Tip Offs and Tipping Points

2024 Commentary

Q1

Last year’s market dynamics were characterized by dominant performance from the largest companies, known as the ‘Magnificent Seven.’ Expectations of subsiding inflation and potential rate cuts helped spur a rally among the broader set of 493 stocks, narrowing the performance gap created by last year’s leading gainers. However, inflation has persisted, consistently exceeding the Federal Reserve’s 2% target. While the economy has shown resilience, the Fed remains cautious about reducing rates too prematurely, concerned that this could reignite inflationary pressures.

As the first quarter concluded, the initial optimism regarding rate-cutting has significantly waned, diminishing the primary momentum behind the market rally. Investors are now navigating a challenging landscape, where high-performing stocks tempt an increase in risk exposure—historically a precarious move. Concurrently, the bond market is experiencing a stagnation phase, with no significant selling or gains, merely lingering in limbo with the fresh scars of past drawdowns serving as a stark reminder of the persistent risks associated with investment-grade bonds.

The value of a disciplined investment process cannot be overstated. Engaging in the market’s upward potential while staying alert to emerging risks has been crucial in preparing for any market conditions, providing investors with both peace of mind and a foundation for unbiased decision-making.

A Tale of Two Markets

U.S. equities have kicked off the year with their strongest start since 2019, as the S&P 500 climbed more than 10% during the quarter. Bolstered by a robust economy and high expectations for incoming interest rate cuts, market participants are optimistic that the Federal Reserve has achieved a ‘soft landing,’ successfully mitigating high inflation without triggering a recession. This year marks a departure from the last quarter of the previous year, with a more diverse range of stock performances, including smaller companies beginning to close the gap with the large-cap leaders that have consistently made headlines.

In contrast, the bond market has seen little movement, particularly in the realm of investment-grade fixedincome. The performance of bonds has been lackluster, and investor sentiment towards fixed-income is disdainful, despite potential rate cuts that typically would elevate bond prices. The recent downturn in these normally secure assets has led investors to reassess the balance of risk and reward, questioning the attractiveness of high-grade bonds even at yields that are at their highest in a decade.

Equities Up Trend, IG Bonds Struggle

Jan -202 4

Feb-2024

Mar-20 24 Apr-20 24

Source: Bloomberg, Redwood. Data as of 4/17/2024. Date range from 12/29/2023 - 4/11/2024. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 3 -4% -2% 0% 2% 4% 6% 8% 10% 12% Investment Grade Bonds Equities

MSCI ACWI Bloomberg Investment-Grade Corporates S&P 500 Bloomberg U.S. Aggregate

Uneven Expansion

As we observe the continuation of the rally from the bottom of 2022, questions arise about the sustainability of this momentum. This is especially true when we look at the growth of the stock market, particularly considering that the S&P 500’s market cap increased by $14 trillion last year alone. To put this in perspective, the 2023 U.S. GDP was $27 trillion. This highlights the significant concentration

of performance and growth among the largest companies in the stock market. Of the approximately 4,000 stocks traded on U.S. exchanges, just 500 companies contributed to 92% of the entire market’s growth, while the remaining stocks collectively added only $1.2 trillion. This scenario underscores the extent of market concentration and raises concerns about the durability of such leadership.

Non-Sustainable Market Cap Growth Rates

Since bottom of 2022, S&P 500 market cap grew more than half of entire 2023 U.S. economy

Source: Bloomberg, Redwood. Data as of 4/17/2024. Data from 10/12/2022 - 4/8/2024. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 4

$0 $27.0T $15.2T $14.0T $1.2T (Trillions) 2023 U.S. GDP S&P 500 Index $5 $10 $15 $20 $25 $30

From Peak to Pitfall

Interestingly, though not entirely unexpected, one consistent marker of market peaks is investor behavior. Typically, investors are not adept at timing the market, often buying high and selling low—contrary to the wellknown investment strategy. Historically, a common pattern is observed where investors increase equity exposure following strong market performances, which

often precedes market downturns. This underscores the risks of deviating from a disciplined investment approach. Without a solid strategy, investors may take on excessive risk in an attempt to catch up with market gains, potentially facing losses that could disrupt their financial plans and long-term objectives.

Peak Allocation to Equities Followed By Losses

Households % allocation to equities and S&P 500 24-month performance following the peak

Source: Bloomberg, Redwood. Data as of 4/17/2024. Date range from 9/30/1954 - 12/31/2023. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 5

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 1 9 5 4 1 9 5 7 1 9 6 0 1 9 6 3 1 9 6 6 1 9 6 9 1 9 7 2 1 9 7 5 1 9 7 8 1 9 8 1 1 9 8 4 1 9 8 7 1 9 9 0 1 9 9 3 1 9 9 6 1 9 9 9 2 0 0 2 2 0 0 5 2 0 0 8 2 0 1 1 2 0 1 4 2 0 1 7 2 0 2 0 2 0 2 3 Allocations to Equities 30% 38% 33% 40% S&P 500 -19.91% S&P 500 -19.07% S&P 500 -41.19%

Rally Losing Steam

Signs are emerging that the strong momentum in equities may be slowing down. Despite the continued rise of the Nasdaq 100 Index, which includes 100 of the largest non-financial companies on the Nasdaq, its momentum is diminishing. The Nasdaq 100’s Relative Strength Index (RSI), a tool used to indicate if something is overbought or oversold, has diverged and started to taper off, suggesting weakening market breadth.

Historically, such downward shifts in momentum and divergence from the underlying rise in prices often precede market downturns. Although we do not make predictions, we closely monitor these trends for signs that the market may be diverging from past patterns. The weakening RSI is a critical indicator that we watch, as it might hint at a greater risk of a forthcoming downturn.

Momentum Fading Despite Rally

Nasdaq 100 composite and its relative strength (RSI) diverging - historical sign of weakness

Nasdaq 100 Relative Strength Index (RSI)

Nasdaq 100 Price

Source: Bloomberg, Redwood. Data as of 4/17/2024. Date range from 6/27/2022 - 4/8/2024. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 6

Rising Prices Falling Momentum 9000 1000 0 1100 0 1200 0 1300 0 1400 0 1500 0 1600 0 1700 0 1800 0 1900 0 25 35 45 55 65 75 85 95 Ju n-2 2 Se p-22 Dec-2 2 Mar-2 3 Ju n-2 3 Se p-23 Dec-2 3 Mar-2 4 Relative Strength Index Nasdaq 100 Price

Interpreting Extended Yield-Curve Inversions

Beyond a mere slowdown in momentum, there are clearer indications that might suggest potential market disruptions ahead. Historically, yield-curve inversions—situations where short-term bond yields rise above those of long-term bonds—have signaled deepening investor concerns about the immediate economic landscape. Notably, every recession since the 1970s has been preceded by an inversion between the 2-year and 10-year Treasury Yields,

typically unfolding within 275 days of the initial inversion. Currently, we are observing an unprecedented duration of this inversion, extending over 650 days, the longest since World War II. The implications of such a prolonged inversion remain unclear. What we do know is that the previous longest inversion in 1978 did ultimately result in a recession, but was followed by what many consider as one of the most prosperous decades of economic expansion in the past 50 years.

Longest Inversion Ever

Length of all U.S. 2s 10s yield curve inversions (days) that were longer than 3 months

New Record: 652 Days

Date of Yield Curve Inversion

Source: Bloomberg, Redwood. Data as of 4/17/2024. Date range from 8/17/1978 - 7/5/2022. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 7

0 100 200 300 400 500 600 700 8/17 /1978 9/11 /1980 1/20 /1982 1/5/1989 2/11 /2000 8/14 /2006 7/5/2022 Days

Inversion

of

Start Dates of Yield Curve Inversions

Start

Forecasting Fails

Forecasting the future remains challenging, even with advanced resources and indicators. Wall Street is rife with speculation, often spearheaded by analysts deemed as experts. This speculation often includes predicting where the market will end the year at. These experts, however, have frequently failed to accurately predict market directions; notably, they have been

incorrect in all their predictions since 2020. Additionally, many large banks and financial institutions not only publish these forecasts but also encourage investors to adjust their portfolios based on such speculative advice. This lack of accuracy should serve as a warning, particularly to investors who depend on these institutions and their predictions for guidance.

Talking Heads’ Pontifications Often Wrong

Wall Street’s “best” strategist predictions often wrong

Wall Street Analyst(s) Next Year Forecast From End of Year

High Estimate of 2023 S&P 500 Closing Price

Low Estimate of 2023 S&P 500 Closing Price

Source: Bloomberg, Redwood. Data as of 4/17/2024. Date range from 12/9/2010 - 12/29/2023. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 8

1000 1500 2000 2500 3000 3500 4000 4500 5000 5500 6000 2020 2021 2022 2023 2024

S&P 500 Index X X X X

Navigating the Discount

The recent drawdown in U.S. Investment-Grade Aggregate (AGG) bonds has resulted in the average bond trading at an 11.6% discount to par as of April 8, 2024. While this discount may appear as an appealing investment opportunity considering bonds redeem at par value at maturity, investors need to be aware of several factors. The AGG has an average duration to maturity of over 8 years, with bonds offering a 3.25% coupon rate. Together with the current discount, this

configuration leads to a yield-to-maturity (YTM) of 4.91%. Although there’s potential value here, caution is advisable, particularly when cash options are currently yielding around 5% and it is extremely unlikely that we will see bonds trade at the same premium to par as before. Effective management of such investments is crucial, given the recent volatility seen in this asset class.

Opportunity, But Limited

Risk and return opportunities in investment-grade bonds need to be carefully considered and positioned when incorporating into a portfolio as bonds mature at par value

Bloomberg U.S. Aggregate Bond Prices

Source: Bloomberg, Redwood. Data as of 4/17/2024. Date range from 5/13/2020 - 4/16/2024. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 9

80 85 90 95 100 105 110 115 2021 2022 2023 2024 Yield To Maturity: 4.91% 11.6% Par Value Average Bond Prices

Yield Spectrum

Bonds play a pivotal role for investors seeking consistent income from their investment portfolios. However, the current yields on public fixed-income options are disappointingly low when compared to short-term treasuries, which are generally regarded as cash equivalents. This shortfall is problematic because, unlike cash, bonds are susceptible to daily market fluctuations, potentially leading to substantial decreases in value. Even investment-grade bonds, traditionally viewed as secure assets, have not been immune to losses, with some experiencing declines that surpassed 18%.

In contrast, private debt has consistently offered yields that exceed those available from cash, providing a buffer against inflation and supporting investors who depend on their portfolios for income. However, the opportunities to earn such premium yields through private debt are often out of reach for the average investor, limiting their accessibility to these potentially higher returns.

Fixed-Income Yield Comparison

Short-Term Treasuries

Source: Bloomberg, Redwood. Data as of 3/31/2024. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 10

8.22% 6.17% 5.25% 4.60% 4.23% 4.10% 2.93%

Navigating the Trade-Offs

Even with the public fixed-income options that may offer higher income, investors often face a trade-off between yield premiums and lower credit quality, and ultimately the risks. Due to the greater risk of default linked to poor credit quality, these assets typically experience significant volatility and frequent price fluctuations. In addition, because these lower credit instruments often move in sync with each other, building a diversified asset allocation utilizing these securities is difficult due to their high correlation.

In contrast, private real estate debt typically presents a stable, almost boring pricing curve, largely insulated

from market fluctuations. This stability allows investors with access to private debt to enjoy consistent returns with minimal price variations. The challenge remains that such investment opportunities are often only available to accredited investors. We are dedicated to overcoming these barriers through innovative strategies and our RiskFirst ® approach. Our methods are crafted to manage complex market conditions and provide sophisticated solutions like private debt to our clients, thereby broadening their investment choices.

How

Much Volatility For >6% Yield

Source: Bloomberg, Redwood. Date range from 8/7/2023 - 4/2/2024. For illustration purposes only.

bayntree.com Bayntree Wealth Advisors | 11

0 2 4 6 8 10 12 14 Au g-23 Se p-23 Oct-23 Nov-23 Dec-23 Jan -24 Feb-24 Mar-24 V olatility Preferred Equity Emerging Market Debt High-Yield Corporate Bonds Private Debt

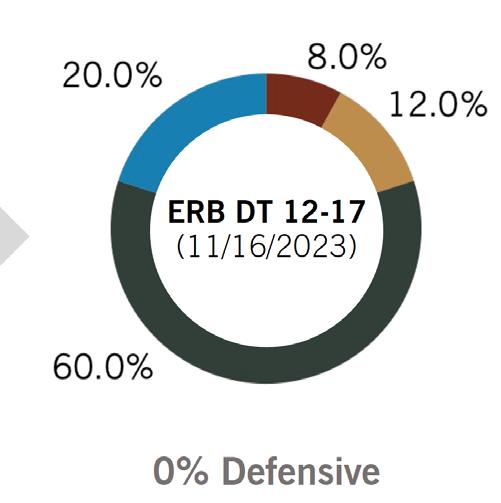

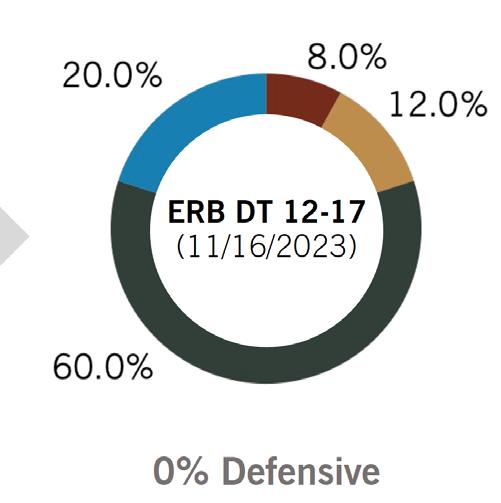

Portfolio Recap

Despite some signs of weakening, the U.S. markets ended the first quarter strongly. Navigating market decisions based on headlines alone can be challenging due to the amount of ‘noise.’ At our firm, we prioritize data-driven decisions that cut through this noise, focusing on data.

Compared to the start of the previous year, the first quarter of 2024 was relatively calm. Throughout this period, our portfolios remained fully invested, allowing us to fully capitalize on market movements. While the future is uncertain, we continue to rigorously monitor potential dangers, and utilize our tactical strategies in order to adjust our risk exposures.

DRB Strategy Positioning

• Tactical High-Yield Corporates

Tactical High-Yield Municipals

AlphaFactor® Tactical Focused

• Tactical High-Yield Municipals

• AlphaFactor® Tactical Focused

AlphaFactor® Tactical International Systematic Macro Trend (SMarT)®

• AlphaFactor® Tactical International

• Systematic Macro Trend (SMarT®)

• AlphaFactor® U.S. Core Equity

AlphaFactor® US Core Equity Activist Leaders®

Equity Skew

• Alpha Leaders®

• Equity Skew

Dynamic Yield

Strategic Bond Active Factor

• Dynamic Yield

Strategic Equity

• Strategic Bond

• Active Factor

• Strategic Equity

bayntree.com Bayntree Wealth Advisors | 12

Strategic Beta

Private

Private Real Estate Debt Tactical

Debt

Tactical High-Yield Corporates

Risk-On RiskOn On-Risk RiskOn Risk-On

(Full Risk On Since 11/16/23)

Estate Debt

• Private Real

Conclusion

As we draw the curtain on the first quarter of 2024, the financial markets present us with a landscape as complex as it is compelling. We’ve witnessed cautious optimism that was initially fueled by the prospect of interest rate cuts, only to be tempered by persistence of inflation above expected. This juxtaposition of hope and restraint encapsulates the current economic narrative.

These market conditions underscore the value of a process-driven approach to risk management. Having a dedicated team and a clear methodology to filter out distractions is essential for focusing on your financial goals. As we move into the second quarter, we are confident in our approach and capabilities.

Dynamic Shifts in DRB

Long IG Fixed-Income Long HY Fixed-Income Long Equity

Source: Bloomberg, Redwood. Data as of 4/17/2024. Please see additional disclosures at the end of this commentary for more information.

bayntree.com Bayntree Wealth Advisors | 13

Tactical

Private Debt

Risk-Off

Mulholland 300

Mulholland 300

Mulholland 300

Mulholland 300

General Disclosures

The market commentary is for informational purposes only and should not be deemed as a solicitation to invest or increase investments in Bayntree Wealth Advisors (‘Bayntree’) services or affiliated services. The information contained herein is not intended to provide any investment advice or provide the basis for any investment decisions. Additionally, these materials are not intended to provide, and should not be relied on for, any tax or legal advice. Please consult a qualified professional before making decisions about your financial situation. Any reduction in taxes would depend on your specific tax situation. Information and commentary provided by Bayntree are opinions and should not be construed as facts. There can be no guarantee that any of the described objectives can be achieved. Past performance is not a guarantee of future results. Information provided herein from third parties is obtained from sources believed to be reliable, but no reservation or warranty is made as to its accuracy or completeness.

Diversification of asset class or investment style does not guarantee against loss or outperformance. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will be profitable. Any individual securities shown are not a recommendation to buy or sell. Any funds shown will have different investment objectives and strategies and are for illustration purposes only and is not a statement of equal comparisons. The price of any investment may rise or fall due to changes in the broad markets or changes in a company’s financial condition and may do so unpredictably. Bayntree does not make representations that any strategy will or is likely to achieve returns similar to those shown in this presentation. Please speak to an advisor before investing any strategy shown within. Indices are shown for informational purposes only; it is important to note that Bayntree’s strategies differ from the indices displayed and should not be used as a benchmark for comparison to account performance. While the indices chosen to represent broad market performance of each asset class, there are report limitations as to available indices and blends, which index can be selected, and how they are presented. Portfolios are sub-advised by Mulholland Wealth Advisors, LLC, (“Mulholland”) an unaffiliated investment advisor registered with the SEC. Such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Please refer to Mulholland’s Form ADV Part 2A (“Brochure”) for more information. RiskFirst® is a registered trademark of Redwood Investment Management, LLC. (“Redwood”), which is an affiliate of Mulholland. Dynamic Risk Budgeted (DRB) and Engineered Risk Budgeted (ERB) portfolios are proprietary to Redwood.

Definitions

Magnificent 7 refers to large mega cap companies consisting of Apple, Tesla, Nvidia, Microsoft, Alphabet, Meta, and Amazon. Drawdown is a measure of peak to trough loss in a given period; a maximum drawdown is a measure of the maximum peak to trough percentage loss in a given period. Large Cap are companies with a market capitalization value of more than $10 billion. Federal Reserve (Fed) is the central bank of the United States that raises or lowers interest rates. Fed Funds Rate is the interest rate that banks charge other institutions for lending excess cash to them from their reserve balances on an overnight basis. Inflation is a decrease in the purchasing power of money, reflected in a general increase in the prices of goods and services in an economy.

Indices

S&P 500 refers to the S&P 500 Index which is a stock market index based on the market capitalization of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor’s. Dow Jones Industrial Avg. (Average) is an index by Standard & Poor’s that tracks 30 widely traded blue chip stocks with large market capitalization. MSCI All Country World Index (MSCI ACWI) is a free-float weighted equity index. It was developed with a base value of 100 as of December 31, 1987. The index includes both emerging and developed world markets. The Bloomberg U.S. Aggregate (AGG) bond index refers to the Barclays U.S. Capital Aggregate Bond Index, which is an index that consists of investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities, and asset-backed securities. It is often considered representative of the U.S. investment-grade fixed rate bond market. Dow Total Stock Index measures all U.S. equity securities with readily available prices. It is a float market cap weighted index. Nasdaq 100 Index is a modified capitalization-weighted index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ. MSCI ACWI ex U.S. Index (MSCI ACWI ex US) is a free-float weighted equity index. It was developed with a base value of 100 as of December 31, 1987. The index includes both emerging and developed world markets, excluding the United States. Short-Term Treasures is represented by the Bloomberg Short-term Treasury Index Investment Grade (IG) Corporates is represented by the Bloomberg US Corporate Bond Index which measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and nonUS industrial, utility and financial issuers. High-Yield Municipals are represented by the Bloomberg Municipal High Yield Total Return Index which covers the USD-denominated high-yield tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds. Long-Term Treasuries are represented by the Bloomberg US Treasury: Long Index which measures US dollardenominated, fixed-rate, nominal debt issued by the US Treasury with 10 years or more to maturity. Investment Grade (IG) Municipals are represented by the Bloomberg U.S. Municipal Index which covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds. Preferred Equity is represented by the S&P Preferred Stock Index which includes all preferred stocks issued by US corporations & those trading in major exchanges, subject to related criteria. Emerging Market Debt is represented by the Bloomberg Emerging Markets Hard Currency Aggregate Index, which is a flagship hard currency Emerging Markets debt benchmark that includes USD-denominated debt from sovereign, quasi-sovereign, and corporate EM issuers. High-Yield Corporate Bonds is represented by the Bloomberg US Corporate High Yield Bond Index which measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Bloomberg EM country definition, are excluded Private Debt is represented by the Redwood Real Estate Income Index which measures the

Indices (Cont.)

Tactical High Yield Corporates is in reference to a portfolio strategy that seeks to hold a diversified portfolio of high-yield corporate bond exposure when various risk measurements show the potential to produce positive returns. During periods that are identified as above average risk, the assets are moved into a defensive position that can include, shorter term U.S. government securities. The strategy seeks to reduce the drawdowns associated within the high-yield bond asset class, while at the same time seeking to capture the potential gains associated with bull market rallies. For purposes of this strategy, “high yield” may include leveraged loan and bank loans. This strategy strives to provide higher-yields to a portfolio as an alternative to traditional investment grade buy and hold fixed-income.

Tactical High-Yield Municipals is in reference to a portfolio strategy that seeks to hold a portfolio of high-yield municipal bond exposure when various risk measurements show the potential to produce positive returns. The strategy can also invest in other fixed-income asset classes such as, but not limited to long-term, intermediate, and short-term municipals. During periods that are identified as above average risk, the assets are moved into a defensive position that can include, shorter term U.S. government securities. This strategy strives to provide exposure to the tax-free high income U.S. municipal market, while having the ability to tactically manage risk. Defensive Yield is in reference to a portfolio strategy that utilizes a longer-term quantitative macro indicator that dictates weightings toward different credit risks in fixed income. When the strategy identifies credit risk to be low, the strategy allocates more toward higher-yielding fixed- income asset classes. Utilizing a macro-overlay, the strategy seeks to be generally invested at all times in the bond market, while seeking to, at times, capture higher-yields when various risk measurements indicate that it is favorable to do so. Investment Grade Corporates are represented by the Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities. Investment Grade Core (AGG) refers to the Bloomberg U.S. Capital Aggregate Bond Index, which is an index that consists of investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities, and asset-backed securities. It is often considered representative of the U.S. investment-grade fixed rate bond market.

AlphaFactor ® U.S. Core Equity is in reference to a portfolio strategy that utilizes a quantitative rules-based investment methodology that applies a multi-factor ranking process and is focused on the largest 1,000 U.S. common stocks based on market capitalization. AlphaFactor ® Tactical Equity is in reference to a portfolio strategy that utilizes a quantitative factor-based investment methodology focused on U.S. equities. The Adviser selects stocks based on a number of characteristics that include, but are not limited to, net share count reduction, free cash flow growth, dividend yield, volatility and debt/ asset ratios. The final selection of stocks is based on market characteristics including, but not limited to, liquidity and market capitalization. AlphaFactor ® Tactical International is in reference to a portfolio strategy that utilizes a quantitative, factor-based, investment methodology focused on large and middle capitalization common stocks of both developed and emerging markets outside of the United States. During periods identified as above average risk, assets may be moved to cash, cash equivalents, and or treasuries. Systematic Macro Trend (“SMarT®”) is in reference to a portfolio strategy that utilizes a quantitative and tactical approach that seeks to hold a diversified portfolio of securities, exchange-traded funds (ETFs), open-end investment companies and/or closed-end investment companies within any of the following asset classes: domestic and international small-cap equities, growth and income equities, preferred securities, convertible bonds, high yield bonds and leveraged loans, emerging market bonds, and real estate investment trusts. During periods identified as above average risk, assets may be moved to cash, cash equivalents, and or treasuries. Equity Skew representing is in reference to a portfolio strategy employs a contrarian strategy seeking to buy underperforming asset classes and/or factors and sell outperforming asset classes and/ or factors based on quantitative research. The primary equity style exposure and factors are large cap growth, large cap value, small cap growth, small cap value, and emerging market equities. Activist Leaders ® is in reference to a portfolio strategy that employs an investment approach that focuses on equity securities that are the target of shareholder activism. These equity securities are identified using a proprietary quantitative methodology built on the foundation of tracking legally mandated filings known as “13D” filings that are submitted with the Securities and Exchange Commission (“SEC”). Typically equity securities of companies listed on a U.S. exchange with market capitalizations of at least $1 billion at the time of initial purchase.

An investor cannot invest directly in an index. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors cannot make direct investments into any index.

Investment advice is offered through Bayntree Wealth Advisors, LLC (‘Bayntree’), is an SEC, Registered Investment Advisor. Such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Insurance and annuity products are offered separately through Bayntree Planning Group, LLC. Bayntree’s advisory fees and risks are fully detailed in its Form ADV Part 2A (Brochure”), which is available upon request. Please note that Bayntree Wealth Advisors and its representatives do not give legal or tax advice. You are advised to seek the advice of a qualified professional prior to making any decision based on any specific information contained herein. The specific tax consequences of any investment or strategy will depend on your specific tax situation. This material may not be published, broadcast, rewritten or redistributed in whole or part without express written permission. Bayntree and Redwood are not affiliated.

Contact Us Bayntree Wealth Advisors 7001 N. Scottsdale Rd., #2055, Scottsdale, AZ 85253 480.494.2750 | bayntree.com