UFC Middleweight Champion Sean Strickland sat behind a bottle of Monster Energy last week while he preached a sermon of intolerance and hate. Even worse, it appears, Monster plans to continue to stand behind Strickland.

For those of you who aren’t up on your cage fighting, Strickland is a mixed martial arts (MMA) fighter whose thoughts and opinions are delivered with the same violence as his kicks and punches. He gladly wears the mantle of the MAGA dream, bashing through spoken and posted insults enemies like working women, immigrants, liberals, gays, and anyone who doesn’t fit within his limited worldview.

Strickland is also one of several MMA fighters who are sponsored by Monster Energy – a company that has never shied from an edgy aura itself, but one that has never taken too strong a political stance in any situation.

Strickland, on the other hand, has a strong political stance on just about everything, and that includes the LGBTQ community.

In early 2022, Strickland tweeted, “If I had a gay son I would think I failed as a man to create such weakness.”

Shortly before the fight, when asked by a reporter about that remark, he replied, “You’re a weak f—ing man.”

He then went on to expand his tirade to the transgender community.

“Ten years ago, to be trans, was a mental f—-ing illness,” Strickland brayed, going on to attack the reporter. “And now all of a sudden people like you have weaseled your way into the world. You are an infection, you are the definition of weakness. Everything that is wrong with the world is because of f–king you.

“The world is not saying, you know what, you’re right, chicks have dicks. The world is saying, you know what, there are two genders. I don’t want my kids being taught about who they could fuck in school … being taught about their sexual preference. This guy is an enemy.”

Now, it’s no secret that UFC is the sporting equivalent of a Trump rally – to the point where president and CEO Dana White has effectively turned UFC fight cards into Trump rallies by walking into the arena with the former president, Kid Rock, and Tucker Carlson. The right wing flaps so hard internally that even when the UFC struck a sponsorship deal with AnheuserBusch for its struggling Bud Light brand – a recent punching

By Jeffrey Klinemanbag for conservatives over its brief marketing relationship with transgender celebrity Dylan Mulvaney – Strickland didn’t get in trouble for swearing he would continue to attack the beer company, tweeting that “women are born not made, transgenders are mentally ill, and society should never accept this as normal.”

After the fight – which Strickland lost, I am glad to report –White flew to the defense of those who might have criticized the fighter, saying the organization promotes free speech and expression from its fighters (note that in previous interviews, White has said he doesn’t want politics from the podium, a view that has clearly changed). The UFC clearly knows its audience!

But what about Monster? Didn’t anyone at the company realize they were backing a guy who has admitted to going through, he said, “this weird neo-Nazi, white supremacist phase when I was younger, and I got kicked out of school for, like, hate crimes, all this crazy sh*t.”

Maybe Monster feels compassion for Strickland, who has said that as a child he was abused by his father and believes he has PTSD. After the “crazy sh-t,” the fight game turned Strickland’s life around, he said. Now he only attacks reporters, the LGBTQ community, Palestinian UFC fighters, “cucks,” women, Democrats, Native Americans, Globalists, and anyone else out there who may be perceived as “woke,” verbally and on social media. Quite a turnaround. Instead of perpetuating crimes against them himself, he – jokingly, of course – encourages his followers to do it.

When I heard about Strickland’s statements, I reached out to Monster CEO Rodney Sacks – who had actually name-checked Strickland during an investor meeting that same week as a “great champion” – to see if the company was considering dropping him. Here’s the terse response I received from Monster spokesman Sam Pontrelli.

“Monster sponsors thousands of athletes all over the world. As such, every once in a while, comments made by one individual will be in contrast to the values of the company. We have no other comment.”

Thanks, guys. Here’s my response to Monster’s response: Your company’s got a hate-monger on your payroll. You can do better. I have no other comment.

By Barry

By Barry

On the heels of December’s wildly entertaining BevNET Live, I can say that things are looking up for the industry. It wasn’t just the 800 strong that attended the event and the hundreds who followed our live stream, that led me to come away with that conclusion, but the breadth of those attendees. We had the great fortune to welcome back our regular standard-bearers, those who have attended almost all of the 20 plus conferences. They come for the knowledge, but just as importantly, to see old friends. But there was a larger portion of the attendees, I’ll call them the new breed, who were bold in their intentions, and fearless in launching the next wave of beverages, who had me even more excited. Yes, I’m considered old – being 75 qualifies me for that – but I was struck how young they were.

If you sampled from our coolers, you knew there was no shortage of variety in the product cohort. There was a strong representation of the stalwart: Soda is back in full force, which I’m excited to see. I was impressed with the taste of all these offerings. Energy was back in full force, and juice variations were everywhere, as well as exotic formulations. Water and

its variations continue to grow unabated. Low- to zero-calorie drinks continue to thrive, but with a new focus, taste. Over the past few years, I’ve commented in my columns that the tastes have not caught up to the efficacy and functionality promised by the new brands. This new generation is getting closer to achieving that holy grail, great taste and oh so good for you.

This all sets the tone for 2024. In my initial conversations with marketers over the past few weeks, I was happy to hear mostly optimism from the ranks. Money is coming in, distributors are taking in new brands, and retailers are expanding their offerings. Hope springs eternal right now, but it’s too early in the year to know if the reality will match the optimism.

We will have a better sense of the battle between reality and optimism in a few weeks, when Expo West Is here. It is the bellwether of the state of the industry. If we all come away from Anaheim feeling as positive about the industry as I hear now in conversation, it’ll be a banner year indeed. Hopefully we can all celebrate our success.

By Gerry Khermouch

By Gerry Khermouch

A couple of years ago, seeing an unmet need, Glazer’s Beer & Beverage decided to step up on the non-alcoholic beverage distribution front in north Texas by acquiring a couple of smaller houses and promising an upgrade to a truly full-service operation. That meant stepping outside its beer footprint in the state, a move that likely made its core suppliers uncomfortable, as it meant Glazer’s was now competing, at least with NAs, against their franchised partners in Dallas/Fort Worth. So it was an experiment that drew both enthusiasm and some degree of skepticism. But the new house, named Jumbo after a key brand in a predecessor company of Glazer’s, soon onboarded an impressive array of fast-growing brands, including those energy growth stars Celsius and C4, and had suppliers believing that maybe there finally was a committed and well-resourced unaligned operation available to them in the area if they weren’t aligned with a strategic like Keurig Dr Pepper, one with extensive reach into both large-format and small-format retailers.

Sadly, that experiment was ending just as I was writing this column. Celsius and C4 exited nearly simultaneously to the Pepsi and KDP systems, respectively, and more recently Congo Brands abruptly shifted its Prime and Alani brands elsewhere. As a standalone NA house without the support of an established beer business, that left Jumbo without the necessary scale to support its ambitions. Rather than regress to sparse coverage, Glazer’s shut the doors effective Feb. 29. Apparently, the Congo move was the last straw.

Longtime watchers of the beverage business may say, ‘that’s how the business works and Glazer’s should have expected this.’ NAs lack the franchise protection of alcoholic brands, but Glazer’s knows that by virtue of working NAs in its 12 beer markets, which it will continue to do. Besides, NA-only houses in other markets like Big Geyser in New York, B&E Juice in Connecticut and Intrastate in Detroit have managed to weather this cycle of arrivals and departures without the stabilizing effect of franchised soft drink brands.

Still, it’s a troubling pattern. After all, these unaligned distributors represent a key pipeline for new innovation to get to retail. At this point, wholesalers have no reason to believe the heartfelt assertions of new-brand owners that they’re here for the long haul. (A few actually seem to be, but wholesalers have no reason to believe any of them.) Their contractual terms are getting increasingly stiffer as they factor in the accelerating speed with which igniting brands are grabbed by strategics. Sadly, history shows that even brands that have been reliable, trustworthy partners are liable to chisel the wholesalers on the way out, if not on the buyouts then on ancillary items like billbacks and inventory. Meanwhile, few of these strategic exits prove to be a platform for an enduring brand. Look at the biggest exits of the past decade and a half: Vitaminwater essentially is inert within the Coca-Cola portfolio (though its sibling Smartwater has fared better), Bai has proved an embarrassment to the KDP team that inherited it from a prior regime and Body Armor almost immediately moved into decline following Coke’s pickup, though it’s still early days and the soda giant is making an earnest effort to get it back on track. Many end up killed outright.

Currently, the industry is exceedingly excited by a new class of gut pops, led by Olipop and Poppi, that seem to be having success poaching drinkers directly from the ranks of CSD users, despite a much higher retail price. Olipop isn’t a DSD play, but Poppi moves through the ranks of many of the same wholesalers who’ve helped

ignite brands like Monster, Bang, Celsius, C4 and Prime, and they’re expressing palpable anxiety to me that it might be the next one to flee. Ditto Congo’s Prime and Alani brands, though Congo has proved to be an unpredictable partner, as Jumbo discovered, and most distributors don’t seem to be baking a long-term relationship into their calculations.

When one takes a longer perspective, one can wonder what all this activity means. As noted earlier, it’s hard to think of many strategic acquisitions that have kept those brands on their disruptive course. Would those brands have gotten further on their own? As family-operated businesses, AriZona Iced Tea and Milo’s Sweet Tea seem to have maintained their special sauce, though AriZona has struggled to make a dent in the healthier side of the segment. Red Bull remains a dazzling growth engine, even through the demise of its founder Dietrich Mateschitz. And Monster Energy may be aligned with Coke, but by continuing to operate independently, generally in control of its marketing and production decisions, it remains a coveted source of margin and growth to its retail partners. Its acquisition of the craft beer collection once called CanArchy (now Monster Brewing) has now given it a distribution system independent of Coke’s, for both alcohol and NA brands, that offers a new avenue for experimentation.

Back to the strategics: they rarely seem able to continue the momentum of their pickups, as the stream of impairment charges they often quietly take attests. I continue to believe that most go into these deals believing in good faith that they can find a way to be good stewards going forward, devising clever ways to incent the founders to stick around a while and to keep the operations out of their bureaucratic maw. But despite good intentions, I believe, it almost never pans out quite that way. Inevitably, the founders move on, compromises are made to the recipes and inertia creeps in. Is that such a terrible outcome for the acquirers, though? A new brand that might have caused severe disruption to the acquirer’s core brands has been neutralized, unwittingly or not. Certainly, for the publicly traded strategics, Wall Street doesn’t seem to exact any great punishment for these misfires.

Hence that concern about the fate of Olipop or Poppi: the risk that they may pose a genuine threat to the core CSD business of Coke, Pepsi and KDP certainly baits those companies to pay – or overpay – for those brands. That way they can either ride the wave or neutralize it. It should be worth a billion or two to avert any threat these brands pose.

Is this an area that the empowered trust busters in the Biden administration should be monitoring? There might be a germ of evidence, assuming the president wins another term. It materialized recently when the Federal Trade Commission moved on some of the major tech players over their investments in generative AI companies and major cloud service providers. “Companies are deploying a range of strategies in developing and using AI, including pursuing partnerships and direct investments with AI developers to get access to key technologies and inputs needed for AI development,” the agency said, and it wants to see what competitive impact this is having. It doesn’t seem like a huge leap to apply that reasoning to other categories of goods and services, especially if the AI investigation bears fruit. Meanwhile, there’s no reason to expect the cycle to stop, at continued cost to the wholesalers who help foster beverage innovation.

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

Nutpods, the plant-based coffee creamer brand founded in 2013 by Madeline Haydon, was acquired by Kroger-backed investment group MPearlRock, helmed by former Keurig CEO Brian Kelley, in January. Terms of the deal were not disclosed.

Having emerged as an early entrant in the non-dairy creamer category, Nutpods bridged the gap from e-commerce exclusive product to develop into a national player with a presence in 15,000 retail stores, and is the top-selling plant-based creamer within natural retail, according to the brand. The company took on investment from VMG Partners in 2019, and has since expanded into ready-to-drink products and collaborations with brands like Chamberlain Coffee.

“We are proud to join MPearlRock in the next stage of our brand’s evolution. Brian’s background with leading global consumer brands

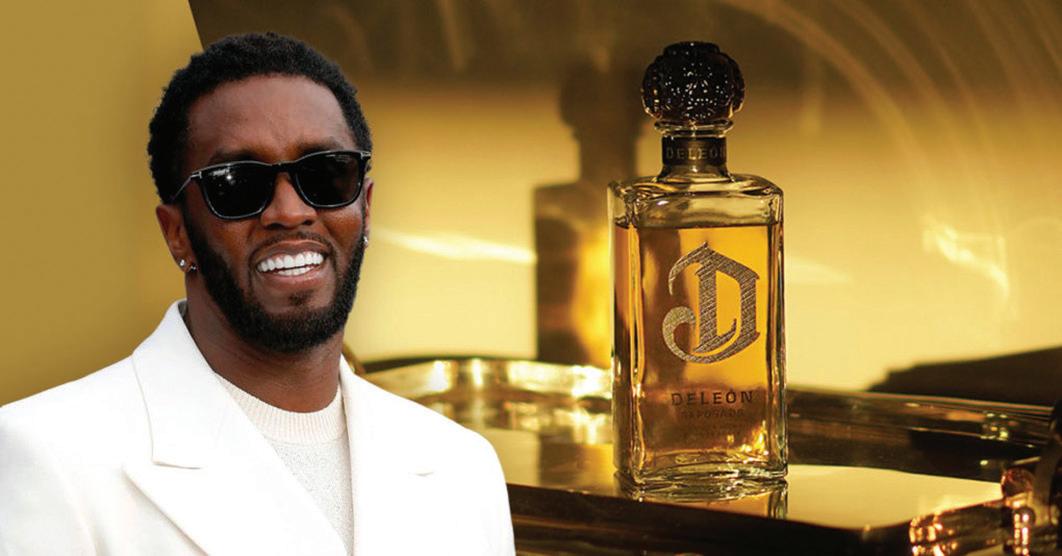

After nearly nine months of an ugly public legal battle, Sean “Diddy” Combs and Diageo settled their dispute over allegations from the music mogul that the brands he collaborated with Diageo on— Cîroc Vodka and DeLeon Tequila— received worse treatment because of his race.

The parties “have now agreed to resolve all disputes between them,” read a statement from Diageo and Combs, issued January 16. “Mr. Combs has withdrawn all of his allegations about Diageo and will voluntarily dismiss his lawsuits against Diageo with prejudice.”

The statement continued that Diageo and Combs have “no ongoing business relationship, either with respect to Cîroc Vodka or DeLeón Tequila, which Diageo now solely owns.” Diageo currently and always has fully owned Cîroc, and the group previously partnered with Combs on brand marketing.

The battle began last May when a complaint was filed by Combs Wines and Spirits, a company owned by Combs, in New York State Supreme Court in Manhattan against Diageo’s North American business. Among accusations of racial discrimination, the lawsuit also said Diageo has put more resources into the portfolio’s other tequilas, including fellow celebrity George Clooney’s Casamigos, which Diageo acquired in 2017 for up to $1 billion.

The filing stated that Combs Wines and Spirits planned to seek “billions of dollars in damages due to Diageo’s neglect and breaches” in a separate lawsuit.

Diageo responded in June by severing ties with Combs, ending the two parties’ 15-year business relationship and claiming that the allegations were false and defamatory. Diageo asked the judge to send Combs’ lawsuit to arbitration or dismiss the complaint entirely.

coupled with MPearlRock’s capabilities and resources makes them an ideal growth partner for us,” Haydon said in a statement. “We are excited to reach more consumers in new channels and new product verticals who allow us to become part of their daily coffee ritual.”

The deal marks an auspicious debut for New York-based asset management group MPearlRock, a partnership between PearlRock Partners (a division of Kroger) and New York-based asset management group MidOcean Partners that’s described as “a strategic collaboration to introduce emerging consumer packaged goods (“CPG”) brands to new customers.”

Announced a week prior to the nutpods deal, the new entity aims to pair MidOcean’s investment expertise with consumer brands and “Kroger’s deep retail and CPG experience” through the leveraging of retail data science and insights its from in-house analytics team, 84.51°

“We have been following nutpods for the past few years and have been impressed with Madeline’s vision and disciplined approach and how she built strong customer loyalty by developing and marketing a truly superior product,” said Kelley.

He continued: “nutpods is a remarkable entrepreneurial success story that exemplifies the businesses and management teams with whom we seek to partner. We are thrilled to support the next chapter in nutpods’ evolution and are delighted to work with Madeline and her team to accelerate growth and provide the resources to best position the brand to deliver unique, healthy products to loyal and new customers.”

The mogul scored a temporary legal victory when the Supreme Court of New York denied Diageo’s motion to dismiss the lawsuit and its motion to force the case into arbitration. In October, Diageo responded by countersuing, and said Combs leveraged allegations of “racial animus” to extort the firm.

While not named as a cause for settlement, the saga was made even more complicated after the spirits company used the sexual assault lawsuits against the music mogul to bolster its case.

Combs is often credited with illustrating the power of celebrity backing to boost spirit sales. In 2007, Diageo enlisted Combs to develop its Cîroc brand, at the time a low-ranked vodka. After Combs took charge of the brand’s strategic marketing, Cîroc ascended to a top seller within a few years, growing from a 50,000-case-per-year vodka into nearly 2 million-per-year. It has since released several product variations, including ready-to-drink line CÎROC Vodka Spritz.

The success of that collaboration spurred Diageo to form a joint venture with Combs in 2014 and to purchase DeLeón, a boutique high-end tequila brand.

In the thick of Dry January, leading nonalc retailer Boisson announced an expansion of its national wholesale business.

Since launching in NYC in 2021, Boisson has been an influential voice within a new generation of businesses growing the burgeoning no-and-low alcohol segment. After expanding to eight storefronts and growing its e-commerce program, the company will leverage new partnerships with KeHe and craft wine and spirits distributor LibDib to cement a national footprint in wholesale distribution.

The announcement follows Boisson’s $5 million bridge funding round landed in September from Convivialité Ventures, the VC arm of Pernod Ricard, and Connect Ventures. That funding coincided with the appointment of a new CEO, Sheetal Aiyer, to further the company’s long-term ambitions of becoming a three-pronged business: retailer, e-commerce site and wholesale distributor. But it looks like distribution will be the company’s next big frontier, with plans to grow its wholesale business by 70% in 2025.

The new push is being helmed by recent hire, Jill Sites, vice president of wholesale, whose resume includes national sales director for Betty Buzz as well as stints at Breakthru Beverage and Redwood Brands. Boisson aims to build on its consumer insights to offer retailers and on-premise more insight into the emerging category.

“Existing spirits and beer distributor networks are phenomenal – I worked for one of the best for almost a decade – but most are just starting to figure out NA, while Boisson brings years of 100% dedication to the category,” said Sites. “We know that we are small, but we are mighty and we see this as the perfect moment to give NA a seat at the big table of industry wholesale distribution.”

The national account strategy with KeHe and LibDib involves “curation and consolidation,” said Sites, acting as the single point of contact with distributors and taking care of paperwork, discounts, pitching to customers and attending shows, in addition to handling shipping and purchase orders.

In September, Nick Bodkins, founder

and president of Boisson, described the company’s next stage of growth as furthering its “verticalized approach to the market” and leveraging Boisson’s flexibility outside of the three-tier system to continue to sell direct to consumers, into bars and restaurants, and specialty grocery.

Boisson has no plans to move away from its retail platforms, which Sites said is the company’s most important channel. But taking a shot at a larger share of the food and beverage market will include expanding to more national retailers, grocery, bottle shops, and entertainment venues. In order to be successful in a low margin, high volume channel like wholesale, the company needs to drive it, said Sites.

“We are never going to beat big BevAlc at what they do, they’re great at it,” said Sites. “But we are looking to work at specialty grocery, natural grocery and fill in holes where we can.”

At independent liquor and some big liquor chains, Boisson is aiming to curate non-alc sets and increase education about non-alc. The company has a more curated and specific wholesale portfolio than the selection in Boisson stores. As certain products grow within the category, they may move to the three-tier system with a larger wholesaler, said Sites, and Boisson will rotate new products in.

Distribution will focus on key growth markets, including New York, California and soon to be Miami, where Boisson has physical retail locations.

Expanding further into retail with specific non-alc sets and finding inroads into the bar have been priorities for non-alc brands as they look for growth. Non-alc beverage sales were about $510 million in the 52week period ending July 29, up 31.2% versus a year ago, marking the category’s largest year of absolute dollar growth in five years, according to NIQ data.

After several years focused primarily on innovating in the food space, Swedish plant-based products maker Oatly is getting back to basics with two new oat milk launches: Unsweetened Oatmilk and Super Basic Oatmilk.

Initially announced during the company’s Q3 earnings last year and launched nationwide in January, Unsweetened and Super Basic add better-for-you options to the brand’s flagship oat milk line. Unsweetened contains zero grams of sugar and 40 calories per serving, while Super Basic – true to its name – simplifies the ingredient panel by removing all oils and emulsifiers, containing only water, oats, sea salt and citrus fiber.

Each SKU is available in 64 oz. cartons and will retail in line with the rest of Oatly’s plant milk portfolio, priced around $5.99.

According to Oatly’s North America president, Mike Messersmith, the company had been limited in its ability to innovate within the oat milk space by its myriad sup -

SYSTM Foods, a joint venture between SYSTM Brands and CPG investment firm GroundForce Capital, acquired Oregon-based Humm Kombucha in January. Financial terms of the deal were not disclosed.

Founded in 2009, Humm produces a variety of low- and zero-sugar kombuchas and functional beverages, including a line of probiotic sodas and seltzers. The brand will join a portfolio of other SYSTM acquisitions, including Chameleon Organic Coffee and functional beverage brand REBBL.

The acquisition is another step in SYSTM’s “strategic objective of creating a leading functional beverage platform” that aligns with its better-for-you CPG portfolio and bolsters its position in refrigerated RTDs, per a press release issued this morning.

“Today’s consumers are seeking healthier, lower-sugar beverage options with functional advantages, ranging from digestive health to immune support, that don’t sacrifice taste or quality,” said SYSTM Foods CEO Andy Fath-

ply chain and manufacturing hurdles. With the brand now confident in its ability to produce and deliver beverages throughout the U.S., Oatly is once again focusing on innovating in its flagship category.

“They [the new oat milks] both represent abilities for us to go deeper with existing customers, and also expand our overall distribution footprint and bring more delicious plant-based oat milk products to more people,” Messersmith said.

Both innovations were responses to consumer feedback, he said. While the brand has received some media criticism in the past over the sugar and oil content of its plant milks, the Unsweetened and Super Basic varieties are a reaction to requests from its existing customers. In the case of Super Basic, Messersmith said the company saw a number of videos on social media of consumers making their own homemade oat milk and recognized an opportunity to produce a more convenient alternative.

“I’ve had friends that showed me their own homemade oat milk, made with cheesecloth and a sieve, and I’m just like, ‘We can do that better for you! It will be easier and taste better,’” he said.

Messersmith said the launch was timed for January in order to be ready for retailer resets, adding that the company’s commercial team made a “concerted effort” to ensure the innovations are available in as many chains as possible at launch. The drinks are currently rolling out now nationwide in retailers including Albertsons, Publix, Sprouts and Target stores.

Additionally, Messersmith said Super Basic will be available in Whole Foods, Meijer and Shop Rite accounts and Unsweetened will add Kroger, Stop and Shop and H-E-B stores among others.

ollahi in the release. “HUMM provides SYSTM Foods with unique capabilities and adds another incredible brand to our portfolio.”

According to Circana, Humm’s refrigerated kombucha products grew dollar sales by 18.5% to $23.4 million in the 52-weeks ending October 8, 2023 in U.S. MULO and c-store retail accounts. That data does not include ecommerce sales or all product lines sold by the brand.

Condiment and beverage brand Acid League is closing its online store at the end of January, pivoting to focus on the expansion of its international retail line.

In a statement posted on its website, the Toronto-based company said maintaining an online inventory of 17 different products – each SKU requiring its own rare and unique ingredients – while simultaneously expanding an international retail line of 28 other products became “totally unsustainable.”

According to co-founder and chief product officer Allan Mai, Acid League agonized over the decision for months, as the brand’s ecommerce site is “such a pure expression of who we are.” In the end, the brand’s decision was rooted in economics.

Acid League’s online products became too expensive to produce due to factors like inflation and updated iOS terms, Mai said, which compounded in such a way that was unsustainable. Though the brand’s director-to-consumer business was smaller than its retail side, the use of specialized ingredients made its management more complex.

“Ultimately, a business needs to scale at one point in order to have enough money to reinvest into the business and continue its mission,” Mai explained to Nosh in an email. “We were over-indexed on putting out so many products that it got in the

way of us developing the distribution that would allow more people to access our offerings.”

Additionally, consumers expressed frustration over difficulty getting their hands on Acid League’s products, either because they were often sold out online or because retail assortment was inconsistent. To offset the closing of its online store, Mai said the company will expand its brick-andmortar distribution throughout North America.

“Regrettably, we know that for some people right now the online store is the only place they can buy our products, and we are gutted [by] this reality, but our hope is that by focusing on getting into more retailers we’ll be able to show up where they grocery shop soon enough,” he said.

Launched in 2020, Acid League produces a portfolio of hot sauces, mayos, ketchup, BBQ sauces, salad dressings, cooking sauces, beverages and, most recently, time-saving shortcut sauces. In 2022, the Torontobased brand closed a $6.2 funding round aimed at supporting expansion into new product categories and strengthening its manufacturing and marketing efforts. To date, the company has raised approximately $11.5 million, reporting revenues upwards of $10 million.

There is still hope for the online store. According to Mai, the team initially con-

sidered simply raising prices on its existing site before quickly pivoting to envision what “DTC 2.0” will look like for the company. As for Acid League’s online-exclusive products, the brand hopes several community favorites will eventually make their way into retail.

Acid League isn’t the only DTC-born brand eliminating its online store in favor of sales in the physical realm: In December, tahini brand Soom shut down its digital storefront as DTC accounted for just 5% of the brand’s revenue, but 24% of its warehouse’s workload consisted of packing orders.

But Soom isn’t ditching omnichannel just yet; the products will remain available on Amazon, Thrive Market and Misfits Market.

Though Acid League plans to dive back into innovation eventually, its current focus is on retail, where supply chains are more predictable and the company can better keep up with consumer demand. Currently, the brand’s products are available at retailers such as Harmons, Sprouts and Whole Foods Market, among others.

“At the end of the day, we decided we had enough products to share, and although we’ll get back to developing new products, that we should focus in the immediate future on making our products as easy to grab [as possible] for more people,” said Mai.

Whole Foods Market has modified the definition of its Forager, Local and Global brand designations, bringing increased clarity between the former two emerging brand-focused programs.

The move follows a slate of organizational structure updates from the Amazon-owned natural retailer, which redrew its regional map in April.

To now qualify as a Forager brand, a supplier must sell its products in about 50 stores or less. During a supplier summit presentation earlier this month, Lee Robinson, VP of Merchandising for Grocery, Refrigerated and Frozen, explained that local Forager teams will also complete an assessment of the brand prior to the final decision.

Forager brands benefit from reduced fees and waived expenses on retail costs like free fills and promotional spend. Brands continuing in the Forager program will receive a notice from Whole Foods by the end of the year and the local forager will remain the supplier’s primary point of contact.

Whole Foods will not accept requests for a brand to be designated as a Forager brand. Any brand that is sold in more than 50 stores will now be deemed a Global brand and the cost of maintaining their spot on shelf will follow Whole Foods’ standard fee structure.

Brands tagged as Local have also been given updated guidance: the definition now covers companies growing, raising or manufacturing their products within the state the product is being sold, or within 275 miles from the store. The company’s headquarters will also have to meet those requirements.

“We are committed to working with you on your growth path and will provide the right support along the way,” Robinson said.

Local brands will now automatically join the Forager program. Previously, brands selling in three Whole Foods regions or less could be considered a Forager brand while suppliers selling in more than four regions were considered Global brands.

By evolving the definition of a local brand, Whole Foods is also hoping to shift the focus from suppliers to products. According to Robinson, these changes were made in response to feedback garnered by its recent supplier Sentiment Survey.

“We’re also evolving our Local marketing to enhance the immersive local experience for our customers,” Robinson said. “We are reimagining how Local shows up through signage and other marketing efforts to connect customers to Local products available in new and more impactful ways.”

Danone has found a buyer for its premium dairy brands Horizon Organic and Wallaby, announcing in January it has agreed to sell the businesses to investment firm Platinum Equity.

The French multinational corporation previously said in January 2023 that it intended to divest its U.S. organic dairy portfolio review and asset rotation program, which had been announced in March 2022.

In a February 2023 report, the company said Horizon and Wallaby represented around 3% of Danone’s total revenues and “had a dilutive impact on Danone’s like-forlike sales growth and recurring operating margin in 2022.” However, in a press release, Danone CEO Antoine de Saint-Affrique said the brands “fell outside” its “priority growth areas.”

“Today marks an important milestone in delivering this commitment while giving the Horizon Organic and Wallaby businesses the opportunity to thrive under new leadership,” de Saint-Affrique stated. “This sale, once completed, will allow us to concentrate further on our current portfolio of strong, health-focused brands and reinvest in our

Danone will keep a non-consolidated minority stake in Horizon. Financial terms of the deal were not disclosed.

A pioneer in organic dairy products, Horizon Organic launched its first USDA-certified organic milk in 1991 and today markets a full line of products including creamers, yogurt, cheese and butter. Danone acquired the brand in 2016 as part of its $12.5 billion purchase of WhiteWave Foods.

According to Circana, retail dollar sales of Horizon’s white milk were up 4.4% to over $665.8 million in the 52-week period ending October 8, 2023. Its ready-to-drink milk beverages were down -2.7% to $119.3 million and yogurts/yogurt drinks rose 63.5% to $8.1 million. That data is not representative of Horizon’s full line of products.

Wallaby Organic is an “Australian-inspired Greek-style yogurt” brand which produces a variety of flavored yogurts including whole milk and lowfat offerings.

Platinum Equity is a California-based private equity firm. According to its website, it manages a portfolio of assets worth over $47 billion across numerous

industries, including European sweet biscuits maker Biscuit International, seafood provider Iberconsa, pet products brand Petmate, and the Detroit Pistons NBA franchise; Pistons owner Tom Gores serves as chairman and CEO of the firm.

“Horizon Organic is an iconic name in dairy that is well recognized and beloved by consumers,” Platinum Equity co-president Louis Samson said in a press release. “The brand has earned a reputation for quality and innovation that is unmatched in the industry. We appreciate Danone’s confidence in our ability to build on that legacy and support Horizon Organic’s growth as a standalone company.”

In the release, Platinum Equity managing director Adam Cooper stated that Horizon Organic will operate as an independent business.

“We have a lot of experience supporting food and beverage businesses,” Cooper said. “We look forward to partnering with Horizon Organic’s management team to ensure a seamless transition and chart a path for continued growth and expansion.”

The popcorn category got a shake-up in January as Weaver Holdings, the largest manufacturer of popcorn in the U.S., was acquired by AUA Private Equity Partners for an undisclosed amount.

According to a press release, West Palm Beach-based AUA aims to inject “efficiency” into Weaver and take the fourthgeneration, family-owned business “to the next level” by adding capital resources and bringing executive experience to its board of directors.

“We are tapping into our bench of operating partners to enact meaningful change at the Company,” said VP of AUA Private Equity Charlie DeVries in a press release statement. “We’ve added Mike Tracy, formerly the SVP of Supply Chain at Conagra, and Ted Schouten, formerly the president of TruFood Manufacturing to the board of directors. Both individuals will help oversee the investment and augment governance.”

The announcement did not include details on any immediate changes to Weaver’s business or manufacturing structure.

AUA currently manages other CPG food manufacturers including Epic Baking Company, specialty food holding company Gourmet Culinary Partners, and Latinx branded and private-label dessert maker Raymundo’s. It has closed partnerships over the years with other CPG producers like Pittsburgh-based TruFood, Indulge Desserts Holdings and frozen Asian appetizer maker Water Lilies Fine Asian Cuisine.

Sales of ready-to-eat popcorn/caramel corn reached $2.1 billion in the 52-week period ending November 10, growing +9.3% year-over-year, according to Circana omnichannel data. Micro -

wave popcorn sales rose 2.6% and kernel popcorn increased 8% during the same period.

Founded in 1928, Van Buren, Indiana-based Weaver is a private label manufacturer and co-packer of ready-to-eat popcorn, popping corn popcorn snacks and microwave popcorn for national brands and foodservice clients. The company also makes the Pop Weaver brand popcorn.

The popcorn category continues to rise for private label brands with sales up for microwave (2.3%) and kernel ((17.8%) in the last 52 weeks, according to Circana data. Yet, Pop Weaver’s microwave popcorn sales were down -6%, with volumes down -7.4%.

It has been a year of change for Weaver, which agreed to sell two co-packing facilities to The Hershey Company in April. The Bethlehem, Pennsylvania and Whitestown, Indiana facilities manufactured the SkinnyPop brand, owned by the chocolate and confectionery giant.

Hershey’s chief supply chain officer Jason Reiman said in a statement at the time it was part of the company’s plan to “continue to evolve our supply chain, making significant investments in the size, scale and capabilities of our network, improving resiliency” by controlling its manufacturing and prioritizing its snacking portfolio.

“By building on the foundation that the Weaver family put in place, AUA Private Equity will allow us to expand our capabilities operationally and increase the pace of product innovation,” Weaver CEO Jason Kashman said in a statement. “The resources that AUA Private Equity brings will ultimately benefit our customers and associates at Weaver.”

The final Circana beer report for 2023 has arrived and it’s time to see how the category and its segments fared in scans, starting with a look at craft.

Of note: Circana includes craft brands owned by large manufacturers in its craft data set, and its definition of “craft” differs from that of the Brewers Association (BA).

Craft finished 2023 with dollar sales down -0.9%, with more than $4.71 billion in sales year-to-date (YTD) through December 31 in multi-outlet plus convenience channels. The decline was in spite of an average price per case increase of $1.50, to $42.62. The decline was also significantly smaller than the -4.4% YoY decline recorded in 2022 and -4.6% decline in 2021.

By comparison, total beer dollar sales increased +2.6%, while the average price per case increased by $1.28, to $29.89.

Craft volume, measured by case sales, declined -4.4%, with a loss of more than 5 million cases. The decline was significantly larger than the -1.7% decline recorded by total beer, but smaller than the -8.6% craft volume decline recorded in 2022.

In the final four weeks of 2023, craft dollar sales declined -1.3% year-overyear (YoY) and volume declined -2.6%. In the last 12 weeks, dollar sales were down -1.5% and volume was down -3%.

Craft’s share of total beer dollars in 2023 declined -0.37 share points, to 10.3%, continuing to fall after declining -0.61 share points in 2022, to 10.63%. Craft’s share of total beer volume declined -0.2 share points, to 7.22%. Flavored malt beverages (FMBs), which increased volume share +0.93 share

points in 2023, to 7.12%, are now nipping at the heels of craft for the fourth largest share of beer volume.

In the convenience channel – the strongest growth channel for beer –craft dollar sales increased +4.5%, to more than $1.63 billion. Overall beer growth in the channel was even larger (+5.2%).

Four beer segments outpaced overall beer in the channel: Imports (+15.1%), FMBs (+19.1%), hard cider (+7.6%) and non-alcoholic (+28.2%). Domestic subpremium (+1.6%) and domestic super premium (+0.2%) were also in the black, while dollar sales for domestic premium (-1.6%), hard seltzer (-6.2%) and assorted (-73.9%) all declined.

Imports recorded the largest increase in share of beer dollar sales, claiming an additional 2.27 share points for 26.19% share, just below No. 1 shareholder domestic premiums (-1.8 share points, to 26.38%).

Craft volume was also in the black, increasing +0.7% versus 2022, above channel trends for overall beer (-0.4%).

The average price per case of craft beer increased by $1.70, to $46.51, slightly above total beer price increases (+$1.67, to $31.66). Craft is the second most expensive beer segment in c-stores behind hard cider (+$2.78, to $50.56), passing assorted, which declined its average case price by $17, to $45.67.

Craft’s share of total beer sales in the channel declined -0.04 share points, to 6.31%. However, craft’s share of c-store beer volume increased +0.05 share points, to 4.3%. Still, the segment has a small share of the pie, with less share than the majority of beer segments oth-

Five beer segments recorded dollar sales growth in 2023 in multi-outlet plus convenience channels: Imports (+11.8%), domestic sub-premiums (+2%), FMBs (+17%), hard cider (+1.7%) and non-alcoholic (NA) beer (+29.3%).

Three segments also gained share of total beer dollars:

• Imports (+1.96 share points, to 24.05%);

• FMBs (+1.17 share points, to 9.53%);

• NA (+0.16 share points, to 0.79%).

Of the five beer segments to record declines, craft had the smallest dollar sales loss YoY, followed by domestic premi-

er than hard cider (0.36%), NA (0.15%) and assorted (less than 0.01%).

In grocery, craft dollar sales declined -3.3%, to nearly $2.6 billion. Craft’s share of total beer sales in grocery declined -0.43 share points, to 19.63%, falling to the No. 3 largest share in the channel. Imports overtook craft for the No. 2 spot, increasing dollar sales +6.4% in the channel, to nearly $2.73 billion, and share of beer dollars +1.49 share points, to 20.61%. Domestic premiums maintained the No. 1 spot, despite a -1.8% decline in dollar sales, with 23.08% share of beer dollars in the channel.

Craft volume took a large hit in grocery, declining -6.3%, marking a loss of more than 4.2 million cases. Price per case in the channel increased by $1.29, to $41.49. Craft is the third most expensive beer segment in grocery, behind hard cider (+$1.47 YoY, to $48.39) and assorted (+$1.89, to $46.76).

Craft case share in grocery declined by -0.29 share points, to 13.92%, maintaining the third largest share of beer volume in the channel behind domestic premiums (-0.41 share points, to 30.45% share) and imports (+1.42 share points, to 17.95%). Domestic sub-premium isn’t too far behind, increasing its own share by 0.23 share points in 2023, to 13.33%.

ums (-1.2%), domestic super premiums (-1.5%), hard seltzer (-13.6%) and assorted (-20.2%).

Imports (+7.9%), FMBs (+13%) and NA (+19.7%) were the only segments to increase volume in 2023 versus 2022. Assorted beer recorded the largest decline (-23.4%), followed by hard seltzers (-18.2%), domestic premium (-4.9%), craft (-4.4%), domestic super premium (-3.6%) and hard cider (-2.3%).

Imports recorded the largest beer volume share gain (+1.76 share points, to 19.65%), while hard seltzer recorded the largest share loss (-1.21 share points, to 6%).

Molson Coors’ Blue Moon Belgian White is still the No. 1 craft brand in Circana-tracked channels, despite continued losses. The brand recorded a -3.2% decline in dollar sales, to nearly $267.9 million, and -6.9% decline in volume in 2023. It was the third consecutive year of dollar sales decline for Blue Moon, following losses in 2022 (-1.3%) and 2021 (-8.5%).

The No. 2 best-selling craft brand was once again Kirinowned New Belgium Brewing’s Voodoo Ranger Imperial IPA, which increased dollar sales +12.4%, to $171.37 million, and volume +7.9%. Voodoo Ranger Juice Force hazy imperial IPA was No. 3 after only its second year in the market, increasing dollar sales +75.4%, to nearly $128.36 million, and volume +75.1%.

No. 4 Sierra Nevada Hazy Little Thing IPA (+7.5%) and No. 9 Anheuser-Busch InBev’s (A-B) Elysian Space Dust IPA (+0.3%) were the only other top 10 craft brands to record dollar sales gains YoY.

The rest of the top 10 craft brands performed as follows:

• Boston Beer Company’s Samuel Adams Seasonal (-4.9%, to nearly $99.25 million);

• Sierra Nevada Pale Ale (-2.3%, to $87.34 million);

• Shiner Bock (-1.4%, to nearly $85.75 million);

• Molson Coors’ Leinenkugel’s Shandy: (-0.6%, to nearly $82.6 million);

• Heineken’s Lagunitas IPA (-11.9%, to nearly $70.85 million).

Five other New Belgium brands made Circana’s top 30 craft brands list: No. 15 New Belgium Voodoo Ranger Fruit Force hazy IPA (launched at the start of 2023); No. 18 Voodoo Ranger Hoppy Pack (+13% YoY); No. 19 Fat Tire Amber Ale (-17.7%); No. 21 Voodoo Ranger Juice Haze IPA (-12.3%); No. 25 Voodoo Ranger IPA (-14.6%).

Kirin-owned Bell’s Brewery also had two entries in the top 30: No. 14 Bell’s Two Hearted (+5.6%) and No. 30 Bell’s Seasonal (+11.2%).

Only four other top 30 craft brands recorded YoY dollar sales gains: No. 11 A-B’s Kona Big Wave (+41.7%, to $67 million); No. 17 Monster-owned Cigar City Jai Alai IPA (+1.1%,, to $39.8 million); No. 24 A-B’s Goose Island Tropical Beer Hug double IPA (+90.3%, to $28.6 million); and No. 27 A-B’s Wick-

ed Weed Pernicious IPA (+8.5%, to nearly $25.7 million).

Nine of the top 30 recorded YoY dollar sales declines:

• No. 12 Firestone Walker 805 (-3.8%, to $64.3 million);

• No. 13 Founders All Day IPA (-6.2%, to $62.1 million);

• No. 16 Samuel Adams Boston Lager (-3.5%, $46.5 million);

• No. 20 Blue Moon Light Sky Citrus Wheat (-22%, to $38.6 million);

• No. 22 Lagunitas Little Sumpin Sumpin (-15.9%, to $33.6 million);

• No. 23 Samuel Adams Variety Pack (-1.1%, to $32.8 million);

• No. 26 Sierra Nevada Torpedo Extra IPA (-3.6%, to $28.3 million);

• No. 28 Sierra Nevada Big Little Thing imperial IPA (-10.8%, to $23.5 million);

• No. 29 Goose Island IPA (-17.3%, to $23.2 million).

Voodoo Ranger Imperial IPA finished 2023 maintaining the No. 1 craft spot in c-stores by dollar sales, increasing dollar sales +15.3%, to nearly $96.6 million. Blue Moon Belgian White was No. 2, with dollar sales declining -3.1% in the channel, to nearly $94.7 million.

Blue Moon remains the No. 1 craft brand by volume, despite a -6.8% decline in case sales. Voodoo Ranger Imperial IPA increased case sales +9.9% YoY.

Four craft brands made the top 30 in c-stores that weren’t in the top 30 overall:

• Rhinegeist Truth IPA (+8.6%, to $11.7 million)

• Georgetown Bodhizafa IPA (+29.4%, to $9.1 million);

• 10 Barrel Pub Lager (+29.4%, to $8.48 million);

• And Tilray-owned Sweetwater 420 extra pale ale (-9.6%, to nearly $7.8 million).

In grocery, Blue Moon was the No. 1 craft brand by dollar sales (-2.9%, to $122.7 million), followed by Samuel Adams Seasonal (-5.3%, to $59.4 million) and Voodoo Ranger Imperial IPA (+5.8%, to $56.2 million).

Tilray-owned Shock Top Belgian White Ale (formerly owned by A-B) was the only yet-to-be-mentioned brand to make the top 30 list in grocery, ranking No. 27, despite a -23.5% decline in dollar sales, to $12.1 million.

Seven of the top 25 craft growth brands in 2023 were NA offerings, according to BWC.

Five of those brands belong to dedicated NA brewer Athletic Brewing Company, including Run Wild IPA (No. 5 growth brand and No. 25 overall craft brand), Free Wave Hazy IPA (No. 10), Upside Dawn Golden (No. 12), Cerveza (No. 22), Athletic Lite (No. 25).

Athletic capped a big year as the No. 15 craft brand family in sales, which increased +80.6%, as volume measured

in case sales increased +79.2%. Athletic was the No. 2 craft growth leader in 2023, increasing sales by more than $35.4 million, to $79.3 million, trailing only New Belgium Brewing, which increased sales +18.2%, to $514.8 million, adding more than $79.3 million in sales last year.

Of the top craft brand families, Athletic gained the most category weighted distribution (CWD) last year (+9.4%, to 27.4%). New Belgium was second (+3.7%, to 72.6%).

The other NA beers to make the cut as top growth brands in 2023 were Boston Beer’s Samuel Adams Just the Haze IPA (No. 15) and Lagunitas Hoppy Refresher assorted pack (No. 18).

Bump Williams Consulting (BWC) described 2023 as a “mixed bag” for the overall craft segment across channels.

In NIQ-tracked off-premise channels (total U.S. xAOC plus liquor plus convenience), craft dollar sales edged close to flat, declining -0.3%, while volume dropped -3.8%, according to the firm, citing NIQ data ending December 30. Craft dollar sales in convenience increased +6.5%, while grocery (-1.4%) and liquor outlets (-5.6%) both declined.

The declines of mainstream craft brands accelerated (-7.5%) in 2023 compared to 2022 (-4.9%), the firm reported. National (+5.8%) and regional (+2.6%) posted dollar sales growth. However, local craft continued to decline, -2.9% in 2023, following declines of -7.1% in 2022 and -4.7% in 2021.

Just two regions eked out craft dollar sales growth: the Mountain region (+0.1%) and New England (+0.4%). The biggest sales declines occurred in the West North Central region (-4%), East North Central (-3.3%) and the Pacific region (-2.4%).

The number of craft brands and SKUs declined -4.4% and -4.9%, respectively. There were 19,722 craft brands at the end of 2023, down from the 20,637 craft brands in 2022, and nearly on par with the 19,718 craft brands in 2021.

The number of SKUs dropped to 24,796, well below the 26,079 in 2022 and 25,238 in 2021.

The number of new craft brands and SKUs in 2023 declined -37% and -35.8%, respectively, compared to 2022. The 2,018 craft brands in 2023 was down from 3,202 in 2022 and 3,022 in 2021. The 2,632 craft SKUs in 2023 fell from 4,099 in 2022 and 3,776 in 2021.

BWC founder Bump Williams noted that beer shelf space remained “stagnant, with existing space instead being reallocated across segments.”

Imports, FMBs and NA beer gained shelf space across all channels, while craft and cider singles gobbled up space in convenience.

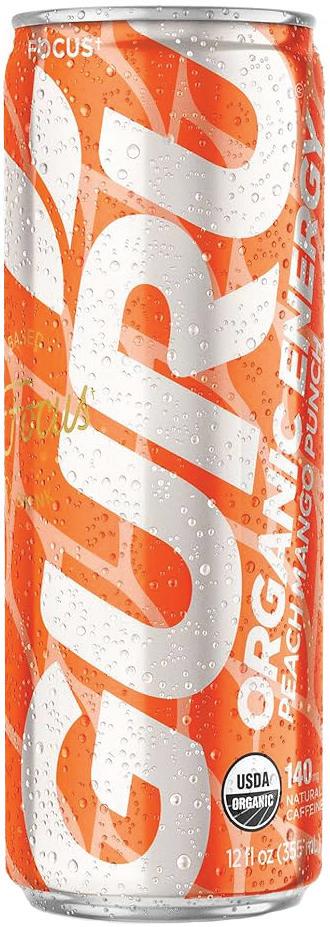

GURU Organic Energy has expanded its punch lineup in the U.S. with the introduction of Peach Mango Punch. Each 12 oz. can contains 140mg of natural caffeine and has just 50 calories. The new flavor is available online via the brand’s website for $29.99 per 12-pack or $56.99 per 24-pack. For more information, visit guruenergy.com/en-us.

First teased last year, Florida-based functional beverage maker Odyssey has unveiled its latest innovation, the 222 line. As its name suggests, the new collection features 222mg of caffeine derived from green tea paired with the brand’s proprietary blend of Lion’s Mane and Cordyceps. Available in four flavors at launch – Blue Raspberry, Cherry Lime, Strawberry Watermelon and Pineapple Mango – the energy drinks are crafted with fruit juice concentrate and naturally sweetened. Odyssey’s new 222 line is available via the brand’s website for $41.99 per 12-pack of 12 oz. cans. For more information, visit odysseyelixir.com.

G FUEL is looking to take consumers back in time with the release of its new Atari 2600+ collection. The G FUEL Atari 2600+ Collector’s box ($99.99), which resembles the vintage gaming console, includes a 40-serving tub of the themed flavor, an Atari x CX40+ joystick tumbler, an Atari keychain, and three 15-serving tubs of some of the console’s most-played cartridges: Asteroids (sour grape), Centipede (strawberry, pineapple and coconut) and Pong (blue raspberry). Consumers can also purchase a standalone Atari 2600+ 40-serving tub for $35.99. For more information, visit gfuel.com.

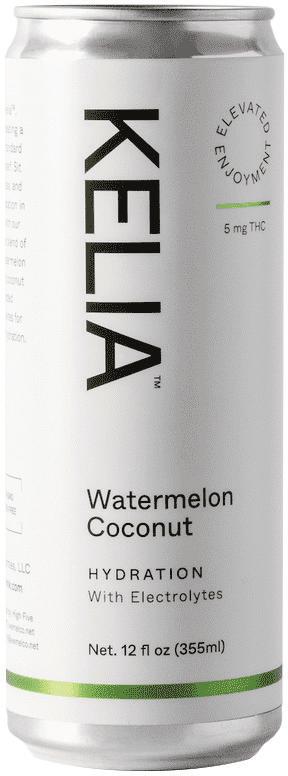

Boston-based cannabis drink producer KELIA has introduced its newest signature flavor, Watermelon Coconut. Each 12 oz. can of the beverage, crafted with watermelon juice and coconut water, contains 5mg of THC and also has added electrolytes. Watermelon Coconut joins KELIA’s other signature flavors, Pineapple Jalapeño and Grapefruit Ginger. The beverage is available at select dispensaries across Massachusetts. For more information, visit keliadrink.com.

BodyArmor has announced the launch of its own zero-sugar sports drink. The new line uses only natural sweeteners, no carbohydrates and more potassium than Gatorade’s zero-sugar variety. BodyArmor Zero Sugar will be available in four flavors (Fruit Punch, Lemon Lime, Orange and Cherry Lime) and will come in 16 oz., 6-packs of 20 oz., and 28 oz. formats (except Cherry Lime, which is only available in 16 oz.). For more information, visit drinkbodyarmor.com.

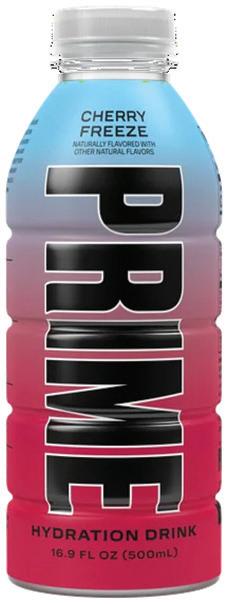

PRIME Hydration – which recently sold its billionth bottle – has launched a new Cherry Freeze flavor featuring a color-changing label. Like the rest of the brand’s hydration beverages, the new flavor features BCAAS and B Vitamins and has just 20 calories. The “cold-activated” bottle features a label that starts with red at the bottom and fades to white, but when cold, the very top changes to a light blue. PRIME’s Cherry Freeze is currently only available for purchase in-store. For more information, visit drinkprime.com.

Just in time for Dry January, readyto-drink mocktail brand Mockly has released its newest SKU, Madame L’Orange. The new elixir is the first launch in the brand’s new low-sugar, low-cal “Second Line” and features tasting notes of smoked orange, allspice, golden honey and ginger. Mockly’s Madame L’Orange is available for purchase online for $15.99 per 4-pack of 12 oz. cans. For more information, visit drinkmockly.com.

Hiyo has unveiled Strawberry Guava as its newest non-alc social tonic flavor. The new offering features functional ingredients lemon balm and passion flower, which have been shown to help alleviate anxiety and depression, the brand claims. Hiyo Strawberry Guava is available exclusively through the brand’s website for $44.99 per 12-pack of 12 oz. cans. For more information, visit drinkhiyo.com.

Seattle-based dairy producer Darigold has unveiled its newest brand, Belle. The new line of 28 oz. dairy-based coffee creamers is made with just five simple ingredients including real cream. Available in four flavors – Vanilla, Sweet Cream, Hazelnut Latte and Caramel – the lactose-free creamers are now rolling out to grocery stores and other food markets across the Northwest. For more information, visit darigoldbelle. com.

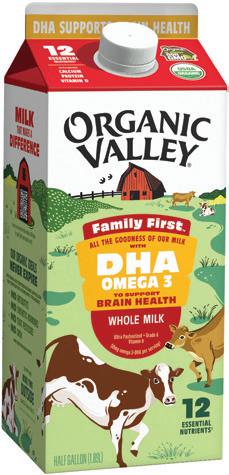

Organic Valley’s latest innovation, Family First Milk, seeks to give families a new way to add DHA Omega 3 into their day. Offered in Whole Milk and 2% Reduced Fat Milk varieties, the milk provides 50mg of DHA Omega 3 per serving as well as 12 essential nutrients. Organic Valley’s Family First Milk will appear on retailer shelves nationwide beginning this month with a SRP of $5.99-$6.99 per 64 oz. carton. For more information, visit ethicallysourced.organicvalley.coop.

California-based Straus Family Creamery – known for its sustainable and regenerative carbon farming practices – has launched organic low fat kefirs in Plain and Blueberry flavors. Both varieties boast 11 different beneficial live and active cultures and deliver 20% of the recommended daily value of calcium. Straus Family Creamery’s Organic Lowfat Kefirs are now available at select Whole Foods Markets and independent retailers across Northern California with a SRP of $6.49 per quart. For more information, visit strausfamilycreamery.com.

Juice giant Tropicana has introduced “Tropcn,” a new limited-edition packaging removing “AI” from its name to celebrate the brand’s natural ingredients and highlight the fact there’s nothing artificial inside. The brand debuted the new packaging earlier this week at the largest consumer electronics event, CES 2024. For those who were unable to attend CES, Tropicana has hidden bottles

of “Tropcn” across participating Kroger banners nationwide. For more information, visit tropicana.com.

Uncle Matt’s is encouraging consumers to “support your sport” with the launch of its new Ultimate Athlete Juice Shots. The 2 oz. pre-workout shots are crafted with a blend of beets, orange juice, coconut water, lemon and ginger. According to the brand, a recent study shows that beets boost athletic performance and reduce muscle soreness. Uncle Matt’s Ultimate Athlete Juice Shots are available on the brand’s website for $24 per 6-pack. For more information, visit unclematts. com.

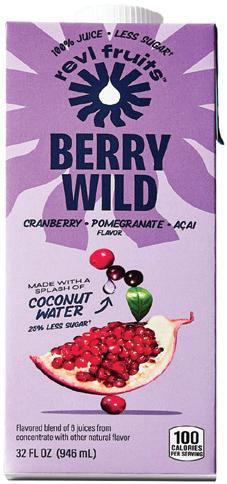

Capitalizing on the growing consumer demand for premium juices, Ocean Spray has unveiled its new Revl Fruits brand. Available in four flavors – Boldly Cran, Tart Cherry, Berry Wild and Truly Tropical – the product is crafted with 100% juice and a splash of coconut water and contains no added sugar. Revl Fruits is available on Amazon for $4 to $8 per 32. Oz. Tetra Pak carton depending on the variety. For more information, visit revlfruits.com.

New year, new flavors! Aura Bora has announced its first flavor of the month for 2024: Cherry Key Lime. As its name suggests, the new dessert-inspired sparkling water variety is crafted with bing cherries and key limes, resulting in the brand’s “sweetest flavor yet.” Though currently out of stock, Aura Bora’s Cherry Key Lime will soon be available for purchase via the brand’s website for $33 per 12-pack of 12 oz. cans. For more information, visit aurabora.com.

Continuing on its quest to help consumers murder their thirst, Liquid Death has announced the launch of three new sparkling water flavors: Cherry Obituary, Squeezed to Death and Grave Fruit. Like the rest of the brand’s sparkling water portfolio, the new varieties have 20 calories and 4g of sugar (from agave) per 19.2 oz. tallboy can. For more information, visit liquiddeath.com.

Coconut Milk and RTD Coconut Milk

Sure, we’ve gone from Soy to Almond when it comes to dairy substitutes, but what comes next? For a long time, it looked like Oat Milk was going to be the big winner, but growth slowed to a pedestrian 7% last year, although Oatly and Chobani outpaced the category. Look at Coconut Milk and there’s a bigger growth story emerging – one that features many of the same labels established in the alt-milk category (Silk, So Delicious, Rebbl, Califia). With Starbucks bringing a flavored RTD Coconut Milk to the masses, the training wheels are on – will it manifest in the dairy aisle as well as the to-go cooler?

BevNET, NOSH and Taste Radio will be interviewing, broadcasting and filming throughout the event. If you’re attending or exhibiting, let’s connect! Reach out at news@bevnet.com, news@nosh.com, or ask@tasteradio.com

The venue may have changed from Santa Monica to Marina Del Rey, but the 2023 edition of BevNET’s annual winter conference in Los Angeles brought the expected high levels of energy and excitement across the two day event in December.

A wide range of topics were discussed but the recurring theme among beverage business entrepreneurs, investors, experts, distributors and retailers presenting on-stage was how to succeed during a difficult environment to raise new investment and how to maintain growth with less.

In a panel discussion that kicked off the first day, a diverse group that included Buster Houston, VP of national merchandising at Albertsons, Vons and Pavilions; Mike Burgmaier, the managing director at Whipstitch Capital; Shannon Deary-Bell, president and CEO of Nor-Cal Beverage Company; and Jessica Pratt, chief sales officer at Pop & Bottle, deliberated over the difficulties emerging brands had in 2023 weathering the “semi-recessionary” climate for raising capital.

Despite the high inflationary environment, the group noted, some of the beverage industry’s recent unicorns – like Essentia and Celsius – emerged after playing the long game and building businesses that endured economic downturns.

All the panelists agreed that pricing will play a key role in determining success as 2022’s runaway inflation continues to dim. Buster Houston, VP of national merchandising at Albertsons, Vons and Pavilions, said that the retailer has identified driving cost savings relative to each category, rather than macroeconomic factors, as key to winning. Successful operators, he added, understand that price decisions should be made both by looking at individual SKUs and also from a distribution standpoint, region-by-region.

Later in day, Nick Giannuzzi, founder and managing partner of CPG focused law firm Giannuzzi Lewendon, and Dr. Andrew Abraham, founder and CEO of Orgain, took the stage to discuss the strategy around Humble Growth, the $312 million fund they co-founded this year.

With Peter Rahal, founder of RxBar, in place as managing partner and the acumen of CPG veterans Mike Repole, Gary Hirshberg and Jared Smith, Humble Growth is targeting opportunities to finance and grow the next generation of early to mid-stage brands.

Abraham highlighted that gross margin, and projections for improvements as the brand scales, remain fundamental to securing investment.

“Unfortunately, I think we need to get to a place where that path [to profitability] becomes tangible earlier,” Giannuzzi said. “We see that a little bit, especially now that investors are hesitant – they’re careful, they’re being very strategic with their money.”

As the team works to build its investment portfolio, Giannuzzi and Abraham emphasized that they are seeking to develop strong relationships with the leaders of those businesses so that they can trust one another’s advice, understand both side’s decision making

process, and avoid invoking things like blocking rights down the line.

Closing out Day One, Hella Cocktail Co. co-founder Jomaree Pinkard talked about his work as CEO and managing director of Pronghorn (he left the company later in December) which has invested about $200 million to empower growth among Black spirits brand founders. Pinkard explained how the investment group is building a template for category disruption among underrepresented groups.

For the first time, BevNET Live also built out a space for emerging brands to talk to and pitch their drinks to retailers throughout both days of the event. The Retailer One-On-One Meetings allowed beverage entrepreneurs to talk to executives, buyers and distributors from the Albertsons Company as well as the L.A. Vibrations team and DSD distributor HiTouch Libations.

Day Two got rolling with a presentation from SPINS Markets Insights Director Scott Dicker who explained what the consumer data analytics company has seen over the last year with disruption and how that is building momentum in certain arenas of the beverage industry.

“We’ve been saying this for years that the life cycle of innovation and brands has been speeding up, and it’s really at warp speed now,” Dicker said. “So, brands enter the market and make a big splash, and on the flip side it’s easier to be forgotten if you’re not executing right away.”

As far as more specific, product-level trends go, Dicker pointed to an embrace of “global” flavors helping to drive trial and discovery as American consumers look for more Asian, Mexican and other international cuisines in their food and drinks.

Honest Tea co-founder Seth Goldman, named BevNET’s Person of the Year for 2022 for his work bringing Just Ice Tea to the market, sat down with Editor-in-Chief Jeff Klineman to discuss the lessons he has learned launching a beverage brand for a second time. Although the industry has changed since Goldman launched Honest Tea over 20 years ago, Just Tea has been able to build an early following and is already leaning into the new age of beverage marketing to capitalize on its momentum.

“It’s impressive to see what social media can create,” he said, answering a question about influencer marketing in CPG. “Yet, just as quickly as it can create, it can undo it. What [Just Tea] is about is authenticity. That never goes out of style.”

For those seeking exit opportunities, a panel composed of Caroline Levy, founder of consumer advisory firm CLAS; GroundForce Capital co-founder and managing partner Mark Rampolla; and Nutter partner Jeremy Halpern had some advice for brands looking to stand out as attractive prospects for a sale.

Rampolla suggested that the strategic beverage buyers today need to see at least $250 million in revenue and existing profitability in order to make an acquisition. He said that what has long been missing between the larger players and small startups is a serious

“middle market;” yet, that market may be beginning to emerge as multi-brand management groups can successfully house numerous brands in the $50 million to $250 million range. Rampolla pointed to Suja’s acquisition of Vive and how Tropicana now operates multiple brands as examples of how these middle market businesses could serve as buyers for rising startups.

Closing out the event, Los Angeles-based hemp-derived THC company Calexeco took home the New Beverage Showdown trophy in a tight contest that included five other finalists including another hemp-infused option Magic Cactus, “clean caffeine” energy drink Plant Press, Spade sparkling premium soda, Erva Brew Co. yerba mate and Fang recovery tonic.

Nosh Live came to its new home in Marina Del Rey, California on November 30 with a blockbuster list of presenters discussing the most pressing issues in consumer packaged food. Industry leaders, entrepreneurs and investors brought their experience to the stage giving attendees valuable insight into how to succeed in the rapidly evolving natural food industry.

In the first panel discussion of the day, investor Wayne Wu of VMG Partners, Whole Foods VP of dry grocery Dan Epley, and two brand executives with That’s It – chief sales officer Katie Eshuys and The Good Crisp Company co-founder and CEO Matt Parry – came to the stage talking about the post-pandemic era of CPG.

While there continues to be strong innovation in the industry, Epley told the crowd, brands that stick to their core, rather than branching out into numerous categories, tend to have stronger foundations that can lead to longevity in retail.

“There’s lots of times where brands get excited about that shiny thing, and that distracts them from the core and if they miss the core then the whole thing falls down,” he said.

Looking ahead, the panelists also discussed the impact of high pricing on the industry, including lower volume sales. With an expectation that the worst of inflation is likely now passed, Wu said that retailers are beginning to push for lower prices but brands should focus on moving units instead of increasing dollar sales.

“I think we’re gonna see the strength of brands come to light by next summer,” Wu said. “If you’re seeing brands still truly growing on a same-store velocity basis. And so we’re really focused on looking at unit growth.”

Later in the day, Kevin Lee, co-founder of plant-based ramen startup Immi, discussed how the company bootstrapped until closing a $3.8 million seed round in 2021 and a $10 million Series A round earlier this year. Lee leveraged his background in venture capital and sitting on the other side of the table to help the brand raise new capital.

“I wouldn’t say that I am particularly proud of having to raise money,” he said. “Who wants to give up equity? It’s not really a great thing.”

But Lee did concede that it is oftentimes a natural path to increasing a brand’s growth and trajectory as a disruptor in an established category.

Discussions around raising capital and the power of disruption continued into the second day of Nosh Live. Two of the founders and general partners of the Family Fund came to the event to talk about the newly formed $25 million fund’s investment strategy in early stage brands.

Launched in March by former SnackNation CEO Sean Kelly, ForceBrands founder Josh Wand and Vital Proteins founder Kurt Seidensticker, the Family Fund writes “smaller checks” to founder-led brands in the late seed to early series A stage investment rounds. Kelly and Wand emphasized that the true value is in operating as a sounding board and support system for CPG leaders.

“How do we help founder performance? A lot of founder performance is on the personal side. It’s the mental, it’s emotional, it’s the spiritual, it’s helping them if they’re having massive personal challenges,” Kelly said.

Part of its role is coaching founders through the fundraising process which Wand called a “scary” and “lonely journey” rife with rejection. The Family Fund not only attempts to ease that burden on new entrepreneurs to the food industry but help set realistic goals that will build to success.

In another panel discussion, a trio of successful entrepreneurs and founders presented their respective experiences navigating the aforementioned “lonely” journey of leading a brand. Nature’s Bakery CMO Vilma Livas, Partake Foods founder and CEO Denise Woodard, and Arnulfo Ventura, former CEO Alter Eco Foods and Beanfields, talked about the lessons they learned from working within large CPG companies and how that shaped their leadership strategies at smaller brands.

Being flexible and easily adapting to change was a common theme among the leaders.

“Keep questioning…It’s never static,” said Livas, who managed brands at Nestlé for over nine years. “It’s something that you have to continue to iterate as the needs of your business and the complexity of your business change.”

Describing it as working from within or “a game of double dutch,” Ventura said that “before you want to come in and add a new move you have to first jump in and get with what’s going on and get with the program.”

Woodward came to her leadership style through her time working at Coca-Cola and the lessons she learned from her entrepreneurial father who started his own trucking business. She added that knowledge is power and having an in-depth understanding of a brand’s business economics will help build a strong foundation for future growth.

In 2023, Nosh honored KIND founder and co-founder of SOMOS Foods Daniel Lubetzky as the Person of the Year and Rao’s Homemade as the Brand of the Year with its annual Best Of awards. Last year’s Rising Star brands were Ithaca Hummus, Once Upon A Farm and frozen treat brand DeeBee’s Organics.

In a crowded field six finalists competed for the title of Nosh Pitch Slam winner 2023. The winner was Lentiful — high protein, high fiber lentil-based meal cups available in seven flavors. The other five competing brands were luxury baked goods maker Lexington Bakes, Maazah Afghan-style sauces and dips, Fair & Square gut-friendly crackers, Zwita ancestral Tunisian foods and Confusion Snacks, an Indian-American fusion snack brand.

The last year brought a sea of craft leadership changes, mergers and acquisitions, crossover product innovation and more. As the bev-alc marketplace becomes increasingly noisy and overwhelming, the unofficial theme of the 2023 Brewbound Live business conference was “focus.”

Leadership at Rhinegeist Brewery kicked off the conference in Marina del Rey, California exploring the transition at the top of the Cincinnati, Ohio-headquartered craft brewery following its own leadership changes.

Adam Bankovich, who was named CEO in October, gave the keynote address and explained how Rhinegeist is getting focused and simplifying its commercial strategy in 2024.

Bankovich admitted that the notion of Rhinegeist – which is also in the business of T-shirts and merch, distribution, private events and marketing, among other things – getting focused might sound rich to some. But in a dynamic industry, those things can both be true. He pointed to RGBevs, Rhinegeist’s attempt at playing in the flavored malt beverage (FMB) space.

“I asked a lot of questions around this when I started,” Bankovich said. “And this was a sales plan that I inherited when I joined the company in October 2022.

“The more I unearthed when I was asking questions around RGBevs – how did we make the decisions to enter this space, how did we make the decisions on the flavors and the liquids, what consum-

Landing in a wholesaler’s warehouse is a big win for a supplier, but it’s often just the first step in a journey that ultimately ends in a consumer’s fridge.

Stone Distributing general manager Brian Fried, Breakthru Beverage California director of beer Sinead Carey and Tryon Distributing director of beer Elledge Davis shared the questions and tasks suppliers need to ask and accomplish along the way.

“As we think about new item launches and new brand launches, what we like to really think about is the end consumer,” Fried said. “As you’re thinking about your portfolio and you’re thinking about your approach to the market, be thinking about what role does that brand play with the consumer? What whitespace does it fill? What niche, what consumer needs is it going to meet?”

When exploring new offerings and new partners, Breakthru deploys a “very robust brand evaluation process” that ranges from market data to fundamental business questions, Carey said.

“We’re using data and analytics to tell us what’s going on in the market,” she said. “We’re also asking some really solid questions of potential partners and potential brands, as in,

er understanding did we have – it was really clear to me that there was no focus in this product line and it was potentially set up for failure,” he continued.

Much of the 2023 business plan that Bankovich inherited was banking on a big year for RGBevs. Citing Circana data through mid-November, the FMB brand family was down -47.4% (a decline of $1.7 million), while its beer brand family was up +14.6% (a gain of $3.6 million).

“We were betting on a lot of growth for our FMB line this year and it didn’t materialize because it was not focused,” he said.

Bankovich shared a slide that showed the percentage of resources – time, energy and money – devoted to the FMBs was outsized compared to its return on investment as the Truth brand family accounts for 56% of Rhinegeist’s volume, compared to 26% for other beers and 13% to FMBs/refreshment.

Bankovich and Rhinegeist co-founder Bryant Goulding also discussed the leadership transition, creating space for leaders to create new pathways and much more in a Q&A following Bankovich’s keynote address.

what are you looking to do? What channel are you trying to focus in on? Do you have some financial support? And are you financially stable, particularly if it’s a smaller supplier?

For Tryon, the first task in building a relationship with a new supplier is to “make sure their vision of success for the launch makes sense with our go-to-market strategy and our capabilities,” Davis said. “After compatibility is established, more complexity can be layered on.

“From there, you can add in the pieces of price promotion or incentivizing but making sure you’re in alignment is the first step,” he added.

At the conclusion of each year, BevNET honors the companies, brands, individuals, products, ideas and trends that have helped drive positive growth across the industry over the last 12 months.

And in 2023, positivity is a truly valuable commodity. It felt something like a culmination of the seismic events of the past few years, as post-COVID market trends crashed into the choppy economic waters and supply chain disruptions born from Russia’s invasion of Ukraine. Within the industry, conditions further stressed entrepreneurs by a collective pivot away from emphasis on raw growth and towards profitability. Beverage founders and operators have suddenly been asked to rewrite the playbooks that had brought them to prominence. Optimistic projections for endless future growth suddenly didn’t seem so certain.

What was predictable, though, was the way in which those beverage leaders responded to the opportunities inherent in that challenge. Giant legacy brands like Gatorade, Monster and Red Bull now face substantial competitors in the guise of Electrolit, PRIME and Pepsi-aligned Celsius, which has been turned around under CEO John Fieldly to nearly $400 million in quarterly sales. The red-hot ‘adult non-alcoholic’ space has been a wellspring of inspiration for product innovators – how else would we get a zero-proof, olive oil-spiked martini? For the answers to questions about the viability of a canned plant-based milk for kids, or if there’s room on the shelf for more robusta-centric RTD coffees, just read on here.

The winners of BevNET’s Best of 2023 Awards embody that spirit and drive, combining inspiration with effort, style, dynamism and personality. Try to tell these brands that they can’t, and they’ll show you how they can.

PRIME