1 minute read

Setting up Bank Rules

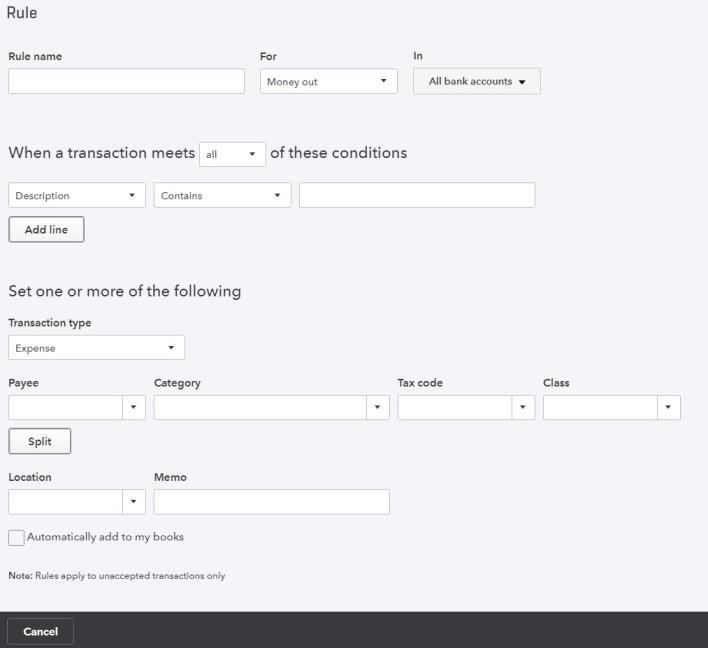

Bank Rules allows greater control of bank transactions as they are added to the QuickBooks Online Company. Bank Rules can be defined via Money In or Money Out and the bank account the transaction it relates to (if you have more than one bank account). The transactions can be identified using separate conditions using • Bank Text, using the logic of Contains or Doesn’t Contain • Description using the logic of Contains, Is Exactly or Doesn’t contain. • Amount using the logic of Equals, Is greater than, Is less than or Doesn’t equal Up to five separate conditions can be added. To complete the rule, allocate the Payee, categorise it, apply a tax code, or apply a class and/or Location. In addition, you can add a memo to the transaction. Example of Creating a new Bank Rule 1. In the new window click on the box in the top right called New Rule

2. Enter a rule name, call it Officeworks 3. Select if this is for Money In or Money Out transactions. Set it as Money Out 4. Select the bank account the rule will relate to

Advertisement

5. Select the appropriate conditions to meet the rule 6. Then select the appropriate actions. Set Payee as Officeworks, Category as Office Supplies, and Tax Code as GST on Non Capital. 7. Optionally choose a Location and/or Class and/or Memo. 8. If transaction is to be added into the file choose Automatically add to my books

Note: transactions Automatically added will not be found in the review tab