During this time, the Gautrain has carried 126 million train passengers and 38 million bus passengers safely and with almost perfect reliability. Just like the rest of the world, Tthe Gauteng Province is facing, global warming through unsustainable carbon emissions. The transport sector plays an important role in this matter and it is responsible for 18% of all man-made greenhouse gas emissions.

The International Association of Public Transport estimates that by 2025, 60% of the world population will live in cities and there will be 6.2 billion private motorised trips made every day in cities worldwide.

The end result will be gridlock, pollution, road traffic accidents and time wasted. The current trajectory is unsustainable, and public transport solutions are needed. Earlier in the year, the MEC for the Gauteng Department of Roads and Public Transport, Jacob Mamabolo, made an announcement determining the Phase 1 route of the proposed extension of the rapid rail line from Sandton to the north-western areas of Gauteng. A plan which will support the greening of the Province’s economy. In 2014, the CSIR did a study that calculated the impact of people moving out of their cars and onto rail – specifically the Gautrain. The institute calculated that by 2020 over 70,000

It has been 12 years since Gautrain first opened its doors to passengers on 8 June 2010. Since then, it has become a system

embedded in the public transport infrastructure and economy of Gauteng.

ISSUE #9

FEATURES

14 MINERALS

Nedbank CIB, through its Corporate and Investment Banking division, is financing lucrative projects as well as sustainability and clean-energy solutions in the African mining industry

REGULARS

10 FROM THE EDITOR Connecting with Africa

12 EVENTS

Conferences and meetings for the African mining industry

How Africa can capitalise on its mineral wealth to develop an electric vehicle value chain

20 ENVIRONMENT

How metal-munching microbes help the rare, toxic element tellurium circulate in the environment

26 HEALTH

A new project in Uganda aims to reduce toxic mercury use in artisanal and small-scale gold mining

32 RENEWABLE ENERGY

Africa’s competitive edge as a clean hydrogen hub PLUS a look at the “Africa’s Extraordinary Green Hydrogen Potential” report

42 INFRASTRUCTURE

Developing Nigeria’s—and Africa’s—infrastructure for gas-to-power projects requires the right kind of vision

42

14

20

26

Africa’s natural gas export infrastructure has the potential to be repurposed to transport hydrogen across Africa and to Europe

Through YES, integrate youth job creation into the Mining Charter and your social and labour plans (SLPs). Create jobs outside the mining industry to build communities that thrive.

Join over 2,200 businesses transforming their companies and communities.

Don’t get left behind.

#SayYES

Go to www.yes4youth.co.za or mail corporatesupport@yes4youth.co.za to find out more about our YES mining turnkey solution.

Anglo American updates on carbonneutrality, biodiversity and responsible mining assurance

The tangible truth of where your mining culture is taking you

76

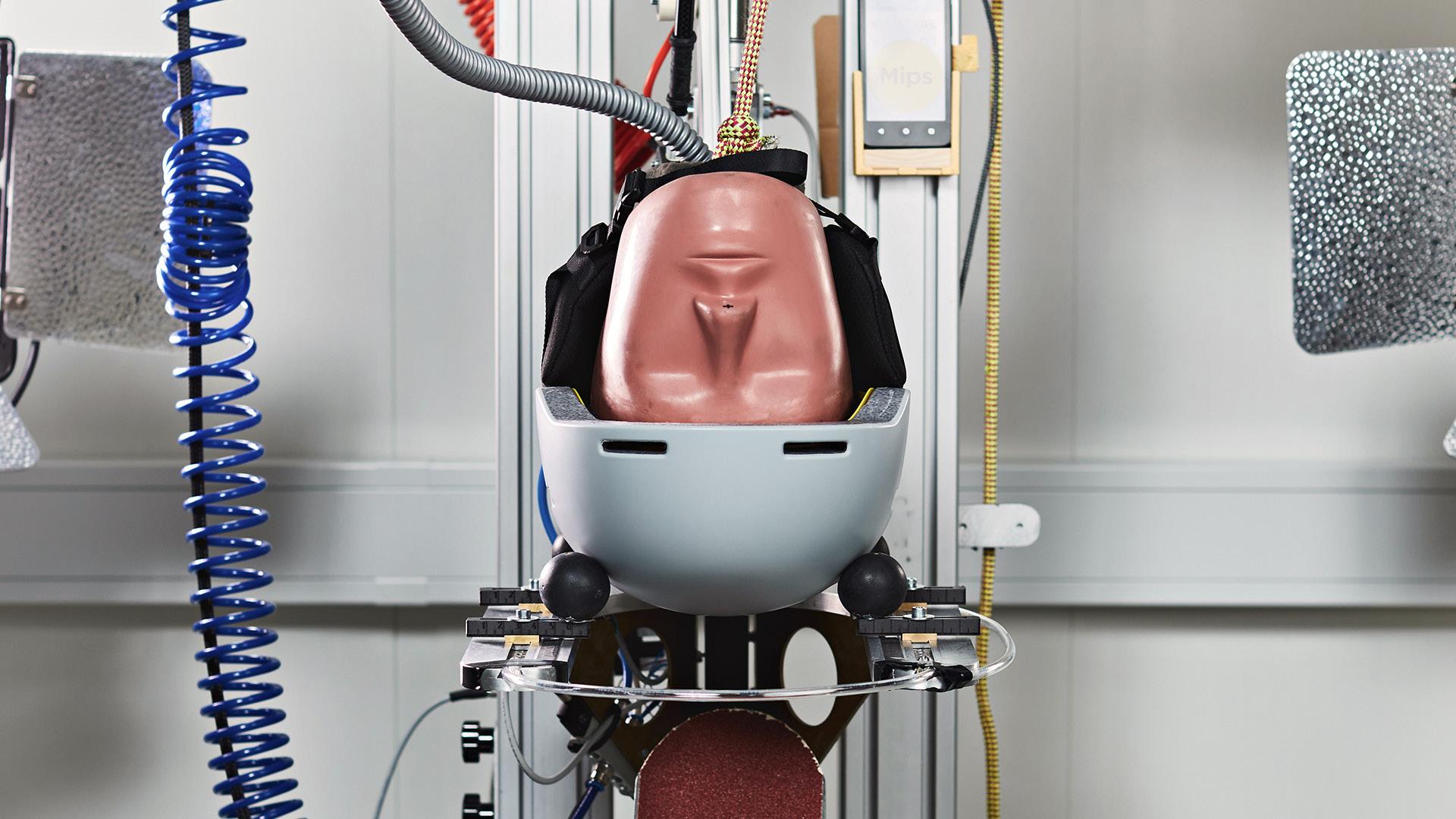

Two safety companies are optimising head protection for people in the working environment

80 IN FOCUS

African upstream activity is trending higher in 2023—what’s driving the increase?

84

Why cyber defence should be a critical component of an environmental, social & governance strategy

90 LAW

The Model Law on Institutional Investor-Public Partnerships initiative will help unlock funding for African climate projects

96 OIL

Treatment of wastewater in Nigeria’s oil fields is failing, raising the risk of health hazards

102 TECHNOLOGY

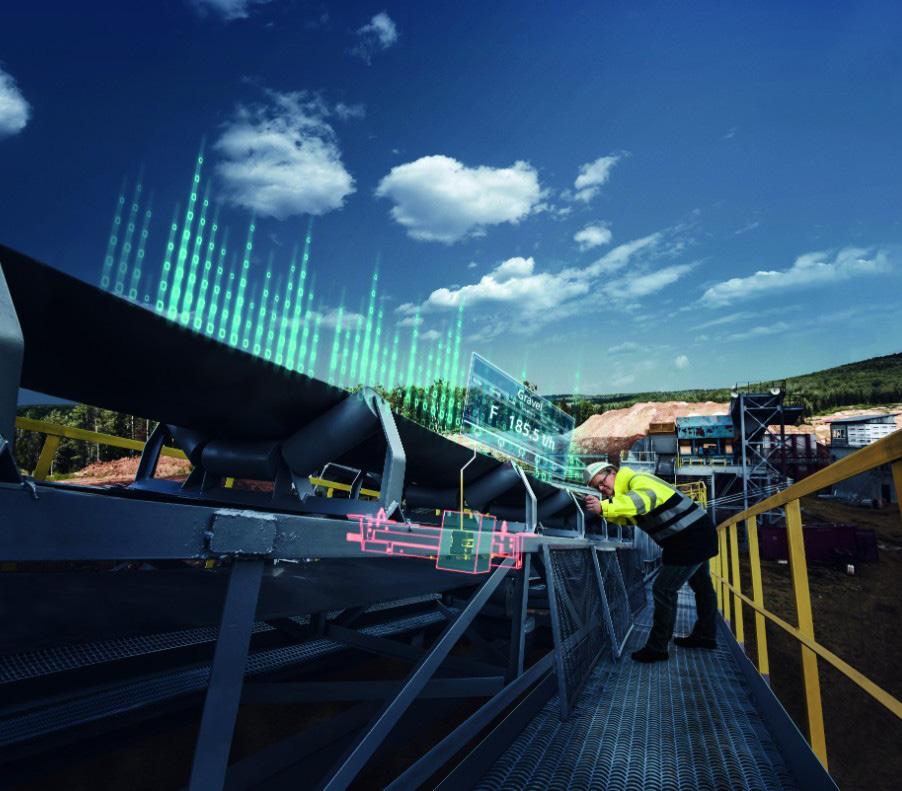

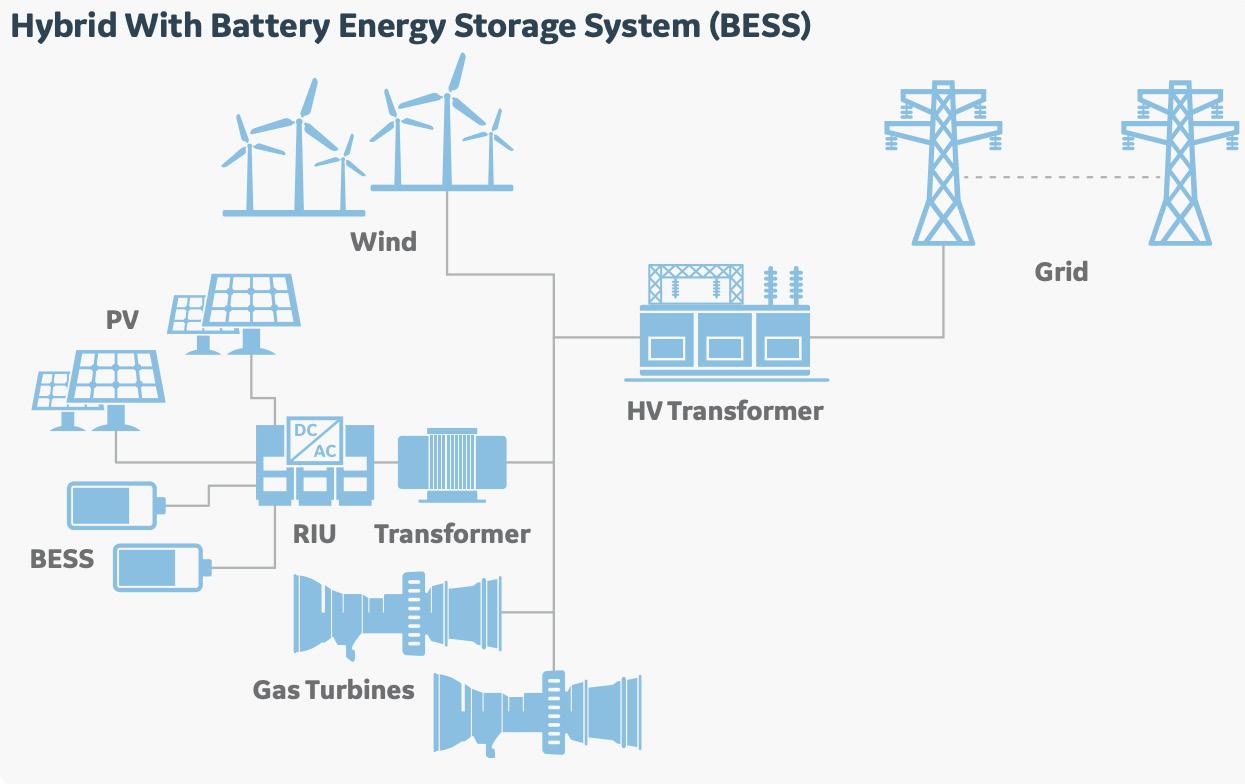

GE is fostering a more sustainable energy transition in mining operations

110

MSME Future Forge is preparing mining SMEs, which supply the mining and energy sectors, with critical business skills

116

A youth training initiative launched by Namibia and Equatorial Guinea has set the tone for an ambitious local content drive

120 GAS

Africa’s gas markets could help solve Europe’s energy crunch in the medium term PLUS Republic of the Congo is set to amplify its LNG production and exports

Kathea Energy is a company born out of Kathea Communications, one of South Africa’s most established and respected distribution businesses in information technology sector: The year 2015 marked its entry into renewables, with the creation of Kathea Energy.

Kathea Energy aims to solve energy problems through partnering with market-leading solar brands, providing innovative products that offer South African businesses and consumers sensible and lasting solar solutions.

Their most important partnership has been with Huawei. Says executive head Sabine Moser, “Our relationship with Huawei began in Kathea Communication, our IT Business in 2015 with video-conferencing products. Once we established our Solar Business, we teamed up with Huawei Fusion Solar. We are now proud to be their largest distributor in sub-Saharan Africa.

“Huawei is a global leader in digital power solutions, and has the strongest solution set available of any inverter manufacturer, so we are very fortunate to be in this partnership with them.”

Moser explains that Kathea Energy has remained true to its roots as value-added distributor; providing numerous solar & PV related hardware, such as solar panels, grid-tied and hybrid inverters, battery systems and other associated accessories, in both the commercial and residential markets. Kathea Energy’s clients include residential and commercial installers and large EPC’s (Engineering Procurement & Construction). She continues “There are very few barriers to entry in this space, but we have found that the difference is made in the provision of excellent pre- and post-sales support. Kathea Energy has invested in a substantial support team and are renowned in the industry as having the best sales and technical support structure for the products we supply.”

ACES Africa is the continent’s leader in building-integrated photovoltaics (BiPV) and one of Africa’s leading solar PV companies, with over 70MWp installed in six countries. ACES works with local partners, renowned investors and best-in-class suppliers that share the company’s values to ensure the best projects are realised.

“ACES Africa is a full turnkey EPC [engineering, procurement and construction] contractor,” says cofounder and managing director, Anré Gous. “We started as an electrical contracting business, Webgear, in 2003 before jumping into renewables in 2015 when everybody started recognising the renewable energy gap. Now, our business is 99.9% solar engineering.”

The company has offices in Johannesburg and Cape Town, as

well as in Nairobi, Kenya—servicing clients throughout the continent.

“Wherever the project is in Africa, we can basically implement our work. Most of Africa is quite reachable for us,” says Gous.

“We also service many of the largest EPC’s in South Africa. What makes us a little different is that we have our own construction teams— not many of the EPC’s do. Some of the other EPC’s in the country also rely on our construction abilities to help them execute projects throughout Africa.”

In 2020, ACES won phase 2 of a tender to supply the Mediclinic Group with solar PV on 10 of its private hospitals throughout South Africa and Namibia, supplying around 5MW. It was grid tied solar systems with generator integrations. This solar rollout is helping Mediclinic attain its net-zero targets, and saving the group money on electricity.

“Now we are busy rolling out phase 3, which will add another 5MW. So,

What is driving the massive growth in solar energy in South Africa is the shortage in supply of electricity, both in the residential and commercial space. “The return on investment of solar power energy creation has always been there” says Moser , “but the electricity provision problems that are being experienced in South Africa has certainly added to the impetuous and motivation for small and large scale transformation towards sustainable energy creation, and this has obviously been advantageous to our business”.

Moser continues: “This increase in adoption has also contributed to the pricing of these solutions becoming more accessible to both small scale and large scale businesses, as well as homeowners.” The trend is certainly moving in a positive direction, and Kathea Energy, along with its partners, such as Huawei, are thankful to be in a position to make this positive change in South Africa, and sub-Saharan Africa.

when we’re done with this phase, we would have implemented 10MW across 24 hospitals in southern Africa,” Gous shares. “So it’s about 1 320 solar panels if you want to put it in module terms. But 705kWp is relatively large for the healthcare sector. From a size perspective, we’re basically supplementing 30% of Mediclinic’s hospital energy off that specific site. In month one, we saved around R200 000 on demand charges.”

ACES used Huawei 100KTL (100kW) three-phase inverters on the Mediclinic projects. “Huawei is our inverter supplier, and we get very good support from them. I think 90% of our PV systems across Africa have been with Huawei products. We chose Huawei because of their reliability and a few other technical benefits. Out of 300 inverters that we’ve installed over the last two years, we haven’t had one failure. Price is also very competitive.”

#9

134 HUMAN RIGHTS

Communities’ rights are being exploited by the Simandou iron ore project in Guinea PLUS Meya Mining in Sierra Leone

150 INTERNATIONAL

54% of projects extracting clean energy minerals overlap with Indigenous lands, research reveals

154 OPINION

Never underestimate the importance of the geoscience companies in Africa

158 REGULATORY

Disappointing licensing rounds: Direct negotiations could be a winwin in 2023 for African oil & gas

164 TAXATION

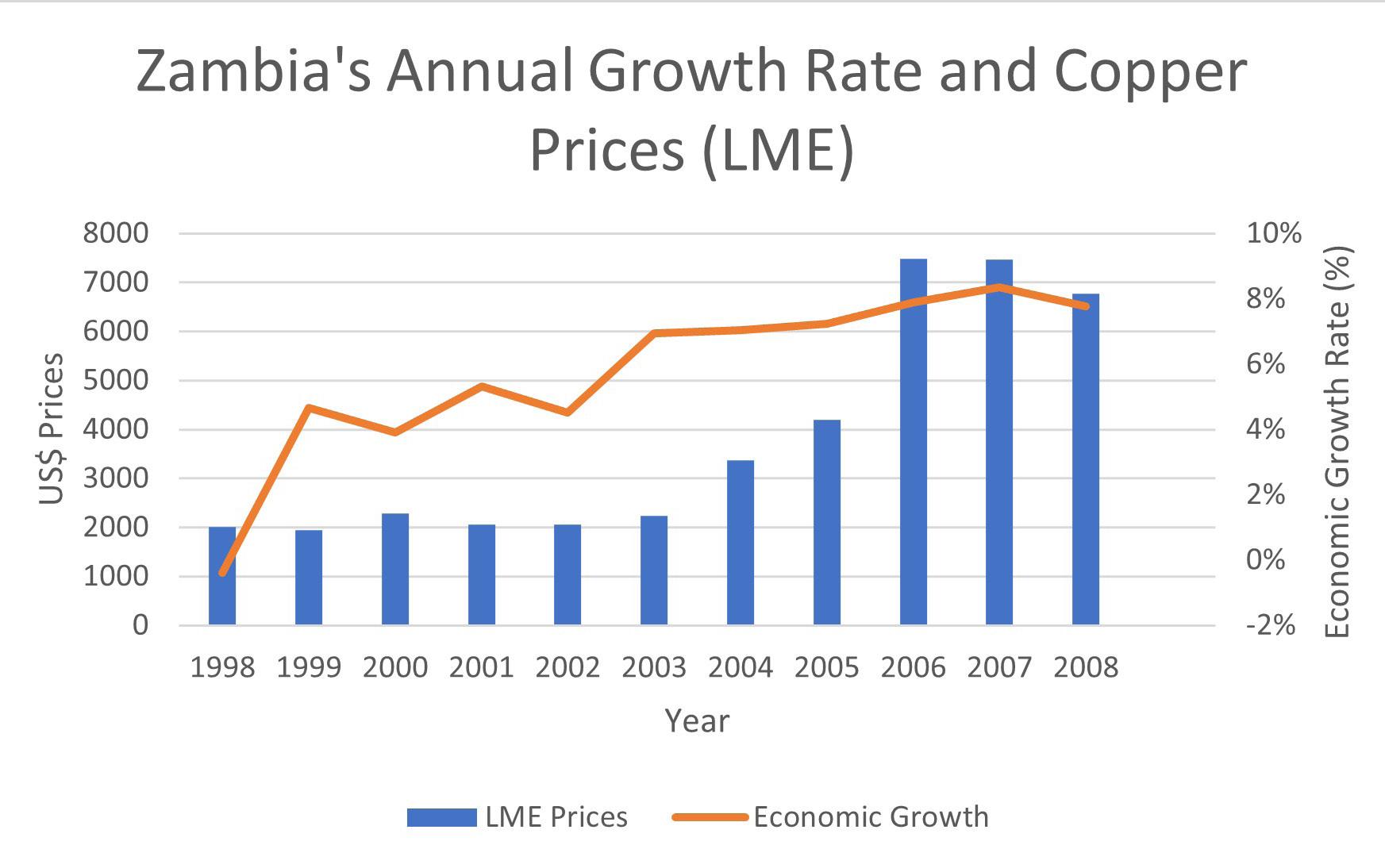

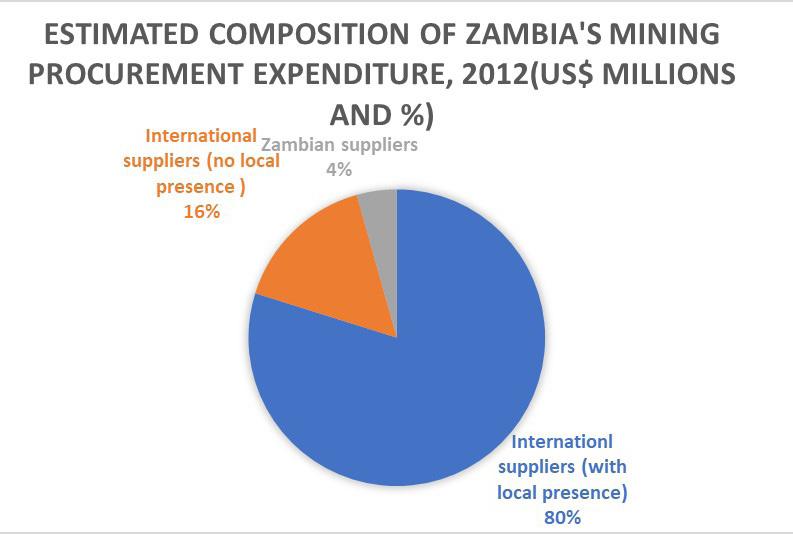

Climate change action could set off a copper mining boom: how Zambia can make the most of it by harnessing non-tax benefits

170 PUBLICATIONS

The latest edition of the “Energy Invest: Equatorial Guinea” report is the most comprehensive guide to the Central African nation’s diverse energy market

134

150 174

182

164

174 CONSERVATION

Mining and armed conflict threaten eastern DRC’s biodiversity in a complex web

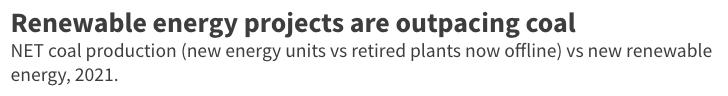

182 COAL

Global coal use in 2022 reached an all-time high

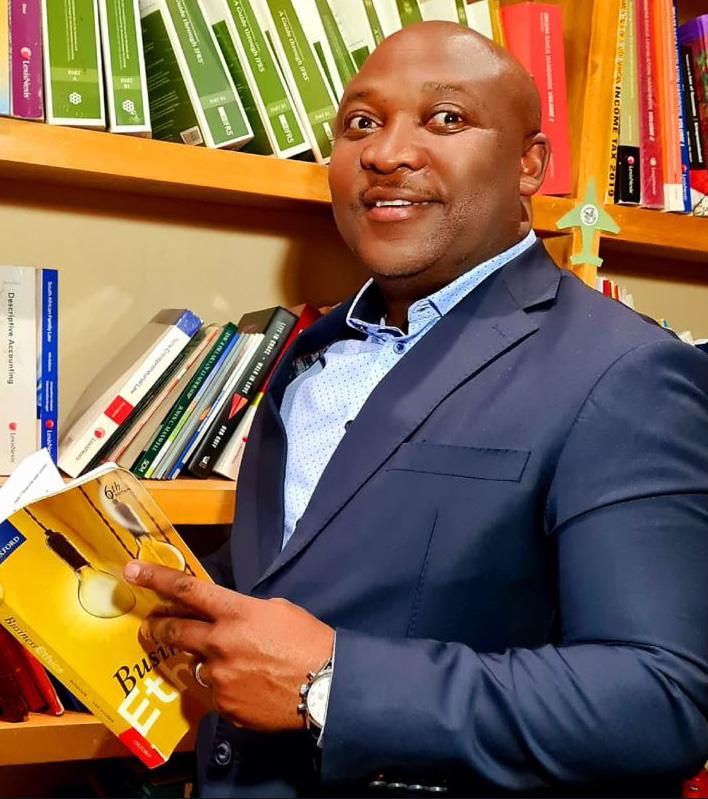

Welcome to 2023, and edition 9 of African Mining News, our first for this year. Despite the year still being in its infancy, I’ve already had the good fortune to have celebrated a momentous event: I turned 50 in January!

But the inception of the new year marks another momentous annual event, The Investing in African Mining Indaba: where the world connects with African Mining™. High-powered mining executives rub elbows with politicians, business is transacted, and colleagues just share a laugh and catch up.

It’s where the mining community comes together to spark change and drive investments, and where the top minds of the industry share their expertise—the likes of Nolitha Fakunda from the Minerals Council SA, Natascha Viljoen from Anglo American Platinum, Dr Nombasa Tsengwa from Exxaro Resources, and Mark Bristow from Barrick Gold Company. Not to mention South Africa’s Minister of Mineral Resources & Energy, Gwede Mantashe. (Be sure to read our profile on his department, outlining how they intend bringing about SA’s Just Energy Transition.)

The importance of this event, and the calibre of attendees, is witnessed by the fact that already two weeks ahead of the opening, the crowd-control barriers were in place. This was soon followed by the closure of streets around the Cape Town International Convention Centre, the venue of this illustrious conference.

I’d like to welcome all the Mining Indaba delegates, exhibitors and media to Cape Town. I encourage everyone to take some time to explore this wonderful city that I call home. Have a pleasant and prosperous stay.

PUBLISHER: Donovan Abrahams

EDITOR: Ashley van Schalkwyk - ashley@avengmedia.co.za

CHIEF SUB-EDITOR: Tania Griffin

DESIGN: Christine Siljeur

EDITORIAL SOURCES: TheConversation.com, Kaspersky in Africa, NJ Ayuk, African Energy Week, planetGOLD Uganda, Human Rights Watch, Amnesty International, DLA Piper, Energy Capital & Power, Herbert Smith Freehills, MSME Future Forge, Anglo American, GE Gas Power

IMAGES: stock.adobe.com

PROJECT MANAGER: Donovan Abrahams

ADVERTISING SALES: Viwe Ncapai, Lunga Ziwele, Carl Chothia, Charlton Peters, Andre Evans, Vijay Sathnarain

ONLINE CO-ORDINATORS: Majdah Rogers, Ashley van Schalkwyk

ACCOUNTS: Benita Abrahams, Bianca Alfos

HUMAN RESOURCES MANAGER: Colin Samuels

CLIENT LIAISON: Majdah Rogers

PRINTER: Print On Demand

DISTRIBUTION: www.africanminingnews.co.za, www.issuu.com

DIRECTORS: Donovan Abrahams, Colin Samuels

PUBLISHED BY: Aveng Media

DISCLAIMER:

© 2023 African Mining News magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of print.

SAIPEC is the only energy, oil and gas event held in partnership with the entire sub-Saharan African petroleum industry. It continues to place its emphasis on the future of the energy, oil and gas industry in the region, with collaboration at the forefront of its objective and local content at its nucleus. It attracts hundreds of national and international oil companies, EPC (engineering, procurement, construction) contractors, service companies, technology providers and the whole oil & gas value chain for engaging and progressive discussions, business transactions and cross-border collaboration.

This conference is the region’s showcase of the latest technology in the mining & processing of minerals, earthmoving, safety equipment and much more. Minerals that have been identified in Tanzania include gold, iron ore, nickel, copper, cobalt, silver, diamond, tanzanite, ruby, garnet, limestone, soda ash, gypsum, salt, phosphate, coal, uranium, gravel, sand and dimension stones.

Cape Town International Convention Centre, South Africa energyindaba.co.za

This conference will discuss, debate and seek solutions to enable adequate energy generation across Africa. A diverse group of luminaries and high-profile speakers will share their real-world insights about the changing energy landscape in Africa. Learn more about energy policy and the role of government, energy funding, green hydrogen, grid technologies, renewable and cleaner energy, energy storage and energy efficiency. Co-located with the 8th Annual Africa Gas Forum (9 March).

8th Sulphur and Sulphuric Acid Conference

The Vineyard Hotel, Cape Town, South Africa

www.saimm.co.za

The production of SO2 and sulphuric acid remains a pertinent topic in the southern African mining and metallurgical industry, especially in view of the strong demand for, and increasing prices of, vital base metals such as cobalt and copper. To ensure you stay abreast of developments in the industry, participate in this conference on the production, utilisation, safe transportation and conversion of sulphur, sulphuric acid and SO2 abatement in metallurgical and other processes.

Hazendal Wine Estate, Stellenbosch, Cape Town, South Africa

www.saimm.co.za

The primary purpose of the first Hydrogen and Fuel Cells conference is the advancement of green hydrogen technologies in southern Africa and the global community, by highlighting the power of renewable and sustainable technologies and addressing the emerging challenges—through the exploration of fuel cells, hydrogen storage and hydrogen generation by way of engagement with industry, academia and government. The two-day conference will feature high-level scientific talks and posters, complemented with keynote and plenary presentations on country overviews, status of leading and major players in the southern African and global arena.

Privately-owned BSSC Radiators continues to develop and transform itself into a market leader, with over four decades of diverse experience and service in the mining industry.

Privately-owned BSSC Radiators continues to develop and transform itself into a market leader, with over four decades of diverse experience and service in the mining industry

Privately-owned BSSC Radiators continues to develop and transform itself into a market leader, with over four decades of diverse experience and service in the mining industry.

Privately-owned BSSC Radiators continues to develop and transform itself into a market leader, with over four decades of diverse experience and service in the mining industry

Through this experience servicing the mining industry, among others, BSSC aims to ensure efficient product delivery – with design and manufacturing to customer specifications. “Irrespective of the duty or application, we have the experience to optimise the heat transfer product for you,” the company enthuses.

Through this experience servicing the mining industry, among others, BSSC aims to ensure efficient product delivery – with design and manufacturing to customer specifications. “Irrespective of the duty or application, we have the experience to optimise the heat transfer product for you,” the company enthuses.

Through this experience servicing the mining industry, among others, BSSC aims to ensure efficient product delivery – with design and manufacturing to customer specifications. “Irrespective of the duty or application, we have the experience to optimise the heat transfer product for you,” the company enthuses.

Through this experience servicing the mining industry, among others, BSSC aims to ensure efficient product delivery – with design and manufacturing to customer specifications. “Irrespective of the duty or application, we have the experience to optimise the heat transfer product for you,” the company enthuses.

Specialising in a wide range of heat-transfer products and services, the company’s competitive advantage, it notes, remains its industry knowledge, solutions-focused approach, and commitment to personalized services, quality standards, the latest innovative practices and reliability.

Specialising in a wide range of heat-transfer products and services, the company’s competitive advantage, it notes, remains its industry knowledge, solutions-focused approach, and commitment to personalized services, quality standards, the latest innovative practices and reliability

Specialising in a wide range of heat-transfer products and services, the company’s competitive advantage, it notes, remains its industry knowledge, solutions-focused approach, and commitment to personalized services, quality standards, the latest innovative practices and reliability

Specialising in a wide range of heat-transfer products and services, the company’s competitive advantage, it notes, remains its industry knowledge, solutions-focused approach, and commitment to personalized services, quality standards, the latest innovative practices and reliability

Essentially, BSSC strives to design heat-transfer products that improve cooling system capabilities for a high output and long-lasting lifespan. Linked to the company’s “uncompromising determination” to achieve a “first time, every time” ethos, clients can be assured of “superior service”

Essentially, BSSC strives to design heat-transfer products that improve cooling system capabilities for a high output and long-lasting lifespan. Linked to the company’s “uncompromising determination” to achieve a “first time, every time” ethos, clients can be assured of “superior service”

Essentially, BSSC strives to design heat-transfer products that improve cooling system capabilities for a high output and long-lasting lifespan. Linked to the company’s “uncompromising determination” to achieve a “first time, every time” ethos, clients can be assured of “superior service”.

Essentially, BSSC strives to design heat-transfer products that improve cooling system capabilities for a high output and long-lasting lifespan. Linked to the company’s “uncompromising determination” to achieve a “first time, every time” ethos, clients can be assured of “superior service”

BSSC further prides itself on an extensive footprint within South Af rica, and Af rica where it supplies products and services to, inter alia, sectors ranging f rom industrial and mining to agricultural, and industries including earthmoving, plant hire and contractors, locomotives, transportation and oil and gas.

BSSC further prides itself on an extensive footprint within South Af rica, and Af rica where it supplies products and services to, inter alia, sectors ranging f rom industrial and mining to agricultural, and industries including earthmoving, plant hire and contractors, locomotives, transportation and oil and gas.

BSSC further prides itself on an extensive footprint within South Af rica, and Af rica where it supplies products and services to, inter alia, sectors ranging f rom industrial and mining to agricultural, and industries including earthmoving, plant hire and contractors, locomotives, transportation and oil and gas.

BSSC further prides itself on an extensive footprint within South Af rica, and Af rica where it supplies products and services to, inter alia, sectors ranging f rom industrial and mining to agricultural, and industries including earthmoving, plant hire and contractors, locomotives, transportation and oil a

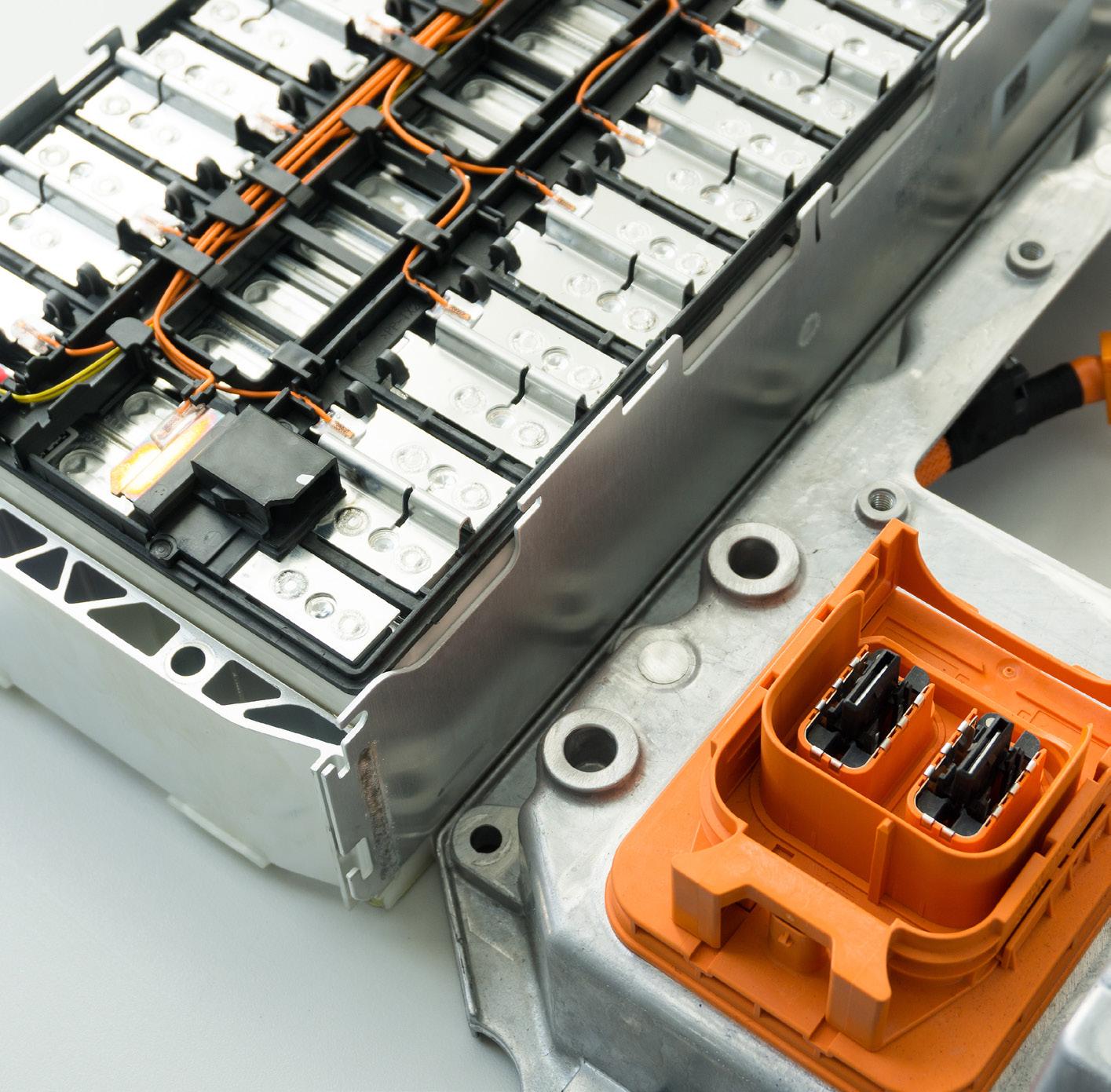

Africans need to pay critical attention to Africa’s position as a key source of critical minerals. Climate change and energy poverty are two sides of the same coin.

Let’s not forget, Africa is blessed with some of the world’s largest reserve of metals and minerals needed for batteries, including lithium and cobalt—making the continent a key supplier for the global energy transition. The African Energy Chamber believes that when we process these minerals in Africa, we rapidly eliminate emission-spewing shipments of the continent’s minerals and commodities.

As the entire global transportation marketplace marches toward an increasingly electrified and battery-powered future, many countries across the African continent stand at the threshold of profound economic opportunity. Now is the time to take action and decide whether or not Africa steps across it.

Countries around the world are encouraging their citizens to transition to electric vehicles (EVs) for both transportation and shipping. In many cases, governments are mandating their adoption by setting firm dates for total bans on gasoline-powered cars and trucks. Considering these circumstances, demand for EV batteries and the raw materials used in their manufacturing process will likely increase

exponentially in the years ahead.

Africa supplies a significant portion of the metals critical to producing the lithiumion batteries that power EVs: namely cobalt, manganese and phosphorus and, to a lesser extent, lithium, iron, copper and graphite. Unfortunately, African mines export most of the minerals extracted to Europe and China, where much of the work that adds to their value takes place. Processes such as beneficiation— the treatment of raw, mined materials to improve their physical or chemical properties—and the smelting and refining that occurs before EV battery assembly, cannot be performed in Africa because there is no infrastructure for it.

To begin the process of building the required infrastructure,

African countries should move closer toward a thorough capitalisation of their mineral resources. As noted in our newly released report, “The State of African Energy: 2023 Outlook”, “They can benefit from value-creation investments by developing the right market to support local demand for these metals, the right infrastructure to create an industrialisation ecosystem, and the right capital markets to stimulate the muchneeded investments across the battery value chain.”

Ongoing developments both in Africa and abroad have the potential to bring the concept of a fully integrated African EV value chain into reality.

The first of these developments is the war in Ukraine. Russia holds a sizeable market share of the global metal production industry. The country is a net exporter of aluminium, copper, pig iron, direct reduced iron, iron ore and nickel. Russia also produces 37% of the world’s palladium supply and 11% of its platinum—metals essential to the worldwide production of catalytic converters. Focusing specifically on EV components, Russia also produces 17% of the global supply of highpurity nickel used in battery manufacturing and 4% of global copper—amounts that establish the nation as one of the world’s most prominent metal suppliers.

Russia’s invasion of Ukraine caused numerous countries to impose import bans on Russian commodities. International companies, independent of their home countries, also initiated ‘self-sanctions’ on Russia by withdrawing their operations from the nation or restricting the sale of their goods within its borders. While the United States and the European Union have yet to announce any sanctions

on Russian metal, this status could change in the near future as the continued tensions in Ukraine do not suggest any coming de-escalation.

Africa could potentially fill the gaps left by a Russian absence from the global mineral supply chain. South Africa, Zimbabwe and Madagascar can collectively supply iron ore, nickel and the platinum group metals, while Zambia and the

Democratic Republic of the Congo can provide copper. Africa’s own demand for Russian imports of steel and aluminium could be affected by sanctioninduced complications. Investing in African infrastructure and developing a domestic supply chain would add diversity to the global metals trade and safeguard it against any future political upheavals or military conflicts.

Demand for EV batteries and the raw materials used in their manufacturing process will likely increase exponentially in the years ahead

Another promising development is Africa’s burgeoning EV industry. Rwanda and Ghana have declared their intentions to make the transition from gasoline-powered vehicles to EVs, while Rwanda and Kenya have committed to incentivising domestic production. Egypt aims to produce 20 000 EVs per year beginning in 2023. Namibia has a goal of 10 000 EVs by 2030, and South Africa expects to see 2.9 million by 2050.

While much of the conversation about EVs pertains to four-wheeled cars, motorcycles and tuk-tuks have always been more popular transportation options in Africa. The global EV market recognises this preference. In 2021, 44% of all twoand three-wheeled vehicles sold were electrically powered.

Previously, Africans had no choice aside from imported e-bikes and trikes, but now companies like Lagos-based Metro Africa Xpress (MAX) are manufacturing them at home. MAX’s newest model, the M3, is a low-cost, long-range motorcycle capable of carrying heavy loads. MAX expects upward of 70% of sold units to serve as commercial taxis.

This increased level of EV adoption, whether brought on solely by consumer choice or encouraged by government policy, will inevitably bring about increased demand for EV batteries. This demand could be satisfied by domestic mining and manufacturing—two links in a larger, fully African EV value chain.

The ratification of the African Continental Free Trade Agreement primed industries across the continent to establish a network that could leverage the expertise and resources of its individual members to create an EV battery manufacturing chain capable of servicing the needs of both African and global markets. Proceeds from this arrangement could fund enhancements to African infrastructure—an evolution that would, in turn, attract further international investment.

To properly seize the opportunities in front of us at present and to ensure the success of this endeavour, it is imperative that we acknowledge past mistakes and current conditions. An undertaking of this scale will require collaboration between governments, cohesive policy agreements, and uniform tax incentives. We cannot progress without commitments to improve roads, expand ports, and provide reliable and affordable electricity. We must also address the glaring workers’ rights issues affecting the subcontracted miners currently labouring at the foundation of this proposed value chain.

If we can work together to resolve these complexities, Africa will be ready to step into a bright, sustainable and profitable future.

NJ Ayuk Executive Chairperson African Energy Chamber

African countries should move closer toward a thorough capitalisation of their mineral resources

23 Blue Street, Isithebe Industrial Township

P.O. Box 51, Mandeni 4490

KwaZulu Natal, Sout Africa

Tel: +27 (032) 459 1364

Email: info@skema.com

Reg No: 96/08120/07

• Tube Rolling

• Thread Rolling

• Thread Rolling

• Re-Bar Bending

• Thread Rolling

• Re-Bar Bending

• CNC Machining

• Re-Bar Bending

• CNC Machining

• Production Pressing

• CNC Machining

• Production Pressing

• Robotic Welding

• Production Pressing

• Robotic Welding

• Bright Steel Drawing

• Robotic Welding

• Bright Steel Drawing

• Coating – Electro Galvanising

• Bright Steel Drawing

• Coating – Electro Galvanising

• Coating – Electro Galvanising

Friction rock stabilisers and roofbolts are able to perform under some of the most stringent conditions.

Friction rock stabilisers and roofbolts are able to perform under some of the most stringent conditions.

Friction rock stabilisers and roofbolts are able to perform under some of the most stringent conditions.

Our

The key element to our success is to focus on our quality.

One of the key elements leading to Skema's success over the past thirty years has been the company's never-wavering focus on quality - starting as a regional winner, to a national player, to the international contender that it is today.

The Design of Skema’s Friction Rock Stabilisers allows them to tighten as lateral rock displacement occurs, enhancing their yield capabilities. After installation (when ground shifts can loosen an ordinary bolt), the Friction Rock Stabiliser tube grips more tightly.

www.skema.com

We recognise the greater needs of the community... Skema also recognises the fact that a firm’s responsibilities are not limited to the needs of its clients, employees and shareholders, but also to the greater needs of the community and environment.

Certain microbes can effectively munch on gold, slowly transforming gold nuggets into chemical forms that can move through the environment.

New technologies often mean elements start moving through the environment in new ways. Take lead plumbing: It helped provide access to fresh water for the masses, but left a toxic legacy that remains to this day (bit.ly/3XrcJNc).

As we transition away from fossil fuels, we are turning to technologies reliant on rare elements that had few uses in the past. One of these is tellurium, an element found in an increasing number of solar panels.

How do we anticipate the potential pitfalls of a dramatic increase in the flux of tellurium through the biosphere? And how do we secure safe and reliable supplies of this commodity?

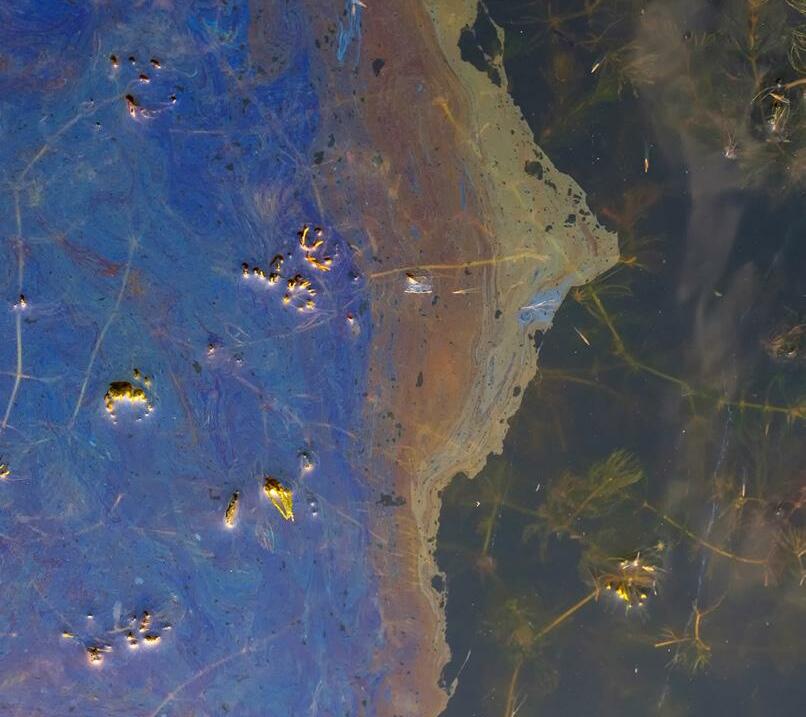

To start answering these questions, we travelled to an abandoned gold mine in Mexico, and discovered how metalmunching microbes are moving this elusive element through the environment.

Tellurium is as rare as gold in Earth’s crust, with only around 1 milligram in each metric tonne of average crustal rock. The silvery substance was discovered only in 1783, and until recently its main claim to fame was the fact it can make you smell unpleasantly like garlic if you handle it.

Tellurium is often found in gold deposits. Despite gold’s famous reputation for durability, over the

past 15 years we have discovered the precious metal is remarkably mobile in the environment—even growing in trees! (bit.ly/3Xn1Ko7)

It turns out that certain microbes can effectively munch on gold, slowly transforming gold nuggets into chemical forms that can move through the environment. These mobile gold compounds (particularly ones that can dissolve in water) are quite toxic: Only a few metal-resistant microbes can thrive in the unique micro-environment found on the surface of a grain of gold.

We wanted to test whether microbes can cycle tellurium through the environment in the same way they do for gold. We used natural ore deposits to do this, but this gives us information about what would happen if tellurium-rich materials were dumped by humans.

Finding a suitable site was a challenge. Since high tellurium content is associated with high gold content, most tellurium deposits close to the surface (such as those near Kalgoorlie, Western Australia) have been mined out a long time ago.

Eventually, our quest led us to Moctezuma in Mexico, where there is a small former gold mine that is exceptionally rich in tellurium.

At the mine, we studied ores and soils away from the main vein

of gold and tellurium. We found tellurium was moving away from the richest ore (bit.ly/3W4Kz9Q), and discovered the first evidence of natural tellurium nanoparticles on the surface of pieces of native tellurium.

This discovery is significant because nanoparticles play a special role in the environment, as they have different properties compared to macro-particles. For example, they tend to be more reactive than larger particles, and they may be toxic in their own right.

The tellurium nanoparticles we found appeared very similar to gold nanoparticles that have previously been found on the surface of gold grains.

We also showed that gold and tellurium have rather different modes of transport in soils and groundwater.

Gold particles can be carried a long way in rivers, for example. However, tellurium metal oxidises quickly when exposed to air, forming highly soluble—and toxic—compounds. Hence, there is no physical transport of grains of tellurium in metallic form.

The movement of tellurium is also limited by reaction with common minerals in soils. This is a good thing, since tellurium’s limited mobility keeps concentrations in groundwater low, and hence limits toxic effects.

In our latest research (bit.ly/3w0DsER), we have detected tellurium nanoparticles in the soil of Moctezuma, away from the metal-rich outcrops.

Because metallic tellurium nanoparticles are highly reactive and not expected to survive for long in soils, this discovery provides the strongest evidence yet that microbes are actively helping to cycle this rare element through the environment.

Tellurium in these soils is most likely subject to a dynamic cycle of oxidation and dissolution, followed by reduction and precipitation—all controlled by microbial activity.

We are only now beginning to understand how microbes cycle ‘exotic’ elements such as tellurium. Understanding these ‘biogeochemical’ processes is important to understand how elements move in our landscapes. We can then assess potential risks, and design efficient mitigation strategies.

This understanding can also aid in developing more sustainable mining (and recycling) technologies. Around Moctezuma, at least, microbes effectively separate gold from tellurium in soils.

Innovative solutions will be required to address our planet’s need to generate more energy more sustainably, and cleaning up mine product processing to better separate all potential commodity elements is just one of these ways.

Owen Peter Missen Research Assistant: Geochemistry Monash University Barbara Etschmann Research OfficerMonash

UniversityJeremiah

ShusterInstrument

ScientistTübingen Structural Microscopy Core Facility

University of Tübingen

Joël Brugger

Professor: Synchrotron Geosciences

Monash University

Stuart Mills Senior Curator of GeologyMuseums

VictoriaInnovative solutions will be required to address our planet’s need to generate more energy more sustainably

Anew project in Uganda aims to advance a more responsible artisanal gold mining sector across the country. The fiveyear planetGOLD Uganda project is funded by the Global Environment Facility (GEF) and implemented by the United Nations Environment Programme (UNEP). The project will be executed by the international nonprofit organisation IMPACT, in partnership with Uganda’s National Environment Management Authority (NEMA) and the country’s Directorate of Geological Survey and Mines (DGSM). IMPACT transforms how natural resources are managed in areas where security and human rights are at risk.

Jeehu (Pty) Ltd is a black women-owned multidisciplinary engineering company specialising in engineering and mining services. It provides quality upskilling short learning programmes in the fields of engineering, business management and life skills. These services are offered to industries, mining houses and government departments around South Africa and beyond—and particularly to youths, underdeveloped and developing communities.

JEEHU ENGINEERING

Design

Design, refurbishing and supply of mechanical structures; Civil construction, concrete work and building work; Steel structural work; Pipe routing design and installation;

Electrical work—installation of HV, MV and LV and maintenance; General engineering and plant maintenance (manufacture and replacement of chutes, liners, belt splicing etc.);

General construction

Mining Mine rehabilitation;

Fluid management—slurry and dewatering;

Deep-well borehole equipping; Drilling; Rendering of other mining services

JEEHU SUPPLIES

Oils and all lubricants; HDPE pipes and all dewatering accessories; Pumps, flow meters and valves

JEEHU MAINTENANCE SERVICES

Jeehu employs a team of dedicated researchers who take great care to search, document and implement the world best practice in the field of plant maintenance. Due to the calibre of staff, the identification of client problems, corrective action and execution of the required task according to international norms and standard is easily obtainable. The design team is well trained for any modification of plants, fabrication and installation of new designs.

JEEHU TRAINING CENTRE

Jeehu is dedicated to upskilling engineers, technologists, technicians, project managers and business managers. The Training Centre offers a range of well-researched and thought-out short courses that will contribute immensely to the professional development of thousands of individuals who will apply the expertise gained from these courses to their own systems and facilities.

Jeehu provides dedicated, effective and efficient engineering and mining

The planetGOLD Uganda project will work together with local communities to reduce the use of mercury in artisanal and small-scale gold mining— the world’s largest source of anthropogenic emissions of mercury pollution—while improving the health and lives of local mining communities. The Ugandan project is part of a global programme similarly implemented in 23 countries.

The project plans to support 4 500 men and women at 11 mine sites in the country, reducing mercury use by

15 tonnes over five years. It aims to reduce the use of mercury by supporting formalisation of the artisanal gold mining sector and increasing access to finance. This will lead to adoption of mercury-free technologies and allow access to more responsible and traceable gold supply chains.

“Artisanal gold mining is a critical source of livelihood for many in Uganda and an important opportunity for economic development. Through the planetGOLD Uganda project, miners will be introduced to

solutions to the environmental and social challenges in the sector, helping to transition toward more responsible gold mining practices,” says Ludovic Bernaudat, head of the GEF Chemicals and Waste Portfolio. A virtual inaugural inception workshop in November last year brought together Ugandan mining governance authorities and the technical services of the mining administration to introduce the key themes and priorities of the project.

According to the World Health Organization, exposure to mercury—even small amounts— may have toxic effects on the nervous, digestive and immune systems, and on lungs, kidneys, skin and eyes, as well as pose a threat to the development of the child in utero and early in life.

In Uganda, an estimated 90% of the country’s gold production is mined artisanally (bit.ly/3i8zO8h), with more 31 000 miners in the artisanal gold sector.

Artisanal and small-scale gold mining is the world’s largest source of anthropogenic emissions of mercury pollution

Sekta is an industrial services force that reflects the maturity of our society and a genuine understanding of the pivotal role we play in it. We provide services to the energy, petrochemical, oil and gas, mining, construction, food and beverage sectors. Our services support an industrious nation and the African continent, so that we can continue to develop in prosperity and pride.

www.sekta.co.za

info@sekta.co.za

Sekta is a specialised industrial services group.

B-BBEE Level 151% black women owned

While the quantities that miners are extracting and processing are very small, the use of mercury is very common. Seventy-three percent of Uganda’s artisanal gold is produced using mercury (bit.ly/3ExiNvT), resulting in more than 15 tonnes of mercury being released annually.

Mercury contaminates the soil, water, air and the equipment that is used. It is highly toxic to miners and others who come in direct contact with it— particularly when vaporised or among children and pregnant

women. Mercury emitted into the air can also circulate around the world and contaminate water, fish and wildlife far from the mine from which it was released.

“In 2019, Uganda ratified the Minamata Convention on Mercury (www. MercuryConvention.org). We are eager to partner with the planetGOLD Uganda project to implement our commitments to reduce and eliminate the use of mercury in artisanal gold mining,” says Dr Barirega Akankwasa, executive director of

NEMA.

“We look forward to introducing a cleaner, more responsible and more prosperous artisanal mining sector that benefits both the people and the planet.”

Adds Agnes Alaba, acting director of the DGSM, “With the growth of the artisanal mining sector over the past decade, Uganda has had to reform its legislative approach to keep up with the changing context of the mining sector. The Mining and Minerals Act 2022 provides the opportunity to support responsible development in the sector, which includes gazetting of artisanal mine sites for easy management, environmental stewardship, improved health and safety at mine sites, and elimination of hazardous chemicals such as mercury.”

planetGOLD Uganda www.PlanetGOLD.org/Uganda

Mercury contaminates the soil, water, air and the equipment that is used. It is highly toxic to miners and others who come in direct contact with it

With growing interest in every aspect of the hydrogen sector, regulation is paramount.

The abundance of renewable resources that Africa possesses, along with a developed renewable energy sector where renewable power can be produced at low cost (a key ingredient for generating low-cost green hydrogen), gives Africa a clear competitive edge as a clean hydrogen hub.

Africa is also geographically well placed to serve both European and Asian markets, and is an established export route. With oil and gas frequently exported from Africa to Asia, Europe and the rest of the world, exporters of hydrogen may be able to leverage these established routes to drive down some transportation/export costs.

Africa’s natural gas export infrastructure has the potential to be repurposed to transport hydrogen across Africa and to Europe via the natural gas pipelines connecting North Africa to mainland Europe.

Foreign government support/buyin for this export route from Africa to Europe exists at the European Union level: The EU Hydrogen Strategy (bit.ly/3D0M6aH) refers to the importation of renewable hydrogen from North Africa to meet projected hydrogen

demand in the context of its 2050 carbon-neutral goals. European bodies such as the Fuel Cells and Hydrogen Joint Undertaking—a private-public partnership aiming to encourage development in the hydrogen industry—emphasise this goal (bit.ly/3VBDqyA).

EU communications call for investment to develop clean hydrogen production across North Africa. EU support could be available for hydrogen projects in Africa in connection with various funding/support schemes including the Connecting Europe Facility (bit.ly/3D6cpfL); the Neighbourhood, Development and International Co-operation Instrument (bit.ly/3s7POsB); and other more development-focused platforms.

The European Bank for Reconstruction and Development has already begun working with governments across the continent, notably in Egypt (bit.ly/3yM8MZC) and Morocco (bit.ly/3yM95DK), to study the challenges in deploying a hydrogen economy.

Following this trend, Germany is in the process of developing a production and import chain for renewable hydrogen in a joint project with western Africa countries (bit.ly/3T9Fdcy).

Germany and Morocco have signed an agreement (bit.ly/3D1kQJa) to develop the production of green hydrogen and further research and development in the space, pursuant to which Morocco is scheduled to build Africa’s first large-scale green hydrogen production plant: the Power-to-X project.

Morocco has also signed a declaration of co-operation with Portugal (bit.ly/3MGFku2) to develop a partnership in the green hydrogen sector.

The Italian government is seeking (bit.ly/3CF7vop) to import clean hydrogen from North Africa, given the pipeline connections, including the Trans-Mediterranean Pipeline, and the lower cost of producing renewable power in Northern Africa.

Africa’s natural gas export infrastructure has the potential to be repurposed to transport hydrogen across Africa and to Europe

Renewable energy for a sustainable future

We seek out energy around the globe: in the power of wind and water, in the heat of the sun,

Follow

OPEN POWER FOR A BRIGHTER FUTURE. enelgreenpower com

Certain countries in Africa are already on the way to creating a hydrogen sector, showing strong government support for the development of the sector— Morocco and South Africa being notable early movers.

Morocco has set up a National Hydrogen Commission (bit.ly/3D5P2my) and is developing its national road map for hydrogen; Morocco is also part of the latest CertifHy (www. certifhy.eu) pilot phase—an EUwide hydrogen guarantees-oforigin pilot scheme.

The South Africa government has published its hydrogen strategy/ roadmap (bit.ly/3ERtJWW); and with its abundance of wind and solar energy production, the country is a natural candidate for becoming a green hydrogen exporter.

In South Africa, as the first phase of the government’s Platinum Valley Corridor initiative (bit.ly/3VxSz47), Anglo American announced a collaboration agreement spearheaded by South Africa’s Department of Science and Innovation with ENGIE, the South African National Development Institute and Bambili Energy to complete a feasibility study to develop a Hydrogen Valley in the platinum group metals–rich Bushveld geological area.

The South African government also announced a fuel cells hub project (bit.ly/3Tu9lPW), which is currently undergoing an environmental impact assessment.

The African Hydrogen Partnership (www.afr-h2-p.com), a pan-African association dedicated to the development of a clean hydrogen economy in Africa, will be helpful in considering a road map to the development of hydrogen at an Africa-wide level, and in considering macro issues across the continent, such as transportation networks. In the first meeting of the African Hydrogen Partnership in Ethiopia (bit.ly/3EIuhyq), the development of green hydrogen for export to Europe and Japan was discussed.

The development of regulation across Africa to effectively regulate the hydrogen supply chain (production, transportation, storage etc.) and to provide appropriate comfort and incentives for financiers, developers and first-movers, will be key to unlocking Africa’s potential in the hydrogen economy. Regulation is particularly important at all levels, given the vast amounts of capital required to invest at the scale needed to bring down costs and prove up the technology.

Capital is already being invested. In South Africa, for example, Sasol and Toyota South Africa Motors have partnered (bit. ly/3yLRAUg) to develop a green hydrogen mobility ecosystem, with a pilot project focusing on fuel cell–powered long-haul trucks for use in one of South Africa’s main freight corridors.

Anglo American is developing a 300-tonne hydrogen fuel cell–powered truck (bit.ly/3MBhlw0) to use in its mining operations in Mogalakwena, South Africa, aiming eventually for usage at its other mining sites.

We anticipate that other mining and energy companies will look to develop hydrogen fuel cell–powered heavy vehicles as a way to decarbonise their operations. Given standard electric battery limitations, hydrogen fuel cells will likely have the upper hand in this race.

With the push for decarbonisation, and with the global green hydrogen market expected to grow from $2.14 billion in 2021 to $135.73 billion by 2031 (bit.ly/3Tuajf2), green hydrogen is proving particularly attractive worldwide, and especially so for Africa.

With its vast resources of sun, wind and coastline, Africa is in a prime position to sustainably harness these resources to meet its domestic growing demand for energy and accelerate the continent’s energy transition. And with certain regions’ potential to be net exporters of green hydrogen, also contribute to the energy transition of its neighbours in Europe and further afield.

Nina Bowyer, Partner Barbara McNulty, Associate Herbert Smith Freehills

The “Africa’s Extraordinary Green Hydrogen Potential” report represents the first detailed research of the feasible development of green hydrogen across the continent

“Thanks to this low-cost electricity and decreasing electrolyser costs, the next step is providing access to a clean fuel, cheaper than all the current fossil fuels. It will enable us to decarbonise the power sector and most hardto-abate sectors: fertilisers, steel manufacturing and refineries.”

According to Thierry Lepercq, founder and president of HyDeal, “As the global energy and climate crises unfold, mass-scale competitive green hydrogen is ready to provide energy security, affordability and decarbonisation. Integrated hydrogen hubs bringing together upstream, midstream and upstream players on the basis of long-term off-take contracts are building powerful business models. Pioneering African countries such as Mauritania are showing the way, proving that Africa can help the world with green hydrogen—ensuring for itself a future of industrial development, fast and clean growth for all.”

The study was previewed last year at COP 27 in Sharm el-Sheikh, Egypt. Government leaders, ministers, international finance, business partners and civil society from across Africa attended the unveiling event. The report was formally handed over to partners on 20 December.

The comprehensive analysis, carried out by international consultancy Corporate Value Associates (CVA), suggests largescale green hydrogen investment can accelerate decarbonisation by enabling large-scale African energy users—such as fertiliser and steel producers—to use green hydrogen. The research is enhanced by CVA’s unique strategic partnership with energy partners across Africa, Europe and around the world.

The study highlights that solar-powered green hydrogen is economically viable and can be produced at less than

€2 per kilogramme—cheaper than traditional fossil fuel energy—and cater both for local energy demand and allow green hydrogen to be exported to global markets. This is equivalent to energy costs of US$60 a barrel.

The research suggests three requirements to enable 50 million tonnes of green hydrogen to be produced in Africa by 2035:

• National planning, regulation and incentive schemes need to mobilise private sector investment.

• Pilot projects need to show successful green hydrogen generation, storage, distribution and use at both demonstration and commercial scale.

• Market-based partnerships are needed to enable mass-scale domestic and international off-take and demand for green hydrogen, and increase cooperation to design, finance, build and operate green hydrogen production, storage and distribution infrastructure.

• €1-trillion green hydrogen investment can deliver the equivalent of more than onethird of Africa’s current energy consumption, boost gross domestic product, improve clean water supply, and empower communities.

The new study outlines how production and transmission of

green hydrogen can lead to a €1-trillion investment yielding 7 exajoules of energy (versus a consumption in Africa of 19.9 exajoules in 2021) and a correlative massive increase in GDP, creating hundreds of thousands of permanent and skilled jobs across Africa.

Large-scale green hydrogen investment will transform supply of clean water in areas regularly impacted by drought and chronic water shortages and will help empower communities.

The new analysis estimates that green hydrogen investment could reduce carbon emissions in Africa by 40%, replacing 500 million tonnes of CO2 a year.

According to the study, large-scale green hydrogen generation will enable Africa to supply 25 million tonnes of green hydrogen to global energy markets, equivalent to 15% of current gas used in the European Union.

The new analysis will be followed by in-depth research of local green hydrogen investment potential, regulatory requirements and changing demand in the coming months.

Download the briefing document at bit.ly/3v5UiS2.

We belie e that earth’s rare and precio s legac can, thro gh responsible mining, create ab ndant o tcomes for o r people, comm ni es, in estors, c stomers and all other stakeholders in gi ing

e pression to life’s special moments.

www.petradiamonds.com

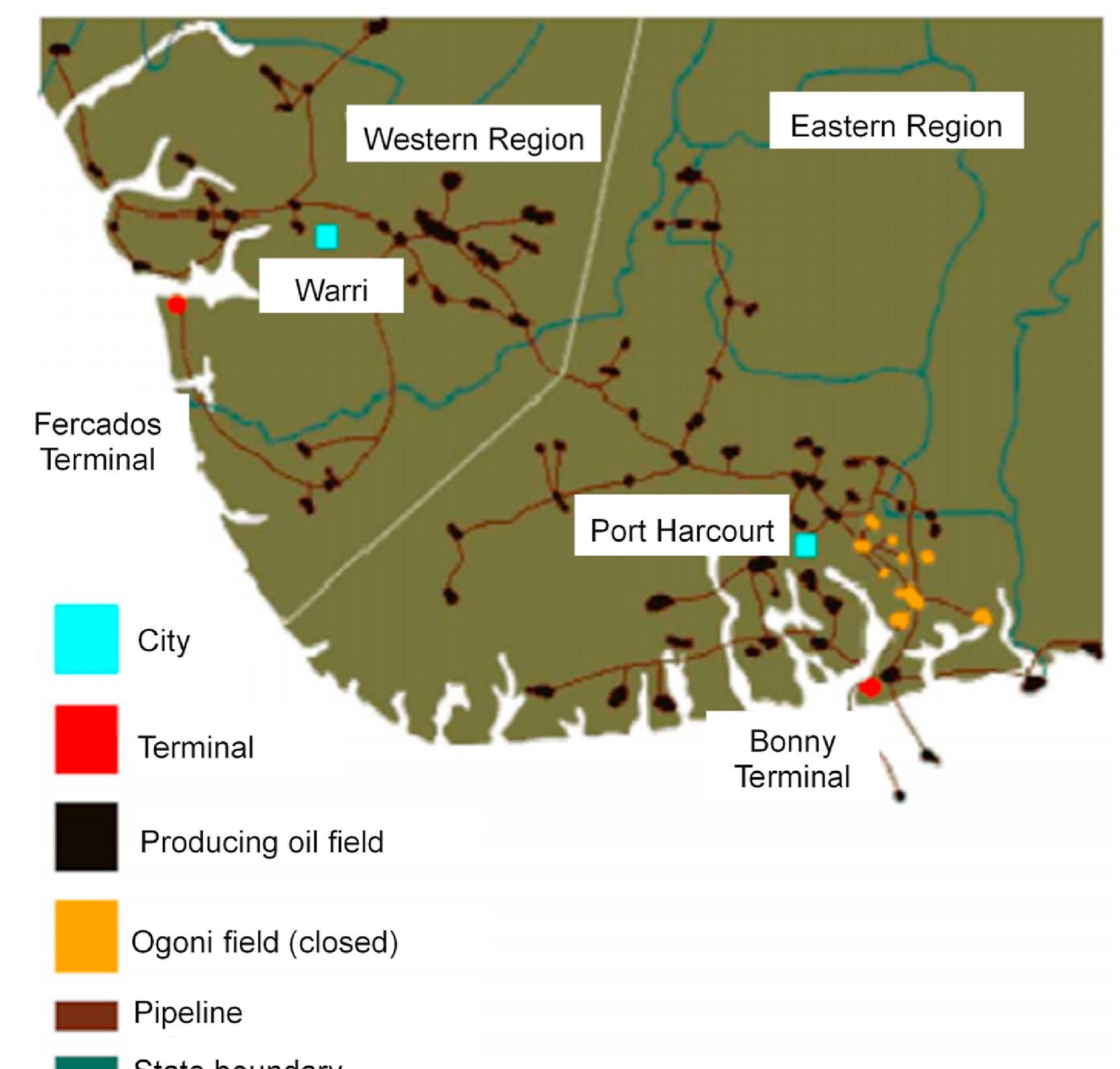

Nigeria experiences significant energy poverty. As noted in the African Energy Chamber’s recently released report, “The State of African Energy: 2023 Outlook”, consistent access to modern energy services—that is, steady and reliable electricity supplies—is available to only 60% of the country’s population on average, and access rates appear to be significantly lower in rural areas than they are in urban areas.

And according to World Bank data, about 99.9 million people, or more than 47% of Nigeria’s population, lived in rural areas as of the end of 2021. That means nearly 100 million Nigerians are living without any true level of certainty that the lights and the electric power that so many in the developed world take for granted will stay on.

I, for one, think they deserve to have that certainty. They deserve it on human grounds, and their country already has a significant amount of what is needed to provide them with it. And by that, I mean Nigeria has gas that it could use to generate power.

Nigeria has already been shown to have more than 200 trillion cubic feet (tcf) of gas in proven reserves, and government officials believe the figure could go even higher, perhaps reaching 600tcf following additional exploration.

If that prediction comes true, Nigeria will have the fourth largest gas reserves in the world, behind only Russia, Iran and Qatar. It will have more than enough gas to meet current demand; it will have enough gas to produce significant volumes of liquefied natural gas (LNG) for export while also supporting gasification programmes, both on the domestic and regional levels.

But it is not enough just to have all that gas. Nigeria also needs the means to make use of its gas. Without the proper infrastructure, it will not be able to put its resources to work and will merely have a scattered collection of raw materials.

In practical terms, this means Nigeria ought to have the following:

• Upstream production facilities for gas;

• Midstream gas transportation facilities such as pipelines, including field networks and trunk lines;

• Downstream gas-processing plants and production facilities for gas-derived fuels such as LNG, compressed natural gas, and liquid petroleum gas;

• Downstream gas distribution systems, including town gas networks;

• Downstream gas storage depots;

• Gas-fired thermal power plants (TPPs), preferably co-generation plants, as they are more efficient.

• Transmission, distribution and storage infrastructure for the electricity produced by gasfired TPPs; and

• Smart and secure operational technology systems that can optimise the flow of data and resources between consumer markets and energy networks.

I am not suggesting it is the Nigerian government’s job to provide all this infrastructure. But I do believe it is Abuja’s responsibility to make sure this infrastructure becomes available. To this end, I think Nigeria also needs government bureaucracies that are competent and trustworthy enough to ensure oil, gas and power-related contracts are only awarded to companies capable of providing the goods and services required within the acceptable parameters.

Developing this infrastructure requires the right kind of vision, which Nigeria already has in place: its “Decade of Gas” programme is designed to make the country entirely gas-powered by 2030.

When President Muhammadu Buhari rolled out this initiative in March 2021, he indicated it aimed to make the gas sector the cornerstone of Nigerian economic activity.

By the time the “Decade of Gas” comes to an end, he said, the country will have done the following:

• Adopted a new oil and gas law to facilitate investment;

• Carried out new exploration projects, discovered new reserves and brought new fields on stream;

• Constructed new gasprocessing plants and production facilities for LPG and other gas-derived fuels;

• Built new export pipelines and constructed new production trains at gas liquefaction plants such as Nigeria LNG;

• Constructed new domestic pipelines along routes to serve local customers plus gas-fired TPPs to increase domestic electricity supplies; and

• Expanded domestic power transmission and distribution networks, especially in rural areas.

Nigeria still has a significant amount of ground to cover before it achieves all these targets. However, it has made progress. The biggest example of this is the Petroleum Industry Act, which Buhari signed into law after it passed both houses of the National Assembly. The Nigerian government is also successfully promoting LPG, a gas-derived fuel, as a replacement for wood and charcoal as cooking fuel. (According to NLNG, domestic LPG consumption has climbed by around 1 000% over the last 14 years.)

And as recently as this past November, Nigeria moved closer to building its first floating LNG facility. Nigerian company UTM Offshore signed a front-end engineering design contract to design the facility with JGC Corporation, Technip Energies and KBR. Chief Timipre Sylva, Nigeria’s Minister of Petroleum Resources, described the project as a step in the right direction for the country to develop, exploit and monetise its natural gas.

During the African Energy Week in Cape Town in October 2022, Amni International Petroleum Development Company Limited (a Nigerian independent oil and

gas exploration and production company) and the African Export–Import Bank signed an agreement for the provision of a $600-million syndicated reserve-based lending facility.

To a lesser extent, Abuja can also claim credit for the headway it has made on the Ajaokuta-KadunaKano pipeline, which is being built to bring gas to the northern part of the country. When finished, the pipeline will deliver fuel to gaspowered industrial facilities and feedstock to TPPs with a generating capacity of 3 600MW.

It may also serve eventually as the first leg of the Trans-Saharan Gas Pipeline (TSGP) network, which will allow Nigeria to export gas to Europe via Algeria. Unfortunately, though, the project has been running behind schedule, and the heavy floods that began hitting many parts of the country in mid-2022 have caused additional delays.

In the meantime, Abuja has also moved forward with plans for establishing another gas export network: the Nigeria-Morocco Gas Pipeline (NMGP), a 5 600km offshore network that would serve more than a dozen West African states. This system would, like TSGP, pump Nigerian gas to Europe, but it would serve the purpose of delivering the gas to regional markets as well. As such, it would establish Nigeria as a supplier of fuel to much of West Africa.

Thus far, neither the NMGP nor TSGP has been built. But Nigerian authorities are working to hammer out agreements on these projects— and they see the ways that European market conditions have changed since the beginning of 2022 as an incentive to work harder and faster.

If they succeed, they will create infrastructure that could do quite a bit to alleviate energy poverty in Nigeria and beyond.

In the case of the NMGP, the construction of this pipeline would provide multiple countries beyond Nigeria with a steady source of

gas. As such, it would serve as an incentive for the construction of TPPs in places where millions of people do not have access to reliable energy supplies. At the same time, the pipeline’s access to European markets, where buyers are more likely to pay in hard currency, would help ensure the profitability of the whole system.

Likewise, the TSGP network has the potential to benefit Nigeria by ensuring the country has enough access to hard-currency markets in Europe to cover the costs of the domestic initiatives that depend on AKK—that is, the gas-fired power and industrial projects in the northern part of the country.

Nigeria gives us examples of measures African countries can take to begin addressing challenges. No, Nigeria has not achieved its ultimate goaleradicating energy poverty, but it has plans and initiatives in place with real potential to make a difference—as long as the country continues pursuing them.

If they have not done it yet, governments throughout the continent should be developing and implementing multi-pronged programmes of their own to eradicate energy poverty. They, like Nigeria, should be leveraging their natural gas resources. They should be developing and executing gas utilisation plans, improving their approach to resource management, monetising natural gas to help pay for infrastructure projects, and launching more gasto-power initiatives.

Instead of being daunted by the vast numbers of Africans without electricity, shrugging our shoulders and giving up, I hope we will be steadfast in our determination to make energy poverty history by the end of this decade.

NJ Ayuk Executive Chairperson African Energy Chamber

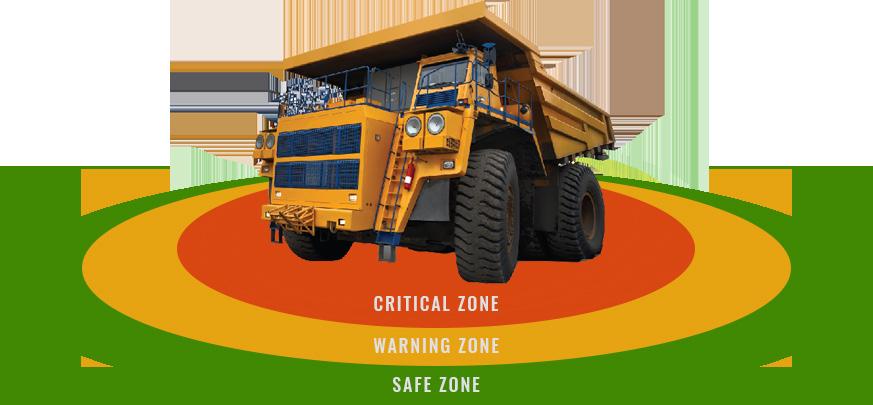

Dust-A-Side is an international company that has channelled more than 40 years of experience in Total Dust Control Management— with services that include dust and road management for opencast and underground mines, treating in excess of 13 000 000 square metres of mine haul roads. It also offers full dust suppression services for material handling applications.

Group CEO Paul Voorhout, a metallurgist by profession, says that Dust-A-Side “aims to be a global leader in dust control management by adding value to our customers, through innovative solutions and utilising the operational skills of our safety-conscious and highly motivated people.” The company already has a presence in more than nine countries worldwide.

He comments that Dust-A-Side stands out from other similar companies in this field due to its “Added Value Quantification” that includes:

• DASMetrics—Road Condition Monitoring & Reporting System, which helps prioritise maintenance schedules, with live data logged every minute and which can be accessed at any time.

• DASDMR—Dust Concentration Measurement System, which measures dust concentrations along with wind speed and direction, in real time.

• Dust Monitoring—High-pressure Dust Suppression Systems; Low-pressure Dust Prevention Systems; and >80% dust reduction.

This year marks Voorhout’s fifth with Dust-A-Side. “I’ve known Dust-ASide for over 30 years; I had worked with a few of the shareholders before they joined Dust-A-Side, so I was very aware of their developments,” he shares. While working in Europe in 2018, he was forced to return to his homeland of South Africa due to personal reasons—and it was decided that he help grow the international side of the business. As international marketing & sales manager, he was tasked with moving the company from a regional-based business to a global one, with a focus on Asia-Pacific and the Americas. Two years ago, he was promoted to group CEO.

Dust-A-Side has enjoyed much success in recent years. Voorhout mentions a few salient points:

• The company survived the COVID-19 pandemic with very little effect on the business, and maintaining its full staff complement.

• Zero Lost-Time Injuries were recorded during 2022.

• Numerous corporate social investment programmes were completed in South Africa, including the adoption of local schools.

• New opportunities arose in several territories that have never been serviced by Dust-A-Side, particularly in Asia and the America; while the company also grew its business in Africa and Australia.

• New technologies were introduced in the market to help clients get the end results they needed more cost-effectively.

• Clients were able to save millions of rands on water, tyre wear, fuel burn and productivity increases.

• There was >1% attrition in employees.

However, it is not always plain sailing. Voorhout says that in his position, each day comes with a new set of challenges: people, clients, products, finances, and others. South Africa has unique challenges. “But in most instances, one needs to remain calm and never overreact. What I say to my team is: Always take yourself out of the challenging position and don’t get emotional—sleep on it and find a solution when you have reorganised yourself.”

It is his inclusive leadership style that stands him in good stead to steer his team to achieve. “I allow for healthy debate, empower people to go ahead and make mistakes and use that as a learning moment. I also think I’m a good listener and people’s person.”

Voorhout adds that he has worked for many bosses over the course of his career, but not all these ‘bosses’ were ‘leaders’. Only two stand out as leaders, and they both led from the front, were strong at building quality teams, allowed equal participation, and always remained calm under pressure. It is these attributes that he tries to emulate.

The CEO and his team see a bright future for Dust-ASide in the coming years. “The mining sector is bullish, with demand going up and we see many new operations opening globally,” Voorhout says. “So we will continue to strive to be a global leader in dust control management by adding value to our customers. By continuing to do what we are doing—and doing it well—we aim to double our business by 2027.”

For more information, visit dustaside.com

Dust-A-Side is the only company that offers complete and integrated dust management solutions that increase productivity and safety, unlock cost efficiencies, and benefit the environment. It provides tailored solutions for haul roads, access roads, stockpiles, yards, broadacre sites, materials handling, bulk transportation, and more. These solutions withstand vast, diverse operating conditions.

Dust-A-Side offers a complete range of erosion control products and solutions designed to meet the needs of civil, mining, quarrying, construction or other projects. There are also tailored solutions for construction sites, mining and quarrying, agricultural settings, urban environments and more.

Dust-A-Side is one of the largest providers of haul road management solutions to the mining industry in the world. It offers a full-service business model incorporating the manufacture, supply, installation, maintenance and management of haul road performance and dust control solutions.

Dust-A-Side provides dust suppression for material handling applications: High-pressure dust suppression systems (50 to 70 bars) for tipping areas, conveyor transfer points and chutes, crushers, screens, stockpiles, stacking and reclaiming loading terminals; Lowpressure dust prevention systems (4 to 6 bars); Fog cannon tech for dust suppression on waste dumps, tipping bins, rail and ship loading, blasting sites and water evaporation.

The mining sector is bullish, with demand going up and we see many new operations opening globally.

Dust-A-Side is a South African international company which has chanelled more than 40 years of experience in Total Dust Management. Our Total Dust Management services include dust and road management for opencast and underground mines, treating in excess of 13 000 000m² of mine haul roads. We offer full dust suppression services for material handling applications.

Our Dust Control Management System consists of a range of environmentally friendly dust suppression products, with a comprehensive stabilization and continuous maintenance programme catering to your pit to port requirements.

The robust sealed haul road surfaces allow optimal production for haul trucks and other vehicles to operate safely in all weather conditions. This is achieved with greater fuel efficiency, safety, and mechanical wear. Water saving remains one of the biggest benefits in employing Dust-A-Side and in excess of 90% saving has been recorded on certain mines

A safer working environment

Effective dust suppression

>90% water savings

Reduced rolling resistance

Decreased diesel consumption

Increased tyre life

Improved hauling cycle time

Reduction of HME repairs and maintenance budget

No recapping required

Reduced production downtime after rain

No investment in road maintenance equipment

Increased productivity

Proven return on investment (ROI)

Dust-A-Side

Menlyn Piazza 2nd Floor, Cnr Glen Manor and Lois Avenue, Menlyn, Pretoria, 0063, RSA

Dust-A-Side has a complete range of dust suppression products to provide the most operationally and cost-effective solution across any operation. They can be used – effectively and economically – in a wide range of applications such as semi-permanent roads, temporary roads, underground work areas, process plants, transfer points, stockpiles, rail veneering, construction sites and more.

DUST-A-SIDE

Based on Bitumen emulsion technology

Creates a sealed, dust free, greater safety performance and an all weather haul road surface

HYDROTAC

Based on Lignosulphonate technology

Creates a bound crusted road surface

Based on Bitumen emulsion technology

Creates a sealed, dust free, greater safety performance and an all weather haul road surface

DAS

Based on Bitumen emulsion technology

Creates a sealed, dust free, greater safety performance and an all weather haul road surface

HYDROSPERSE

Based on a combination of Lignosulphonate and Bitumen emulsion technology

Creates a semi-sealed road surface

Resistant to leaching

Excellent dust suppression capabilities

Creates a hard and stabilized surface

Mostly used for hard-park areas or areas that require extra stabilization

Also used as a sealing product in rail wagons and stockpiles

ACRIBIND

Based on a blend of Polymer and Lignosulphonate technology

Creates a partially sealed road surface

Excellent dust suppression capabilities

HYDROWET

Based on Surfactant technology

Has no binding abilities but facilitates the compaction of the road It is an excellent wetting agent

Very low dosage required

THERE ARE TWO DISTINCT PHILOSOPHIES TO CONTROL DUST WITH WATER SPRAYERS DURING MATERIALS HANDLING PROCESS.

Before you decide on a dust control system it is important to understand the difference between a dust prevention and dust suppression system. A lot of operations will require both, however the performance of the overall system and the effectiveness of controlling dust will be determined by whether or not the system is configured for your specific needs.

1.Low pressure (< 10 bar) and high water volume systems can be employed. This treatment philosophy is referred to as dust prevention. The spray system will discharge water directly on the material at the beginning of the transfer point. Being low pressure, the flow of water and droplets sizes are much bigger and hence referred to as wetting systems.

2.On the other hand, dust suppression systems (also known as misting systems) employ high pressure (> 50 bar) and low volume of water in the form of a fine atomised mist to capture dust that is already airborne and bring it back to the source.

Dust suppression and dust prevention systems are not exclusive; many operations have both systems configured to effectively control dust.

While dust prevention can be used in materials handling operations, dust suppression is the preferred option, owing to low water consumption, especially in areas where water is scarce. This option also minimizes water addition to material.

Our Total Dust Management services include fallout dust and road management for both opencast and underground mines as well as plant areas.

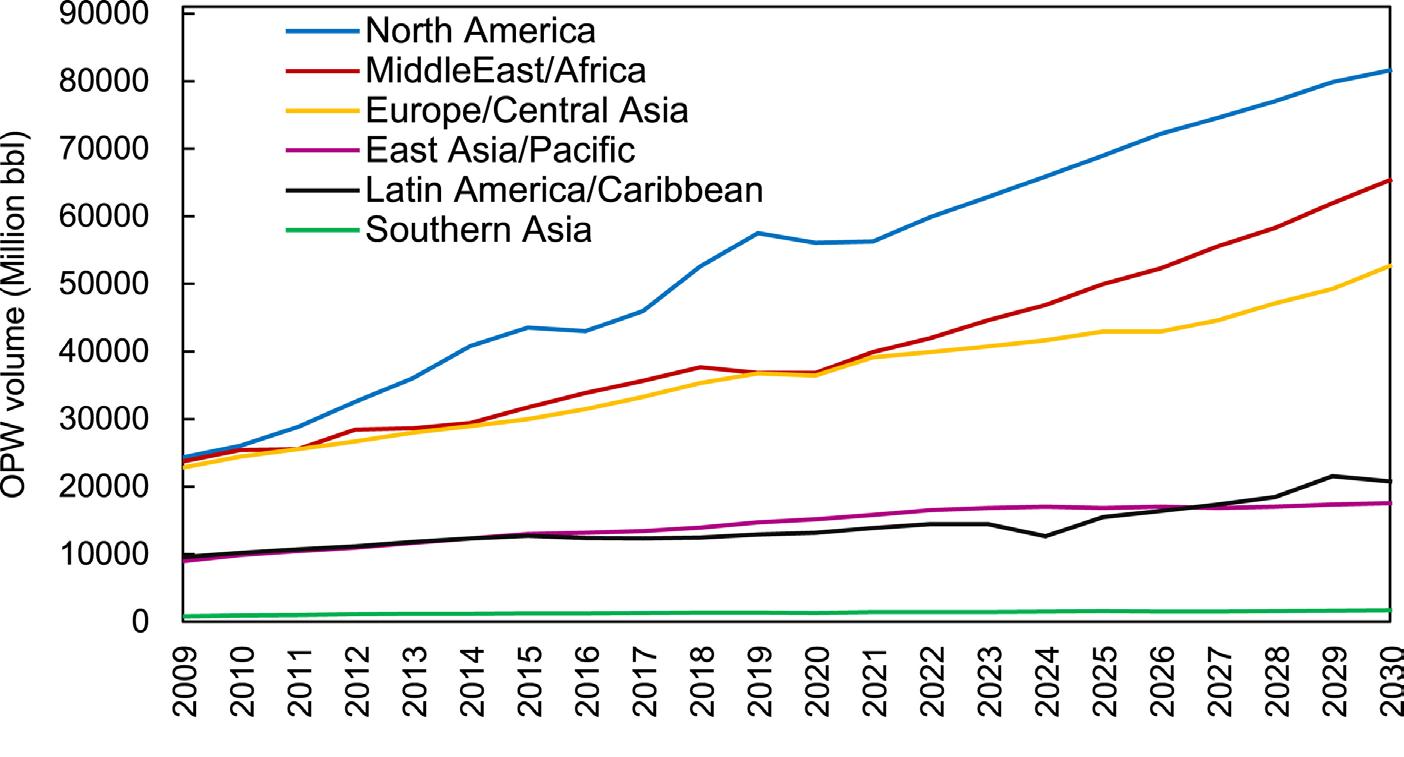

The ability of a nation to produce a safe and reliable supply of energy is one of the most important aspects of socio-economic development. Global energy supply and consumption have increased exponentially since the 1990s. (Figure 1). Unsurprisingly, the growing energy demand has also resulted in a technology shift. with the development of several alternative forms of energy production, including nuclear and renewables. These forms of energy now account for at least one third of energy production globally.

Africa remains significantly underdeveloped in terms of energy generation and equitable distribution to its growing population. Currently, more than half a billion people lack access to energy on the African

continent. The result is that Africa is the lowest consumer of primary energy globally (Figures 2 and 3). Traditionally, energy generation

in Africa has relied on fossil fuels. Since the 1990s, more than two thirds of Africa’s energy has been generated from coal and gas. Gas, in particular, has seen a drastic increase in development over the last century, now accounting for 30–40% of total energy generation on the continent.

Fossil fuels feature prominently in Africa’s energy generation mix, largely because these sources are geographically abundant and easily mined. Moreover, their requisite energy generation technologies are readily available, have been used for many decades and are easy to maintain. However, Africa finds itself in a precarious position as the world has started to shift away from fossil fuels, turning towards energy technologies. To date, these technologies have yet to be developed and implemented on the African continent.

Figure 1. Global energy consumption, per energy source. Figure 2. Overall global energy consumption per country.The world emits approximately 35 billion tonnes of CO2 per annum; a near-twenty-fold annual increase since the 1990s. Thus, a global target of achieving a carbon netzero by 2050 has been set. This target is largely linked to restricting the global average temperature rise to no more than 2 degrees Celsius above pre-industrial levels. Unfortunately, despite Africa contributing less than 5% of total global CO2 emissions, the impact of climate change and extreme weather conditions affects the most vulnerable populations on this continent significantly. Critically, fossil fuels will likely continue to be used for energy generation in Africa in the short to medium term. Therefore, integrated solutions are needed to ensure that Africa can meet its desired socio-economic development goals, while still achieving sustainable growth.

The shift towards low carbon and sustainable technologies will depend heavily on minerals currently deemed critical. These minerals, such as lithium, copper, cobalt, platinoids, and rare earth elements, are needed to support the development of advanced technologies focussed on achieving energy efficiency and ultra-large processing capabilities.

However, minerals such as uranium and hydrocarbons will also be needed to support the just transition. Moreover, phosphate-bearing minerals will be in high demand, as they are needed to support agriculture and food security.

Integrated solutions for Africa Africa’s stagnated socio-economic and technology development can be attributed to the insufficient availability of geological data and information. Integrated solutions may assist in meeting the continent’s sustainable development goals. These include technologies such as large-scale carbon capture and sequestration, which may enable a sustainable a just transition towards a lowcarbon economy. Furthermore, integrated solutions have the potential to support innovative and rapid geoscience mapping and the characterisation of mineral domains and natural resources using a swath of satellite, airborne and groundbased information.