BUSINESS QUARTERLY

Introducing a new concept in family living. One where everyday family life is made extraordinary. Imagine Sunday morning pancakes cooked on a state-of-the-art Gaggeneau stove and enjoyed with a view of a parkland paradise. Imagine dinner parties downstairs in the sprawling entertainment area while the kids have pillow fights in one of the four bedrooms upstairs. Imagine a pristine 300m lagoon as your swimming pool. One where your kids can paddleboard and kayak and more importantly, one you never have to clean.

City Centre’s Luxury Family Residences, now available from R2.6 million.

steyncity.co.za

Frances Baard District of the Northern Cape

The Frances Baard District Municipality is predominantly a mining and agricultural district, with a lot of potential yet unlocked. Although it is the smallest district in the Northern Cape, it has the strongest economic region in the province—accounting for 36% of the provincial gross domestic product.

The district comprises four local municipalities: Dikgatlong, Phokwane, Sol Plaatje and Magareng.

Warrenton, the administrative centre of Magareng Local Municipality, is situated approximately 75 kilometres north of the capital Kimberley, on the banks of the Vaal River. The local municipality is referred to as Magareng due to its convergence of two important transport routes that lead to the

two busiest business hubs in the country, namely the N12 national road as well as the N18 route from the North West which also passes through Warrenton.

The railway line that connects Gauteng with the Northern and Western Cape Province runs through Magareng Municipality, with a railway station at Warrenton and Windsorton. The railway line also connects the Northern Cape and North West Province.

The municipal area comprises an urban node, villages and farms. The urban node consists of Warrenton, Warrenvale and Ikhutseng, while small agricultural villages have been established throughout the municipal area—of which Bullhill, Fourteen Streams, Sydney’s Hope, Windsorton Station, Moleko’s Farm, Nazareth and Hartsvallei Farms are the most prominent. The rest of the area comprises mainly mixed farming.

• Old Doornhof Hostel (ERF no. 421) — Call centre and satellite college — R60 million

• Old Cheese Factory (ERF no. 311) — Grain silo facility — R130 million

• Old Kopano Bakery (portion of ERF no. 585) — Bakery — R10 million

—here’s what it is doing to better the country, under the leadership of Velaphi Ratshefola

Century City Letting offers various luxury apartments across Century City—such as the Residences, Island Club, Manhattan Suites and Conferencing, as well as Bridgewater with its glorious views. Our mission is to deliver a relaxed and refined long-term rental experience. We stand out from the rest with our standards of integrity, expertise and sophistication.

You will feel like you are inside a lush, luxury travel magazine as you explore our individual apartments. At the Residences and Century City Letting, we exude energy, luxury and leisure.

The Residences at Crystal Towers offers you luxurious, self-catering apartments with 24-hour on-site security, situated directly across the Canal Walk shopping mall.

All the rooms offer views of Century City and are elegantly furnished with flat-screen TVs and free Wi-Fi. The kitchens are fully equipped with refrigerators, microwaves, dishwashers, ovens, stoves etc. The stylish bathrooms have underfloor heating plus heated towel rails.

Within this safe environment there are many restaurants, bars, convenience stores, corporate offices and conference centres.

There are a number of adventurous activities that can be done around Century City, including birdwatching at Intaka Island, ambling through Ratanga Park, enjoying a boat cruise along the canal, and so much more.

Century City is a great choice for travellers interested in shopping, tourist attractions and sightseeing.

Business travellers particularly like the location. They have rated it 9.0 for a work-related trip.

Free parking is available on-site and an airport shuttle can be requested at a nominal charge to Cape Town International Airport, located 20 kilometres away.

We speak your language and provide you with the luxury staycation you deserve!

BY

BY

Sekta is an industrial services force that reflects the maturity of our society and a genuine understanding of the pivotal role we play in it. We provide services to the energy, petrochemical, oil and gas, mining, construction, food and beverage sectors. Our services support an industrious nation and the African continent, so that we can continue to develop in prosperity and pride.

www.sekta.co.za info@sekta.co.za

Sekta is a specialised industrial services group. B-BBEE Level 151% black women owned

Welcome to edition 11 of African Business Quarterly.

To quote the legendary Bob Dillon, “The times, they are a-changing.” While we’re not out of the woods just yet, I’ve seen enough these past few months to subscribe to the great man’s sentiments.

I had a busy May and June, shuttling from city to city: first to the Tourism Indaba in Durban, then home to Cape Town for the Mining Indaba, and then finally to Johannesburg for the Junior Indaba.

It was quite a trek, but an enlightening experience nonetheless. I was able to interact with a variety of businesspeople who, despite the stresses and strains of doing business in South Africa, haven’t thrown in the towel. At each of the events, people were smiling, networking and concluding deals.

Split between the Durban International Convention Centre and the Durban Exhibition Centre, the Tourism Indaba saw hundreds of tourism and travel-related businesses turn out in their hundreds. As one of the industries hardest hit by the fallout of the COVID-19 epidemic, it was heartening to see.

Hosted at the Cape Town International Convention Centre, the Mining Indaba was an overwhelming experience. Busy as an ant hive, it was jam-packed with businesses from around the world. If there was ever any doubt that mining was the backbone of South Africa, this event put that notion to rest.

In contrast, the Junior Mining Indaba, hosted in the Rainbow Room at the Country Club in Johannesburg, was a more intimate affair. A succession of speakers—including legends of mining such as Rick Menell, Frans Baleni, Richard Spoor and May Hermanus—related their real-world experiences of working in the industry. These events have convinced me that South Africa is not yet dead and buried. Yes, people, the times —they definitely are a-changing.

ADDRESS: Boland Bank Building, 5th Floor, 18 Lower Burg Street, Cape Town, 8000 Tel: 021 418 3090 | Fax: 021 418 3064

Email: majdah@avengmedia.co.za Website: www.mother&child.co.za

© 2022 African Business Quarterly magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of going to print.

The Maslow Hotel, Sandton, Johannesburg, South Africa salessummit.co.za

This full-day, in-person training conference is open to all sales teams of any businesses and industry. Learn fresh sales skills from top sales trainers. Spark new sales ideas and get motivated. Welcome to Sales Strategy 2.0: What to do when ‘Tried and Tested’ no longer works.

Lagos, Nigeria (venue TBC) theiier.org

ICABMIT 2022 is sponsored by the International Institute of Engineers and Researchers. It aims to be one of the leading international conferences for presenting novel and fundamental advances in the fields of business management and information technology. It also serves to foster communication among researchers and practitioners working in a wide variety of scientific areas with a common interest in improving business management and IT related techniques. The conference will bring together leading researchers, engineers and scientists from around the world.

www.infrastructure-africa.com

Infrastructure Africa will connect industry stakeholders, foster dialogue, provide leading-edge information, promote investment and expansion, as well as facilitate business development around Africa’s growth and infrastructure needs. Connect with infrastructure professionals to gain access to leading-edge innovation and knowledge, access infrastructure project opportunities and grow your business— from the comfort of your office or home.

Century City Conference Centre, Cape Town, South Africa

cemafricasummit.com

CEM Africa’s solutions showcase brings together a variety of successful brands that will be sharing how they have successfully integrated CX into business operations. As an attendee, you will gain a deeper insight into the ever-evolving field of CX and develop a unique vision that will change the way you perceive and progress the verticles you impact today. Panel discussions drive value and uncover golden nuggets by teasing out speakers’ expertise. And hear from leading innovators in focused 60-minute workshop sessions.

Venue TBC innovationsummit.co.za

The SA Innovation Summit is the largest startup event in Africa. The summit provides various platforms for developing and showcasing African innovation, as well as facilitating thought leadership. It will present an inspiring jam-packed programme, exhibitions and activations showcasing the latest tech and trends, panel discussions, masterclasses and workshops, pitch battles and a match-and-invest connecting platform. In this age of technology, anything can go viral. That’s why this year, the SA Innovation Summit will be exploring the theme, “Innovation Goes Viral”.

Velaphi Ratshefola— or Bra V, as he is popularly known —is managing director of Coca-Cola Beverages South Africa (CCBSA). He had the privilege of leading the integration of six different entities to build the company, steering the business to win multiple global and supplier awards. African Business Quarterly spoke to him about all these successes.

The humble family man grew up in Soweto, and was later sent to the North-West Province to study law at the North-West University. “I studied law, worked as a prosecutor, dabbled in human resources, sales and operations.” He says he is pedantic about excellence, hard work, and giving others a chance to achieve their greatest potential, even when they do not see it themselves. “We have a moral responsibility to do what we can to benefit others.”

Indeed, as the man at the helm of CCBSA, Ratshefola is doing much to benefit employees, customers and the greater society. He mentions a number of successes that have come to pass under his leadership:

• CCBSA has moved from a Level 8 to Level 1 BBBEE contributor a year ahead of schedule, which gives credence to the company’s commitment to broad-based black economic empowerment and the country’s development agenda.

• The company launched its employee share scheme, Ikageng (“the name was chosen by one of our cleaners”, shares Ratshefola). This scheme gives all employees the same shares, despite their level in the organisation.

• CCBSA has supported black emerging farmers through the Mintirho Foundation Trust launched in 2018, and has disbursed approximately R343 million to black entrepreneurs in farming and agro-processing. Twenty-six beneficiaries across South Africa have been supported, creating over 1 540 new jobs for rural communities —around 57% of those employed being black women. The foundation will focus on ensuring its beneficiaries receive the best support to ensure long-term sustainability and diversification into other areas.

Regarding gender inclusion, Ratshefola says CCBSA has ambitious goals underpinned by a well-crafted transformation strategy that seeks to increase gender parity. “Since our inception in 2016, our intentional commitment to empowering women within our own ranks, as well as our network of partners and suppliers, has been relentless —but, most importantly, highly effectively in shifting the needle on gender empowerment. Our insistence on fulfilling our ambitious targets in a broad-based way has been our motivation. This strategy has seen us raise our complement of women in senior management to an impressive 40.5%, with 44% occupying places in middle management and 33.2% in junior management. The company has also increased the representation of women in its exco to 37.5%.”

• Youth- and women-owned businesses have been developed through Bizniz in a Box, a programme that provides young people and women with an opportunity to create their own livelihoods and create jobs for others in their communities.

• CCBSA has a capable and diverse leadership team that is demographically representative. There is a sizable number of women in leadership (junior, middle, senior and executive leadership). “I have won (on behalf of the company, let me hasten to add) the Top Male Driving Gender Empowerment Award for three consecutive years.” CCBSA has also been lauded with the Standard Bank Top Women Awards for three consecutive years.

• The company has provided water to 15 000 households—giving communities a total of 150 million litres of clean, drinkable water. CCBSA has also reduced the water the company uses internally in manufacturing processes.

Furthermore, the company has established progressive initiatives which, among others, include Women@CCBSA. Ratshefola explains that this is a women-led network designed to create a space for women to engage, coach and mentor each other in order to ensure they have the support and inputs needed to help them reach their full potential.

Through CCBSA’s collective 5by20 initiative, the company has assisted women entrepreneurs across the Coca-Cola value chain (agricultural producers, suppliers, distributors, retailers, recyclers, and artisans) to overcome challenges when establishing and growing their business. “We are proud to have contributed toward enabling the economic empowerment of more than 6 million women around the world. Thirty-four percent—just over 2 million—of those women enabled by the 5by20 programme live and do business in Africa,” adds Ratshefola.

Being such a water-intensive business, what is CCBSA doing to conserve this precious resource? Says Ratshefola, “CCBSA has long recognised its moral and commercial responsibility to use water wisely in its manufacturing processes, and to play a significant role in helping to improve South Africa’s water security.”

The Coca-Cola Company’s Water Stewardship Strategy 2030 is based on the reasoning that water is important ‘capital’ for the company, as it is the main ingredient in its beverages. South Africa is a waterscarce country, and prone to droughts. The business has thus adopted a three-pronged strategy to water which is focused on regenerative operations, healthy watersheds, and resilient communities.

Regenerative operations are intended to reduce local shared water challenges by complying with Coca-Cola’s water stewardship requirements to prevent water wastage, reduce the amount of water being used, and safely discharge water—as well as achieve regenerative water use by reducing, reusing, recycling and replenishing within CCBSA’s operations. This strategy focuses on sustainable, efficient water usage, improving local water challenges, and partnering with others to improve watershed health and enhance community water resilience, with a stronger emphasis on helping women and girls, says Ratshefola.

CCBSA’s efforts in support of the Water Stewardship Strategy in South Africa show how a global strategy can be turned into concrete local projects.

One example, Ratshefola relates, is Coke Ville: a project bringing solar-powered groundwater harvesting and treatment for communities experiencing water insecurity. Launched in 2020, the project has expanded to a total of nine sites in Limpopo, Eastern Cape, Gauteng and KwaZulu-Natal. Each project is designed to provide these communities with 10 to 20 million litres of water annually. By the end of 2021, Coke Ville was generating more than 130 million litres of water to the benefit of more than 15 000 households.

“We have also deployed new technologies to reduce consumption and reuse wastewater. In Polokwane, which is situated in CCBSA’s most water-stressed region, the company has reduced net water consumption by 60% in 2020 and many of our facilities are now among the leaders in Africa in terms of water and energy efficiency,” adds Ratshefola.

“Innovation is at heart of what we do at CCBSA,” says Ratshefola. “CCBSA is perfectly placed to take advantage of global trends that show a definite shift toward what consumers want: more choice and sustainably manufactured beverages. Our market leading position provides an excellent platform to diversify into other beverages by targeting consumers with differentiated propositions across various market segments.”

Furthermore, CCBSA has rolled out its 2-litre returnable polyethylene terephthalate (PET) plastic bottle into more regions across South Africa. By offering a returnable PET bottle, CCBSA is creating greater value for money, as well as an incentive for consumers to collect packaging rather than disposing of it into the environment. When the PET bottle is returned, it puts money in the pockets of consumers, as they get discounts for their next purchases of similar beverages.

CCBSA seeks to operate in such a way that its operations are intrinsically linked to the sustainability of the environment in which it operates, as well as to create social value and make a positive difference for customers and the greater society, especially in the company’s host communities.

The business is investing in various initiatives to deliver on its sustainability strategy:

In recent years, CCBSA has invested in water and energy infrastructure to boost efficiency while reducing consumption and its carbon footprint.

The company has ramped up its solar power generation capacity, with its manufacturing facilities now using solar power around the country. The aim is to continue increasing solar electricity as much as possible. Further changes in energy usage will come from modernising production lines as new technology becomes available.

In 2021, CCBSA celebrated 10 years of healing the environment through its School Recycling Programme—working with over 860 schools and more than 700 000 learners around the country to successfully remove and recycle in excess of 9 100 tonnes of waste from the environment, of which 30% needed to be the PET plastics used in the bulk of CCBSA’s drinks packaging. Since its establishment in 2011, the programme has invested substantially as a crucial part of CCBSA’s commitment to help create a waste-free South Africa, in line with the Coca-Cola Company’s global commitment to create a World Without Waste by 2030.

Times are tough, and many companies are feeling the pressure—from surviving the difficult economic climate, to surviving the coronavirus pandemic.

Employee mental health and general well-being is a top priority for Ratshefola. “We have a responsibility to our people to ensure they look after themselves. Empathy and compassion trump everything else. Hence our commitment as CCBSA to put our employees at the centre of everything we do, and helping them cope and managing work-life balance.”

A challenge that is more personal is the pressure Ratshefola places upon himself: Like any leader, he wants to succeed and lead a passionate and resilient group of people—particularly during trying times. “The last two years have been unprecedented and have tested many people globally, but mainly leaders, in ways they have never been tested before. I lead from the front, and encourage the rest of my leadership to do the same. I strongly believe we can navigate these challenges and come out stronger on the other side.”

How has CCBSA embraced the changes brought about by the Fourth Industrial Revolution? Ratshefola says, “The business vision is to harness the power of data to enhance operations that further enable the company to service its customers optimally, and meet them at their needs.”

He continues, “To predict what business will look like in the future, we need to consider what we know now, what is happening around us, and consumption patterns of consumers in the future. It is almost like looking through a crystal ball, understanding megatrends and asking the questions, ‘What will be the impact on the future of the business should these trends materialise, and what type of future do we envision?’ That way, we can create a future we want. And the powerful combination of innovation and technology is driving our transformation to unlock value.”

Returnable PET is part of the Coca-Cola Company’s World Without Waste vision, which focuses on the entire packaging value chain from how bottles and cans are designed and made, to how they are collected, recycled and reused later.

“We also have various community-orientated initiatives that support the sustainable economic growth of our host communities, including the Local Distribution Partner Programme that forms part of the distribution channel for CCBSA’s products, and social upliftment programmes such as Coke Ville,” adds Ratshefola.

“Socio-economic pressures have forced consumers to think about how they spend their money,” says Ratshefola. “At no other time in recent years has the share of wallet been more pronounced or acute. This requires that we think strategically and innovatively to ensure we meet our customer needs and satisfy our consumers.”

The tough regulatory environment requires serious pivoting, the MD believes. Regulations are important in any country or environment, but they should not be at the detriment of business growth fuelled by a stable trading environment, he adds.

Ratshefola sees CCBSA as a successful company, with a solid business model that will keep it relevant in the years ahead. “We want to be a company known for how great it treats its employees and puts them at the centre of everything it does, thereby becoming an employer of choice and the best company to work for. We want to do this not because it is fashionable, but because it is the right thing to do—because, without employees, businesses will never realise their long-term vision of growing sustainably. We want our company to be recognised for the contribution it has made in society, and its proud legacy it is working toward and intends to leave for future generations.”

Images: www.facebook.com/CocaColaAfrica, www.coca-cola.co.za

Playing an enabling role in securing an adequate and nutritious supply of food to support a rapidly growing population has remained a foundational focus for the Omnia Group since its inception almost seven decades ago. This imperative has required a future-focused approach –one that empowers farmers and prioritises the growth of resilient food systems through Omnia Agriculture’s market-leading value propositions, across more than 10 markets.

According to Omnia’s agriculture marketing director Louis Strydom, “Omnia today is recognised for its holistic approach in supporting customer needs. We achieve this through access to expertise such as agronomists, R&D facilities and laboratories. We also deliver science-driven technologies that allow for precision soil health analysis, resulting in reduced inputs for water, fertiliser and other nutrients.” According to him, these innovations prioritise efficacy, crop quality and enhanced yields, emphasising sustainability for the benefit of the entire agriculture value chain.

His comments are supported by colleague Mandla Mpofu, who is responsible for Omnia’s SADC (Southern African Development Community) markets. “Our purpose of sustaining livelihoods drives our passion to see things grow. This is the motivation behind Omnia Nutriology®, our innovative approach

to agriculture that is rooted in the science of growing. Guided by our ‘feet on the farm’ practices, we collaborate with, and empower, more than one million farmers across the SADC region. Through access to our expertise and quality inputs, we help enhance crop yields and profitability, thus supporting food security. In Zambia, this translates to some emerging farmers increasing their yield by as much as 500%.”

With good soil health being a key challenge for every farmer in the world, Omnia is at the forefront of providing pioneering solutions with wide applicability. Omnia Australia is a leader in the production of K-humate products: a rich, humic-based soil conditioner and biostimulant that has a positive impact on both soil and plant health. Humic acids are naturally derived from the breakdown of plant and microbial matter, which form the foundation of all fertile soils.

They enhance nutrient efficacy and significantly reduce leeching, waste and nitrogen emissions.

K-humate thus has the potential to further improve farmer yields, the quality of produce, profits and business competitiveness by:

• Increasing fertiliser efficiency;

• Improving water-holding capacity;

• Bolstering the penetration and retention of calcium in the soil; and

• Enhancing good soil structure and fertility.

“We continue to expand access to our K-humate products, exporting humic acid coatings to countries with poor soil environments—exacerbated by dry conditions, scarce irrigation sources and old soil—in East Africa, SADC and South America. Our offerings continue to play a major role in bolstering macadamia production in Mozambique and in the Kenyan avocado, wheat and soybean markets,” says James Freemantle, managing director at Omnia Specialities Australia.

With the recognition and demand for greener and more sustainable agri-solutions rapidly growing, Omnia continues to leverage its talent and R&D capabilities to consistently evolve its value proposition. The business remains invested in augmenting products, services and expertise to ensure responsive solutions.

“In 2021, we put R17 million behind R&D efforts to create scientifically driven and environmentally efficient solutions. We are also developing a full Agribio hub with organic fulvates and kelp (seaweed) products as well as bacterias and fungi. Our Agribio products are playing a vital role in enabling the regeneration capabilities of soil fertility, to the benefit of communities and economies. Beyond this, our R&D strategy is focused on humic acid derivatives to appeal to more industries, such as liquid fertilisers,” continues Freemantle.

Sustainability is deeply embedded in Omnia’s business growth and stakeholder value strategy. The business has adopted a holistic approach to environmental, social and governance imperatives throughout its agriculture value chain. In addition to the products and services that enable farmers to engage in greener farming practices, Omnia has also structured its supplier selection processes in a way that empowers and develops local suppliers. The business has set prerequisites for recycled materials within its supplier selection processes, ensuring it partners with businesses that align with its sustainability principles.

“We hold ourselves to a high standard, aligning our business strategy to our sustainability and environmental agenda. Reducing our carbon footprint throughout the group is a key consideration in how we do business,” says Mpofu.

Omnia’s supply chain journey exemplifies this. In the past year, the group has diversified its transport utilisation to include rail into the SADC region. Omnia’s

Omnia Nutriology R&D: Omnia customers have access to expertise such as agronomists, R&D facilities and laboratories

rail service’s greenhouse gas emissions (GHG) are significantly lower than other forms of transport. Between 2020 and 2021, Omnia’s GHG emissions reduced by more than 363 091 tonnes. This reduction is equivalent to the annual emissions of about 79 000 vehicles.

Omnia’s holistic approach to agriculture reflects the principled way in which the group conducts business. Mpofu adds, “We embed sustainability throughout our product value chain, offering solutions centred around bolstering the efficiency of our products, enhancing outcomes and profitability for customers and partners, reducing environmental impact and helping securing food supply across the markets we serve.”

Strydom concludes, “South Africa is a producer of quality produce for demanding international markets, where there is a strong push for environmentally friendly products. Omnia ensures farmers do the right things at the right times, using the right products.”

Established nearly 70 years ago, Omnia is based in South Africa and listed on the Johannesburg Stock Exchange. Operating across 25 countries, Omnia is expanding its presence across SADC, North America, Canada, Brazil and Australasia. Internationally recognised for innovative research and development, Omnia differentiates itself based on its leading supply chain and manufacturing capabilities, as well as its specialised customer solutions that are accessible to clients in the agriculture, mining, water, consumer care, food and pharmaceutical, coatings as well as manufacturing sectors.

Leading the field in the way it incorporates used oil into its emulsion explosives, Omnia Group company BME is extending the benefits of this growing sustainability initiative to mining customers and other approved partners.

With its innovative culture and decades of successful blasting operations, BME has become the leading consumer of used oil in the explosives sector. This harmful waste product is used as a fuel agent in the company’s high-quality emulsions, ensuring that it is safely disposed of during the blasting process.

“Through our large collection network, we can ensure that used oil from customers and other sources does not find its way into valuable water resources or soil as a contaminant,” said Ramesh Dhoorgapersadh, BME’s General Manager for Safety, Health, Environment and Quality (SHEQ). “This helps us fulfil the Omnia vision of protecting life, sustaining livelihoods and creating a better world.”

BME consumes almost 25-million litres of used oil annually in South Africa alone and plans to increase its collection and processing capacity steadily in the years to come. It has been estimated that it takes only a litre of oil to contaminate a million litres of water, making the safe disposal of oil a strategic global imperative – especially for water-scarce countries. Dhoorgapersadh emphasised the alignment of BME’s used oil initiative with the United Nation’s Sustainable Development Goals (SDGs) – which focus on goals such as access to clean water, food security and eradicating pollution.

“It is important to appreciate the ecosystem impact of oil in the environment,” he said. “Contamination not only poisons

water but can affect food security by undermining the health of soil and agriculture.”

BME was therefore reaching out to partner with mining and other players to promote the SDGs in pursuit of a sustainable future for the planet. He emphasised, however, that the collection, testing, treatment and utilisation of used oil is a complex and demanding process. It cannot be reliably conducted without a robust infrastructure and meticulous attention to quality in every step of the operation.

Dirk Voogt, BME’s General Manager for Production and Logistics, explained that the company’s oil collection network has evolved over many years – aligning each phase with its ISO 9000 quality certification. It is also registered as an approved collector and processor with the Recycling Oil Saves the Environment (ROSE) Foundation.

“Our extensive logistical arrangements include taking used oil from our mining customers, but also from our network of 11 approved suppliers – or bulking points,” said Voogt. “The oil is processed and tested at our dedicated facility in Delmas, from where it can be channelled into our emulsion production.”

Driving its increasing consumption levels is BME’s expanding business and its leading emulsion technology which can incorporate steadily higher proportions of used oil in comparison to conventional fuel agents. He notes that its used oil capability is not limited to South Africa but has been applied for mining customers as far afield as West Africa and Indonesia.

“We can collect all the used motor oil from a mine’s vehicles on a regular basis, providing a safe and environmentally sound service that is very convenient for the customer,” he said. “The responsible disposal of the oil in our emulsion adds another dimension to our partnership with mining customers – supporting their sustainability efforts while reducing their logistical load and environmental risk.”

The environmental, social and governance (ESG) benefits extend further than this, said Sachin Govender, Used Oil Manager at BME. He explained that small businesses are among the most important contributors to the success of the company’s used oil collection network. The initiative therefore creates long-term business opportunities in the local economy, stimulating entrepreneurial activity and generating jobs.

“Our infrastructure relies on small and micro-businesses to collect oil in a compliant manner from a range of sectors outside mining such as vehicle maintenance workshops,” said Govender. “This has led to a bulking point network that already provides employment for over 120 people in South Africa.”

He noted that BME is expanding this initiative into neighbouring countries where it can draw on small – even informal – businesses to collect used oil, thus creating demand in the local economy. The company’s regular and growing demand for used oil provides a solid platform for these small businesses to develop their expertise and standards, so they can fulfil this demand into the future.

Voogt highlighted that the used oil methodology employed in Indonesia is applied on a remote mining site, where BME manufactures emulsion for its customer. Despite the remote location, the manufacturing process can achieve loading levels – of used oil relative to virgin fuels – similar to those in South African operations.

“We are also taking this technology into our other operations around the globe,” he said. “Wherever there are sufficient sources of used oil, we can put the equipment and processes in place to support the principles of a more circular economy.”

The important impact of BME’s used oil initiative was recently recognised by the Chemical and Allied Industries’ Association (CAIA). In CAIA’s annual awards to the sector, it gave BME the Responsible Care® initiative of the year award in the Category A segment

To watch a video about BME’s used oil initiative, visit the links below: https://watch.wave.video/V7uPc0WI76VXmCes OR https://youtu.be/q-T4UYjQaJE

still need to manage exponential growth of information, adoption of new technologies with accelerated digital transformation, industry disruption and global crises such as the political issues facing the United States, Russia and China.

While developed countries are focusing on risks such as climate change and harm to biodiversity, in the South African context, immediate risks include social unrest and economic collapse.

Emerging from the pandemic and striving to become a nation that owns its future will require urgent action. We know by now what needs to be done—that we need ethical and visionary leadership to get it done—and that we need to hold people responsible for their performance. That performance must be linked to consequence management.

What does this mean from a risk competency point of view? The following competencies are required to remain and grow as a future-fit risk professional:

management and quality decision making, guided by the IRMSA Integrated Strategy, Risk and Resilience Guideline.

• An increase in risk practitioners’ competency in risk and resilience, through applied risk-management skills building, support programmes, risk-management training, and risk-leader mentorship interventions.

• Support of boards, oversight bodies, executive management and line management in the comprehension of the value of risk management and realising the benefits of an effective risk management capability to support them in quality decision making.

IRMSA, as the only professional body for risk management in South Africa as recognised by the South African Qualifications Authority (SAQA), promotes and develops credible risk professionals.

The Institute of Risk Management South Africa (IRMSA), under the leadership of CEO Pat Semenya, serves aspiring risk practitioners, risk professionals and decision makers in southern Africa dedicated to the advancement of the risk management profession.

The institute serves all its members and aspiring risk professionals by providing technical guidance and support via its online technical library.

It also provides globally recognised qualifications and has a network of corporate members and employers - ensuring that their members are employed in all industries and across the public and private sector globally.

Through research and thought leadership, the institute publishes the South Africa Risk Report on an annual basis as well as the globally recognised IRMSA Guideline on Integrating Strategy, Risk and Resilience. Through these publications, IRMSA sets the standards for the risk profession. These are standards that define the knowledge, skills and behaviours that today’s risk professionals need in order to meet the demands of an increasingly complex business environment.

The coronavirus pandemic highlighted the weaknesses in public and private leadership responses to it. In addition to the obvious challenges of the past two years, organisations

• Strategic and innovative leadership from the risk professional’s office, projecting courage, accountability and continuous learning and education.

• An enabling and applied risk-management approach and delivery.

• Scenario planning and the crafting of alternative futures for one’s organisation, resulting in options available that enable speedy and quality decisions that lead to timeous action.

• Adopting and adapting to the strategic and operational benefits of digital transformation in the enterprise risk management space, enabling timely and effective response strategies to threats and opportunities, near real-time reporting, and faster quality decisions.

• Integrated strategic thinking to make sense of uncertainty, understanding the big issues that can significantly threaten or benefit the organisation, contributing to the debate inside and outside the organisation, guiding decision making, and ensuring strategic objectives are achieved.

• Implementing a continuous cycle of learning from mistakes, recalibrating and redesigning of strategies to ensure risk response strategies reflect the unfolding situation and the building of a resilient culture.

The outcomes of building the suggested IRMSA risk management competency/capacity profile are:

• Improved governance through accountability

This is done by providing the following professional support in both the public and private sector:

• Complete range of training covering strategy, risk and resilience for risk professionals and organisational leadership in both the private and public sectors;

• Full learnership services from student selection, planning, project management, training, mentorship and support, to work placement and follow-up support;

• Internships and work-integrated learning opportunities;

• Mentorships and coaching;

• Competency assessments;

• Blended learning solutions; and

• Board exams to acquire the risk management designations (CRM Practitioner and CRM Professional), the two most important risk-management designations registered with SAQA.

For more information on IRMSA, visit www.irmsa.org.za

For the 2022 IRMSA Risk Report, visit www.irmsa.org.za/Risk-Report-2022

For the 2022 Guideline on Integrating Strategy, Risk and Resilience, visit www.irmsa.org.za/guideline

Follow IRMSA on social media:

Twitter: @IRMSAInsight

Facebook: @IRMSAInsight

LinkedIn: The Institute of Risk Management South Africa – IRMSA

The Institute of Risk Management

South Africa is dedicated to the advancement of the risk management discipline

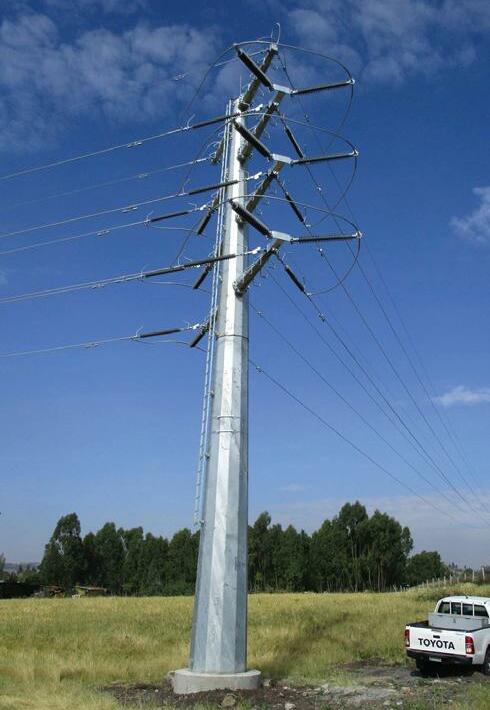

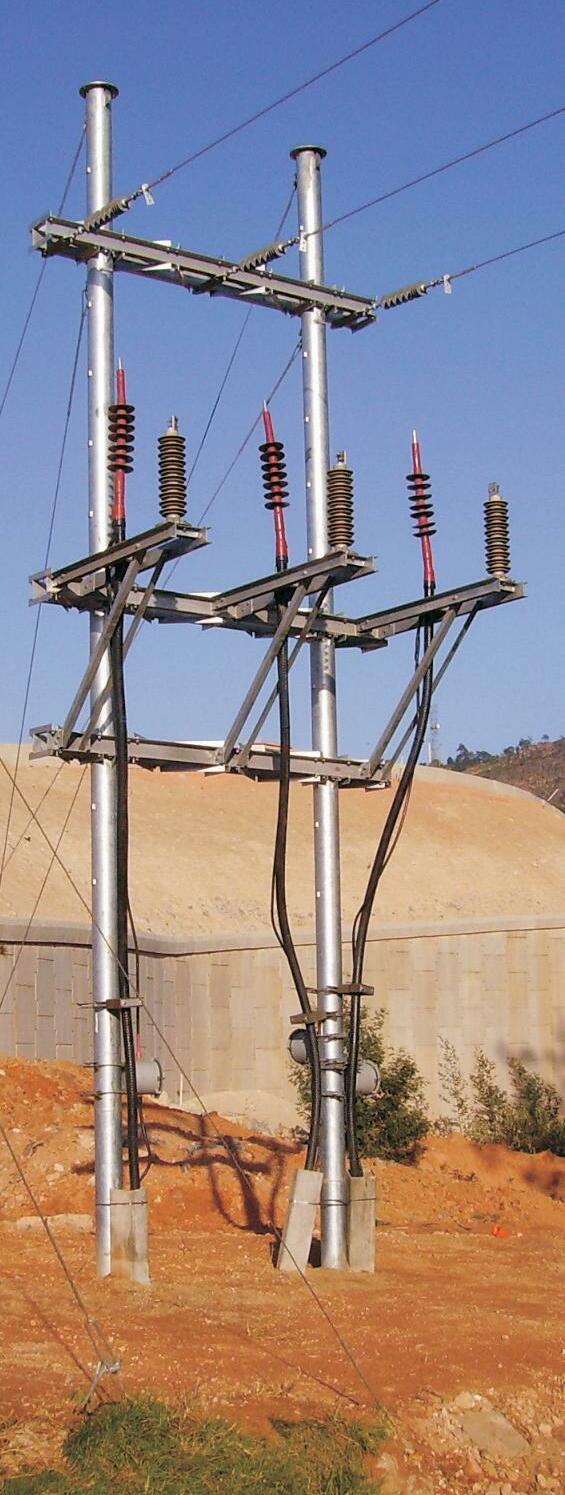

Addressing energy poverty will take a multi-resource approach in Africa

How can Africa be expected to leapfrog to a renewable energy future without the adequate financing to do so?

The African continent has the most people without access to energy, and yet also represents the continent with the fastest growing population. As demand continues to far outweigh supply, energy poverty becomes more of a crisis across the continent.

In order to address this crisis and achieve the United Nations Sustainable Development Goal 7—universal access to affordable, reliable and sustainable electricity—NJ Ayuk, executive chairperson of the African Energy Chamber (pictured), has outlined a strategy.

Speaking during the January 2022 edition of the Rystad Talks Energy webinar—a platform for enhanced dialogue on Africa’s economy, led by Rystad Energy CEO Jarand Rystad—Ayuk emphasised that in order to address energy poverty, Africa needs to have a multi-resource approach, whereby the continent utilises all its natural resources in the short term, slowly reducing the reliance on oil and coal in the medium term through the uptake of natural gas, and transitioning to cleaner sources in the longer term.

“If we want to look at a solution, we need to make sure we create the energy we need immediately and use the resources we have. We have to use all forms of energy we have. Climate change is a big problem, but we also have 600 million with no access to electricity and 900 million with no access to clean cooking. We should be able to use oil, natural gas and, in some stages, coal. We need to move toward renewable energies and carbon capture, but still continue to fight for poor people,” he said.

“We need to look at the wealthy nations to cut down emissions and then address Africa. We are all in this together. Right now we have a crisis in Europe where people are turning to coal. They are changing regulations to start looking at gas. We can phase out coal and do it fast, but we need to explore other resources in the short term, like gas.”

Specifically, Ayuk reaffirmed both his and the AEC’s position on natural gas, emphasising that the resource has a critical role to play in Africa’s energy transition. The problem lies not with leapfrogging to the future—as is seen in other sectors such as telecommunications, where Africa has made considerable progress with mobile money platforms—but rather in the unrealistic expectations of the West. How can Africa be expected to leapfrog to a renewable energy future without the adequate financing to do so?

Meanwhile, Africa’s struggle with energy poverty can be attributed to a variety of factors, some of which include the continent’s reliance on foreign aid; ineffective resource

management; and tight market controls. By addressing these factors, Africa can not only open up its market, spurring business across multiple sectors, but establish domestic capital-raising opportunities that will improve investment across the energy sphere.

“We have to be honest, it’s poverty. Poverty causes energy poverty. Africans are also responsible for this. We have relied on foreign aid and waiting for someone to come and do things that we have been able to do ourselves. We have not managed our natural resources well. If we focus on revenues and building power plants, we could have had fast-tracked industrialisation. We have relied on multinational institutions and development partners, and they have not met commitments. I am a big fan of free markets, individual liberty and letting the markets work for themselves. We need to change in Africa because we deserve better,” Ayuk stated.

Inadequate infrastructure and the blocking of financing by international organisations is problematic. European countries, for example, are still using African gas to power their economies—which is fair—and yet African gas investment has been restricted. Africans, like the West, have a right to develop their resources, working together with international investors to power Africa and accelerate industrialisation.

In order to increase investment and drive renewable energy development, Africa needs to implement structural reforms within its energy sector by focusing on creating enabling environments for investment; introducing attractive fiscal terms for foreign players; and incentivising increased private sector participation in the sector.

“We have to do bigger things in Africa. We need to make it easy to do business, we need to become more transparent, we need to fasttrack projects, cut our bureaucracy and really take a look in the mirror. With every day that we have a child in Africa going to bed without lights, we take away opportunity from that child. Energy poverty should be the fight of our lifetimes,” Ayuk concluded.

While foreign capital is important, African institutions also have a role to play in driving the continent’s energy growth. Accordingly, facilities such as the African Energy Bank could not only meet demand for capital in the renewable energy space, but enable the effective development of oil and gas resources across the continent. The creation of an African Energy Bank will open up critical solutions for Africa’s energy sector.

African Energy Chamber (www.EnergyChamber.org)“We need to move toward renewable energies and carbon capture, but still continue to fight for poor people.”

Groundwater could help kickstart green recovery in African countries: how to begin

African leaders have joined a worldwide thrust for a ‘green recovery’ from the COVID-19 setback and the climate crisis. As the African Union’s Green Recovery Action Plan (bit.ly/3NqT3oJ) puts it, this essentially means investing in the sustainable use of resources. A joint statement (bit.ly/3uAJ8Et) endorsed by 54 African leaders emphasises the continent’s need to develop “based on a deep understanding of climate risks”.

Research (bit.ly/35l6WU2) suggests such green recovery strategies—especially in agriculture and food security—could draw on a relatively underdeveloped resource: groundwater.

Groundwater is water under the surface of the ground, typically accessible via wells and boreholes. It is not visible like a great river. This can be beneficial because groundwater is less exposed to evaporation and surface pollution.

Groundwater has supported impressive spurts of development in some parts of the world. California’s irrigation and industrial boom, India’s green revolution, and China’s national grain production increase are examples.

But in sub-Saharan Africa, groundwater does not get such attention. Rather, regional water resource management focuses on surface water development. The Nile Basin Initiative (www.nilebasin.org) and the Zambezi River Authority (www.zambezira.org) are two such examples. There are not any high-profile groundwater authorities.

Knowledge about groundwater is scarce in some countries. Development tends to be informal and limited to shallow use. This contributes to the belief that groundwater resources in sub-Saharan Africa are not large enough, or conveniently located, to significantly contribute to socio-economic development.

But our synthesis of regional findings (bit.ly/3Loi4iq) suggests otherwise.

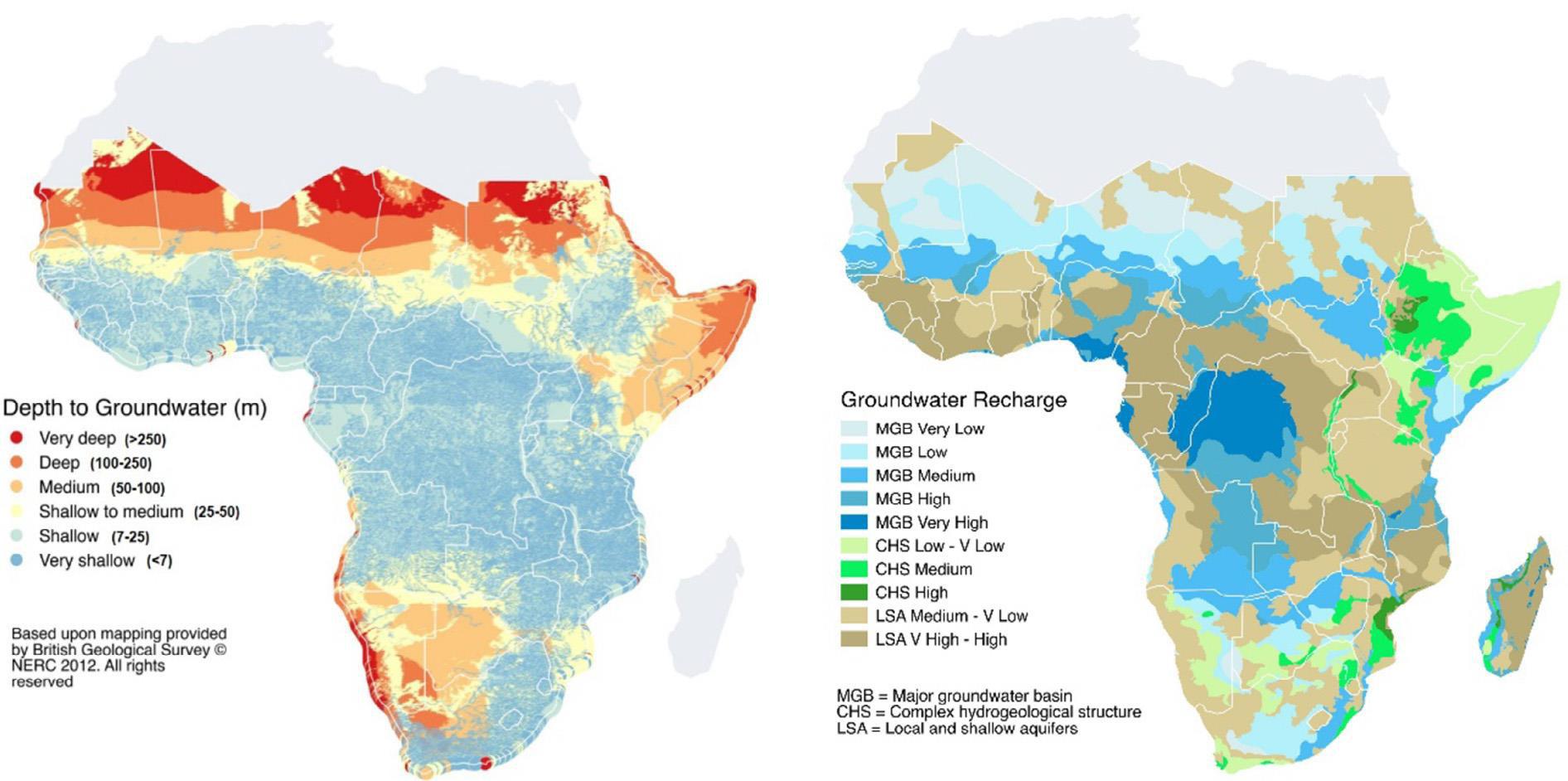

Combining data on the physical availability of groundwater with information on politicaleconomy factors, our study revealed that groundwater is by far the largest regional water resource by volume. Annual renewable groundwater in the region is equivalent to 15 years of average total flow of the Nile River. We also found that renewable groundwater is often available where it is most needed and at depths of less than 100 metres.

Strikingly, we found that less than 5% of the region’s renewable groundwater is being used. Its potential for sustainable use is tremendous.

The correlation between groundwater abstraction and total grain production in China from 1950 to 2011. (Source: Jie Liu and Chunmiao Zheng)

The correlation between groundwater abstraction and total grain production in China from 1950 to 2011. (Source: Jie Liu and Chunmiao Zheng)

a. Depth to groundwater across sub-Saharan Africa. (Source: Alan Mackenzie Macdonald et al. 2012); b. Groundwater recharge across sub-Saharan Africa. (Source: Federal Institute for Geosciences and Natural Resources, Germany, and Unesco 2008)

Various studies also support our technical findings. A recent study (bit.ly/36VmMVW) found opportunities for sustainably withdrawing groundwater across much of the continent. In short, there is an opportunity for a renewed regional focus on sustainable groundwater development.

Our findings suggest groundwater could support critical sectors across the region.

For example, it could help increase sub-Saharan Africa’s current irrigated land area, which is currently 3% (bit.ly/3iP3qV2).

Groundwater could increase per capita water consumption, currently the lowest globally (bit.ly/36SdmKR).

It could help cities guard against shocks such as the “Day Zero” water crisis in Cape Town, South Africa (bit.ly/3IPSX6C). And it could lessen the impacts of recurrent droughts (bit.ly/3LtN2FJ).

Stronger regional water and food security could support poverty reduction (bit.ly/3DkBGRI), economic structural change (bit.ly/3tS8f6B) and a transition to higher value-added activities (bit.ly/3JZ1y8s). Ultimately, these could contribute to greater regional prosperity (bit.ly/3tOxZ3r).

Preliminary results from an economic simulation in Uganda (bit.ly/3IKff9K), for example, found that doubling

investment in sustainable groundwater development could increase agricultural GDP by 7%, create 600 000 jobs, and alleviate poverty for half a million people nationally by 2030.

cost and availability of drilling equipment and pumps, among others.

There are already examples of how innovation and leadership in the region can unlock this potential. A managed aquifer recharge scheme in Windhoek, Namibia (bit.ly/3qM1Ckl)—the driest capital in the region—is an engineering and financial success for city water supply. The scheme also preserves the fragile Okavango River.

The cost of technologies such as renewable energy and desalination is falling. They offer further possibilities, coupled with approaches such as farmer-led irrigation development and improved end-use efficiency measures.

Groundwater has the potential to support broad economic, humanitarian and social development in sub-Saharan Africa. It has done so in other regions globally. But resource development must be sustainably managed.

There is no denying the potential for pitfalls. For example, overexploitation of groundwater in some parts of California has led to water stress and land subsidence (on.doi.gov/3qOyIA1). Consolidating such international lessons with recent regional experiences (go.nature.com/3K4mXNa) could inform sustainable groundwater governance in sub-Saharan Africa from the outset.

As a starting point, a framework for action could include raising the profile of sustainable groundwater development potential in the region. The emphasis should be on ecosystem health and empowering vulnerable communities.

There is evidence that macro policy support in China, New Deal (bit.ly/3iMS0S0) infrastructure in the United States, and electricity pricing policy in India all helped kickstart largerscale groundwater development (bit.ly/3qM706T).

Understanding political economy factors in subSaharan Africa is vital to unlocking the potential benefits of groundwater development and managing trade-offs. Such factors include land rights and tenure, energy availability and price, access to credit, and the

The year 2022 presents promising opportunities. In February, addressing the African Union, the United Nations SecretaryGeneral highlighted (bit.ly/3uwRKfe) the importance of green recovery to ignite economic recovery. The AU’s theme of 2022 focuses on transforming food and agricultural systems (bit.ly/3DntFLU). Groundwater, which is the theme of World Water Day 2022 (www.worldwaterday.org), can help respond to such calls to action.

Bradley Hiller Former AsiaGlobal Fellow Asia Global Institute University of Hong Kong Jude Cobbing Adviser: Water Governance and Infrastructure Save the Children USGroundwater could help increase sub-Saharan Africa’s current irrigated land area, which is currently 3%.

Why Europe can look to Africa as a preferred gas supplier

African gas producers need to improve policy planning and enactment, and deal with negotiation to make themselves attractive markets to partner with.

ith recent sanctions on Russia by Western nations threatening the critical supply of Russian gas to European markets,

Wan opportunity has emerged for African gas producers to step up—enhancing hydrocarbon production and exports to meet international supply gaps.

Significant progress has already been made to establish Africa as a viable gas export market, and now, with geopolitical tensions rising, Africa should focus on establishing itself as the preferred supplier

to international markets.

The withdrawal and disruption of supply channels from Russia—as the second largest gas producer globally and the biggest supplier of natural gas to Europe— will not only send Europe into a deeper energy crisis, but will cause price hikes globally. However, this represents a golden opportunity for Africa.

On 22 February 2022, member states of the Gas Exporting Countries Forum (GECF) met in Doha, Qatar to discuss the impact of the mounting tensions between Russia and Ukraine and its impact on the global gas market. In the Doha Declaration—issued after the meeting concluded—parties emphasised that despite their commitment to increasing gas production to meet growing energy demand globally, they do not have the capacity to help Europe replace 40% of its energy consumption in the event Russia cuts supply. These commitments will not only be critical for Europe’s energy crisis but for Africa’s sectoral expansion.

In an exclusive interview with the African Energy Chamber (AEC) in February, Gabriel Mbaga Obiang Lima, Equatorial Guinea’s Ministry of Mines and Hydrocarbons, said: “Infrastructure is going to be critical. Investors in Europe may be selling solutions to be able to put as many terminals as possible, which will allow us to export gas to them. That is what we need in order to be competitive in gas.”

African producers can take advantage of the outcome to attract investments required to build infrastructure that would enable them to expand exploration, production and exportation to meet the anticipated increase in demand in Europe. “The ongoing European energy trilemma and challenges provide a golden opportunity for

African gas producers to develop a robust, bankable gas strategy to cater for motherland Africa and our European friends’ energy demand. I believe Africa can leverage current trends to attract much-needed investment to develop the infrastructure needed to accelerate production for regional consumption and exportation. The time to act on the Trans-Africa Gas Plan is now,” stated Abdur-Rasheed Tunde Omidiya, president of the AEC Nigeria and West Africa.

Already, African countries have started ramping up production. The AEC, in its Q1 2022 Outlook, predicts Nigeria to increase gas production from 2016 of about 1 550 billion cubic feet to up to 1 780 billion cubic feet in 2022. These production increases will enable Nigeria to increase domestic capacity, ensuring energy security both domestically and continentally, while creating the opportunity to scale up exports to European markets.

Other African producers such as Algeria and Niger who, together with Nigeria, recently signed the Declaration of Niamey during the Economic Communities of West African States Mining and Petroleum Forum—paving the way for the construction of the multibillion 4 128-kilometre Trans-Saharan Gas Pipeline that will run through the three countries into Europe—now have an opportunity to attract funding for the project rollout and expand

their production and exportation capabilities to Europe. Once completed, the pipeline is expected to transport 30 billion cubic metres of gas per annum, which Europe will desperately need to meet demand.

Algeria’s proximity to the European market makes the North African country of strategic importance as a potential gas supplier for Europe. Algeria, the world’s sixth largest gas exporter and the largest gas producer in Africa, has already expressed its plan to double exploration and production in the next five years. In 2021, Algeria increased its export volumes to Europe to 53 billion cubic metres from 40 billion cubic metres in 2020, and is estimated to export 46 billion cubic metres or more in 2022 as demand in Europe is expected to continue rising.

At the same time, Equatorial Guinea, with over 1.5 trillion cubic feet of natural gas reserves that remain untapped, can also take advantage of the anticipated European gas crisis to attract more investment for its natural gas market growth and development.

African gas producers need to improve policy planning and enactment, and deal with negotiation to make themselves attractive markets to partner with.

African Energy Chamber (energychamber.org)

African Energy Chamber (energychamber.org)

“The time to act on the Trans-Africa Gas Plan is now.”

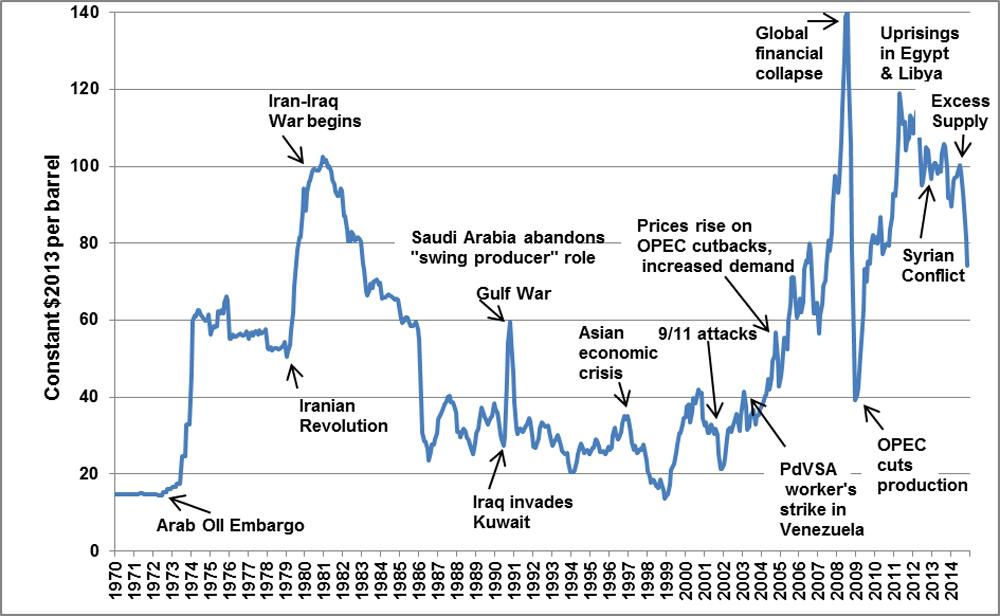

Oil price shocks have a long history, but today’s situation may be the most complex ever

Many factors can trigger oil price shocks.

The world is in the grip of an oil price shock. In just a few months, prices have risen from US$65 a barrel to over $130 (bit.ly/3qGrVbg)—causing fuel costs to surge, inflationary pressure to rise and consumer tempers to flare. Even before Russia’s invasion of Ukraine, prices were climbing rapidly because of roaring demand and limited supply growth.

Price shocks are not new. Viewed historically (bit.ly/3NrLmyx), they are an integral

part of oil market dynamics, not anomalies. They have occurred since the birth of the industry (bit.ly/3wIkSTr).

Many factors can trigger oil price shocks. They include large shifts in either demand or supply anywhere in the world, since oil is a global commodity. Shocks can also result from war and revolution; periods of rapid economic growth in major importing nations; and domestic problems in supplier countries, such as political conflict or lack of investment in the oil industry.

Overall, the worst spikes have combined two or more of these factors—and that is the situation today.

Crude oil prices react to many types of geopolitical events, from weather disasters to wars, revolutions and economic growth or recessions. (Source: US Department of Energy)

Crude oil prices react to many types of geopolitical events, from weather disasters to wars, revolutions and economic growth or recessions. (Source: US Department of Energy)

Currently there is no way to know how long the factors driving it will last, or whether prices will go higher

Global oil production began in the mid-1800s and grew rapidly in the first half of the 20th century (bit.ly/3iJFtia). For much of that time, oil majors—companies like Chevron, Amoco and Mobil, which were created after the Supreme Court ordered the breakup of Standard Oil in 1911 (bit.ly/3tJnNcA) —operated effectively as a cartel, maintaining production at levels that kept oil abundant and cheap to encourage its consumption.

This ended when Iran, Iraq, Kuwait, Saudi Arabia and Venezuela formed the Organization of Petroleum Exporting Countries (OPEC) in 1960 (bit.ly/3JNxE6U), nationalising their oil reserves and gaining real supply power (bit.ly/3wJ4fXS). Over the following decades, other nations in the Middle East, Asia, Africa and Latin America joined—some temporarily, others permanently.

In 1973, Arab members of OPEC cut their oil production when Western countries supported Israel in the Yom Kippur War with Egypt and Syria (bit.ly/36Uo9UH). World oil prices shot up fourfold, from an average of $2.90 per barrel to $11.65 (bit.ly/3tMA6oM).

In response, government leaders in wealthy countries introduced policies to stabilise oil supplies. These included finding more oil, investing in energy research and development, and creating strategic oil reserves that governments could use to mitigate future price shocks.

But six years later, oil prices more than doubled again when Iran’s revolution halted that country’s output. Between mid-1979 and mid-1980, oil rose from $13 per barrel to $34 (brook.gs/35hSoEJ). Over the next several years, a combination of economic recession, replacing oil with natural gas for heating and industry, and shifting to smaller vehicles helped mitigate oil demand and prices (on.cfr.org/3uFZonM).

The next major shock came in 1990 when Iraq invaded Kuwait (bit.ly/3JYRMmo). The United Nations imposed an embargo on trade with Iraq and Kuwait (bit.ly/3wKBsSG), which raised oil prices from $15 per barrel in July 1990 to $42 in October ( bit.ly/3NqFcia). US and coalition troops moved into Kuwait and defeated the Iraqi army in just a few months. During the campaign, Saudi Arabia increased oil production by more than 3 million barrels per day (bit.ly/3NuUwKs), roughly the amount previously supplied by Iraq, to help dampen the increase and shorten the period of higher prices.

More disruptive price shocks occurred in 2005–2008 and 2010–2014. The first resulted from increased demand generated by economic

growth in China and India (on.cfr.org/3DkmdBm).

At that time, OPEC was unable to expand production due to long-term lack of investment.

The second shock reflected the impacts of Arab Spring pro-democracy protests in the Middle East and North Africa (bit.ly/3iF4Z83), combined with conflict in Iraq and international sanctions that Western nations placed on Iran to slow its nuclear weapons programme. Together, these events pushed oil prices above $100 per barrel for a four-year stretch—the longest such period on record (bit.ly/3INbyzU). Relief finally came via a flood of new oil from shale production in the US (bloom.bg/3iFnaKG).

Today, multiple factors are raising oil prices. There are three key elements (bit.ly/3NlHTBD):

• Oil demand has grown more rapidly than expected in recent months as countries emerged from pandemic lockdowns.

• OPEC+, a loose partnership between OPEC and Russia, has not raised production at a commensurate level, and neither have US shale oil companies.

• Countries have drawn on stocks of oil and fuel to fill the supply gap, reducing this emergency cushion to low levels.

These developments have made oil traders worry about looming scarcity. In response, they have bid oil prices up (bit.ly/3LqIujL). It is worth noting that while consumers often blame oil companies (and politicians) for high oil prices, these prices are set by commodity traders (bit.ly/36RPFm2) in venues such as the New York, London and Singapore stock exchanges.

Against this backdrop, Russia attacked Ukraine on 24 February 2022. Traders saw the potential for sanctions on Russian oil and gas exports and bid energy prices even higher.

Unexpected factors also have emerged. Major oil companies including Shell, BP and ExxonMobil are ending their operations in Russia (bit.ly/3qGjnBu). Spot market (bit.ly/3qJva1Y) buyers have rejected seaborne Russian crude (bbc.in/3NvxCTh), probably for fear of sanctions.

And on 8 March, the US and UK governments announced bans on imports of Russian oil (on.ft.com/3qFG6xi). Neither country is a major Russian buyer, but their actions set a precedent that some analysts and traders fear could lead to escalation (bit.ly/3iJAvSg), with Russia reducing or eliminating exports to US allies.

In my view, this set of conditions is unprecedented. It reflects not just increased complexity in the global market, but also an imperative for energy firms—which already are under pressure from shareholder climate activists—to avoid further reputational damage and leave one of the most oil-rich countries in the world. Some companies, such as BP, are abandoning assets worth tens of billions of dollars (reut.rs/3uwyM8x).

As I see it, the key players that can help curtail this price shock are OPEC—mainly, Saudi Arabia—and the US. For these entities, holding back oil supply is a choice. However, there is no evidence yet that they are likely to change their positions.

Restoring the Iran nuclear deal (bit.ly/3tKK21Z) and lifting sanctions on Iranian oil would add oil to the market, though not enough to greatly reduce prices. More output from smaller producers, such as Guyana, Norway, Brazil (bit.ly/36sOARP) and Venezuela (on.ft.com/3JOxjkq), would also help. But even combined, these countries cannot match what the Saudis or the US could do to increase supply.

All of these uncertainties make history only a partial guide to this oil shock. Currently there is no way to know how long the factors driving it will last, or whether prices will go higher. This is not much comfort to consumers facing higher fuel costs around the world.

Scott L. Montgomery Lecturer Jackson School of International Studies University of Washington

Scott L. Montgomery Lecturer Jackson School of International Studies University of Washington

Icarried out a little exercise on Google. I searched “Africa”, and then “African countries”. Top among the 3.4 billion results in the first search and 272 million in the second were stories about the Omicron variant of SARSCoV-2 and bans on African countries. Then about wars and conflicts, and some sporting stories.

For a long time, the dominant narrative about the African continent has been one long tale of gloom and doom: the world’s epicentre of poverty and disease, a stain on the conscience of the world; a continent desperately in need of aid, and to which the rich and powerful countries must urgently stretch a helping hand of benevolence.

But Africans are not throwing a pity party. Of course, challenges and difficulties remain, but they are not peculiar to African countries. A new generation of African entrepreneurs are rising to the challenge. They are setting a new tone for how the continent engages with the rest of the world.

Away from dependency-inducing aid models (bit.ly/36nriMU), African entrepreneurs

are charting a new course for inclusive growth on the continent. In a new handbook on African entrepreneurship (bit.ly/3D6s4tR), we brought together 46 scholars to explore issues ranging from institutions and ecosystems to technology entrepreneurship, entrepreneurship in conflict zones, and gender and diversity issues.

The book is a reference for researchers and practitioners with interests in international business, entrepreneurship and emerging economies. It is also a resource for students, course co-ordinators and programme leaders facilitating modules in entrepreneurship and business management. It is intended to guide policymakers across Africa and beyond. The book provides insights into how African entrepreneurs are navigating often turbulent institutional environments and volatile markets. It also sheds light on innovative networking and resourcing strategies business owners are using.

This handbook offers a view of the often simplified, but quite complex, multi-layered world of African entrepreneurship. It unpacks problems and prospects, cultures and contexts, and the features and future of African entrepreneurship. The contributions draw on empirical field work and practitioner reflections.

The Palgrave Handbook of African Entrepreneurship features country-level cases and insights from western, eastern, southern and North Africa. It looks at key emerging themes such as technology entrepreneurship, gender and diversity issues, and entrepreneurship in conflict zones.

African entrepreneurship shares similar characteristics with any other type of entrepreneurship. Perhaps one defining element is the heightened, albeit not exclusive, sense of community.

This partly explains why the African technology entrepreneurship landscape is particularly exciting. Hubs of tech-savvy, typically young, entrepreneurs are springing up all over the continent. They are thriving on the ideals of knowledge sharing and co-creation. As we reported in another study (bit.ly/3LaWY6X), these tech hubs have rapidly expanded on the African continent over the past decade. In 2015, the World Bank reported ( bit.ly/3um4CVy) the existence of 117 in Africa. By October 2019, this number had risen to 643—that represents growth of 450% (bit.ly/3wvjhjT).

These hubs have been hugely successful (bit.ly/3tBgfIV) in creating new jobs, stimulating the entrepreneurial ecosystem, and improving the quality of life through technology. They are also challenging traditional universities as sites of knowledge production. This has been achieved by adopting a flat structure where

hub members exercise creative autonomy. They have also adopted a transdisciplinary approach to bring together academia, industry and government sectors to find solutions to societal problems.

African tech entrepreneurs have achieved this in often extremely challenging institutional conditions and turbulent business environments. They have to grapple with derelict and inadequate infrastructure and higher risks arising from weak and poorly enforced laws, among others. There are also challenges of limited economic integration among African countries, but these are now being prioritised by regional bodies. One important challenge (bit.ly/36ItOx2) that has attracted limited attention, but is hugely significant, is the hostile protectionist measures imposed by Western governments. They are often on products and in areas where African countries are competitive.

One chapter in our handbook explores (bit.ly/3Nmj3Se) how African tech entrepreneurs survive this proverbial valley of death. Another contribution wonders (bit.ly/358bptl) how much progress could be made if African countries gave more open, universal access to their own citizens to enterprise and innovation across the continent. This is an especially timely and pertinent consideration, in the light of often hostile attitudes of African governments to technology entrepreneurship.

For example, in June 2021, the Nigerian government banned Twitter indefinitely (cnn.it/3ivtmVE), leaving many businesses scrambling for survival in Africa’s most populous country. One source reports (reut.rs/3JBfi95) that 20% of 39.6 million Nigerians use Twitter to advertise their businesses.

Across the continent, entrepreneurs are trying to forge ahead in conflict zones , in camps for the forcibly displaced, and in refugee

settlements. The handbook highlights examples of resilient and innovative entrepreneurship from places such as northeast Nigeria (bit.ly/36LcIyQ), where the Boko Haram insurgency has displaced nearly 2.4 million people (bit.ly/3qtYIAf); Libya (bit.ly/3L9KjRH), where businesses are reeling from the impact of an ongoing civil war; and Kenya (bit.ly/3DaGycg), where refugee entrepreneurs are drawing on social networks to overcome constraints of an encampment policy that restricts their movements and economic opportunities.

These are not just rosy stories of great successes and triumphs. Many of these businesses fail or struggle to grow. The majority of African entrepreneurs are still informal micro-enterprises. However, the true picture of the continent is not of helplessness. African entrepreneurs, with all their challenges and difficulties, are giving it a good go.

If they are truly ready to do business with Africa, the rich and powerful countries need to shed the paternalism that has defined and driven interaction with African countries for decades. This dependency-inducing model is damaging and not fit for purpose. The ‘developed’ countries need to give more attention to issues such as liberal trade policies and removal of tariffs and other non-tariff barriers to African products and African businesses. It is not enough for rich countries to pay lip service to the ideals of free trade and do the opposite in practice.

African entrepreneurs are ready and able to hold their own at the international stage. Just give them the chance.

Seun Kolade Associate Professor: Strategic Management De Montfort University

“ Hubs of tech-savvy, typically young, entrepreneurs are springing up all over the continent. ”

“With the introduction of this new system, we will be able to ensure commodities are delivered in the correct health facilities, in the right quantities, and at the right time.”

As a frontline healthcare worker at Isiolo County Referral Hospital, Denis Mutirithia (pictured on previous page) has a critical role in saving lives—and a new digital tool to help him do so. The pharmaceutical technologist is tasked with predicting and preventing shortages and stockouts of essential medical supplies, including contraceptives.

If he receives stock from the Kenya Medical Supplies Authority (KEMSA) on time, the hospital’s patients will have access to the medicines they need, when they need them. But delayed supplies can unleash a litany of crises, from illness to unintended pregnancies, and higher risk of maternal and newborn deaths.

As the COVID-19 pandemic ravaged health systems and shuttered health facilities, family planning and contraceptives have been among the most extensively disrupted services (bit.ly/36Urbsa). The costs are being borne by the most vulnerable women and girls (bit.ly/3qGgwZm), with spikes in unintended pregnancies reported among adolescent girls in some parts of Kenya.

“When a woman’s reproductive health is stuck, her life is also stuck,” said Editar Ochieng, founder of a women’s shelter and legal aid organisation (bit.ly/3qIKJa8) in Kibera, a sprawling slum in Nairobi. “Access to contraceptives is one of the most crucial empowerment tools that women in Kibera need to improve their lives, but often this is not available.”

Now, a new mobile phone app is set to become a game changer for healthcare workers like Mutirithia. The Electronic Proof of Deliveries, or e-POD app, keeps track of supplies to primary health facilities through the simple touch of a button and was developed to improve essential deliveries across Kenya.

“By checking the app on my phone, I am able to tell when a particular delivery of family planning commodities is expected to arrive. This helps us advise clients accordingly, so that they get their method of choice at their next appointment,” he says.

The e-POD app received an award for best innovative health supply chain solution at the 2021 Global Health Supply Chain Summit in December 2021. So far, it has been rolled out in 10 Kenyan counties in the country—including Nairobi, Isiolo, Kisumu, Homa Bay, Lamu, Kilifi and Kwale—and is expected to be available in all 47 counties by mid-2022.

The mobile app was developed as part of the Last Mile Kenya programme (bit.ly/3tLZfj8), implemented through a partnership between KEMSA and Coca-Cola Beverage Africa, with the support of the United Nations Population Fund (UNFPA). Borrowing from Coca-Cola’s expertise and best practices in supply chain management and distribution, the app digitises data entry at the point of delivery to provide real-time data on the commodities received, their quantities, and time of delivery.

It uses GPS to ensure deliveries arrive where and when they are supposed to, and health facilities can easily report back on whether they received the correct specifications. The app also monitors order turnaround times to prevent delays that could lead to exhausted stocks of life-saving supplies.

Director of Operations at KEMSA, Edward Njoroge, said: “Prompt delivery of commodities and supplies has been one of the significant challenges we have been experiencing as KEMSA. With the introduction of this new system, we will be able to ensure commodities are delivered in the correct health facilities, in the right quantities, and at the right time. This will help us facilitate timely payments to our suppliers, transporters, and timely billing to development partners supporting family planning programmes.”

e-POD is one of two recent family-planning tracking apps developed with support from UNFPA. The second is Qualipharm (bit.ly/3NufMAd), created with local public health organisation HealthStrat, to track consumption of family-planning commodities at county, sub-county and facility level. The app is loaded onto tablets distributed to commodity managers, including pharmacists, and commodity managers at public health facilities who use it to electronically take stock of commodities consumed during the period as well as placing new orders. The adoption and

use of the digitised, mobile-based commodity reporting solutions at the facility level provides an end-to-end visibility of commodities while improving the quality of data reported.

These apps are, says Charity Koronya, of UNFPA, “a game-changer—not only for healthcare staff but also for the citizens who rely on public health facilities to access life-saving commodities. Provision of family planning commodities contributes to the elimination of unintended pregnancies, which eventually leads to reduction of maternal and newborn mortality as well as improving the health and well-being of women and girls.”

The COVID-19 pandemic has affected women’s access to family planning information and services around the world, with some 12 million women (bit.ly/3JR75Oe) experiencing disruptions to family planning services since it started, particularly in low-income countries and marginalised communities.

UNFPA works with local and international partner organisations across Kenya to strengthen efforts to ensure universal access and rights to sexual and reproductive healthcare, reaching more than 900 000 people with family planning services in 2020 (bit.ly/3wLQLL1).

United Nations Population Fund (www.unfpa.org)

The app also monitors order turnaround times to prevent delays that could lead to exhausted stocks of life-saving supplies.

Seeking jobs abroad is not an option for young Nigerians—they do not have the right skills