New Momentum for Globalisation

Reduce dependencies and build economic resilience

Shaping globalization in the context of systemic competition

Germany both exports and imports a lot. Its economic success largely depends on foreign trade. In recent years, however, the conditions for globalization have come under increasing political pressure: Systemic competition with autocracies, tensions between the United States and China, the consequences of the Covid-19 pandemic, the ecological costs associated with globalization, and the current energy crisis pose major challenges to globalization. The European Union and Germany must find new answers to this unprecedented situation.

Moreover, Russia’s war of aggression against Ukraine illustrates how autocratic regimes are inclined to sacrifice economic prosperity and interdependence for their own internal stability and geopolitical ambitions. Systemic competition will continue to be a struggle between rules-based cooperation on the one hand and power-political influence on the other. This calls for a rethinking of the way German industry sees globalization as a pillar of its economic success.

The success and benefits of globalization are measured not only by efficiency gains. Global value chains will have to increase in terms of quality and resilience. Diversification and resilience play an important role in this. This next stage of globalization will require behavioural changes from political and business actors as well as on the part of society at large.

How can business contribute to a renewed momentum for globalization

More than ever, internationally active companies must be ambitious and active in shaping the international environment, as well as factor geostrategic risks into their decision-making processes. Unless they are willing to help shape global change – economically, ecologically, and socially –, companies will be losing their ability to make decisions with regard to uncertainties They must establish standards required to engage in given markets and be prepared to withdraw from countries or markets in case of violations or a disproportionate risk of violating these standards themselves. Public perceptions of businesses privatizing profits and socializing losses must remain an absolute regulatory exception in a state of permanent crisis.

Cedric von der Hellen | Außenwirtschaftspolitik | T: +49 30 2028-1602 | c.hellen@bdi.eu | www.bdi.eu Matthias Krämer | Außenwirtschaftspolitik | T: +49 30 2028-1562 | m.kraemer@bdi.eu | www.bdi.eu

2023

January

STATEMENT | FOREIGN ECONOMIC POLICY | GLOBALISATION

Strengthening Germany as investment and business destination

In international competition, Germany and Europe need a position of strength and an attractive im-age. In addition to prosperity and innovative strength, this also includes better conditions for attracting private and public investment from home and abroad. This also includes a public investment offensive. In addition, research and development activities in this country must be intensified and technology transfers favoured to increase Germany's and Europe's innovative strength. An internationally competitive corporate tax law would noticeably increase the necessary private investment in research and development, at least in Germany. At the same time, the great potential in the area of digitalized industrial production (Industry 4.0), e.g. with the digital euro, must be exploited in order to create efficiencies and new innovation potential. The transformation, e.g. within the framework of the Green Deal, must not be forced through prohibitions, a tight regulatory corset or punitive levies. Rather, more freedom and more ambitious promotion of the new and sustainable is needed.

The German Federal Government must coordinate foreign economic policy more actively at national, European, and international level

The topic of foreign economic policy requires central coordination in the Federal Government and intensive consideration in the German Bundestag. At the same time, policymakers are called upon to systematically involve the business community in foreign policy and foreign trade processes. Existing trade policy instruments (export credit guarantees, country agreements) must be evaluated and improved.

International trade and international investment under fair conditions are the prerequisite for securing growth, sustainability and jobs in Germany and the EU. The German government must also do more at the EU level to promote international trade rules and economic partnership agreements between the EU and third countries to protect the economic actors of the internal market from unfair competition by third parties. Successful instruments must be further developed and consolidated jointly (nationally, Europe-wide, internationally).

Acknowledge and endure ambivalences

The great benefits of free trade and global networking must be more firmly anchored in the public debate. Politically driven initiatives that are deficient in terms of content and technology, such as the German supply chain due diligence law (Lieferkettensorgfaltspflichtengesetz), must be questioned. A weakening and fragmentation of the world trade order and protectionism must be counteracted by all actors - politics, business, and society.

New Momentum for Globalisation 2

New Momentum for Globalisation 3 Table of Contents Shaping globalization in the context of systemic competition ......................................................1 Globalisation must combine efficiency with resilience and sustainability...................................4 Enterprises must take active part in reshaping globalisation........................................................5 Strengthening Germany as a business and investment location 6 The German federal government must actively coordinate foreign economic policy on the national, European and international level.......................................................................................8 Acknowledging and accepting ambivalence..................................................................................12 Conclusion.........................................................................................................................................14 Globalisation at a glance 14 Publishing Information 21

Globalisation must combine efficiency with resilience and sustainability

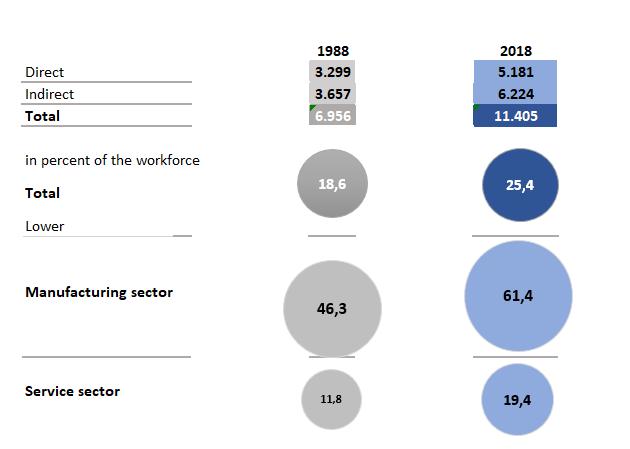

Germany’s economy is highly integrated into the global economy. In 2020, Germany exported goods worth 570 billion euros to non-EU countries and imported 478 billion euros’ worth of goods from these countries 1 This means that almost half of Germany’s imports and exports (47.35 percent and 46.61 percent respectively) are closely tied to countries outside the EU Every fourth job in German industry depends on exports 2

The figures above are the result of a business model whose success was in no small part based on cheap energy imports and growing exports. While staying true to their values and interests, Germany and the European Union must reposition themselves in the geopolitical competition – even if this means deviating from flawless regulatory policy

Germany and the EU welcome foreign investment. However, some countries do not shy away from using their economic leverage to advance their own geostrategic interests. In certain cases, foreign acquisitions should include an obligation to reduce barriers to investment in the country of the foreign investor. Foreign investments in critical infrastructure should be tied to localisation rules where this makes sense in terms of security policy (e.g., data storage and the necessary technical equipment must be kept within the EU). A ‘government-to-government’ regulation could be attached to selected investment projects to avoid international tenders and limit the group of bidders and investors. Of course, such restrictions need to be applied with caution to avoid slipping into a state of permanent investment protectionism.

German and European companies are successful in the international investment market. Policymakers would be well advised to trust the business sector to be able to cope with the challenges presented by the hybrid economy. A sure sign of their competence is the low number of calls that are made on investment guarantees

Policymakers, enterprises and society all need to deal with the systems competition we face with autocratically governed states, diverse trade disputes and the transition of the economy in line with ESG requirements

3 At the same time, it is very important to focus not just on efficiency as the sole parameter but also to consider global supply chains and the resilience of international trade relations. This would trigger new growth and increase profitability. The transition puts enormous pressure on enterprises Policymakers underestimate the effort it takes to restructure multinational trade flows and need to allow more time for this process

1 Destatis (2021) Press Release No. 054 of 9 November 2021: Exporte im Dezember 2020; URL: https://www.destatis.de/DE/Presse/Pressemitteilungen/2021/02/PD21_054_51.html (accessed on 6 December 2021).

2 Destatis, Exportabhängigkeitsquote der Erwerbstätigen, 2019, https://www.destatis.de/DE/Themen/Wirtschaft/Globalisierungsindikatoren/schluesselindikatoren.html#246062 (accessed on 1 November 2022)

3ESG refers to the consideration of environmental, social and governance criteria

New Momentum for Globalisation 4

Enterprises must take active part in reshaping globalisation

In view of the shifting geoeconomic landscape, enterprises can only maintain their decision-making power if they actively contribute to shaping the global transition in economic, ecological and social terms

Making supply chains more resilient

Openly sharing ideas and analyses is particularly important in times of crisis to help develop common solutions at the political, social and economic level. The generational handover taking place in enterprises is certainly also bringing in new approaches and objectives that focus more strongly on ecological and social sustainability International corporations are already subjected to extensive reporting duties and these are likely to increase in future. Small and medium-sized enterprises will also have to professionalise and elaborate their internal reporting. Structured business data makes it easier to define and implement these new business objectives and also helps enterprises meet the increasing pressure from society to fulfil specific ESG requirements

A level playing field and uniform standards also encourage employment-rich growth in line with the targets of the B7, the leading business and industry associations of the G7 countries, and help make the economy more resilient by diversifying supply chains, establishing corporate alliances with trustworthy and like-minded partners, joint projects and pioneering industrial standards 4 Efforts to strengthen economic sovereignty must not lead to protectionist tendencies, surplus capacities or market distortions.

Taking geoeconomic risks seriously

According to figures from the German Federal Statistical Office, China was Germany’s most important trade partner for the sixth time in a row in 2021, in terms of volume of foreign trade. Goods traded between the two countries amounted to a value of 246.1 billion euros 5 The second most important trade partner for Germany was the Netherlands with 205.1 billion euros, followed by the United States with 194.2 billion euros

Trade with China has thus increased by around 20 percent since 2019. German imports from China have also grown. In 2021, Germany imported 142.4 billion euros worth of goods from China, a 30 percent from two years ago. The upward trend continued significantly last year, additionally boosted by the imports of chemical products for medicinal use and data processing equipment.6

An escalation of geopolitical disputes with China and any ensuing economic sanctions would massively damage the global economy. In this context, and also in view of the Russian war of aggression in the Ukraine, enterprises need to prepare more thoroughly for the risk and consequences of geopolitical tensions for their business operations. They need to make their value and supply chains more resilient to crisis through diversification and fallback measures and also, in extreme cases, be prepared to

4 Business 7 – Strong and Reliable Partner of the G7 (bdi.eu)

5 Destatis, Rangfolge der Handelspartner im Außenhandel der Bundesrepublik Deutschland (vorläufige Ergebnisse), 2021, 13 December 2022, <https://www.destatis.de/DE/Themen/Wirtschaft/Aussenhandel/Tabellen/rangfolge-handelspartner.pdf;jsessionid=04BFC244E947B1A1FBB0381B9880F610.live731?__blob=publicationFile>.

6 Destatis, Press Release No. 239 of 13 June 2022 https://www.destatis.de/DE/Presse/Pressemitteilungen/2022/06/PD22_239_51.html, (accessed on 1 November 2022).

New Momentum for Globalisation 5

withdraw from certain countries and markets. Not only extreme events such as the outbreak of a war can pose sudden major challenges to the business sector

The threat of political sanctions due to new trade disputes, industrial espionage, and sabotage of and cyberattacks on logistical hubs, critical infrastructure and production facilities all require comprehensive management, particularly in conjunction with the present geopolitical risks 7 This also includes ESG management, which can even be seen as a competitive advantage by institutional financiers who favour investments targeted at climate protection

Strengthening Germany as a business and investment location

Investment is an essential prerequisite for innovation, sustainable growth, a successful transition and job creation. The federal government must become more ambitious about setting forward-looking parameters to encourage investment.

Ensuring freedom of investment and maintain open markets

The scale of a country’s foreign capital ties through foreign direct investment (FDI) is a major indicator of its investment appeal. As of year-end 2020, German direct investment abroad had dropped by 75 billion euros to 1.3 trillion euros. The top destination for German FDI was once again the United States with 353 billion euros, accounting for almost 30 percent of all German FDI. Foreign direct investment in Germany amounted to 594 billion euros as of year-end 2020, mainly from European countries. Investment from European countries accounted for 80 percent, a larger proportion than German FDI in European countries 8

To ensure that Germany remains attractive for foreign investors, policymakers must uphold the freedom to invest and keep markets open. A general acceptance of foreign investment amongst the population is a decisive factor here. The German public needs to be informed more clearly about the significance of foreign investment. Foreign investment should only be restricted for reasons of public security and public order. German direct investment abroad can also provide opportunities to establish standards internationally, including social and environmental standards

Improving the innovation environment

The innovative capacity of Germany and Europe is extremely important for the economic success of these regions. This is particularly true in the global competition with the United States and China. A public framework for innovation is required that is aligned to the dynamic developments of the market. One of these dynamic developments is Industry 4.0, an industrial production system that is increasingly digitally integrated along its complex value chains. The expansion of digital ecosystems leads to new business models and innovation. Digital payment methods are the currency of these ecosystems. We believe this makes it essential to introduce a digital euro.

Germany must become more attractive for domestic and foreign investment. Appropriate incentives to expand R&D activities and production capacities within Germany will stimulate innovation. The

7 see BDI, Resilienz gegenüber Sicherheitsrisiken stärken (bdi.eu), accessed on 19 October 2022.

8Deutsche Bundesbank, Direct Investment Statistics (FDI stocks) at the end of 2020, of 6 May 2022; Stock Data | Deutsche Bundesbank

New Momentum for Globalisation 6

expansion of the tax credit for research and the implementation of the so-called “super depreciation allowance” agreed in the coalition agreement would encourage private investment in research, development and production. Germany’s urgent need to catch up becomes all too clear in direct comparison with the United States, whose Inflation Reduction Act (IRA) has further increased the tax incentives for new technologies located within its borders.

Reducing dependencies

The Russian war of aggression against the Ukraine in violation of international law has underlined Germany’s dependency on Russian oil and gas. However, Germany’s dependency on China for many mineral commodities is already more pronounced than its dependency on Russian oil and gas. And unlike with oil and gas, Germany does not have any national (strategic) reserves of these mineral commodities. A supply cut would have an immediate and far-reaching impact on German industry.

In order to reduce these dependencies, the federal government should work closely with industry to develop a comprehensive political strategy for its supply of raw materials with the objective of establishing integrated value chains within Europe that go from extraction, through processing up to industrial production. Industry and policymakers must together encourage wider public acceptance regarding the extraction and processing of raw materials in Europe

Further measures that policymakers can take in order to reduce dependencies and strengthen Germany and Europe as a business location include ensuring an uninterrupted supply of (green) energy, reducing energy costs for energy-intensive processing companies, and providing tax incentives and direct financial support for business to relocate to the region.

New Momentum for Globalisation 7

The German federal government must actively coordinate foreign economic policy on the national, European and international level

The global developments of the last few years have shown that an avowal to a strong Europe is not enough to tackle the challenges presented by the systems competition. This applies all the more since Russia’s illegal war of aggression has openly called the current world order into question The federal government must now pursue security interests and economic policy objectives together and across the board. It must also draw more attention to foreign economic policy and thus to promoting foreign trade in order to boost Germany as an industrial location

This also applies to the German Bundestag and the Members of the Bundestag A foreign trade committee could be set up to coordinate the relevant parliamentary debates and activities. These should include:

Entering free-trade agreements with like-minded partners

The German economy cannot function without open markets abroad. The German federal government must therefore step up its efforts on the national and European level for the negotiation and ratification of free-trade agreements, particularly with like-minded partners such as Australia, New Zealand and Canada, and with high-growth markets such as Mexico (this would be a modernisation of the agreement of 2000), Chile, the Mercosur countries, India and Indonesia.

German industry supports the objective of the European Union to enter into free-trade agreements with strategic trade partners. These agreements should be comprehensive and tailored to the characteristics of modern trade. They need to take into account globalised value networks, for example, and the use of centralised trans-shipment and storage centres The agreements should cover not only the reduction of tariffs (with exemptions for some sensitive agricultural products) but also WTO-plus terms such as the reduction of technical barriers to trade, opening up the procurement system, and regulations for digital trade. Chapters on sustainability and social and ethical standards should also form part of modern trade agreements. Free-trade agreements should nonetheless be lean and flexible to encourage their ratification by potential trade partners. Mechanisms for monitoring, speedy and effective dispute settlement, and mediation should also be provided for. This is all the more important considering that the dispute settlement mechanism of the World Trade Organisation (WTO) is currently only functioning to a limited extent As a rule, the free-trade agreements with the EU must meet the WTO regulations on free-trade agreements (GATT Article XXIV, GATS Article V, enabling clause for developing countries).

Separating negotiation of investment protection and free trade

Investment protection and free-trade agreements should in future be negotiated in separate processes. While the protection of European investment abroad is important, the complex negotiations on freetrade agreements often break down because of the reciprocal demands of the negotiating parties around investment protection. To reduce the complexity of free-trade agreements, these areas should therefore be negotiated separately

New Momentum for Globalisation 8

Strengthening transatlantic cooperation

Transatlantic ties are extremely important for German industry. The United States is not only one of its most important trade partners but also one of the major like-minded countries that shares the values of Germany and the EU. The United States narrowly became the most popular destination of German goods exports in 2021, with a total value of just under 122 billion euros

In the case of imports, the United States ranks third with around 72 billion euros after the People’s Republic of China and the Netherlands.9 Including trade in services, the United States is the most important trade partner both in exports and imports

The two partners also have close links in investment. In 2021, German companies invested around 637 billion US dollars in the United States. Germany thereby rose one rank compared to 2020, pushing Canada (around 607 billion US dollars) down to third place.10 A further intensification of political and economic relations would assist the economy on both sides of the Atlantic, also in view of the current geopolitical and economic challenges

The EU-US Trade and Technology Council (TTC) is the forum that is pushing for increased transatlantic cooperation. The TTC sends out a much-needed and powerful signal for more transatlantic unity It is good to see that the United States and the EU are working together more closely than they have in decades. Political avowals must now be translated into concrete action.

The issue of reducing trade and investment barriers must not fade into the background and measures should be implemented for the long term. Even if the reduction of tariffs on industrial goods is not on the TTC’s agenda at present, the abolition of all tariffs on industrial goods should remain an objective in transatlantic trade. The TTC should also work towards regulatory cooperation. For the TTC to succeed in the long term it is important that stakeholders are closely involved in the coordination processes Decisions that are taken by the two parties should be implemented speedily on both sides of the Atlantic. The Transatlantic Business Initiative (TBI)11 of German industry also contributes to strengthening economic relations between Germany, the United States and Canada.

Fully tapping the potential of the EU internal market

The internal market is of central importance to German industry. Trade within the EU-27 accounts for around two thirds of German goods exports and imports. Germany generates just under one half (48 percent) of its net exports (exports minus imports) within the internal market. German companies export more just to France, for example, than they do to China. And in turn, around 45 percent of imports to Germany originate from other EU countries, while only 11 percent of imports to Germany come from China and seven percent from the United States. France alone exports around twice as much to Germany as it does to the United States. Germany accounts for almost one quarter of all exports and imports (around 23 percent each) within the EU-27.12

9 Destatis, Rangfolge der Handelspartner im Außenhandel – German Federal Statistical Office (destatis.de) (accessed on 31 October 2022).

10 Bureau of Economic Analysis, U.S. Department of Commerce, Direct Investment by Country and Industry, 2021 | U.S. Bureau of Economic Analysis (BEA) (accessed on 6 December 2022).

11 www.transatlanticbusiness.eu

12 Eurostat: https://ec.europa.eu/eurostat/statistics-explained/index.php/International_trade_in_goods/de (accessed on 31 October 2022).

New Momentum for Globalisation 9

In light of this, the federal government is called upon to develop an ambitious vision and concrete measures to deepen the European internal market. At the European level, the Global Gateway Initiative is an important step to tackling the most urgent global challenges. These and further measures are urgently necessary, particularly given the current geoeconomic changes. Immediate action is required to respond to the parallel shock of the war in Europe and the Covid-19 pandemic and help European economies on the long road to recovery. Policymakers must not lose sight of the fact that only an economically strong Europe with a competitive industry and an integrated internal market can be a politically strong Europe that is able to establish and defend its interests, standards and values at the global level.

Modernising the WTO

The World Trade Organisation (WTO) is the guardian of free and rule-based global trade. The overriding objective of the WTO is the worldwide elimination of trade barriers through binding, nondiscriminatory regulations. Unfortunately, this multilateral organisation is facing considerable challenges. The main problem is a lack of agreement among its 164 member states. In view of increasing protectionism, state interventions and national go-it-alone solutions, the WTO needs to make progress in key points to ensure a level playing field in global trade

The BDI continues to have faith in the WTO. All WTO members share a strong common interest in an orderly and functional global trade order However, controversial points, including the role of the plurilateral organisations, the issues of distortions to competition, and transparency and notification will have to be overcome. If not, alternative structures will have to be considered

Climate clubs can help meet international climate goals

To achieve a level playing field, the BDI calls for a harmonisation of climate protection efforts at the global level. A comprehensive decarbonisation of industry around the world is an important pillar for meeting global climate targets. In the context of the G7, the potential of climate clubs to advance international climate protection is under discussion. A climate club must be structured on a cooperative basis and be open to all countries. The challenges involved in including developing countries should be addressed by providing a phased path to membership. The BDI also supports the introduction of global carbon prices (e.g. with emission trading systems or carbon taxes).

As the decarbonisation of the industrial sector harbours both opportunities and major challenges for highly industrialised economies, German industry believes that coordinated efforts among all industrial nations are urgently required in the field of low-carbon or carbon-free hydrogen production and in establishing and expanding the required infrastructure. Energy partnerships and harmonised international green energy requirements could help accelerate the launch to market of, e.g., low-carbon and carbon-free hydrogen. A uniform global system of standardisation and certification would additionally contribute to a global rollout of green energies.

Proportionate investment controls

A look at the investment screening currently being discussed in the United States with a focus on outbound investment, and also the European framework for the screening of foreign investment, leave no doubt that the options to monitor and prohibit foreign investment represent an intervention in property rights and contractual freedom – both of which are major pillars of a free market economy. Nonetheless, justified security policy concerns need to be weighed up against economic risks.

New Momentum for Globalisation 10

If the United States goes ahead and sets up a screening mechanism for outbound investment, this will certainly trigger an intensive debate in Europe on the appropriate response.

Generally, international trade and international investment based on fair framework conditions are a prerequisite for securing growth, sustainability and jobs in Germany and the EU.

The EU needs an effective and balanced toolbox that can ensure a level playing field in the global competition in line with European export and import interests and is attuned to the changing framework conditions for international trade. Specifically, this means that a European instrument to protect against extraterritorial economic dependencies (anti-coercion instrument), for example, must operate within multilateral principles. The International Procurement Instrument initiated by the European Commission is thus helpful for opening up third markets without burdening the internal market with more bureaucracy and baseless discrimination.

Fundamentally realigning foreign trade promotion

Compared to other European and Asian Export Credit Agencies (ECAs), German export financing is not – and has never been – adequately prepared for the permanently changing competition and customer-side requirements and the increasing number of global crises. This is shown very clearly, e.g., by the permissible proportion of local costs. The definition of ‘foreign projects of strategic national interest’ also needs to be subjected to critical review and the scope of application of the associated strategic measures should be opened up for larger sections of the export industry. We need innovative, creative and flexible solutions that provide targeted support to German exporters. The instruments used must take account of the specific characteristics of the German export market and should more rigorously pursue the objectives of securing jobs, promoting technologies and preserving industries and trades 13

New Momentum for Globalisation 11

13 BDI, Zukunft der Außenwirtschaftsförderung, July 2022, Library: Publications, statements and position papers | BDI accesssed on 19 October 2022.

Acknowledging and accepting ambivalence

International economic cooperation is burdened by obvious tensions. This is evident in the current problems surrounding the procurement of oil and gas, which is no longer being sourced from Russia. To secure our energy supply nonetheless, both oil and gas are being procured from countries that do not share our values, such as Qatar and the United Arabic Emirates. The economic relations of the EU must also be regarded in this context. China is a major global market that German companies cannot – and do not wish to – do without despite the fact that the Chinese leadership has become increasingly autocratic over the last few years and there are no indications of a shift towards the international fundamental rights and standards anchored in the UN. These ambivalences must be discussed openly, particularly by the stakeholders involved and highlighted in public debate.

Friendshoring is no silver bullet

In view of the current geoeconomic upheavals, relocating supply chains to countries with trustworthy governments, also known as ‘friendshoring’, is often seen as a key solution. The aim is to expand free market access and reduce the risks for the domestic economy and close trade partners.

The governments of Canada and the United States recently suggested including friendshoring as a new standard that also connects new institutions and relationship patterns with supply chains 14 Countering the fragmentation of the multilateral system of the World Trade Organisation with friendshoring alone, with reference to supposedly ‘secure trade’, actually harbours the risk of further fragmenting the WTO system. WTO director Ngozi Okonjo-Iweala even sees a trend here towards fragmentation of the world trade order and a new phase of protectionism.15

Fact-based social debate

The BDI underlines the commitment of the business sector towards global social responsibility. At present, different systems are coexisting and are in competition with one another but they also have to cooperate. Global challenges such as climate and environmental protection or combating poverty need to be tackled collaboratively, with different political and social systems working together.

Trade relations with autocracies must be based on clearly agreed objectives and be outspoken about the current deficits. At the same time, trade with individual countries needs to be possible from the start with the aim of improving standards steadily through intensive trade. We need to recognise what has already been achieved through increased cooperation instead of insisting on ESG from an outside perspective. The benefits of gradual improvements should not be underestimated in this debate.

Although the hope of ‘change through trade’ has turned out to be largely baseless, trade with autocratic systems can still b’ regarded as an evolutionary process even if this does not necessarily lead to a system change. As acute differences could ultimately require an abrupt stop to trade, this should always be factored in and one-sided dependencies on individual markets need to be reduced to ensure that individual companies and industries could survive in such a scenario.

14 Chrystia Freeland is right on ‘friend-shoring.’ Our allies need Canada to help reduce dependence on Russian energy | The Star

15 WTO, National Foreign Trade Council: Strengthening the WTO and the global trading system, Remarks by DG Okonjo-Iweala, April 2022; access on 22 September 2022: WTO | News - Speech - DG Ngozi Okonjo-IwealaNational Foreign Trade Council: Strengthening the WTO and the global trading system

New Momentum for Globalisation 12

German industry is in constant dialogue with foreign industries and policymakers, including countries that challenge our western ideas and values. Countries such as China account for a significant share of German foreign trade and are an important source and destination of foreign direct investment. All the same, we should acknowledge that China, in particular, with its Leninist form of government and its state-dominated hybrid economy poses a particular challenge. The government is increasingly openly rejecting western standards of a level playing field and law-based neutrality, even in the global business environment, and with the help of massive state support is trying to secure advantages for its own companies on all markets.

New Momentum for Globalisation 13

Conclusion

In view of the acute geoeconomic challenges, Germany needs a proactive foreign economic policy that is focused on securing the competitiveness of Germany and Europe as an industrial location. Alongside internationally competitive incentives for foreign and domestic direct investment, the federal government must put national and global security and economic interests at the top of the agenda and pursue these in a rigorous and comprehensive way. New free-trade agreements with strategic partners and a reliable deepening of transatlantic relations will help strengthen efforts to reach our climate targets, also with new trade partners.

An internationally competitive industrial location will increase the resilience of companies and create new opportunities for the diversification of value chains. From this position of strength, it will be possible to shoulder the ESG requirements and meet the economic and social objectives together

Globalisation at a glance

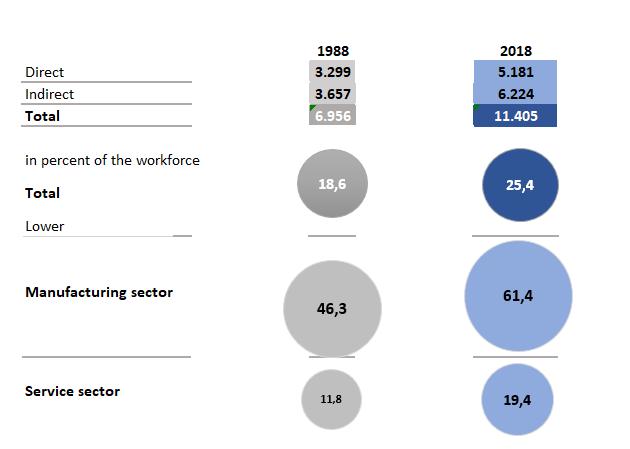

The German export industry secures jobs

Trade disputes and geopolitical uncertainties are currently making life very difficult for the exportoriented German industry. This could ultimately have an impact on employment considering that the growth in jobs over the past 20 years can largely be attributed to the well-performing export business. A good 25 percent of jobs in Germany in 2018 were based on exports, compared to just 19 percent in 2018.16

Directly / Indirectly / Total / In percent of total employees / Total / Of which / Manufacturing / Services

Export industry secures many jobs

Number of jobs in Germany dependent on exports, per 1,000 in Milliarden Euro

Directly: Employees in companies that produce export goods and services

Indirectly: Employees in supplier companies that produce inputs for export goods

Source: Federal Statistical Office, IW Consult, 2020 IW Medien/iwd

16 iwd, Viele Jobs hängen am Export 4 February 2020; accessed on 22 September 2022 Many Jobs Depend on Exports - iwd.de

New Momentum for Globalisation 14

Germany is a winner of globalisation

The integration of German industry with the rest of the world has brought large gains in prosperity for the German population. Measured by increase in annual income per capita, Germany has definitely benefited from globalisation

The winners of globalisation

Average increase in annual income per capita between 1990 and 2018 in Milliarden Euro

Source: Prognos/Bertelsmann Foundation, Globalisierungsreport 2020)

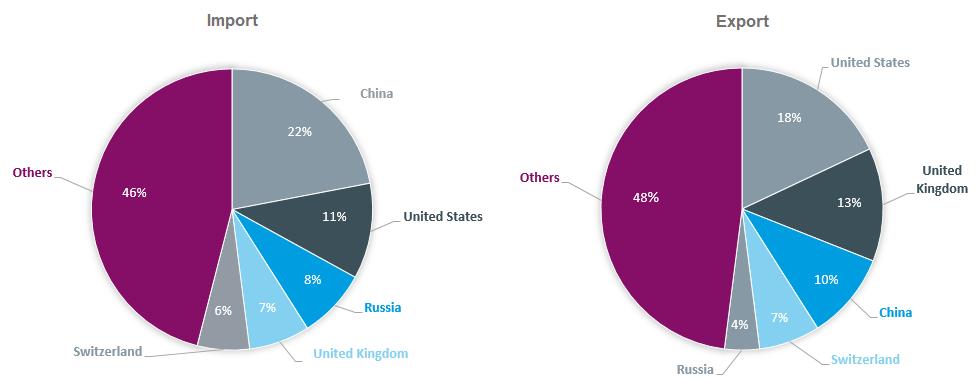

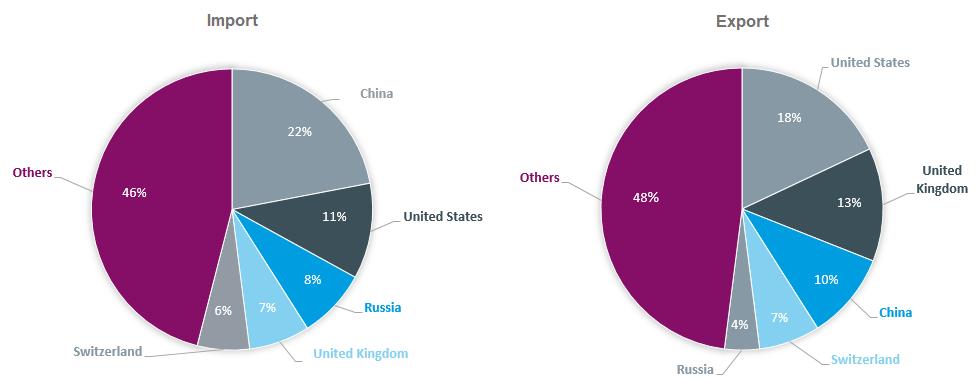

The United States and China are the two most important international trade partners of the EU The EU receives a large share of its imports from China but sells most goods to the United States in Milliarden Euro

Source: Eurostat, Trade in goods by top 5 partners, European Union, 2021 (in percent)

New Momentum for Globalisation 15 1.787 € 1.609 € 1.583 € 1.344 € 1.275 € 1.167 € 1.112 € 0 € 500 € 1.000 € 1.500 € 2.000 € JAPAN IRELAND SWITZERLAND FINLAND ISRAEL NETHERLAND GERMANY

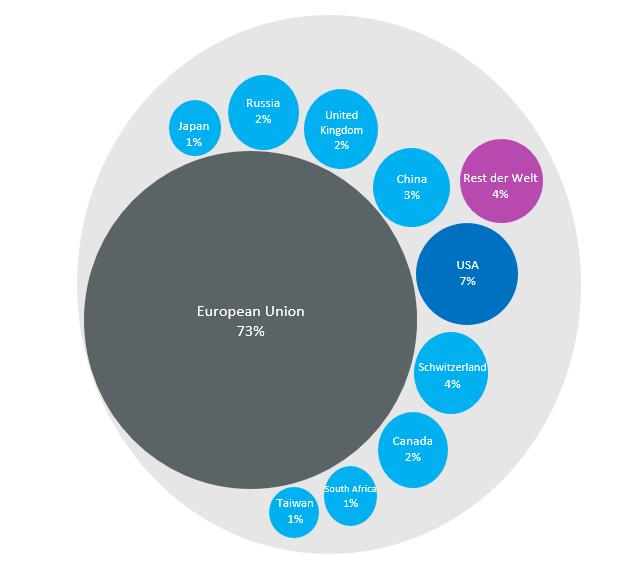

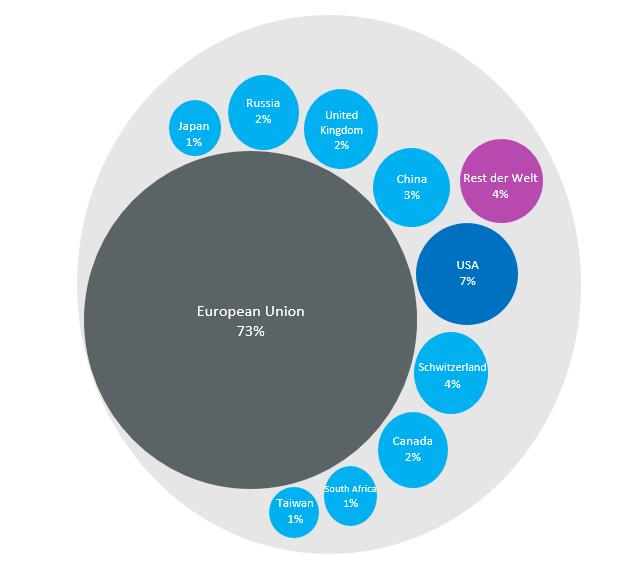

Almost three quarters of imports of dependent industrial goods originate from EU countries

73 percent of all dependent17 industrial goods are sourced from EU countries. The following country abbreviations have been used: Russia (RUS), South Africa (ZAF), Japan (JPN) and Taiwan (TWN). Figure 1 shows the shares per trade partner in dependent industrial goods in 2019 for Germany

Russia / United Kingdom / Rest of world / European Union / US / Switzerland / South Africa / Canada

Source: ifo Institute, KAS, Internationale Wertschöpfungsketten – Reformbedarf und Möglichkeiten, August 2021, p. 16.

17 Dependent goods or goods which are dependent on foreign suppliers meet the following three criteria: 1. Relevance for German production: (i) Focus on the five most important sectors and (ii) The three most important inputs for these sectors. 2. Low diversification: Herfindahl Hirschman Index (HH Index) > 33% 3. Substitution with domestic production difficult: German imports > German exports.

New Momentum for Globalisation 16

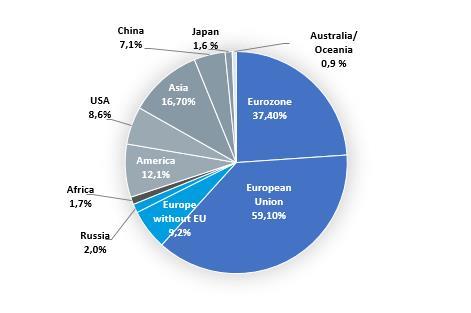

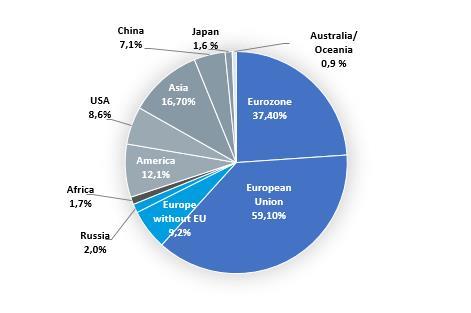

Trade volume according to destination region

Proportion of trade of German goods exports per geographical region In 2006 and 2021

German exports (region of destination) For 2019, proportion in percent; total 1,318 billion euros in Milliarden Euro

Source: Statistical Federal Office

New Momentum for Globalisation 17

Source: BMWK, Fakten zum deutschen Außenhandel, July 2022

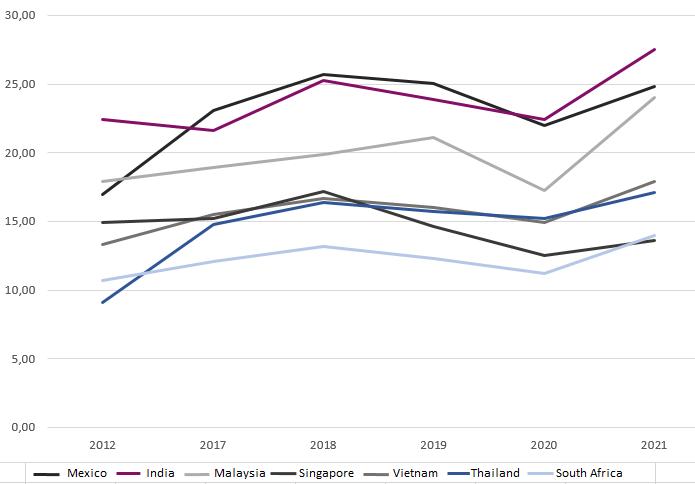

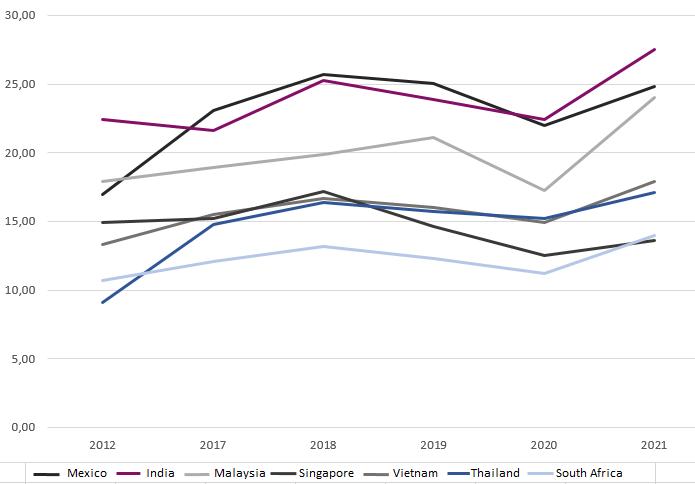

The increasing diversification of industry Development of foreign trade (exports and imports) between Germany and selected developing countries, in billion US dollars

in Milliarden Euro

Source: Federal Statistical Office (Destatis), 2022 | As of 9 December 2022; Genesis Database, own figure

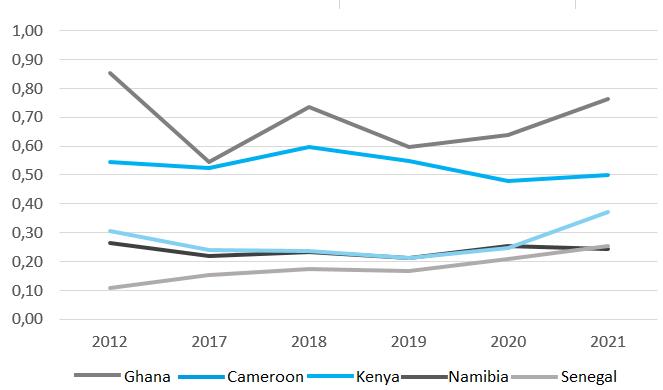

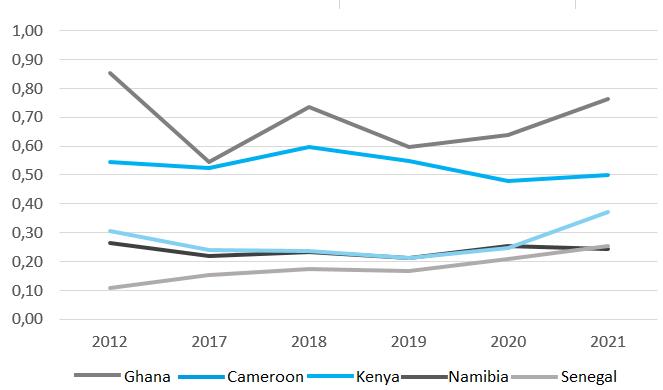

The increasing diversification of industry Development of foreign trade (exports and imports) between Germany and selected African countries, in billion US dollars

in Milliarden Euro

Source: Federal Statistical Office (Destatis), 2022 | As of 9 December 2022; Genesis Database, own figure

New Momentum for Globalisation 18

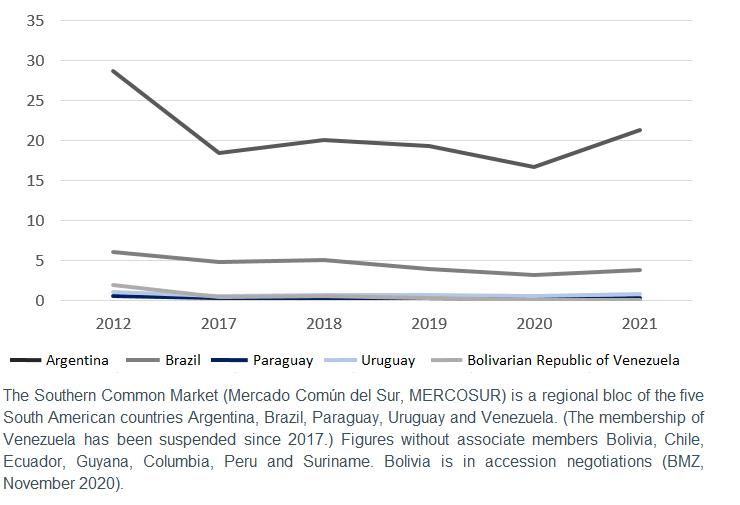

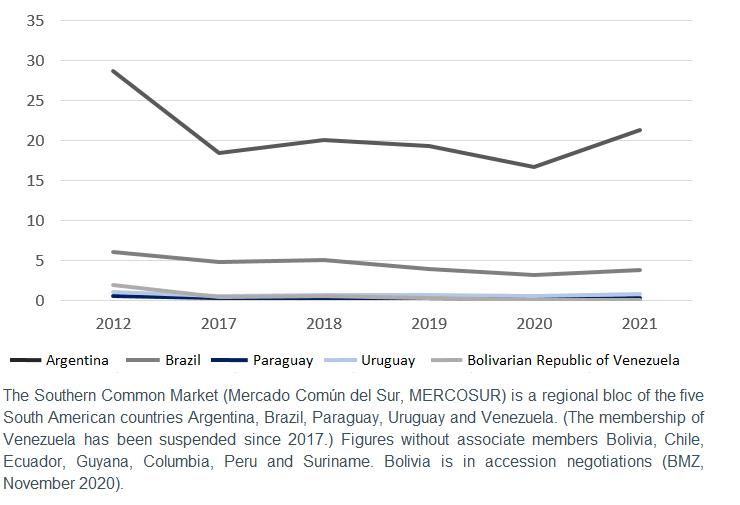

MERCOSUR agreement would drive diversification of industry

Development of foreign trade (imports and exports) between Germany and the MERCOSUR countries* in billion US dollars

Source: Federal Statistical Office (Destatis), 2022 | As of 9 December 2022; Genesis Database, own figure

*Direct and indirect investment (via dependent holding companies) / Directional basis: Abroad / Net direct investment abroad / All countries excluding reporting country / All industries

Source: Deutsche Bundesbank, own figure, as of May 2022.

New Momentum for Globalisation 19

Investment trends German direct investment abroad, stocks in euro billions 800 900 1000 1100 1200 1300 1400 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Direct investment abroad

Investment trends

Direct and indirect investment (stocks) / Net direct investment in selected developing countries, in euro millions

Investment trends

Direct and indirect investment (stocks) / Net direct investment in Mercosur countries and Chile and Mexico, in euro millions

New Momentum for Globalisation 20

0 1000 2000 3000 4000 5000 6000 7000 8000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Indonesia Malaysia Philippines Thailand Vietnam 0 5000 10000 15000 20000 25000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Mexico Argentina Brazil Chile Paraguay Uruguay

Source: Deutsche Bundesbank, own figure, as of May 2022.

Source: Deutsche Bundesbank, own figure, as of May 2022.

Publishing Information

The Federation of German Industries (BDI)

Breite Strasse 29, 10178 Berlin

www.bdi.eu

T: +49 30 2028-0

Lobby register number: R000534

Editors

Matthias Krämer Head of External Economic Policy

T: +49 30 2028-0000

m.kraemer@bdi.eu

Cedric von der Hellen Senior Manager, External Economic Policy

T: +49 30 2028-1602

c.hellen@bdi.eu

BDI Document Number: D 1655

New Momentum for Globalisation 21