Technification at a Farm in Mexico

Artemia Nauplii and Microbiome Management

Managing EHP in Shrimp Farming

Taste Matters in Fish Nutrition

Technification at a Farm in Mexico

Artemia Nauplii and Microbiome Management

Managing EHP in Shrimp Farming

Taste Matters in Fish Nutrition

Sheng Long, your professional and trusted aquaculture partner. We are committed to supporting our valuable customers’ success by providing innovation programs with high-performance feeds, healthy shrimp larvae, aquatic probiotics & healthy products and new farming models & technology.

Add: Block A5, Duc Hoa 1 Industrial Park,Duc Hoa District, Long An Province

Tel: (84-272) 3761358 - 3779741 Fax: (84-272) 3761359

Email: thanglong@shenglongbt.com Website: www.shenglongbt.com

Add: Plot No. A-11/1, Part-A, SIPCOT Industrial Park, Thervoykandigai Village, Gummidipoondi Taluk, Thiruvallur District, Tamil Nadu 601202, India.

Tel: 91-44-6790 1001 Fax: 91-44-6790 1017

Email: info@shenglongindia.com Website: www.shenglongindia.com

Shrimp: Weak Prices Dampen Growth

Ponds in India. p44 Copyright GalaxEye.

Editor/Publisher

Zuridah Merican, PhD

Tel: +6012 205 3130

Email: zuridah@aquaasiapac.com

Editorial Coordination

Corporate Media Services P L

Email: irene@corpmediapl.com

Web: www.corpmediapl.com

Design and Layout

Words Worth Media Management Pte Ltd

Email: sales@wordsworth.com.sg Web: www.wordsworth.com.sg

AQUA Culture Asia Pacific is published bimonthly by

Aqua Research Pte Ltd

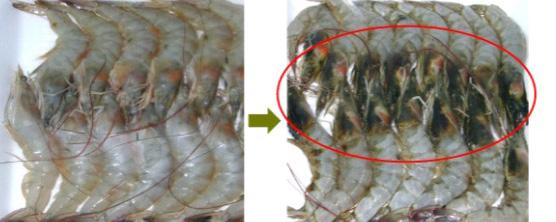

3 Pickering Street, #02-36 Nankin Row, Singapore 048660

Web: www.aquaasiapac.com

Tel: +65 9151 2420

Printed in Singapore by Times Printers Private Limited 18 Tuas Avenue 5 Singapore 639342

Subscriptions

Subscribe via the website at www.aquaasiapac.com

Subscriptions can begin at any time.

Subscriptions rate/year (6 issues): SGD 70, Email: subscribe@aquaasiapac.com

Tel: +65 9151 2420

Fax: +65 6223 7314

Copyright © 2025 Aqua Research Pte Ltd.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior permission of the copyright owners.

Volume 21, Number 1 January/February 2025 MDDI (P) 023/10/2024

From the editor

2 The year ahead and a wish list

Industry News

4 Singapore Aquaculture Plan/First ranking for SeaChange® 2030

Shrimp Aquaculture

8 Six years on, at a farm in Mexico

Zuridah Merican talks with Ing Ramsès A Chavez Zazueta on changes at Acuicola 11 de Diciembre S.A.

Hatchery & Nursery

12 The future of vannamei shrimp genetics

A future with genomic advancements, regional adaptability and sustainability practices both economic and environmental resilience. By Natthinee Munkongwongsiri, Chotitat Luengchaichawange, Daniel Fegan and Craig L. Browdy

15 Artemia nauplii and microbiome management: Combining assets to deliver robust post larvae

An interview with I&V BIO’s Rudi Bijnens and Steven Debono from Kytos

19 Enhancing growth and feed conversion

Addressing environmental and health stressors with functional nursery feeds. By Marc Campet

Feed Technology

22 A new horizon in shrimp farming with nutritional EHP management

Ragnhild Dragøy discusses a white paper reviewing the threat of EHP in shrimp and studies on its mitigation via enhancing shrimp resilience with krill meal and oil

25 Taste matters: Exploring the fish gustatory system for overcoming aquaculture challenges

Understanding the role of taste receptors in regulating both feed intake and feeding efficiency is crucial, says Sofia Morais

30 The EHP threat in shrimp aquaculture: Challenges, consequences and prevention

The latest advances in managing EHP,from the laboratory to the pond side. By Sophie Reys, Pierre Fortin and Nicolas Tanrattana

Industry Review-Marine Shrimp

34 “Rise” for Asia’s farmed shrimp industry

Reporting from the dsm-firmenich’s Aquaculture Conference on shrimp supply and demand, HOSO markets, post-harvest quality and pond management.

39 Asian marine shrimp in 2024: Continuous weak prices dampen growth A snapshot on the situation moving forward

42 Insights on shrimp farming in India, Indonesia and Vietnam An overview of the challenges and evolving practices at GSF 2024.

44 India’s farmed shrimp industry today

Fluctuating shrimp prices create financial uncertainty for producers. By Laxmappa Boini, Ravinder Rao Bakshi and M. Gunakar

Innovations

47 An eye in the sky for aquaculture insights Suyash Singh explains how GalaxEye Blue transforms aquaculture interventions

50 A forum in Singapore to uplift and transform the local aquaculture sector AquaTropics Forum 2024 was on “How Science meets Industry”

Show Review

54 Mexican shrimp industry meet in 2024 CONACUA is the leading aquaculture conference and trade show in Mexico

Aqua Culture Asia Pacific is a print and digital magazine. View E-magazine & Download PDF of past issues for free www.aquaasiapac.com

57 Aquaculture and its innovators in Singapore Insightful discussion on digitalisation in aquaculture at the Asia-Pacific Agri-Food Innovation Summit

60

Zuridah Merican

Happy New Year and best wishes for 2025. Here is a summary of the prognosis for the aquaculture industry and the wish list for each sector.

The shrimp sector will face price uncertainty. Ecuador will still emerge as the largest producer and supply exceeds demand. However, here in Asia, we cannot remain status quo with its mediocre survival rates due to disease.

1. Asia needs to invest in productivity. Improving survival rates from the average 55% to 80% will substantially reduce cost of production. Strategies include health interventions and precision feeding technology. Cost-cutting is only a bandaid solution which does not add value in the long term.

2. Asian farms have gathered loads of data from its failed crops and disease outbreaks, but it is not harnessing them using big data analysis. It is time to try to determine trigger points to forecast impending disease situations. We see such predictability as important for stock insurance leading to more investments.

3. Processing plants must take on an anchor role to continuously buy shrimp from farmers, freeze and

OUR MISSION

We strive to be the beacon for the regional aquaculture industry.

We will be the window to the world for Asia-Pacific aquaculture producers and a door to the market for international suppliers.

We strive to be the forum for the development of self-regulation in the Industry.

store. This acts as a buffer to price fluctuations in the international markets. This gives farmers confidence to culture all year round giving each country a better supply predictability.

The freshwater fish sector may experience challenges due to increased trade tariffs, as the US has historically been a significant market for pangasius and tilapia. This sector will also see a distinct bifurcation of product for domestic consumption and for export.

4. Logistics costs have increased 3-fold due to the respective problems of the Suez and Panama Canals. Central American countries have an added advantage when supplying the US market. Asia must seek its own proximity advantage - look at China as well as the Asian region as alternative markets.

5. Producer countries must realise that domestic and export consumers of the tilapia require very different product forms –small table-size fresh whole fish versus zero off flavour frozen fillets from larger fish.

The marine fish sector is still searching for a single species to be the ‘tropical salmon.’ The Asian seabass or barramundi shows great promise. Resources should focus on this single species.

6. Asian countries must work together to build an integrated ecosystem. Not all countries have the competitive resources to cover the whole value chain. While Thailand, Indonesia and Vietnam have clean waters and the equitable labour costs for farming and processing, Singapore has the financial and knowledge resources to build on the genetics, early-stage feed, and vaccines for disease mitigation. All these countries must work on generic marketing of the species.

The feed sector has changed dramatically over the past two years. Fishmeal prices are on the downtrend

as the South Pacific Ocean experiences ‘La Nina.’ Soybean meal and DDGS will be abundant as coproducts from the biodiesel and ethanol industries.

7. As alternative feed ingredients benchmark themselves against fishmeal, the window for insect meal and single cell proteins is narrowing. This will provoke consolidation and efficiencies to make these products more cost competitive.

8. The push for sustainable feeds from sustainable ingredients will speed in 2025. Carbon footprint data will be added to the feed formulation matrix with LCAs as the major currency.

Other opportunities and threats will include:

9. 2025 will be start of a full year of US AD & CVD duties on imported shrimp. How will Southeast Asia - washing i.e. China using these countries as a manufacturing base benefit the industry. The jury is still out for aquaculture. Will this change the ranking of major export countries?

10. The industry has seen an influx of the younger generation and a vibrant start-up community. They will be more science based and willing to share information. With the tightening of liquidity, Asia will continue to see a strengthening of start-ups with more focus on matching their products and services to the industry but with a lot less hype and hubris.

The aquaculture industry still plays a critical role in the megatrend of providing food for the world’s growing population. Despite the naysayers, there is no credible alternative as relying on wild catch will only mean overfishing and exorbitant prices for seafood.

If you have any comments, please email: zuridah@aquaasiapac.com

F ood security is an existential issue for Singapore. It currently imports more than 90% of its food, which makes the country vulnerable to food supply disruptions due to factors like climate change and disease outbreaks. To ensure its food resilience, the Singapore Food Agency (SFA) has committed to support the local agri-food sector to build its capability and capacity to produce food locally.

Singapore’s aquaculture industry is small, comprising 98 sea-based and 33 land-based seafood farms in 2023. Nevertheless, it contributes significantly to local production and fish has been identified as a nutritious source of protein that can be produced efficiently in land scarce Singapore. It faces several challenges including limited sea space, suboptimal water quality, demands to mitigate its impact on the environment, and a limited domestic market with strong import competition.

To address the above challenges, the industry is increasingly adopting innovative and sustainable methods, while keeping to a mix of production systems that are suited to Singapore’s unique constraints. On November 19, Senior Minister of State for Sustainability and the Environment Dr Koh Poh Koon launched the Singapore Aquaculture Plan (SAP) to transform the aquaculture sector to be more productive and sustainable.

The SAP is a collaborative year-long effort by two subcommittees formed in November 2023. Consisting of the industry, nature groups, academia, off-takers, and various government agencies, the committees’ work embodies a collective vision for the sector and serves as a roadmap for future aquaculture development in Singapore. The sub-committees have identified innovative approaches to balance sustainability with productivity and to uplift the aquaculture sector, anchored by five pillars.

• Space and Infrastructure Planning: To improve the robustness of site studies to ensure optimal site selection and develop key infrastructure, focusing on sustainable energy solutions and shared facilities.

• Enabling Regulations: Refining regulations to be more outcome-and science-based.

• Research, Innovation, Enterprise: Leveraging on the capabilities and solutions developed within the Marine Aquaculture Centre, the Singapore Food Story R&D Programme and AquaPolis to innovate and undertake collaborative research initiatives.

• Ecosystem Development: Continue to grow local champions, and foster partnerships, especially with technology firms, international aquaculture leaders, and talent pipeline from institutes of higher learning.

• Demand Offtake and Promotion of Local Produce: Continue the efforts to engage public and key stakeholders, while refining marketing and promotional strategies.

SMS Koh also announced the launch of the National Broodstock Centre and the Hatchery Development and Recognition Programme to ensure a consistent supply of superior fingerlings for farms. These initiatives fill a critical gap in the aquaculture sector, reduce the need for imported fingerlings, and offer tangible benefits such as a higher survival rate of fingerlings.

In addition, SFA has also started operations at the Aquaculture Sensing Network to support the aquaculture industry in water quality monitoring and better monitor nutrient discharges from farms. This comprises of a network of water quality sensors at aquaculture zones, complemented by water and sediment sampling. The data produced will provide operational insights on various water quality parameters, giving early warning against environmental threats such as harmful algal blooms. More information: https://go.gov.sg/sappaper19nov24

complemented by water and sediment sampling. The data produced will provide operational insights on various water quality parameters, giving early warning against environmental threats such as harmful algal blooms. More information: https://go.gov.sg/sappaper19nov24

Thailand’s Thai Union Group PCL, the world’s seafood leader, has been ranked number one in the food products industry on the 2024 Dow Jones Sustainability Indices (DJSI) with a total score of 85 points as of December 23, 2024. This achievement highlights its unwavering dedication to sustainable and responsible business practices under its globally recognised sustainability strategy, SeaChange® 2030.

This marks the 11th consecutive year that Thai Union has been listed on the DJSI, a family of indices evaluating the sustainability performance of thousands of publicly traded companies. The company was previously ranked number one on the Food Products Industry Index of the DJSI in 2018, 2019, and 2022. In the dimensions of Governance & Economic, Environmental, and Social, Thai Union achieved a 100% score. It also achieved the same in sub-dimensions including Transparency & Reporting, Materiality, Risk & Crisis Management, Supply Chain Management, Tax Strategy, Environmental Policy & Management, Biodiversity, Human Rights, and Health & Nutrition.

“Achieving the top spot in the DJSI food industry ranking is an extraordinary honour and a reflection of the collective efforts of our team and stakeholders around the world,” said Thiraphong Chansiri, CEO of Thai Union Group. “At Thai Union, we are not just focused on providing quality seafood to consumers worldwide; we are also committed to protecting our planet and empowering the communities we work with. SeaChange® 2030 continues to be the driving force behind our actions, ensuring that we remain a positive force for change in the industry.”

Stewardship Council Feed Standard certification through Thai Union Feedmill

• Collaborating with the Thai government on a Zero Wastewater Discharge Project, achieving 100% wastewater treatment at the Company’s fish processing plant

• Partnering with Seven Clean Seas and Second Life to tackle plastic pollution through innovative waste reduction solutions

• Implementing a Global Ethical Recruitment Policy to ensure fair, transparent, and professional hiring practices

These efforts are an essential part of SeaChange® 2030, which is built around 11 interconnected goals, including a 42% reduction in Scope 1, 2, and 3 greenhouse gas emissions by 2030, a commitment to net zero by 2050, and a THB 250 million (USD7.3 million) investment in ecosystem restoration and protection.

“This recognition reinforces the tangible impact of our sustainability initiatives and motivates us to aim even higher,” said Adam Brennan, Chief Sustainability and Communications Officer at Thai Union. “SeaChange®2030 is central to our strategy. We ensure that we not only reduce emissions and waste but also address broader challenges such as biodiversity loss, responsible sourcing, and creating equitable workplaces. Our actions today are designed to leave a positive legacy for future generations.”

5 First ranking for Thai Union’s SeaChange® 2030 Thailand’s Thai Union Group PCL, the world’s seafood leader, has been ranked number one in the food products industry on the 2024 Dow Jones Sustainability Indices (DJSI) with a total score of 85 points as of December 23, 2024. This achievement highlights Thai Union’s unwavering dedication to sustainable and responsible business practices under its globally recognised sustainability strategy, SeaChange® 2030.

Over the past year, Thai Union has continued to make progress in its sustainability initiatives, including:

• Launching the Shrimp Decarbonization Initiative in partnership with The Nature Conservancy and Ahold Delhaize USA to significantly reduce greenhouse gas emissions within the shrimp supply chain

• Becoming the first in Asia to achieve the Aquaculture

The S&P Global Corporate Sustainability Assessment (CSA) evaluates and assesses the sustainability practices of companies globally every year, with more than 3,000 across 62 industries actively participating. The CSA enables companies such as Thai Union to benchmark their performance on a wide range of industry-specific economic, environmental and social criteria that are relevant to sustainability focused investors.

This marks the 11th consecutive year that Thai Union has been listed on the DJSI, a family of indices evaluating the sustainability performance of thousands of publicly traded companies. The company was previously ranked number one on the Food Products Industry Index of the DJSI in 2018, 2019, and 2022. In the dimensions of Governance & Economic, Environmental, and Social, Thai Union achieved a 100th percentile score. The Company also received 100th percentile scores in sub - dimensions including Transparency & Reporting, Materiality, Risk & Crisis Management, Supply Chain Management, Tax Strategy, Environmental Policy & Management, Biodiversity, Human Rights, and Health & Nutrition.

Thai Union’s Seachange® Commitment in aquaculture by 2030 includes 100% farmed shrimp and its feed is produced responsibly, meeting industry credible standards, or is in an improvement program that minimises impact on surrounding ecosystems and 100% of the farms it sources from are a safe and decent workplace. Source: seachangesustainability.org

In December, BASF announced that it has signed a binding agreement to sell its Food and Health Performance Ingredients business, including the production site in Illertissen, Germany, to Louis Dreyfus Company (LDC), a leading global merchant and processor of agricultural goods including high-quality, plant-based ingredients.

BASF’s Food and Health Performance Ingredients portfolio plays a vital role in addressing growing trends in human nutrition. However, the business has limited synergies and integration into BASF and is no longer a strategic focus area.

As part of the agreement, approximately 300 employees are expected to transfer from BASF to LDC as of the closing of the transaction. Both parties have agreed not to disclose financial details of the transaction. Continuous and reliable supplies and business relationships will not be impacted by this transaction.

Michael Heinz, Member of the Board of Executive Directors of BASF SE and responsible for the Nutrition & Health division, said, “Building on our teams’ success to develop this business very well over the last years, LDC as a futureoriented company can offer our employees and the portfolio a promising perspective. The divestment of this business

to LDC supports our strategic portfolio optimization and will allow us to focus on our core businesses in Nutrition & Health. We remain committed to leveraging our core product platforms and expanding our business in key areas such as vitamins, carotenoids, and feed enzymes.”

Michael Gelchie, LDC’s Chief Executive Officer, added, “In line with LDC’s strategic plans for revenue diversification through more value-added products and growth in downstream markets, this agreement is an opportunity to accelerate LDC’s participation in the rapidly growing plantbased ingredients market.

“We are excited about the prospect of this transaction, as LDC’s first investment in dedicated facilities to produce food and health performance ingredients at scale.”

The food and health performance ingredients business includes food performance ingredients such as aeration and whipping agents, food emulsifiers and fat powder grades; health ingredients such as plant sterols esters, conjugated linoleic acid (CLA), omega-3 oils for human nutrition and some smaller product lines. The transaction is subject to customary closing conditions, including approval from relevant regulatory bodies.

In December, Cargill (EWOS) Canada and Mowi Feed in Scotland and Norway were the latest to achieve Aquaculture Stewardship Council (ASC) Feed Certification, proving their strong commitment towards environmental sustainability and social responsibility in their feed operations, said ASC in a press release.

Cargill (EWOS) Canada became the first ASC certified feed company in Canada. Their feed mill, operating out of Surrey, British Columbia, produces feed for a variety of species, including trout, salmon, seabass, seabream, and meagre, seriola, cobia and tilapia. Cargill Canada’s ASC feed certification is a key step forward for the supply of responsible feed to farms across North America and the Pacific Rim.

Mowi Feed has also achieved ASC feed certification for both its facilities in Scotland and Norway. Operating out of Kyleakin on the east coast of the Isle of Skye, Scotland, and Valsneset in central-western Norway, respectively, their state-of-the-art feed mills produce feed for salmon. Both ASC feed certifications for Mowi Feed reflect further progress for responsible salmon farming in the UK and Norway.

ASC drives farmed seafood transformation by leveraging expertise, fostering innovation, and partnering with the

supply chain to amplify impact. These recent certifications, alongside all other certifications and commitments achieved since the launch of the ASC Feed Standard, play a pivotal role in this mission of transforming the industry towards greater environmental and social responsibility.

There are now 16 units of certification in the ASC Feed programme (comprising 22 individual certified feed mill sites) across numerous countries including Canada, Chile, Ecuador, Honduras, Mexico, Norway, Thailand, Vietnam, and the UK, displaying the strong global uptake of the ASC feed certification programme.

A diverse mix of multinational and regional companies have achieved ASC Feed certification showing that complying with its robust requirements is accessible and achievable. With numerous further feed companies in the initial audit phase, 2025 is already shaping up to be another strong year of ASC Feed Certification uptake.

ASC certified farms have until 31 October 2025 to ensure their feed supply is ASC-conforming – in other words, feed produced by mills that are certified against the ASC Feed Standard. The use of ASC-conforming feed is necessary for ASC certified farms to continue meeting the ASC Farm Standard and retain their certification.

SPECIFIC FOR YOUR SUCCESS

Animals robustness and resilience comes from within. We believe that’s never been more true than today.

Our passion is harnessing the natural power of yeast and bacteria to support health, well-being and performance of all farmed aquatic species.

We help our industry partners and farmers sustainably feeding and farming shrimp with a complete range of microbial solutions for: gut health, immune support, antioxidant balance and micro-nutrition pond water and soil quality.

A follow-up on developments at Acuicola 11 de Diciembre S.A. with Ing Ramsès A Chavez Zazueta

By Zuridah Merican

In 2018, I visited the Acuicola 11 de Diciembre farm belonging to a young shrimp entrepreneur, Ing Ramsès A Chavez Zazueta. Back then, Chavez discussed how he and other farm owners in Sinaloa state, Mexico had managed to overcome AHPND (acute hepatopancreatic necrosis disease) or otherwise referred to as early mortality syndrome (EMS) which occurred in 2013. Prior to EMS, Mexico’s shrimp production was more than 120,000 tonnes. Then came EMS which brought down production to just over 40,000 tonnes in 2013.

By 2024, after having recovered from EMS and post Covid, Mexico’s production reached a remarkable 170,000 tonnes. Another trump card for the industry is that its in-country demand is taking up almost all of the shrimp produced. Shrimp imports are banned except from the three southern neighbouring countries. Mexico has three major shrimp farming states, led by Sinaloa, Sonora and Nayarit. Sinaloa is the leading shrimp farming state with a historic figure of 95,000 tonnes produced in 2021.

Annually, there is the Conacua conference and trade show which gathers aquaculture stakeholders in Sinaloa. The 2024 edition was held on November 2728 in Los Mochis, and I met up with Chavez to discuss developments at his farming group. Chavez is also Secretary General of Acuacultores de Ahome, the aquaculture association in Ahome municipality, Sinaloa, which is a co-organiser of Conacua with Conafab, the federal level feed association of Mexico. See page 54-56.

AAP: What has changed since 2018 at your farming group

Ramsès A Chavez Zazueta: We have expanded to three farms. We now have two in Sinaloa and one in Sonora state. The total area is 420ha. The stocking is 15-20 PL/m2 in the 187ha farm around Los Mochis. Generally, it is semiintensive culture, but we have a range of stocking densities, depending on the location. The Sonora farm is smaller at only 115ha and the two other farms are in the Ahome municipality in northwestern Sinaloa.

The latest addition is a farm in Sinaloa which we took over from a farmer leaving shrimp farming. In 2013, when EMS came to Mexico, the owner could not deal with the disease and decided to sell his farm.

Disruption in production with low prices

AAP: What is the general situation with production in Mexico?

Chavez: The final production numbers in 2024 are still not available but industry has estimated that 90% of the production will be from Sinaloa and Sonora. However, in 2024, here in Sinaloa, we estimated that production will be less by 30% because prices for the second half of the year were not tenable in comparison to the cost of production. Many producers did not stock in the second half of the year.

In 2023, Sinaloa produced 90,000 tonnes. For 2024, the estimate is 55,000 to 60,000 tonnes only. In comparison to Sinaloa, Sonora has more integrated groups and most probably does not have these production problems. Sonora is expected to maintain its 2023 production or if anything shows a decline by 5-10% only.

AAP: What improvements and innovations have helped you during the last six years?

Chavez: Remember, that in 2018, I mentioned how our survival rates went down to 55%. Today, there have been improvements of 10% - to 65% - 68%. My target is 70% and so we are still not there yet. The improvement is not large, but it does help. Here, most producers are managing diseases better by knowing the causes.

However, since 2022, with low prices, technification and reinvesting in farms are something we all need to do. We need to be more efficient in production by harvesting more kilograms of shrimp per square metre. If we do not take this option, we cannot compete in the domestic and international markets.

By technification, I mean installing aerators, automatic feeders and more efficient pumping of water to ponds. Pond electrification is rare in Mexico, but a necessity with intensification of farms.

At the Sonora farm, I had no choice but to invest in electrification. This is a huge investment, but I expect a return from this investment in 3 years. The problem in Mexico is that the electric grid is not near farms, which are in coastal areas. We explored the solar option, but it is not possible for such an industrial scale.

AAP: What are the benefits with these investments?

Chavez: I am seeing some benefits of technification. We now produce around 3.2-3.4 tonnes/ha as compared to 1.8-2.2 tonnes/ha previously. Harvest sizes are larger at 34-36g, feed conversion (FCR) is lower from 1.9-2.0 to 1.75-1.8 and days of culture (DOC) are shorter, down to 202 days from 215 days. We now feel that we can compete internationally. All the above have been achieved despite maintaining stocking density at 15-20 PL/m2. Perhaps it is also time to explore higher stocking density.

We are exploring on how to change our farming models by looking at culture practices in Ecuador, Central America and Asia. Here in Sinaloa, we grow to large shrimp and only have time for one cycle. Now our average weekly growth (AWG) is 1.38g/week. In Mexico, nothing has changed

Top left, View of farms. Ponds in the background are in one of the two sites in Topolobampo, Ahome; Bottom left, autofeeders in ponds. Chavez has run a test with sonic autofeeders but has yet to implement this for the whole group. Right: A shrimp harvest.

with regards to broodstock. Hatcheries develop specific tolerant lines from large shrimp and the focus is on disease resistance.

However, a strategy is to have two cycles/year and with a better growth rate. This is the second year that we are using autofeeders and I see some potential with our technification.

AAP: What have been your strategies to reduce production costs?

Chavez: A pain point is the low prices since 2022. Selling prices in November were MXN105-110/kg (USD5.205.45) for 36g shrimp. The cost of production (COP) was MXN82/kg (USD4.05). We have been trying to lower the fuel cost of pumping water. With electrification in the Sonora farm, in July, I migrated to a new pumping system with automation, one which can be programmed to be economical.

At this conference, we are learning what the industry in Ecuador and other producers in Mexico are doing better. Some in Mexico have 2-3 cycles per year. They are not harvesting such large shrimp but maybe two cycles of 20g. We need to see the economics of harvesting 20g shrimp compared to harvesting 36g shrimp. We need to relook at our practices and explore how to be more profitable.

We have several partial harvests, starting with 15g shrimpthe second is 19-20g shrimp, the third 24-27g shrimp and the fourth for 31g shrimp. If survival is good, a last harvest of 36-37g shrimp. We sell fresh shrimp to the domestic market and also send shrimp to the processing plant for brine freezing.

AAP: What have been the developments with this phase?

Chavez: This is an important phase, preparing post larvae for stocking the next cycle. This is done during the break cycle period. The yearly farming cycle for farms in Sinaloa ends on the first weekend of November and restocking is regulated to start only in the last weekend of March. The date is determined by Acuacultores de Ahome A.C. and enforced by the local authority. The association also establishes the period to dry out the ponds. All these steps have been put in place to avoid diseases, which are more susceptible during the colder season.

Since 2018, the nursery at Acuicola 11 de Diciembre farm has remained unchanged. Post larvae (PL10-12) are stocked and grown to 300mg for stocking. There are two cycles in the nursery phase.

AAP: From 2020-2021, what was shrimp farming like at your farm and overall in Mexico?

Chavez: From a business point of view, many other producers and I had expected it to be difficult. On the contrary, we were all farming as normal. There were no imports of shrimp while the consumption and market demand were very good. We saw record prices in 2021. (Note: according to indexmundi.com, prices were highest at MXN316.92/kg in July 2021).

However, there was a downside to this excitement on high prices. Many producers were so excited about this trend and expected the higher prices to stay. They started reinvesting into farming and some took up loans to expand. Over one year, shrimp prices dropped to the bottom. Post Covid, it became a perfect storm when interest rates increased to 11.25% in March of 2023 and later followed by the devaluation of the Mexican peso (MXN) against the US dollar. Many farms went bust and only the larger groups managed to navigate this storm.

The Installation of a new pumping system at Acuicola 11 de Diciembre S.A in July 2024. With electrification in the Sonora farm, in July, Chavez migrated to a new pumping system with automation, one which can be programmed to be economical. Previously pumps were diesel powered. (source:https://www.facebook.com/search/ top/?q=Acuicola%2011%20diciembre).

Chavez: I am very interested to see what acoustic feeding can do to increase yields. We are working with Mazatlanbased Acuicultec, which is developing an acoustic feeding system with artificial intelligence. In the past two years, we have been working with them on autofeeders and on control of aeration and reduction of pumping. We also had a trial with AQ1, and we are happy with results such as a drop in FCR and DOC and larger size. I am now tempted to increase stocking density to increase yields.

As a group we are managing the ups and downs of this industry. I am very concerned with the oversupply situation and economic sustainability of shrimp farming. I believe that the large integrators will continue to produce more and more and workers in the smaller farms will lose their jobs. We may see a smaller group of large producers. This race is not healthy. Similar to other countries such as Ecuador, shrimp farming in Mexico provides employment to communities. I also believe in social sustainability - the benefits of shrimp farming should be distributed to many in the community and not only to few.

revolutionary a algaereplacement&functionalfeedinone

Liquid diet harnessing the advantages of algae and probiotics to enhance the health and performance of shrimp in the early life stages.

The future is genomic advancements, regional adaptability, and sustainability practices for a transformation that fosters both economic and environmental resilience

By Natthinee Munkongwongsiri, Chotitat Luengchaichawange, Daniel Fegan and Craig L. Browdy

The global shrimp aquaculture industry stands at a crossroad, where innovation is essential to overcome challenges and unlock new opportunities. Genetic advancements have become a key component in addressing critical issues like health management, improving productivity, and ensuring environmental sustainability.

This article explores how innovations in vannamei shrimp genetics and advanced breeding strategies are shaping a sustainable and resilient future for the industry.

Shrimp genetics in Latin America and Asia have evolved along distinct paths, shaped by differences in farming systems, disease pressures, and environmental conditions.

In Latin America, where extensive farming systems dominated, the focus was on breeding shrimp with disease tolerance, particularly specific pathogen resistant (SPR) lines. These lines were developed by selecting survivors of disease outbreaks, which allowed farms to maintain production in environments with lower biosecurity standards and minimal infrastructure investments.

However, while SPR lines demonstrated resilience to pathogens, they often grew more slowly compared to their counterparts.

In contrast, Asia embraced a more intensive farming approach, driven by smaller landholdings and the need to maximise yield per hectare. The adoption of specific pathogen free (SPF) broodstock became the cornerstone of biosecurity strategies. Many Asian farmers invested in biosecure facilities, such as treatment ponds and pathogen testing, to minimise the introduction of diseases like yellowhead and white spot syndrome viruses.

The SPF approach prioritised fast growth, enabling shrimp to reach harvest size quickly and reduce the window of exposure to diseases.

“They address the industry’s dual need for growth and resilience, ensuring farmers in diverse regions can rely on shrimp stocks that perform well under varied farming conditions.”

While both strategies addressed regional needs, they also came with trade-offs. SPF shrimp lacked the genetic resilience to withstand new pathogens, while SPR shrimp often sacrificed growth speed for survival. Furthermore, attempts to introduce fast-growing Asian lines in Latin America, or disease-tolerant Latin American lines in Asia, yielded inconsistent results, as these genetics were not adapted to the respective regions’ conditions.

To bridge this gap, the industry has shifted toward the development of “balanced lines” - shrimp that combine optimal growth with robust disease tolerance. Unlike earlier efforts to cross fast-growing and resistant families, which often resulted in high variability and inconsistent performance, balanced lines are achieved through rigorous, multi-generational selection processes. These lines leverage advanced genomic tools to identify families that exhibit both traits simultaneously, ensuring consistency and adaptability.

Balanced lines represent a transformative innovation in vannamei shrimp genetics. They address the industry’s dual need for growth and resilience, ensuring farmers in diverse regions can rely on shrimp stocks that perform well under varied farming conditions. This shift underscores the critical role of long-term, science-driven breeding programs in meeting the evolving demands and assuring profitability of shrimp aquaculture.

Advances in genomic selection have revolutionised genetic programs, enabling the development of balanced lines that achieve both high growth rates and strong disease tolerance. By employing tens of thousands of SNP markers and robust phenotypic evaluations, breeding programs today achieve unprecedented precision. These tools reduce inbreeding risks, enhance selection accuracy, and ensure consistent results across generations.

“Acceleration of genetic gains by precisely targeting traits like growth, disease resistance, and environmental robustness using a “Selection Index”.

Advanced breeding programs seamlessly integrate phenotypic and genomic selection. To enable effective selection, precise, accurate and consistent measurements of phenotypic responses are essential. While genomic tools improve selection accuracy, robust phenotypic evaluations ensure that desired traits manifest under realworld farming conditions.

SyAqua is building a database tracking shrimp performance across Asia, spanning multiple production cycles. Through collaborations with an expanding group of technology companies, seed suppliers and growers, the database will continue to grow, providing key insights into the translation of genetic strategies into commercial farm profitability.

This type of dual approach enables:

• Acceleration of genetic gains by precisely targeting traits like growth, disease resistance, and environmental robustness using a “Selection Index”.

• Effective investment into genomic selection for tangible, measurable outcomes that benefit farmers.

Our use of a tailored “Selection Index” has allowed the simultaneous selection for multiple traits within the balanced lines, targeted to the needs of the market. This has allowed the development of a robust line that can meet the challenges of many different environmental and farming conditions.

Balanced lines have emerged as a revolutionary solution to the historical trade-off between growth and resistance. Through more than a decade of dedicated genomic and phenotypic selection, these lines have been optimised to combine fast growth with the robustness required for challenging environments. SyAqua has been instrumental in this transformation, consistently delivering lines that perform well in real world environments for both survival and growth. At the end of the day, bottom line farm profitability depends on simultaneously balancing and maximising both traits.

The results speak volumes:

• A 44% improvement in growth rates over five years.

• A 22% increase in resistance to Vibrio parahaemolyticus, the causative agent of early mortality syndrome (EMS).

• Survival rates of up to 88% during 100-day culture cycles, even under adverse conditions.

These achievements underscore the impact of advanced genomic tools and strategic breeding, providing farmers with high-performing stocks tailored to diverse production challenges.

Recently, several local breeding programs have developed in Asia. Results from these companies have been mixed with some achieving high quality post larvae (PL) with a focus on a well-managed broodstock program and world class hatchery systems.

On the other end of the spectrum, there are many suppliers who operate in the “secondary” or “F2” market. These suppliers produce broodstock from 2nd generation post larvae (i.e. growing PL from imported broodstock to broodstock for sale locally).

This is a short-term approach as they may be compromised by disease infection and inbreeding that accumulate quickly. It is increasingly difficult to know the true genetic source of shrimp seed. The most successful producers have a rigorous seed quality control program coupled with strong relationships with suppliers to ensure consistency.

The shrimp aquaculture industry continues to evolve, facing challenges such as disease management, feed efficiency, climate adaptability, and environmental sustainability. To meet these demands, genetic strategies are focusing on enhancing disease tolerance, improving feed conversion efficiency, and developing shrimp resilient to environmental stresses.

Emerging technologies, including AI and big data, are enabling predictive models that refine breeding programs, creating precise tools to help farmers maximise profitability and reduce their environmental footprint. These advancements complement ongoing efforts to deliver sustainability-focused solutions:

• Feed Efficiency: Optimised genetics reduce waste, improve water quality, and promote healthier pond ecosystems.

• Resilience: Shrimp with greater disease tolerance reduce reliance on chemical interventions, minimising ecological strain and production risks.

profitability, resilience, and environmental stewardship. The best genetics coupled with advanced production technologies and management practices, will enable a new era of precision and sustainability in shrimp aquaculture.

• Consistency: Balanced lines ensure reliable performance, reducing crop failures and supporting profitability.

By integrating genomic advancements, regional adaptability, and sustainability practices, shrimp farming is undergoing a transformation that fosters both economic and environmental resilience.

Innovation is not just a buzzword for SyAqua; it is the foundation of the company’s mission to transform shrimp farming. From pioneering balanced lines to leveraging cutting-edge genomic tools, the company’s breakthroughs are empowering farmers with genetics that drive

Natthinee Munkongwongsiri, PhD is Field Research Manager at SyAqua Siam Co. Ltd. Email: natthinee.m@syaqua.com

Chotitat Luengchaichawange is Head of Genetic Department at SyAqua Siam Co. Ltd.

Daniel Fegan is Chief Impact Officer at SyAqua Group, Thailand. Email: dan.fegan@syaqua.com

Craig L. Browdy, PhD is Chief Technology Officer, SyAqua Group.

THE platform for industry stakeholders to explore new options, and chart a new path for long-term economic sustainability based on PRECISION farming for higher PRODUCTIVITY, leading to better PROFITABILITY ASIA’S LEADING

Artemia is a widely used live feed for shrimp post larvae. Traditionally, hatcheries incorporate Artemia hatching facilities into their daily operations. Hatcheries need clean and pathogen-free instar1 Artemia nauplii

Since 2013, I&V Bio, starting from a centre in Chonburi, Thailand, has taken the Artemia -hatching burden away from shrimp hatcheries. It produces Artemia nauplii on a commercial scale and at the same time guaranteeing the hatchery manager a steady daily supply of live nauplii ready for use. While cysts are convenient for longterm storage and on-demand hatching, live or enriched nauplii may provide the most digestible and nutrientrich option.

Fast forward to 2022, I&V Bio and Kytos are blending innovative hatchery technologies with microbiome management to redefine industry standards in hatchery operations. During larvi 2024 held in Ostend, Belgium on September 9-12, Zuridah Merican sat with Rudi Bijnens, the Global Marketing and Sales Director at I&V BIO and Steven Debono, a sales representative at Kytos to discuss their views and future in hatchery operations.

Live Artemia versus traditional Artemia

I&V Bio’s approach challenges traditional Artemia suppliers, particularly those offering canned cysts. “Traditional live Artemia comes with risks, especially in environments prone to Vibrio and other contaminants. Without proper sanitation and protocols, these risks can persist in tanks. In contrast, our live product is guaranteed to be free of pathogens such as Enterocytozoon hepatopenaei (EHP), Vibrio, and viruses,” Bijnens emphasised.

“This quality assurance not only enhances hatchery efficiency but also helps I&V Bio carve a competitive niche. Despite competition from established suppliers of Artemia cysts in a can, like those in Russia as well as from copycat producers of live nauplii, our product and service model have enabled us to capture significant market shares. In our markets in India and Indonesia, it has been 40-50% and we can easily expand our capacity where the need arises.”

Bijnens further argued that Artemia cysts, require hatching, separation, and enrichment before use. This decades-old practice is labour-intensive, inconsistent, and prone to variability, leading to inefficiencies and increased costs. However, I&V Bio uses a separation technology which does not use a physical barrier, the nucleus remains undamaged, and mortality is almost zero during harvesting. The live feed comes preprepared, eliminating the need for complex hatching processes. Most importantly, hatcheries only purchase the feed they require and can optimise cash flow without tying up resources in bulk Artemia purchases.

“We take over liabilities in a crucial part of the hatchery operation protocols,” said Bijnens. “The product is pathogen-free, ensures stable microbiomes, and simplifies day-to-day operations—key factors that appeal to progressive hatcheries looking for reliable and efficient solutions.”

I&V BIO was founded in 2012 by Luk Van Nieuwenhove and Frank Indigne. Since 2013, from its first facility in Thailand, the company has rapidly grown its operations across the globe with multiple facilities in India (three), Indonesia (two), Vietnam, and Ecuador (one). In Saudi Arabia, there is an exclusive in-house production for NAQUA, following its proprietary protocols. The latest is a small facility in Bangladesh.

A key milestone in its growth trajectory is its recent entry into the Chinese market, with a facility under construction on Hainan Island, enabling a foothold into the vast Chinese aquaculture market. In August 2024, I&V Bio announced a strategic joint venture with Guangdong Yuehai Feed Group, one of China’s premier aquaculture firms.

“The venture in Hainan Island marks a significant step, given the high concentration of hatcheries there. Despite recent setbacks due to a typhoon, we remain optimistic about commencing production by the end of the year.”

China presents immense opportunities for I&V Bio. While current logistical constraints limit its reach to areas accessible within a day, the company is poised to capture a substantial share of the Hainan market first. Bijnens shared, “Our goal is to replicate the success we have seen in other countries. But, next to producing the highest and best quality Artemia, enriched or not, the challenge in China is logistics.”

For I&V Bio, delivering live Artemia daily and directly to hatcheries is a cornerstone of its operational strategy. Logistics plays a crucial role; domestic flights and its fleet of insulated trucks ensure timely delivery, even in challenging conditions. Since 2013, the company has maintained an impressive record of uninterrupted daily deliveries—a feat which was proudly highlighted.

“Building trust remains a top priority. When they choose I&V Bio, they trust us to deliver a consistent, diseasefree product every day and we cannot fail on the promise. This commitment reduces our clients’ operational burdens and translates into significant cost savings,” noted Bijnens.

“We are proud to say that in all of the countries we have operated in; we have never missed a delivery. This is an achievement. Furthermore, unlike commodities, we offer stable pricing for our Artemia nauplii.”

As customers experience the benefits of I&V Bio’s consistent, high-quality products, the company expects its reputation to grow further. The bet is that their focus on reducing operational burdens and offering enriched, pathogen-free Artemia will position them as a preferred partner in the hatchery segment.

Despite the clear benefits, some hatcheries remain hesitant to adopt this innovation. According to Bijnens, smaller hatcheries are particularly slow to adapt, believing that their existing protocols are unique and irreplaceable. Bijnens predicts a gradual but inevitable

shift towards other modernised live feed solutions. He recalled how years ago, small hatcheries previously managed their own broodstock before specialised facilities became the norm.

“There could be an important correlation between quality post larvae and microbiome to certify post larvae..” -Steven Debono.

“For larger, industrialised hatcheries, the transition is more straightforward. These operations understand the hidden costs of variability in traditional Artemia hatching processes and are quicker to recognise the value of consistent, ready-to-use live feed.”

Bijnens continued, “Most hatcheries are still separating Artemia as they did 30 years ago. Without a doubt, they will find variability in hatching, daily yields, and damages. Artemia differs from source to source, so it is always finding new optimisation, and this variability creates extra cost.”

The team noted that change at the farm has been easier than at the hatchery level. Bijnens speculated that farmers have become more efficient at increasing margins, but hatcheries, are under pressure on margins. “It has been difficult for hatcheries to raise prices because their production yields are not consistent plus the fact that they cannot guarantee a reliable supply of high-quality post larvae. Nobody has a way to measure robustness or that the post larvae are certified.”

“There could be an important correlation between quality post larvae and microbiome to certify post larvae but there is still a lot of work to do to prove this,” added Debono.

Fresh live feed significantly outperforms frozen alternatives in terms of nutritional value and performance. “You see deterioration in quality with freezing, even if the nutritional composition appears similar,” said Bijnens as he iterated on I&V Bio’s commitment to provide fresh, high-quality live feed as a foundation of its value proposition.

There is an innovation on Artemia enrichment. Commonly, enrichment is oil-based, where Artemia are exposed to emulsions. “In oil-based enrichment, Artemia filter-feed and store the emulsion in their gut. The enrichment is not absorbed into their body and degrades rapidly once removed from the emulsion,” explained Bijnens.

“In collaboration with Skretting, I&V Bio has introduced algae-based enrichment. This approach leverages natural food for Artemia , allowing them to metabolise and absorb nutrients. Algae-based enrichment results in significantly higher nutritional value, reduced water pollution, and a more stable microbiome in shrimp.”

“These benefits translate into improved shrimp robustness, growth, and microbiome diversity, setting a new benchmark in aquaculture feed technology,” added Debono.

The Kytos advantage: Monitoring microbiomes

Kytos takes aquaculture innovation further by addressing a critical gap: microbiome management. Through advanced analytics, Kytos provides hatcheries and farms with

actionable insights into their microbiomes, enabling them to predict and prevent potential issues such as disease outbreaks. Their software provides a full microbiome health dashboard with over 10 health indicators and timely identification of health problems. Their service aims to relieve the burden in sampling, analysis, interpretation, and solutions.

“Think of it as shedding light on something previously invisible,” explained Debono. Traditionally, farmers and hatcheries could only react to bacterial problems after they occurred, often discarding entire tanks. Kytos offers a proactive approach, using microbiome analysis to anticipate potential crashes and recommend corrective actions.

On what Kytos can do for the hatchery and farms at large, Debono explained. “By analysing microbiome samples, Kytos predicts issues up to 15 days in advance, allowing for timely intervention. Even though the farm and hatchery already conduct real time analyses, conditions could suddenly change. Our technology helps farmers understand how their pond or tank will evolve.

“We want farmers and hatcheries to comprehend the underlying causes of their challenges, resulting in longterm improvements and with rapid turnaround times, users receive microbiome insights within minutes of submitting samples.”

The partnership between I&V Bio and Kytos represents a synergy of complementary expertise. While I&V Bio simplifies live feed operations, Kytos ensures that the microbiome within the hatchery environment remains stable and suitable for optimal growth.

“Our collaboration is more than just technical,” said Bijnens. “We both share a commitment to working closely with hatcheries, and our combined value proposition amplifies the benefits for customers.”

This collaboration also leverages artificial intelligence (AI) and machine learning to improve data collection and analysis over time. As data points accumulate, Kytos can deliver increasingly precise insights tailored to individual hatcheries, further enhancing decision-making and efficiency.

Both Kytos and I&V Bio see data as the foundation for future advancements in aquaculture. By collecting and analysing microbiome data, they aim to move towards predictive models that can anticipate and mitigate risks.

Debono shared an example from a farm using Kytos technology for many years. Over time, an accumulation of data points has allowed the farm to develop a clearer and more specific understanding of its microbiome dynamics, leading to better outcomes.

“Everything starts with data collection,” said Debono. “The longer you work with the technology, the more comprehensive, specific and actionable the insights become.”

“The holy grail is that industry has never managed to link post larvae quality to farm yield.”- Rudi Bijnens

Despite their innovations, both Debono and Bijnens acknowledged challenges in market adoption. One key hurdle is the financial pressure on hatcheries, which limits their ability to raise prices. Additionally, a lack of universally accepted metrics for assessing post larvae (PL) quality hampers the ability of hatcheries to charge premium prices for superior products. Bijnens added, “The holy grail is that industry has never managed to link post larvae quality to farm yield.”

There is scepticism among some hatchery operators, particularly in regions like Vietnam, where traditional practices remain deeply entrenched. However, in countries like Indonesia, the response has been more enthusiastic, with many hatcheries fully embracing I&V Bio’s technology and closing their own Artemia production facilities.

Looking ahead, both Debono and Bijnens are optimistic about the potential for their technologies to make a difference. They envisioned a future where microbiome management becomes a standard part of hatchery and farm operations, leading to more consistent and reliable production.

For I&V Bio, the ambition extends beyond Artemia . “We might have other live food products in the pipeline,” Bijnens hinted. However, the company believes that fresh, pathogen-free feed is key to maintaining stable microbiomes and achieving superior performance.

By Marc Campet

Aquaculture production in Asia-Pacific is expected to continue its growth momentum in the coming years. The region’s aquaculture market is projected to grow at a compound annual growth rate of 5.3% from 2025 to 2030, according to data from Grand View Research (2024). However, environmental and health stressors in the hatchery and nursey stages are anticipated to pose significant barriers to expanding production and achieving aquaculture success for shrimp producers in the region.

The challenge: Moving from controlled to open environments

In Southeast Asia, where high density culture in open environments are common systems for shrimp farms, there is a constant and increasing threat to shrimp post larvae from all pathogens despite efforts to increase biosecurity. In the early stages of their development, the lack of an adaptive immune system in shrimp makes them particularly vulnerable to external conditions, especially when they are exposed to diverse water quality, various infectious environments, during transportation, transfer and counting. Without proper immune support and precise nutrition solutions, the transfer of juvenile shrimp from hatchery to new environments, typically switching from closed control environments to semiopen ones, may result in reduced survival rate and/ or performance loss, and potentially affect the whole production process.

In the absence of a long-lasting immunity memory in shrimp, after exposure to bacteria and viruses, immunity regulation is pivotal for crop success. Early-stage nutrition for shrimp plays a significant role in enabling shrimp to grow faster and remain healthy and robust for a successful harvest. To mitigate the growing challenge of antimicrobial resistance, aquaculture producers

must adopt more efficient management practices, ensuring sustainable operations and profitability across production cycles.

An effective approach is to incorporate functional feeds to help shrimp cope with environmental, physiological and healthrelated stress. Shrimp producers in the region are turning to a new generation of functional feeds designed to support immune function and enhance post larvae resistance to pathogens. Choosing the right holistic feed solution to boost growth and survival performance of juvenile shrimp requires careful consideration of three key attributes.

Small feeds produced by cold microextrusion technology will have a high level of protein digestibility that directly supports the growth performance of juvenile shrimp. The low temperatures of 70°C to 80°C during feed processing results in reduced protein denaturation and a lower loss of the vitamin content of the feed. In fact, an in vitro test by ADM’s Product Development and Applications team in 2021, found that feed produced using cold extrusion technology registered 92.5% protein digestibility as compared to conventional extruded feed with 87.7% to 91% protein digestibility.

Furthermore, when combined with spheronization (or marumerization), which ensures the homogeneity of size and shape of the feed, the feed intake by shrimp post larvae and juveniles is maximised.

Another advantage of cold extrusion and spheronization is that it helps to maintain water stability with reduced leaching of nutrients in water. This contributes to improved water quality in hatcheries and nurseries. This is especially vital during the critical early life stages of shrimp where frequent changes in water quality and environments can be harmful to their future growth and performance.

Utilising special feed additives can be effective in countering stress factors such as during grading and counting, transport and during acclimatisation of young shrimp to new environmental conditions in the hatchery and nursery. Addition of functional additives to nursery feed help shrimp mitigate stress, support immunity, and avoid the reduction in performance as a result of pathogens. It is important to note that while functional feeds can be efficient in enhancing productivity, to maximise benefits, shrimp farmers should complement their use with strict farming and biosecurity protocols.

Trials with a novel yeast

Pichia guilliermondii , a novel yeast, with its unique morphology, structure, and bioactive cell wall components, can assist in managing high periods of high heat through a modulating effect on gut microbiota and immune function. A study conducted by ADM in Thailand showed that the inclusion of P. guilliermondii in shrimp diets gave significant impacts on critical immune parameters, offering immune support for enhanced productivity and performance in juvenile shrimp (ADM, 2012).

Pathogen-free Litopenaeus vannamei shrimp with an initial live weight of 6.5g were housed in 2.5m3 tanks and fed either a control or treatment diet containing 0.18% P. guilliermondii . Feeding was five times a day over 28 days. At the end of the feeding period, a sample of 15 shrimp per group were infected by a Vibrio harveyi suspension and the concentration of total and granular haemocytes in haemolymph samples were measured three hours following the injection.

The inactivated yeast hence positively influences the innate and adaptive immune system of the shrimp with the proliferation of beneficial gut microflora and a faster and stronger inflammatory response to infection. Other trials in Vietnam (ADM, 2019) have also indicated that the addition of P. guilliermondii to the shrimp basal diet resulted in significant improvements in average shrimp body weight gain, with the inactivated yeast supporting growth performance in the absence of pathogen infection.

WeaN Prime® is a top-quality nursery feed specifically formulated by ADM to improve the overall health of shrimp and fish juveniles. It combines three functional additives, including P. guilliermondii. Other ingredients include fish meal, krill meal, pea protein, wheat meal, soy meal, soy lecithin and fish oil. This advanced blend has been proven to improve growth performance and feed conversion ratio (FCR), even under pathogen exposure or stress conditions.

infected by a Vibrio harveyi suspension and the concentraMon of total and granular haemocytes in haemolymph samples were measured three hours following the injecMon.

The granular haemocyte counts significantly increased in the haemolymph of shrimp fed P. guilliermondii (P < 0.05; Figure 1) and the number of V. harveyi cells remaining in haemolymph three hours following a challenge was significantly lower as compared to the shrimp fed the control diet (P < 0.05; Figure 2).

The granular haemocyte counts significantly increased in the haemolymph of shrimp fed P. guilliermondii (P < 0.05; Figure 1) and the number of V. harveyi cells remaining in haemolymph three hours following a challenge was significantly lower as compared to the shrimp fed the control diet (P < 0.05; Figure 2).

An elevated proportion of granular haemocytes amongst total haemocytes, as showcased in shrimp fed feeds with P. guilliermondii, demonstrated primed immune capabilities and a more effective response to pathogen challenges.

Figure 1. Number of granular haemocytes and total haemocytes in Litopenaeus vannamei fed feeds with 0.18% Pichia guilliermondii in a trial in Thailand, after infection with a Vibrio harveyi suspension (ADM, 2012).

infected by a Vibrio harveyi suspension and the concentraMon of total and granular haemocytes in haemolymph samples were measured three hours following the injecMon.

A study by ADM on the effects of this nursery feed on young aquatic animals in Vietnam revealed significant growth improvements, increase in feed intake and improved FCR in young tilapia, fed WeaN Prime® as compared to other mash/micro extruded pellet feeds. During the research, 24 tanks of 200L were divided into three experimental groups (WeaN Prime®; Competitor 1; Competitor 2), with 100 tilapia larvae per tank in water temperatures ranging from 28.5°C-30°C. The tilapia fry (from one day after yolk sac absorption) were fed the nursery feeds four times a day for 40 days.

The granular haemocyte counts significantly increased in the haemolymph of shrimp fed P. guilliermondii (P < 0.05; Figure 1) and the number of V. harveyi cells remaining in haemolymph three hours following a challenge was significantly lower as compared to the shrimp fed the control diet (P < 0.05; Figure 2).

Figure 2. Number of Vibrio harveyi cells remaining in haemolymph of Litopenaeus vannamei fed feeds with 0.18% Pichia guilliermondii, three hours following a challenge with a V. harveyi suspension (ADM, 2012).

The results showed that the larvae fed WeaN Prime® had a final live weight of 6.8g after 40 days. This was 60% and 31% higher as compared to the other experimental groups (Figure 3), a 19% and 8% increase in feed intake (Figure 4), and FCR improved to 1.01 (Figure 5).

To solve the nutritional challenges of today and future generations, WeaN Prime® optimises nutrition and maximises production for shrimp producers in the Asia-Pacific region while mitigating environmental impact and optimising the use of natural resources. Produced using cold-extrusion technology, the feed with lower leaching rates, can be easily adapted to farming systems with low water exchange.

Combined with improvements in growth performances and FCRs, active agents such as activated clay, organic acid blend and P. guilliermondii (Aquatrax) have been shown to reduce stress and boost the immunity of shrimp larvae during the early critical stages of their life cycle, showcasing the effectiveness of functional feeds in helping producers achieve aquaculture success.

References

Grand View Research, 2024. Asia Pacific Aquaculture Market Size & Outlook, 2024-2030; https:// www.grandviewresearch.com/horizon/outlook/ aquaculture-market/asia-pacific ADM, 2012. ADM Internal Study no. CSINTEQC2012. TB 001, Thailand, 2012. ADM, 2019. ADM Internal Study no. SHV G NBC 1903 (Trial 1), SHV G NBT (Trial 2), Vietnam 2019

feeding

To solve the nutriMonal challenges of today and future generaMons, WeaN Prime® opMmises nutriMon and maximises producMon for shrimp producers in the Asia-Pacific region while miMgaMng environmental impact and opMmising the use of natural resources. Produced using cold-extrusion technology, the

and

A white paper * reviews the threat of EHP in shrimp and studies on its mitigation via enhancing resilience with krill meal and oil

By Ragnhild Dragøy

As one of the most valuable and heavily traded aquatic commodities, shrimp production has evolved significantly over the past years (FAO, 2022). The focus has shifted from the low-density farming of the black tiger shrimp (Penaeus monodon) to the intensive culture of the whiteleg shrimp (Litopenaeus vannamei), which now accounts for approximately 53% of global crustacean aquaculture production.

Disease outbreaks have emerged as a major threat, causing significant economic losses over the years (De Schryver et al., 2014; Lee et al., 2022). The mid-1990s were dominated by viral pandemics like the white spot syndrome virus (WSSV), while the period from 2009 to 2015 saw a rise in bacterial pathogens such as vibriosis, causing early mortality syndrome (EMS). More recently, the last decade has been marked by the emergence of

parasites, namely Enterocytozoon hepatopenaei (EHP), which causes hepatopancreatic microsporidiosis (HMP).

EHP threat

EHP causes extensive production and economic losses, evident in countries like India, with an estimated production loss of 0.77 million tonnes and a corresponding economic impact of USD576.62 million (Patil et al., 2021). In Thailand, annual losses due to EHP are speculated to be around USD180 million. In EHPinfected farms, shrimp often fail to grow beyond 12g in a typical 110-day culture, leading to losses ranging from USD4,500 – 32,100/ha (Shinn et al., 2018). This is further compounded by increased shrimp size variability in infected ponds; while it is around 10% in healthy ponds, it can exceed 30% in severely infected ones, often making harvests unprofitable.

EHP is an intracellular parasite that provokes a chronic, progressive infection, leading to a gradual decline in shrimp well-being. It primarily targets the hepatopancreas, which plays a vital role in the synthesis and secretion of digestive enzymes, nutrient absorption, and metabolism and storage of fats, carbohydrates, and minerals (Fan et al., 2016; NRC, 2011; Xu et al., 2020).

The hepatopancreas is also essential for immunity, as it synthesises immune factors in response to microbial invasions (Xu et al. 2020; Ji et al., 2009; Sun et al., 2008). Moreover, the hepatopancreas supports gut health, closely linked with the gut microbiome. This microbiome facilitates gut development, vitamin synthesis, and metabolic functions, and is essential for efficient nutrient digestion and absorption (Ringø et al., 2022; Holt et al., 2021).

EHP infection causes the degeneration of hepatopancreatic cells, impairing hepatopancreas function and disrupting growth-regulating hormones (Wu et al., 2022). This results in reduced nutrient absorption, depleted energy reserves, and host starvation. Consequently, EHP infection in shrimp leads to slower and reduced growth, chronic mortality, and poor feed conversion (Ning et al., 2019). This is summarised in Figure 1.

It also adversely affects the shrimp’s microbiome, diminishing the diversity of beneficial organisms and compromising functions associated with nutrient absorption, immunity, and overall host health (Duan, et al., 2021). As the infection severity increases, the risk of secondary infections and pathogen vulnerability escalates. This significantly impacts shrimp farm productivity and yields mostly due to the slow growth rate, as farmers risk losing their entire stock or are forced to harvest early.

Unlike bacterial or viral diseases, EHP lacks overt clinical symptoms, complicating early detection and causing significant economic losses before it is even identified (Aldama-Cano et al., 2018). Consequently, the industry is focusing on preventive measures (e.g. drying and chlorination) and nutritional strategies to enhance shrimp health and resilience against such pathogens (Jaroenlak et al., 2018). However, the challenge remains significant due to EHP’s resilient spores which can survive several years outside their host, making the disease particularly difficult to eradicate once it is present in pond environments (Wang, et al., 2020).

Implementing a nutritional approach can significantly enhance shrimp resilience against EHP and preventively mitigate its impacts. This strategy can improve disease resistance, stimulate the immune system for better pathogen defence, optimise gut microbiota for efficient nutrient absorption, and optimise hepatopancreas function, thereby supporting overall shrimp health and growth.

Dietary krill inclusion stands out as a promising approach (Figure 2). Technological advances in krill harvesting and processing have led to the production of valuable krill-based products suitable for shrimp feed, including krill meal (KM) and krill oil (KO) (De Schryver et al., 2014). KM and KO offer a rich nutritional profile with feeding attractants, enhancing both shrimp health and feed intake (Smith et al., 2005; Jannathulla et al., 2021; Soares et al., 2021).

Aside from an abundance of high-quality protein and essential free amino acids, the content in KM is rich in phosphatidylcholine (PC). Its omega-3 fatty acids, such as eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), supports cell functions, stress resistance, and immune health (Köhler et al., 2015). Moreover, astaxanthin in both KM and KO contributes to colouration, has potent antioxidative properties, and acts as an attractant, improving feed palatability and intake (Barros et al., 2014).

A study explored the effects of dietary KM and KO inclusion on EHP-infected shrimp. Over a 10-week trial, whiteleg shrimp were fed different diets, including a control diet (POS), 3% KM (KM3), 10% KM (KM10), and 2% KO (KO2) (Aker BioMarine). After an initial 35-day feeding period, shrimp were challenged with EHP. An additional control group (fed with a control diet) did not undergo EHP infection (NEG).

At the end of the study, shrimp fed diets incorporating 10% KM and 2% KO recorded notable improvements (Figure 2). Shrimp in these two groups presented increased body weight compared to the infected (POS) and non-infected control (NEG), and the 3% KM.

Additionally, the krill-fed groups demonstrated enhanced R-cell activity in the hepatopancreas, serving as a qualitative measure of nutrient absorption, digestion, and storage. In contrast, the infected control group (NEG), which was fed a standard diet without krill, exhibited reduced vacuolisation, highlighting the positive impact of krill on hepatopancreas function.

SINGLE SCREW EXTRUSION SYSTEM OPTIMIZES FLEXIBILITY AND MARKET OPPORTUNITIES

Optimize the return on your capital investment with a single screw extrusion system. Buy one system and cost-effectively deliver product to multiple market opportunities.

• One system capable of economy up to super premium fresh meat petfood

• Aquatic feeds that range from floating to sinking shrimp feed

• Capitalize on high margin petfood treat opportunities

• Significantly lower operating cost per ton versus competitive systems

An Extru-Tech Single Screw Extrusion System provides all the flexibility and production efficiencies at around half the cost of competitive extrusion systems with high operating costs.

Contact Extru-Tech today at 785-284-2153 or visit us online at extru-techinc.com

These krill products show potential in mitigating the effects of EHP infection in shrimp. Their high nutritional value, rich in omega-3 fatty acids and antioxidants, is key to boost the shrimp’s immune system and enhance their growth and hepatopancreatic health and function.

The comparable levels of KO in 10% KM and 2% KO diets, along with their similar positive effects, suggest the importance of omega-3 fatty acids in addressing EHP infection in shrimp. The presence of PC in both KM and KO might also play a role in the protection against damage and starvation caused by EHP infection, as it can aid in maintaining cellular integrity and energy retention. This is in line with previous studies demonstrating the benefits of krill-based diets in improving hepatopancreas function (Ambasankar et al., 2022).

Furthermore, the omega-3 fatty acids in KO have been shown to alter intestinal microbiota and strengthen the intestinal immune barrier (Liang et al., 2022), which is crucial given the impact of EHP on gut bacterial community (Shen et al., 2022). Additionally, the immune-stimulatory properties of krill are also evidenced by enhanced expression of immune-related genes (Ambasankar et al., 2022).

The integration of krill into shrimp diets can therefore foster a healthier gut environment, supporting better nutrient absorption and overall shrimp health. Overall, krill-based supplements offer great potential as a natural, effective solution to managing EHP in shrimp farming.

“The observed outcomes with krill supplementation suggest a shift towards more holistic, nutrition-based strategies in aquaculture, which could transform traditional practices and improve the sustainability of shrimp farming globally.”

The findings of this recent study highlighted the potential with the supplementation of dietary krill products in giving nutritional support to EHP-infected shrimp. The positive impact of these products suggests the need to re-evaluate conventional feeding practices given their potential to improve farm productivity and sustainability.

The research lays the groundwork for further exploration into mitigating the impact of EHP infections on shrimp growth performance.

Future studies should examine the optimal inclusion rates of krill products across shrimp species and life stages, and particularly under farming environments. It is also crucial to explore how krill products specifically improve growth performance, focusing on the role of omega-3 fatty acids and PC in the health of the hepatopancreas and intestine of EHP-infected shrimp. However, we believe that the potential of krill products extends beyond EHP management, offering broader implications for disease resistance and immune system enhancement in shrimp farming.

This aligns with the industry’s ongoing efforts to adopt more sustainable and natural solutions for disease control. The observed outcomes with krill supplementation suggest a shift towards more holistic, nutrition-based strategies in aquaculture, which could transform traditional practices and improve the sustainability of shrimp farming globally.

References are available on request