IN FOCUS FUTURE PIPELINE

De Beers Group reports on progress toward achieving 2030 sustainability goals

Artisanal gold mining in South Africa is out of control —mistakes that got it here

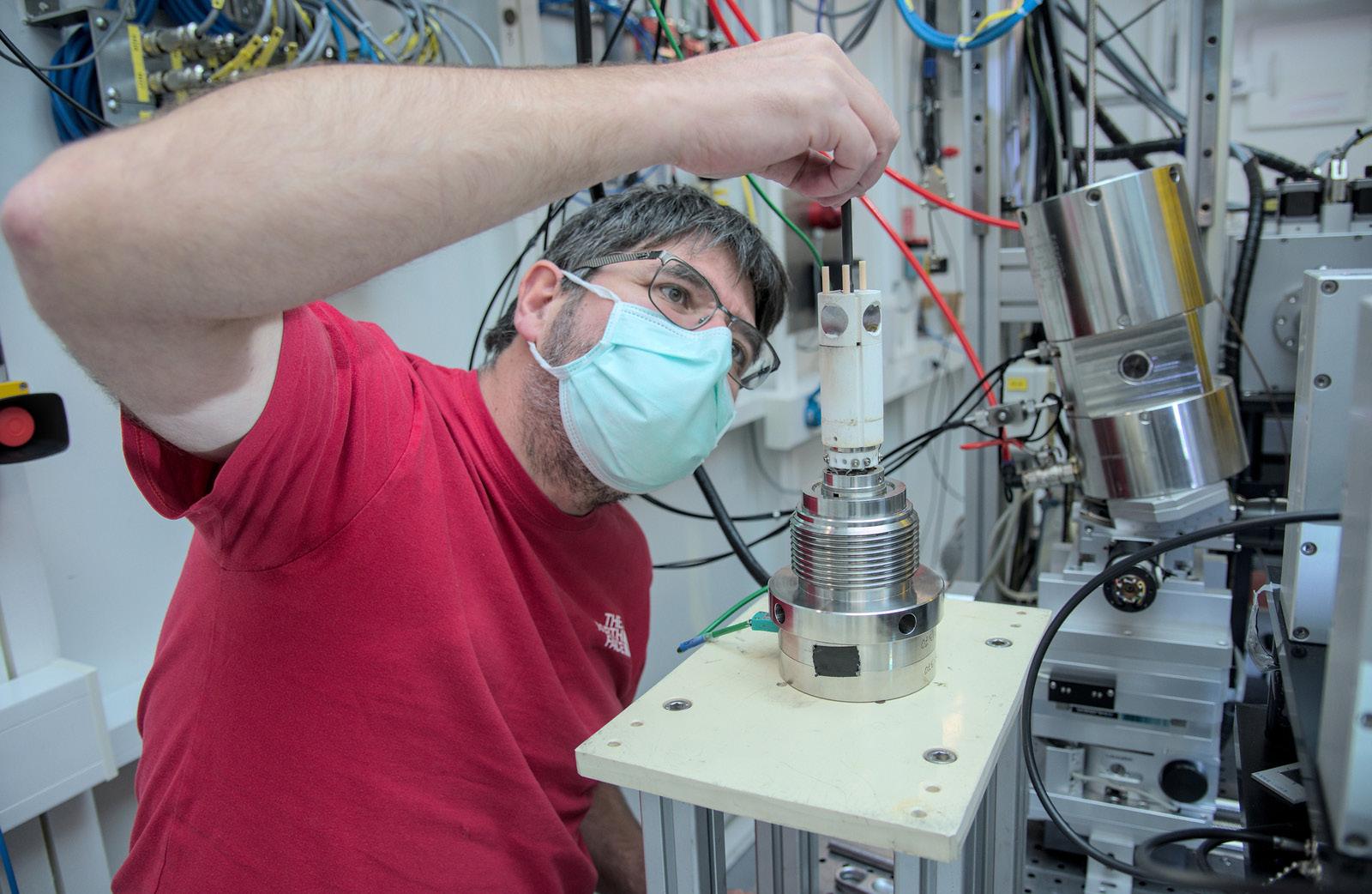

Powerful X-rays reveal the birth of giant rare earth element deposits—and may give clues for sustainable mining

> Partnering with the North West Department of Education on a 50/50 basis we have constructed and opened within our Waterkloof Hills Estate:

• a Primary school that can accommodate 1 280 learners starting at Grade R and

• a Secondary school that can accommodate 875 learners starting at Grade 8 at a cost of R140 million.

The school facilities, which are wheel-chair friendly, include a school hall, interactive boards with projectors in the classrooms, laptops for all educators, soccer fields, multipurpose courts, multi-function rooms, science laboratories, eating halls, libraries, computer rooms, sickrooms and 256 parking bays, amongst others.

Learners from both our estate and the neighbouring suburbs may enrol in the schools.

> Celebrating our contribution to the achievement of SDG 11 by providing our permanent employees with the opportunity to own their own homes in a safe and sustainable urban housing estate (Waterkloof Hills Estate)

> Delivering on our mission: to leave a lasting legacy of sustainable benefits for our stakeholders by delivering More than mining

> Meeting our Mining Charter and Wage Agreement commitments

BY JUNE 2022:

• 1 575 of our employees have bought homes in the estate, where over 5 000 people are living

• a secure perimeter wall with 24-hour access control keeps our employees’ families safe in the well-manicured estate, which offers a number of communal parks with braai areas and playground equipment for children

safe, resilient and sustainable

s the year winds down, I’d like to welcome you to African Mining News 8, our final edition of 2022. That being said, the work doesn’t stop, as we’re already hard at work on edition 9 slated for the end of January 2023.

It’s been a tough year, with many industries still striving to overcome the ravages of the COVID-19 pandemic. We’ve been there, too. It’s with this in mind that I’d like to thank all our advertisers for their support throughout the year. It hasn’t been easy for anyone financially, so we appreciate that you would trust us with your ad spend.

What the new year holds we can only speculate, but I think we can safely say it’s going to be a long road filled with potholes, and bumps and bruises.

However, what fills me with confidence that we’ll come out the other side is the interviews with businesspeople I’ve done this year. Sitting face to face or via virtual platform with numerous CEOs and MDs, listening to them speak with such passion and conviction about their future projects, gives me hope.

It’s easy to become despondent when you’re constantly being pummelled by body blows. I suppose Sylvester Stallone said it best in Rocky Balboa when he told his son: “It ain’t about how hard you hit, it’s about how hard you can get hit—and keep moving forward.”

Enjoy the read, stay safe, and may you have a blessed festive season with your family and friends.

ashley@avengmedia.co.za

Participants in the mining industry face many complex challenges and the legal landscape is intricate and evolving. Our mining team understands the market and has a wealth of industry experience in all facets of this specialist sector, built over many years of in-depth involvement.

Our team is multi-disciplinary and includes a number of leading legal experts across a broad range of areas of speciality in south and eastern Africa. Our immersive and longstanding association with the resources sector means we have sound, practical knowledge and can offer a full range of services in a comprehensive and commercial way. Our lawyers are highly skilled and have extensive experience. We are a solution driven and dynamic team and are well placed to offer relevant advice at a strategic level as well as on dayto-day legal issues.

We have long-standing relationships with a large number of key players in the South African and Kenyan industry and also act for many mid-tier and junior miners. We have been engaged by a number of foreign companies seeking to invest across Africa’s mining industry, including

clients from Europe, North America, India, Russia and China. Our team has been involved in many of the largest and most prominent and complex resource industry transactions and matters in South, East, and sub-Saharan Africa, including recent headline landmark black economic empowerment (BEE) transactions. Whatever your needs in the sector, we have the technical expertise and provide a cohesive and integrated service based on excellence.

Mining is a global business. Commercial and financing transactions and disputes increasingly have an international dimension. As well as providing local and national support, we can support your business needs wherever in the world you do business.

Labour disputes, regulatory uncertainty, changing policies and laws, and stringent environmental regulation all add up to one truth – you need the right legal team working with you. A team with experience and insight not only in all aspects of law, but in the mining industry as a whole. A team like CDH. We have been key to some of the largest, most prominent resource industry matters and transactions in South, East, and Sub-Saharan Africa including BEE deals, regulatory issues, mining M&A, mining sector restructurings and funding transactions. And we can help you too. Contact our award-winning team :

ALLAN REID

Joint Sector Head: Mining & Minerals

Director: Corporate & Commercial T +27 (0)11 562 1222

E allan.reid@cdhlegal.com

FIONA LEPPAN

Joint Sector Head: Mining & Minerals

Director: Employment Law T +27 (0)11 562 1152

E fiona.leppan@cdhlegal.com

CDH has a multi-faceted legal team that successfully guides mining businesses through a constantly evolving legislative framework. Partner with us for expert, practical advice.

From vision to fruition.

Cape

This event will connect the world with the African energy industry. The platform of choice for investors, IPPs, utilities and government leaders, the 2022 event will provide the deal platform and engine room for growth across Africa’s renewable and low-carbon sector. If your company is involved in Africa’s energy transition, this is the place to be.

Mintek, Randburg, South Africa and online www.saimm.co.za

This is a hybrid conference on mine-impacted water, including acid mine drainage—with the theme of “Impacting the circular economy, closing the water loop”. It will provide an excellent opportunity for industry, researchers and other global stakeholders to share their knowledge, new processes and technologies that can be used to advance the implementation of sustainable solutions to the challenges associated with mine-impacted water.

V&A Waterfront, Cape Town, South Africa aecweek.com

African Energy Week is the African Energy Chamber’s annual event, uniting African energy leaders, global investors and executives from across the public and private sector for four days of intense dialogue on the future of the African energy industry. An interactive conference, exhibition and networking event, AEW was established in 2021 under the premise to make energy poverty history by 2030—hosting panel discussions, investor forums, industry summits and one-on-one meeting opportunities, and driving the discussions that will reshape the trajectory of the continent’s energy development.

International PGM Conference Sun City, Rustenburg, South Africa www.saimm.co.za

This conference series has covered a range of themes since its inception in 2004, and traditionally addresses the opportunities and challenges facing the platinum industry. The 8th International PGM Conference will, under the guidance of the organising committee, structure a programme that covers critical aspects of this continually evolving and exciting industry. Topics to look forward to include: fuel cells; solar power and renewable energy; mine planning and design; ESG issues; and the 4th Industrial Revolution, among others.

Wallenberg Conference Centre, Stellenbosch, South Africa www.saimm.co.za

The fast, efficient and safe abstraction of raw mineral reserves is of strategic importance for leading mining companies. The South African mining sector needs to mechanise at a faster pace in order to remain globally competitive. This conference—titled “Tunnel boring in civil engineering and mining”—is in response to the civil and mining industry being under immense pressure to deliver projects fast, efficiently and as safely as possible. Tunnel boring and mechanised underground excavation and support installation is proving to be an invaluable and cost-effective tool in the execution of a project.

Rub shoulders and conduct business with the high-flyers in the African mining industryTown International Convention Centre, South Africa greenenergyafricasummit.com

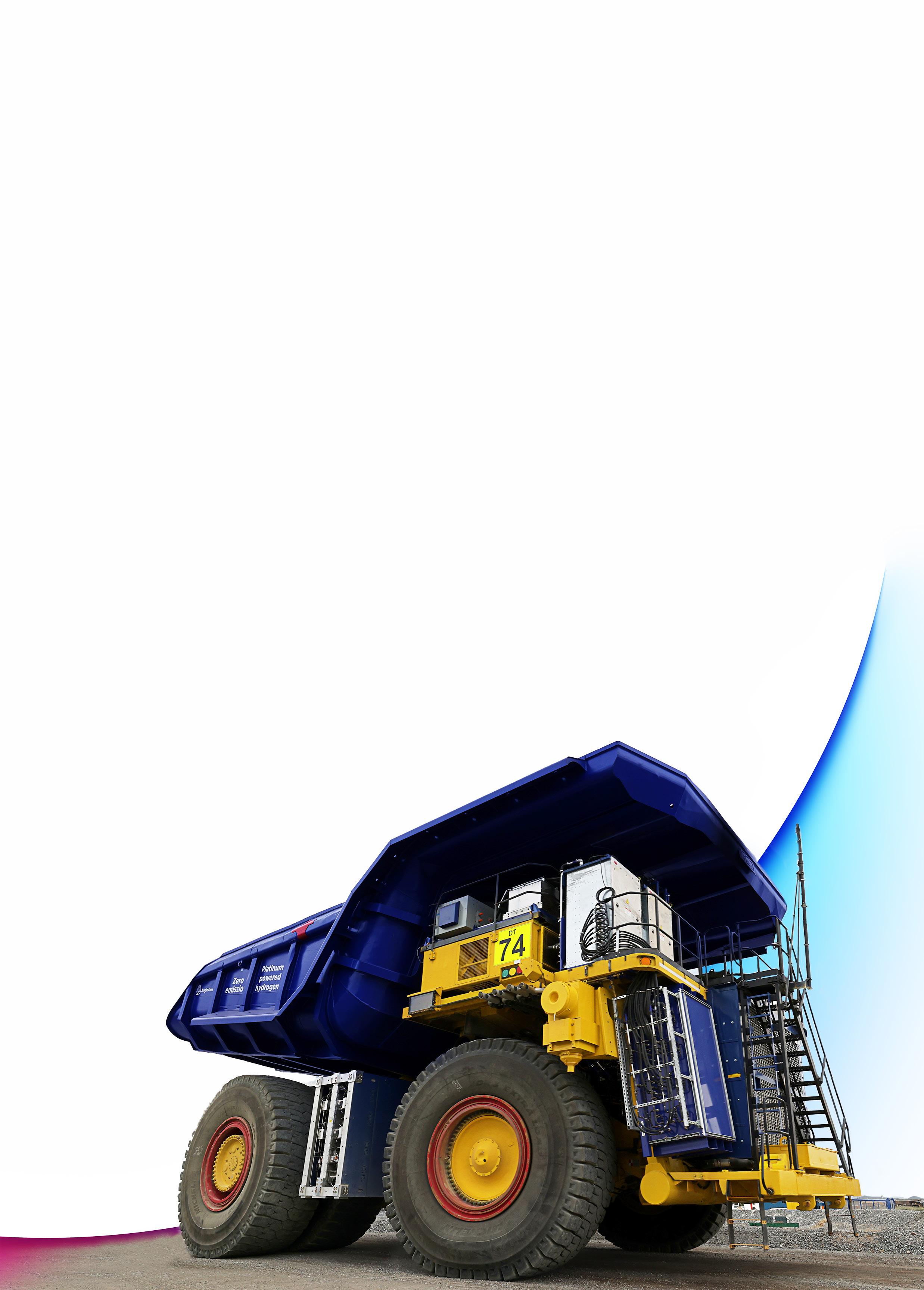

Light on emissions. Light on the environment. Fuelled by the lightest element on earth – hydrogen gas.

Our nuGen™ Zero Emission Haulage Solution (ZEHS) represents the future of mining. It’s an end-to-end integrated green hydrogen production, fuelling, and haulage system, featuring the world’s ‘lightest’ 510-tonne truck.

nuGen™ is one of the initiatives in our FutureSmart Mining™ programme that is making mining more digitised, integrated, and safer; supporting the environment, creating jobs, and helping us build a better future.

Scan the QR code to find out how our business is working towards a shared, sustainable future for all.

Together, we are shaping a better future.

South Africa is one of Africa’s leading industrialised economies, endowed with enormous

natural resources potential that is critical to enabling life as we know it and helping to decarbonise the world’s energy and transport systems.

In South Africa, Anglo American is actively helping realise this natural potential by sustainably producing many of the metals and minerals essential to realising the globe’s low-carbon future and developing a 3-5GW regional renewable energy ecosystem – in partnership with a global energy partner, EDF Renewables. This system has the potential to draw on the country’s abundant renewable resource potential and result in the construction of a network of on-site and off-site solar and wind farms. Each of Anglo American’s operations lies within a unique wind, solar, and topographic resource area.

One site may be suitable for solar power, and another is better suited for wind power generation. While each mine operation has different energy consumption patterns, when connected into a singular system, and as each site’s renewables become optimal, they are poised to deliver around-the-clock energy to all the company’s operations.

The goal behind the ecosystem is not only to provide for Anglo American’s energy demands but also to supply surplus energy into the grid while opening the door to developing an entirely new renewable energy generation industry and all the services that will support it.

Leveraging its FutureSmart Mining™ programme – bringing technology, digitalisation and sustainability together to make mining more integrated, automated, and carbon-neutral whilst using far less water – Anglo American has already secured 100% renewable electricity supply for all its operations in South America. It is expected that by next year, 56% of Anglo American’s global grid supply will come from renewables.

As the global mining company progresses towards its 2040 target of neutral carbon operations, its partnership with EDF Renewables is designed to abate the largest single source of its Scope 2 emissions, its current grid energy usage in South Africa.

The transition to a low-carbon future is not without challenges for a country like South Africa. These challenges cannot be addressed by any single entity, private or public. That is why transitioning to a lowcarbon future requires collaboration across institutional lines, joining civil society, communities, private sector, and government in a joint bid to ensure that the move to a low-carbon economy is just and seen to be so by all.

Anglo American supports South Africa’s just energy transition by placing people at the heart of its initiative. Already, over R5 billion in investment has been made in scalable, long-term economic development, education, and

health interventions to help improve the lives of its employees and help build thriving host mining communities.

Through the development and construction of the regional renewable energy ecosystem, Anglo American seeks to generate up to 40 000 new jobs by the end of the project.

The build-out of renewable energy across South Africa will also provide the foundation for developing a hydrogen economy through the production of green hydrogen. Earlier this year, in a world first, the company launched a pilot of an end-toend integrated green hydrogen production, fueling and haulage system for its mine sites – the nuGen™ Zero Emission Haulage Solution (ZEHS). This world-first and ambitious pilot project marks the first time a 220-tonne truck with a 290-tonne payload was converted to run on hydrogen. The truck is a 2MW fuel cell battery hybrid - the best available technology combination for this specific use case - with a hydrogen fuel cell providing roughly half of the power required and a battery pack the other half, allowing us to recover energy while braking.

Specifically, Anglo American expect hydrogen and electricity from renewable energy sources to progressively displace diesel and petrol for vehicles and other machinery. The economic development associated with these changes could also provide the backbone for creating a hydrogen economy in the region – thus helping to drive South Africa’s just energy transition farther through employment and economic activity in this supply chain and the construction and services sectors.

In this way, the pathway to Anglo American’s carbon neutrality offers a case for continued investment in South African mining, the catalyst for new economic activity around renewable energy within the region and supports a nation’s journey toward a just energy transition into the low-carbon economy of the future.

THE ECOSYSTEM’S GOAL IS NOT ONLY TO PROVIDE FOR ANGLO AMERICAN’S ENERGY DEMANDS, BUT ALSO TO SUPPLY SURPLUS ENERGY INTO THE GRID.

For almost 130 years, Rand Mutual Assurance (RMA) has been compensating injured miners and ensuring beneficiaries and their families receive the care to which they are entitled, following a workrelated injury or occupational disease. It is a well-established social assurer that is compassionate and caring, delivering beyond compensation of injuries and diseases.

The South African Constitution promotes equity for all people in the country, and this includes injured or disabled workers. The impending Compensation for Occupational Injuries and Diseases (COID) Amendment Bill is intending

to extend further duties to both employers and compensation funds, such as RMA, to participate in and fund workplace rehabilitation.

RMA is already committed to rolling out workplace rehabilitation ahead of the promulgation of this Amendment Bill. We spoke to Dr Miranda Moloto, head of the newly established rehabilitation division at RMA, to find out more about this worthy service.

Dr Moloto graduated from Sefako-Makgato Medical University and pursued a career in occupational and public health, following a short stint as a family practitioner. She studied health management systems after discovering that her passion lies in the betterment

of the broader population as opposed to impacting one patient at a time. She has worked in, among other areas, digital health and telemedicine (application of medicine and ICT) to deliver quality, efficient and accessible healthcare to underserved communities.

Having worked at RMA for almost a year—with the latter three months in the rehabilitation division—Dr Moloto feels she has come full circle in her career in occupational and public health, as an assurer of workers’ lives. “It felt like the logical next step for me to join an organisation that puts high value on social impact and compassionate compensation. It just made sense and resonated with my personal aspirations.”

Rehabilitation is a multidisciplinary team intervention designed to optimise functioning and reduce disability of an individual with a health condition.”

According to Recovery Partners (rrp.com.au), workplace rehabilitation is “a procedure designed to provide guidance and support to injured employees, and facilitate a safe and timely recovery and subsequent return to work.” Dr Moloto adds that rehabilitation does not reverse or undo the damage caused by trauma, but rather helps restore the individual to optimal health, functioning and well-being.

Rehabilitation makes sense for all individuals concerned, she says. “Some employers have been known to terminate injured workers without allowing an opportunity for rehabilitation. There is a greater demand for employers to understand and practise inclusion of workers even after injury. To protect and retain jobs, employers are required to think beyond the usual recruitment way.”

But workplace rehabilitation remains a contentious matter with many organisations because the art and expertise of rehabilitation does not really lie inside of a mine or a factory. “The workplace needs a conscience following an incident (injury or disease),” says Dr Moloto. “Rehabilitation is meant to begin while [the affected workers] are being treated in the acute hospital following an injury on duty. So, full participation in the journey of restoring dignity, mobility and more, in my opinion.”

Rehabilitation is a multidisciplinary team intervention designed to optimise functioning and reduce disability of an individual with a health condition. The whole chain of medical disciplines is involved in rehabilitation: nursing, physiotherapy, occupational therapy, speech therapy, psychotherapy. The family, the employers and caregivers are also part of the rehabilitative team.

Dr Moloto says rehabilitation services can include physical rehabilitation—work hardening, improving joint mobility, and releasing contractures after burns—as well as speech therapy to restore language and retrain the brain to perceive language.

“The workplace’s role is to seek to understand the limitations of an injured worker.“

She notes that previously, workplaces that provided occupational health services carried out disability/ incapacity management. The occupational health practitioner was traditionally the liaison between the treating specialist/ rehab professional as well as the line manager/human resources practitioner within the workplace. “In my view, this case manager remains central to the process. However, the COID Amendment Bill now places the line and HR managers in employee rehabilitation. They need to participate further in decisioning on adapting the workplace, paving the workplace to accommodate the disabled

worker within reason, and without safety risk.”

The wellness practitioner in the Employee Assistance Programme (EAP) has been playing the role of rehab practitioner by taking care of mental health and other psychosocial issues that impact workers’ productivity. “These services are unfortunately not accessible to most workers, as they are considered expensive and/or unnecessary. The rise in mental health issues, though, has put mental rehabilitation in the spotlight,” says Dr Moloto.

The workplace’s role is to seek to understand the limitations of an injured worker. This is done by attendance of rehab meetings called ‘family meetings’ with

the multidisciplinary rehab professionals. Thereafter, the workplace has a responsibility to utilise rehab professionals and occupational practitioners to ensure a sound return-to-work plan is drawn up.

Furthermore, explains Dr Moloto, the workplace needs to open opportunities of employment and promotion for the injured worker by implementing the ‘reasonable accommodation’ principle by adapting the job tasks, changing the worker’s tools, providing mental health through the EAP, as well as frequent reviewing of the worker’s condition via the rehab practitioner, case manager or occupational health practitioner (depending on the size of organisation).

LEBOGANG KHUNOU - IT LEAD khunoul@ngubane.co.za | 011 234 0800 COMPANY PROFILE

Built over 25 years of excellence as a multidisciplinary professional services firm, Ngubane is not just a team of accountants, auditors and consultants—we are trusted and reliable business partners that care about the future. Through industry experience, deep expertise and understanding of the wider global business perspective with its nuances and the South African politicaleconomic environment, we help create long-term value and limitless future growth opportunities for clients.

Because our solutions form part of the fabric of your organisation, we don’t just tick boxes, we provide sustainable answers, for sustainable results.

The Mining & Resources Industry significantly contributes to the South African economy. Ngubane understands that, and is the ideal thinking partner— providing in-depth consulting services that provide tangible results.

The following is an overview of our IT services:

As companies pivot toward more elaborate digitisation of business processes and value chains, data is exponentially generated and processed. Although this brings about myriad benefits, the threat of vulnerabilities is still lurking. These vulnerabilities can be influenced by a lack of security controls around applications, hardware and people who form part of business processes. We provide our clients with enablers to secure the digitalised environment by providing Assessments, Training and Awareness, Auditing and Compliance, and Consultancy services.

• Cybersecurity Health Check

• Vulnerability Assessments

• Penetration Testing

• Web App Assessments

• Wi-Fi Assessments

Training and Awareness

a) Cybersecurity Awareness & Training: We train users to be able to recognise an attack and remain compliant to organisational policies and procedures while responding to a security incident. Our scope covers phishing, malware, password security, desktop security, wireless security, incident response, business continuity, physical security, disaster recovery and ethical hacking depending on requirements.

b) Phishing Campaign Simulation: We either launch a standard or tailored phishing campaign simulation.

c) Wi-Fi Evil Twin Simulation: Our approach simulates attacks for clients and give insights with respect to cybersecurity hygiene pertaining to Wi-Fi.

a) Gap Analysis: We establish roadmaps aimed at closing identified gaps to achieve the required security control environment.

b) Regulatory Audits: We assist clients to achieve regulatory and statutory requirements.

a) Cybersecurity Governance and Risk Management: We help our clients with establishing governance documents and frameworks that aid the organisation with robust risk management and compliance practices. This ensures our clients are better equipped to manage cybersecurity threats such as data loss and leakage, ransomware infections, and advanced

persistent threats. We further assist clients to position cybersecurity at a strategic level, and to be addressed at such a level.

b) Policy Framework Design: We design practical policies and procedures in line with internationally recognised standards and frameworks.

c) Architecture, Networks, Applications, Cloud: We advise clients on measures to abate cyber risks associated with applications, networks and cloud systems. We provide advice on privileged account management and identity management, to mention a few.

As an integral part of corporate governance, boards are expected to ensure astute IT governance practices are implemented to enable business planning for IT, successful competitive positioning and fruitful business utilisation of IT. The advent of the King Code of Corporate Governance Report has brought the importance of IT governance to the fore, even more than before.

Our work revolves around establishing the adequacy and effectiveness of IT strategies, organisational structures, policies, procedures and investments in supporting corporate strategies and business operations, and therefore the business performance and sustainability. Our framework is tailored to assess, but may be further streamlined for detailed focus based on client requirements:

• IT strategic alignment

• IT investment management

• IT risk management

• IT resource management

Ngubane provides long-term value and limitless future growth opportunities for clients

Despite a perpetual increase in IT investment, a large proportion of IT projects still fail. IT projects are marred by high technical debt, cost overruns, low quality deliverables, late implementation and scope creep, among others. Late or non-delivery of IT projects sets organisations back in terms of the attainment of strategic goals. This means strategic objectives for which the projects are initiated are not met, or the return on investment is delayed.

• Our Project Assurance Framework that brings about transparency on projects spans the following:

• Pre-implementation Review

• End-to-end Assurance Review

• Post-Implementation Review

COVID-19 has put financial pressure on organisations across the globe, not only to be sustainable but to stay afloat. Boards and executives are expected to manage organisations optimally, even more than before. Within IT organisations, astute IT asset management is pivotal in enabling them to attain their sustainability goals. Also, with privacy regulations becoming even more important, organisations need to understand their software landscape in order to effectively minimise datarelated risks.

Our software licence management services enable organisations to have clear visibility of their software assets, contracts, licences and usage. Our services include:

• Compilation of Software Asset Management policies and procedures to manage software licences more effectively and thus lead to cost savings.

• Implementation and maintenance of licence inventory as part of the IT asset management process.

• Assessment of the licences that the organisation has in terms of number, usage, costs, contractual obligations, renewal schedules

• Review of licence agreements

• Determining usage for optimal cost control and operations support

With the continuous development of the Fourth Industrial Revolution, organisations have become more dependent on

technology. Technology is a necessity, as it allows for a faster, more convenient and more efficient way of running organisations. Businesses incorporate the use of technology for accounting, human resources, inventory, and customer relationship management, among other business technology benefits.

The processing of transactions are IT systems driven. As such, systems are inseparably part of the overall business processes and thus are to be assessed as part of auditing.

Our framework is tailored to assess, but may be further streamlined for detailed focus based on client requirements:

• IT governance (IT strategy, organisational structure, architecture and regulatory compliance)

• Information Security Management

• System Change Management

• Problem & Incident Management

• User Access Management

• Contract Management

• Physical Security Management

• IT Service Management

• IT Service Continuity Management

• Facilities & Environmental Controls

As the world moves toward digitisation of financial transactions, systems have become the centre of processes and thus stringent application controls should be in place to ensure access to and changes made to the data are accurate and valid. Application controls guarantee appropriate protection as well as the confidentiality, integrity and availability of the data processed via the application.

The objectives of the review of Application Controls are to:

• Ensure the completeness and accuracy of the records and the validity of the data.

• Ensure records processing from initiation to completion.

• Ensure only valid data is input or processed.

• Ensure unique, irrefutable identification of all users.

• Provide an application system authentication mechanism.

• Ensure access to the application system by approved business users only.

• Ensure data integrity feeds into the application system from upstream sources.

Our framework is tailored to assess but may be further streamlined for detailed focus based on client requirements: Input and Access Controls; File and Data Transmission Controls; Processing Controls; Output Controls; and Master Files and Standing Data Controls.

Technology innovations have resulted in bridging global boundaries. For enterprises as well as professionals, the question is no longer what technology can do for businesses but what businesses can do with technology and data.

The Computer Assisted Audit Techniques (CAATs) tools that we use allow massive data to be analysed timeously and effectively. Our framework is tailored to assess, but may be further streamlined for detailed focus based on client requirements:

• Audit support of CAATs.

• Continuous auditing (independent automated assessment and reporting of strategic key performance indicators, operations KPIs and key controls; and key financial controls.

• Continuous monitoring (automated analysis and reporting, facilitating continuous management selfassessment for strategic KPIs, operations and key financial controls).

Tools include: Nessus for network vulnerability assessments; Sekchek for operating system reviews; Aburtus and ACL for data analytics, continuous auditing and continuous monitoring; and Soterion for SAP Governance, Risk and Compliance.

For more information, visit www.ngubane.co.za

De Beers Group reported on the strong progress made in 2021 toward the achievement of its 2030 “Building Forever” sustainability goals in its latest sustainability report, published on 31 May this year.

In the first full year since announcing the 12 goals, De Beers made meaningful progress in each of its priority focus areas—leading ethical practices, protecting the natural world, partnering for thriving communities and accelerating equal opportunity— despite ongoing challenges presented by the COVID-19 pandemic that continued to impact the company’s operating environment in 2021.

• Increased capacity of De Beers Group’s innovative diamond traceability blockchain platform, TracrTM, which now has the ability to register up to one million diamonds per week;

• Launched the pilot of De Beers Code of Origin, a consumer-facing trusted source programme;

• Brought the first dedicated GemFairTM parcels of ethically sourced artisanal and smallscale (ASM) mined diamonds to market (GemFair is De Beers Group’s initiative to support the formalisation of the ASM sector);

• Implemented a land reclamation programme in Sierra Leone to bring old artisanal mine sites back to productive farming use, supporting livelihoods and food security for local communities.

• Reduced energy intensity by 11% as De Beers strives to be carbon-neutral across its operations by 2030;

• Continued to progress a project to build a 60MW solar farm at Venetia mine in South Africa;

• Launched Okavango Eternal—a five-year partnership with National Geographic to help protect the critical source waters of the Okavango Delta in southern Africa;

• Continued to actively manage biodiversity and protect threatened species across approximately 500 000 hectares of protected land in southern Africa (the Diamond Route);

• Completed a strategy for addressing Scope 3 emissions in De Beers Group’s global supply chain.

• Supported more than 2 600 jobs through enterprise

development initiatives in southern Africa and supported more than 18 000 students at 25 schools in South Africa;

• Commenced delivery of the partnership with National Geographic, which includes commitments to support the development of livelihood opportunities for 10 000 people across Africa’s Okavango Basin and help ensure water and food security for more than one million people;

• Pledged $6.8 million to support vaccine procurement and rollout in De Beers Group’s host countries, including establishing vaccination clinics at the company’s operations for employees and community members;

• Invested $35 million in social investment initiatives.

Accelerating equal opportunity

• Announced an additional $3-million investment to extend the AWOME programme in southern Africa, which is focused on supporting women entrepreneurs to grow their businesses—more than 1 800 entrepreneurs have been supported to date;

• Engaged 1 500 girls in STEM (science, technology, engineering and mathematics) in southern Africa in partnership with WomEng and provided 21 scholarships to women studying STEM at a university in Canada, in partnership with UN Women and Scholarships Canada;

• Awarded 12 young jewellery designers in De Beers Group’s host countries training opportunities through the company’s Shining Light Awards competition;

• Launched the #BlackIsBrilliant campaign in partnership with RAD Red Carpet Advocacy, bringing together black jewellery designers with top celebrity stylists.

Beyond its Building Forever sustainability commitments, De Beers Group continued to make a vital contribution to its host countries and communities through tax and royalty payments, employment and local procurement, which totalled $4.7 billion in 2021. In addition, 80% of the revenue generated by the company’s operations remained within host countries.

Bruce Cleaver, CEO of De Beers Group, said: “As the first full year since announcing our ambitious 2030 sustainability goals, 2021 was a pivotal year for our business. We embedded the goals into our operational and commercial frameworks, established critical foundations and partnerships, engaged with stakeholders and took tangible steps forward— all while continuing to operate against a backdrop of COVID-19.

“Our Building Forever sustainability goals underpin our commitment to create a better future for people and the planet, and we will continue to build on our strong momentum throughout 2022 and beyond.”

The full report, titled “Building Forever: Our 2021 Sustainability Report”, includes a detailed overview of progress, including relating to each goal, and is available to download from bit.ly/3vGHDWB.

Illegal and unregulated artisanal gold mining on the Witwatersrand Basin, located south of South Africa’s Gauteng province, is an increasing threat to community, industrial and state security. Reports on turf wars between rival gangs (bit.ly/3bSYMWb), or shootouts between illegal miners and security officers (bit.ly/3w1HJYZ) are commonplace.

But recent incidents point to a spike in the scale of illegal activity, conflict and criminality.

In October 2021, approximately 300 illegal miners, known as zama zamas, attacked and shot

at police and security officers (bit.ly/3SJxO40) when the officers tried to prevent them from delivering food parcels to underground miners.

In June 2022, about 150 illegal miners stormed gold miner Sibanye-Stillwater’s mothballed Cooke shaft near Randfontein in an attempt to gain control (bit.ly/3SHLIng).

And in July, South Africans were reeling at the horrific robbery and gang rape of a film crew (bit.ly/3Qdryjn) at a mine dump close to West Village, a multiracial suburb of Krugersdorp on the West Rand.

West Village community members have since spoken out about being “prisoners in their own homes” (bit.ly/3C1lLsR). They attribute rampant crime in the area over the last few years to the influx of illegal mining—a situation that law enforcement officials seem unable or unwilling to control.

In the wake of these incidents, the spotlight must turn to the systemic reasons artisanal gold mining has become such a threat to peace and security. These include the state’s decades-long failure to nip an unregulated and illegal artisanal gold mining industry in the bud. These incidents are also the result of the failure to formalise artisanal mining as a livelihood strategy through appropriate policies and legislative provisions.

Artisanal gold mining in South Africa is out of control—mistakes that got it here

Artisanal mining is a labourintensive form of mining that uses rudimentary tools and technologies. Other sub-Saharan African countries (bit.ly/3C3oxOw) recognise artisanal mining as a formal mining category. These include Burkina Faso, Côte d’Ivoire, the Democratic Republic of Congo, Ethiopia and Kenya.

Foundational policies in the early years of South Africa’s democracy did not support artisanal mining as a permanent livelihood strategy. The 1994 Reconstruction and Development Programme (bit.ly/2G18IuU) simply committed the government to encourage “small-scale mining”. This was on the proviso that safety, labour, environment and health conditions could be maintained. The 1998 Minerals Policy (bit. ly/3dpdLYq) identified artisanal with subsistence mining. It flagged the need for the state to employ resources to “control artisanal mining as effectively as possible.”

The 2002 Mineral and Petroleum Resources Development Act (bit.ly/3dkIdTz) only recognises large- and small-scale mining. It criminalises all mining outside these categories.

In addition, the 2005 Precious Metals Act (bit.ly/3zMfgrc) empowered the South African Diamonds and Precious Metals Regulator to regulate the acquisition, smelting, refining and beneficiation of gold. This removed the prior involvement of the South African Police Service and has been a key enabling factor for the unregulated gold mining industry.

An illegal artisanal gold mining industry takes root

South Africa’s Witwatersrand goldfields have produced over 30% of all the gold ever mined (bit.ly/3zK7PRa). But in recent decades, large-scale gold mining has declined precipitously. Between 2012 and 2019, the industry shed 42 000 jobs (bit.ly/3w1Iotr).

The Minerals Council of South Africa and police have identified a five-tier hierarchy (bit.ly/3dq4jnQ) in the illegal and unregulated gold mining industry. Illegal miners are on the bottom tier. Gangs and illegal mining bosses (bit.ly/3QGFRN0), licensed bulk buyers (scrap metal dealers and pawn brokers) at national or regional level, front company exporters, and international intermediary buyers and companies are the more significant criminal actors.

The Institute of Security Studies estimates that the approximately 30 000 illegal miners produce R14 billion (just over US$8 million) worth of gold per annum (bit.ly/3SP31mC). From the state’s perspective, this is “lost production”. The United Arab Emirates and Switzerland (bit.ly/3SLi8NF) have been identified as the primary export destinations.

Images: www.businesslive.co.za; www.dailysun.co.za

In this context, an illegal and unregulated gold mining industry, among the most lucrative and violent on the African continent, has taken root.

Thousands of illegal miners pursue artisanal mining as a permanent, though precarious, livelihood strategy (bit.ly/3QCVoOa). Recent PhD graduate Maxwell Chuma explored this (bit.ly/3SGgey1). He studied the natural, social, financial, human and physical capitals that frame artisanal mining in South Africa. He examined the push and pull factors that drive people into this high-risk activity.

The push factors include a loss of formal employment in the mining industry, lack of alternative employment opportunities, and drought conditions in neighbouring countries. The pull factors include the ease of accessing mineralised land, social capital provided by national and ethnic groups in control of illegal mining, and the relatively stable income.

The risks and illegality of the work itself, trespassing, the rampant use of mercury and the criminality of the sector (bit.ly/3w2Y2ET) make this dangerous and volatile work.

In 2014, the South African Human Rights Commission conducted investigative hearings into unregulated artisanal mining (bit.ly/3vUHoY7). The commission called for the state to institute an appropriate policy and regulatory framework to facilitate and manage artisanal mining as a livelihood strategy.

In March 2022, Minister of Mineral Resources and Energy Gwede Mantashe published the Artisanal and Small-scale Mining Policy (bit.ly/3drlHs4). The policy recognises the potential of artisanal mining as a livelihood strategy. But it reserves the permit system for South Africans. It tasks a National Co-ordination and Strategic Management Team to “halt” illegal mining.

The policy has been criticised for its failure to take public comments into account. It has also been criticised for its fantastical assumption that “platoons of illegal miners will miraculously stop their illegal activities overnight.” (bit.ly/3SJyHJS) Implementing the policy will also require legislative amendments, which may take years to finalise.

Mantashe, as well as the department, must urgently speed up attempts to formalise artisanal mining as a livelihood strategy. The department should properly engage the mining industry and civil society in this process.

At the same time, a coordinated transnational effort to break the stranglehold of the criminal syndicates must continue.

Applying a set of principles (bit.ly/3bSpUon) agreed by countries of the OECD

(Organisation for Economic Co-operation and Development) on managing supply chains in conflict and high-risk areas could also help manage the problem.

Finally, the powers conferred on the precious metals regulator need to be revisited. The changes need to ensure property security checks on sellers can be conducted and patterns in the supply of gold can be determined. Unscrupulous licensed bulk buyers of illegally mined gold must also be identified and brought to book.

Tracy-LynnField Professor of Environmental and Sustainability Law University of the Witwatersrand

Dr Maxwell Chuma Facilitator, Moderator and AssessorLearnEx Corporate Training

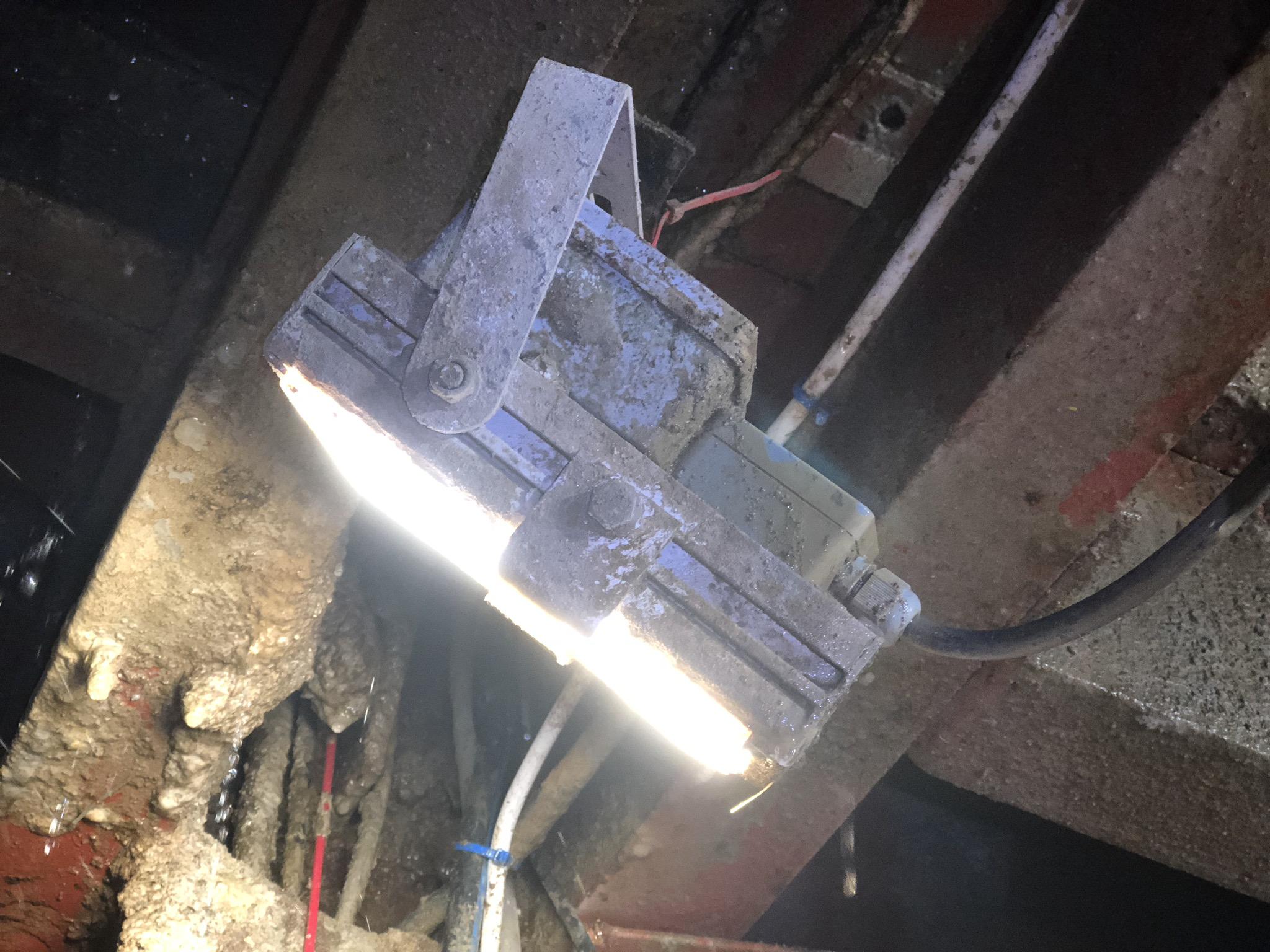

Diesel Electric Services has become a preferred partner

(PTY) LTD has been involved in the design, manufacture, delivery, installation, commissioning, service, maintenance and associated repairs of turnkey power infrastructure solutions in the mining industry since inception in 1993.

The company’s expertise lies in both greenfield sites as well as retro fitment and upgrades on existing infrastructure. Our strength in sitespecific solutions is what makes us a leader and preferred partner in the market.

In-house capability includes for regulatory approval associated with environmental impact assessments as well as fire department registration. To assist with local requirements with regard to regulatory approvals, an inhouse fuel containment system was development which varies between a two-hour and fourhour fire rating. This is engineered in accordance to client-specific requirements.

The staff complement consists of 550 full-time employees, separated into many teams, and managed by competent supervisors and managers i.e. Sales, Contracting, Manufacturing, Installations, and Technical Support, among others. This ensures a first-class, quick and reliable response to any possible client request or need.

The service department boasts a staff complement of 71 field technicians and 22 employees to assist with the administrative side, and are fully conversant in Pastel and the issuing of quotations.

The manufacturing facility is around 50 000 square metres of working space. At present there are two panel shops totalling 8 500 square metres, where manufacturing takes place.

These panel shops are fully equipped for basic sheet metal work, busbar bending and in-house programming of different control interface solutions offered to customers.

IEC/SANS 60439 requires detailed testing to confirm that one’s calculations are correct; this covers busbar supports, busbar spacing, riser supports, temperature rise, ventilation requirements, neutral bars support and earth bar mountings being the most important.

IEC/SANS 61439 allows verification without actual destructive testing being used.

By using successful FTT/PTT results from IEC/SANS 60439 in IEC/ SANS 61439, we have been able to complete a sequence of tests using the destructive tests covered by IEC/SANS 60439 as the verification process covered by IEC/SANS 61439.

Our CIDB accreditation includes for an 8EB, 8EP (Electrical) and 7ME (Mechanical) CIDB rating, proving we have excellent abilities to perform in the industry. Currently we are in the process of applying for an 8ME rating testimony to our mechanical capabilities and associated achievements.

Our combined technical expertise exceeds 1 100 years —that can only be obtained by years of experience.

For additional information, contact the company: Tel: 086 110 6633 sales@dieselelectricservices.co.za www.dieselelectricservices.co.za

Mining is not typically associated with visions of a circular economy. But if the world is to transition to a lowcarbon future, more minerals and metals will be required, not less. This shift will require vast volumes of copper, lithium, cobalt, platinum, chrome and manganese.

The circular economy is not a new concept, but it has been growing in importance —recently promoted by influential organisations such as the Ellen MacArthur Foundation (bit.ly/3QyxDHk) and the World Economic Forum (www.weforum. org/topics/circular-economy).

In our current economy, we take materials from the Earth, make products from them, and eventually throw them away as waste—the process is linear. In a circular economy, by contrast, we stop waste being produced in the first place.

The circular economy is based on three principles, driven by design. First eliminate waste and pollution, then circulate products and materials at their highest value, and finally regenerate nature. It is underpinned by a transition to renewable energy and materials. A circular economy decouples economic activity

from the consumption of finite resources. It is a resilient system that is good for business, people and the environment.

Africa is endowed with abundant mineral resources including gold, silver, copper, uranium, cobalt and many other metals that are key inputs to manufacturing processes around the world. However, extracting those precious resources from the ground comes at an environmental cost that is increasingly coming under scrutiny, and that is where circular thinking can play a huge part.

The African Circular Economy Alliance (ACEA) is a governmentled coalition of African nations with a mission to spur Africa’s transformation into a circular economy that delivers economic growth, jobs and positive environmental outcomes. By adopting circular economy principles, Africa’s mining industry can seize opportunities to reduce costs while mitigating risks associated with shifting consumer and investor preferences, and new regulations and standards.

According to the ACEA report, “Increasing Circularity in Africa’s Mining Sector” (bit.ly/3w8PYCA), given the economic contribution of mining to African countries, the circular economy would significantly contribute to creating a sustainable mining industry. For countries that depend on mining as the primary economic activity,

it contributes considerably to their foreign earnings. For example, Botswana mining has accounted for roughly 85% of national foreign exchange earnings, 33% of government revenue, and 25% of gross domestic product for the past four decades. The mining industry has a critical role to play in supporting the transition to a circular economy.

As we move along the energy transition and the demand for Africa’s mineral wealth increases, adopting a circular economy strategy can assist the mining industry adapt to increased pressure on limited resources. There are, however, challenges that need to be overcome in this circular journey, including deficient infrastructure. The lack of clean energy resources for the mining sector will impede the drive to reduce carbon emissions in the industry.

Part of a circular economy strategy is to optimise the use of resources, therefore designing efficient systems that use the circular economy principles will reduce consumption intensity and the cost of sourcing resources. An example of this can be witnessed with Syama Gold Mine’s shift to renewable energy from its existing source of power: a 28MW diesel generator. The mine signed a 16-year contract for a hybrid power plant with Aggreko (bit.ly/3ppL2FF). In 2020, Syama Gold mine’s cost of electricity decreased by 40% and carbon emissions by 20%.

One of the benefits of the circular economy is its ability to decrease operating costs by increasing operational efficiency.

The ACEA identified three crucial circular economy principles for the African mining industry to engage with. First to recycle, reduce and reuse resources and waste. Secondly, to regenerate natural resources, and finally to design out waste.

One of the chief areas for reuse comes in the use of water by the mining sector. Water is used to process minerals, transport slurry and control dust—and a large mine can use as much as 30 418 megalitres each year, enough to feed more than half of Africa’s population for a day. According to the ACEA, the mining industry is the second-largest water user, right behind agriculture, in South Africa. Effective management of clean water and wastewater is key to maintaining supplies of this resource.

The use of water can be decreased if the mines’ wastewater is recycled, reused, concentrated and reclaimed. Mining companies can improve wastewater management in three ways: lining waste and tailing dams to avoid water seepage; putting wastewater in tanks to prevent evaporation; and filtering water from slurry/ sludge/tailings before storing the waste in dams. Anglo American is developing a technology that will close the loop by creating a sealed system that increases efficiency and directs water recycling and reuse (bit.ly/3ppLqnB).

Other areas of the circular economy that fall into this category include recycling and reusing vehicle parts; repurposing waste rock; recycling and reprocessing tailings; recycling and reusing construction materials; rehabilitating mines for economic development; and recycling food waste for energy generation.

Mining uses a lot of energy, there is no escaping that. It is crucial throughout the life cycle of a mine, from exploration to processing the final product. Traditionally, the sector has relied on diesel and electricity from the grid to meet these needs. For example, figures from Glencore show that it uses up to 210 petajoules of energy annually—equivalent to the energy consumption of around 12.7 million people in Africa. This high energy use comes with an elevated level of carbon emissions.

By switching to renewable energy resources such as solar and wind energy to power mining operations can help regenerate natural systems. When compared to traditional diesel-powered generators, renewable energy is cheaper and produces less carbon emissions. One mine that has benefited from a transition to renewables is the Syama Gold Mine in Mali (pictured on opening page).

A more forward-looking and less accessible solution to reducing resource consumption and recycling waste is designing smart mines with the environment in mind. This entails building sustainability into the design process from the outset and looking to invest in renewable energy such as solar and wind, and employing technologies to eliminate water usage in mines. This would be most feasible for upcoming mining projects on the continent.

Some companies are already putting redesigning mining operations into consideration. Anglo American is currently investing in exploring a FutureSmart Mine (bit.ly/3c65qsn) that will be circular, save costs, increase efficiency, and ease mines’ operations. Pictured above is its nuGEN hydrogen-powered mine haul truck.

Mark Venables Consultant African Mining

Mark Venables Consultant African Mining

Indaba

In a circular economy, we stop waste being produced in the first place.

The recent passing of Nigeria’s new petroleum act heralds an exciting new chapter for Africa’s energy sector—but it’s complicated

The Joburg Indaba will be back in person this year at the Inanda Club, Johannesburg on 5th & 6th October. It is a highly influential mining industry platform, renowned for its straight talk, refreshing insights and collaborative atmosphere. Since its inception, the Joburg Indaba has developed a reputation as a highly regarded gathering that unpacks a wide range of critical issues affecting all stakeholders in the mining industry.

This year celebrating its 10th Anniversary edition, the Joburg Indaba brings together CEOs and senior representatives from the major mining houses, investors, Government, parastatals, organized labour and experts from legal and advisory firms.

Plus, the Gala Dinner returns on 4th October, where we will be inducting new members into the SA Mining Hall of Fame!

The recent passing into law of Nigeria’s Petroleum Industry Act (PIA), and the establishment of the Upstream Petroleum Regulatory Commission (www.NUPRC.gov.ng), marks the beginning of an exciting new era for the energy sector in Nigeria, West Africa and the continent at large.

Policy and regulatory clarity are essential to the development of Africa’s energy resources, and the oil sector in particular. The new act confirms that Africa is taking control of its own resources and setting the agenda for how they will be deployed.

The passing of the act follows decades of work to evolve the sector in line with the needs of the energy business in the industry, the communities impacted, and the Nigerian economy at large. However, the act is complicated, its language ambiguous, and its workings yet to be fully understood.

The Nigerian oil industry has grown significantly, and the energy landscape has changed enormously—hence the need for a new approach.

Nigeria remains Africa’s leading oil producer, with production of 86.9 metric tonnes during 2020 (bit.ly/3QFxEca). At the same time, oil plays a significant part in Nigeria’s domestic economy, with the oil and gas sector accounting for about 5.8% of the country’s gross domestic product (brook.gs/3AqpBdN) and 95% of its foreign-exchange earnings in 2019.

The passage of the act has come with a renewed assertiveness in the Nigerian oil sector, with underdeveloped assets being reallocated (bit.ly/3QxbU2p) and

CEO Gbenga Komolafe signalling a commitment to building synergy and smooth industry operations in the national interest (bit.ly/3SZKc06).

“The commission is very deliberate in identifying and promoting new projects and new field developments to boost the national oil production” says Komolafe. “We will continue to work with all stakeholders on these strategic areas.”

The new PIA dispensation will allow for the more efficient and sustainable allocation of Nigeria’s oil assets in the best interests of Nigerians and African people at large.

That said, the new environment is deeply complex, and the ambit of the new regulations is vast.

Image: www. businessday.ng

NUPRC

The Nigerian oil industry has grown significantly, and the energy landscape has changed enormously —hence the need for a new approach.

• South Africa Law Firm of the Year Chambers Africa Awards, 2021 & 2022

• ESG Initiative of the Year African Legal Awards, 2021

• Women Empowerment in the Workplace Award (Overall Winner: Southern Africa) Gender Mainstreaming Awards, 2021

• M&A Firm of the Year: South Africa International Financial Law Review Africa Awards, 2021

• Tax Firm of the Year: South Africa International Tax Review EMEA Tax Awards, 2021

The NUPRC, for instance, is tasked with ensuring compliance to petroleum laws, regulations and guidelines, as well as monitoring operations at drilling sites, wells, production platforms and flow stations, crude oil export terminals, refineries, storage depots, pump stations, retail outlets and pipelines.

It must also supervise all petroleum operations carried out under licences in the country, monitor operations to ensure they are in line with national goals; ensure health, safety and environmental compliance; maintain records on petroleum reserves, production, licences and leases; advise government on technical and policy matters, process licence applications; collect government revenues and maintain and administer the National Data Repository.

Besides the NUPRC, the Petroleum Act also established the Nigerian Midstream and Downstream Petroleum Regulatory Authority (www.NMDPRA.gov.ng). Together, these authorities are responsible for the technical and commercial regulation of petroleum operations in their respective sectors, and have the power to acquire, hold and dispose of property.

The act provides for the Nigerian National Petroleum Company to be run as a quasi-commercial enterprise, with its shares jointly held by the ministries of finance and petroleum.

The act also establishes the Host Community Development Trust Fund, which is geared to providing social and economic benefits for host communities where petroleum resources are located, and to enhance peaceful co-existence between licensees or lessees and host communities.

The PIA further establishes a hydrocarbons tax, to be levied on income from oil companies’ onshore resources such as crude oil, condensates and natural gas liquids.

The wide-ranging area of responsibility covered by the PIA, and the use of terms that have yet to be clarified in court, makes for a complicated piece of legislation that bears further explanation.

“Nigeria is to be congratulated on the progress it has made in codifying the terms for the exploitation of its oil assets,”

says Paul Sinclair, Africa Oil Week vice-president of Energy and director of Government Relations. “However, the global oil industry is clamouring for the chance to gain further clarity on the new laws. We look forward to doing just that, at Africa Oil Week [3 to 7 October, in Cape Town].”

Africa Oil Week offers pioneering insights, from ministerial panels to strategic outlooks designed to drive investment into the African upstream for the benefit of the continent. At the heart of the event are some of the most compelling insights into the upstream strategies of governments from across the continent.

Global oil industry investors will have an opportunity to inspect the granular detail of Nigeria’s Petroleum Industry Act and how they can get involved, where NUPRC CEO Komolafe and other senior Nigerian oil officials will engage with stakeholders on the new dispensation.

Africa Oil Week africa-oilweek.com

While South Africa has been preoccupied with rolling electricity blackouts, security of liquid fuels supply has been overlooked—even though, by my calculations, by value of sales it is 60% larger than electricity sales.

The one liquid fuels related story that attracted attention in the local media (bit.ly/3dNwZr1) was the temporary closure of an inland oil refinery due to delays in crude oil supplies. The refinery is owned by Natref, a joint venture between the chemical and energy company Sasol—the majority shareholder—and TotalEnergies.

No details have been given about the closure. But it is a rare occurrence and probably a consequence of disruptions to global logistics and oil supplies caused by Russia’s invasion of the Ukraine.

Natref is the last surviving oil refinery in South Africa. Three others were closed in the past two years.

These refinery closures and the possible permanent closure of the Natref refinery are shots fired

in the long-running contestation between the oil refiners and the government, which has been trying to introduce cleaner fuels specifications (bit.ly/3dNj8kd)— and, in parallel, policies requiring oil companies to keep some stocks to act as a buffer against occasional supply interruptions.

Both policies are in line with international trends. The attempt to move to cleaner fuel specifications began in 2006 and is aimed at assisting the domestic auto manufacturing industry, which produces mainly for European markets, where engines need to match Europe’s cleaner fuels.

The oil industry’s response to the government’s cleaner fuels initiatives has been robust. Initially, it sought to blackmail the government by threatening closure unless the government gave it the capital to upgrade its refineries, without any consequent ownership rights. The industry euphemistically termed this a “cost recovery mechanism” (bit.ly/3dNDry0). The government eventually backed down from its

deadlines. But it did not succumb to the demands for cash gifts.

In the latest round, the two Durban refineries made good on their threats: Engen (Petronas) in 2020, following an explosion and fire (bit.ly/3dOlMq7), and Sapref (Shell and BP) after its temporary closure during the insurrection in July 2021 (bit.ly/3c9SstN). Natref appears to be playing a waiting game on the government’s latest deadline, which has been shifted from 2023 to 2027.

If the government holds the line, Natref may also close, with possible knock-on effects for Sasol’s coalto-liquids plant in Secunda, whose production is partially integrated with that of Natref.

The closures of South Africa’s small, old and inefficient refineries are economically painful in the short term. But they also offer the prospect of better outcomes—economic, environmental and security of supply—if the government acts sensibly, particularly in relation to electric vehicles.

The government has pursued an import substitution industrialisation approach to the liquid fuels industry since the 1930s and has used various regulatory instruments (bit.ly/3AhfPcC) to protect the oil refiners.

But the need to move to cleaner fuels to support local auto manufacture has proved to be a tipping point. The difficulty for the auto manufacturers is that it does not make commercial sense to manufacture two engines for each vehicle—one for South Africa’s dirty fuels and another for Europe’s cleaner fuels. The domestic auto industry has, like refining, long been protected by the government. It occupies a key position at the heart of South Africa’s manufacturing industry and its interests appear to have been chosen over those of the oil refining industry.

The refinery closures hold implications for the future of auto manufacturing and transport in the country.

In the short term, fuel imports are meeting demand. But the auto manufacturers face a new threat to their European markets: electric vehicles. Some local auto manufacturers have appealed to the government to include electric vehicles within its support and subsidy programmes. At present, the import of electric vehicles is actively discriminated against. But the Department of Trade, Industry and Competition is dragging its heels.

There is a good prima facie case for South Africa to switch to electric vehicles. Imported US dollar–denominated petroleum could be substituted by mainly rand-denominated solar and wind-based power generation. The productivity gains from more efficient electric vehicles and the impetus to South Africa’s emerging battery

manufacturing industry are part of the case. This could also be seen as the ultimate version of the government’s long-running import substitution industrialisation.

The closure of the oil refineries has actually made it easier for the government to switch its attention to electric vehicles, which would also assist in meeting its international emissions targets. It also means the adjustments envisaged in the just energy transition (bit.ly/3QYTmb5) have, in effect, already happened in the refining industry.

Returning to the question of security of supply for internal combustion engines, there are also advantages for the government in so far as strategic stocks are concerned. Since there are fewer oil refineries, less crude oil stocks are required. This may be a good thing, given the troubles associated with them.

Firstly, there is the economic argument that strategic stocks sterilise large quantities of cash. In turn, this has a high opportunity cost in South Africa with its many other pressing social needs.

The Minister of Mineral Resources and Energy told Parliament in 2022 that the strategic oil stocks were valued at R1 750 764 252 (bit.ly/3c8EVmj).

Secondly, there are governance issues. In 2015, the Strategic Fuel Fund illegally sold 10.3 million barrels (the entire stock) at bargain basement prices to oil traders. In 2020, the High Court returned the stocks to the fuel fund (bit.ly/3dNjveB).

The closure of oil refineries has inadvertently provided a windfall for fuel users: it has allowed the government to sell off some of the stocks (bit.ly/3cfs8yb) and use the proceeds to subsidise fuel prices during an oil price spike.

These subsidies are to be partially funded by the sale of strategic oil stocks to the value of R6 billion (bit.ly/3c8EVmj). By my estimates, this represents approximately half of the strategic stocks, which leaves a bit more than the surviving refineries need.

A much better solution would be to hold strategic stocks of refined products in the inland market, which is approximately 60% of the South African market (bit. ly/3Adah34). Although discussed in the government at least 20 years ago, this option has not been pursued.

Does the closure of the refineries affect South Africa’s security of supply? Not much. The country has merely swapped reliance on crude oil imports for refined product imports. Rather than international supply risks, the bigger risks seem to be domestic (bit.ly/3py9vsz).

The 1998 White Paper on Energy Policy (bit.ly/3Kf9GTc) said that the government would maintain three months of oil supplies. But there has never been a budget allocation to allow the country to reach this level.

In 2012, the government gazetted a draft plan proposing that its holdings be reduced to 60 days, supplemented by the industry holding 14 days of refined products. The draft has never progressed to a final policy, probably due to financial constraints and the industry’s unwillingness to foot a part of the bill.

There has been no shortage of ideas and policy proposals on strategic stocks in democratic South Africa. The shortage is of cash to fund the ideas. Given South Africa’s increasingly constrained finances, there seems to be little prospect of security of supply being resolved soon. Security of supply may only be improved when South Africa switches to electric vehicles.

Rod Crompton Adjunct Professor African Energy Leadership Centre Wits Business SchoolWhat is the government’s policy on the security of supply?

The refinery closures hold implications for the future of auto manufacturing and transport in the country.

N(ULP and LRP) and oil. We supply products as a wholesale to larger commercial clients and enter into supply agreements with depots, retailers, mining, agricultural and similar commercial clients.

We source our products from various refineries and storage facilities in South Africa, such as Sasol (supply from Secunda, Natref), Caltex and Engen (supply countrywide) and Total (supply from all Total depots).

This, in turn, makes it possible for us to negotiate rebates for contracts/potential business deals and clients, should the volumes/ amounts in litres/kilogrammes be of viable sorts.

We offer delivery of products to our customers‘ door, wherever they are in South Africa or the Southern African Development Community

Lesotho, Malawi, Mozambique, Namibia, Swaziland, Tanzania,

petroleum industry. We supply a range of underground and above-ground storage tanks, tank ancillary equipment and diesel bowsers (diesel carts)—and export

Our service is our reputation and credibility. We are one of the fastest delivery services, with excellent sales and expertise in the field.

www.njizepetroleum.co.za

Njize Petroleum provides a one-stop service

Companies operating at sea must embrace conservation and sustainability —and not wait to be forced into it

Compared to all other institutions in the world, corporate enterprises have the most significant impact on the environment. According to the Carbon Majors Report published by the Carbon Disclosure Project in 2017 (bit.ly/3d7Ou5d), 100 companies are responsible for 71% of global emissions.

Given corporations’ contributions to climate change —and other environmental issues— executives need to understand both the impacts and solutions to the world’s environmental concerns. As a corporate strategy and innovation researcher, I was curious about the level of sustainability understanding and innovative problem-solving among top executives at companies that operate at sea, including oil & gas, shipping and logistics, mining and minerals, cruise lines and agriculture.

The United Nations’ Sustainable Development Goals (sdgs.un.org/goals) provide a blueprint for sustainable organisational practices. Corporations should be cognisant of these areas and make productive efforts toward sustainable development. For companies operating at sea, marine conservation and the sustainable use of oceans, seas and marine resources should be a top priority.

Growing marine traffic is expected to add to friction—such as collisions or the introduction of invasive species—between ships and ocean life. Global transportation and logistics forecasts suggest maritime traffic could increase by as much as 1 209 percent by 2050 (go.nature.com/2HFpErf). The preservation of ocean life requires deliberate measurement and management in the form robust environmental, social and corporate governance (ESG) reporting by those companies operating at sea.

ESG reporting, however, is still in its infancy in the ocean industries (bit.ly/3QEjYxE) and marine impact measures are more qualitative than quantitative. My recent research shows that reporting practices on ESG among companies operating at sea are not a top priority, which puts the health of the marine environment at risk.

Today, most CEOs subscribe to the stakeholder theory (bit.ly/3BB1Pwg) that argues a firm’s purpose is to create value beyond its shareholders.

Since the 1960s, stakeholder theory has been the dominant perspective among businesses. Corporate social responsibility (CSR) is a firm’s commitment to fulfil its social and environmental obligations in pursuit of its economic objectives (bit.ly/3TYmgui).

According to a 2006 study by leading strategy researchers, Michael Porter and Mark Kramer (bit.ly/3dgZZau), not only does CSR

benefit society, it also enhances competitiveness and business performance among participating enterprises. CSR “has emerged as an inescapable priority for business leaders in every country,” they write.

Over the past 20 years, businesses have also focused on measuring their environmental and social responsibility efforts. In contrast to the ideals and goals CSR qualitatively identifies, ESG reporting quantitatively measures firms’ CSR impacts and progress.

My research explores current ESG reporting practices among companies operating at sea. Based on 14 interviews with large multinational companies operating at sea and an examination of their ESG reports, I found:

• A lack of consistency among reporting measures;

• Superficial organisational knowledge and reporting; and

• Industry change will only occur as a result of consumer advocacy or regulation.

Preserving life below water is one of the UN’s Sustainable Development Goals. But many of the reports examined in my study excluded marine life and ocean sustainability metrics.

Among the reports that included information on marine life, the approaches to measure impact and progress had not been standardised, yielding poor and ineffective quantitative environmental. The executives of these companies described the importance of action and disclosure of progress in this area, but lacked the specific knowledge to measure and manage their impact.

It is evident from the reports and interviews that ESG reporting standards must be established, and precisely indicate how companies can fulfil their social responsibility in this area.

My research also confirmed prior work that suggests ESG reporting in the area of marine life is qualitative and superficial.

Many executives communicated that they face myriad public issues and do not prioritise reporting on marine life, such as the impacts

their operations may have on marine animals, their efforts to preserve biodiversity, and ocean pollution. Instead, they said their ESG reports were designed to provide a high-level summary of their commitments and progress toward ocean sustainability.

However, executives acknowledged their operations at sea are deemed to be less concerning to the general public as compared to other issues because they were less visible. Accordingly, ocean life sections of ESG reports were not as in-depth as others such as clean energy.

The final and most concerning finding was the reactionary approach for the executives to change. They described how they would take necessary steps toward change, but only out of necessity for survival.

As one CEO stated: “There are so many issues and we can’t always be proactive. If we were required to make changes to how we operate and report, we always would. But the push would have to come from the public or regulators.”

This is a problem, given the importance of the ocean’s

ecosystem to overall planetary health (bit.ly/2SKHzms). Tiny ocean plants called phytoplankton, for example, produce 50% of the oxygen in the air we breathe. There is, however, some hope.

As Peter Drucker, an Austrian American management consultant, educator and author, aptly stated: “What gets measured gets managed.” (bit.ly/3RHngSb) Without meaningful, specific and quantitative measures to assess progress and innovations that support change, success in reaching environmental goals is unlikely.

The findings of my research are somewhat promising, as they show executives are willing to commit more resources to sustainability efforts. However, it is evident there needs to be a clear path and support for such efforts from all stakeholders. It is concerning that sustainability efforts of our most precious resource are nebulous and not considered a top priority.

Grant Alexander WilsonAssistant Professor: Marketing Hill and Levene Schools of Business University of Regina

ESG reporting standards must be established, and precisely indicate how companies can fulfil their social responsibility in this area.

Environmental Social Governance (ESG) is a global phenomenon that has become the industry standard for investors to evaluate the long-term sustainability of mining organisations. This movement started in 1997 when the Global Reporting Initiative (GRI) developed the first and most widely used standards for sustainability reporting. ESG has evolved into a global sentiment that compels companies to adopt frameworks that provide transparency to sustainability goals. These events led to the publication of standards by the Sustainability Accounting Standards Board (SASB) in 2018. ESG compliance is a mine’s responsibility to implement processes that minimise pollution, reduce the impact on local communities and create longevity through sustainability for all its stakeholders. Shareholders expect board members to implement strategies, initiatives, goals and targets to ensure long-term profitability.

The mining industry will forever be criticised for its environmental and social impacts. However, in the years, many companies have taken steps to improve their ESG performance. One way they are embracing ESG is by increasing their transparency and disclosure around issues such as water use, and energy consumption, social responsibility and ethical behaviour.

Mining companies’ most significant challenge is implementing a digitised ESG solution. The ESG framework requirement is so vast that the executive and management teams often don’t know where to start. Industry leaders like XGRCSoftware have developed implementation roadmaps underpinned by a range of integrated system solutions. They’re designed to meet all the requirements of an organisation’s ESG strategy, from planning to monitoring and reporting, by aggregating ESG data in a single, auditable framework that drives compliance and corporate sustainability.

ESGs plays a pivotal role in the mining industry mainly because it is devoted to improving the living conditions of communities surrounding these mining sites. They plan it through various means by providing them with training courses, microenterprise development programs and more, which support sustainable livelihood opportunities. It helps to achieve social goals like gender equality and increased employment rates among youth. All this data should be available in a single, auditable environment that transforms all this information into an Asset (DataAsAnAsset).

An ESG software solution, implemented and maintained correctly, is a potent tool that creates longevity and sustainability through protecting the environment, stakeholders like communities and employees based on international best practice standards. It ensures sustainable growth for all different types of stakeholders. XGRCSoftware can help mining companies today by implementing a digital ESG solution to assist management and executive teams to be more competitive tomorrow. ESG should become an integral part of any organisation’s operations.

www.xgrcsoftware.com info@xgrcsoftware.com