advanced natural solutions for the Asian aqua and livestock feed industries.

“Our continuous challenges and motivations lie in innovating the model to improve scalability and cost-effectiveness, making these solutions accessible to a broader user base rather than just niche markets.”

Would you compare AquaProducts to a startup?

TL: No, AquaProducts does not fit the typical startup profile. The technology we use for the enzymatic hydrolysis of fish byproducts has been developed since the 1980s. The main challenge has been scaling this model. Over the past fifteen years, we have successfully built and developed several marine hydrolysate factories, initially within international groups and recently, independently with Maqpro Biotech Indonesia. These ventures are now thriving, with fully grown production capacities. This industry thrives on experience and knowhow rather than intellectual property or novel technology, and we are constantly learning and improving.

Our continuous challenges and motivations lie in innovating the model to improve scalability and costeffectiveness, making these solutions accessible to a broader user base rather than just niche markets.

TL: Our immediate focus is refining our model to make it easily scalable with limited capital expenditure, enabling rapid expansion in regions with abundant undervalued marine byproducts. We see significant opportunities for growth in Southeast Asia and other regions globally. The supply of byproducts keeps growing, and the demand for functional protein is unlikely to be oversaturated. Our long-term vision includes implementing our scalable model worldwide and addressing the continuous need for sustainable and functional protein sources.

RESTRICT inappropriate use of antibiotics and chemicals

REDUCE losses from subclinical disease and outbreaks

INCREASE economical and ecological sustainability

BOOST feed perfomance and farm productivity

These diets increased the overall growth performance of tilapia and increased phosphorus, calcium and ash accumulation levels in the whole body, bones, and scales compared with unsupplemented diets. Moreover, the study demonstrated a reduction of P released in the water.

By Nguyen Van Nguyen, Le Hoang, Pham Duy Hai, Tran Van Khanh and David Bal

The increasing use of plant protein meals in the aquafeed industry has become a global trend. Their use can be problematic as they are less digestible and contain antinutritional factors (Danwitz et al., 2016). Particularly, the presence of phytate dramatically affects the digestibility of phosphorus (P) in the diet. Additionally, phytate also affects the environment through undigested phytate-P, which is excreted through the faeces. Phytate comprises 60 to 80% of the entire P, a chelated form of magnesium, calcium, and sodium salts found in plantbased diets (Shahzad et al., 2020; Rodrigues et al., 2023).

In general, aquatic animals are not capable of digesting organic P in feeds using their endogenous enzymes. A possible strategy to counterbalance the negative effects of phytate in plant ingredients is to incorporate exogenous phytase in aquafeeds. Phytase can reduce the amount of inorganic phosphorus (iP) supplementation and decrease P and nitrogen (N) excretion in faeces, benefiting both animals and the environment.

Despite quality studies on dietary phytase and enzyme mixtures in Nile tilapia (Oreochromis niloticus) feeds, information on the influence of dietary levels of phytase

on tilapia performance and environmental impact remains limited. Thus, the aim of the present study is to investigate the effects of the novel bacterial 6-phytase Rovabio® PhyPlus on growth, feed utilisation, digestibility, nutrient retention, and body composition in Nile tilapia fed a complete plant-based diet.

This is to examine the effects of the dietary supplementation of this new generation phytase Rovabio®PhyPlus on growth performance, nutrient digestibility and retention, and bone characteristics of Nile tilapia fed practical diets formulated with three different available phosphorus (AvP) levels.

Seven experimental plant-based diets were formulated to be isoproteic (30% crude protein), isolipidic (7% crude fat), and to meet all known nutrient requirements of Nile tilapia (Table 1). Two positive control (PC) diets were considered: PC1 with a standard AvP requirement for Nile tilapia (0.9%) and PC2 with a minimum AvP requirement (0.6%). Ingredients

Table 1. Formulation and nutrient composition of experimental diets. FTU= fytase units; AvP=available

Treatments Description of the experimental diets

PC 1

PC 2

NC

PC 2

Min 3000 kcal GE, 30% CP, 7% fat, and 0.90% AvP (use MCP)

Min 3000 kcal GE, 30% CP, 7% fat, and 0.60% AvP (use MCP)

MMin 3000 kcal GE, 30% CP, 7% fat, and 0.40% AvP (no MCP)7% fat, and 0.40% AvP (no MCP)

Remark

standard tilapia diet

Minimum dose of Av P of Nile tilapia (reduced AvP diet to eliminate safety margins on P)

severely phosphorus deficient diet

In total 420 all-male tilapia (ABW of 68.9 ± 1.1 g/ fish) were selected for the feeding trial and randomly distributed into 28 fibreglass tanks of 200L each, at a density of 15 fish per tank. Fish were fed twice daily (9am and 4pm) to satiation for 2 months. Uneaten feeds were removed 20 minutes after feeding, to calculate the feed consumption. Dead fish were removed and weighed daily, and feed intake was monitored weekly to assess growth and feed efficiency.

Min 3000 kcal GE, 30% CP, 7% fat, and

0.60% AvP (use MCP)

T1 NC + 500 FTU

T2 NC + 1000 FTU

All fish were bulk weighed and counted after 30 days and after 60 days of the feeding trial to determine weight gain. Water quality parameters (dissolved oxygen, pH, temperature) were monitored daily and ammonia compounds (NH3-N, NO2-N) weekly during the culture period. Water exchange was fixed at 10% daily to maintain suitable conditions for an optimum growth and health status of tilapia.

Minimum dose of av P of Nile tilapia (reduced avP eliminate safety margins

T3 NC + 1500 FTU

T4 NC + 2000 FTU

Supplementation of Rovabio® PhyPlus enzyme

NC Min 3000 kcal GE, 30% CP, 7% fat, and

0.40% AvP (no MCP) severely phosphorus deficient

Table 2. Experimental design of diets.

T1

T2

T3

T4

NC + 500 FTU

NC + 1000 FTU

NC + 1500 FTU

NC + 2000 FTU

Table 2. Experimental design

A negative control diet (NC) was formulated without inorganic-P source (no MCP) and with a low level of AvP (0.4%). Four diets with phytase (T1, T2, T3, and T4) were prepared by supplementing the NC diet with four levels of Rovabio®PhyPlus of 500 FTU/kg, 1000 FTU/kg, 1500 FTU/kg, and 2000 FTU/kg respectively. Chromic oxide (Cr2O3) was used as an inert marker to measure nutrient apparent digestibility coefficients at an inclusion level of 0.5%. The formulation had a high plant protein content (Table 2).

Experimental set up

Ingredients were analysed to determine the nutrient composition for the feed formulation and test diets were sampled for chemical analysis. Liquid phytase (Rovabio®PhyPlus 5000L) was also analysed and coated onto extruded pellets accurately according to the tested dose.

After a week of feeding with the experimental diets, faeces were collected at the bottom of each digestibility tank. Collection was at 10:00am and 60 minutes before the next feeding. Faecal samples from each tank were stored at –20°C for chemical analysis. At the beginning of the trial, a pooled sample of 20 fish was taken for the determination of whole-body chemical composition, amino acids profile, and the ratio Ca, P in bone and scale.

Supplementation of Rovabio® enzyme

At the end of the trial, five fish from each tank (20 fish per treatment) were sampled for analysis. For culture water, a sample at the beginning and 28 samples at the end of the trial were collected for analysis of N and P content released into water. Fish in each tank were weighed after 30 days and 60 days of culture. Weight gain, final body weight, survival rate and feed conversion ratio (FCR), were determined. Apparent dry matter digestibility coefficients (ADMD) of different diets were measured using the equation of Cho et al., (1982). Apparent digestibility coefficients (ADCs) for crude protein, crude lipid, ash, gross energy, phosphorus, starch, and amino acids (arginine, histidine, lysine, methionine, and threonine) were calculated according to Bureau and Hua (2006) as follows:

A total of 2000 all-male tilapia, with an initial body weight (IBW) of about 30-40g/fish were reared in six fiberglass tanks of 1000L prior to the feeding and digestibility assays. During 15 days acclimation period, fish were fed a commercial diet (35% crude protein and 6% fat) twice daily at 9am and 4pm.

Experimental set up

.

A total of 2000 all-male tilapia, with an initial body weight (IBW) of about 30-40g/fish were reared in six fiberglass tanks of 1000L prior to the feeding and digestibility assays. During a 15-day acclimation period, fish were fed a commercial diet (35% crude protein and 6% crude fat) twice daily at 9am and 4pm.

ADMD (%) = 100 - 100 (% Cr2O3 in feed / % Cr2O3 in faeces)

Apparent digestibility coefficient (ADC):

ADC (%) = 100 - 100

% Cr2O3 in feed % nutrient in faeces

% Cr2O3 in faeces % nutrient in feed ( ( X

There was no significant difference in the survival rates of fish among the treatments and overall survival was over 97.5 % (Table 3). Reduction in AvP from 0.9% to 0.6% clearly reduced the performance on day 60. Further reduction in AvP by 0.2% points in NC caused significant additional performance losses in all measured parameters.

After 60 days of culture, the highest FBW and WG were observed in PC1 (0.9 AvP), and statistically similar to phytase supplemented treatments at 1500 and 2000 FTU/kg levels. There was not enough substrate (phytic-P : 0.33%) to release the same amount of P (0.5%) in the diet. Yet achieving statistically similar performance results implied that the optimum AvP level should be between 0.6-0.9%.

Final body weight (FBW), FCR and weight gain (WG) of fish fed 1000 FTU phytase (T2 diet) was similar with the PC2 diet (0.6% AvP) indicating that 1000 FTU might be equivalent to 0.2% AvP. There was not enough substrate

1. Tank system used for the faecal collection for the digestibility assay

IBW =Initial body weight; FBW=final body weight; WG=weight gain; FCR=feed conversion ratio; TGC=thermal growth coefficient; ADG=Average daily growth; SR=survival rate. (Values mean ± SD (n=4). Values in the same row with different superscripts are significantly different (P<0.05)

Table 3. Performance data summary.

to release the same amount of P but this implied that the optimum dose may be around 1000FTU. Thus, all performance parameters were positively affected by the phytase supplementation (Table 3 and Figure 2).

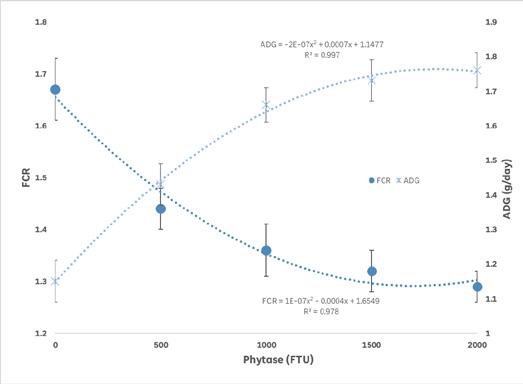

FCR decreased (p<0.05) with the increase of phytase dose while ADG increased significantly (p<0.05) from 1.15 to 1.76. Starting from 500FTU/kg and subsequently at 1000, 1500, and 2000 FTU/kg, ADG and FCR were significantly better that the negative control (p<0.05).

Data in Figure 3 showed that FCR and ADG were positively affected by the enzyme supplementation. ADG increased significantly (p<0.05) from 1.15 to 1.76 after 60 days of trial, while FCR declined significantly (p<0.05) from 1.44 to 1.29 with increasing phytase dose in the diets.

(Figure 4). There was not any significant differences in amino acids profiles between initial fish and harvested fish and among all treatments.

The AvP equivalency values of the phytase were calculated using linear and nonlinear response equations (Table 4) established for bone characteristics at the graded doses of phytase supplementation. The characterisation of bone indicated that increasing the doses of supplemental phytase (500, 1000, 1500, and 2000 FTU/kg of diet) in the diets increased the released AvP of 0.14%, 0.23%, 0.30%, and 0.32% respectively. In addition, the evaluation of bone characteristics also illustrated that the specific equivalency values of Rovabio® PhyPlus (FTU/1 g inorganic P) ranged from 221 - 503 FTU (Table 5).

IBW =Initial body weight; FBW=final body weight; WG=weight gain; FCR=feed conversion ratio

TGC=thermal growth coefficient; ADG=Average daily growth; SR=survival rate (Values mean ± SD (n=4).

There was a positive influence of the tested phytase on P, Ca, and ash content of the whole body. Fish fed with 1000 to 2000 FTU phytase showed an increased wholebody P, Ca and ash compared to NC diet and levels equivalent to PC1 and PC2. Fish fed PC1 with high levels of inorganic AvP exhibited the highest ash, P, and Ca content. Similarly, Ca and P content in the scale and bone of tilapia increased significantly compared to NC group Parameters

Values in the same row with different superscripts are significantly different (P<0.05)

Table 3. Performance data summary

Figure 3. Feed conversion ratio (FCR) and average daily growth (ADG) of experimental Tilapia fed different levels of Rovabio® PhyPlus in diets.

Figure 3. Feed conversion ratio (FCR) and average daily growth (ADG) of experimental Tilapia fed different levels of Rovabio® PhyPlus in diets.

Data in Figure 3 show that FCR and ADG were positively affected by the enzyme supplementation. ADG increased significantly (p<0.05) from 1.15 to 1.76 after 60 days of trial, while FCR declined significantly (p<0.05) from 1.44 to 1.29 with increasing phytase dose in the diets.

Phosphorus equivalency values

Phosphorus equivalency values

The AvP equivalency values of the phytase were calculated using linear and nonlinear response equations (Table 4) established for bone characteristics at the graded doses of phytase supplementation. The characterization of bone indicated that increasing the doses of supplemental phytase (500, 1000, 1500, and 2000 FTU/kg of diet) in the diets increased the released avP of 0.14%, 0.23%, 0.30%, and 0.32% respectively. In addition, the evaluation of bone characteristics also illustrated that the specific equivalency values of Rovabio® PhyPlus (FTU/1 g inorganic P) ranged from 221 - 503 FTU (Table 5).

Bone characteristics Response equations without added PyPlusa R2 Response equations with added PyPlusb