Answ er the ‘BURNING’ ques tion with fire pre v ention

Answ er the ‘BURNING’ ques tion with fire pre v ention

In the event of fire, are you certain that your business, people, plant and investment are protected ?

AST offers a range of cutting edge Fire Suppression Technology to protect what you value the most!

We work with clients, system integrators and engineers to ensure that fire systems are properly designed and operational in order to detect and eliminate fire before it can cause destruction. CONTACT

+ 27 (0) 11 949 1157

We drive inclusive growth and transformation by financing property entrepreneurs in their purchase and refurbishment of rental properties, with a focus on affordable rental housing, through:

Entrepreneurial growth

• SME development with a housing outcome

• Access to finance – any language, any level

• Training and mentoring clients every step of the way

Local economic development

• Support for the influx of talent and increased diversity in our inner cities

• Stimulate local economic and social development

• Inclusive economic growth happens locally

Job creation and skills development

During construction

Urban regeneration and densification

• Finance repurposing and new build in inner cities

• Precincts where in neighbourhoods are regenerated

Fiscal impact for local government

• Increasing inner city property values

• Increased & compliant utilities & rates base

• Allows government to focus on productive infrastructure investment

Urban land reform

• Empowerment finance model

• Inclusion changes ownership.

TUHF21 achieves real and evidence-based development impact, by backing people with local knowledge and networks to deliver practical urban development and affordable housing solutions.

We incubate financial solutions that have business continuity and are sustainable, developing solutions until they are ready to stand alone, always looking for new, innovative ways to provide real development impact. Building on the 18-year success story of TUHF, our focus now is on three pillars to harness fresh opportunities:

Managing and growing the Intuthuko Equity Fund, uMaStandi township housing development product, and others such as our Sustainable Bond Framework for Green and Sustainable Bonds.

Developing new solutions based on relevant and practical research.

Providing impact tracking and reporting services for the group to ensure the development impact activities continue in a financially sound and highly governed manner.

FROM

PUBLISHER

Donovan Abrahams

EDITOR

Ashley van Schalkwyk ashley@avengmedia.co.za

CHIEF SUB-EDITOR Tania Griffin tania@avengmedia.co.za

DESIGN AND LAYOUT

Stacey Storbeck Nel (Indio Graphic Design) indiodesign@mweb.co.za

T

So why am I telling you this seemingly insignificant story? It’s a cautionary tale for those looking to start their own business. In these tough economic times, more and more people are going the entrepreneurial route. To these budding businesspeople I say good luck, but I also advise you to do the basics right. Get your foundation in place, even for just a micro-business you run from your home. Please don’t cut corners. Comply with legislation and get your ducks in a row—or you could see all your efforts come to naught.

When I heard about the young lad’s dilemma, I recalled a conversation I had some years ago with Raymond Ackerman. Asking for some business advice, the Pick n Pay founder imparted the following bit of knowledge (and I paraphrase): When starting a business, the first thing you do is hire a lawyer and an accountant, and don’t argue about how much they charge.

Admittedly, not every startup will have the finances to hire a lawyer or accountant at inception. A more affordable way of ensuring compliance is to contact the Companies and Intellectual Property Commission (CIPC). There are offices around South Africa (except in the Eastern Cape), but it can also be contacted on 086 100 2472. Alternatively, check the website www.cipc.co.za.

So stay compliant. And peruse our publication for more valuable business lessons and opportunities in Africa.

Ashley van Schalkwyk

Rashieda Wyngaardt

23 to 25 August

Online

www.africanconstructionexpo.com

The African Construction & Totally Concrete Expo is a significant contributor to the economic growth, recovery and transformation within southern Africa’s construction industry and places a special focus on buyer and seller engagements. It offers five technical talks, bringing like-minded people together to learn and share experiences about the built industry.

23 to 25 August

Online

www.africanconstructionexpo.com

The 4th annual African Smart Cities Summit (at the African Construction Expo) will explore major trends, celebrate Africa’s progress, debate challenges and opportunities and discover the innovations set to advance African cities. The summit will facilitate positive growth through strategic thought leadership and inspiring case studies. The inclusion of the Smart Cities Pavilion on the exhibition floor showcases how technology and innovative solutions can transform African cities.

24 & 25 August

Online

www.terrapinn.com

Power & Electricity World Africa is the definitive virtual event: unique and forward-thinking, combining new technology, efficiency, new thinking and best practice in the industry. Year on year, Power & Electricity World Africa provides partners with access to African utility, government and IPP decision makers who traditionally are difficult to reach. This year’s virtual event will be no different, delivering on how market players can capitalise on business opportunities across the continent.

25 & 26 August

Online

africabanksummit.com

With the emergence of neo banks in the region, the gap between the banked and unbanked segment is further narrowing through their efforts. Neo banks are challenging mainstream banks

with exceptional customer support services and turnaround time in service delivery. Gathering the crème de la crème of West Africa’s fintech sector to address solutions around transforming the region’s digital financial services roadmap, the 5th Africa Bank 4.0 Summit will focus on enhancing the coverage of access to finance across the region.

14 & 15 September

Sarit Expo Centre, Nairobi, Kenya www.africatechsummit.com

Africa Tech Summit Nairobi connects tech leaders from the African ecosystem and international players under one roof. Network with key stakeholders including tech corporates, mobile operators, fintechs, DeFi & crypto ventures, investors, leading startups, regulators and industry stakeholders driving business and investment forward.

21 to 23 September

Cape Town, South Africa and online innovationsummit.co.za

The SA Innovation Summit is the largest startup event in Africa. It provides various platforms for developing and showcasing African innovation, as well as facilitating thought leadership. It brings together top entrepreneurs, investors, corporates, policymakers and thought leaders to support startups and inspire sustained economic growth across Africa.

28 to 30 September Online www.theafricaceoforum.com

The COVID-19 crisis rapidly accelerated numerous trends already in the making, such as the diversification of global value chains, the rise of Sino-American rivalry, the elevation of climate change as a priority, and the fast-tracking of digitalisation. New economic realities are emerging and putting the brakes on a 70-year economic cycle dominated by globalisation, industrialisation and fossil fuels—and forcing us to rethink the strategies of African economies and businesses alike. The Africa CEO Forum, the largest gathering of the African private sector, provides a platform where the continent’s most influential decision-makers can make their voices heard on the new world before us. It’s also a prime opportunity to discuss how African businesses can best adapt to and stay competitive in an everevolving environment.

SAIPA members aim to provide the highest level of expertise and service to clients and are bound by the Institute’s Professional Conduct Standards and Ethical Pledge. They also act as trusted business advisors, assisting and driving businesses to not only survive but thrive.

As Bigen greets one remarkable visionary and welcomes another, it will open yet another chapter of ongoing success and build on the company’s legacy of satisfied clients across Africa

Bigen, a leading African infrastructure development group of companies, has recently announced the retirement of current CEO Dr Snowy Khoza, who has been at the helm since 1 October 2010— holding the distinct roles as the group CEO and executive chairperson of Bigen Africa Group Holdings. Dr Khoza will be going on a well-deserved and planned retirement on 31 December 2021 and will be handing over the baton to Mr Luthando Vutula as CEO incumbent on 1 August, providing ample time to complete a proper handover before he fully takes over the helm on 1 October 2021.

Internationally acclaimed as an astute business professional and the recipient of numerous prestigious local and international awards, including being named as one of Africa’s most influential women in 2020, Dr Khoza was the first female in South Africa to lead a major infrastructure development company. Over the past 11 years, Dr Khoza was particularly successful in spearheading Bigen’s repositioning from a conventional South African civil engineering firm, to an African infrastructure development leader in deliberate pursuit of improving livelihoods for the people of Africa.

Mr Kelepile Dintwe, non-executive chair of the Bigen Board, pronounced Dr Khoza as a dynamic and inspiring visionary with remarkable leadership acumen, and in a recent public announcement said: “The immeasurable business value created by Dr

Khoza during her tenure at Bigen can never be overstated, which spans a successful growth phase of the business to navigating the global economic shakedowns within the built and environment sector seen over the past three years, and recently the obvious impacts of the COVID-19 pandemic. On behalf of the Bigen Board and shareholders of the company, I would like to thank Dr Khoza for her years of dedication, passion, commitment with integrity and vision to bring the company where it is today.”

Dr Khoza described her tenure with the Bigen Group as a humbling journey of reaching new pinnacles of success and of immense fulfilment, especially considering the remarkable difference Bigen has made to the livelihoods of millions living on the African continent: “There are no words that can express how sincerely grateful I am for the privilege and honour to have been part of the Bigen family for the past 11 years. Together with an exceptional board of directors, visionary leaders, shareholders, loyal clients and steadfast employees, we have reinvented and strengthened Bigen to the point where we are now regarded as a leading champion of the infrastructure development impact agenda in Africa. Together, we have not only improved the quality of life of millions of people across the African continent, but also earned a solid reputation as partner of choice in helping the continent achieve its Sustainable Development Goals (SDGs) by 2030.”

“Starting a leadership transition process over the next two months brings to a close a remarkable era of growth, transformation and sustainable business reinforcement under the admirable leadership of Dr Khoza, and opens the doors to the continued shaping of the Group into a new growth trajectory,” said Dintwe. “Mr Vutula is a highly revered and successful business leader with extensive years of experience in similar markets to Bigen, and we look forward to him building on the solid foundation and momentum achieved by the outgoing CEO and the Bigen leadership team.”

Previously the CEO of Ubank, Vutula hails from an impressive business background where he has held senior executive and non-executive positions in major South African development, management and finance companies, contributing at main board level to the setting and implementing of strategic policies. He brings to the table years of experience, business acumen and leadership skills honed from leading high-performance teams and extensive exposure to infrastructure development on a national and international level. Having established networks in all tiers of the South African Government, Vutula is involved with various multinational agencies and diplomatic circles in Africa, Scandinavia and North America, as well as donor agencies

such as The United States Agency for International Development and the European Union.

Before accepting the position as CEO of Bigen, Vutula held the positions of CEO at well-established financial services provider Ubank; Head of Sectors at ABSA Retail and Business Bank; managing executive at ABSA Home Loans, and managing director of ABSA DEVCO. Prior to joining ABSA, he served on the executive level at the National Housing Finance Corporation, where he was responsible for a number of portfolios. He has chaired several boards in both the private and public sectors.

Regarded as a thought leader and trendsetter, Vutula is no stranger to the media. Known and widely respected at key decision-making levels in the SA housing industry, financial sector, and in the public sector at national, provincial and local levels, he is often quoted as an expert on issues such as inner-city regeneration and social housing.

Among numerous other academic achievements, Vutula holds a Master’s Degree in Development Finance from the University of Stellenbosch, a BA Honours Degree in Business Administration from the University of Stellenbosch, and a Bachelor’s Degree in Economics and Accounting from the University of Botswana.

“I am honoured to follow in the impressive footsteps of my predecessor, Dr Snowy Khoza,” said Vutula. “During her dynamic tenure of eight years as CEO and three years as executive chair of Bigen, she accomplished remarkable feats and developed Bigen from being a South African-based consulting engineering firm, to a driver of socio-economic change across Africa through innovative, solutions-focused engineering, advisory and infrastructure development. I am excited to continue her legacy, and while some things may change, certain things will always be prioritised in our decision-making: our people, our continent, creating wealth for our stakeholders and leaving a legacy we are proud of.”

The Bigen Group has, since its inception

The development and implementation of a 360km strategic water transfer system for the Botswana government has resulted in an award for infrastructure development company Bigen, and improvements to socio-economic conditions in the capital city of Gaborone.

50 years ago, earned a solid reputation as an innovative, solutions-focused engineering and infrastructure development partner and employer of choice, invested in the future of Africa. Powering social and economic growth by developing sustainable infrastructure across Africa, the Bigen Group is an influential contributor to socio-economic development across Africa, creating and sharing wealth for all its stakeholders. Throughout its journey of half-a-century, the Group has grown and transformed from a traditional engineering consultancy operating from one office in Polokwane, to an engineering firm operating

from eight regional offices in South Africa, to a truly African infrastructure development group of companies with its headquarters based in Mauritius and South Africa and with office presence in Kenya, Ghana, Botswana, Mozambique, Namibia and Zambia.

Over the past five decades, the Bigen Group has kept pace with the fast-growing infrastructure development needs of the continent and has evolved into a powerful change-maker in the agricultural, water and sanitation, real estate, transportation, energy, health, and development advisory sectors—responding to the continent’s

Through its involvement with many health projects such as the Konza Hospital in Kenya, Women & Children’s Hospital in Lesotho, Kampala Hospital in Uganda and the Riverside Private Hospital in Francistown, Botswana, the Group has assisted in bringing improved healthcare infrastructure to 1.2 million people in one year alone.

At the end of July 2020, 62 SIPs were gazetted, six of which involve Bigen, namely:

• Phase 2A of the Mokolo Crocodile River (West) augmentation project, Limpopo;

• Rehabilitation of the Vaalharts-Taung irrigation scheme, Northern Cape and North West;

• Berg River Voëlvlei augmentation scheme, Western Cape;

• Phase 2 of the Lesotho Highlands water project, Gauteng;

• Lufhereng development, Gauteng; and

• Vista Park 2 and 3, Free State.

socio-economic development needs with a blend of financial, technical, environmental, development impact and advisory and institutional services.

As an African group, working in Africa for the people of Africa, the Bigen Group has become extremely adept in achieving a keen balance between profitability and its passion for beneficiating community well-being aligned with helping the continent achieve its SDGs by 2030. Achieving these goals has become especially critical since the outbreak of the COVID19 pandemic which, according to a World Bank Report, has forced up to 40 million people living in Africa into extreme poverty. This is severely impacting the achievement of the SDGs, of which SDG1 (no poverty by 2030) is suffering the largest setback.

Classified as an essential service, the Group was able to operate throughout the different levels of lockdown and its related restrictions, and continued to support the government in its quest to combat this disease by supplying drinkable and running water critical for impoverished communities to comply with national directives, including hygiene and hand washing. The upgrading of healthcare facilities and erection of temporary ones to accommodate COVID-19 patients were other important projects Bigen was able to undertake for,

inter alia, its Department of Heath clients. The Group also managed to donate thousands of masks and hand sanitisers to impoverished communities—and with development impact always top of mind, its projects during the COVID season persistently improved the quality of life of thousands of people.

South Africa’s post-lockdown economic recovery plan, as announced by President Cyril Ramaphosa on 15 October 2020, is a four-pronged approach that includes a particularly strong focus on infrastructure development to boost investment and growth. Envisaged is a R1-trillion investment with pledges amounting to R664 billion, with R170 billion in capital expenditure already committed. For all of Bigen’s directorates, this strategy holds much business potential in the countries of the African Continental Free Trade Area, which has been launched this year. The president reported in his New Year’s message that important progress had been made in vital economic reforms that would ensure affordable energy, cheaper and faster broadband and more competitive railways and ports of entry. Bigen is already involved, by way of engagement on specific projects, in the South African Strategic Integrated Projects (SIP) programme of the Department of Public Works and Infrastructure under the presidential Infrastructure Co-ordinating Commission Council.

Bigen, with its goal of maximising infrastructure development in Africa to boost socio-economic development outcomes, is regarded as a partner of choice for governments seeking to reach their SDGs. This is based on the Group’s ‘one-stop’ capability, strong social and environmental conscience, and core vision to improve quality of life through infrastructure that provides sustainable social and economic benefits for countries, regions and communities. The Group’s philosophy is embodied in its creed of “doing good while doing business”, which is consistently evident in the socio-economic impacts derived from every project the Group undertakes. Through all its projects, the Group endeavours to increase access to services, reduce poverty, build capacity, and generate opportunities for increased economic participation and employment.

Interconnectedness and accessibility are key economic drivers, and Bigen plays a key role in ensuring these through the development of roads, ports and communication network infrastructure, as well as the provision of services and facilities such as schools, hospitals and clinics. During the past few years alone, the Group has improved the lives of millions of people through its involvement in:

• The development and delivery of an excess of 320 000 housing opportunities across the continent;

• The delivery of various energy solutions to over 400 000 households across the continent;

• The provision of access to economic opportunities, movement of goods and services through roads, rail and bridge projects over 4 500km;

• The provision of clean drinking water and human dignity, employing formalised sanitation solutions to around 600 000 households; and

• More than 42 000 schools projects in South Africa alone.

In addition, Bigen continues to support national economies through expanding and improving port terminals; providing telecommunication services and completing feasibility studies such as for mines and hospitals.

Bigen is often described as “engineers with a conscience”, producing top-quality projects on brief, on time, within budget and with development impact always top of mind. It is, therefore, no surprise that the Group has been appointed on many state-of-the-art projects throughout the years, notably the award-winning NorthSouth Carrier Water Transfer Scheme in Botswana, the award-winning Klarinet Ministerial Integrated Housing Project and the prime Val de Vie Estate projects in South Africa.

More recently, the Group was also appointed as civil & electrical engineers on

the world-class Tambo Springs Logistics Gateway project. Strategically situated on the southern periphery of Ekurhuleni near the OR Tambo International Airport and several major road networks, the facility is expected to unlock economic growth and job creation of more than 8 000 direct jobs in the province. Seamlessly integrating road, rail, air and sea transportation of freight, it is a key platform for the manufacturing, distribution, warehousing and shipping industries, and will likely double the province’s freight capacity.

Bigen boasts a rich legacy of innovative projects in more than 19 African countries, and its epic journey of providing costeffective infrastructure development solutions toward building sustainable communities is validated by its projects to the value of more than US$14 billion over the past 10 years alone.

The Group is also making a remarkable difference in providing improved access to quality healthcare for thousands of people across the continent. Through its involvement with many health projects such as the Konza Hospital in Kenya, Women & Children’s Hospital in Lesotho, Kampala Hospital in Uganda and the Riverside Private Hospital in Francistown, Botswana, the Group has assisted in bringing improved healthcare infrastructure

to 1.2 million people in one year alone.

Some of Bigen’s other current projects transforming lives and boosting economies on the continent of Africa include:

• The development of 30 000 housing units for the Ghanaian armed forces in Ghana;

• The North South Carrier Pump Station and Associated Works project in Botswana to increase water transfer capacity on the North South Carrier Water Pipeline;

• The Pokuase Interchange Project in Ghana to alleviate traffic congestion; and

• The Walvis Bay to Kranzberg Railway Upgrade project in the Erongo region in line with Namibia’s goal of developing a regional transportation hub linking the country with southern Africa.

“There is enormous opportunity for the Bigen Group, to not only rebuild Africa in the aftermath of COVID-19 and the recent South African civil unrest and plundering, but also to assist Africa in reaching its 2030 Sustainable Development Goals. Although we are filled with mixed emotions having to say goodbye to the iconic Dr Snowy Khoza as CEO, we are also looking forward to Mr Vutula joining our family and helping us to achieve continued success,” said Mr Dintwe. “Because of Dr Khoza’s drive and distinguished ability of turning Bigen into an infrastructure development leader, we are ready to take on the future with unstoppable enthusiasm and vigour. We are confident that as we say goodbye to one remarkable visionary and welcome another, we will open yet another chapter of ongoing success and build on our legacy of satisfied clients across Africa.” ◆

Bigen Group

Tel : +27 (0)12 842 8700 Fax: +27 (0) 12 843 9000/9001 E-mail: pretoria@bigengroup.com www.bigengroup.com

With digital transformation a top priority on the corporate agenda as companies identify new ways to grow their business, cyberattackers remain very active. Although Africa is not considered a focus area for the more sophisticated types of cybercriminal activity such as targeted attacks or advanced persistent threats (APTs), the continent is certainly not immune to these or other types of cyber risks.

Kaspersky research shows that in 2020, worldwide, about 10% of computers experienced at least one malware attack. In some African countries, the figure was only slightly under the global 10% average— making the African region comparable to that of North America or Europe in terms of cyberattacks. On some parts of the continent, in countries like Liberia, Tunisia, Algeria and Morocco as examples, Kaspersky has seen a slightly higher rate, while other parts show a lower rate: a 5% or 6% average. For the first quarter of 2021, the figures were only slightly lower than 10%, both in relative and absolute terms.

Says David Emm, principal security researcher at Kaspersky: “Generally speaking, and based on our research, Africa has the same hit rate as we would see for other parts of the globe when it comes to cyberattacks and activity. This only emphasises that the cyber threat landscape truly does incorporate the whole globe where no continent or country is free of this growing danger and where all consumers, businesses and industries alike need to pay attention to effective cybersecurity measures—and especially during the current pandemic and resultant turbulent times.”

In South Africa, Kenya and Nigeria, Kaspersky’s research has identified the top malware families as ransomware, financial/ banking trojans, and crypto-miner malware. When comparing Q1 2021 with Q2 2021,

Kaspersky saw a 24% increase in ransomware in Q2 2021 in South Africa, as well as an increase of 14% in crypto-miner malware. In Kenya and Nigeria, Kaspersky saw a large increase in financial/banking trojans in Q2 2021 when compared to the figures for Q1 2021: a 59% increase in Kenya and a 32% increase in Nigeria.

While on a technical level, not much has changed when it comes to cyberattacks; but the pandemic presents a persistent topic in which the world has a vested interest. So, it offers a wealth of opportunities for cybercriminals to use malware to attack. Everything from the daily numbers and lockdown restrictions to vaccinations, hackers are leveraging on every aspect of the current situation to compromise systems.

“While the bulk of attacks are still speculative and randomly targeting individuals and businesses, there is a shift happening with the increase of APTs and more strategically targeted based attacks. These use continuous, clandestine and sophisticated hacking techniques to gain access to a system and remain inside for a prolonged period, with potentially destructive consequences. Because of the time and effort required to perpetrate such an attack, these are often levelled at high-value targets such as nation states and large businesses,” adds Emm.

As the cyberthreat landscape evolves, the nature of malware is changing. “Take ransomware,” says Emm. “In the beginning it was very random, targeting as many people as possible, hoping for a relatively small amount of money paid in ransom. During the past five years, there has been a shift with a decline in the number of ransomware families being developed as well as an overall global decline in attacks. However, attackers are now focusing on specific companies and individuals where they can get the maximum benefit. The new

approach of ransomware is to expose data, negatively impacting the reputation of a company. To this effect, financial crime has become more sophisticated and organised.”

The financial services sector remains a top targeted industry in Africa when it comes to cybercriminal activity and such cyberthreats—not surprising when one considers the digital-first approach this sector continues to take, driven by the needs and expectations of its customers.

“It is relatively easy for a hacker to target an individual and capture passcodes, one-time passwords, and install malware on their computers to get financial information. This is expanding to financial institutions, given the sheer number of new entrants in the market emerging. For hackers, online or cyber fraud offers direct monetisation of an attack and gives them access to money as quickly as possible,” adds Emm.

Financial-based malware and cyberattacks are also becoming more targeted, complicated and difficult to prevent, and with digital transformation progressing at a rapid rate within such a sector, there is no shortage of attack surfaces for cybercriminals to exploit.

“In a world where cybercrime remains rife and is only fuelled by aspects like the pandemic, there is never a moment one should not consider the implications of a cyberattack, especially as the cyberthreat landscape evolves and become even more targeted and sophisticated than it was a mere few years ago. Cybercrime is a business; consumers and companies alike must remain vigilant against an increasing attack surface. Not only does this entail a more focused cyber training approach for staff within an organisation but also using the latest technologies that feature AI and machine learning for accurate and proactive protection and prevention in real-time,” concludes Emm. ◆

With Sage Intacct, you can expand your reach and improve efficiency during financial close

With Sage Intacct’s cloud software, you can speed up your financial close by tracking inventory and automating processes. Intacct allows businesses to reduce their work hours by simply syncing all the expense reports in minutes without having to view them. Using intacct’s planner feature, these reports can be organised into a budget and easily handed in at the end of the month so that

robotic process automation, as well as real-time financial reporting systems. “At OS Holdings, your business’ success is our business,” says Nomsa Nteleko, the company’s co-founder and CEO.

“While businesses are still defining what the ‘new norm’ is, business owners must make operational changes, now, that will future-proof their business—which is why products such as Sage Intacct are a vital element of your business’s operation.

expenses are paid as they are incurred.

Sage Intacct offers high-quality service that is dedicated to helping businesses expand their reach and improve efficiency during financial close. Intacct’s customers typically report a 10% increase in revenues, 25% reduction in costs, and 50% faster close.

Accurate reports lead to better decisions. Sage Intacct is the trusted financial solution for over 5 000 businesses across the globe.

OS Holdings is an award-winning, client-centric and process-driven software solution business with a footprint in South Africa, Eswatini and Zambia. We assist medium to large organisations in automating their business processes, and we provide the systems to deliver on these processes, to ensure greater efficiency throughout the organisation.

Our systems mix consists primarily of enterprise resource planning, business process management, customer relationship management, artificial intelligence and

“As we move to the next normal, finance leaders have the challenge to achieve better and accurate insights for improved decision-making. A solution like Sage Intacct allows companies to pay for what they need, benefit from more efficient implementations, and achieve reduced total cost of ownership—helping them to easily navigate difficult times while enabling the finance team to work easily and securely from any location,” she adds.

Sage Intacct also offers multiple opportunities to interact with the platform, with the goal of improving your experience so that you can optimise the financial close process.

Connect multiple systems: Intacct’s data flow feature allows for seamless communication and easy integration with third-party applications. It’s used to create a

‘virtual close’ by transferring information between financial applications, allowing you to link bank accounts, billing systems and more. This makes it possible for users to view raw data, match transactions and reconcile accounts using real-time data. As a result, you’ll know exactly where your business stands financially and be able to provide reporting on demand. ◆

Tel: (010) 109 6124 Email: info@osholdings.co.za www.os-holdings.co.za

“AT OS HOLDINGS, YOUR BUSINESS’ SUCCESS IS OUR BUSINESS” – NOMSA NTELEKO

The Department of Communications and Digital Technologies has embarked on a process to develop the Data and Cloud Policy

When addressing the virtual colloquium on the Draft Data and Cloud Policy in June this year, I emphasised the importance of building a digital economy, as it presents opportunities to create jobs. The digital economy is driven by digitalisation, which is the use of digital technologies and digitised data to impact how work gets done, transform how customers and companies engage and interact, and create new digital revenue streams.

As government, we believe data is the critical asset to set the digital economy in motion. We therefore did not decide to develop the Data and Cloud Policy to control and direct how it should be used, but rather as an enabler for social and economic development.

With skills development being a critical intervention to enable economic participation and inclusion, the policy reinforces the issue of skills and capacity development at different levels, including government, to create a digitally transformed society through the implementation of the National Digital and Future Skills Strategy published by the department in 2020.

As government, we also recognise the importance and availability of skills that exist outside state institutions, hence the policy proposal about the D Advisory Council that will draw experts from government, private sector and academia, among others, to contribute toward certain aspects of data governance, including the development of standards relating to the management of data.

The digital economy evolves at a faster pace and has the potential to render many innovations obsolete within a short period.

The policy asserts the role of the Department of Science and Innovation to lead South Africa’s research and development in collaboration with the department to accelerate inclusive economic growth, make the economy more competitive and improve people’s daily lives.

The policy further proposes the establishment of a dedicated research and development capacity, which is critical for the development of human capital to derive value from data and cloud and the establishment of reliable, world-standard cyber infrastructure.

The Draft Data and Cloud Policy is about reinforcing the acceleration of the rollout of digital infrastructure to reinforce a connected society. It is also about the storage, and processing and digitisation of government data to create access for citizens, emerging businesses, government and even the private sector.

The government data referred to must be accessed data in useable form to innovate, develop digital products and services that improve the way we do business, interact with government and each other, support evidence-based policymaking and ultimately enhance service delivery by government.

Furthermore, it is about creating a feasible environment for data sharing and interoperability to strengthen co-operation and collaboration among government departments and state-owned enterprises to satisfy the unlimited needs of government and citizens. The co-operation and

collaboration are done through optimisation of existing capacities and capabilities of other government and government institutions to create required capacity for data collection, storage and processing.

The draft policy recognises the need for data security and protection, hence its reinforcement of cybersecurity protection of personal information, including the recommendation for review where necessary to support data protection and security and a data-driven economy. It is about recognition of what already exists and implementing necessary enhancements to make it better.

In clarifying the issue of data localisation, government has a responsibility to the security and sovereignty of the Republic. As such, we unapologetically insist that critical information infrastructure data—all ICT systems, data systems, databases, networks (including people, buildings, facilities and processes)—that are fundamental to the effective operation of the Republic be stored within the borders of South Africa.

I would like to emphasise there is no intention to force the private sector to store their data in the High-Performance Computing Data Processing Centre. We are clearly indicating that government data will be stored there, while we strengthen and preserve the confidentiality and security of the stored data in a manner that will encourage other parties to store their data there. ◆

Last submission as Minister of Communications and Digital Technologies

Take Note IT provides proactive information technology services for early detection of cybersecurity threats

It is the British wartime Prime Minister Winston Churchill who is credited with saying, “Never let a good crisis go to waste.” He is cited as stating this in the mid-1940s, when the world was in the throes of the devastating World War 2.

The unprecedented COVID-19 pandemic and its many impacts can be equated to a state of war. Millions of lives have been lost and the global economy has been turned upside down.

As millions around the world abandoned their office work stations, it led to a new phenomenon of working from home or working from anywhere. This has fasttracked the need for digital transformation globally, necessitating the need for advanced technology systems that could handle this vast demand.

While people could not meet physically, technology stepped into the gap to facilitate connectivity and productivity.

It is here where the Churchill quote has rung true for us at Take Note IT. This was a time that required agility, resilience, innovation and expertise. The increase in digital connections necessitated increased cybersecurity. In the midst of the pandemic, we saw an uptick in demand for our services in IT.

Founded in 2007, Take Note IT is a leading provider of cybersecurity and IOT early-warning technologies. We are a level-one BBBEE company that is 100% black female-owned, providing professional business and technology consulting services as well as cybersecurity services: cybersecurity monitoring and incident response services

utilising next-generation endpoint protection, threat intelligence and services.

We offer proactive and cost-effective IT services for early detection of cybersecurity threats and protect our clients’ infrastructure before incidents happen. Take Note IT leverages the best software engineering and process skills to provide value-added services to customers.

Our services are rendered across industries such as insurance, manufacturing, retail, telecommunications, financial services, pharmaceuticals, government, consumer services and emerging technology businesses.

Our core strengths are unyielding integrity, applied innovation, commitment to quality and passion for excellence. One of our core competencies in IT service delivery is

having domain/technology knowledge across industry verticals and technology horizontals.

All of this has become ever more crucial with the advent of the much-vaunted POPIA (Protection of Personal Information

Act) in July this year. One of the conditions of this law is that parties who process personal information must take “appropriate reasonable technical and organisational measures” to secure the integrity and

confidentiality of personal information in its possession or under its control.

The Cybercrimes Act has also been signed into law. This underscores the importance of the work we do. This also places greater responsibility on business to ensure clients’ information is not compromised due to cyberattacks or data breaches.

While cybersecurity is critical in this era of digital transformation, it can also alleviate one of the biggest challenges we face in South Africa: youth unemployment. The field of cybersecurity presents massive job opportunities for the youth.

The latest jobs numbers released by Statistics SA show that the official unemployment rate has increased, growing to a record high of 32.6%. Economists had expected the official unemployment rate to rise as a result of new job seekers such as school leavers and graduates entering the labour force. Among the highest unemployment rates were recorded for the youth (those aged between 15 and 24) at 63.3%, and those aged between 25 and 34 at 41.3%.

We believe, however, that there are many untapped opportunities in cybersecurity, given the high demand for these skills and the vacancies that are currently estimated at between 3 and 4 million globally.

Take Note IT runs a Cyber Centre of Excellence that equips young people with these skills and provides them with work opportunities. We are exceptionally passionate about mentoring and creating opportunities for young people in the IT industry. We have championed Take Note IT’s cybersecurity excellence by offering training opportunities to graduates at Take Note IT and its associated companies internationally. This equips them with much-needed work experience, setting them up to be employed in the cybersecurity space.

While we acknowledge the crisis that the pandemic has wrought, we must look for possible green shots that will lead to the recovery of our economy. We at Take Note IT believe that recovery is firmly intertwined with the digital transformation taking place and opportunities it provides. ◆

For further information about our services, visit www.takenoteit.co.za.

Through world-class research and education, the Centre for Renewable and Sustainable Energy Studies is building human capital and promoting innovation

The Centre for Renewable and Sustainable Energy Studies (CRSES) at Stellenbosch University enables a sustainable future for Africa through world-class renewable and sustainable energy research, advisory services, awareness campaigns and training programmes.

Our postgraduate programmes in Renewable and Sustainable Energy studies as well as Smart Grid Technology focus on the training of scientists, planners, economists, project developers and engineers to equip them to work in the fascinating field of renewable and sustainable energy.

Modules from our acclaimed postgraduate degrees are also made available as short courses to the public and private sector. These modules are registered with the Engineering Council of South Africa as short courses that qualify for Continuous Professional Development points. Each of the courses will earn you 4 CPD points.

This course forms the foundation of the various modules in Renewable and Sustainable Energy Studies. It addresses the scientific, engineering and resource aspects of various types of renewable energy systems, and the integration of systems to provide effective and sustainable production and delivery of energy.

Course participants will be exposed to an introductory level of technical insight into the various renewable energy production, storage and transmission systems, and will apply the knowledge in a project-based learning experience.

The course provides an insight into the

supply side of the power system. The focus of the course is on power characteristics of conventional power stations, intermittent renewable power stations and utility-scale energy storage.

Economic dispatch, energy storage scheduling, load-frequency control and inter-area power flow, dynamic system stability and inertia will also be covered.

An overview of applicable network codes and regulations, as well as introduction to power system modelling and simulation software will be discussed.

The course provides an introduction to communications theory followed by an insight into the different communications technologies, both wireless and cable-based, with their application areas and to highlight specific application and requirements for Smart Grid Technology. Basics of information transfer, characteristics, performance, and requirements—as particularly relevant for the Smart Grid— are covered.

The course considers the practical and commercial application of the various technologies for biomass conversion into bioenergy. The production of first- and second-generation biofuels, electricity and heating as the main forms of renewable energy will be covered, with an emphasis on the critical issues of sustainability, energy efficiency and commercial feasibility. The following aspects of bio-energy production are included in the course.

The aim of the course is to provide

attendees with the understanding and tools to design grid-tied (including hybrid configurations with backup power) PV systems within the South African solar resource, technical and legislative contexts. The underlying design criteria is to optimise the energy yield versus lifecycle costs of the PV system within the given resource, technical and legislative constraints i.e. optimising the financial viability of the system.

This module deals with the harvesting of energy from wind. It addresses the availability of the resources, the types of systems and machines, their capabilities and

limitations, the processes of setting up such systems, and their associated costs and environmental impacts.

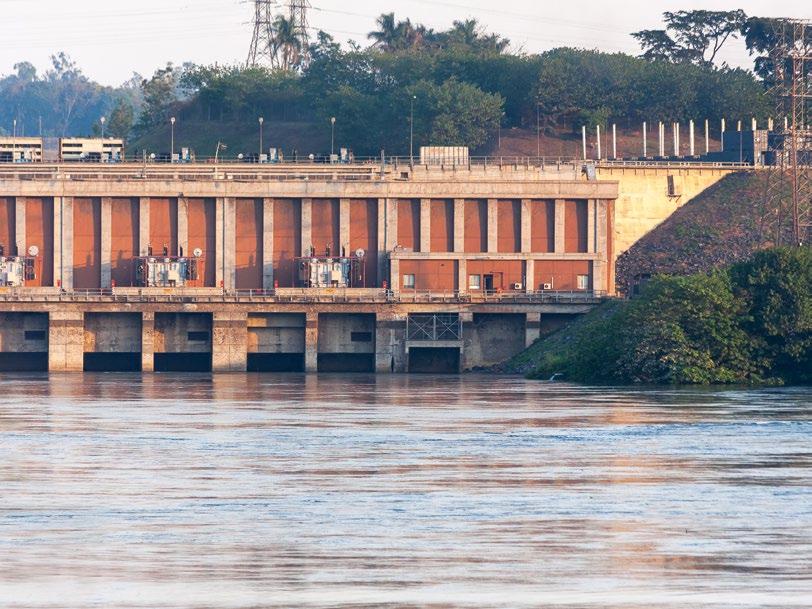

Ocean and hydro power can make a significant contribution to the generation of renewable electricity. In this introductory course, both ocean and hydro energy associated with the elevation or movement of water is studied, giving students a basic overview of the relevant resources, conversion technologies, project development and implementation, and the associated environmental and economic impacts.

The coursework targets load modelling strategies, short-term load forecasting, demand-side management technologies, measurement, and verification, mini- and microgrids topologies, tariff design and advanced metering infrastructure and data

management.

The load modelling component focuses on understanding the concepts involved in deterministic and probabilistic load modelling, and application of these concepts to load forecasting.

The demand-side management component focuses on demand profile and energy management interventions, including maximum demand management, peak clipping, valley filling, load shifting, strategic growth, strategic conservation, and energy-efficient technologies.

The measurement and verification of demand-side management interventions are introduced, including process flow, project planning, baseline modelling, performance evaluation and the reporting protocols that apply. Concepts such as baseline modelling options and methodologies, baseline adjustments, measurement boundaries, energy auditing and uncertainty are addressed in detail.

The tariff design aspects focus on the

theoretical framework for tariff design, particularly with reference to tariff regulations and policies, tariff theory on pricing, and tariff structures and models. Concepts such as smart metering architecture and the use cases for smart metering solutions—including smart billing, smart DSM and smart loss management— are addressed.

The objective is to enable participants to understand the concepts and technologies used for electric energy storage. The course highlights lithium-ion batteries as the dominant technology in new projects and addresses the complex safety, performance and life issues of this technology. The course covers the technical and financial parameters that drive the project designs of gridconnected and off-grid energy storage. Participants become familiar with the major factors that determine energy storage selection and sizing, and receive various case studies to use for benchmarking. The module aims to provide professionals with sufficient understanding to establish the key requirements and financial benefits of energy storage technology and applications in various grid-connected and off-grid systems. ◆

For more information, email crses@sun.ac.za or visit www.crses.sun.ac.za.

Follow us on: twitter.com/crses_us www.linkedin.com/groups/Centre-RenewableSustainable-Energy-Studies-4853266 www.facebook.com/CRSES.Stellenbosch. University

Africa looks likely to continue relying on power from fossil fuels for some time

The narratives of ‘leapfrogging’ to new technologies are pervasive when it comes to development in Africa.

One example is skipping cord phones and landlines to advance directly from limited phone coverage to wide mobile phone usage (bit.ly/3gYgAj8).

Another that is frequently discussed is Africa’s potential for a quick transition to renewable energy. This is important both

from a climate change and an economic development perspective. Providing affordable clean energy is big on the United Nations Sustainable Development Agenda: Goal 7 (bit.ly/3vGoi5c).

Several drivers could prepare the way to Africa’s energy transition. Renewables are becoming increasingly competitive (bit. ly/3xIvLTu), with their costs rapidly declining both globally and in Africa (bit.

ly/3xKq47i). The prices of batteries to balance intermittent supply from renewables are also declining steeply. The average market price of lithium-ion battery packs has fallen to US$137 per kilowatt-hour installed in 2020 (bit.ly/3xFYfgp). This is an 89% decline since 2010.

This downward trend in technology costs is coupled with Africa’s renewable energy abundance. The continent has 40%

of the world’s solar resources (bit. ly/3vuIkQi). And renewables are flexible in scale. For example, solar can power both industrial demand at a gigawatt scale as well as a small mini-grid in a remote village.

But our recently published study (go. nature.com/3eOmXmd) shows that, within this decade, there is currently limited evidence for a quick transition to renewables in Africa. Though the study predicts overall generation to more than double, solar and wind are likely to account for less than 10% of the electricity mix in 2030. According to our estimates, the share of generation based on fossil fuels, especially natural gas, will decline only slightly.

These results were predicted by a machine-learning model we built using a state-of-the-art algorithm for predictive analytics. First, we trained the model to examine drivers behind the successful commissioning of past projects. Then, we applied the model to a pipeline of 2 500

planned power plants across 54 African countries to estimate whether these planned plants would be successfully realised.

Our analysis examined the importance of different project characteristics and country-level development indicators for the successful realisation of power plants. We found that the factors relating to project design are especially pertinent. For instance, smaller project sizes, government or well-designed independent power producer (IPP) ownership structure, and the participation of development finance institutions all have a positive effect on a project.

Technology type also plays an important role. For example, gas and oil power plants have historically had better success chances than most renewable energy projects, with

the exception of more recent solar power plants. Countries’ favourable governance and socio-economic outcomes may also help, but appear to be of relatively lower importance.

Our research highlighted large and critical regional as well as national variations:

First, there were significant geographical disparities in the chances of successful commissioning of planned projects. Some countries and regions are planning generation projects that combine more of the success factors mentioned above than others. We predict 91% of the planned capacity in North Africa will be successfully commissioned. This decreases to 78%, 76% and 71% for southern, West and East Africa, respectively, and drops to only 52% for Central Africa.

Such differences can similarly be strong within a region. For instance, in East Africa, the pipelines in Madagascar and South

Sudan are predicted to have a success chance of below 30%. Ethiopia’s pipeline, on the other hand, which comprises a large share of East Africa’s planned capacity, has a predicted success rate of 85%.

Second, there are spatial differences in the share of non-hydro renewables in the generation mix. For example, while non-hydro renewables are predicted to account for 3% and 6% in all newly added generation in Central and West Africa, respectively, this number increases to 19% and 25% in southern and East Africa.

Third, the predicted pace of the transition to renewables may also vary by country. South Africa is a notable example. Traditionally heavily reliant on fossil fuels, the country is predicted to account for roughly 40% of all new solar generation commissioned on the continent by 2030, aided by its Renewable Energy IPP Procurement Programme (bit.ly/2SppL1F).

The results of our study suggest that as things currently stand, a significant number of African countries may not make a decisive leap to renewables this decade. This implies that countries may lock their economies into a future of relatively carbon-intensive power generation.

Power stations usually operate for decades, locking in capital. This makes the switch from fossil-fuel plants, once built, more challenging and costly than to attract investments into new renewable energy projects.

IF CLEAN ENERGY IS TO POWER AFRICA’S GROWING ENERGY DEMAND, CONSIDERABLY MORE RENEWABLE ENERGY PROJECTS WILL HAVE TO BE PLANNED AND THEIR SUCCESS CHANCES SHOULD BE IMPROVED.

In view of the cost reductions of clean technologies, continued investments in fossil-fuel plants face risks of asset stranding. This is when assets can no longer earn a return, given market and regulatory changes

brought about by the climate change agenda (bit.ly/3gWQMUh).

Therefore, it seems worth closely considering the economic rationale for relying on fossil-fuel-based generation, paying close attention to country-specific endowments and development needs.

If clean energy is to power Africa’s growing energy demand, considerably more renewable energy projects will have to be planned and their success chances should be improved. ◆

Sponsor income-generating work experiences for South African youth—and reap the BBBEE benefits

Agrowing number of multinational mining and resources organisations are creating life-changing work opportunities for South African youth. They are driving social impact and community upliftment, all while bolstering their BBBEE (broadbased black economic empowerment) ratings and Social and Labour Plans (SLPs).

They have joined the more than 1 553 businesses—such as Investec, Toyota, Shoprite, PG Group and South32—that have partnered with the Youth Employment

Service (YES) to co-create a future that works. These powerful partnerships have already created more than 58 500 jobs. Jobs that are creating new taxpayers, new skilled employees and new customers. Jobs that mean a new, more inclusive South Africa.

Through YES, companies sponsor 12-month, income-generating work experiences for South African youth—and reap the BBBEE benefits. They simply

choose a solution that best suits their goals:

• Provide a 12-month work experience within their own company.

• Sponsor the placement of a YES Youth in third-party enterprises or communitybased non-governmental organisations (NGOs), like healthcare workers, teaching assistants, and more.

• Sponsor a YES Youth to grow or support a new enterprise: such as Blossom Care Solutions, a women-led micro franchise that manufactures 100% compostable and affordable menstrual hygiene products.

The Local Economic Development (LED) Plan ensures mining companies contribute to the development of communities where activities take place and where workers are recruited. YES helps with two key aspects of your LED:

By placing youth in these sectors with YES, you:

• increase capacity to locally produce products and services; and

• build infrastructure and services in underserviced communities.

By placing youth in these sectors with YES, you:

• support local business, NGOs and small and medium enterprises (SMEs);

• provide crucial work-readiness and entrepreneurial training through YES digital delivery model; and

• claim up to 50% back on your skills development spend (category F&G).

For the Human Resources Development

Plan, the focus is on developing the skills of both workers and community members. Skills development is not just confined to mining, but extends beyond to include skills in other sectors.

Through the YES IP model, youth from across the country get that first chance at playing an active role in resetting the economy. The IP model offers several benefits:

Companies that are unable to accommodate youth within their own structures can sponsor the placement of YES candidates in third-party organisations, making this a cost-effective option with less admin and more impact.

YES identifies experienced, suitable third-party host organisations from its network of partners that can recruit and provide youth with quality work experiences.

Through YES, 35 IPs have been vetted across various sectors, translating to a wide range of jobs that deliver social impact. These sectors include education, healthcare, SME development, digital, early childhood development, manufacturing, agriculture, conservation and marketing and sales.

YES is a not-for-profit joint initiative between business, government and labour that aims to address the youth unemployment crisis in South Africa. Since being founded 130 weeks ago, YES has worked with more than 1 553 South African companies to create more than 58 500 jobs, with no government funding. This has seen over R3.2 billion being ploughed into communities and the economy through youth wallets. ◆

#SayYES to a future that works. Visit www.yes4youth.co.za for further information.

Kathleen Hlaleleni Dlepu and Daisy Sekao Molefe founded the firm in 1995 and their legacy endures today among our determined and highly skilled team of mostly women lawyers. Under the leadership of directors, Kathleen Dlepu and Solomon Stanley Isaka Boikanyo, who joined the firm as a director in 2014 after Daisy Molefe’s departure to the judiciary, we are a force of excellence, empowerment and progress.

Our vast and growing base of valued clients keeps us committed to a high standard of professional legal services. We rely on years of experience and wellrecognised legal expertise to defend the interests of individuals, private and public companies, government departments and everyone in between. As a client of Molefe Dlepu, you can expect informed, innovative and practical legal advice rooted in ethics and hard-earned skill.

At Molefe Dlepu, we challenge ourselves to redefine the concept of a successful law firm through our devotion to good practice, better people and a stronger society. This starts with raising a generation of brilliant lawyers from previously disadvantaged backgrounds, a majority of whom are women. We also give back to communities through social programmes for the less fortunate and keep a healthy portfolio of pro bono cases. Beneath all our work lies a united belief in access to justice for all.

We want the name Molefe Dlepu to mean merit. We aim to be South Africa’s foremost independent black-owned law firm by establishing ourselves as a reliable source of superior legal services. We nurture a network of relationships with local and international law firms that grow our resources and sharpen our skill set.

Our success and reputation on an international scale is strengthened by our collaboration with diverse talented lawyers that are recognised by associations such as the National Bar Association and the Black Lawyers Association (SA). Our connection to associate firms across the globe lends us the boundless wisdom necessary to handle cases of national and international concern. Molefe Dlepu has the experience, talent and legal arsenal to provide first-rate professional legal services in every case.

As attorneys and litigators, we defend your interests in legal matters ranging from family law to corporate, commercial and financial services. Our team of litigators is trained to be relentless and always wellinformed when defending our clients.

We offer you an ever-expanding catalogue of legal services. Labour law, tender legislation and rules, SABS compliance, regulatory work and policy formulation are all legal spheres that Molefe Dlepu comfortably excels in.

As conveyancers, we handle the full width of property law, including the transfer of property, drafting of leases as well as the registration and cancellation of mortgage bonds – among many other services.

As notaries, we carry out and oversee a range of legal formalities, such as the preparation of contracts, witnessing of signatures and certification of documents. Our highly qualified notaries are a prized resource for consistently legally sound arrangements. We are trusted by the best.

South Africa has its fair share of gas-related incidents reporting fires and explosions costing domestic, commercial and industrial facilities millions of rands. However, these statistics say nothing of numerous other smaller events that occur and go unrecorded, such as boiler fires, process oven failures, piping ruptures, non-conforming installations, and non-suited/non-approved equipment among others. These have been the cause of unpublicised damages and injuries. Unfortunately, action is often only taken on these issues after some large and tragic event occurs.

The Pressure Equipment Regulations (PER) Reg. 17 states: “No person shall…

(a) handle, store or distribute any gas in any manner, which includes the filling of a container, other than in accordance with the relevant health and safety standard incorporated into these Regulations under section 44 of the Act;

(b) install or remove an appliance, pressure equipment or system for gas in any manner other than in accordance with the relevant safety standard incorporated into these Regulations under section 44 of the Act;

(c) install or remove a gas appliance, or a gas system or a gas reticulation system, unless such person is an authorised person.”

Taking the above regulations into consideration, one needs to consider the experience, knowledge, qualification and competency of any person, whether internal or contracted, working in the gas industry

or with gas-related equipment. Unless properly trained and qualified, no personnel or operator should be permitted to attempt repairing/replacing pipes or pressure equipment, tune burners, work on or replace burner management/control systems.

The intent of Reg. 17 is also to ensure all persons working on gas systems are registered and licensed with the registration body, namely the South African Qualification and Certification Committee for Gas (SAQCC Gas).

Combustion equipment safety is critical to the daily operation of all facilities and the safety of every employee, yet awareness on this topic is lacking simply because it is deemed too ‘complicated’. It takes diligence and understanding to protect employees, facilities and industrial organisations from combustion-related incidents involving fuel-fired equipment. Being competent in only a specific field (silo approach) is not enough; persons working on gas systems should have a total understanding of the complete and integrated philosophy and functionality of gas systems (lateral approach).

Once again, understanding the gas system or specifically combustion equipment safety is very critical from a performance and maintenance perspective. An equal degree of emphasis should be placed on the importance of using compliant equipment, which also conforms to the required health and safety standards.

There is typically no screening for how far away from the most recent health and safety

standards the old ‘grandfathered’ technology has become. Passing a statutory inspection sometimes means you could be ‘technically’ in compliance with archaic and antiquated equipment that is 50 or more years old. This could be equipment that requires many manual steps to operate safely and presents serious risk of improper manual startup or shutdown daily. Equipment could be ‘in compliance’ with this kind of inspection, but quite far from the current health and safety standards “level of safety”.

Should grandfather equipment be progressively upgraded in line with newer technologies? Possibly. From a financial perspective, probably ‘no or not now’; from a safety perspective, a definite ‘yes’. The risk assessment of current gas equipment and gas systems needs to be ongoing and analytically direct the way to concrete affirmations of upgrading the site’s equipment. Once an incident occurs, it means years of court cases, job losses and changes, higher insurance rates, and maybe even criminal litigation. It also takes years to overcome the stigma of possible safety credibility to employees, industry and the community at large.

Start with a review of the equipment’s state of protection relative to current health and safety standards: an equipment gap analysis. Prioritise your needs and address them at a comfortable pace. Conduct a human gap

analysis to identify the state of knowledge and skills regarding your operations and maintenance staff. Make training a regular and serious effort.

The bottom line is that by ensuring persons are competent and implementing comprehensive equipment safety programmes, lives can be saved. The right thing to do is to be proactive and at the very least ensure persons working on gas systems are licensed to operate and that manufactured, imported and supplied equipment conforms to the required regulations. Ensure equipment permits are obtained from the required authority, in this case, the Southern African Gas Association (SAGA).

SAGA also verifies Natural and Liquefied Petroleum Gas Industrial Equipment locally manufactured, imported and supplied prior to being placed in the market. This covers all equipment operating above 0.5 GJ/h or 10 kg/h or 140kW in the commercial, industrial and specialised environments. It is being expanded to include natural gas vehicles (NGV), natural gas fuelling stations, compressed natural gas (CNG) and liquefied natural gas (LNG) industrial applications.

The intent is to prevent the import and supply of non-conforming equipment and that all equipment sold or placed in the market meets the Pressure Equipment Regulations.

Using

Never do gas work on piping, appliances or equipment yourself—always use a registered Gas Practitioner. Unregistered gas work is illegal and can be extremely dangerous, resulting in serious injury or even death. Registered Gas Practitioners have the necessary experience, competency, equipment and system knowledge to do the necessary work safely.

Insurance companies may not cover fire

or public liability claims caused by do-it-yourself or non-registered persons, as the gas installations will be deemed illegal.

When using a Gas Practitioner, you need to ensure:

• the person is in possession of a licence issued by the registrar, being SAQCC Gas; and

• the person issues the correct Gas Certificate of Conformity (CoC) to the user on completion of all gas installation work. This applies to all gas work on your property, regardless of whether it is a residential, commercial or industrial property.

A Gas Practitioner is responsible for selective or all the work commencing at the gas meter outlet or reticulation shut-off valve and all the piping, safety and pressure accessories including the appliance/ equipment downstream thereof.

If you notice something potentially dangerous, or any of the following, stop what you are doing and immediately call a registered Gas Practitioner or your gas distributor: Gas appliance/equipment burning incorrectly e.g. yellow or uneven flames, pungent odours, black carbon soot, appliance going out regularly, visible damage to gas pipes.

If you smell gas and you suspect it’s a gas leak, or are unsure, shut off the main valve of the gas system, phone the Gas Practitioner and/or gas distributor of the gas to report the matter.

The main natural gas distributors in South Africa—Sasol (Gauteng, Mpumalanga, KZN), Spring Lights Gas (KZN) and Egoli Gas (Gauteng)—are responsible for work on gas meters and the gas distribution and reticulation system. Virtual piping networks also form part of the distribution system.

You can check if your Gas Practitioner is registered to work in South Africa by searching the register of SAQCC Gas at www.saqccgas.co.za or contact the registrar on +27 (0) 11 285 0038.

• A Gas CoC is an assurance that: the Gas Practitioner is appropriately registered;

• the work completed has been inspected and tested and is proven to be safe;

• the work complies with the requirements of South African legislation such as the Occupational Health and Safety Act, the Pressure Equipment Regulations and respective South African National Standards;

• the Gas Practitioner has officially informed you of the safety procedures as to your gas system; and

• you have met your legal obligation to own a safe gas installation and have a permanent legal record for the job done.

A Gas CoC shall be provided to you after commissioning of the gas system, but no later than 7 days after completion of the following gas work, but not limited to:

• installing new gas pipe work;

• extending or repairing existing gas pipe work;

• installing new appliances/equipment e.g. heaters, hot water units, stove tops, gas trains, burners;

• replacing an appliance/equipment;

• maintenance and/or repair to the pipe work, equipment and pressure accessories; and

• converting a gas system or appliance/ equipment for use on another fuel e.g. from LPG to natural gas or vice versa.

The gas industry is moving away from the hard copy (pre-printed) CoC toward an electronic version that was phased in from 1 March 2021 over a six-month period, whereafter the hard copy will come to an end.

Bringing new technology to the gas industry adds a lot of value especially from a safety and compliance perspective, and ensures ease of doing business straight from a tablet or smartphone.

The CoC needs to be signed by both the Gas Practitioner and the user to be valid.

If you do not receive a Gas CoC, this could jeopardise your insurance if a gas-related incident subsequently causes fire or damage to the property or injury to a person.

If a Gas Practitioner fails to issue the user with a Gas CoC, or refuses to do so, contact the SAGA office. Always remember that Safety Isn’t Negotiable. Ensure the right things are done right the first time.

SAGA ensures all persons working in the methane-based environment are competent to undertake work that complies with the relevant legislation and national health and safety standards in order to provide safe and efficient operations from point of supply to users in the domestic, commercial and industrial markets within southern Africa.

It covers industrial thermoprocessing, CNG, LNG, NGV and biogas by: • providing training to persons working in

the gas industry to become competent gas practitioners;

• developing skills and competencies and ensuring knowledge sharing throughout the industry;

• assisting industry to comply with legislation;

• educating stakeholders in safety and standards;

• advocating the safe and efficient use of gas and pressure equipment; and

• interfacing with government on regulatory issues.

• Establishment of bilateral partnerships;

• Involvement in the Southern African

Development Community Cooperation in Standardisation (SADCSTAN);

• Expansion into NGV and industrial CNG/LNG/biogas environments;

• Collaboration with stakeholders on the adoption and development of Health and Safety Standards;

• Ensuring safety through training and skills upliftment;

• Registration of competent persons to work on gas systems; and

• Practical assessments of competencies and compliance requirements for gas systems: installation, operations, maintenance, commissioning, startup and shutdown activities and much more. ◆

SAGA contact information

Address: 27 Princes Avenue, Windsor West, Randburg, Gauteng, South Africa, 2194 Tel: +27 11 4312016 or +27 11 476 4403 Email: care@sagas.co.za Websites: www.sagas.co.za and www. safegasequipment.co.za

Ensuring all persons working in the methane-based environment are competent to undertake work which complies with the relevant legislation and national health and safety standards in order to provide safe and efficient operations from point of supply to users in the domestic, commercial and industrial markets within Southern Africa. Covers Industrial Thermoprocessing, Compressed Natural Gas (CNG), Liquified Natural Gas (LNG), Biogas, and Natural Gas Vehicles (NGV)....

· Providing training to persons working in the gas industry to become competent gas practitioners · Developing skills, competencies and ensure knowledge sharing throughout industry · Assisting industry to comply with legislation · Educating stakeholders in safety and standards · Advocating the safe and efficient use of gas and pressure equipment

The Petroleum Agency SA represents the government and the people of South Africa in managing a diversified and fully developed upstream oil and gas industry

The Petroleum Agency South Africa (PASA) promotes exploration for onshore and offshore oil and gas resources, and the optimal development thereof on behalf of the South African government. The agency regulates exploration and production activities, and acts as the custodian of the national petroleum exploration and production database.

Dr Phindile Masangane was appointed the new chief executive officer of PASA in May 2020. As arguably one of the best qualified women in the South African energy sector (she holds a PhD in Chemistry, an MBA from Wits Business School and a Bachelor of Science degree), she brings to the position a wealth of knowledge and an array of experiences— including developing, deal-structuring and financing of renewable energy projects. Furthermore, Dr Masangane has participated in national energy policy development including for biofuels, renewables and the gas programme.

African Business Quarterly spoke with Dr Masangane about, among others, the mandate and work of PASA, as well as its development plans.

PASA promotes exploration for onshore and offshore oil and gas resources and their optimal development on behalf of the government. Please give us some more details about the agency’s mandate. PASA has three main functions, as follows: The first is to attract investment to South Africa’s oil and gas upstream industry; in other words, investment into exploration and production of oil and gas in South Africa. We have a team of geologists and

geophysicists who interpret data gathered through past exploration activity to determine prospectivity, and use this to attract exploration companies to South Africa.

The second function of PASA is to regulate the upstream industry in terms of the Mineral and Petroleum Resources Development Act, its regulations and other applicable legislation. The agency has staff responsible for ensuring legal, technical and environmental compliance as organisations enter into contracts with the state to explore for oil and gas.

The third function is to act as the national archive for all data and information produced during oil and gas exploration and production in South Africa, and to curate and maintain this data for use and distribution.

Other functions include advising the government on any issues pertinent to oil and gas as well as carrying out any special projects as directed by the government.

From the above, it is clear that PASA is the regulator for South Africa’s oil and gas upstream industry. However, the agency by no means sees its role as only reactive. On the contrary, it is one that is proactive—and the agency’s purpose is to facilitate and regulate oil and gas exploration to achieve production of indigenous oil and gas. This will ensure energy security and bolster economic growth, and play a strong role in addressing the eradication of poverty on South Africa.

What is the agency’s focus and development plans for 2021?

South Africa’s upstream oil and gas industry is still in its infancy, despite the country

having excellent petroleum resource prospectivity. In 2021, we want to be focused on supporting our operators to accelerate their exploration activities so that we can have more discoveries.

We will also be supporting Total and its joint venture partners to efficiently move to the next stage of their programme following the discoveries at Brulpadda and Luiperd.