Sweet Dreams

Coffee Makers Seek to Balance Flavor & Function

Best of 2024 Awards p. 34

Flavor & Ingredient 2025

Preview p. 40

Tracking Trends in Spirits p. 56

By Jeffrey Klineman

Coffee Makers Seek to Balance Flavor & Function

Best of 2024 Awards p. 34

Flavor & Ingredient 2025

Preview p. 40

Tracking Trends in Spirits p. 56

By Jeffrey Klineman

As I write this, we’re almost through with Dry January and not since I sleep-trained my last kid have I ever been this ready for something to be over. It’s not because I’ve been enduring a stretch of sobriety made all the more painful by my inability to put booze between me and the current jackassery coming out of Washington – there’s no way I’d have gone into the new administration without some emergency brown liquor – but because I’m getting bored to death of the one-size-fits-all marketing approach that this annual fad has unleased.

If I get one more mocktail recipe, or receive one-more midJanuary pitch for a story on the latest alcohol-free spirit based on a Dry January news peg, I’m going to use them to fire the still long enough to make Molotov Cocktails for the entire brand communications industry.

It’s time for a new approach, kids. Dry January might be catching on, but aside from wreaking havoc on the beverage alcohol side of the business, it’s doing more for the PR agencies of the world than it is the brands they represent. We need a year-long approach to selling the adult non-alcoholic (ANA category), not a pit stop.

The fact is, this monthly paean to preening self-affirmation has caused as much delusion around its ability to ignite a business as chugging a bottle of Night Train. With so much innovation coming out of the NA category, it’s weird that we have a product set whose core marketing initiative is based around one Dry month per year.

For as much momentum as the NA category has – and you’ll read plenty about its effects on everything from the mixer business to the spirits category to Gerry Khermouch’s own drinking habits in this issue – it can’t simply use Dry January as its Pumpkin Spice moment. These product types aren’t wired to have NA as a flavor-based LTO – they need to be enduring brands whose utility isn’t as a try-me-I’m-not-so-bad crutch to help you get through to February.

Of course, you’d think that the hype wouldn’t be necessary. The consumer intent is there – we all want to drink less, of course, but we need it to be an interesting experience, one that

gets us somewhere in place of the booze, or that offers a flavor or textural experience that makes for a premium experience. Sell us on the food friendliness, the positive feelings, the killer design. Don’t just exert peer pressure around a fad.

So far, the idea that Americans might be drinking less hasn’t been enough to float an entire category. Last year, according to Nielsen, retail sales of NA products hit $823 million in the U.S. And that’s including the relative behemoth that is Athletic Brewing. By way of comparison: Last year, Ocean Spray sold more than $1 billion in cranberry juice cocktails alone. I’d argue that while a lot of that Ocean Spray was used for Cape Codders, an equal amount was mixed with club soda for an NA treat.

Yes, the Adult NA category is expected to hit about $5 billion by 2028, and yes, there are some wonderful stories like Athletic Brewing and Ritual. Those are brands which have long since left the idea of Dry January behind. A while back I wrote about why the NA beer occasion feels much more compelling than the spirits occasion, but if you really believe in the concept, why just look to January (or “Sobertober” as your backup plan). NA substitutes can’t just look to one month a year to build awareness, because they’re competing with hundreds of refreshment beverages whose reason for being isn’t just that they don’t have booze in them.

And there’s a much larger market out there in the American consumers who want to drink less over the course of the year – and those who aren’t going to drink at all.

According to a recent survey by NCS Consumer, 30% of Americans tried Dry January this year. That might seem like an impressive bump until you consider that the same survey revealed that about 25% of adult Americans don’t drink.

Now, you’d be justified in complaining that those numbers don’t tell the whole story. You’d probably be right. But at the same time, Dry January isn’t telling the whole story either – and if you can’t tell it the other 11 months of the year, chances are you’re going to need a lot more relief than what they’re selling in the Sober Bar down the block.

By

I’d been procrastinating for far too long: it was time to clean up the old credenza. Knowing it would be a quiet day, I went in to do it on MLK Jr. day. But like many a credenza-cleaning publisher, the enterprise took me elsewhere. No, not Narnia (although I’d love to know what’s really in Turkish Delight) but down memory lane.

Early in my career in beverage publishing, a mentor showed me a system to keep track of my accounts. Remember, I’m 76, and I started working on this stuff way before anyone would deploy computers. I know: as with credenza ownership, that’s just something most of you cannot relate to. It was a simple system: a 5”x8” card for every company I would work with. I would have the vitals – name, address, phone number, assistant’s name, birthdays, suit size, really anything. I would write notes of our interaction, pricing, which issues vexed the client, and other important stats. I still use the system today. People have ridiculed me for years, but I stand by my cards.

I kept every one of the accounts, and now have a record of 32 years of work (give or take some long lunches). At this stage it’s a pretty formidable stack of cards, well over 1500. I separate them into companies that have advertised with me, and those that have not: The stack of advertisers was greater than the non-advertisers, which was surprising to me. Over the years I’ve

had about 950 companies that have run with me. Going through the piles brought back incredible memories. Once I saw the name, I actually remembered the person, the brand and the circumstances of our working together. Yes, I’ve been blessed with a terrific memory.

As we’re all well aware, the failure rate in beverages is 80-85%, so most of them are no longer in existence, but they were still vivid. This trip down Memory Lane was becoming exhilarating!

Each card brought back a time and place in the industry’s time line. Categories were exploding, with new brands at every turn. The growing stack chronicled the evolution of beverages. There were so many cycles of products. Early on, I dealt with the presidents and CEOs of the companies, the legends of the beverage universe. The personalities were larger than life. Today’s climate isn’t the same. One of my pet peeves is that most people don’t even put their phone numbers on their cards or in their email signatures. That’s sad. How can I call them to discuss selling my old credenza? It’s nice and clean.

The industry has evolved so much over the years. Through my cards I was a witness to a special kind of history: beverage history. The 32 years have flown by. I can recount them, card by card.

www.bevnet.com/magazine

Barry J. Nathanson Publisher bnathanson@bevnet.com

Jeffrey Klineman Editor-in-Chief jklineman@bevnet.com

Martín Caballero Managing Editor mcaballero@bevnet.com

Ray Latif Contributing Editor rlatif@bevnet.com

Brad Avery Reporter bavery@bevnet.com

Justin Kendall Editor, Brewbound jkendall@bevnet.com

Monica Watrous Managing Editor, Nosh mwatrous@bevnet.com

Adrianne DeLuca Assistant Managing Editor, Newsletters adeluca@bevnet.com

Sales

John McKenna Director of Sales jmckenna@bevnet.com

Adam Stern Senior Account Specialist astern@bevnet.com

John Fischer Senior Account Executive jfischer@bevnet.com

Jon Landis Business Development Manager jlandis@bevnet.com

Art & Production

Aaron Willette Design Manager

Nathan Brescia Director of Photography

BevNET.com, Inc.

John F. (Jack) Craven Chairman

John Craven CEO / Founder / Editorial Director jcraven@bevnet.com

Headquarters

65 Chapel Street Newton, MA 02458 617-231-8800

Publisher’s Office

1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

Subscriptions

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

By Gerry Khermouch

Often on a Sunday evening I head down to a country-style Irish bar off the Bowery called The Scratcher that features a couple of acoustic music acts performing in what’s supposed to temporarily be an attentive “listening room” setting. Many weeks I’ve never heard of either act but, given the talent pool in New York, I’m almost never disappointed. And you can’t beat the price: no cover, just a tip bucket for the musicians.

But here’s the catch: the owner, who’s offering such a nice amenity, makes no money unless we keep drinking. True, they pour an excellent pint of the very sessionable Guinness Stout. But even we imbibers sometimes approach our limits. Enter Athletic Beer, which these days seems to be on every table in the joint.

That may, or may not, have been a consumption occasion that the earlier developers of alcohol-alternatives envisioned when they threw their hat into the ring. But we’re all learning that the occasions where these beverages fill a need are vast. Certainly, it’s not just alcohol abstainers: all indications are that the vast majority of alc-alternative drinkers continue to consume alcohol – “zebra striping” between alcohol and NAs, as the Brits say these days. That proliferation of occasions encourages me to believe that this alc-alternative segment isn’t just a fad but something that may have legs. (Another unlock in my own un-stylish lifestyle: going to Flannery’s to watch Tottenham Hotspur soccer games from England at 9 in the morning. Now there are options beyond alcohol in the morning or bad coffee.)

Of course, there are probably too many entrants already. Hundreds of them, and more materializing every week. Ya gotta love capitalism! But the experimentation is fascinating. The NA beers just keep getting better and better. As my wife often points out at the Scratcher, after toggling between Founders All Day IPA and Athletic through a couple of cycles, you kind of forget that the beer in your hand might be non-alcoholic. It tastes great and keeps the party going. What more do you need? Even more fascinating is what’s going on outside of fake beer. You have beverage geniuses trying to

replicate such challenging segments as red wine and Scotch whisky (so far with so-so results, to my palate) and others trying to create entirely new recipes that are nurse-able (is that a word?), complex and maybe offer some kind of sensation to replace the one we get from alcohol. I have my money on some of those, like Kin, because they’re putting themselves into an apples-and-oranges comparison rather than being judged on how closely they replicate some established alcohol category.

You may have heard all this before, from more convincing voices than mine. But there are a couple of aspects of these brands that I want to highlight here. For one, they are intriguing but most don’t make overt, and potentially overstated, functional claims, which I feel has been a slippery slope for many other categories of non-alcoholic beverages. As I’ve pointed out before in this column, some segments may start with the promise of a true functional benefit but seem inevitably, in the course of going broader, to start dumbing down the very attributes that make them more unique, migrating from a specific functional positioning to a more “lifestyle-y” vibe. We’ve seen that with brands like Bai and Essentia Water, and some of the gut pops may now be making that migration. So they develop decent-sized businesses but it’s disheartening to recognize that they’re no longer moving the ball forward on health and wellness in a very meaningful way.

By contrast, alcohol-alternatives for the most part avoid that trap, targeting sheer flavor and enjoyment, and offering a way to balance or omit consumption of an ingredient, alcohol, that should be consumed in moderate amounts. (And no, I don’t buy the Surgeon General’s report that alcohol should never be consumed at all.)

The other point I want to make relates to distribution. Readers of this column will know that I view the beer distribution networks as crucial for the incubation of new nonalcoholic beverages and am constantly wishing they would give this segment the focus and resources it deserves, to their own financial benefit. Too often, though, they only pay lip

service to this part of their portfolio, in part because of the flight risk of these brands but also because of misaligned incentives as well as sheer institutional inertia.

Yet you could not come up with a more close-in category adjacency to alcohol than this segment. It serves the same sets of occasions, in the same on- and off-premise settings, often closely mimicking beer, wine, whiskey or canned cocktails. (Even more so than those Delta-9 THC drinks I covered in a recent column, and without the regulatory risk.) Might this finally be the NA category that fully gets their attention?

Of course, their core suppliers are assuring them, as usual, ‘don’t worry, we’ve got this covered.’ On the beer side, nonalc extensions from Guinness and Heineken are doing well. But as often happens in newer categories, the independents have a fair amount of momentum, most of all Athletic. On the wine and spirits side, it’s more up for grabs, though major players like Diageo and Pernod Ricard are wheeling and dealing to get promising brands into their orbit.

For the entrepreneurs involved, the potential exits are a model of clarity: those same alcoholic beverage giants to whose products they’re offering an alternative. (“Disrupting,” if you must.) Because these are so close an adjacency, I like to think there’s less post-acquisition execution risk, as these drinks slot right into the muscle memory of sales and marketing people who flog Bud Light or Tito’s or Jameson. Looking through the lens of consumption occasions had

me flashing back to an episode some years back when bicycle advocates like me were invited to participate in the initial planning sessions (called “charrettes”) for New York’s bike share program, Citi Bike. They sat us at big round tables with large city maps on which we were to suggest where the bicycle docks should be located. But before we got started, the Department of Transportation people asked us to take a moment to think of occasions when folks would actually want to take a series of short bike rides, for a master list they were compiling. My hand shot up. “Beer-biking!” I said. I was referring to brewery outings by my neighborhood homebrew club where, if the beers were particularly delicious, it would be nice not to have to ride our own bikes home over the 59 Street Bridge, which always seemed steeper on the way back. “Brilliant!” the DOT guy at my table exclaimed. Then he thought about it a moment and said, “I can’t write that down. The city can’t be encouraging alcohol consumption on our bikes.” Well, Citi Bikes duly arrived in 2013 and have been a great boon to our city. And now there’s another answer to that quandary. Switch to some delicious NAs to keep the party going! Back then, who knew?

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

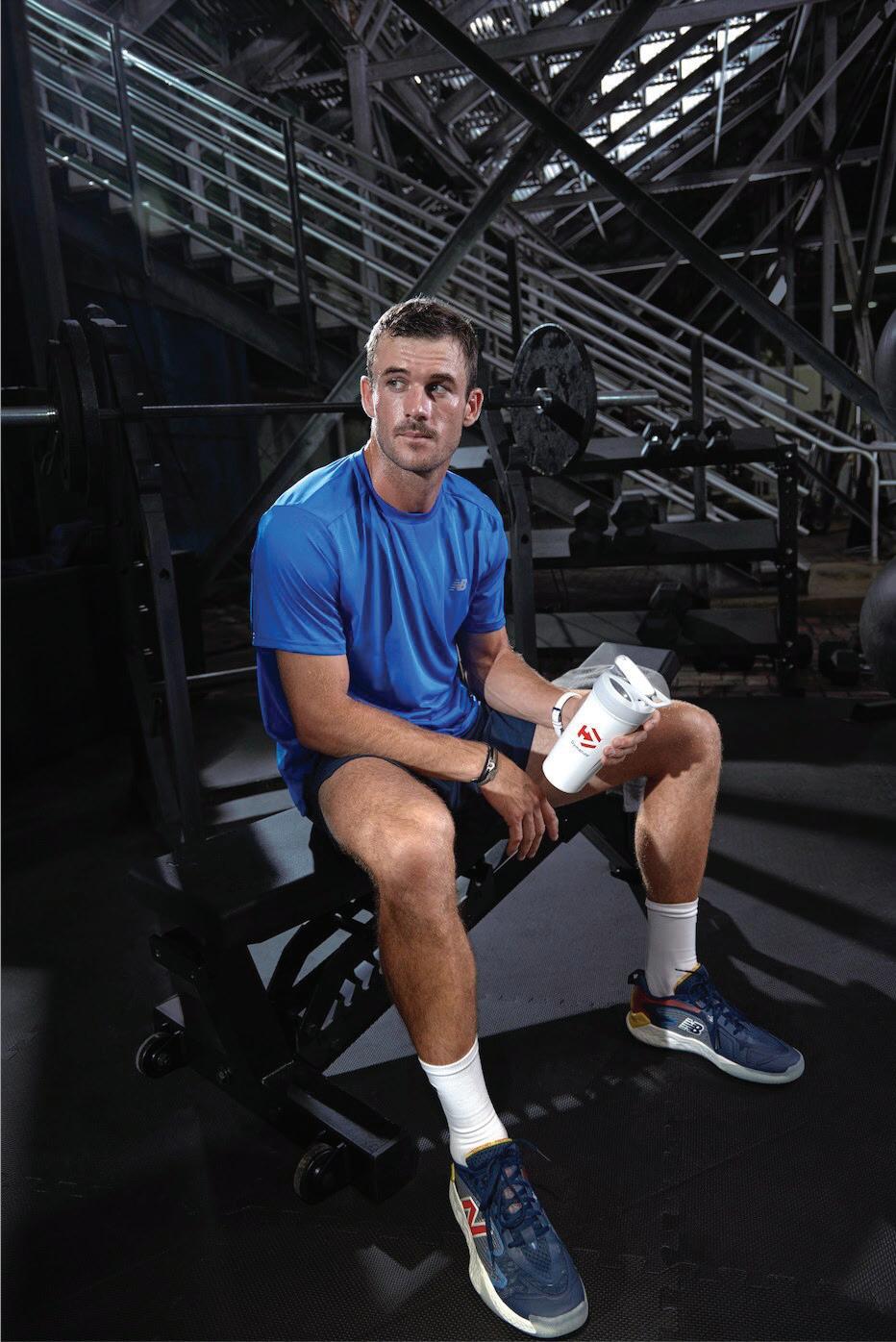

Anheuser-Busch is still gunning for a share of the energy drink segment, announcing on January 15 a new partnership with sports nutrition business 1st Phorm to launch a RTD energy line.

According to a press release, Ultimate Fighting Championship (UFC) CEO Dana White will be included in the partnership. White and UFC previously entered a multi-year marketing partnership with AB which involves branded integration between the companies.

“1st Phorm brings over 20 years of category experience and deep relationships in the sports nutrition industry and fitness community,” said 1st Phorm CEO Sal Frisella in the release. “By combining our strengths with Anheuser-Busch’s experience in beverage innovation and scale, we look forward to creating a new wave of energy and other beverages.”

“Building on our commitment to consistently deliver quality and innovation, Anheuser-Busch is excited to partner with 1st Phorm, a company and brand that shares our vision and passion for creating products that meet the evolving needs of consumers,” said AB CEO Brendan Whitworth. “This brings together two American manufacturers with proud St. Louis roots and complementary expertise.”

Founded in 2009, 1st Phorm produces a variety of nutrition supplements and powder mixes, and currently makes a line of zero sugar, functional RTD energy drinks available in six flavors.

A representative for AB confirmed that the partnership will involve a new energy drink line, and is not related to 1st Phorm’s existing RTD portfolio. The forthcoming product is expected to launch by the summer.

The announcement is the first signal that AB is still interested in carving out a stake for itself in the non-alc energy drink sector, following the $990 million acquisition of Ghost Lifestyle – in which AB was a minority stakeholder and distributor – by Keurig Dr Pepper in October.

Finding a consistent foothold in energy has been a longtime goal for the business; in 2017 AB acquired Hiball Inc. for an undisclosed sum, but the brand struggled in the market post-acquisition and was officially discontinued in 2023. Energy drinks and other NA offerings have become increasingly important to AB-affiliated distributors in recent years, with brands ranging from giants Monster and Bang to newer entries like yerba mater brand CLEAN Cause spending time on distributors’ trucks. 1st Phorm was founded around 2009 in Missouri by entrepreneurs Sal and Andy Frisella. Andy Frisella is the founder of several brands and previously reported earning over $100 million in sales across his business ventures, but he also recently courted controversy.

Spindrift Beverage Company announced in January that it had reached an agreement for San Francisco-based private investment group Gryphon Investors to acquire a majority stake in the sparkling water brand, and is tapping experienced CPG executive Dave Burwick as its new CEO.

The deal, expected to be closed sometime in Q1 of this year, will see Spindrift founder and current CEO Bill Creelman retain a “significant equity stake” in the company while shifting into a new role as chairman of the board.

Creelman will be joined on the board by Ryan Fagan, managing director at Gryphon, as well as Gryphon partners Matt Farron and Mike Ferry.

Founded in 2010, Massachusettsbased Spindrift hit its stride after early experiments in craft soda evolved into its flagship product: sparkling water blended with fresh squeezed fruit juice, a concept that proved a hit with consumers and retailers seeking a differentiated product within the saturated category. Over the 52-week period ended December 28, 2024, Spindrift dollar sales totaled over $275 million while volume increased 22%, according to Goldman Sachs analysis of NielsenIQ data. The brand has also dabbled in innovation, including Spindrift Spiked hard seltzer.

A Wall Street Journal story in December indicated that a deal with Gryphon Investors could be valued above $650 million.

“I’m incredibly proud of what we’ve built at Spindrift over the past 15 years,” said Creelman in a press release. “For this next stage of growth, we looked for two things: a leader who could understand our business and the brand as natively as the people who work here today and an investment partner with the right financial and operational resources to galvanize our market leadership.

“I have known and respected Dave for nearly a decade, and with his experience and Gryphon Investors’ expertise, I’m

confident that we will continue to have tremendous success in growing the brand and inspiring consumers to choose beverages that are based on the belief that the best tastes come directly from nature.”

In tapping Burwick, Spindrift is bringing in deep executive experience with large CPG brands. In addition to two decades at PepsiCo, Burwick has served as president and CEO of both The Boston Beer Company and Peet’s Coffee, as well as president, North America at Weight Watchers. During his tenure at Boston Beer, which concluded last February, he helped develop Truly Hard seltzer into a billion-dollar brand.

“I’m excited to join this dynamic team,” said Burwick. “Spindrift’s combination of talented professionals, superior products, and loyal customers has created a fantastic brand with a great future — one I can’t wait to be a part of.”

Gryphon Investors’ portfolio includes CPG brands like Dessert Holdings and Eight O’Clock Coffee, as well as investments in other industries.

“Spindrift has a strong, beloved brand and differentiated product portfolio because it’s made with exceptional thought and care,” said Fagan. “This attention to quality underlies the company’s outsized share of growth across beverage categories — nearly tripling in size since 2020 — and it’s what attracted us to invest in the business. We are thrilled to be partnering with both Bill and Dave, as well as the entire Spindrift team.”

Morgan Stanley & Co. LLC and Lazard acted as financial advisors to Gryphon. Simpson Thacher & Bartlett LLP and Morgan, Lewis & Bockius LLP acted as legal advisors to Spindrift. Piper Sandler and JP Morgan acted as financial advisors to Spindrift.

The Food and Drug Administration (FDA) announced in midJanuary it has banned the use of Red Dye 3 (Red No. 3) in food and beverage due to its potential to cause cancer.

The FDA has revoked the authorization to use the synthetic dye using a 1958 provision, the Delaney Clause, prohibiting the use of any carcinogenic food additives from the Food, Drug and Cosmetic Act.

Food makers using the synthetic dye have two years to reformulate their products, according to the FDA, and imported food will also need to comply with the directive by that time. Common foods that use the synthetic coloring are candy, cakes and cupcakes, cookies, frozen desserts, and frostings and icings.

The FDA did concede that Red No. 3 is “not as widely used in food and drugs when compared to other certified colors,” but the food coloring has been shown in studies to cause cancer in male rats.

The dye has already been banned almost completely in Europe, Australia and New Zealand.

The news was initially teased in a Biden White House Fact Sheet yesterday, explaining the administration’s food system investments. Similar rumors had surfaced in December during a U.S. Senate health committee meeting. At the time, FDA deputy commissioner for human foods Jim Jones said that a petition calling for a Red Dye 3 ban was being reviewed by the authorization board.

Various industry groups have applauded the decision, with the Environmental Working Group (EWG) calling it a “monumental victory.”

Ready-to-eat meal purveyor Proper Good, Inc. announced on Jan. 13 that it closed a $3.5 million funding round in the fourth quarter of 2024, backed by internal investors. The capital infusion will help fuel brick-and-mortar growth and increase household penetration.

“We’re absolutely thrilled to have the incredible backing of our investors as we deepen our retail partnerships. This support empowers us to bring an even wider variety of delicious, easy meals to Walmart shelves in 2025,” said Christopher Jane, co-founder and CEO, in a press release.

Launched by Jane and his sister Jennifer in 2020, the Austin, Texas-based company produces a portfolio of simple-ingredient, single-serving meals, ranging from oats to soups to pastas. In 2021, Proper Good secured a $400,000 investment for 20% equity from entrepreneur Mark Cuban during an appearance on “Shark Tank.”

“For years, Red 3 remained in food products, despite growing evidence linking it to health problems, particularly in kids,” said EWG president and co-founder Ken Cook in a statement. “This ban sends a strong message that protecting the health of Americans – especially vulnerable children –must always take priority over the narrow interests of the food industry.”

Food safety advocate and co-founder of Yuka Julie Chapon said the rule was “about time.”

“The FDA’s decision is a step forward, but we must continue to push for stronger regulations – dozens of risky additives are still allowed in the U.S.,” she said.

The National Confectioners Association (NCA) had a more tempered response to the decision, saying that “the conversation around state-level proposals that seek to ban certain FDA-approved food additives has been filled with myths pushed by unqualified voices and lacking facts.”

The trade group’s public statement went on to note that Indiana, Maryland, South Dakota, Washington and West Virginia had all rejected laws that would ban certain food additives because the “proposals lack scientific basis.”

“We are in firm agreement that science-based evaluation of food additives is needed – and we follow and will continue to follow regulatory guidance from the authorities in this space, because consumer safety is our chief responsibility and priority,” said NCA president and CEO John Downs. “Usurping FDA’s authority does nothing but create a stateby-state patchwork of inconsistent state requirements that increase food costs, create confusion around food safety, and erode consumer confidence in our food supply.”

The direct-to-consumer brand expanded into brick-and-mortar retail in 2022 with a rollout to over 2,000 Walmart stores nationwide. Today, Proper Good has 19 items across three categories in 2,500 Walmart stores throughout the U.S., which retail for under $5 each.

To support the Walmart launch, the company closed a $3.5 million seed funding round in 2022 led by YETI Capital and The Artisan Group, with additional participation from Doug Bouton, cofounder of Halo Top and Gatsby Chocolate.

Jane previously told Nosh that for Proper Good to become a household name as a premium shelf-stable brand, it recognized it couldn’t be a DTC-only company. The brand chose to build its position at Walmart instead of pursuing natural and specialty retailers immediately.

“We’re proud to partner with Walmart as our first entry into the brick-andmortar scene, given that over 90% of the U.S. population lives within 10 miles of a Walmart store,” said Jane in 2022. “However, we’re able to move upstream

into more natural, specialty channels in the future since we also offer items made with high protein and low sugar.”

In late 2023, the company raised $5 million from current and new investors, including YETI Capital, to fuel retail growth and marketing.

Proper Good isn’t the only DTC meal company to venture into brick-and-mortar retail in recent years. In 2018, Kroger purchased Home Chef and launched a collection of retail meal solutions. In 2023, Daily Harvest made the jump into store freezers across the country, debuting at over 1,000 Kroger stores nationwide.

Beyond retail expansion, Proper Good’s new funds will be deployed to accelerate product development, expand operations, and enhance consumer offerings, per today’s announcement.

Though the company didn’t disclose specifics regarding potential new product releases, it told Nosh via email that it remains “focused on continued innovation in clean-ingredient and ready-to-eat meals that are under $5.”

Tosi Snacks has installed its board chair, Kevin Rutherford, as CEO and raised a new tranche of funding to fuel new marketing campaigns in the coming year.

The announcement came as the Anaheim, Calif.-based company closed a Series B round of nearly $16 million, led by previous investor Cambridge SPG.

Founded in 2012, Tosi makes USDA Organic certified, gluten-free, vegan meal and snack bars and clusters sold in over 1,200 U.S. stores as well as in Dubai, Hong Kong and the Dominican Republic.

Tosi previously announced a “significant multi-million dollar” funding round in 2018, also led by Cambridge SPG. The current round included other previous investors who have remained undisclosed.

Tosi’s Series B round “marks an important capital milestone for Cambridge SPG, which has invested over $250 million of equity in the organic food sector,” said Cambridge Companies SPG managing partners Filipp and Polina Chebotareva in a written statement.

“We are committed to investing hundreds of additional millions in this sector going forward because there is such a strong need to clean up the broken food system in America,” the partners said.

Cambridge SPG’s portfolio includes other food and beverage brands like Once Upon a Farm, The Coconut Cult, Sol-ti, Vive Organic, Suja, 4th & Heart, Lifeaid Beverage Company and Starbird Chicken.

With the blessing of Cambridge SPG, mother-daughter cofounding team Stefanie and Chelsea Hults had encouraged Rutherford to take on a more hands-on leadership role in Tosi’s day-to-day operations. He became board chair about two years ago.

The Hults will remain in “critical roles” as the team evolves into the new leadership structure and “builds out lanes” in job responsibilities, Rutherford said.

“Obviously, these two founders did everything and now just can’t do everything because we are about to scale to a whole different level,” he said.

Rutherford said he was ready to jump back into leading a team where he could directly impact a brand’s trajectory. Drawing from his marketing and leadership roles at companies like SC Johnson, Miller Brewing Co., Kashi and Nuun Hydration, Rutherford will help steer the brand’s efforts in building out awareness and trial. The new funding will most directly go towards more marketing spend on demos and sampling.

The business has grown sales about “300% for the last couple years,” Rutherford said, but is ready to add more fuel to the fire in not only its wide retail distribution network but also in ecommerce channels, where it has been focusing in the last year.

“There is real energy behind the brand. Interest in Tosi remains strong,” Rutherford said. “Consumers are looking beyond the overly used term ‘better-for-you.’ That’s what Tosi is. It’s very distinctive and highly differentiated.”

The Brewers Association (BA) has named Bart Watson as the trade group’s next president and CEO.

Watson succeeded Bob Pease, who retired from the organization on January 3. His first day in the new role was January 6.

“I am honored to be chosen to lead the Brewers Association, and I look forward to building on the strong foundation laid by the leaders before me,” Watson said in the announcement. “Craft has been going through a difficult period and I am committed to finding ways to help our members navigate those challenges. Our members are incredibly innovative and adaptable entrepreneurs, and I’m ready to work with them and for them to support their businesses and bring excitement back to the category.”

The BA board of directors confirmed his appointment at a December 12 board meeting.

“Bart’s in-depth understanding of the craft beer industry and landscape and his decade-plus of experience within the Brewers Association makes him uniquely poised to step into the president and CEO role on day one with a strategic vision and plan,” Leah Cheston, board chair, said in the announcement. “The board of directors is excited for the next chapter and looks forward to working with Bart to chart the path forward for our members and our industry.”

In his new role, Watson will be tasked with addressing “legislative and regulatory issues impacting independent craft breweries and producers,” championing brewers in the media and across industries, overseeing the development of events and member resources and supporting the organization’s board in its “ongoing development as a strategic governing body.”

Watson has served as chief economist of the BA since 2013. He was promoted in April to VP of strategy and later was named as VP of strategy and membership in a staff reorganization last month.

Pease announced plans to retire in July, after 32 years with various versions of the trade group.

Two New England legacy craft houses are merging in a deal that unites 14 brands.

The parent companies of Harpoon and Smuttynose – Mass. Bay Brewing Company and FinestKind Brewing, respectively – have merged to form Barrel One Collective, the companies announced in news first shared with Brewbound on December 31.

Barrel One Collective is poised to become the largest maker of craft beer in New England and the 14th largest in the country by Brewers Association (BA) data. Combined, the brands produced 165,000 barrels of beer in 2023, according to the release.

“This merger is about much more than just growth,” Mass. Bay founder Dan Kenary said in the announcement. “It’s about honoring our legacy while writing an exciting next chapter for our companies and the Northeast craft beer industry at large.”

Mass. Bay and FinestKind each bring a wide portfolio of brands to the new rollup. Mass. Bay’s book includes Harpoon, UFO, Long Trail, Clown Shoes, Otter Creek, The Shed, Catamount, Dunkin’ Spiked and Right Coast Spirits, while FinestKind makes and sells Wachusett, Five Boroughs and Island District Cocktails, in addition to Smuttynose.

Kenary will lead Barrel One Collective as CEO and FinestKind CEO Steve Kierstead will serve as chief commercial officer, according to the release.

“FinestKind Brewing is a fellow Northeast craft trailblazer that shares our passion for brewing excellence, innovation, and creating quality brews our communities can be proud of,” Kenary said in the release. “With a combined 75 years of craft brewing expertise, this merger represents our commitment to setting these companies on an exciting growth trajectory and continuing to bring the very best products to our fervent customer base.”

With the combination of companies there are “unfortunately, some redundancies,” Kenary told Brewbound and declined to specify how many jobs have been eliminated.

The new company’s name pays homage to Harpoon’s brewing permit, which was numbered #001 as the first the Commonwealth of Massachusetts had issues for commercial brewing after several dormant decades. Harpoon was founded in 1986, two years after fellow Boston-based craft pioneer Samuel Adams, which was contract brewed elsewhere.

Cynthia Fisher, the wife of Boston Beer founder and chairman Jim Koch for more than three decades, will one day inherit his controlling interest in the company, Koch told the Wall Street Journal.

“She doesn’t hit anybody’s radar screens, but she is a force of nature,” Koch said of Fisher, a Boston Beer board member who became a successful healthcare entrepreneur, founding cord blood stem-cell banking company ViaCord in 1993 and selling it for $300 million in 2007.

The actual succession plan is a marked change from 75-year-old Koch’s typical answer of “don’t die.”

Koch holds the entirety of Boston Beer’s Class B voting shares, which will transfer to Fisher in the future, he told the outlet.

When the succession plan will unfold is still unknown since Koch has no plans to retire, he told the Journal.

The California Craft Brewers Association (CCBA) has appointed Kelsey McQuaid-Craig as the state trade group’s new executive director.

McQuaid-Craig succeeds Lori Ajax, who announced plans to exit the role at the end of the year. The leadership transition has already begun, which the trade group described as “collaborative and overlapping transition” that “ensures the CCBA will remain at the forefront of advocating on behalf of its membership, as well as ensuring strategic partnerships with allied organizations will continue.”

Ajax had held the executive director role since January 2021, taking over for long-time executive director Tom McCormick, who retired.

McQuaid-Craig joins the CCBA from outside of the beer and bev-alc industries. She most recently served as director of policy and programs with the California Chapter of the American College of Emergency Physicians. She holds a master’s degree in Public Administration and is a Certified Association Executive.

“As a dedicated association professional who enjoys a good craft beer, I look forward to learning from and engaging with the CCBA Board and members to strengthen the California craft brewing industry,” McQuaid-Craig said in the announcement.

CCBA board chair Sierra Grossman added: “The Board knows that Kelsey will focus on ensuring the CCBA’s organization is as strong as it can be as we continue to be challenged in our ever-changing economic climate. With a strong association, we can continue to play a pivotal role in being the voice of craft brewers at the state Capitol.”

The CCBA is the largest and oldest state trade organization representing craft breweries in the U.S. having formed in 1989. California ranks first in the nation with 987 craft breweries and more than 3.245 million barrels of beer produced, according to national trade group Brewers Association.

Spindrift debuted its latest flavor innovation: the Cosnopolitan. As its name suggests – mind the ‘No’ – the new offering is a zero-proof cranberry and citrus seltzer. This isn’t the first time Spindrift has reframed its juicy sparkling waters as a mocktail – in late 2022, the brand added the Nojito to its core lineup. Spindrift’s Cosnopolitan is now available on the brand’s website for $26 per 24-pack of 12 oz. cans. For more information, visit drinkspindrift.com.

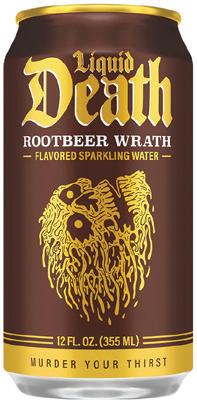

Amidst rising interest in the modern soda category, Liquid Death has released a collection of three soda-inspired sparkling water flavors: Killer Cola, Doctor Death and Rootbeer Wrath. All three varieties are available at Target for $7.99 per 6-pack of 12 oz. cans. For more information, visit liquiddeath.com.

Organic energy drink brand Unity has introduced its newest flavor, Peach Mango. Each 12 oz. can features 180mg of caffeine derived from organic green coffee bean extract and contains just 40 calories. According to co-CEO Caleb Weidenaar, the brand recently switched from glass bottles to cans to improve convenience for consumers. Unity Peach Mango is available on the brand’s website for $23.94 per 6-pack or $47.88 per 12-pack. For more information, visit idrinkunity.com.

Red Bull kicked off the new year by launching Red Bull Zero in the U.S. The new energy drink variety is sweetened with monk fruit extract and features tasting notes of pineapple, vanilla, and tutti frutti. Red Bull Zero is now available at retailers nationwide in 8.4 oz. matte, light blue cans. For more information, visit redbull.com/us-en.

Recognizing a growing consumer interest in higher protein content, plant-based shake producer Koia has unveiled its latest product line, Koia Elite. Offered in two flavors – Vanilla and Chocolate – each 12 oz. bottle has 32 grams of protein derived from complete pea protein containing all nine essential amino acids. Koia Elite is currently available in the refrigerated functional beverage set at Whole Foods Market nationwide in 12 oz. bottles. For more information, visit drinkkoia.com.

Slate Milk bulked up its portfolio of high-protein,

low-sugar shakes with the debut of 32g Protein Nutrition Shakes. Available in the brand’s signature milk chocolate flavor, each 11 oz. ultra-filtered milk beverage contains 150 calories, 1 gram of sugar, and 2 grams of net carbs. Slate Milk Chocolate Nutrition Shake 32g Protein is now available on the brand’s website for $41.99 per 12-pack. For more information, visit slatemilk.com.

In anticipation of what it’s calling a “cherry-coded” 2025, Pepsi has announced the launch of its Wild Cherry & Cream flavor, available in regular and zero sugar varieties. Starting the week of January 20, both varieties will join the CSD giant’s permanent portfolio in 12 oz. cans nationwide. Additionally, for a limited time, Pepsi and Pepsi Zero Sugar Wild Cherry & Cream will be available in 20 oz. bottles. For more information, visit pepsi.com.

New Zealand-based craft soda brand Sidekick Soda has dropped three new flavors: Pear, Strawberry and Cherry. For the Cherry flavor, Sidekick has partnered with the Cherry Rescue Project, which addresses food waste by rescuing cosmetically imperfect cherries suitable for consumption. Additionally, the brand has released a 300ml eco-friendly can format. The new flavors are now available online and at select retailers like Erewhon and Pop-Up Grocer with a SRP of $3.98 per can and $4.95 per 275ml glass bottle. For more information, visit sidekicksoda.com.

RECOVER 180 has expanded its portfolio of premium hydration beverages with its newest flavor, Strawberry Banana. Like the rest of the brand’s lineup, the new flavor features a mix of coconut water, essential vitamins and key minerals. RECOVER 180 Strawberry Banana is slated to launch in 20 Kroger divisions next month, followed by Sprouts Farmers Market in April. For more information, visit drinkrecover.com.

Hydration beverage brand HOIST has teamed up with Folds of Honor, a non-profit providing educational scholarships to children and spouses of America’s fallen or disabled military service members and first responders, to create its newest flavor, Five Star Punch. The new offering comes in a custom-designed bottle featuring relics of the American flag, and a portion of proceeds from each bottle sold will go to Folds of Honor. Hoist Five Star Punch is available on the brand’s website for $28 per 12-pack of 16 oz. bottles. For more information, visit drinkhoist.com.

Halfday has expanded its lineup of better-foryou, gut-healthy iced teas with the launch of Sweet Tea. According to the brand, the new flavor is “the classic southern sweet tea taste you expect without the sugar crash that usually comes with it.” Each 12 oz. can has 30 calories, 5 grams of sugar, and 8 grams of fiber. Halfday Sweet tea is available at Whole Foods Market Nationwide. For more information, visit drinkhalfday.com.

AriZona is kicking off the new year with a slate of new product releases. The brand has launched its new 22 oz. cans in four flavors: Blueberry White, Rx Watermelon, Frost Chillzicle, and Mango Dragonfruit. Originally limited to exclusive 2024 releases, Frost Chillzicle and Mango Dragonfruit have returned due to overwhelming demand, AriZona claims. All four new 22 oz. can flavors are available for a SRP of $1.49 at major retailers like 7-Eleven, Sheetz, and BP. Additionally, the brand has expanded its 34 oz. PET line with Kiwi Strawberry, Blueberry White, and Tropical Chillzicle flavors. For more information, visit drinkarizona.com.

Organic farmer-owned cooperative Organic Valley is moo-ving into non-dairy creamers with the launch of four new products: Cinnamon Spice Oat Creamer, Caramel Oat Creamer, Vanilla Oat Creamer and Oatmeal Cookie Oat Creamer. The dairy-, nut- and lactose-free creamers have 30 calories per serving and are made with oats sourced directly from Organic Valley’s U.S. organic family farms. For more information, visit organicvalley.coop.

MALK announced the return of its Organic Holiday Nog. The seasonal offering is crafted with filtered water, organic almonds, organic maple syrup, organic nutmeg extract and Himalayan pink salt. MALK Holiday Nog is available at retailers nationwide in a 28 oz. bottle for a limited time. For more information, visit malkorganics.com.

PKN, which claims to have been the first brand to introduce pecan milk to the market, has unveiled its latest offering: PKN JOY Barista. The new offering, made in partnership with baristas, features sustainably sourced, upcycled pecans rich in flavonoids and antioxidants.

Consumers can purchase PKN JOY Barista on the brand’s website for $15.99 per 2-pack of 32 oz. cartons or $44.99 per 6-pack of 32 oz. cartons. For more information, visit thispkn.com.

Ocean Spray is seeking to give consumers a new way to enjoy juice drinks by introducing its new powdered drink mixes, crafted in collaboration with Dyla Brands. Available in three flavors – Cran x Grape, White Cran x Peach, and White Cran x Strawberry – the stick packs are made with cranberry juice powder sourced from Ocean Spray’s co-op and are free of sugar and synthetic dyes. Ocean Spray Drink Mixes are available on Amazon for $14.95 per 40-count box. For more information, visit oceanspray.com.

San Francisco-based food tech company Compound Foods, the makers of Minus Coffee, have abandoned their initial approach to CPG– a two-SKU line of 7.5 oz. single-serve cans – for an instant alternative. The company has unveiled a new powdered oat milk latte, now available for $35 per 9.7 oz. bag to subscribers. The instant beanless coffee touts 50 mg caffeine, 100 mg L-theanine, and 6 grams of pea protein per serving. For more information, visit drinkminuscoffee.com.

Marrying Constellation Spirits’ heavy hitters for the first time, High West and Casa Noble have teamed up for a unique whiskey blend that combines High West’s straight rye whiskeys with the deep flavors of Marques de Casa Noble Añejo barrels. Tequila and whiskey alike lovers will likely get down with the caramel and oak notes in this limited edition. Priced at $174.99. For more information, visit highwest.com.

Black-owned premium tequila company Jon Basil by founder Uduimoh Umolu announced a perfect wintertime addition to the company’s lineup: an 18-month oak barrel-aged tequila. Priced at $59.99-64.99, Jon Basil has steadily been expanding this year with additional distribution in New York, California, and Miami. Available at major retailers now. For more information, visit jonbasiltequila.com.

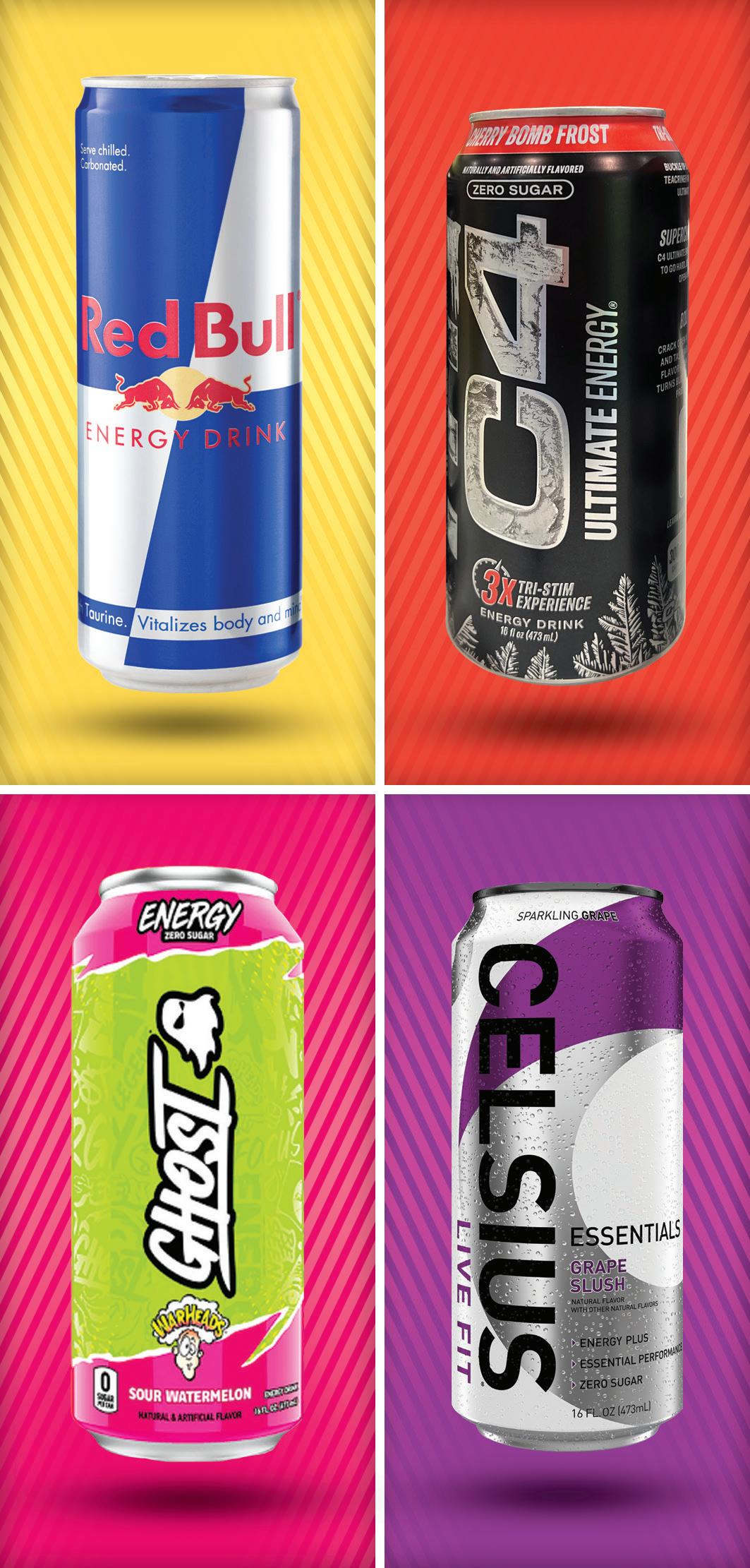

It’s still a bull market for Red Bull. At year end, according to our Circana numbers, the company that invented the category grew revenue 5% — the same amount as the category itself. But Red Bull isn’t the whole category anymore: extreme growth brands like Celsius, Alani Nu, C4 and Ghost together added more than $1.2 billion in new revenue to the category last year, each growing 15% or more. With 8 out of the top 10 brands growing last year, it just shows why so many convenience stores are squeezing more energy into those aisles.

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 12-29-24

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 12-29-24

The 2024 edition of BevNET’s annual winter conference in Marina Del Rey brought the expected high levels of energy and excitement across the two-day event in December.

A wide range of topics were discussed but the recurring theme among beverage business entrepreneurs, investors, experts, distributors and retailers presenting on-stage was how to succeed in a time of economic uncertainty and what the true meaning of category-disrupting innovations is.

In a presentation that kicked off the first day, Craig Dubitsky discussed how he’s bringing his experience creating “joyful” CPG brands into his new coffee venture happy, co-created with actor Robert Downey, Jr.

“I’m allergic to this word ‘disruption,’ Dubitsky said during the presentation. “It’s not about disrupting anything. No one ever said, ‘honey, next time you’re getting some toothpaste, can you get me some of that Hello toothpaste, they’re such challengers the way they disrupted my routine.’ No one says that.”

Dubitsky, who has also founded breakthrough brands such as cleaning products company Method, lip balm maker Eos and toothpaste company Hello, believes that in order for a product to bring the type of magic that upends a category, it has to innovate with emotion in mind.

Later in the day, a diverse panel including Rocana Venture’s co-founder and general partner Gurdeep Prewal, Willow Growth Partner’s founder and general partner Deborah Benton and Barrel Ventures managing partner Nate Cooper discussed whether or not VC cash is right for your business is dependent on the firm itself and the relationships a founder has built.

“Beverage can be a fantastic VC investment, because the outcomes can be huge, and have been huge, which is very much in alignment with how venture capital and portfolio construction for venture capital works,” said Benton. “Why it may not be a great investment for venture capitalists, candidly, a lot of VCs [don’t] know beverage very well.”

She cautioned founders to seek out firms that at the least are focused on the space or are run by former operators. Prewal added that raising at any stage, even for the VCs themselves, is extremely difficult in the current market. Cooper said he believes money will begin to move once again, as long as there are more exits to PE and dollars flowing from other streams beyond “the big three.”

Closing out day one, Cameron Gould-Saltman, TikTok Shop’s head of food and beverage explained that companies that have seen success on the platform are taking a creator-first approach to building their reach. While they must be comfortable ceding some control to influencers and creators, he believes this approach has been most effective to authentically build followings for a new storefront and introduce U.S. consumers to the concept of shopping via social media.

During the event’s second day, Recess founder and CEO Ben Witte discussed how brands establish new categories. He told the audience that although CBD was a pivotal first step for establishing the business as being at the forefront of the emerging relaxation drinks sector, he “saw the writing on the wall” that the regulatory environment would not turn in the ingredient’s favor. So, business innovated and evolved while Witte made sure not to lose sight of the core proposition around the relaxation need state he was con-

fident would remain in vogue with or without cannabidiol.

CBD-infused Recess products are still on the market, but they now represent less than 10% of the business’ sales, whereas its mocktails are over 90%.

“Consumers buy solutions, not ingredients,” Witte said. “I really believe it’s important to focus on the key value propositions and the specific occasions and need states you’re most relevant for.”

Later in the day, Thirstwell founder and CEO Brandy Rand picked back up on the subject of rising demand for relaxation drinks in a session focused on how cultural shifts have led to changes in how consumers “drink their feelings.” She pointed to a decline in American happiness, dropping from the 15th happiest country in the world to 23rd, out of 140 tracked nations, according to at least one survey.

In response, she said brands could benefit from working to uplift consumers who are feeling down through positive messaging and upbeat ad campaigns.

“Marketing through feeling for beverages is not a revolutionary thing, the biggest companies in the world have done this for decades,” Rand said, pointing to trends during the 2008 recession when brands like Coca-Cola mounted marketing campaigns focused on happiness and “lifting people up” that proved highly successful.

For founders facing the ultimatum of “get profitable or get packing” amid economic uncertainty, LifeAID founders Orion Melehan and Aaron Hind walked through some of the steps they took to get to this point and aimed to demystify at least some of the fog that surrounds the path to profit.

Among the steps they took included hiring a proper accounting team to identify inefficiencies, optimizing inventory and learning how to prioritize their key accounts, slashing marketing and reducing payback periods, and – hardest of all, they said – layoffs. In the end, the business accrued 24% in savings and is still running at a profit today.

Achieving profitability, Melehan said, is a key to longevity for a brand, and suggested it can be a proper marker of success.

Closing out the event, New York City-based hydration beverage brand Recoup took home the New Beverage Showdown title in a tight competition that featured five other finalists, including Dappy non-alcoholic functional beverage, Passion Joy sparkling passion fruit beverage, Melo sparkling kava drink, Guinep nonalcoholic cocktail, and Grind with Gratitude performance water and THC-infused seltzer.

Nosh Live 2024 kicked off with panels, presentations and conversations that pieced together fundamental components of successful CPG businesses and offered brands advice on how to navigate current economic headwinds, shifting consumer habits and prepare for an uncertain landscape in the years to come.

During the first session of the first day, Once Upon a Farm co-founder and CEO John Foraker and chief brand officer Jennifer Garner explained how the team’s early idea to “Fresh Pet” the baby food aisle allowed it to not only differentiate itself within a stale and stagnant category, but also secure early buyin from its retail partners. Now, “every major retailer” is scaling coolers as demand for fresh products grows, said Foraker.

This past year, OUAF launched nine new products and he claims six of those SKUs are the fastest selling dry baby snacking items across “the entire MULO universe… I’m talking [about] Gerber, Nestle, everybody.” That fast growth was made possible because the brand was clear on its mission from day one, he said.

“When you’re an emerging brand, and you hammer your core, and you build a loyal audience of millions of households, and then you launch some great innovation that they view as additive to building the brand. You can get that innovation to go really big, really fast,” Foraker said.

Later in the day, Rachel Hirsch, managing partner at Wellness Growth Ventures, Steve Young, managing partner at Man-

na Tree and Wayne Wu, managing partner at VMG, discussed why tinned fish, cottage cheese and sparkling water are the apple of some VC’s eyes

While the trio took to the stage to share their thoughts on the state of VC investing, they also emphasized the importance of not taking on institutional capital unless absolutely necessary. Hirsch detailed how despite being a venture firm, Wellness advocates for its portfolio brands to explore the many forms of non-dilutive capital that are often untapped, particularly among its core focus on women-owned businesses.

For those in need of capital, panelists put a heavy emphasis

on why simplicity, focus and strong gross margins remain essential to getting investors to buy in. Wu believes that despite the environment being tough, there’s more early stage capital available to food and beverage brands today than there was 20 years ago, adding that interest has shifted back onto those with less aggressive go-to-market strategies, simpler teams and focused product portfolios.

On day two, brand leaders, founders, and industry stakeholders took the stage to tell their stories and give attendees useful advice on building long-lasting success in CPG food.

Brad Charron discussed how he became the “re-founder” and CEO of ALOHA in 2017 and why he saw the potential for success.

“The company was trying to do too much, too fast, too soon. Not an original story,” he said. “Here’s what I saw: Untapped, enormous potential. I love to compete, and I love to compete for something that’s worthwhile fighting for.”

When Charron took over the leadership role, one of the first meetings he had with a retail buyer ended with Charron being told ALOHA was being dropped from Target. Charron said he couldn’t blame them because it was a “beautiful idea that wasn’t executing.”

Fast-forward seven years and the company is a profitable, employee-owned B Corporation with more than $100 million in sales.

How did Charron help turn ALOHA around? His first task was SKU rationalization because there were “too many products.”

Although ALOHA makes protein drinks and powders, the focus needed to be on bars, which were the brand’s core line.

“Be great at something first and then expand,” he said. “Get excited about your ideas, get excited about the future, innovate in your heart and execute with mental focus.”

Closing out the annual winter conference, California-based “crème cloud” producer Mochi Love took home the Pitch Slam trophy in a tight competition that featured five other finalists, including Doosra modern Indian snacks, Brune Kitchen clean label cookies, Harken functional, better-for-you candy bars, NOOISH matzo ball soup, and Chutni Punch finishing seasoning powders.

As the champion of Pitch Slam 15, Mochi Love walked away with a $10,000 awareness-building advertising package from Nosh and bragging rights.

As craft beer enters a new uncharted era, leaders of established breweries shared how they keep decades-old flagship brands fresh and relevant for new generations of drinkers during the Brewbound Live business conference.

“Something that’s really important, particularly with a decades-old brand, is you don’t want to alienate your fan base that has built and followed you just to chase innovation,” Bell’s Brewery EVP Carrie Yunker said. “You really want to make sure that it makes sense for that family and that is what they expect to be drinking.”

Yunker discussed how Bell’s has evolved two of its biggest beers, flagship Two Hearted IPA and seasonal Oberon, into brand families. For Two Hearted, Bell’s found drinkers appreciated classic styles brewed excellently, but Oberon fans were different.

“That consumer really gave us a lot of permission to play with flavor, to play in a space where things were a little more vibrant and exciting,” Yunker said.

Rogue Ales president Steven Garrett discussed the Newport, Oregon-based craft brewery’s journey to launching an entire family of Dead Guy-branded beers, named for the brewery’s flagship.

“In one word, it was terrifying. Dead Guy Ale has been around for 32 years. We probably get pictures once a week of someone who has tattooed the Dead Guy logo onto their body, so this is a brand that has passion, that people care about. They’ve been drinking it for a long time,” Garrett said. “The idea of ‘Is there going to be backlash? Or is there gonna be an uprising?’ as we do this was definitely top of mind.

“There’s a risk to innovating, but there’s probably a bigger risk to just standing still,” he continued. “Now that we’re doing it, now that it’s starting to work, it’s interesting to see all the people that have worked at Rogue for a lot of years that are like,

‘Oh, we thought about this for a long time, and it’s just hard to pull the trigger.’”

Craft beer ended 2023 with dollar sales roughly flat (-0.9%) at multioutlet grocery and convenience stores but volume -4.4%, according to market research firm Circana. Could craft brewers seek to emulate other beer category segments that found more growth last year, such as non-alcoholic beer, which grew dollar sales +29.3%?

Only if it makes sense to consumers, CANarchy Craft Brewery Collective chief commercial officer Chris Russell said.

“When it comes down to it, you don’t want to overextend or extend too quickly and come across as inauthentic,” he said. “For us, we sometimes overthink it and evaluate it in every different way you possibly can, but I think at the end of the day, if it’s something that the consumer is going to identify with, if they can see a connection between Dale’s Pale Ale, the flagship that’s been around for almost 25 years, and a non-alcoholic beer, then it works.”

CANarchy line-extended Oskar Blues Dale’s Pale Ale in 2023 to include Dale’s Light Lager, a counterweight to the Dale’s Double IPA that rolled out in 2022. All three beers got refreshed branding that highlighted the Dale’s name, rather than Oskar Blues.

“I’ve worked with the Oskar Blues Dale’s brand for about 11 years now. I can still tell somebody that I work for Oskar Blues and they look at me like, ‘Huh, what’s that?’ and then you say Dale’s Pale Ale and they know exactly what you’re talking

about. I think the idea of getting out of your own way sometimes is important,” Russell said.

“For us, we wanted to really simplify the overall art and focus in on that iconic oval that the Dale’s is front and center with,” he continued. “It’s not hiding or trying to remove Oskar Blues by any means, but letting the franchise brand stand out more.”

Lawson’s Finest Liquids, the youngest brand represented on the panel, has taken its time when extending its Sunshine brand to new products, CEO Adeline Druart said.

“Our goal is not to mess it up, but really to enhance the brand,” she said. “We’re very intentional about line extension and we’re slow at it because we started with Double Sunshine almost 15 years ago and then Sip of Sunshine is going to be celebrating 10 years.”

The Waitsfield, Vermont-based craft brewery ships its offerings through a cold supply chain. Because of the complexities associated with that, Lawson’s has yet to launch a variety pack, a popular package format in craft beer of late. But they are “determined to figure it out,” Druart said.

“We focus on core values,” she said. “When we make the product, we want it to be the finest, the freshest and always kept cold. It’s a 100% refrigerated supply chain, and it’s short shelf life. It’s 60 days. … We do intend to solve this, because a variety pack not only anchors your consumer into your flagship brand – our Sip of Sunshine – but then introduces the consumer to a product that they may not have found or picked or wanted to try.”

More than 270+ beverage brands and approximately 60,000+ attendees

Where

Anaheim Convention Center Anaheim, CA

Exhibitor Booth

Abstinence Spirits 4399C

Acai Roots 2899B

Alexandre Family Farm F2

Alexandre Family Farm N836

Amaz 4912

Amy & Brian Naturals N1117

AQUA 9+ 2445

Ardor Organic N1940

Atomico 5369

Bala Enzyme 2215

Bear Maple 4936

Beekeeper Coffee N236

BeGOAT 227

Belvoir 5246

Best Day Brewing 4916

Better Booch N718

Betty Buzz 8606

Bigelow Tea 881

Blue Bottle Coffee 5412

Blue Diamond (Almond Breeze) 5779

Blue Monkey 5621

Blue Monkey N324

Blueshift Nutrition 3743

Blume Honey Water 4498A

Exhibitor

Bollygood N1206 Boochcraft F80

Bored & Thirsty 4695

Bragg Live Food Products 5478 BrainJuice N435

Brooklyn Food and Beverage N1804

Califia Farms 923

Caliwater N2206

CatSpring Yaupon F78

CForce by Chuck Norris 5153

Chlorophyll Water N1033

Cirro Water 242 CLEAN Cause 1406 Clear Theory N1248

Clearly Canadian 5068

Cloud Water

and Events • March 4-7, 2025 Trade Show • March 5-7, 2025

BevNET, NOSH and Taste Radio will be interviewing, broadcasting and filming throughout the event. If you’re attending or exhibiting, let’s connect! Reach out at news@bevnet.com, news@nosh.com, or ask@tasteradio.com

Exhibitor Booth

Flow Alkaline Spring Water 5389

Fomilk 494

Forager Project 5081

Four Sigmatic N507

Fresh Fizz Sodas 8707

Fruga 4788

Garden of Life

Nuun Hydration

Solgar Vital Proteins 3535

Gatorade 5727

Gatorade N728

Gavina 358

GnuSante Creations N1243

Good Idea 5761

GoodBelly, Cheribundi N729

GoodSport Nutrition N1108

Gorgie N1346

Goya Foods 1473

Groundwork Coffee N813

Guayaki Yerba Mate 2027

Harmless Harvest 376

Harney & Sons Tea 2018

Hawaii Volcanic Beverages 5009

Hawaiian Soda Co N919

Health Verve 5130

Health-Ade 5347

Hethe Water 8508

heywell N1806

Hint 5307

hiyo N1146

Holy! Water 7814

HOP WTR 5704

Hoptonic Tea F32

HP Hood (Planet Oat) 5758

Huel 3895

Huxley N1341

Exhibitor Booth

Huzzy Smart Sips 8812 Iba 7820

Ito En (North America) 5505

Jayone Foods 978 JOCKO FUEL 994

Joe Coffee 5299B

JuneShine 3999

Juni 5045

Just Ice Tea N833

Karma Water 3097

Kefir Lab 5644

Ketone IQ 8509

Ketone Labs 4373

Kimino N339

Kin Euphorics 4790

Koia 3599

Koko & Karma 2999C

Kor Shots N929

L.A.Libations 5005

Lakewood Organic 1517

Lavazza 363

Leisure

Local Weather 5496

Machu Picchu Energy N547

Magic

Exhibitor

Booth

Organic Valley 1641

OWYN 5189

Pacific Gold Creamery 8212

Panera Coffee N1010

Panos Brands 905

PathWater N1900

Peace Coffee N1329

Peerless Coffee & Tea 1528

Perfy 5652

Pickle Juice 5465

PIRQ 5472

Plant Press N1753

Plink! 7824

Pocas International 896

Polar Beverages 5688

Pop and Bottle 5069

Pop and Bottle F42

Positive Beverage 5707

Pressed Juicery N1709

Pricklee 7821

Proper Wild N2231

Protein2o N1012

Proud Source Water N1609

Pulp & Press 5593

Q Drinks 5599

RAMBLER 4969

Rasa F36

RAW FARM 5595

Recess 5791

Recoup Beverage N1529

Remedy Organics N2001

Ringa 8203

Rishi Tea & Botanicals N2003

ROAR Beverages 5464

Ryl Tea 5682

Saint James Iced Tea 5105

Exhibitor

Booth

Sambazon 5338 Sang 8306

Sanzo N138

Sati Soda F125

Say When Beverages N1839

Sencha Naturals 5320

Shine Water 5666

Sisters Coffee Company N2252

Skinny Mixes 5174

Slice Soda 5681

Smart Juice 2205

Smith Teamaker 3594

Som Sleep 5207

Spade Soda N2026

SPI West Port (ALO, Jenji) N504

Spindrift

Strive

Suja

N2316

SYSTM Brands (Rebbl, Humm, Chameleon) 5689

Tache Milk N1447

Taika N337 Teapigs 1576

Teeccino 534

The Ginger People 1455

The NA Beverage Company 4694

The Republic of Tea F109

The Republic of Tea N1952

The Vita Coco Company 1877

The Wonderful Company 311

Beverages 5490

Tonic F82

Juices N2121

Brothers Tea F87

Water N1114

Each year bestows upon the beverage industry a unique set of challenges and obstacles, presenting brands and entrepreneurs a delicate puzzle rife with opportunities and pitfalls. The scope and the complexity of this endeavor is enough to intimidate – or worse, defeat –even the most experienced of hands and deepest of pockets, so it’s only right that each year we honor those who have run the gauntlet and emerged from the struggle with tangible gains intact.

As we enter 2025, all semblance of so-called normality feels under threat. The prodigious rise of GLP-1 drugs is exerting its own gravitational force on various categories and sections of the store, while a new White House administration promises to be anything but predictable with regards to health and commerce policies. At a state level, some governors are pulling the reins on hempderived THC, and others are clearing its path. Even things that feel timeless – the sweet indulgence of a fizzy soda, the subtle elegance of a perfect cocktail – are being carefully reimagined in ways that both fit modern tastes and harken back to simpler times.

This year’s Best of Award winners exemplify the bravery, ingenuity and persistence required to pass through these uncertain times, a group boldly moving into the future and illuminating the way for others to follow in their footsteps.

David Crooch, General Manager, Non-Alcoholic Beverages, Diageo; CEO & Co-Founder, Ritual Beverage Co.

David Crooch is the Person of the Year for 2024 because he’s going to be playing the role of Designated Driver for the NonAlcoholic Spirits Category.

The brand he co-founded and still leads, Ritual Beverage Co., is already the NA spirits category leader by a wide margin, and it was recently purchased by spirits giant Diageo. The beverage giant then put Crooch in charge of the company’s entire NA Spirits portfolio, including previous purchase Seedlip, one of the category’s pioneers.

Crooch, a repeat entrepreneur, now finds himself with the responsibility of fulfilling the widespread expectation taking root among spirits companies, bars, and restaurants that consumers are thirsty for non-alcoholic analogs of their most popular cocktails. That he’s doing it at one of the largest spirits companies in the world makes the task extra daunting – but also confers resources to him that no one else in his category has had to date.

The normalization of any new category concept has to happen from a brand standpoint. For nonalcoholic beer, that movement has been established by Athletic Brewing. In the realm of non-alcoholic spirits, Diageo has added NA versions of category leaders like Captain Morgan’s, Gordon’s, and Tanqueray to its portfolio, but it has put its biggest stack of chips on Ritual, and on David Crooch.

When we’ve spoken with entrepreneurs about the brands that inspire them, about the marketing strategies they admire, they just can’t decide: is it Poppi, or is it Olipop?

We’ve decided for them. It’s Olipop. And it’s Poppi.

Right now, the spotlight on both far outshines any daylight between them, and they’ve captured the collective imagination of retailers, entrepreneurs, and consumers alike. Together, these brands have busted through the long-held notion that soda is on the way out, that craft soda would always be a bit player, that gut health would never live up to its promise, or that premium pricing was never coming back to CSDs. And in doing so, the competitors have found close to $1 billion in revenue between them.

Olipop is the creation of a pair of entrepreneurs who had been burned before, only to come back stronger, with a better plan and an easier-to-understand product in classic soda flavors. Poppi is the result of a pivot, with investor Rohan Oza and founders Allison and Stephen Ellsworth rebooting Mother, an apple cider vinegar-based health drink as the wildly flirtatious, fruitforward and TikTok-friendly Poppi.

Together, these brands have finally legitimized alternative sodas as a category, initially flying under the aegis of gut health but gradually forming brand identities of their own. Poppi has made it clear that it’s angling for the mainstream, while Olipop continues to hew more closely to its prebiotic roots. Regardless, both brands are trending up sharply: around 300% year-over-year, according to a recent analysis of Nielsen IQ data by Goldman Sachs. Both brands hold steady price points well in excess of $2 per can, and have solid conventional runways, eyeing multipacks in grocery, single serve convenience, and heavier food service presence as ways to build share. Their respective dives into pro sports partnerships this year signals they still have plenty of new venues and audiences to capture, as well.

Who will sell first? Who will sell the highest? Right now, that question doesn’t matter - the only thing that matters is that they’re in lockstep as they share the title of BevNET’s Best Brand of 2024.

Three years ago, we gave the 2021 Best Marketing award to Poppi in recognition of the next gen soda’s mastery over the young medium of TikTok, after it turned an inadvertent viral post into a social media machine that’s still chugging along at full power. At the time, Poppi was a fresh brand, full of promise, establishing its name on a new marketing frontier. But in 2024, it found time to shine on one of advertising’s oldest and boldest stages.

Poppi’s 60-second Super Bowl LVIII ad in February became, according to at least one analytics firm, the most watched commercial out of this year’s game – no small feat for a multi-million dollar introduction declaring loudly and proudly that “soda is not a dirty word.” Titled “The Future of Soda is Now,” versions of the commercial have continued to play on TV throughout 2024, including during the World Series for another big eyeball-grabbing sports event. Fittingly, like Poppi’s TikTok phenomenon before it, the success was also somewhat unexpected; the commercial wasn’t originally intended to premiere during the Super Bowl, but a last minute opening thrust the brand into prime time and it’s a testament to the company that it was prepared to meet the moment.

That the spot would turn into one of the most successful campaigns from the entire event is all the more evidence that our CoBrand of the Year has its thumb on the pulse of the market, and that is easily worth our recognition.

Just Ice Tea has been an astounding business story since it launched in the wake of Coca-Cola’s discontinuation of Honest Tea in May 2022. Honest cofounder Seth Goldman – dismayed to see his life’s work ended so abruptly – created Just Ice Tea to fill the coming void for an organic RTD tea brand, and moved with such speed that consumers could still find stray bottles of Honest in stores when it first hit shelves. This year, as Just became the core focus of its parent company Eat the Change, it continued writing a powerful growth story that’s just as impressive as its founding.

Goldman often likes to measure Just’s development in terms of his experience building Honest Tea, and by his estimations the brand has grown about as big in two years as Honest was after 10. Sales were up triple-digits in 2024 and the business is projecting a footprint of 10,000 doors over the next year, with the brand just beginning to broach mainstream outlets in a serious manner. In one sense, Just is the reborn phoenix that rose from the ashes of an iconic brand, but as it racks up sales this is clearly a company that’s swiftly making its own name known.

Recess was crowned the “LaCroix of CBD” when it debuted in 2019 as part of a wave of trendy cannabinoid brands that rushed into the market at the turn of the decade, bolstered by an “It Factor” hype that surrounded its modern branding and function-forward product. But like hipster-fave LaCroix, CBD’s time in the media limelight was very 2010s, and Recess wasn’t about to be left behind as last decade’s fad.

Over the last five years, Recess has embraced the pivot, seeking to become – as CEO Ben Witte calls it – “the Red Bull of relaxation.” There’s now the Recess Mood functional sparkling water line, powder mixes and its canned mocktails that are striking the Adult NA trend while it’s hot. Now in over 18,000 retailers with a robust ecomm business as well, the company is reporting that it’s doubling its revenue annually, and it’s now scaling with eyes set on crossing the coveted $100M threshold. The beverage industry, and the world at large, has constantly shifted under this brand’s feet but Recess has proven time and again it’s able to move fast, innovate and stay on top of the trends. For a brand encouraging consumers to take a break and chill, Recess doesn’t appear to be slowing down for a minute.

Some brands succeed by confirming accepted notions of how the beverage market works – and some succeed by doing the total opposite. Consider Brēz a leader within the latter group, as evidenced by its inventive and disruptive approach to slanging cans of low-dose, cannabis-and-mushroom-infused sparkling drinks. Under the auspicious guidance of its outspoken founder Aaron Nosbisch, Brēz has done more than put up around $25 million in sales (per Nosbisch) since formally launching in summer 2023; Brēz’s D2C sales focus, slick branding, creative social media presence and clear identity as a true alternative to alcohol has given it a distinctive edge amongst a rising competitive field, proving it a vital force in normalizing cannabis drinks. Its ability to, so far, effectively realize even some of the enormous potential in next-gen functional beverages – wellness-minded products with real appeal across demographics and need states, that can look the part at a corner store or in Miami for Art Basel, and that, most importantly, taste damn good – is worth celebrating.

Barcode

It’s still early, but after just four years in the game, Barcode is shooting with a hot hand. The upstart brand -- created by Bar Malik, an experienced sports trainer and former head of player performance with the NBA’s New York Knicks -- got off the blocks strong in 2021, profiting from Malik’s formidable combination of sports nutrition expertise and deep connections in the league (Kyle Kuzma of the Washington Wizards is a co-founder). Its novel approach won over scouts from top retailers and DSDs eager for innovative hydration products capable of taking share from Gatorade and BodyArmor.

Barcode has been doing exactly that, and in 2024 its momentum accelerated. Continuing to work from its winning playbook, Barcode has gone deeper with its NBA partners; after scoring a deal with the Brooklyn Nets at the end of 2023, this year saw Barcode team up with the Miami Heat and San Antonio Spurs -- home to Barcode investor/partner Victor Wembanyama -- as both teams’ official performance drink, and as a concession in Miami’s Kaseya Arena. Former NBA star Metta World Peace (née Ron Artest) has backed the company with investment through his wellness-focused fund, True Skye Ventures.

That traction has attracted authentic partnerships taking the brand outside of sports and into broader lifestyle and culture: see the arrival of hip hop legend Jadakiss as an investor and ambassador this summer (complete with his own signature flavor, Blue Kiss) or its Erehwon smoothie collab with Winnie Harlow.

Blending a science-driven approach with a growing constellation of the NBA’s most promising young stars, Barcode has set a course to become the hydration drink of choice for a new generation of athletes and fans.

Innovation within ready-to-drink coffee has been hit-or-miss in recent years, though not for lack of trying to dazzle consumers with wacky flavors, added functional ingredients or plant-based milks of seemingly every kind. Since launching in 2018, Sahra Nguyen and her Brooklyn-born company, Nguyen Coffee Supply, have followed a deeper, more personal strategy for disrupting the stagnant category; this year, the buzz has been palpable.