Blackwood Technology Fires Up

Torrefied Pellet Plant

Page 12

Blackwood Technology Fires Up

Torrefied Pellet Plant

Page 12

New Developments in Biocarbon Standards

Page 22

Tracking Wood Bioenergy Projects and Fiber Prices

Page 28

Counnt t on Mys y tik® ® Grease e to t combaat t relent n less weaar r and teear a in n seve v re e apppli l caations s of o plain n and d rol o li l ng g

bearings that oper e ate in mild d to o high h temperratur u es

wh w er e e high h loads and mettal-tto-me m taal l frricti t on exi x st. .

Wh W en the pressure’s on n to o get t the e jo j b done, ou o r

lu l br b iccants help keep p you runni n ng strong. g

With a decade in the torrefaction industry and a successfully launched commercial black pellet plant in Thailand, Blackwood Technology is preparing for growth.

Caitlin Scheresky

From Pellets to Carbon-Negative SAF

Pathway Energy CEO Steve Roberts discusses the company’s plans to use industrial wood pellets for the production of sustainable aviation fuel.

Anna Simet

Chris Wiberg

Anna Simet EDITOR asimet@bbiinternational.com

The cover of this issue of Pellet Magazine—torrefied or black pellets—could have very well been a cover a decade ago or longer. One of the main differences between then and now, however, is the momentum of the driving force behind the technology and product: decarbonization efforts. The question is, will that be the key to the market finally taking off, solving the perpetual chicken-egg problem of using torrefied biomass to replace coal? Judging by the volume of announcements, projects, research and other efforts we’re seeing related to torrefaction or biomass carbonization, it just might be.

For our cover story, junior staff writer Caitlin Scheresky discussed Dutch company Blackwood Technology’s journey with CEO Maarten Herrebrugh. He explains that the road to where they are now—most recently which has led to the opening to the company’s first commercial plant—has been bumpy. The company originally behind its FlashTor technology took off in 2010, but folded several years later when demand for black pellets took a dive due to policy changes. The core team there, however, very much believed in the technology and future of torrefied biomass, so they created a new company to continue the mission. The black pellets produced at the new plant, which is located in Thailand, will be used to replace coal in power generation and steel production. Read more in feature article “Bullish on Black Pellets,” on page 12.

On the same note of torrefied pellets, we have an update from the University of Minnesota’s Natural Resource Research Institute’s $4.5 million research project focused on breaking barriers to using biobased carbon in the steelmaking process. Their work thus far has resulted in the engineering of a biocarbon that mimics a coal-like reaction at the bench and pilot scale. The pelletized biocarbon material was successfully tested in intermediate scale-up trials at a steel recycling plant electric arc furnace. Be sure to check out “Biocarbon Meets Steel Production” on page 24.

Moving to white pellets, Drax recently announced a supply agreement with future sustainable aviation fuel (SAF) producer Pathway Energy, which plans to build a wood pellet-based SAF production facility on the Gulf Coast. Wood pellets are being looked at as a potential SAF feedstock contender, but this is the first substantial supply agreement that we’ve seen. As such, we engaged Pathway Energy CEO Steve Roberts for a Q&A in our page-29 article, “From Pellets to CarbonNegative SAF.”

The final article I’ll highlight is an update on developments regarding biocarbon standards on page 22, by Chris Wiberg of Timber Products Inspection/Biomass Energy Lab. The fact that there is a need for an overhaul is encouraging. And while it’s exciting to see the emergence of some new markets for wood pellets, both white and black, for applications from steelmaking to SAF, only time will tell if these efforts will have a meaningful impact on the industry.

DIRECTOR OF CONTENT/SENIOR EDITOR

Anna Simet | asimet@bbiinternational.com

SENIOR NEWS EDITOR

Erin Voegele | evoegele@bbiinternational.com

CONTRIBUTIONS EDITOR

Katie Schroeder | katie.schroeder@bbiinternational.com

JUNIOR STAFF WRITER

Caitlin Scheresky | caitlin.sheresky@bbiinternational.com

MAP DATA & CONTENT COORDINATOR

Chloe Piekkola | chloe.piekkola@bbiinternational.com

VICE PRESIDENT, PRODUCTION & DESIGN

Jaci Satterlund | jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee | rboushee@bbiinternational.com

CEO

Joe Bryan | jbryan@bbiinternational.com

PRESIDENT

Tom Bryan | tbryan@bbiinternational.com

CHIEF OPERATING OFFICER

John Nelson | jnelson@bbiinternational.com

DIRECTOR OF SALES

Chip Shereck | cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown | bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller | jtiller@bbiinternational.com

SENIOR MARKETING & ADVERTISING MANAGER

Marla DeFoe | mdefoe@bbiinternational.com

MARCH 18-20, 2025

Cobb Galleria | Atlanta, GA

Now in its 18th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming— powered by Biomass Magazine—that maintains a strong focus on commercialscale biomass production, new technology, and near-term research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

(866) 746-8385 | www.biomassconference.com

JUNE 9-11, 2025

Chi Health Center | Omaha, NE

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible and the financial and marketplace impacts to participating producers. (866) 746-8385 | www.CarbonCaptureStorageSummit.com

Chi Health Center | Omaha, NE

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.. (866) 746-8385 | www.sustainablefuelssummit.com

BY TIM PORTZ

In any other year, the biggest story for January in the wood pellet heating sector would have been the long-overdue return to cold weather across much of the United States. Wood pellet usage correlates tightly to the accumulation of heating degree days (HDDs), which have been in short supply since 2020. After lagging the accumulated HDDs of last year’s disappointingly mild season, winter returned around Christmas and hung around for all of January. Temperatures went low and stayed low, and wood pellets started to move.

On Dec. 16, Concord, New Hampshire, was the only location of 12 on the Pellet Fuels Institute HDD Index that had accumulated more HDDs than the prior heating season, and only by the thinnest of margins (1%). Most locations were trailing last year’s accumulated HDDs by about 10%. In just six weeks, the same index showed HDDs even or ahead of last year’s pace in all but four of the 12 locations we track. Three locations, each in critical wood pellet regions, were more than 10% ahead of last year’s pace. While sales data for January won’t be available until April (U.S. EIA Monthly Densified Biomass Fuel Report), producers across the country are reporting brisk sales.

Still, the potential for the best January sales since 2020 is playing second fiddle to the gaveling in of the 119th Congress and the swearing in of President Donald J. Trump for his second term in office. Just one month in, and Trump is beginning the radical shake up of the federal government that was the foundation of his campaign. So far, President Trump has offered an early retirement buyout to nearly 2 million federal employees, put 1,000 staffers at the Environmental Protection Agency on notice of termination, removed references to climate change from the EPA and USDA websites, and is aggressively pursuing the abolishment of the Department of Education and U.S. Agency for International Development. Predicting what other sweeping changes or proposals will have unfolded by the time this issue of Pellet Mill Magazine lands on its readers’ desks is a fool’s errand.

Executive orders have allowed President Trump to move quickly, and as a result, his early actions have garnered most of the political news since his inauguration. Congress, by design, is confined to a more methodical and plodding pace, but the legislative backlog they will eventually have to tackle is significant, and it is loaded with opportunity and risk for the forest products sector and wood pellet manufacturers specifically.

The Farm Bill, currently riding on its second year-long extension, has to be on the short list for Congress to address. Last year, while the Pellet Fuels Institute was in Washington, D.C., for a spring fly-in, there was a flurry of activity as then-Senate Agriculture Committee Chairwoman Sen. Debbie Stabenow and House Agriculture Chairman Rep. Glen “GT” Thompson each published draft summaries of their ideas for a new Farm Bill. In both the House and Senate summaries, key programs like the Advanced Biofuels Payment Program, Wood Innovation Grants and Community Wood Energy Grants were included. The timing could not have been better, and our conversations in Senate and House offices that spring day seemed fruitful and impactful. Then, as so often happens on Capitol Hill, progress sputtered. Now, with control of the 119th Congress consolidated in the Republican party, the road forward for the passage of a new Farm Bill seems more likely. The PFI’s outreach to House and Senate agriculture committee members is underway, connecting these important provisions to the economic impact that wood pellet manufacturing makes to members’ states and districts.

Running parallel to Farm Bill discussions are efforts to discern what may arise from the simultaneous work to pass a tax extenders package and the efforts that might be categorized under the broad heading of “government efficiency.” In 2020, our sector won a long-sought-after tax credit for qualifying appliances, albeit one limited to residential installations and capped at $2,000. This credit was extended in 2023 and for now is available to consumers through 2032. Maintaining this credit is a high priority for the PFI, and constant vigilance as Congress begins its work on a tax package or potential budget reconciliation will be a must.

For now, Congress seems poised in a calm-before-thestorm posture with its days being consumed by confirmation hearings and committee leadership appointments. Soon, however, the work of legislating will commence, and so too the PFI’s continued advocacy for wood pellet manufacturing and utilization.

Author: Tim Portz

Executive Director, Pellet Fuels Institute tim@pelletheat.org

www.pelletheat.org

JAPEX Begins Operations at 75-MW Biomass Power Plant

Japan Petroleum Exploration Co. Ltd. (JAPEX) on Jan. 6 announced the Chofu Biomass Power Plant commenced commercial operations on Dec. 30. The 74.95-MW facility is fueled with 100% imported wood pellets.

Chofu Bio-Power LLC and its five sponsors, which include JAPEX, Tokyo Energy & Systems Inc., MOT Research Institute Ltd., Chofu Seisakusho Co. Ltd., and Kawasaki Kinkai Kisen Kaisha Ltd., celebrated groundbreaking of the facility in mid-2022. Plans for the project were first announced in September 2021.

The plant, located in the Chofuogimachi Industrial Park, Shimonoseki-city, Yamaguchi Prefecture, is expected to generate approximately 520 gigawatt hours of electricity per year. Power produced by the facility will be sold to Chugoku Electric Power Transmission & Distribution Co. Inc. under the feed-in tariffs scheme for renewable energy.

The government of South Korea in late 2024 announced it will end subsidies for new biomass energy projects and existing state-owned facilities that cofire imported biomass with coal starting in 2025, and will also phase out subsidies privately owned facilities starting in 2026. Subsidies will remain in place to support the use of domestically sourced biomass.

A notice published by the government on Dec. 18 attributes the new policy to efforts to reduce dependence on imports and environmental concerns.

Data published by the International Energy Association shows the use of solid biofuels in South Korea’s electricity generation grew significantly from 2015 through 2023, accounting for 7.455 gigawatt hours (GWh) in 2023. The government notice indicates Vietnam and Russia are among the top suppliers of biomass fuel to South Korea. The U.S. also exports a small volume of wood pellets to the country. According to data published by the USDA Foreign Agricultural Service, U.S. producers exported approximately 31,457 metric tons of wood pellets to the South Korea in 2023. That volume accounted for less than 1% of the total volume of wood pellets exported from the U.S. during the year.

BY ERIN VOEGELE

During the first 11 months of 2024, the U.S. exported only 18.5 mt of wood pellets to South Korea, according to the USDA.

The U.S. exported 879,332 metric tons (mt) of wood pellets in December, bringing total exports for the full year 2024 to a record 10 million mt, according to data released by the USDA Foreign Agricultural Service on Feb. 5.

The 879,332 mt of wood pellets exported in December was up slightly when compared to the 973,783 mt exported in November, but down when compared to the 1.04 million mt exported in December 2023.

The U.S. exported wood pellets to more than a dozen countries in December. The U.K. was the top destination for U.S. wood pellet exports at 649,587 mt, followed by Denmark at 128,295 mt and the Netherlands at 33,055 mt.

The value of U.S. wood pellet exports fell to $162.15 million in December, down from $162.25 million in November and $186.41 million in December of the previous year.

Total U.S. wood pellet exports for 2024 reached 10 million mt at a value of $1.86 billion, compared to 9.6 million mt exported at a value of $1.73 billion in 2023. The U.K. was the top destination for U.S. wood pellet exports last year at 7 million mt, followed by Japan at 1.15 million mt and the Netherlands at 659,358 mt.

The U.K. Department for Energy Security and Net Zero on Feb. 10 announced it will move forward with a short-term support mechanism for large-scale biomass generators that plan to develop bioenergy with carbon capture and storage capacity.

The country’s current biomass subsidies are set to end in 2027. The newly announced support mechanism will offer continued support for eligible biomass generators that have a minimum electricity export of 100 megawatts. The transitional support will be offered as a contract for difference with a generation collar. The new subsidies will apply to lower volumes of generation than current subsidies and will be designed to maximize energy security benefits.

According to Drax Group plc, the transitional subsidies will be available for all four biomass units at Drax Power Station from April 2027 through March 2031.

U.S. manufacturers produced approximately 930,000 tons of densified biomass fuels in October, according to the January edition of the U.S. Energy Information Administration’s Monthly Densified Biomass Fuel Report. Sales of densified biomass fuel reached 950,000 tons during the month.

The EIA collected data from 77 operating manufacturers of densified biomass fuel to complete the report. Facilities with annual production capacities of less than 10,000 tons were not included, as they are required to report data annually rather than monthly.

The manufacturers surveyed for October had a total combined production capacity of 13.34 million tons per year and collectively had the equivalent of 2,431 full-time employees. Respondents purchased 1.88 million tons of raw biomass feedstock in October, produced 930,000 tons of densified biomass fuel and sold 950,000 tons of densified biomass fuel. Production included 148,059 tons of heating pellets and 783,569 tons of utility pellets.

Domestic sales of densified biomass fuel in October reached 198,453 tons at an average price of $236.05. Inventories of premium/ standard pellets fell to 266,549 tons in October, down from 312,120 tons in September. Inventories of utility pellets fell to 598,835 tons in October, down from 647,720 tons in September. Exports in October reached 757,813 tons at an average price of $204.22 per ton.

Enviva has announced it will close its 115,000-metric-ton-per-year wood pellet plant in Amory, Mississippi, effective Feb. 7. The company cited market dynamics and the facility’s infrastructure and operations as reasons for the closure.

The Amory facility was acquired by Enviva in 2010 and was the first U.S. plant operated by the company. The facility was previously owned by CKS Energy Inc.

“Enviva has made the decision to shut down operations at its Amory, MS facility, effective February 7,” said the company in a statement. “As part of our post-emergence exercises, we are reviewing the overall operational efficiencies of our entire fleet. Due to market dynamics and the Amory facility’s infrastructure and operations, along with the relationship of its size and scale relative to the rest of our portfolio, it has been decided resources are better invested in other areas moving forward.

“We are deeply grateful for the hard work and dedication of all those who have contributed to the Amory facility over the years, and we are committed to supporting our team through this transition,” the statement continues. “Enviva remains committed to manufacturing high-quality sustainable wood pellets and focused on the long-term success of our business as we navigate these changes.”

BY CHLOE PIEKKOLA

*information provided is based on estimated trends from 2022-’24 and may not re ect actual totals.

Data gathered from the State of Main Governor s Energy O ce.

After a decade in the torrefaction technology industry and a successfully launched commercial black pellet plant in Thailand, Blackwood Technology B.V. is preparing for growth.

BY CAITLIN SCHERESKY

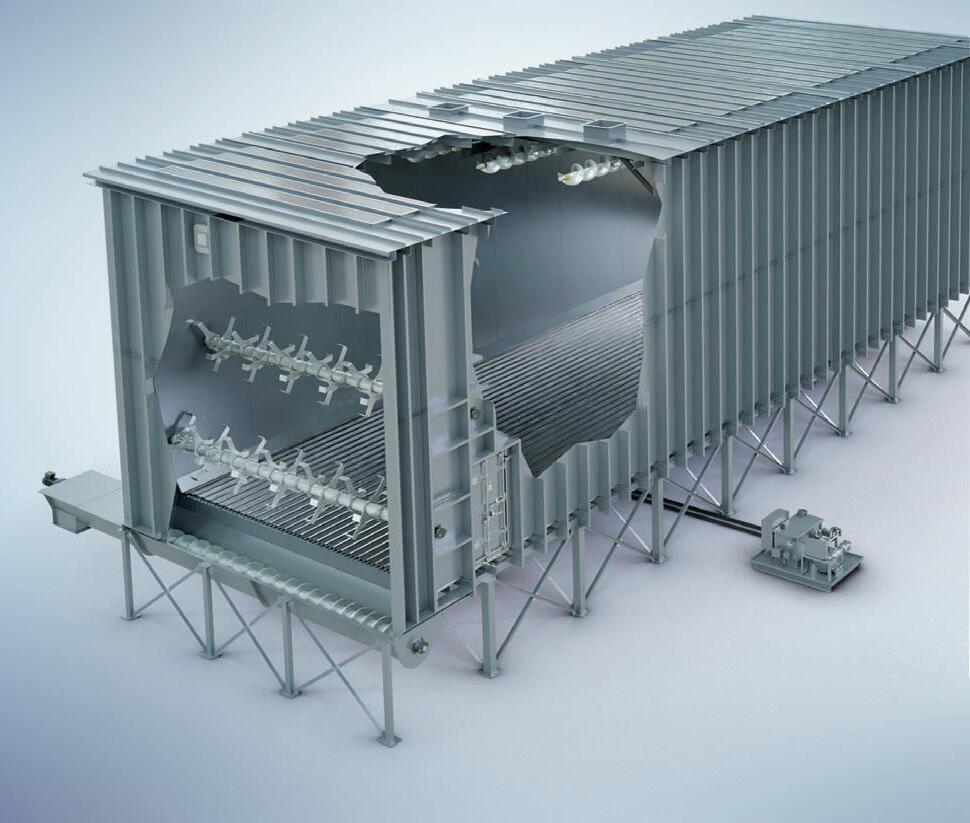

In November, Blackwood Technology announced the successful start of production at the first commercial FlashTor black pellet plant in Lampang Province, Thailand. The plant is owned and operated by NT Biomass Products Company Ltd. and will annually produce 75,000 metric tons of black pellets that will be used to replace fossil coal in power generation and steel production.

Blackwood Technology B.V.’s first commercial-scale black pellet plant in Lampang Province, Thailand, is online and producing at commercial scale.

Blackwood, a Dutch renewable energy technology company, focuses on the torrefaction and carbonization of biomass. Where Blackwood differs from other technologies in the industry is in its FlashTor technology, derived from its predecessor, Topell Energy. Topell demonstrated FlashTor’s success at a demo plant in Duiven, the Netherlands, and Blackwood has followed in its footsteps.

Pellet Mill Magazine readers may recall the announcement of the plant’s inauguration in summer 2022 by Blackwood and TTCL Public Company Ltd., a Thai engineering, procurement and construction company and Blackwood’s partner for the project. The goal was to demonstrate the value and sustainability of Blackwood’s FlashTor technology at industrial scale, which proved to be successful.

Torrefaction, the process of heating woody biomass at 250-320 degrees Celsius with low oxygen to produce high-grade solid biofuels, has many benefits, and CEO Maarten Herrebrugh is confident Blackwood has it down to a science. “Blackwood’s FlashTor technology uses a multistaged reactor system, which allows us to split the process in two steps: first, a heating-up step and second, a torrefaction and carbonization step.” Herrebrugh explains that torrefaction and carbonization result in chemical decomposition reactions that can be volatile. FlashTor’s multistaged system builds in scalability with an optimally controlled process that he says other technologies have lacked.

FlashTor also speeds up torrefaction, which is traditionally a tedious and slow process, according to Herrebrugh. Blackwood maintains that the technology is flexible with respect to the particle size and nature of the incoming biomass, which keeps cost down.

Black pellets have several benefits over a standard wood pellet, Herrebrugh explains. “The main benefit of black pellets is that it

allows power stations and other industrial coal users to replace thermal coal with renewable biomass while using their existing infrastructure,” he says. “The torrefaction process increases the calorific value and grindability of the biomass, which make it suitable for use in pulverized coal infrastructure.”

Another benefit of black pellets is the reduced logistics cost, because on a mass or volume basis, a black pellet contains more energy than a traditional pellet. And black pellets are water resistant, so they can be stored outside on the coal yard, Herrebrugh says.

Also on Blackwood’s roster are SuperBlack pellets, which Herrebrugh identifies as a key tool in the decarbonization of the steel

industry. “When we started with Topell, and later with Blackwood, our focus was the replacement of thermal coal in power stations and industrial boilers. But more recently, we have seen a lot of demand from the steel industry and other base metal producers to replace metallurgical coal with biocarbon,” Herrebrugh explains. “These applications require a more carbonized black pellet.” With a higher fixed carbon level and reduced volatiles, Blackwood believes its Super Black pellets are ready to answer the call.

As Herrebrugh notes, the road to success didn’t come without turmoil. Blackwood’s predecessor, Topell Energy, closed shop in 2014 after Dutch subsidies stopped, which resulted in a significant drop in demand for torrefied biomass. Once a pioneer torrefaction technology company, Topell’s shutdown prompted widespread concerns about a torrefied future.

Formed in 2008 and making waves by 2010 with the development of the world’s

first commercial-scale torrefaction plant in the Netherlands, Topell represented a future where black pellets replaced coal. “With black pellets produced at [the Netherlands] plant, we conducted successful cofiring tests with European power stations, proving that black pellets can be used as a drop-in fuel replacement for fossil coal in pulverized coal power stations,” Herrebrugh explains.

Despite Topell’s demise, the core team still believed in a future for torrefied biomass. This led to the formation of Blackwood Technology, Herrebrugh says. “We proposed to the shareholders of Topell the creation of a new company that would take over all the IP and know-how from Topell in return for a share in the new company,” he says. It worked, and Blackwood rose to the challenge in 2015.

As all businesses do, Blackwood had to face the million-dollar question of profitability. “With Blackwood, we didn’t want to raise venture capital. We wanted to generate our own cash flow from engineering assignments, and ultimately, technology licensing

agreements,” Herrebrugh says. “Based on the lessons learned from the Topell plant, we designed a second-generation torrefaction technology, which we branded the FlashTor technology.”

Blackwood still holds a licensing agreement with Eskom, a South African utility and Blackwood’s first customer, to produce further torrefaction plants.

With a strong start in South Africa under its belt, in 2017, Blackwood shifted attention to Japan. “The 20-year feed-in-tariff program for biomass in Japan offered a potentially strong foundation for a black pellet supply chain because it could guarantee investors of torrefaction plants a long-term offtake contract for the product.” But this, as Herrebrugh and black pellet industry veterans will recognize, is easier said than done.

Herrebrugh describes the state of the black pellet market as “a classical chickenand-egg situation; end users were interested in black pellets, but before committing to a long-term offtake contract, they wanted to conduct large-scale cofiring tests that would

require an industrial-scale production facility. And in order to fund a project for such a production facility, you would need a longterm offtake contract.”

Blackwood quickly found itself looking for potential partners with a focus on Southeast Asia to build such a facility. “Ultimately, our business development efforts resulted in a partnership with TTCL Public Company Ltd., a Thai EPC and investment company with Japanese roots,” alongside which Blackwood built its first FlashTor demonstration plant in Thailand in 2022, and now a commercial torrefaction plant.

Blackwood’s success is remarkable, considering the minor success of commercial torrefaction across the board and the industry's slow development pace. “There have been quite a few parties that failed to bring their technology from lab or pilot scale to a viable industrial scale...[and] potential offtakers [are] only willing to sign binding multiyear

investment projects go through a structured project development process that ultimately results in a final investment decision,” Herrebrugh explains. “Blackwood offers project developers services in each stage of the project’s development.”

This is exactly where Blackwood thrives, and its success is reliant on collaboration. “Initially, the driving forces behind the production of industrial wood pellets and interest in black pellets were country-specific programs that supported the cofiring of biomass in power stations. What we now see is that well-functioning carbon credit markets are a strong driver for decarbonization efforts of coal users,” Herrebrugh says. “As Blackwood, we are too small to participate in any policy conversations. Instead, we use our experience with cofiring black pellets in pulverized coal power stations to assist coal users in other industries with conversion from fossil coal to sustainable biocarbon.”

Perhaps a more under-the-radar key to Blackwood’s success is its dedication to

plants in Thailand can both process multiple feedstocks like woody biomass as well as corn residues and other agro residues.”

Blackwood has also held smaller-scale black pellet tests in residential settings to operate wood pellet stoves, though Herrebrugh notes that true market growth will come from industrial demand. To work toward this, Blackwood is looking internationally. “We are working on several new potential projects in different stages of development in different regions of the world,” Herrebrugh states. “For most of these projects, we will be the technology licensor, [and] for one specific project we are one of the project development partners.”

Blackwood’s international interest expands all the way to North America, Herrebrugh says. “In the past, there was no real incentive for [North American] wood pellet producers to consider adding black pellet capacity to their wood pellet plant.”

The United States supplies the majority of the EU’s wood pellet demand, which Her-

After its recent success, Herrebrugh says Blackwood is looking forward to preparing for growth. “While working on the next projects, we want to start laying the foundation for a global roll-out of our FlashTor technology,” he explains. Work on this growth prep has already begun as a result of the success of Blackwood’s Thailand plant, and good things are on the horizon.

Herrebrugh notes that the market has and will be Blackwood’s biggest challenge. “We have solved this by teaming up with TTCL, which has been willing to invest in first a demo plant in Thailand and now in NTBC, the first commercial-scale black pellet plant in Southeast Asia,” he says. New partnerships are also in the works, according to Herrebrugh. “We have always believed in partnerships with strategic players ... we are working on new partnerships that can lead to an accelerated roll-out of our technology, and strengthen our offering and presence in specific regional markets.”

Of all of Blackwood’s accomplishments, Herrebrugh cites the development of FlashTor technology “from an idea to a proven industrial scale technology” as his proudest. “Our longer-term goal is to have at least one million [metric] tons of annual black pellet production by our FlashTor technology within the next five years.”

Author: Caitlin Scheresky caitlin.scheresky@bbiinternational.com

Pathway Energy CEO Steve Roberts discusses the company’s plans to use industrial wood pellets for the production of sustainable aviation fuel.

BY ANNA SIMET

In December 2024, Drax and Pathway Energy announced a multiyear deal that could see Drax supplying upward of 1 million metric tons of wood pellets to Pathway’s currently proposed sustainable aviation fuel (SAF) plant on the U.S. Gulf Coast. In the months leading up to the announcement, Drax had hinted at such prospects, indicating plans to develop a pipeline of biomass sales opportunities in North America, including in the SAF market. Drax CEO Will Gardiner confirmed as much during a November quarterly earnings call.

Currently, Drax has 17 operational wood pellet production plants across North America and a 450,000-metric-ton facility under construction in Longview, Washington. While Drax is well

known in the industrial wood pellet industry, Pathway Energy is a new and unique market participant. Pellet Mill Magazine interviewed Pathway Energy CEO Steve Roberts to introduce the company, technology and plans.

Who is Pathway Energy and what is the company's background?

Roberts: Pathway Energy is a developer of ultra-carbon-negative fuels. Our company is focused on meeting the global demand for sustainable aviation fuel to decarbonize aviation emissions. Prior to leading Pathway, I served as a partner at Nexus PMG, an infrastructure advisory and project development firm dedicated to

reducing carbon intensity and enhancing resource efficiency. While heading the distressed assets division at Nexus PMG, the Pathway team and Nexus saw an opportunity to bring a new, synthetic dropin jet fuel to the market. We launched last December in partnership with Nexus Holdings and announced the development of our first facility on Texas’s Gulf Coast.

Tell us about your technology/technical process.

Roberts: Our development platform combines scalable carbon removal process pathways including biomass energy carbon capture and storage (BECCS) and biomass to liquids (BtL) technologies leveraging point-source capture to produce ultra-carbon-

negative fuels. We combine biomass power generation with gasification and FischerTropsch technology and capture the CO2 that would normally be emitted from the process. After working with various feedstocks, technologies and assets within lowcarbon infrastructure projects, we recognized the value of leveraging commercially demonstrated technologies. We are aggregating the most mature technologies available today, which will derisk our facility, production process and output. The intro-

Steve Roberts

duction of our ultra-carbon-negative fuel is an industry first. We will be a manufacturer of synthetic drop-in jet fuel that achieves a 550% reduction of carbon compared to traditional jet fuel, which will help carriers abate up to 6,000 long-haul flights annually. The core processes at our SAF facility in Port Arthur include integrated power generation and gasification (via Fischer-Tropsch) and fuel upgrading. We’ve partnered with multinational heavyweights including Sumitomo SHI FW, which will supply the project with proven power production and gasification process technology packages.

Pathway has a partnership with Drax. Why is Drax an ideal partner for you and what does the partnership entail?

Roberts: Pathway’s long-term feedstock supply from Drax enables us to supply over one million tons of sustainable biomass pellets annually to our Port Arthur facility. Securing a strategic partnership with renewable energy leaders like Drax Group offers potential SAF customers long-term certainty for the sustainability and scalability of our facility. Through our partnership, we will be able to produce 30 million gallons of carbon-negative jet fuel annually,

which is equivalent to more than 150 million gallons of the carbon-neutral blended SAF. There is also the potential for Drax to become a strategic partner in the project, investing $10 million, and supplying two additional Pathway SAF projects.

Pathway plans to convert wood pellets into SAF. Can you explain why it makes sense (processwise, economicswise) to use wood pellets versus unpelletized wood (i.e., wood chips)?

Roberts: Through biomass power, gasification and syngas conversion technologies, Pathway converts sustainably sourced wood pellets, a homogenous and globally traded commodity, into SAF. Pathway’s decision to use wood pellet feedstock from world-class partners like Drax Global and proven technologies from Sumitomo SHI FW derisks feed system failures and optimizes gasification performance. This will ensure a higher availability long term and improve overall operability of the facility. Wood pellets also provide the highest standard in sustainability with an established chain of custody certification and offer substantial logistics advantages over other renewable biomass feedstocks. The sustain-

ability, scalability and logistics advantages are key reasons the wood pellet industry supplies the largest renewable biomass energy facilities globally.

Explain the carbon capture component of Pathway’s project model.

Roberts: Pathway is focused on developing a platform of commercial-scale facilities in areas with a high potential for geological storage to utilize BECCS and gasification technology to capture and store carbon. Carbon capture is an integral part of our process, allowing us to capture more than 99% of the CO2 that would normally be emitted in these processes. Through CO2 capture, we are able to achieve massive reductions in the carbon intensity of the fuel—the project will sequester over 1.9 metric tons of CO2. This is one of the most compelling reasons we decided to site our facility in Texas, which is in close proximity to other companies that are also advancing carbon sequestration development. In Port Arthur, we have access to three different storage platforms within 50 miles of our facility. Through capture and sequestration, we can capture up to 99% of the carbon.

Regarding your Pathway Energy GT project, what details can you tell us about it right now?

Roberts: Pathway’s $2 billion flagship facility in Port Arthur, Texas, is expected to produce 30 million gallons of ultra-carbon-negative SAF. The SAF produced at the facility will enable a 550% reduction of carbon emissions compared to traditional Jet A fuel. The facility is expected to come online in 2029.

For additional projects, would the feedstock strategy continue to be wood pellet utilization?

Roberts: Pathway Energy is currently only focused on utilizing wood pellets as its feedstock for ultra-carbon-negative SAF.

What does Pathway look for in an ideal project location?

Roberts: The Texas Gulf Coast has the benefit of a highly skilled local workforce and existing infrastructure from the oil and gas industry. Port Arthur also has existing industrial-scale import and export logistics including established truck, rail, barge and pipeline access. Combined, this makes it the ideal location for Pathway’s first facility. For future facilities, a key component is sites with a high potential for geological storage to utilize BECCS along with established logistics infrastructure, which the industrialized areas along the U.S. Gulf Coast offer.

What instills confidence in you that Pathway Energy will be successful?

Roberts: For over a decade, investment and advisory firm Nexus Holdings supported the development and execution of more than $35 billion in low-carbon infrastructure projects. Nexus Holdings brought together a highly skilled team to form Pathway Energy, including team members with deep technical, commercial, financial and industrial management experience within high value low-carbon infrastructure projects.

We are confident that this team, along with the proven technical and strategic partners, have the collective knowledge, technology and experience to deploy this platform.

In your opinion, what’s the most compelling or exciting part of this industry?

Roberts: The most exciting aspect is the potential for next-generation fuels like ours to tackle hard-to-abate industries like aviation, as well as the interest we’re already

seeing from carriers. Once operational, the first Pathway facility will have one of the world’s lowest-carbon-intensity SAF products available to the market, and we are looking forward to playing a critical role in driving large-scale emission reductions across the aviation sector.

Author: Anna Simet asimet@bbiinternational.com

It has been over three years since I last contributed to Pellet Mill Magazine. Prior to that, I had been writing columns multiple times per year for a decade-plus, spanning the period during which the solid biofuels industry created and adopted industry standards. These standards include initiatives such as the creation of the International Organization for Standardization Technical Committee 238 suite of solid biofuel standards that are now referenced in nearly all solid biofuel export agreements, as well as the creation and implementation of the Pellet Fuels Institute and ENplus wood pellet quality certification schemes. As my articles often focused on providing updates on these developing standards, I found that as they matured, there was less to write about,

BY CHRIS WIBERG

so it was convenient for me to take a break. Fast forward to 2025, we are now on the cusp of needing to standardize an entirely new but related industry: biocarbon.

Chris Wiberg

For those who have been part of the biocarbon industry for many years, perhaps even decades, you may be thinking “But we already have standards.” This is true, but current biocarbon standards have significant problems and are in desperate need of an overhaul. This is similar to where we were with solid

biofuel standards in 2007. At that time, solid biofuel standards were provided by a variety of regional entities but were not aligned. The solution was the creation of ISO TC 238 to be used by all countries with interest in solid biofuels to work together to create standards. Now, nearly 20 years later, the solid biofuels industry has a suite of standards that are recognized globally and have good methodological alignment (e.g., methods start with sampling and sample prep, which are referenced by each subsequent test method, and test methods also crossreference each other to provide complete test packages).

In contrast, let’s look at the most cited biocarbon standard. The International Biochar Initiative standards (published in 2015)

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

reference test methods that are to be used when testing “biochar.” The problem with the IBI standards is that they reference methods from several different sources (ASTM International, AOAC International, TMECC, U.S. EPA and even from individual research papers), leading to poor methodological alignment. As a result, laboratories being asked to perform testing per the IBI standards need to decide for themselves how to best fulfill these methods, resulting in differences between laboratories. Not surprisingly, poor laboratory repeatability and reproducibility has been a commonly cited issue.

Fortunately, a fix has been developing for a few years. While efforts had a slow start, they’re now quickly gaining momentum. In early 2021, ISO TC 238 first became aware of the biocarbon standards void. The following October, ISO TC 238 created Task Group 1 (TG1), with a mandate to map the need for biocarbon standards as part of the iron and steel sector. Over a two-year period, this effort expanded to biochar, biocarbon and biocoal, and in May 2024, the Technical Committee was renamed “ISO TC 238 – Solid Biofuels and Pyrogenic Biocarbon,” whereby ISO TC 238 now serves as the platform for creating ISO standards for these materials.

The good news is that ISO TC 238 already has 47 published standards, which included thermally treated solid biofuels (e.g., torrefaction, steam explosion, hydro thermal carbonization and charring) in their initial design. Additionally, ISO TC 238 has six active working groups currently focused on reviewing each of the 47 test methods to revise them as needed to ensure they are useable for biocarbon materials. The bad news is that making revisions to ISO stan dards is a slow process, so it will likely be two to three years before these standards are fully updated to cover biocarbon ap plications. That said, it is still much quicker than the nearly 20 years it took to write and refine them as solid biofuel standards.

While there is a lot of comfort in knowing that the biocarbon industry now has an ISO platform for creating standards, the North American biochar industry has raised concerns that the two- to three-year

timeline for ISO to update its current standards is just too long. Updated standards are needed as soon as possible to facilitate the pace of growing commerce and carbon markets. For this reason, the US Biochar Initiative has engaged the American Society of Agricultural and Biological Engineers to develop an American National Standard for biochar. Work on this standard began in June 2024 with the intent of having a standard published within one year. It is the intent of the American National Standard to incorporate ISO test methods as much as possible to preserve alignment with international standards, but it may also reference other standards when necessary. The American National Standard is a North American initiative with the participation of biochar experts from the United States, Canada and Mexico.

In summary, there is a lot going on related to biocarbon standardization. I currently serve as the project leader for the USBI American National Standards project, as well as chairman of the US TAG to ISO TC 238. It is my intent to continue contributing to Pellet Mill Magazine to keep everyone up to date on both initiatives. Additionally, I will be providing a presentation on this topic at the 2025 International Biomass Conference and Expo in Atlanta. The title of my presentation is “New Developments in Biocarbon Standards,” on March 19. I will also provide periodic updates on the Biomass Energy Lab LinkedIn site, so follow us if you would like to stay connected.

Author: Chris Wiberg VP of Biomass Energy Lab Timber Products Inspection Inc./Biomass Energy Lab twiberg@tpinspection.com

Federally funded research is bringing biomass to steelmaking to reduce the use of fossil coal and lower carbon emissions.

With one year of research under their collective belts, researchers have removed some of the barriers to using biobased carbon in the electric arc steelmaking process. The research is being conducted at the University of Minnesota’s Natural Resources Research Institute as a $4.5 million project, funded by a $2.9 million U.S. Department of Energy grant

BY JUNE BRENEMAN

with a match of $1.6 million from NRRI internal funds and industry assistance.

A recent trip by research leaders to the European Biocarbon Summit revealed that steelmakers are ready and waiting for a biocarbon product that can replace fossil coal in the steelmaking process. Steel production accounts for about 8% of global carbon emis-

sions. “Every major steel producer we talked to wants to lower the carbon impact of their product,” says Eric Singsaas, NRRI Materials and Bioeconomy Research Group leader. “In some markets, it’s driven by regulation. In others, it’s customer driven.”

And while planet Earth has been very effective at turning biomass into coal over mil-

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

lions of years under high pressure and heat, replicating that above ground in real time offers some interesting challenges.

Steel is an alloy of carbon and iron. It is a critical material for national security and economic prosperity. In the electric arc furnace steelmaking process, pulverized fossil coal is injected into the molten slag near the end of the melting process. It produces a foaming reaction that provides insulation to the molten steel, holding in heat, and it also helps remove impurities such as sulfur and protects the slag lining in the refractory.

The limitation of pyrolysis-processed biomass (biocarbon) is that it’s not a dense material. And the injection process uses pneumatic pressure to get the material through the slag. The carbon source has to be robust enough to survive transfer into the furnace. In addition to conveyance, biocarbon behavior in the slag is not ideal, according to Matt Young, NRRI biomass research engineer. “On its own, the foaming reaction of biocarbon is too violent. It raises quickly—like mints in a cola—and dissipates too quickly,” he explains. “Foaming with injected coal raises the slag up a few inches and holds that foam reaction. The time and height, the kinetics, that’s what we’re trying to engineer.”

The challenge for NRRI researchers is to densify porous, low-density biocarbon to work as well as fossil coal. By experimenting with different performance modifiers and testing various binders, they engineered a biocarbon that mimics this coal-like reaction at the bench and pilot scale. The pelletized biocarbon material was successfully tested in intermediate scale-up trials of 25 kilograms at a steel recycling plant electric arc furnace.

The next target for the research is developing “charge carbon,” which is added to the scrap steel and metallic iron at the beginning of the melting process to provide energy and act as a reducing agent. The goal is to successfully demonstrate biocarbon in these steelmaking steps at the commercial scale

at a full-scale electric arc furnace steel facility in 2026. “While the global steel industry knows they need to use biocarbon, they don’t know how to use biocarbon,” Singsaas says. “So that’s the focus of this Department of Energy grant. Over the past decade, we’ve become leaders in biocarbon densification, though this is a much more complex, more finessed product than we’ve tried in the past.”

NRRI’s integrated research teams are uniquely qualified to develop biobased industrial solutions. The NRRI Materials & Bioeconomy team’s 12 scientists work with 10 engineers and technicians on the NRRI Minerals and Metallurgy team, and NRRI’s Forests and Lands research team can provide critical analysis of the U.S. wood basket to inform biomass availability. A life cycle analysis is also part of the project to understand the environmental impacts of biocarbon in steelmaking, as well as a technoeconomic analysis to inform industry cost impacts.

To accelerate these innovations, the NRRI researchers are actively seeking research partnerships across the globe—steel companies, biomass providers, biocarbon producers or other interested parties. “NRRI is really at the forefront of developing industrial metallurgical carbon because of the broad expertise across many disciplines that intersect here,” says Brett Spigarelli, NRRI lead metallurgical engineer. “Decades of past research is paving the way for this critically important innovation in steelmaking. NRRI is ready to lead.”

The Natural Resources Research Institute is a state-chartered, University of Minnesota System research unit with three sites in Northern Minnesota, fulfilling a mission to deliver integrated research solutions that value our resources, environment and economy for a sustainable and resilient future.

Author: June Breneman NRRI Manager, Marketing & Communications jbreneman@d.umn.edu

BY KAYLEIGH RAYNER BROWN AND PARKER MACNEIL

Combustible wood dust in wood pellet and bioenergy plants presents a risk of fires and explosions that must be addressed to protect personnel, equipment, production and business reputation. Process safety management provides a framework to systematically address these risks. Key safety measures, such as process design, process and equipment integrity, and explosion mitigation are all implemented through effective process safety management (PSM) systems. This article outlines key elements of PSM and the suggested activities companies can undertake to strengthen their programs and close gaps.

Wood pellet plants, bioenergy facilities and other entities within the biomass sector face the ongoing challenge of minimizing combustible dust hazards in their day-to-day operations to protect their workers and prevent facility downtime. Flash fires (deflagrations) and explosions caused by ignited wood dust can harm personnel, damage equipment and interrupt business in these facilities. PSM systems help prevent process safety incidents and mitigate their effects by aiding in the development of safe work procedures, incident investigations and corrective action planning.

Chapter 8 in NFPA 664, Standard on the Prevention of Fires and Explosions in Woodworking Facilities, provides requirements for management system elements relating to process safety to help mitigate the impact of combustible dust fires and explosions, including operating procedures and practices, housekeeping, hot work and inspection, testing and maintenance. While not explicitly legislation, the Canadian Standards Association Z767, Process Safety Management, can also be used to implement a PSM system within facilities and organizations that may not be covered by process safety or combustible dust regulations but still have significant process safety risks. When looking to either establish new management system elements or improve an existing management system, it can be difficult to identify the key elements to focus on and how to implement them. Organizations should first establish the programs and policies they have in place and identify the gaps related to potential risks and hazards. A self-assessment against a management system framework can be used for this. After identifying areas for improvement, focused efforts and initiatives can be undertaken to close the gaps and roll out the programs throughout the organization.

Process design, process and equipment integrity, and explosion mitigation are instrumental in reducing combustible dust risk. Effective explosion mitigation requires conducting a process risk assessment to identify, analyze and document process-related hazards and implement risk reduction measures. This involves assessing whether a process hazard analysis (PHA) or dust hazard analysis (DHA) has been completed and if a plan has been put in place for implementing control measures related to risk assessments and hazard analyses. Companies should do the following:

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

• Define responsibility and develop a procedure for safety approval of new projects and changes.

• Develop hazard identification procedures and analyze potential risk scenarios.

• Implement safeguards aligned with good engineering practice.

Process and equipment integrity include the inspection, testing and maintenance (ITM) of equipment and the establishment of safe work practices to help prevent or mitigate hazardous scenarios involving combustible dust (fires, deflagrations, explosions). Specifically, it should be determined whether formalized ITM procedures have been established for all onsite equipment and whether written procedures for operating the process and equipment have been established. Companies should:

• Identify process safety critical equipment at your facility.

• Implement a process for a pre-startup safety review before running a new or modified process or equipment.

• Create an alarm and instrument management program.

A robust PSM system requires support from the company’s senior leadership. Senior management should be accountable for the PSM system goals and objectives related to process safety, considering risks throughout the facility lifecycle. Suggested activities to improve leadership support and accountability include establishing a formal corporate process safety policy; developing a process for senior management to get feedback from all employees about the process safety policy; and providing training for managers, coordinators and supervisors in process safety culture leadership.

Management systems also require an effective safety culture. Process safety culture is the collective mindset of the organization with respect to safety and risk, including attitudes and behaviors. Organizational policies should include statements establishing process safety as part of the company cul-

ture and a measure of successful operations. Recommendations for improving safety culture include conducting routine process safety culture surveys, explicitly acknowledging the critical function of frontline workers in identifying hazards, and implementing initiatives to combat complacency.

The application of process safety elements allows companies to systematically establish programs and policies to manage combustible dust hazards while making them applicable to other facilities in their organization.

Process safety elements play a key role in preventing fires and explosions caused by combustible dust. Companies should use self-assessments to evaluate their management systems and current safety culture to identify gaps to address opportunities for improvement. Industry best practices such as pre-startup safety reviews, DHAs and safety culture initiatives support the effective implementation of risk reduction measures. By applying these process safety concepts, biomass facilities can help protect their facilities and prevent downtime, leading to safer and more efficient operations.

This article builds on the outcomes of a research project by Rayner Brown et al. (2024) that was recently completed and published by Dalhousie University, the Wood Pellet Association of Canada, BC Forest Safety Council and Dust Safety Science. The project authors gratefully acknowledge funding from WorkSafeBC under an Innovation at Work grant. The views, findings, opinions and conclusions expressed herein do not represent the views of WorkSafeBC.

Authors: Kayleigh Rayner Brown Lead Engineer, Industrial & Process Safety

Parker

MacNeil

Lead Engineer, Industrial & Process Safety

Jensen Hughes www.jensenhughes.com

BY BROOKS MENDELL & STEPHEN WRIGHT

As of January 2025, Forisk’s wood bioenergy database tracks 387 operating and announced projects related to wood pellets, electricity, combined heat and power, liquid fuels and thermal. These projects represent a combined potential wood consumption of 115 million green tons per year. Based on Forisk’s viability screening, 358 projects pass, indicating potential wood use of 99.4 million green tons per year. The South leads the United States in bioenergy investment as measured by potential wood use, with 61% of the total possible new demand. This highlights the attractiveness of the South due to feedstock availability, continued government support, and increasingly, the ideal geology for carbon capture and storage.

How are bioenergy projects evaluated?

Forisk tracks all publicly announced woodusing bioenergy projects in the continental U.S. and applies a two-part screen to identify projects that are likely to succeed based on technology and status. If the technology of a project is viable today (such as wood pelletizing or wood to electricity) at commercial scale, then the project passes the technology screen. The status screen evaluates projects based on where they are in the development process. If a project has two or more necessary permits, contracts or financing commitments, then it passes the status screen. These include air quality permits, power purchase agreements, supply agreements and engineering procurement contracts. “Likely”

or “viable” projects are those that pass both screens.

Weighted Average Year-Over-Year Wood Fiber Prices: Recent Data

Data from the Forisk Wood Fiber Review indicates that U.S. softwood fiber prices rose by 2% year-over-year through Q4 2024, while Canadian prices climbed by 5%. Quarterly price declines in the U.S. are attributed to market adjustments driven by an oversupply from natural disasters and reduced consumer demand. In Canada, prices generally saw moderate increases, with most producers purchasing the fiber required for their reduced operating rates, though at higher prices.

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

In the U.S. Northeast, fiber prices decreased across most projects, with hardwood residual chips having the largest decrease, down 11% year-over-year. Brooks Mendell, CEO of Forisk Consulting, commented, “Softwood lumber markets seem to be showing life, though many producers noted no changes to their previously planned extended outages during the holiday season.”

This article includes data from the Forisk Wood Fiber Review, a quarterly publication tracking North America’s major wood fiber and log markets, and the Forisk Research Quarterly, which includes forest industry forecasts and analysis by sector.

Authors: Brooks Mendell & Stephen Wright

Forisk Consulting LLC 770-725-8477

bmendell@forisk.com SOURCE:

Canadian roundwood prices increased by 18%, while chip prices increased by 1% yearover-year. In British Columbia, softwood pulp log prices fell by 4% for Q4 2024, whereas they increased by 7% in the Maritimes. Delivered softwood chip prices increased by 11% in Al berta and 4% in East Ontario/Quebec but fell 1% in British Columbia. According to Stephen Wright, product manager of the FWFR, “The Canadian forest products industry continues to face significant contraction, with 862 million board feet of capacity reductions announced across three sawmills this quarter. However, the avoidance of a prolonged rail strike and a relatively calm fire season provided some tem porary relief.”

U.S. roundwood prices increased by 6% year-over-year, and chip prices rose by 1%, though this varied regionally. In the Lake States and Northwest U.S., prices for most products were flat or declined year-over-year, except for hardwood roundwood, which increased 2% and 8%, respectively. In the U.S. South east and South Central regions, fiber prices fell for six out of the eight products tracked, with Southeast softwood residual chip prices falling the most (15%) and South Central hardwood roundwood increasing the most (7%) for the quarter. Year-over-year, prices for softwood and hardwood residual chips and roundwood were mixed.

• Hydraulic Truck Dumpers custom engineered for each application

• Live Bottom Hoppers including Backrakes for handling stringy bark

• Telescopic Cylinders specifically designed for use on a truck dumper

As of Februar y 4, 2025

4B Components, Ltd.

Advanced Cyclone Systems, S.A.

Advanced Renewable Technology

International - ARTi

AGRA Industries, Inc

Airo ex Equipment & Wolf Material

Handling Systems

Allied Blower & Sheet Metal Ltd.

Allied Mineral Products, Inc

Amandus Kahl USA Corporation

Amos-AgMachinery, LLC

AMP-Cherokee Environmental Solutions

Andritz Feed & Biofuel

Aryan Boilers Private Limited

Aumund Group

Azure Renewables

B3 Systems, Inc

Babcock & Wilcox

Bandit Industries, Inc

Basic Machinery Co., Inc

BE&E

BEP Engineering Services

BID Canada / McDonough Manufacturing

BioMass Energy Techniques Inc

Biomass Magazine

Bluewater Energy Solutions

BM&M Screening Solutions

BMH Technology Oy

Brad Thompson Company

BrandTech

BRUKS SIWERTELL

Brunette Machinery Co., Inc

Bulk Conveyors, Inc

Burcell Technologies, Inc

C3 Surplus LLC

Caldwell/Preload

Carbonfuture

Carrier Process Equipment Group, Inc. (CPEG)

CG Thermal

Chainparency

Chase Nedrow Industries

City of Benson/Swift County

Continental Conveyor, Ltd.

Corrosion Monitoring Services, Inc

Costruzioni Nazzareno srl

CPM

CTP Team S.r.l.

DeNOx Enviroment

Detroit Stoker Company

Dos Santos International

Dryer One

Durr Cyplan ORC

Durr Systems, Inc

Dustmaster Enviro Systems

EcoPartners, LLC

EHW Italia

ElectraTherm inc

ETA Energy Transaction Advisors

Evergreen Engineering, Inc

Fagus GreCon, Inc

Ferotec

Finna Sensors

FLSmidth USA, Inc

FMW North America, Inc

FNA Inc

FORGE

Georgia Forestry Commission

GKD-USA, Inc

GLOCK Ecotech GmbH

Grain Ecosystem

Grain Elevator Repair Products

Hallco Industries, Inc

Howden

Hudco Industrial Products, Inc

Hurst Boiler & Welding Co., Inc

Idaho National Laboratory

Imerys

In con

INTEC Engineering GmbH

Ivys Adsorption Inc

Jacobs Global

JC Steele & Sons, Inc

JD Global, LLC

John King USA, Inc

K.R. Komarek

Kamengo Technology, Inc

KEITH Manufacturing Co

KESCO, Inc

KettenWulf

Kice Industries, Inc

Kiln-direct

Komax Systems, Inc

Laidig Systems, Inc

Larson Engineering, Inc

LDX Solutions

Macon Construction

Martin Engineering

Material Control Solutions LLC

MBA Energy & Industrial, LLC

Messersmith Manufacturing, Inc

MHE - Material Handling

Equipment Co

Mid-South Engineering Company

MoistTech Corp.

Momar, Inc

Nestec, Inc

Northern Blower, Inc

Phoenix Fabricators & Erectors LLC

Plattco Corporation

Player Design, Inc

Premium Plant Services, Inc

Process Combustion Corporation

ProcessBarron

Proco Products, Inc

PRODESA

Professional Lubricant Solutions

Prometec Tools Oy

PST AB

PYREG Inc

R&R-BETH

Rawlings Wood Hogs

Revere Control Systems

Rossell Automation Company

SALMATEC GmbH

Sapphire Gas Solutions

Schaeffer Manufacturing Co

SHW Storage and Handling Solutions

Solex Thermal Science, Inc

South Carolina Forestry Commission

Southwest Research Institute

SPG

SPR Packaging

Stela Drying Technology Corp.

SYNCRAFT - Climate Positive Solutions

Tarsco Bolted Tank

Tenneco

TerraSource Global

The New York Blower Company

Thomas & Muller Systems, Ltd.

Timber Products Inspection/Biomass

Energy Laboratories

Troy Industrial Solutions

TSI, Inc

USNR

Valmet, Inc

Vecoplan, LLC

Warren & Baerg Manufacturing, Inc

WastAway Fuels

Wellons

West Salem Machinery Co

Wunderlich-Malec Engineering

Change Service Requested

BCI equipment is built to last, one piece at a time, by a team that still believes quality matters.

From custom design, to fabrication, to service & support...

BCI is Elevating Conveying Standards

• Chain Conveyors

• Bucket Elevators

• Parts & Accessories for all makes/models of conveying equipment

Over 200 Years of Combined Experience. Made in the USA.