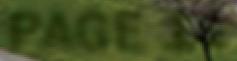

Updates Enable HPA and Lower CI Scores

PAGE 14

PLUS Iowa Project Aims to Master Corn Stover Ethanol Process

PAGE 20

How CARB's New Feedstock Tracking

Guardrails Impact Ethanol

PAGE 34

CTE Complete is uniquely innovative. Combining the strengths of our Technology Center with our Technical Services and Operational Support teams, we provide on-site expert guidance beyond our enzyme and yeast solutions. Ready to elevate your plant’s performance?

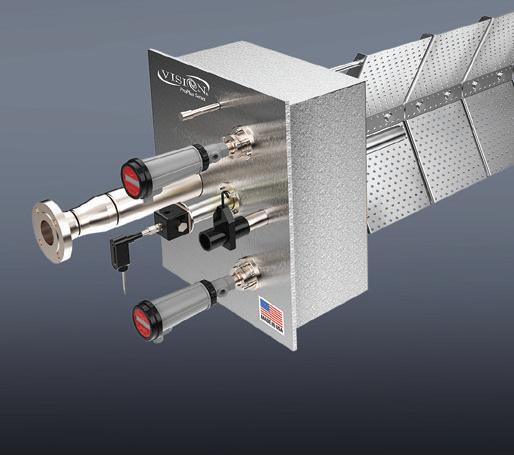

OK, so our IRmadillo™ may have a long nose and a funny look.

But that nose can sni out exactly what’s going on inside every one of your processes. Every single second of the day.

And if you know the precise chemical composition inside all your lines and tanks, there’s virtually nothing you can’t improve.

Filled with ground-breaking new technology, IRmadillo™ helps keep yeast happy, eliminates failed batches, reduces enzyme use, and much, much more.

So while you’re sitting around waiting for your next set of HPLC results, why not visit our website, and read up on the whole amazing IRmadillo™ story?

Reconfiguring the Flow

Distillation upgrades support HPA production while lowering CI

Prioritizing Preprocessing

Quality control and front-end solutions increase corn stover viability

Advancements in testing give producers peace of mind

Traceability:

Updates to California's LCFS add necessity to evolving tools for ag data tracking

President & Editor Tom Bryan tbryan@bbiinternational.com

Online News Editor Erin Voegele evoegele@bbiinternational.com

Contributions Editor Katie Schroeder katie.schroeder@bbiinternational.com

Features Editor Lisa Gibson lisa.gibson@sageandstonestrategies.com

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer Raquel Boushee rboushee@bbiinternational.com

CEO Joe Bryan jbryan@bbiinternational.com

Chief Operating Officer John Nelson jnelson@bbiinternational.com

Director of Sales Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Circulation Manager Jessica Tiller jtiller@bbiinternational.com

Senior Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

Ringneck Energy Walter Wendland Commonwealth Agri-Energy Mick Henderson Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Atlanta, GA (866) 746-8385 | www.biomassconference.com

Now in its 18th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. Powered by Biomass Magazine, the conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming, maintaining a strong focus on commercial-scale biomass production, new technology, and near-term research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

Omaha, NE (866) 746-8385 | www.fuelethanolworkshop.com

Now in its 41st year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercialscale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

Omaha, NE (866) 746-8385 | www.sustainablefuelssummit.com

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-7468385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

Please recycle this magazine and remove inserts or samples before recycling

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

Our focus is mostly on corn and corn stover this month, but our cover story is more about outputs than inputs. “Reconfiguring the Flow, on page 14, chronicles the early performance of a distillation revamp at Three Rivers Energy, a 55 MMgy ethanol plant in Coshocton, Ohio, where Fluid Quip Technologies has installed steam-lowering, CI-reducing Low Energy Distillation coupled with grain neutral spirits production. The story explains how FQT’s system has the potential to cut an ethanol plant’s steam requirements nearly in half by, among other things, cascading the process heat ultra efficiently. The result is not only less energy use, but a lower CI and reduced overall costs. And because LED frees up steam for additional processes, it makes sense to pair it with high-purity alcohol production, a synergy Three Rivers Energy seized.

We jump from optimizing conventional corn ethanol production to cracking the code on its future counterpart in “Prioritizing Preprocessing,” on page 20. Catching up with New Energy Blue about its planned cellulosic ethanol plant in Mason City, Iowa, we report that the company is two years out from production but deeply immersed in project development, engineering and production science to overcome the myriad obstacles of corn stover ethanol production. Molecularly, the future plant’s principal output will be identical to corn ethanol. Financially, however, it will have exceptional value because of its low CI and cellulosic pedigree.

Stover, without question, is a supremely challenging biofuel feedstock, but grain, too, has its occasional issues. We’ve been lucky with good corn quality over the past few years due to mostly cooperative weather, but producers and third-party industry labs remain ever vigilant about the possibility of contaminated grain. As we learn in “Managing Mycotoxins,” on page 28, it’s not rainy days that concern mycotoxin sleuths, but drought. Following prolonged dry conditions, it is especially important for producers to understand what’s coming into their plant, not just so they can buy feedstock at the right value, but so they can steer upfront quality with precision. We explain how third-party labs get this done—working around the clock, if needed—to provide fast, accurate results for their clients.

Our feedstock foray wouldn’t be complete if it didn’t include something on farming itself. As it were, plenty of timely storylines are converging around low-carbon and regenerative agriculture—most related to feedstock sustainability and associated tracking and verification tools. In “Traceability: Rules and Tools,” on page 34, we look at the California Air Resources Board’s recent amendments to the Low Carbon Fuel Standard, which appear to require “guardrails” that instruct fuel producers participating in the LCFS to track biofuel feedstocks to their point of origin; they may also require certain sustainability verifications. Ethanol industry trade groups are pushing back with sharp criticism of land-use-change theory and pointing out the holes in CARB’s plan. But as we’ve seen before in the Golden State, such arguments often fall on deaf ears.

When it comes to fermentation, why settle for anything less than Lallemand Biofuels & Distilled Spirits? With our industry-leading lineup of yeast and yeast nutrition, plus our newly added Spartec® enzymes, you get the best tools available to optimize your ethanol production. And that’s just the beginning. Our renowned educational programs and handson services complete the package, delivering a winning combination to maximize your results.

WITH LBDS, BETTER ISN’T JUST POSSIBLE — IT’S GUARANTEED.

President Trump has made it clear that revitalizing rural America will be a priority for his administration, and biofuels are key to accomplishing that goal. That’s why, just days before the inauguration, Growth Energy released a roadmap to revitalize rural America, identifying specific policy goals and actions the 119th Congress and the incoming Trump administration should take to unleash American energy dominance through the expanded use of homegrown American ethanol. The four-part roadmap is below.

Only biofuels can unlock the investments and jobs needed to revitalize rural America. We cannot allow regulatory uncertainty to hold back billions of dollars of investment into rural communities.

Renewable Fuel Standard (RFS): Set timely, ambitious biofuel requirements under the RFS to spur continued growth and investment in rural communities.

Small Refinery Exemptions (SREs): Continue to limit SREs and ensure SREs are reallocated to prevent biofuel demand destruction.

Carbon Capture, Utilization, and Storage (CCUS)/Permitting: Meet permitting timelines for carbon sequestration projects and support innovative transportation and storage technology.

New Markets: Promote investment in a fast-growing ecosystem of bioproducts, from sustainable aviation fuels (SAF) to green chemicals to biobased solutions for marine and freight transport.

E15 reduces fuel prices—but only when federal regulations don’t block consumer access. It’s time to lift the needless regulations standing between U.S. consumers and lower-cost E15, so all Americans can make their own fuel and vehicle choices.

E15: Restore permanent, unrestricted access to E15 for all months, all states, all stations and all fuel dispensers.

Retail Expansion: Promote programs designed to fast track the investments needed to offer better options at the pump.

Marketing Barriers: Streamline regulations that impose onerous labeling and underground tank requirements on existing infrastructure.

Vehicle/Fuel Standards: Ensure engine performance and fuel standards harness the full power of American bioethanol to reduce tailpipe and carbon emissions.

Pro-growth tax policy can unlock billions of dollars in new investments in U.S. energy innovation. With proper implementation, new tax credits could be the starting pistol to revitalize rural America, support rural communities waiting to access new economic opportunities and deliver on the promise of climate-smart agriculture.

Low-Carbon Solutions: The U.S. Treasury Department must provide clear and timely tax guidance that accurately rewards all available decarbonizing strategies on the farm and at the biorefinery.

Modeling: Ensure fuel standards and tax policy are guided by Argonne National Laboratory’s GREET model, which is the gold standard for measuring the emissions-reducing power of farmbased feedstocks and biofuels.

SAF/Flexibility: Ensure regulations give farmers the flexibility they need to adopt lowcarbon strategies that work best for their farm.

Clean Fuels Tax Extension: Extend a progrowth 45Z so biofuel producers and our farm partners have the long-term certainty needed to accelerate innovation in America’s bioeconomy.

America is the world’s largest producer and exporter of biofuels. With fair access to foreign markets, American producers will dominate the global bioeconomy.

Fair Trade: U.S. trade diplomats must combat unfair trade barriers and tariffs imposed by competitors in Brazil, China, India, Europe and Southeast Asia.

Expanding Markets: Open new export opportunities for low-carbon biofuels by supporting higher blends in Canada, Japan, India, Mexico and across the globe.

Domestic Feedstocks: Advance fuel policies that do not advantage foreign feedstocks over lowcarbon commodities harvested on American farms.

Learn more at growthenergy.org/roadmap.

By the time you read this in March, President Trump will have been inaugurated, and Canada will be preparing for its next federal election under new Liberal leadership. With Republicans in Washington and Conservatives surging in Canada, both countries are at a crossroads. Policies that deliver real economic, environmental and rural benefits will take center stage—and ethanol is uniquely positioned to deliver.

Canada’s demand for clean fuel makes it the top buyer of U.S. ethanol, importing 639 million gallons annually—45% of all U.S. exports—while supporting 395,000 U.S. rural jobs. The U.S. ethanol industry produces 10% more fuel than it consumes, with Canada filling the gap by importing to meet its ethanol needs. This symbiotic relationship highlights the strength of cross-border trade in renewable fuels, benefiting farmers and consumers seeking affordable, cleaner energy options.

Since Canada’s Clean Fuel Regulations took effect in 2023, ethanol consumption has jumped 20%, reaching 3.4 billion litres. Domestic production, led by companies like Greenfield Global, Suncor and IGPC, is strong, but U.S. imports remain key to meeting the increased demand. For U.S. producers, Canada provides a stable export market for ethanol and corn, supporting agricultural livelihoods and bolstering rural economies.

Ethanol’s benefits go far beyond trade statistics. In both countries, the sector creates rural jobs, strengthens farming communities and yields measurable environmental benefits. In 2023 alone, U.S. ethanol added $54.2 billion to GDP, showing the strength and value of this renewable resource. Recent advances in carbon capture and low-carbon feedstocks have improved ethanol’s environmental impact, making it central to reducing transportation emissions while preserving consumer choice.

As the last decades in both countries have shown, ethanol is more than just a fuel—it’s a solution to shared challenges and an industry built on shared values. With new leaders and administrations taking office, policymakers in Canada and the U.S. have fresh opportunities to strengthen economies, drive innovation and invest in rural communities. Ethanol delivers on all three fronts and deserves an expanded role in our shared energy future.

our future

Canada-based Greenfield Global Inc. is offering its operational, full-staffed 48 MMgy fuel ethanol plant in Winnebago, Minnesota, for sale via auction, according to Chabina Energy Partners LLC.

Greenfield has retained Chabina as its exclusive financial advisor to sell the Winnebago facility. According to information

released by Chabina, the decision to sell the facility reflects Greenfield’s commitment to concentrating its resources on initiatives that more closely align with its long-term growth strategy.

The Winnebago facility, previously owned by Corn Plus, was acquired by Greenfield in late 2020. The plant originally

The USDA has awarded $120 million in grants to 516 projects under the Rural Energy for America Program. One of those awards will support an improvement project at Nebraska-based KAAPA Energy LLC.

KAPPA was awarded a $1 million REAP grant to support the installation of an additional fermenter at its ethanol plant in Minden, Nebraska. According to the USDA, the new system is expected to enable KAAPA to generate $3.3 million in

Aemetis Inc., a renewable natural gas and renewable fuels company, has announced the receipt of $11 million, after transaction costs, from the sale of $13.5 million of Inflation Reduction Act investment tax credits generated by a solar electricity generation project at its Keyes, Caliornia, ethanol plant and two dairy biogas digester projects (Aemetis Biogas). Aemetis

has also entered into an agreement to sell the tax credits generated by the additional three dairy digesters that Aemetis commissioned in December 2024.

Aemetis generated IRA Section 48 investment tax credits from its investment in a 1.9 megawatt solar photovoltaic and battery microgrid built at the Keyes ethanol plant and from two dairy biogas digesters

began operations in 1994. Corn Plus operated the facility for more than two decades before idling the plant in September 2019. Greenfield acquired the facility in 2020 and resumed operations at the plant in late 2021. The facility is currently operational.

new revenue per year and, through associated upgrades, yield 31 million kilowatt hours of energy annually, which is enough energy to power 2,969 homes per year.

A full list of REAP awardees is available on the USDA website.

constructed and placed in service by Aemetis in 2024.

When fully operational, Aemetis' biogas assets are expected to produce more than 1.6 million MMBtu per year of RNG and generate annual revenues of $250 million.

Green Plains Inc. has announced that key milestones for its proposed carbon capture pipeline with Tallgrass—dubbed “Advantage Nebraska”—have been met, and the project remains on track for operation in the second half of 2025. Three Green Plains facilities are expected to be among the first significant volumes of low carbon

ethanol from aggregated carbon capture and sequestration in the U.S., positioning the company to participate in the early days of the 45Z Clean Fuel Production Credit, the details of which were recently revealed.

In his comments on the project, Todd Becker, president and CEO of Green Plains, stated that Tallgrass has secured all

Lallemand has announced the appointment of Justin van Rooyen, succeeding Angus Ballard, as the president and general manager of its Lallemand Biofuels & Distilled Spirits business, a global provider of fermentation ingredients to the fuel and beverage alcohol industries, effective February 1, 2025.

the rights of way for laterals connecting to Green Plains’ Nebraska facilities, Wood River, York and Central City. When completed, the project will enable permanent sequestration of 800,000 tons of the biogenic CO2 produced by the plants each year.

Angus Ballard has successfully led the LBDS business since 2014 and will transition to the role of senior vice president and special advisor at the Lallemand Group level, while simultaneously supporting the LBDS management team and leadership transition over the next several years.

Van Rooyen joined Mascoma LLC in 2007, which was then acquired by Lallemand in 2014. Over the last 10 years he has directed the expansion of the LBDS business in Brazil and has successfully led many strategic projects in his role as senior vice president, business development.

RCM Thermal Kinetics, a division of RCM Technologies Inc., has announced the launch of its innovative New Ethanol eXpansion Technology (NEXT) program. This solution is designed to revolutionize ethanol plant expansion projects by enhancing production capacity and energy efficiency without requiring costly and time-

consuming major equipment replacement. International fuel ethanol consumption is projected to grow by 173% from 2021 through 2030. As this global demand rises, NEXT offers ethanol producers a sustainable and efficient path to increased profitability. Incorporating advanced engineering concepts adapted from the refining

industry, NEXT can enable existing ethanol plants to unlock over 20% additional production annually, which, for a plant currently producing 100 million gallons of ethanol per year, would equate to an increase in production of 20 million gallons without major equipment replacement.

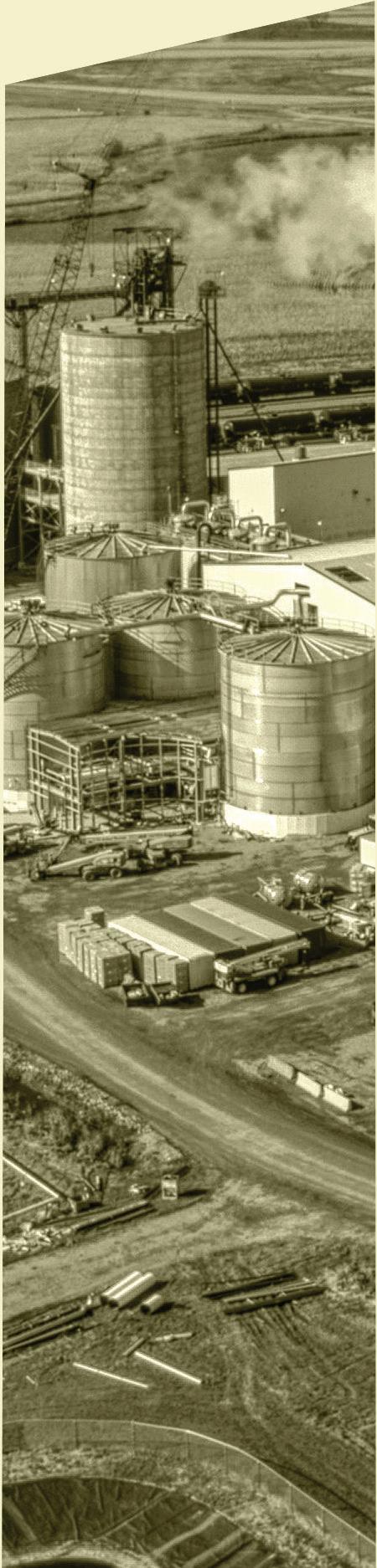

A revamped distillation system offers producers the potential to reduce steam usage, produce high-purity alcohol and lower overall carbon intensity score.

By Luke Geiver

The 12-month results for Fluid Quip Technologies’ trademarked Low Energy Distillation and Grain Neutral Spirits systems are in. After more than a year in operation at Three Rivers Energy in Coshocton, Ohio, both bolt-on technologies outperformed initial estimates, according to Michael Franko, FQT’s vice president.

The LED system—designed to reduce process energy steam usage by reconfigur-

ing distillation flow without relying on a membrane-based approach—was initially estimated to reduce steam usage per gallon of ethanol by 47% from the industry average of 14.5 pounds per gallon.

“The project has exceeded these goals and continues to exceed expectations,” says Eamonn Byrne, chief operations officer at Three Rivers Energy. The Coshocton plant was one of the first in the U.S. to deploy FQT’s LED and GNS set-ups, and according to Franko, FQT’s team has more than

proven its ability to help ethanol producers reduce energy consumption and lower carbon intensity (CI) scores by reconfiguring distillation.

“The LED approach brings a lot of opportunities to the plant,” Franko says. “We see a significant expansion of this technology throughout the industry for its ability to lower CI.”

The LED and GNS systems partner well together, allowing access to new markets, as LED provides the added ability to

produce high-purity alcohol (HPA) products through a revamped distillation setup. Since 2019, a handful of ethanol producers have added GNS or other HPA production capabilities, most of which were designed to serve the hand sanitizer market. McCord Pankonen, service director of the ethanol and biodiesel divisions for EcoEngineers, says it makes sense for producers to invest in GNS or HPA production. He says the expected growth rate in HPA use in the next five years will range between 5% and 10%.

“A lot of people ask me why an ethanol producer would invest in HPA,” Pankonen says. “It is to diversify their portfolio.”

The opportunity of LED lies in its ability to cascade steam in a smarter way, Franko explains. “It utilizes the steam more efficiently. Many plants are using 20-year-old distillation technology. LED is a newer, proven distillation technology to operate more efficiently with lower cost.”

The LED process can lower a plant’s CI score by 4 to 6 points and cut steam usage by up to 50%. The system also eliminates the need for clean-in-place related downtime. Throughput could also be increased and water load reduced.

In traditional distillation processes, steam is used to boil the combination of fermented ethanol and water. The process allows the ethanol vapor to separate from the water. Directly injecting new or recycled steam into distillation helps control the tem-

perature of the steam, which allows optimal ethanol separation from the water-ethanol mix.

Franko says the ethanol industry typically employs three methods of distillation: pressure distillation, vacuum distillation and hybrid distillation. Pressure distillation relies on two or more columns operating at different pressures in order to separate the water-ethanol mixture. Vacuum distillation utilizes a beer column, rectifier column and a stripper column, where steam is injected to separate the last of the ethanol after it has gone through the other columns. During that process, the injected water then must be removed downstream, increasing CI.

The LED system can be incorporated into either distillation design by eliminating the need for direct injection steam through a series of equipment changes, reengineering or rearranging flow patterns. Franko

and his team refer to the changes as “distillation reclaim opportunities.”

The goal of LED is to arrange the hottest temperature and highest pressure on the cleanest fluids while reusing energy in multiple effects. Unnecessary phase changes are historically one of the largest users of energy in distillation, but LED removes them. This adjustment, while significant in the amount of energy conserved, is simple and operates similarly to existing distillation systems.

“This modern technology utilizes proven distillation principles, without a need for expensive replacement parts/membranes,” Franko says.

In some cases, an additional beer column will be added along with new reboilers. If the goal is increased ethanol production, molecular sieve capacity may also need to be increased. LED provides a great opportunity for low-CI expansion. The addition

of reboilers, beer columns or molecular sieves are the main capital costs related to equipment additions, Franko says. “Changing a plant to an LED style setup should take roughly 12 months total project time, with minimal downtime, usually falling within a plant’s normal shutdown schedule.

“LED may be a unique operational setup, but it is not something new in a plant that they haven’t seen before,” Franko adds. “You just have to get the team to understand the different flow patterns.”

When Franko talks with prospective producers about the system, he says they often understand the process changes immediately and can envision how an LED system would work at their respective plants.

The origins of LED link back to FQT’s work with two ethanol plants in Brazil. Ac-

cording to Franko, the FQT team, supported by Thermal Kinetics, helped the Brazil plants reduce energy consumption by using waste low-pressure steam.

The set-up endeavored to meet the needs of the biomass boilers, while maintaining the functionality of the distillation process. At a Sao Martinho plant in Brazil, the team integrated its LED system in conjunction with a mechanical vapor recompression technology to achieve what FQT says is one of the lowest steam-usage rates in the entire ethanol industry.

John Kwik, executive vice president of FQT, called the LED setup, “a real technology disruptor for the South American ethanol market.”

Agenor Pavan, chief operations officer of the Sao Martinho plant, said the LED system has allowed the plant to avoid investing in additional steam generation or biomass feedstock volumes needed to power its boilers.

Methods of Distillation

• Vacuum distillation

• Pressure distillation

• Hybrid distillation

• Note: most are integrated with evaporation

Steam Usage in Distillation, Dehydration, Evaporation (DDE)

• Type A: 16 lb steam / gallon Ethanol

• Type B: 13 lb steam / gallon Ethanol

• Type C: 11.5 lb steam / gallon Ethanol

• Low Energy Distillation (LEDTM): 9-10 lb steam / gallon Ethanol

EFFICIENCY IN DISTILLATION: Fluid Quip Technologies’ Low Energy Distillation technology can significantly reduce steam usage in DDE, decreasing costs and carbon intensity scores.

SOURCE: FLUID QUIP TECHNOLOGIES

Since commencing operation of its LED system at Three Rivers Energy, FQT has had several interested parties tour the facility to see how the system works and what it looks like, Franko says.

Gevo is already configuring its planned Net-Zero 1 ethanol plant in South Dakota around LED with a focus on driving the CI value as low as possible, Franko says. Once built, the plant will feature—and rely on—FQT’s LED system integrated with mechanical vapor recompression. Having LED at the center of the Net-Zero 1 plant is a testament to the power and ability of its design and FQT’s engineering prowess, Franko says.

“We are engineering [Net-Zero 1’s] LED system for what we believe will be the lowest-CI ethanol plant in the world,” he says.

For existing ethanol producers that know they can benefit from investing in

CI-lowering technology, the LED route is clear, according to Franko. The advantages are there, and the CI-reduction has been proven.

Reconfiguring the distillation flow at an ethanol plant can also create more opportunities in the GNS and HPA sectors.

The FQT team says a plant can use additional steam not utilized in the LED system to produce an HPA steam product. Three Rivers Energy was already working with Gojo Industries to supply HPA for hand sanitizer. According to Franko, although GNS capabilities can be added to a plant’s distillation setup at any time, the move might not always make sense without a clear vision of the end market a plant might serve.

Canada-based Greenfield Global and ClearSource, a division of New York-based Western New York Energy, are two ethanol producers with large investments into HPA and GNS.

In 2023, Greenfield Global added 30 million gallons of grain-based HPA production to its Johnstown, Ontario, distillery. The company has a global footprint in ethanol production, along with HPA used for spirits, academia, pharmaceuticals and hygiene customers.

ClearSource has more than 600 feet of HPA distillation spread throughout four towers, the tallest at 168 feet tall. ClearSource produces GNS by distilling the alcohol up to seven times to make what it believes is the purest offering on the market.

EcoEngineers’ Pankonen, formerly a general manager with Greenfield Global’s Minnesota ethanol and HPA operation and a career expert in the biofuels markets, is

fully aware of the challenges and opportunities for biofuels producers that participate in the GNS market.

Through his current work assisting producers in employing new low-carbon strategies enabling them to keep pace with market leaders, Pankonen has watched the demand for HPA surge since the pandemic. Now, the demand has moved past hygiene products into other markets like those served by Western New York Energy.

Ethanol producers need to understand offtake agreements like any supplier would, he adds, before they look at investing in the distillation capabilities necessary to bring their product to the 190plus proof purity level the HPA market demands.

In addition to understanding the HPA market and offtake possibilities, Pankonen points out that producers need to continually refresh their knowledge of CIs. Technologies like FQT’s LED and GNS systems inherently lower the CI score of a plant, but they do require investment. Pankonen and his team are helping producers understand how CI scores are modeled.

“It’s important, no matter the technology or end market, to understand how they will affect the CI score,” he says. Having that confidence and knowledge of a CI score is important to investors and boards, he adds.

“You need to speak to a technology’s CI score like you do to a dried distillers grain product or corn oil or, in this case, HPA production.”

Author: Luke Geiver writer@bbiinternational.com

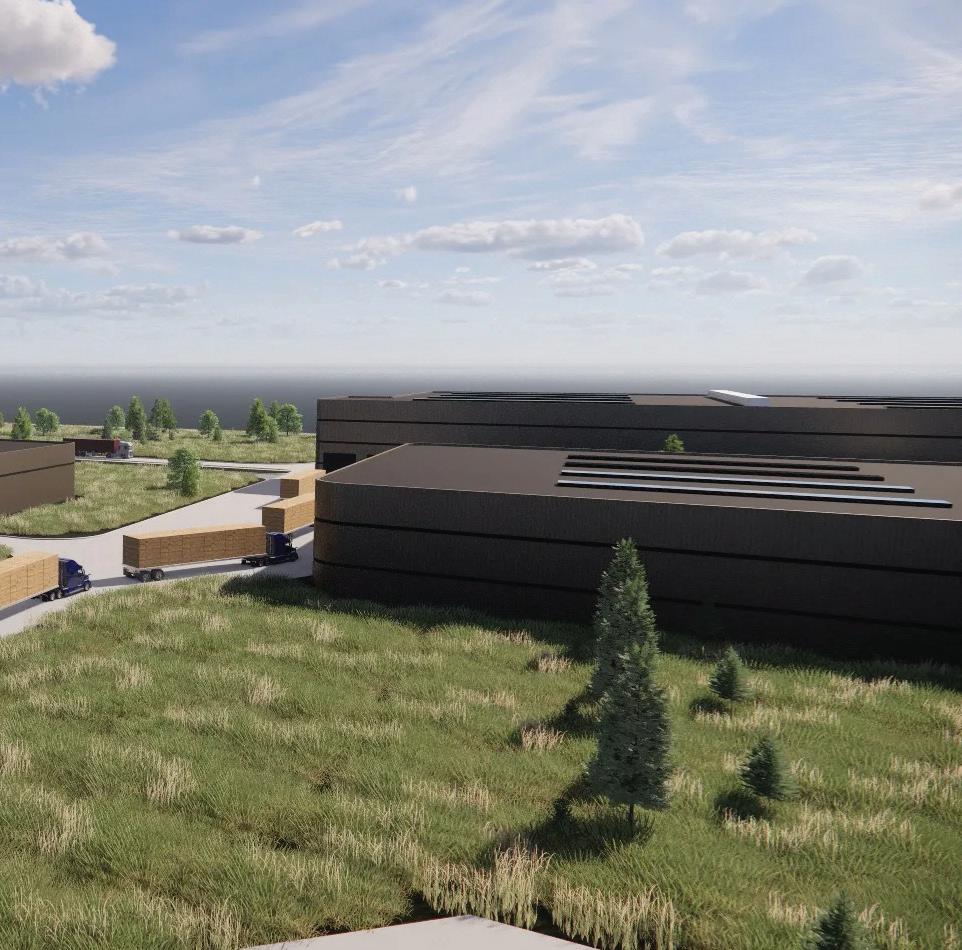

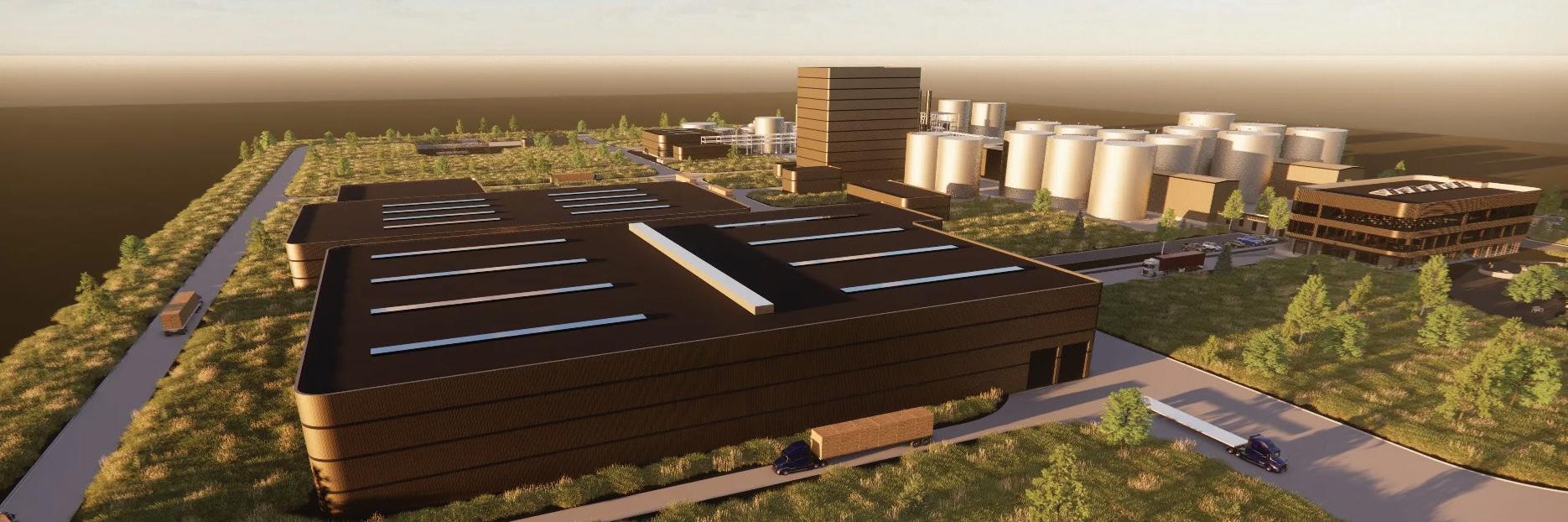

New Energy Blue has its sights set on a 20 MMGy biomass refinery in Mason City, Iowa, using corn stover as a feedstock and pumping out cellulosic ethanol and lignin by early 2027.

Drawing on decades of experience with partners in Scandinavia in handling and processing agricultural waste, New Energy Blue is confident that it can overcome

the obstacles faced by previous corn stover ethanol producers, namely preprocessing for optimized physical properties and quality control.

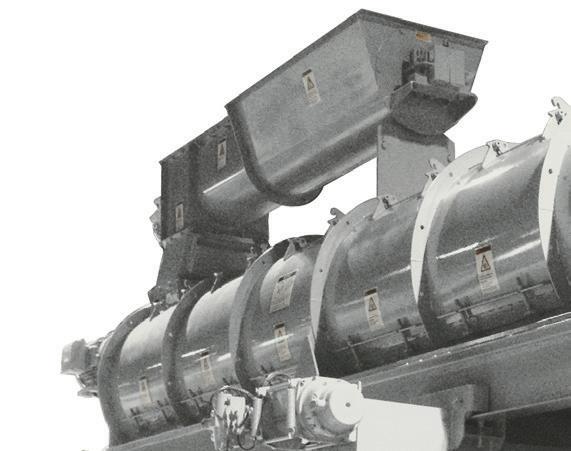

Through a $2 million U.S. Department of Energy Collaborative Research and Development Agreement, New Energy Blue, Idaho National Laboratory, National Renewable Energy Laboratory, Finland-based Valmet and West Salem Machinery of Oregon will work to integrate processing and hydro-

thermal pretreatment of corn stover to produce biochemicals and fuels.

“It’s important to consider quality of feedstock coming into the plant,” says Kelly Davis, vice president of New Energy Blue. Previous attempts at corn stover cellulosic ethanol production did not take the time to develop proper systems to ensure the feedstock works efficiently through the entire process, says Tom Corle, founding partner, chairman and CEO of New Energy Blue.

New Energy Blue’s cellulosic ethanol refinery planned for Iowa is backed by Scandinavian technology partnerships, ongoing U.S. research into corn stover and a focus on front-end problem-solving.

By Lisa Gibson

“So we have spent a decade working on that and, in the past two years, we’ve invested well over $1 million around equipment and aggregation practices to be able to accomplish what we’re looking to do at our facility.”

“This is a new startup, but yet it’s not,” Davis says. “We’ve done our homework for the past 10 to 12 years and the process has scaled up 10 times every time. Now, we’re scaling up 10 times again, but it’ll be a full commercial facility.” Mason City will be

the flagship, “but by the time we’re digging ground in Mason City, Tom will be out looking to build our second facility.”

“INL’s role is going to be separation, fractionation, during the processing of the corn stover to generate blends that have the right physical properties, and we will then test the flowability of these properties—

how they perform during some pretreatment processes,” says John Aston, staff engineer in INL’s Biological and Chemical Processing Department. “The purpose of the process is to tailor feedstock into specific physical properties that can perform better during pretreatment or during handling and feeding of the material to the pretreatment.”

New Energy Blue, specifically, is using a feeding system centered around a compression screw feeder, Aston explains. The right

consistency is vital: too loosely packed and the material will roll out of the system; too tightly packed and the system will seize up, requiring shutdown and increased maintenance costs.

“In the right consistency, we need the right balance of fines in the material, right particle shape, particle size distribution and ash content,” Aston says.

About 200 million tons of corn stover are available annually that could be used sustainably to make fuel, he says. Lynn Wendt, INL senior research scientist, says, “It is currently just harder than the corn grain because it is more complex, essentially, so industry has struggled to use corn stover to this date and the work that we’re doing up front in preprocessing is an attempt to solve some of the challenges with flowability, with variability of the material.”

Wendt and Aston are working specifically on air classification for fractionation. It’s a particularly promising practice for corn stover

feedstock with its anatomically diverse properties, Aston says. The leaf and husk have lower densities than the cob, so an air stream is an effective way to separate the stalk from the cob. “Once you understand the specific material you’re working with, especially the moisture content, you can get in and start to separate the leaf from the husk,” Aston says.

The INL team started evaluating air classification more than 10 years ago, initially on logging and forestry feedstock materials, as a means of removing dirt and ash. Passing that material through an air classifier screened out the lighter, dry soil and dust. “Once you achieve those separations, you then start to look at formulations for different systems,” Aston says.

“One of the advantages of air separation is they have a very low energy consumption, so they don’t cost a lot of money, but you can improve the quality of the material quite significantly,” Wendt says.

“I think if we can demonstrate at the pre-pilot scale, which is the scale of our facility, we could accomplish quality improvement with air separation of corn stover, that ... would be a valuable tool,” she adds. “There’s a pathway of pre-pilot work that will happen in the next couple of years, then we see that moving on to more demonstration and then finally commercial scale. It is doable.”

In addition to the fractionation benefits, the quality control potential in the research is of vital interest to New Energy Blue. “We are all looking to optimize that feedstock area to the most efficiency, like the movement of the bales and cleaning of bales. For instance any rot, foreign matter, rubber tires, anything else that might be buried into a bale, that all gets removed,” Corle says.

“The work with INL will be with bales to understand preprocessing better,” Davis adds. “They can help us improve when we build our second and third facilities.”

New Energy Blue will source its corn stover feedstock from a 30-mile radius of its Mason City location. A farmer-owned partnership program—New Energy Farmers— will help control bale quality before the INL process is ready for implementation, while nurturing relationships with area farmers in a profit-sharing model. “It’s very unique,” Corle says. “It’s like a hybrid co-op.” He adds that the company has already contracted the feedstock it will need.

Investments into corn stover aggregation have allowed an increase in bale size

from 900 pounds to 1,400 pounds, resulting in fewer bales needed, Corle says. “We’re able to do that more efficiently and drive down cost overall, but we’re also actually cutting that in the field as well.”

New Energy Blue is working with equipment developers to design a specialized corn row header for cutting and chopping in the field. “All that creates less dust, less dirt and less energy use at the facility.”

The New Energy Farmers program will employ equipment and staff of about 60 balers who will cut, bale and stack the stover at the field’s edge, then transport it to strategically located storage barns. The refinery will house 3.5 to four days’ supply of bales onsite.

“All of the logistics are essential but the farmer buy-in and ownership of New Energy Farmers is also essential, simply because they need that revenue,” Corle says.

New Energy Blue’s front-end process for its Mason City plant was designed in Denmark and will be fully automated, utilizing cranes to unload stover bales from trucks, with a speed of about six minutes per truck, Corle says. “I can’t wait to show the ethanol industry these cranes and how they’re going to move these bales,” Davis adds.

From there, the process is simple, Corle explains. The plant will deploy heated reactors developed by Valmet. “We cook the biomass almost like cooking a potato, and it loosens up the sugars and the lignin walls that those sugars are attached to. We don’t use acid or ammonia, so we have a very clean process throughout.” he says.

The cooked stover then enters a hydrolysis system that utilizes enzymes. Albert Bryde Nielsen, product marketing manager for Novonesis, says the difference between enzymes for starch-based ethanol and for second-generation ethanol is that the former requires a low dosage of mainly amylase and glucoamylase to break down starch to glucose, while the latter uses a high dosage of many different types of enzymes, such as betaglucosidases, LPMOs, xylanases, betaxylosidases, cellobiohydrolases and endoglucanases.

“New Energy Blue’s plant in Mason City indeed could serve as a good U.S. model for second-generation ethanol using corn stover as substrate,” Nielsen says.

After hydrolysis comes fermentation, dehydration and evaporation, all similar to that of a first-generation ethanol plant except with a longer fermentation retention time. “The process works the same with the molecule,” Corle says.

New Energy Blue’s corn stover biorefinery will pump out 150,000 tons of lignin annually, and almost half of its cellulosic ethanol will be used to produce bioethylene for biobased plastics.

Lignin is a high-value substance, Davis and Corle say, with immediate use in asphalt and road resurfacing markets. New Energy Blue has many years of research experience in the lignin-for-asphalt space in Europe.

“Cellulosic ethanol producers want to burn lignin for power but it has a far more valuable use,” Davis says. “In the future, cer-

tain lignin fractions will be even more valuable than paving roads with it.

“Our objective is not building a secondgeneration ethanol plant,” she adds. “We are building a biomass biorefinery. Lignin will drive revenue to the facility from further refined products in the future.”

With lignin separation, the biorefinery can likely achieve a carbon intensity score of -50 and possibly -100 grams of carbon dioxide equivalent per megajoule through the GREET model.

To provide for bioethylene production, New Energy Blue will construct a cellulosic ethanol-to-bioethylene conversion facility on its Port Lavaca, Texas, property. The bioethylene produced there will go to a partner, Dow, via pipeline. The site was selected for its proximity to Dow’s U.S. Gulf Coast operations.

“When I go out and talk about our biomass conversion process, most people are more interested in the bioethylene side than our second-generation ethanol,” Davis says. “We know we can go to California with second-generation ethanol, but I became very intrigued by the bioplastics side because I know that ethanol needs new uses.”

The campus will also feature a biotechnology laboratory for up-and-coming technologies, as well as for further research and training on operating such a facility.

But policy remains a hurdle, both Davis and Corle say. “Renewable chemicals don’t have any incentives,” Davis says. “All the incentives are going toward the fuel world. So we need to work with Washington a little better, with this next administration, to make it possible for us to start making renewable chemicals to replace fossil fuels.”

Corle adds, “We need to focus on chemicals because if you want a third of that biomass, which is lignin, going into other valuable products ... we need to have better policies in this country. That’s what’s going to have the pull through. This could go even faster than when ethanol was built out in a decade with policy support, with that great policy beyond just fuels.”

In the meantime, Davis says, “We’re having a lot of fun with the future separation of products into other chemicals. ... It’s not like when we started making ethanol and nobody wanted us—we had to push our way in. This is different. There is a consumer pull, and we’re enjoying that right now.”

New Energy Blue’s Mason City biorefinery will help bring visibility to the potential of lignin in renewables markets, but also to

corn stover as a biofuel and chemicals feedstock.

“We need to do this first project right and we know how to do it, but the whole world needs to see it completed and that’s our focus currently,” Corle says.

Author: Lisa Gibson lisa.gibson@sageandstonestrategies.com

Mycotoxin testing offers producers the necessary details on contamination levels in the corn entering the plant and the DDGS leaving it.

By Katie Schroeder

A thorough understanding of mycotoxin content in incoming corn assists ethanol producers in cost reduction and high-quality production, says Ryan Whipkey, director of global products with EnviroLogix. Producers can “get the right price” for their corn by determining the degree of contamination present, and segregate or reject the corn based on its contamination levels, making timely, accurate testing a vital part of their process.

A variety of testing techniques and methodologies are utilized across the industry. EnviroLogix, a lab and technology company, developed a test strip process now be-

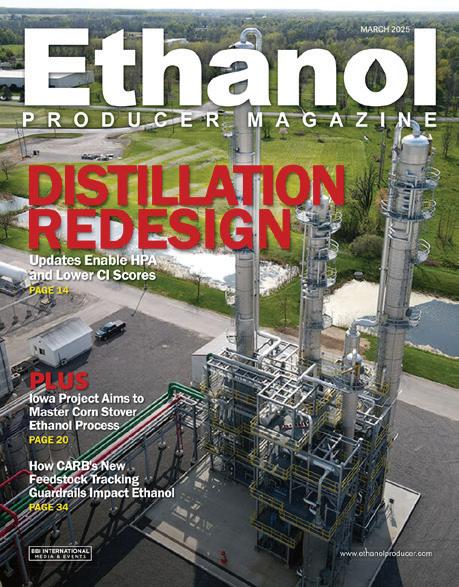

ABOVE AND BEYOND: Foundation Analytical Laboratory offers “critical rush” results, with a turnaround time of less than 24 hours. The lab will bring in staff for overnight shifts to make sure ethanol plants get results back on time.

PHOTO: FOUNDATION ANALYTICAL LABORATORY

ing used by ethanol producers to assess corn and DDGS samples on site. Foundation Analytical Laboratory serves the ethanol industry as a contract lab, delivering quantitative, granular results to 174 ethanol plants. Each company offers ethanol producers a means of detecting a mycotoxin problem before it becomes a threat.

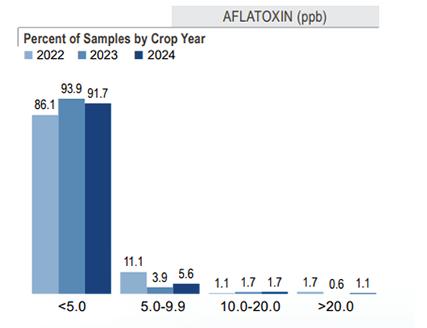

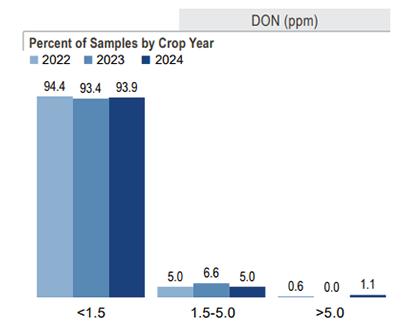

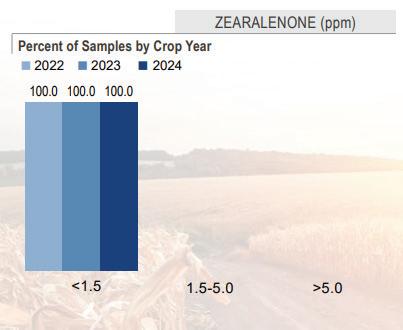

The four major mycotoxins of concern in DDGS from U.S. ethanol plants include fumonisin, aflatoxin, DON (also known as vomitoxin) and zearalenone. The U.S. Food and Drug Administration has implemented regulations for aflatoxin and guidance levels for fumonisin and DON. These toxins negatively impact animal health in a variety

of ways, ranging from cancer to gastric distress and feed refusal. All major mycotoxins cause some degree of immunosuppression, Whipkey explains.

“Each animal has their own kind of greater susceptibility to different types of toxins,” he says. “And generally speaking, the smaller the animal, the younger the animal, the more impactful the mycotoxin issue. So, for feed it’s pretty serious. It can impact your profitability significantly by [lowering] your feed conversion [rate].”

Whipkey explains that ethanol plants generally test for one or two toxins on inbound corn—depending on the data surrounding crop quality—but then test for the four major toxins after conversion to DDGS. These toxins can occur in corn crops due to

fungi growth present during certain growing years.

EnviroLogix was founded in 1996 in Portland, Maine. The company started out testing for contamination in food and wine using Enzyme Linked Immunosorbent Assay (ELISA) testing, then evolved to develop custom assays for crop science companies, focusing on GMO diagnostics. Through relationships built with grain elevators and corn mills, EnviroLogix recognized the need for improvements in mycotoxin testing.

“At the time, it was black light inspection and ELISA testing for finished products,” Whipkey says. “Using our immuno-

assay capabilities, development capabilities, we developed the first qualitative mycotoxin test strip ... for aflatoxin.”

The first iteration of these lateral flow test strips extracted hydrophobic mycotoxins from bulk grind corn or any other commodity using organic solvents such as methanol or ethanol. Since its first-generation test, EnviroLogix has innovated to deliver testing technology that uses a water-based extraction and common testing protocol across the major mycotoxins.

New product configurations streamline the process by “combing up” test strips, allowing multiple tests to be run at the same time, Whipkey explains. “You have multiple test strips with a handle on it, so the operator has less motion, less handling of these

devices,” he says. “[We’re] really just trying to make it as simple and fast and accurate as possible to get a test result for inbound grain inspection, and then also for testing the products or coproducts of the processing facility or a mill.” The EnviroLogix testing process for the four major mycotoxins has been reduced from 20 minutes to seven minutes.

The tests are then fed into EnviroLogix’s QuickScan reader, which analyzes the data and yields a quantitative result. “The QuickScan will read the test, create a certificate of analysis, capture the data on a local data log,” Whipkey says. While the sample is being analyzed, lab staff are able to enter additional information about the sample, which can then be formatted along

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

with the test results into a spreadsheet or uploaded to the cloud, accessible to anyone within the organization.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

EnviroLogix innovated further by developing a data management tool named TotalHub that records test results and makes them easily accessible online to all stakeholders that have been given access, such as the plant’s grain merchandiser or director of nutrition at a nearby feed mill. “Having that instant data visibility after a test is run in the cloud and being able to customize any alerts that you want, or ... being able to process the data quickly, will allow you to have an understanding of your risk during a new crop,” Whipkey says. “And then you can customize your testing plan to cost-optimally manage the risk.”

EnviroLogix has leveraged its technology to allow plant operators to assess the reliability of their test results by evaluating test administrators. “The QuickCheck program helps ensure that operators run the test correctly. They get a blind coded sample, the operator runs it, and then you can check and ... know immediately in TotalHub if it’s in range or out of range—if they pass or fail,” Whipkey says. This information helps producers quantify the effectiveness of their program, setting them apart from their competition.

Foundation Analytical Laboratory prioritizes understanding the ethanol producer’s perspective and the impact test results can have. “You’re sending the samples in because you need results,” says Diane Young, director of technical services and owner of Foundation Analytical. “And when you’re going to make production decisions, the biggest question you ask yourself is where you are going to send the samples to get tested.” Young wants ethanol producers to view Foundation Analytical as an extension of their business.

A key part of the company’s success is its faith-based culture, which is emulated in its passion for serving clients well, Young says. The lab executes a wide array of testing, analyzing mycotoxins, residual antibiotics, proximate analysis and much more. It meets the microbiological and environmental testing needs of the ethanol, food and animal feed industries. The lab participates in several proficiency testing programs and quality assurance processes throughout the year as an exercise in excellence, Young says. Since she founded the company in 2009, it has grown from five people to 34, including several with their roots in the ethanol industry. After working in the food industry for over 17 years, Young saw an opportunity to start a contract lab that prioritized customers and understood their need for a quick sample turnaround with reliable results. “From our perspective of

coming from the other side of the sample, it gives us that sense of urgency and putting ourselves in their shoes because we’ve been there,” Young says.

Foundation Analytical utilizes an ultra-high purity liquid chromatography system (UPLC), coupled with a triple-quad mass spectrometer—the “gold standard” for mycotoxin analysis, she explains. The UPLC system uses aqueous and organic mobile phases to push the mycotoxins through an analytical column. This column helps separate the mycotoxins based on chemical and physical characteristics. Following this separation, the sample is subjected to electrospray ionization (ESI), applying high voltage to ionize the samples and form an aerosol. This ionized aerosol is sent through the first quadrupole of the mass spectrometer where the ions are filtered based on their mass-to-charge ratios to separate targeted ions from background ions.

In the second set of quadrupoles, targeted ions for each mycotoxin are then fragmented further before being sorted again in the third quadrupole. The targeted ions and ion fragments are then sent to the detector where the software can translate the results into chromatograms and mass spectra that are used to analyze the mycotoxins. While the UPLC-mass spectrometer pairing might not be the fastest or cheapest option, this method of mycotoxin analysis provides the most sensitive, reliable and robust means of accurately measuring mycotoxin levels within a wide range of sample types, according to Young.

The chromatography testing used at Foundation Analytical provides precise, quantitative results, she says. The lab tests for DON, aflatoxin, fumonisin, ochratoxin, T-2, HT-2 and zearalenone. Many samples are sent in at corn harvest, as it is important to get baseline data on the condition of each year’s crop, Young explains. Producers also send in samples when cleaning out storage bins, to avoid surprises in the DDGS.

When the lab first acquired the technology, the mycotoxin team could not turn

out many sample results in a day due to constraints within the process. However, through proprietary innovation in processing, Foundation Analytical is now able to turn around results in 24 hours or less.

“If we get your samples by 10 in the morning, we can have results by the end of the day,” says Young. “Now, it may take a lot of people just to get that throughput, but we figured out how to get it done.”

The lab accommodates the varying timelines of ethanol producers by offering three different levels of “rush”—critical, major and regular. Critical rush guarantees that ethanol producers get test results back within a 24-hour period. Major rush ensures that producers get results by end of business the day after the sample was received. And finally, regular rush yields results by end of business two days after the sample was received.

“There are times where we get 100 critical rushes in a day,” Young says. “And how do we handle that? Well, we pull people in. We work longer hours. We start earlier, you know, somebody comes in during the middle of the night. I think the most we ever had was 142 critical rush samples in a day.”

Accuracy constitutes a vital priority for Foundation Analytical. Young explains that she tells her team to treat test results as if they must be defendable in court. “Make sure that you’re confident enough—that we have all the quality parameters put in place,” she says. “And we work hard for that.”

The U.S. Grains Council tracks mycotoxins for assessing corn harvest quality in its annual Corn Harvest Quality Report. Alex Grabois, manager of global strategies and trade for USGC, explains that mycotoxins are an important data point for countries receiving exports of U.S. corn or corn products such as DDGS.

“The main goal with this report is really to show what the trends are and to be as transparent as possible with end-users of U.S. corn around the world, so that they

understand what each harvest is looking like, and so that we can answer key questions for them to continue the relationship and increase the use of U.S. corn,” Grabois says.

USGC works with Centrec, a consulting group based in Champaign, Illinois, to gather roughly 600 corn samples from elevators across the U.S., testing them for moisture, mycotoxin content and other quality determining factors. The data is divided into three export regions—Southern Rail, Pacific Northwest and the Gulf of Mexico—to make it clearer for international customers and enabling them to assess the quality of the corn they are importing from a specific region, Grabois explains. USGC used EnviroLogix’s testing materials to assess the mycotoxin levels in its samples.

The Corn Harvest Quality Report results for 2024 indicate a positive year for corn yield and crop quality. Yields for 2024 are among the highest on record, with 89% qualifying as Number 1 yellow corn, 96% qualifying as Number 2.

“We also find that seeing the mycotoxin level, there is a correlation between the weather and grain quality and mycotoxin,” Grabois says. “Some of the biggest indicators of mycotoxins in a given year tend to come from droughts. And while mycotoxins do naturally occur in grain, the weather conditions can either accelerate or mitigate. In the case of 2024, we were very fortunate that the weather conditions and just the general harvesting time frame was not conducive to mycotoxin development.” Nearly 99% of the samples tested below FDA action levels for two of the major mycotoxins—aflatoxin and DON, he explains.

“We always say it’s important to continuously test the grain,” Grabois adds. “On the U.S. side, because we have this action level and we have a set of protocols, corn that falls above those limits is just not export[able].”

Author:

Katie Schroeder katie.schroeder@bbiinternational.com

- 2025 International Fuel Ethanol Workshop & Expo (in all attendee bags)

- 2025 ACE Conference

- North American SAF Conference & Expo

- Team M3 Ethanol Maintenance Conference ETHANOL PLANT MAP Receive 6 Months FREE Online Advertising! Advertise now on Ethanol Producer Magazine’s U.S. & Canada Ethanol Plant

The California Air Resources Board has approved point-of-origin feedstock tracking requirements for crop-based biofuels, adding appeal to emerging traceability technologies and programs.

By Luke Geiver

The California Air Resources Board has altered its Low Carbon Fuel Standard several times since first implementing the historic policy framework in 2011. In November 2024, CARB adopted a new round of program amendments on a range of issues, including a topic that has been hotly debated: biofuel feedstock-related land-use change.

In the November decision, CARB approved (12:2) implementation of what it calls “guardrails” that require fuel producers participating in the LCFS to track crop-based and forestry-based feedstocks to their point of origin. Once tracked, the feedstocks also need to be certified sustainable. At the heart of the amendment was a push by CARB to ensure that feedstock used to produce biofuels or sustainable aviation fuel does not require additional acreage.

In November, CARB said it was in favor of convening a public forum in the following 12 months on the latest science on land-use change related to transportation fuels and the impact on greenhouse gas emissions, including the most commonly used models such as the Global Trade Analysis Project. CARB said the forum, when convened, should also consider how best to mitigate any risks of harmful land-use impacts or food market conflicts identified for consideration in a

future LCFS update. Industry, environmental advocacy groups, academia, government agencies and the USDA should all be included in the talks, CARB said. Such a forum had yet to be scheduled at press time.

While CARB offered up a clear landuse change examination plan in late 2024, the amendments had not fully taken effect by press time in January and the agency had not indicted when they might, except for this statement: “Because of the significant public health and welfare benefits of the proposed regulations ... the board hereby determines there is good cause for the regulations to become effective as expeditiously as possible.”

The new guardrails for feedstock used to produce fuel under the LCFS program are linked more directly to biomass-based diesel and sustainable aviation fuel than to corn-based ethanol, but they would still apply. In addition to the requirement to track feedstock to the point of origin, independent feedstock certification would also be needed to “ensure feedstocks aren’t undermining natural carbon stocks,” according to CARB.

Under the policy framework prior to the adoption of the November 2024 amendments, fuel pathway holders using a specified source feedstock had to maintain records

showing chain of custody from the point of origin to the fuel production facility. Attestation letters were not required.

But CARB changed that view in its amendments, stating: “To ensure specified source feedstock supply chain entities provide the correct source, type and quantity of the specified source feedstock, staff proposes to require that all specified source feedstock supply chain entities maintain attestation letters for CARB-accredited verifier and CARB review.”

The requirements mean a producer needs signed letters of authenticity from a feedstock supplier on the source, type, quantity and sustainability of the feedstock.

Under CARB’s plans, the auditing process for sustainability certification necessary to participate in the LCFS would be multifaceted and could follow other sustainability certification schemes recognized by CARB. Practices under those programs include: no cultivation on areas that serve for nature protection; avoidance of damage to habitat; crops grown on suitable soils with good agricultural practices; no soil contamination or erosion; no application of fertilizer that contaminates groundwater; responsible insect treatments; and responsible waste management practices.

Feedstock providers interested in participating in the LCFS will select a CARBapproved certification system. A third-party

CORN FOR CARB:

The California Air Resources Board approved amendments to its Low Carbon Fuel Standard that would require point-of-origin tracking and sustainability verification for crop-based and forest-based biofuels.

auditor will confirm accuracy and registration information. “LCFS pathway holders must provide certificates to CARB-accredited verifiers and CARB upon request,” the agency’s board said.

CARB says feedstock auditors will perform site visits, ensure cropping practices meet sustainability requirements, review management systems, review social practices—such as worker treatment—and review economic sustainability of the applicant.

Prior to their adoption in November, CARB discussed the changes with the public for nearly a year. In early 2024, several biofuel associations spoke out against point-of-origin tracking requirements, focusing on the cost for farmers or producers, the improbability of CARB overseeing such a process, and the irrational basis for the change to LCFS protocol if linked to land-use change.

Christopher Bliley, senior vice president of regulatory affairs for Growth Energy, said the change to protocol on the basis of links to landuse change are both legally flawed and unnecessary.

“Put simply, CARB has failed to identify any credible evidence of direct land-use con-

version that could be mitigated by some form of feedstock tracking based on social, economic and environmental criteria of an unknown form and substance,” Bliley said. “As many decades of data has demonstrated, increases in bioethanol demand have consistently been met with increased yield per acre, not with increased corn acreage.” Because CARB already disincentiv-

izes sourcing biofuel feedstocks with higher land-use change risks, creating a system to further that is unnecessary, Bliley adds.

In comments prior to the November adoption of the amendments, RFA president and CEO Geoff Cooper said the proposed sustainability requirement and the link of feedstock to land-use change were disconnected from reality and that the

land-use change debate has already been debunked.

The verification system CARB would use to ensure a feedstock’s point of origin and sustainability was also a point of contention. Bliley called out the vague description CARB provided on functionality of its third-party system, adding that an unspecified system could exclude as much as 60% of the current credit-generating fuels from the LCFS program.

But Bliley argues that the sustainability audit itself falls outside the scope of the LCFS. He questions whether CARB has the authority to perform on-site visits, investigate issues and generally enforce such a range of federal, state and local rules.

Like many commenters from California, as well as outside of the state, Cooper also pointed out that the new amendments would increase fuel prices in the state as a result of decreased supply.

Before the November vote, multiple California news outlets pressed CARB on the fuel price issue, prompting the agency to hold a press conference to specifically address the concerns. Despite stating adamantly that changes to the LCFS would not impact fuel prices throughout the months leading up to its November amendment decision, the CARB board ended its legal amendment announcement documentation, stating that CARB would, in fact, review its policies in six months and ensure that gas prices were not impacted by the decision to alter the LCFS.

California Senate Minority Leader Brian Jones, R-San Diego, has already introduced a bill that would repeal the LCFS amendments adopted by CARB on the grounds that they will increase gas prices for Californians.

Missouri Attorney General Andrew Bailey also spoke out in opposition to the changes planned for the LCFS. In addition to the cap on soybean oil feedstock allowed for use under the amendments, Bailey commented on the sustainability requirements for feedstock. “CARB has initiated plans to prevent Missouri-made biofuels from enter-

ing the California market by setting a cap of 20% on soybean oil allowed for credits and adding stringent reporting requirements that could force Missouri farmers to submit sensitive information about their private operations.”

CARB Chair Liane Randolph said the changes to the LCFS will strike a balance between reducing the environmental and health impacts of transportation fuels used in California, “and ensuring that low-carbon

options are available as the state continues to work toward a zero-emissions future.”

The idea of tracking feedstock to its point of origin and ensuring that it is meeting certain sustainability requirements is not new. The U.S. EPA proposed (unsuccessfully) a similar rule in 2009. In July 2024, a group of ag associations called on the U.S. Office of Management and Budget to unbundle climate smart provisions tied to the 45Z tax credit. The provisions are similar to

With ch oice s fr om spon geblas ting , hyd ro bl as ting , indus tr ia l vacu uming and mor e , P re mium Plan t S er vi ces has t h e r ig h t mix

o f maint enance options for your f ac ilit y.

• Conf ined space rescue

• Dr y ice blasting

• Hydroblasting

• Hydro reclamation

• Indus trial vacuuming

• Restoration

• Sandblas ting

• Slurr y blasting

• Spongeblasting

• Surface chemical cleaning

• Tube bundle and heat exchan ger cleaning

Markets the sustainability requirements in the LCFS amendments. The outcome is yet to be officially determined but 45Z guidance released in January indicated that unbundling will happen.

Still, several companies are developing programs and technologies that will be vital, if and when feedstock point of origin and sustainability certification practices are a firm requirement for biofuel producers selling into the California market.

With Verity Carbon Solutions, a platform owned and operated by Gevo Inc., farmers can get rewarded for ag-smart practices while creating trackable data on feedstock or farming practices. The system uses distributed ledger technology—like blockchain—to provide carbon scoring and accounting across the supply chain.

KBC, a global energy and process management technology company owned by Tokyo-based Yokogawa Electric Company, is now offering its production accounting services to the feedstock sector. Through its trademarked VM-PA Composition Tracking module, the company can support the traceability of feedstock from its reception points through its processing all the way to the finished products. The traceability functions can include different batches, processing at different terminals and more.

Veriflux, founded in 2020, and winner of a U.S. EPA small business innovation research program funding award, got its start creating a program to help producers track product in accordance with the RFS. But the company says it learned the demand for traceability extends well beyond the RFS. “That’s why we spent all of 2023 developing Veriflux360, to help users meet any traceability requirement for any product type in any market across the globe,” according to the company. To date, Veriflux has used its tracing system for endto-end traceability, proof of sustainability and compliance management.

Other ag retailers like Indigo Ag or Farmers Business Network have developed traceability systems to track or reward farmers for participating in sustainability programs that ensure they are adhering to practices such as no till. FBN has connected with ADM growers to help them certify their grain as sustainable.

The Low Carbon Intensity Crop program from BASF and Anew is an integrated service that helps ethanol producers source low-CI corn directly from the farmer. BASF has expanded its xarvioFM (Field Manager) program to include ethanol producers. The system allows producers to access documentation that confirms farmers are using sustainable agriculture practices and can even provide a CI score for the corn. Through the program, agronomists help connect growers with ethanol producers looking for trackable feedstock with a low CI score.

Author: Luke Geiver writer@bbiinternational.com

• Delivers up to 15% increased corn oil recovery

• Enables pathway to produce low-CI cellulosic gallons

• Dewaters corn kernel fiber for reduced natural gas consumption

• Maximizes plant operability

To learn more, contact your account manager.

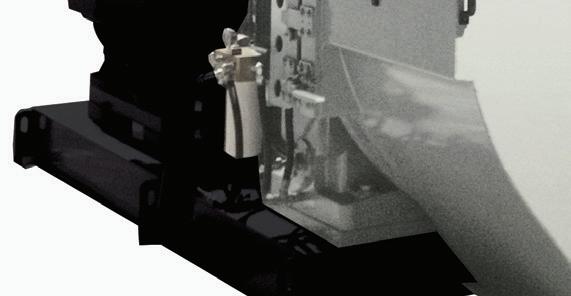

A new instrument from CFR Engines Inc. helps ethanol producers detect water contamination and determine fuel quality.

By Katie Schroeder

WI Instruments’ Model E, a new brand under CFR Engines Inc. (CFR) offers ethanol producers an opportunity to check for water contamination and test their ethanol’s density and purity (such as methanol content)—all with one instrument. Ethanol’s propensity to absorb water can cause corrosion or even phase separation, explains Dr. Lennon Lee, Director, Innovation Center with CFR Engines.

By utilizing Model E, producers are able to execute multiple tests (purity, water and

density) with one instrument, a single injection point and a minimum 3 mL sample. “The idea is just one person covers all these different needs,” Lee says. “You don’t need to have a very large lab. It’s really small, in fact, maybe you don’t even need a lab, you just need a tabletop space to start measuring this. There’s no toxic [material] that requires an actual lab or gas lines.”

Model E uses Mid-IR spectroscopy chips and CerebrumTM algorithm to offer ethanol producers enhanced accuracy—near

the zero-error line. Other tests require additional chemicals, gases or careful cleaning of the instruments to deliver accurate test results. However, no complex cleaning method is needed for Model E in between samples, according to Lee. Ethanol producers can simply use around 20 mL of the next sample to flush out the previous sample and start measuring. Along with accuracy benefits, Model E also delivers test results in about a minute, giving ethanol producers an opportunity for a quick response to any problem.

EFFICIENCY:

Advanced waste heat integrated heat pump application reduces distillation and slurry steam use by over 80%.

By Tom Tucker

In recent years, there has been an increased focus on energy efficiency in industrial facilities to minimize both operating costs and carbon emissions in the form of greenhouse gases. Many agricultural industrial sectors, such as ethanol, seed oil recovery, food processing and pulp/paper operations, use dryers that require a significant amount of energy. Since water evaporation is an energy inten-

sive operation, much of the dryer energy input is ultimately released to the atmosphere through exhaust as water vapor and heated “air” from the dryers themselves, or from a pollution control device like a scrubber or oxidizer.

The quantity of the exhaust and the relatively high temperature—160°F to 400°F, depending on the operation—make it a suitable source of heat, allowing a potential reduction in the amount of natural gas required for steam production and dry-

ing. Common approaches to recover and reuse the exhaust waste heat have generally focused on use of heat exchanger based applications. While a well-designed system can be effective and relatively trouble-free, this approach typically limits the amount of heat that can be recovered.

Pine Lake Corn Processors was established in 2005 with a capacity of approxi-

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

mately 20 MMgy. Through actively improving efficiency and plant ethanol output, its current capacity is over 95 MMgy. Much of this improvement has been under the leadership of James Broghammer, CEO, and a chemical engineer who has logged over 35 years of process industry experience.

Seeking to reduce dryer gas use and improve CI score, Broghammer first contacted Tom Tucker at Kinergetics after hearing about the success of their proprietary Syrup Concentrator at another plant. The Syrup Concentrator is a cost-effective way to reduce dryer loading by using waste heat to increase the solids percentage of the stillage prior to it entering the dryer. The Syrup Concentrator can increase plant efficiency by 2,800-3,300 Btu/gallon, with greater gains possible depending on process integration opportunities available.

The Syrup Concentrator was brought on-line at Pine Lake in 2020 and has consistently delivered the desired results. However, Broghammer, looking to further improve efficiency and CI score, reached out to Kinergetics again in late 2022 to discuss possible opportunities to reduce boiler process steam usage significantly.

As a chemical engineer and U.S. Department of Energy Qualified Steam Specialist with over 30 years of industrial operations and ethanol process improvement experience, Tucker was already familiar with the design of the necessary heat recovery equipment and system, and how to effectively apply the design to meet Broghammer’s objectives. What followed was a cost-effective system that would meet the steam reduction targets in a way that would be sensible to plant operators, and be cost effective to operate, among other important factors.

“While steam reduction and CI score are important to me, I could not accept an approach that would unnecessarily complicate operations for my staff or pose a downtime risk in the event of a maintenance shutdown or equipment failure; the heat recovery system had to be efficient, reliable and redundant,” says Broghammer.

In an effort to help move industry to-

wards greater efficiency gains to reduce use of fossil fuels, in recent years the DOE and others have been focusing much more on heat pump-based efficiency applications, since they have the potential to provide far greater fossil fuel reduction. While there are a variety of heat pump types and approaches possible, the basic idea of any heat pump application is to increase the temperature of a waste heat source from a relatively low temperature to a much higher temperature using a vapor compression cycle. While heat pump applications can offer great potential, they require energy to drive the vapor compression process.

As a result, minimization of compression power requirements is critical for a cost-effective application and care must be given to their application. Thus, the heat pump in and of itself is not a “silver-bullet” for movement towards a net-zero solution. A solution to the increased power needs of compression is the waste heat integrated recompression system (WHIR). The patent pending WHIR system combines Kinergetics’ direct contact heat recovery system de-

sign with mechanical vapor recompression (MVR) that is driven by a steam turbine or an electric motor, depending on plant needs. The system is well-integrated to reduce the power needs for the MVR, with process conditions sometimes altered to optimize heat recovery.

The Kinergetics WHIR system was the chosen application for Pine Lake’s systems as it is relatively low cost and was easily integrated with the existing process, meeting the aforementioned requirements of Broghammer. When the system is brought online the second quarter of 2025, a distillation and slurry steam use reduction of over 80% is expected.

The WHIR system can be a true structural change in the way energy is used for

ethanol production. Systems that provide such significant reductions in energy use are generally expensive. While the economics at Pine Lake were such that alternative financing was not desired, some facilities may opt to use an “energy-as-a-service” (EaaS) model to reserve cash flow for other plant improvements. Use of the EaaS model is becoming more common, as it allows a plant to benefit from substantial energy efficiency and carbon reductions with zero CAPEX. The EaaS solution is usually based on a contract between facility and the EaaS service provider that allows the system to be paid for and maintained over an agreed upon contract period.

While Kinergetics addresses engineering, it has trusted relationships with several firms making it possible to provide an EaaS

Their valuable contents are at risk. But if your site planning included J.C. Ramsdell secondary containment systems, you’re protected from the unthinkable. Your contents are safe— the environment is safe. Ramsdell has been protecting them both since 1988.