The ASCPA is here to help you meet your CPE requirements, and in-person learning is not going away. See ascpa.com/classroom for in-person learning opportunities.

The Arizona Society of Certified Public Accountants

President & CEO Oliver Yandle

Editor Haley MacDonell

Advertising Heidi Frei

Board of Directors

Chair Andrea Levy

Chair-Elect Lauren Murro

Secretary/Treasurer Eugene Park

Directors

Austin Billingslea

Ben Cilek

Dave Collins

Tithi Debnath

Marissa Graves

Joe Heidleburg

Ignatius Jackson

Gabby Luoma

Dennis Osuch

Lisa Parke

Jesse Porras

Stella Shanovich

Immediate Past Chair Rachael Crump

AICPA Council Members Mike Allen

Jared Van Arsdale

AZ CPA is published by the Arizona Society of Certified Public Accountants (ASCPA) to provide information, news and trends to the accounting profession. It is distributed six times a year as a benefit to ASCPA members. The ASCPA, its members, board of directors and administrative staff assume no responsibility for advertisements herein. The ASCPA and the above people also assume no liability for business decisions made by readers in reference to statements and/or claims in articles or advertisements within this publication. Opinions expressed by contributors are not necessarily those of the ASCPA.

Arizona Society of CPAs 410 N 44th Street, Suite 205 Phoenix, AZ 85008-7604

Telephone (602) 252-4144

AZ Toll-Free (888) 237-0700

www.ascpa.com

Haley MacDonell

Haley MacDonell

Happy New Year! Each fall marks the start of the Jewish New Year, Rosh Hashanah, a holiday which has been celebrated for over a thousand years. Rosh Hashanah is one of my favorite holidays. We set aside time to reflect and create new goals for the coming year.

Let’s reflect on this past year’s advocacy efforts alongside key AICPA professional trends.

Andrea Beth Levy, CPA Chair, Arizona Society of CPAs Vice President of Finance and Operations Greater Phoenix ChamberIn May, I attended the AICPA Spring Council, representing our state alongside our President & CEO Oliver Yandle, the ASCPA’s Director of Government Relations John Baumer and members Jared Van Arsdale and Jessica Iennarella. The AICPA discussed preserving trust in our profession and key trends impacting business leaders today. One year ago, primary concerns identified by business leaders included excessive business regulation, talent retention, digital transformation, hybrid culture and the impact of inflation. This year, the primary concerns shifted to lack of profitability, labor costs and core competencies of human resource management. While helping others grow professionally and personally is essential to our professional success, attracting and retaining talent continues to be a key trend.

Returning to our state, the 2023 legislative session was one of the longest legislative sessions on record, accompanied by a historic number of vetoes.

Let’s celebrate our top three legislative successes, including:

• the early passage of income tax conformity.

• a solution to the pass-through entity tax structure identified by our Tax Legislation Review Committee.

• the continuation of the Arizona State Board of Accountancy.

Every eight to ten years, the Legislature must approve a continuation of the Arizona State Board of Accountancy (ASBA). This year was no exception. The continuation of ASBA was included in House Bill 2011. The Senate Commerce and House Commerce Committee held a public meeting in January to recommend the continuation of ASBA for eight years. In July, the Legislature approved ASBA until July 2031. The passing of HB2011 is an incredible success for our profession, marked by the support of ASCPA volunteers, staff, lobbyists and membership support. In this issue, we explore our legislative recap from DeMenna Public Affairs and our annual Political Action Committee (PAC) reports.

Navigating government is a strategic and thoughtful balance, and the ASCPA remains a nonpartisan resource for all CPAs of Arizona. In addition to providing valuable professional opportunities, the ASCPA represents the profession in policy and regulatory decision-making. Thank you to our ASCPA members who participated in CPA Day at the Capitol, our Income Tax Conformity Debrief, and our Legislative Roundtable and Legislative Scoop webinars. This support fosters essential relationships with lawmakers and further advances our profession.

Our ASCPA PAC is a crucial source of funding that amplifies our professional voice and transforms our vision into reality. For this reason, please consider financially supporting our PAC’s important work. Your financial support makes a real difference. Wishing everyone a happy and successful fall season. l

Best, Andrea Beth Levy

Allison Lynn Dozbaba, CPA, of Wallace Plese + Dreher and Jodi L. Noble, CPA, of Deloitte were recognized in The Most Influential Women in Arizona Business list by AZ Big Media.

Lixun “LT” Tang, CPA, was promoted to partner at Price Kong.

Julie K. Buelt, CPA, was promoted to planning & research manager in the City of Chandler’s Police Department.

Terry H. Gelber, CPA, of Taxanista passed the U.S. Tax Court Non Attorney exam and received Tax Court Practice Privileges.

Kelly Paige Kamienski, CPA, was promoted to vice president of finance at Carlisle Weatherproofing Technologies.

It is with sadness that we share the passing of two Life Members who have made a significant impact on the CPA profession in Arizona. The ASCPA is grateful for the dedication and service of Allen L. Nahrwold, CPA, and Michael T. Daggett, CPA, who were honored as Life Members in 1999.

Allen served as chair of the Arizona Society of CPAs in 1979 and was a previous chair of the Arizona CPA Foundation for Education & Innovation and State Board of Accountancy.

Michael served as chair of the Arizona Society of CPAs in 1989 and chaired the Arizona State Board of Accountancy and the National Association of State Boards of Accountancy.

Learn more about Allen and Michael and their contributions to the profession: www.ascpa.com/in_memoriam.

Allen L. Nahrwold, CPA Michael T. Daggett, CPAAbout 1 in 4 of non-retired adults in the U.S. do not have any retirement savings1

Enhance your retirement advisory offering by emphasizing the incentives offered through SECURE Act 2.0 including:

• Enhanced tax credits for employers to start new plans

• New credits for employer contributions

• Increased age for required minimum distribution

• Future incentives like student loan matching and catch-up contributions

With a Pooled Employer Plan (PEP), employers can collectively participate in a 401(k) plan that is professionally administered by a Pooled Plan Provider--making it easier for small businesses to get their retirement plan up and running.

Paychex is an industry leader in Pooled Employer 401(k) plans and the nation’s largest 401(k) plan provider. Together we can close the retirement gap and make offering and saving for retirement a reality for your clients and their employees..

1 https://www.federalreserve.gov/publications/2022-economic-well-being-of-us-households-in-2021-retirement.htm

By Ryan DeMenna

By Ryan DeMenna

“It’s a good bill.”

This is the constant refrain of the lawmaker about to cast a vote for legislation they support. But, what qualifies as a “good bill” is certainly debatable.

Of the roughly 1,800 pieces of legislation introduced every year by Arizona legislators, a handful are housekeeping measures necessary to modernize outdated statutes and keep state government functioning. A solid argument can be made that these measures constitute “good bills”.

This session, legislation sponsored by Representative David Livingston to continue the Arizona State Board of Accountancy (Board) for eight years is the perfect example of a good bill.

This one might sound like a snoozer to some, but the importance of a functioning Board to the CPA profession cannot be overstated.

While the Board’s mission is to protect the public, its very existence helps maintain Arizona’s substantial equivalency with 54 other U.S. CPA licensing jurisdictions. This means the CPA credential is like a driver’s license, allowing Arizona CPAs to operate in other states. Failure to reauthorize the Board would eliminate over 11,000 Arizona CPA certificates and erase substantial equivalency, making it impossible for Arizona CPAs to practice in their home state and across state lines. To be competitive in a national market, Arizona CPAs must have a functioning Board.

The ASCPA knew, however, that this good bill was still likely to encounter some push back.

Former Governor Doug Ducey made the overhaul of Arizona boards and commissions a central theme of his administration. For years, boards and commissions were characterized as another layer of government regulation that ultimately served as a barrier to entry into a profession. This theme was adopted by policymakers who passed a flurry of legislation establishing “universal licensing,” adding more public members to boards and commissions and other actions.

But in the world of CPAs, the Board does not present a barrier to entry. Anyone can be an accountant. The CPA credential is voluntary, and the Board only certifies and oversees individuals and firms with the CPA designation. CPAs know this, but lawmakers paint with a broad brush, and distinctions like this are easily overlooked.

The ASCPA was ready to tackle these arguments as the bill advanced, but legislative opposition ultimately materialized due to the Board’s self-review.

This requires some explanation.

In the late 70s, the Legislature established the sunset review process, which requires state agencies, boards and commissions to receive a systematic review (basically, an audit) to determine if they should be continued or terminated. The Office of the Auditor General doesn’t have the resources to conduct every sunset review, so the Auditor General identifies and recommends which agencies on the chopping block should receive a full-blown sunset review, and which should self-review.

These recommendations are presented to the Joint Legislative Audit Committee (JLAC), which is comprised of legislators from the House and Senate. JLAC determines whether the Auditor General should conduct the sunset review or if the agency, board or commission should self-review. Simply put, if there are problems with a particular state agency, board or commission, then it receives a visit from the Auditor General. If no problems have been identified, then it’s asked to self-review.

Unsurprisingly, JLAC directed the Board to self-review.

So, as the Board continuation bill advanced, a handful of members began to voice opposition to the bill due to the self-review, arguing that it was the proverbial fox guarding the henhouse.

This was especially frustrating as legislators had directed the Board to self-review and, paradoxically, continuation was opposed by some legislators because it self-reviewed. These concerns materialized as the bill had nearly completed its legislative journey, and the ASCPA was not going to leave the Board’s fate to chance. The ASCPA worked with the bill sponsor and key legislators to ensure that the Board continuation had more than enough support to pass. These same lawmakers were armed with talking points and prepared to speak in support of the bill if legislators concerned with the self-review worked to defeat it during its final vote.

Ultimately, only a handful of legislators voted against the Board continuation, and the bill was signed into law by Governor Hobbs in April.

Federal income tax conformity is also a great example of a good bill. This is another issue that may seem like a snoozer to the uninitiated, but if the state’s tax statutes aren’t updated and aligned with federal tax code changes made in the preceding year, then taxpayers are forced to make assumptions when filing their state taxes. This leads to uncertainty and confusion, which results in higher costs, needless complexity and amended returns.

In the months leading up to the 2023 legislative session, the ASCPA ramped up its efforts to have conformity passed as early in the session as possible.

To help ensure swift legislative action, the ASCPA worked with the chairs of the House Ways & Means Committee and Senate Finance Committee to introduce identical versions of the conformity bill.

After both bills had advanced out of committee, the ASCPA coordinated with legislative leadership to deploy a rarely used parliamentary procedure that allows a bill in one chamber to be substituted for an identical bill in the other chamber. In other words, the ASCPA engineered a scenario in which the conformity bill effectively circumvented half of the legislative process.

Lawmakers passed the conformity bill in late February, making it the second bill signed into law by Governor Hobbs. When you consider the fact that Arizona state government changed dramatically in the wake of the 2022 general election, having conformity signed into law in record time only reinforces the ASCPA’s ability to navigate Arizona’s ever-changing political terrain.

Continued on next page...

Thanks to the help of the dedicated volunteers who serve on the ASCPA’s Tax Legislation Review Committee (TLRC), all tax-related legislation receives a thorough scrubbing to ensure that the mechanics are in order, helping to avoid unintended consequences if it becomes operational as law.

The TLRC also identified an issue with the recently enacted passthrough-entity tax structure in which Partnerships were at a disadvantage when compared to S-corporations. The ASCPA brought this issue, along with the statutory change necessary to resolve the difference, to key lawmakers and legislative staff

who rely on the TLRC, and the fix was included in the fiscal year 2024 state budget.

It is this unique yet necessary form of legislative engagement that continues to reinforce the ASCPA as the gold standard for advocacy.

Every year, the ASCPA – led by its President & CEO Oliver Yandle, and its Director of Government Relations John Baumer – works tirelessly to ensure that the ASCPA voice is heard in the legislative process. Annual events like CPA Day at the Capitol do just that, providing an opportunity for members to meet with lawmakers and advocate for their profession.

Oliver, John and the team at the ASCPA also work to ensure that their members are in the know when it comes to the Legislature, regulation of the profession and state politics. Members receive regular legislative updates, including the Legislative Scoop, a webinar series exclusive to ASCPA members who

get to hear directly from legislators about State Capitol updates while earning Continuing Professional Education credit.

Advocacy at the Legislature continues to be more important than ever, and the ASCPA has consistently shown that it can rise to any challenge.

The ASCPA’s unwavering advocacy efforts have positioned the ASCPA and its members as trusted experts and advisors to lawmakers and their staff. They know the ASCPA advocates for good bills. l

Ryan DeMenna is a partner at DeMenna Public Affairs, which has been supporting the ASCPA’s advocacy efforts for more than 20 years. To learn more about how you can support our advocacy efforts, visit ascpa.com/advocacy.

– Cantor Forensic Accounting, PLLC

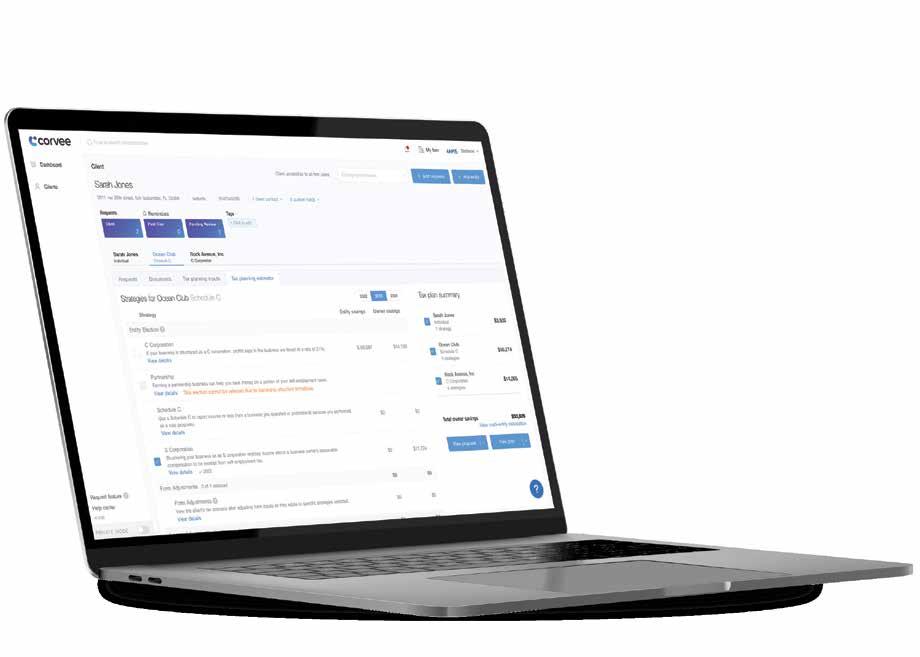

Trusted by accounting industry professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere.

65% of consumers prefer to pay electronically

62% of bills sent online are paid in 24 hours

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles.

The ASCPA PAC is a well-respected voice at the Arizona Capitol, renowned for providing guidance and expertise in accounting, finance, business and tax matters.

A political action committee (PAC) is a fundraising entity that pools contributions from individuals and donates those funds to campaigns for or against candidates, ballot initiatives or other PACs. The ASCPA’s PAC exists to ensure CPAs and the CPA profession have a seat at the policymaking table. It ensures CPAs can focus on accounting, while we monitor changes in policy and oversight for you.

Without active participation in the political process, we risk CPAs and the CPA profession being overlooked or otherwise adversely affected by legislation. Thank you to our top donors in the 2022-2023 fiscal year who have donated to the ASCPA PAC.

$5,000

Deloitte & Touche LLP

$1,250

Price Kong & Co., CPAs, P.A.

$750

Brenda Blunt

$500

Benjamin Cilek

Samantha Crum

Rachael Crump

Tithi Debnath

Thomas Duensing

Rufus Glasper

Barbara Gonzalez

Joseph Heidleburg

Andrea Levy

Gabrielle Luoma

Lauren Murro

Bruce Nordstrom

Eugene Park

Jay Parke

Jesse Porras

Megan Romo

Christopher Tyhurst

Jared Van Arsdale

Oliver Yandle

$250

Sandra Abalos

Michael Allen

Corey Arvizu

Kevin Bach

Steven Bandler

John Baumer

Glenn Bier

Kimberly Bolligar

Francis Brady

Randy Brammer

James Brewer

Christine Brueser

Debra Callicutt

Brian Campbell

David Collins

Christopher Coots

Virginia DeSanto

Bradley Dimond

Michael Drexler

Matthew Everroad

Randy Fletchall

Cheryl Folkerth

Brian Foltyn

Thomas Friend

Sharlynn Garza

Anthony Gerlach

Charles Goodmiller

Christopher Gracey

Jake Gregory

Brian Hemmerle

Charles Inderieden

Colette Kamps

Nikki Kuretich

Donna Laubscher

Chris Ludwig

Daniel Mace

Jason Mattina

Tiffany McBride

Phillip McCollum

Norman Mendoza

Jeremy Miller

Jessica Moulder

John Murdough

Melinda Nelson

Stephen Pope

Jonathan Poppel

Mackenzie Rentschler

Christina Roderick

Stephen Rodis

Barbara Rohwedder

Eric Rudner

LeAnn Rudolph

Stella Shanovich

Jill Shaw

Jennifer Shields

Jeremy Smith

Steven Tait

Matthew Waller

Jennifer Ward

Pamela Wheeler

Cale Whittington

Edward Zollars

Your membership dues and your investment in the ASCPA PAC help fund the important work the ASCPA advocacy team does to protect the CPA credential, advance the profession and advocate for sound policy in Arizona. In tandem, CPA volunteers contribute their professional expertise as guidance on issues that matter and dedicate their time to helping us develop relationships with legislators. All of these contributions, combined with the support of the best lobbyists, put our priorities into action.

House Speaker Ben Toma | R-Peoria

A consistent champion of the ASCPA’s causes, Toma engineered the 2023 “bill swap” for income tax conformity to ensure the legislation could be signed well in advance of tax day.

Senate Minority Leader Mitzi Epstein | D-Tempe

Leader Epstein has been a staunch ally in the Board of Accountancy continuation effort as well as income tax conformity.

Representative David Livingston | R-Peoria

As chairman of the Senate Finance Committee, Livingston championed income tax conformity during tumultuous years following the TCJA and pandemic-related IRC changes. In 2023, he sponsored HB 2011 to continue the Board of Accountancy.

House Minority Leader Lupe Contreras | D-Avondale

Rep. Contreras has helped advance our legislative efforts and been willing to listen to CPAs when it matters. Now, Contreras is the leader of the House Democratic Caucus and a major connection to the ASCPA as Arizona navigates a divided government.

The ASCPA had a successful legislative session on behalf of Arizona CPAs. No matter the year or the issue, the ASCPA has your back at the Legislature.

In December, newly elected and incumbent legislators heard from Arizona CPAs about changes made to the Internal Revenue Code. This event encouraged lawmakers to get the conformity ball rolling early. Income tax conformity legislation (SB 1171) was the second bill signed by Gov. Hobbs on Mar. 3 after House Speaker Ben Toma expedited the bill through the House.

The ASCPA led the legislative effort to re-authorize the Arizona State Board of Accountancy as part of the regulatory sunset review process. HB 2011 cleared the Legislature and was signed by Gov. Hobbs on Apr. 13 to continue the Board of Accountancy for another eight years.

The second annual CPA Day at the Capitol was held in February. In addition to building a stronger connection between state policymakers and the ASCPA, attendees advocated for early income tax conformity, maintaining the gold standard of licensure mobility and reciprocity, and a willingness to engage as nonpartisan resources to legislators.

The ASCPA Tax Legislation Review Committee (TLRC) provided language to address the misalignment of partnerships and S Corporations in the Arizona pass-through-entity tax (PTET) structure. The fix included in SB 1734 incorporates the TLRC’s revisions for tax years 2024 forward. The PTET fix is one example of how the ASCPA has enhanced the organization’s standing and its advocacy program with state policymakers. Legislators on both sides of the aisle seek feedback and review from the ASCPA and our expert members on legislation.

Thank you to the volunteers of the ASCPA’s Tax Legislation Review Committee, who provide nonpartisan technical expertise on all tax legislation: James Busby, Gary Williams, David Walser, Ed Zollars, Michael Lemme, Lisa Johnston, Chris Hallstrom, Stephanie Brooks, Elizabeth Dennis, Michael Martin and Caron Mitchell.

If you know a new CPA or CPA candidate that is not a member, please encourage them to join the ASCPA. Share how your membership has impacted your career and connected you to the CPA community. New members can use the August/September prorated dues rate and discount code AZCPA23 to waive the $25 application fee. www.ascpa.com/join

The ASCPA PAC acts as the collective, cohesive voice of the entire CPA profession in Arizona politics.

In supporting Republican and Democrat candidates who align with the profession and the ASCPA’s goals and priorities, the PAC serves as the “CPA Party,” ensuring CPAs have a seat at the decision-making table when it matters.

To learn more about the candidates the ASCPA PAC has supported, please visit www.ascpa.com/2023pacreport.

To continue supporting our critical efforts, please consider donating at www.ascpa.com/pac.

The Scottsdale City Council is scheduled to meet twice a month on Tuesdays. The six councilmembers and the city’s mayor file onto the taupe dais and sit behind their name plaques. City staff sit on the other side of the room, and in the middle are Scottsdale residents ready to comment on an issue they’re passionate about.

The council works through their agenda. A city clerk is retiring after 20 years on the job. The mayor calls for an executive session. Councilmembers ask questions about a flood hazard mitigation project for the Rawhide Wash. Each councilmember brings a unique perspective and background to the job. There is a lawyer, an architect, the president of an electrical supply company, a teacher, an electrical engineer, the founder of a computer company and a CPA.

Barry Graham is an active CPA who currently holds elected office in the state of Arizona. After taking office in January 2023, Graham now serves a four-year term on the Scottsdale City Council.

Graham’s journey into public service started long before he took his seat on the city council. He grew up and went to school in the Scottsdale public education system. After graduating from Chaparral High School, he moved to Massachusetts, where he studied and began working as a financial analyst in the state legislature. In 2011, he moved back to Arizona and started at Wallace, Plese + Dreher (WP+D), where he now works as a senior audit manager.

Since returning to the state, Graham has volunteered for more than 10 years on Scottsdale boards and on three of the city’s commissions, where he listened to residents and learned what issues were most important to the community.

At the same time, he was working with many Arizona-based businesses as a CPA providing financial statement audit and review services, advising on governance, analyzing internal procedures and cultivating skills that he now brings to the table as a councilmember.

“In early 2022, I was looking at city leadership, where we were going as a city, and noticing more sentiment that local government was not listening to and respecting residents,” Graham recalled. “So, in early 2022, I made the decision to become a candidate.”

It wouldn’t be easy – he and his wife had welcomed twin sons the year before, and he intended to continue his role at WP+D – but he knew it was something he was passionate about. His volunteer experience and his life in Scottsdale became cornerstones of his campaign.

“Just like you can’t dislike accounting and become an accountant, you can’t go into community service unless you enjoy it,” Graham said. “It is a lot of hours, whether I’m serving a client or working with constituents.”

He was endorsed by other councilmembers and community leaders as council-ready and began his campaign with “Experience Matters” at the forefront. There are six city councilmembers in Scottsdale, and three are up for election every two years. In the August primary, he was the top non-incumbent by votes and advanced to the general election, where he secured his council position with nearly 47,000 votes.

“When I was sworn in in late January, I took my seat with everybody on the council,” he remembered. “I’ve known most of them for many years. I had a lot of relationships with colleagues and staff. They’ve all been very welcoming.”

Continued on next page...

There was so much more to learn about a city the size of Scottsdale, its quarter-million residents, over 2,700 employees and a budget exceeding $2 billion.

“I knew a lot going into my term,” Graham explains, “but I continue to keep studying the issues that affect residents’ quality of life like public safety, parks, streets, sanitation, water, zoning and tourism. People talk about the top of the ticket items, like federal office, but the school boards and the city councils can really affect your day-to-day life.”

Graham believes his skills as a CPA help contribute to the city’s overall transparency and efficiency. While being a CPA might not be the typical path for a city councilmember, Graham is content knowing that he has supported the city he grew up in and how it’s changing. He remembers when some of the city’s busiest roads, like Thunderbird, were dirt roads, and now the city welcomes new businesses and residents every month. Graham and his fellow councilmembers have an impact on what makes the city so attractive.

“People come here for the quality of life, and they expect and deserve a responsive local government,” Graham says.

“I really encourage people to spend more time learning about who is at the bottom of your ballot, because they are going to impact your life. There aren’t too many CPA elected officials out there. I recommend that more people who are thinking about going into public service and community leadership study accounting.” l

CAMICO knows CPAs, because we are CPAs.

Created by CPAs, for CPAs, CAMICO’s guiding principle since 1986 has been to protect our policyholders through thick and thin. We are the program of choice for more than 8,700 accounting firms nationwide. Why?

CAMICO’s Professional Liability Insurance policy addresses the scope of services that CPAs provide.

Includes unlimited, no-cost access to specialists and risk management resources to help address the concerns and issues that you face as a CPA.

Provides potential claim counseling and expert claim assistance from internal specialists who will help you navigate the situation with tact, knowledge and expertise.

Does your insurance program go the extra mile? Visit www.camico.com to learn more.

CAMICO is ASCPA preferred provider of CPA Professional Liability Insurance.

Harris Hauptman

Senior Account Executive

T: 800.652.1772 Ext. 6727

E: hhauptman@camico.com

W: www.camico.com

Since the roll-out of the ERTC, many CPAs have faced challenges and questions regarding the credit. Our team saw the need to educate—so we built a platform for CPAs created by experts in the industry. You won’t find content like this anywhere else.

The Remediation Program is a service offered through Silicon Ledger that aims to assist businesses in reviewing their supporting documents for compliance with the IRS guidelines regarding the Employee Retention Tax Credit.

Service Includes:

• Review of your underlying documentation to assess adherence to IRS guidelines

• Review of credit calculation to assess maximization

• If necessary, a consultation with an ERTC-focused tax attorney

SILICONLEDGER.COM/REMEDIATION

Silicon Ledger is a turn-key ERTC solution: managing the process from qualification through submission.

Silicon Ledger’s qualification process is powered by Stout. Stout has an independent process to understand and analyze the challenges and impacts that each of our clients experienced during the pandemic.

Once your business qualifies, we coordinate the preparation of your 941-X with BDO, one of the nation’s leading accounting and advisory firms.

CPA’s Who Have Clients with insufficient documentation: It is important to identify the proper resources and services required to properly document the Client’s position before the IRS issues the Client an Information Document Request (IDR).

CPA’s are in a unique position to bring value to their Clients by providing clarity regarding ERTC: to protect shareholders, ALL Small Businesses should have thorough documentation and clarity surrounding why their business DOES OR DOES NOT file for ERTC.

By Bruce Hosler, EA, CFP,® CPWA,® AIF,® CEPA®

By Bruce Hosler, EA, CFP,® CPWA,® AIF,® CEPA®

Donor-Advised Funds (DAFs) are attractive to our clients for many reasons. One of the big reasons is that a DAF provides you with the opportunity to add value by providing guidance around the rules of donating highly appreciated assets.

Many people are accustomed to being solicited every year by various charities seeking cash donations, so it is common to make charitable cash donations annually. The state of Arizona supports specific classes of charities by offering state tax credit programs. Generally, one of the requirements of Arizona tax credit donations is that they must be in the form of a cash donation. Donations “in-kind” typically don’t qualify for the Arizona state tax credits.

If you look at the instructions on the Arizona State Tax Form 321, it states, “Arizona law provides for a credit for cash contributions made to certain qualifying charitable organizations (charities).”

Donor-Advised Funds can be used creatively to convert highly appreciated assets into cash donations. Let’s consider some of the “complex assets” one may own that can be donated to a Donor-Advised Fund:

• Highly appreciated stock

• Private company stock

• Restricted stock

• Partnership interests

• Non-publicly traded stock

• Hedge fund interests

• Insurance policies

• Stock options

• Foreign-traded stock

• Real estate

• Collectibles

• Trusts

• Intellectual property

• Commodities

• Tangible Personal Property (collectibles, artwork, vehicles, jewelry, coins, timber)

Are you considering all of these options when you are advising clients? Typically, we find the flexible optionality that a Donor-Advised Fund offers – which allows gifting to multiple charities over many years avoiding capital gains tax –is preferred when making a sizable in-kind donation.

Sometimes clients may want to donate only some of the appreciated assets. With wise coaching, you can help them understand that they may have options to make partial gifts of these highly appreciated assets.

I hope you are thinking about how you might get creative in helping your high-net-worth clients who are philanthropically inclined to use a Donor-Advised Fund to help accomplish some of their goals. There is the potential of avoiding capital gains tax while helping their favorite charities, sometimes over a number of years.

Clients love the idea that they can stay engaged by directing donations from the Donor-Advised Fund every year as they help the causes that are near and dear to their hearts.

Before we get too far into the weeds, I want to pause and let you know that not everything is perfect when you use a Donor-Advised Fund. Below are examples of the complexities and key considerations you will want to consider.

• You can’t have a binding sales agreement or debt when donating real estate. It must also have a marketable value.

• If you give small business stock (C-Corp, S-Corp, or partnership/ LLC), the DAF may only hold the active business interests for 60 months.

• Transfers of business interests may be subject to the board, other shareholders, or partnership or partners’ approval.

• S-Corps and partnership/LLC interests may subject the charity to unrelated business income tax (UBIT).

• The appraised value of some business assets may be subject to a marketability or minority interest discount.

• Tangible property is often difficult to value and frequently requires specialists to appraise and evaluate for proper tax substantiation.

• Donors may not have evidence of the basis for inherited property or assets acquired long ago.

• Tangible property is almost always limited to basis due to the relateduse rule.

This list highlights some limited areas you should be aware of when advising clients to donate these types of appreciated assets to a DonorAdvised Fund.

Donors with a social annual gifting obligation, such as an annual scholarship donation (to a college alma mater), tithes or other annual commitments, such as to their church, can usually benefit from this strategy.

As discussed earlier in this article, Arizona Tax Credits must be made by cash donation. The Donor-Advised Fund can be used to donate highly appreciated assets in kind, and then the donor can make a “cash donation” from the Donor-Advised Fund to charities that qualify for the tax credit.

In summary, DAFs are a powerful tool for managing your client’s charitable giving and potentially avoiding capital gains tax. However, they are complex and not suited for everyone. As tax professionals, always consult with a financial professional before making any recommendation regarding Donor-Advised Funds to make sure they are suitable for the client’s situation. l

Bruce Hosler, EA, CFP,® CPWA,® AIF,® CEPA® is founder and principal of Hosler Wealth Management and an ASCPA member. He can be reached at info@hoslerwm.com. Hosler will also be speaking at Converge, the ASCPA’s annual conference. You can register for the event at www.ascpa.com/converge.

This material is intended for informational/ educational purposes only and should not be construed as tax or investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Consult with a qualified financial advisor or tax professional before making any decisions based on this information.

Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is no guarantee of future results.

November 6-7

Desert Willow Conference Center, Phoenix

At Converge, you’re in the driver’s seat. Pick the sessions and areas of practice you want to attend for a personalized day of learning.

Converge, the ASCPA’s annual conference, is a two-day event packed full of presentations, interactive sessions and networking opportunities. Earn up to 16 credits of CPE in six areas of practice.

Register now at www.ascpa.com/converge.

platinum sponsor

gold sponsors

Arizona Tuition Connection | Bell Bank

Catholic Charities Community Services | CTI Corporate Tax Incentives

Global Credit Union | Hosler Wealth Management, LLC Institute for Better Education | Paychex | Sacks Tierney

specialty tracks

accounting & assurance

tax

technology

corporate finance

financial planning leadership

business valuation, litigation & forensic construction

This summer, the ASCPA’s Not-forProfit Conference welcomed both in-person and virtual attendees back to the Desert Willow Conference Center for a day of learning. Topics included leases, board service, fraud and industry updates. Thank you to our Not-for-Profit Conference committee for their support!

Mesa, Arizona

11 a.m. - 12:30 p.m.

www.ascpa.com/bts

Earn CPE and take a tour of someplace new! Behind the Scenes is bringing you to one of Caliber’s commercial properties to enjoy old-fashioned soda floats and a presentation on Opportunity Zones. ASCPA members Coulson Painter, vice president and corporate controller, and Scott Mills, director of tax, will discuss the benefits and incentives of investing in a Qualified Opportunity Fund and what the future could hold for Opportunity Funds.

September 21

Navigating Job Fatigue and Career Burnout: From Recognition to Resolution

Noon – 1 p.m.

www.ascpa.com/lga

The ASCPA’s Leadership & Growth Alliance is back with a new webinar series that is free for members and lets you earn up to four credits of CPE. In this session, learn to recognize the signs of job fatigue and career burnout so you can intervene when balancing work and your professional life becomes challenging.

This month, the ASCPA office moves away from Washington Street, where it has been since 2007, to another location in Phoenix.

Online Access

Go to

to access links to all

Once a quiz is purchased, a link and password will be emailed to you. Your results will be sent immediately after completion, and certificates are emailed within five business days.

410 N 44th Street, Suite 205 Phoenix, AZ 85008-7604

Pre-Order & Save:

For more than 30 years, the Arizona Tax Guide has been an essential reference for tax professionals. It includes:

• The Arizona Income Tax Guide: Better understand income tax law with easy reference to tax tables and individual, corporate, partnership and trust tax differences.

• The Arizona Sales and Use Tax Guide: Simplify Arizona and city sales and use tax returns with details on sales tax classifications, exemptions, deductions, rates, compliance, audits and more.

• The Arizona Personal Property Tax Guide: Overview Arizona’s personal property tax system, including exemptions, the classification structure and assessment rates, reporting, valuation and appeals.

• The Arizona Unclaimed Property Guide: Understand unclaimed property, reporting requirements and more.