LAWYER

SHROPSHIRE WINTER 2023

THE SHROPSHIRE

H M CORONERS SERVICE FOR SHROPSHIRE, TELFORD, AND WREKIN THOUGHTS ON MEDIATION SHROPSHIRE FUTURE PARTNERS

THE OFFICIAL JOURNAL OF

LAW SOCIETY

2 SHROPSHIRE LAWYER XXXXXXXXXXXXXXXXXXX Don’t change what you do. Just make it easier to do. See how Clio makes legal practice management easier. Discover Clio today at clio.com/uk/s shropshire-lawyer or call +44-800-433-2546.

PUBLISHER

Benham Publishing

Aintree Building, Aintree Way, Aintree Business Park, Liverpool L9 5AQ

Tel: 0151 236 4141

Fax: 0151 236 0440

Email: admin@benhampublishing.com Web: www.benhampublishing.com

ACCOUNTS DIRECTOR Joanne Casey SALES DIRECTOR Karen Hall

STUDIO MANAGER Lee Finney

MEDIA No. 1994

PUBLISHED

Winter 2023 © The Shropshire Law Society Benham Publishing Ltd.

LEGAL NOTICE

© Benham Publishing. None of the editorial or photographs may be reproduced without prior written permission from the publishers. Benham Publishing would like to point out that all editorial comment and articles are the responsibility of the originators and may or may not reflect the opinions of Benham Publishing. No responsibility can be accepted for any inaccuracies that may occur, correct at time of going to press. Benham Publishing cannot be held responsible for any inaccuracies in web or email links supplied to us.

DISCLAIMER

The Shropshire Law Society welcomes all persons eligible for membership regardless of sex, race, religion, age or sexual orientation.

All views expressed in this publication are the views of the individual writers and not the society unless specifically stated to be otherwise. All statements as to the law are for discussion between members and should not be relied upon as an accurate statement of the law, are of a general nature and do not constitute advice in any particular case or circumstance.

Members of the public should not seek to rely on anything published in this magazine in court but seek qualified Legal Advice. COVER INFORMATION

Photo of Danny Smith used with permission.

SHROPSHIRE LAWYER 3 CONTENTS

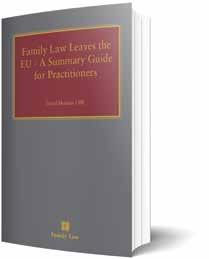

CONTENTS 12 05 President’s Foreword 06 Your Committee 08 News 10 Diary of a Baby Lawyer 11 What is a Solicitor Apprenticeship? 12 Thoughts on Mediation 14 Should I get an electric car? 15 What can I do to help my employees as they tighten their belts? 16 H M Coroners Service for Shropshire, Telford, and Wrekin 20 Shropshire Future Partners 26 Top Tips for your B2B Terms & Conditions 28 Tim’s Top Tips 29 Book Review NEXT ISSUES APRIL 2023 JULY 2023 Advertising Anyone wishing to advertise in the Shropshire Lawyer please contact Catherine McCarthy before the copy deadline. 0151 236 4141 catherine@benhampublishing.com Editorial Anyone wishing to submit editorial for publication in the Shropshire Lawyer please contact info@shropshirelawsociety.com. www.shropshirelawsociety.com info@shropshirelawsociety.com @ShropLawsoc 20 16 14

Poppy’s second chance at love

Poppy’s owner first contacted her local rehoming centre and said she needed to hand Poppy, a four year old Chihuahua cross, over to us as she had sadly recently been given a diagnosis that she had a terminal illness. She was advised to apply for a free Canine Care Card and nominate a Dog Guardian; someone she trusts to sign over the care of Poppy to Dogs Trust should she need it. She’d then be able to spend the most time possible with Poppy and feel reassured that she’d be given the best possible care at Dogs Trust when they could no longer be together.

When Poppy’s Dog Guardian contacted us to advise that her owner was now receiving palliative care and that they needed to activate her Canine Care Card, Poppy was collected by Dogs Trust the very next day. After a vet and behavioural assessment we decided the best place for Poppy would be a loving foster home. We were able to advise the foster carers of all the information we’d been given by Poppy’s owner regarding her life, diet and routine to enable us to make this transitional period as stress-free as possible for Poppy.

Within almost no time, we were able to find very affectionate Poppy a lovely new home for her second chance at love.

Poppy’s story is one of many we come across at Dogs Trust.

Many owners are growing increasingly worried about gradually losing their independence or their health deteriorating. Dogs Trust want to offer owners peace of mind that we will be there at this difficult time to care for and rehome their four legged friends should the worst happen.

Therefore we’re pleased to announce that we have extended our Canine Care Card service. Dogs Trust will care for your dog should you move into a care home, become seriously ill or pass away.

For more information on our Canine Care Card service and how to register your dog please type in this link www.dogstrust.org.uk/ccc where you will find our online application form and more information on our free service.

If you have any queries regarding the Canine Care Card please email CCC@dogstrust.org.uk or call 020 7837 0006 and we will be happy to help. ■

Who’ll keep her happy when your client’s gone?

We will – as long as your client has a Canine Care Card. It’s a FREE service from Dogs Trust that guarantees their dog a second chance a life. At Dogs Trust, we never put down a healthy dog. We’ll care for them at one of our 21 rehoming centres, located around the UK. One in every four of your clients has a canine companion. Naturally they’ll want to make provision for their faithful friend. And now you can help them at absolutely no cost. So contact us today for your FREE pack of Canine Care Card leaflets – and make a dog-lover happy. E-mail ccc@dogstrust.org.uk Or call 020 7837 0006 Or write to: FREEPOST DOGSTRUSTL (No stamp required) Please quote “334975”

4 SHROPSHIRE LAWYER ADVERTISEMENT FEATURE

©

Trust

All information will be treated as strictly confidential. Service only available for residents of the UK, Ireland, Channel Islands & Isle of Man. A dog is for life, not just for Christmas® dogstrust.org.uk Registered charity numbers: 227523 & SC037843

Dogs

2021

President’s Foreword Winter 2023

This is the first edition of the magazine that I have the pleasure of introducing.

I am delighted to have been elected President of Shropshire Law Society and very much look forward to reading and contributing to this publication. We have an exciting year ahead of us and I hope that you will be able to join me at these events where we can celebrate Shropshire’s legal success and community.

This magazine can only exist with your contributions to which I am very grateful so please do let us have any of your articles either as a one off, or as a regular feature emailed to info@shropshirelawsociety.com.

I would like to invite you all to a President’s drinks reception, where I will be able to introduce you to members of the committee and provide highlights of the forthcoming year ahead. It would be great to see as many of you as possible. So please look out for the invite.

This first publication of the magazine has some really engaging and interesting articles, Chloe Turner provides an interesting insight into the emerging new way to qualify as a Solicitor as an apprentice which I am sure you will all find intriguing.

As it is my intention to champion the successes of Shropshire Law firms I am delighted that there is an article about Beth Heath for winning Clinical Negligence Solicitor of the year, her work has been invaluable to championing the rights and legal rights and rebalancing those people affected by the Shropshire Maternity Scandal.

I hope that you find the article relating to the Shropshire Future Lawyers Event interesting it was great to see so many upcoming partners attending this event.

All that is left for me to say is a Happy New Year and I look forward to meeting you all in person. �

Danny Smith President

SHROPSHIRE LAWYER 5 INTRODUCTION

Danny Smith

Your Committee

Danny Smith

PRESIDENT

PCB Solicitors, Cypress Centre, Shrewsbury Business Park, Shrewsbury danny.smith@pcblaw.co.uk

Lucy Speed

VICE PRESIDENT

Lanyon Bowdler Solicitors, Chapter House North, Abbey Lawn, Abbey Foregate, Shrewsbury, SY2 5DE lucy.speed@lblaw.co.uk

Victoria Pugh

TREASURER

Hatchers Solicitors, Welsh Bridge1, Frankwell, Shrewsbury, SY3 8JY, v.pugh@hatchers.co.uk

Jennifer Richards

HONORARY SECRETARY

PCB Solicitors, Trevithick House, Stafford Park 4, Telford, TF3 3BA Jennifer.Richards@pcblaw.co.uk

Robert Adams

Wace Morgan Solicitors, 21 St Mary’s Street, Shrewsbury, SY1 1ED robert.adams@wmlaw.co.uk

David Raymont MFG Solicitors

Padmore House, Hall Park Way, Telford david.raymont@mfgsolicitors.com

Jenny Bromwich

Shropshire Family Law, 47 Whitehall Street, Shrewsbury, SY2 5AD j.bromwich@shropshirefamilylaw.com

Mark Turner

Aaron and Partners, Lakeside House, Oxon Business Park, Shrewsbury, SY3 5HJ Mark.Turner@aaronandpartners.com

Samantha Roberts

FBC Manby Bowdler, Juneau House, Sitka Drive, Shrewsbury Business Park, Shrewsbury, SY2 6LG samantha.roberts@fbcmb.co.uk

Samantha

Millea

PCB Solicitors, Trevithick House, Stafford Park 4, Telford, TF3 3BA samantha.millea@pcblaw.co.uk

Charlotte Nutting

Roy Thornes Solicitors, Crossway, 156 Great Charles Street, Queensway, Birmingham, B3 3HN CharlotteNutting@roythornes.co.uk

Gemma Williams

Lanyon Bowdler Solicitors, The Business Quarter, Eco Park Road, Ludlow, SY8 1FD Gemma.Williams2@lblaw.co.uk

Christine Rimmer

Hatchers Solicitors, Welsh Bridge1, Frankwell, Shrewsbury, SY3 8JY C.Rimmer@hatchers.co.uk

Hannah Harrison

NFU Mutual, Mutual House, Shrewsbury Business Park, Sitka Drive, Shrewsbury Hannah.Harrison@nfu.org.uk

Zoe Smith

ORJ Solicitors, Blount House, Hall Park Way Telford TF3 4NQ zoe.smith@orj.co.uk

Katie Hughes-Beddows

Aaron and Partners, Lakeside House, Oxon Business Park, Shrewsbury, SY3 5HJ Katie.Hughes-Beddows@aaronandpartners.com

Hannah Fynn

Aaron and Partners, Lakeside House, Oxon Business Park, Shrewsbury, SY3 5HJ Hannah.Fynn@aaronandpartners.com

Nicola Davies

Agri Advisor, Glynton House, Henfaes Lane, Trallwng, Powys, SY21 7BE Nicola@agriadvisor.co.uk

Gemma Hughes

Lanyon Bowdler Solicitors, Chapter House North, Abbey Lawn, Abbey Foregate, Shrewsbury, SY2 5DE gemma.hughes@lblaw.co.uk

6 SHROPSHIRE LAWYER COMMITTEE

Meet your Committee Danny Smith

What did you want to be when you were younger?

My aspirations when I was younger were to do anything that made money, watching my Mum and Dad do 8 cleaning jobs between them I saw the benefits of hard work, something which has never left me and I continue in the same vain today.

Career highlight so far? Appearing before the Court of Appeal on a case that decided Magistrates Court procedure and set precedent for how cases are sent to the Crown Court. On a more personal note, receiving an Honorary Doctorate from my university in recognition of my work in both my legal career and for my charitable interests in raising aspirations.

Favourite quote? “Injustice anywhere is a threat to justice everywhere. We are caught in an inescapable network of mutuality, tied in a single garment of destiny. Whatever affects one directly, affects all indirectly.” – Martin Luther King Jr.

Favourite movie? A Few Good Men.

Dream dinner guest? Her late Majesty the Queen and William Clegg QC.

What do you enjoy most about your job?

The most enjoyable part of my job is the variety of people that I meet and scenarios in which people find themselves in. The spectrum of criminal and family law spreads from the very young, the youngest client being 10 years of age to the very elderly all with unique circumstances and levels of understanding and being able to explain complex legal issues and explaining them in a manner that they will understand and then representing their interests in a court room is a great privilege and is something that I enjoy every day.

How did you end up where you are?

My sister Jodie was the first person to go to university in our family but she took a year out and started university in the same year as me. She started a Law Degree and I started a Degree in Computer Science. I soon realised that there was no debate to be made with an algorithm and transferred over to Law. I then went to collect my sister from her law lecture and become so intrigued by the lecture on the English legal system and contract law that I was invited to join. I then completed my legal practise course and I then persuaded a local firm in Walsall, Clive Shepherd and Co and I then managed to secure a position as a newly qualified Solicitor at PCB Solicitors where I have not looked back since.

What do you do when you are not working?

I love baking and exploring new restaurants and eating great food. I like spending time with my children and family. �

Danny Smith is an Equity Partner at PCB Solicitors, Head of Criminal Law and also does Family Advocacy. Danny is a Solicitor Advocate which means he has rights of audience to appear in the Crown Court and Higher Courts. He is also a Duty Solicitor.

SHROPSHIRE LAWYER 7 COMMITTEE

Danny Smith

PCB Solicitors have raised over £1,000 for Hope House & Ty Gobaith

During 2022, PCB Solicitors chose Hope House & Ty Gobaith as their local charity to support throughout the year. Through a number of events including Eat Cake, completing a Yorkshire Three Peaks Challenge and supporting Hope House & Ty Gobaith’s Final Moments Matter campaign PCB have raised over £1,000.

Hope House & Ty Gobaith ensure that children with lifethreatening conditions enjoy the best quality of life, together with their families. They provide specialist care and bereavement support, when and where the children and families need it, and work to ensure that no one faces the death of a child alone.

Ryan Bickham Partner in PCB Solicitors said “We chose Hope House & Ty Gobatih and have really enjoyed supporting them throughout the year. They have engaged with us to explain about what they do and this has encouraged to become more involved and help out a fabulous charity which is unfortunately necessary for those in challenging circumstances.”

Lanyon Bowdler news

Congratulations to Charlotte Gregory, a solicitor in our Criminal Law Team, who has qualified as a duty solicitor, having had her portfolio of evidence accepted by the Legal Aid Agency.

Legal Support Assistant becomes a Trainee Claudia Booth joined the firm in July 2021 and has been working as a legal support assistant within the Clinical Negligence Team based at our Hereford office. Claudia graduated from Cardiff University in the summer of 2020 with a first in law and has completed her LPC. January 2023 will see the start of her journey to qualify as a solicitor when she begins her training contract with the firm.

Focus on HR and Career Fairs

Here at Lanyon Bowdler, we as a firm are very keen to expand our links with schools and students local to our offices. We have attended various career events, and have lots more planned as we move into 2023. Events vary and can involve having a stand at local universities or school career fairs, or a talk to students about ‘A Day in the Life of a Trainee Solicitor’. These events can help students gain an insight into what a career within the legal sector may involve, it also allows for any questions they may have prior to starting their own career.

HR are heavily involved in the organisation of these events with the help of Lucy Speed (Partner), they are attended

Hope House & Ty Gobaith Final Moments Matter campaign took place for 36 hours between Sunday 20th November and Monday 21st November 2022. The campaign is to give children and families Final Moments that Matter and they needed to raise £500,000, which is the annual cost of providing the best end of life care for every child and family in this region who turns to them.

Thanks to the generosity of some key benefactors they started the campaign with a ‘matched giving pot’ of £250,000. This meant that every donation that they received during the Final Moments Matter campaign was doubled. So they only needed to raise £250,000 to reach their £500,000 target.

PCB Solicitors raised a fantastic £460.50 which resulted in £921 towards their target. �

by either Emily Atkinson (HR Assistant) or Emma Harrison (Learning & Development Manager) along with other members of staff – such as trainee solicitors, legal assistants, legal support assistants and apprentices. With the range of experience we bring from these various job roles, we are able to provide very relevant advice on all aspects of a working at a law firm! We always enjoy attending these events, students are very engaging and we receive some very positive feedback!

More information about our current vacancies and applying for a training contract or work experience can be found on our website: www.lblaw.co.uk/careers.

Alternatively, the HR Team are more than happy to help with any queries you may have regarding recruitment and can be contacted by emailing: recruitment@lblaw.co.uk .

Podcast – The Legal Lounge

We are busy planning the next season and have lots of informative discussions in the pipeline. If you have not visited yet you can do so here: The Legal Lounge (lblaw. co.uk), we talk about many aspects of law in England and Wales. The episodes focus on human stories and scenarios that could affect us all. We’ve covered family law, personal injury, clinical negligence and plenty more.

The Legal Lounge is interactive and allows for you to request subjects or scenarios to be discussed. If you have a request please do let us know by getting in touch here: www.lblaw.co.uk/contact-us �

8 SHROPSHIRE LAWYER NEWS

Ryan Bickham

Shropshire solicitor named as Clinical Negligence Lawyer of the Year

Asolicitor from a Shropshire law firm is officially the best in her field after winning a major national award.

Beth Heath, of Lanyon Bowdler, has been named as the Clinical Negligence Lawyer of the Year at the Personal Injury Awards, which recognise the excellence of law firms and individuals in the personal injury and medical negligence sectors all over the UK.

Judges said: “The winner of this award is a department head and rising talent in clinical negligence practice, achieving big things in a short space of time. They manage a large team across multiple offices that continues to rank highly.

“They are renowned for a thorough and organised approach, and for their caring and compassionate attitude.”

Brian Evans, managing partner at Lanyon Bowdler, said Beth’s award was richly deserved and a testament to the strength and commitment of the whole clinical negligence team.

He said: “Our congratulations go to Beth on a great win against some stiff competition, including the Chief Assessor of the Law Society’s Clinical Negligence Panel, and the head of medical negligence from Slater & Gordon’s London office. This is a brilliant achievement and is well deserved.

“I know Beth would say that she could not have won this award without the support of her team, so without wishing to detract from Beth’s stellar personal achievement, everyone in the team is a winner for the support they give which enables Beth and our other clinical negligence partners and senior lawyers to do what they do.”

Beth has been a leading voice in recent years dealing with cases involving the maternity services scandal at Shrewsbury and Telford hospitals.

She said: “Being named as Clinical Negligence Lawyer of the Year is a major honour, which I hope will give our clients even more reassurance that Lanyon Bowdler can be trusted with such sensitive cases.

“Clinical negligence cases, particularly ones involving maternity services, are understandably distressing and we always take care to support our clients during the process.

“The motivation behind all cases is a desire to get answers to what went wrong and to help bring about improvements so the same mistakes are not made again.

“That will always remain our priority as we continue to work on behalf of our clients.” �

PCB are happy to introduce our New Conveyancing Team based in our Telford Office

We welcome Beth Morris who has 6 year’s experience with clients nationally and locally in the Conveyancing and Commercial industry. Beth is a fully qualified Licensed Conveyancer. Beth’s strength lies in residential property work ranging from freehold properties including New Build developments to Leasehold properties and re-mortgages. We also welcome Lisa Wootton who is a Conveyancing Assistant and has 6 year’s experience in Residential Conveyancing. Both have joined us from Terry Jones Conveyancing bringing long

standing clients and providing them with support and to minimise disruption, bringing all round stability.

Our Friendly Telford Team will support you through every step of the way, communicating in a way which is tailored to you.

If you are Buying, selling or re-mortgaging let PCB take the stress away and contact our Telford Team for a quote on 01952 403000 and ask for Beth or Lisa for a competitive quote. �

SHROPSHIRE LAWYER 9 NEWS

Beth Heath

Beth Morris & Lisa Wootton

DIARY OF A BABY LAWYER

PART THREE

The New Year usually encourages a time for reflection and resolutions that we hope to stick to throughout the next 12 months. For a trainee solicitor this reflection procedure and consideration of future goals is a process that we have to go through constantly, whether it be the weekly training record entries we have to keep up with, the feedback we receive on almost any and every task set or the future career plans that can adapt and change at any moment.

As discussed in my last diary entry, the big decision of which practice area to qualify into is still looming over my head and I am fast approaching my fourth and final seat of my training contract. Therefore, it is the perfect time to reflect on the previous experiences and consider those I wish to achieve once qualified.

One of the most valuable lessons I have learnt and often reflect on during my time as a trainee is a lesson we hear in many areas of life – quality over quantity. I know it is a common trait of trainees that we receive a task from a supervisor and try and complete it as quickly as possible so as to demonstrate how productive and efficient we can be. However, this is not the best approach to take and can result in errors we may have otherwise easily avoided (and will kick ourselves for once pointed out). One of my supervisors once told me that they would rather wait that little bit longer and receive a perfect draft from a trainee than have to spend their own valuable time redrafting and amending work completed in a rush in an attempt to impress with speed. This has stuck with me and, although of course certain tasks need to be completed swiftly to meet deadlines, taking the time to sit back and consider the task at hand and then subsequently completing that task to a higher quality has earned me much improved feedback and satisfaction from both supervisors and clients. Of course we have to be aware of our time and fee targets (how could we forget) and those ever demanding client expectations however, top quality takes time and perfection cannot be rushed.

Every baby lawyer is without a doubt going to experience some level of embarrassment at their own silly mistakes at some point and it is those mistakes that will shape us into better lawyers so we cannot be too harsh on ourselves. I for one will never (again) forget to check my pen is working before going into a meeting with a partner, double check the preferred name of the client before addressing them and will always make sure to have a spare suit blazer in the car in the event that an impromptu meeting is sprung upon me.

Moving on to manifestations and resolutions, of course there are the usual aspirations of being healthier, spending less time glued to my phone and saving up for that rainy day. However, in terms of career goals, these can change and surprise us as much as the British weather at times and I have no doubt that this will continue long past my days as a baby lawyer.

We spend a lot of time as trainees simply observing our seniors and I have always been in awe of how they seem to be able to answer any question thrown at them, seemingly on the spot. This I believe is a skill that will grow with time once comfortable and familiar with my chosen practice area and it has always been a ideal of mine to reach the point whereby I can predict what the client may need before meeting with them, and have a bullet proof answer ready and waiting to launch once asked. This of course cannot always be possible and, as past experience has shown, clients can surprise us at any point with the unexpected and sometimes bizarre. Therefore, I always remember that vital lesson – ‘if you fail to prepare, prepare to fail’.

I have had to face my long term goals and aspirations head on recently when discussing and deciding upon final seats and potential qualification; it is a topic that I am sure my family and friends are sick of hearing about. However, another valuable lesson learnt through this ‘narrowing down’ process is to always be honest and true to yourself and your own desires. It cannot be underestimated how big of a decision your practice area of choice is and I have had to consider and try to recollect my undergraduate, postgraduate and trainee thoughts, feelings and goals when entering into this career in the first place and what I hoped to achieve and gain from it. It is a long road to qualification and I am sure all lawyers (both baby and senior) can agree that it is an even longer career ahead and to be truly satisfied, happy and fulfilled in my role is of utmost importance. As I write this diary entry, the future is still relatively unclear however I hope by the time my next entry is published, this baby lawyer will have a clearer path ahead. �

Eleanor Howells Trainee Solicitor at Lanyon Bowdler solicitors

10 SHROPSHIRE LAWYER ARTICLE

Eleanor Howells

WHAT IS A SOLICITOR APPRENTICESHIP?

When I was 16, I knew that I wanted to become a solicitor, but I didn’t want to go to university. The thought of attending university full time just didn’t appeal to me. The reality is that not everyone wants to or can afford to go to university. Whilst preparing my UCAS applications during my A-levels, I heard about a new apprenticeship route that allows a person to qualify as a solicitor whilst working within a law firm.

The first solicitor apprenticeships started in 2016. The following year, I secured a solicitor apprenticeship role at my firm, FBC Manby Bowdler, who have championed legal apprenticeships right from the very start.

The most common question I get asked is ‘What is a solicitor apprenticeship?’.

Today, there are various apprenticeships available that allow a person to qualify as a solicitor. There are graduate entry apprenticeships for students who have already completed their law degree, or law conversion course, who can then start a 30-month programme (2 and a half years) to qualification.

The original solicitor apprenticeship, which I enrolled on, is a six-year course. A student works within a firm or company and is allowed 20% ‘off the job’ study time. For the first 5 years of the apprenticeship, a student works towards an LLB Law Degree and prepares a portfolio of qualifying work experience relating to the SRA competencies. For the final year, all apprentices will prepare and sit the Solicitor Qualifying Exams. Unlike when I tried to research the course at its inception 5 years ago, there is now a lot of information about solicitor apprenticeships on university pages and the SRA website. At the end of an apprenticeship, solicitor apprentices will have the same qualifications and title as a solicitor, who qualified via the ‘traditional’ route, but this is achieved in the same timeframe whilst gaining invaluable on the job experience. There is also the added benefit of no student debt and a salary whilst you train.

I am now 8 months from qualification, and I feel the apprenticeship has equipped me extremely well for life as a newly qualified solicitor. The apprenticeship offers flexibility, as there is opportunity to work in different departments throughout the course, before becoming specialised in one area. By qualification, I will have spent five years working in FBC Manby Bowdler’s family department, much longer than any trainee solicitor would spend in the department before qualification. I have learnt about opening and running my own files and I have been involved with factually and legally complex matters. It is an opportunity to earn whilst you learn, removing the expense of training and the cost of taking exams.

For employers, it allows a business to introduce new career pathways and diversify talent pools, opening the door to people from all academic and social backgrounds. Even magic circle firms are now recognising the benefits of solicitor apprenticeships. Allen & Overy were the first Magic Circle firm to embrace the scheme and recently recruited six apprentices in September 2022 and others are now following.

Of course, this route to law is not for everyone. It is an intense and demanding course as well as a big commitment to juggle work and study, but it is such a rewarding challenge. If your mind is set on a career in law, just as mine was, this is a great alternative route to law that is being embraced by the legal profession with opportunities increasing each year. �

SHROPSHIRE LAWYER 11 ARTICLE

Chloe Turner

Chloe Turner

THOUGHTS ON MEDIATION

PART 2: THE MEDIATION DAY

This article is based on the writer’s own experiences and thoughts arising out of a combination of practising as a mediator for over 15 years and a litigator for depressingly longer than that. Doubtless some readers will have their own views on what follows based on personal experience and their own sphere of practice, particularly those engaged in matrimonial law. However it is hoped that this may be of some interest to practitioners, offering as it does views from both sides of mediation practice.

The article comes in two parts, this part now being the second and covering the mediation day itself.

Start of the day

At the start of the mediation day all involved should have completed the preliminary arrangements referred to at the end of the previous part to this article. Papers will (hopefully) be in reasonable order, and the parties in their respective breakout rooms ready to start promptly and confidently at the agreed start time.

A mediator should always attend early with any assistant/ observer (the attendance and identity of whom will have been confirmed beforehand) in order to see that the arrangements are all in in place. However it is also important that the mediator spends such time as is necessary with the individual parties in order for introductions to be made, any new issues to be raised, for the mediator to be satisfied that each party understands the process, and in particular so that any sensitive dynamic of the dispute may be aired in confidence.

The importance of that preliminary time is not to be underestimated. It should ensure that each party feels empowered in the mediation, despite the history of the dispute and any prior acrimony between the parties (and

sadly sometimes their representatives). The day belongs to the parties alone, not the mediator or the representatives. It should be possible to secure agreement between the parties as to who will speak first in any opening session.

Care should be taken to ensure that the mediation agreement is correctly signed by the parties and their representatives, and any other attendees, in order to ensure the confidentiality of the process. If for any reason any attendee refuses to sign, they should be invited to leave and the mediation proper should not commence until that issue has been addressed.

The opening session

The usual format of the mediation day is for there to be an open session, usually in the mediator’s room which will hopefully be large enough to accommodate everyone comfortably.

However it is sometimes the case that a party will state that they do not wish to attend an open session, the most often cited reason being alleged aggressive behaviour on the part of the other party (or their representatives) on earlier occasions. Whilst respecting the wishes of all parties the mediator should not just accept that without further enquiry. Unless there are pressing reasons for the open session not to take place (for example genuine fear), the potential benefits of the opening session are likely to outweigh such concerns. It enables the mediator to repeat what has been said to the parties in private with regard to the nature of the process (thereby reassuring the parties that each will be treated equally), and at a basic human level the preliminary introductions will hopefully be courteous and set a good bedrock for the day to come. Whilst it is doubtful that it will cause a party to regard the other as having a halo, equally it may reassure them that they might not have horns after all.

12 SHROPSHIRE LAWYER

ARTICLE

Opening statements should be as brief as circumstances allow, hopefully alluding to the salient aspects of the dispute with reference to the position statement, but also reiterating that the party is there in good faith to achieve settlement. It is a good time for any apology to be made: an early sincere apology will often be appreciated by the receiving party, and may well bear fruit as the day progresses. Of fundamental importance is the realisation by each of the parties that they will be listened to and respected (despite the history of the dispute), which will hopefully afford them a break from the past.

Where the opening meeting goes from that point onwards depends on the parties themselves. If there is constructive discussion that should be allowed to continue, and indeed in some cases settlement can be arrived at without the need for any breakout sessions. The mediator must be astute in monitoring the tone of language and body language during this time. Open sessions are rarely comfortable experiences, but there is a marked distinction between a candid and uncomfortable exchange of views and the session becoming oppressive or abusive. If the latter, the mediator should find a way of concluding the session and moving the parties on to breakout sessions.

Breakout sessions

The first breakout not uncommonly sees each party expressing disappointment at what was said and querying the usefulness of the mediation itself. However there will also hopefully be an acknowledgment that they were listened to with respect, enabling the mediator to start drawing out what it is believed salient issues and needs are and how best to engage the other side in addressing those. Frequently further information is required from the other side.

At the end of each breakout session the mediator should clearly establish the nature of the authority they hold in requesting information from the other party and/or making any offers.

It is seldom the case that constructive suggestions for settlement will flow after the first breakout sessions, but time is well spent in causing the parties to reality test their own position on various issues before the move to considering and making offers.

At all times the parties should feel empowered to make suggestions as to how matters may be progressed, and it is sometimes the case that a further open session will assist (whether just the representatives or sometimes just the parties themselves).

The role of party representatives

Competent representatives will be familiar with the fact that whilst they can advance the case of their client emphatically, during the mediation day they primarily operate as mediation advocates in order to assist their client with the best chance of settlement. Acting as a litigation advocate as if at a hearing seldom assists anyone.

Offers

Initial offers are seldom received with satisfaction, usually with affront and sometimes with a reference to the need for hats and coats: it has been said that the parties are never further apart than when the first offer is made. However offers have to start somewhere.

Wherever possible the parties should be encouraged to make bold offers, safe in the assurance that in a mediation they can explore avenues of settlement and that nothing is binding until any settlement is the subject of a written agreement. There is no reason why such an offer cannot come from the claiming party, and it enables the mediator to invite the party receiving the offer to respond in a similar fashion. Minor concessions from stated positions (commonly known as ‘salami slicing’) are to be discouraged wherever possible: they are frequently a waste of time and can be taken as an indicator of bad faith.

Settlement

The parties should not be shoehorned into any settlement. A mediation day is particularly exhausting for a lay party, and the need to end the mediation to reflect on the situation should be respected by all concerned. Although a mediation day may end without an apparent result, often it will have proved a catalyst for continuing without prejudice discussions resulting in settlement. In such circumstances a mediator will usually make known their willingness to continue to assist if required to do so.

Assuming that the parties reach settlement it is for the representatives (not the mediator) to draw up the written terms of settlement such as to be capable of being signed at the conclusion of the mediation: however the mediator should check that all terms are included, and that the document is not materially deficient. Where the parties are not able to sign a concluded settlement agreement (for example where there are certain issues that need to be verified and/or authorised, or the parties do not have representation but wish to take advice on the drafting) then the parties should be encouraged to nonetheless put down the terms in writing but with a suitable caveat such as ‘without prejudice, subject to contract’.

Conclusion

The end of the mediation day will almost inevitably see all concerned tired, and may take many forms: from a party storming out of the building to all retiring to the pub. The parties will hopefully feel that they own the outcome and have closure, and the importance of a handshake is never to be underestimated. �

SHROPSHIRE LAWYER 13 ARTICLE

Peter McLoughlin is an experienced solicitor mediator, accredited with both CEDR and CIArb and is a member of a number of panels.

SHOULD I GET AN ELECTRIC CAR?

One of the most asked questions being raised at the moment is should I get an electric car through my limited company. In recent years it's become clear having a conventionally powered company car as part of your company remuneration is not always a good idea – both from a tax perspective and from a sustainability angle.

The good news is that electric vehicles (EVs) are now more readily available. And choosing an EV as a company car may well be a great idea from both an environmental and tax perspective.

A greener choice of car?

Having an EV as your company is an eco-friendlier choice in many ways. An EV has zero emissions, produces less noise pollution and can be cheaper to run.

There are arguments over the green credentials of EVs, as lithium batteries will eventually need replacing and electrical power to charge the batteries currently still relies heavily on carbon-based power stations. But as technology, battery recycling and the use of renewable energy increases, having an EV as a company car will certainly help you do your bit for lowering carbon emissions.

Taxing a company car

When you tax a company car, there are two tax areas to consider:

� The tax deduction for the company when acquiring the vehicle

� The personal tax benefit in kind (BIK) value on which the driver is taxed.

Both are tipped in your favour when comparing the rules for EVs compared with conventionally powered cars.

Tax allowances for EVs

For the company, 100% first-year allowances can be claimed on the purchase of an EV, if it’s new and unused. Any charging point you install at the business for your EV will also qualify for the super-deduction of 130% of the cost, which is certainly a good incentive.

Compare this to the company buying a conventional fuelled car. No first-year allowances are available but annual writing down allowances of 6% (18% if emissions < 50g/km) can be claimed instead.

As the driver of the vehicle, your benefit in kind (BIK) is calculated at 2% of the vehicle’s list price for the current tax year. BIK rates for conventionally powered cars are far higher, ranging up to 37%, depending on emissions. In the most common band, the BIK is around 28%. If your fuel is provided, as an EV driver, you pay no additional tax, whereas there is an additional tax charge if fuel is provided in a conventionally powered company car.

Is now the time to switch to an EV?

If you’ve previously dismissed the idea of a company car because of the complex and expensive tax regime, now may be the time for a rethink.

Talk to us about the tax implications of an EV

If you’re thinking about getting an EV as a company car, come and talk to us. We’ll help you calculate the tax impact for both the company and driver, and can explain the relevant capital allowances that can be claimed when purchasing an EV for the company. �

Andrew Hague Partner

14 SHROPSHIRE LAWYER

ARTICLE

WHAT CAN I DO TO HELP MY EMPLOYEES AS THEY TIGHTEN THEIR BELTS?

Giving gifts to your employees can be a great way to increase engagement and raise the overall morale of your team, especially as we all feel the effects of rising costs. But how much can you give before there are tax implications?

The good news is that you can give gifts that don’t exceed £50 in value to your employees without any tax or National Insurance (NI) charges arising – as long as you follow HMRC’s rules. The company's cost is also tax-deductible, saving corporation tax.

Can I give tax-free gifts to my employees?

As part of HM Revenue & Customs’ (HMRC’s) Trivial Benefits scheme, you can give gifts to your employees to mark birthdays, weddings or just ‘because’, all without attracting any tax charges. Company directors can also benefit from the same Trivial Benefits scheme.

� Trivial benefits can be provided to employees without any adverse tax or NI implications.

� To qualify, gifts can’t be a reward for services, can’t be cash or a cash voucher, can’t be contractual, and the cost mustn’t exceed £50 per gift.

� For directors the total gifted can’t exceed £300 in any year. Although gifts are not limited for other employees if it was a regular gift then it’s likely to be treated as a reward for services – which would then have tax implications.

� If over the course of a year, a director awarded themselves 6 x £50 gift cards (maxing out the £300 cap) as a higherrate taxpayer they could save around £130 in tax and NI compared with a £300 salary. The company would also save about £45 in NI.

� Gift cards are fine as long as they aren’t pre-loaded debit cards that can be used to withdraw cash –you can’t give cash as a gift.

How does the Trivial Benefits scheme work?

If an employee is given a bottle of wine for hitting a sales target, that would be taxable. If they were given the wine because it’s their birthday, as long as it was below £50 it would be within the exemption. It could also be given just because you’re in a good mood and feeling generous – it just can’t be anything related to the company or individual performance.

Talk to us about meeting the rules around employee gifts It’s essential that you stick to HMRC’s rules around employee gifts and don’t end up unintentionally creating a negative tax impact for people on your team, or for the business.

If you want to discuss this further, we can help by providing guidance. Give us a call 08000 664 664 �

Andrew Hague Partner

SHROPSHIRE LAWYER 15

ARTICLE

H M CORONERS SERVICE FOR SHROPSHIRE, TELFORD, AND WREKIN

Many years ago I was president of the Shropshire Law Society, it was therefore a great pleasure to be invited by your President, Gemma Hughes, to join you at the President’s Dinner at the Mercure Hotel, Telford on the 6th October 2022. It was clear that the Shropshire Law Society is thriving, well organised and knows how to enjoy itself.

I was first appointed an Assistant Deputy Coroner in 1995 by my predecessor David Crawford-Clarke, coroner for Mid and North-West Shropshire. At that time there were three separate districts in Shropshire the other two being the East Shropshire (now the unitary authority of the Borough of Telford and Wrekin), whose coroner was Michael Gwynne, and South Shropshire, whose coroner was Anthony Sibcy. Over time, these three districts merged into one coronial area with the present legal entity of Shropshire, Telford and Wrekin coming into effect in 2013. This year was a Big Bang for coroners, when not only the Coroners and Justice Act 2009 was enacted, but also the Coroners (Inquests) Rules 2013 and the Coroners (Investigations) Regulations 2013 came into effect all on the same day.

The coroners service remains a local service, funded by both Shropshire Council and the Borough of Telford and Wrekin, but now with national standards and guidance led by the Chief Coroner whose position was created under the 2009 Act. The first Chief Coroner was His Honour Judge Peter Thornton KC followed by his Honour Judge Mark Lucraft KC and currently His Honour Judge Tommy Teague KC. The Chief Coroners over time have provided very helpful law sheets and guidance all of which are publicly accessible and are on the Chief Coroner’s website.

https://judiciary.uk/courts-and-tribunals/coronerscourts/coroners-legislation-guidance-and-advice/

Up until 2013 coroners could be either medical or legal but since then only lawyers can be appointed, with then medical coroners remaining but fixed in post.

A further recent development has been the introduction of the Medical Examiners scheme which has been operating primarily in hospital cases but from April this year (2023) the scheme will roll out into the community. All deaths will then be scrutinized at some level by a medical examiner and their

16 SHROPSHIRE LAWYER

FEATURE

team. It is still early days to see how the system will evolve but it is a primary layer of scrutiny which should improve registration and any subsequent reports to the coroner. The Medical Examiner has its own website. The National Medical Examiner is Dr Alan Fletcher.

NHS England » The national medical examiner system

Essentially the role of the coroner is to investigate violent, unnatural or unknown deaths. Statistics for each of the 83 coroner areas in England and Wales are also publicly available, through the HM Government website.

Coroners statistics 2021 – GOV.UK (www.gov.uk)

In our area 1971 deaths were reported last year (2022). The majority of these upon enquiry, with and without a postmortem examination, resulted in a natural cause being provided and no further action was required. The remainder proceeded to inquests and last year we held 259 Inquests. These are public hearings, and all inquests are listed on the Shropshire Council website https://www.shropshire.gov. uk/bereavement-services/inquests accessible by family, friends, public and the media. Inquests are usually listed 3 months in advance.

The inquest answers 4 questions who the deceased was, how, when and where they came by their death. Although the principles and purpose are the same, each inquest is different, turning on its own facts and circumstances. In some cases, we know at the outset all that could be known later, and we will open and close the inquest on the same day i.e. a fast-track inquest. Others will be in the 3 month target date for inquests to be concluded. Those which are more complicated, or complex will take longer with a pre-inquest review hearing, if appropriate. The majority of inquests are held by the coroner alone with perhaps 3 or 4 a year being held with a jury (death in prison or in police custody or accident at work).

All inquests, however conducted, result in a Record of Inquest (see link at bottom of page 4). It answers the 4 questions and additionally sets out the registration particulars so that upon receipt from us the registrar can then issue the full death certificate. To that point families receive from us interim death certificates to enable legal and financial arrangements to be made.

Another major development has been the provision of advance disclosure. Advance disclosure of all the relevant inquest papers is sent to the family (or their legal representatives if instructed) so they know the evidence which the coroner will rely on. This enables families to have a much better understanding of any issues or concerns they have and, more often than not, reduces the need for witnesses to give evidence in person also giving the family the option, if they wish, not to attend at all. Inquests can be short from 5 minute fast tracks to 1 to 2 hours. More involved cases can take 1 to 2 days or longer, with complex jury cases taking 2 to 3 weeks.

Our service is based at the Shirehall in Shrewsbury where we have an excellent team of 2 admin staff and 6 coroner’s officers, with 2 assistant coroners providing holiday cover. With the rapid advancement in IT the team can work both at the Shirehall and at their home. Additionally, increased use of remote attendances enables families and other court users to avoid otherwise lengthy journeys to come to court.

By profession I was a civil litigation lawyer. I was also a Deputy District Judge on the Northern Circuit primarily sitting at the Cheshire Civil Courts. The underlying principle of the overriding objective transfers well to inquests, seeking fairness to all concerned, recognizing the important distinction between the two. In civil litigation the process is contentious, with one party seeking to prove a case against another and the judge finding in favour of one or the other. In inquests it is inquisitorial, there are no parties, just persons with an interest with the coroner seeking to answer the 4 questions.

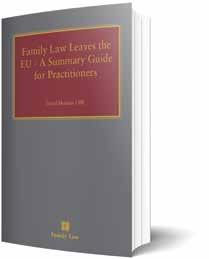

Additionally and on a lighter note, we hold treasure inquests under the Treasure Act 1996. Last year we held 10 such inquests with a variety of interesting objects, primarily of gold and silver (at least 10% content) and over 300 years old. This is just an overview. For those with an interest I have already referred the Chief Coroners Guidance and the recent legislation. Additionally, there are widely recognized texts on Coroners’ Law; Jervis on Coroners (14th Edition), Dorries Coroners’ Courts – A Guide to Law and Practice (3rd Edition) and Inquests – A Practitioner’s Guide (3rd Edition)

From time to time we have medical students from Keele University (based at SaTH) who come and observe inquests as part of their training. If any lawyer, trainee or qualified, would like to see what we do please check our website, HM Coroner's Service | Shropshire Council make yourself known to us and we will find time to meet you.

On a personal level I thoroughly enjoy the work, it is challenging and rewarding, a combination of law and facts, putting the family at the centre, whist recognizing the interest of other persons who may be affected.

Floreat Shropshire Law Society! �

John Ellery

H M Senior Coroner, Shropshire Telford and Wrekin and immediate past President Coroners Society of England and Wales

SHROPSHIRE LAWYER 17 FEATURE

Hi,I'm Kate

How to enjoy conveyancing again, in 2023!

Happy New Year! I hope you all managed to switch off, relax with your loved ones and enjoy the festive break.

Talking of happy and as the headline states…in this issue the theme is ‘how to enjoy conveyancing again, in 2023.’

Survey Question

I thought this theme would be a good place to start the new year, after reading about a survey of the 200+ delegates at November’s Society of Licensed Conveyancers Conference in Derby.

One of the questions in the survey asked: Do you enjoy being a conveyancer as much as you did in the past? Sadly, but perhaps not surprisingly, 86% of the delegates answered ‘No’.

Increased Workloads, Compliance Concerns

In the article, from Today’s Conveyancer, reasons for this were conveyancing now being ‘far more involved, complex, stressful and burdensome’ than ever before with ‘the conveyancing process involving some 30 or more steps – a marked increase from the 12 main steps of years gone by.’

Given the increased workloads, compliance concerns and stresses each transaction now presents, we asked our clients to name the best Index service, technology and compliance solutions that help them enjoy conveyancing.

Kate Bould Managing Director Index PI West Midlands

The ‘Magnificent 7’ Solutions:

1 Client Onboarding

Our digital client onboarding solution is fully compliant and the quickest and best, end-to-end, client onboarding solution on the market.

It provides compliance peace-of-mind to reduce stress and saves our clients a mountain of paperwork and time in the onboarding process, which enables them to engage with their clients earlier and more often, for stronger relationships.

To find out more, go to: www.IndexOnboarding.co.uk

2 Free Document Retrieval

Our Free Document Retrieval service provides conveyancers with unlimited copies of all the documents they need in their conveyancing transactions.

This is a free service no other provider offers and you don’t even need to be an Index client to benefit. All law firm property teams in Worcestershire and across the West Midlands should be tapping into this one!

18 SHROPSHIRE LAWYER XXXXXXXXXXXXXXXXXXX

out on top...

These Magnificent 7 Index solutions came

changes to the CQS practices for Part 2 of the UK Finance Handbook, conveyancers are now required to confirm adherence to the new CQS Standards for recording Part 2 checks.

Our Lender Checker solution ensures conveyancers keep pace with the ever-changing Lender Part 2 requirements. New updates are clearly highlighted, and checked 4 times a day so you don’t have to!

4 Title Due Diligence with AI

Our Title Due Diligence solution uses artificial intelligence, which automatically analyses title documents, highlights risks, and produces client-ready reports, including red flags, detailed analysis or even a full Certificate of Title. It requires no data labelling or training – quite simply, it just works ‘straight out of the box’

5

Complete Compliance Solution (& free health

6 AML & ID Checks with ‘Safe Harbour’

Our digital AML & ID Checks with ‘Safe Harbour’ ensure clients meet AML legislation requirements by confirming an end-users address, DOB, mortality and presence on Politically Exposed Persons (PEP’s) and Sanctions lists – all in real-time and without the need for conveyancers to physically see their clients.

7 Free Specialist SDLT Advice

We work with one of the UK’s leading tax specialists providing our conveyancer clients access to free, independent, specialised, bespoke, and compliant SDLT advice, to ensure calculations are accurate.

check)

As well as our tie-in with the WLS on a regional basis, nationally, Index is a formal partner of The Law Society on their Conveyancing Quality Scheme programme, helping the CQS achieve its goals of driving and improving standards.

Through our pre-emptive Index Complete Compliance Solution, we provide firms with the advice, guidance and practical tools needed to gain and maintain CQS accreditation. In most instances (100% to date), we’re able to implement this service for FREE!

SHROPSHIRE LAWYER 19 XXXXXXXXXXXXXXXXXXX Kate Bould Best regards Follow us linkedin.com/company/index-wm twitter.com/indexpi_wm Until Next Time… If you’d like to hear more about any of our solutions that help our clients enjoy conveyancing, I’d love to hear from you. e. katebould@indexpi.co.uk t. 0121 546 0377 Best regards Kate Bould SERVICE, TECHNOLOGY & COMPLIANCE www.indexpi.co.uk linkedin.com/company/index-wm Compliance Case Study Service: Index Complete Compliance Solution Actions: Following the firm’s Free Compliance Health Check, the report recommended the implementation of Digital AML and Source of Funds solutions, which we implemented. Outcome: In April 2022, the client saved 9% on their PII renewal (nearly £7,000) versus their previous year’s premium. Achieved as a direct result of the Index Complete Compliance Solution service. Residential SDLT Case Study Property Type: 5 bed family home Property Value: £1,195,00 Area of Doubt: Within the main house, there was a separated living area, lockable by door, which means privacy assured. Original SDLT Liability Calculated: £48,250 Our SDLT Specialist’s Calculation: £36,300 Overall Saving: £11,950 Date: October 2021 Date: June 2022 3 Lender Checker With last year’s

SHROPSHIRE FUTURE PARTNERS

Iwas really pleased to be joined by Mark Turner from Aaron and Partners, Lucy Speed from Lanyon Bowdlers, Graham Fuller from FBC and Tom Davies from WR Partners who all gave their time to share their knowledge and experience of being partners and in Tom Davies’ case the financial and tax implications of becoming a partner. All of their contributions was received with great thanks from all attendees at the event.

Tom Davies’ lecture of the financial and tax implications was really engaging and I even think some of the partners in the room learned a thing or two.

The panel were able to answer a lot of those questions that are not usually asked of partners within their firms. It was a great event attended by upcoming talent of Shropshire and I have no doubt I will see many of you around partnership in the future.

Thank you to all that attended and I have included Tom Davies’ power point presentation which has some really helpful information about the financial tax implications of becoming a partner. �

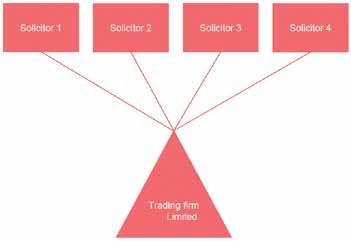

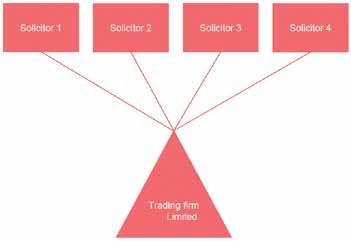

FINANCIAL AND TAX IMPLICATIONS OF BECOMING A LEGAL PRACTICE

What am I going to talk to you about? � Points & risks to consider before buying in � ‘Buy-in’ models and valuations � Different business structures and associated considerations � Questions

POINTS TO CONSIDER BEFORE ‘BUYING IN’ – MUST BE SCEPTICAL

Are there any ongoing claims against the firm? � Any potential future liabilities payable by the firm?

Suitable insurance in place?

Reputation damage – lead to less future profits?

Unlikely to be disclosed in the accounts unless very late in proceedings

Are the current partners transparent about the claims position of the firm?

Access to prior year SRA Accountant Reports and internal breach register

Is the profit share fair? � Doesn’t necessarily have to be equal

Representative of work done or capital introduced?

Interest on capital mechanism – could be structured in a way that some partners, who have larger capital balances, benefit from unfair interest rates and mechanisms

Clearly definable – not able to be distorted by nonspecific non-financial matters

�

�

�

�

�

�

�

�

ARTICLE 20 SHROPSHIRELAWYER

� Will you be ‘worse off’ post appointment? (Loss of employment benefits, pension etc. vs potential tax savings & increased earnings(?))

Will you be liable for personal fines?

� Do certain types of work carry personal fines?

� Audit partners associated with Carillion collapse fined £250k, audit managers £30k+

� Is there support available from senior partners, departmental heads, Law Society etc.?

� Are systems and workflows in your team sufficient to mitigate risk?

� Is the team suitably skilled to avoid this?

� Additional remuneration or profit for additional risk?

‘BUY-IN’ MODELS AND VALUATIONS – NO RIGHT APPROACH OR ANSWER

Introduce ‘full’ capital balance on day one

� From personal funds or bank/ professional loan - personal wealth & circumstances dependent. May be worth a loan even if cash available?

� Fully capitalised on day one, so all profits achieved are yours to draw until capitalisation levels next reviewed (usually done annually or bi-annually)

Pros

� Interest paid should be tax relievable in any structure

� No distortions in capital account balances, less room for unfair interest on capital mechanisms

� Loan often secured against current/ capital account in business

� Supporting business’ cash reserves on day 1

� Firms often have relationships with banks

Cons

� Interest payable on loans (risk vs. return)

� Another loan to consider on top of mortgage, car loans etc.

� Can be hard to plan in times of economic/interest rate uncertainty

No capital introduction on day one, expectation to ‘leave’ profits in business

� Capital account is built up over time by not drawing profits in full

� Formal agreements, plans and timescales required in advance of buying in

� Requires business to be profitable enough to cover drawings and leave a proportion

Pros

� Don’t have to find large sums in order to become a partner � Allows younger team members to become partners – less personal wealth required � Effectively been ‘gifted’ share of net assets of business by current and outgoing partners � No interest payable � No additional personal borrowing

Cons

� Lack of commitment shown(?) � Relies on vacating partners to leave their current accounts in the business whilst incoming partners build theirs up � Requires business to be profitable (not too much of an issue with established practices, but can be something to consider with startup firms or firms that rely heavily on work that thrives in strong economy) � Can lead to a reduction in balance sheet position if incoming partners cannot leave profits in as fast as vacating partners draw theirs out � Tax paid on profits without access to cash

Hybrid of models one and two

� Proportion of capital account is introduced on day one, then remainder built up over time by not drawing profits in full � Formal agreements, plans and timescales required in advance of buying in � Requires business to be profitable

Pros

� Don’t have to find large sums in order to become a partner � Allows younger team members to become a partner –less personal wealth required � Shows commitment on day one � Supporting business’ cash reserves on day 1

Cons

� Interest payable on loans � Vacating partners (which will be you one day!) can perhaps have a larger proportion of their current account on retirement � Needs business to be profitable (but not as key as in model two)

� Another loan to consider on top of mortgage, car loans etc.

� Can be hard to plan in times of economic/ interest rate uncertainty �

SHROPSHIRE LAWYER 21 ARTICLE

What to look out for when considering buying in

� No structure around buying in model/ approach and when cash & profits are to be introduced or allocated

� No calculations around capitalisation levels prepared – don’t necessarily need to be formal (it’s an art, not a science!), but something should be in place

� Current owners not forthcoming with timescales, expectations etc.

� Disparity between what payments to the business represent. Are they purchasing a share of the business or loaning to the business? (limited companies structure only)

� Lack of clarity on drawings/remuneration post acceptance

Different business structures – again, no correct answer

� Unincorporated partnership

� Limited Liability Partnership (LLP)

� Limited company – individual director/shareholders

� Limited company – corporate director/shareholders

� Corporate partnership or corporate LLP

DIFFERENT BUSINESS STRUCTURES – AGAIN, NO CORRECT ANSWER

Unincorporated partnership – non tax matters

� 2 or more individuals in partnership – no upper limit

� Owners called ‘partners’

� Simple

� Registered at HMRC only, no registration at Companies House – accounts not publicly available

� Profits/ capital of business belong to the partners and this is clearly defined as such in the annual accounts

� No limited liability, if partner’s capital in business is not sufficient to cover any liabilities, claimant can pursue partner’s personal assets

� Very simple SRA registration

Unincorporated partnership – tax matters

� Profits of partnership are declared to HMRC on partnership tax return

� Profits of partnership taxed on the partner’s individual tax returns in the year they are achieved – irrespective of whether or not they have been drawn

� Profits subject to income tax and class 2 & 4 National Insurance contributions

� Little scope for tax planning

� Post-tax profits are available for partners to draw, subject to capitalisation considerations

� Different income streams subject to slightly different allowances, rates etc.

� No capital gains tax considerations

� Partner’s current and capital accounts form part of their estate for inheritance tax purposes but qualify for ‘business property relief’

Limited Liability Partnership – non tax matters

� 2 or more individuals in partnership – no upper limit � Owners called members or designated members � Slightly more complex than an unincorporated partnership, but still simple � Registered at HMRC and Companies House – accounts are publicly available � Profits/ capital of business belong to the members and is clearly defined as such in the annual accounts � Limited liability, if partner’s capital in business is not sufficient to cover any liabilities, claimant cannot pursue partner’s personal assets � Very simple SRA registration

Limited Liability Partnership – tax matters (identical to a partnership)

� Profits of partnership are declared to HMRC on partnership tax return � Profits of partnership taxed on the member’s in the year they are achieved – irrespective of if they are drawn � Profits subject to income tax and class 2 & 4 National Insurance contributions � Little scope for tax planning � Post-tax profits are available for members to draw, subject to capitalisation considerations � Different revenue streams subject to slightly different allowances, rates etc. (bank interest has additional allowances, rental income not subject to National Insurance) � Minimal capital gains tax considerations � Partner’s current and capital accounts form part of their estate for inheritance tax purposes but qualify for ‘business property relief’

22 SHROPSHIRE LAWYER ARTICLE

Limited company – individual and corporate ownership

Limited company – individual director/ shareholders –non-tax matters

� A limited company is a type of business structure considered a legally distinct entity, registered at Companies House

� 1 or more individuals own shares in, or a share of, a limited company

� Owners called shareholders

� People who run the company called directors – often the same people as the shareholders in owner managed companies

� Annual accounts are submitted to Companies House

� Relatively straight forward to understand

� Profits/capital of a company belong to the company until they are distributed to the shareholders

� Personal liability limited to amount of share capital subscribed or guarantee given � Simple SRA registration and requirements

Limited company – individual director/ shareholders –tax matters

� Profits of a limited company are subject to corporation tax at the company’s marginal rate – 19% up to £50k, marginal rate between £50k & £250k, 25% above £250k (from1 April 2023)

� Much more scope to reduce profits of a company than a partnership or LLP

� Shareholders are then subject to income tax on declarations made to them

� Small salary which avoids any Ee’s NI being paid, but director still gets NI qualifying year

� Dividends taxed at 8.75%/ 33.75%/ 39.35% - drawings can be staggered to maximise efficiency

� Interest charged on director’s loans subject to 20%/ 40%/ 45% income tax, but qualify for corporation tax relief in the company. Very tax efficient means of withdrawing funds

� When a shareholder leaves a limited company, the sale of their shares is deemed as a market value transaction and subject to capital gains tax. Will often qualify for ‘Business Asset Disposal Relief’ and be taxed at 10% (on gains up to £1m, 20% thereafter)

� If a shareholder dies in office, the market value of their

shares form part of their estate for IHT purposes, but again qualifies for inheritance tax relief

Limited company – corporate shareholders – non

tax matters

� Trading business is a limited company � Directors of the trading company are the ultimate business owners � Shareholders of the trading company are the individual’s companies � Retained profits/ capital of the trading company belong to the trading company � Therefore, an off balance sheet document is required where profits are directly attributable to the individuals who own the business � A robust shareholders agreement is required, outlining what the profit distribution method is and what happens when shareholders leave or retire

Limited company – corporate shareholders – tax matters

� Trading company profits subject to corporation tax in the same way as if individual shareholders in place � Distribution of profits from trading company to holding company are tax free due to intercompany dividend rules � Allows for the different owners to then make their own decision on their personal drawings � Some shareholders can choose to leave their cash in their own limited company to reduce dividend tax payable, whereas others can draw all their cash if they wish to or need to � Allows for spouses and/or adult children to own a minority stake in the holding companies, allowing distributions to be made to them to utilise tax bands and allowances. No dilution of the trading company’s ownership � On leaving the business, the shareholders final distribution is tax free, as above � The holding companies in which the individuals own their shares do not qualify for BADR for CGT or BPR for IHT due to these companies being classed as investment companies rather than trading companies

Corporate partnership or LLP

SHROPSHIRE LAWYER 23 ARTICLE

Corporate partnership or Corporate Limited Liability Partnership – non tax matters

� 2 or more companies in partnership – no upper limit

� Unincorporated partnership or LLP as outlined, where partners/ members are limited companies

� Owners called ‘corporate partners’ or ‘corporate members’ � Seen as complex and difficult to understand for nonaccountants and tax professionals

� Profits/ capital of trading partnership/ LLP belongs to the CPs/ CMs and are clearly defined as such in the annual accounts

� Limited liability in both structures, ‘double layer’ of protection in corporate LLP

� Complex SRA registration and requirements

Corporate partnership or Corporate Limited Liability Partnership – tax matters

� Profits of partnership/ LLP are declared to HMRC on partnership tax return

� Profits of partnership taxed on the corporate member’s corporation tax returns in the year they are achieved –irrespective of if they are drawn � Profits subject to corporation tax at the company’s marginal rate

� Much greater scope for tax planning due to corporation tax regime

� Allows for spouses and/or adult children to own a minority stake in the holding companies, allowing distributions to be made to them to utilise tax bands and allowances. No dilution of the trading company’s ownership

� Partnership/ LLP post-tax profits are available for corporate members to draw, subject to capitalisation considerations

� No capital gains tax considerations in partnership/ LLP, but each individuals company subject to CGT as referred to in limited company slides � Individuals limited company ownership form part of their estate for inheritance tax purposes but qualify for ‘business property relief’ – as in limited company slides

My advice

� Look to gain some understanding of each of the topics discussed appropriate to the firm you have been offered ownership of � Get advice!

Tom Davies Commercial Manager WR Partners

24 SHROPSHIRE LAWYER ARTICLE

To advertise in Shropshire Lawyer, please call Catherine McCarthy our Business Features Editor on 0151 236 4141 or email catherine@benhampublishing.com Want to feature in Shropshire Lawyer?

Davies, Commercial Manager at WR Partners

Free SRA Transparency Rules compliance diagnostics check

It has been a few months since the SRA announced their intention to perform spot-checks on all law firm websites (approximately 9,000) for compliance with their transparency rules. This extends to those firms who have previously filed a self-declaration stating they are fully compliant.

The announcement included an additional check on practices that offer conveyancing, probate, immigration, employment tribunals or motoring offences, to ensure they publish specific information on their website; including the details of the service, who delivers them and pricing. This joins the comprehensive transparency rules developed to help consumers make informed decisions about the services available to them.

WR Partners have launched an online diagnostic on our website to help give you an idea of what should be satisfied. This diagnostic is not designed as a comprehensive checklist

SRA-ad.pdf 1 14/12/2022 13:32:28

for SRA Transparency rules compliance, but the results of the diagnostic may help your firm address any areas of concern in advance of the completion of your declaration.

Tom Davies is part of a team focused on professional services businesses at WR Partners. We work with many solicitors and are dedicated to finding the right solution for you and your practice. We have a wide range of services that can be tailored to help you grow, thrive, and strive for a bright future. If you want to discuss SRA Transparency rules compliance in more detail, please contact us. ■

hello@wrpartners.co.uk www.wrpartners.co.uk 01743 273273

SHROPSHIRE LAWYER 25 ADVERTISEMENT FEATURE Protecting your future Is your website compliant with the SRA rules?

the link on our homepage: wrpar

Use our free website diagnostic tool to identify any issues.

M Y CM MY CY CMY K

Click

tners.co.uk

C

Tom

TOP TIPS FOR YOUR B2B TERMS & CONDITIONS

When acting for suppliers of goods and services in disputes with business customers, there are some clauses we like to see in the terms and conditions which can really boost your chances of getting a positive outcome.

Here are the top picks as recommended by Martin Kaye Solicitors:

� A requirement for the customer to pay your invoices regardless of any claim for a reduction, complaint or counterclaim. This means that your invoices are payable regardless and the customer's complaint has to be dealt with separately.

� A clause providing that your terms are the only ones that apply, therefore excluding any terms the customer may wish to introduce. However, it is important to get the sales process right too, in order that the contract is taking place on your terms.

� Making clear that delivery times are estimated only, helping you to avoid any argument that you have breached the contract by delivering late.

� Limiting or excluding certain types of liabilities (e.g. consequential losses or loss of profits) and/or capping the liability to a specific sum, typically the price paid for the

goods/services. Such clauses are not usually enforceable if they go too far in limiting the customers' claims, however, it is usually possible to reduce potential liability in this way.

� Making clear that the laws and courts of England and Wales apply to the contract. It may sound obvious but where one party is based in another country, it could mean that the laws of that other country apply where the contract does not specify England and Wales.

If you are dealing with consumers, i.e. in a B2C setting, the contract will be subject to the Consumer Rights Act, where different considerations will apply. If you have any questions regarding terms and conditions on B2B contracts, or any other disputes-related legal issues, please do get in touch. �

Andrew Oranjuik Partner and Head of Litigation Martin Kaye Solicitors

26 SHROPSHIRE LAWYER

ARTICLE

What should law firms prioritise in 2023?? As new research from legal software provider Clio reveals, the answer above all else is adaptability. Ever-evolving working habits, new client expectations, and challenging market conditions mean that standing still in today’s landscape is the same as going backwards.

Clio’s brand-new Legal Trends Report shows just how profound an impact this constant change is having on law firms. It also highlights how firms can make themselves adaptable (and even antifragile) by adopting legal technology. The right solutions will allow law firms to meet both their clients’ and staff’s expectations – which will play a key role in helping law firms survive in what may be turbulent times ahead.

Why firms must adapt to lawyers’ changing working habits The pandemic forever changed how lawyers want to work. Indeed, the 2022 Legal Trends Report shows that:

� 44% of lawyers are more likely to want to work throughout the day rather than a traditional 9-to-5 schedule � 45% prefer meeting clients virtually � 49% of lawyers say they prefer to work from home

Client expectations also continue to change