news ISSUE 5 R45.00 IN FOCUS FUTURE PIPELINE Why digitalisation offers high returns for emerging gas producers How large miners and states stifle local capital in the DRC CLEAN, AFFORDABLE POWER A REALISTIC OPTION Myths and truths around South Africa’s recent renewable energy auction Equatorial Guinea models success of US investment in African gas INSIDE: CHANGING MINDSETS OIM CONSULTING MANAGING DIRECTOR, ARJEN DE BRUIN RSA R45.00 OIM Consulting aims to give people the tools and the means to become successful in order to impact communities and the greater South Africa ISSUE 6

African

30secondsisallittakesforasmall firetoburnoutofcontrol! Willyourassetssurvive?

ASTnotonlyoffersawiderangeoffireprotection

Contactustoday! 0119491157 SALES@astafrica.com www.astafrica.com IGS0085

HowSafeisyourbusinessfromfire?

systemsandsolutionsthatmeetyourbudgetandsuit yourneeds,wealsooffercomprehensive consultationsperformedbyqualifiedexpertswith yearsexperience,ensuringthatyouhavethebestfire suppressiontechnologyatyourdisposal.

Your business has something special to offer and our job is to give your customers a way to discover you and your brand online. And still have time for your family

We help you develop your story and your voice and connect with the clients who want to do business with you. We like to talk about your business as much as you enjoy sharing it with others. That means we treat your business like it’s our own. We get down to the nitty gritty and find out as much as we can in an initial free consultation with you where you let us in on the journey you’ve taken up to this point and the goals you have, moving forward. We’ll be actively by your side all the way because your success is our success. Chat with us on WhatsApp Visit our website

Let’s chat about your business!

CONTENTS

COVER PROFILE

16

CHANGING MINDSETS

OIM Consulting aims to give people the tools and the means to become successful in order to impact communities and the greater South Africa.

“I’d like us to be the consultancy people phone because we can transform their mines,” says MD Arjen de Bruin.

4 African mining news Issue 6

BME provides sustainable solutions and ongoing support that create value across the blasting cycle - for our partners, their workforce and the broader mining community.

BME provides sustainable solutions and ongoing support that create value across the blasting cycle - for our partners, their workforce and the broader mining community.

BME provides sustainable solutions and ongoing support that create value across the blasting cycle - for our partners, their workforce and the broader mining community.

BME, together with Protea Mining Chemicals, forms the mining division within the Omnia Group. The Omnia Group is a JSE-listed diversified provider of specialised chemical products and services used in the mining, agriculture and chemicals sectors. www.bme.co.za

BME, together with Protea Mining Chemicals, forms the mining division within the Omnia Group. The Omnia Group is a JSE-listed diversified provider of specialised chemical products and services used in the mining, agriculture and chemicals sectors. www.bme.co.za

BME, together with Protea Mining Chemicals, forms the mining division within the Omnia Group. The Omnia Group is a JSE-listed diversified provider of specialised chemical products and services used in the mining, agriculture and chemicals sectors. www.bme.co.za

Since 1984, we’ve consistently raised the bar on industry, safety & environmental standards.

FOR EXPLOSIVES, THINK

BME.

Since 1984, we’ve consistently raised the bar on industry, safety & environmental standards.

FOR EXPLOSIVES, THINK

BME.

Since 1984, we’ve consistently raised the bar on industry, safety & environmental standards.

FOR EXPLOSIVES, THINK BME.

CONTENTS ISSUE #6 FEATURES 30 IN FOCUS A burgeoning energy sector: Promoting investment in Zimbabwe 38 OPINION Ghana needs to rethink its small-scale mining strategy 44 LAW Investment laws in Mozambique have been evolving with time to meet international best practices 50 OIL Namibia’s first oil discovery, Shell’s Graff-1 well, is a game changer for the country 58 GAS Equatorial Guinea models success of US investment in African gas 62 MINERALS Travelling through deep time to find copper for a clean energy future 68 RENEWABLE ENERGY Myths and truths around South Africa’s latest renewable energy auction The world, investors and the broader industries are watching how Namibia manages this discovery. 62 38 50 30

Our Executives are: Our Executives are: Our Executives are: Our Executives are: Our Executives are: Our Executives are:

80 HEALTH Zambia must treat children suffering from lead poisoning from mines 86 ENVIRONMENTAL SAFETY How engineered bacteria could clean up oil sands pollution and mining waste 92 SKILLS DEVELOPMENT Japan, Hitachi Construction Machinery and UNIDO to train construction equipment operators in Zambia REGULARS 10 FROM THE EDITOR 12 EVENTS Conferences and meetings for the African mining industry Mining is wasteful and unsustainable, and the industry is in desperate need of effective solutions to treat its large bodies of waste. 74 TECHNOLOGY Mining the moon’s water will require a massive infrastructure investment —but should we? CONTENTS ISSUE #6 86 COMPANY PROFILES Watex Global 20 Spill Doctor 24 DY- Mark Global 26 Trollope Mining 28 8 African mining news Issue 6

Linvar prides itself on matching its great products with exceptional service.

Our team of professionals are available to provide assistance for all customers, from small businesses seeking innovative storage solutions, all the way to manufacturing and warehousing with complex logistics requirements.

We also specialise in supplying and fitting factory, office and warehouse shelving, racking and mezzanine floors. Linvar provides a full range of services including planning, design, and project implementation management.

Our trained advisors have many years of experience within the Storage and Materials handling industry, with a combined knowledge to make sure you get exactly the right product for your needs. They will happily visit you on site to discuss your requirements. We are able to quote you on Drive-in Racking, Decked Racking, Pallet Racking, High Bay Racking, Live Carton Storage, Live Pallet, Mobile and Light-duty Racking.

Johannesburg: 011 608 0250 Cape Town: 021 380 8760 Durban: 031 700 1434 Port Elizabeth: 041 367 1178 East London: 082 441 2939 Get in touch: Download NOWONLINE! www.linvar.co.za The Linvar APP Chat to us on WhatsApp STORAGE& MATERIAL HANDLING SOLUTIONS

We can turn things around

One of the joys of being an editor, or journalist for that matter, is meeting people through the interviews we conduct. And almost always you’re confronted with an opinion that differs from yours. It’s easy to get caught up in the negative side of life. This is particularly true in South Africa where we’re confronted daily with news designed to rob us of our positivity. However, during the interviews I’ve conducted, I’ve met the people at the coalface: CEOs, CFOs, COOs etc. It fills me with the hope that these people are looking beyond the doom and gloom. No, they’re not blind to the reality that is South Africa, but they choose not to drape themselves in sackcloth and ash.

While to some it may sound like blue-sky thinking, it takes me back to my early days in journalism.

Young, naïve and idealistic, it soon became clear there was a clear divide in the newsroom over the issue of ‘sunshine journalism’, or just reporting the good news. Some felt that, as a community newspaper, the ‘hard news’ should be left to the other papers in the company.

The issue was never resolved. Will it ever be resolved? Probably not. Bad news sells, as the saying goes. And while both arguments have merit, it’s nice to see and hear the good news stories.

And that is what I’ve found when interviewing these business leaders. Their positivity and willingness to persevere in the face of adversity gives me hope that, despite the bleak outlook, we can turn things around.

Enjoy the magazine.

10 African mining news Issue 6

THE EDITOR

FROM

From simple to challenging: With radar technology that is highly robust, flexible and economical all at the same time, VEGA is putting things on track to ensure more reliable and efficient production processes involving bulk solids.

Due to our decades of experience we understand the requirements of the industry quite well. That’s why VEGAPULS level sensors are able to deliver exact measured values even when conditions get extreme because of dust, noise or buildup. And why they are also ideal for simple applications where efficiency, and economy in particular, are required.

www.vega.com

Accurate down to the smallest grain. Radar for reliable levels in bulk solids applications

MEET UP

Rub shoulders and conduct business with the highflyers in the African mining industry

EIMS 2022 will bring together global mining companies, investors, solution providers and governments to explore new mining opportunities in the market, introduce their brands, make new connections and create long-term strategic partnerships. It will also offer key insights into the market, in-depth analysis of resources & opportunities, overview of the mineral commodities available, permits & bids, their geological background, reserves and production.

2022 PGMs Industry Day www.pgmsindaba.com/otherindabas/the-pgms-industry-day

For one day only, producers, investors and users of platinum group metals (PGMs) will gather to discuss all things related to PGMs. Join industry experts from different areas of the sector as they unpack critical issues including the current and future potential for PGMs applications, supply and demand fundamentals affecting the PGMs market, and much more. The event will take place online and in person at the Country Club Johannesburg, Auckland Park.

Mines and Money – Online Connect minesandmoney.com/online

Mines and Money Mines Online Connect brings together miners, investors, financiers and industry professionals to network, hear market analysis, compare investment opportunities, share knowledge, discuss, debate and most importantly, do business— all in a virtual and online format. The 72-hour event offers senior management teams of mining companies the opportunity to connect and meet face-to-face with carefully qualified investors from institutional funds, private equity groups, family offices and private investors to discuss project updates and share presentations virtually.

12 African mining news Issue 6

5 TO 7 APRIL 28 & 29 MARCH 6 APRIL

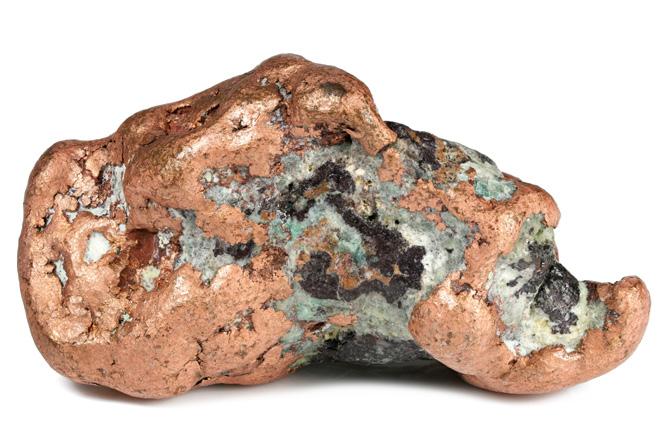

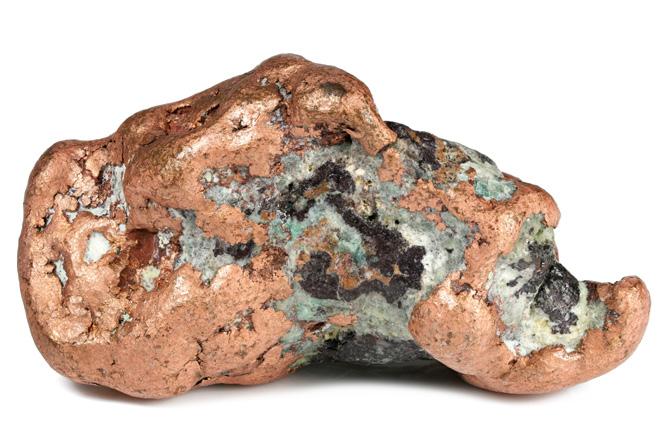

EVENTS

3rd Egypt International Mining Show 2022 – Virtual Connect egypt-mining.com

Africa.

for over 27 years, Mining Indaba has a unique and widening perspective of the African mining industry, bringing together visionaries

innovators from across the spectrum: attracting more junior, mid-tier and major mining companies, more investors and, as always, the largest gathering of mining ministers in Africa. Meet everybody who’s anybody, from the world’s biggest industry giants to tomorrow’s barrier-breaking disruptors —transforming the trajectory of

Presented by Professor Steven Rupprecht from the University of Johannesburg, this learning event will help you with mine design criteria; understanding the mine planning cycle; equipment selection; cut-off grades; risk analysis; the role of environmental, social and governance; and financial technical evaluations, among others.

FN9233 Consolidations South Africa to Zambia and DRC From 1 ton Bakkies to 34 ton Superlinks • Local Collections • Crating and Packaging • Warehousing • Dedicated and Express Loads • BV and FERI facilitation • Customs entries LET US SWEAT THE SMALL STUFF! Cargo 2 Congo Ka Go 2 Go FN9233 Consolidations South Africa to Zambia and DRC From 1 ton Bakkies to 34 ton Superlinks • Local Collections • Crating and Packaging • Warehousing • Dedicated and Express Loads • BV and FERI facilitation • Customs entries LET US SWEAT THE SMALL STUFF! +27 79 569 4248 | +27 11 316 5003 | mike@greendoorlogistics.co.za www.greendoorlogistics.co.za Cargo 2 Congo Ka Go 2 Go Consolidations South Africa to Zambia and DRC From 1 ton Bakkies to 34 ton Superlinks • Local Collections • Crating and Packaging • Warehousing • Dedicated and Express Loads • BV and FERI facilitation • Customs entries Cargo 2 Congo Ka Go 2 Go 23 TO 26 MAY

Mine Planning and Design School (Online) www.saimm.co.za 9 TO 12 MAY Investing in African Mining Indaba is solely dedicated to the successful capitalisation and development

mining interests

your

Investing in African Mining Indaba miningindaba.com EVENTS

of

in

Succeeding

and

business.

PUBLISHER: Donovan Abrahams EDITOR: Ashley van Schalkwyk ashley@avengmedia.co.za CHIEF SUB-EDITOR: Tania Griffin DESIGN: Christine Siljeur CONTRIBUTING WRITERS: African Energy Chamber (www.EnergyChamber.org), Rohitash Chandra, Jo Condon, Julian Diaz, Alex Ellery, Grace Goodrich, Wikus Kruger, Richard Kwaku Kumah, Chido Mafongoya, Dietmar Müller, Office of the UN High Commissioner for Human Rights, Presidency of the Republic of Kenya, United Nations Industrial Development Organization, Leon van der Merwe, Ashley van Schalkwyk, Vikramaditya G. Yadav IMAGES: unsplash.com, pexels.com stock.adobe.com COVER PROFILE IMAGES: Mont Fur Fine Photography PROJECT MANAGER: Viwe Ncapai ADVERTISING SALES: Kay Davids, Rochelle Elias, Randimo Kaylor, Wendy Scullard, Marc Wessels, Mellouise Thomas ONLINE CO-ORDINATORS: Majdah Rogers, Ashley van Schalkwyk ACCOUNTS: Benita Abrahams HUMAN RESOURCES MANAGER: Colin Samuels CLIENT LIASON: Majdah Rogers PRINTER: Print on Demand DISTRIBUTION: www.africanminingnews.co.za www.magzter.com DIRECTORS: Donovan Abrahams Colin Samuels PUBLISHED BY: Aveng Media Boland Bank Building, 5th Floor 18 Lower Burg Street Cape Town, 8000 Tel: 021 418 3090 Fax: 021 418 3064 Email: ashley@avengmedia.co.za Website: www.avengmedia.co.za DISCLAIMER: © 2022 African Mining News magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of print. THE AFRICAN MINING NEWS TEAM 14 African mining news Issue 6 CREDITS

LIGHTER - FASTER - STRONGER – SAFER

LIGHTER - FASTER - STRONGER – SAFER

LIGHTER - FASTER - STRONGER – SAFER

LIGHTER - FASTER - STRONGER – SAFER

YOUR MINING SCAFFOLDING SOLUTION

YOUR MINING SCAFFOLDING SOLUTION

YOUR MINING SCAFFOLDING SOLUTION

YOUR MINING SCAFFOLDING SOLUTION

Layher is the world’s largest producer of high-quality system scaffolding, with all its material manufactured at the company’s headquarters in Germany. Layher’s Allround scaffolding system is designed with high precision and allows up to eight connection points at the rosette.

Layher is the world’s largest producer of high-quality system scaffolding, with all its material manufactured at the company’s headquarters in Germany. Layher’s Allround scaffolding system is designed with high precision and allows up to eight connection points at the rosette.

Layher is the world’s largest producer of high-quality system scaffolding, with all its material manufactured at the company’s headquarters in Germany. Layher’s Allround scaffolding system is designed high precision and allows up to eight connection points at the rosette.

Layher is the world’s largest producer of high-quality system scaffolding, with all its material manufactured at the company’s headquarters in Germany. Layher’s Allround scaffolding system is designed with high precision and allows up to eight connection points at the rosette.

Based in Johannesburg since 2011, South African subsidiary Layher (Pty) Ltd provides high standards of engineering and service, while ensuring that customers can profit without compromising on safety.

STRONGER STEEL

Layher

components.

LIGHTWEIGHT

By using higher-tensile steel, a thinner material and innovative profiles, our steel decks are up to 43% lighter than carbon steel. This allows for FASTER and SAFER assembly.

HOT_DIP GALVANISED

Layher’s steel components are all manufactured in Germany, and hot -dip galvanised in specialised galvanising facilities – the largest such facilities in Germany! Layher’s hot dip galvanising offers superior protection from corrosion, resulting in a longer service life.

QUALITY

CONTROL

AND

TECHNICAL INFORMATION Technical Data documentation, instructions for Assembly and a pprovals according to EN 10204 and production certified according to ISO 9001: 2008

TRAINING, ENGINEERING AND TECHNICAL SUPPORT

www layher co za

scaffolding uses high tensile steel which provides its components with higher load bearing capacity and allows for the manufacture of lighter

16 African mining news Issue 6 COVER PROFILE

CHANGING MINDSETS

OIM (Operational Improvement Management) was established in 1985 by Professor Robert Tusenius from the Stellenbosch Business School, to focus on the public and private sector—building on NGO initiatives to establish a just, prosperous and equal-opportunity South Africa. African Mining News spoke with managing director Arjen de Bruin to find out more about the rationale behind OIM Consulting and the work it is doing in the mining industry.

Back in the ‘80s, the main focus of the company was on culture, due to the political climate at the time. According to De Bruin, Prof. Tusenius’ view was basically that, if there is a fence dividing two countries, why is the one country doing better than the other—what makes them different? Why does a river change the effectiveness of one nation versus another? He then began looking at the cultural aspects of South Africa.

Many businesses sat up and started listening to what Prof. Tusenius was saying. He wanted to create a culture in organisations so that no matter the race or background of the employees and management, everyone would subscribe to that same culture.

He believed that views impact attitudes, which in turn impact behaviour. The goal was to have a common behaviour.

Thus, OIM began as a culture company. There have been a number of shifts in focus since its establishment. In 1995, OIM moved from workshop facilitation to consultation and training. In 1997, the company developed a more formalised and integrated approach to business performance improvement in various areas. From 2006, manufacturing solutions and operations capabilities were added, along with the business lines of Talent Management (2006), Value Chain Solutions (2007), and Research & HR Outsource (2008). OIM Leadership Talent was established in 2009. In 2010, then CEO Tjaart Minnaar introduced Operations Solutions. But many clients wanted to become more efficient and effective in their processes after they had successfully changed the culture in their organisations, so OIM Consulting expanded into leadership development. It was at this time that De Bruin joined the company, which was now able to give clients an integrated view of change in culture—becoming more efficient and developing their

leadership talent. “We try to see a company holistically,” says De Bruin. “We have a mantra that says, ‘Operational efficiency without culture change is unsustainable’.”

OIM’s service offerings were reorganised in 2013 into one central company, OIM Group, to focus on the core business areas of operational optimisation, people management and organisational performance.

Then in 2018, management realised that the company’s supervisory development programme was a niche in the market. Other culture companies were just doing culture, and other training companies were simply offering training. OIM decided to focus on the role of the supervisor. Says De Bruin, “A small mine in the Northern Cape actually said to us, ‘You’re doing all this efficiency and culture stuff, but you’re not working with the supervisors. When you leave, we don’t think you’ve really changed anything.’ But we told them we worked with the supervisors, we talked to them, we had workshops with them. And they said that’s the point—we were doing things for them. So they suggested we build a supervisory programme to teach the supervisors skills and competencies.”

OIM Consulting aims to give people the tools and the means to become successful in order to impact communities and the greater South Africa

COVER PROFILE Issue 6 African mining news 17

According to De Bruin, there are a number of reasons these supervisors are not able to work efficiently. The most common is that employees with strong technical skills are promoted to the role of supervisor, but they are not able to work with people—they are used to drilling and blasting, for example. That is what they are good at. Unfortunately, they cannot lead. Another reason is that there is a massive skills shortage in the country. Someone may list on their CV that they have five years’ experience as a supervisor, but that does not mean he or she is good at it. But the mining companies need to plug their gaps, so they recruit these inefficient supervisors.

“We always talk about two types of supervisors,” De Bruin explains. “Those who are willing but not able, so they want to do the job but they should never have been in that role. Then you have the able, but not willing—they have all the tools, they know what to do, but they’re just not willing. Those are the ones you need to have discussions with.”

Only about 20% of supervisors are competent, De Bruin reveals. “But when we coach them, we move them from 20% to 55% competent. We’re not saying we’re going to make every person competent, but if we can just get these guys to execute their day better, that makes a difference.”

That is why OIM analyses role execution: “Most supervisors only effectively execute the day 51% of the time. Now we move the dial to 81% and we increase the

competency. You can actually coach people to be effective. They don’t have to shoot the lights out; you only need to get them to do what they need to do effectively —and if they can lead their teams better, then that’s even better.”

So in 2018, OIM built a whole new framework from scratch, identifying the competencies needed by supervisors and developing training and coaching programmes. OIM Group was restructured and rebranded as OIM Consulting. Consultants coached the supervisors for 12 to 16 weeks and operational KPIs were measured to see where there had been improvements—both in individuals and in the organisation as a whole. It was a great success, but OIM did not think it would become such a sought-after service in the mining industry. Soon other organisations were approaching OIM Consulting for its supervisory programme, stating that they were also struggling with inefficient and ineffective supervisors who were not operating at the optimal standard.

“That was a game changer for us,” says De Bruin. “We picked up a lot of good clients such as Khumba and Gold Fields’ South Deep.” The latter had a history of 11 years of losses, so OIM left a team behind there in 2020 and helped turn the mine around (see sidebar). In 2021, Anglo American Platinum signed a four-year programme with OIM Consulting to coach all their supervisors throughout their operations.

DIGGING DEEP

Like many other sectors in South Africa, the mining industry was severely impacted by the national COVID-19 lockdown in 2020. In line with the measures announced by Minister of Mineral Resources and Energy Gwede Mantashe on 25 March 2020, mining operations—particularly deeplevel mining, which is generally considered labour-intensive —were scaled down significantly.

Gold Fields’ South Deep Mine, located on the West Rand, was placed on care and maintenance in April and, in compliance with government regulations, operated well below its full labour complement for the remainder of the lockdown period. Despite this, South Deep continued to show progress on most of its operational measures during the first half of 2020, compared to the same period in 2019, largely due to an organisational culture and capability alignment process.

Since acquiring South Deep in 2006, Gold Fields experienced a number of organisational challenges and setbacks, preventing it from operating as a modern, bulk, mechanised and profitable mine. To address these challenges, Gold Fields embarked on a strategic transformation journey that included an organisational restructuring exercise, followed by a broader cultural and capability alignment process.

South Deep engaged OIM Consulting to support the cultural and operating aspects of the process. OIM Consulting’s fourpillared process is centred around what it considers to be the beating heart of any organisation: its frontline leaders. “Our process addresses cultural change, the identification and building of new capabilities, and performance assessment, management and improvement —with a pivotal focus on the supervisor as key to sustaining this improvement,” explains De Bruin.

18 African mining news Issue 6 COVER PROFILE

The initial results at South Deep were extremely encouraging, with the mine reporting a profit at the end of the initial 12-month period. More revealingly were the metrics that demonstrated significant operational improvement: the mine saw a 41% increase in gold production when comparing H1 2019 with H2 2019. Its overall productivity in 2019 improved by 30% to 26.7 tonnes per employee, costed from 20.5 tonnes per employee in 2018. The overall efficiencies for development and destress improved to 60m/rig per month in 2019 from 39m/rig per month in 2018—all contributing in turning the net loss made in 2018 to a net profit of over R104 million in 2019. As De Bruin points out, “these results were achieved with approximately 30% less staff and equipment than the year before.”

De Bruin attributes the integration of culture, capabilities and practices as the foundation that underpins all operational improvements. “In order to improve output and efficiencies, one needs to start with changing mindsets, through developing appropriate and relevant skillsets and toolsets.”

says De Bruin. “People talk about mechanisation—we talk about modernisation. Mechanisation is just people buying equipment. Modernisation is having the right people with the right equipment with the right processes with the right mindset.

“You can automate all you want, but there’s still a guy who needs to do his job effectively. So get the culture right, get the process right, but also get your operational leadership working. Obviously, we need the execs. We talk about culture creators and culture carriers. Your execs create the culture, but your supervisors and superintendents carry your culture—and if there’s a disconnect, you never fully deliver.”

The whole philosophy of OIM Consulting is that they want to impact people, because people impact communities—and if you impact communities, you actually create a wealthier community and a wealthier South Africa. “Our role is basically to give people the tools and the means to become successful so that companies can actually generate wealth, because if a company makes more money it usually expands and more people are hired,” adds De Bruin.

The company has big plans for the future. Most importantly, OIM Consulting wants to become the global thought leader on supervisors within the mining industry. “I think we are already a thought leader within the South African context,” says De Bruin with pride. “We’ve also worked in Rwanda and Zimbabwe and we’ll be going to Lesotho soon. So we have an idea of what an African supervisor looks like.” The next step is to go international and work with global mining houses. The company is looking to double its growth again this year and employ 100 consultants by 2023 (up from the current 65).

OIM Consulting is expanding its digital capabilities to excel in the Fourth Industrial Revolution, having already branched into augmented reality and gamification. The company has also created OIM Raeda, its Coaching to Performance supervisory development platform on which an individual’s competencies, role assessments and role execution, and operational KPIs are loaded—plus the whole year’s calendar of coaching, with space to add in notes. It is an individual’s entire coaching history.

De Bruin concludes, “I’d like us to be the consultancy people phone because we can transform their mines. I’d like people to say, ‘Call OIM—they’re the guys who can do this’.”

For further information, visit https://oimconsulting.com/

“If you don’t have competent people doing and executing the job properly, it’s not going to work,”

Issue 6 African mining news 19 COVER PROFILE

QUALITY PRODUCTS

ON TIME, EVERY TIME

Reinforced Hosing, manufacturer of Watex hose products, has became a major force in the hardware industry

20 African mining news Issue 6 COMPANY PROFILE

quality

It was back in 1999 that Gavin Brown and Dev Howett established Reinforced Hosing to fill the gap left by the closure of Illmans Plastics and Saplex Industries. The fledgling company faced many challenges, particularly around product quality and growing a customer base.

But with hours of hard work and planning, Reinforced Hosing rapidly became a major force in the gardening sector of the hardware industry.

Reinforced Hosing was listed by Pick n Pay, and soon the first orders of Watex garden hoses were filtering into the group nationally. Today, after more than 20 successful years, Watex is a household name in the garden hose business and can be found on the shelves of many supermarkets, hardware stores, nurseries, and others.

Reinforced Hosing manufactures PVC hoses —from garden hoses to agricultural dragline, gas, mining, suction, multipurpose, fire, fuel, oxy and acetylene and clear tubing (see sidebar). All products are produced from virgin materials that have a UV protection additive to deal with the harsh climatic conditions prevalent in South Africa. Also available is a top-quality range of Watex hose-end fittings.

PRODUCTS ON OFFER

Garden Hose & Accessories

• Tap adaptors

• Sprinklers

• Sprayers

• Hose menders and joiners

• Hose connectors

• Pyramid sprayers

• Green wall vertical garden system

• Garden hose

• Builders hose

• Hose hangers

Agricultural Hose

• Crop spray hose

• Dragline hose

Industrial Hose

• LP gas hose and regulators

• Acetylene and oxygen hose

• Air and water hose

• Clear reinforced tubing

• Clear thick/thin wall tubing

• Fuel reinforced hose

• Multipurpose hose

• Fire hose

• Suction hose

Mining Hose

• Anti-static hose

• Anti-static loading hose

• Standard/medium/heavy duty mining hose

• Rockdrill hose

Project

has remained a major focus over the years.

Issue 6 African mining news 21 COMPANY PROFILE

Watex CEO, Gavin Brown

The company is proud to have SABS certification on its mining and gas hoses, which are manufactured to SANS 1086:2007 and SANS 1156-2:2012 quality standards respectively.

Project quality has remained a major focus over the years. CEO Brown employed the services of Tim Niemand, whose expertise spans more than 50 years. Niemand introduced a superb adhesion formulation which, together with other innovative research, put Watex on par with—if not better than—most international brands. “Our quality is of the best available in South Africa, and we continually strive to improve an already top-class product,” adds Niemand.

Brown explains that when the exchange rate favours the dollar, there is a plethora of cheap imported hose entering the market and which undersells the Watex brand in large quantities. “But our saving grace is that the quality of these products is inferior to our Watex brand.

Although the import threat is very real, many of our dealers remain loyal to the brand and quality, while others tend to buy on price alone.”

The CEO ascribes the company’s ongoing success to multiple factors, top of which is its ability to deliver a quality product on time, every time. In addition, within its first 10 years of existence, Reinforced Hosing identified further growth areas to ensure its future, branching out into the mining sector and the rest of the African continent—becoming wellrepresented in countries such as Zimbabwe, Zambia and Botswana, among others.

When the Dragline range showed exponential growth, the company realised the farming community was an important player in the irrigation sector, and made a huge effort to rapidly increase its share of this market, Brown reveals.

It is the goal of Reinforced Hosing to remain a local manufacturer supporting local business and creating employment for South African people, thereby adding value to the economy.

Contact details

Address: Cnr Aschenberg & Davis Street, Chamdor, Krugersdorp 1739

Tel: 011 769 2600 Email: info@watex.co.za www.watex.co.za

22 African mining news Issue 6 COMPANY PROFILE

The CEO ascribes the company’s ongoing success to multiple factors, top of which is its ability to deliver a quality product on time, every time.

WATEX REINFORCED PVC MINING HOSES COMPLY WITH SANS 1086/2007 AND ARE DESIGNED FOR AFRICAN MINING CONDITIONS AND HAVE A WIDE RANGE OF APPLICATIONS. WATEX MINING HOSE APPLICATIONS: • Jack Hammers • Compressors • Pneumatic Tools • Air & Water Conveyance • Excellent Cut & Abrasion Resistant • Oil & Diesel Resistant • Lightweight & Flexible WATEX Yellow Heavy Duty super flexible mining hose, suitable for colder conditions. Operating temperature -10O C to +50O C. PRODUCT CODE: RMY10030 RMY12030 RMY20030 RMY25030 RMY32030 RMY40030 RMY50030 Nominal ID (mm) 10 12 20 25 32 40 50 Burst Pressure Kpa 6800 6800 6000 5600 4000 3500 3500 Working Pressure Kpa 1700 1700 WATEX Green Heavy Duty super flexible mining hose, suitable for colder conditions. Operating temperature -10O C to +50O C. PRODUCT CODE: RMG10030 RMG12030 RMG20030 RMG25030 RMG32030 RMG40030 RMG50030 Nominal ID (mm) 10 12 20 25 32 40 50 Burst Pressure Kpa 6800 6800 6000 5600 4000 3500 3500 Working Pressure Kpa 1700 1700 1500 1400 1000 900 900 WATEX Blue Heavy Duty super flexible mining hose, suitable for colder conditions. Operating temperature -10O C to +50O C. PRODUCT CODE: RMB10030 RMB12030 RMB20030 RMB25030 RMB32030 RMB40030 RMB50030 Nominal ID (mm) 10 12 20 25 32 40 50 Burst Pressure Kpa 6800 6800 6000 5600 4000 3500 3500 Working Pressure Kpa 1700 1700 1500 1400 1000 900 900 WATEX Orange Heavy Duty super flexible mining hose, suitable for colder conditions. Operating temperature -10O C to +50O C. PRODUCT CODE: RMO10030 RMO12030 RMO20030 RMO25030 RMO32030 RMO40030 RMO50030 Nominal ID (mm) 10 12 20 25 32 40 50 Burst Pressure Kpa 6800 6800 6000 5600 4000 3500 3500 Working Pressure Kpa 1700 1700 1500 1400 1000 900 900 WATEX-MRD Red Rockdrill Hose. Heavy Duty Ultra High Pressure Hose. Operating temperature -0O C to +50O C. PRODUCT CODE: MRD12030 MRD25030 MRD50030 Nominal ID (mm) - 12 - 25 - - 50 Burst Pressure Kpa - 10000 - 8000 - - 4500 Working Pressure Kpa - 3000 - 2000 - - 1125 WATEX - Anti-Static Loading Hose. Anti-Static and Semi conductive, complies with SANS 2878:2011 PRODUCT CODE: RMA16030 RMA20030 Description Nominal Internal Diameter (mm) Nominal Internal Diameter (mm) ATS - Smooth ID 16 20 OD 24 Max 29 Max ATR - Ribbed (Heavy Duty) 20 25 Reinforced Hosing (Pty) Ltd Website: www.watex.co.za • email: info@watex.co.za • Tel: +27(11) 769 2600 QUALITY HOSE MANUFACTURER

MAKE YOUR MARK

As the African mining industry continues to experience rapid growth, so too does the need to keep up with the latest and greatest products available on the market. The market is full of marking and survey paints, so how do you know you’re getting the best bang for your buck? Sure, there are plenty of cheaper

imports available that offer just that: a cheap inferior product that’s short-lived and needs to be reapplied too many times.

Unfortunately, saving money doesn’t always mean fewer expenses and frustrations. A simple marking and identifying task can take double the time if using low quality products that predictably

clog and spit. On the other hand, using a higher quality marking paint can provide highly visible and longlasting marks even in dark areas.

Dy-Mark’s Mine Marking and Mine Marking Non-Flammable aerosols have been specifically designed for use in mines and excavation sites—with both products available in horizontal

Dy-Mark’s Mine Marking paints are formulated to be as tough as the environment they are used in

26 African mining news Issue 6 COMPANY PROFILE

and inverted (trigger) formats. The horizontal format is suited for spraying rock walls and faces, while the inverted (trigger) format is suitable for marking on the ground and on mine ceilings.

Dy-Mark Mine Marking is widely recognised as a quality product and has been used for marking out ore zones in grading control,

pit walls and survey grid layouts. Mine Marking Non-Flammable marking paint is specifically designed for use in coal mines and other fire-sensitive situations.

Both Dy-Mark Mine Marking and Dy-Mark Mine Marking NonFlammable have proved to be popular in mines throughout the SADC countries, Australia, Chile, Turkey, Indonesia and Papua New Guinea. Mine Marking and Mine Marking Non-Flammable have been formulated to give bright, highly visible marks, ideal for dark mining environments. Both paints will mark on rock, dirt, gravel, asphalt and other surfaces.

Formulated to be as tough as its environment, Dy-Mark’s Mine Marking paints overcome the exceptional darkness and distance factors faced in mining. Specially engineered with the market’s needs in mind, Dy-Mark’s Mine Marking paint delivers an easy-to-use, highly visible and long-lasting product.

Not only has Dy-Mark developed these distinct marking paints but has also brought to the market an extendable Mine Marking Handle, suitable for use with both Mine Marking and Mine

Marking Non-Flammable vertical cans. Specifically designed for marking mine ceilings, this three-part handle extends up to five metres. Available in lightweight aluminium, the handle is constructed to reach inaccessible areas. Reducing back strain and fatigue, the Mine Marking Handle is becoming a welcomed product in mines across Africa.

With over 50 years of experience, Dy-Mark has become one of Australia’s leading manufacturers of a range of specialised marking, coating and packing products. The DyMark range includes marking paints and inks, protective metal coatings, marking pens and aerosol lubricants and cleaners. These products are widely used in several industries, both in Africa and internationally. Dy-Mark offers a complete solution for all your mine marking needs with convenient, easy-to-use and high-quality products.

Built to last, Dy-Mark’s Mine Marking range features the products of choice if you’re after quality products that are just as tough as their environment.

Issue 6 African mining news 27 COMPANY PROFILE

Formulated to be as tough as its environment, DyMark’s Mine Marking paints overcome the exceptional darkness and distance factors faced in mining.

QUALITY WORKMANSHIP

Trollope Mining Services has enjoyed a sound working relationship with several well-known mining companies over the last three decades

Trollope Mining Services (Pty) Ltd is a Level 2 BBBEE rated company that is 26% black-owned and provides the services of opencast mining, crushing & screening, civil infrastructure and rehabilitation while operating in the civil and mining industries.

Established in 1975, the company boasts a substantial fleet of equipment and, although traditionally operations were predominantly based in the coal sector, current operations have extended into platinum, andalusite, gold, phosphate, manganese, limestone and diamonds with strategic intent being to diversify into other mineral sectors and grow its geographical footprint into Africa. The company is currently operating in Botswana and has experience of projects in Guinea and the Democratic Republic of the Congo.

Currently employing just over 2 000 people, Trollope Mining Services has enjoyed a sound working relationship with several well-known mining companies over

the last three decades—including Exxaro, Universal Coal, Mbuyelo Coal, Kangra Coal, Rhino Minerals, Northam Platinum, Pilanesberg Platinum, Kropz, Lucara, Anglo American and BHP Billiton.

Being a privately owned entity, Trollope Mining Services operates on good sound corporate practices and is recognised for delivering a superior service in the mining sector and services industry as a medium to large contractor, always at the highest levels of production and safety. With its focus being customer-orientated and performance-driven, the company prides itself on the quality of workmanship on operations.

Its core philosophy is “Business is about people”. Much time and money is invested in employees and the communities in which the company operates. This is done through various mechanisms such as external and internal training, learnerships, social economic development programmes, and charity fundraising events.

Trollope Mining Services currently has mining operations in the following sectors: energy (thermal coal and coking coal); base metals (manganese and chrome); precious metals/gemstones (diamonds, gold, palladium, platinum, rhodium and silver); and agriculture/construction material (limestone and phosphate). The company also completed operations in the industrial/ chemical sector, mining fluorspar and andalusite.

Its other services include:

• Opencast mining;

• Bulk earthworks;

• Plant hire;

• Crushing & screening;

• Material handling;

• Drilling & blasting; and

• Rehabilitation

Contact details

Address: Farm Elandsfontein 412JR, R25, Ekurhuleni, 1464

Tel: +27 (0)11 281 6000 Email: admin@trollopegroup.co.za

Trollope Mining Services delivers a superior service in the mining sector and services industry

28 African mining news Issue 6 COMPANY PROFILE

POWER PLAYER A burgeoning energy sector: Promoting investment in Zimbabwe 30 African mining news Issue 6 IN FOCUS

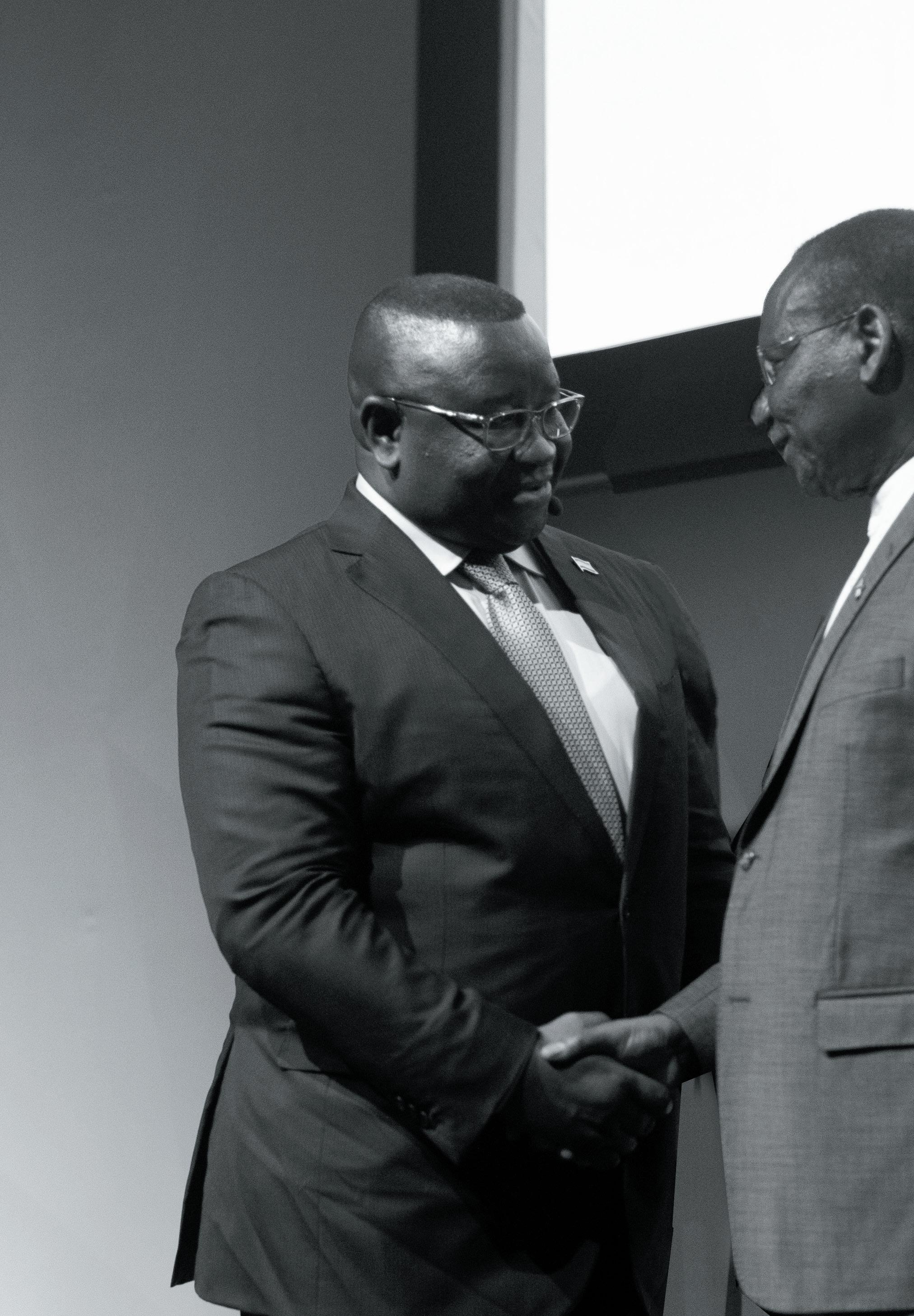

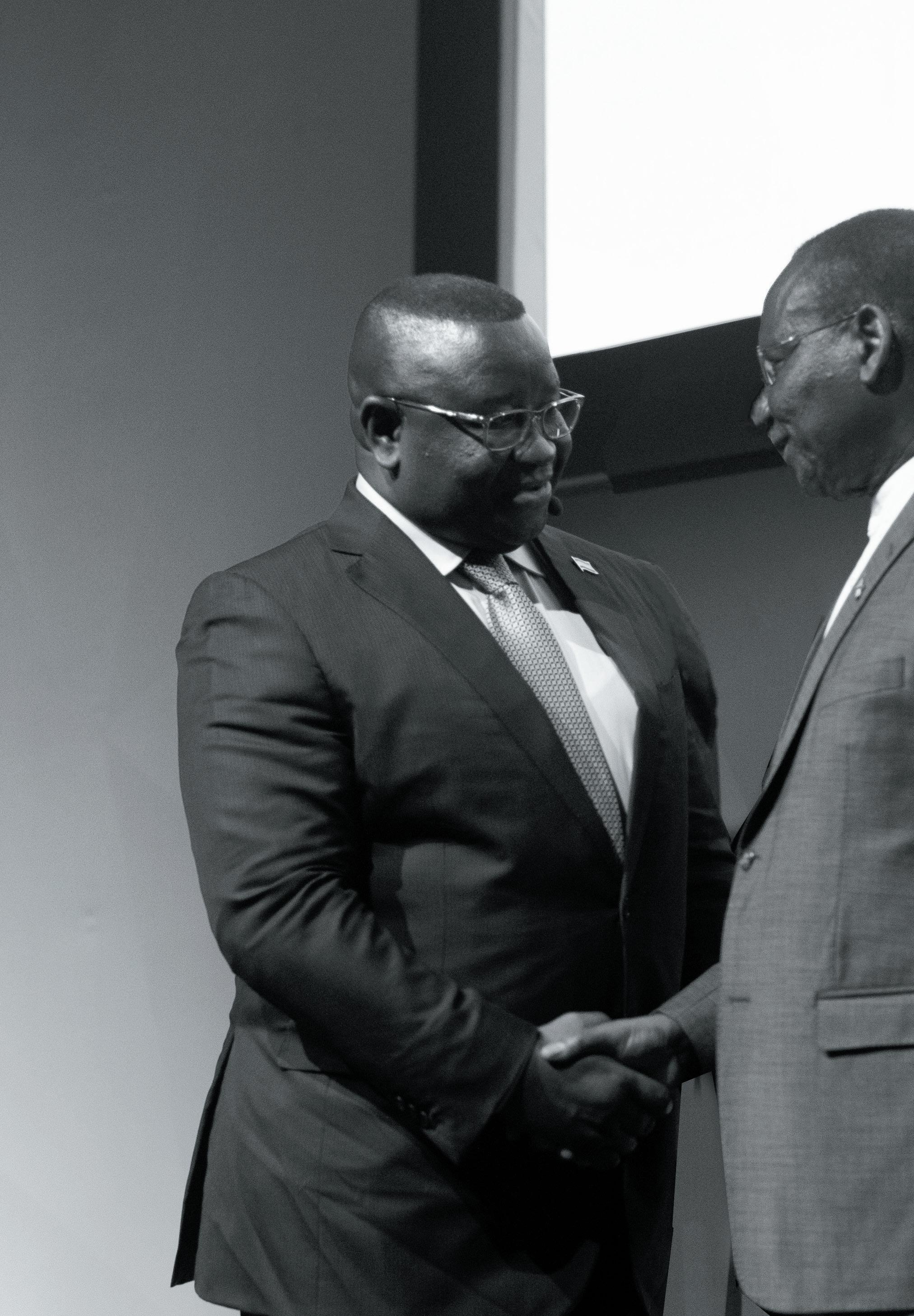

Committed to promoting pan-African investment opportunities, NJ Ayuk, executive chairperson of the African Energy Chamber, conducted a working visit to Zimbabwe at the end of last year to open a dialogue on the country’s promising energy sector. Meeting with Emmerson Mnangagwa, President of Zimbabwe, and presenting his recently published book, Billions at Play: The Future of African Energy and Doing Deals, Ayuk emphasised Zimbabwe as a top investment priority, driving development across multiple energy sectors. Ayuk’s meeting with President Mnangagwa focused on Zimbabwe’s energy potential and delineated strategies by which this potential can be achieved.

Across the country, power generation and transmission remain some of the most critical investment opportunities, as existing coal-fired power stations require upgrades, and untapped natural gas and renewable resources lack exploitation. Therefore, Zimbabwe is seeking new investors and projects to increase installed powergeneration capacity, diversify its domestic energy sector and boost country-wide energy security.

NJ Ayuk presents his recently published book to Zimbabwe President Emmerson Mnangagwa

NJ Ayuk presents his recently published book to Zimbabwe President Emmerson Mnangagwa

Zimbabwe’s coal reserves have the potential to address energy supply challenges and meet demand across the region.

32 African mining news Issue 6 IN FOCUS

With approximately 30 billion tonnes of coal in 21 known deposits that could have a lifespan of over 100 years,

Currently, the country’s largest thermal power station, Hwange Thermal Power Plant, has a capacity of 750MW, supplying critical electricity to the population. However, with ageing power plants requiring upgrades and the country opting to reduce its reliance on coal, alternative power-generation solutions are being considered and significant investment opportunities have emerged.

Ayuk’s visit initiated a dialogue on one of the country’s most promising sectors: renewable energy. Zimbabwe is home to impressive hydropower potential—estimated at

18 500 GWh per year, of which 17 500 GWh is technically feasible—and aims to drive further investment and associated development to establish domestic energy security and independence. To date, only 19% of the country’s hydropower potential has been exploited, with most of Zimbabwe’s electricity supply produced at the 750MW Kariba Dam Hydroelectric Power Station. With further potential from the Zambezi River, as well as several small-scale prospects across the country, the resource could potentially position the country as a regional renewable competitor.

Image:

www.hararepost.co.zw

34 African mining news Issue 6 IN FOCUS

Monitor Data Analytics & AI Predictions Diagnostics Digital Twin Data Inputs Improvement Predictions Analytics Diagnostics Monitor Health Production Revenue Safety A company of the SCHAUENBURG International Group www.schauenburg.co.za Schauenburg Systems (Pty) Ltd 26 Spartan Road, Spartan Ext,21 Kempton Park, 1619 Tel: +27 (11) 974-0006 Email: sales@schauenburg.co.za Lamproom Management Solutions Environmental Monitoring Solutions SmartConnex Gas Detector and Communication GDI Sentinel GDI SmartWear+ GDI SmartWearV GDI Viro-Cap Collision Avoidance Solutions LED Caplamps ROXY 40 SCSR AUTO CONNECT • Multiple Gas • Man-down • Panic • Dust + Noise Integration • Location SAFE • Actionable Information • Real Time Connection (WiFi/BLE) • Location-based Events • Interconnected Eco-system • Android App Support SMART • Easy to Understand • Electronic Reports • Interactive Dashboard • Intuitive App Interface • Auto-feature Updates SIMPLE SmartMine Safety Solutions DATA TRANSFORMED INTO ACTIONABLE INFORMATION

Furthermore, Zimbabwe holds significant exploration opportunities for stakeholders. Despite the lack of proven oil and natural gas reserves—and the continued dependence on crude imports to supply the nation— Zimbabwe is redirecting its focus on exploration, specifically of natural gas. Having experienced critical electricity shortages for decades, Zimbabwe is seeking alternative powergeneration solutions, in which natural gas may be a viable alternative. The southern African nation is pursuing partnerships and investment deals with international stakeholders, focusing on accelerating exploration and driving energy sector diversification and growth. Meanwhile, according to the International Trade Administration, Zimbabwe’s lithium deposits are the largest in Africa. With the rapid increase in global demand given the mineral’s importance to the energy-battery industry, the country has the potential to become a major exporter, while contributing to the global energy transition.

To position itself as a clean energy player, Zimbabwe requires significant investment in mining, with additional opportunities available in mining supplies, transportation infrastructure and materials. In a bid to attract further investment, the government has proposed regulatory changes to the Mines and Minerals Act, making it more progressive and investor-friendly. With a renewed interest in increasing domestic production, the government is seeking significant capital investments.

“With established sectors requiring upgrades, and emerging sectors seeking international participation and investment,

the country offers significant potential for both regional and international players,” stated Ayuk. President Mnangagwa has declared a commitment to developing a robust energy sector in Zimbabwe to meet rising power demand brought about by an increasingly vibrant, productive and resilient economy and people. With significant potential across multiple segments of its energy economy, Zimbabwe hopes to attract both regional and international investment, utilising its energy sector as a catalyst for wider socio-economic growth.

African Energy Chamber (www.EnergyChamber.org)

36 African mining news Issue 6 IN FOCUS

POTENTIAL SHIFT

Ghana needs to rethink its small-scale mining strategy. Here’s how

Ghana is among the top two gold producers in Africa (bit.ly/3f9dy9i). What has caught little attention, however, is the fact that more than 35% of total gold output in Ghana comes from artisanal and smallscale miners (bit.ly/3f7lsjz). Artisanal and small-scale mining is estimated to support the livelihoods of some 4.5 million Ghanaians, about 12% of the population (bit.ly/3HJXRSc). They account for more than 60% of the country’s mining sector labour force (bit.ly/3HP182H).

Artisanal and small-scale mining is a low-tech, indigenous and often informal. It occurs in over 80 mineralrich developing countries. Up to 100 million people globally work in this sector (bit.ly/3GfkXzT).

38 African mining news Issue 6 OPINION

@ZiboneleFM_98.2 t @ZiboneleFM98_2 Zibonele FM 98.2 076 551 5915 Studio Line 2 021 361 8962 Studio Line 2 021 361 2105 Station Number: 021 361 7109

Artisanal and small-scale mining has a long history in Ghana. It was only in 1989, however, that the government recognised its legitimacy (bit.ly/3G6N9VD) through the Small-scale Mining Act (PNDCL 218), later integrated into the current Mining Act 703 of 2006 (bit.ly/3r9SqFQ). The act provides a blueprint for its formalisation. It also reserves small-scale mining for Ghanaians. The law requires prospective local miners to apply for a licence to mine up to 25 acres of land in designated areas.

The government’s intention to formalise the sector has had very little success. More than 85% of all small-scale mining operations in Ghana are carried out by unlicensed operators (bit.ly/3r1FxNU).

Due to the sector’s evolving nature, the distinction between artisanal and small-scale mining has become contentious and blurred. To avoid any complications, most scholars now use them interchangeably. Some use the level of sophistication employed to make a distinction. But in Ghana today, one sees rudimentary tools (traditional artisanal mining) and modern tools (small-scale mining) being used on a single mining site.

Jackboot approach

The government’s response to illegal mining has been to use the military to raid small-scale miners. There is a long history to such a combative approach in Ghana. It dates as far back as the British colonial administration, which enacted the Mercury Ordinance of 1933 (bit.ly/3JXRpcs) to ban and criminalise native miners.

In 2013, then president John Mahama formed the InterMinisterial Taskforce to ‘flush out’ illegal miners, which led to many arrests and the expulsion

of illegal Chinese miners. The use of force intensified under the current president, Nana Akufo-Addo, who vowed in 2017 to put his presidency on the line to fight illegal mining in Ghana. This culminated in the setting up of Operation Vanguard (bit.ly/334NKJd), the largest centralised military-police joint task force to combat illegal mining in Ghana.

The real problem, however, is the government’s failure to implement its legislative framework for the formalisation of small-scale miners.

Images: www.miningmx.com, www.modernghana.com

The real problem is the government’s failure to implement its legislative framework for the formalisation of small-scale miners.

40 African mining news Issue 6 OPINION

We do integrated mining

As mining solutions architects, Ukwazi is able to seamlessly integrate key activities and disciplines across the mining value chain. Partner with our specialist teams and industry experts now, and achieve a cost profile that is compliant, efficient, sustainable and safe to operate.

Public Reporting Project Management Project Development & Delivery Mine Valuations Mining Studies Permitting Solutions Techno-Economic Assessments Sustainable Mining Onsite Services

Barriers to formalisation

The government first introduced a framework for the formalisation of small-scale miners more than 30 years ago. But it has very little to show for it. Less than 15% of smallscale mining operators have been able to acquire the requisite mining licences. Many do not bother to apply due to the tedious and cumbersome nature of the regulatory process.

To gain a better understanding of why the formalisation process has not achieved much, an aspect of my PhD research (bit. ly/3r674xy) sought to unearth local perspectives on the underlying conditions for the creation of these informal local mines. It examines how these underpin persistent informality.

There are two problems. The first is that the current formalisation blueprints fail to adapt to the conditions of the majority of local miners. The second is that the blueprints make it very difficult or too costly for small-scale miners to comply. They are therefore a disincentive to formalise.

Only a small segment of smallscale miners can raise the amount of money required to become formal operators (bit.ly/3GciZjX). The costs include application fees as well as the money required for the preparation and processing

of the application. Then there are costs for environmental permits, the hiring of surveyors and for the acquisition of business documents. A prospective smallscale mining licensee could spend at least US$4 000 to secure the requisite legal status.

When unofficial payments (bribes) are included, according to small-scale miners, the costs of getting a licence to mine 25 acres can balloon to as much as US$7 000. A burgeoning body of research (bit.ly/3Gbciyo) has shown that artisanal and smallscale miners in Ghana are driven to mining by poverty.

The second challenge revolves around a centralised bureaucracy and lack of effective engagement with all stakeholders. Despite the administration of small-scale mining being decentralised into nine mining districts across the country, only the national head office can issue a smallscale mining licence. Key local stakeholders like municipal and district assemblies with better understanding of the complexities play no effective role in the licensing process.

Again, the creation of a centralised task force to address a localised problem runs parallel to existing local structures. This undermines effective policing, monitoring and accountability.

Finding solutions

President Akufo-Addo’s call for a dialogue on illegal mining in his January 2021 State of the Nation address (bit.ly/3ncoVSj) portends a potential shift.

To create the enabling policy environment for a blooming artisanal and smallscale mining industry that is environmentally sustainable and economically beneficial to the state and citizens, greater engagement with local actors is the path to chart.

The solution is the devolution of small-scale mining decisions to municipal and district assemblies working in collaboration with traditional authorities. This will facilitate greater recognition and inclusion of local actors in the licensing process. It will also open dialogue with local miners, since municipal and district assemblies are the local development agents. This will bring decision-making processes closer to smallscale miners and enhance the effective policing and monitoring of the sector.

The reform of the licence regime for small-scale mining should be driven by the need to match the costs of formalisation with the complex socio-economic dynamics of the majority of operators. This is attainable when policy treats small-scale mining as a survivalist sector rather than a platform for wealth creation.

Artisanal and small-scale mining has also suffered because of its portrayal by the media and public misrepresentation as a vehicle for ‘quick money’.

42 African mining news Issue 6 OPINION

Richard Kwaku Kumah PhD Candidate School of Environmental Studies Queen’s University, Ontario

BUSINESS BOOST

Investment has played a pivotal role in the economic development of Mozambique. It has been recorded that the country has been one of the ‘fastest-growing economies’ on the African continent for the last two and a half decades, wherein it has outdone both regional and global growth averages with its rich oil and gas reserves that have been a magnet for major investments from various countries across the world (bit.ly/37hWJVU).

Investment laws in Mozambique have been evolving with time to meet international best practices. The main law that governs national and foreign investments is Mozambique’s Law on Investment, No. 3/93, passed in 1993. Its related regulations in August 2009, Decree No. 43/2009 replaced earlier amendments from 1993 and 1995, providing new regulations to the Investment Law. This article will give an overview of the new regulations.

Mozambique has outdone both regional and global growth averages with its rich oil and gas reserves that have been a magnet for major investments

Investment laws in Mozambique have been evolving with time to meet international best practices

44 African mining news Issue 6 LAW

Mozambique’s Law on Investment puts in place the requisite regulatory framework to promote foreign direct investments (FDIs). FDIs in Mozambique have been anchored by two mega-projects, namely the Mozal aluminum smelter established by mining giant BHP Billiton, and the Temane gas field developed by petrochemicals firm Sasol. These projects pioneered the way for other megaprojects, as they proved that Mozambique was investorfriendly. Sizeable investments in the agriculture and tourism sectors followed as a result of investor confidence in the country.

The Mozambican Investment Law Regulation has been amended by Decree no. 20/2021, which entered into force on 13 April 2021. With the aim of adapting national and foreign investment processes (“investment projects”) to a new institutional framework of co-ordination and in the context of a policy to attract and facilitate those investments, Decree no. 20/2021, of 13 April (“Decree”), was approved, introducing amendments to the Investment Law Regulation.

Below are the some of the major highlights of the amendments:

1. For the purposes of transferring profits abroad and reexportable invested capital, the minimum value of FDI through the allocation of own capital shall now be MZN 7.5 million, and the minimum value for annual exports of goods or services shall be increased to MZN 4.5 million.

2. The initial investment to be made in the first two years of activity by companies established outside Industrial Free Trade Zones, but that wish to benefit from the respective regime, will now have a minimum amount equivalent to MZN 75 million.

3. The Agency for the Promotion of Investment & Exports replaces the Investment Promotion Centre and the Office of Economic Zones for Accelerated Development as the entity responsible for the development, promotion and management of investment projects, as well as the promotion of national exports.

4. As regards the entities responsible for the approval of the investment projects, we note the following:

• Secretaries of State in the Province: for national investment projects in an amount not exceeding the equivalent to MZN 4.5 million;

• Director General of APIEX: Investment projects in an amount not exceeding the equivalent to MZN 7.5 billion and projects under the Special Economic Zone and Industrial Free Zone regimes;

• Minister that oversees the area of Finances: Investment projects in an amount not exceeding MZN 37.5 billion;

• Council of Ministers: Investment projects in an amount exceeding the equivalent to MZN 37.5 billion.

5. The transfer of an investor’s position, including in undertakings and units of the Integrated Tourism Resort Zone, shall now only be subject to authorisation by the entity that authorised the respective project and upon proof of compliance with the relevant tax obligations.

6. Investment project proposals must be sent to the Mozambican Agency for the Promotion of Investment and Exports in four copies, drafted in the official application form, and accompanied of the documents needed for the analysis. Depending on each case, the investment project proposals shall be accompanied of documents as lease contracts, property titles or professional internship and Mozambican workforce employment plans (for local content purposes). Decisions from the Provincial Secretary of State, APIEX General Director and Finance Minister shall be performed until three workdays after the reception of the proposal and APIEX shall inform the investors of the decision, until 48 hours after it.

7. Investors may assign totally or partially their rights regarding an investment, through duly based request to the entity that approved the project. The request shall be accompanied of tax compliance proofs.

8. Companies with headquarters in Economic Special Zones need to request authorisation to hire foreign employees and shall register them with the entity that supervises the employment sector.

46 African mining news Issue 6 LAW

Work with us in 2022

is a black owned legal practice with over 10 years experience in Labour Law, Litigation, Compliance; and driven by values of excellence, empowerment, evolution, ethics and sustainability.

Scan the QR code to meet your team of warriors of the law

9. Approved investors have access to a permanent residence authorisation, which may be extended to their partner and children up to 21 years old.

10. Transfers to foreign territory of profits and dividends are permitted, since the exchange legislation and the payment of taxes are complied.

11. The certification of companies operating in Economic Special Zones is made through the issuance of the competent certificate by APIEX, on 10 workdays after the reception of the request.

12. Inspections to companies with headquarters in Economic Special Zones need a previous authorisation by APIEX and shall be informed to those companies by this entity until five workdays after receiving the inspection request, except when the inspecting authority is the Tax Authority or the Economic Activities National Inspection.

13. Industrial Free Zones are created by decision of the Ministers Council, after proposal of the Finance Minister. APIEX shall analyse the proposal and elaborate an opinion to be analysed by the Ministers Council, and investors have six months after the authorisation date to establish their enterprise in the Industrial Free Zone.

14. The percentage of authorised sales to the local market from companies established in Industrial Free Zones may be modified by the Finance Minister, after founded request by the investors and positive opinion from APIEX and Tax Authority.

15. Claims related with investment matters regulated by the Investment Law and Regulation need to be sent to APIEX, which distributes them by the defendant authorities. If the defendant authorities do not answer APIEX nor execute any measure to solve the claim, APIEX shall propose a solution to the Finance Minister, which will decide the question.

In conclusion, the amendments were intended for the main purpose of aligning it with the new investment institutional framework. It is also in line with investment-friendly policies that the country has been diligently pursuing. The regulations therefore encourage national and foreign investment in the country, which further encourages a significant boost in investments. It is advisable that investors take note of the new regulations and ensure they are complaint with the same when they invest in the country.

Images: www.nsenergybusiness.com, www.south32.net

Leon van der Merwe and Chido Mafongoya Centurion Law Group

Mozal aluminium smelter established by mining giant BHP Billiton

Leon van der Merwe and Chido Mafongoya Centurion Law Group

Mozal aluminium smelter established by mining giant BHP Billiton

48 African mining news Issue 6 LAW

Temane gas field developed by Sasol

Knowledge is power

Products and solutions

FREE access to three days packed with strateic conference sessions and technical workshops. Networking Join facilitated matchmaking to help connect you with the right contacts as well as dedicated networking areas, meet and greets and social events.

Gain

Connect with the world’s leading products and services providers, from across the power, energy and water value chain, all under one roof. SAVE THE DATE 7 - 9 June 2022 CTICC, Cape Town, South Africa Formerly Your inclusive guide to the energy transition. enlit-africa.com Host publication Created by REGISTER TO ATTEND at www.enlit-africa.com

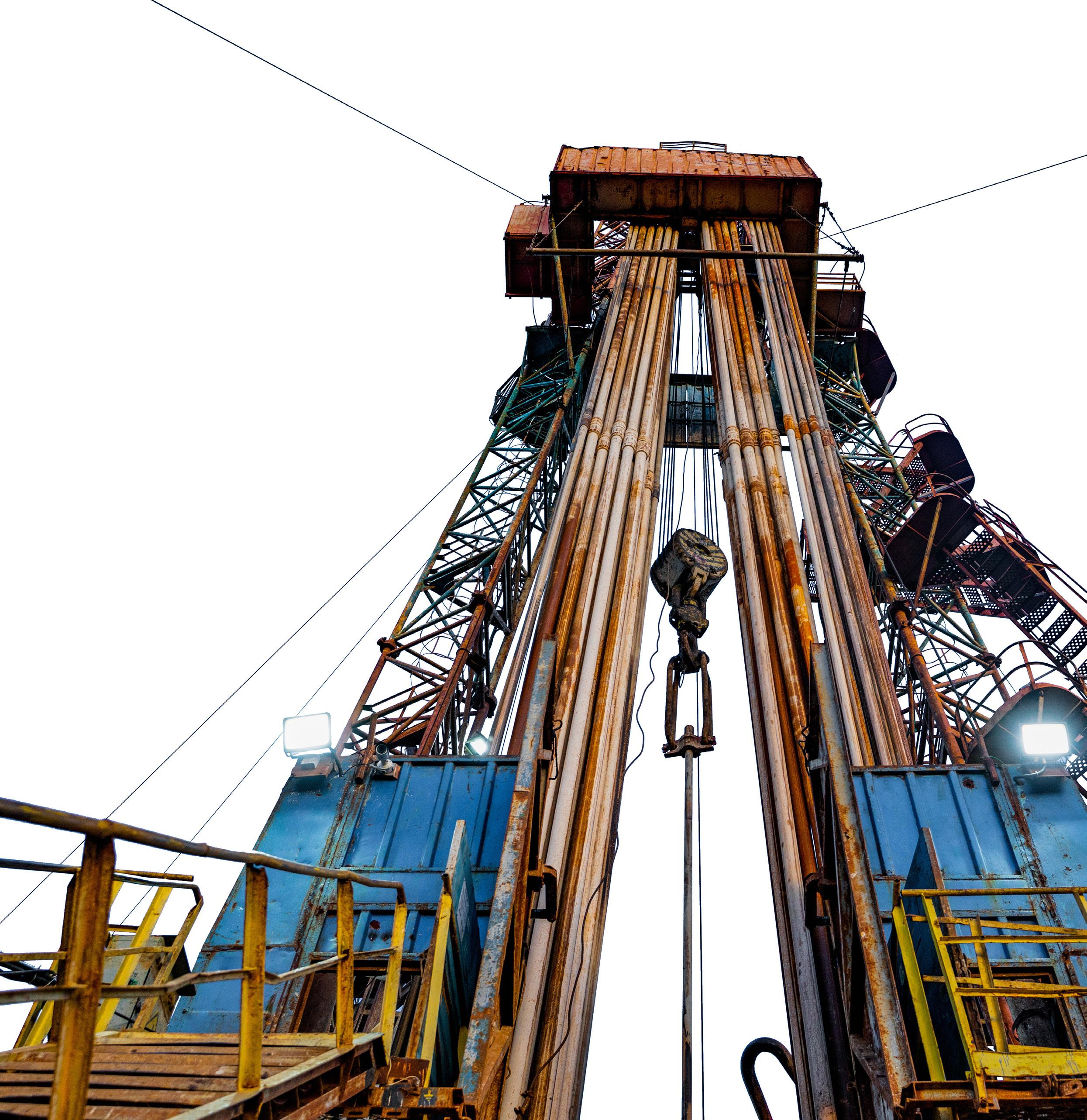

A NEW DAWN

Namibia’s first oil discovery is a game changer for the country

50 African mining news Issue 6

OIL

Issue 6 African mining news 51 OIL

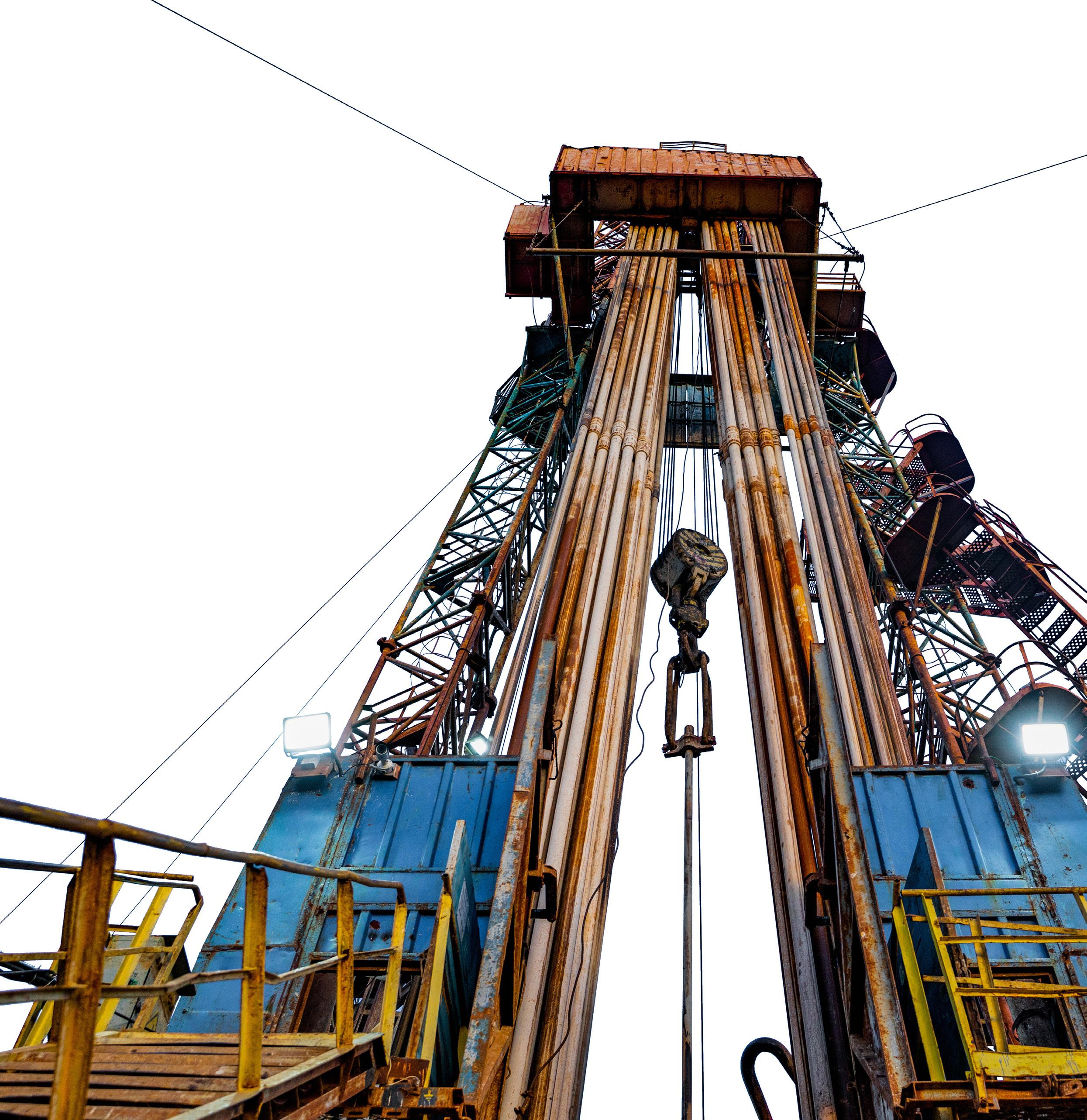

In February this year, oil and gas giant Shell made an oil discovery in the Graff-1 well located in Block 2913A in the Orange Basin, offshore Namibia (270 kilometres from the town of Oranjemund). Along with partners QatarEnergy and the national oil company of Namibia, NAMCOR, the well was spud in December 2021, using the Valaris-owned DS-10 drillship.

NAMCOR announced at the beginning of February that the Graff-1 deepwater exploration well had made a discovery of light oil in both primary and secondary targets. The oil companies are now performing extensive laboratory analyses to gain a better understanding of the reservoir quality and potential flow rates achievable.

“We hope that this discovery puts to rest doubts about the hydrocarbon potential of Namibia and opens a new dawn in the country’s future prosperity,” said managing director of NAMCOR, Immanuel Mulunga.

The African Energy Chamber spoke to Frank Fannon, former United States Assistant Secretary of State for Energy Resources and current managing director of Fannon Global Advisors, about the significance of Namibia’s new oil discovery.

Fannon was the recipient of the 2021 AEC Lifetime Achievement Award during last year’s African Energy Week in Cape Town for his strong support of the African energy sector and making energy poverty history.

Images: www.offshore-energy.biz, NAMCOR 52 African mining news Issue 6 OIL

LE South Africa celebrates 50 years of reliability solutions

Lubrication Engineers (LE) South Africa celebrates its 50th birthday in 2022 – a major milestone for the company, which has now been family-run for three generations. The company is celebrating 50 years of providing specialist lubrication products and reliability solutions to the local market, and plans to continue expanding its coverage and entering new markets.

Lubrication Engineers was first founded in 1951 in Fort Worth, Texas. LE South Africa was established in 1972 and was the first international distributor of LE products outside of the USA. Today, LE offers distribution in more than 60 countries worldwide. LE South Africa holds the rights for LE products in sub-Saharan Africa and remains one of the top five LE distributors globally by product volume.

“We believe the secret to the business’s longevity is the fact that LE has always focused on designing products that meet the needs of specific applications,” says Callum Ford, National Marketing Manager at LE South Africa. “That, coupled with our product quality, customer service and the fact that we focus on creating total reliability solutions for our customers, is what has seen us continue to grow for 50 years.”

Ford adds that LE also has a deep understanding of its customers’ requirements, the challenges they face and the trends that affect their industries, which has allowed it to

lubricants and general greases) to meet changing needs. This has included developing environmentally-sensitive products, specialist lubricants (such as food-safe options for the food, beverage and agricultural sectors), as well as complete lubrication storage and handling systems, automated lubrication dispensing solutions and reliability programmes, among others.

“

monitoring

“While it’s gratifying to be able to celebrate 50 years in business in 2022, we’re not resting on our laurels,” says Ford. “We continue to grow our team of lubrication specialists and tribologists (we’re currently setting up a presence in the Northern Cape, for example) and extending our reach into the farming and marine sectors, as well as other specialist fields. We hope to be successfully serving our customers for many decades to come.”

For more information, visit www.lubricationengineers.co.za.

Condition

practice is gaining more traction and is of high value to our customers and their industry needs.”

What are your thoughts on this discovery, and what will it mean for the country’s energy sector?

This discovery is a game changer for the country. Namibia has had 40 plus years of uneconomic or dry holes since the Kudu gas field discovery in 1974. Shell’s new Graff-1 well confirms to the global industry that Namibia has the resources to attract the world’s best and brightest.

What advice would you give to Namibia on how to handle exploration and production of the discovery?

With a discovery of this potential significance, there are often political voices that would like

to start spending money and accelerate timelines or cut corners to meet political rather than business cycles. I would encourage the country to stay on a disciplined path: to focus on the technical elements, safety and environmental performance, among others. The world, investors and the broader industries are watching how Namibia manages this discovery. It will be important that the country and the private sector execute the plan.

What should be done from a regulatory point of view to develop an oil and gas bill?

Namibia’s lack of discovery success in the past has meant

it could watch the rest of the world test different models. I would encourage the country to integrate the best elements and reject the bits that compromise the country’s values. We know that Namibia wants to increase foreign investment. Identify and integrate those factors into legislation. The country would also like to ensure a longterm industry. The regulatory context and fiscal regime should incentivise those goals rather than short-term returns. Further, since resource projects —oil, gas, mining—are longterm investments, all market participants should expect certainty in decision-making.

54 African mining news Issue 6 OIL

The world, investors and the broader industries are watching how Namibia manages this discovery.

Premium quality Aluzinc steel sectional tanks for bulk water storage throughout Africa • High corrosion resistance • Cost effective • On-site assembly • Tough and durable • Low maintenance • 5kL to 4000kL • Steel-domed roofs or open-top tanks • Human consumption/ food grade certified • Tanks < 350kL require no concrete foundation Proud BBBEE Level 2 Contributor sales@rainbowres.com | +27 (0)11 965 6016 | +27 (0)83 226 8572 www.rainbowtanks.co.za MINING | INDUSTRY | MUNICIPAL | AGRICULTURE | FOOD AND BEVERAGE | FIRE FIGHTING accredited

What will the discovery mean for local content?

It is appropriate to encourage local content, especially where that content can add real value to the enterprise. In practice, the best application of local content is when there is clear alignment between the local business or workforce and the project. At the discovery stage, there is likely little opportunity for local content, since there is still more of a design phase. However, I would expect there would be more opportunity for local content as the onshore services will be required when the project advances. I would think there may be some initial training opportunities for local businesses and education to explore what those future win-win situations may be in the near- to mid term.

How does this discovery work in the face of energy transition, and what is the environmental impact?

High oil and gas prices have underscored that we will need oil and natural gas for many years into the future. The transition away from oil will take many decades, and it will be uneven with certain regions able to transition sooner than others.

Yet, increasing calls to address climate change and transition away from hydrocarbons are very real. The market, investors, shareholders and the public, more broadly, will increasingly demand that those hydrocarbons be produced safely and environmentally sustainable. I suspect that concepts align with most Namibians, particularly given the importance of tourism.

It will be important for Namibia or any other project in the world to demonstrate it is operating with the environment in mind and with the highest standards.

African Energy Chamber (www.EnergyChamber.org)

56 African mining news Issue 6 OIL

WEALTH FOR ALL

Ground-breaking five-year wage agreement between Siyanda Bakgatla Platinum Mine, AMCU and NUM

In February 2022, Siyanda Bakgatla Platinum Mine negotiated a historic wage agreement with the Association of Mineworkers and Construction Union (AMCU) and the National Union of Mineworkers (NUM) for the period 1 March 2022 to 28 February 2027.

Says SBPM executive for Sustainable Development and HR, Hope Tyira, “Thanks to our strong and mature relationships with our workers and their representatives, we have a longterm contract that will benefit all our employees. Having certainty with regard to our wage bill for the next five years allows us to plan and secure the sustainability of our mine as we create wealth for all our stakeholders.”

He adds, “I believe both unions signing such an agreement is a first in the mining industry in South Africa.”

SBPM enjoys sound employee relations, based in part on the share participation scheme that ensures employees own 7.3% of the mine, while the host communities own 27% through a trust.

Tyira notes it is important for these two key stakeholders to participate in the value added by SBPM. “They are part owners and are committed to ensuring the long-term sustainability of SBPM. This year, SBPM paid dividends amounting to R84 million —and each qualifying employee received an average of R14 000. The dividends are over and above their usual monthly bonuses.”

This new collective agreement, concluded in terms of the Labour

HOPE TYIRA - Executive Head: Sustainable Development and HR

Relations Act, covers specific wage increases for the next five years and a number of allowances: homeowners’ allowances, living out allowances, rock drill operators’ and sewerage plant allowances, medical aid, and provident fund contributions, long service awards, as well as family responsibility/parental leave. The agreement precludes industrial action on matters covered in the contract.

Tyira says, “We are delighted that the unions have agreed to support us in our application to the Department of Labour for exemptions of the Basic Conditions of Employment Act for the five-year period due to operational requirements relating to shift schedules. They will also support management in our efforts to reduce absenteeism. We have a great relationship with the unions, and the beautiful thing here is that the unions are actually the owners of this mine, having 7.3% ownership of this mine.”

He explains, “How we’ve structured the deal is that the C1 to D1 employees basically get 5.5% for year 1 to year 3. We’ve paid a premium for year 4 and year 5 by giving them 7% guaranteed. This is over and above the allowances. With A to B7 categories, we’ve ensured we’ve given them a higher percentage with 6.5% in the first three years with the premium in the last years, to basically make it worth their while to consider this long-term deal.”

Jimmy Gama, AMCU national treasurer, concurred that “this is a very good agreement. We really appreciate

the engagement that we’ve had with the company and the positivity on the side of the company. We always find it difficult to engage with other companies when it comes to wage negotiations, but we appreciate SBPM senior management and it encourages us to see a wholly owned black company positive on this type of issue rather than taking a negative view.

“We believe this is a living agreement in terms of our members in general. If you take a year 1 increase, it takes that employee to a figure of R16 352—which is a living wage that AMCU has always been fighting for. And we believe that in year 5, there will be no employee from Siyanda earning less than R21 000 basic salary.”

NUM deputy general-secretary William Mabapa is more cautious, saying the union needs “time to unpack this five-year agreement”. He explains that, “The package that is inside that agreement is so attractive that you will want to secure it for a period of time. Because you are not sure what the employer may say— anything can happen. Any agreement can be renegotiated if parties realise that we are part of this agreement, but there are challenges that are compelling us to do [unpacking].”

Tyira reiterates that stability is the major issue—for the employees and for the communities served by SBPM. “I hope the industry can learn from this in terms of getting stability, and that the unions can take it forward to make sure our industry is stable.”

Issue 6 African mining news 57 ADVERTORIAL

CLEAN, AFFORDABLE POWER

Equatorial Guinea models success of US investment in African gas

58 African mining news Issue 6 GAS

United States operators, including Noble Energy, Marathon Oil and Chevron, have played a critical role in executing the first phase of Equatorial Guinea’s flagship Gas Mega Hub—serving as a model for future US investment in gas value chains across the continent.

The African natural gas value chain has become the preferred destination for foreign direct investment: not only because the continent holds over 500 trillion cubic feet of proven reserves but also because natural gas is a critical step in the global energy transition and provision of clean, affordable power. In the US, the Biden Administration has made clear its commitment to supporting developing countries in their own pursuit of low- or zero-carbon economies.