GROUP PROJECT

PRABHNOOR SINGH PrabhnoorSingh.067@yorkvilleu.ca

COMPANIES LISTED ON THE TORONTO STOCK EXCHANGE WOULD BE A BETTER LONG-TERM INVESTMENT

• Canadian Natural Resources Limited (CNQ.TO)

• Canadian National Railway Company (CNR.TO)

https://ca.finance.yahoo.com/

2 GROUP PROJECT About

Figure 2: (Samworth, 2023)

Figure 1: (foodnavigator.com, 2014)

Why Investing in Company is a Smart Long-Term Decision

Exploring Canadian Natural Resources Limited (CNQ.TO): An in-depth look at the Toronto Real Time Stock Price

Investing in Canadian Natural Resources Limited (CNQ.TO)

Exploring the Canadian National Railway Company (CNR.TO)

Maximize Returns from Long Term Investment in Canadian National Railway Company (CNR.TO)

CNR.TO & CNQ.TO: A Long-Term Investment Analysis

References

3 PRABHNOOR SINGH

1.

2.

3.

4.

5. 6.

Index

7.

Why Investing in Company is a Smart Long-Term Decision

4 GROUP PROJECT

Figure 3: (StackCommerce, 2022)

Why Long-Term ?

Growth potential as one reason why investing in a company can be a smart long-term decision.

If a company has a strong business model and is in an industry with solid long-term growth prospects, it has the potential to significantly increase its revenue, earnings and cash flow over time. This growth can then translate to appreciation in the company’s stock price, leading to capital gains for shareholders.

“At a minimum, investing allows you to keep pace with cost-ofliving increases created by inflation. Additionally, a long-term investment strategy can provide the possibility of compounding interest, or growth earned on growth (Making Smart Investments: A Beginner’s Guide, 2021)”.

5 PRABHNOOR SINGH

Figure 4: (Olivier, 2021)

Exploring Canadian Natural Resources Limited (CNQ.TO): An in-depth look at the Toronto Real Time Stock Price

6 GROUP PROJECT

Figure 5: (Parker, 2022)

Understanding CNQ.TO

Understanding CNQ.TO is essential for investors looking to gain insight into the Toronto Real Time Stock Price of Canadian Natural Resources Limited. With a better understanding of the stock, investors can make more informed decisions about their investments.

“CNQ’s revenue and earnings have grown significantly in recent years, fueled by higher oil prices. However, its production has been relatively flat” (Canadian Natural Resources Limited (CNQ.TO) Stock Price, News, Quote & History - Yahoo Finance, 2023).

7 PRABHNOOR SINGH

Figure 6: (Culinary Lavender - Lavender Ontario - Cooking & Recipes, 2021)

CALVIN J. BAST

SENIOR VICE-PRESIDENT, PRODUCTION

MARK A. STAINTHORPE

CHIEF FINANCIAL OFFICER AND SENIOR VICE-PRESIDENT, FINANCE

Leadership Team

8 GROUP PROJECT

N. MURRAY EDWARDS EXECUTIVE CHAIRMAN

TIM S. MCKAY PRESIDENT

Figure 7-10: (Management – Canadian Natural Resources, 2023)

Company Financial Performance

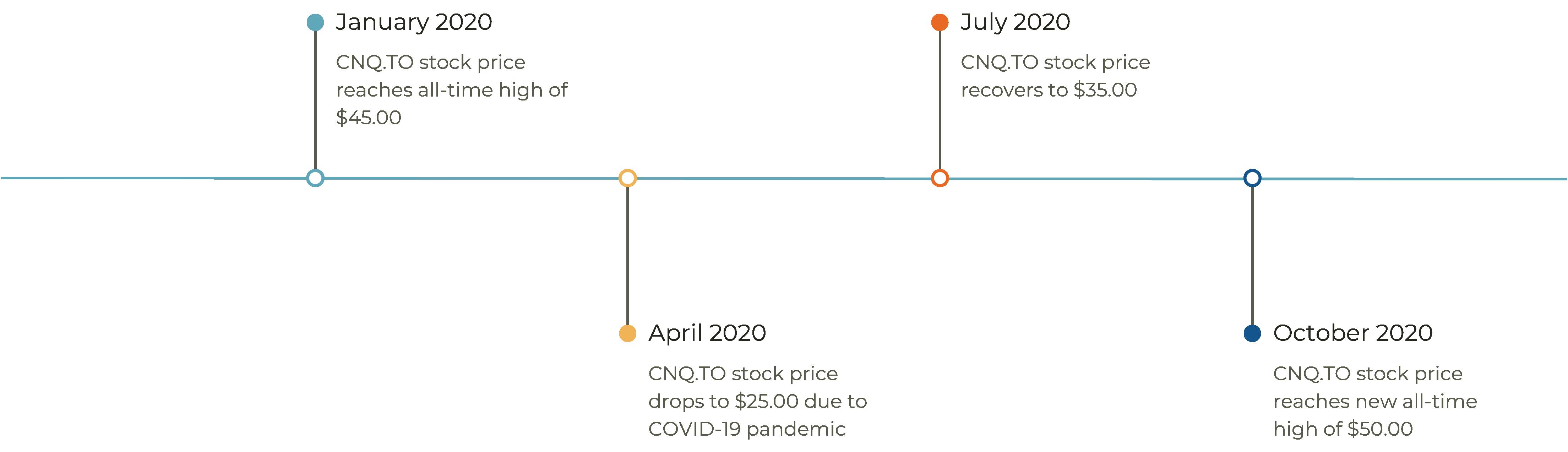

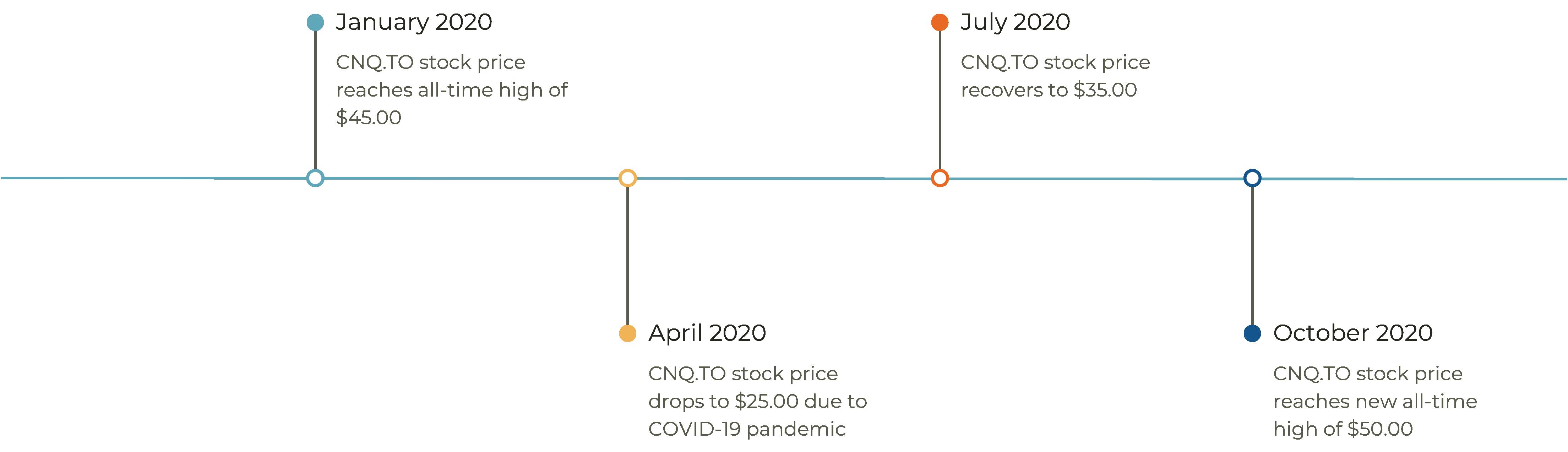

CNQ.TO has seen a steady increase in price over the past few months.

*Data sourced from Yahoo Finance.

9 PRABHNOOR SINGH

Company Profile

An in-depth look at Canadian Natural Resources Limited (CNQ.TO) and its Toronto Real Time Stock Price, including an overview of the company, analysis of its financial performance, and examination of industry trends.

“Dividends: CNQ pays a quarterly dividend of C$0.85 per share, for a yield of 4.2%. The dividend has increased in 8 of the last 10 years”. (Canadian Natural Resources Limited (CNQ.TO) Stock Price, News, Quote & History - Yahoo Finance, 2023)

10 GROUP PROJECT

*Data sourced from Yahoo Finance.

11 PRABHNOOR SINGH

““CNQ.TO is a great example of a Canadian natural resource stock that has seen tremendous growth in recent years.””

Key Company Milestones

12 GROUP PROJECT

Dependencies and SWOT Analysis of CNQ.TO

CNQ.TO is a stock traded on the Toronto Stock Exchange and is part of Canadian Natural Resources Limited. Understanding the dependencies and SWOT analysis of CNQ.TO is essential for investors to make informed decisions.

“The company maintains certain midstream activities within Western Canada that includes an electricity co-generation system, pipeline operations and an equity interest in the North West Redwater Partnership. Canadian Natural is headquartered in Calgary, Alberta, Canada” (MarketResearch.com, 2022).

13 PRABHNOOR SINGH

Figure 11: (Meijaard, 2020)

14 GROUP PROJECT

Investing in Canadian Natural Resources Limited (CNQ.TO)

Figure 12: (Canadian Natural Resources – Canadian Natural Is One of the Largest Independent Crude Oil)

Overview of Canadian Natural Resources Limited

Canadian Natural Resources Limited (CNQ.TO) is a leading Canadian energy company that produces and markets natural gas, crude oil, and natural gas liquids. CNQ.TO is a publicly traded company on the Toronto Stock Exchange.

“Canadian Natural Resources Ltd. is a senior oil and natural gas production company, which engages in the exploration, development, marketing, and production of crude oil and natural gas. It operates through the following segments: Oil Sands Mining and Upgrading; Midstream and Refining; Exploration and Production; and Head Office.” (“Canadian Natural Resources | Company Overview & News,” 2023).

CNQ Investor Relations

Investor relations is an important part of investing in Canadian Natural Resources Limited (CNQ.TO). CNQ provides investors with the information they need to make informed decisions about their investments.

15 PRABHNOOR SINGH

Figure 13: (Technology Networks, 2018)

16 GROUP PROJECT Canadian Natural Resources Limited (CNQ.TO)

https://ca.finance.yahoo.com/

Figure 23: (Canadian National Railway Company (CNR.TO) Stock Price, News, Quote & History - Yahoo Finance, 2023)

Long-Term Investment

CANADIAN NATURAL RESOURCES LIMITED (CNQ.TO)

CHALLENGE

As an oil and gas producer, CNQ’s earnings and cash flow are highly dependent on oil and gas prices, which can be volatile. This poses risks for long-term investors.

CNQ has struggled to grow its oil and gas production in recent years. Production is expected to remain flat or decline in the near future.

“Tightening environmental regulations around emissions and resource development pose ongoing challenges for CNQ” (Zeng et al., 2022).

SOLUTION

▶ CNQ focuses on cost optimization and maintains a strong balance sheet to navigate through commodity price cycles. It also pays a stable dividend.

▶ CNQ is focusing on expanding its oil sands operations and implementing new technologies to optimize production and recover more resources.

▶ CNQ is investing in emission reduction technologies and processes to improve the sustainability and efficiency of its operations. It has set targets to reduce emissions intensities.

*Data sourced from Yahoo Finance.

Resource Portfolio

Investing in Canadian Natural Resources Limited (CNQ.TO) requires a diversified resource portfolio to ensure a successful return on investment. A wellrounded portfolio of resources can help to mitigate risk and maximize returns. (CANADIAN NATURAL RESOURCES LIMITED ANNOUNCES 2023 FIRST QUARTER RESULTS CALGARY, ALBERTA -MAY 4, 2023 -for IMMEDIATE RELEASE, n.d.)

A balanced, diversified portfolio can help offset risks and maximize total returns. However, CNQ still offers exposure to Canada’s energy sector and the potential for capital gains and dividend income within that context. So investors need to weigh the risks and potential rewards for their specific situation and goals.

18 GROUP PROJECT

Figure 15: (jplenio, 2018)

Market Share

*Data sourced from Yahoo Finance.

19 PRABHNOOR SINGH

50%

CNQ.TO has a

market share.

Financial Performance

20 GROUP PROJECT

“

Industry insights are the key to successful investing.”

*Data sourced from (shane_oliver, 2020).

21 PRABHNOOR SINGH

22 GROUP PROJECT

Investing in Canadian Natural Resources Limited (CNQ.TO)

Figure 16:

▶ The Canadian National Railway Company (CNR.TO) is a major freight railway operator in Canada and the United States. This slide provides an overview of the company’s operations and performance.

▶ Canadian National Railway Co. (CNR) is a transportation business that provides services such as rail, intermodal, trucking, supply chain services, business development, and maps and network. It operates over 19,600 miles of track across Canada, extending to Chicago and the Gulf of Mexico. In 2019, CN delivered almost 6 million carloads (CNR.TO - Canadian National Railway Co. Stock PriceBarchart.com, 2023)

Overview of CNR.TO

23 PRABHNOOR SINGH

Figure 17: (Pixabay, 2023)

CNR.TO Business Model

The Canadian National Railway Company (CNR.TO) has a robust business model that includes revenue streams, operations, investments, and partnerships.

24 GROUP PROJECT

CNR.TO Executive Team

25 PRABHNOOR SINGH

TRACY ROBINSON President and Chief Executive Officer

ED HARRIS Executive Vice-President and Chief Operating Officer

GHISLAIN HOULE Executive Vice-President and Chief Financial Officer

DOMINIQUE MALENFANT Executive Vice-President and Chief Information and Technology Officer

Figure 18-21: (Leadership Team | Who We Are | about CN | Cn.ca, 2022)

History of Canadian National Railway

26 GROUP PROJECT

*Data sourced from (BrainyQuote, 2013).

27 PRABHNOOR SINGH

“Exploration is the engine that drives innovation. Without it, there would be no progress.”

Pros & Cons of CNR.TO

CNR.TO has both positive and negative aspects that should be considered when exploring the company as an investment opportunity.

28 GROUP PROJECT

Toronto Real-Time Price, Currency in CAD

▶ The Toronto Stock Exchange is a major hub for the Canadian National Railway Company (CNR.TO). Realtime prices of CNR.TO are tracked in Canadian Dollars (CAD).

▶ Canadian National’s railway spans Canada from coast to coast and extends through Chicago to the Gulf of Mexico. In 2019, CN delivered almost 6 million carloads over its 19,600 miles of track. CN generated roughly CAD 14 billion in total revenue by hauling intermodal containers (25% of consolidated revenue), petroleum and chemicals (21%), grain and fertilizers (16%), forest products (12%), metals and mining (11%), automotive shipments (6%), and coal (4%). Other items constitute the remaining revenue (TMX Money, 2023).

29 PRABHNOOR SINGH

Figure 22: (ArtTower, 2014)

Canadian National Railway Company (CNR.TO)

30 GROUP PROJECT

https://ca.finance.yahoo.com/

Figure 14: (Canadian Natural Resources Limited (CNQ.TO) Stock Price, News, Quote & History - Yahoo Finance, 2023)

Long-Term Investment

CANADIAN NATIONAL RAILWAY COMPANY (CNR.TO)

CHALLENGE

Economic sensitivity: CNR’s profits are closely tied to the broader economy. During recessions, volumes and revenues decline.

CNR faces challenges around network congestion and capacity constraints, especially during peak periods.

CNR operates in a highly regulated environment and faces risks associated with more stringent regulations or unfavorable changes (KPMG US, 2022).

Emerging technologies like autonomous vehicles and drones could potentially disrupt the rail freight industry over the long term (The Disruption, 2017).

SOLUTION

▶ CNR’s profits are closely tied to the broader economy. During recessions, volumes and revenues decline (The Impact of Recessions on Businesses, 2023).

▶ CNR is investing heavily in infrastructure expansion, equipment upgrades, and technology to improve network fluidity and increase capacity.

▶ CNR maintains a constructive relationship with regulators through transparency, good governance and sound environmental/safety practices.

▶ CNR is investing in new technologies of its own to enhance efficiency, safety and customer service. It also pursues strategic acquisitions.

31 PRABHNOOR SINGH

Maximize Returns from Long Term Investment in Canadian National Railway Company (CNR.TO)

Figure 24: (David, 2017)

Overview of the CNR

The Canadian National Railway Company (CNR. TO) is a major player in the transportation industry, providing freight and passenger services across Canada and the United States. This slide provides an overview of the company’s operations and how investors can maximize returns from long-term investments in CNR (Canadian National Railway (CN) | the Canadian Encyclopedia, 2017).

CN is investing in technologies to deliver highquality service to customers, improve safety and sustainability, create capacity and reduce costs and delays. This is part of their ambition to build the premier railway of the 21st century. CN is committed to maximizing returns from long term investments in their railway company (CN Outlines Details of Strategic Plan | Cn.ca, 2022).

Figure 25: (Borowsky, 2019)

Figure 25: (Borowsky, 2019)

Financial Performance Overview

CNR has seen steady growth in revenue and net income over the past year.

*Data sourced from Yahoo Finance.

Market Trends and Forecast

Management Team’s Outlook

The management team of Canadian National Railway Company (CNR.TO) is confident that their long-term investments will yield maximum returns. They are optimistic about the future of the company and its potential for growth (CN Outlines Details of Strategic Plan | Cn.ca, 2022).

I am confident that CN’s senior management, a team of worldclass railroaders who are focused on redefining the rail industry, have the skills and determination to lead the Company into this exciting next phase.”

— Robert Pace, Chair of the Board of Directors of CN

Figure 26: (Retro Locomotive Train, 2022)

Advantages of Investing in CNR

Investing in CNR is a great way to maximize returns from long-term investments due to its diversified revenue streams, strong financial position, and high growth potential.

FIGURES

1. foodnavigator.com. (2014, October 2). Nestlé and Kellogg acknowledge risks of carbon pollution from power plants. Foodnavigator.com. https:// www.foodnavigator.com/Article/2014/10/03/Nestle-and-Kellogg-join-BICEP-climate-change

2. Samworth, T. (2023). Historic CNR Logo Painted On Locomotive 6167 In Guelph, Ontario. Dreamstime.com. https://www.dreamstime.com/ traditional-insignia-canadian-national-railways-painted-historic-steam-locomotive-display-adjacent-to-guelph-image195461888

3. StackCommerce. (2022, February 27). Gear up for tax season with 43% off this income and expense tracker. Mashable; Mashable. https:// mashable.com/deals/feb-27-ifinancer-tracker

4. Olivier. (2021, March 5). Rental income of non-residents of Canada | Effisca. Effisca. https://www.effisca.com/en/rental-income-of-non-residentsof-canada/

5. Parker, V. (2022, December 7). 88 Energy signs rig contract for Hickory-1 well on Alaska’s North Slope. Vox Markets; Vox Markets. https://www. voxmarkets.co.uk/articles/88-energy-signs-rig-contract-for-hickory-1-well-on-alaska-s-north-slope-99a9f34/

6. Culinary Lavender - Lavender Ontario - Cooking & Recipes. (2021, July 14). Lavender Ontario. https://lavenderontario.org/home/culinary-lavender/

7. Management – Canadian Natural Resources. (2023). Cnrl.com. https://www.cnrl.com/about-us/management/

8. Management – Canadian Natural Resources. (2023). Cnrl.com. https://www.cnrl.com/about-us/management/

9. Management – Canadian Natural Resources. (2023). Cnrl.com. https://www.cnrl.com/about-us/management/

10. Management – Canadian Natural Resources. (2023). Cnrl.com. https://www.cnrl.com/about-us/management/

11. Meijaard, E. (2020, July 21). Coconut oil production threatens five times more species than palm oil. Eco-Business; Eco-Business. https://www.ecobusiness.com/opinion/coconut-oil-production-threatens-five-times-more-species-than-palm-oil/

12. Canadian Natural Resources – Canadian Natural is one of the largest independent crude oil and natural gas producers in the world. The Company continually targets cost effective alternatives to develop our portfolio of projects and to deliver our defined growth plan, thereby creating. (2023). Cnrl.com. https://www.cnrl.com/

38 GROUP PROJECT

References

FIGURES

13. Technology Networks. (2018, October 4). Next Generation Satellite Data Provides Better Tornado Forecasts. Informatics from Technology Networks; Technology Networks. https://www.technologynetworks.com/informatics/news/next-generation-satellite-data-provides-better-tornadoforecasts-310337

14. Canadian Natural Resources Limited (CNQ.TO) Stock Price, News, Quote & History - Yahoo Finance. (2023). @YahooFinanceCA. https://ca.finance. yahoo.com/quote/CNQ.TO

15. jplenio. (2018, July 14). Light Bulb Idea - Free photo on Pixabay. Pixabay.com. https://pixabay.com/photos/light-bulb-light-idea-bokehenergy-3535435/

16. Service, W. (2019, August 20). Origins of CNR in Red Deer go back to 1910-1911. Red Deer Advocate; Red Deer Advocate. https://www. reddeeradvocate.com/opinion/origins-of-cnr-in-red-deer-go-back-to-1910-1911/

17. Pixabay. (2023). Pixabay.com. https://pixabay.com/photos/search/playing%20cards/

18. Leadership Team | Who We Are | About CN | cn.ca. (2022). Www.cn.ca. https://www.cn.ca/en/about-cn/leadership-team/

19. Leadership Team | Who We Are | About CN | cn.ca. (2022). Www.cn.ca. https://www.cn.ca/en/about-cn/leadership-team/

20. Leadership Team | Who We Are | About CN | cn.ca. (2022). Www.cn.ca. https://www.cn.ca/en/about-cn/leadership-team/

21. Leadership Team | Who We Are | About CN | cn.ca. (2022). Www.cn.ca. https://www.cn.ca/en/about-cn/leadership-team/

22. ArtTower. (2014, November). Steam Train Locomotive Ancient - Free photo on Pixabay. Pixabay.com. https://pixabay.com/photos/steam-trainlocomotive-ancient-512508/

23. Canadian National Railway Company (CNR.TO) Stock Price, News, Quote & History - Yahoo Finance. (2023). @YahooFinanceCA. https://ca.finance. yahoo.com/quote/CNR.TO?p=CNR.TO

24. David. (2017, June 6). Metal Casting and Foundry Production. Reliance Foundry Co. Ltd. https://www.reliance-foundry.com/blog/beginner-guidemetal-casting

References

39

IMAGE

25. Borowsky, A. (2019, January 2). Adversity as Motivation - Age of Awareness - Medium. Medium; Age of Awareness. https://medium. com/age-of-awareness/adversity-as-motivation-8c8a49e71b90

26. Retro Locomotive Train. (2022). Displate; Displate - metal posters | Collect Your Passions. https://displate.com/displate/5351598

TEXTS

• BrainyQuote. (2013). BrainyQuote; BrainyQuote. https://www. brainyquote.com/quotes/edith_widder_550187

• Canadian National Railway (CN) | The Canadian Encyclopedia. (2017). Thecanadianencyclopedia.ca. https://www. thecanadianencyclopedia.ca/en/article/canadian-nationalrailways

• Canadian Natural Resources Limited (CNQ.TO) Stock Price, News, Quote & History - Yahoo Finance. (2023). @YahooFinanceCA. https:// ca.finance.yahoo.com/quote/CNQ.TO

• Canadian Natural Resources | Company Overview & News. (2023). Forbes. https://www.forbes.com/companies/canadian-naturalresources/?sh=6ffb860b527d

• CANADIAN NATURAL RESOURCES LIMITED ANNOUNCES 2023 FIRST QUARTER RESULTS CALGARY, ALBERTA -MAY 4, 2023 -FOR IMMEDIATE RELEASE. (n.d.). Retrieved May 22, 2023, from https://www.cnrl.com/ content/uploads/2023/05/0504-Q123-Front-End.pdf

• CN Outlines Details of Strategic Plan | cn.ca. (2022). Www.cn.ca. https://www.cn.ca/en/news/2021/09/cn-outlines-details-ofstrategic-plan/

• CNR.TO - Canadian National Railway Co. Stock Price - Barchart.com. (2023). Barchart.com; Barchart. https://www.barchart.com/stocks/ quotes/CNR.TO

References

40 GROUP PROJECT

TEXTS

• KPMG US. (2022, March 4). KPMG; KPMG. https://advisory.kpmg.us/articles/2022/ten-key-regulatory-challenges-2022-climate-sustainability.html

• Making Smart Investments: A Beginner’s Guide. (2021, August 26). Harvard Business Review. https://hbr.org/2021/08/how-to-make-smartinvestments-a-beginners-guide#:~:text=At%20a%20minimum%2C%20investing%20allows%20you%20to%20keep,of%20compounding%20 interest%2C%20or%20growth%20earned%20on%20growth.

• MarketResearch.com. (2022, June 23). Canadian Natural Resources Ltd (CNQ) - Financial and Strategic SWOT Analysis Review. Marketresearch. com. https://www.marketresearch.com/GlobalData-v3648/Canadian-Natural-Resources-CNQ-Financial-31849673/

• shane_oliver. (2020, October 14). Nine keys to successful investing - and why they are more important than ever in the face of the coronavirus shock. AMP Capital; AMP Capital. https://www.ampcapital.com/americas/en/insights-hub/articles/2020/october/nine-keys-to-successfulinvesting

• The, D. (2017). Disruption: The Future Of Rail Freight. Oliverwyman.com. https://www.oliverwyman.com/our-expertise/insights/2017/sep/oliverwyman-transport-and-logistics-2017/operations/disruption-the-future-of-rail-freight.html

• The Impact of Recessions on Businesses. (2023). Investopedia. https://www.investopedia.com/articles/economics/08/recession-affectingbusiness.asp

• TMX Money. (2023). Tmx.com. https://money.tmx.com/en/quote/CNR/company#profile-section-company-spoke

• Zeng, H., Zhang, X., Zhou, Q., Jin, Y., & Cao, J. (2022). Tightening of environmental regulations and corporate environmental irresponsibility: a quasinatural experiment. 24(11), 13218–13259. https://doi.org/10.1007/s10668-021-01988-8

References

41

Figure 25: (Borowsky, 2019)

Figure 25: (Borowsky, 2019)