The Family Business Meet Two Families United by the Accounting Profession AZ CPA July/August 2023 The Arizona Society of Certified Public Accountants y www.ascpa.com

– Cantor Forensic Accounting, PLLC

Trusted by accounting industry professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere.

65% of consumers prefer to pay electronically

62% of bills sent online are paid in 24 hours

TOTAL: $3,000.00

Get started with CPACharge today cpacharge.com/ascpa

increase

*** PAY CPA 22%

in cash flow with online payments

CPACharge is a registered agent of Wells Fargo Bank N.A., Concord, CA, Synovus Bank, Columbus, GA., and Fifth Third AffiniPay customers experienced 22% increase on average in revenue per firm using online billing solutions

+

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles.

AZ Individual Tax Credits AZ Corporate Low Income Tax Credit AZ Disabled/Displaced Tax Credit Changing Lives Donations 602-218-6542 | WWW.CEAZ.ORG Four Ways You Can Change a Life! Catholic Education Arizona is an IRS 501(c)(3) nonprofit charitable organization and has never accepted gifts designated for individuals. Per state law, a school tuition organization cannot award, restrict or reserve scholarships solely on the basis of donor recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. TURN YOUR AZ TAX LIABILITY INTO CHANGE FOR GOOD! Offer affordable rents & mortgages Nourish families with healthy meals Promote improved quality of life Uplift family caregivers Invest your Arizona taxes with FSL to: 602-285-1800 | WWW.FSL.ORG

Arizona’s Largest Individual and Corporate Tax Credits

WHAT YOU NEED TO KNOW

CORPORATE:

MAX DONATION: AZ TAX LIABILITY

Eligibility: C-Corps S-Corps LLC with an S-election Most insurance companies

INDIVIDUALS:

Choose From: Low-Income Student Education

AZ CPA

The Arizona Society of Certified Public Accountants

President & CEO Oliver Yandle

Editor Haley MacDonell

Advertising Heidi Frei

Board of Directors

Chair Andrea Levy

Chair-Elect Lauren Murro

Secretary/Treasurer Eugene Park

Displaced / Disabled Student Education

Dollar for Dollar Tax Credit

Eligibility: Arizona Taxpayers

Choose From:

Recommending a Student

Recommending a Private School

IBE Most Needy Fund

Dollar for Dollar Tax Credit

ibescholarships.com

Notice (A.R.S 43-1603): A school tuition organization cannot award, restrict, or reserve scholarships based solely on a donor’s recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent.

Directors

Austin Billingslea

Ben Cilek

Dave Collins

Tithi Debnath

Marissa Graves

Joe Heidleburg

Ignatius Jackson

Gabby Luoma

Dennis Osuch

Lisa Parke

Jesse Porras

Stella Shanovich

Immediate Past Chair Rachael Crump

AICPA Council Members Mike Allen

Jared Van Arsdale

AZ CPA is published by the Arizona Society of Certified Public Accountants (ASCPA) to provide information, news and trends to the accounting profession. It is distributed six times a year as a benefit to ASCPA members. The ASCPA, its members, board of directors and administrative staff assume no responsibility for advertisements herein. The ASCPA and the above people also assume no liability for business decisions made by readers in reference to statements and/or claims in articles or advertisements within this publication. Opinions expressed by contributors are not necessarily those of the ASCPA.

Arizona Society of CPAs 4801 E. Washington St., Suite 180 Phoenix, AZ 85034-2040

Telephone (602) 252-4144 AZ Toll-Free (888) 237-0700 www.ascpa.com

ORIGINAL $655 PLUS $652 ORIGINAL $1,308 PLUS $1,301 SINGLE MARRIED $1,307 $2,609

2023 MAXIMUM ALLOWED CREDITS

4 AZ CPA JULY/AUGUST 2023

MacDonell

By Haley MacDonell

By Kerry A. White, CPA

By Sloan Smith, CAIA, MBA, CPWA®

9 The Family Business

13 Harnessing Automation in Your Asset Management System

16 Supporting the Next Generation of CPAs 19 Is an Endowment the Right Solution for a Nonprofit Organization?

22 What’s Happening at the ASCPA? Columns & Departments Chair’s Message by Andrea Beth Levy, CPA 6 Member News 7 Quick Quiz 2 3 9 The Family Business AZ CPA Features Volume 39 Number 4 July/August 2023 4801 E. Washington St., Suite 180 Phoenix, Arizona 85034-2040 www.ascpa.com JULY/AUGUST 2023 AZ CPA 5

ASCPA Chair’s Message

ROI of Dialing Down

How many times have you thought about scheduling vacation, but paused? How many times have you delayed scheduling vacation because you were concerned you may not achieve your bonus? Or someone will take your place? If your response is yes, you’re not alone.

According to a recent Inc. article, the average American takes only half of their earned vacation time. Of those who do take vacation, over 25% of employees work during their paid time off to avoid being overwhelmed when they return to the office.

Andrea Beth Levy, CPA Chair, Arizona Society of CPAs Chief Financial Officer, VOICE Amplified

Before the global pandemic, there were many years when I would take vacation for the eight days of Passover. Then 2020 happened, and even the idea seemed impossible. Financial forecasting and financial reporting requirements increased, and the business demands overshadow the idea of taking time off. Let’s explore the data-driven reasons to prioritize vacation and address strategies to ask for your well-deserved time off.

Health Benefits: In a recent Forbes article, research has shown taking regularly scheduled vacations can help reduce the risk for a cluster of health issues including heart disease, stroke and type 2 diabetes. A separate article from Inc. notes health benefits last beyond the duration of the vacation including “fewer stress-related physical complaints such as headaches, backaches and heart irregularities, and [employees] still felt better five weeks later.” Taking vacation improves your overall health.

Compensation Impacts: Next, let’s look at the correlation between taking your well-deserved vacation and achieving bonuses and raises. A recent HBR article found that people who took fewer than 10 vacation days per year had a 35% likelihood of receiving a raise or bonus in a three-year period; while people who took more than 10 of their vacation days had a 65% chance of receiving a raise or bonus.

Vacation Request Strategies: Ready to book that vacation? One strategy is to develop a vacation schedule between three and 12 months in advance. Read your organization’s time off policy and ensure your request meets the policy requirements. Learn your department’s ebb and flow for busy season. If possible, schedule your vacation during a slower season of the year. In some cases, your time off request may not align with slower times; especially if you’re requesting time off for religious holidays or family events – it’s okay. With advanced notice, your organization will have an easier time supporting and accommodating your request. Next, request for your time off in writing. Ensure your request has been approved by your supervisor, prior to booking travel arrangements.

Most importantly, don’t let other team members intimidate you from asking for time off, because you deserve it. Consider asking an experienced colleague for career advice and how they’ve navigated time off requests.

Time away from our daily routine can provide clarity, creativity and a refreshed perspective. If planning a vacation sounds like extra work, consider finding an allinclusive vacation. Years ago, I found a spot on the beach that included surfboard rental, beach chairs and umbrellas. It was a wonderful place to unwind and enjoy beach weather without the stress of detailed planning. I look forward to hearing about your ROI impact of dialing down.

To see a full list of references and resources, visit www.ascpa.com/ takeyourvacation. l

Best, Andrea Beth Levy

6 AZ CPA JULY/AUGUST 2023

Member News

Kelly K. Damron, CPA, was promoted to accounting chair at Grand Canyon University.

Joshua Jumper, CPA, CGFM, was promoted to audit partner at Heinfeld, Meech & Co, P.C.

Cristina R. Oropeza, CPA, was promoted to audit manager at Heinfeld, Meech & Co, P.C.

Scott Linh Tang, CPA, was promoted to senior associate at Heinfeld, Meech & Co, P.C.

Kaylan Brushwood, CPA, and Gina Khawam, CPA, of BeachFleischman graduated from Greater Tucson Leadership.

Joseph Wagner-Corona, CPA, was promoted to the assistant director of finance for the City of Tolleson.

Lorraine Alemany Murrietta, CPA, was appointed to the Board of Directors for Make-AWish Arizona.

JULY/AUGUST 2023 AZ CPA 7

APS APS APS APS Delivering Results - One Practice At a time Selling Your Practice Alone? Put the Odds in Your Favor… Call APS Today! Sherif Boctor, CPA (Licensed in CA) Sherif@APS.net 888 783 7822 x1 www.APS.net Scan Here

The Family Business

By Haley MacDonell

By Haley MacDonell

“What do you want to be when you grow up?”

The question may be trickier to respond to as we get older, but kids often have an easy answer. According to a survey of 2,000 Americans by Zety, some of our most common childhood dream jobs were doctor, musician, movie star and athlete. When we grow up, we take inspiration from what we see in media and the people in our own lives, including our families. Meet fathers and sons who share their interest in the accounting profession.

Continued on next page...

JULY/AUGUST 2023 AZ CPA 9

The Scotts

Nathan Scott felt like he knew more about taxes than the average kid. After all, his dad was an accountant. He remembers the days spent in the office during summer break and recalls being shocked at learning about the high percentage of taxes taken out of a paycheck.

in the office in those days, including Nathan’s father. There was often an empty office space where Nathan or any of his siblings could spend the day playing games on the computer.

Years later, Nathan pursued an accounting degree, following two of his older siblings who also stayed in the numbers game and studied finance.

“I did get some advice from my dad when I was in school,” Nathan remembered. “And now, he’s thinking about what he’ll do with the firm in the next 10 years. I always considered that as a route, to go into the family business.”

It wasn’t until his sophomore year of college, after taking a few accounting courses himself, that Nathan truly saw the way the business worked during a summer job with his dad. He helped around the office and tagged along on visits to meet with local companies on bookkeeping jobs.

“He’s a genius,” Nathan said. “That’s how I always saw him as a kid, and that’s what I saw close up when I actually worked with him. It was cool to see him not only doing the math, but also interacting with the clients.”

Out of college, Nathan started his career in public accounting and transitioned to corporate

accounting in 2022. Now, he is a senior accountant at onsemi, a maker of semiconductor products and solutions, and has earned his CPA designation.

The exam has changed a lot since his dad took the exam with pen and paper — and without a calculator, which wasn’t permitted on the exam until 1994. Patrick remembers taking all four parts over the span of a few days, whereas Nathan had 18 months to complete the exam.

“That’s overwhelming,” Nathan said. “Having 18 months to complete the exam was an advantage, and I was able to really focus on certain sections. Maybe, the questions can be more challenging, because they know you’re really focused on a specific section. It’s a very difficult test either way.”

For Nathan, it was a no-brainer to become an accountant, and he’s eager to return the favor of offering advice to accounting students considering the profession.

“CPAs have tons of different options,” Nathan said. “I feel like I could go in so many different directions, and I know there are international opportunities. That’s something I really want to do one day.”

When Nathan’s father, Patrick, graduated with an economics degree years before, he had returned to his hometown to look for a job. Nathan’s grandfather recommended Patrick apply at a local accounting firm that they had a good relationship with. Patrick eventually became a CPA and received an Elijah Watt Sells award for stellar scores across all four sections. Patrick got the job and worked his way up from the bottom, eventually buying out the owner.

As a kid, Nathan and his siblings all took turns spending days during the summer at their dad’s office, a business with a legacy. A few of the clients are children of his original clients, families they’ve now known for decades. The practice had a small team working

10 AZ CPA JULY/AUGUST 2023

Nathan, Patrick and Nathan’s older brother Andrew take a photo after skydiving to celebrate Patrick’s 50th birthday. Andrew studied finance originally and is now a police officer.

“I really respect my dad, looked up to him, wanted to be like him,” Nathan explained. “I knew I was going to be an accountant. It sounds funny: What 10-year-old puts ‘accountant’ as their dream job?”

The Kennedys

Growing up, Lawrence Kennedy remembers his dad working from home. He was always around, but what exactly he did - that was less clear. He knew it was something to do with accounting and testifying in court occasionally.

“Through junior year, I had no idea what accounting was, other than taxes,” Lawrence said, “and I knew my dad didn’t do taxes, at least not directly.”

Brendan, his father, worked in business valuation and litigation support, a niche of the accounting profession that assesses economic value for the purpose of partner ownership, taxes, divorce proceedings and other disputes. It’s a small section of the industry, with only 3,200 CPAs holding the Accredited in Business Valuation (ABV®) credential as of 2018. In 2006, Brendan started his own business that grew and would later be merged with ATLAS CPAs & Advisors PLLC in 2019.

Out of high school, Lawrence worked different jobs to see what career he wanted to pursue. His sister, Jacquie, was in college studying education and worked for their dad until the last semester of school. When the job opened up, Lawrence knew he wanted to be the replacement.

He helped out with data input, research and some analysis. At the time, his dad worked from home, so they worked together in a bedroom converted into an office. One of the first client services he shadowed was a lost profit and lost business value litigation case, complicated by destroyed inventory and a difficult landlord making renovations.

“The more I saw what my dad was doing, the more I realized how interesting it was,” Lawrence said. “I enjoyed the analysis and developing a reasoning behind why a company performs a certain way. At the end of the day, in that case, we prevailed. This client’s business was destroyed, and we were able to help him get something to compensate for what had happened.”

From that case forward, Lawrence’s interest in accounting grew.

“He started to see that as something he could do,” Brendan remembered. “Accounting has provided me with a good living and good opportunities, and it’s always challenging. I was very pleased to see him pursue this, and I think he’ll be better than me one day.”

When Brendan was first starting out, his original ambition was agribusiness, but he soon traded out chemistry for accounting. He went on to pursue his CPA, inspired by his brother and sister who were also accountants.

After a year in the administrative position, Lawrence began an accounting degree and went on to earn his associates in business and then bachelor’s degree in accounting by 2021.

In classes, he started putting the pieces together. Some of the concepts and work seemed familiar from professional experiences in bookkeeping or fraud investigations, but now he understood the correct terms and vocabulary to talk about it with confidence. Some topics like adjusting entries were completely new to him.

It’s been 10 years since Lawrence and Brendan started working together, and many of the first years were spent working out of the house. Now, Brendan is a partner and Lawrence is a senior valuation analyst, both working in business valuation and litigation support. Though part of a larger organization, they often work closely in their department of four to handle client cases.

“I’m not sure I give him the praise that he deserves, because he’s my son,” Brendan explains. “I don’t want to appear like I’m bragging on my son, but he deserves to be bragged about sometimes.” l

JULY/AUGUST 2023 AZ CPA 11

Today, Brendan and Lawrence still work remote and collaborate often in business valuation and litigation support with ATLAS CPAs & Advisors.

“They both encouraged me to take that route, and it’s been a great career,” Brendan said.

“There were five of us that turned out to be accountants.”

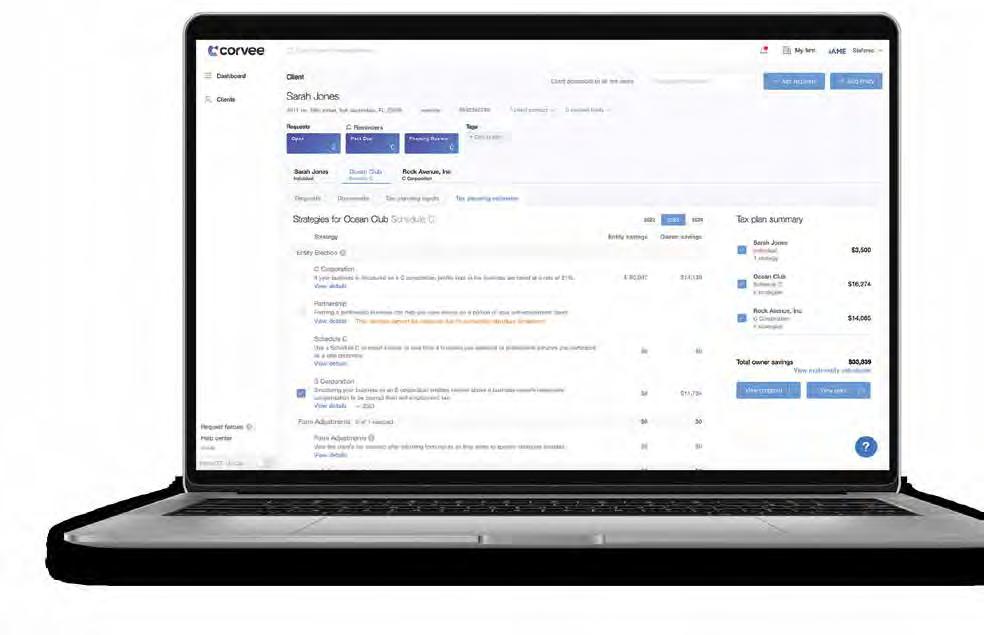

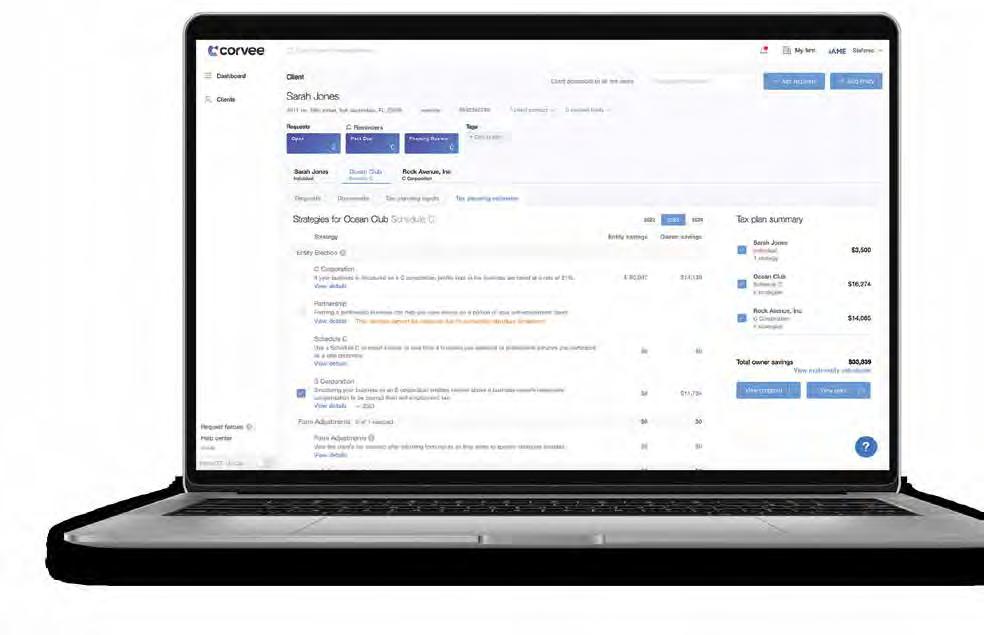

1,500+ tax strategies Find savings for every client Start saving your clients money on taxes today. Get your demo at corvee.com/azcpa

Harnessing Automation in Your Asset Management System

By Kerry A. White, CPA

By Kerry A. White, CPA

It occurred to me after being asked to write about asset management systems in the world of real estate accounting that it was possible that I was being asked to write about systems for tracking and managing fixed assets.

Instead, this is written from a higher-level perspective of an asset manager who is interested in managing a portfolio of real estate assets, because my background is in real estate from an institutional investor. Therefore, what follows are the challenges of finding an asset management system to meet the needs of an asset manager/investor’s needs, what the market offers and what we use and why.

Asset management from an institutional perspective has several challenges when scaling from single assets to having several hundred. There are several different property types involved across many locations, with multiple property managers or operators using different accounting and property systems in most portfolios. How do we aggregate those disparate systems so we can make timely, relevant and reliable decisions to help our clients make the best decisions regarding their assets?

Continued on next page... JULY/AUGUST 2023 AZ CPA 13

We wanted a real estate asset management system that would:

• Have the system consume trial balances and general ledger data from any accounting system, either through a direct connection to the operator or property manager or via a manual upload.

• Similarly, consume tenant data, budgets, underwriting models, pipeline and acquisition data, valuation data, financing, sales and disposition data.

• Bring in market, ESG and other data from resource providers as information needs change.

• Conform this data to a standardized chart of accounts within the system so accounting data brought in maps to the system’s chart of accounts and produced standardized reporting allowing for apples-to-apples comparison between different portfolios, property types, geographies or operators.

• Analyze to compare underwriting to actuals to budget to see how assets are performing to original underwriting and/or to budget to help improve our underwriting and make strategic decisions covering the assets (i.e., hold, sell, invest).

• Manage ad-hoc questions with one source of information.

• Manage the portfolio assets from pipeline, through acquisition, management and disposition.

There are several systems available that have comprehensive suites of software for various property types:

• Yardi - offers the widest range of software for different property types from housing, commercial, self-storage, government and even ports. Yardi is the largest player in the field of real estate asset management systems and one of the most expensive. Yardi also offers market research for decision-making and risk mitigation. Yardi has operational data and predictive insights to assist with forecasts, budget performance and valuation.

14 AZ CPA JULY/AUGUST 2023

• MRI - offers three solutions consisting of housing, commercial and analytics. The housing and commercial platforms are integrated solutions for their respective property types. The analytics platform is a data warehouse that combines various data sources for either predefined or self-service analytics.

• RealPage – consists of an integrated suite of products for commercial property and various housing property types for financial, reporting, expense, vendor and site management. In addition to sustainability and ESG, there is also analytics available with a focus on housing property types.

• Entrata – is a traditional accounting and property management system with commercial and housing featuring end-to-end management.

There are many others that are good accounting systems, and more of these systems are adding analytics to their platforms, which can help asset managers manage properties. For our needs, we had to bring in data to a system agnostic solution, across many property types. In addition, we are not generating accounting data but are consumers; we chose Pereview as our asset management system.

Pereview was able to meet our challenges in the most comprehensive manner available from the asset management systems available for our needs in a cost-effective manner. Pereview was the second asset management system we implemented, and we decided to make the switch because Pereview met our challenges more effectively than its predecessor.

Pereview helped us to:

• Reduce the time preparing consuming spreadsheet models and to create the same reporting using the accounting, budget and static data contained within the product.

• Create dashboards that update as data is uploaded and validated in the system.

• Generate custom dashboards and reporting as a self-service through an integrated PowerBI instance in the system.

• Add customized reports within a reporting library of standard reports to meet the needs of each group of users (portfolio management team, asset management and the investor).

This article should not be misconstrued as an endorsement of any particular system but rather we are detailing our experience to date regarding our evaluation of the various needs and goals we wanted to achieve with an asset management system. Specifically, we required a system that allows us to consume accounting and property data from multiple managers, properties and accounting and property management systems. From that data, it allowed us to create reporting for different types of users beyond the traditional financial statements to support asset management functions and analysis. This allows us to respond in a timely manner and gain holistic insights into managing and reporting on our portfolios. We can also extend our use of accounting data further to support performance measurement calculations.

The best part is that we can take all this data across a wide range of property types, property managers, geographies, acquisitions dates and life cycle stages (construction, lease-up, stabilized) and tell a story about the portfolio. That is, how is the portfolio developing? Where do we see opportunities and causes for concern? Having the ability to distill millions of data points into something meaningful for the users without needing armies of accountants or analysts and a lot of Excel spreadsheets from a single source of truth allows us to do more meaningful work for our clients and provide greater value with our insights. l

Kerry A. White,

kwhite@rclco.com.

CPA, is vice president at RCLCO Fund Advisors and an ASCPA member. You can reach her at

The Arizona CPA Foundation for Education & Innovation supports efforts of the Arizona Society of CPAs to attract and prepare individuals with the highest potential for contribution to the accounting profession in Arizona through initiatives in formal education.

Supporting the Next Generation of CPAs

Melanie Carpenter Grand Canyon University Interested in Public Accounting

Alexsandra Castro University of Arizona Interested in Public Accounting

Beatriz Garibay-Solorio Grand Canyon University Interested in Becoming a Controller

Melanie Carpenter Grand Canyon University Interested in Public Accounting

Alexsandra Castro University of Arizona Interested in Public Accounting

Beatriz Garibay-Solorio Grand Canyon University Interested in Becoming a Controller

16 AZ CPA JULY/AUGUST 2023

Alexander Gonzales University of Arizona Interested in Audit

Congratulations to our 2023-2024 scholarship recipients.*

You can support the Foundation and student scholarships by visiting www.ascpa.com/foundation or scanning the QR code to donate.

Opportunities are available to get involved with the ASCPA’s student outreach initiatives.

Learn more: www.ascpa.com/studentengagement.

*Scholarship recipients chosen from Arizona State University were not selected by the university in time for publication.

Laila Herbert Northern Arizona University Interested in Audit

Julia Spencer University of Arizona Interested in Public Accounting

Clayton Marty Grand Canyon University Interested in Sports Accounting

Grace Wiersma Northern Arizona University Interested in Nonprofit Accounting

Ngoc Nguyen University of Arizona Interested in Auditing

Ashley Wilcyznski Northern Arizona University Interested in Public Accounting

*Scholarship recipients chosen from Arizona State University were not selected by the university in time for publication.

Laila Herbert Northern Arizona University Interested in Audit

Julia Spencer University of Arizona Interested in Public Accounting

Clayton Marty Grand Canyon University Interested in Sports Accounting

Grace Wiersma Northern Arizona University Interested in Nonprofit Accounting

Ngoc Nguyen University of Arizona Interested in Auditing

Ashley Wilcyznski Northern Arizona University Interested in Public Accounting

JULY/AUGUST 2023 AZ CPA 17

Madison Riedling Northern Arizona University Interested in Public Accounting

C NVERGE23

November 6-7

Desert Willow Conference Center, Phoenix

At Converge, you’re in the driver’s seat. Pick the sessions and areas of practice you want to attend for a personalized day of learning.

Converge, the ASCPA’s annual conference, is a two-day event packed full of presentations, interactive sessions and networking opportunities. Earn up to 16 credits of CPE in six areas of practice.

Register now at www.ascpa.com/converge.

platinum sponsor

gold sponsors

Arizona Tuition Connection | Bell Bank

Catholic Charities Community Services | CTI Corporate Tax Incentives

Global Credit Union | Hosler Wealth Management, LLC Institute for Better Education | Paychex | Sacks Tierney

specialty tracks technology

corporate

business valuation, litigation & forensic

accounting & assurance

construction

finance financial planning leadership tax

REGISTER

Is an Endowment the Right Solution for a Nonprofit Organization?

By Sloan Smith, CAIA, MBA, CPWA®

By Sloan Smith, CAIA, MBA, CPWA®

Many feel that endowments are financial structures that are only used by large nonprofits such as hospitals and universities.

This concept may appear overwhelming and unattainable for smaller nonprofits who believe endowments are a place where capital from donations can be saved and invested once they have achieved financial success and stability. However, a nonprofit of any size can start an endowment. Endowments should be viewed not only as an insurance policy for the future but also as part of a financial plan that ensures an organization will be able to continue to carry out its mission.

Continued on next page...

JULY/AUGUST 2023 AZ CPA 19

Figure 1: The Nonprofit Life Cycle and Financial Priorities

Source: http://www.nonprofit-consultants.org/wordpress/wp-content/uploads/2015/03/Nonprofit-Financial-Resources-Cash-Reserves-Endowment-.pdf

What Is An Endowment?

An endowment is an investment vehicle that is restricted where the corpus is typically unaltered and invested to generate income to be spent on a specific purpose. It is formed when the nonprofit and its donors decide to build a reserve of capital with the objective of establishing a financial bedrock for the organization. Ultimately, there are three types of endowment structures: permanent, quasi and term.

• A Permanent Endowment has funds that must be held in perpetuity and invested to produce a spendable payout to help fulfill an organization’s mission.

• A Quasi Endowment has reserves set aside by management or the board of directors, where the principal or income may be used at their discretion.

• A Term Endowment is similar to a permanent endowment, except that, upon the passage of a stated time period or the occurrence of a particular event, all or part of the donation may be exhausted.

The Pros and Cons of Establishing an Endowment

Before any nonprofit makes the decision to form an endowment, the advantages and disadvantages must be clearly outlined. Smaller or even newly formed nonprofits tend to concentrate on their annual expenses such as payroll. However, the goal for these newer organizations should be to reduce these financial stresses and diversify their income.

Though nonprofits often face demands that far exceed their resources, an endowment reduces its vulnerability to economic cycles and risks. The benefits of establishing an endowment can be substantial. It shows the community and donors that the organization is financially sound and intends to be around for a very long time. This message alone has the ability to assist fundraising.

But it must be understood that endowments do not make sense for all organizations, and not everyone thinks highly of them. A valid argument against creating an endowment is current needs. Some may argue that contributions should be used to fund immediate projects such as renovating a church facility, purchasing materials for an

underprivileged school or providing meals for the less fortunate. In some extreme cases, an endowment may be viewed as unethical considering capital is restricted when there are ways to use the money right now.

Another concern is the timeconsuming nature of endowment management. Nonprofit organizations require resources to manage both money and people. Universities, hospitals and other large nonprofits usually have a team that is focused on running the endowment both from an operational and investment standpoint. Nonprofits without endowments do not have to deal with these issues.

How to Determine Whether to Build an Endowment

So, when would it make the most sense for a nonprofit to establish an endowment and how could they do it? Unfortunately, there is no easy answer but there are a few steps that can assist in this decision-making process. The first step is to develop an organizational plan that focuses on responsible financial planning and management. The organization should discuss whether income from fundraising or donations should go directly to operating expenses.

Startup Build Working Capital/Cash Growth Build Working Capital/Cash & Reserves Maturity Build Endowment Maturity Build Endowment YEARS REVENUE & CLIENTS Decline Liquidate Assets 20 AZ CPA JULY/AUGUST 2023

It may be appropriate to use this capital to enhance the organization’s reputation by holding it in an endowment. Another important step is to talk to the nonprofit’s board and donors about the potential need for cash reserves. Board members are responsible for making sure that the organization has the necessary financial resources to achieve its mission both in the present and future. If the nonprofit has sufficient reserves to handle an economic downturn without cutting back on services and staff, there should be a discussion about how to manage this excess capital.

Ultimately, if the cash reserves continue to grow over time and there are limited concerns about expenses, then it may make sense to direct these funds toward an endowment or

potentially establish longer-term cash/ operating reserves which may provide more spending flexibility.

Next, if the nonprofit has the ability to establish a cash reserve account and an endowment fund, hiring an investment manager may be suitable. Small to medium-sized nonprofits have the option to create a diverse portfolio in a cost-efficient manner that provides a much better return profile than simply holding all the reserve and endowment capital in cash.

Lastly, the cash reserve and endowment efforts should be mentioned in capital campaigns and fundraising events. These components can be used to deliver a message of strength, where donors can understand the positive difference their contributions can

make to the organization and that their donation creates more value than if it were given elsewhere.

Overall, there are good and bad reasons to have an endowment. However, it is important to understand that you do not need to be a large nonprofit entity to establish one. Educating the nonprofit’s board of directors and leadership on this investment structure and having an in-depth discussion about the additional value it can bring is key. Either way, it should be a crucial talking point for nonprofits as they try to grow their organizations and enhance their fundraising efforts.

Sloan Smith, CAIA, MBA, CPWA®, is a principal and director at Innovest Portfolio Solutions. Innovest specializes in helping faithbased organizations meet their investment goals. Smith was a speaker at the Arizona Society of CPAs’ Not-for-Profit Conference in June.

Tired? Over-worked? Ready for a Change? PRACTICE SALES Buy / Sell / Merge Cash Buyers Waiting! 480.525.8983 • www.cpasales.com Richard L. Joliet, CPA Member of ASCPA

l

JULY/AUGUST 2023 AZ CPA 21

What’s Happening at the ASCPA?

April 26: Top CPA Exam Passer’s Luncheon

The ASCPA hosted an event to recognize the achievements of the CPA exam’s top scorers. Thank you to ASCPA members Rachael Crump and Lisa Lumbard for sharing their CPA exam experiences and early career, and to Monica Petersen for attending.

May 18: Annual Meeting & Awards Luncheon

The ASCPA recognized our newest Life Member Karen McCloskey, the 2023 Excellence in Teaching award recipient Scott Emett and the service of our outgoing chair Rachael Crump at our annual gathering.

May 23: Representing Arizona CPAs

ASCPA President & CEO Oliver Yandle and Director of Government Relations John Baumer attended the AICPA Spring Council in Washington, D.C. Thank you to ASCPA members Andrea Levy, Jared Van Arsdale and Jessica Iennarella for attending to advocate on behalf of Arizona CPAs. They met with representatives of Arizona’s Congressional Delegation to advocate for “safe harbor” tax filing extension legislation, expanding the use of 529 plans to include professional licensure costs and more.

Get Involved

Prefer Learning in Person?

ASCPA Learning Center

www.ascpa.com/ classroom

Don’t miss out on the August Surgent cluster on taxation and engage with an instructor teaching to the classroom. In-person only.

Topics include:

· Advanced Trust Issues

· Select Estate and Life Planning Issues for Middle-Income Clients

· Four Tiers of Loss Limitations

· The Top Five Issues in Dealing with LLCs and Partnerships

22 AZ CPA JULY/AUGUST 2023

AZ CPA Quick Quiz

You’ve Read It, Now Get Credit

Earn one hour of CPE credit in specialized knowledge by completing the AZ CPA Quick Quiz, available online. Receive a score of 70 percent or more about this issue’s articles for credit. It’s that easy!

Fees: Members: $25 Nonmembers: $40

Online Access

Go to www.ascpa.com/quickquiz to access links to all active quizzes. Once a quiz is purchased, a link and password will be emailed to you. Your results will be sent immediately after completion, and certificates are emailed within five business days.

June 2: Leadership Day

Leadership Day is an annual event that brings together some of the most involved members in our organization for a day of inspiration and ideation. Attendees listened to presentations on diversity, equity and inclusion from Kimberly Ellison-Taylor and the state budget from Arizona Senator Ken Bennett.

JULY/AUGUST 2023 AZ CPA 23

Are you maximizing your member experience? Read the AZ CPA magazine. Log in to the Connect site and select your communities of practice. List your business on the Find a CPA referral directory for free. Respond to a colleague’s Connect post. Get the most out of your ASCPA membership by participating in these activities. To learn more about your membership, schedule time with the membership team by emailing membership@ascpa.com. Access an electronic checklist with links here: Review leadership and volunteer opportunities to get involved. Use exclusive member discounts to save on personal and professional products. Use the CPE tracker. PRSRT STD U.S. Postage PAID Phoenix, Arizona Permit No. 952 ADDRESS SERVICE REQUESTED 4801 E. Washington St., Suite 180 Phoenix, AZ 85034-2040

By Haley MacDonell

By Haley MacDonell

By Kerry A. White, CPA

By Kerry A. White, CPA

Melanie Carpenter Grand Canyon University Interested in Public Accounting

Alexsandra Castro University of Arizona Interested in Public Accounting

Beatriz Garibay-Solorio Grand Canyon University Interested in Becoming a Controller

Melanie Carpenter Grand Canyon University Interested in Public Accounting

Alexsandra Castro University of Arizona Interested in Public Accounting

Beatriz Garibay-Solorio Grand Canyon University Interested in Becoming a Controller

*Scholarship recipients chosen from Arizona State University were not selected by the university in time for publication.

Laila Herbert Northern Arizona University Interested in Audit

Julia Spencer University of Arizona Interested in Public Accounting

Clayton Marty Grand Canyon University Interested in Sports Accounting

Grace Wiersma Northern Arizona University Interested in Nonprofit Accounting

Ngoc Nguyen University of Arizona Interested in Auditing

Ashley Wilcyznski Northern Arizona University Interested in Public Accounting

*Scholarship recipients chosen from Arizona State University were not selected by the university in time for publication.

Laila Herbert Northern Arizona University Interested in Audit

Julia Spencer University of Arizona Interested in Public Accounting

Clayton Marty Grand Canyon University Interested in Sports Accounting

Grace Wiersma Northern Arizona University Interested in Nonprofit Accounting

Ngoc Nguyen University of Arizona Interested in Auditing

Ashley Wilcyznski Northern Arizona University Interested in Public Accounting

By Sloan Smith, CAIA, MBA, CPWA®

By Sloan Smith, CAIA, MBA, CPWA®