Contents • March – April 2023 • Volume 21 - No. 2 Columns 6 First Drop Fighting Sequelitis 8 Publisher’s Toast Accountability Calls 10 Gerry’s Insights Enter the Influencers Departments 12 Bevscape/NOSHscape/Brewscape Jack Owoc Out At VPX/ Bang; Fly By Jing Brings in $12M in Growth Capital; House Beer Back Under New Ownership 24 New Products Olipop, Reign, Liquid Death 28 Channel Check RTD Cocktails Rising 106 Promo Parade MALK Highlights Clean Ingredients in TV Ad Event Coverage 32 Expo West 2023 Recap; Winter Fancy Food 2023 Review 36 CBC 2023 Preview Features 40 Water Inside the Craze for Cans (Brand News) 48 Powders & Mixes The Path to Retail (Brand News) 56 Cannabis Drinks Explaining The Minnesota Experiment (Brand News) 62 Craft Beer A Culling Looms Special Section 67 Functional Beverage Guide with services and suppliers MAGAZINE BevNET Magazine (ISSN 2165-6061, USPS 24-552) is published bi-monthly by BevNET.com, Inc. 65 Chapel Street Newton, MA 02458. Periodicals postage paid at Boston, MA and additional mailing offices. POSTMASTER: Please send address changes to BevNET Magazine, Subscriber Services, 65 Chapel Street Newton, MA 02458 www.twitter.com/BevNET www.facebook.com/bevnetcom www.bevnet.com/magazine/subscribe Follow Us Online 40 48 56 67 5 FUNCTIONAL BEVERAGE GUIDE • 2023

By Jeffrey Klineman

Not All Sequels Are Equal

It’s always interesting to me when there’s a big rush into a category after the big deals get done: I’m always forced to wonder if it’s a fight over scraps or if there’s still meat on the bone.

Take, for example, energy drinks and sports drinks, two of the fastest-growing product types in the beverage industry. You’d think that after a brand like Body Armor was picked up by Coke that there might not be much of an appetite for entrepreneurs to go after the hydration space, knowing that one of the biggest beverage companies on the planet had already picked its horse. But in fact electrolyte drinks continue to inspire entrepreneurs across the country, with products like Biolyte, BioSteel and Electrolit continuing to grow, alongside revamped companies like Hoist; meanwhile athletes and entertainers have also launched drinks like Logan Paul and KSI’s PRIME and the new Ready Nutrition platform from NFL player Aaron Donald and former basketball star Pat Cavanaugh.

And while Body Armor is continuing to make its way inside the Coke system, there have been clear signs of a slowdown in growth alongside the usual concerns around whether the company overpaid for a brand when it hadn’t fully figured out how to maintain its momentum. That’s Coke’s problem now, of course, and not necessarily anything inherent in the strategy that made Body Armor such a hotly pursued acquisition, but it does kind of make one rethink the old attitude that there are only two or possibly three real takeover targets in any particular category.

Then there’s the energy drink space – where Red Bull is ensconced as a strong, independent brand leading the category, Monster is aligned with Coke and Rockstar is owned by PepsiCo – there’s been plenty of jockeying among the rest of the beverage world to get ahold of a growing generation of new companies.

First Bang opened retailers’ eyes to the possibility of the “fitness energy” adjacency, and now a cadre of brands like Celsius, Nutrabolt, Ghost, and Zoa have found partnerships with their own beverage giants, while once again there’s share and buzz coming into the category from “creator brands” like Alani Nu and even newcomer Gorgie.

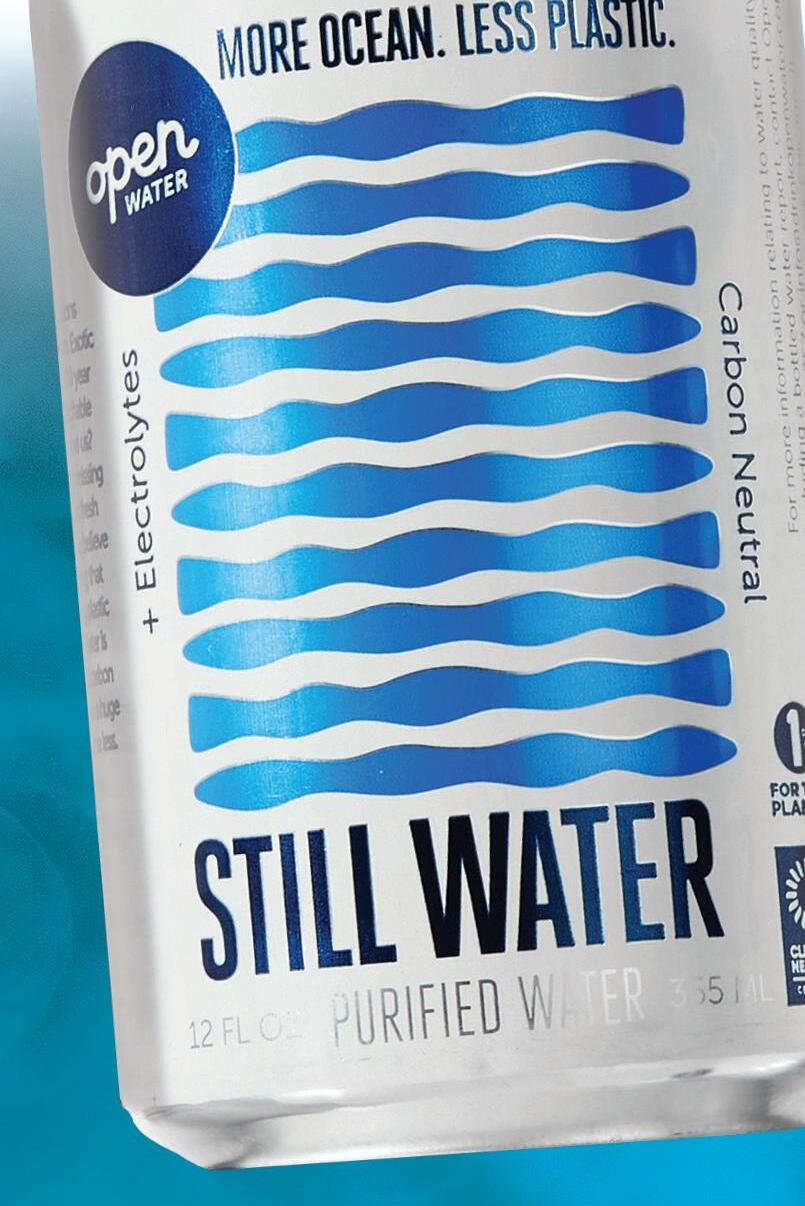

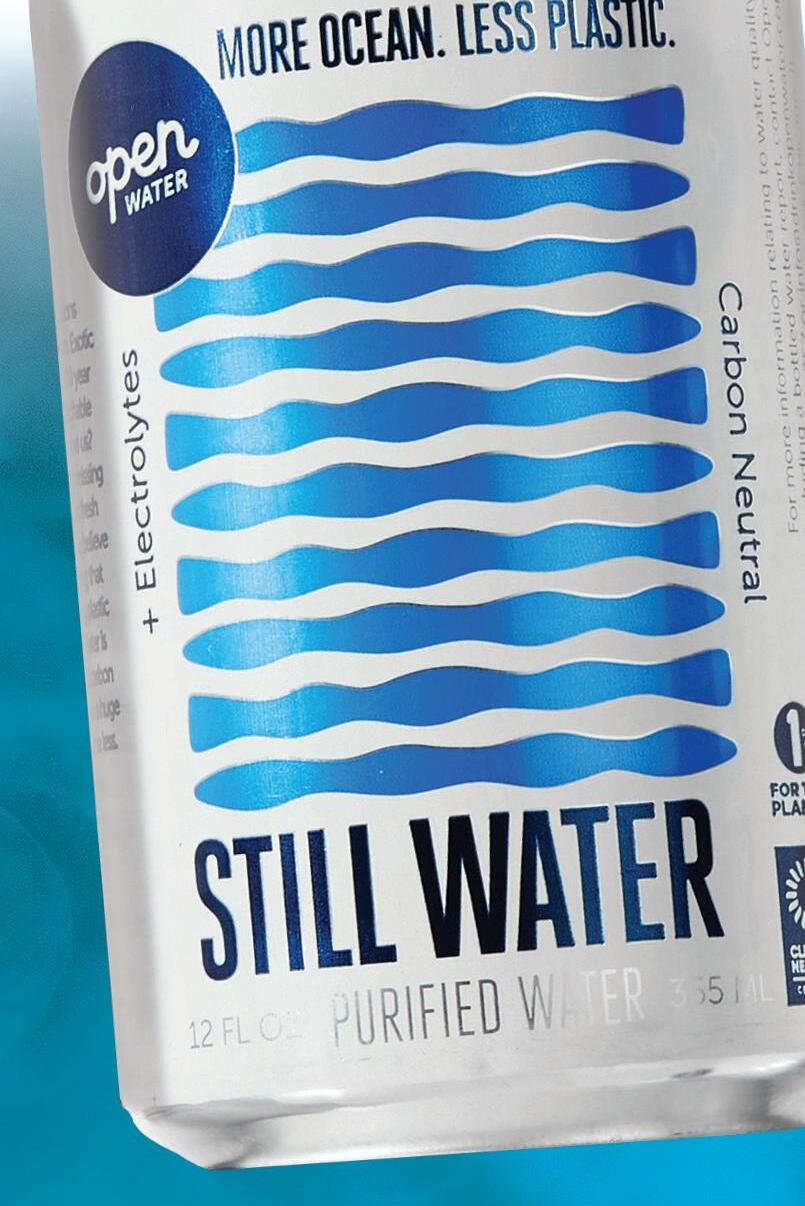

What about water? It would seem to have finally exhausted itself with the sale of premium brands like Core and Essentia, but those companies being taken off the table has just brought on a whole new cohort intent on subdividing the category even

more. A bunch of the Essentia team migrated quickly to the funky bottles of Eternal Water, while other startups are pushing aluminum and paper-based alternatives to the traditional PET. Meanwhile, no sooner do LaCroix and Sparkling Ice right their ships and Spindrift and Topo Chico establish the high end of the sparkling range, than a whole new crop of carbonated upstarts enter the fray.

So is this kind of proliferation okay? For years, I’ve been wary when an entrepreneur approaches BevNET attempting to sell us on the potential of a “me-too” brand, one that largely knocks off an existing product while offering a tiny slice of difference. Often, they seem to be aimed at a group that’s too small or esoteric to create a major marketplace or else the founders seem to interpret the business as just another fashion statement, and are just trying to make the same green juice that the rest of the cool kids are drinking. But this is different – these are companies that are taking the energy of categories that are still largely mainstream and offering, well, more.

In the case of sports drinks, formulas are advancing – many of these brands are offering heavier doses of their rehydrating formulas (Biolyte and Hoist both market themselves as IV bags in a bottle). The energy products are also adding a host of gymready ingredients and ramping up the caffeine past what the established brands offer, while water brands continue to find different vehicles to soak up the share of stomach that might have once gone to soda. There’s still variety and differentiation to be found – although there’s also the possibility that the sheer volume of that variety might overwhelm consumers.

Still, taken together, they’re more likely to impress than bewilder. In a recent Beverage Market Buzz report, Rabobank analyst Jim Watson applauded the energy that has gone into these categories, singling out sports and energy drinks as “a story of big innovation and vibrant startups,” and are categories that “have benefited from an aggressive update to core products, driven by the success of newer category entrants.”

Entrepreneurs should be applauded when they can look at a category that might appear played out, and still find a new approach that stirs the imagination. Some of us might see the wall, but we can all admire those who, every once in a while, see the cracks, and push on through.

6 BEVNET MAGAZINE – JANUARY/FEBRUARY 2018

Doole on Unsplash • MARCH/APRIL 2023

Photo by Samara

The First Drop

By Barry Nathanson

By Barry Nathanson

Being Held to Account

First the good news. We just returned from a stellar and overwhelming Expo West. The excitement and energy were something to behold. Over 70,000 attendees packed the halls over the 4 -day trade show. It was hard to make your way through the North Hall the first day, though someone pointed out to me that the reason was that the other halls weren’t open so many exhibitors from there came over to browse. The logic of it made sense to me. For whatever reason, it was packed. I visited dozens of friends, some new but most relationships accumulated from over 30 years running around in this business. It was a great way to benchmark my career in beverages. Catching up was my favorite part of the show. For the BevNET team, the show was an incredible success. The editorial team covered the width and depth of Expo West in stride, and the reporting was second to none. I always marvel how they can cover such a vast event with substance, and insights.

In the lead up to Anaheim, I was reaching out to the exhibitors to take their pulse of their expectations, and to a brand, it was high. Yet, I also heard some dark clouds in many conversations. These talks continued in Anaheim with many brands. While the general drift was that business was going strong,

there were cautionary tales to consider. Over the past few years, funding, before, during and after the pandemic, was difficult. Then the floodgates opened and raising capital was not an issue. Investment dollars poured in. Just going to our BevNET site, you saw article upon article of rounds of funding coming in. Yet, there is always a price to pay and in my conversations, paying the piper was just around the corner. I heard from dozens of companies that investors were becoming impatient, wondering where the returns were for the money they’ve put in. The push was for profitability –investors are tired of their portfolios being in the red, and wanted some green. Many of the marketers said they had to curtail some of their marketing dollars, hold back on new product launches and sales pushes into new markets to satisfy a restless quest for accountability for their investments.

While, as a whole, business is strong and growing, the murmurs I heard could be just the tip of the iceberg. I hope I’m wrong and that business as usual will continue, but investors have a different agenda. I hope we can maintain a balance, to support the brands, but it’s incumbent that the brands do their part and maximize their brands’ value and balance sheet.

www.bevnet.com/magazine

Barry J. Nathanson PUBLISHER bnathanson@bevnet.com

Jeffrey Klineman EDITOR-IN-CHIEF jklineman@bevnet.com

Martín Caballero MANAGING EDITOR mcaballero@bevnet.com

Ray Latif CONTRIBUTING EDITOR rlatif@bevnet.com

Brad Avery REPORTER bavery@bevnet.com

Justin Kendall NEWS EDITOR, BREWBOUND jkendall@bevnet.com

Carol Ortenberg EDITOR, NOSH cortenberg@bevnet.com

Adrianne DeLuca REPORTER adeluca@bevnet.com

SALES

John McKenna DIRECTOR OF SALES jmckenna@bevnet.com

Adam Stern SENIOR ACCOUNT SPECIALIST astern@bevnet.com

John Fischer ACCOUNT SPECIALIST jfischer@bevnet.com

Jon Landis BUSINESS DEVELOPMENT MANAGER jlandis@bevnet.com

ART & PRODUCTION

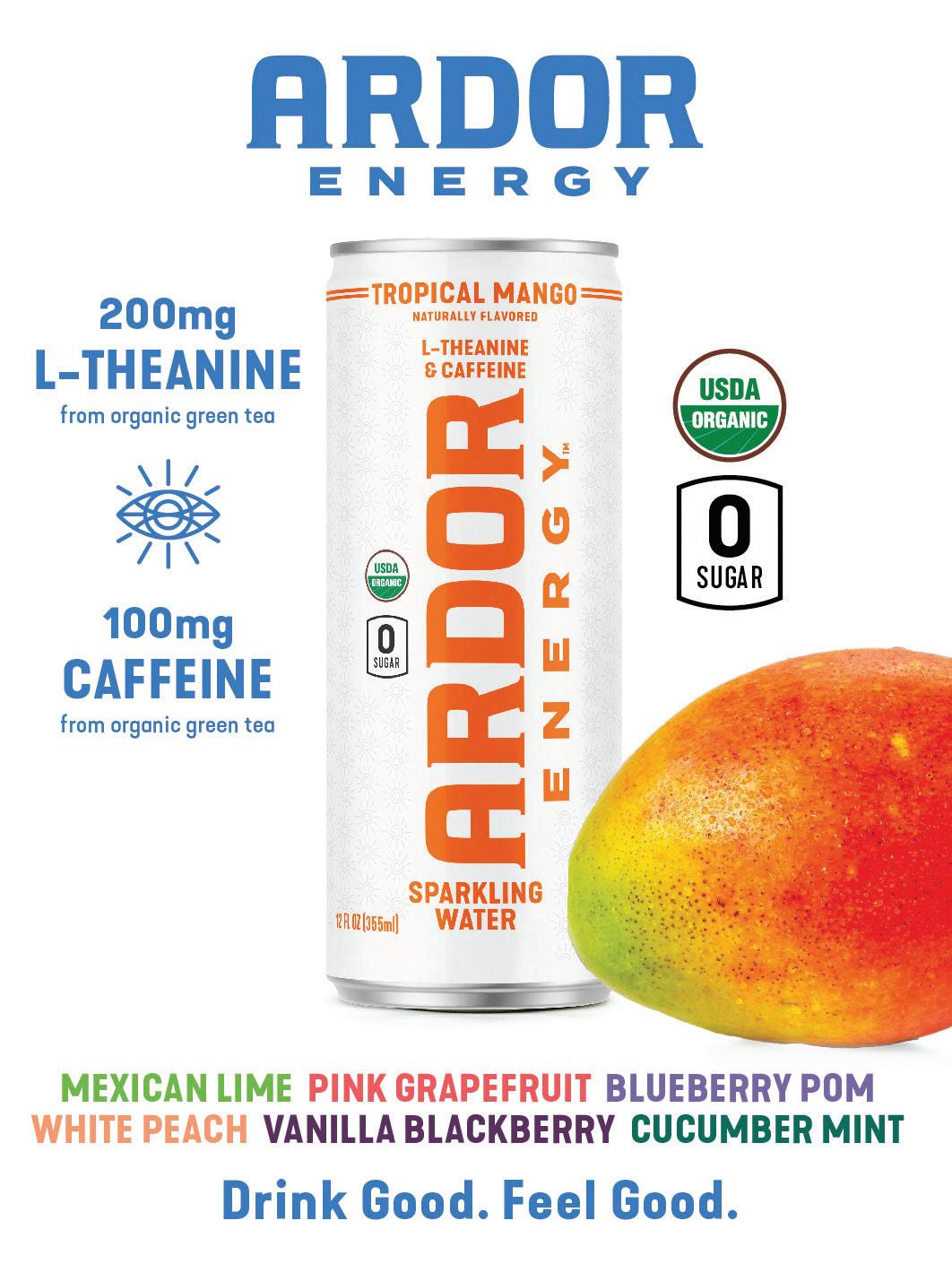

Aaron Willette DESIGN MANAGER

Nathan Brescia DIRECTOR OF PHOTOGRAPHY BEVNET.COM, INC.

John F. (Jack) Craven CHAIRMAN

John Craven CEO & EDITORIAL DIRECTOR jcraven@bevnet.com

HEADQUARTERS 65 Chapel Street Newton, MA 02458 617-231-8800

PUBLISHER’S OFFICE 1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

SUBSCRIPTIONS

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

BPA Worldwide Member, June 2007

Do Your Part: Please Recycle This Magazine MAGAZINE 8 BEVNET MAGAZINE • MARCH/APRIL 2023

Publisher’s Toast

Gerry’s Insights

By Gerry Khermouch

Influencers’ Brave New World

There are some readers of my newsletter who must think I’m pretty wired into this new world of social media influencers. After all, no sooner does some mega-influencer sign on as an investor and endorser of some new beverage brand than I weigh in with my authoritative take on the transaction. What’s their personal history? How big is their following, and on what platforms? Do they seem to be a good fit with the brand? Does that unfortunate incident at the Oscars after-party (or was it the dry cleaners on Melrose?) pose a risk to the brand? But I’ll fess up: As often as not, I’ve come by this insight only by Googling that same person an hour earlier. Until that moment, I’d only had the vaguest notion, if any, of who they were.

In short, this emerging world of so-called creator brands still is new and mysterious to me. These brands that the creators don’t merely endorse but themselves create, sometimes entirely out of left field, just because they have a yen for, I don’t know – coffee? – are a mind-boggling phenomenon and I’m sure many MBAs in glass towers are frantically trying to decipher where it goes. Did I mention coffee? That was an area of interest to the then teen-aged YouTube star Emma Chamberlain, who’d charmed millions of followers with her “haul” videos showing how she put together a killer look for, like, $18 at the thrift shop. Chamberlain created a quite delicious bagged coffee brand under her name that took off as a DTC item and has been edging into retail. Her hold on her followers came through to me a few months ago when I swung by a popup event the brand was doing at the flagship Brooklyn store of Blank Street Coffee. It was packed with exuberant young women who, to my eyes, looked exactly like Emma Chamberlain. Right, I reminded myself. She’s taught them all how to dress.

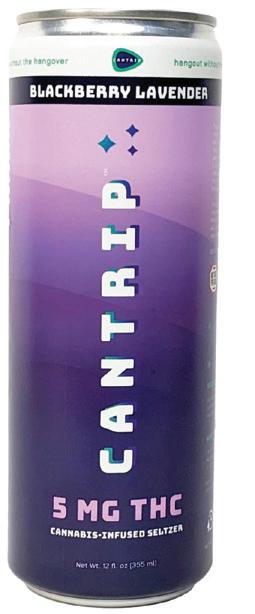

At the recent Expo West, Chamberlain debuted a canned coffee extension that’s going straight into 4,000 Walmart stores. So much for the proverbial slow build. That makes it clear that something is happening and we don’t quite know what it is. I should note that these creator brands are distinct from brands created by celebrities who’ve established themselves in conventional activities like movies, music or sports, as when rock star Sammy Hagar created his Cabo Wabo tequila brand. And both are different from when celebrities sign on as investors and endorsers to existing brands.

Creator brands have been exploding in categories like food, personal care and pet care. In beverages, the creator brand that’s had bloodshot eyes popping out of heads like in an R. Crumb comic has been Prime Hydration. That’s the sports drink launched by the social influencer cum fighter Logan Paul and his ring adversary and buddy KSI, the UK rapper. By their own account, the brand sold 100 million bottles in its first year, and that was with production seriously lagging demand. That in turn led to online videos of shoppers fighting in grocery aisles for scarce bottles – which I’m sure discouraged consumers and caused them to completely lose interest in the brand. Kidding! The majority owner and day-to-day partner in this enterprise has been Congo Brands, the company founded by the youthful entrepreneurs Trey Steiger and Max Clemons. They’ve made a specialty out of harnessing influencers to brands: first, gym rat Christian Guzman for 3D Energy, which has enjoyed some success, and then fitness icon Katy Hearn behind Alani Nutrition, which has ignited at Target and served as the first true vindication of their concept. In annual scanned sales, Alani Nu is well beyond $300 million. The partners seemed to have their sights set next on an RTD tea brand via a partnership with country crooner Mor-

gan Wallen before something unraveled that deal. But you get the point. Alani has done well in an incredibly competitive energy category. Then there’s Prime. In its first year, Prime has handily eclipsed Alani’s performance. It’s really extraordinary, and that’s before one takes into account that there’s nothing at all breakthrough about the formula, maybe less so even than Body Armor (which put the first scare in memory into Gatorade and enjoyed an $8 billion exit to Coca-Cola). It just seems that their followers will follow Paul and KSI to the ends of the earth, or at least to a Tesco grocery. This has got to be making the CPG giants nervous. It might be another great leveler, where brand incumbency and boundless resources don’t confer as much of an advantage as they used to. Already, social media is an alternative to paid TV and DTC is an alternative to retail, though there has been a sharply escalating cost to those tools. But what’s the cost of marketing creator brands? Their consumers are coming to them, with great eagerness, pleading to be sold. One example of how this plays out? Prime apparently was able to cadge a steep discount on a Super Bowl ad just before kickoff by promising Fox that it would be bringing to the big broadcast a legion of young sports fans who do not currently have football on their agenda. So Prime seems to have paid less than Coke, Pepsi or Bud for its presence on the must-watch event.

It’s still early days, but this creator segment seems to have its own ecology. Recently, gigantic Westrock Coffee bought tiny Bixby Coffee Roasters. Hunh? Bixby’s great, but I wondered, what does Westrock need them for? Creators. Bixby’s founders, Miles Fisher and Remington Hotchkis, seem to have a knack for engaging with creator types, like Emma Chamberlain, with whom it worked to develop her line. Westrock has been reaching out to the creator economy on its own but, as its founder/CEO Scott Ford told investors, it couldn’t hurt to harness Fisher and Hotchkis in what he views as “really a sales force and a selling site acquisition for us.” Westrock is a behind-the-scenes player in beverages, but might we be approaching a point at which the branded CPG giants will be establishing their own departments to try to woo creators?

But will the creators even need them? Even if they don’t need them to navigate their growth phases, what about an exit? From the creators’ perspective, is there even a need for an exit? After all, creators gonna create, maybe through the ebbs and flows of individual brands and categories, and there’s not necessarily a time limit on how long they’ll stay at it. Hey, Mick Jagger and Bob Dylan are still rockin’ and rollin’ into their late 70s and 80s.

From the strategics’ perspective, if the brand embodies the founder, what’s the value of acquiring a creator brand whose founder is unlikely to stay engaged? Even with more conventional brands, the road forward seems hard enough when the founder exits. Congo seems to be enduring some stresses with Alani’s creator, Hearn, and it’s an open question whether the brand has progressed to a point where her direct involvement no longer is crucial to its success. There’s also the risk factor. The big CPGs have periodically suffered their share of unpleasant surprises with celebrity endorsers whom they had presumably vetted. Creators are even more of a black box. With Paul, for instance, any would-be Prime acquirer would have to wonder, what are the odds that he kills either himself or somebody else in one of his stunts? Less luridly, what if he just loses interest? I certainly don’t know the answers to these questions. I’d barely heard of Paul before wholesalers were heralding Prime as the second coming. But it’s a brave new world and some of these quirky personalities on your iPhone screen may turn out to be the next kings of commerce.

10 BEVNET MAGAZINE • MARCH/APRIL 2023

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

Tru Inc. Raises $6.5M Series A to Support Footprint, Team Expansion

In February, functional beverage maker Tru Inc. raised $6.5 million in a Series A funding round led by BTomorrow Ventures, an existing investor and the corporate venturing arm of British American Tobacco.

Founded in 2015 by CEO Jack McNamara, a former pro hockey player, and tech entrepreneur Yashwardhan Banthia, Tru initially went to market with a line of 1.69 oz. shots. However, the business was slow to grow, and in December 2020 it shifted focus to a full-sized functional sparkling water line. That pivot proved to be a game changer for the Massachusetts-based startup – earlier that year Tru had received a critical $1.5 million cash infusion necessary to “save” the struggling company.

Since then, Tru has now reported two consecutive years where revenue grew about 120% annually and this new financing is poised to help the brand reach new markets and grow headcount.

“I continue to be impressed by the stellar growth the Tru team have achieved over the past year,” said Lexy Prosszer, founder & investment principal of Btomorrow Ventures, in a press release. “We are excited to continue our great partnership, supporting the brand in this next expansion phase as they look to strengthen their position in the market across the USA.”

BTomorrow had previously participated in Tru’s $3.6 million financing round in 2021, which also included investment from (and a DSD distribution partnership with) Bay State powerhouse Polar Beverages. According to the company, that relationship has now helped Tru to expand its footprint to around 2,000 stores within the

grocery and convenience channels, including Market Basket, Harris Teeter, Wegmans, and regional Walmart locations.

Positioning itself as a “carbonated complement to Vitamin Water,” Tru’s portfolio of 12 oz. canned drinks includes Power, Energy, Defend, Focus, Dream, Rescue and Beauty varieties, each made with different vitamin and ingredient blends.

Answering questions via email, McNamara said Tru has recently added retail partners like Tops and Discount Drug Mart. The brand has launched in ShopRite and Stop & Shop stores and an expansion into the New York City market “is imminent.”

Positioning Tru’s full-sized offerings as an enhanced water, McNamara added, has allowed the brand to stand out more within its retail locations.

“Rather than swim against the current, we are following the flow of data which suggests that customers are looking for more bene-

fits in beverages, aluminum packaging in the water set, and less sugar,” McNamara said. “Having executed this with great flavor, we will continue to drive trial inperson via samplings while adding online awareness through social media.”

Since BTomorrow first invested in Tru in 2020, McNamara said the relationship with the venture group has been significant in aiding the company’s strategy across nearly all aspects of the business, providing insight and guidance in manufacturing, sales and marketing. He credited BTomorrow with helping Tru to mature as a business “by transitioning to a data centric approach that maximizes for growth and efficiency.”

Tru is now working to expand its team and intends to bring on a fulltime CFO and double its sales force this year, McNamara said. Although growing its store count is part of its strategy going forward, the top priority will be on going deeper in existing accounts and increasing individual store velocities.

“We have always taken a balanced approach to allocating capital so that we can continue to elevate every discipline of the business…. [O]ur key to winning this game will be controlled growth with a premium level of customer service that touches every level,” he said.

12 BEVNET MAGAZINE • MARCH/APRIL 2023 The Latest Beverage Brand News Bevscape

Snoop Dogg Enters Cold Brew Coffee With Indo

Get this Dogg a drink.

Rap legend and prolific entrepreneur/marketeer Snoop Dogg has stepped into the ready-to-drink coffee space with Indo, which launched its line of unflavored cold brew, packaged in 12 oz. cans, online in March.

The brand is the brainchild of Michael Riady, a former real estate investor in Southeast Asia who pivoted into the specialty coffee business in 2017 as a partner in Los Angeles-based, Indonesian-focused roaster and cafe Tentara Surf & Coffee Roasters. After the company’s two physical stores shuttered during COVID, Riady continued to import and roast Indonesian coffee and sell it online while mulling his next move. Citing The Honest Company as an example, he set his sights on securing an “A-list” celebrity partner with whom to grow a revamped version of the brand.

In the midst of that search, Riady reconnected with an old friend from Los Angeles with connections to the entertainment industry, which led to an introduction to Snoop Dogg. The hip hop icon joined Indo as an equal equity business partner shortly thereafter and his impact was immediately felt; it was his idea to change the name.

In an email to BevNET, the rap legend explained “Michael Riady came to see me with the best cup of coffee that I’ve ever had and from there we came together to create a company that embodies my belief in hard work and ownership.”

Over his career as a businessman, Snoop Dogg has occasionally dabbled in the beverage industry, mostly as an alcohol marketer. Longtime fans will recall his memorable ads for St. Ides malt liquor in the early 90s, but his track record stretches well into the 2000s (as a pitchman for Blast by Colt 45) to the present day, where he’s currently seen in commercials for Corona. He’s been particularly active in wine as of late, having worked a multi-year partnership with Australian label 19 Crimes (alongside frequent pal Mar-

tha Stewart) and releasing a limited edition Death Row Records red wine. In a nod to his breakout single “Gin & Juice,” in 2020 Snoop collaborated with celebrity spirits seller Trusted Spirits on Indoggo, a gin infused with natural strawberry flavor.

Better known for his love of cannabis, Snoop said his personal relationship with coffee goes “way back,” having helped fuel himself and collaborators during long nights in the recording studio. Getting involved in a coffee brand felt “like full circle for me as an owner and creator,” Snoop said in an email.

“My first record was Gin and Juice, you know the lyrics,” wrote the hip-hop icon, who is credited as a co-founder. “I was ‘rolling down street smoking indo, now I’m drinking Indo.’ It’s always been my 1-2 punch.”

With Snoop on board, Indo’s aim is to “make coffee cool and fun” and serve as a contrast to existing specialty brands in the RTD space, Riady explained, sprinkling in references to inspirational names like Red Bull and Liquid Death. The rapper himself is not featured or mentioned on the can; Snoop will promote the brand “in ways that he wants to,” Riady said, while he focuses on executing on the business. On its website, the brand is teasing the tagline “Sip It Like It’s Hot,” as well as forthcoming episodes of “The Owners Series” that spotlight creators and entrepreneurs such as artist Esther Anaya and CocoTaps founder Coco Vinny. Indo also had a marketing presence at Shaq’s Fun House, a music festival created by NBA legend Shaquille O’Neal that took place over Super Bowl Weekend.

When asked how he planned to promote the company, Snoop mentioned targeting specific consumer audiences including “college kids that need to fuel the dream, the nurses putting in long hours, or the engineers putting in the long hours in the studio.”

The coffee itself is a low-acid, organic Indonesian single origin with 250mg of caffeine per can, and is now available online at the brand’s website and via Gopuff, Bevmo and in all hotel rooms at Resorts World Las Vegas, a $4.3 billion resort, mall and casino complex that opened in 2021. The suggested retail price for one 12 oz. slim can is $5.99, and distribution is set to continue through authorized retailers like Erehwon, Albertsons and Safeway in the months ahead.

As Indo ramps up, Riady emphasized that the core of its business is still roasting whole bean coffee, which it continues to sell online. The company is also working on another RTD product: a 10% ABV espresso martini, priced at $24.99 per 4-pack, currently available for waitlist. Even with a big name partner, Indo remains a small operation: the team is less than 10 people, and just closed a pre-seed funding round from friends and family last year.

14 BEVNET MAGAZINE • MARCH/APRIL 2023

Jack Owoc Out At VPX/Bang

Jack Owoc, the controversial CEO and founder of Bang Energy maker Vital Pharmaceuticals, was dismissed in March as the company’s chief executive and chief science officer, and from its board of directors, where he had served as chairman. John C. DiDonato, Vital’s chief transformation officer, has been appointed interim CEO in addition to his existing role.

The company announced the move in a brief press release issued close to midnight on Thursday.

“On behalf of the Board of Directors, we acknowledge Jack’s vision in founding this leading brand and creating a world-class product in the energy drink category. As the Company continues to pursue value maximization, we are grateful to Mr. DiDonato and the executive leadership team for their stewardship and to the talented and hard-working members of the Bang Energy team for their unyielding commitment to the brand,” said Steve Panagos, Chairman of the Board.

The release did not specify what potential role, if any, Owoc may play in the company’s future, but specified that he will “no longer serve in his current role.”

DiDonato is the National Practice Leader and Managing Director at Huron Consulting Company and brings “more than 35 years of experience leading companies through complex financial and operational transformations.”

As part of the restructuring, Gene Bukovi has also been elevated to the position of Chief Operating Officer.

Though his career in CPG and supplements precedes Bang,

Owoc’s brash personality and management style have been a core element of the brand’s identity during its prodigious rise over the past decade, eventually becoming the third-largest energy drink behind Red Bull and Monster, as well as inspiring a new wave of workout-oriented, high-caffeine beverages. His approach has also snared VPX in multiple litigation cases, including ones in which he has been accused of misleading consumers about the ingredients and functional benefits in Bang drinks.

The company’s future was put into doubt after it declared bankruptcy shortly after a jury sided with Monster Energy Co. in its false advertising lawsuit against VPX in California federal court in September, awarding the company nearly $293 million in damages. Monster is currently seeking a further $167 million in punitive damages, lawyer fees and unjust profits.

In the months since, Owoc has touted Bang as being on track to complete “the greatest comeback in beverage history” by rallying around new products, formats and independent distribution partners. However, CPG veteran Kathy Cole, who joined Bang as COO in October to oversee the “integration of a new high-performance operations model,” departed the company within months. Meanwhile, several large chain retailers have reportedly stopped carrying Bang.

15 For more stories, check out Bevnet.com

FDA Says CBD Is Not A Dietary Supplement, Tasks Congress With New Oversight Plan

The U.S. Food and Drug Administration (FDA) is looking for Congress to take charge in regulating cannabinoid (CBD) products after concluding the agency’s existing authority over food additives and supplements does not provide all the necessary tools for managing the risks of CBD. The news arrived nearly five years after the FDA announced it would begin looking into developing guidance on cannabinoid use.

Additionally, the FDA denied three citizen petitions that requested CBD be regulated as a dietary supplement. That decision came from findings of the FDA’s CBD working group which examined studies on Epidiolex, a CBD-based drug, and concluded that the risks of CBD do not align with the existing safety parameters for dietary supplements or food additives. The agency is asking for additional data and more studies.

In lieu of taking the lead itself, the FDA is asking for Congress’ help to develop a new regulatory body that can serve as a gatekeeper for legal CBD. Whether that body resides within the existing structure of the FDA remains to be seen, but the agency was clear on its position that these products need to be regulated so that consumer demands can be met and the emerging industry can grow within a federally-set framework.

The agency believes the new body will need to have the authority to effectively regulate labeling of CBD products, prevent contaminants, institute CBD content limits and wield the power to put minimum purchase age limits in place. Access and oversight plans for CBD products and for how consumption of CBD by animals could potentially impact and infiltrate the human food system will also be developed through this proposed regulatory path.

The news came days after the federal agency released industry guidance for the development of cannabis-based drugs, including specific processes and

factors for scientists to consider when working with hemp and marijuana ingredients. As CBD products continue to be sold in the market, the FDA said it will continue monitoring how those products are marketed, sold and take appropriate action when necessary in accordance with state regulators.

“We will remain diligent in monitoring the marketplace, identifying products that pose risks and acting within our authorities,” the agency said in a statement. “The FDA looks forward to working with Congress to develop a cross-agency strategy for the regulation of these products to protect the public’s health and safety.”

Looking forward, Congress has quite a regulatory task in front of them. While the legislative branch could grant the FDA the ability to generate a new CBD regulatory body on its own, the agency’s broader human food regulatory functions have also come under recent scrutiny.

The release of the Reagan Udall Foundation report analyzed the function of the FDA’s human food program and recommended that an internal structural overhaul may be necessary for the agency to be able to effectively regulate the food, a change that would likely require congressional approval. This means that while the FDA may need congressional help to create a body for CBD oversight, it may at the same time be seeking permission to adapt its own structure.

This move means that CBD food and beverage brands essentially will keep on doing what they have been: waiting a bit longer before they can begin selling products at major retail chains. Many retailers have stated they will not merchandise ingestible CBD products until federal guidance is published since the ingredient remains unregulated and illegal to include in food and beverage products. For now, most brands are limited to online directto-consumer platforms and independent retail outlets but are optimistic about the impact of today’s announcement.

According to John Simmons, co-founder of CBD/THC beverage brand Weller, his team has been incorporating the suggested risk management tools relative to CBD labeling, contaminants and content limits for several years to ensure the products

are ready to go into major retailers when federal regulatory guidance is released. He explained many of these measures are table stakes for early-CBD adopting retailers like Wegmans and Sprouts.

Relaxation beverage brand Recess also believes the overall industry is steadily progressing along its path to retail. The company, which recently expanded its CBD-free Mood line due to increasing consumer demand, has previously said that line has helped the company secure and maintain key retail placements as it awaits federal CBD guidance.

“We are encouraged by FDA’s announcement to work with Congress to establish a workable regulatory framework for CBD at the federal level,” said Ben Witte, founder and CEO of Recess. “We look forward to maintaining a constructive dialogue with policymakers to ensure that regulations are established that protect consumers and establish clear rules for suppliers, brands and retailers to operate within.”

Jonathan Eppers, founder of CBD beverage brand Vybes, said he doesn’t believe much will change for the CBD industry in the short term following the announcement. He said VYBES continues to see strong demand, highlighting that the category is likely growing slower due to the lack of federal regulation preventing it from entering major retailers, but believes overall, CBD is on an upward track.

“I’m encouraged that FDA is asking Congress, who has been pro-CBD for years, to write laws that regulate CBD,” said Eppers in an email. “CBD regulations are one of the only bipartisan issues both Republicans and Democrats agree on, so maybe we’ll get something sooner than we all think.”

Simmons believes regulation could come as early as mid-summer and expects that CBD regulation will be added to the 2023 Farm Bill.

“The timing of this statement from the FDA gives legislators the opportunity to ensure the missing pieces from the 2018 Farm Bill can be properly added to the new version,” said Simmons. “That’s probably the smoothest legislative pathway, since Congress has been unable to pass independently introduced CBD legislation in years past.

16 BEVNET MAGAZINE • MARCH/APRIL 2023 The Latest Food Brand News Noshscape

Hot Stuff: Fly By Jing Brings in $12M to Scale Brand & Retail Presence

After moving from online into retail last year modern Chinese food brand Fly By Jing announced in March it raised an additional $12 million in funding to fuel continued expansion primarily in conventional grocery stores.

Existing investor Prelude Growth Partners and Pendulum, an investment and advisory firm for leaders and founders of color, were the two largest investors, with entrepreneur Dave Gruntman, Palm Tree Crew and numerous other angel investors also taking part.

“As a founder, and someone who did everything myself in the early days, it’s a constant evolution of thinking bigger,” founder and CEO Jing Gao said. “Bringing on private equity investors is an example of allowing others to help me propel my vision forward.”

The capital, Gao said, will be used to drive further expansion mainly in conventional retailers. After launching in stores last year, the company has achieved a 50/50 split in revenues between retail and D2C; this year, Gao expects that ratio to rise even further, closer to 70/30.

“The next period is really about figuring out the transition to a true omnichannel brand,” Gao said. “Our next phase is about really establishing a brand for everyone, and not just to coastal cities, not just for the foodies, but really an everyday item, like sriracha and Heinz ketchup.”

Since its $5 million raise in 2021, the company has grown its door count to 4,000 retailers including distribution in Whole Foods, Sprouts, Target, Costco and Wegmans.

Gao said she originally wanted to focus on the natural retailers to start; Target however, offered to collaborate with the brand on how it could address the “problem” of the “ethnic” aisle, which segregates certain items away from their conventional counterparts. The chain agreed to test Fly By Jing’s Chili Crisp in the hot sauce aisle, though sales data later showed that it performed better in its original placement in the Asian food set.

“It’s not just us, there’s a rising tide of founder identity and mission driven brands that are now starting to pop up in the

ethnic aisle. It’s no longer the stale aisle that people didn’t really go down -- it’s actually a destination,” Gao said. “That was actually a big unlock for us. There’s been a reclamation of the ethnic aisle that we’ve been a key part of.”

Gao has a cookbook, The Book of Chili Crisp, coming out in 2023, which she believes will also help drive awareness and understanding of the company’s signature product.

The plan, Gao said, is to eventually build out a larger platform of products, likely more condiments. Online, the company will continue to offer a larger “pantry” of products, such as a wider array of spices, hot pot bases, black vinegar and dumplings, which Gao says serve as a vessel for its sauces. In retail, Fly By Jing wants to focus on shelf stable products that can be merchandised in the same set. Earlier this year, it introduced an extra spicy version of its chili crisp in Whole Foods. Another D2C product, Chili Crisp Vinaigrette, could also make the jump into retail.

To support the growth across product types and retailers, the company has also grown its c-suite, recently bringing on former Follow Your Heart CFO Matt Dunaj as its COO/CFO and former Sovos Foods VP of sales Jason Parasco as its chief commercial officer. Fly By Jing also recently earned B Corp certification.

Gao herself is dedicated to continuing to push the CPG industry on its acceptance of new products and brands created by female, BIPOC and AAPI founders. As an example of the hurdles Fly By Jing has had to overcome, Gao said the reason why the brand went D2C initially was simply because retailers would not give the product a chance.

“As we have proven ourselves again and again, there’s finally more and more people giving us a shot, and giving others a shot as well, which is kind of this idea of the rising tide. I think that all we can hope for is progress -- and we are making progress in the right direction,” Gao said. “There’s excitement, which really, I would say, we, along with other brands like us, created ourselves. We really had to exert ourselves in order to make this happen.”

Ace in the Hole: Oats Overnight Raises $21M

There are many ways to fund a startup, but using the winnings from a career as a successful, high-stakes professional poker player is certainly not the norm. However, Oats Overnight CEO Brian Tate is ready to go all-in, announcing in March a $21 million investment.

The oversubscribed round included participation by Singh Capital Partners, BFG Partners, Impatient Ventures, Watchfire Ventures, Morrison Seger Venture Capital Partners, Vanterra Ventures, Access Capital, and Pure Ventures. Prior to this, the company had been self- funded by Tate, and then raised $9 million in funding, mainly via several SAFES.

Tate formerly was one of the top poker players in the world, prior to that career playing Magic the Gathering professionally. The inspiration for the company came from his preferred meal while on tour playing poker; several members of his executive team are also former professional poker players.

Founded in 2015, the Arizona-based company has a run rate of over $100 million, with $55 average order volumes, and profitability expected by April, according to Tate.

The new capital will mainly hit the balance sheet, Tate said, and go towards acquiring more inventory and upgrad-

ing its manufacturing processes via new equipment purchases. Oats Overnight is a vertically integrated company, handling the manufacturing, packaging and fulfillment of its protein-enhanced, lowsugar, creatively flavored oats. To support these efforts, the company has 250 employees, largely on the manufacturing side.

“We feel really excited to have this capital for the balance sheet to invest in machinery, invest in this new facility and get efficiencies up. Automation, of course, is always a big win from a margin perspective, and really helps us reach that profitability faster,” Tate said.

18 BEVNET MAGAZINE • MARCH/APRIL 2023

“We took just what we needed to be both comfortable going into whatever this next year will bring at a macro level...we want[ed] to make sure we can be solid, but also maybe [go on the] offensive.”

Currently the business’ sales are 80% direct-to-consumer, 10% on Amazon and 10% in retail, but the company hopes to bring that online to retail ratio closer to 50/50 by 2026.

In brick and mortar, which Oats Overnight entered two years ago, the company sells shelf-stable bottles, filled with 2.2 oz. of oat milk powder and its flavored oat/protein mix, requiring consumers only to add water. The packaging was selected because the end product is more like a shake than a bowl of oatmeal and is easier for on-the-go consumption. Though the bottle format is unusual in the oatmeal set, Tate says the product competes with single serve heat-andeat oatmeal bowls. The brand is in over 2,000 stores including Walmart, Whole Foods SoPac region, HEB, Meijer, Safeway Albertsons, and Wegmans.

However, it’s online where the brand

has really taken off, selling 2.8 oz. sachets which retail for $60 for 16 meals, or $84 for 24 meals and are far more efficient to ship. Customers add their own liquid and then, ideally, shake the mix in a blender bottle or blend.

In addition to one-time purchases, the company also maintains an active subscription business, currently with 130,000 subscribers. First-time subscribers are offered $21 off their order as well as a free blender bottle, and then subsequently receive $6 off every future order. Subscribers typically order 16 packs per month, Tate said, and the company “overindexes on retention” with most shoppers who pause their subscriptions returning in six months, spurred to rejoin by the release of a new flavor.

“We’ve seen LTV expand at a 25% CAGR over the last five years and those LTV expansions allowed us to pay incrementally higher CACs while still maintaining a really, really healthy payback period,” Tate said. “We have a very strong brand LTV which allows us to be much more nimble.”

This emphasis on flavor variety and

limited time offerings has been another key to the company’s growth. Every subscriber’s order includes a packet of a flavor currently in testing, with customers encouraged (and incentivized) to provide feedback. These real-time focus groups then help Oats Overnight determine which products should be offered on the wider ecommerce platform as well as what may eventually make it to retail.

Subscribers not only have a private Facebook group, which currently has 21,000 members and an average of 1,000 comments per day, but access to exclusive flavors. Currently that subscriberonly storefront, for example, has 35 flavors while one-off customers have access to only 21 options.

“We always give feedback to our customers. We say ‘this is what we heard from you. This is how we changed the formula,’ or ‘this is why it was not released,’” said Nina McKinney, chief strategy officer. “There’s this actual incentive to be involved in our product development process because their voice is truly being heard and listened to.”

For more stories, check out nosh.com 19

A-B Ceases Operations at Platform and Dishes Out Layoffs at Other Craft Breweries

Anheuser-Busch InBev (A-B)-owned Platform Beer Co. ceased operations in February, less than four years after the Cleveland-based brewery was acquired and joined the beer giant’s craft unit, the Brewers Collective.

The brand will live on as three IPAs – Haze Jude IPA, Odd Future Imperial IPA, and the new Canalway IPA – according to an A-B spokesperson.

Brewbound spoke with leaders from A-B’s High End division – which includes the Brewers Collective – in December. They said the division’s priorities for 2023 were “maximizing” Stella Artois, growing its premium lagers and continuing to lead craft growth with its Brewers Collective brands.

Brewers Collective VP of marketing Carrie Shafir noted the craft division consists of 20 brands, and “if we’re not focused, it can get messy very quickly.” She said the division would continue to focus on “leading with style” and gaining share in “top performing craft styles.”

One day after the news of Platform’s shutdown, reports began to roll in of layoffs at some of A-B’s other craft breweries. Employees have been let go from Houston, Texas-based Karbach Brewing and Patchogue, New York-based Blue Point Brewing, according to LinkedIn posts from workers. Layoffs have also been reported at Lexington, Virginia-based Devils Backbone, Asheville, North Carolina-based Wicked Weed, and Chicago-

based Goose Island Brewery, A-B’s largest craft brewery.

It is unclear how many employees or breweries were affected. In a statement to Brewbound on February 23, A-B High End division president Andy Thomas said:

“Winning in craft remains a key pillar of our strategy to lead and develop the Premium segment, but winning means something different in today’s marketplace than it did a few years ago. This week, several of our craft brewery partners announced local team updates that will allow them to better address evolving consumer needs and trends in their home markets and beyond. As the craft industry continues to transform, we’re staying laser focused on continuing to lead growth in the segment.”

A-B has long had ties to craft beer, beginning with investment in Widmer Brothers and Redhook nearly 30 years ago, which evolved into the Craft Brew Alliance (CBA) in 2008, the platform of eight craft brands A-B acquired in totality in 2020 after owning a 31.2% share.

The world’s largest beer manufacturer began acquiring craft breweries in its own right early in the last decade, beginning with its purchase of Goose Island in 2011. Since then, the Brewers Collective has expanded to include 20 brands nationwide.

House Beer Racing Back on the Scene Under New Ownership

Premium craft lager brand House Beer is revving things up in 2023 with new ownership. The decade-old company is set to be acquired by motocross athlete Carey Hart, who will “restart production and bring the brand back to its former glory,” House Beer announced in February.

The Venice Beach, California-based craft brewery was founded in 2013 with a focus on on-premise sales, As a result, the brewery struggled to fi nd footing when shutdowns from the COVID-19 pandemic “diminished” its business, and House Beer halted production in early 2022 with little fanfare.

Hints that House Beer may be returning began in September, when the brand returned to its Instagram page after a more than six-month hiatus. In response to comments asking if the beer was returning, the company said “our beer is heading out to more bars and restaurants very soon.”

Financial details of the deal were not disclosed.

“I am thrilled to have the opportunity to return House Beer to the market,” Hart said in the release. “The beer has always been a favorite of mine, and I knew I wanted to be a part of letting it come back to life. House Beer has a diehard fan base and a rock-solid flavor profi le, and I am excited to help it reach new heights.”

Hart, who is married to singer-songwriter Pink, plans to “bring a new level of energy and innovation” to House Beer, while “still maintaining the brand’s traditional brewing methods and commitment to quality,” according to the release. The fi rst batches of House Beer’s flagship House Premium Craft Lager (4.5% ABV) will be available in Southern California beginning in March, in 12 oz. can 6-packs and 12-packs, 12 oz. stubby bottles, and on draft . The beer is being produced by “a contract facility on the Central Coast,” a spokesperson told Brewbound.

Hart plans to “refocus” on his home market of Southern California, as well as introduce House Beer to grocery stores, and increase the brand’s share in the off-premise, according to the release. Scout Distributing will be House Beer’s “primary distributor,” but the company “may have announcements soon about other distributors,” the spokesperson said.

“We’re delighted to have found a new steward of the House Brand in Carey,” former CEO Chris Barrow said in the release. “We can’t think of anyone better suited to carry forward the legacy of the brand into the coming years, and we’re excited to share a House with him as soon as the cans start rolling off the line.”

20 BEVNET MAGAZINE • MARCH/APRIL 2023 The Latest Craft Beer Brand News Brewscape

Sierra Nevada Makes Minority Investment in Riot Energy; Will Package and Produce

Sierra Nevada Brewing Co. has made a minority investment in Riot Energy, a Venice, California-based energy drink company. The California brewery will “initially serve as an investor,” but will “eventually produce and package Riot Energy products” once its CanDo Innovation Center is up and running.

Sierra Nevada announced construction of the 85,000 sq. ft. CanDo facility in September. The Chico, California-based production facility will have a 500,000-barrel annual capacity and will be dedicated to beyond beer offerings, including Strainge Beast hard kombucha and non-alcoholic versions of Sierra Nevada’s existing beer offerings.

The investment in Riot may help the more than 40-year-old brewery connect with younger consumers who are “seeking better-for-you recipes,” according to the release. Founded in 2016, Riot is a “100% plant-powered,” certified organic energy drink company. Its products contain “no added sugar, no artificial sweeteners and no unrecognizable ingredients.”

“Consumers are underserved by the big beverage brands,” Riot founder Laura Jakobsen said in the release. “We are creating a different, more crafted choice to be energized with the simpler, cleaner ingredients consumers are demanding, yet current category brand leaders aren’t trusted to deliver.”

Sierra Nevada was the third-largest craft brewery by volume in 2021, according to the BA. The company produced more than 1.1 million barrels of beer in 2021, a -1% decline year-over-year (YoY). 2022 was “relatively flat and down just slightly from a volume perspective,” Sierra Nevada VP of sales Ellie Preslar told Brewbound in September.

Riot marks Sierra Nevada’s second foray into M&A, albeit a minority stake. In February 2019, the company acquired San Francisco-based Sufferfest Beer Company, a craft brewery whose gluten-reduced offerings were marketed toward athletes and made with ingredients such as bee pollen and sodium. However, by the end of 2020, Sierra Nevada discontinued the Sufferfest brand.

Braxton Brewing Spins Off Garage Beer into New Company

Braxton Brewing Co. has formed a partnership with brand investment marketer Andrew Sauer to spin off its Garage Beer light lager into a new company: Garage Beer Co.

Sauer, who will serve as president of Garage Beer Co., will focus “on growing distribution, sales and notoriety” of Garage Beer, while Covington, Kentuckybased Braxton will handle production of the 4%-ABV, 95-calorie beer. In addition to producing the lager, Braxton will continue selling the beer in its taprooms and promoting it throughout the Cincinnati area.

Speaking to Brewbound in February, Braxton co-founder and CEO Jake Rouse described the creation of Garage Beer Co. as “a true partnership” with Sauer. Braxton will maintain an equity ownership stake in the newly formed business along with Sauer.

“The newly formed Garage Beer Company has the ability to bring more resources to growing Garage Beer to a much larger footprint than Braxton can,” Rouse said. “It just basically allows us to level up focus and an ability to scale in a much larger way.”

Sauer will bring a national brand perspective to Garage Beer and “truly focus on growth,” with a dedicated sales and marketing team for the brand, Rouse said.

As president of Garage Beer Company, he will also have the autonomy to lead the organization, including raising capital. A CPG marketing professional who previously worked for Jim Beam and J.M. Smucker Company and most recently served as CEO of Hilo Nutrition, Sauer will be tasked with “fueling stronger, more strategic growth, including attracting new consumers, shelf space and celebrity talent,” according to a press release.

“This team expansion, to us, will allow the Braxton team to do what they love the best, and to get back to their roots as beer makers,” Sauer said in the release. “While we get to focus on bringing the best light beer on the market to more people, we’ll focus on our Midwest roots first, and expand into new corners of the world who are thirsty for something authentic, innovative and different. We’re all really excited about the growth and expansion potential of this amazing brand.”

Garage Beer launched in August 2018 as a 15-pack priced at $15.99. The brand maintained that $15.99 price point until last year, when retailers increased it by about $1, Rouse said.

The spin off comes as Braxton has reformulated Garage Beer’s recipe to make the beer “lighter.”

Garage Beer also received a packag-

ing refresh and will begin hitting retail shelves in 16 oz. 6-pack cans, 12 oz. 15pack cans, and 19.2 oz. single-serve cans over the next couple of weeks, Rouse said.

In 2021, Braxton Brewing’s production was flat at an estimated 20,000 barrels, according to the most recent data available from the Brewers Association. Braxton ranked as the largest taproom brewery by volume in the south region as designated by the trade group.

With Sauer taking the lead on marketing and selling Garage Beer, Rouse told Brewbound that Braxton will be able to focus on launching new brands and opening new brewery locations in the Cincinnati/Northern Kentucky International Airport and in Union, Kentucky.

“I’m excited overall about what Braxton has in store and super excited as we continue to use most of our capacity for Garage Beer while we grow together,” Rouse said.

22 BEVNET MAGAZINE • MARCH/APRIL 2023

Montauk Begins Distribution Expansion Following Acquisition by Tilray Brands

Montauk Brewing Co. has begun the distribution expansion leadership promised following its acquisition by global cannabis firm Tilray Brands. The New York-based craft brewery has begun distributing in Connecticut and Rhode Island, in addition to filling out its presence in New York and New Jersey.

Montauk’s existing network includes Boening Brothers on Long Island, SKI Beer in New York City and Kohler Distributing in northern New Jersey. Over March and April, the brewery has filled out the remainder of New Jersey with Shore Point Distributing and Kramer Beverage, as well as upstate and western New York with Oak Beverage, A.L. George, Saratoga Eagle, Lake Beverage and Dutchess Beverage.

For its new states, the brewery has partnered with Northeast Beverage and F&F Distributors in Connecticut, and C&C Distributors in Rhode Island. The company is also eyeing “even more areas for distribution over the next few months,” according to a press release.

“Over the past 10 years, our fans have been asking for Montauk on tap in their favorite bars outside of Long Island and NYC, and we are so excited to finally deliver,” Montauk co-founder Vaughan Cutillo said in a press release.

Montauk’s flagship Wave Chaser IPA (6.4% ABV), which accounts for about 50% of Montauk’s business, will “lead the charge” with the expansion, along with the brewery’s seasonals Montauk Summer Ale (5.6% ABV) and Watermelon Session Ale (4.9% ABV).

Tilray acquired 100% ownership of Montauk in November for an initial purchase price of $35.11 million, made up of $28.688 million

in cash and $6.422 million in stock, according to a 10-Q filing. Tilray was still in the process of assessing the final fair value of Montauk’s net assets as of Tilray’s Q2 2023 earnings report in January, but preliminary estimates value the brewery’s total assets to be worth $53.403 million, with $8.048 million in liabilities, for a net asset value of $45.355 million.

Montauk joins a bev-alc portfolio Tilray has been building since 2020, including Atlanta, Georgia-based SweetWater Brewing, Breckenridge, Colorado-based Breckenridge Distillery and San Diego, California-based Green Flash and Alpine Brewing. At the time of the Montauk acquisition, Tilray chairman and CEO Irwin Simon expressed the company’s intent to “leverage SweetWater’s existing nationwide infrastructure and Montauk Brewing’s northeast influence” to “significantly expand” Tilray’s overall distribution network and grow all its bev-alc brands.

“Our meetings with distributors in these new footprints have been exciting and productive,” Tara Hanley, Northeast area sales manager for Sweetwater and Montauk, said in the release. “They see the momentum and impressive scan data in Metro NY, so the time is perfect for Montauk to expand. The fans are ready, the brand is ready, and we are ready to work closely with all of our new partners.”

Montauk’s production volume declined -4%, to 46,935 barrels, in 2021, the majority of which was contract brewed, Montauk general manager Terry Hopper told Brewbound in November. The combined annual output for all four of Tilray’s craft brands would be more than 309,000 barrels of beer, according to the BA’s 2021 estimates.

For more stories, check out brewbound.com

23

ALT DAIRY

Willa’s has unveiled a revamped formula for its shelf-stable Barista Oat Milk, which features whole grain oats, fi ltered water, vanilla extract, maple sugar and salt. Each 8 oz serving contains two grams of fiber and four grams of protein. Willa’s Barista Oat Milk is available online for $39.99 per 6-pack of 32 oz. boxes. For more information, visit willaskitchen.com.

Plant-based nutrition company PlantBaby unveiled the newest innovation under its Kiki Milk brand, Mac Nut Kiki Milk. Available in shelf-stable 32 oz. cartons, the product is crafted with organic macadamia nuts, organic Brazil nuts, organic cashews and organic sprouted pumpkin seeds. Mac Nut Kiki Milk is available online for $52 per 6-pack. For more information, visit kikimilk.com.

Treehouse Milk relaunched with a new line of canned pecan milks under its Treehouse Naturals sub brand. Offered in two flavors – Original and Chocolate – the nut milk comes in 7.5 oz. cans and is currently available online for $39.99 per 8-pack. For more information, visit treehousenaturals.com.

Elmhurst has expanded its plant-based milk and creamer lineup with Maple Walnut Barista Edition. The new offering combines walnuts, oats and maple syrup to create a creamy consistency that “steams and froths flawlessly,” the brand claims. Elmhurst Maple Walnut Barista is available at Sprouts Farmers Market nationwide for a suggested retail price of $6.99. For more information, visit elmhurst1925.com.

CSDs

Pepsi celebrated spring early with the relaunch of its limited edition Peeps-flavored soda. The marshmallow treat-inspired flavor debuted in spring 2021 as an LTO given away to a few thousand lucky consumers through a contest. This time around, Pepsi x Peeps will be available at retailers nationwide in 7.5 oz. cans and 20 oz. bottles. For more information, visit pepsi.com.

Coca-Cola teamed up with Grammy-awardwinning artist Rosalia to launch its self-pro-

claimed “edgiest” Coca-Cola Creations product yet, Move. The “transformation”-flavored beverage trades out the brand’s iconic red can for pink and black packaging and is slated to hit store shelves across the United States, Canada and 20 other markets later this month in regular and zero-sugar varieties. For more information, visit coca-colacompany.com.

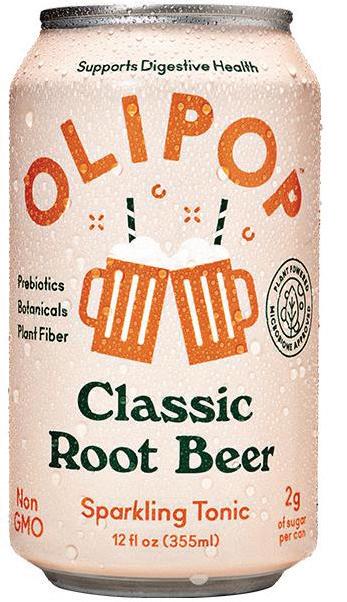

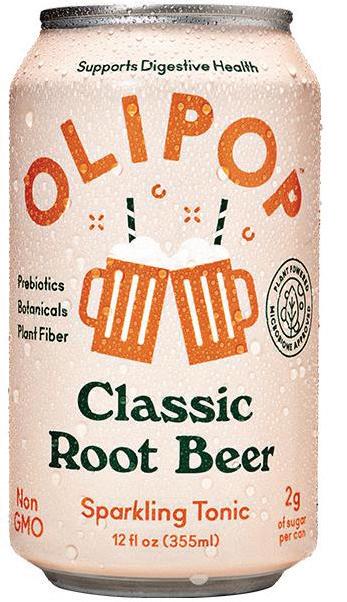

OLIPOP expanded its lineup of prebiotic sodas with the addition of a new Lemon Lime flavor. According to the brand, the new offering tastes like “sweet key lime pie with a squeeze of lemon” and contains just 4 grams of sugar per 12 oz. can. OLIPOP Lemon Lime will soon be available online and at retailers nationwide such as Target, Wegmans and Whole Foods for $35.99 per 12-pack. For more information, visit drinkolipop.com.

COFFEE

TikTok star Chris Olsen has entered the CPG world with the release of his new sustainable coffee brand, Flight Fuel. Inspired by Olsen’s “Flying for Coffee” series – where he hand delivers coffee to the likes of Kamala Harris, Ashley Tisdale and Megan Trainor – each Flight Fuel product is named after one of the world’s major airports. At launch, the line includes LAX Vanilla and JFK Caramel coffee concentrates, which contain 94.5 mg of caffeine per serving. Both concentrates are available online for $20 per 8 oz. bottle. For more information, visit fl ightfuelcoffee.com.

STOK expanded its lineup of cold brew products with the addition of Espresso Blend. The new offering features tasting notes of chocolate, brown sugar and dried fruit and is available at retailers nationwide for a suggested retail price of $5.99 per 48 oz. bottle. For more information, visit stokbrew.com.

Philadelphia-based specialty coffee roaster La Colombe announced the launch of a new 42 oz. multi-serve cold brew product. Available in four flavors – Little Bit Sweet, Mocha, Caramel and Vanilla Oatmilk – the multi-serve cold brews will be available at select retailers for a suggested retail price of $6.29 each. For more information, visit lacolombe.com.

24 BEVNET MAGAZINE • MARCH/APRIL 2023 The Newest Beverage Options New Products

ENERGY

Monster’s performance energy drink brand Reign announced the launch of a new line extension, Storm. Available in four flavors – Kiwi Blend, Harvest Grape, Valencia Orange and Peach Nectarine – the sugar-free functional beverages are slated to roll out in slim 12 oz. cans later this year. Storm marks the third product in the Reign portfolio, joining Reign Total Body Fuel and Reign Inferno. For more information, visit reignbodyfuel.com/en-us.

RTD COCKTAILS

Tequila seltzer maker Casatera unveiled its latest innovation, a Tropical Collection Variety Pack. Slated to roll out in March, the collection features four flavors: Mango, Pineapple, Passionfruit and Coconut. Each 12 oz. can (7% ABV) contains zero sugar and zero carbs. Casatera Tropical Collection Variety Pack will be distributed across eight U.S. markets including Florida, Massachusetts and New York. For more information, visit drinkcasatera.com.

Tip Top Proper Cocktails rolled out a new RTD 100ml canned cocktail: The Jungle Bird. Available online for a limited time via Tip Top’s website, the cocktail features just four ingredients: rum, lime, pineapple and red bitters. Bottled at 50 proof, The Jungle Bird (25% ABV) is available for $39.99 per 8-pack. For more information, visit tiptopcocktails.com.

SPIRITS

Known for designing custom luxury game tables, from billiards to poker and more, 11 Ravens is now looking to offer players a premium spirit to sip at their next game night as well. The company launched Ravella, a tequila brand debuting nationwide with an Extra Añejo expression. The cask strength spirit is produced in small batches in Jalisco, Mexico and will retail for $279.99 per 750 mL bottle. For more information, visit ravellatequila.com.

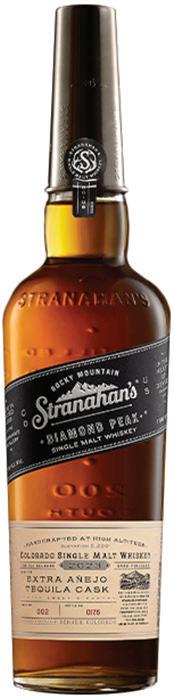

Stranahan’s Colorado Whiskey announced its second annual Diamond Peak release: Diamond Peak Batch #2: Extra Añejo Tequila Cask. The single malt whiskey is aged 5-8 years in Stranahan’s whiskey barrels and

then spends another two years in Extra Añejo aged casks that previously held Jose Cuervo’s premium Reserva de Familia tequila.

Maryland-based Old Line Spirits is introducing two new American single malt whiskeys: Flagship (95 proof) and Navy Strength (114 proof). Flagship is aged between 4-6 years and, carrying an SRP of $44.99 per 750 mL bottle, will replace the distillery’s previous 86 proof American single malt offering. Navy Strength will retail for $54.99 per 750 mL bottle. For more information, visit oldlinespirits.com.

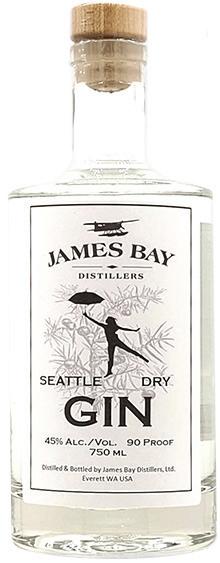

Honoring its Pacific Northwest home, James Bay Distillers has launched a Seattle Dry Gin, bottled at 90 proof (45% ABV), featuring a prominent coriander flavor to provide “a true on-the-rocks dry gin to sip and enjoy with food.” The distillery recommends pairing the spirit with roast lamb, pork or beef and roast vegetables.

TEA

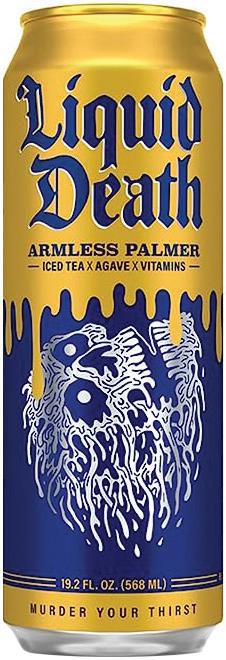

BevNET’s 2022 Brand of the Year, Liquid Death, used Expo West to formally launch its previously announced first non-water product, a 3-SKU line of flavored iced teas in 19.2 oz cans: Armless Palmer, Rest in Peach and Grim Leafer. Similar to the brand’s flavored sparkling waters launched last year, the teas are sweetened with agave, while packing 30 calories, 30mg caffeine, B vitamins and 6 grams of sugar per can. The release is part of the company’s ambitious growth plans for this year, which also include a shift to U.S. production for its waters.

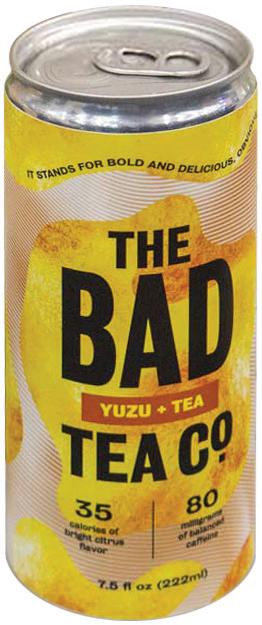

Formerly known as Chatty Matcha, The BAD Tea Co. made its Expo West debut with an expanded product line, including nitro chai and Yuzu + Tea flavors, the latter intended as a unique riff on a classic Arnold Palmer. Each 7.5 oz. can contains 35 calories and 80 mg of caffeine. The company’s original nitro matcha drink remains, too.

Known for developing unique flavors without deploying sweeteners, Rishi Tea’s family of sparkling botanical drinks continues to expand with the introduction of Blue Tea Jasmine. For more information, visit sparkling-botanicals.com.

26 BEVNET MAGAZINE • MARCH/APRIL 2023

Channel Check

SPOTLIGHT CATEGORY

PREMIXED COCKTAILS

There have been so many interesting new brands that have joined the premixed cocktail market, but here in the MULOtracked categories it’s hard to find many breaking through. That doesn’t mean that entrepreneurial brands aren’t on the rise: look at Buzzballs and Beatbox as independent brands that are growing in mainstream retail. But the rising tide is also benefitting newly acquired companies like On the Rocks and Cutwater, both of which are tied to big organizations. Look for a lot of mixing of the old and new as little brands like Long Drink and big ones like Jack and Coke start getting tracked more closely.

PREMIXED COCKTAILS

TOPLINE CATEGORY VOLUME

28 BEVNET MAGAZINE • MARCH/APRIL 2023 What’s Hot and What’s Not

BRAND DOLLAR SALES CHANGE vs YEAR EARLIER Buzzballz $148,950,462 53.4% Rancho La Gloria $115,845,951 -6.8% Cutwater Spirits $96,217,948 41.4% Jose Cuervo $88,770,567 -15.3% On The Rocks $53,024,657 79.1% Dailys $51,523,518 -25.6% Crown Royal $46,089,723 67.2% Beatbox $44,507,072 110.0% Monaco $44,479,300 36.2% Chi Chis $39,396,077 6.6% 1800 $23,125,010 -22.7% Uptown $21,135,369 10.2% Long Drink $16,962,818 280.2% Uno Mas $16,482,180 -10.2% Devils Backbone $15,688,382 65.9% Jack Daniels $14,068,459 156.1% Flybird $12,604,184 20.4% Bacardi $12,404,027 26.6% Liqs $11,732,030 122.6% Malibu $10,504,983 501.3%

Sports Drinks $10,897,834,469 12.0% Bottled Juices $8,650,351,261 7.7% Bottled Water $24,293,157,800 11.3% Energy Drinks $19,093,664,054 11.2% Tea/Coffee - RTD $8,257,319,085 4.9% Liquid Drink Enhancers $530,306,374 1.6% SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 02-26-23

CAPPUCCINO/ICED COFFEE

CANNED

FLAVORED SELTZER/SPARKLING/MINERAL

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 02-26-23

30 BEVNET MAGAZINE • MARCH/APRIL 2023

BRAND DOLLAR SALES CHANGE vs. YEAR EARLIER Red Bull $7,169,880,072 6.7% Monster $5,369,774,554 10.9% VPX $980,663,873 -27.3% Celsius $883,414,502 148.3% Rockstar $710,982,911 1.4% NOS $452,610,554 9.1% Reign $449,076,178 2.0% C4 $371,515,397 118.1% Alani Nu $355,620,214 102.1% Ghost $329,422,878 901.1%

ENERGY DRINKS

BRAND DOLLAR SALES CHANGE vs. YEAR EARLIER Starbucks $2,244,885,196 6.9% Monster $704,961,169 3.8% Coca Cola $170,334,723 -7.8% Black Rifle Coffee Co $119,946,005 106.3% Private Label $63,548,867 9.2% Kitu Super Coffee $53,717,529 12.7% Intl Delight $32,219,099 109.1% La Colombe $29,494,483 3.3% VPX $16,810,845 -57.3% Black Stag $15,579,726 398.8%

AND BOTTLED

BRAND DOLLAR SALES CHANGE vs. YEAR EARLIER Pure Leaf $973,346,040 2.8% Arizona $929,536,757 7.7% Lipton $557,922,717 -0.6% Gold Peak $539,137,460 13.1% Brisk $443,009,292 11.4% Snapple $383,412,155 2.2% Monster $195,869,080 1.2% Guayaki $141,849,782 7.6% Peace Tea $92,095,290 -5.7% Private Label $91,371,921 49.3%

TEA

BRAND DOLLAR SALES CHANGE vs. YEAR EARLIER Sparkling Ice $843,292,642 1.7% Private Label $670,740,275 6.3% La Croix $543,155,156 -0.7% Bubly $380,541,002 -1.6% Polar $299,728,247 19.5% Spindrift $158,769,531 35.1% Perrier $140,620,721 -12.8% Aha $135,126,541 -10.8% Waterloo $107,509,700 51.5% Bubbl R $92,318,856 69.0%

RFG KOMBUCHA

NONFLAVORED CONVENIENCE/BOTTLED STILL WATER

SPORTS DRINKS

TOP BEER VENDORS

31 SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 02-26-23

BRAND DOLLAR SALES CHANGE vs. YEAR EARLIER Anheuser $16,209,047,685 -0.6% Molson Coors Brewing $7,618,060,077 2.2% Constellation Brands $7,489,794,528 12.0% Mark Anthony Brands Inc $2,933,953,804 2.9% Boston Beer Co $2,422,148,394 0.0% Heineken Usa Inc $1,513,665,689 -8.4% Diageo Beer Company Usa $756,509,611 3.6% Pabst Brewing Co $553,776,173 2.7% Kirin-Lion $549,551,153 16.6% D G Yuengling & Son Inc $415,969,683 -1.5%

BRAND DOLLAR SALES CHANGE vs. YEAR EARLIER Gatorade $6,943,253,885 12.5% Bodyarmor $1,530,112,235 -4.4% Powerade $1,211,725,292 -3.0% Electrolit $355,755,147 35.0% Prime $159,729,662 7265.5% Private Label $66,284,794 16.5% Biolyte $38,810,005 38.0% Pedialyte $37,294,323 55.9% Suerox $8,200,027 69.2% VPX $4,651,273 119.3%

BRAND DOLLAR SALES CHANGE vs. YEAR EARLIER Private Label $5,203,033,606 28.6% Aquafina $1,309,197,661 3.8% Glaceau $1,164,443,820 13.3% Dasani $960,185,437 -3.1% Poland Spring $906,612,062 12.4% Pure Life $756,025,262 -0.4% Deer Park $559,141,847 14.0% Fiji $528,928,715 4.0% Essentia $491,552,267 9.4% Ozarka $458,436,339 12.0%

BRAND DOLLAR SALES CHANGE vs. YEAR EARLIER GTS $304,742,181 3.7% Health Ade Kombucha $105,554,587 10.0% Kevita $60,829,657 -18.6% Brew Dr Kombucha $34,998,999 9.6% Private Label $28,057,595 -4.2% Humm $20,741,474 11.0% Aqua Vitea Kombucha $4,761,477 -2.2% Live $4,454,539 -8.7% Mother Kombucha $3,039,328 9.7% 221 B C Kombucha $2,689,843 27.6%

Expo West 2023 Recap: Exits and Expansions Abound

Despite economic clouds looming ahead, Natural Products Expo West was back in full force this March, as brands, entrepreneurs and industry members brought energy and innovation worthy of the year’s biggest natural trade show.

As the doors opened on day one of Expo West, several brands used the occasion to announce exits, starting with renewable drinking water technology company SOURCE Global’s acquisition of sustainable packaged water brand Proud Source.

Speaking at Proud Source Water’s booth in Expo’s North Hall, Neil Grimmer, Global CPG President for SOURCE Global, described the acquisition as a natural decision as the two companies aligned on multiple points: Both businesses are certified B Corps, both emphasize sustainability and access to water as key values, and – yes – they both have “Source” in their names.

“You’ll walk around the show, and you’ll see brands with a cool graphic design on the pack and edgy marketing campaigns; Proud Source is different,” Grimmer told BevNET.

SOURCE Global is the manufacturer of the SOURCE Hydropanel, a renewable technology that sources water from vapors in the air and converts it into drinking water. To date, the company has placed its panels around the world to help provide easier access to water to dry and impoverished regions, as well as selling its own line of bottled waters under the SOURCE name.

Based in Idaho, Proud Source Water produces a line of aluminum-packaged bottled waters in bottles and cans. Its water comes from naturally alkaline springs in Mackay, Idaho and Marianna, Florida, and SOURCE Global has acquired the company’s two manufacturing facilities at those sites as part of the deal. The brand is distributed nationwide, including

a partnership with PepsiCo Beverages North America it entered in 2021.

Also at the show, Arkansas-based GEN Z Water announced its acquisition by family owned beverage company Langers Juice for an undisclosed amount.

One of several non-PET packaged water startups to emerge in the wake of Liquid Death’s rise, GEN Z has made its tonguein-cheek approach to marketing “flavorless transparent liquid” its calling card. The company launched online in August 2021 with in reusable 20 oz. aluminum bottles (available individually and in 12-packs), and has since entered brick-and-mortar retailers in the Midwest, as well as moving into Target.

For California-based Langers, adding GEN Z gives the beverage maker a stake outside of fruit-based categories, as represented by its Langer Farms juices and No Worries cocktail mixer brands. The company markets an organic flavored sparkling water and a caffeinated sports drink called LyteAde.

Catching up with BevNET at the show, GEN Z co-founder Doug Batie said he was “not shocked” that his company achieved such an early exit, as the company’s trajectory since launch has put it on track to “skip” scaling and go right to a sale. A former executive at Welch’s, Batie noted his familiarity and connections with Langers helped create the relationship, and that the pitch wasn’t difficult once Langer understood how the brand is positioned around “aspirational” marketing rather than emphasis on the liquid itself.

As for the product itself, Batie said GEN Z will continue to utilize its network of co-packers as it transitions fully into its new parent company. The Arkansas-based brand will also maintain its geographic focus on growing accounts in the

32 BEVNET MAGAZINE • MARCH/APRIL 2023 By BevNET Staff Event Coverage

Midwest, where it is carried at chains like Target and OnCue. Elsewhere, Asian-inspired seltzer Sanzo’s brand new SKU, Pomelo, along with a revamped packaging design, were the main highlights at its booth. But the introduction of 6-count and 12-count multipacks – the format which drives over 90% of flavored sparkling water sales, according to Sanzo – may represent an even more significant step.

According to founder and CEO Sando Roco, the new 6-packs are entering a “high percentage of our existing retail partners” in March at $9.99, but the format is also opening new doors.

“We are excited that over 1,000 new doors have already been signed on in key regions such as the Northeast, California and the Pacific Northwest, and we expect to onboard more strategic partners in key regions coming out of Expo West and heading into peak season,” Roco said.

Sanzo’s launch of the Multipack reflects a deeper purpose. Sanzo’s mission from launch has been centered on bridging Eastern and Western cultures, as it “reflects a trust that the product will be loved and shared with family and friends.”

Amidst much discussion of topics like functional ingredients and sustainable agriculture on the trade show floor, there was a noticeable lack of concern amongst brands we spoke with regarding erythritol.

To recap, a study published in February in the scientific journal Nature Medicine reported that erythritol appeared to be causing blood platelets to clot more easily in patients. Research also indicated that people with existing risk factors for heart disease were twice as likely to experience a heart attack or stroke if they had higher levels of erythritol in their blood compared to lower levels.

That bit may have made a good headline, but the beverage entrepreneurs we spoke with at the show who are actively working with the sweetener didn’t view the study as a makeor-break moment for erythritol.

One natural energy drink brand leader noted that the ingredient has been recognized as GRAS by the FDA for several decades, while also questioning the dosages administered to subjects in the study. Another noted that, across the range of sugar alternatives currently available, erythritol has established itself as superior to others, despite what this new study may suggest.

Most notably, none of the people we spoke to who actively use erythritol had any plans to stop doing so – at least for the moment.

33

Winter Fancy Foods Show Recap

The Specialty Food Association’s Winter Fancy Food Show returned to the Las Vegas Convention Center in February with plenty of new product innovations in the beverage set, including updated positioning for kombucha brands and growing prominence for outer space aesthetics.

Clocking in at over 1,100 booths and approximately 13,000 registered attendees, the show saw a rise of new ingredient trends and emerging brands, particularly in the non-alcoholic beverage space.