PLUS: The offshore comeback Pipeline smackdown Focus on safety

PLUS: The offshore comeback Pipeline smackdown Focus on safety

This Louisiana offshore hub is redefining itself for an ‘all things energy’ future.

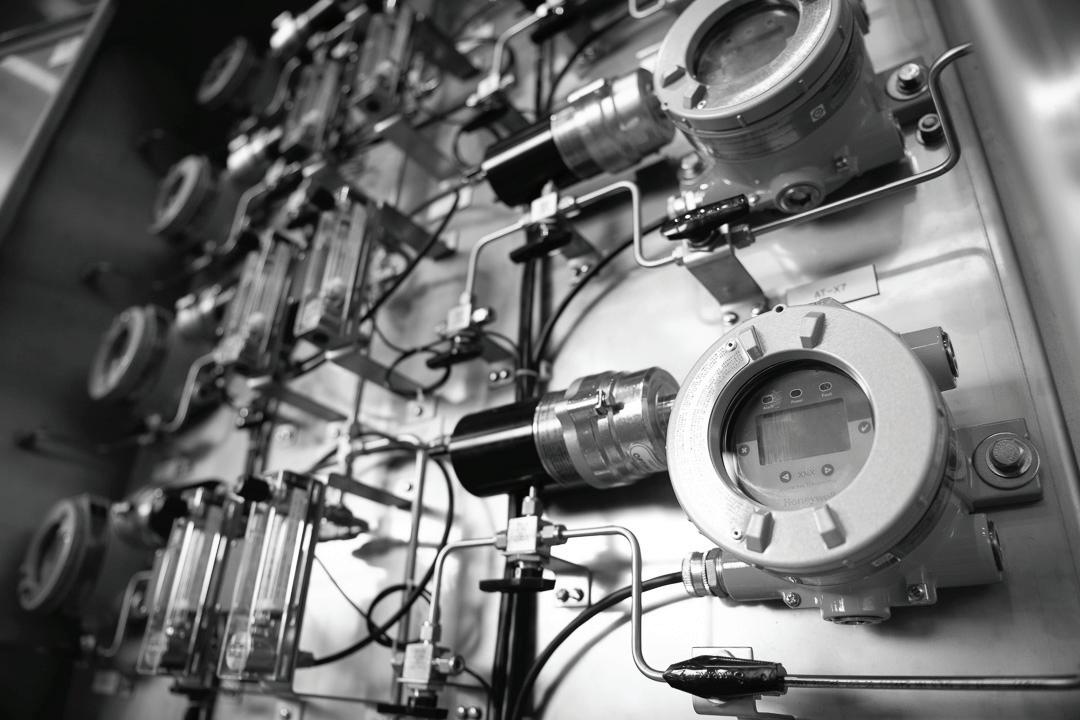

Founded in 1989, ISC has become a premiere electrical and instrumentation contractor within the industry. From humble beginnings in Baton Rouge, Louisiana, we’ve been blessed to see our company grow to have offices in 5 locations across the U.S. We want to say thank you to the amazing customers we’ve had the priviledge of working with, but especially to our associates, who go above and beyond every day to live out the ISC values of safety, quality, integrity, and innovation.

This Louisiana offshore hub is redefining itself for an ‘all things energy’ future.

64 Tug of war Streamlined processes help contractors strike a balance between safety and productivity.

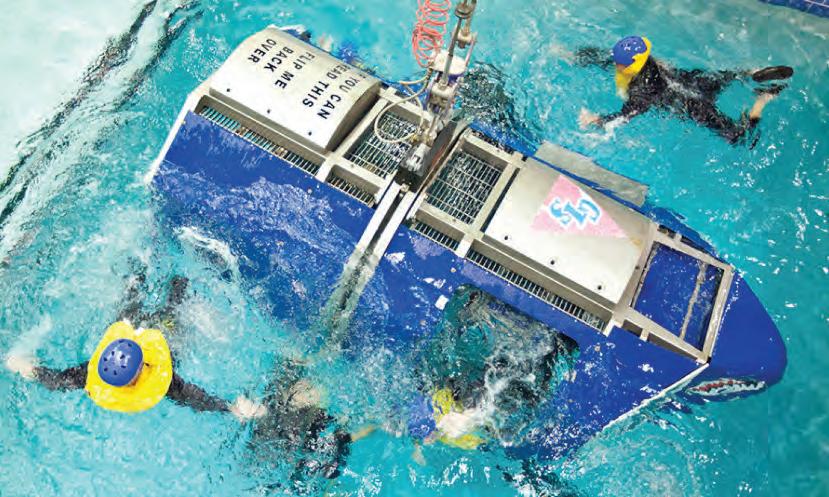

Failsafe

Industry leans on partnerships, technology and a lot of practice to prep for the unthinkable.

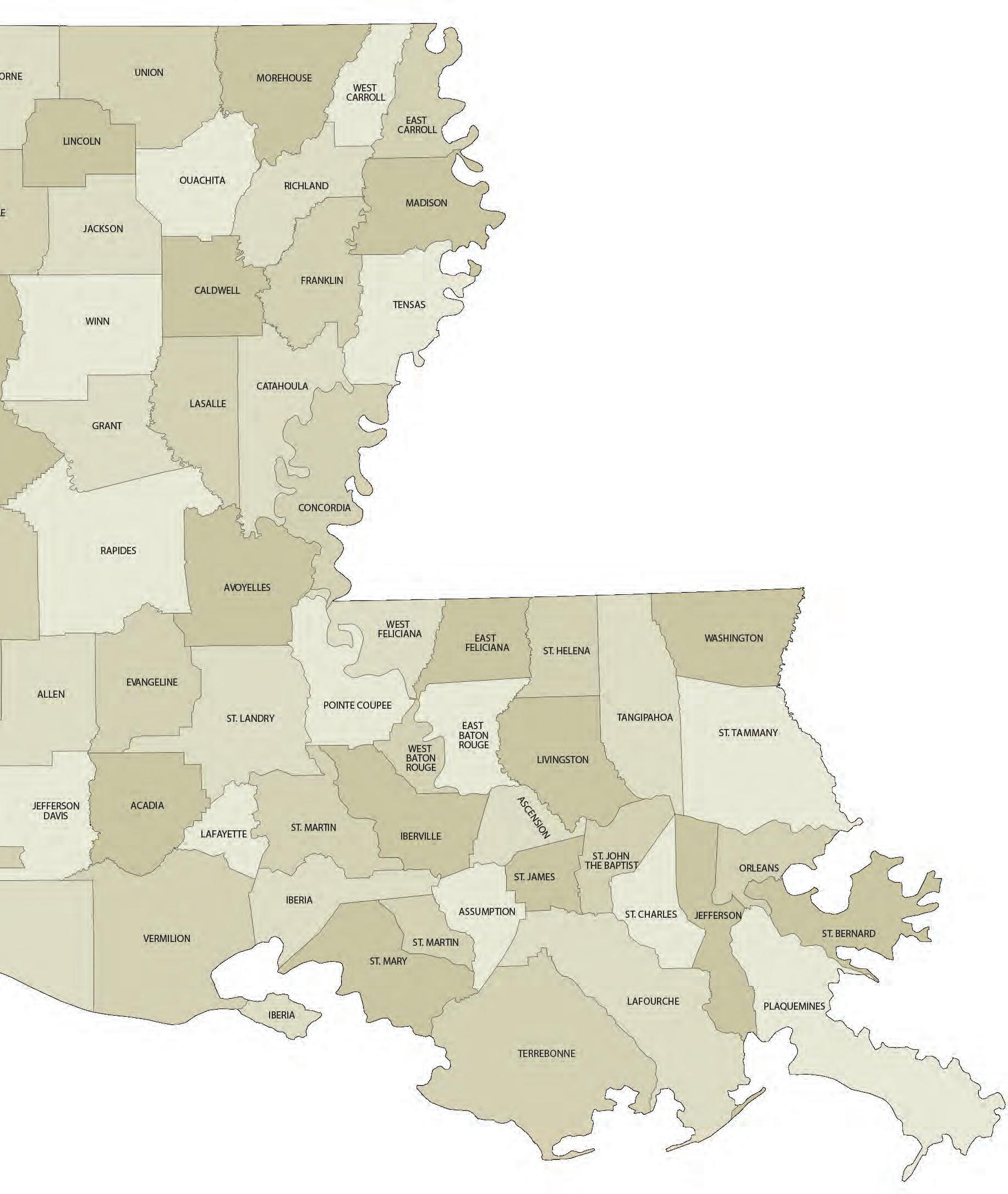

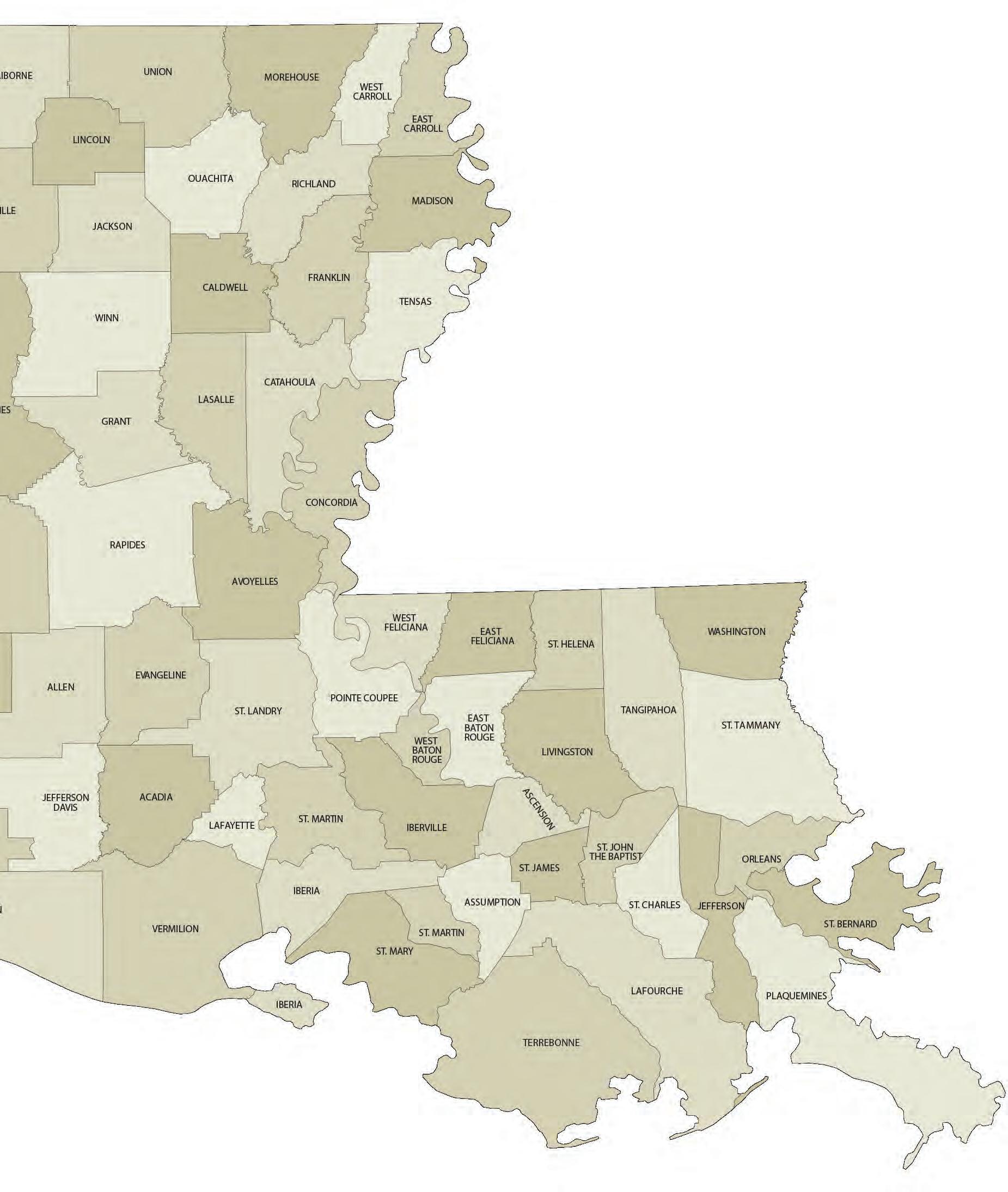

80 Insight: Why Louisiana energy expansion should matter to you

82 Our maps of the projects driving industrial growth 86 Toughest Challenge

A tragedy takes Koura executive Erick Comeaux on a whole new journey.

The Roundtable

Five south Louisiana leaders discuss the challenges and opportunities facing industry in the last quarter of 2024 and beyond.

Publisher: Julio Melara

Associate Publisher: Erin Pou

EDITORIAL

Executive Editor: Penny Font

Editor: Sam Barnes

Contributing Photographers: Cheryl Gerber, Don Kadair, Leroy Tademy

ADVERTISING

Assistant Manager/Sales & Marketing Operations: Kynley Lemoine

Senior Multimedia Marketing Consultant & Team Leader: Kelly Lewis

Multimedia Marketing Consultants: Rachel Andrus, Nancy Bombet Ellis, Ethan Shipp, Emma Walker

Digital Operations Manager: Devyn MacDonald

Media Strategy Manager: Paul Huval

Partner Success Manager: Matt Wambles

Digital Operations Assistant: Derrick Frazier

STUDIO E

Creative Director: Timothy Coles

Corporate Media Editor: Lisa Tramontana

Content Strategist: Emily Hebert

Business Development Manager: Manny Fajardo

Multimedia Marketing Consultant/Custom Publishing: Judith LaDousa

Multimedia Marketing Consultant: Ashleigh Ward

MARKETING

Marketing & Events Assistant: Mallory Romanowski

ADMINISTRATION

Business Manager: Tiffany Durocher

Business Associate: Kirsten Milano

Office Coordinator: Donna Curry

Receptionist: Cathy Varnado Brown

CREATIVE SERVICES

Director of Creative Services: Amy Vandiver

Art Director: Hoa Vu

Senior Graphic Designer: Melinda Gonzalez Galjour

Digital Graphic Designer: Ellie Gray

Graphic Designer: Sidney Rosso

AUDIENCE DEVELOPMENT

Audience Development Director and Digital Manager: James Hume

Audience Development Coordinator: Ivana Oubre

Audience Development Associate: Catherine Albano

Customer Experience Coordinator: Kathy Thomas

A publication of Melara Enterprises, LLC

Chairman: Julio Melara

Executive Assistant: Brooke Motto

Vice President-Sales: Elizabeth McCollister Hebert

Chief Content Officer: Penny Font

Chief Digital Officer: Erin Pou

Chief Operating Officer: Guy Barone

Louisiana’s

50 Revitalizing Southwest Louisiana

The region undergoes a transformation filled with promise.

71 Leaders of Industry 10/12 Industry Report shines a light on companies and organizations that make an impact in their fields and in their communities.

Circulation/Reprints/Subscriptions/Customer Service

225-928-1700 • email: circulation@businessreport.com

Volume 9 - Number 2

BY SAM BARNES

It’s not likely that Louisiana’s fledgling electric vehicle battery industry would even exist without federal assistance, but state economic leaders really don’t care.

More than a dozen new incentives enacted through the Inflation Reduction Act, the Infrastructure Investment and Jobs Act, and the CHIPS and Science Act have fueled investments nationwide in the EV manufacturing space and resulted in more than 84,000 announced jobs, according to the U.S. Department of Energy.

That’s made it financially viable for many foreign-owned companies to consider transporting mined materials from such faraway places as Australia, Mexico and Mozambique into Louisiana to manufacture EV battery components. And, despite reports that EV sales are falling short of expectations, the long-range need to reduce the country’s dependence on China will continue to prop up the supply side of the equation.

To date, some seven projects totaling nearly $2.8 billion have been announced in the state, all to manufacture materials for EV batteries. One facility—Syrah Technologies in Vidalia—is already producing a graphite-based product for Tesla.

“The pressure to create competition for China in this space is clear,” says Susan Bourgeois, secretary of Louisiana Economic Development. “It would be foolish for us not to view that as a major sector for us in the next year to 36 months. We’re addressing what Louisiana needs to do right now

to capitalize on this opportunity.”

Such projects are receiving virtually no regulatory pushback at the local, state or federal levels. For example, Australian-owned Element 25 received an air permit in near-record time for its proposed 65,000-ton-per-year high-purity manganese sulfate monohydrate— known as HPMSM—facility in Ascension Parish.

None of the companies planning to build in Louisiana will be direct competitors, since they will each manufacture a different lithium-ion battery material. EV batteries consist of cathode, anode and electrolyte components that require various materials such as lithium, cobalt, manganese, iron, graphite and nickel to operate effectively.

Element 25’s $300 million HPMSM facility will take about two years to construct once a final investment decision is reached. The company plans to import raw materials from its Butcherbird Mine in western Australia—a 30day journey by ship—with many of the remaining inputs to be

sourced from U.S. and Louisiana suppliers.

In Vidalia, Australia-based Syrah Technologies is already producing about 11,250 tons a year of a graphite-based active anode material, or AAM. The company gets the material it needs from its Balama Graphite Operation in Mozambique, the largest integrated natural graphite mine and processing operation in the world.

“Syrah is in the midst of finalizing their third phase,” Economist Loren Scott says, “and it’s occurring in one of the most economically desperate areas of our state. Here you have a company bringing in about 220 jobs with an average salary of $116,000. That is huge.”

In St. Gabriel, Orbia Fluorinated Solutions’ subsidiary Koura is planning two simultaneous expansion projects at its existing Iberville Parish plant—a $400 million investment to produce LiPF6, a component that facilitates the flow of electricity; and a $400 million investment to manufacture R-142b, a primary

building block in polyvinylidene fluoride (a critical binding agent for batteries).

The company expects to begin construction in 2025 and be operational by 2026.

Elsewhere in the state, Japanese chemical company UBE Corp. has announced it will invest $500 million in a manufacturing facility that will produce dimethyl carbonate and ethyl methyl carbonate at Cornerstone Energy Park in Jefferson Parish. And in Rapides Parish, Ucore North America plans to invest $75 million to establish North America’s first modern technology rare earth element separation and purification facility.

In Gramercy, ElementUS, a joint venture of DADA and Enervoxa, plans to invest $800 million in a facility to extract rare earth elements at the Noranda Alumina site. And in Ascension Parish, Capchem Technology USA Inc., a subsidiary of Shenzhen Capchem Technology Co., plans to invest $350 million to build an integrated carbonate solvent and electrolyte manufacturing facility.

Kate MacArthur, president and CEO of Ascension Economic Development Corp., is optimistic that the two projects in her parish will move forward, and doesn’t anticipate that any short-term declines in EV demand will impact their trajectory.

“Element 25 and Capchem are planning for 30 to 40 years down the road,” she says, “so even if people aren’t purchasing today, they know that ultimately this market will expand.”

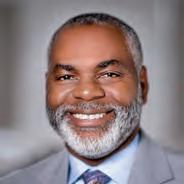

BY SAM BARNES

Some of Jeb Bruneau’s earliest memories are of his father–long-time state legislator Peppi Bruneau–standing up for right-to-work legislation in the 1970s.

It was a critical moment in time for the Louisiana business community, and it thrust his family into the middle of an embittered fight between organized labor and the right-to-work movement.

“Good, bad or indifferent, when you’re a politician’s son, you get it all,” says Bruneau, president & CEO of Associated Builders and Contractors New Orleans/Bayou Chapter. “It got pretty nasty. I remember my mom never letting us go outside because someone had shot through one of our windows.”

Bruneau is a New Orleanian to his core. He grew up and attended school in the Lakeview area After graduating from LSU with a degree in political science in 1992, he briefly flirted with the idea of entering law school, then possibly a career in politics himself, but his father encouraged him to enter the workforce instead.

Bruneau worked as a salesman for a liquor distribution company for more than a decade, but in the days and weeks following Hurricane Katrina his path took on a decidedly different direction. “I was the head of our neighborhood civic group at the time, and I got a lot of national exposure because of that,” he says. “It was weird. I’d be working in some grocery store somewhere and I’d have to go out and do an interview with CNN.”

Not long after, Bruneau made an unsuccessful run for the state legislature, then later worked a two-year stint for the Pelican Institute, a public policy think tank. He then took a job in business development at a Baton Rougebased consulting firm, where he gained invaluable experience as a lobbyist over some eight years. Along the way, he made numerous connections in industry,

one of whom was John Walters, who was at the time vice president of governmental relations with Louisiana ABC, who suggested Bruneau apply for the position (in 2019).

“It was an interesting jump,” he says. Other than being president of the civic association, I had never been in an executive role. Now, some five years later, I can’t imagine doing anything else.”

Two big things happened while I was a relatively new executive. I had been here only a little more than a year when the world changed. I found myself in the office alone during COVID, and a lot of the things we do are public facing.

The big push was to get Gov. John Bel Edwards to make con-

struction an essential job. I had owners calling me because they were very concerned about the city of New Orleans, the state and the construction industry.

We got through that, then got slammed by Hurricane Ida. Our buildings here in St. Rose all got water in them, and we went through a major fight with the insurance company. Through both events, we found a way to keep our craft training going. Construction was deemed essential, so neither the plants nor the industrial contractors ever quit working.

It’s going to be extremely important for us to address the worsening worker shortage. We’ve got the largest construction project in the world going

on right now in Plaquemines Parish at Venture Global. That one project, alone, is sucking up a lot of the workforce not just from Louisiana, but Texas and all over the place.

And there are some other huge investments coming up in St. Charles Parish, so there’s going to be a big demand on the industrial side. We need people to go to work, from laborers to helpers and skilled crafts, as well as management, from foremen all the way up the chain.

At ABC, we plan to expand and grow to meet those needs. It’s still in the pilot stage right now, but we’re conducting a pipefitting class at a satellite location in Port Sulphur, with Performance Contractors as our partner. We’re also working with two high schools on the Northshore ... where we’re piloting some welding classes. While we have this beautiful facility here in St. Rose, in today’s world you must go where the people are, so I think we’ll continue to see the expansion of satellite locations.

Mardis Gras and the carnival culture are important to me. My dad has been involved with the Krewe of Endymion since I was a child, and I’ve been a member since I was in high school. Next year, both my boys will be riding on the float with me.

And I’m a huge LSU and Saints football fan. I think when we came back during that Atlanta Falcons game after Katrina, it symbolized the City of New Orleans coming back and showed to the world that it was alive and vibrant. There’s also nothing like a Saturday night in Tiger Station. It’s a special place.

However, it’s family and friends that are most important to me; it sounds hokey, but they’re very much a part of who I am.

Gov. Jeff Landry issued an executive order in February making key changes to the qualifications for participation in the state’s Industrial Ad Valorem Tax Exemption Program, or ITEP—a property tax abatement incentive meant to encourage industrial investment. It partially reversed some of the requirements that Gov. John Bel Edwards put into place in 2016, while including other key revisions. Some of the fine details remain to be worked out, but the order made three distinct changes. Here’s a breakdown, accompanied by feedback from industry leaders.

Here are the three primary changes made to the ITEP protocol.

• Removed the job creation and retention requirement

• Changed the way local governments affected by an ITEP project provide input into an ITEP application

• Shortened the timeline for local input

The order retains the requirement for local input but provides that it be obtained through a single parish committee made up of:

• Parish president or president of the policy jury

• President or superintendent of the school board

• Sheriff

• Mayor, if located in a municipality

• Non-voting committee members from the local assessor’s office and local economic development representation

• Miscellaneous capital additions remain excluded from the ITEP program CHECK IN

Two key measures from the original order remain in place.

• The abatement remains limited to 80% of the qualifying property value for the first five-year contract and approved renewal

We asked key industry leaders to provide their insights into how the new ITEP protocol is going. Here’s what they shared.

“The removal of the jobs creation and retention requirements is important. At the initial stage of planning a large-scale capital project, it is sometimes unclear just how many permanent jobs it will create …. additionally, very large and expensive modernization and capacity improvement projects were excluded (in the previous ITEP framework). This simplistic calculation missed the point of ITEP as an economic incentive to make large investments.”

—TOM YURA, vice president of operations – Americas Mitsubishi Chemical Group, Geismar

“… There will still be multiple state and local agencies that a company making application must seek approval from; however, the timeline is shorter and that is helpful. Projects must now gain approval before beginning construction and that may help provide clarity to governmental decision makers.”

—CONNIE FABRE, president & CEO, Greater Baton Rouge Industry Alliance

“With the opportunity to have the Louisiana Economic Development overrule a decision by a local body, the impression (among public bodies) is that authority has been taken away from locals.”

—Calcasieu Parish public body comments, according to JIM ROCK, executive director, Lake Area Industry Alliance, Lake Charles

“One major change by the governor is that the job creation element was removed and only the capital investment is considered. We have heard mixed reviews on this from some of our local officials. However, there are times that a project will not create new jobs, but the improvements will solidify the industry for 15 to 20 years.”

—GEORGE SWIFT, founding president/CEO, Southwest Louisiana Economic Development Alliance

“I think it clearly has accelerated the process. I think the new process is one that would yield good results for Louisiana’s economy.”

—GREG BOWSER, president & CEO, Louisiana Chemical Association

During a scheduled outage, Deep South was tasked with replacing two coke drums at a refinery. The new drums each weighed 452,800 pounds and were 96 feet long and more than 19 feet in diameter comparable in size and weight to the old drums. Completing the replacement within the window of time and in tight confines required precise logistics, specialized crane configurations, and multiple means of transport.

A year prior to the outage, Deep South received the new coke drums from a ship at the Port of Houston and then barged them to a dock on the Calcasieu River in Louisiana. Once on location, the coke drums were rolled off of the barge and staged using the Deep South’s 440-ton Terex-Demag CC-2400-1 with a 177.2-foot main boom, counterweights and a tail crane. Each drum was erected into the vertical position and placed in a jig stand to add insulation.

To allow the refinery unit to keep running at full capacity until unit shutdown, the crane had to be assembled offsite and moved into position when ready—an operation that Deep South had never done. Performing this move required significant cooperation between the project engineering and VersaCrane design engineering teams to determine a composite center of gravity and ensure stability. The transport of the crane from its assembly/staging position to its final lift position took approximately one hour.

After the unit shutdown was complete, the Deep South crew moved the fully-assembled VersaCrane TC-24000 into the final lifting position with the boom in the air—a company first—to begin the derrick cutting and coke drum exchange. Once the new coke drums were placed, the derrick structure was reset. So as not to delay unit start up, Deep South transported the more than 1.6 million pound fully-assembled crane back to a nearby laydown area for disassembly and demobilization.

We put the multi in multimedia...

WE PUT THE MULTI IN MULTIMEDIA

Digital Marketing

Visual Production

Award-winning, nationally recognized media production and creative marketing along side the trusted media brands you know and love.

Digital Marketing

Strategy

Brand Equity

Events

Creative Services

Custom Publishing

Video Production

Custom Leadership Training

& Events

Scan to learn more about our awardwinning, nationally recognized media and creative marketing services along side the trusted brands you already know and love.

Scan to learn more

This Louisiana offshore hub is redefining itself for an ‘all things energy’ future.

BY SAM BARNES

“Whatever type of energy we’re talking about, if it happens offshore, we’re going to play a role in it.”

CHETT CHIASSON, executive director, Greater Lafourche Port Commission

Chett Chiasson isn’t interested in competing with any of Louisiana’s other ports.

There’s really no need, since as executive director of the Greater Lafourche Port Commission he’s chasing a distinctly unique holistic vision for Port Fourchon.

Situated a mere stone’s throw from the Gulf of Mexico, the port has always been intimately tied to Louisiana’s offshore oil and gas industry—servicing more than 95% of all Gulf deepwater activities.

But these days, Port Fourchon is evolving, intentionally pursuing a more diversified agenda with a focus on all things energy, now on the verge of becoming home to Louisiana’s inaugural wind turbine.

“You won’t hear me talking about cargo and containers–that’s not at all what we’re about,” Chiasson says. “We’re not looking at competing with our brethren across Louisiana.”

It would be an understatement to say that the port and its tenants have endured their fair share of storms, both literally and figuratively, over the last 10 years. When the oil market bottomed out from 2014 to 2016, they were each faced with a difficult decision: Evolve or dissolve.

Then came the COVID-19 pandemic and a devastating blow from Hurricane Ida. Employment in the area dropped from above 100,000 in 2014 to a bottom of 81,000 in 2021.

“That was a mother of a hit,” says economist Loren Scott with Loren C. Scott & Associates in Baton Rouge, who currently forecasts employment in the area to slowly, but steadily, rise to 89,000 by 2026. “Since 2021, they’ve begun to recover, but they’re still a long way below where they were in 2014.”

To survive, Port Fourchon’s tenants have done whatever it takes to stay relevant. Several companies diversified into non-oil and gas related work or shifted into the maintenance and repair side of things.

Edison Chouest, a firm that

owns and operates some 300 supply boats servicing the offshore industry, now builds to service the offshore wind industry and other vessels. Bollinger Shipyards, a major shipbuilder in the region, now has a long-term contract with the U.S. Coast Guard to build Fast Response cutters. And marine construction firm ThomaSea has shifted beyond the oil and gas market by fabricating research vessels and brown-water barges.

Port Fourchon itself has become particularly adept at navigating the frustratingly slow and tedious waters of state and federal regulations to fund a variety of infrastructure and dredging projects, while also adopting an “all things energy” mindset.

As a result, they’re evolving into

a testbed, of sorts, for innovation as they pursue investors in offshore wind, hydroelectric power, LNG, coastal restoration and offshore platform fabrication and decommissioning.

It plays into Chiasson’s mindset of holistic resiliency, whereby industry and the environment aren’t competitors, but collaborative partners.

LNG–who hopes to build an LNG export facility on port property–credits Chaisson’s evolutionary vision for growing the port in the face of some rather daunting odds.

15,000

Number of people per month flown to offshore locations supported by Port Fourchon

“They work very well together,” Chiasson says. “We all must live in the same happy world. Bottom line: We want a good economy, good environment and the ability to provide energy.”

Jonathan Bass, CEO of Argent

“What was Port Fourchon 15 years ago? What has Port Fourchon become today? It’s a completely different animal,” Bass says. “Chett’s strength is that he goes out there and does the heavy lifting. I’ve seen him in Washington D.C. more than Louisiana. He’s out there pushing forward with his vision.”

Christy Zeringue, incoming

“[Port Fourchon] has been cutting edge on their designs for the future state of what a wind port could look like.”

JAMES

CEO of the South Louisiana Economic Council in Thibodaux, didn’t hesitate to ask Chiasson to become the council’s board chairman after assuming her new role this fall following the retirement of Vic LaFont. “I knew exactly who to call,” Zeringue says. “He’s a visionary, a pioneer in this energy addition space.”

She says it’s Port Fourchon’s comprehensive approach to energy that is catching everyone’s attention. SLEC works with Port Fourchon as a liaison and facilitator. “They’re leaders in the energy space. They’re adding a land-based windmill at the port … how many other places can say that they’re doing that? How many ports?

“My challenge is that we need to tell our own story … that way

we can set the narrative about how uniquely poised we are to bring in all these different energy industries. And that we have a skilled workforce that can either be retrained or reskilled, so they have the certifications they need.”

Chiasson and the port were in the process of developing a master plan when the oil market bottomed out a decade ago—a painful hit that only served to accentuate the need for a new strategy. The contents of the plan are now being played out, with just more than $270 million in capital projects scheduled over the next two years.

A few of the more significant include:

• The development of Fourchon Island, a proposed deepwater port south of the existing facilities. A total of $200 million is projected for the development, which will focus on offshore wind and offshore rig repair, refurbishment and decommissioning. Leases have already been signed with C-Logistics, Bollinger Shipyards and Gulf Island Shipyards. Permits are expected later this year.

• The purchase of 850-acre

Caillouet Island, which will provide unrestricted access to Port Fourchon Island and be supported by a new Fourchon Bridge. The port is also donating 165 acres to the state for the creation of a Coastal Wetlands Park. The $700,000 attraction is set to begin construction in late 2024 and will include an elevated viewing tower.

• The $1.1 million installation of Louisiana’s first wind turbine by Gulf Wind Technology in Avondale. The 200KW to 300 KW of power generated by the

turbine will be used for the port’s operations center and the Coastal Wetlands Park viewing tower. Construction of the turbine foundation is set to begin late this year.

• A new $4.3 million, 6,000-square-foot terminal at South Lafourche Leonard Miller Jr. Airport, which is under the port’s jurisdiction. The airport supports numerous helicopter and fixed-wing flights and is used heavily by the offshore oil and gas industry.

“Closely related to the port is a $411 million project by Entergy to construct the Bayou Power Station,” Scott says in his recently released Louisiana Economic Forecast. “This will be a floating

natural gas-powered station to provide power to Port Fourchon, Golden Meadows, Leeville and Grand Isle.”

From atop a barge across from a substation in Leeville, the 112 MW power station would provide much-needed redundant power.

“This will give them the ability to provide more resilient rapid startup capability and give us a more reliable and resilient power grid,” Chiasson says.

The port executive is particularly excited about recent successes in garnering federal funding for dredging activities that will ultimately accommodate a wider range of tenants.

“We’ve been finalizing all our approvals and working with different agencies for an initial deepening project that will take us from 27 to 33 feet. That should start before the end of the year,” he says. “It will allow our tenants to be more efficient in serving the larger vessels that are already using the port.”

More importantly, potential funding from the federal Water Resource Development Act could facilitate the dredging of the southernmost section of Bayou Lafourche to a depth of 50 feet, critical to the development of the Fourchon Island deepwater port and the proposed Argent LNG facility.

“Fortunately, about half of Fourchon Island is already under lease to Bollinger Shipyard, Sea Logistics and Grand Isle Shipyards,” Chiasson says. “By having it leased, we can go to the Corps of Engineers to demonstrate the need for the 50-foot draft. You’ve got to have the chickens before you can build the coop.”

Once permits are received, it will take the port nearly a decade to create the island, as the project calls for transforming about 900 acres of marshland into a new 500-acre development.

The port administration is also waiting on another supportive infrastructure project: A 9-mile

stretch of elevated LA 1 leading to Port Fourchon, set for completion in late 2027. “That is a major piece of infrastructure that will provide long-term resiliency for the port and for accessing the port,” Chiasson says.

Port Fourchon’s willingness to embrace all things energy has led to an implausible partnership in recent months. By year’s end, Gulf Wind Technology expects to begin constructing the foundation for the state’s first wind turbine at the port’s Coastal Wetlands Park.

The 187-foot-tall turbine will collect data and potentially power the port’s nearby emergency operations building.

“When I found out the port had an appetite for embracing renewable energy, we hit it off,” says James Martin, CEO of Gulf Wind Technology in Avondale. “Chett talked about the vision he

had for the area, and we began performing a wind assessment and working with the port to determine the right location. They’ve been cutting edge on their designs for the future state of what a wind port could look like.”

Earlier this year, the turbine and its components arrived at Avondale Global Gateway after a transatlantic journey from Ireland. Since then, Gulf Wind Technology has been testing the technology in a wind tunnel at its facility.

peak wind events.

Percentage of the nation’s oil supply in which Port Fourchon plays a strategic role

“The project is also demonstrating that the port can handle the components of the turbine, such as the tower, gearbox, generator and blades. We wanted to showcase that you can import, store on site etcetera,” he adds. “The aim for this turbine is that it’s going to have new technologies installed on it on a rotating basis.

Every season we might put a new set of blades on it, or we might put new sensors on it.”

is equally valuable.”

Once it’s operational, Chiasson hopes to showcase his port as a national leader in the servicing of offshore wind power. “If offshore wind does take off in the Gulf, we certainly believe and know that Fourchon is going to play a role in that industry because of the supply chain that already exists and the expertise we have in servicing offshore industry,” he says.

“Our objective is to install a technology demonstrator turbine at Port Fourchon,” Martin says.

“It is an example of a small robust turbine that we are going to adjust so that it can operate in the low wind speed environments of the Gulf and be resilient against

Martin expects the turbine to be producing power by the end of Q1 2025. “But there’s really no rush … we’ll have just as much enjoyment planning the project and putting the project together than we will in seeing the turbine spin,” he adds. “That’s the cherry on the top, but the journey

The port is also picking up a related tenant: Crowley Offshore Wind, which plans to spend $50 million a year through 2026, with the anticipation that it will service offshore wind developments in state waters.

“Businesses here are already working in the northeast on offshore wind projects (such as Block Island Wind Farm),” Chiasson says. “That expertise can transition easily. They’re still working offshore, still loading and unloading heavy stuff … it’s still part of

that offshore process and we have that expertise here. Whatever type of energy we’re talking about, if it happens offshore, we’re going to play a role in it.”

Port Fourchon’s biggest attribute is “location, location, location,” says Argent LNG’s Bass. “The port checks every box. There’s proximity to a pipeline … we’re only 1,500 yards from it, and there’s a community and a local government that’s supportive of the project. Then there’s the community … Chett can’t go a week without people in the community asking him about the LNG project.”

Bass expects his proposed $10 billion, 20 million tons-per-year facility to begin the FERC pre-filing process this fall. If approved–which could take up to two years–Argent would take delivery of its first module 18 months later, with subsequent modules following every one to two months until completion.

Earlier in the year, Argent tapped Worley as its EPC and development partner, with Worley’s initial focus being the development of site layouts and the selection of process technologies. Argent also selected GTT’s cryogenic membrane containment system for the transport and storage of the LNG.

Bass expects about 1,000 permanent jobs to be created by the facility, without another 3,500 construction jobs over a six- to seven-year period. He admits that the project must first overcome some serious headwinds, principally the current federal LNG pause, “but I think we’ll get past all of this anti-gas mentality … it’s the only immediate lever they can pull that’s better than coal.”

Tommy Faucheux, president of the Louisiana Mid-Continent Oil & Gas Association in Baton Rouge, says Port Fourchon’s willingness to accept all forms of energy will undoubtedly create

jobs in the long run.

“A lot of those service companies are going to need opportunities to grow, expand and diversify,” Faucheux says. “And at Port Fourchon, they’re the world’s experts in operating in the Gulf. If they can service the oil and gas industry, they’re absolutely capable of servicing offshore wind or something else.

“I think it’s great for Louisiana business, because they’re playing a critical role in the industry’s success at home. It creates long-term job protection.”

But as projects ramp up, it could serve to exacerbate a lingering and persistent problem for the Bayou Region: an alarming lack

of workers. “There was a large segment of the population that just threw up their hands and said I’ve had enough after Hurricane Ida,” Scott says. “And I’m sure Francine, although not as bad, will reinforce that a bit.

“Gulf Island Shipyards was forced to hire international crews to work its offshore rigs,” he adds. “They’re having to fill these jobs somehow. The jobs are there, but they’re having a hard time finding people.”

SLEC’s Zeringue agrees that it’s the workers, not the jobs, that are scarce. That’s why workforce development has become a particularly important focus for the council in recent years, in addition to business retention and recruitment.

Faculty members from Nichols State University’s College of Business Administration and Fletcher Technical Community College are on the SLEC board to facilitate the workforce discussion. They also get input from South Louisiana Community College. “Through their collaboration,

they’re able to quickly put together programming for maritime management, welding certifications, etcetera, to meet the needs of industry.

“We have meetings with them where we bring in our industry partners to find out where the gaps are,” Zeringue says. “When the industry folks can tell our higher education folks where the gaps are, as well as how much they’re offering in salaries, that generates a lot of interest. They’re also helping fund some of the training through donations, or in-kind donations, to facilitate the training.”

Chiasson says irrespective of the challenges, there’s palpable

Louisiana’s five deep draft ports on the Lower Mississippi River represent “one of the busiest port complexes in the world.”

In a coordinated effort, these five ports have commissioned an independent firm to develop a market analysis and strategic plan to identify new cargo opportunities and expand international trade.

This historic cooperative undertaking will be led by Martin Associates Economic & Transportation Consultants under the

direction of the World Trade Center New Orleans. Cargos in the analysis include containerized cargo, break bulk and project cargo, as well as bulk cargo. Interviews with key maritime stakeholders, the market analysis, and logistics cost analysis will help create a cargo development strategy to help the five ports along the Lower Mississippi River to successfully compete regionally and internationally.

Brian Haymon CEO, Loadstar Product Handling

Evan

President & Managing Principal, Lee & Associates

WHEN THE ANCIENT Greek philosopher Heraclitus wrote that “The only constant in life is change,” he could just as easily have been talking about industry in south Louisiana thousands of years later. As 2024 winds to a close, the region finds itself in a constant state of adapting to complex challenges while grappling with how to harness new technologies.

With this dynamic situation in mind, 10/12 Industry Report invited five local thought leaders to share their ideas and insights surrounding the key issues facing the petrochemical industry today, as well as the opportunities that they see for their sectors and this area moving forward. From artificial intelligence and energy grid diversification to debt markets

and expanding development, these leaders offered real-life examples of how they are tackling pressing issues and revealed what is driving their successes as they work to position our state for future growth.

Comments made during the roundtable have been edited and condensed for clarity and for space. Read and share the online version.

Alliance Safety Council has your back. Our team of experts creates, delivers and manages compliance training so you can focus on what you do best. We’re your partner in building a job-ready workforce.

Your workforce is mobile, and so are we! We’re committed to making training as accessible as you need it to be. Whether it’s at home, on a phone or in a lab, our training meets you where you are — anytime, anywhere.

Mid-South OTI Education Center

The Mid-South OSHA Training Institute (OTI) Education Center, a consortium between Alliance and LSU’s College of Engineering, delivers occupational safety and health classes.

The Certified Occupational Safety Specialist (COSS) program caters to new safety practitioners, while the Certificate for Occupational Safety Managers (COSM) program is for experienced safety professionals. Both can qualify as CEUs for safety professional certifications.

Safety Awareness Fundamentals (SAF)

The SAF suite of computer-based courses provides standardized, awareness-level training on 40+ safety topics.

Pyvot Verify

Make any online training available 24/7/365 with AI-assisted remote proctoring technology.

HAZWOPER

24- and 40-hour courses include scenario-based lessons and handson, real-time air monitoring exercises.

In St. Gabriel, probably the most challenging issue is diversifying the energy grid. As facilities are trying more low-carbon products and even low-carbon energy, there is a transition that needs to happen. Diversifying the electric grid is not just about saving and creating jobs in St. Gabriel but in industry as a whole. It presents a variety of challenges and opportunities. The challenges are geopolitical and geo-economic; we don’t want instability in our region and throughout the world. But the opportunities are simply to create clean energy and to prevent leaks and flares and things of that nature. I embrace modernization and expansion that is an environmental win.

Lionel Johnson

Public opinion around the environmental impact of industry is a huge challenge, and it needs to be addressed with more education about recent advancements in monitoring and reducing emissions. Industry needs to stand up and speak about the measures taken to ensure the safety of our communities. We have the technology to be able to monitor and address almost everything that could possibly occur. Emissions have not led us to stop driving cars or barbecuing. There is a need for more balanced and informed conversations.

I think industry as a whole and the workers of our industry tend to stay silent on this, and there needs to be a groundswell to shift public perception.

—Kathy Trahan

OWhat do you see as the most pressing issue facing your industry as you move into 2025? I

think it is the political climate. There is opposition from those who want to inhibit growth of the industry, and often we ignore them, but I believe that is the wrong strategy. They are hitting social media. They are hitting schools. The kids who are hearing this today will be parish council members in 15 years. They will be mayors. They will be decision makers, and if they have been told for years that industry is bad, that is going to influence the future. I think industry is going to have to figure out a way to get just as assertive in its messaging. We have to get better at telling the good side of the story of the industry and debunking the negativity.

—Jerry Jones

Dne emerging issue is producing energy to support growth and new technology. AI, for example, requires huge amounts of energy. We need to be open to new sources like Small Nuclear Reactors (SMRs) and other alternative forms of production, even as we continue to expand and harden the grid. A related emerging issue is competing for talent. Too many younger workers see ours as an industry of the past. We need to showcase our technology and commitment to produce clean energy. Local communities also need to see us not as old-world polluters, but as drivers of economic growth that can improve education, healthcare and other outcomes, especially for those living close to industrial areas. We have to increase our investment and present ourselves in a much more positive light, and then show people the good we are doing. We must change the narrative.

—Brian Haymon

ebt markets continue to be a challenge for us. I work with companies that would be service providers to petrochemical, and what they need is warehouse space. Getting warehouses built is becoming more and more of a challenge because the debt markets are very tight right now. There is plenty of equity in the market for deals, but debt has been a challenge. Getting funding for speculative development wasn’t that big of a challenge 24 to 36 months ago. Now, it’s kind of like looking for a needle in a haystack. Population decline is also a real challenge, and it goes hand in hand with the ability to attract debt into the market. A lot of institutional groups want to invest capital or deploy debt in areas that are experiencing population growth. Louisiana is missing out on a huge opportunity to be a strategic location for supply chain logistics for companies, especially with the new container port south of New Orleans. Look at our interstate connectivity, our rail connectivity. Baton Rouge is the only MSA along the I-10 corridor that has three north/south interstate corridors within 80 miles of it. I like to say that I-10 and the Mississippi River, that’s Main and Main and we are sitting on top of it. So there is a ton of potential there.

—Evan Scroggs

It’s amazing how AI has changed the way business is done just in the last 24 months. We use it for market research and forecasting. We’ve used it to help give us an idea about future tenant demand. Probably the most compelling way I have seen AI implemented locally is to help solve supply chain and logistics questions. You can provide it inputs— where the product is manufactured, who the end consumer is, which ports it is being exported from, where it’s being imported to, how many warehouses your supply chain infrastructure allows for—and it can help determine the best footprint or the best location based on those inputs. That’s been pretty fascinating to see. But we are just scratching the surface.

—Evan Scroggs

Ithink from an environmental standpoint, it is going to make us better at monitoring emissions. When you have a 400-mile pipeline, a lot of things can happen in 400 miles, and I think AI is going to help us minimize fugitive emissions. I think it is going to help us forecast maintenance needs. A piece of equipment has a lifespan, and I think it is going to be able to monitor wear and tear and give us a better ability to decide when it’s time to take a piece of equipment out of service. But we must address the energy demands that AI is going to require. The great news for Louisiana is that natural gas is still a clean way to produce electricity. Louisiana has all the natural gas we need, and we can build all the power plants we want. But still that takes time, and we are going to have to have that energy. The other thing that I think will come with increased AI is increased cybersecurity issues. Where there is opportunity, there are bad guys that are going to take advantage of it. You have to address both of them simultaneously.

—Jerry Jones

LAoadstar has adopted AI to improve our safety and operating performance. Each month, our supervisors conduct hundreds of observations of employees performing tasks in the field. We used to collect the paper observation forms and look for trends. Now the observation data is collected electronically and fed into an AI software that identifies gaps—the people, tasks or other things we are not observing as often as we should. The software generates a weekly to-do list for each supervisor so our observations are more comprehensive and our management has a more accurate picture of how our guys are performing in the field. In another AI application, we hired a local firm, DisruptREADY, to develop AI software that applies complex pay and billing rules to invoices and payroll. It used to take one person three days to process a two-week pay and billing cycle. Now it takes about three hours. It’s been a game changer in terms of efficiency.

Artificial intelligence has become an essential technology in the corporate world. How are you incorporating it into your own industry?

—Brian Haymon

Ibelieve government has a role to play. I have projects that are in place that I call legacy projects. I know I won’t see them through, but I know I will get them started. I think our state leaders need to have legacy in mind. We have to have a futuristic approach. I completed a Ph.D. program in public policy, and the last year and half, I saw the university grapple with how to handle AI. So not just in this industry but in all industries, I think we need to start embracing it, understand the opportunities, and understand the challenges with security. Our statewide leaders have to have the foresight to address these things together, understanding that with term limits, they won’t be the one that might get all the credit for it, but it will be a part of their legacy.

I has become an essential component in our operations. “AI is going to take your job” is what you hear, but the people who know how to use AI will be able to do the work of two to three people. We use human-assisted AI in our online training courses for facial recognition and the flagging of anomalies. Prior to COVID, we had this technology ready for the power sector, because it is so geographically dispersed. Since then, we have transitioned it to other sectors. With human-assisted AI, humans are still an important part of the process. In our solution, AI flags potential deviations from the rules during online training, but humans make the final call on whether the student will get credit for the course based on testing parameters set by the course provider.

—Kathy Trahan

—Lionel Johnson

St. Gabriel is a city with many advantages. Our public services, our police protection, our youth programs, our senior programs, and our economic development efforts are just a few of the benefits that we take seriously.

Uniquely situated to partner with world class industry, our state’s Capital and our region’s educational powerhouses, St. Gabriel offers our resident’s a lifestyle unlike any other in the Capital Region.

The residents of St. Gabriel, both corporate and residential, have an impact on the city as a whole. Our partnerships are leading us to become a city of excellence and achievement moving forward.

One thing that has become a common thread over the last year goes back to workforce availability. Companies can’t find the people they need. That was not a problem pre-COVID, at least not at the level it is now. On the positive side, there’s the rapid expansion of carbon capture utilization and storage. CCUS can be a gamechanger for Louisiana. That wasn’t on the horizon 10 years ago. And it picked up in the last year like I never expected. So I think we see some challenges in 2024, and I also see some great opportunities that are out there. I am learning more now than I was 20 years ago because there is just so much more that you have to absorb. This is probably one of the most exciting times in the energy industry, and I think Louisiana stands in a position to be a major player in this game.

—Jerry Jones

We continue to see younger workers emerging as leaders and decision makers. They bring their own expectations for our industry and its future. Some have told me they see our industry as too conservative and risk averse. They sometimes encounter an attitude of “if it ain’t broke” that can stifle creativity and innovation. In the site logistics space where Loadstar works, barges, railcars and trucks are handled much the same as they have been for decades. Change is surely coming. Will our industry adapt, or will we lead? This is one reason why innovation is a core value at Loadstar. We have introduced virtual reality and AI, and we are just getting started. We want to help our customers figure out the changes that work best for them and then go make it happen.

—Brian Haymon

Streamlining the onboarding process for our contractors has been one of our big wins. We work with the one resource that nobody can get more of—time. We look at every process and say, “How can we shave time off of this?” We measure by ZIP codes—where people live versus where they work versus where they train—to show the time and emissions we are saving them by training them where they are. At the same time, technology and the infrastructure to support online training has gotten better, so we are able to deliver richer training experiences. When we talk to industry partners and stakeholders, we look for that common thread—how we can eliminate redundancies and how we can provide them just-in-time resources that give them what they need.

What is the biggest change you have seen in your sector so far in 2024, and how has it affected your organization?

WI—Kathy Trahan

hen I started with Lee & Associates in 2023, we were really the only national commercial real estate company in town, and since then there have been a few other national groups that have opened offices in New Orleans. That is a big change. I don’t know if it has really affected our organization. I do think it is going to have an effect on smaller boutique brokerages that may run into limited resources and capacity to handle the research required to stay competitive. For us, it’s affirming that we were ahead of the curve and seeing where the industry was going.

think the biggest changes for us have been investment and development. Several local facilities are doing modernization projects and expansions. We have one new facility coming on board. All of them are environmentally friendly. We are talking about billions of dollars in investments right here in St. Gabriel. We have plastics. We have fertilizers. We have herbicides. We have insecticides. So we are talking about protecting crops, protecting people and protecting water. I embrace modernization and expansion that is an environmental win.

—Lionel

Johnson

—Evan Scroggs

Loadstar provides product handling and site logistics services to the refining, chemical, and marine industries. We load and unload railcars, trucks, barges, and ships; we switch railcars; and we operate docks, warehouses, tank farms, rail yards, and other assets on behalf of customers. Our employees handle all classes of cargo including liquids, solids, and compressed gases.

Our people come first. As a Best Place to Work, we attract top talent that delivers the outstanding customer service that sets us apart. Together we are building a great company, one that will lead our industry for generations to come.

www.loadstar.com www.loadstar.com

We are focused on utilizing technology and data that we have collected to help our members meet rapidly changing needs. We are going to continue to use technology to scale as an organization, and that scaling will provide additional data to feed that engine. We’re also going to be proactively embracing a userobsessed approach. How do we make it easy for people to access our training? Also, we are really seeing a big push for more just-in-time resources. How can we support our contractors as talent exits industry? With so many Baby Boomers leaving, there is a big gap that needs to be backfilled, and we want to collect that information and provide them with the resources they need to help get projects completed on time and on budget.

—Kathy Trahan

We are looking to add two partner-level brokers to our company over the next six months as we continue to grow. We are also going to be opening a New Orleans office in the next 12 to 18 months. Another focus for us is continuing down the I-10 corridor. We have an office in Lafayette, we are in Baton Rouge, and we want to lock down New Orleans, but we’re also looking over toward Mobile. There are a lot of similarities between the Mobile market and New Orleans and Baton Rouge combined. It is a port city, with a lot of trade through there, good infrastructure, and it’s a place that we want to focus on. So it’s all about continued growth, both geographically and by adding good talent and good brokers.

—Evan Scroggs

SFt. Gabriel is positioned where we have parcels of property that are wanted by industry. We still have enough green space for expansion and continued growth. We are positioned perfectly off the I-10 corridor and along the Mississippi River, and we can seize our role in meeting that demand. On the macro level, I see that as more jobs, environmental wins, and opportunities for increasing the quality of life not just for the people of St. Gabriel, but for the people who work and live in the region.

—Lionel Johnson

What

Ithink Loadstar will continue to enjoy healthy growth. Customers trust us to handle their critical operations safely, and we will do our best to continue to reward their trust. We will build on our work in VR, AI and other technology to develop creative solutions. Loadstar is honored to have twice been recognized as a Best Place to Work, and we think our ability to attract and retain great people will continue to set us apart. We are locally owned and operated, and we will remain that way for generations to come. We aspire to be an industry leader and to make our world a better place.

ossil fuels will always be a part of the equation in Louisiana, but we are going to have to see an all-of-the-above approach: fossil fuels, solar, wind, CCUS. And as a law firm, we are going to be players in all of that because that is where the energy industry is going. Lithium mining is going on right at the Arkansas-Louisiana border. We are getting several manufacturers that make components for lithium battery manufacture. There are opportunities in the battery world that Louisiana hasn’t even touched on yet. So We are looking at all sectors in energy, and it is ever changing. That is both exciting and terrifying.

—Jerry Jones

—Brian Haymon

BY SAM BARNES

Louisiana service companies and oil ‘majors’ renew their focus on offshore oil despite federal challenges.

Acomplex set of variables is driving a resurgence in the Gulf of Mexico. Despite a federal push away from fossil fuels, the Gulf’s major oil players are investing in new production platforms that will increase, or at least maintain, current production rates for several years.

Industrial Info Resources of Houston is currently tracking 97 offshore oil and gas projects totaling nearly $27 billion that are in the planning, engineering or construction stage.

“The majors are developing more projects than I’ve seen in the last five years,” says Gordon Gorrie, vice president of oil and gas research at Industrial Info.

“There are several new projects taking off … not just additional steel platforms but a lot of deepwater floaters and semi-submersibles. And most of that is offshore of Louisiana, not Texas.”

That’s welcome news for south Louisiana’s oilfield service industry. When the market bottomed out from 2014 to 2016, the rig count in the Gulf dropped precipitously from 60 rigs to about 14. Now, it’s around 20 to 22.

“There are a large number of production platforms going into the Gulf of Mexico, with 12 of them having just announced, or are very close to announcing, an FID (Final Investment Decision),” says economist Loren Scott with Loren C. Scott & Associates in Baton Rouge.

Shell PLC and Equinor ASA, who recently approved a 90,000 barrels per day oil and gas platform in the Gulf, said they would aggressively invest in exploration to continue production through 2050.

The deepwater Gulf of Mexico will also remain a key component of BP’s overall energy portfolio, even as it invests in the energy

“At $80 oil, the profitability is in drilling for oil, not in renewables.”

MIKE MONCLA, president, Louisiana Oil & Gas Association

transition, with a goal of increasing production to 400,000 barrels per day.

Technology is part of the reason for the resurgence. Chevron disclosed in August that it had pumped oil from its Anchor Oilfield at 20,000 psi pressures using specially designed equipment. BP has its own high-pressure technology and is expected to soon pump its first 20,000 psi well in the Kaskida Oilfield about 250 miles southwest of New Orleans.

“It’s like a whole new frontier has opened up,” Scott says. “What they’re doing out there, technologically, is more difficult than landing a man on the moon.”

Mike Moncla, president of the Louisiana Oil & Gas Association, says sustained oil prices are also fueling investment.

“The industry is commodity

Chevron is a prime player in deepwater exploration in the Gulf. Presently five Chevron-operated deepwater platforms in exist in the Gulf, and the company is developing two more.

driven, and for the last several years we’ve had $80 oil as an average,” Moncla adds. “Shell and BP have invested a lot in the renewables side, but recently they’ve decided to concentrate more on being profitable for their shareholders. And at $80 oil, the profitability is in drilling for oil, not in renewables.”

That’s grabbing the attention of Louisiana’s oilfield service companies. Prior to 2023, Danos Group in Gray had made a significant move into onshore work, particularly in the Permian Basin, but the ratio has recently begun to tilt back to offshore.

In March 2023, Danos acquired Wood’s offshore labor supply operations, then a year later Per-

formance Energy Services (PES) in Houma. “The Wood’s acquisition was a pure play in terms of investment in offshore production,” says Paul Danos, CEO of Danos Holdings, “and while Performance has some work in Israel, outside of that all of their work is offshore.”

As a result, Danos has retrenched itself squarely in the offshore market, with nearly 75% of its business now in the Gulf of Mexico. “Our recent acquisitions help us leverage our existing infrastructure and make us more competitive in that space,” Danos says.

Nevertheless, he remains “cautiously optimistic” about the future of offshore oil and its impact on south Louisiana service companies.

“The ‘cautious’ part comes from experience,” he says. “Our company has been around some 77 years, and we’ve moved through many oil and gas cycles, so being cautious just comes with the territory.

“And while there continues to be good opportunities, we need a federal government that wants to produce oil and gas in the Gulf,” he says. “If they do, there are companies that are still interested in this space.”

Many oil producers also point to environmental reasons for the ramp up in offshore attention.

A recent report by the National Ocean Industries Association, an industry group, asserts that greenhouse gas emissions associated with extracting a barrel of oil from

Operated assets (facilities)

Non-operated assets

Offices or facilities

Airbases

Marine shorebase

the Gulf are one-third lower than emissions from a land-based well. “It’s a combination of God-given geology and the small footprint that they occupy,” Danos says. “They’re producing a lot of barrels in very small and confined area. And they can stick it in a pipeline, not on a ship that burns fuel.”

The recent offshore surge seems to fly in the face of the Biden Administration’s attempts to curtail future investment.

The U.S. Department of Interior released its 2024-2029 National Outer Continental Shelf Oil and Gas Leasing Program nearly 500 days late and with the fewest oil

and gas lease sales in the program’s 45-year history. Only three lease sales are scheduled in 2025, 2027 and 2029.

“And there’s no guarantee that they’ll have those,” says Tommy Faucheux, president of the Louisiana Mid-Continent Oil and Gas Association. “With the couple of lease sales that we had recently, Congress had to force them to happen.”

As a result, 2024 will be the first year in the program’s history with no sales at all. “If you look at the long-range forecast for production, it’s going up but then it starts to tail off and drop,” Scott says. “The decline curve is much shallower than a shale rig, but it does decline. Unless you get more drilling, you’re going to see that decline in production continue in the Gulf.”

Industrial Info’s Gorrie says new offshore investment will only help maintain the current rate of 2 million barrels per day, as the more mature platforms are producing less oil.

According to the American Petroleum Institute, most of the oil currently being produced is from leases sold during the Reagan and Clinton administrations.

“That’s how long it takes,” says LOGA’s Moncla. “Just because there’s a lease doesn’t mean it’s going to be drilled this year. When they ink a lease, they have to do seismic studies, geological surveys and figure out the best place to drill, then it might take a year or two to get a rig. Then you’ve got the logistics of getting the oil or natural gas to the shore. It takes years.”

And while the oil and gas industry continues to innovate to maximize production at existing lease sites, “they’re doing it with the leases they have now,” Faucheux says. “We have to figure out at a policy level how to increase the number of leases in order to incentivize these companies to explore and produce for the next 10 to 20 years.”

Faucheux points to the upcoming Dec. 20 suspension of the National Marine Fisheries Ser-

“We need a federal government that wants to produce oil and gas in the Gulf.”

PAUL DANOS, CEO, Danos Holdings

vice’s “biological opinion”–used by federal agencies when permitting new oil wells–as another threat to production.

In August, the U.S. District Court for the District of Maryland ruled in a lawsuit brought by environmental groups that the NMFS opinion “underestimated the risk and harms of oil spills to protected

species.” The ruling creates uncertainty for oil and gas operations while NMFS completes a new biological opinion, as ordered by the court.

While it won’t stop Gulf of Mexico production, Faucheux says, “it will make it very hard to get new permits for any type of activity.”

That’s given pause to companies such as Danos, who remain wary about the future even as they prepare for a ramp up in work.

“Historically, the Gulf of Mexico has had a predictable regulatory market, relative to other places in the world,” Danos says, “but that has been totally undermined over the last two years.”

BY SAM BARNES

Louisiana’s multipronged push toward industrial- and utility-scale solar is making big waves.

First Solar’s Georges Antoun can hardly contain his excitement about the future of the state’s solar energy market.

What began as a trickle could soon become a tidal wave of new investment, and his photovoltaic solar panel manufacturing facility will take the lead as the industry’s biggest employer when it begins operating in New Iberia next year.

Antoun, the company’s chief commercial officer, hopes to dispel a common misconception about the solar industry–that it’s not a job creator. As evidence to the contrary, he points to the more than 700 employees who will be working at his New Iberia facility once it’s fully operational at the end of 2025.

The massive $1.1 billion, 2.4-million-square foot manufacturing facility will be capable of churning out more than a dozen panels per minute, with some 120 trucks coming in and out of the facility every day. “It’s wrong to say you don’t like solar because it creates fewer jobs than an oil rig,” Antoun says. “The University of Louisiana at Lafayette released a study that said for every direct job

the factory brings, it will create 7.5 indirect or induced jobs.

“And any time you put in a manufacturing facility, you have suppliers who build around you,” he adds. Case in point: Ice Industries, an industrial manufacturer and supplier, recently announced that it will invest $6 million to build a new production facility in southwest Louisiana that will “roll form” steel back rails for First Solar’s panels.

What’s happening in New Iberia is not an anomaly. Across the state, dozens of solar projects are at varying phases of development, and energy providers, private developers and the industrial sector are all gunning for more solar development as they look for practical ways to achieve renewable energy and net-zero goals.

Developers are taking advantage of funding from the Inflation Reduction Act to add solar projects across the U.S. at a record pace.

Installed solar capacity has grown 34% since Q2 2023, with more than 110,000 MW of projects now operating. Additionally, nearly 233,000 MW additional solar capacity is in development in

the U.S. through 2028, according to Market Intelligence data.

Antoun expects that Louisiana will become a strong player in the market, as its existing workforce can easily transition to the manufacturing space. “That’s a large part of the reason that we’re locating here,” he says. “We found that oil and gas skills easily transfer to the manufacturing side.

“As a state, we need to diversify and create resiliency so that we’re not on an up and down five-year cycle dependent upon one industry,” Antoun adds. “Also, without renewables in the state you’re not going to attract the data centers or the AI companies because they all want to be served by renewables.”

In recent years, the petrochemical industry has become a surprising bedfellow in the advancement of solar power. Frustrated by the pace of renewable energy adoption by local energy providers

such as Entergy, the Louisiana Energy Users Group, or LEUG, a decades-old coalition of industrial companies, received approval from the Louisiana Public Service Commission in June to begin investing in their own solar farms.

It’s a necessary move, the owners say, as it will enable them to more swiftly achieve their own net-zero goals. LEUG’s membership includes companies such as Dow Chemical, Chevron, Air Products, Georgia-Pacific, ExxonMobil, Honeywell, Monsanto, Nucor Steel, Phillips 66, CF Industries and BASF, among others.

Initially, they’ll be allowed to create their own source of renewable energy, but the energy still must traverse Entergy’s transmission lines and will be capped at 500 megawatts, ensuring they remain dependent on the utility. LEUG companies hope to eventually be allowed to bypass Entergy altogether, although that was not part of the recent LPSC decision. The move marks a pivotal point for utility regulation in a state that has

“As a state, we need to diversify and create resiliency so that we’re not on an up and down five-year cycle dependent upon one industry.”

GEORGE ANTOUN, chief commercial officer, First Solar

long enabled a single company to dominate most of the market for the supply and transmission of electricity. LEUG first brought the plan to the commission in 2019.

“Industry has been asking for renewable power and the need to access renewable power for more than four years,” said LEUG spokesman Randy Young, a partner with Kean Miller in Baton Rouge, during the June meeting. “Four years fast-forward … Entergy has 50 MW of solar on the ground. That’s all they have.”

While Entergy has other solar investments in varying stages of development, the pace has been too slow for LEUG’s member companies, each of whom has its own corporate goals for using renewable energy sources.

Young said by investing in their own energy sources, his member companies will be able to create more “price certainty” when purchasing energy.

“Secondly, they’ll know how much volume they’re going to get and how many renewable energy credits they’re going to get,” Young said in the meeting. “This allows them to create that certainty in terms of the price, the volume and the renewable energy credits.

“We hope that Entergy’s projects and programs are successful, but this creates another option for those industrial companies that need to do something today.”

In May, the LPSC approved an Entergy proposal to add up to 3 GW of solar power to its generation portfolio, marking the largest renewable power expansion in state history.

The approval authorized a streamlined procurement and approval process that will enable the construction of several solar resources within the state.

The initiative aligns with Entergy’s plans to grow its renewable energy resources by 2031 and its

commitment to achieving net-zero carbon emissions by 2050.

Today, nearly 25% of Entergy Louisiana’s generation portfolio comes from carbon-free resources, including nuclear and renewable technologies.

UL Lafayette has emerged as the undisputed local leader in the solar arena, buoyed in part by the success of its 1.1 MW outdoor Louisiana Solar Energy Lab.

Terrence Chambers, director of the lab and a mechanical engineering professor at the university, says the six-year-old research and training facility is one of the largest and best equipped in the southeastern U.S. and is what initially attracted First Solar to the area.

And in 2023, the university received a $1 million U. S. Department of Energy grant to jump start the “Louisiana Solar Corps,” a statewide solar energy workforce

training program with a focus on underrepresented communities.

Through the program, Chambers and others are helping technical and community colleges such as South Louisiana Community College and River Parishes Community College to establish their own solar training programs by developing curricula and training faculty.

They recently conducted a week-long training course for the faculty of RPCC. “They now have their own solar training program,” Chambers says. “That’s the kind of thing we’re doing to help grow the programs across the state and, in turn, enable the solar industry to grow.”

UL Lafayette is also propping up an Advanced Manufacturing Laboratory on campus that will train the bulk of the workers needed by First Solar. Dr. Jonathan Raush, director of the Institute for Materials Research & Innovation,

will oversee the facility, which is funded in part by a $40 million donation from First Solar.

“The training will be specific to the processes used at the factory,” Chambers says. “Most of them will go through our facility for training prior to being hired.”

Once operational, the Advanced Manufacturing Lab will provide a sustainable source of training for the manufacturer.

In the meantime, First Solar is sending workers to its other facilities in Alabama and Ohio for on-the-job training. “As workers move on, change jobs, etcetera, we’ll need to sustain that workforce and the university has committed to helping us with that,” Antoun says.

But the university’s plans for the lab extend far beyond the solar industry.

“The processes you use to make solar panels are almost identical to the ones used to make computer chips,” Chambers says, “so our long-range vision is for it to be used for semi-conductor manufac-

“(We’re helping) to help grow the programs across the state and, in turn, enable the solar industry to grow.”

turing, with the goal of building a semi-conductor industry in Louisiana.”

First Solar’s Antoun has his own “big picture” view. With significant growth expected in local solar demand, he hopes to create a vibrant and healthy customer base in Louisiana and across the Gulf South.

At present, about 95% of First Solar’s customers are developers and utility companies.

“We’re hoping that most of these guys are going to buy First Solar panels, not Chinese,” he says. “We’re differentiated from other manufacturers because we’re close. We’re hoping all these modules we produce will go to Louisiana projects, as well as to Texas, Mississippi, Alabama and Florida.”

Another item on Antoun’s wish list: that the state will incentivize the process by encouraging the developers of local solar projects to use locally-based manufacturers. “I believe the current administration is looking into the potential of that.”

BY SAM BARNES

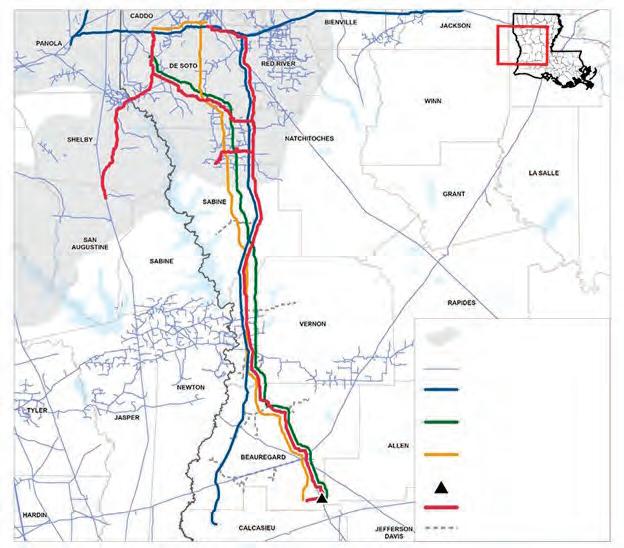

Louisiana’s pipeline industry struggles with infighting and other roadblocks as it aims to meet LNG demand.

Irrespective of the current LNG permitting pause, existing demand and a readily available supply are fueling the construction of thousands of miles of new natural gas pipelines from the Haynesville and Permian shale plays.

As many as eight pipeline projects continue to advance across Texas and Louisiana to feed five LNG export projects currently under construction along the Gulf Coast, according to the most recent data provided by the U.S. Energy Information Administration’s Natural Gas Pipeline Project Tracker.

That equates to more than 20 billion cubic feet per day of new capacity to feed liquefaction trains coming online through the end of the decade.

And there’s no sign that things are slowing down. Gordon Gorrie, vice president of oil and gas research at Industrial Info Resources in Houston, is currently tracking 155 projects totaling $22 billion in natural gas pipelines and compressor stations across the two states that are either planned, designed or under construction.

Gorrie, who monitors oil and gas investment worldwide, says most of the pipelines are making

a beeline for the Gulf Coast to serve LNG facilities in Texas and Louisiana.

“The vast majority in Louisiana are coming out of the Haynesville Shale play, but the Permian Basin has opened up a bit too,” Gorrie says. “Those come down to the Houston area and go from there across to Louisiana.

“And when a project is announced in Texas or Louisiana, there’s a good chance that it will move forward,” he adds. “The citizens of those two states are generally favorable toward putting in new pipelines, unlike in the northeast and other places.”

Market dynamics favor a robust pipeline market in the long term, says Greg Upton, executive director of LSU’s Center for Energy Studies in Baton Rouge. That’s because U.S. oil and gas production is expected to grow for decades.

“Globally, it’s going to be driven by the developing world,” Upton says. “If we’re going to connect production all over the U.S. with markets all over the world, midstream assets are going to be part of that connection. So as long as those longer trends persist, there are going to be investments in these midstream assets to get product down to the Gulf Coast.”

The race to get natural gas from the Haynesville Shale to the southwest Louisiana LNG market has created an intensely competitive market as companies such as Energy Transfer, DT Midstream, Williams Cos. and New Generation Gas Gathering (NG3) battle for the same land space.

“Much of the time, these disputes are about territory rights,” says Eric Smith, director of the Tulane Energy Institute. “A pipeline is essentially a business that moves product from point A to point B, and if two companies are drawing on the same field or supplying the same terminal, there has to be some sort of agreement as to how that can be done in an orderly manner. Otherwise, they’re going to fight tooth and nail.”

Case in point: After months of legal wranglings, Williams Cos. received the legal green light in late July to continue building its 1.8 billion-cubic-feet-per-

day Louisiana Energy Gateway, or LEG, project, a natural gas pipeline that will fuel LNG export terminals with Haynesville Shale gas. That’s after a court threw out an Energy Transfer attempt to halt construction.

The two companies had been in a dispute in which Energy Transfer contested having the LEG line cross under its pipeline in DeSoto and Sabine parishes. Ultimately, the 42nd Judicial District Court in DeSoto Parish ruled that Energy Transfer could not block Williams from constructing the pipeline. “Construction can begin in earnest on the Louisiana Energy Gateway, which is expected to be in service by the second half of 2025,” a Williams spokesperson said in a written statement. LEG was just the latest project to overcome Energy Transfer’s crossing objections. DTM found an alternative route for its Louisiana Energy Access Project after a court ruled against it last year. And Momentum Midstream

“Much of the time, these disputes are about territory rights.”

ERIC SMITH, director, Tulane Energy Institute

recently settled its crossing dispute to move forward with the 1.7 bcf/d New Generation Gas Gathering LLC pipeline.

But the long-term threat to pipeline development isn’t legal infighting.

It’s the external roadblocks thrown up by the federal government and courts, Upton says. In particular, the current LNG export facility permitting pause could have significant impacts on pipeline development for years.

“When an LNG facility owner signs a long-term contract to export gas produced on the Gulf Coast, they must line up every single part of that supply chain,” he notes. “You need to have the producer to produce the gas and the midstream assets to get it to the Gulf Coast … so when you throw in uncertainty over permitting, it has a ripple effect on everything because all these assets must come online at the right time.”