11 minute read

Data Centers

from AZRE May/June 2020

by AZ Big Media

Data center developers face challenges when selecting where to build Infill or outskirts?

By STEVE BURKS

The Phoenix Metro market has gradually become a major factor in the world of data center development in the United States. According to CBRE’s most recent North America Data Center Report, Phoenix was the second-most active market in the United States, ahead of long-time primary markets like Silicon Valley, Dallas/Fort Worth, Chicago and Atlanta.

Most of that data center activity has been occurring in the far reaches of the Valley, in areas like Goodyear and far east Mesa. Large-scale data center developments like EdgeCore in east Mesa and Stream Data Center and Compass Data Centers in Goodyear get much of the attention. Also, Microsoft is building on all three of its sites in the West Valley and Google is getting permits for its site in that submarket as well.

There is a new, large data center development that is just getting underway. QTS Data Centers, which is a branch of QTS Realty Trust, Inc., is just beginning work on its second Phoenix location. QTS has been approved for 2 million square feet of data center product on an 80 acre site. Based on recent trends, it would be easy to assume that this new facility was being built in Goodyear or West Phoenix or Far East Mesa, but this new facility is a rare infill project. The new QTS facility, which is being built by DPR Construction, is located along McDowell Rd., between 37th and 40th

EMPOWERED THOUGHT LEADERS BOLDY CHANGING THE CONSTRUCTION INDUSTRY.

PASSION RELATIONSHIPS INNOVATION DEVELOPMENT EXCELLENCE

Top Phoenix data center submarkets

The majority of enterprise class data center developers and colocation operators maintain significant facilities in the Phoenix market, all with ongoing expansion plans as of 2019. The following are some of the competition in certain submarkets:

TEMPE/SKY HARBOR

• Iron Mountain Data Centers: With its acquisition of I/O Data Centers, Iron Mountain instantly became one of the major players in the market. The company has since nearly doubled the campus by adding 550,000 square feet and 48-megawatts.

• QTS: Its presence in the market could more than double when it completes full build out of its planned facility at 40th St. and McDowell. The facility could reach up to 2 million square feet at buildout, making it one of the largest sites in Phoenix. Chandler/South Phoenix

• Digital Realty: Its Chandler Price Road campus has over 520,000 SF and up to 60 MVA of power, not including future expansion.

• CyrusOne: CyrusOne, starting in 2011, has now grown as one of the largest colocation providers here, with over 85 acres of secured campus and planned development exceeding 90 megawatts across two campuses in Chandler and Mesa.

• EdgeCore: This new wholesale colocation provider located in the Mesa Elliot Technology Corridor (southeast Mesa) is delivering its first phase in 2019 and can offer over 1.25 million square feet and 280 MWs from its on-site substation.

• H5 Data Centers: H5 upgraded an existing 180,000 SF data center that can now offer up to 30 megawatts of both retail colocation and wholesale colocation.

• INAP: INAP recently took over the Bank of America data center as its operator, with BofA downsizing into a colocation customer, allowing INAP to expand and offer colocation space in this 191,000 SF facility.

DEER VALLEY

• Aligned Data Centers: With its flexible data center design that can offer high density up to 50 KW per cabinet capacity, Aligned’s 51-acre campus can total 550,000 SF and 120 megawatts. Its second phase under construction will offer 200,000 SF and 60 MWs with a guaranteed PUE of 1.15.

• Evocative: Co-located on Aligned’s campus where Aligned targets wholesale colocation users, Evocative Data Centers provides managed colocation in the same facility for customers of ~1 MW or less.

• Flexential: In its 110,000 SF facility, Flexential offers 5 MWs of colocation space.

GOODYEAR/WEST PHOENIX

• Stream Data Centers: Acquired a 418,000 SF facility with 157 acres of land this year that can expand to over 2 million SF and 350 MWs at full build out.

• Compass Data Centers: Its land site acquisition in Goodyear will allow it to construct a 350+ MW campus of turnkey data center build-to-suits. Source: Site Selection Group, LLC

streets in Phoenix, just north of the Loop 202.

“The reason that site was attractive to QTS was because of its location,” said Mark Bauer, managing director at JLL and the national director of JLL’s Data Center Solutions Group. “That is where a lot of the fiber optic connectivity is located and it’s close to the airport. There are challenges, but where do you find 80 to 100 acres in an infill site?”

Bauer worked with QTS to land this property at auction three years ago. He said that it was rare for a day to go by without a multifamily broker contacting him about that piece of property.

“QTS has a huge platform, and they are in several big markets and have made their commitment to the Phoenix market and they are in discussions with several of their customers for the building in Phoenix,” Bauer said. “They are very optimistic that they will be going vertical by the end of the year.”

QTS is working with SRP on locating a power substation on the property, which will provide the facility with enough power to operate two data center buildings. Earth work began on the property in early 2020.

Finding an infill site this large for a data center, with all of the power and connectivity that they require, is quite rare.

“It is a unique project, unique location and hard to replicate,” said Bauer. “I’ve worked with several other developers who are not in this market but want to be and we have looked for sites that are similar to that and they are very hard to find. And if there is a site of that size available, then there are challenges with it that make it more risky.”

The risk in locating a facility in an infill location is being able to secure enough power to operate a data center, which uses in excess of 100MW at a typical location. If there is not a power source nearby, a data center developer would have to run heavy power lines from the closest substation to the facility, which can be very expensive,

More than just concrete, a unique aesthetic design solution. ARCHITECTURAL PRECAST CLADDING

CYRUS ONE: Data center Chandler provides mission-critical data center facilities that protect and ensure the continued operation of IT infrastructure for more than 550 customers, including nine of the Fortune 20 and more than 100 of the Fortune 1000 companies.

especially in an infill location near the airport, like the QTS facility.

“It’s challenging, it’s time consuming and there’s no guarantee because you’re dealing with the airport and the FAA and they don’t move fast and typically they are going to require underground delivery of power,” said Bauer. “When you look at underground heavy power lines, those are very costly. The cost is ten-fold from going above-ground. The big draw to the markets like Goodyear and Mesa is the easy access to heavy power.”

“The way most cities evolve is that the connectivity is always in the center of the city, and then power is always on the outskirts,” said Ian McClarty, president of phoenixNAP, which operates a data center location at 32nd St. and University in Phoenix. “You try to find a balance, and sometimes you get lucky and you find some areas that have access to power and they also have access to some fiber.”

McClarty and phoenixNAP built their data center in 2010, so he has seen growth of the data center market in Phoenix and its steady migration out to the suburbs. When McClarty and phoenixNAP were working on developing their facility, they made sure they had secured enough access to power to support future growth.

“What we did when we first built our facility, we actually had requested additional power draws from the utility companies,” McClarty said. “We had some special concessions that we were able to tap into and secured access to power for any future builds. So at some point in time, when I have to build a second facility, it will be near this facility in an infill location, because I’ll be able to run a lot of fiber line between the facilities and I have enough power to be able to build another facility.”

For infill locations, the access to power and the lack of available lots are two challenges when data center operators are comparing them to

2019 Primary Market percentage of total data center product under construction

Source: CBRE Research,

CBRE Data Center Solutions, Q2 2019

PROUD TO BE ARIZONA’S LEADING ELECTRICAL CONTRACTOR 75 YEARS STRONG.

CONSTRUCTION SERVICES | SERVICE | TECHNOLOGIES | TEGG SERVICE | PRECONSTRUCTION | VIRTUAL DESIGN

DATA CENTER IN PHOENIX

cannon-wendt.com | 602.279.1681 ROC068027 - ROC027458 - ROC068026

Under One Roof.

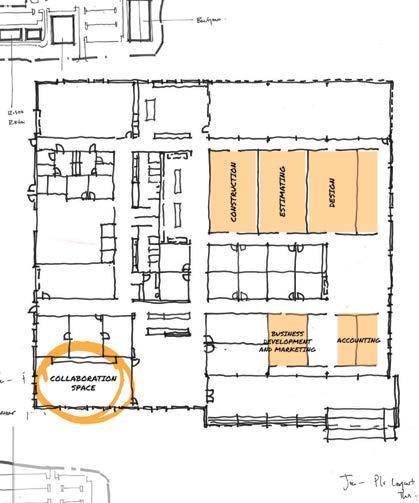

To us, there’s design-build and then there’s LGE Design Build. Having been in business since 1994, we’ve learned a few things about how architects, estimators and contractors work together for the better.

We’ve even built our new office to embody our core values with an open, creative and inspiring space that encourages collaboration and integration of our outstanding team members and their departments.

INAP CHANDLER: High-density configurations, including cages, cabinets and suites with fully integrated monitoring and a dedicated 22 MW substation feed by three different upstream substations.

locations in the exterior of the market. Utility companies like APS and SRP have been very active in building new substations in the suburban markets, both to power new data centers and other commercial development, but also that is where the majority of new single family housing is being built.

One major advantage that infill locations have is connectivity. In the center of the Valley, there are more fiber optic cables that are the spine of the internet. Think of these cables as rivers that carry the information that flows globally on the internet or between servers in various locations around the world. Telecommunication companies install these fiber optic cables and will have Point of Presence equipment located in data centers, to serve as a main connection points for customers sending information through their system.

A facility like phoenixNAP, which is located in the heart of the city, has dozens of these telecommunications

companies with equipment and fiber optic cable running directly into the facility. McClarty said the goal of phoenixNAP was to be the most connected facilities in the market, something he could accomplish in his central location.

“Our goal as a company was to build the most inter-connected facility in the metro region. Period,” McClarty said. “That was our goal. and we’ve done a great job of adding unique, distinct providers that are not offered anywhere else in the metro region. We have all of these cool, international providers that are only offered in our facility and all of the other facilities have to interconnect back to us to be able to get access into those carriers.”

A faster, denser fiber network lowers latency, a crucial factor for applications such as the Internet of Things, 5G wireless networks and self-driving vehicles. With so many carriers in its facility, phoenixNAP is an attractive location for companies that want fast connections to other markets, like California, without paying higher West Coast prices.

Compare the number of provider companies with a presence at the phoenixNAP facility to the number at the CyrusOne Chandler I facility. According to data from DataCenterHawk.com, the Chandler I facility has 11 providers with a presence in their facility, compared to phoenixNAP, which has more than 50.

“I go after people who are really focused on telecom connectivity and they might be a small deployment with us, they might only put a couple racks with us, but I love those customers,” said McClarty. “They want to be the closest to the connectivity hub and get really inexpensive options to connect back to the carriers.”

Many data centers do not need as much connectivity to serve their clients, which means a site further away from the center of the market makes sense, due to better access to power and greater availability to land. Also, in fast-growing areas like Goodyear, there are fewer hurdles to get over to get a building done.

“You have to be able to deploy space within 90 to 120 days, that’s why these developers continue to build and have space available,” Bauer said. “Twelve months is a key timeframe for these types of buildings. The key is, where can they buy and be under construction and deliver within 12 months? Most often, that’s in areas like Goodyear or east Mesa.”

something’s different.

Size. Speed. Strength. Our agility and experience outpace the competition and create critical results and performance every time. Experience the difference. WILLMENG.COM | ROC #082904, Class B-01

Our work unites communities, builds and empowers people, and inspires innovation. Our experience in the construction of mission critical facilities rests on a foundation of cuttingedge technologies, led by the Rosendin engineers who helped write the book on data center electrical systems.

Get inspired at rosendin.com.