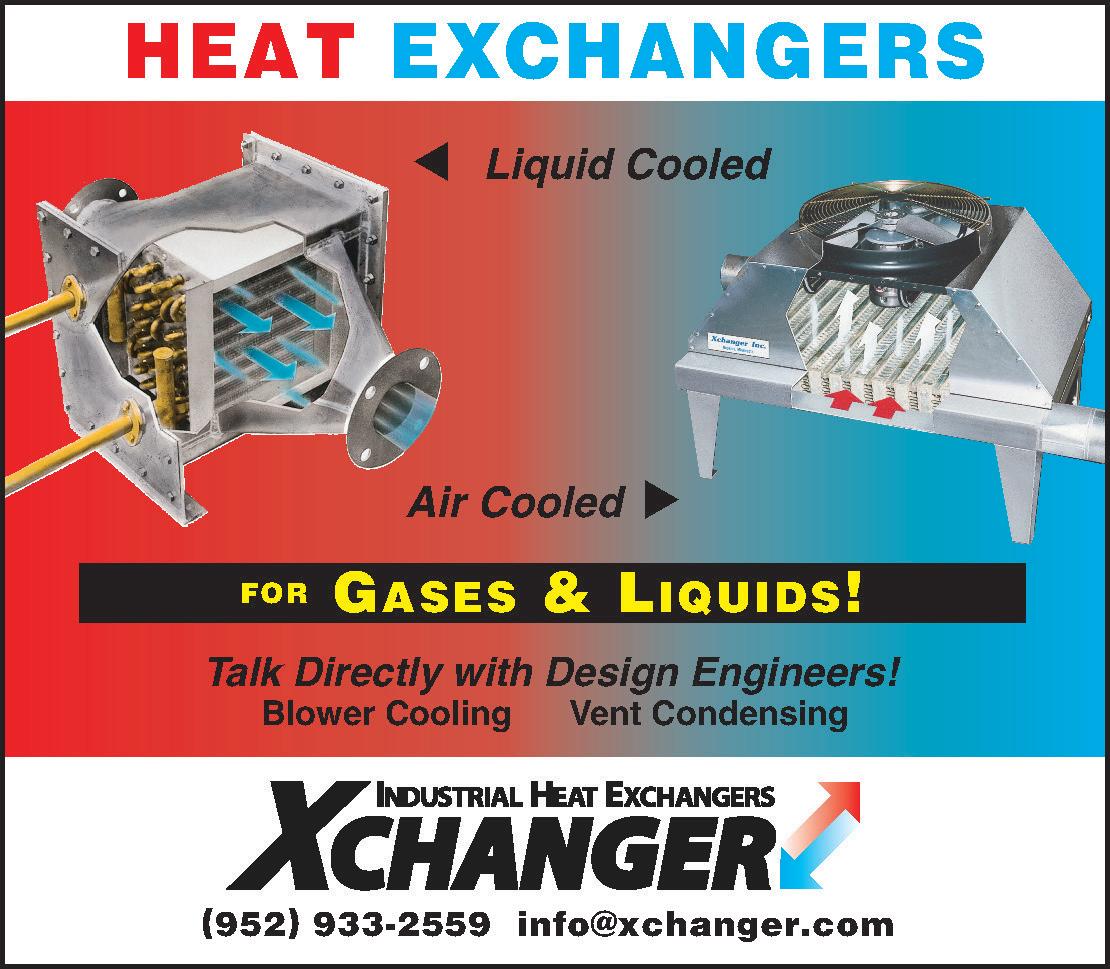

PLUS: A Year in Retrospect: Global Pellet Market Conditions In the Wake of War PAGE 28 The Renewable Fuel Standard and eRIN Progress PAGE 16 Issue 1, 2023 BiomassMagazine.com The Many Benefits of New Hampshire’s Burgess BioPower RELIABILITY ACROSS THE RIVER PAGE 22

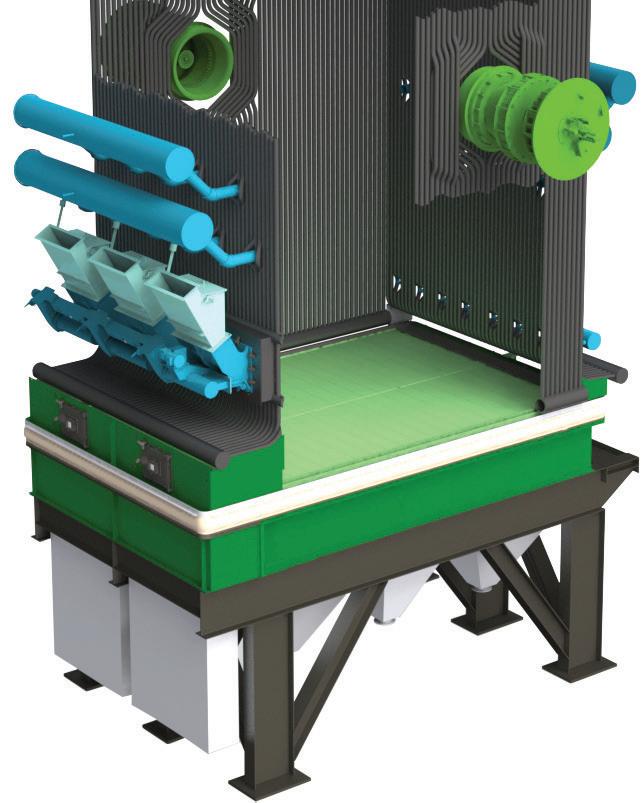

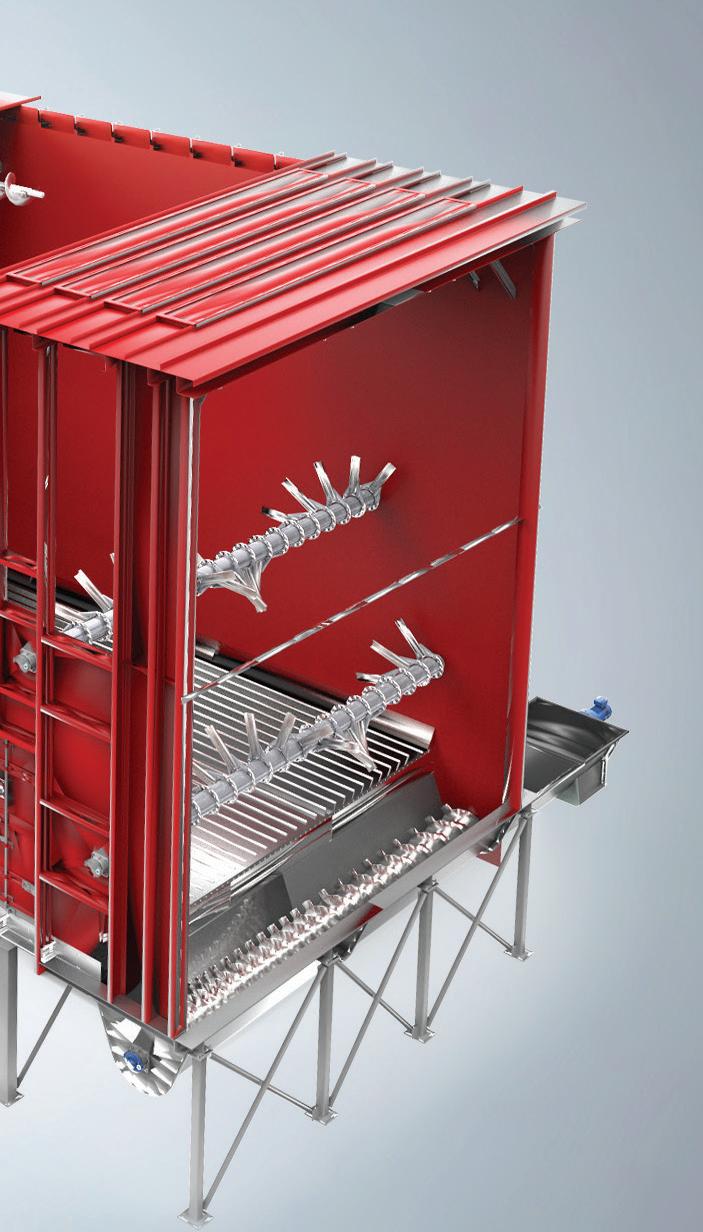

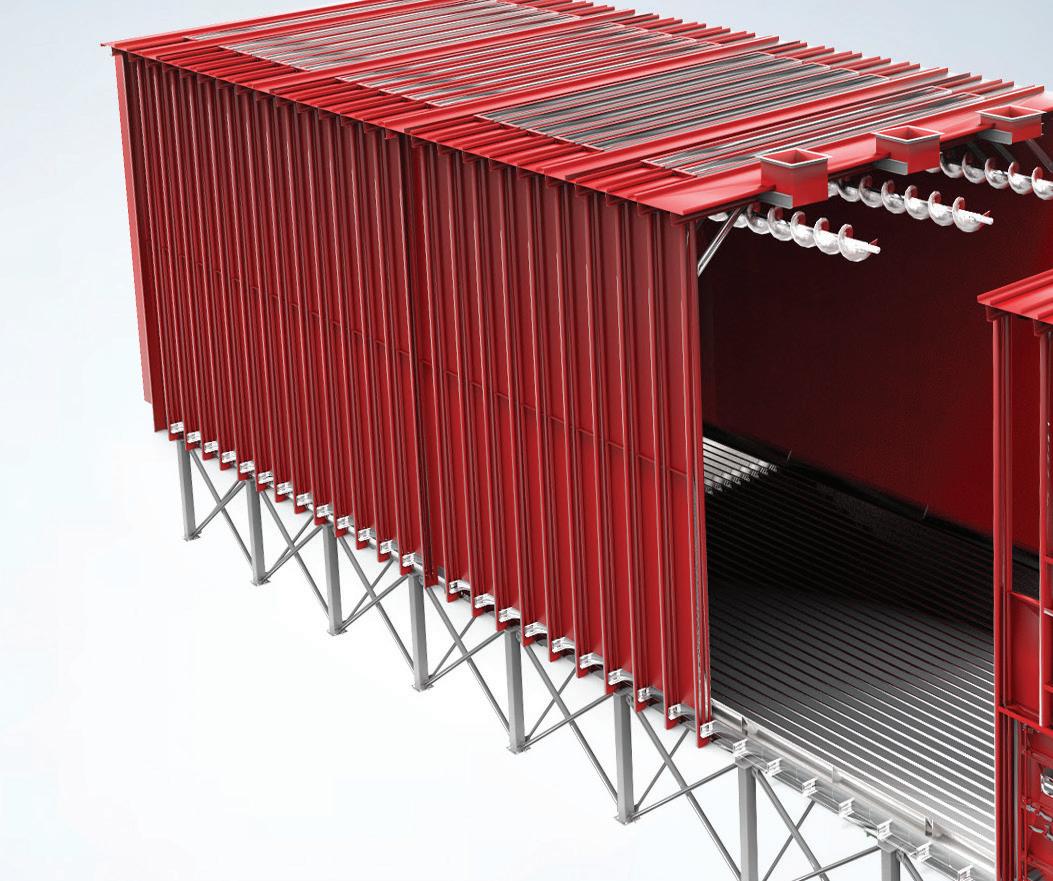

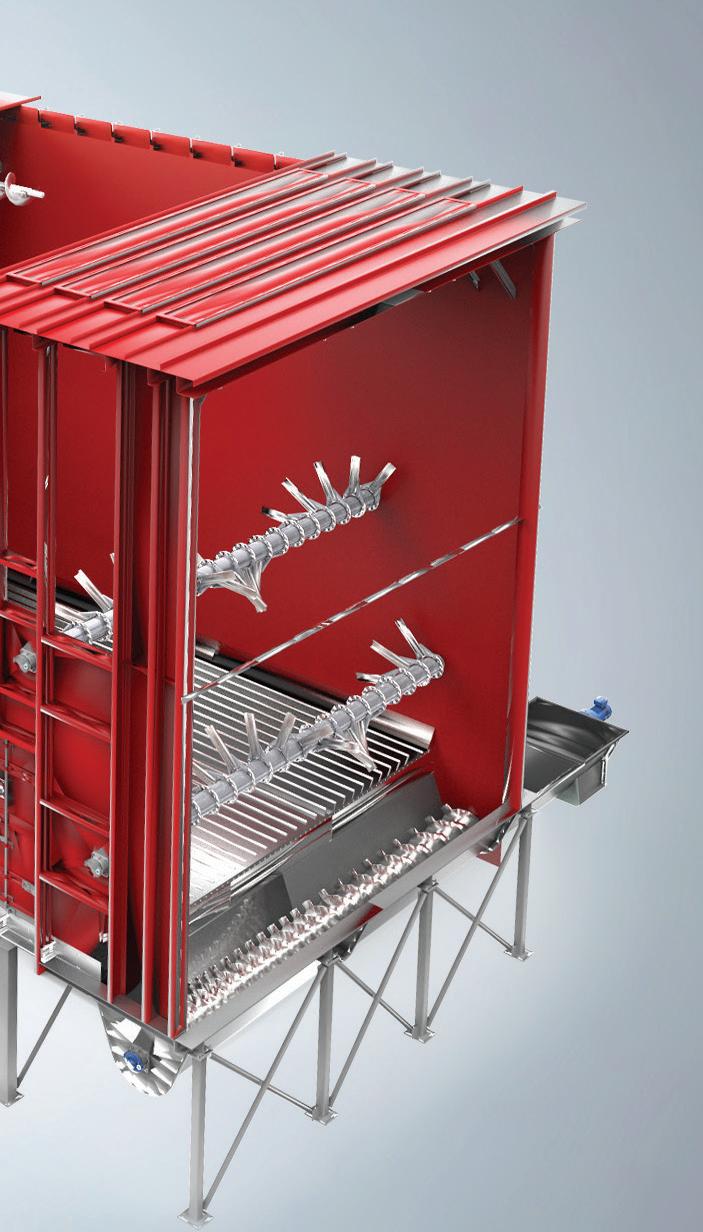

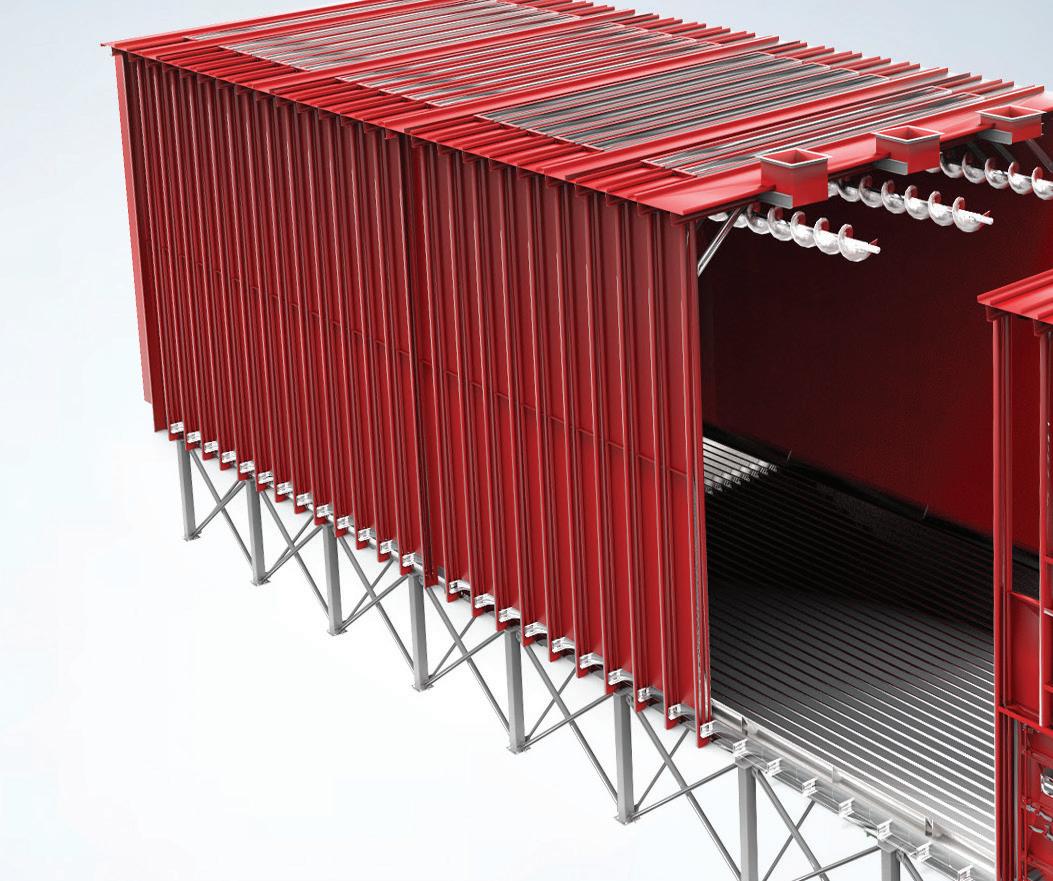

Increase your profits with intelligent solutions bruks-siwertell.com Chipping • Conveying • Milling • Screening • Ship loading • Ship unloading • Stacking & Reclaiming • Truck unloading • Wood residue processing

ON THE COVER

Burgess BioPower is a 75-MW biomass power plant located across the Androscoggin River from Berlin, New Hampshire. The plant began operations nearly a decade ago and is the state’s largest generator of renewable electricity.

COLUMN

04 EDITOR’S NOTE

The Future of Biomass is Brighter than Ever

By Anna Simet

06 COLUMN

2022 A Banner Year for Biomass

By Carrie Annand and Julee Malinowski-Ball 09 COLUMN

It’s Time to Accelerate Biomass, Not Slam the Breaks

By Christian Rakos

Biomass Magazine: (USPS No. 5336, ISSN 21690405) Copyright © 2023

FEATURES

16 POLICY

A Foot In The Door Pending a final rule, some biomass-based power generators will have the opportunity to participate in the federal Renewable Fuel Standard program.

By Anna Simet

22 PROJECT DEVELOPMENT

A Powerful Community Partner

Berlin, New Hampshire, and surrounding communities have been positively impacted by local biomass plant Burgess BioPower since it began operations in 2014. Now, the city is partnering with Burgess to make use of the facility’s waste heat.

By Keith Loria

28 MARKETS Filling the Gap A year after Russia invaded Ukraine, the impacts on global pellet markets, particularly in Europe, continue.

By Katie Schroeder

CONTRIBUTIONS

34 PROJECT DEVELOPM,ENT

Bioenergy Project Development: Sometimes, It’s Okay to Teach to the Test The closer project development resembles an engineering scope of work, the better.

By Ted Niblock

34 FEEDSTOCK

Feedstock Variability: Causes, Consequences and Mitigation of Biological Degradation Researchers describe feedstock variability and why it matters for biorefinery operations.

By U.S. DOE Feedstock-Conversion Interface Consortium and Feedstock Logistics Program

38 BIOCOAL Biochar’s Role in Farming and Soil Health Production and use of biochar from waste material reduces demand for landfill capacity and greenhouse gas emissions, while helping transform agriculture from chemical dependency to sustainability.

By Stephen Smith and Russel Peterson

SPOTLIGHTS

41 MID-SOUTH ENGINEERING Ask an Engineer Five Questions with Chris Brown

BIOMASSMAGAZINE.COM 3

DEPARTMENTS 10 BIOMASS NEWS ROUNDUP 12 PODCAST PREVIEW

ISSUE 1 | VOLUME 16

BBI

is published quarterly

BBI

308

Accounting and Circulation

to subscribe. Periodicals postage

and

POSTMASTER: Send address changes

Biomass Magazine/Subscriptions,

¦ ADVERTISER INDEX 8 2023 Int’l Biomass Conference & Expo 29 Air Burners, Inc. 33 Airoflex Equipment 2 BRUKS Siwertell 36 CPM 15 Detroit Stoker Company 19 Evergreen Engineering 18 Fagus GreCon, Inc. 44 Gidara Energy 31 Hermann Sewerin GmbH 21 Hurst Boiler & Welding Co. Inc. 24 KEITH Manufacturing Company 42 KESCO, Inc. 41 Mid-South Engineering Company 12 MoistTech 25 ProcessBarron 35 Rawlings Waste Wood Recovery Systems 28 Timber Products Inspection/Biomass Energy Labratories 37 Vecoplan LLC 13 Wolf Material Handling Systems

by

International

by

International,

Second Avenue North, Suite 304, Grand Forks, ND 58203. Four issues per year. Business and Editorial Offices: 308 Second Avenue North, Suite 304, Grand Forks, ND 58203.

Offices: BBI International 308 Second Avenue North, Suite 304, Grand Forks, ND 58203. Call (701) 746-8385

paid at Grand Forks, ND

additional mailing offices.

to

308 Second Avenue North, Suite 304, Grand Forks, ND 58203.

ANNA SIMET EDITOR asimet@bbiinternational.com

The Future of Biomass is Brighter Than Ever

It’s an exciting time for bioenergy. To mention just a few of many bright spots, global pellet demand continues to rise, we are finally seeing major traction on inclusion of eRINs in the federal Renewable Fuel Standard, the North American renewable natural gas sector is growing exponentially, and sustainable aviation fuel is quickly transitioning from a future plan to reality. To close the door on 2022, I decided to look back at the top story in each issue of the 2022 volume of Biomass Magazine. The following are their titles and leads.

Issue 1: Advancing Bioenergy in the North: While there are some hurdles to overcome, Arctic and Subarctic governments such as the Northwest Territories are working to replace fossil fuels with bioenergy—including modern wood heat and renewable diesel.

Issue 2: Fueling the Hydrogen Revolution with RNG: Stewart Stewart of BayoTech discusses the U.S. hydrogen industry, its potential to utilize RNG, and the company’s rollout of regional hubs.

Issue 3: Navigating the Turbulence of Global Trade: Coming off a season with inventory levels the highest they have been in several years, an impending pellet shortfall in Europe has some U.S. heating pellet producers eyeing a challenging opportunity.

Issue 4: Minnesota Biomass Revival: Urban centers are expecting the current onslaught of emerald ash border-killed wood to continue, but lost infrastructure will need rebuilding for woody biomass markets to rebound.

The variety of topics was interesting, and you’ll find that same theme in this issue: variety. When we talk broadly about bioenergy, it’s really unique in that it is so expansive; types of renewables are what they are (i.e, wind, solar, coal, etc.). But biomass or bioenergy—incredibly versatile. We can do so much with it. For example, our page-22 feature and cover story, “A Powerful Community Partner,” details Burgess Biopower, a 75-MW biomass power plant in the city of Berlin, New Hampshire. The plant buys more than 800,000 tons of biomass from over 154 towns and cities in the state. It also provides reliable, baseload power, creates hundreds of jobs in a previously struggling community, and it supports nearly $70 million in annual economic activity (and that’s not all). Now—if all goes according to plan—it will partner with the city of Berlin to send its waste heat downtown, initially to melt snow and ice on the sidewalks and roadways to make it more accessible during harsh winter months, and potentially, provide district heating, as the project underway will only utilize about 8% of the plant’s waste heat. Says Pamela Laflamme, city of Berlin, “This allows us both the opportunity to upgrade our aging downtown infrastructure and add in an innovative component that will save the city money in maintenance, provide economic opportunity, and allow our residents a place to walk during the winter without dealing with the issues of snow and ice.”

In another story, staff writer Katie Schroeder revisits a topic that we have been following, and that’s the impact of the Russian invasion of Ukraine on global pellet markets. Industry stakeholders foresaw a potentially catastrophic situation well in advance, and have worked to minimize its effects, which will continue to linger indefinitely. Check out “Alleviating a Shortfall,” on page 28, for the latest.

In our final feature, “A Foot in the Door,” page 16, Biomass Power Association CEO Bob Cleaves discusses the U.S. EPA’s recently proposed set rule for the Renewable Fuel Standard, which, after longer than a decade of pressure, has finally included eRINs—albeit not yet to the extent the original legislation mandates. The progress, however, is a good indicator that more is to come.

There are a lot more topics to read about in these pages, from feedstock degradation and mitigation to the production and benefits of biochar. As your industry trade publication, our goal is to bring you the most useful, recent and relevant information that will help you stay informed and make connections. We look forward to doing so in 2023—Happy New Year.

4 BIOMASS MAGAZINE | ISSUE 1, 2023

¦ EDITOR’S NOTE

EDITORIAL

EDITOR

Anna Simet asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele evoegele@bbiinternational.com

STAFF WRITER

Katie Schroeder katie.schroeder@bbiinternational.com

ART

VICE PRESIDENT OF PRODUCTION & DESIGN

Jaci Satterlund jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

PRESIDENT Tom Bryan tbryan@bbiinternational.com

VICE PRESIDENT OF OPERATIONS/MARKETING & SALES

John Nelson jnelson@bbiinternational.com

SENIOR ACCOUNT MANAGER/BIOENERGY TEAM LEADER

Chip Shereck cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe mdefoe@bbiinternational.com

2023 Int’l Biomass Conference & Expo

FEBRUARY 28 - MARCH 2, 2023

Cobb Galleria Centre, Atlanta, GA

Now in its 16th year, the International Biomass Conference & Expo is expected to bring together more than 800 attendees, 140 exhibitors and 65 speakers from more than 21 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine—that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development. (866) 746-8385 | www.BiomassConference.com

2023 Int’l Fuel Ethanol Workshop & Expo

JUNE 12-14, 2023

CHI Health Center, Omaha, Nebraska

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercial-scale ethanol production—from quality control and yield maximization to regulatory compliance and fiscal management. The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies. (866) 746-8385 | FuelEthanolWorkshop.com

Subscriptions Biomass Magazine is free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.BiomassMagazine.com or you can send your mailing address and payment (checks made out to BBI International) to Biomass Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues & Reprints Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 701-746-8385 or service@ bbiinternational.com. Advertising Biomass Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Biomass Magazine advertising opportunities, please contact us at 701-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Biomass Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to asimet@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

BIOMASSMAGAZINE.COM 5

INDUSTRY EVENTS ¦

TM Please recycle this magazine and remove inserts or samples before recycling COPYRIGHT © 2023 by BBI International

Please check our website for upcoming webinars www.biomassmagazine.com/pages/webinar

2022 a Banner Year for Biomass

BY CARRIE ANNAND & JULEE MALINOWSKI-BALL

Last year was a banner year for the biomass power sector in California and nationally. In August, the Inflation Reduction Act, which, among other issues, encourages investing in domestic energy production, primarily clean energy. For the biomass industry, the IRA extends existing tax credits for new biomass power facilities, as well biofuels and funding for biofuel infrastructure development. The act also offers assistance for biogas and biomass electricity production and tax credits for carbon capture and storage (CCS). Overall, the IRA gives the biomass power sector reductions in costs and opportunities to invest in new technologies.

The following month, California Gov. Gavin Newsom signed Senate Bill 1109, which extends requirements on electric investor-owned utilities (IOUs) to procure energy from biomass-generating electric facilities by five years. This law calls on the IOUs to extend existing contracts or procure at least 125 MW of sustainable and renewable power from biomass-generating facilities.

The two pieces of legislation provide much-needed stability to the entire biomass industry. The California legislation ensures the existing facilities have contracting options, while the federal law provides funding and tax incentives.

While 2022 was a banner year, the Biomass Power Association and the California Biomass Energy Alliance are not resting on our laurels. Both entities will continue to push to maintain existing facilities and new opportunities. On the federal side, BPA will continue pursuing RINs for electric generation, also known as eRINs. Nearly 15 years after the establishment of the federal Renewable Fuel Standard program, the U.S. EPA in December proposed a rule for electricity generators to participate in the program, allowing them to receive shared credits for the power they supply to electric vehicles. These RIN credits stand to be a source of support for biomass power producers; however, the EPA still needs to approve biomass power feedstocks for inclusion in the RFS. BPA will be engaging with the EPA as well as other allies in Washington to get eRINs for biomass power over the finish line, at long last.

In California, CBEA will focus on promoting baseload and dispatchable renewable power by ensuring biomass continues to be one of California’s clean and renewable energy tools. In addition, CBEA will push to implement and expand

SB 1109 to include facilities receiving the majority of their fuels from agricultural waste in order to improve air quality by reducing open burning. While this does not sound like an enormous task, opponents of the biomass power industry in California erroneously link biomass to the burning of fossil fuels. The opponents portray the fuels used at biomass facilities as trees harvested for fuel, rather than otherwise useless woody residues. Even regulators tend to overlook the biomass power industry. In a clean energy hearing before the California Energy Commission, several renewable energy supply options were listed, but biomass was nowhere to be seen. CBEA is working to change this.

CBEA will also work to promote the state’s healthy forest initiatives. A rift exists in California’s environmental community about whether to follow past policies of leaving the forests alone, versus managing public forests. This debate continues even though a recent UCLA study showed carbon pollution from California’s 2020 wildfires erased 16 years of the state’s greenhouse gas emission cuts. The study further states the need for “increased investment in preventative measures.” CBEA agrees with the study by supporting forester and firefighter efforts to manage the forests by removing underbrush and dead and dying trees to reduce the risk of forest fires.

CBEA also supports investments in carbon capture and sequestration. Currently, California depends on power sources with air emissions to ensure grid reliability. Carbon capture and sequestration allow the state to keep the lights on while moving to a clean energy future.

Last year was a good year for the biomass industry. This year is about building upon last year’s achievements and ensuring policies are implemented.

www. usabiomass.org

6 BIOMASS MAGAZINE | ISSUE 1, 2023

Authors: Carrie Annand Executive Director, Biomass Power Association

Julee Malinowski-Ball Executive Director, California Biomass Energy Alliance www.calbiomass.org

Annand Malinowski-Ball

To succeed in today’s market, you need to connect with your customers at the right time using multiple marketing channels. Biomass Magazine offers many opportunities to reach customers wherever they may be. M A R K E T I N G C H A N N E L S Reach Your Customers Across All Contact an Account Manager Today to Build Your Ideal Marketing Campaign: 701-746-8385 ser vice@bbiinternational.com www.biomassmagazine.com

It’s Time to Accelerate Biomass, Not Slam the Breaks

BY CHRISTIAN RAKOS

The Green Deal has led the world in addressing the climate emergency, but with the Russian invasion of Ukraine, it has also become a race to help solve a generational energy crisis.

Breaking the EU’s reliance on often-imported fossil fuels will require, among other interventions, an unprecedented expansion of renewable energy to be completed in record time. As a result, the European Commission’s newly proposed 2030 target for renewable energy consumption has jumped from 40% to 45%—more than double today’s share.

There is no margin for error to meet this aggressive target, and the EU cannot afford policies that reduce or limit existing renewable energy generation. Yet, this is exactly the intention of proposals from the European Parliament to reduce use of sustainable woody biomass, the EU’s leading source of renewable energy. Not only would these proposals have massive and far-reaching negative consequences, but they have not been properly assessed by EU institutions, a prerequisite for sound policymaking. They also contradict analysis from the European Commission showing the use of bioenergy must increase significantly to meet climate targets.

The need for a rapid energy transition is not in question, but there is widespread skepticism that 45% by 2030 is within reach. A recent report from the International Energy Agency shows that although the EU will dramatically expand use of renewables by 2030, it will fall short of its RePowerEU goal with deficits projected “across all sectors.” To illustrate the breadth of the gap, the IEA forecasts that wind power only reaches 60% of the new 36 gigawatts needed. This analysis even includes assumptions of stronger policy support, regulatory reforms and grid expansion.

It is clear the EU must achieve as much progress as possible over the next eight years, regardless of agreed targets. By limiting the amount of sustainably sourced woody biomass that can be counted as renewable and removing the ability to subsidize it— even for some of the most advanced applications—Parliament’s proposals would push renewable targets further out of reach.

The IEA’s 10-point plan to reduce the EU’s reliance on Russian natural gas underscores that dispatchable, low-emission generation from bioenergy can and should be maximized. This was further reiterated in its joint work with the European Climate Foundation, which stated that increasing biomass use in power and heat could offset up to 2 billion cubic meters of natural gas, amounting to a positive cumulative climate impact of 4 million tons of saved CO2 emissions.

Even today, thousands of European cities and villages in Sweden, Denmark, Lithuania, Germany, France, Spain and Italy are heated with wood chips from harvest residues, making them inde-

pendent from natural gas. The proposal to stop or reduce this sustainable practice in the current situation seems counterproductive. Harvest residues would decompose within a few years and lead to CO2 emissions. So, why not use them?

The European Commission’s own impact assessment for the amendment of the Renewable Energy Directive (REDIII) states that the use of bioenergy must increase by an average of 69% if we are to meet climate targets, particularly for heat and balancing the grid, as well as decarbonizing the maritime, aviation and industrial sectors. Sustainable woody biomass is a key component of this, representing today almost 70% of bioenergy use and with margin for growth, as the commission assessment makes clear. The arbitrary restrictions proposed by Parliament will make these incredibly difficult, if not impossible, to achieve.

The European Commission’s impact assessment shows bioenergy use must increase this decade under all scenarios and double by 2050 to meet EU climate goals.

Arguments made in support of restrictions on biomass—particularly the use of primary woody biomass, which is essentially all low-value wood coming from a harvest, often cite another study from the commission’s science and knowledge service, the Joint Research Centre. But the JRC makes no distinction between primary and secondary biomass in terms of sustainability. In fact, all five of the report’s win-win scenarios that benefit climate change mitigation and have a neutral or positive effect on biodiversity include the use of primary woody biomass. The risks associated with the remaining scenarios are all managed by REDII or by proposals for REDIII, in both the commission proposal and council’s general approach.

Woody biomass is already the most-regulated industry in the forestry and renewable energy sectors. A final agreement on REDIII will include additional provisions to ensure it continues to contribute positive outcomes for the climate and biodiversity. The greatest risk associated with sustainable woody biomass, at this moment, is that we fail to maximize its use and prevent the European Green Deal from moving from promise to reality. Trilogue negotiations over REDIII must avoid this outcome and ensure the use of sustainable woody biomass can continue to contribute to renewable targets in line with leading models, and provide energy security to Europe.

BIOMASSMAGAZINE.COM 9

Author: Christian Rakos President, World Bioenergy Association www.worldbioenergy.org

Biomass News Roundup

Vision RNG LLC announced a renewable natural gas (RNG) agreement with the Laurel Ridge Landfill in Corbin, Kentucky. Owned by Laurel Ridge Landfill LLC, a subsidiary of Waste Connections Inc., the project will use 1,800 cubic feet per minute of landfill gas (LFG) and construction is scheduled to be completed in the fourth quarter of 2024. The project will annually produce 450,000 MMBtu of RNG that will be injected into a nearby natural gas transmission pipeline. The RNG will be used by various customers across the U.S for transportation fuel and other sustainability purposes.

Énergir Development, a diversified energy business, and Nature Energy, a biogas plant owner/operator, are joining forces to jointly develop biomethanization plants in Quebec. Under the agreement, Énergir and Nature Energy will develop and implement up to 10 projects, producing up to 200 million cubic meters of RNG per year. The projects would supply one-third of Quebec’s 2030 RNG target.

The governments of Ontario and Canada are investing more than $11.3 million to expand CHAR Technologies’ High Temperature Pyrolysis facility in Thorold, Ontario, to produce RNG and biocarbon, creating the largest facility of its kind in Canada, and the only RNG facility in the country to exclusively use woody biomass. Joint funding is being made available through the Federal Economic Development Agency for Southern Ontario and the In-

vestments in Forest Industry Transformation Program, as well as Ontario’s Forest Sector Investment and Innovation Program. The new facility will produce 10,000 metric tons of biocarbon annually, and enough RNG to heat over 5,500 homes.

The USDA on Dec. 15 awarded $285 million to 844 projects under the Rural Energy for America Program. The agency also announced it is offering an additional $300 million in REAP funding, including $250 million allocated through the Inflation Reduction Act. Out of the project awardees, many bioenergy projects received funding, including four biogas/RNG projects.

New York-based East Branch RNG LLC was awarded a $249,000 grant to support the purchase and installation of a biogas plant that will produce RNG from dairy manure.

Indiana-based Biotown Biogas LLC was awarded a $249,999 grant to support a project to collect and clean methane gas from dairy waste and install a compressor system to generate RNG for sale into the transportation market.

Aemetis Biogas LLC was awarded a $25 million loan to provide long-term financing for the construction of six anaerobic digesters and associated pipelines as part of the Aemetis biogas project in California.

Fiscalini Alpha LLC, a cheese company located in California, was awarded a $249,900 grant to help offset the costs associated with installing anaerobic digesters to produce biogas.

1.4

10 BIOMASS MAGAZINE | ISSUE 1, 2023

Clean Energy Fuels Corp., the largest provider of clean fuel for the transportation market, announced the opening of an RNG fueling station that will provide an anticipated

million gallons of the fuel annually for Amazon and other truck fleets in the greater Chicago area. Located in Romeoville, the station is part of an agreement between Clean Energy and Amazon for Clean Energy to build 19 stations nationwide. The station initially will fuel more than 100 Amazon trucks and is designed with sufficient fueling capacity to accommodate several hundred more trucks.

IMAGE: CLEAN ENERGY FUELS CORP.

Topsoe, a global leader in carbon emission reduction technologies, announced its involvement as a partner in Europe’s largest green fuel project for shipping, FlagshipONE. The news follows a final investment decision by the project owner, Danish energy company Ørsted. Topsoe will provide engineering, procurement and fabrication for the project’s eMethanol technology. The plant will be built in northern Sweden and is expected to be operational in 2025, producing approximately 50,000 tons per year of eMethanol from renewable energy and biogenic CO2

In early December, the U.S. EPA released a final rule to create canola oil fuel pathways under the Renewable Fuel Standard for renewable diesel, jet fuel, naphtha, liquified petroleum gas (LPG) and heating oil produced via a hydrotreating process.

In the rule, the EPA said these fuel pathways meet the lifecycle greenhouse gas (GHG) emission reduction threshold of 50% required to generate D4 biomass-based diesel and D5 advanced biofuel renewable identification numbers (RINs) under the RFS. Based on that determination, the agency is adding the canola oil fuel pathways to the list of approved pathways in the RFS regulations. Under the rule, renewable diesel, jet fuel and heating oil produced with canola are eligible to generate D4 RINs if they are produced through a hydrotreating process that does not coprocess renewable biomass and petroleum, and for D5 RINs if they are produced through a process that does coprocess renewable biomass and petroleum. Naphtha and LPG production from canola oil using a hydrotreating process are also eligible to generate D5 RINs.

The U.S. EPA has approved a fuel pathway that allows Chevron U.S.A. Inc. to generate D6 RINs under the Renewable Fuel Standard for several biofuels produced from soybean oil via coprocessing with petroleum at its refinery in El Segundo, California (Chevron El Segundo Soy FFC Pathways). Chevron’s petition, filed in September 2020, originally sought approval for a D5 advanced biofuel pathway. Work by the agency to consider the D5 pathway continues.

According to documents released by the EPA, Chevron petitioned the agency to approve a facility-specific pathway for the generation of D5 RINs for renewable gasoline, renewable gasoline blendstock, renewable jet fuel and nonester renewable diesel fuel produced from soybean oil through coprocessing with petroleum feedstocks in the fluid catalytic cracking (FCC) unit of the El Senundo refinery. Based on its assessment, the EPA said that renewable gasoline, renewable gasoline blendstock, renewable jet fuel, and renewable diesel produced through the Chevron Segundo Soy FCC Pathways qualify to generate D6 RINs, provided Chevron adheres to conditions specified by the agency, and that the fuel meets other definitional and RIN generation requirements for renewable fuel specified by the RFS regulations.

Fulcrum BioEnergy Inc. announced that it has successfully produced a low-carbon synthetic crude oil using landfill waste as feedstock at its Sierra BioFuels Plant near Reno, Nevada, which the company believes is the world’s first commercial-scale landfill waste-to-fuels plant. Fulcrum said it is making progress on its planned growth program, which it expects will have the capacity to produce approximately 400 million gallons of net-zero carbon transportation fuel annually. The company’s development program includes the Centerpoint BioFuels Plant in Gary, Indiana, the Trinity Fuels Plant in the Texas Gulf Coast region, and the NorthPoint project in the United Kingdom.

BIOMASSMAGAZINE.COM 11 BIOMASS NEWS ROUNDUP ¦

IMAGE: FULCRUM BIOENERGY INC.

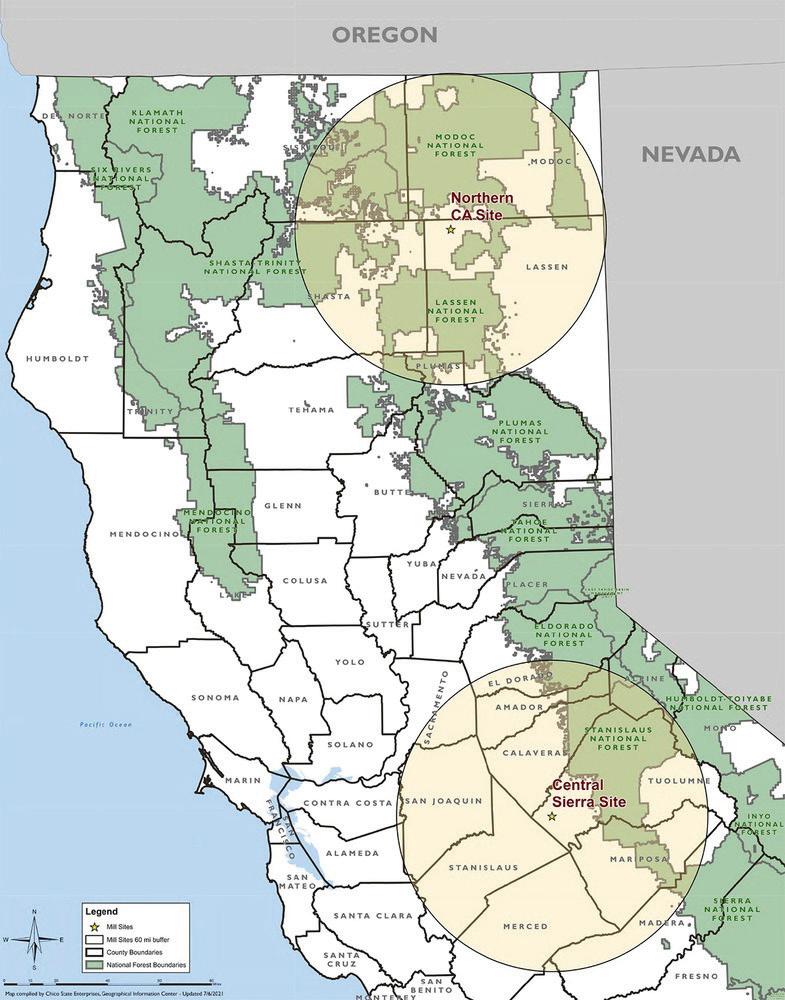

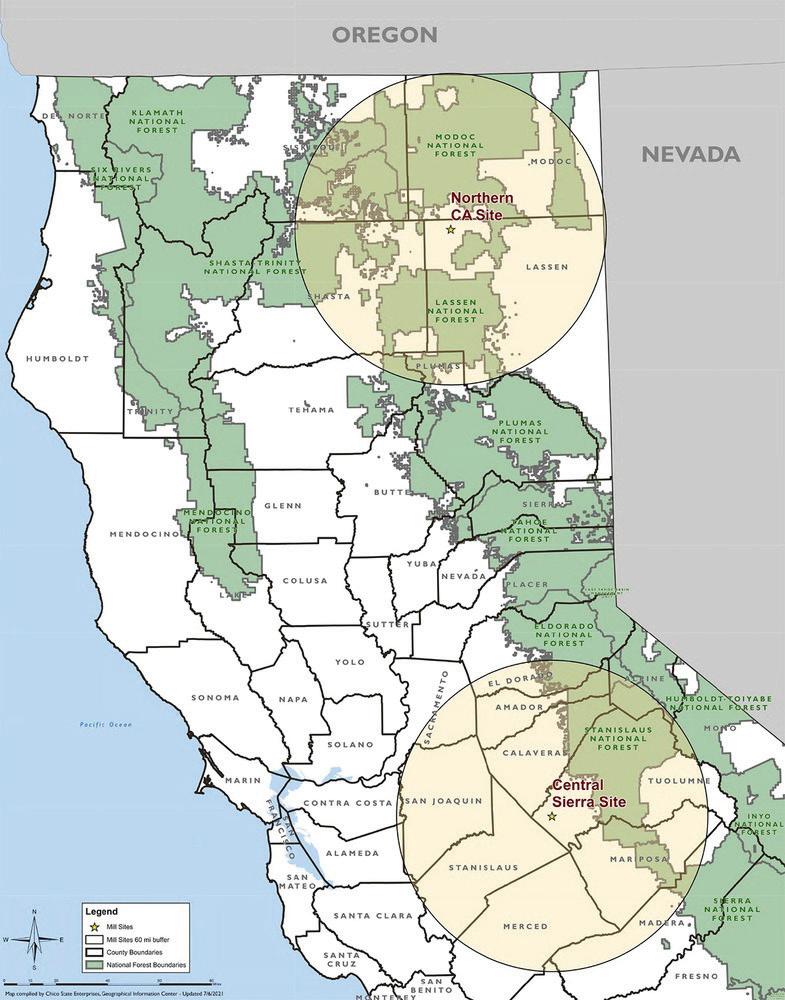

Golden State Natural Resources, a California-based nonprofit public benefit corporation, is developing two industrial wood pellet projects within the state as part of its effort to increase forest resiliency and reduce the risk of catastrophic forest fires. GSNR has purchased sites in Tuolumne County and Lassen County. The planned capacity of the Tuolumne site is 300,000 tons per year,

with the Lassen site expected to produce 700,000 tons per year. Wood pellets produced at the proposed plants will be railed to port for export.

GSNR President and CEO Greg Norton discussed the project during a virtual public scoping meeting held Dec. 6. Norton said GSFA is currently targeting the summer of 2023 for completion of the environmental impact report certification and financial close for the projects. Construction of the pellet plants would begin soon after, with completion currently expected in November 2024. The plants could begin commissioning in January 2025. In-forest work is expected to begin in mid-2023, allowing the company to build an inventory of biomass feedstock.

A proposed wood pellet plant in Vermont has been awarded funding by the USDA’s Rural Energy for American Program. PK Wood Pellet LLC was awarded $450,000 in grant funding to support the purchase and installation of equipment necessary to start a new wood pellet production facility. The facility is expected to have the capacity to produce 30,000 tons of pellets annually.

Enviva held a ceremonial ribbon cutting at its recently opened marine export terminal at the Port of Pascagoula, Mississippi. Enviva owns and operates the deep-water marine terminal in the Bayou Casotte Harbor in Jackson County in partnership with Jackson County Port Authority. Since 2019, the Port Authority and Enviva have invested over $90 million to build the terminal, which can receive product by rail, barge and truck as well as support Panamax-sized vessels. The facility includes two wood pellet storage domes with a total storage capacity of 90,000 metric tons. Enviva plans to export wood pellets from the now fully operational Port of Pascagoula terminal to power and utility customers across Asia, Europe and the Caribbean, with a majority of the terminal’s future shipments slated for Japan.

12 BIOMASS MAGAZINE | ISSUE 1, 2023

BIOMASS NEWS ROUNDUP ¦

IMAGE: GOLDEN STATE NATURAL RESOURCES

The U.K. government on Dec. 13 announced £25 million ($29.9 million) in funding to support technologies that can produce hydrogen from sustainable biomass and waste while removing carbon dioxide from the atmosphere. The funding is being offered as part of the U.K.’s effort to support clean energy production and mitigate high energy prices caused by Russia’s invasion of Ukraine, and aims to accelerate the deployment of hydrogen from bioenergy with carbon capture and storage (BECSS). The U.K. Department of Business and Industrial Strategy said hydrogen BECSS technologies are expected to play a key role in meeting the country’s net-zero emissions goal. The announced funding will go directly toward progressing BECCS projects from the design stage to demonstration.

Renewables are expected to account for 22% of U.S. electricity generation in 2022, increasing to 24% in 2023, according to the U.S. Energy Information Administration’s latest Short-Term Energy Outlook, released Dec. 6. Renewables accounted for 20% of electricity generation in 2021. The electric power sector is expected to have 5,994 MW of biomass power in place by the end of this year, including 3,560 MW of waste biomass capacity and 2,435 MW of wood biomass capacity. Biomass capacity is expected to expand to 6,009 MW by the end of next year, including 3,590 MW of waste biomass capacity and 2,419 MW of wood biomass capacity.

The owner of eight biomass power plants in the Northeast U.S. has filed for bankruptcy, according to court documents. On Sept. 15, Stored Solar Enterprises filed for Chapter 11 in the District of Maine, reporting assets of $50 to $100 million, and liabilities of $10 million to $50 million. The plants listed in the filing, located in Maine, Massachusetts and New Hampshire, were sold through a court agreement to Hartree Partners, a global merchant commodities firm specializing in energy, one of the company’s

largest creditors. The bankruptcy did not include Ryegate Power Station in Vermont. Local news outlets report plans are to resume operations at the plants in 2023.

Among the 844 projects awarded a collective $285 million through the USDA Rural Energy for America Program, several biomass heat and power projects were awarded funding. These projects include:

-Milligan Farms LLC, located in Michigan, will receive $98,529 in grant funding to support the purchase and installation of a biomass burner to replace a propane-fueled grain dryer.

-In New Hampshire, Berger’s Springledge Nursery and Produce was awarded $94,979 in grant funding to support the purchase and installation of a solar array and wood chip boiler system. The biomass boiler is expected to offset the use of 7,900 gallons of No. 2 fuel oil per year.

-Tennessee-based New River Hardwoods Inc. was awarded $250,000 in grant funding. The grant will, in part, support the installation of a biomass boiler system used for curing operations.

-A $20,000 grant awarded to Erik’s LLC DBA Mill Creek Gardens LLC will support the installation of a biomass boiler. The system is expected to reduce both electricity and natural gas use by the company.

The Biomass Power Association on Dec. 22 commended Congress for passing two bills that recognize the benefits of biomass as a source of renewable electricity. The National Defense Appropriations Act of 2023 contains language requiring the U.S. Department of Defense to consider biomass a “renewable energy source,” and the Omnibus Appropriations bill contains a provision directing the federal government to recognize the carbon benefits of biomass.

GUAR ANTEED TO PERFORM ENGINEERED TO

BIOMASSMAGAZINE.COM 13

ROUNDUP ¦

LAST MATERIAL HANDLING SOL U TION S See Us at Booth 52 2 at International Biomass BIOMASS NEWS

PODCAST PREVIEW PLAY WITH ANDREW WHITE, CHAR TECHNOLOGIES

Biomass Magazine’s final guest of its inaugural podcast season was Andrew White, CEO of CHAR Technologies. He describes the company as the result of “a eureka moment in the lab.” White has two master’s degrees, won the IBK Capital Ivey Business Plan Competition, was named the OBBA’s Young Entrepreneur of the Year, and he led CHAR to be named one the CIX Top 20 Most Innovative Public Companies.

BMM: What’s the background of CHAR Technologies? What is your company all about?

White: High-temperature pyrolysis is inherently what we’re all about, which is heating material up in the absence of oxygen, at high temperatures—800 degrees Celsius, so about 1,500 or 1,600 degrees Fahrenheit—creating biochar and renewable gases … we’re able to capture things like green hydrogen or renewable natural gas (RNG) from the process. The company was founded based on research I was doing at University of Toronto when I was finishing my master’s in chemical engineering back in 2010. I wrote my thesis on converting a very specific feedstock—digestate, the compost that comes out of an anaerobic digester—into activated carbon, and then cleaning the biogas that comes out of that digester, so a real focus on the circularity of using this low-value residual to make a higher-value product ... We launched the company in 2011, got our first round of funding in 2013, and by 2018, we had built our first facility in London, Ontario, taking digestate and creating

an activated carbon we called SulfaCHAR. Around the same time, we started looking at other feedstocks like wood residuals, pallets, wood chips, bark and saw dust, different nut shells, miscanthus—a whole host of different fun materials, and ran them through the system to find out what kind of biocarbons and gasses we could make. So, our plant always makes those two outputs—gasses and biocarbons. Generally, we categorize the biocarbons as biocoal, so for us that means a metallurgical coal replacement that is very fine quality and high-spec …we’re generally focused on steelmaking replacing fossil coal … [and] the cork market has become quite an attractive area for biocarbon production.

BMM: Recently, the government of Canada invested $1.5 million to support your Therold, Ontario, RNG and biocarbon project. What are the details? Is it under construction yet?

White: It is, and we’ve actually hit a reasonably major milestone in phase one of the project, which is moving our existing facility from London to Thorold [Ontario], so that we’re in one location. We had fantastic hosts at the site we were on, but we were in a relatively tight envelope—we had a 2,500-square-foot building with a little space around it. We’re now in a 17,000-square-foot building and have about 50,000 square feet of space around it. It’s actually pretty cool, a former pulp and paper plant, and we’re going into biomass processing—making biocarbon and renewable gasses instead of paper—but we’re kind of reusing this facility that has always processed wood in one way or another. When our plant moved, the capacity of the system was around 1,000 to 2,000 tons a year of biocarbon. That’s enough for trials, but we really want more production, so phase two of the project will be expanding

14 BIOMASS MAGAZINE | ISSUE 1, 2023

Y

WHITE

capacity, building larger processing kilns—that’s what we call our pyrolysis units—and getting our production up to about 12,000 tons a year of biocarbon. Simultaneously, we’ll be adding the RNG component, and once fully commissioned, we expect the plant to be producing about 5,000 gigajoules a year of RNG. Listen to the rest of the podcast:

BIOMASSMAGAZINE.COM 15 PODCAST PREVIEW ¦

podcasts: S01 E12 Surveying Momentum in the Biomass Economy Featuring Ben Hubbard, CEO of Nexus PMG UPCOMING S02 E1 Josiah Hunt, Pacific Biochar S02 E2 Cody Myers, Green Rock Energy Partners Interested in being a guest? Contact Danielle Piekarski at dpiekarski@bbiinternational.com

Don't Miss an Episode: Biomass Magazine’s recent

our

www.biomassmagazine.com/pages/podcasts

A FOOT IN THE DOOR

After a decade-plus pursuit, some biomass-based power generators will have the opportunity to participate in the federal Renewable Fuel Standard program.

BY ANNA SIMET

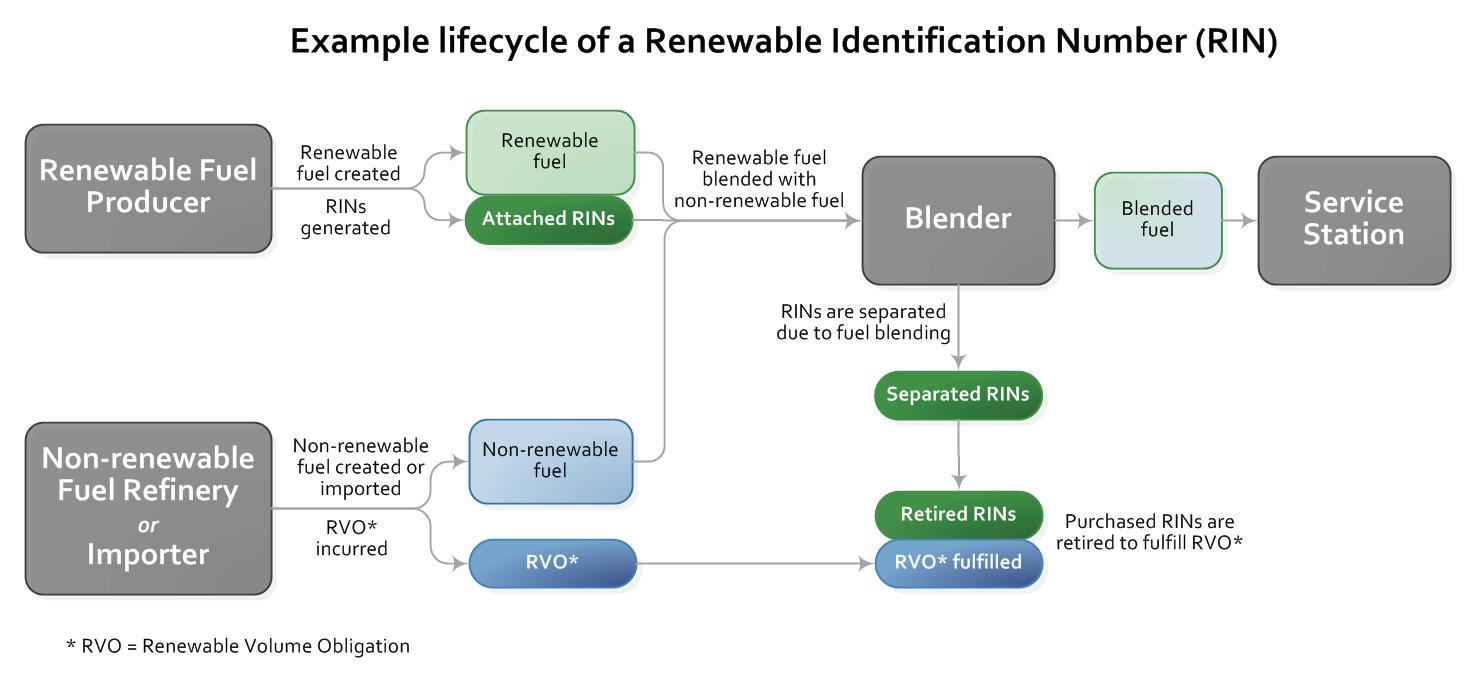

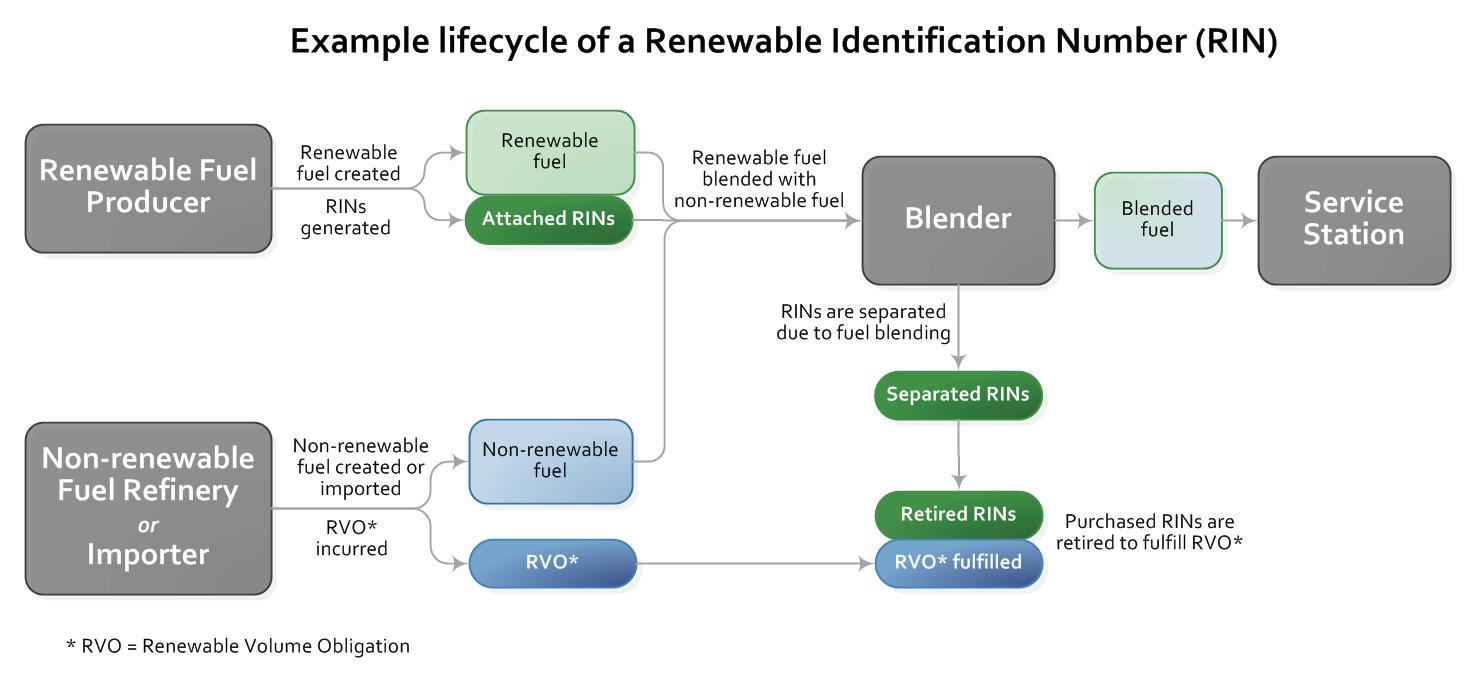

The RFS Power Coalition has been pursuing inclusion of biomass-based power in the federal Renewable Fuel Standard for longer than a decade. The RFS, created under the Energy Policy Act of 2005 and expanded under the Energy Independence and Security Act of 2007, requires an in-

creasing volume of renewable fuel to replace oil-based transportation, heating or jet fuel. Obligated parties, which include refiners or importers of gasoline or diesel fuel, achieve compliance by blending renewable fuels into transportation fuel, or obtaining renewable identification numbers (RINs), which are the credits, or currency,

used for compliance. RINs are generated by submitting detailed feedstock and process information, among other requirements, and receiving pathway or process approval by the U.S. EPA.

Each year, the EPA sets renewable volume obligations (RVOs) for the following year, including quantities of cellulosic bio-

16 BIOMASS MAGAZINE | ISSUE 1, 2023 ¦ POLICY

fuel, biomass-based diesel, advanced biofuel and total renewable fuel. Each fuel falls under a RIN pool, from D3 to D7, based on the feedstock used, fuel produced, energy input, GHG reduction thresholds and other criteria. Despite a provision in the 2007 statute that that nonliquid fuels—renewable electricity from biomass or renewable

natural gas (RNG), for example—could be deemed as electric vehicle transportation fuels if properly demonstrated, the electricity component has never been acted upon. That is, until now. More than a decade after the pursuit began, the RFS Power Coalition has a foot in the door. The EPA released its proposed “set” rule on Dec. 1, setting

the 2023, 2024 and 2025 RVOs, and including long-awaited regulatory provisions to allow RINs to be generated for renewable electricity used to fuel vehicles, or eRINs, the first major progress in implementing an extremely complex facet of the RFS.

In mid-December, the coalition held a webinar featuring Bob Cleaves, attorney

BIOMASSMAGAZINE.COM 17

and president of the Biomass Power Association, who guided attendees through an analysis of the proposed set rule’s eRIN provisions. Cleaves, who has spearheaded the effort, began by explaining that though a lawsuit against the EPA a few years ago was not successful, ultimately, the campaign and efforts at the congressional and federal

levels led to this development. “While this rule is focused on RNG and biogas in the near-term, what we’re really focused on is the fact that EPA has already begun to review pathway petitions for our industry, for the use of our fuels to make electricity,” he says. “EPA does not give our [industry’s] potential to contribute enough credit in this

proposed RSF rule …” While the proposal is limited to biogas, Cleaves says, in the regulatory impact analysis, EPA does recognize that nonbiogas potential, such as wood and the biogenic portion of MSW, is significant.

When the RFS was originally enacted, the levels were fundamentally set by Congress until 2022. “But post-2022, it is en-

18 BIOMASS MAGAZINE | ISSUE 1, 2023 ¦ POLICY

DON’T LET THIS HAPPEN TO YOUR FACILITY Combustible dust can cause personnel injuries, equipment & plant damage. Spark & embers from dryers, hammer mills, pelletizers & coolers can cause cascading dust fires & explosions GreCon Spark Detection & Extinguishing Systems are a preventative measure against fire or dust explosions by detecting and extinguishing sparks & embers in processing and conveying equipment without production interruption. Reduce Your Risk • Improve Productivity • Meet Regulations Let us tailor a system for you. Call today 704-912-000 www.fagus-grecon.us SOURCE: U.S. EPA

tirely within the EPA’s discretion as to how to set those volumes moving forward,” Cleaves says. “And it’s important to note that the RFS does not sunset—it’s not a statute, it’s not like the production tax credit or other federal incentives that have an end date. There is no end date to the RFS, and that’s a really important consideration.”

In the proposed rule preamble, the EPA says that “The RFS program is entering a new phase, and we are introducing a new regulatory program governing renewable electricity.”

Cleaves says it is a sweeping change, particularly as it relates to cellulosic biofuels. “It’s a long time coming … [the RFS] is very complicated and we’ve been involved in suggesting a number of different ways in which they could implement this program … I think the agency has done a very good job with the architecture of the program.”

The 2023, 2024 and 2025 RVOs are in the proposed set rule, a deviation from the single-year projections as has been done in the past. “EPA decided to do a threeyear projection to create additional market certainty,” Cleaves says. “Essentially, the volumes go from a modest 720 million gallons—which is entirely non-eRINs, it’s RNG to CNG and LNG—and then dra-

Proposed Volume Targets for Cellulosic Including RNG and Renewable Electricity (million RINs)

2023 2024 2025

Liquid Cellulosic 0 3 6 CNG/LNG biogas 719 814 921 eRINs 0 600 1,200

Totals 719 1,417 2,126

SOURCE: U.S. EPA

matically increases in 2025 and 2026 (to 1.42 billion gallons and 2.13 billion gallons, respectively), even though EPA isn’t formally setting a target for 2026.”

Cleaves points out that liquid cellulosic biofuel from wood has never taken off, and that RNG, CNG and LNG are meeting about 95% of the D3 RIN category. “That modestly increases over the three-year period, but the real action is eRINs,” he says. There is a dramatic ramp up from 2025 and beyond.”

Currently, EPA has set eRINs at 600 million in 2024, doubling to 1.2 billion in 2025.

Cleaves says BPA has not yet done a thorough analysis, but he believes that fairly quickly after 2025, the nation will run out

of biogas-to-electricity sources, and that’s when the opportunity for nonbiogas, biomass-based electricity will come into play. “A number of our members have received pathway application completeness determination by the EPA, which from my standpoint means that EPA is acknowledging that our types of electricity qualify under the RFS and the eRIN program, provided that the lifecycle analysis proves out. We have a lot of confidence that’s going to happen.”

Uncertainties

From Cleaves’ perspective, a critical issue regarding the rule—one that the EPA seems to acknowledge—is uncertainty regarding whether projected demand

BIOMASSMAGAZINE.COM 19

Proposed Volume Targets (billion RINs*)

2023 2024 2025

Cellulosic biofuel 0.72 1.42 2.13

Biomass-based diesel 2.82 2.89 2.95

Advanced biofuel 5.82 6.62 7.43

Renewable fuel 20.82 21.87 22.68

Supplemental standard .25 n/a n/a

for EVs exceeds the currents supply, and how and when nonbiogas feedstock sources used to make electricity will help satisfy that demand. “It’s unlike ethanol, where if you produce a gallon, you qualify under the RFS—you don’t have to prove that’s used for transportation,” he says. Rather, eRINs are to be based on the number of EVs deployed, instead of the amount of renewable electricity that could be theoretically matched with EVs. “We, as an industry, are really beholding to the projected demand for EVs, which I think has made the EPA’s job particularly challenging,” Cleaves says, adding that many groups release annual projection reports for EV uptake, but they’re typically inaccurate due to market factors that are impossible to predict.

The EPA is also cognizant of uncertainties related to how quickly electricity generators and original equipment manufacturers (OEMs) will be able to complete the necessary steps to register. “This is an administrative burden that I think is very significant for the agency and market participants—the overall rate of participation and registration,” Cleaves says. “Importantly, I think EPA is saying ‘If we get it wrong, we’ll consider adjusting it,’ and I think it’s highly likely EPA will get it wrong … we need to figure out how the agency can make a mid-course correction. This will be a focus of our comments on the proposed rule.”

Program Structure

In the case of eRINs, OEMs—the auto manufacturers such as Tesla, General Motors, Ford—are the RIN generators, and can do so based on light duty EVs through established contracts with parties who produce renewable electricity from qualifying biogas sources. “The qualifying electricity produced—put on a commercial electric grid serving the conterminous U.S.—is contracted for eRIN generation, so long as the OEM demonstrates that the vehicles it produces have used a corresponding quantity of electricity,” Cleaves says. “The requirements for biogas generation and electricity producers are in the proposed rule, but only the OEM is allowed to generate the RIN … in this rule, electricity generated from solar, wind and hydropower do not quality under the RFS, because the program is only focused on renewable biomass.”

As for the disposition chain, the concept was introduced in 2014, when the EPA began approving RINs for RNG through contracts and affidavits. In order for a fuel to quality for RINs, there must be proof or demonstration that it’s used for transportation. “The EPA has done this by matching contracts and affidavits—the amount of RNG generated with the amount of gas that’s consumed,” Cleaves says. “They’ll generally follow the same approach with eRINs, but it’s a little more complicated.”

The reason for that is it’s physically impossible to distinguish renewable from nonrenewable electricity when it’s put onto the grid, according to Cleaves. “So, EPA is saying there has to be an accounting or records management system.”

The only parties that ultimately matter for eRIN creation are the generator and the OEM, Cleaves emphasizes. “The generator is in the best position for certifying the amount of electricity put on the grid—through revenue-grade meters—and certifying that the fuels they’re using are compliant with the RFS. The OEM is in the best position to calculate how much electricity is consumed by the fleets they sell in the U.S. Those two pieces of data need to be matched, and that’s essentially how the program works.”

U.S. EPA

Many more details regarding how OEMS will calculate EV RINs are included in the proposed rule, as well as details of recording, recordkeeping and the contract-based structure with electricity generators, or RIN generation agreements, and “a comprehensive set of regulatory requirements,” Cleaves says. He notes that though

20 BIOMASS MAGAZINE | ISSUE 1, 2023 ¦ POLICY

‘The RFS program is entering a new phase, and we are introducing a new regulatory program governing renewable electricity.’

U.S. EPA

SOURCE:

OEMs generate the RINs, they will not be the sole proceed earner. “EPA expects the parties [OEMs and generators] to share revenue through contracts outside of the EPA’s regulatory regime,” he says. “An interesting feature is that EPA is indicating that because of energy losses and charging efficiencies, OEMs need to contract 24.2% more electricity than what is actually consumed in the fleet.”

The EPA estimates there are roughly 500 landfill-to-electricity and 200 digester-to-electricity projects in the U.S., many of which are small and will have third-party burdens to participate in the program, Cleaves notes. “These onboard challenges in 2024 and 2025 are significant, to say the least,” he says, reiterating that the program has many complexities, but EPA has done a good job to try to minimize them.

Looking Ahead

While Jan. 1., 2024, is the program start date, OEMs will be permitted to generate eRINs for renewable electricity produced from Jan. 1 through April 1 without an EPA-accepted registration, provided certain conditions are met.

In the meantime, Cleaves says the BPA will be following a number of topics, including whether projected EV numbers are realistic. “This will impact not only us, but the biogas industry,” he says. “If you’re facing the decision of taking out a genset and putting in an RNG system, are you going to do that now, given this eRIN program? If you have mothballed a biomass plant, will it be worth reopening—if not in 2024 or 2025, what about in 2026 or 2027?”

Another issue is that the rule is very narrowly focused on biogas, with no timeline for integration of other sources of renewable biomass-based electricity. “Based on our interactions with the EPA and the fact that we already have three facilities listed on the EPA’s pathway website, we do know that nonbiogas sources of electricity

will be an important part of the eRIN future,” Cleaves says. “We hoped EPA would recognize that in the draft rule … you really can’t tell a complete story without talking about nonbiogas sources. A really important question for us—and we don’t have many answers right now—is how quickly will EPA act on nonbiogas pathways?”

Cleaves says it’s understandable why the program is designed for OEMs to play the

role they have been given. “But has the EPA gone a little too far in giving them market power over the program?” he adds. “I think time will tell.”

The proposed rule is due to be finalized by June 14.

Author: Anna Simet asimet@bbiinternational.com

BIOMASSMAGAZINE.COM 21

50 YEARS Rotary Dryers Sand Dryers Grain Dryers Lumber Kilns Cement Kilns Brick Kilns

A POWERFUL COMMUNITY PARTNER

BY KEITH LORIA

Since the mid-1800s, the economy of Berlin, New Hampshire, known as “The City that Trees Built,” revolved around the paper mill located in the heart of the city. Therefore, it was a devastating blow when the Fraser Paper pulp mill closed in 2006, as the community of Berlin and the rest of the region were dependent on the mill as a critical employer. “In 2008, an opportunity arose to bring new life to the shuttered mill by converting its existing black liquor boiler into a state-of-the-art, 75-MW biomass power generating facility, and Burgess

22 BIOMASS MAGAZINE | ISSUE 1, 2023

Berlin, New Hampshire, is working with its local biomass plant on a project to make use of the facility’s abundant waste heat.

Burgess BioPower receives wood chips from more than 150 suppliers in the surrounding communities.

IMAGE: BURGESS BIOPOWER

BioPower was born,” says Sarah Boone, vice president of public affairs for Burgess BioPower. “Today, Burgess BioPower delivers 500,000 megawatt hours of local, clean and reliable power to New Hampshire annually, along with acting as an economic driver in the state’s North Country and beyond.”

The site that Burgess sits on is a 65acre parcel of land, half of which housed the prior pulp mill when it was in operation. Over the past decade, the facility has estab-

lished itself as one of the most technologically advanced biomass plants in the country, representing a $275 million investment that received enthusiastic support from the state of New Hampshire, local governments and businesses when it began development. The project completed construction in 2013, and has been in commercial operation since 2014. “Annually, Burgess handles more than 800,000 tons of wood chips delivered from wood suppliers in 150plus New Hampshire communities,” Boone

says. “Unlike other renewable resources, Burgess is a baseload supplier, operating with over 90% availability and capacity.”

Burgess BioPower came to fruition because of the collaborative efforts of project developers, state and local officials, and Eversource (formerly Public Service of New Hampshire), all of whom recognized the state and the region needed local, renewable power sources. “New Hampshire is heavily dependent on natural gas, leaving the state vulnerable to extreme market conditions, constrained supply, and delivery challenges,” Boone says. “Creating renewable generation assets that utilize local resources and offer fuel diversity was a key priority for stakeholders.”

Not surprisingly, Burgess BioPower received widespread, enthusiastic support from the community as the plant worked through the proposal and approval process. Beyond its renewable power-generation benefits, local, state and regional stakeholders saw that Burgess BioPower would not only serve a critical need for renewable, price-stable baseload power, but also that it would play a crucial role in supporting the forest products industry, generating and sustaining jobs throughout the region.

Today, Burgess BioPower is the largest single buyer of biomass in the state. This provides critical financial support to regional foresters and sawmills, which is especially crucial in the wake of additional paper mill and power plant closures.

The Plant in Action

Burgess BioPower is the largest renewable energy generator in New England and the fourth largest power producer in New Hampshire. Beyond power production, the plant provides immense economic benefits for northern New Hampshire, supporting more than 240 jobs statewide and generating nearly $70 million in annual economic activity, according to a 2020 economic impact study.

“Burgess has generated more than $550 million in statewide economic activity in its operating history to date, and is projected to generate $1.38 billion over 20 years,” Boone

BIOMASSMAGAZINE.COM 23

DEVELOPMENT ¦

PROJECT

Burgess BioPower is located across the Androscoggin River from Berlin, New Hampshire.

IMAGE: BURGESS BIOPOWER

says. “Burgess provides diversity and security because it runs on locally sourced fuel and is not subject to the high variability of fossil fuel markets.”

Burgess operates under a 20-year power purchase agreement with Eversource, which provides much-needed, long-term price stability in an energy market that has seen dramatic fluctuations in recent years. “Since the start of commercial operation, Burgess has explored a number of colocation possibilities, including a greenhouse, data center and cryptocurrency mining operation, among others,” Boone says. Several years ago, there were attempts to utilize the waste heat from the plant, such as efforts that would see a four-acre hydroponic greenhouse that would produce more than a million pounds a year of baby leafy greens—but that project never materialized. “The greenhouse project began in late 2018 and advanced to the engineering stage, but ultimately did not come to fruition due to a combination of factors, including COVID-19, market limitations for the greenhouse company’s products, and legacy site issues,” Boone says.

However, Burgess continues to facilitate colocation opportunities and would welcome additional development on-site, according to Boone, and it’s believed that similar projects like this will be operational in the years to come. While none have come to fruition yet, a new project with the city is unfolding.

Big Project, Big Benefits

Last summer, the city of Berlin was awarded a $19 million grant through the Rebuilding American Infrastructure with Sustainability and Equity program through the U.S. Department of Transportation. The city will use the funding to construct and replace infrastructure in downtown Berlin to allow the city to use waste hot water from Burgess BioPower to melt snow and ice on city roads and sidewalks, similar to what the city of Holland, Michigan, did years ago and has since expanded.

Currently, Berlin’s Public Works Department is responsible for managing over 60 miles of paved streets, as well as sidewalks and several municipal parking lots. In the winter, this includes plowing roads and

snow removal, and when spring arrives, sand buildup from snow management must be removed from the downtown streets and sidewalks. Inaccessibility during the winter months leads to an estimated $900,000 in foregone revenue, thus making it very challenging to successfully keep a business open in the downtown area.

Pamela Laflamme, director of strategic initiatives and assistant city manager for the city of Berlin, notes the grant is part of a larger downtown reconstruction project, which will include reconstruction of streets, sidewalks, public parking, replacement of two box bridges, water and sewer infrastructure upgrades and the snowmelt infrastructure component. “This allows us both the opportunity to upgrade our aging downtown infrastructure and add in an innovative component that will save the city money in maintenance, provide economic opportunity, and allow our residents a place to walk during the winter without dealing with the issues of snow and ice,” she says.

Installing the heating system will allow the city to replace around two miles of roads

24 BIOMASS MAGAZINE | ISSUE 1, 2023

¦ PROJECT DEVELOPMENT

In July, Burgess BioPower made a payment of $523,000 to the city of Berlin, the first payment to the city from the facility’s sale of renewable energy certificates as outlined in a payment-in-lieu-oftaxes agreement. The plant contributes 12% of the city of Berlin’s tax revenue.

IMAGE BURGESS BIOPOWER

IMAGE BURGESS BIOPOWER

in the downtown area as well as a bridge in need of repair. Additionally, the city believes the partnership with the plant will be a good demonstration to attract other businesses that could use the remaining waste heat on the plant’s 60-acre property.

The way it will work, Boone explains, is flowing through a network of pipes, the waste hot water will be transported across the Androscoggin River beneath city streets, sidewalks and parking lots throughout the winter. “The expectation is that the project would reduce costs for the city, in terms of snow removal and treatment, while also serving as an economic driver for the downtown, drawing and inspiring businesses to relocate or expand in the downtown,” Boone says.

According to the grant application, the snow-melting system will use condenser water from Burgess BioPower, which will be circulated to the downtown area and then back to

the plant. This will effectively cool the water, as is needed by the power plant, while heating the downtown surfaces. Water will be pumped across the river through 24-inch, high-density polyethylene piping mains running on a reconstructed bridge. The piping will split into two mains, each with a supply and return line, traveling underneath two main streets to serve multiple snow-melting zones. These zones will consist of a wire mesh layer over crushed gravel, with the mesh affixed to one-inch-diameter loop tubing made of a crosslinked polyethylene material. The tubing will be installed in a compactable layer of sand, with pavers overtop.

In total, the city’s goal is to heat just over 380,000 square feet, which would only use around 8% of Burgess’s waste heat output.

As currently conceived, the city will fund, construct and own all project equipment, and Burgess will operate and maintain the pump house and

BIOMASSMAGAZINE.COM 25

equipment located adjacent to the Burgess plant. According to the project application, Burgess will provide its engineering resources to support detailed project design, specification and construction. This arrangement leverages the skill sets and primary focus of both entities.

The installation of the proposed snowmelt system and the associated useful thermal energy generation would qualify for thermal renewable energy certificates (T-RECs) under the state’s renewable portfolio standard, which requires load-serving entities to acquire renewable energy certificates from qualified generators equal to a set percentage of the load they serve. These credits are calculated based on megawatt-hours of useful thermal energy produced. T-RECs associated with the proposed project would be a result of both the snow-melt system itself and use of the building heating system. The city estimates the combined value of these credits is anticipated to be $550,000.00 annually.

On top of T-REC generation, preventing major revenue loss to inaccessible downtown businesses, and reducing expenses associated with snow and ice removal, there are even further benefits. These include reduction of property damage on vehicles and buildings due to elimination of salt and potholes, and reduced emissions associated with winter maintenance activities, including sand application and cleanup, all together totaling a discounted value of benefits around $18 million over the project term. Boone notes that Burgess is also working with the city of Berlin to assess the feasibility of expanding the system to include district heating, which could significantly reduce heating costs and fuel oil use for buildings connected to the system.

Saving the Day

When the pulp mill closed in 2006, Berlin struggled to hang on. The mill had been the primary employer in the community for decades and the impact of its closing was

Burgess is the largest single buyer of biomass in the state. The wood ash generated by the contribution process is used for agriculture, compost and public works projects.

IMAGE: BURGESS BIOPOWER

IMAGE: BURGESS BIOPOWER

immeasurable. Burgess BioPower was exactly what the community needed, serving as a critical economic driver, helping the city get back to a point where it could thrive. “Burgess BioPower’s impact on Berlin and northern New Hampshire was immediate,” Boone says. “The project created more than 500 construction jobs during the roughly 26-month construction schedule, and it has created and sustained hundreds of jobs within the region’s forestry industry.”

Further, she notes, Burgess is Berlin’s first real economic development success story in more than 40 years. After ranking No. 10 from 1991-2011, Coös County, in which Berlin is located, jumped to the fourth-highest annual growth rate among New Hampshire counties between 2014 and 2018, which coincided with Burgess’ start of operations. In terms of city services and budget, Burgess BioPower contributes 12% of the city of Berlin’s tax revenue; 25% of annual water fees, and 10% of annual sewer fees.

In the wake of economic turmoil, the successful development, construction and operation of Burges changed the outlook for Berlin and the surrounding community, Boone reiterates. “Burgess BioPower brought diversity and industry viability to an area that was once solely dependent on the pulp and paper industry,” she adds.

Contact: Anna Simet asimet@bbiinternational.com

26 BIOMASS MAGAZINE | ISSUE 1, 2023

¦ PROJECT DEVELOPMENT

THE NEW BIOCHARGER Eliminate Wood Waste. Generate Power. Charge Electric Vehicles. Air Burners BioCharger helps you eliminate massive piles of wood waste while generating power to charge your electric vehicles, equipment, and power tools. It closes the loop so you can work on or o -grid. The BioCharger is the direct result of a successful, strategic partnership with Volvo Construction Equipment and Rolls Royce to develop environmentally friendly, cost-e ective renewable energy solutions to fight climate change, improve business operations, and boost your bottom line Contact us for a quote today. 772.220.7303 Sales@AirBurners.com AirBurners.com No Grinding Required Clean, Fast Burns Produces Electric & Thermal Energy EV Battery Charging Station GRANTS AVAIL ABLE FOR MUNICIPALITIES Scan the QR code to learn more about our machines

INTRODUCING

FILLING THE GAP

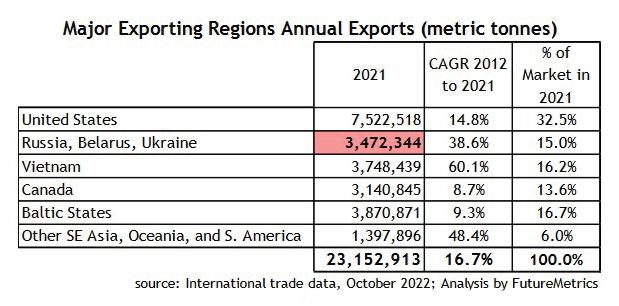

Nearly a year after the Russian invasion of Ukraine, Biomass Magazine examines the impact this event has had on global pellet markets, particularly in Europe.

BY KATIE SCHROEDER

BY KATIE SCHROEDER

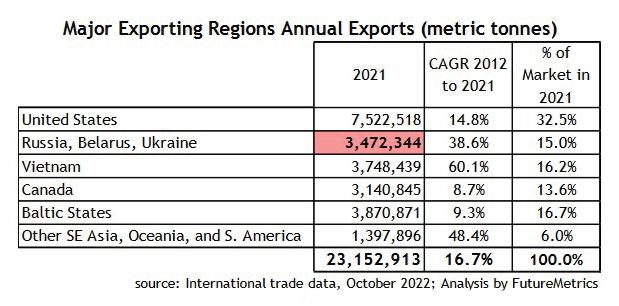

In March 2022, Russia invaded Ukraine, leading to economic and social turmoil throughout Ukraine and across the continent. Many nations in western Europe and across the globe reacted with economic sanctions against Russia, in order to demonstrate their support of Ukraine and admonishment of the attack. While necessary, sanctions have had a major impact on the European economy, including the pellet market. In December, Biomass Magazine checked back in with industry experts on the impacts Russia’s invasion has had on the industry over the past year.

Russia being banned from the market left a 2.5 million to 3-million-metric-ton shortfall, says Tim Portz, executive director of the Pellet Fuels Institute. A few of his members, which include domestic heating pellet manufacturers and other stakeholders across the U.S., have been able to overcome the challenges of exporting overseas, and—at least temporarily—participate in the market. Since last February, the pellet industry has been bracing itself for the worst-case scenario, strategizing to avoid a pellet shortage. “Back to February, European pellet interest started raising concern, because whether it’s in Europe or the U.S., the very worst thing for the pellet industry is to not be able to supply the fuel,” Portz says. “No one wants that. People don’t want that here; people don’t want that in Europe … it gives people a bad feeling about wood pellets. We want people have a good feeling and surety of supply.”

High demand for wood pellets—stemming from a combination of the Russian market exclusion and other sanctions—has pushed prices

28 BIOMASS MAGAZINE | ISSUE 1, 2023 ¦ MARKETS

BIOMASSMAGAZINE.COM 29

up drastically, explains William Strauss, president of consultancy firm FutureMetrics. Also catalyzing greater demand is the increase in sales of pellet stoves and boilers throughout Europe, very likely a result of high natural gas prices. Strauss says prices have reached up to over 800 euros ($846) per ton, with a long-term average of between 200 and 220 euros. Prices shifted downward in late November and early December due to warmer-than-normal autumn temperatures, allowing industrial pellet producers to scale back on the quantity of pellets sent to some larger buyers—for example, MGT Teeside and Lynemouth Power Station, both of which are located in the United Kingdom. When operating at capacity, these plants utilize over one million tons of pellets annually. Instead, the pellets unneeded by these operations are flowing into the western European market, helping alleviate the shortage, Strauss explains.

The United Kingdom was one of the countries hardest hit by the loss of Russian pellets, according to Matthew Goodwin, general secretary and standards manager with the U.K. Pellet Council and director of the European Pellet Council. Prior to the invasion, half of the U.K.’s pellet supply was produced locally, while the other half was imported. Approximately 80% of those imports were sourced from Russia, Ukraine or

Belarus, a total of 240,000 metric tons. “In the space of one day, we lost 240,000 tons of imports, which, for the U.K. in particular, was a really big issue,” Goodwin says.

In response to the Russian and Belarusian pellet import bar, producers in the U.K. increased pellet production by 5% to 10%. Though not a substantial amount, Goodwin says, that increase and maximization of uptime has helped fill the gap. ENplus pellets from Brazil have also contributed, and another tactic that Goodwin and his colleagues worked on with the U.K. government was a one-year waive of the ENplus certification requirement on wood pellets, which has allowed the sourcing of heating pellets from North America, which are A1 quality but not ENplus certified. With some screening, the market has also been able to use tens of thousands of tons in industrial pellets from Drax. “North America has some great-quality pellets, but there are very few ENplus-certified companies,” Goodwin says. “So, we’ve been able to bring in PFI-certified pellets or even just A1 grade pellets without any certification—as long as we can prove sustainability, then we can use them in the U.K.”

Goodwin explains that the U.K. government was very proactive in working with the U.K. Pellet Council to change the requirements and help compensate for the

shortage. Wholesale prices came down from $450 to $350 in late November and early December. “That was a big win with the change of policy that came at a perfect timing,” Goodwin says. “But at the moment, in the U.K., I can’t say we will not have any shortages—it’s very cold here now, and in a month’s time, I might be saying something completely different.”

Portz reaffirms this, explaining that the unknown of how intense the winter will be has made it difficult for suppliers in the U.S. to know whether or not to take the opportunity of selling to the European markets. The economics of exporting for U.S. pellet producers may not work very well for those without ocean-bound access, due to shifting prices and demand. “If all the sudden, the bottom drops out of the thermostat in Europe, everything could change, and in a hurry,” Portz says. “Pellet sales tend to be very fickle, and a cold snap will really excite consumers to action.”

There are several factors that lead U.S. producers to view the European markets as either a risk or an opportunity, Portz says. Some producers don’t want to risk not being able to supply long-time customers by diverting some of their supply to a different market. “You have some producers who say, ‘I do not want to sit on this inventory, it was slow-moving, it didn’t move last year, I’m going to take an opportunity and I’ll take the risk of having to disappoint my domestic retailers,’” Portz says. “And again, other people have decided that they don’t want to do that. Who ends up being right or wrong is yet to be determined, and everything that influences wood pellet production—the strength of the year, our ability to get fuel to everybody who wants it, etcetera—all of it hinges on weather.”

It can be difficult for pellet producers to walk the tightrope of having an adequate supply, but not so much that they are left with considerable inventory post-season. “In the past three years, U.S. sales have

30 BIOMASS MAGAZINE | ISSUE 1, 2023

¦ MARKETS

Under the Radar

In December, the Organized Crime and Corruption Reporting Project published a report indicating some traders are evading European Union sanctions on Russian and Belarusian wood and wood pellets, claiming they are coming from Central Asia. “On paper, the EU’s imports of wood from the two Central Asian states have surged from around 445,000 euros’ worth in 2020 and 2021, to over 30 million euros between June and October 2022 alone, after the sanctions started to be enforced,” the report says. “Yet Kazakhstan and Kyrgyzstan have few forests—trees cover less than 6% of their terrain—and both stopped exporting most types of wood in late 2021.” The report, part of which focuses specifically on wood pellets, can be accessed at iccrp.org

ranged anywhere from 1.75 million to 2.2 million—that’s coming up on 500,000 tons, which is in the neighborhood of 25%,” Portz says. “Not many products have demand cycles that are that variable—I would say heating fuel is one of the most variable products out there.”

For U.K. producers, the shortage caused by the removal of Russian pellets from the market has led to a “rebalancing of the industry,” Goodwin explains. Prior to the shortage, the pellet industry was barely profitable for some time, with many companies consolidating, players coming and going, and U.K. pellets being undercut by cheap Russian pellets. “In the U.K., we’ve actually grown over this period—we now have more members for the first time [in] a long time,” he says. “And I think the prices are not going to go back to where they were.” Due to the state of the energy market and the fact that the Russian pellet industry is unlikely to reenter the pellet market for a while—if at all—Goodwin believes now is the best time for people to invest in pellets. “I think once we get past the blip at the moment, pellets are going to be very competitive in the long term, and I think that should give people confidence to invest in producing pellets. It’s very much what we, as the British Pellet Association, want to promote—localized production, because it makes sense,” he says.

Author:

Katie Schroeder Staff Writer, Biomass Magazine katie.schroeder@bbiinternational.com

BIOMASSMAGAZINE.COM 31

BIOENERGY PROJECT DEVELOPMENT:

SOMETIMES, IT’S OKAY TO TEACH TO THE TEST

BY TED NIBLOCK

The development of bioenergy projects is so variable and filled with uncertainty that it’s easy to give up on any kind of organization or structure in the process. It takes very little time to learn the key elements of a successfully developed project, but a staggering amount of work to check all the boxes.

Since a decent project opportunity begins with a few key elements nailed down, it’s usually the easiest to achieve project opportunities that immediately explode into an endless horizon of details. It is to the benefit of all partners involved, whether finance, construction, operation, commercial partners, regulators or the community, that the developers organize the unorganizable. So, faced with a vast universe of constantly shifting project components, what does bringing order from chaos look like?

Development Defined

Before diving into how project development gets organized, it is worth reflecting on what “development” even means. I’ve been asked this question countless times. The best answer I have come up with isn’t pithy.

Imagine if every project you completed at your job needed to be a stand-alone profitable business. Like any business, it will need:

● Sourcing and pricing for supplies and materials.

● Clear and compelling predictions of sales and revenue.

● Staff and service providers, and their respective costs and roles.

● A suitable site.

● Permits and permissions.

● Plans for maintenance and upkeep, including costs.

● The right to use needed technology.

● Design and engineering for the facility plan.

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Biomass Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

32 BIOMASS MAGAZINE | ISSUE 1, 2023 ¦ PROJECT DEVELOPMENT

IMAGE: ALBANY GREEN ENERGY

● A construction provider to build the facility.

● Support of local stakeholders (government, related industries, labor and commerce groups, site neighbors, advocacy groups).

● Financing.

It is turning the clay of opportunities, ideas, capabilities, market drivers and economic analysis into a useful piece of pottery that makes money.

Financing: Last But Not Least

It’s amazing how often that last bit gets glossed over or taken as fiat. Financing is last on the list not because it’s least important, but because all other items must be in place (or identified to the satisfaction of the financing party) before the project can begin construction.