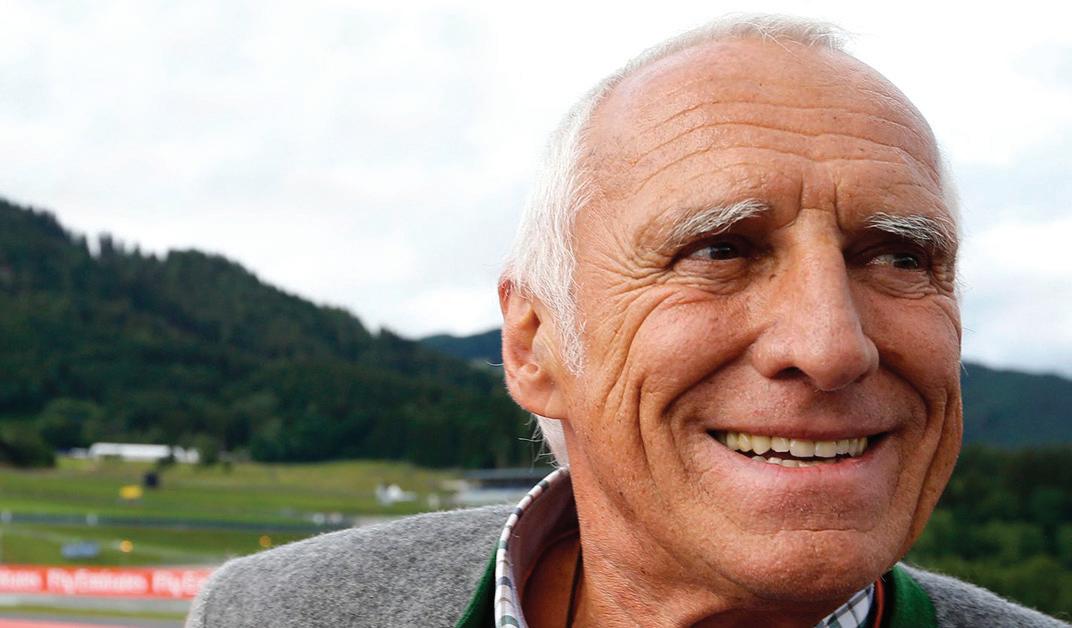

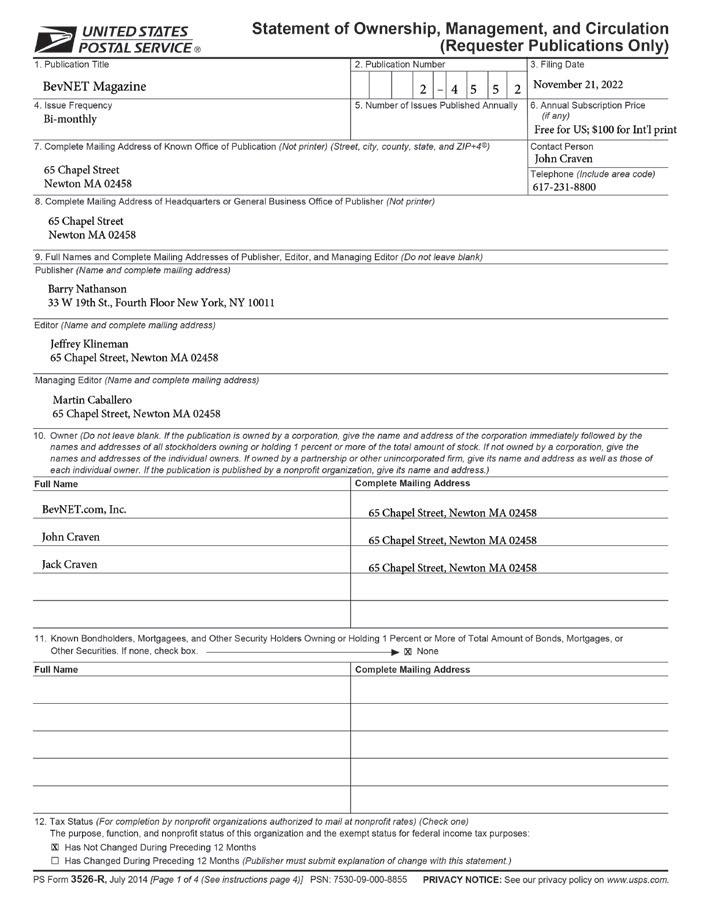

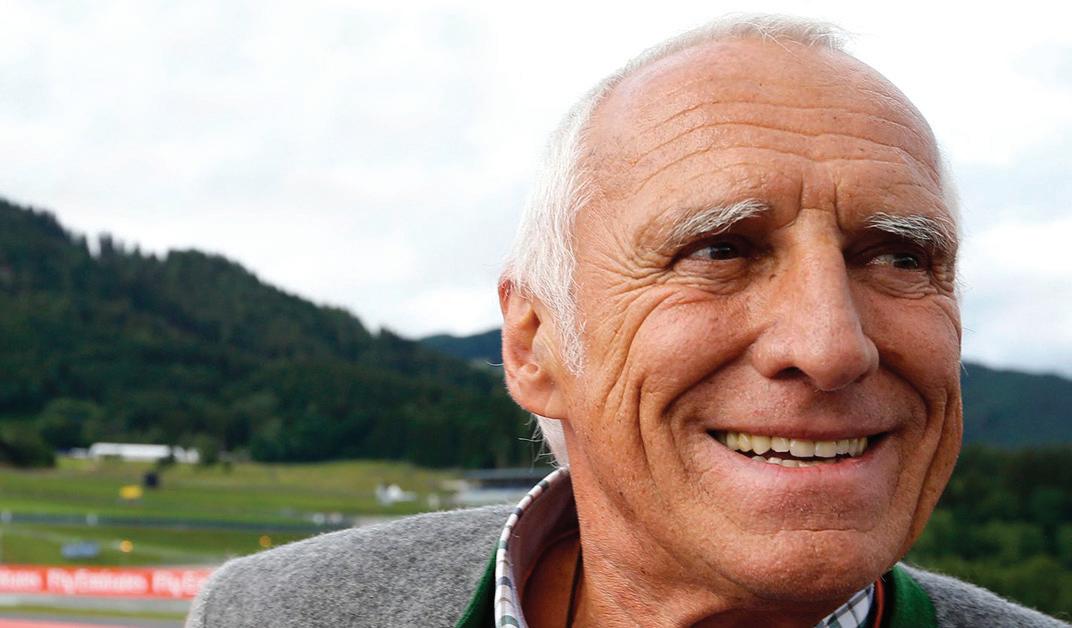

Contents / November – December 2022 / Volume 20 / No. 6 COLUMNS 6 First Drop Influencers Find the Brand Building Shortcut 8 Publisher’s Toast Beverages Still For The Dreamers 42 Gerry’s Insights Dietrich Mateschitz’s Lasting Legacy DEPARTMENTS 12 Bevscape/NOSHscape/Brewscape VPX Files for Chapter 11 Bankruptcy Protection; FDA Defines ‘Healthy’ On-Pack; Reyes Strikes Again with Deal for Paradise Beverage in Hawaii 32 New Products Red Bull, Zevia & La Colombe 36 Channel Check Ciders Take Center Stage 120 Promo Parade Monster Energy Inks Deal With New York Rangers EVENT COVERAGE 44 Show Preview NACS 2022 Recap: Lots of Iced Tea, Plus Tropical Wave FEATURES 46 Sparkling Water Innovation Driving Options On-Shelf (with Brand News) 52 Kombucha & Probiotics Booze Makes a Comeback (with Brand News) 60 Dairy & Alt-Dairy Shifting Strategies Highlight Health (with Brand News) SPECIAL SECTION 67 New Beverage Guide MAGAZINE BevNET Magazine (ISSN 2165-6061, USPS 24-552) is published bi-monthly by BevNET.com, Inc. 65 Chapel Street Newton, MA 02458. Periodicals postage paid at Boston, MA and additional mailing offices. POSTMASTER: Please send address changes to BevNET Magazine, Subscriber Services, 65 Chapel Street Newton, MA 02458 www.twitter.com/BevNET www.facebook.com/bevnetcom www.bevnet.com/magazine/subscribe Follow Us Online 46 52 60 67 5 NEW BEVERAGE GUIDE • 2022 Cover Image By: Garnish Studios - www.garnishstudios.com

BY JEFFREY KLINEMAN

The Brand Builder’s Shortcut?

It’s likely that by the time this hits your desk/inbox/birdcage fl oor I’ll have interviewed a woman named Emma Chamberlain about her Chamberlain Coffee brand during our NOSH Live show, along with Chris Gallant, her company’s CEO.

The interview will have been an attempt to understand this so-called “Creator Economy” – a fancy name for brands started by the social media stars your kids are watching on Youtube/ Instagram/TikTok/Twitter (note I didn’t say LinkedIn, where I tend to hang out). In researching the interview, I’ve come to understand that a lot of entrepreneurs are fearful of the implications of the Creator Economy, as they are worried that they’ll get squeezed out by someone with strong bandwidth and a ready-made audience. Should they?

The always coffee-slurping Chamberlain has an audience and more: her team claims she has 35 million followers; she launched her company in 2019 and it pulled in more than $7 million in investment this year, not bad for a brand that so far consists of steeped coffee bags, beans, some fl avor collaborations and a lot of fun accessories.

Chamberlain’s popularity comes through her sense of being “real.” Her early videos combined the angsty confessional style of a 17-year-old raised on reality shows with the silliness of a smart kid who has had too much caffeine. She doesn’t really rely on stunts, drugs, the latest dances or pure bodily objectifi cation. She’s also a talented editor who is able to get a message and mood across through fi lters, the addition of quick-cut meta-commentary on her own monologues, and a willingness to never take Emma Chamberlain the character too seriously. It worked: she’s now got a podcast, has been on Jimmy Kimmel and to the Met Ball: fashion houses like Louis Vuitton have started dressing her up and sponsoring her, she’s making lots of money and has swanned from talkative teen into a model and fashion infl uencer.

So if she’s able to take these followers and turn them into coffee drinkers, that has to mean something, right? It’s an evolutionary moment – we’ve gone from hiring a celebrity to endorse a brand (think Miller Lite commercials), to having a celebrity invest time or money in a brand and support it (think Vitaminwater), to having a brand bring in a celebrity “co-creator” (think Zoa or Foodstirs). Now, the Creator gets top billing; the product is an extension of their popularity and audience devotion. The rest of the business is assembled behind them, and if it gets traction, it scales.

Here’s the great part about something like Chamberlain Coffee: it’s absolutely an inch wide and a mile deep. Her followers are late teens and early 20s: Gen Z for sure. But how long will they stay with her?

It’s in researching this point that I became a cool uncle, because I got to DM my nieces and tell them about my interview with Chamberlain, which they thought was much more interesting than parts of my job that involve getting yelled at by, say, the founder of BANG.

My 25-year-old niece Margot – a graduate student and former investment banker – was aware of Chamberlain, but

on the outside of her sphere of infl uence (she was awed, nevertheless – I’m just that impressive). Younger, more fashion-focused friends of hers had much more developed opinions about Chamberlain, her style choices, and her coffee brand. They were all positive! Their texts about her had lots of “!!!!”

My younger niece Rebecca, a soccer-playing college junior, reached out to her cohort for an incredible trove of Emma treasures. At 21, both her college and high school friends had actual relationships Emma. They loved her podcast because she’s “super relatable but also is mature beyond her years and gives very good advice.” They love her style and think “she isn’t controversial and defi nitely sets a lot of fashion trends and such,” and that “she has a slay personality and is super funny.”

Asked about her coffee, there was agreement that it fi t her brand. One fan admired the brand’s “great aesthetic – I have two totes and a Mason jar.”

Then I reached out to my sister, Andrea, who is the mother of these two amazing nieces. What follows is a direct quote from our text exchange:

Me: Your daughters have been very helpful in my research into an upcoming interview with Emma Chamberlain. So thank you for having them.

My Sister: Who is she?

Me: Exactly.

So there you go. What will it take to extend these brands to niches beyond their founders’ followers? What will it take for the founders themselves to keep their followers interested for life? And, of course, are the products any good?

In Chamberlain’s case, they seem to fi t the moment for sure. They are customizable, she has great recipes, it looks cool. It’s a extension of her brand, it makes sense, it resonates with her image and her audience. But I worry. Not so much about the coffee, but about us.

I’m worried that we might be living in a society in which being famous means that you’re qualifi ed to do all kinds of things that you probably shouldn’t, like be President. Still, as we saw in that last example, if people don’t like the brand, they’ll reject it once they get the chance. Meanwhile, enjoy your coffee.

THE FIRST DROP

6 BEVNET MAGAZINE – JANUARY/FEBRUARY 2018

NOVEMBER/DECEMBER 2022

Photo by Samara Doole

on Unsplash

The Long Run

Yesterday was a majestic day in New York: the New York Marathon was back in all its glory. Over 50,000 runners from all corners of the world participated in this iconic event. While the temperature, in the 70’s, was more reflective of late spring or early fall, it made for great viewing. The cloud cover and a little sprinkle made it bearable for the runners, so a great time was had by all. As I stood at the same spot that I’ve perched at for 30 years, I heard so many different languages spoken, country flags waved, and saw so many different beverages in the hands of spectators.

I thought back to the early days of the race, and how my viewing coincided with my entry into the beverage space. It made me aware of what people were drinking. Back in those days, the choices were few. Obviously, the runners were pretty much imbibing just water. Gatorade and other sports drinks were just entering into our spheres. The spectators were pretty much drinking soda. Beverage Marketing Corp. had just coined the term “New Age Beverages” and they were just starting to make an impact on our world. Boy, did it ever explode over the next few years, leading to

the plethora of options we have today. In this limited space, I couldn’t even begin to list the categories that sprouted up. There have been thousands of brands that have crossed my desk. To those of you that have stopped by my office, you’ve seen shelf upon shelf of products lining my walls. So many ask to be placed on what they believe is a wall of fame – but I always share that all the products are ones that have failed. It is my cautionary tale of how hard it is to be successful in the beverages.

What has not changed in the 30 plus years I’ve observed the beverage arena is the failure rate, which is still close to 90 percent. There are so many reasons brands fail that I cannot begin to objectively list them, but that is the reality. It is also the reason I so admire all of the marketers with an idea, an execution plan and a hope to achieve success. All the dreamers who dared to enter the fray are to be praised for their efforts. There is still a place to make it in the marketplace. I hope you are one of the success stories, and that I get to see someone chugging you either to get through the Marathon, or sipping it for enjoyment from the sidelines.

www.bevnet.com/magazine

Barry J. Nathanson PUBLISHER bnathanson@bevnet.com

Jeffrey Klineman EDITOR-IN-CHIEF jklineman@bevnet.com

Martín Caballero MANAGING EDITOR mcaballero@bevnet.com

Ray Latif CONTRIBUTING EDITOR rlatif@bevnet.com

Brad Avery REPORTER bavery@bevnet.com

Justin Kendall NEWS EDITOR, BREWBOUND jkendall@bevnet.com

Carol Ortenberg EDITOR, NOSH cortenberg@bevnet.com

Adrianne DeLuca REPORTER adeluca@bevnet.com

Lukas Southard REPORTER lsouthard@bevnet.com

SALES

John McKenna DIRECTOR OF SALES jmckenna@bevnet.com

Adam Stern SENIOR ACCOUNT SPECIALIST astern@bevnet.com

John Fischer ACCOUNT SPECIALIST jfischer@bevnet.com

Jon Landis MANAGER OF BRAND RELATIONS jlandis@bevnet.com

ART & PRODUCTION

Aaron Willette DESIGN MANAGER

Nathan Brescia PHOTOGRAPHER

BEVNET.COM, INC.

John F. (Jack) Craven CHAIRMAN

John Craven CEO & EDITORIAL DIRECTOR jcraven@bevnet.com

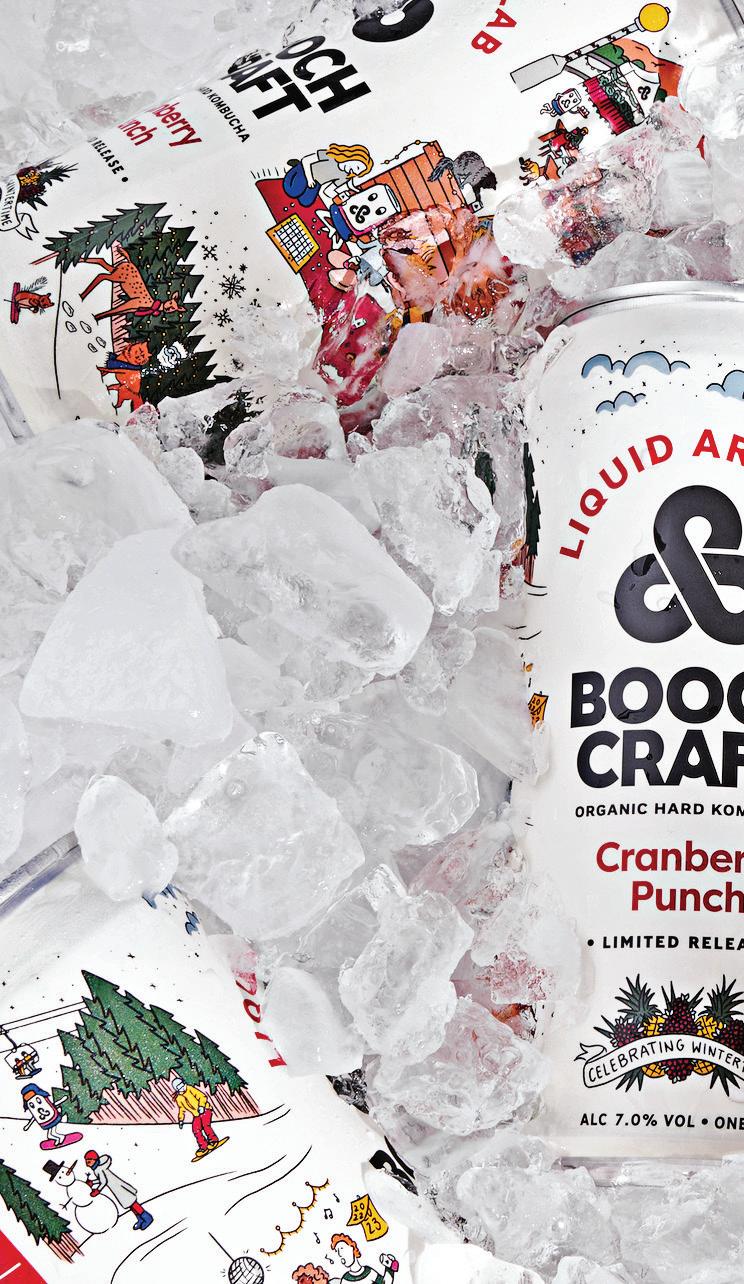

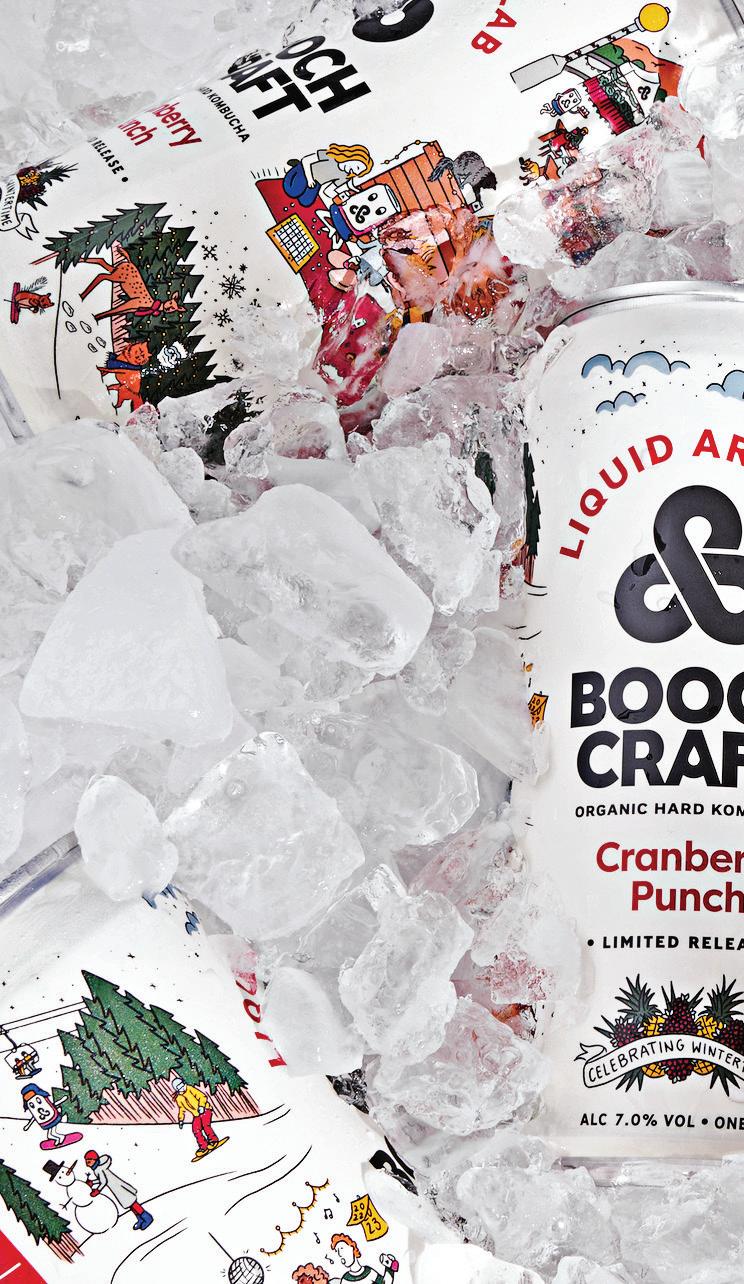

HEADQUARTERS

65 Chapel Street Newton, MA 02458 617-231-8800

PUBLISHER’S OFFICE

1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

SUBSCRIPTIONS

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

BPA Worldwide Member, June 2007

Do Your Part: Please Recycle This Magazine PUBLISHER’S TOAST

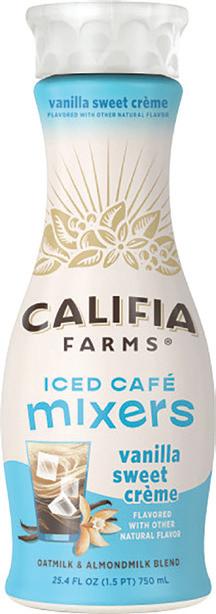

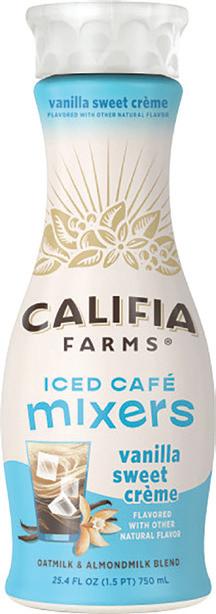

BARRY NATHANSON MAGAZINE 8 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

BY

BEVSCAPE

Liquid Death To Launch Iced Teas, Begin Shift to U.S. Production In

Can a brand built on counterculture, rebellion and fl aming skulls become the next big mainstream beverage giant? That remains to be seen, but Liquid Death CEO Mike Cessario is certainly up for the challenge.

In just a few short years, the former advertising executive has emerged as an unlikely visionary businessman, injecting a punk rock aesthetic and healthy disregard for ‘safe’ marketing tactics into a packaged water brand expected to clear $130 million in sales this year -- and to double in 2023. According to internal company documents viewed by BevNET, Liquid Death has achieved 94% national distribution coverage via DSD and broadline partners, carrying the ability to service 346,000 doors across the U.S., while only clocking in at 13% brand awareness. To the chagrin or disbelief of many, Liquid Death has achieved a $700 million valuation by selling water in a can, generating a war chest of $195 million in investment -including October’s $70 million Series D -- along the way.

If January’s $75 million Series C round was a confi rmation of Liquid Death’s growth thus far, October’s round underscores the belief that the brand can go even further, mainly thanks to the performance of its fl avored sparkling line released in January. Within three months of its introduction, the product had “gone nuclear,” according to Cessario, generating 40% of the brand’s total Amazon revenue without cannibalizing its existing business. In brick-and-mortar retail, the fl avored line outsold all varieties of Topo Chico in Target and became the #2 best-selling sparkling water at 7-Eleven. Retailers that had initially been skeptical on stocking a Liquid Death product that strayed from the brand’s zero-calorie, zero-sugar roots were eventually won over.

To Cessario, that experience has underscored Liquid Death’s true point of differentiation as a beverage maker: bringing otherwise disinterested consumers into the better-for-you space. Beyond the various publicity stunts and provocative ads, the brand has created a connection with its audience that allows its waters to play at retailers as diverse as Whole Foods and Walmart at virtually the same price. The early success of the fl avored line, positioned somewhere between a soda and a zero-calorie Sparkling Ice or Spindrift, suggests

that consumers are eager to evolve alongside the brand. It’s also now seeing its fi rst line extension since the launch with a fourth fl avor, Convicted Melon, launching in the near future.

“What we’re seeing is that the brand can be a platform for healthy beverages,” Cessario said. “Healthy beverage categories typically don’t have the most exciting, fun marketing; it tends to kind of be all very the same kind of bland. I think there’s a possibility for Liquid Death to go into multiple healthy beverage categories and sort of be the cool, fun brand. And for me, outside of our ‘Death to Plastic’ mission, what we’re really trying to do is bring healthy beverages to people who don’t typically drink them.”

The fi rst test of the brand’s broader viability is set to begin soon with the introduction of iced teas, Liquid Death’s fi rst non-water product. The line was previewed at the National Association of Convenience Stores (NACS) 2022 show in Las Vegas with three aptly named fl avors: Rest In Peach, Grim Leafer and Armless Palmer. The teas are expected to hit

12 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

THE LATEST BEVERAGE BRAND NEWS

2023

shelves this spring and will be available for $2.79 per 19.2 oz can ($17.99 per 8-pack case), with six grams of sugar from agave each.

Thanks to its large audience, healthy halo and dearth of recent large-scale innovation, the iced tea category “checked all of our boxes,” said Cessario. With just 30 mg of caffeine from black tea, the product allows Liquid Death to dip its toes in the general ‘energy’ space without going full force with a dedicated product, a move the CEO suggested was unlikely.

“When your brand is called Liquid Death, if you were to create an energy drink with 300mg of caffeine, and a kid could drink five in an hour and actually die, it’s not funny,” he said. “I think what makes us successful is taking something that is completely safe and having fun branding it as something extreme where it is very tongue-in-cheek and fun because it’s sort of two different worlds at odds with each other coming together. That’s what makes it interesting.”

The extension will also serve to test whether Liquid Death’s strong presence in on-premise channels can go beyond water. The brand is currently in over 400,000 restaurants, bars and other on-premise venues; through its exclusive partnership with Live Nation, where the product has found traction as a non-alcoholic option for partying and nightlife occasions. It’s unclear whether the iced tea will also be prominently featured in those channels or if it would be carried as the exclusive category product for Live Nation properties.

“For us, it’s more exciting to find products [where] maybe the category in general has never had the right kind of brand to bring, you know, more audience, or more different kinds of people into those categories,” Cessario said. “Places where there already are 100 cool, loud, exciting brands -- it doesn’t make as much sense to kind of go [into those categories].”

Iced tea -- and more potential innovations -- are expected to help fuel the company’s march towards profitability and stronger gross margins. But operations are also set for a major overhaul next year, as Liquid Death transitions its sourcing from “mountain water” from the Austrian Alps to natural springs in the U.S. Cessario said the move was “always on our radar,” but a lack of U.S. co-packers who could produce spring water in cans forced the company to source from abroad. Now that Liquid Death has more options stateside, the transition is expected to begin next year and be completed by 2024-2025, by which point gross margins are projected at 46-47%. Moving production to the U.S. will also sidestep ocean freight, which weighed down both profitability and the company’s more-sustainable positioning.

That growth, along with a planned expansion into Europe, will require even more funding, and October’s announcement teased the potential for Liquid Death to go public in the future. Having been encouraged by the $5.5 billion valuation attached to publicly traded energy drink company Celsius, Cessario called the prospect of an IPO “interesting” but emphasized that his company was not committing to going down that road just yet.

As the brand’s reach and platform widens, though, Cessario said Liquid Death will stick to the marketing approach that has taken it this far by focusing on “insane ROI on every marketing dollar” the company spends. In other words, don’t expect the brand to splash the cash on an NBA sponsorship anytime soon.

“When you create something where a lot of people legitimately love it and think it’s the greatest thing ever, but then you’ve got some people who completely don’t understand it and think it’s the dumbest thing ever, that kind of a dynamic has been proven to lead to a tremendous amount of success,” he said.

13

BEVSCAPE

VPX Files for Chapter 11 Bankruptcy Protection

Vital Pharmaceuticals (VPX), the maker of Bang Energy, has fi led for Chapter 11 bankruptcy protection.

Business operations will continue, the Florida-based company said in a press release in October, as it moves ahead with efforts to rebuild the Bang distribution network – now up to 269 DSD houses around the country – following the termination of the brand’s agreement with PepsiCo earlier this year. VPX has also received $100 million in loans from a syndicate of lenders to ensure operations are not interrupted during the Chapter 11 restructuring process.

“We are excited about our future, and particularly the new distribution system that we have spent the better part of this year assembling,” VPX founder and CEO Jack Owoc said in the release. “Utilizing our new state-of-the-art decentralized direct store distribution (DSD) will allow Bang Energy to get back to our pre-Pepsi meteoric annual success of several hundred percent year over year growth. We are coming like a freight train and cannot be stopped.”

The fi ling comes in the wake of a federal court ruling in September ordering VPX to pay $293 million in damages to Monster Energy Co. after a jury found that the company had violated the Lanham Act by falsely marketing its “Super Creatine” supplement as a functional ingredient in Bang that is superior to standard creatine. Those damages could be potentially tripled in a post-trial hearing, though VPX may appeal the decision.

During the trial, VPX’s attorney David P. Muth warned that a decision favoring Monster could potentially push the company into bankruptcy.

The legal blow came just months after VPX lost a separate trademark dispute with Monster and family-owned beverage brand Orange Bang, in which VPX was ordered to pay $175 million as well as a 5% royalty fee for every can of Bang sold.

Besides Monster, VPX has recently faced a spate of breach of contract lawsuits from PepsiCo, prior to a

mutually agreed upon termination of its distribution deal this summer. It is also engaged in a trademark infringement lawsuit with Sony Music Entertainment, which alleged the beverage brand improperly used its music in social media advertisements. Last month, a Miami federal judge sided with Sony in a pretrial decision, following a similar decision in a lawsuit against VPX from Universal Music Group last year.

VPX acknowledged in the release that the lawsuits played a role in the decision to fi le for bankruptcy protection, noting that the cases “impacted the Company’s shortterm outlook,” while the need to rebuild its DSD network led to a summer revenue gap. The company said it intends to use the Chapter 11 process to “recapitalize and emerge from bankruptcy well-positioned to continue its rapid growth in the beverage market.”

Though Bang has commanded a strong position in the U.S. energy drink category as the number three brand behind Monster and Red Bull – reporting over $1.1 billion in annual retail revenue – it has faced consistent and steep sales declines over recent months. According to NielsenIQ, retail dollar sales fell -21.3% in the two-week period ending September 24 and volume declined by -25%. Over the 52week period, sales dropped by -8.3% and volume was down -9.7%.

But in the release, Owoc projected a positive outlook, vowing that the brand would one day see a return to the triple-digit growth numbers it experienced in 2019 when it fi rst emerged as a signifi cant national brand eager to unseat Monster as the largest energy drink in the country.

“This company was founded on determination and a relentless passion for giving our customers and consumers what they want – and we will continue to do so,” Owoc said in the release. “I know we will successfully emerge from this process as a stronger company.”

14 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

Essentia Founder, Former CEO Reteam for Enhanced Water Brand Yesly

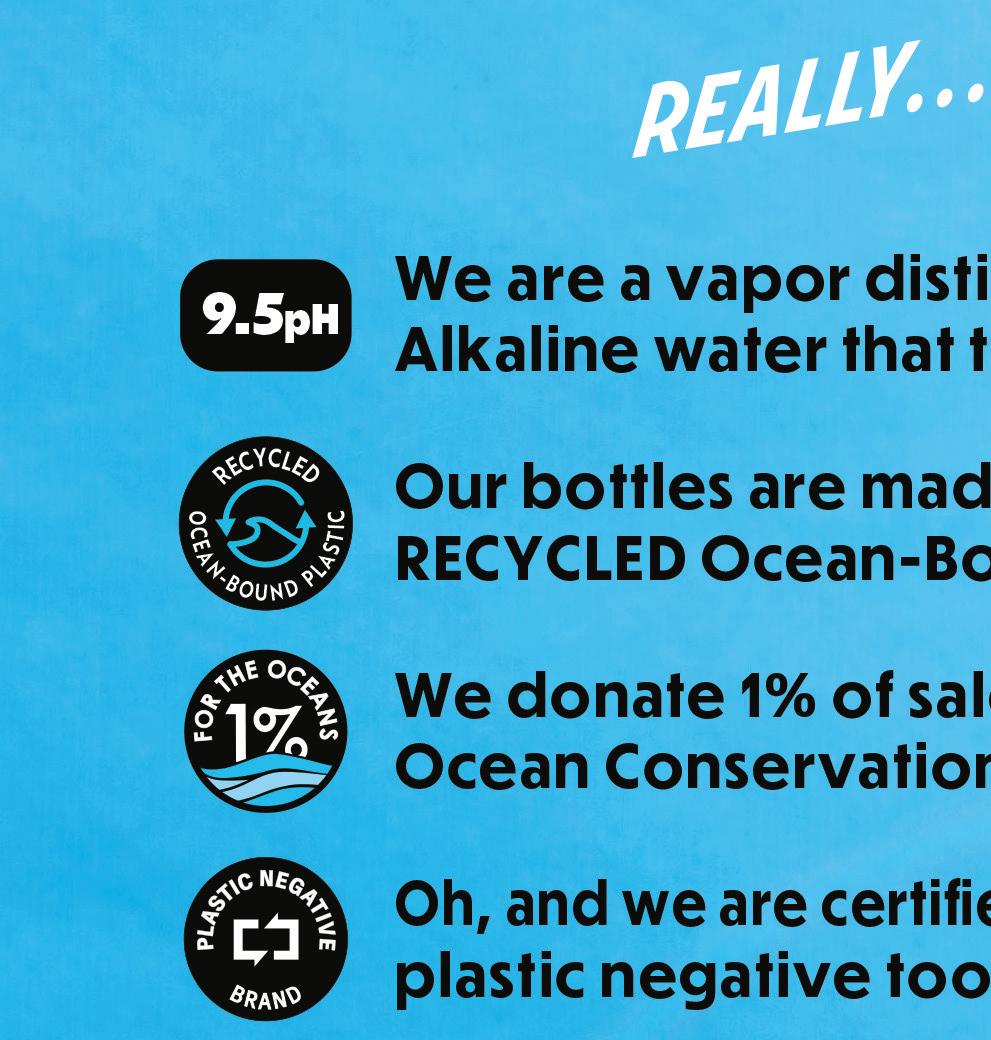

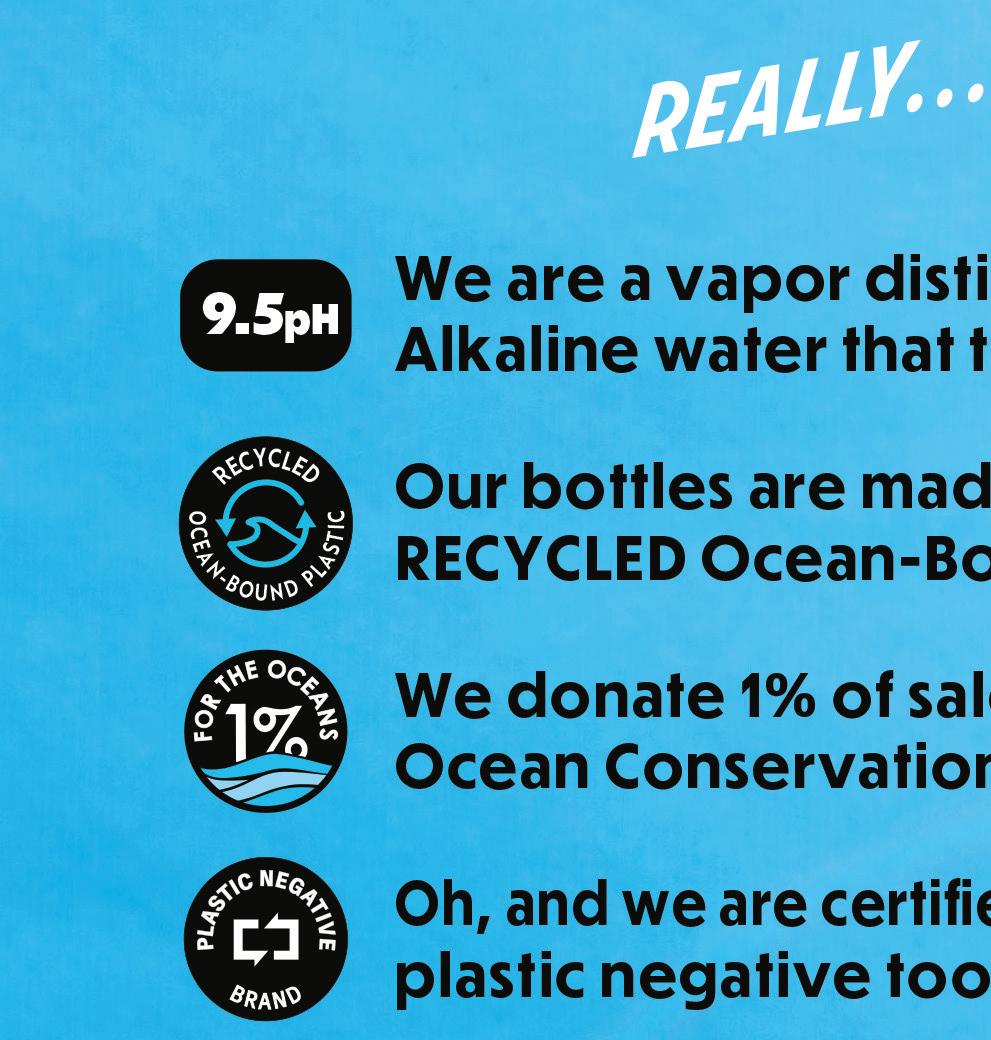

After an exit to Nestlé last year, Essentia founder Ken Uptain and its former CEO Scott Miller are jumping back in the water with Yesly, a new brand of canned enhanced waters launching early next year.

The new venture, fi nancially backed by Uptain with Miller serving as CEO, is targeting a white space for a zero calorie, better-for-you still beverage with functional benefi ts, the founders told BevNET this week. Billed on the 16 oz. cans as an “Enhanced Still Water Beverage,” Yesly contains vitamins B6, B12 and C and electrolytes and is sweetened with stevia. The drinks will be available in four fl avors: Pomegranate Acai Blueberry, Lemon, Black Cherry and Kiwi Strawberry. Pricing for the line is still being fi nalized.

As canned water brands like Liquid Death have fed demand for more options in the packaged water category, Yesly aims to provide a similar point of differentiation in the enhanced water set as its tall cans look to stand out on shelf from plasticpackaged national brands like Vitaminwater and Bai.

“After having successfully had the opportunity to transition the [Essentia] business to Nestlé, we sat down and chatted about what’s next,” Miller said. “We really thought that the water category had just continued to have such great growth with multiple consumption [occasions] throughout the day that Ken and I decided to start a new brand, which is really in the area of what I’ll call the ‘On-the-go lifestyle brand.’ Whether you’re taking a walk, whether you’re hiking or just on-the-go throughout the day.”

Uptain founded Essentia in 1998, leading the brand over the course of two decades as it became a nationwide premium bottled water player. Miller, the former CEO of Tampico Beverages, joined the company as CEO in June 2020 overseeing its fi nal leg of growth leading up to the exit –reported to be in the high nine-fi gures – in March 2021.

While Miller’s tenure with Essentia was relatively brief, leaving the company in February, he and Uptain said they became fast friends who shared a business philosophy, making the creation of a new beverage brand a natural next step. Much like their Essentia colleague, former chief strategy offi cer Neil Kimberley, who jumped back into the industry this year to help launch enhanced sparkling water brand Bossa Nova, the founders said they couldn’t stay idle and were eager to get back into startup mode.

“I think it’s in your blood,” Uptain said. “Especially after a success like Essentia.”

However, in this new act Uptain said he is looking to play a supporting role. He is the sole fi nancier providing a set amount that will fuel Yesly for the fi rst two years, and he is also tapping into his network of industry partners to establish a strong grounding for the brand. Meanwhile, Miller will take the lead on day-to-day operations.

Other Essentia alumni are joining them as well; Essentia head of fi nance Justin Connell has come on board as Yesly’s

CFO. Miller said the company is now looking for a full time brand manager to lead marketing and will be hiring for sales positions closer to the Q1 launch.

Yesly has secured a distribution agreement with New York metro area DSD house Big Geyser to begin rolling out in January, Miller said, and the company will take a regional approach to retail to start, also targeting the California, Florida and Seattle markets.

Jerry Reda, president and COO of Big Geyser, said he was excited for the chance to work with Uptain and Miller again, having worked with them while distributing both Essentia and Tampico. Reda called Yesly itself “clean, fresh and exciting,” suggesting the combination of packaging, formulation and brand positioning made it a unique opportunity that doesn’t compete with any other brands in the distributor’s portfolio.

“I have an endless amount of respect for both Scott Miller and Ken Uptain for their achievements in the business,” Reda said. “Ken was able to stay the course and be patient with Essentia and that paid off for him and many other people around him, so I applaud him for that. And, I look at Scott as being one of the top 5% of best operators and CEOs of this business, and I don’t say that lightly.”

As the brand establishes a national DSD network, Miller said ecommerce is also in the works and Yesly will likely begin selling on Amazon shortly after the brick-and-mortar launch, but direct-to-consumer will not be a priority as the company aims to be “effi cient and effective.”

The Yesly branding and packaging was created in partnership with consultancy fi rm Retail Voodoo and Miller said messaging will focus around positivity, ideally serving as a broad net that can appeal across demographics.

“The name Yesly is this kind of positive expression of what we want to do to the consumer, we want to give them a great tasting product that’s better-for-you but also it’s fun and exciting for them,” Miller said. “We’ll say things like, ‘Say yes to what’s next’ and really it’s about a brand with inclusivity where everyone’s welcome. We want to serve every consumer with a mouth. That’s the goal.”

16 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

BEVSCAPE

BEVSCAPE

Laird Superfood to Shut Down Oregon Production Plant

Laird Superfood is shutting down its Sisters, Oregon production and fulfillment facility and laying off all workers at the end of this year, the company announced in October.

In a letter shared with employees, CEO and president Jason Vieth, who joined the company in January, cited “an inability to produce at this facility at a rate that is competitive with the industry,” which has intensified already existing financial pressures. The company markets a variety of food and beverage products across categories and formats, but the change only affects its powdered creamers and hydration products, which will be shifted to an unnamed copacker, according to a press release.

“This strategic pivot to an outsourced manufacturing model will significantly improve our financial profile by reducing fixed overhead and simplifying our business, enabling us to focus on maximizing our commercial growth potential,” said Vieth in a statement.

The plant, located on 275 W. Lundgren Mill Drive in Sisters, will be permanently shuttered on December 31, 2022. Around 46 employees are expected to be impacted, starting in mid-December.

Speaking to local media in October, Vieth said the Sisters facility was down from 147 to 83 full-time employees since the start of the year, saying the company had “over-hired” relative to the size of the business. The company will have 38 workers after further reductions are completed, 10 of which will remain in Central Oregon, based on reports.

“We are grateful for the support of the Sisters, Oregon community and our dedicated employees who have helped to build the Laird Superfood brand,” Vieth said in the letter. “Discontinuing our manufacturing operations was an extremely difficult decision. We are deeply committed to supporting our employees during this transition and will provide all affected team members with severance and outplacement services.”

Launched in 2015 by big wave surfer Laird Hamilton and his wife, former U.S. volleyball star Gabrielle Reece, Laird Superfood built a foundation for its flagship “superfood” coffee creamers online before making the transition to retail. As the company grew, it expanded into other product categories including kombucha, powdered beverage mixes, refrigerated RTDs, as well as granola, oatmeal and bars, the latter via its $12 million acquisition of Picky Bars last year. Danone Manifesto Ventures backed the brand with a $10 million investment in 2020.

The company’s production facility in Sisters was seen as a major component of its growth; in 2020, then CEO Paul Hodge told BevNET of plans to add a 30,000 sq. ft. building to the manufacturing campus, and said Laird was interested in helping Sisters to “build a more robust middle-class demographic” by developing affordable housing.

However, Laird has struggled with profitability and financing. Since going public in September 2020 at $22.00 per share, the value has tumbled to around $1.72 as of press time. In the spring, the company mentioned it had reduced headcount during Q1 through “a combination of automation and process improvements.” In Q2, net sales decreased 6% to $8.7 million, compared to $9.2 million in the same period the prior year. The company had around $25 million on hand at the beginning of Q3.

The company reportedly received an unsolicited, roughly $27.5 million acquisition bid from EF Hutton SPV this summer.

“For a company of our size in the current market situation, there is no doubt that protecting cash is the paramount strategic initiative. As I shared on the first quarter call, we’re taking aggressive steps to moderate our own cash burn, including cost improvement initiatives and balance sheet management activities,” said Vieth, according to a transcript of the call.

Suja Acquires Cold-Pressed Juice Shot Brand Vive Organic

Cold-pressed juice maker Suja has acquired California-based Vive Organic, producers of a range of 2 oz. juice shots, for an undisclosed fee. The deal is Suja’s first acquisition since its sale to private equity firm Paine Schwartz Partners in July 2021.

Founded in 2015, Vive Organic emerged as a pioneering brand in the refrigerated premium juice shot category, offering a range of immunity focused, physician-formulated blends sold at retailers like Whole Foods, CVS, Target and other major national chains. The company secured a $13 million series B funding round led by Monogram Capital in July 2020.

Having emerged a few years earlier in 2012, California-based Suja helped seed the retail market for premium cold-pressed juices, operating out of its own 200,000 sq. ft. production and toll processing facility in Miramar, California, and eventually expanded to a wide variety of juice-based drinks, including kombucha, enhanced water, sparkling juice and shots with functional ingredients. At one point, The CocaCola Company was a 33% stakeholder in the brand with an option to buy the company outright within a certain timeframe. After Coca-Cola allowed the deadline to expire, Suja was picked up by Paine Schwartz for an undisclosed fee.

Under a unified portfolio, both Suja and Vive Organic will see “improved operational capabilities, enhanced marketing and sales efforts, extended innovation reach, and benefits of scale,” according to a press release. Wyatt Taubman, Vive’s CEO and co-founder, is expected to continue and “partner with Suja’s leadership to maintain the brand’s successful momentum in the market.”

“Ten years ago, Suja set out with a vision to make organic freshpressed juices available to everyone. The addition of Vive Organic strengthens our offerings and accelerates our mission to build one of the foremost healthy beverage platforms in the world,” said Bob DeBorde, CEO of Suja. “We have a shared focus on prioritizing sustainable, ethical extraction and production processes, as well as a similar purpose of helping consumers take charge of their wellness journeys. We are excited about building on each company’s momentum and, together, we will innovate the next generation of wellness offerings.”

Taubman praised the Vive Organic team for working “tirelessly to inspire more people to start their own holistic wellness journey.”

“In just five years, our team has built the fastest-growing juice shot company in the country,” Taubman said. “Becoming part of Suja will not only accelerate our efforts and enable us to grow the combined business to even higher heights, but also further amplify our mission with a broader group of consumers.”

Kevin Schwartz, CEO of Paine Schwartz, called the deal “an important next step in (Suja’s) evolution.”

“We continue to believe in the significant value creation opportunities in the better-for-you space, and with this transaction, Suja is even better positioned to capture them. We look forward to supporting the Company in this next phase of growth as it expands its product offerings, widens its distribution, and brings Suja and Vive Organic to even more consumers,” he said.

18 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

For

check out bevnet.com

more stories,

Nothing “Ugly” About It: Misfits Market Acquires Imperfect Foods

Grocer Misfits Market is eating up the competition, announcing it will acquire fellow e-commerce retailer Imperfect Foods. The deal will put the combined company on a path to hit $1 billion in sales and achieve profitability by 2024, a press release said.

Wilson Sonsini Goodrich & Rosati served as legal advisor to Misfits Market while Solomon Partners acted as fi nancial advisor and DLA Piper as legal advisor to Imperfect Foods. Terms of the deal were not disclosed.

Since Misfits Market’s inception in 2018, and Imperfect’s in 2015, the companies have raised roughly $526.5 million and $229 million, respectively.

In the near term the two companies will operate as independent businesses, but ultimately Misfits Market founder and CEO Abhi Ramesh will assume the combined entity’s primary leadership role. Executives from Imperfect Foods will join the Misfits Market team, but the fate of Imperfect Foods’ newlyappointed CEO Dan Park, as well as what this combined entity will be called, have not yet been disclosed.

“We have a tremendous opportunity to advance the shared mission of both brands, which is nothing less than a fundamental re-imagining of both the grocery category and the broken U.S. food system,” Abhi Ramesh, CEO and founder of Misfits Market, said in a release. “The strengths of the Imperfect Foods organization, from its in-house delivery fl eet and robust private label program to its sustainability commitments and innovation, add immediate scale and depth to what we’re building at Misfits Market.”

Initially both Imperfect Foods (formerly Imperfect Produce) and Misfits Market began as subscription boxes sending customers “ugly,” or imperfect, produce that would otherwise be discarded by retailers or growers. At fi rst, the novel concept appealed to sustainability seeking shoppers.

The two have since evolved their models to incorporate other categories of

goods -- including shelf stable items, meat and seafood -- in an effort to offer more of a full grocery shopping experience. The subscription model has also evolved to allow customers to make one-off purchases and have more say in the products they receive.

The positive effects of these retailers have, at times, been in dispute with some critics arguing they actually contribute to food insecurity by taking products that otherwise would be donated. Still others believe that the impact of saving “ugly” food has been overstated, with many of these less attractive items typically sold to food service providers who don’t care about appearance.

Alongside these questions, in order to have products across the store, both retailers have had to make compromises when it comes to peddling their “ugly” assortments. While they still offer misshapen produce, the two have expanded their idea of imperfect and misfits to include products that are short coded, seasonal, overstock or simply have a fl aw in packaging.

There’s certainly interest in the concept. According to research group Innova Market Insights, 62% of shoppers surveyed said they would be willing to pay extra for food and beverage options that fi ght food waste and roughly 50% are working to cut their own food waste.

At the same time, for all online retailers, the operating environment in the past two years has been volatile. When the COVID-19 pandemic hit, shoppers turned to online grocers which increased order volume, and, at times, required wait lists. Although that demand has waned, Misfits Market and Imperfect may be able to keep consumers’ interests with their cost savings play.

According to marketing solutions company Vericast, 83% of baby boomers cite price increases as the biggest challenge when purchasing food. Even 57% of affluent shoppers called out pricing as a concern, with 39% switching to online shopping as a means of cost savings.

Consumer interest has in turn led to increased competition in the channel, but together, Misfits and Imperfect may have better luck maintaining their stronghold over newer players such as Martie, which also sells shelf-stable grocery items that are either overstock, seasonal items or short coded.

“Scale matters in grocery, and this combination makes us a truly meaningful disruptor in the space,” said Imperfect Foods CEO Dan Park in a press release. “The combined experience and expertise of this newly merged team will exponentially increase our ability to take on established players in the traditional grocery space.”

While platforms like Good-To-Go have tried to put a spin on Misfits’ model, the company operates with limited quantity “surprise bags” that ring in at a specifi ed price threshold, it does not yet allow shoppers to select what goes into their bag.

Rather than hold its own inventory, tech platform Flashfood partners with existing retailers in more of an Instacart meets click-and-collect model. Shoppers on the Flashfood app can select items from retailers such as Giant Eagle or Stop and Shop, pay, and then head to the store for pick up.

NOSHSCAPE THE LATEST FOOD BRAND NEWS 20 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

Beyond Meat v. Don Lee: All Claims Dismissed As Settlement Reached

Five years since Don Lee Farms first sued Beyond Meat for breach of contract, four months since it alleged “something is really wrong” at the alt-meat brand through numerous federal false advertising claims, and three days into the trial proceedings in Los Angeles Superior Court, the plant-based meat brand and its former comanufacturer reached a settlement agreement.

The parties released a joint statement in October stating neither admit liability or wrongdoing and both are satisfied with the outcome. The agreement will dismiss all claims and cross-claims filed in both California state and federal court between the two companies.

According to an SEC filing by Beyond Meat regarding the breach of contract settlement, the terms “did not have a material impact on Beyond Meat’s financial position or results of operations.” The companies reached a separate “confidential written settlement agreement” to dismiss the federal false advertising claims.

The original dispute dates back to 2017 with claims that Beyond had wrongfully terminated its five-year exclusive manufacturing contract with Don Lee, misappropriated trade secrets by sharing proprietary processes developed by Don Lee for Beyond products with new co-manufacturers, and thus, created unfair marketplace competition. A judge later dismissed the misappropriation of trade secrets and unfair competition accusations; however, the contract dispute was allowed to proceed.

Since the initial filing, the two companies have slotted upwards of four derivative actions against one another, including a countersuit from Beyond claiming it voided the contract due to unsafe conditions and subpar health and safety practices in Don Lee’s production facilities.

In 2020, Beyond Meat stockholders sued its senior management team, including co-founder and CEO Ethan Brown, former

executive chairman Seth Goldman and former CFO Mark Nelson, stating the team “breached their fiduciary duties” by not properly disclosing the state of the lawsuit. Beyond Meat settled that case earlier this year.

In June, Don Lee took aim at Beyond again, making a series of accusations in a countersuit that ranged from questioning capabilities of its co-founder and CEO Ethan Brown, to alleging the company had been misleading consumers with its nutrition and ingredient labels. The latter accusation opened the floodgates for multiple consumer-led class action lawsuits that see Beyond Meat challenged for fraudulent nutritional claims.

The subsequent class actions focus primarily on Don Lee’s accusation that Beyond Meat does not contain “equal or superior protein” to real meat or that the products are free from “synthetic” ingredients, despite assertions within Beyond’s labels and marketing materials. Consumers from California, New York, Illinois and Iowa have signed onto complaints which will likely still stand up despite the two parties settling the motivative dispute.

Beyond filed a motion to dismiss Don Lee’s false advertising derivative ahead of the trial, claiming the co-manufacturer had been aware of Beyond’s recipes for nearly six years and voided the statute of limitations by the time it took aim on the products in court. Additionally, Beyond said Don Lee could not make accusations of false advertising when it participated in the production of the alleged, falsely advertised products. That motion had not been heard ahead of trial.

The news comes on the heels of Beyond’s Q3 earnings report in which Brown announced quarterly and full-year sales were lower than expected and that the company would cut 200 jobs in order to continue pursuing profitability.

PowerPlant Partners Closes Fund III at $330M, Expands into Consumer Tech

Venture capital firm PowerPlant Partners announced in September the close of its Fund III at $330 million. Double the size of its 2019 predecessor, Fund III will focus its investments solely in growth stage companies and consumer-facing brands “that are better for the people and planet,” according to a press release.

“With this additional capital, we’re expanding our team and building an even stronger bench of industry-leading operating advisors and partners,” said PowerPlant Partners co-founder and comanaging partner, Mark Rampolla, in the release.

The firm’s portfolio includes Vive Organic, Your Super, Thistle, Bon Devil (formerly The Coconut Collaborative) and Apeel Sciences.

The firm plans to invest $15 to $40 million in target companies and has already made four investments from fund III, including Miyoko’s Creamery, Liquid Death and Partake Brewing. Most recently, PowerPlant announced an investment in and partnership with holding company SYSTM Brands to launch SYSTM Foods, a platform focused on acquiring sustainable and socially conscious food and beverage brands; the company has already added Chameleon Cold Brew and REBBL to the SYSTM portfolio.

In conjunction with the Fund III announcement, PowerPlant Partners revealed plans to expand beyond investing in food and beverage plant-centric products, as it has focused on with fund I and II, to include consumer technology, service and enablement companies focused on improving “human and planetary life.” According to PowerPlant, this shift will enable the firm to grow its platform in the consumer-wellness space and offer a more integrated network portfolio.

“We are thrilled to receive such strong support and commitment from our limited partners, especially during a period of increased market volatility,” said Dan Gluck, comanaging partner of PowerPlant Partners, in a press release. “This new fund will allow us to deepen and grow our efforts to find, fund and scale breakthrough companies that are building a healthier, more sustainable future.”

22 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022 NOSHSCAPE

Secret Sauce: Bachan’s Raises $13M, Will Hit Profitability This Year

Condiment brand Bachan’s announced in September it has raised $13 million in capital, impressing investors with its plans to hit over $30 million in revenue this year.

The round, which closed earlier this summer, was led by investment fi rm Sonoma Brands Capital, which was founded by KRAVE jerky founder Jon Sebastiani. The round also saw participation from existing investors Prelude Growth Partners and New Fare Partners, along with RVCA founder and president Pat Tenore and fi lmmaker Destin Daniel Cretton.

“[In 2021] we took the approach of raising less, growing the brand, protecting shareholder value, and then racing down the road when we built more value,” Bachan’s founder and CEO Justin Gill said, “Then 2022, we essentially wanted to raise what we felt could get us to profitability and turn us into a selfsustaining organization”

Gill plans to use the capital to grow the company’s 16 person team as well as support new accounts. This summer the brand brought on new CFO David Lacy, formerly CFO at KRAVE. Some of the capital will also give early executives liquidity to pay back debt taken to launch the company.

Founded in 2019, Bachan’s produces a line of Japanese barbeque sauces available in Original, Hot & Spicy, Yuzu and Gluten-free varieties.

The three-year-old company fi rst attracted investors with its products’ unique taste profi le and potential for revenue growth. Bachan’s previously raised $4 million in summer 2021 in a round that saw participation from former Whole Foods Market co-CEO Walter Robb alongside celebrity investors including Ryan Tedder, Aaron Paul, Whitney Port, Chase Utley and Abe Burns.

The sauces are sold in 11,000 stores including Whole Foods Market, Sprouts Farmers Market, Target Kroger and this fall, will reach Publix and Albertsons. Bachan’s expanded into the club channel in 2021 when it was picked up by Costco. Gill said that while foodservice is on the docket for next year for now, the company plans to focus on driving trial, velocities and ACV in retail. Though the brand has no plans to expand beyond its current set, he said the ultimate goal is to build a portfolio of shelf-stable, clean-label, Japanese-inspired products.

Maintaining a tight portfolio and focusing on sustainable growth have been part of Gill’s secret sauce from the start, he said, and it’s paid off. The company is on track to report over $30 million in revenue this year, 500% growth from 2021, and Gill said it will be profitable by year’s end. One key to success was a focus on growing natural, specialty, conventional grocery sales in tandem with D2C, rather than focusing on D2C before moving into brick and mortar.

Although comparable to a more traditional teriyaki sauce or glaze, the term “barbecue sauce” has allowed Bachan’s to get on shelf in the traditional condiment set alongside brands such as Rufus Teague, New Primal, Primal Kitchen and Kevin’s, rather than in the international aisle. Not only does the barbecue sauce category attract more shoppers, but it also

helps position the sauce as a more versatile condiment like ketchup, Sebastiani said, rather than something that should be used only with Japanese dishes.

“We have become part of [our customer’s] household pantry,” Gill said. “[It] comes down to having a really highquality product that’s versatile and that people want to use in every meal, not just once a year.”

Overall, the condiment category has seen lasting growth as the popularity of at home cooking, spurred by the pandemic, has yet to wane. A survey by marketing fi rm Hunter last year found that not only were 51% of Americans cooking more than in 2020, 71% intended to continue cooking at home even after the pandemic ended.

While mealtime shortcuts such as sauces have risen, Bachan’s fl avor profi le has also given it an edge. According to research conducted by Whole Foods Market, “BBQ Goes Global” was the top condiment trend of the summer, and Kroger cited “umami” as its top fl avor trend prediction for 2022.

Bachans is the number one selling shelf-stable barbecue sauce in the natural channel, Gill said, bringing in the highest dollars per store, per week, in the category. Online, the brand has found that the average shopper repurchases once every 45 days. That loyalty to the brand, as well as its unique cold fi ll process and lack of gums, is what’s helped Bachan’s maintain its top position, Gill said, and ward off competitors or private label offerings.

“[Justin] caught lightning in a bottle and now it’s just protecting the momentum,” Sebastiani said. “Bachan’s hits the data points that we think are highly relevant, it’s past a signifi cant point of a proof of concept. It’s got very high margins, and it is wildly profitable already…[Justin is an] emotionally invested founder that we think has a story to tell and only just assists the fact that the product, the secret sauce in the bottle, is driving this virality right now.”

NOSHSCAPE 24 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

FDA Defines Healthy On-Pack

The agency opened up a public comment period for 90 days allowing stakeholders to comment or raise concerns regarding the new rule. The news also comes as the White House is turning its attention to nutrition. The Biden Administration hosted the Hunger, Nutrition, and Health conference in Washington for the first time in 50 years, which will address hunger, nutrition as well as work on plans to reduce dietrelated diseases and close disparity gaps in nutrition standards within the next decade.

After six years of discussion and controversy, The U.S. Food and Drug Administration (FDA) is one step closer to finalizing a definition for the word “healthy” for use on food and beverage packaging with the release of a proposed rule in September.

The guideline aims to align the term’s regulatory definition with modern nutritional science, the Nutrition Facts label and the current Dietary Guidelines for Americans.

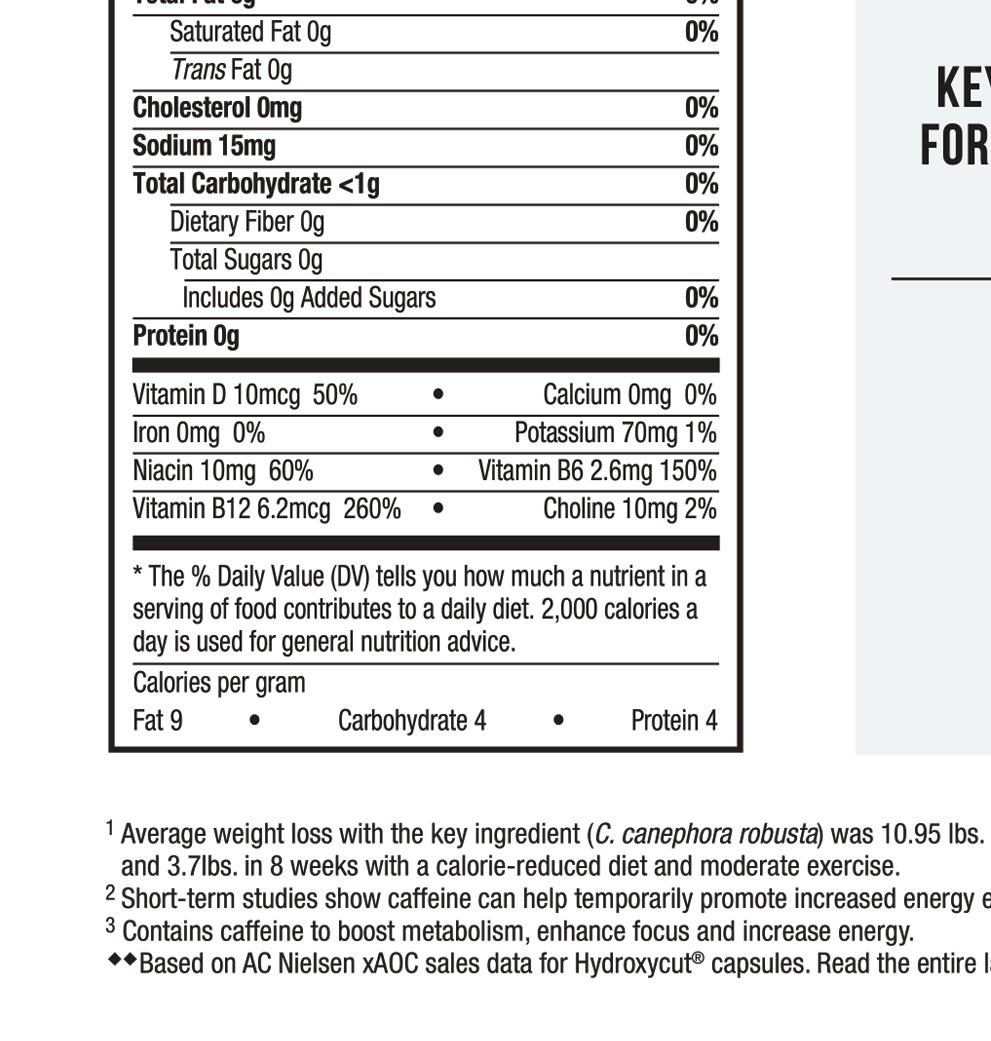

Nutrient dense foods like fruits, vegetables, low-fat dairy and whole grains are key to healthy dietary patterns, according to the FDA. However, foods including nuts and seeds, higher fat fish like salmon, certain oils and water have now been added to that list. Under the new definition, the FDA also offered parameters for what constitutes “nutrient dense,” defining it as food with little added sugars, saturated fat, and sodium, but containing vitamins, minerals and “other health-promoting components.”

In order to be labeled “healthy,” a food or beverage must contain “a certain meaningful amount” of at least one nutrient dense food group or subgroup, per the recommendations of the Dietary Guidelines; the parameters around each “meaningful amount” is specific to each food group or subgroup.

Healthy foods are also required to fall below a specified limit for saturated fat, sodium and added sugars. Each threshold is determined by the percent of the Daily Value (DV) recommended for each individual nutrient and the permitted ratio is calculated relative to the product’s serving size.

“For example, a cereal would need to contain ¾ ounces of whole grains and contain no more than 1 gram of saturated fat, 230 milligrams of sodium and 2.5 grams of added sugars,” the rule states.

Under the new regulation, foods must contain the minimum amount of at least one nutrient dense food and be within the nutrient limits regarding fat, sodium and sugar in order to be labeled as “healthy” on front of pack.

Earlier this year, the agency also announced it was looking into creating a symbol to denote healthy food that could be used voluntarily on pack. That symbol is still currently in the works.

The FDA has recognized the word healthy as an “implied nutrient” claim since 1994. At that time, the agency formally recognized the word holds a specific meaning for consumers and indicates a food may help them maintain healthy dietary practices, the agency said in the proposed rule. It also recognized that nutritional science has evolved since the mid-1990’s and stated that its former definition was outdated and excluded many foods that should have been considered healthy.

“Diet-related chronic diseases, such as cardiovascular disease and Type 2 diabetes, are the leading causes of death and disability in the U.S. and disproportionately impact racial and ethnic minority groups,” said FDA Commissioner Robert M. Califf, in a press release. “Today’s action is an important step toward accomplishing a number of nutrition-related priorities, which include empowering consumers with information to choose healthier diets and establishing healthy eating habits early. It can also result in a healthier food supply.”

Snack maker KIND secured a win earlier in September in a federal class action lawsuit challenging its use of terms like “healthy” and “natural.” According to the new regulation, about 5% of all packaged food current is labeled as healthy. The agency said it hopes that the updated definition will increase that percentage as well as encourage food manufacturers to reformulate in order to meet the new “healthy” requirements.

25

For more stories, check out nosh.com

Modern Times’ Anaheim Taproom Closes; Merger with Maui Done; Former CEO Jennifer Briggs Exits

Leisuretown, Modern Times’ Anaheim, California-based taproom, complete with a swimming pool, has closed, Brewbound has confirmed. News of the closure was first reported by Spectrum News 1.

Social media profiles for the location have been taken down, but Spectrum News 1 cited a statement Modern Times posted in October that the location was “closing its doors for good.”

“It has been an incredible, joyous, heartbreaking, life-affirming journey, and — even though we are deeply saddened to see it end — we cannot thank you enough for being part of it,” the statement read. “This is a hard day, but we’re not done. Not by a long shot. More to come.”

The Anaheim taproom is the fifth Modern Times location to close this year. With its closing, 33 employees are out of work, Brewbound has learned. In February, the company shuttered its taprooms in Portland, Oregon; and Oakland, Santa Barbara and Los Angeles, California, which resulted in the termination of 73 employees. Modern Times’ three remaining taprooms in Encinitas and San Diego are still open, according to the company’s website.

The end of operations in Anaheim happened in mid-October.

On Oct. 31, Maui Brewing closed on its acquisition of Modern Times as the companies merged to form Craft ‘Ohana. Maui was slated to acquire the business for $15.3 million as the backup bidder in an auction that saw offers as high as $21 million. However, Maui ended up paying $10 million for the business, Brewbound has learned. The Anaheim location was excluded from the sale.

In August, former Modern Times CEO Jennifer Briggs was promoted to chief experience officer of the combined company, a role that was expected to oversee “human resources, cultural development, DE&I [diversity, equity and inclusion], marketing, brand development, direct-to-consumer and hospitality functions.” However, Briggs decided not to continue with the company and her last day was in October, she told Brewbound. The split was amicable.

Briggs steered Modern Times through stormy seas and to its eventual sale to Maui. The company’s troubles bubbled to the surface in May 2021 when founder and former CEO Jacob McKean resigned after Modern Times was called out for fostering a toxic workplace culture in the industry-wide reckoning that began on social media last year. Briggs’ tenure included guiding Modern Times through a court-ordered receivership, and an auction process that included more than a few hiccups.

Modern Times’ financial status was illustrated in court records during the receivermandated auction process in June, which revealed the company would owe a total of $8.28 million over the 186.3 months then-remaining on its lease. Rent for the Anaheim location cost $44,455 per month, more than twice the monthly rent of any other location.

In 2019, Modern Times valued itself at $264 million in financial records shared as part of a crowdfunding campaign on WeFunder.

American Canning Signs Agreement with Ball, Decreases Order Minimum for Printed Cans to 1 Truckload

American Canning, an Austin, Texas-based aluminum can and packaging supplies provider, has signed a supply agreement with global can manufacturer Ball Corp. as an “official distributor” of blank and printed brite cans.

Through the agreement, American Canning can order printed cans with a minimum order requirement of 1 truckload per SKU (about 204,000 standard 12 oz. cans).

Brite can minimum orders will vary by can size and style, but will be about a half-pallet of standard 12 oz. cans, according to an American Canning spokesperson.

The agreement includes all core can sizes for brites and printed cans, including 12 oz. standard and sleek, 16 oz. standard and 7.5 oz. sleek.

The news may be a welcome option for bev-alc producers who were left to find alternative can supply solutions this year, after Ball announced it increased its minimum order requirement for printed cans from one truckload per SKU to five truckloads (a jump from 204,000 cans to more than 1 million cans). The change was announced in November 2021 and went into effect in March.

Earlier this fall, producers got a slight glimmer of hope when a Ball representative told a brewer client, in an email obtained by Brewbound, that they had been “give the green light to start printing single truck load runs again” with a surcharge of $3,500 per truck for orders fewer than three truckloads.

American Canning serves approximately 6,000 beverage producers across beer, wine and spirits, but the majority of its clients are craft breweries. The company’s agreement with Ball will now allow those small- and mid-sized producers to make smaller printed can orders, without the extra surcharge.

“We have purchased and sold Ball brite cans for many years now,” Monica Christmas, American Canning’s purchasing manager, said in a press release. “This agreement allows us to serve our customer base with a more diverse product portfolio through the addition of printed cans. It also guarantees supply and lead times in a more consistent way than we previously had.”

In 2021, American Canning announced plans to build its own aluminum can manufacturing plant. The plant is set to be operational in November, with sales available in Q1 2023, according to the spokesperson. The plant will have an annual production capacity of 300 million cans (both printed and blank).

American Canning co-founder David Racino spoke to Brewbound in December about the plant, which will use a “more sustainable” method for can manufacturing. The plant will also use a “liner technology that includes the use of a pre-coated aluminum sheet,” which will protect “hard-to-hold beverage ingredients as craft expands into more beverage categories,” the spokesperson said.

In February, American Canning moved its operations to a 155,000 sq. ft. facility. The new space increased capacity for the company threefold, to an estimated 20 million cans, and houses the manufacturing plant. The company also added its second shrink-sleeve line in June, increasing its shrink sleeving capacity to 1.5 million cans per week.

Ball will hold its Q3 earnings call with investors Thursday, November 3. In its second quarter conference in August, the company announced plans to permanently close manufacturing facilities in Phoenix, Arizona, and St. Paul, Minnesota. Ball CEO Daniel Fisher said its customers’ decisions to increase price at the risk of volume losses were to blame for the closures.

26 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

THE LATEST CRAFT BEER BRAND NEWS

BREWSCAPE

Beer Institute Picks Brian Crawford as Next President & CEO

Five months after the departure of Jim McGreevy, the Beer Institute (BI) has named its next president and CEO.

In October, the trade group announced the appointment of Brian Crawford, the executive vice president of government affairs for the American Hotel and Lodging Association (AHLA), as its next leader during the organization’s annual meeting in Chicago. Crawford will assume the role on December 5.

“I am incredibly honored to join the Beer Institute team and become part of the vibrant American beer industry,” Crawford said in a press release. “It is clear that the beer industry is strongest when we work together to strengthen and grow the beer category for brewers and suppliers, consumers and communities alike. I look forward to starting and working every day to promote the more than two million hardworking Americans whose jobs rely on beer.”

Crawford joins the BI as beer continues to lose share of total beverage alcohol to spirits. In recent years, the BI has attempted to beat back efforts by spirits producers to achieve tax equalization and expand market access in states, as well as ongoing aluminum tariffs and other supply chain issues. Meanwhile, spirits-based, ready-to-drink canned cocktails have grown in popularity over the last couple of years.

“The beer industry has seen significant category growth and with Brian’s leadership, we will be able to accelerate that momentum with leaders in Washington and help ensure beer companies are positioned to best serve our customers, consumers and communities,” Brendan Whitworth, Anheuser-Busch CEO and chairman of the BI, said in a release. “Brian brings deep experience across government and public affairs, as well as a strong foundation driving policy

outcomes, making him uniquely qualified for this important role.”

“The past two years have been pivotal to the future of our industry, and selecting a new chief executive of the Beer Institute has been particularly important as we look to the road ahead,” added Gavin Hattersley, Molson Coors Beverage Company CEO and vice chairman of the BI. “Whether that means challenging aluminum tariffs or advocating fair tax rates for beer, I have no doubt that Brian has the experience, passion and integrity necessary to lead us into an exciting next chapter.”

Crawford assumes the role from Jim McGreevy, who departed the organization that he had led since 2014 to join the Coca-Cola Company’s North America Political Action Committees (PACS), as VP of public policy, federal government relations and political engagement (PPGR).

During his tenure with the BI, McGreevy helped the industry achieve now-permanent federal excise tax relief via the Craft Beverage Modernization and Tax Reform Act in 2020.

Crawford, who joined AHLA in February 2014, has led the organization’s efforts in Washington, D.C., as well as led the “lodging industry’s largest political action committee, HotelPAC,” according to a bio. Crawford was named to The Hill’s list of top lobbyists in 2021.

Prior to joining AHLA, Crawford worked for more than eight years as a senior staffer in the House of Representatives, including five as chief of staff for former U.S. Rep. Tom Rooney (R-FL), deputy chief of staff for former U.S. Rep. Ric Keller (R-FL).

Crawford also worked with trade group the Associated Builders and Contractors for six years, including more than three as senior director of legislative affairs. He also spent nearly two years at the National Small Business Association as a manager of government affairs.

Topo Chico Spirited: Spirit-Based Offering Coming From Molson Coors

in 2023

Topo Chico’s fated move into hard spirits is coming in 2023, via Molson Coors.

On the heels of the fast-growing Topo Chico Hard Seltzer brand, Molson Coors will launch a spirit-based version of Topo Chico in key markets, such as the southwest and southeast and parts of the Midwest.

David Coors, Molson Coors’ VP of next generation beverages, made the reveal during the company’s distributor convention in Nashville. Coors reminded wholesalers that he warned them a wave of spirit-based, readyto-drink (RTD) canned cocktails was coming during last year’s convention.

Topo Chico Spirited (5.9% ABV) will come in three flavors, two with a tequila base and one with a vodka base.

Jamie Wideman, Molson Coors VP of innovations, and her team worked closely with the Coca-Cola team to develop the product.

Wideman told wholesalers that the line is “premium, bar-worthy cocktails, ready-todrink and made with top-notch ingredients,” including blanco tequila from Mexico. Topo Chico is made with “real spirits, real juice and

sparkling water.” The goal, Wideman said, was to create “sessionable, light-flavored cocktails.”

“These are real cocktails, not hard seltzer,” she added. “Our packaging is going to cue cocktail. We know the opportunity here is massive. We’ve got a winner on our hands.”

Matt Escalante, Molson Coors VP of marketing for hard seltzers, stressed that Topo Chico Spirits “isn’t a replacement for our hard seltzer.”

Escalante reeled off a few highlights from Topo Chico Hard Seltzer’s national launch, including:

• Margarita variety pack was Drizly’s No. 1 selling new item in Q2;

• Topo Chico Ranch Water is the “fastest turning” ranch water pack in the country;

• The brand family is now “neck and neck” with Bud Light Seltzer for the No. 3 hard seltzer spot, excluding spirit-based offerings, namely High Noon Sun Sips.

Year-to-date through September 4, offpremise dollar sales of Topo Chico’s variety pack are up +86.4%, to nearly $94 million, in multi-outlet and convenience stores tracked by market research firm IRI. The pack is the 45th overall best-selling beer category item at

retail and Molson Coors’ eighth best-seller in its portfolio, according to the firm.

Meanwhile, Margarita sales are nearly $29 million, Ranch Water sales have surpassed $17 million, its Strawberry Guava pack has posted more than $13 million in sales, and its Tangy Lemon Lime single can has topped $6 million (+149.5% year-over-year).

In Topo Chico’s next chapter, the brand has an opportunity to reach new drinkers and raise awareness with 21- to 34-year-olds, Escalante said.

Escalante said the original pack is among the five fastest turning 12-packs in the seltzer segment, and Margarita being “highly incremental,” with the majority of Topo Chico Margarita buyers new to the franchise. Escalante said the company needs to get these core packs “everywhere,” and the company will support them with national advertising.

“We have big ambitions to be the No. 1 hard seltzer with Latinos,” he said. “We already index 25% higher with Latino drinkers than any other seltzer. And it’s not just Mexican Americans either. It’s Puerto Ricans, Cubans, Dominicans, a wide variety of Latino Americans.”

28 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022 BREWSCAPE

Boston Beer & PepsiCo’s Hard MTN Dew Distribution Deal Challenged in Virginia by Blue Ridge and Reyes’ Premium

Wholesalers’ fourth category frustrations finally boiled over in October, as Blue Ridge Beverage Company and Premium Distributors, a Reyes Beer Division subsidiary, filed a complaint with the Virginia Alcoholic Beverage Control Authority against Boston Beer Company over its appointment of PepsiCo’s Blue Cloud Distribution as the distributor of Hard MTN Dew.

This marks the first formal challenge brought by an existing Boston Beer wholesaler to the company’s distribution agreement with PepsiCo for Hard MTN Dew.

In the 13-page complaint, Blue Ridge and Premium argue that Boston Beer’s appointment of Blue Cloud violated the state’s beer franchise act (Beer Act), which reads: “no brewery shall enter into any agreement with more than one beer wholesaler for the purpose of establishing more than one agreement for its brands of beer in any territory.”

Premium has distributed Boston Beer offerings in northern, central and southeastern Virginia since acquiring Northern Virginia Beverage (2004), Chesbay Distributing (2012) and Loveland Distributing (2018).

Meanwhile, Blue Ridge has distributed Boston Beer products in western Virginia since being appointed by the brewery in the mid-1980s, as well as through acquisitions of “several distributors” in southwest Virginia.

The distributors argue that the law prohibits Boston Beer from “entering into any agreement that splits the distribution rights to its brands of beer between different distributors in the same designated sales territory.” As such, they argue Boston Beer “established an unlawful ‘dual-distribution’ scheme for its Hard MTN Dew brand” in the 37 counties and cities where Premium serves as Boston Beer’s “exclusive distributor,” as well as the 43 counties and cities where Blue Ridge holds exclusivity. The law does allow for dual distribution deals in situations such as one brewery purchasing another, but they note that this instance does not apply.

Premium and Blue Ridge also argue Boston Beer has “unilaterally amended” their distribution agreements by “eliminating” their role as Hard MTN Dew’s exclusive distributor in their respective territories without providing at least 90 days’ written notice.

“Boston Beer’s actions have been undertaken with full knowledge that the Beer Act does not permit a brewery (and the holder of a Virginia Beer Importer’s license) to divide its brands of malt beverages between two or more distributors appointed to service the same sales territory,” the complaint reads.

Premium and Blue Ridge allege Boston Beer’s violations of the act were in “bad faith.”

“Boston Beer knew, or should have known, that its ‘collaboration’ with PepsiCo to manufacture the Hard MTN Dew brand of malt beverage and distribute the same exclusively through distributors owned and controlled by PepsiCo would

trample on the long-standing exclusive franchise distribution rights that Boston Beer had already granted to its other distributors, such as Premium and Blue Ridge,” they argue.

“The appointment of a single county or city to which Boston Beer had already granted distribution rights to another could be reasonably termed a mistake,” they continued. “To appoint 80 such cities and counties, however, displays a conscious disregard by Boston Beer towards both the good faith obligations owed to its existing distributors and to the laws of the Commonwealth.”

The distributors are asking the ABC to enter orders:

• holding Boston Beer in violation of the Beer Act;

• nullifying the appointment of Blue Cloud as the distributor of Hard MTN Dew in territories already appointed to Premium and Blue Ridge;

• barring Boston Beer from appointing any distributor other than Premium and Blue Ridge to distribute the company’s malt beverages in their respective sales territories;

• asserting that Boston Beer acted in bad faith in violating the Beer Act;

• awarding Premium and Blue Ridge “reasonable costs and attorney fees;”

• and granting “such relief as the board shall deem appropriate.”

In a statement, a Reyes spokesperson said: “We deeply respect Boston Beer and our longstanding business relationship, but we are also committed to upholding the franchise laws of the Commonwealth of Virginia. We cannot comment further due to the ongoing nature of the litigation.”

A Boston Beer spokesperson declined to comment on the pending litigation.

30 BEVNET MAGAZINE – NOVEMBER/DECEMBER 2022

BREWSCAPE

Reyes Strikes Again with Deal for Paradise Beverage in Hawaii

The Reyes Beer Division continues to wheel and deal. Just one day after revealing a 16 million case deal for Capitol Wright Distributing near Austin, Texas, the largest beer wholesaler in the U.S. announced on Oct. 5 an agreement to acquire Paradise Beverage in Hawaii, the company’s 12th market.

The transaction is slated to close in early December. Once closed, Reyes will add about 8.9 million cases and 2,300 customers to its operations. Key suppliers include Molson Coors, Constellation Brands, Boston Beer Company, Diageo, Heineken USA and Maui Brewing.

The addition of Paradise, Capitol Wright (slated to close in December) and DET Distributing in Tennessee (expected to close in November) will put Reyes’ case volume firmly above 300 million cases.

Reyes will operate Paradise under the Hawaii Beverage LLC banner and maintain the distributor’s five facilities across the state.

“On the heels of announcing new business in Tennessee and Texas, we are humbled by this opportunity in Hawaii,” Reyes Beer Division CEO Tom Day said in a press release. “We are fortunate to be in the position of accelerated growth that we’re in today – and it’s all thanks to our hard working teams. We wouldn’t be here, or be approached for opportunities like these, without our employees, their high standards of excellence and the service they provide to our suppliers and customers every day.”

Tom Reyes, president of Reyes Beer Division West, noted in the release that the Paradise deal is the first expansion of the Reyes Beer Division West footprint outside of California.

“Paradise and Reyes have similar missions and values rooted in integrity and excellence and we are eager to join our teams and get to work,” he added.

“Our family has been incredibly honored to have been owners of Paradise Beverages for over four decades and it is bittersweet to say goodbye to this company and its exceptional group of people,” Anderson Holdings chairman and CEO William Anderson said in the release. “I am extremely grateful to John Erickson, president of Paradise Beverages, for his exemplary leadership and his team’s hard work to build an organization of which our family is very proud. We strongly believe that Reyes is the right owner going forward and will continue to build on Paradise’s strong performance and deliver excellence for our many long-term customers, employees, and the Hawaiian business community.”

Paradise Beverage was founded in 1948 as the Crockett Sales Company, according to its website. The company, which adopted its current name in 1976, grew by acquisition several times in its history, adding the Coors and Stroh brands in 1980 and the portfolio of McKesson Wine & Spirits in 1988. Paradise acquired rights to Miller in 1995 and Heineken and Samuel Adams in 1996.

For

brewbound.com 31

more stories, check out

CSDs

Pepsi took inspiration from a classic campfi re treat for its latest fl avor series: The S’mores Collection. When combined, the three fl avors – Toasty Marshmallow, Graham Cracker and Chocolate – make a classic s’more. The Pepsi S’mores Collection is sold in a 7.5 oz. mini can trio. For more information, call 1 (800) 433-2652.

Zevia launched its new limited-edition CranRaspberry fl avor. The drink will be available on Amazon through January 8 and at select Target and Costco locations in 8-packs of 12 oz. cans. For more information, call 1 (855) 469-3842.

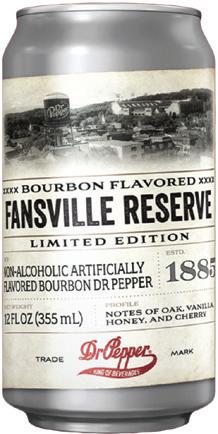

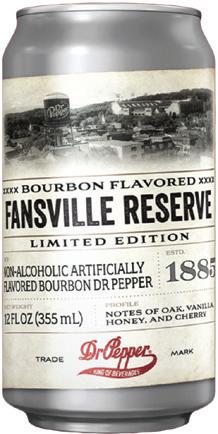

In conjunction with tailgate season, Dr. Pepper unveiled its latest LTO: Bourbon Flavored Fansville Reserve. The non-alcoholic beverage features sweet, savory and woody fl avor notes with hints of cherry, vanilla, chocolate and caramel. To get their hands on the LTO, consumers must enroll in the Pepper Perks program and participate in a scratch-to-win game on the Dr. Pepper website. For more information, visit drpepper.com.

Fever Tree expanded its lineup of cocktail mixers with Blood Orange Ginger Beer. The new offering was specifically formulated to pair with characteristics “unique to bourbon” to create a new twist on the Kentucky Mule, according to the brand. For more information, call (347) 735-5437.

RTD COFFEE

Veteran-owned specialty coffee brand Fire Dept. Coffee entered the RTD coffee set with its launch of two non-alcoholic “spirit-infused” nitro cold brew products: Whiskey Infused Irish Coffee and Bourbon Infused Vanilla Bean. Both varieties are available online for $47.88 per 12-pack of 7 oz. cans with retail distribution slated for later this year. For more information, visit fi redeptcoffee.com.

La Colombe is celebrating the winter holiday season by bringing back Peppermint Mocha Latte. Additionally, the brand will roll out a new dairy-free version of the festive drink:

Oatmilk Peppermint Mocha Latte. Both varieties are crafted with 100% Arabica single-origin Brazilian cold brew coffee. La Colombe Peppermint Mocha Latte and Oatmilk Peppermint Mocha Latte will be available beginning Nov. 7 for $3.99 per 9 oz. can and $36 per 12-pack at Whole Foods and Sprouts nationwide. For more information, visit lacolombe.com.

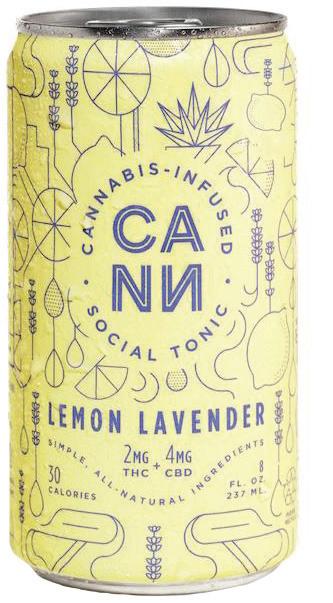

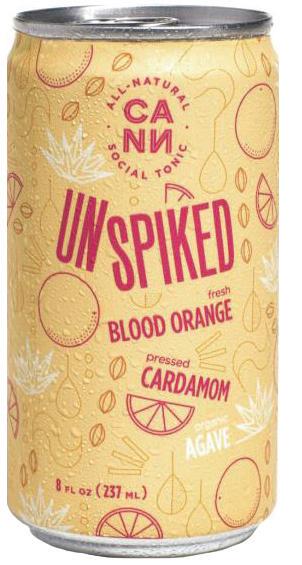

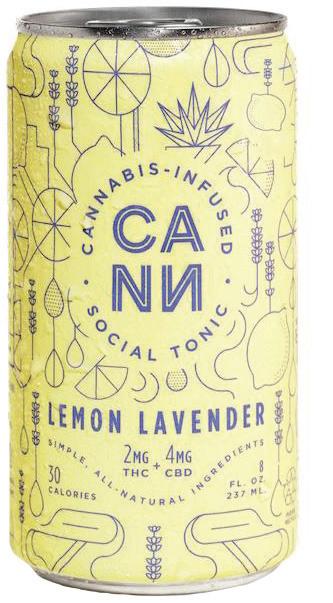

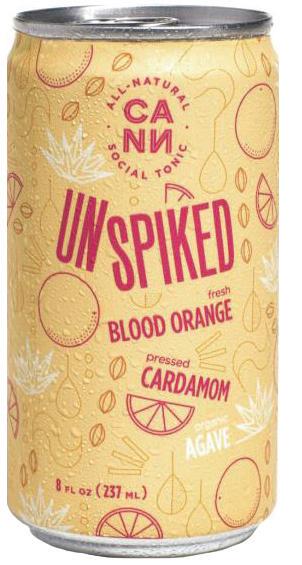

CANNABIS

Flora Hemp Spirits unveiled its latest LTO: Passion Fruit “Margarita” Cannacocktail, which features 5mg of hemp-derived THC, 10mg of CBD and just 40 calories per 8 oz. can. The new offering is available exclusively online for $23.99 per 4-pack.

Jones Soda Co. has expanded its Mary Jones brand of cannabis-infused sodas with a new 100mg THC product. Available in four fl avors – Berry Lemonade, Orange & Cream, Green Apple and Root Beer – the drinks will come in 16 oz. multi-serve resealable cans. Mary Jones Tallboys launched in California in October for $20 per can.

Massachusetts-based startup HighTide announced it will roll out its fl agship line of Cannabis Margaritas to licensed dispensaries in November. Available in three fl avors –including Classic and Diablo Spicy – each 12 oz. can is infused with adaptogens and 5mg of THC. For more information, visit drinkthetide.com.

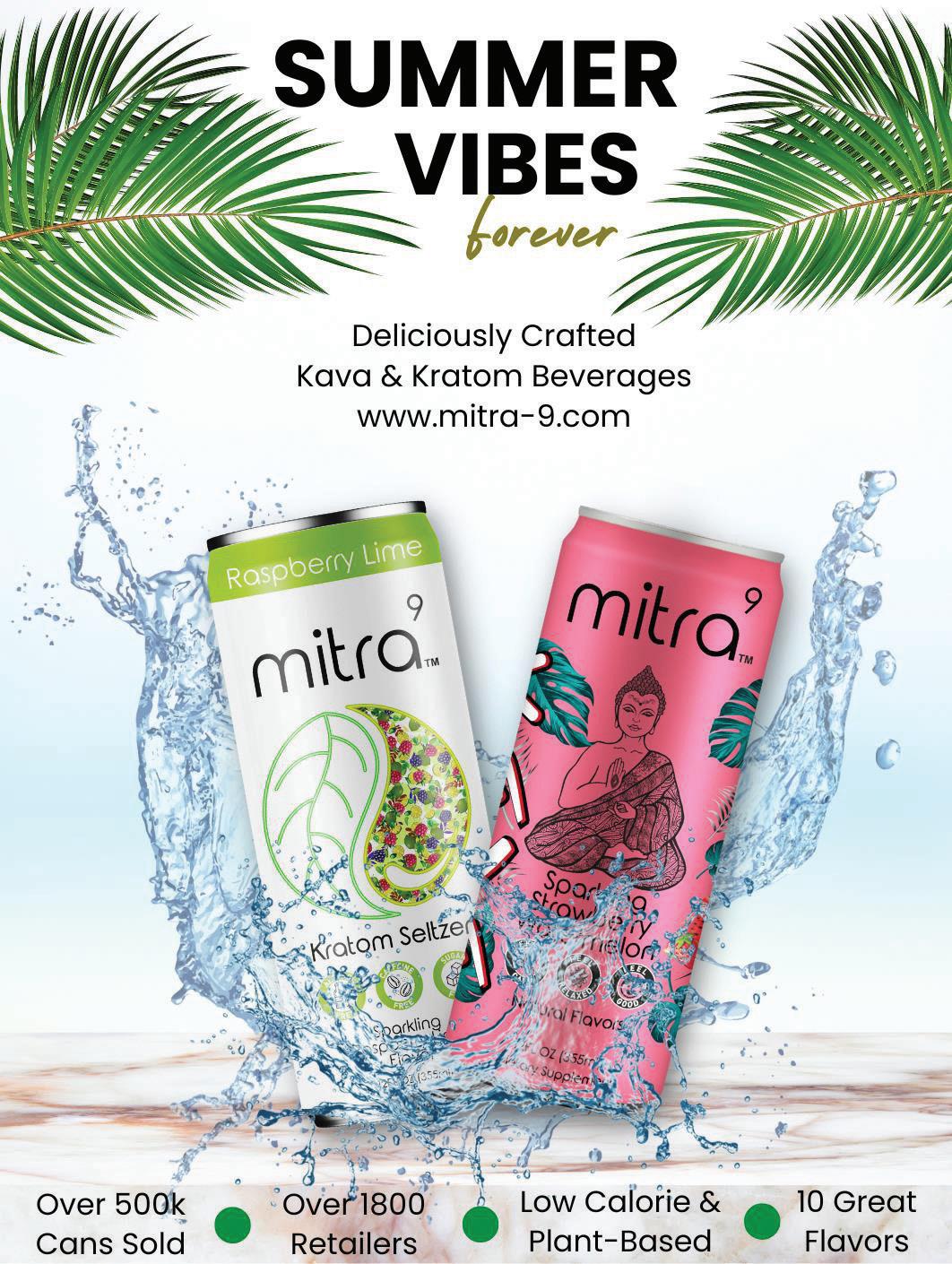

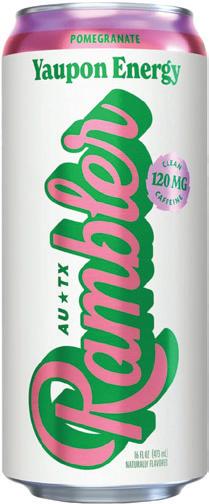

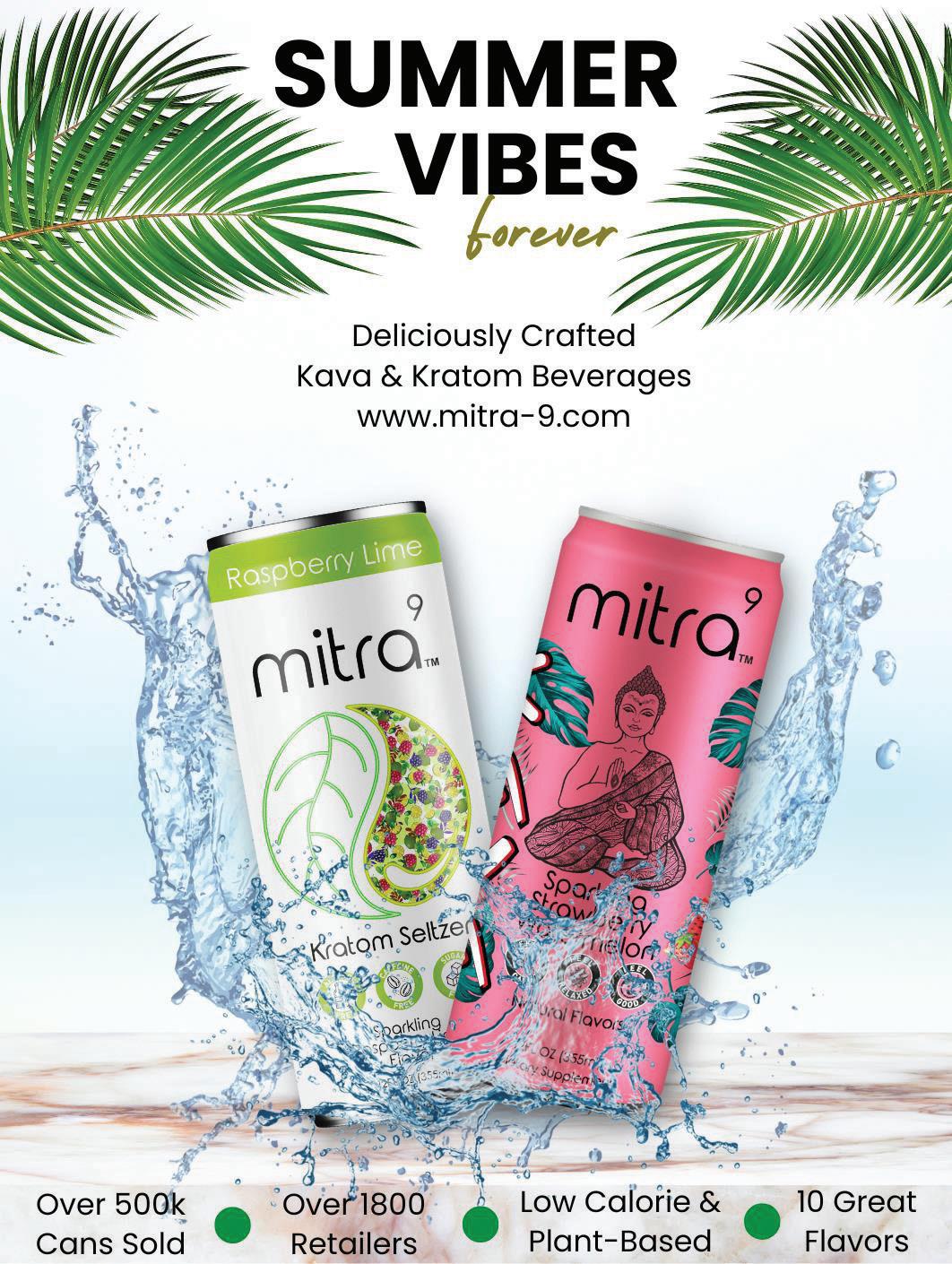

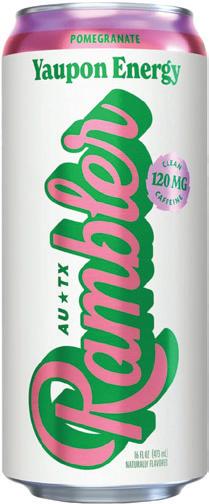

ENERGY