CTE Complete is uniquely innovative. Combining the strengths of our Technology Center with our Technical Services and Operational Support teams, we provide on-site expert guidance beyond our enzyme and yeast solutions. Ready to elevate your plant’s performance?

Moving Fiber Forward Experts focus on specific feedstock testing

Aligning the Pieces of 45Z Guidance, frameworks bring some clarity to incentive By Luke Geiver

Built for Mars, Used for Ethanol Advanced process liquid technology offers real-time analysis By Luke Geiver

Diversified in the Dakotas: A Tour of Tharaldson Ethanol

A peek inside North Dakota's largest ethanol plant By Katie Schroeder

Coverage of the Renewable Fuels Association's National Ethanol Conference By

Connecting Supply with Demand Ethanol's evolution prompts resurgence of grain supplier partnerships

President & Editor

Tom Bryan tbryan@bbiinternational.com

Online News Editor Erin Voegele evoegele@bbiinternational.com

Contributions Editor Katie Schroeder katie.schroeder@bbiinternational.com

Features Editor Lisa Gibson lisa.gibson@sageandstonestrategies.com

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer Raquel Boushee rboushee@bbiinternational.com

CEO Joe Bryan jbryan@bbiinternational.com

Chief Operating Officer John Nelson jnelson@bbiinternational.com

Director of Sales Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Circulation Manager Jessica Tiller jtiller@bbiinternational.com

Senior Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

Ringneck Energy Walter Wendland Commonwealth Agri-Energy Mick Henderson Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Omaha, NE (866) 746-8385 | www.fuelethanolworkshop.com

Now in its 41st year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercialscale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

Omaha, NE (866) 746-8385 | www.sustainablefuelssummit.com

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

September 22-24, 2025

Please recycle this magazine and remove inserts or samples before recycling

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-7468385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

Minneapolis, MN (866) 746-8385 | www.safconference.com

Serving the Global Sustainable Aviation Fuel Industry Taking place in September, the North American SAF Conference & Expo, produced by SAF Magazine, in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI) will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers.

COPYRIGHT © 2025 by BBI International

It’s fitting that our largest issues of the year—May, June and July—coincide with the planting and critical growth stages of corn. Our ties to farming run deep, so it feels right that our offices are bustling while growers are hard at work. As each year’s corn crop rises from the ground to knee high, it’s our busy season—and yours, too.

Indeed, the yellow dent corn sprouting up this spring is a true biorefining wonder crop, which is most evident when its parts are broken down—physically or in situ. Corn kernel fiber (CKF) ethanol is nothing new, but the clarification of how it should be measured and delineated from corn starch ethanol—and how cellulosic volumes are parsed out— have renewed the business case for it. On page 14, we continue our multi-part reporting on CKF ethanol in “Moving Fiber Forward,” which focuses on how Edeniq is leveraging its analytical expertise to support ethanol producers in their pursuit of both cellulosic and low-carbon biofuel.

Next, in “Aligning the Pieces of 45Z,” on page 20, we take a close look at the tax credit while federal agencies, industry trade groups and policymakers address the frameworks needed for ethanol producers to make it work. The industry is generally pleased with what’s in the guidance for the new model, including a feedstock calculator, clarity on credit eligibility, definition of a 45Z facility and the potential eligibility of various feedstocks and fuels. Notably, however, the administration did not address certain feedstocks in the guidance, including CKF, which may be added later. Producers also have concerns about the “wage and apprenticeship” requirements of the credit, which seem unreasonable for rural ethanol plants.

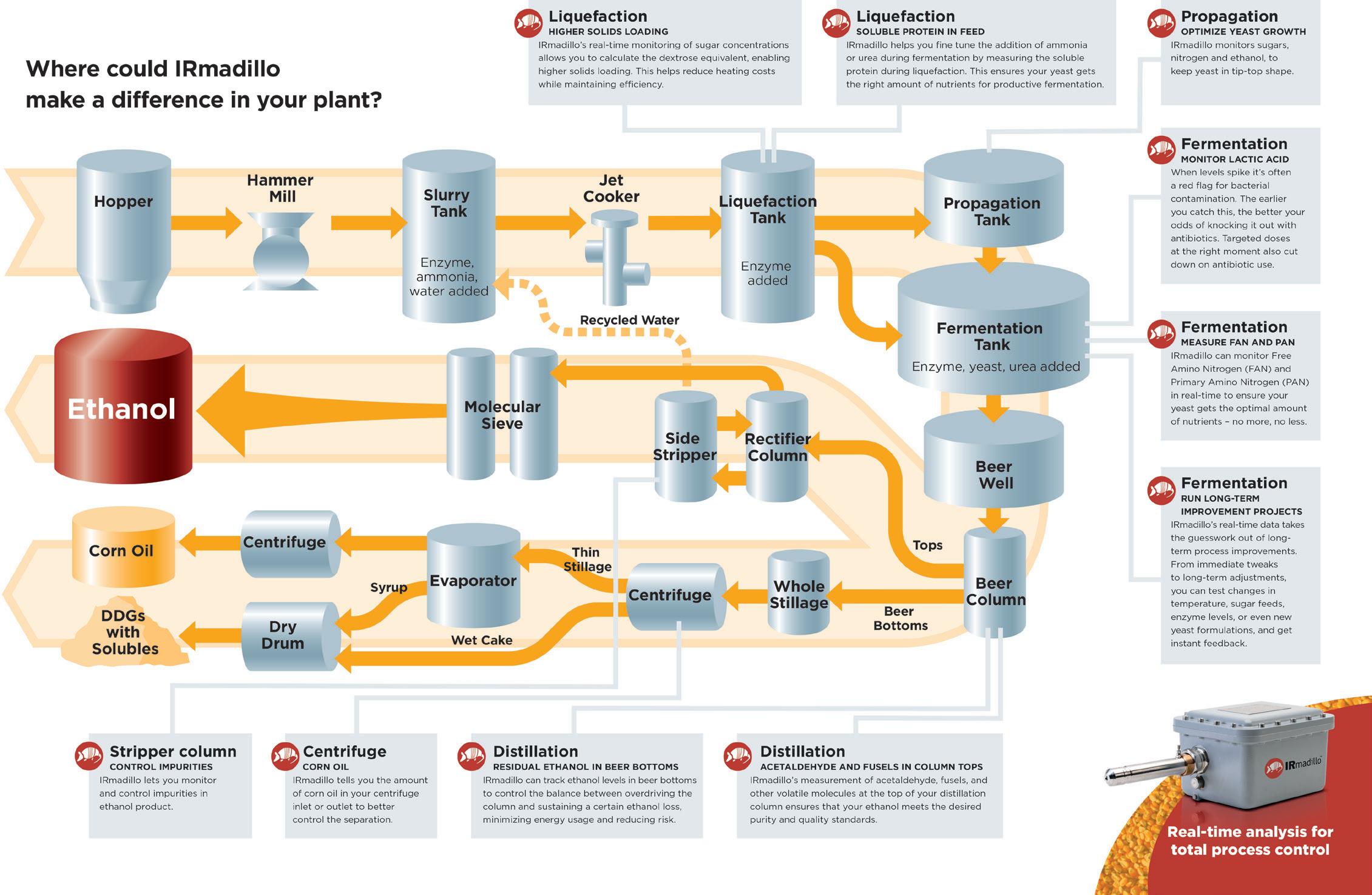

We loop back to analysis in “Built for Mars, Used for Ethanol,” on page 28, which looks at Keit Industrial Analytics’ advanced process liquid analyzer. As the story’s title suggests, the FTIR technology was originally intended to take measurements of the Martian atmosphere but has since found a more terrestrial use—and a name inspired by an earthly creature with an armored shell. The IRmadillo enables producers to know what’s happening in their fermentation tanks in real-time, while zeroing in on optimal run times and identifying potential problems before they start.

In “Diversified in the Dakotas: A Tour of Tharldson Ethanol,” on page 34, we offer readers a vibrant look at North Dakota’s largest ethanol plant, which has found success through scale, efficiency gains and the expansion of its coproduct portfolio. We’re thrilled to share images of the plant and some of the fine people who work there.

Turning to policy and markets on page 42, we bring you images and highlights from the National Ethanol Conference, the Renewable Fuels Association’s annual industry event. And coming full circle to corn, our staff-written lineup concludes with a story about grain procurement. “Connecting Supply with Demand,” on page 46, looks at how some producers are returning to outside grain originators for feedstock support, resilience and the ability to focus on their core business while a large-scale partner helps them navigate their low-CI feedstock future.

Traditional cleaning methods expose your team to serious risks like injuries and heatstroke in hot, confined spaces. Automated tube cleaning keeps operators safe, using dual-direction high-pressure cleaning for better performance and heat transfer. Operators can remotely control the cleaning speed, ensuring consistent, thorough results. Protect your team and improve e ciency—contact NLB today to transform your operations!

Remove the operator from the blast zone. Increase tube heat transfer.

Enhanced operator control produces better results.

For the last several years, one of the Renewable Fuels Association’s top priorities has been elimination of the Reid vapor pressure (RVP) barrier that prevents E15 from being sold during the high-traffic summer months in most of the U.S. gasoline market. Bipartisan bills have been introduced in both chambers of Congress to permanently remove the arcane RVP barrier nationwide, and RFA continues to work closely with allied organizations and supportive lawmakers to secure passage of this commonsense legislation.

And while eradicating the RVP obstacle will help open the door to broader adoption of E15, other deregulatory actions are needed to truly break down the door and spur rapid growth in the marketplace.

Outdated regulations and guidelines still make it difficult, if not impossible, for many retailers to sell E15 through their existing equipment (like underground storage tanks and fuel dispensers)—even though that infrastructure is, in most cases, perfectly compatible with E15. As a result, many retailers have been led to believe they must replace or upgrade their equipment before they can offer E15. For small and mid-sized fuel retailers, replacing expensive tanks or dispensers is simply not an option, especially with uncertainty around the future availability of federal grant funding to help offset these costs.

In addition, Environmental Protection Agency regulations still require retailers to plaster their dispensers with intimidating orange E15 “warning labels,” despite the facts that 1) consumers have driven more than 125 billion trouble-free miles on E15, 2) the fuel has been in the market for nearly 13 years, and 3) E15 is legally approved for use in almost every vehicle on the road today.

These bureaucratic red-tape barriers are ripe for deregulatory action by EPA. Fortunately, President Trump and new EPA Administrator Lee Zeldin have already signaled they are ready to aggressively take on unnecessary regulatory burdens that are holding back American energy sources—including biofuels like ethanol.

President Trump already has some history on these issues. In January 2021—just five days before Joe Biden was sworn in as our 46th president—the outgoing Trump administration proposed new regulations that would have made it easier for fuel retailers to offer E15 to their customers. EPA proposed to eliminate or significantly modify the menacing E15 pump label, while also proposing provisions that would make it much less burdensome for retailers to demonstrate the compatibility of their existing infrastructure with E15. Unfortunately, the Biden administration failed to advance that proposal, and it languished in EPA purgatory for four years.

More recently, Trump said his vision for expanding E15 at retail stations still includes “letting them use the existing pumps.” Following through on this plan to allow E15 in existing infrastructure would help to immediately boost demand for corn and ethanol, while providing consumers greater access to lower-cost, cleaner fuel.

RFA is encouraging EPA, under Administrator Zeldin’s leadership, to pick that proposal up, dust it off and move quickly to finalize it. While finally resolving the RVP barrier is the first step toward E15 becoming the “new norm” in place of E10, taking deregulatory action to allow E15 sales through existing infrastructure is also vitally important.

Japan is quickly establishing itself as a leader in the ethanol space across multiple applications. Not only is the island nation starting to implement around on-road ethanol use for transportation, but it is well on its way to establishing synthetic aviation fuel (SAF) and using ethanol in the biochemical space. Japan also happens to be a country with strong diplomatic ties to the United States and a long relationship with the U.S. Grains Council office in Tokyo, prompting stakeholders to look favorably toward American ethanol.

The Council, along with representatives from Growth Energy and the Renewable Fuels Association, visited Tokyo at the end of January to strengthen those ties and engage in dialogue to communicate that the U.S. is equipped and ready to supply the fuel volumes Japan anticipates needing. Hosted by the U.S. Ambassador and Foreign Agricultural Service Japan, the team supported an industry focused roundtable to further the momentum in the country.

The Government of Japan announced last November that it is moving forward with a target to implement blending 10% ethanol (E10) with its fuel for light-duty vehicles by 2030 and a 20% blend (E20) by 2040.

Japan’s gasoline consumption is around 12 billion gallons per year, with a government set annual target volume for fuel ethanol of 218 million gallons. Currently Japan is importing around 140 million gallons of ethanol from the United States, in the form of ethyl tert-butyl ether (ETBE), so this annual goal demonstrates the desire for Japan to continue growing market demand and opportunity.

Long term, Japan will need to determine whether to maintain a share of ETBE in the marketplace or include direct blending to fulfill its E10 and E20 goals. At these consistent blend rates across the entire country, the demand for E10 and E20 is 1.2 billion gallons and 2.4 billion gallons, respectively.

Additionally, Japan is looking to establish its SAF industry and sees a huge potential for capitalizing on the ethanol-to-jet (ETJ) pathway to achieve its goals.

Total demand for SAF from Japan’s aviation industry is 450 million gallons by 2030, from both hydroprocessed esters and fatty acids (HEFA) and ETJ pathways; about half of that supply is projected to come from ETJ. Biochemicals are also in the playbook for the Japanese, with several multi-national companies exploring the value proposition that a versatile commodity like ethanol brings to the table.

The Council’s trip to Japan was key in acknowledging the progress the country has made in the past several years in these ethanol arenas, but more than that, it assured Japan that American-made ethanol will support their energy transition.

Through several private sector meetings, the Ministry of Economy, Trade and Industry, and an industry roundtable with key stakeholders in the transportation and refining industries, the team established continued confidence in America’s ability to provide clean, economical fuel.

It is evident Japan is preparing for implementation of E10 in 2030; this includes putting effective policies in place, supporting the private sector and establishing mechanisms to measure and demonstrate compatibility.

The Council is committed to providing continued support through technical assistance, training and resources to ensure Japan can continue to lead and demonstrate the benefits of ethanol inclusion in its economy well into the future.

A new day is dawning for ethanol production. Our industr y-leading lineup of yeasts and yeast nutrition, plus our newly added Spar tec® enz ymes, are pushing the limits of fermentation and reaching levels of performance never achieved before. Paired with our renowned educational programs and expert ser vices, we’re setting a course for even greater yields and performance.

With LBDS, THE FUTURE OF FERMENTATION IS BRIGHT AND THE POSSIBILITIES ARE ENDLESS.

Comstock announced a new investment and strategic collaboration with Marathon Petroleum to advance its lignocellulosic biomass refining solutions to commercial maturity. Comstock Fuels Corporation, a subsidiary of Comstock, has entered into a series of definitive agreements with subsidiaries of Marathon Petroleum, involving the purchase of $14 million in Comstock Fuels equity.

The investment includes $1 million in cash and $13 million in payment-inkind assets by Marathon, comprised of equipment, related intellectual prop-

erties and other materials located at a Marathon renewable fuel demonstration facility in Madison, Wisconsin. Comstock Fuels will use the Madison Facility to increase Comstock Fuels’ current pilot production capabilities in Wausau, Wisconsin.

Comstock Fuels’ advanced lignocellulosic biomass refining solutions are designed to align with oil producers by converting massive supplies of historically inaccessible biomass feedstock into “drop-in” hydrocarbon fuels for use in existing petroleum-based infrastructure.

At its 22nd International Marketing Conference and 65th Annual Membership Meeting in Austin, Texas, the U.S. Grains Council announced it will bring forward a vote to amend the organization’s name to the U.S. Grains and BioProducts Council.

Council delegates will decide whether to move forward with the new name via a majority vote on Aug. 1 during its 65th Annual Board of Delegates Meeting in Grand Rapids, Michigan, as the organization celebrates its rich history in sup-

porting the U.S. agricultural industry over the past 65 years.

“The reality is we are now not just limited to taking meetings within the global ethanol space, we are interfacing with players in the broader energy industry,” said Ryan LeGrand, USGC president and CEO. “Ethanol and related products have become part of our identity in practice, but not in name, and it is time to signal to these new audiences that we have something to offer.”

Honeywell announced that Taiyo Oil Co. Ltd. has chosen the Honeywell UOP ethanol to jet (ETJ) technology to produce sustainable aviation fuel (SAF) at its Okinawa Operations in Japan. This facility will be based on Honeywell UOP’s first ETJ license and basic engineering design in the Asia Pacific region with a production target of 200 million liters (53 million gallons) per year.

Expected to begin operation in 2029, the facility becomes the fifth of its kind in the world and will provide a vital supply of SAF to both domestic and in-

ternational markets, contributing significantly to the growing demand for SAF driven by the aviation industry’s efforts to reduce carbon emissions.

Honeywell’s innovative ETJ technology helps enable the conversion of ethanol derived from diverse feedstocks―including corn, sugar and cellulosic materials―into SAF. This fuel meets the rigorous standards of the aviation sector while demonstrating a significantly lower impact on the environment.

The Renewable Fuels Association congratulated member company Elite Octane, based in Atlantic, Iowa, for producing its billionth gallon of ethanol.

“We congratulate the investors and staff at Elite Octane on this terrific milestone and doing so in such a relatively short time in operation,” said RFA President and CEO Geoff Cooper. “Over the past seven years, they have worked tirelessly to support the local economy in Iowa, providing cleaner, lower-cost fuel ethanol and other coproducts. We are proud of their success and their impact on the American ethanol industry.”

Led by president and CEO Nick Bowdish, who also sits on the RFA Board of Directors, Elite Octane began its operations on July 1, 2018. The plant currently employs 50 people and has a production capacity of 150 MMgy. The plant has paid local corn farmers more than $1.6 billion since commencing operations. Altogether, the biorefinery processed 333 million bushels of corn to produce one billion gallons of ethanol, over two million tons of distillers grains and 355 million pounds of corn oil.

Edeniq utilizes analytical expertise to support ethanol producers in their pursuit of a lower-carbon gallon and elusive, lucrative cellulosic ethanol.

By Katie Schroeder

New testing methods have reopened the door for cellulosic corn kernel fiber ethanol produced in-situ to generate D3 renewable identification numbers (RINs). In-situ production of cellulosic ethanol breaks down corn kernel fiber alongside starch during fermentation. Differentiating the volume of ethanol produced from starch, which qualifies for a D6 RIN, and the cellulosic volume derived from fiber, which qualifies for a more valuable D3 RIN, was the major obstacle holding in-situ production volumes back.

Edeniq leverages this new testing methodology alongside its proprietary mass balance work to bring its customers consistent, accurate and timely data on the conversion of sugars and carbohydrates, also known as glucans.

Understanding glucan conversion helps ethanol producers make decisions on opera-

tions and market options, says Brian Thome, CEO of Edeniq. The lab’s results enable ethanol producers to assess their facility’s fermentation efficiency and evaluate enzyme dosing and supply, corn oil extraction and conversion of cellulosic material in-situ.

“We’re able to accurately quantify and qualify those glucans that are being converted and then how much of the ethanol production is attributable to those sources,” he says. “Obviously, the value for that for the ethanol plants is not only just holistically on their operations, but also on the increased value they get for low carbon-intensity ethanol in California, other low-CI markets, and then also the D3 RINs on the cellulosic side.”

Edeniq was launched in 2008 with the vision of identifying, developing and deploying new technologies for the ethanol industry, particularly for cellulosic production. Early on,

the company pursued equipment development—technologies such as the patented Oil Plus, a corn oil extraction system, and Cellunators, colloidal milling systems that optimize particle size, maximizing surface area for enzyme absorption.

Over time, that goal evolved into a focus on carbohydrate testing. In 2010, Edeniq discovered corn kernel fiber’s cellulosic potential. “We accidentally put corn kernel fiber in with a bunch of cellulosic mass on something we were working on for cellulosic [data],” Thome

says. “We had weird results, [and realized] there’s something here that we didn’t expect. And thus, Intellulose ... was born, which was the effort to really look more closely at how we could measure and qualify and quantify the amounts of corn kernel fiber that might be converted in-situ in existing plants.”

Edeniq contributed comments and participated in the discussion leading up to the EPA’s 2014 rulemaking on corn kernel fiber. In 2015, the first of Edeniq’s customers submitted a D3 RIN registration. Three ethanol

producers were approved in 2016, followed by three more in 2017.

Shortly afterward, an administration change impacted the cellulosic market. “[We] had a number of plants by then that were getting lined up and ready to go and wanted to go in and create D3 RINs. Unfortunately, the previous Trump administration made some decisions to change gears,” Thome says. “And so D3’s went by the wayside for quite a while. We shifted our focus over to working with our customers for CARB purposes, measuring

corn kernel fiber [holistically] and not just the cellulosic portion.”

When the Biden administration reinstated an emphasis on D3 RINs, Edeniq responded quickly, helping ethanol producers take advantage of that opportunity. Thome explains that perseverance is paramount when adapting to challenges, such as changing administrations or market shifts. Ethanol producers are adept at handling these changes, he says. “Anybody in this industry will tell you, there’s ups, there’s downs, there’s times when it’s tight and times

when it’s not. You just have to hang on and you just have to persevere. You have to work hard and maintain your focus.”

To help maintain stability, Edeniq prioritizes multiple products that are less susceptible to political shifts and identifies more stable markets.

The amount of D3 RINs issued grew after Neogen developed its verification method using its proprietary assay and registered the process with ASTM International. The registration process was completed in January 2024, according to Neogen. Once the method became ASTM accredited, the U.S. EPA recognized it as a way to determine the amount of cellulosic ethanol produced in-situ, allowing ethanol producers to access D3 RIN verification. The method’s introduction caused “a wonderful overnight change,” according to Thome.

Before Neogen’s method emerged, the EPA’s rulemaking only allowed for a method developed by the National Renewable Energy Laboratory or a method approved by a voluntary consensus body, such as ASTM. Neogen built upon the framework provided by the NREL method to measure more of the glucan conversions, Thome says.

Testing for in-situ cellulosic material conversion entails evaluating individual glucan conversion via the mass volumes entering and leaving fermentation. Using proprietary reagent assays, Neogen targeted the specific glucans relevant to understanding conversion of cellulosic material, eliminating conversion activities that could muddy the results.

“Developing these assays and reagents takes a lot of work and a lot of money for the companies doing it,” Thome says. “So, understanding what the NREL method did originally, applying some additional assays, reagents and steps in order to isolate and look at the conversions of other individual glucans

that could influence the results, then, most importantly, going through a number of working group sessions with other really good people in the industry in terms of scientists, users at labs like [ours].” Ethanol producers that would be subject to the methodology’s results also were involved, checking the impact of the test and what it would mean for a plant’s bottom line.

The final step, putting the methodology through the ASTM process itself, differentiates between the percentage of ethanol produced from fiber—which is not cellulosic but does qualify for low-carbon fuel credits—and the cellulosic percentage. Nearly one-third of the corn kernel fiber ethanol produced is cellulosic, Thome explains. The average yield increase from in-situ holistic fiber ethanol production stands at 3.6% to 3.8%. Running the ASTM standard over the past 18 months, Edeniq tracked an average cellulosic percentage of 1.05% across the ethanol producers it works with.

“Think of it as 3.6% is corn kernel fiber, so [derived from] all of the different fiber glucans,” he says. “And 1.05%, meaning just under one-third of that corn kernel fiber, is actually coming from the cellulosic portion.”

Edeniq’s Intellulose platform measures carbohydrate conversions happening during fermentation for both fiber and the cellulose found within it. One version of the platform, Intellulose 2.0, measures the glucan conversion of corn kernel fiber holistically, while the other, Intellulose EPA, utilizes the ASTM method to identify the subset of cellulosic material found in corn kernel fiber. Although the ASTM method is public, Edeniq uses proprietary mass balance techniques to ensure its test results are reproducible and precise, helping it stand out from competitors.

“[Producers] have to work hard at keeping their plant operating day in and day out,”

Thome says. “And they’re working with a hundred different levers. The last thing we want to be is a lever that they don’t want to deal with. The plant takes samples, they freeze them, send them to us, and we take it from there.”

The company’s 35 lab technicians use a four-step quality control strategy that adheres to National Institute of Standards and Technology requirements. “We talk openly about the fact that every time the customer sends a sample set, we are earning their business all over again,” he says. “We need to deliver on time, accurately, every time.”

To further enhance the credibility of the results, Edeniq works with third-party quality assurance providers (QAP) to ensure the lab is audit-ready, explains Thome. The company values the extra assurance provided by QAP because it helps establish a “robust underpinning” to the ethanol industry’s RINs and avoids any potential problems, he says.

Another component of Edeniq’s operating philosophy is “staying in your lane,” avoiding offering advice on issues outside the com

pany’s purview, Thome says. This philosophy comes into practice often, as Thome and his team are frequently approached with questions ranging from which enzyme to use to opinions about third-party engineering firms to potential dose rates. “The answer ... is the plant has to decide what’s best,” he says. “And that’s part of what I mean by staying in our lane. We are not the marketer of the D3 RINs. I could talk about what I see our other customers doing when someone asked me a question about certain marketing of D3 RINs, but I’m also careful to say, ‘But you need to go talk to your marketer, and you need to do what’s best for you as a plant.’”

Edeniq continues to explore new applications for its carbohydrate testing platform. “We quietly have some research and development going on with other polysaccharide carbohydrate types of testing, getting into some other industries where there’s a need to look, for example, at disease detection in agriculture

and things like that,” Thome says. “A little bit separate from what we do today, but focused still on our core capabilities, which are what you would consider extremely rigorous and difficult-to-operate polysaccharide analytical methods.” The company’s passion for the energy, food and water sectors drives exploration of opportunities in those areas, all while remaining invested in the ethanol space.

Constant communication with ethanol producers helps Edeniq identify where to focus its innovation, applying its analysis to other feedstocks or grain products. The ceiling of how much cellulosic ethanol can be extracted from corn kernel fiber has not yet been reached, according to Thome. Opportunities such as hemicellulose conversion could increase the amount of qualified D3 gallons. “The enzyme companies are doing a great job of working hard to improve certain activities,” he says. “Plants are learning more, we are learning more that we can share with our customers around what may continue to drive those cellulosic conversions ever higher.”

Corn kernel fiber constitutes an opportunity for ethanol producers to increase their total yields, access lucrative D3 RINs and sell to low-carbon markets. Reliable results are vital in making that market attainable.

“We stand behind the numbers we provide, period,” Thome says. “And we take that seriously, so when a customer receives their results, their reports, we’re putting a number in front of them and saying, ‘This is your percent of ethanol right now coming out of that sample set for this period of time that is attributable to either fiber or cellulose, whatever the case may be, and we stand behind it.’”

Author: Katie Schroeder katie.schroeder@bbiinternational.com

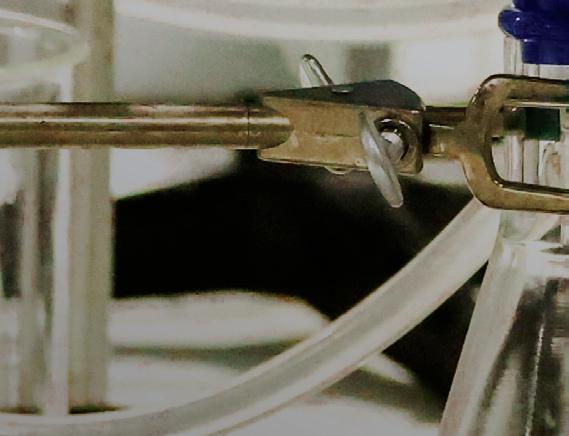

ATTAINING ACCURACY: An Edeniq laboratory technician prepares a sample for acid hydrolysis.

PHOTO: EDENIQ

The 45Z tax credit is closer to reality, with a web of major federal agencies, industry advocates and policymakers confirming key frameworks needed for ethanol to participate.

By Luke Geiver

The critical pieces of the 45Z tax credit puzzle have been on display for interpretation by the greater biofuels industry and the current administration since early January. At the start of the year, 45Z—designed to award the production of low-emission transportation fuels—was assigned a monetary value by the U.S. Department of the Treasury.

The U.S. Department of Energy, for its part, released its GREET model to more accurately calculate carbon intensity (CI) scores of renewable fuels. The USDA released an interim rule on technical guidelines for quantifying, reporting and verifying the greenhouse gas emissions (GHG) associated with the production of corn, sorghum and other biofuel feedstocks, as well as a Feedstock Carbon Intensity Calculator (FD-CIC) to help producers better quantify the true CI values of their efforts.

All these 45Z-related puzzle pieces remain separate components of an incomplete whole, waiting on ongoing comment periods,

stalled by government-linked timeline hurdles or the policymaking preferences of the Trump administration. But, as several industry voices have noted, having the pieces on the table now could finally give producers access to proper rewards for their clean fuels, should everything align.

Following the release of the 45Z guidance notice and the subsequent updates by the DOE and the USDA on the GREET modeling and USDA FD-CIC, numerous energy accounting, tax and law entities provided their own assessments of the components, primarily basic outlines of the variables that matter to understanding 45Z at the time of the guidance release. Most also note that the guidance is not yet finalized. At press time, there was still no clear timeline as to when the credit framework might be finalized or implemented.

Pillsbury Winthrop Shaw Pittman LLP, Baker Botts, Latham & Watkins and others all outline several of the same key terms in the guidance.

The term “facility,” is important as it refers to a single production line that is used to produce transportation fuel. The facility can also include carbon capture equipment and components located in a different building or geographic area, provided they function interdependently.

A “producer,” is the person/entity who engages in the production of the transportation fuel and does not need to own the facility. Activities that do not result in chemical transformation wouldn’t qualify as “production.”

“Production,” the tax and law firms point out, begins with the processing of primary feedstocks and ends with ready-to-sell fuel.

A “qualifying sale” involves the sale of a “transportation fuel” for use in the production of a fuel mixture, in trade or business, or sold in retail. “Transportation fuel” is notable because it is defined as “suitable for use as a fuel in a highway vehicle or aircraft.” But actual use as a fuel in a highway vehicle or aircraft would not be required.

A producer would meet the sustainable aviation fuel (SAF) requirement if it sells a synthetic blending component that is then blended into an ASTM spec mixture.

Don Lonczak, a tax partner who focuses on energy at Pillsbury Winthrop Shaw Pittman LLP, says the most essential aspect of the guidance is the initial emissions rate table because it sets forth categories of transportation fuels, pathways and feedstocks. Lonczak’s team regularly helps clients with tax credits, including those like the 45Z, to qualify, finance projects or transfer credits.

The 45ZCF-GREET model used to create the emissions table that Lonczak cites has

long been preferred by the biofuel industry because it uses the most accurate and up-to-date production technology data and does not overstate indirect land-use change in its calculations of CI scores.

In a hearing with the House Committee on Ways and Means in December 2024, roughly one month before the release of the 45Z guidance and subsequent USDA and DOE announcements, members of Growth Energy and the Renewable Fuels Association called for the GREET model to be used in the guidance.

Growth Energy’s CEO, Emily Skor, said the GREET model should specifically be used for emissions calculations because of its treatment of indirect land-use change.

BCI equipment is built to last, one piece at a time, by a team that still believes quality matters.

From custom design, to fabrication, to service & support...

BCI is Elevating Conveying Standards

• Chain Conveyors

• Bucket Elevators

• Parts & Accessories for all makes/models of conveying equipment

Over 200 Years of Combined Experience. Made in the USA.

For Jenny Speck, partner at Vinson & Elkins tax practice, the most important piece of the 45Z guidance is multi-pronged. “It provided taxpayers with clarity on eligibility for the credit, the definition of a 45Z facility, and importantly, the potential eligibility of various feedstocks and fuels.”

Vinson & Elkins is already helping clients understand the impact of the 45Z rules on their businesses, Speck says, notably the pre-

vailing wage and apprenticeship requirements, registering to be a clean fuel producer, modifying offtake agreements, selling the 45Z tax credits or strategizing future business plans. And, if 45Z isn’t an option under the current guidance for a producer, Vinson & Elkins can help clients identify other opportunities.

Geoff Cooper, RFA president, says the initial guidance on 45Z was important for several reasons. “We desperately needed to see

some structure to the rules surrounding the credits, as well as the 45ZCF-GREET model and the USDA’s FD-CIC feedstock calculator.” The 45ZCF-GREET model release is particularly important, he adds, because the model reflects a big step forward in understanding the emissions benefits of ethanol.

“Emissions from feedstock production contribute to more than half of ethanol’s carbon footprint,” Cooper says.

The model’s release also represents a useful framework for continuing to understand the advancing science and properly valuing the innovation taking place in the industry.

The American Coalition for Ethanol welcomed the USDA’s release of the guidelines and the FD-CIC. ACE has been working for months with government and industry to create a better understanding and system for climate-smart agriculture (CSA) practices through programs designed to streamline the process.

Skor notes the importance of the guidance as it relates to investment. She wants the 45Z credit to be extended to 10 years and the Ways and Means Committee to consider putting the SAF credit on par with a previous tax credit known as 40B—roughly $1.25 per gallon as opposed to the 35 cents per gallon credit available to SAF in the Treasury’s 45Z guidance.

While the guidance from the Treasury, USDA guidelines and DOE release represented a tremendous amount of progress, according to Cooper, many important areas were excluded completely or left undetermined.

Cooper says the Treasury failed to address some feedstocks, including corn kernel fiber, that he and other leaders from industry trade groups called for in the initial January guidance release. The assumption is it will be added later.

In late February, the DOE’s Alternative Fuels Data Center’s numbers showed that the tax credit amount for non-aviation fuel was 20 cents per gallon and 35 cents per gallon for SAF. For facilities that satisfy the wage and apprenticeship requirements, the credit amount would be $1 per gallon for non-aviation fuel and $1.75 per gallon for SAF. The wage and apprenticeship requirements were created in the Biden Administration and call for wage minimums during the construction, alteration or repair of facilities. For the apprenticeship requirements, 15% or more of the labor force working on the construction, alteration or repair of facilities must be from a registered apprenticeship program.

Cooper is already calling for significant revision to the wage and apprenticeship requirements.

“They just aren’t practical for much of the industry,” he says.

Skor is also calling for a re-evaluation of the prevailing wage and apprenticeship components, citing the rural location of most biorefineries and the lack of access to labor in the type and numbers needed to fulfill the requirements.

The January version of the Treasury notice also doesn’t include on-farm practices in CI calculations, Cooper notes.

Speck also points to a lack of guidance on how producers may request provisional emissions rates (PER). She says the issue is especially important because of the limited feedstocks and production pathways in the 45ZCF-GREET model that may leave some in limbo until subsequent guidance on the PER request procedure is published.

The comment period on the Treasury’s guidance ended in April. Some members of Congress have already introduced legislation to extend the tax credits another 10 years, while others have called for the repeal of the 45Z tax credit altogether. But leading industry voices have continued to tout the importance of the framework as an economic driver for rural and farm economies, along with the evolution of the SAF industry, regardless of administration.

Cooper says his team will continue to push policymakers to finalize the moving parts, including the Treasury rules, the USDA feedstock rules, the feedstock calculator and the DOE’s 45ZCF-GREET model.

“Getting the emissions pathway rules right will be a big deal,” he says. “This includes making sure technologies are fairly considered and producers are able to get credit for their unique technologies and attributes.”

The RFA also wants to see on-farm practices integrated into emissions calculations. Overall, the industry needs procedures, reporting and compliance requirements that are streamlined and manageable, RFA says.

Growth Energy, ACE, RFA, the Clean Fuels Alliance, the Advanced Biofuels Association and others say more work needs to be done on the final framework of 45Z, but the work is worth doing.

“For the first time ever, you have major federal agencies and a major regulatory framework confirming that indirect land-use change is close to zero and that typical corn ethanol has a carbon intensity below 50 grams per megajoule and cuts GHG emissions by half compared to gasoline,” Cooper says.

Integrating on-farm practices with current ethanol production technology into a CI score has also never been done before.

“We have told our story, and our points are getting through,” Cooper adds. “But I wouldn’t call anything a ‘win’ until we see final guidance that harmonizes the components of the 45Z.”

OK, so our IRmadillo™ may have a long nose and a funny look.

But that nose can sni out exactly what’s going on inside every one of your processes. Every single second of the day.

And if you know the precise chemical composition inside all your lines and tanks, there’s virtually nothing you can’t improve.

Filled with ground-breaking new technology, IRmadillo™ helps keep yeast happy, eliminates failed batches, reduces enzyme use, and much, much more.

So while you’re sitting around waiting for your next set of HPLC results, why not visit our website, and read up on the whole amazing IRmadillo™ story?

Author: Luke Geiver writer@bbiinternational.com

Jeff Bonar CEO, CapCO2 Solutions

Ethanol Producers are Sitting on A Gold Mine – Using Your CO2 to Make Green Methanol

Bryan Yeh Vice President of Engineering & US Operations, Canary Renewables Corp.

Pretreatment Technologies for Renewable Diesel & SAF Feedstock

Fanny Roldan Associate Director –Commodity Insights Consulting, S&P Global Commodity Insight

Sustainable Aviation Fuels : Can Airlines achieve 10% Blend Commitment?

Logan Leduc Manager, LCA, EcoEngineers

Larry Tree President/CEO, Proteum Energy, LLC

Partnering for Lower CI & Increased Production & Pro ts

Diversifying Ethanol Markets Through Exports to Canada

Anne Chronic Director of Market Analytics, Phibro Ethanol

Your Plant, Made Better: Best Practices for Antimicrobial Selection and Application

Chad Asmus Sustainable Ag Product Strategist, BASF Corp. Overcoming Hurdles When Farmers Implement Climate Smart Ag

• Delivers up to 15% increased corn oil recovery

• Enables pathway to produce low-CI cellulosic gallons

• Dewaters corn kernel fiber for reduced natural gas consumption

• Maximizes plant operability

To learn more, contact your account manager.

Keit Industrial Analytics gives ethanol producers a new, real-time look at production with its advanced process liquid analyzer technology.

By Luke Geiver

Keit Industrial Analytics’ inline process liquid analyzer technology now used in many U.S. ethanol plants was originally intended to take measurements of the Martian atmosphere.

The small group of optical physicists and engineers who started Keit wanted to create a system to measure the mid-infrared spectrum using a notoriously fragile process. They knew the analysis would work in space, but they also knew the traditional systems wouldn’t survive a launch.

“The main reason stuff gets up to space and doesn’t survive is because of the launch,” says Dan Wood, CEO of Keit.

After creating a stable, sensitive instrument capable of surviving the physical abuse of a launch, Wood and his team realized they’d made a robust piece of electronics that could take measurements in harsh environments. Today, the U.K.-based company serves several industries that had all but discarded the idea of using mid-infrared spectrometry to measure liquids, including oil and gas, pulp and paper, chemical manufacturing, industrial biotechnology, food and drink, pharmaceuticals and ethanol production. The technology is aptly named the IRmadillo, a reference to its size and ability to go almost anywhere.

Keit is a spin-off company of the European Space Agency Business Incubation Centre UK. After the company’s tech survived a satellite take-off, Keit went to work developing a system that could capture sensitive measurements.

Early venture capital investors in Keit were so impressed with the capabilities of the technology that they invested without knowing which industries the company would eventually serve. Although Wood has worked with clients in several industries, ethanol was seen as an early fit. Today, the company serves ethanol producers in Europe and North America.

Keit started by performing testing for a start-up firm looking at producing propanediol. With positive results in hand, the company partnered with a large enzyme supplier that wanted Keit’s tool because of its ability to validate product performance for ethanol clients.

“You can see biochemistry happening in real-time,” Wood says of its tech.

Unlike traditional high performance liquid chromatography (HPLC) products, IRmadillo provides more than just snapshots of a liquid reaction. For ethanol producers, the tech can show different types of sugars and the levels of organic acids, as well as ethanol and glycerol concentrations in the fermentation tank, all in real-time.

The system is based on a major tweak to the traditional analytical technique known as Fourier transform infrared (FTIR), commonly used to measure how light and chemicals react together in a liquid. The classic FTIR design has been around for more than a century and relies on a pair of mirrors, one always moving. The light refracts off the mirror system to display various signatures that are then used to reveal the activity in a liquid. According to Keit, the issue with the traditional light measurement approach is that single moving mirror. The necessity of the mirror’s movement means the system is always sensitive to vibrations that can throw it out of balance and reference. Such a system is best

suited for an extremely stable bench or lab environment.

The optical physicists at Keit were able to reimagine the setup and get the needed light signatures without the single moving mirror (or lasers and liquid nitrogen cooling sometimes required to obtain such information from light in liquid used with FTIR spectrometry).

The optics inside IRmadillo are free to vibrate because they all move together, and the vibrations of the different components effectively cancel each other out, according to the company. The redesigned approach makes measuring and monitoring continuous processes much easier and more reliable than measuring with conventional in-

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

struments, which might need background reference scans every few hours to ensure process balance isn’t disrupted.

Eliminating the fragility from FTIR has allowed industrial clients like ethanol producers to gain a new understanding of liquid reactions not fully possible with interval-based monitoring provided by HPLC systems or the less sensitive NIR (near infrared) systems commonly relied upon.

FTIR is very different from NIR, Wood says, as it is looking at the fundamental molecular vibrations, rather than the second-order effects of those vibrations. Near infrared analysis is like trying to recognize someone by looking at their shadow versus looking at their face. FTIR, unlike NIR, can differentiate the DP3, DP2 and glucose molecules in a mixture.

FTIR not only provides detail, but also speed. Many plants test their fermentation tanks for bacterial infections, yeast issues and other scenarios every eight to 10 hours, Wood says. But problems arise when infections appear at hour 12.

“It could be six hours before you know of an issue,” he says.

In some instances, adding high volumes of antibiotics is the only answer, but it’s possible the yield numbers have already been negatively impacted. Not only can a bad fermentation impact yields, it can also disrupt the settings on the distillation column downstream. So, [it is typically not]just about resolving one issue alone, Wood says.

He says many modern ethanol plants are producing yields in a tight range anyway, but for those looking to increase from 13.8% to 14%, for example, real-time measuring is key.

“For those plants, it’s the small improvements across the facility that matter, rather than avoiding failing fermentations,” Wood says. “You can’t improve what you can’t measure.”

Using a real-time monitoring system isn’t only about saving batches from going bad or becoming less productive. Keit’s sys-

tem is also able to help producers understand the accurate run times needed for fermentation batches. In one case, a producer using IRmadillo learned that their fermentation times were actually maxed out four hours earlier than they thought. Instead of running fermentation for 48 hours, the producer was able to cut the times to 44 hours, a savings that helped overall throughput, Wood says.

United Wisconsin Grain Producers installed IRmadillo on a recirculation line of a fermenter to track sugars, glycerol, lactic and acetic acids and ethanol. Wood says the technology has illustrated the importance of making changes early, finding solutions to issues before they start.

Keit designed the small IRmadillo for seamless integration at any ethanol plant, which means the units can be installed directly through existing flanges into tanks, with or without a ball valve for isolation, or fitted into recirculation pipework. All of the units communicate directly with a plant’s DCS.

The units can be used in any of six common areas: monitoring and optimizing enzymatic breakdown in the slurry tank; monitoring enzymatic breakdown in the liquefaction tanks; watching or controlling propagation in the propagation tank; monitoring or controlling fermentation; monitoring distillation columns; and monitoring and optimizing final drying steps between the molecular sieve and ethanol storage tanks.

Keit is carrying out a trial to monitor propagation and fermentation at the same time, Woods says.

“One of the areas many plants do not understand fully is when to send prop out to fermentation,” he says. “Most producers just say they do it at a certain time. Most will acknowledge they don’t really know.”

Keit will sell directly to clients or perform test trials for producers that want to see for themselves how the units will work within their existing system. Units can also be rented. Most units are roughly $100,000, including set-up and initial training. Keit has already hired a 20-year ethanol industry veteran out of Iowa to install IRmadillos and help with any questions.

Customer-validated models have shown that the units pay for themselves in under a year, according to Keit. Saving one fermentation batch from a lactic acid infection could cover the costs. A benefits calculator from Keit often shows producers can save more than $1 million per year.

But Woods is most proud of the results from industry surveys he sends to clients after installation.

“We survey them to find out how we did. We consistently get an 8.8 out of 10.

We get a lot of comments that say we give a lot of good support. You can’t afford to be bad people to work with.”

Keit is already working with producers to develop new dashboards for monitoring all the units at a plant to help assess and optimize the production process.

Every unit is outfitted with a diamond tip probe for safety and accuracy in cleanin-place procedures.

Although Keit is working to help producers understand their next-level tech and why it exceeds the limitations of HPLC, Wood still advocates for producers to continue running their HPLC set-ups. Proven and high-performance HPLC suppliers currently working in the ethanol space include Metrohm, PerkinElmer and Chrom Tech Inc.

Metrohm provides NIR spectrometry systems along with HPLC systems. NIR technology is often used with non-contact measurements of solids (like protein levels in grain before grinding into flour) or water measurements in aprotic solvents.

PerkinsElmer provides many ethanol labs with HPLC and benchtop analysis equipment well-suited for sample testing. Most systems require minimal training and maintenance. The company’s NIR analyzers are typically installed to measure continuous product optimization or moisture after grain drying.

Chrom Tech now provides an advanced HPLC system that reduces the standard analysis run time of 20 minutes by up to one-third. The company also has an HPLC column design that allows the testing column to last longer.

Keit works with ethanol plants to provide their IRmadillos as pre-calibrated analyzer units or as a tool based on a plant’s common HPLC results.

The company has come a long way from its work developing methodology to test the atmosphere and conditions on Mars, Wood says. The ethanol industry has become an earthbound fit for its space-capable technology because of IRmadillo’s standout ability to take detailed and accurate measurements.

It seems the industry’s push to find efficiencies and collect more data landed at the perfect time for Keit’s tech, Wood says. “We’ve essentially designed a highly capable spectrometer system that will go where no spectrometer has gone before.”

Author: Luke Geiver writer@bbiinternational.com

in rh ythm with natur e

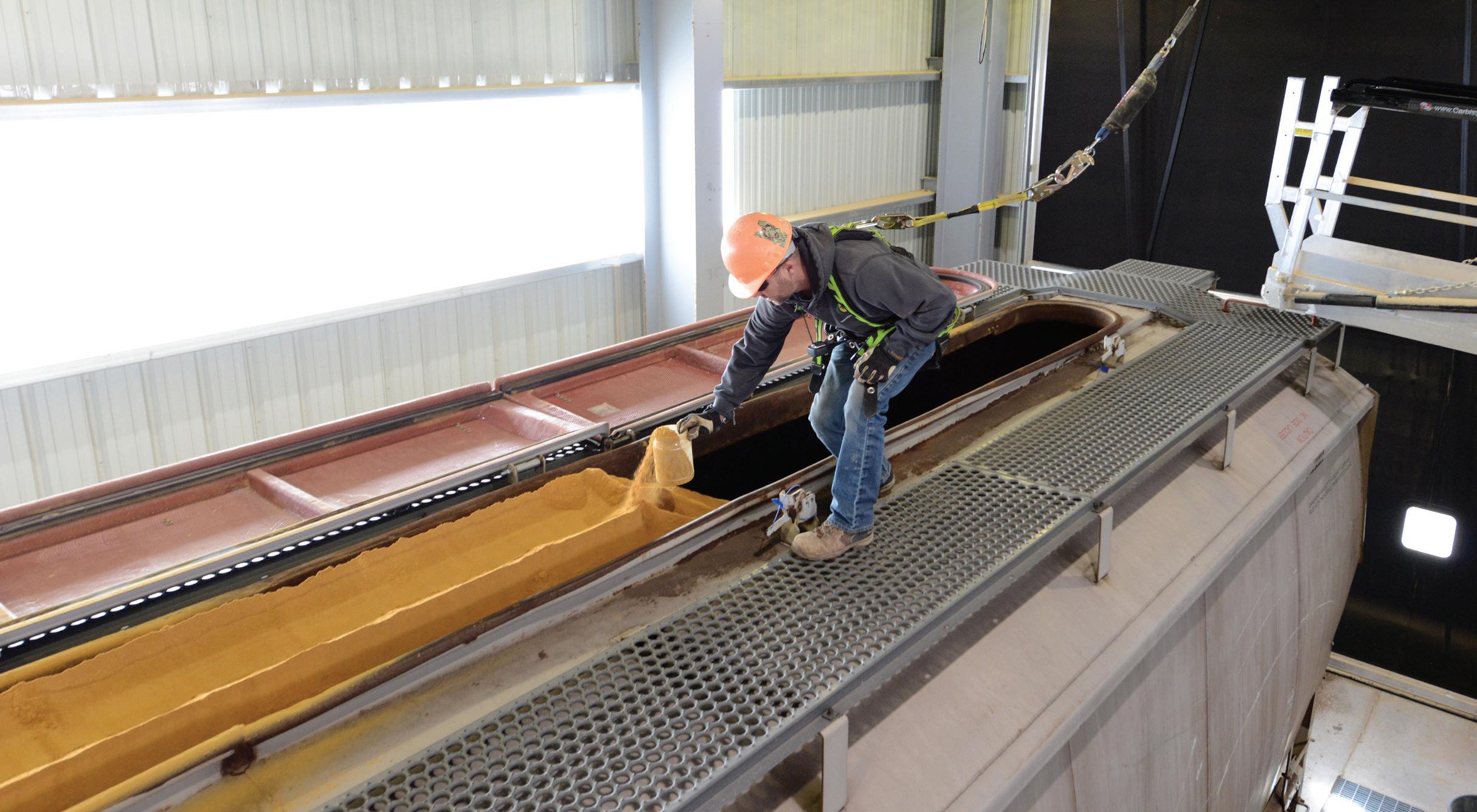

In the 17 years since Tharaldson Ethanol was built in 2008, the plant has explored new coproducts and expanded its production capacity, establishing itself as a destination for farmers across North Dakota and serving as both a market for local farmers’ corn and a source of feed for ranchers across the continent.

Gary Tharaldson, a North Dakota-based billionaire, decided to expand into an ag related industry in his home state. The site near Casselton was a good fit due to its proximity to the Burlington Northern Santa Fe railroad and Interstate 94, as well as its central location in North Dakota corn country, explains Ryan Carter, chief operating officer at Tharaldson Ethanol.

According to Danum Hofland, plant engineer at the facility, that year was a wet one in the Red River Valley, which constituted a challenge due to the amount of class 5 fill that needed to be trucked in to prep for concrete footings. When the plant was built, the nearby community was concerned about the water usage needed to run the ethanol plant. In response, the Tharaldson team reached out to the mayor of Fargo and asked to take some of the city’s treated wastewater, which was being treated and discharged into the nearby Red River. The plant did not build any wells to supply the plant with water, but rather built a pipeline from Fargo to Casselton, running the plant off of the city’s reused water.

Vogelbusch designed the facility, but North Dakota-based Valley Engineering handled the engineering. When the plant started up on December 31, 2008, it had a capacity of 124 MMgy but only ran at 40-45% capac-

ity due to problems with the dryer. Carter explains that ICM came to the plant in 2009 and added a new drying system, which fixed the problem. “We continued over the years to just put new technologies in, and now we're here today, probably one of the more efficient plants in the nation,” Carter says.

Over the years, Tharaldson Ethanol added a new energy center, more fermentation capacity and switched from continuous fermentation to batch fermentation. The plant now produces 175 MMgy of ethanol. Carter and Hofland explain that batch fermentation delivers lower operating expense and higher efficiency, along with cleaner fermentation. A batch takes around 56 hours to complete. The facility has seven fermenters, each with a capacity of 1 million gallons.

A staff of around 80 people runs the plant; many originate from the nearby towns of West Fargo, Mapleton and Casselton. The

North Dakota’s largest ethanol plant finds success through scale, refinement and change.

By Katie Schroeder

22-member maintenance team works to keep the plant up and running, rebuilding pumps and other components as needed.

Tharaldson Ethanol receives trucks within a 150-mile radius, mostly from North Dakota. The plant can receive up to 400 trucks per day loaded with 1,000 bushels of corn each. Hofland explains that the facility has 12 long-term storage bins, each holding 500,000 bushels, on top of its two shortterm storage bins for a total of 7.5 million bushels of corn storage.

North Dakota Grain Inspection uses two probes to evaluate the moisture content, damage and test weight of the corn. Using Compuweigh’s system, Tharaldson Ethanol automates the delivery process as much as possible. Trucks delivering corn attach a card near their windshield, which is scanned as they enter the testing building and the scale, generating an invoice for that farmer’s de-

livery. According to Hofland, the speed of movement for the line of trucks depends primarily on how long it takes the truck driver to open their roll tarp for testing and open their gates over the dump pit.

Although most corn comes to the plant via truck, some of it arrives by rail. Most outgoing product leaves the plant by rail. To accommodate shipping, Tharaldson Ethanol built 13 miles of track loops for loading and unloading. Roughly 20 railcars of protein, 50 railcars of DDGS and 120 tanker cars of ethanol leave the plant each week. Tharaldson Ethanol’s DDGS are transported by truck and rail to ranchers and farmers in western states, down south to Texas and Mexico and up north to Canada.

In February 2024, the facility added Fluid Quip Technologies’ MSC system that produces 100,000 tons per year of a highquality protein ingredient, which can be used

in feeding chicken and swine, or in pet food. Hofland explains that Tharaldson would like to get into the aquaculture feed market as well. With MSC added to the facility, Tharaldson’s coproduct list now includes DDGS, wet distillers grains, distillers corn oil (DCO) and protein.

Tharaldson’s DCO yields jumped from 0.85 pounds per bushel up to 1.2 pounds per bushel after adding a demulsifier and the MSC system, according to Carter. Almost all of the facility’s 62 million pounds of DCO goes to renewable diesel production.

Founded with a focus on efficiency, Tharaldson Ethanol moves into the future with purpose, looking for new opportunities to optimize and improve.

Author: Katie Schroeder katie.schroeder@bbiinternational.com

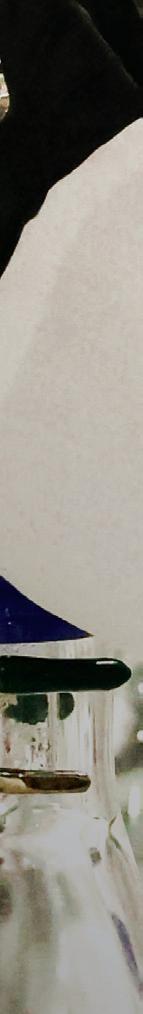

WIND PROTECTION: Tharaldson Ethanol built shelters around its ethanol loading arms to protect operators from North Dakota's cold winds.

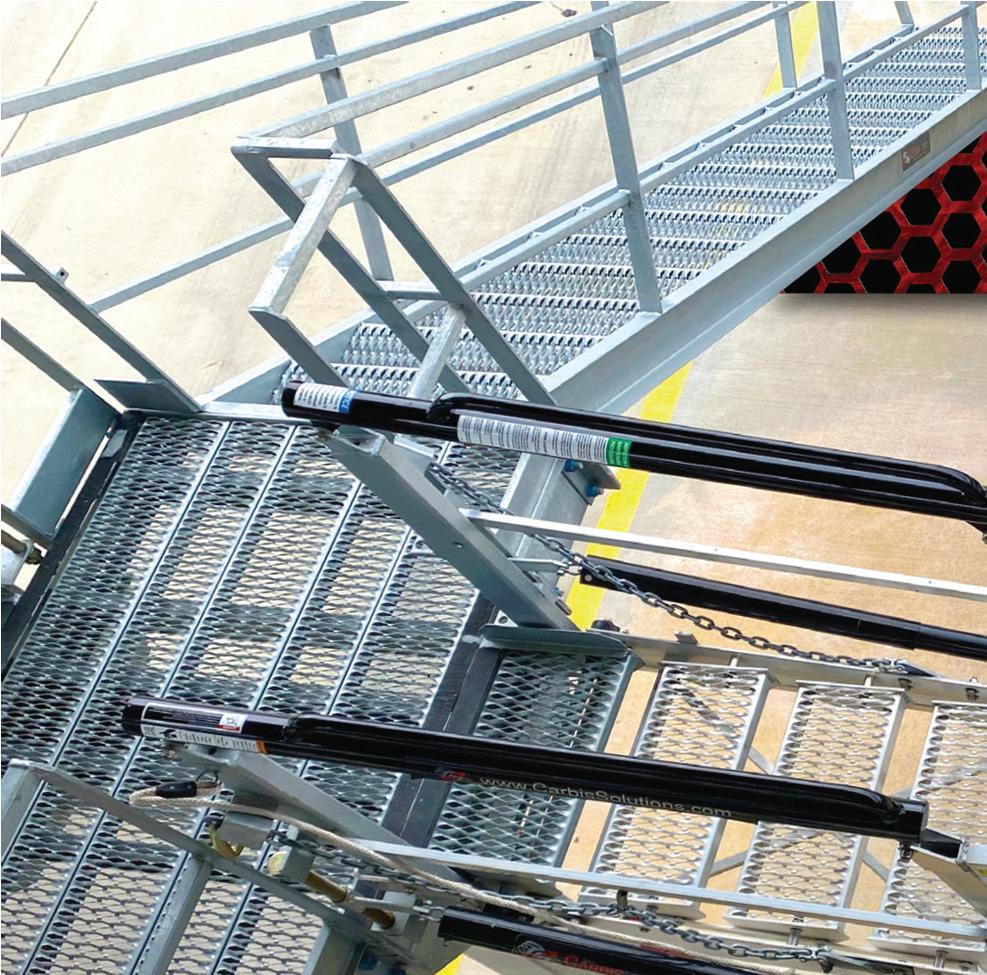

RUNNING RAIL: Tharaldson's 13-mile rail loop supports hundreds of rails cars hauling corn in and transporting ethanol, DCO, protein and DDGS out.

Grain Inspection tests the corn delivered to the facility using probes, which gather the data necessary to determine corn

SECURE STORAGE: Tharaldson Ethanol's two ethanol storage tanks can hold 2.2 million gallons each.

By Katie Schroeder

Photos by Renewable Fuels Association

The Renewable Fuels Association’s 30th annual National Ethanol conference was held Feb. 17-19 in Nashville, Tennessee. Running with the tagline “Back to Roots” speakers reflected on the ethanol industry’s past, discussed ethanol’s current impact and looked toward the industry’s future under a new Trump administration.

Addressing the attendees, Geoff Cooper, CEO of the RFA, emphasized the impact that the Renewable Fuel Standard and the ethanol industry have made on the agricultural sector. “From the early days of ‘gasohol’ during the Carter administration to the transformative passage of the Renewable Fuel Standard in 2005, the ethanol industry has evolved into a cornerstone of both U.S. energy security and agricultural prosperity,” Cooper said. “The success of ethanol, driven by the RFS, has had a profound impact on American consumers and farmers alike, helping lower pump prices, enhance energy independence, and bolster rural communities.”

In line with the “Back to Roots” theme, this year’s NEC featured a panel titled “Back to the Beginning Celebration” during which ethanol industry veterans shared stories from their decades in the industry and how they got involved.

Other panels and speakers covered a plethora of topics including carbon markets, 45Z tax credits, the future of electric vehicles, challenges and opportunities for American agriculture, and more.

Rick Schwarck received the RFA’s 2025 Industry Award for his work in uniting the industry and promoting ethanol’s health benefits. “Many years ago, Rick began a conversation with researchers at the Hormel Institute, University of Minnesota, and University of Illinois-Chicago about the potential dangers of certain toxic components in our gasoline—like aromatic compounds,” Cooper said in a statement. “Those early conversations eventually grew into a multi-year, multi-institution, multi-milliondollar research program that resulted in important scientific breakthroughs and greatly advanced the understanding of the cancer risks associated with toxic fuel compounds and the benefits of using more ethanol. That work continues today and continues to yield remarkable new insights.”

The 2026 NEC will be held Feb. 24-26 in Orlando, Florida.

KEYNOTE: In his remarks, Geoff Cooper, CEO of the RFA, discussed the challenges farmers are facing and ethanol’s value to the farming sector as a source of stable income.

LEARNING FROM EXPERIENCE: A panel of established industry veterans shared their experiences. Panelists included, left to right: Geoff Cooper, RFA CEO (moderator); Dave VanderGriend, CEO of ICM; Todd Brown, board member at Dakota Ethanol; Karol King, board chairman of SIRE; Rodney Jorgenson, board member at Al-Corn Clean Fuel; and Rod Gangwish, board member at KAAPA Ethanol Holdings.

WELCOME TO NASHVILLE: Derek Peine, general manager of Western Plains Energy and vice chairman of the Renewable Fuels Association, welcomed conference attendees and reflected on the ethanol industry’s growth over the past 30 years.

RECOGNITION: The RFA recognized Rick Schwarck, co-founder of Absolute Energy, for his contributions to the ethanol industry with the organization’s 2025 Industry Award.

AROUND THE WORLD: Ed Hubbard, general counsel and vice president, government affairs for the RFA, discusses expanding the global market.

Panelists discuss the future of electric vehicles. From left to right: Robert White, senior vice president, industry relations and market development, RFA (moderator); John Howard, director, product management, Experian Automotive; Andrew Koblenz, executive vice president of senior affairs and industry initiatives, National Automobile Dealers Association; LeeAnn Goheen, senior director, government affairs, NATSO & Sigma.

INDUSTRY INSIGHTS: Kenneth Zuckerberg, director of global research with CHS, shares his expertise on how the growth in renewable fuels has impacted commodities.

As the ethanol industry navigates new opportunities in low-carbon fuels, contracts with grain procurement agencies are rising in popularity.

By Lisa Gibson

Beyond a guaranteed supply of grain at all times, there are two key reasons to contract with a large grain supplier, according to Prestin Read, CEO of Mid America Bio Energy.

“They bring some market intelligence geographically that is wider than just our immediate draw area that helps us make better corn-buying decisions,” he says. Second is the accounting and logistics back office support. “We’re a 50 MMgy plant and if we were to self originate all our grain, that would take a whole new staff that we would have to hire and train. Economically, it’s better for us to piggyback off Scoular’s already critical mass in that area.”

MABE’s ethanol plant, Mid America Agri Products Wheatland LLC in Madrid, Nebraska, brought on commodities giant Scoular as its grain procurer in February. Read says the plant had been contracting with a smaller supplier but after recent severe droughts in its draw area, the company determined it needed an expert with a larger geographical footprint.

“Scoular’s place in the supply chain is to bring together that demand piece and the supply piece,” says Melissa Norem, grain division, general manager at Scoular, adding that the company works with farmers in the geographical areas of their clients, but also with commercial supplies that can include multinationals. “We might be looking at the local market, domestic market across the whole U.S. and the export market. How we’re creating those relationships is providing volume and liquidity to both the end-user— MAAPW—and also to the farmer and the commercial accounts.”

Norem says that while Scoular has partnered with ethanol producers for decades with ebbs and flows, she has seen a recent resurgence in the amount of producers contracting with grain procurers. The industry is evolving, she explains, and ethanol producers need to be able to focus on new opportunities instead of day-to-day grain procurement.

Scoular is in the market every day, building and maintaining relationships with farmers and commercial suppliers. Those relationships are key when ethanol producers need grain outside their original draw area.

“Never in the year is there just the right supply and the right demand,” Norem says. “Scoular’s place is to help even that out. There are going to be years when there is just a surplus of grain in that area, and our job is to help find markets for that grain.

“Prestin’s role, MAAPW’s role, is to economically produce ethanol. That means some days they might be in the market for grain and some days they might not. Where Scoular operates is we are in that market every day balancing that supply-and-demand piece.”

Each client has a point of contact, a grain trader, who communicates with them daily and shares market insights. Read says his team also has weekly calls with a wider Scoular team to help guide how MAAPW sets corn bids. “We take what Scoular provides

us on the general grain markets and combine with what we’re seeing on the ethanol side and we come up with our bid to post to buy corn, which is run through Scoular,” he says. “Corn is our largest input cost by far, so making smart decisions on how we procure our corn and hedging a crush margin, locking in ethanol price and locking in corn price, definitely is a big key to profitability in this industry. Scoular, without a doubt, helps us make smarter decisions on the corn side.”

Scoular secures the bid, the farmers are contracting through Scoular, and Scoular is contracted with MAAPW. Norem says Scoular works closely with the grain procurement managers at ethanol plants to determine needs and help manage logistics. Scoular can also provide trucking, depending on the capabilities of the supplier.

Whoever is dropping off the grain, the local suppliers are familiar with MAAPW’s quality standards, Norem says. “The local producer (farmer) base is very aware and they’re appreciative to have 16 to 17 million-

bushel demand in that area. Having that demand piece in a local area is very important to that producer base.”

Quality assurance is yet another benefit of contracting with a grain procurer, Read says.

Norem adds, “That is part of the service Scoular provides is we will ensure that we are getting the quality that the plant needs and we’ll make that draw circle as big as it needs to be to ensure they have the quality that they need.”

During the ethanol industry's peak growth period of the 2000s and 2010s, many producers were contracted with suppliers like Scoular, Norem explains. The industry has moved away from those agreements, but is coming back to them for two main reasons, she says.

The first is the volatility, including in weather that Read cites as his main reason for contracting with Scoular. “Production is

Visit us at booth #1237 and learn how Ecolab’s range of solutions are making it easier for ethanol producers to fuel the future.

much more variable, so the draw territory has to expand where the grain wasn’t produced because of weather,” Norem says.

The second driver is new market opportunities in government programs and incentives, including carbon capture and storage. “The ethanol plant has the opportunity to focus on those areas and not on the grain side,” Norem explains.

Scoular trades more than 1 billion bushels each year, 300 million purchased directly from farmers. “We have that muscle built, we have that established,” Norem says. “Prestin has to be updated on the new government requirements and Scoular allows producers to focus on that instead.

“That’s where I’m starting to see more of the procurement agreements surface again,” she adds. “The ethanol industry is in a really interesting phase in its life.”

MAAPW will be linked to Tallgrass’ Trailblazer pipeline in the fourth quarter of this year. “Of course, 45Z credits are front and center in our industry right now,” Read

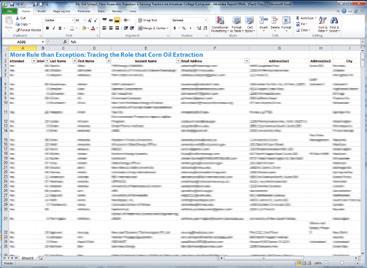

TESTING THE SUPPLY CHAIN: In anticipation of assisting its clients in navigating government incentives like 45Z, Scoular is building out staff in the decarbonization and climate-smart agriculture realm, as well as holding events like More than Dirt, pictured, to help educate the supply chain about regenerative ag and innovative technologies.

PHOTO: SCOULAR

says, adding that without the final rule, it’s difficult to anticipate what’s coming. “But we do know that when it comes time to engage with our local producers, to grow this low-carbon corn with certain ag practices, we’re going to need some help from a larger company to go out, do the record-keeping, measurement, verification [and] reporting requirements.

“We know as we move into this decarbonization era for ethanol in general, in par-

ticular for our plant, with our CO2 project, we’re looking forward into climate-smart ag coming down the pike, we knew we needed a partner like Scoular, a bigger company to help us implement that program when the time is right.”

While Scoular likely won’t be a measurement, reporting and verification (MRV) partner in the market, the company is active in the decarbonization space with trial projects

in the supply chain to enhance understanding in the market, Norem says, including helping to confirm what governing agencies will require as proof of an ethanol producer’s claims about its low-carbon fuel.

“That is where Scoular helps, not only the ethanol plant to determine what parties we need to be involved in that process, but also to bring the opportunity to the [farmers]—for us to be able to say, ‘Here’s a new opportunity for you. If you’re doing these things and if you are accounting for them, per the rules, here is an opportunity for a new market for you.’

“We’ve made a commitment, we’re building out staffing for that realm and doing some pilots and various regenerative ag projects.”

The trials Scoular has conducted are mainly in the wheat and flour milling industries, but have spilled into ethanol as well. “That whole ecosystem is getting built, so what Scoular’s trying to do is build out our knowledge base within that ecosystem, one of the components certainly being ethanol 45Z,” Norem says.

Despite the uncertainty in 45Z, producers like MAAPW are anticipating a need for help in navigating new markets, and turning to grain procurement experts like Scoular.

“The ethanol industry, like many industries, is going through a transition phase to know what that next era looks like, and that’s where I think this partnership has really come to fruition and provides value going forward,” Norem says.

Author: Lisa Gibson lisa.gibson@sageandstonestrategies.com

Model E by WI Instruments, a CFR Engines Inc. brand, delivers high-precision ethanol analysis with unmatched speed, offering ethanol and fuel producers accurate results within a few minutes.

By Katie Schroeder

WI InstrumentsTM builds upon the CFR Engines Inc. legacy of fuel testing excellence, expanding its analytical solutions to meet the evolving needs of the global fuel and ethanol industry by providing value and confidence in every test. Model E utilizes mid-IR technology and improved modeling techniques, enabling fuel and ethanol producers to measure samples with unparalleled accuracy and precision.

April Zamora, global product manager of the WI Instruments product line, explains that Model E can precisely measure ethanol and methanol concentration levels in conformance with ASTM D5845 while also

analyzing ethanol and denaturant content up to 100% in correlation with ASTM D5501. The instrument complies with ASTM D7777 through its integrated density meter and correlates with ASTM D7923, D6839, D6730, and D4815. Model E provides a comprehensive solution for ethanol purity, blending optimization, and contaminant analysis, including water detection.

Unlike traditional gas chromatography instruments, Model E provides superior precision and accuracy with minimal calibration and maintenance requirements. With spectroscopy-based instruments, performance is highly dependent on modeling, and the opti-

mized model algorithm for Model E ensures improved repeatability and consistency with each sample across the globe.

“Model E is smarter and faster than traditional analysis techniques,” Zamora says. “With an intuitive design, Model E enhances ethanol and blending production efficiency and provides a seamless user experience whether you’re a chemist, lab tech, engine or process operator. Designed for both laboratory and process environments, Model E empowers users to make data-driven decisions with confidence, optimizing fuel quality and regulatory compliance with ease.”

September 22-24, 2025 Minneapolis Convention Center Minneapolis, MN

SAF Magazine, in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI) will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers.

The North American SAF Conference & Expo is designed to promote the d evelopment and adoption of practical solutions to produce SAF and decarbonize the aviation sector. Exhibitors will connect with attendees and showcase the latest technologies and services currently offered within the industry.

Experience-driven start-up, maintenance, and service to enhance system reliability, efficiency, and long-term operation.

Ongoing support tailored to your process, with Trucent certified technicians, over 25,000 in-stock parts, and an innovation team dedicated to making impactful improvements.