CONVEYORS, CRUSHERS, AND SCREENS

AUGUST 2023 | www.canadianminingjournal.com | PM # 40069240 FORTUNA’S SUCCESS STORY IN WEST AFRICA ALMONTY’S PROFITABLE TURNAROUNDS A REMARKABLE YEAR FOR CANADA’S TOP 40 Canada’s TOP 40

Hand protection for mining hazards 800-265-7617 superiorglove.com/mining

FEATURES

TOP 40

15 Top 40 revenues are more than $177 billion in 2022.

29 A Canadian success story in West Africa: Reporting on the Fortuna Silver Mines’ Séguéla mine visit.

TECHNOLOGY

23 Is there a mining technology investment landscape?

GLOBAL MINING

25 Almonty Industries: The experts in profitable turnarounds.

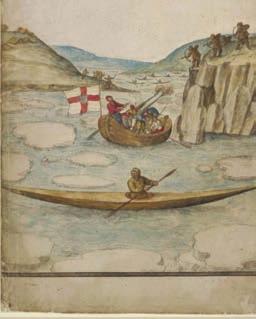

57 What future for shipping in the Arctic region?

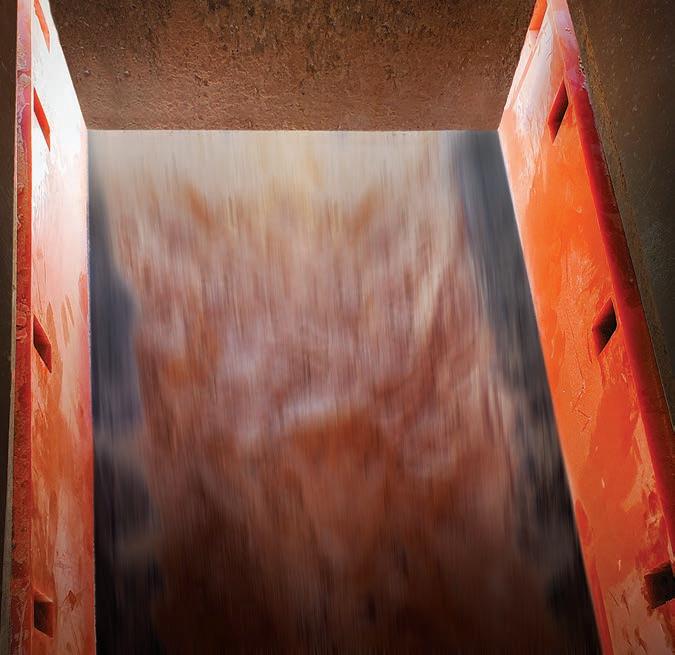

CONVEYORS, CRUSHERS, AND SCREENS

41 Efficient shaft revitalization with remote-controlled demolition equipment.

43 Mobile crushing carves a path into mining.

46 Finding the best solution to common screening issues.

48 Prepping for conveyor maintenance and upgrades.

52 Essential considerations in belt conveyor design.

RECLAMATION, ELECTRIFICATION, AND DECARBONIZATION

33 Zero carbon solutions for tomorrow’s clean technologies.

36 Seabridge Gold’s model for responsible exploration, mining, and Indigenous engagement.

39 The new age of productivity and sustainability.

55 Clean mining.

HISTORY OF MININGY

59 Canada’s first mining scandal.

DEPARTMENTS

4 EDITORIAL | A remarkable year for Canada’s Top 40.

6 FAST NEWS | Updates from across the mining ecosystem.

9 LAW | Gitxaala First Nation challenges British Columbia’s mineral tenure regime.

10 CORRECTION |

11 MIN(E)D YOUR BUSINESS | Distributing securities to Canadian First Nations and the need to modernize NI45-106.

13 COSTMINE | The effect of rock’s compressive strength on costs.

60 ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

www.canadianminingjournal.com

For More Information

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

Coming in September 2023 Canadian Mining Journal’s September issue will report on gold projects of merit across Canada and North America. We will also look at innovative technology designed to help gold miners operate more efficiently and sustainably.

Front cover image: Workers at the Sangdong mine in South Korea. CREDIT: ALMONTY INDUSTRIES

29 33 AUGUST 2023 VOL. 144, N O .6

CANADIAN MINING JOURNAL | 3 43

A remarkable year for Canada’s Top 40

Tamer Elbokl, PhD

It is that time of the year again where we publish our highly anticipated Top 40 ranking of Canadian mining companies, which is based on financials from 2022. See pages 15 to 22 to go immediately to the charts! Top 40 total revenues climbed up to more than $177 billion in 2022, enhanced by first place Nutrien’s total revenue boost by almost $15 billion. The numbers show that the mining sector continued to handle the diminishing impacts of Covid-19 pandemic effectively. As mentioned in the article, encouraged by the soaring commodity prices in recent years, several corporations were able to throw money into capital projects, including mergers and acquisitions, in expectation of higher demand.

It required a robust corporation to deal with the impacts of the Covid-19 pandemic and geopolitical instability on the mining sector in the last few years. The mining sector in Canada proved to be as solid and robust as it could be.

Also in this issue, we feature several articles on conveyors, crushers, and screens on pages 41 to 54. On pages 25 and 33, there are also two interviews with industry leaders (CEOs of Almonty Industries and Nouveau Monde Graphite) that offer updates on their major projects and their forecast for the future of the industry and the challenges they are facing.

Earlier this month, I visited Fortuna Silver’s new Séguéla gold mine in the north of the West African country of Côte D’Ivoire. I totally enjoyed my first mine visit outside of North America, and the article on page 29 offers a brief story of the mine site visit. Fortuna Silver Mines is a Canadian precious metals mining company with four operating mines and a development project in Argentina, Mexico, Peru, Côte d’Ivoire, and Burkina Faso. Fortuna produces gold and silver and improved its ranking on this year’s Top 40 list from 31 in 2021 to 28.

We also continue publishing the new department called “Min(e)d Your Business” in this issue (see page 11). This issue’s article reports on distributing securities to Canadian First Nations.

Moreover, John Sandlos continues to contribute to a series of articles on the history of mining that started in May 2023 issue, and this issue, he reports on Canada’s first mining scandal on page 59.

Finally, our next issue, September 2023, will report on gold projects of merit across Canada and North America. We will also look at innovative technology designed to help gold miners operate more efficiently and sustainably. Relevant editorial contributions can be sent directly to the Editor in Chief no later than Aug. 7, 2023. CMJ

AUGUST 2023 Vol. 144 – No . 06

225 Duncan Mill Rd. Suite 320, Toronto, Ontario M3B 3K9

Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl TElbokl@CanadianMiningJournal.com

News Editors

Marilyn Scales mscales@canadianminingjournal.com

Walter Strong wstrong@canadianminingjournal.com

Production Manager

Jessica Jubb jjubb@glacierbizinfo.com

Advisory Board

David Brown (Golder Associates)

Michael Fox (Indigenous Community Engagement)

Scott Hayne (Redpath Canada)

Gary Poxleitner (SRK)

Manager of Product Distribution

Allison Mein 416-510-6789 ext 3 amein@glacierrig.com

Publisher & Sales

Robert Seagraves

416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos

416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.:

1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group

Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published 10 times a year by Glacier Resource Innovation Group (GRIG). GRIG is located at 225 Duncan Mill Rd., Ste. 320, Toronto, ON, M3B 3K9 Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891. Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods:

Phone: 1-888-502-3456 ext 3; E-mail: amein@glacierrig.com

Mail to: Allison Mein,

225 Duncan Mill Rd., Ste 320, Toronto, ON M3B 3K9

We acknowledge the financial support of the Government of Canada.

4 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FROM THE EDITOR

Canada’s TOP 40

maestrodigitalmine.com SuperBrite™ Marquee Display SuperBrite™ Marquee Display provides fail-safe, real-time data by ensuring only current information is displayed – preventing unsafe old data from display when network is off-line. Easily integrated into wireless or Ethernet network and written to directly from any Vigilante AQS™ or Zephyr AQS™ stations, SCADA, DCS, PLC or HMI control system. Eliminate guesswork and know with confidence when it’s safe to move about the mine. “MAXIMIZE SAFETY AND PRODUCTIVITY BY PROVIDING REAL-TIME AIR QUALITY DATA AND EMERGENCY MESSAGES ON A LARGE DISPLAY THAT INTEGRATES WITH ANY NETWORK.” Safety in Numbers.

| MAC offers TSM as a subscription

• DECARBONIZATION | Meet net-zero targets with Decarbonomics from SNC-Lavalin

The Mining Association of Canada now offers its Towards Sustainable Mining (TSM) program as a subscription service. This performance system improves environmental and social practices in the mining sector. The first to sign up was Ioneer (ASX: INR), owner of the Rhyolite Ridge lithium-boron development in Nevada.

Ioneer has committed to the standard’s implementation. In its next ESG report, set to be released in September, the company will publicly report on its performance on the standard’s eight protocols, including climate change, tailings management, water stewardship, Indigenous and community relationships, safety and health, biodiversity conservation, crisis management, and preventing child and forced labour.

“The new TSM subscription service represents a natural evolution for the standard as uptake by mining associations internationally continues to grow alongside individual company interest focused on prioritizing greater transparency on how their mines operate,” said Pierre Gratton, president and CEO of the Mining Association of Canada. “Fourteen mining associations on six continents now incorporate TSM as a mandatory component of their membership and we are proud to welcome companies in our sector, like Ioneer, that are voluntarily opting to hold themselves accountable to the high ESG standards that form the baseline of the program.”

First established in 2004, TSM helps drive performance improvement at the site level. Using the program contributes to securing support for mining projects from the communities where they operate. CMJ

SNC-Lavalin is launching its decarbonization service for the industrial sector – enabling industrial users in global markets to make informed, tailored and data-led decisions about reaching net-zero targets.

The move is the latest progression for the award-winning Decarbonomics service, following its initial launch at the start of 2022 for commercial and government sector building portfolios. SNC-Lavalin has adapted the tool to enable its expansion into sectors such as mining, industrial, power and renewables, and aviation infrastructure.

What is Decarbonomics? It is a data-driven approach to decarbonizing existing assets and processes, through cost and program-optimized Net-zero strategies. By working on the ground with clients and understanding how their industrial complexes operate, Decarbonomics calculates the potential carbon and cost savings that can be achieved by combining digital tools with process engineering expertise. This is based on a three-step approach of benchmark, roadmap and delivery which has a proven track record of success in the commercial buildings and public sector with multiple use cases, both in the U.K. and North America.

The result is tailored, robust roadmaps that take into account the financial and operational impacts of introducing energy efficiency improvements, low carbon technology, or other interventions that will enable energy intensive users to decarbonize operations.

SNC-Lavalin has delivered this scope of work for multiple clients including its role as engineering partner for the U.K. government’s Industry of Future Programme in 2022. During its first year of operation, Decarbonomics helped more than 2,000 building and estates working with 150 consultants around the globe. Three hundred thousand tonnes of carbon reduction were identified, and two industry awards were won. CMJ

6 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FAST NEWS

Updates from across the mining ecosystem

Copper smelting CREDIT: NORDRODEN/ADOBE STOCK

• ESG REPORTING

Make sure to send your press releases to: editor@canadianminingjournal.com

CREDIT: DEEMERWHA STUDIO/ADOBE STOCK

DEEPLY INVESTED IN MINING.

Updates from across the mining ecosystem

• AUTOMATION | Hexagon to buy out Canadian automation firm Hard-Line

Hexagon’s solutions connect all parts of a mine with technologies that make sense of data in real-time

CREDIT: HEXAGON

CREDIT: HEXAGON

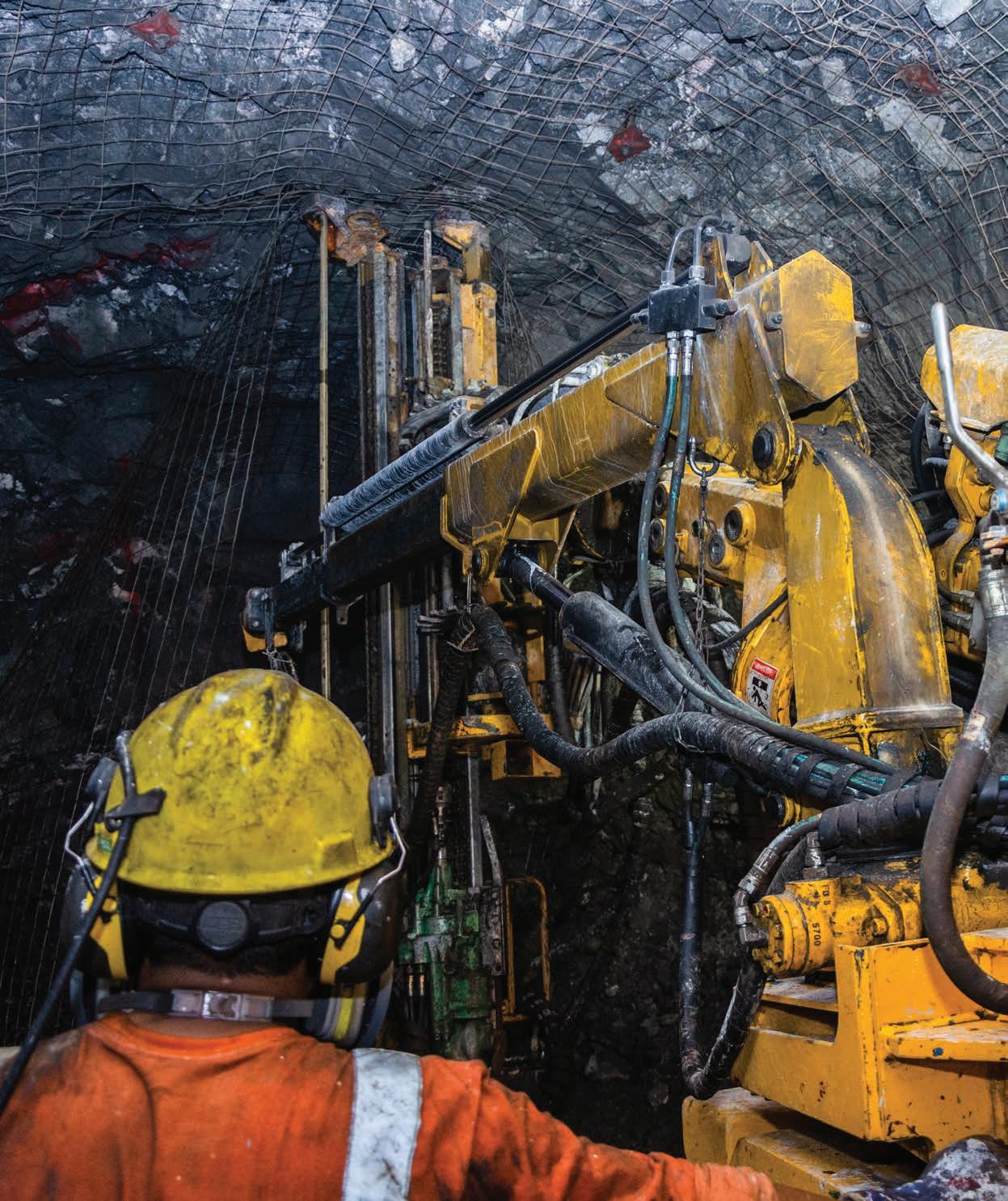

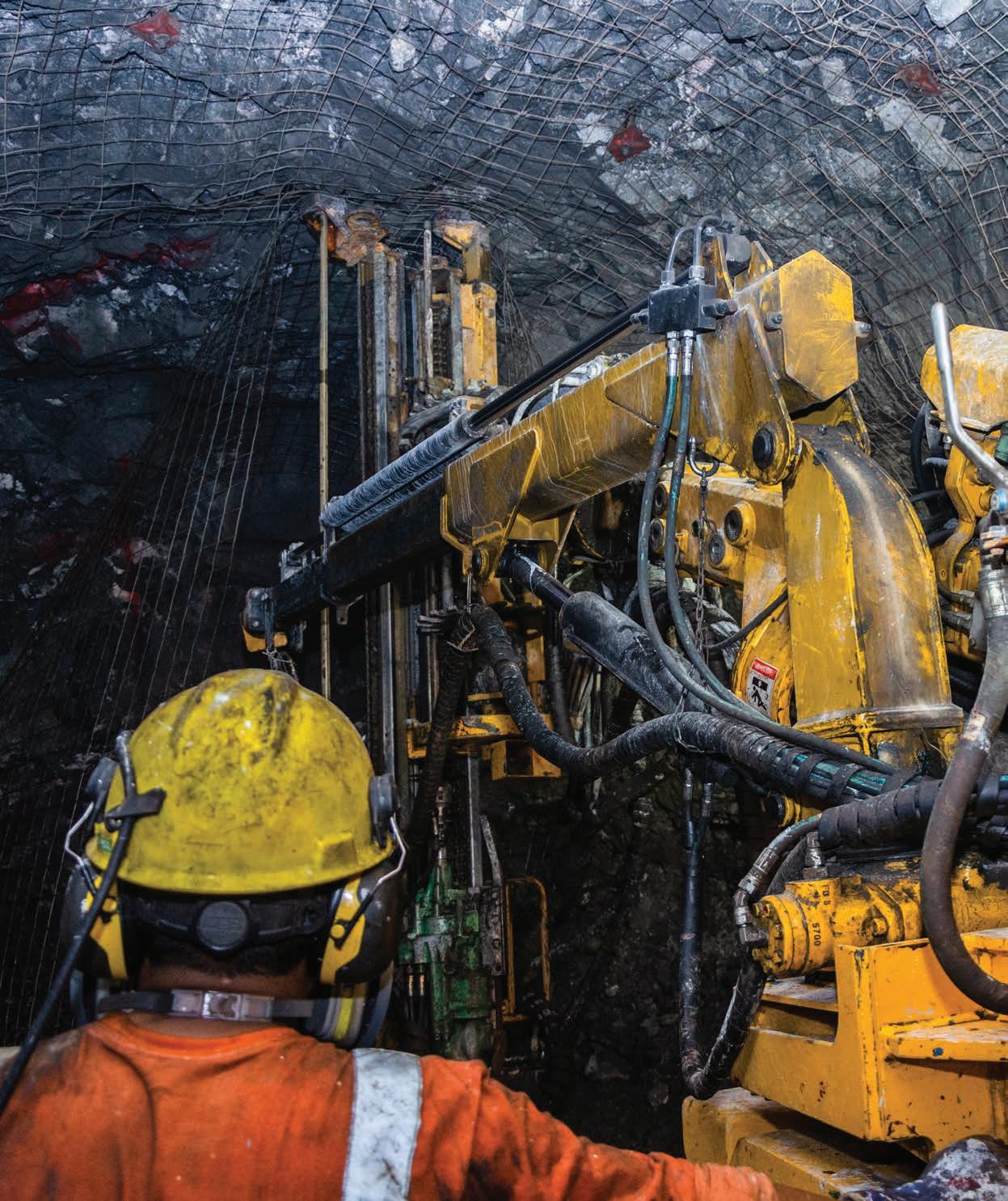

Sweden’s digital technology group Hexagon announced in July the acquisition of Canadian mine automation and remote control solutions Hard-Line for an undisclosed sum.

The move, Hexagon said, will help the company strengthen its solution offering with remote control via electronic and hydraulic by-wire technologies, innovation necessary for achieving full autonomy in the mine.

“The pressure to remove humans from dangerous situations where it’s unsafe to operate a manned vehicle is increasing, particularly as mines push deeper underground for minerals and metals,” Nick Hare, president of Hexagon’s mining division, said in the statement.

The company will operate as part of Hexagon’s mining division. CMJ

• EXPLORATION | Windfall Geotek uses AI to pinpoint gold targets

Windfall Geotek has used artificial intelligence (AI) to pinpoint at least 12 gold targets on properties belonging to Exploits Discovery about 90 km south of Gander, Nfld. The targets were generated using AI on a compilation of available historic data and proprietary machine-learned filtering.

The project area is in south-central Newfoundland and covers 1,208.75 km2 known as the Great Bend, Middle Ridge, and True Grit project areas. Only a limited amount of exploration over the past 40 years has been conducted in this area, making it an ideal candidate for Windfall’s industry-leading appraisal system.

Windfall is an AI company that has been in business for over 15 years developing its proprietary CARDS analysis (AI) and data mining techniques. Windfall Geotek a multidisciplinary team that includes professionals in geophysics, geology, AI, and mathematics. It combines available public and private datasets including geophysical, drill hole and surface data.

The algorithms designed and employed by Windfall are calculated to highlight areas of interest that have the potential to be geologically similar to other gold deposits and mineralization. The company’s objective is to develop a new royalty stream by significantly enhancing and participating in the exploration success rate of mining and to continue the Land Mine detection application as a high priority.

CMJ

• MILLING | Eriez magnetic liners cut energy use

A new report from Eriez reveals how its magnetic mill liners (MML) are significantly improving safety standards, energy efficiency, and operational longevity at the Nexa Resources N.A. installation in the central Andes of Peru.

Each MML is composed of individual sections that are much lighter than traditional liners, facilitating safer and easier installation procedures. Weighing only 20 to 40 kg per section, the MML eliminates the requirement for specialized cranes within the mill, streamlining operations and enhancing safety protocols.

There are environmental advantages to using MMLs. Heavier steel liners require enormous fuel consumption for transportation and material handling while lightweight MMLs can be installed by hand. Additionally, Nexa reports a significant reduction in noise levels with the MML.

The case study highlights the energy-efficient aspects of MMLs. In traditional ball mills, small ball chips do not contribute to grinding, leading to wasted energy. However, MMLs eliminate small ball chips, resulting in energy savings of up to 11% during the grinding process.

Unlike conventional liners that necessitate frequent replacement, the Eriez MML has garnered a track record of success through many installations in diverse mining operations worldwide. These installations provide evidence that MMLs outlast rubber or metallic liners by two to three times. CMJ

8 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FAST NEWS

Gitxaala First Nation challenges

British Columbia’s mineral tenure regime

By Robin Longe and David Hunter

The province of British Columbia’s “free entry” mineral tenure regime, which allows the holder of a free miner certificate to acquire mineral claims issued by the provincial government, is the subject of a recent court challenge brought by the Gitxaala First Nation in the Supreme Court of British Columbia. The Gitxaala allege the current mineral tenure regime violates the provincial Crown’s constitutional obligation to consult prior to disposing of an interest on lands where Aboriginal rights have been asserted, in addition to the province’s commitment to implement the United Nations’ Declaration on the Rights of Indigenous Peoples. The court began hearing arguments on this ground-breaking legal challenge on April 3, 2023.

In British Columbia, the Mineral Tenure Act governs the acquisition of entitlements to minerals held by the provincial government on certain “mineral lands,” which includes provincial government land and private land where mineral rights have been reserved to the government. Under this system, which has been in place since the gold rush era, a person who holds a free miner certificate is able to acquire mineral claims on mineral lands without requiring the consent of the government or landowner.

This process of mineral claim acquisition, commonly referred to as the “free entry” system, was designed to encourage mining activity of the province’s vast and underexplored resource potential. While a mineral claim provides the holder with certain limited rights to minerals that may or may not be present, it does not permit the claim holder to cause any material disturbance to the lands or to develop and operate a mine. Rather, the mineral claim represents a mere chattel interest in the minerals which, with limited exceptions, remain under government control. Without additional permits, a claim holder is restricted to carrying out low-impact, non-mechanized activities.

The Mines Act is the principal statute regulating mining activity through the lifecycle of a mine in British Columbia, through initial exploration to development and operations and, ultimately, to closure and reclamation. The process to obtain a Mines Act permit to conduct any impactful operations includes requirements, proportionate to the proposed activity, for consultation with third parties whose interests may be affected, including Indigenous groups. If and when the potential impact of the proposed activity increases, a proponent will face a correspondingly more intensive regulatory regime, requiring third-party consultations and the requirements of other legislation, including for example, over environmental and water management.

In 2018 and 2020, the province’s chief gold commissioner,

without consultation with the Gitxaala Nation, registered several mineral claims over lands on Banks Island, B.C. – an area the Gitxaala claim they have exclusively occupied, governed, managed and harvested for thousands of years. The Gitxaala have asserted Aboriginal rights, including Aboriginal title, to this area, and, consequently, argue they are entitled to the exclusive possession, use and control of minerals. The Gitxaala’s position is that the provincial government failed to consult prior to accepting and registering mineral claims over lands where Aboriginal rights and title have been asserted.

In addition to other declarations, the Gitxaala are seeking to set aside the Banks Island mineral claims, together with an order to discontinue or suspend the operational functions of the mineral titles registry which grant mineral claims without consultation.

In brief, the principal legal issue in the proceeding is whether the registration of a mineral claim, in and of itself, triggers the duty to consult and accommodate affected Indigenous groups. Canadian case law has established that the duty to consult arises whenever the government is contemplating a decision or

AUGUST 2023 CANADIAN MINING JOURNAL | 9

LAW

CONTINUED ON PAGE 10

CREDIT: SHAWN.CCFADOBE IMAGES

action that has the potential to adversely affect asserted or established Aboriginal or treaty rights. When triggered, the duty to consult (and accommodate where appropriate), is a process that requires collaboratively working together to find a compromise that balances the conflicting interests at issue, in a manner that minimally impairs the right.

In its response, the province asserts the system for registration of mineral claims is consistent with its obligations under Section 35 of Canada’s Constitution Act, 1982, and the principles guiding the conduct of the Crown in its dealings with Indigenous peoples. The position of the provincial government is that the registration of a mineral claim alone does not adversely affect Aboriginal rights, and the Mines Act permitting process (which includes consultation with Indigenous groups) is required before the occurrence of impactful mining activity. Since, in some instances, the accommodation of Aboriginal interests may mean the denial of applications for certain authorizations

(including Mines Act permits), the province has argued that the conduct of the government on Banks Island is consistent with its obligations.

The Gitxaala’s legal challenge to the province’s mineral tenure regime is an example of the ongoing tension between the rights of Indigenous peoples and government decisions associated with resource development activities. The outcome of this case is likely to have significant implications, both for Indigenous groups in British Columbia and for mining companies operating within the province. It remains to be seen whether and to what extent these impacts might extend beyond the process to acquire new mineral claims, to also affect the interests of private parties in acquiring and transferring mineral tenures. CMJ

Correction

On page 18 of the printed May 2023 issue, the last paragraph under “Generation Mining” title should read as follows:

“As Generation Mining noted in its latest corporate presentation, “Green is the new gold.” There are several deposits to be mined; together they total 230.7 million measured and indicated tonnes at 0.55 g/t palladium and 0.21% copper, as well as 28.6 million inferred tonnes grading 0.39 g/t palladium and 0.23% copper. Platinum, gold, and silver will also be recovered.”

memo2023.cim.org

THE NEXT LEVEL SEPTEMBER 17 - 20, 2023 SASKATOON COME AND JOIN US! REGISTER NOW LAW

ROBIN LONGE is a partner in Dentons Canada LLP’s Corporate group and acts as co-leader of the Firm’s national mining group. DAVID HUNTER is a partner in Dentons Canada LLP’s Corporate group.

By Andrew Spencer, Robin Junger, Sasa Jarvis, and Cory Kent

Distributing securities to Canadian First Nations and the need to modernize NI45-106

The management of mining projects in Canada must be aware of the unique rights of the Canadian Indigenous groups. These rights, which have their basis in the Canadian Constitution and in various treaties, are protected by a judicially constructed “duty to consult” whenever a government action of decision that may impact these rights is contemplated. The duty to consult may be triggered by any number of decisions in the mining context and might include the issuance of a permit or the approval of an environmental assessment, as examples. While the duty to consult is owed by the government, and not a proponent, it is well-established that the government may delegate various procedural aspects of its consultation obligations to a third party, such as a mining company. Moreover, most mining companies also realize the overall benefit of constructive engagements with Indigenous groups (over and above helping the government meet its duty to consult).

For these reasons, many operators have made the decision to consult early and often with the Indigenous Peoples on whose traditional lands they operate. The aim of these engagements is typically to gain a social license to operate in the project area and to have a measure of Indigenous support to help strengthen the resolve of government decision makers that are called to make permitting and other decisions that impact Indigenous rights. These discussions will sometimes result in commercial arrangements between an operator and an Indigenous group in the form of an exploration, cooperation, or impact benefit agreement (IBA) (or other similar such terms). Sometimes these agreements will provide Indigenous groups with equity participation rights to allow for the participation in the long-term upside of resource development in their traditional territory. These agreements are important, as they provide local Indigenous groups with short- and long-term economic benefits and a myriad of other operational guarantees. Determining whether to include equity participation will require careful consideration by mining companies and depend on the circumstances of each project and negotiation.

The problem

Canadian securities laws may make it difficult for mining companies and their Indigenous partners to fulfil the terms of their

commercial agreements in some respects. In Canada, the issuance of securities must be preceded by the filing of a prospectus with applicable regulatory authorities, or the issuance must be permitted pursuant to an exemption from the prospectus rules.

National Instrument 45-106 – Prospectus Exemptions (NI45106) contains several exemptions, many of which will be familiar to mining companies, including the ubiquitous “accredited investor” and “family, friends, and business associates” exemptions which junior issuers frequently use in private placements. Unfortunately, NI45-106 does not provide a clear exemption that can easily be used to distribute securities to an Indigenous group. Some First Nations, by virtue of their financial resources will be “accredited investors;” however, the status of First Nations as an exempt entity remains questionable when those financial thresholds are not met. The First Nation’s governance structure often does not fit neatly into any category of accredited investor. In these other cases, companies and their legal counsel may struggle to find a way to distribute these securities in compliance with applicable securities laws.

Certain issuers have availed themselves of little used exemptions in NI45-106 to make one-time distributions. NI45-106 does have an exemption for “isolated distributions by issuer.” This exemption may work to allow for an isolated distribution; however, by its nature, it may not be suitable for agreements that require a series of issuances to a counterparty over a period of

AUGUST 2023 CANADIAN MINING JOURNAL | 11

MIN(E)D YOUR BUSINESS CONTINUED ON PAGE 12

PHOTO:

IZZOTTI/ADOBE

ANDREA

IMAGES

months or years. This exemption has been used by issuers in the past for one-off distributions, such as for the settlement of legal disputes. When relied upon, the use of this exemption has been scrutinized by securities regulators and may not be considered appropriate for distributions to First Nations.

Where exemptions have not been clearly available to an issuer, issuers have sought relief from securities regulators. For example, Benchmark Metals Inc. (Re: Benchmark Metals Inc., 2021 ABASC 109) obtained exemption order from their principal regulator, the Alberta Securities Commission (ASC), to allow them to distribute securities in this context. Benchmark entered an exploration, cooperation, and benefits agreement with the Tsay Keh Dene Nation, the Kwadacha Nation and the Takla Nation in connection with advancing their Lawyers Gold-Silver project in British Columbia. As part of that agreement, Benchmark agreed to issue to the First Nations warrants to purchase Benchmark common shares. In the Benchmark case, the company decided, that there was no exemption available to distribute share purchase warrants which had been negotiated for. Benchmark sought and obtained an exemption order from the ASC for the distribution of warrants to the affected First Nations. While exemption orders may provide an avenue for relief, as it did in the Benchmark instance, they can be costly (in terms of application and legal fees) and time consuming and moreover may not be readily available.

The solution

In the name of reconciliation and to permit Indigenous communities’ participation in the capital markets and in the financial upside associated with resource development on their traditional territory, the Canadian securities administrators must push the provinces and territories to modernize to NI45-106. More specifically, Indigenous governments and other community groups should be deemed “accredited investors” in the same way as other government entities such as municipalities, public boards, or commissions. To deem school boards as accredited while denying this status to Indigenous governments in certain cases is paternalistic. It makes it more difficult for these groups to fully participate as equity holders in the companies operating in their traditional territory. The Canadian Federal Government identified “creating prosperity with Indigenous Peoples,” “supporting Indigenous economic participation in major projects,” and “advancing economic reconciliation by unlocking the potential of First Nations lands” as major aims of the 2023 budget. The provinces and securities regulators need to do their part to help realize these goals too. CMJ

MIN(E)D YOUR BUSINESS 12 | CANADIAN MINING JOURNAL www.canadianminingjournal.com Eriez.com | 814.835.6000 Greater Recovery Better Grade with Eriez Deep Field 3,500 Gauss Magnetic Wet Drums Optimize Your Roughing, Cleaning & Scavenging with Eriez Magnetic Elements & Tanks • Hybrid Rare Earth-Ceramic elements produce greater recovery in cobbing and roughing stages • Cleaning and finishing magnetic elements improve selective separation WetDrum_HalfPg_CMJ_8_23.qxp_Layout 1 7/18/23 2:08 PM Page 1

ANDREW SPENCER and SASA JARVIS are partners, capital markets and securities, at McMillan LLP. ROBIN JUNGER is a partner, Indigenous law environment, at McMillan LLP. CORY KENT is an office management partner, Vancouver, B.C. and a partner, capital markets and securities, at McMillan LLP.

By Ali Vossoughian

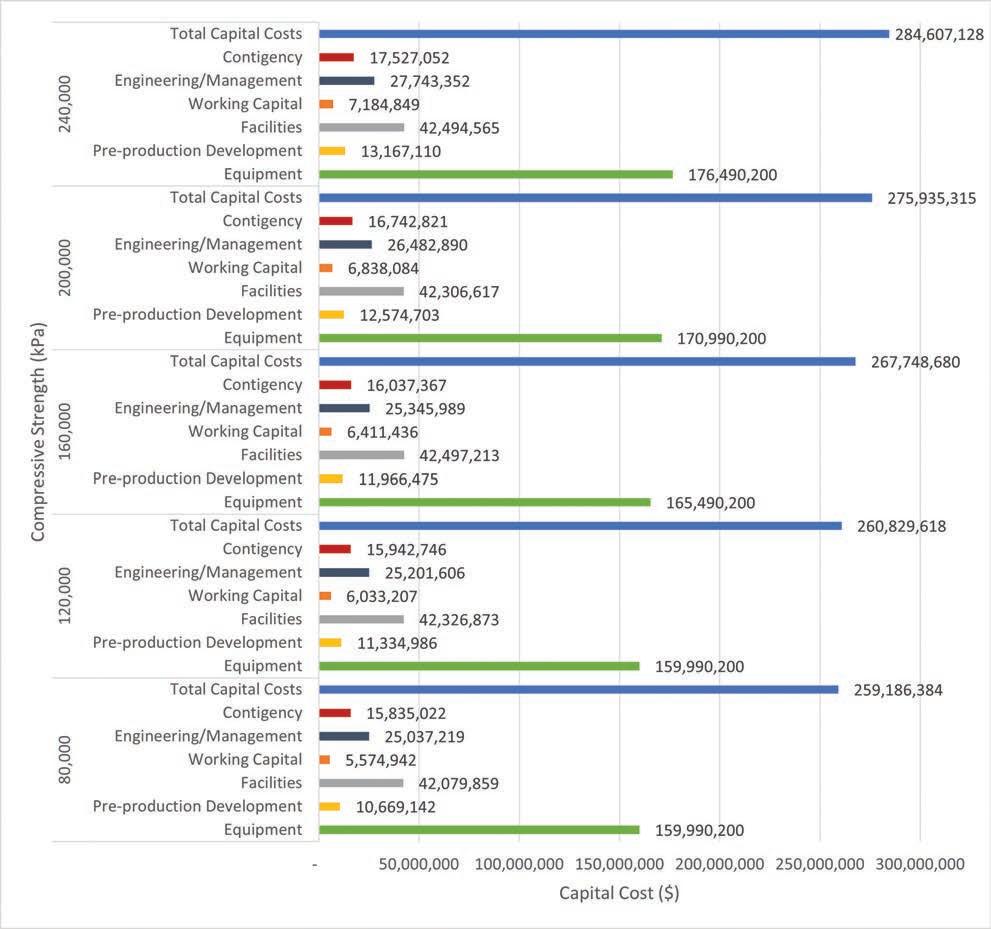

The effect of rock’s compressive strength on costs

The mining industry operates in a dynamic and challenging environment where various factors influence the overall cost of mining operations. Efficiently managing these parameters is crucial for optimizing productivity and ensuring profitability. While many aspects have been extensively studied and incorporated into mining strategies, certain key factors, such as compressive strength, have often been overlooked or not given sufficient attention. This article aims to shed light on the significance of compressive strength as one of the major factors of mining costs.

Mining operations involve a multitude of parameters that directly or indirectly impact the cost of extraction, processing, and transportation. Parameters like ore grade, deposit depth, and mineralogy have long been recognized as critical factors affecting mining costs. Other parameters, such as labour costs, energy consumption, and environmental regulations, have also received considerable attention in the mining industry. Companies invest significant resources in analyzing and optimizing these factors to minimize costs and maximize operational efficiency. However, the influence of compressive strength on mining costs has often been underestimated, despite its crucial role in determining the feasibility and profitability of mining operations.

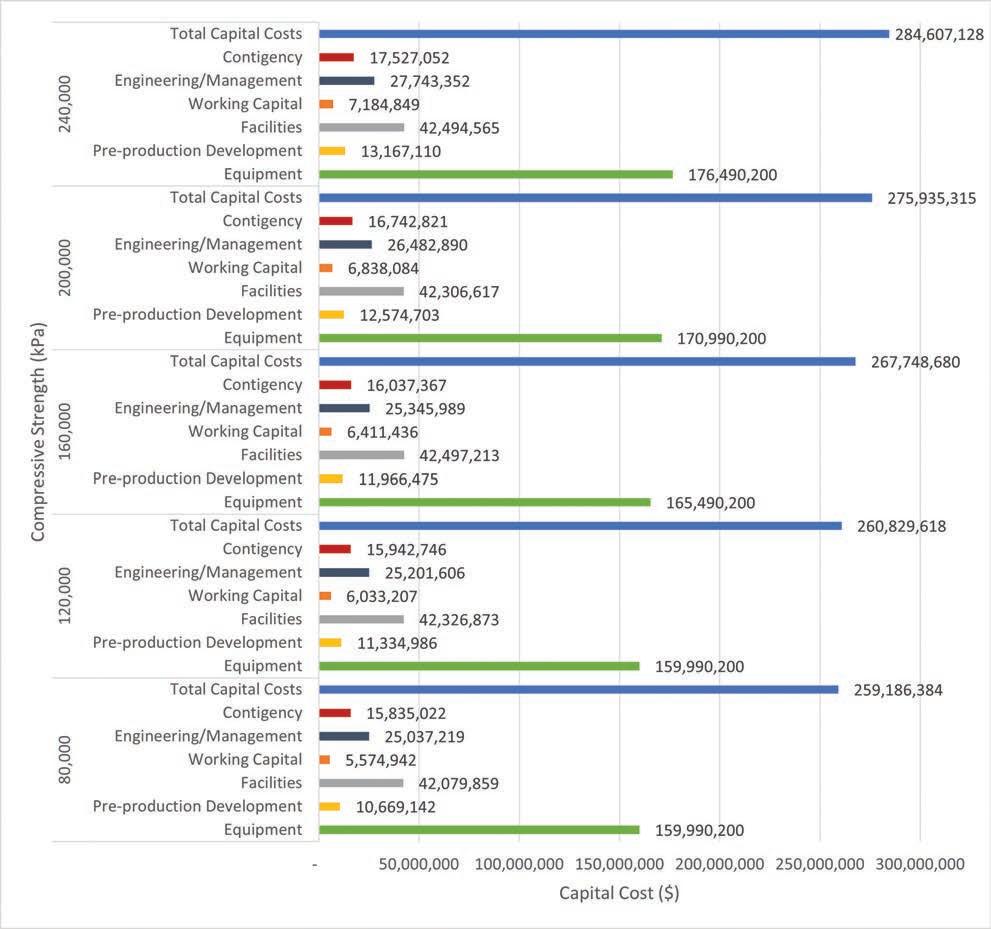

Compressive strength, referring to the ability of a rock or ore body to resist compression or breakage, is an essential geological property that directly influences the choice of mining methods, equipment selection, fragmentation, and overall operational planning. This article targets the effects of compressive strength on open-pit gold heap leach mining operations. A set of five identical models with different compressive strength values, ranging from 80,000 kPa to 240,000 kPa with a 40,000 kPa increment, were created using cloud-based SHERPA Surface software powered by Costmine. It is worth mentioning that all other parameters, such as labour costs, equipment costs, and supply costs, were provided by other Costmine publications, including Mining and Mill Equipment Costs Guide and Mining Cost Service. These established sources ensure the reliability and accuracy of the cost-related information incorporated in the analysis. For further information, please visit the Costmine website at costmine.com.

This article addresses the impact of compressive strength on blasting supply, equipment, hourly personnel requirement operating costs, and capital costs in a specific mining operation scenario. The study assumes a mine life of 14 years, comprising a two-year pre-production period with 3,500,000 tonnes of stripping and four three-year phases, each averaging 40,000 ore t/d. The total minable resources

are estimated at 168 million tonnes, and the mine operates on a schedule of two 12-hour shifts per day for 350 days per year. The rock quality designation (RQD) is assumed to be 82% and has a 2.60 t/m3 density.

Blasting supply

By increasing the compressive strength of rock, the powder factor, which represents the weight of explosive required to fragment a specific amount of rock, also rises. Consequently, the amount of explosive agent needed increases accordingly. Moreover, as compressive strength influences the drill hole pattern, it becomes necessary to increase the number of drill holes leading to a greater requirement for cap, primers, and detonation cord.

The correlation between compressive strength and bit wear is a crucial aspect to consider in drilling operations as well. As the compressive strength of the rock increases, it tends to have a direct impact on the wear and tear experienced by the drilling bits. Higher compressive strength leads to increased resistance and hardness of the rock, which can result in accelerated bit wear.

Equipment

Compressive strength exerts a profound impact on rock drilling, playing a pivotal role in determining the efficiency and effectiveness of drilling operations. As the compressive strength of the rock increases, the drilling process becomes more arduous and challenging. Depending on the scale of the operation, it necessitates a higher utilization of drill equipment and may even require additional drills.

Moreover, as discussed in the previous section on blasting supply, the heightened compressive strength demands an increased

AUGUST 2023 CANADIAN MINING JOURNAL | 13

COSTMINE

»

Figure 1. The correlation between compressive strength and operating cost.

COSTMINE

amount of explosive agent. This, in turn, prompts a need to either augment the utilization of bulk trucks or increase their numbers. It is worth noting that escalation in equipment utilization or the addition of more equipment directly correlates with an increase in fuel consumption.

Hourly personnel requirements

In the equipment section, it was observed that the number of equipment or their utilization rises with increasing compressive strength. Consequently, this leads to heightened demand for drillers, mechanics, and labour responsible for operating the drills, maintaining the equipment, and operating the bulk trucks, respectively.

Operating and capital cost

The operating costs in mining operations encompass various components that contribute to the overall financial expenditure.

Figure 1 outlines the operating costs associated with supplies, hourly labour, equipment operation, salaried labour, and miscel-

laneous expenses. As depicted in Figure 1, these costs tend to increase with higher compressive strength, indicating the impact of rock properties on operational expenses. Notably, the total operating costs exhibit an upward trend as compressive strength rises.

Capital costs are a vital consideration in mining ventures, covering a range of expenditures, such as equipment, pre-production development, facilities, working capital, engineering/ management, and contingency, which is 10% of the summation of all the parameters. Figure 2 visually represents the capital costs associated with various compressive strength scenarios, showcasing the financial investment required for mining operations. Notably, the figure reveals a clear trend indicating that as the compressive strength increases, so does the total capital cost. This correlation emphasizes the impact of rock properties on the financial aspects of mining projects, highlighting the need for careful budgeting and resource allocation. CMJ

14 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Ali Vossoughian is a mining engineer with Costmine.

Figure 2. Relationship between compressive strength and capital cost.

Canada’s TOP 40 2022

AUGUST 2023 CANADIAN MINING JOURNAL | 15

PHOTO: VECTORO, TIMOFEEV, MISHAINIK, JOHN, ADIN/ADOBE IMAGES

By Tamer Elbokl, PhD

Canada’s TOP 40

Top 40 revenues reach a record

$177 billion in 2022: up $28 billion from the previous year

Nutrien dominates again and Japanese Sumitomo joins the list for the first time

Top 40 revenues climbed up to more than $177 billion in 2022, mainly enhanced by Nutrien’s total revenue boost by almost $15 billion. Therefore, it is no surprise to our readers to see Nutrien, again, on top of our annual Top 40 list for 2022. In 2018, the Agrium and PotashCorp merger created Nutrien, a leader in global agriculture. Since then, Nutrien has dominated our Top 40 list. In July 2022, Nutrien announced agreements to acquire Brazilian agricultural retail companies Casa do Adubo S.A. and Marca Agro Mercantil. These acquisitions are meant to support Nutrien’s retail growth strategy in Brazil and may have added to Nutrien’s revenue boost in 2022.

It is interesting to realize that Nutrien’s domination on top of the list may not be affected in 2023 ranking by the recent acquisition of Newcrest by Newmont, as evident by combining Newmont’s and Newcrest’s revenues in 2022. Last May, Newmont agreed to acquire Newcrest by way of an Australian scheme of arrangement under which Newmont will acquire 100% of the issued shares in Newcrest Mining. The acquisition, though, “creates an industry-leading portfolio with a multi-decade gold and copper production profile in the world’s most favorable mining jurisdictions,” said Tom Palmer, president and CEO of Newmont.

Again, most of the companies on this year’s list are primary gold miners. That includes the new additions to the Top 40: Sumitomo and Aries. There are some copper-gold miners and many gold-silver miners. Several companies moved up the list assisted by their acquisitions and mergers in 2022. Both gold and copper continued their gains overall last year.

The good, the bad, and the ugly!

Good news is that 26 out of the 40 on the list achieved more total revenue in 2022 than in 2021. The bad news is that only four companies: Nutrien, Tech Resources, Agnico Eagle, and Capstone Copper bagged the biggest revenue gains in 2022 compared with 2021; good for them! In the next section, we will explain how they were able to make those profits.

Additionally, 14 companies were unable to improve their revenues in 2022 over 2021 numbers.

Net revenue (synonymous with profit) refers to the company’s total revenue less its operating expenses, interest paid, depreciation, and taxes. Surprisingly, only 12 of the 40 were able to report positive net revenue change in 2022, and that is the ugly truth.

Notable changes

Other than Nutrien’s stronghold to the first place, this year’s ranking has been dynamic. Among the many changes, Teck resources moved up to the second place from the fourth place in 2021 and 2020.

Yamana Gold (11th place last year) disappeared from the list, and Pan American moved up the list to 12th place, following the completion of its previously announced acquisition of all the issued and outstanding common shares of Yamana, also following the sale by Yamana of its Canadian assets to Agnico Eagle. It is worth noting that Agnico Eagle’s merger with Kirkland Lake Gold (completed in February 2022) may have

The criteria for choosing the TOP 40

To be eligible for CMJ’s Top 40 Canadian miners list, companies must meet two of the following three criteria:

1 Be domiciled in Canada.

2 Trade on a Canadian stock exchange.

3 Have a significant share of an operating mine or advanced development in Canada.

We have put extra effort into checking the eligibility of all the miners on the current list. However, we remain open to the suggestions of our readers.

16 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

contributed to its total revenue boost by more than $2.6 billion in 2022 compared to 2021.

Capstone Copper climbed from 27th place in 2021 to 16th in 2022, likely a result of its combination with Mantos Copper.

Turquoise Hill Resources (10th place in 2021) disappeared from the list this year, as Rio Tinto has completed its acquisition of Turquoise Hill in Dec. 2022.

Only two royalty and streaming companies (Franco-Nevada and Wheaton Precious Metals) made the list this year, down from three last year. Despite the acquisition of Great Bear Resources, Kinross Gold moved down slightly only to the ninth place (from eighth in 2021). Fortuna Silver Mines combined with Roxgold late in 2021, and Fortuna moved up the list from 31st to 28th place in 2022 (see our report on Fortuna’s Séguéla mine visit on page 29 of this issue).

New to the list

Aris Gold joined the list this year. GCM Mining (formerly Gran Colombia Gold) was 31st on the list in 2021, but it is no longer on the list this year due to the fact that it acquired all outstanding Aris Gold shares that were not already held by GCM Mining in July 2022, and the resulting entity was named Aris Gold Corp., which explains why Aris Gold suddenly made it to the 34th place on the list this year out of nowhere.

The Japanese are here: Why Sumitomo?

Also, new to the list is the Japanese Sumitomo Metal Mining. Listed on a Canadian stock exchange (TSE: 5713), and based on several agreements between Sumitomo and Iamgold, Sumitomo now owns 30% of the Côté-Gosselin gold mine in Canada. The Côté-Gosselin gold project remains on track for gold production in early 2024. Additionally, beginning in January 2023, Sumitomo will contribute funding amounts to the Côté-Gosselin gold project for approximately $340 million over the course of 2023. In exchange, Iamgold will transfer an approximate 10% interest in the Côté-Gosselin JV to Sumitomo. Sumitomo also owns 80% of the advanced exploration Frotet gold mine in Quebec, with 20% owned by Kenorland Minerals. Whether this is the beginning of a Japanese wave of companies added to our list or not is something that we can only tell in the next few years.

The runner-ups

Again, this year, a list of five runner-ups is provided. As usual, the list was predominated by new companies that made it for the first time, including SilverCorp Metals, Endeavour Silver, K92 Mining, and Osisko Gold Royalties (all mainly gold and copper miners). And like last year’s runner-ups list, only Wesdome Gold from the previous year’s runner-ups made the list this year, advancing up to 43rd from 44th in 2021.

The oilsands

Canada has committed to net-zero by 2050. However, an interim goal would require the oil and gas industry to cut 42% of its greenhouse gas (GHG) emissions below 2019 levels by 2030. Both levels of government are providing support to the industry in the form of funding and tax credits but disagree on the methods to reach a carbon-neutral economy.

Ottawa is crafting policies that would put legislative pressure on the sector to decarbonize more quickly, including an impending emissions cap and killing “inefficient” fossil fuel

subsidies. Despite that, as shown in the oilsands table, Canada’s oilsands sector saw tremendous increases in revenues in 2022, compared to 2021. Oil prices continued to soar due to the geopolitical instability caused by the war in Ukraine.

Cenovus Energy replaced Suncor Energy on top of the list. In June 2022, Cenovus Energy acquired BP’s 50% stake in Sunrise oilsands project. British energy giant, BP, is planning to focus on offshore oil development instead of Alberta’s oilsands. Cenovus also completed the acquisition of Husky Energy for $3.9 billion in stock in Jan. 2021.

At the time of drafting this article, Imperial Oil’s 2022 total revenue had not been reported yet.

2023 Forecast

In May 2023, Teck Resources confirmed that it has received a revised, unsolicited, non-binding proposal from Glencore, which would see that company acquire Teck. However, later in June 2023, Glencore confirmed that it submitted alternative proposal to acquire Teck’s steelmaking coal business. As a result, Teck Resources may disappear from the list next year and may or may not be replaced by Glencore.

Copper Mountain will disappear from the list, since it was announced in June 2023 that Hudbay Minerals has acquired all the outstanding common shares of Copper Mountain, which made the latter a wholly owned subsidiary of Hudbay. However, the transaction created a premier American focused copper miner. In general, big acquisitions and mergers are expected in 2023. CMJ

AUGUST 2023 CANADIAN MINING JOURNAL | 17

Top 40 2022

18 | CANADIAN MINING JOURNAL www.canadianminingjournal.com Number of operating Rank mines in 2021 2022 Company HQ Country Industry Listed at Symbol Canada Commodity exposure 1 1 Nutrien Canada Mining & Chemicals TSX NTR 6 Potash, Phosphate Rock 4 2 Teck Resources Canada Mining Company TSX TECK.B 3 Widely diversified 2 3 Newmont United States Mining Company NYSE NEM 3 Copper, Gold, Lead, Silver, Zinc, Indium, Molybdenum, Uranium, Cobalt 3 4 Barrick Gold Canada Mining Company TSX ABX 1 Cobalt, Copper, Gold, Lead, Molybdenum, Nickel, Silver, Uranium, Zinc 5 Sumitomo Metal Mining Japan Mining & Manufacturing TSE 5713 0 Antimony, Copper, Gold, Nickel, Silver, Cobalt, Molybdenum 5 6 First Quantum Minerals Canada Mining Company TSX FM 0 Widely diversified 7 7 Agnico Eagle Canada Mining Company TSX AEM 13 Copper, Gold, Lead, Silver, Uranium, Zinc 6 8 Newcrest Mining Australia Mining Company ASX NCM 2 Copper, Gold, Lead, Molybdenum, Niobium, Rare Earth, Silver, Tungsten, Zinc, Iron Ore, Phosphate Rock, Cobalt 8 9 Kinross Gold Canada Mining Company TSX K 0 Copper, Gold, Silver, Tin, Zinc 9 10 Lundin Mining Canada Mining Company TSX LUN 0 Cobalt, Copper, Gold, Lead, Nickel, Palladium, Platinum, Silver, Tin, Zinc 11 11 B2Gold Canada Mining Company TSX BTO 1 Gold, Copper, Diamond, Magnetite, Phosphate Rock, Silver, Titanium, Uranium, Vanadium, Zinc 13 12 Pan American Silver Canada Mining Company TSX PAAS 2 Copper, Gold, Lead, Molybdenum, Silver, Zinc 14 13 Hudbay Minerals Canada Mining Company TSX HBM 1 Copper, Gold, Molybdenum, Silver, Zinc 17 14 Cameco Canada Mining Company TSX CCO 5 Cobalt, Copper, Gold, Lead, Nickel, Silver, Uranium, Zinc 16 15 Franco-Nevada Canada Royalty & Streaming TSX FNV 0 Widely diversified 27 16 Capstone Copper Canada Mining Company TSX CS 0 Cobalt, Copper, Gold, Iron Ore, Lead, Magnetite, Molybdenum, Silver, Zinc 15 17 SSR Mining United States Mining Company TSX SSRM 1 Copper, Gold, Lead, Molybdenum, Manganese, Silver, Zinc 22 18 Champion Iron Canada Mining Company ASX CIA 1 Cobalt, Copper, Gold, Iron - Total, Iron Ore, Magnetite, Silver, Zinc 20 19 China Gold International Canada Mining Company TSX CGG 0 Copper, Gold, Lead, Molybdenum, Silver, Zinc 18 20 Wheaton Precious Metals Canada Royalty & Streaming TSX WPM 0 Cobalt, Copper, Gold, Iron Ore, Lead, Molybdenum, Nickel, Palladium, Platinum, Silver, Tin, Zinc 19 21 Iamgold Canada Mining Company TSX IMG 3 Antimony, Copper, Gold, Lead, Nickel, Platinum, Silver, Zinc 21 22 Equinox Gold Canada Mining Company TSX EQX 1 Copper, Gold, Molybdenum, Silver 23 23 Eldorado Gold Canada Mining Company TSX ELD 1 Copper, Gold, Lead, Silver, Zinc 25 24 Torex Gold Resources Canada Mining Company TSX TXG 0 Copper, Gold, Silver 24 25 Centerra Gold Canada Mining Company TSX CG 1 Copper, Gold, Molybdenum, Silver 26 26 Alamos Gold Canada Mining Company TSX AGI 2 Copper, Gold, Lead, Silver, Zinc 29 27 Lundin Gold Canada Mining Company TSX LUG 0 Gold, Silver 31 28 Fortuna Silver Mines Canada Mining Company TSX FVI 0 Copper, Gold, Lead, Silver, Zinc 32 29 First Majestic Silver Canada Mining Company TSX FR 0 Copper, Gold, Iron Ore, Lead, Molybdenum, Silver, Zinc 28 30 New Gold Canada Mining Company TSX NGD 2 Copper, Gold, Lead, Molybdenum, Silver, Tungsten, Zinc 30 31 Dundee Precious Metals Canada Mining Company TSX DPM 0 Arsenic, Copper, Gold, Lead, Silver, Sulphur, Zinc 33 32 Ero Copper Canada Mining Company TSX ERO 0 Copper, Gold, Nickel, Silver 38 33 Calibre Mining Canada Mining Company TSX CXB 0 Copper, Gold, Silver 34 Aris Mining Canada Mining Company TSX ARIS 0 Copper, Gold, Silver 35 35 Argonaut Gold United States Mining Company TSX AR 1 Copper, Gold, Silver, Lead, Zinc 37 36 Taseko Mines Canada Mining Company TSX TKO 1 Copper, Gold, Molybdenum, Niobium, Silver 40 37 Victoria Gold Canada Mining Company TSX-V VIT 1 Cobalt, Copper, Gold, Nickel, Platinum, Silver 43 38 Karora Resources Canada Mining Company TSX KRR 0 Copper, Gold, Nickel, Silver, Zinc 34 39 Copper Mountain Canada Mining Company TSX CMMC 1 Copper, Gold, Silver, Zinc 45 40 Largo Canada Mining & Manufacturing TSX LGO 0 Vanadium, Iron Ore, Tungsten, Molybdenum, Fluorite, Titanium

Sorted by total revenue

AUGUST 2023 CANADIAN MINING JOURNAL | 19

DOLLARS

figures

THE REDPATH WAY SINCE 1962. SAFE, DEPENDABLE, PROFESSIONAL redpathmining.com AFRICA | ASIA | AUSTRALIA | EUROPE NORTH AMERICA | SOUTH AMERICA Mine Development Shaft Sinking Mass Excavation Production Mining Raiseboring Raise Mining Underground Construction Mechanical Excavation Engineering & Technical Services Specialty Services Total revenue in Net income in Operating cash million C$ million C$ flow in million C$ 2022 2021 2022 2021 2022 2021 49,298 34,737 9,968 3,949 10,554 4,871 22,533 13,481 3,317 2,868 7,983 4,738 15,505 15,320 –558 1,460 4,190 5,364 14,331 15,023 562 2,532 4,530 5,488 12,515 10,576 2,794 940 1,585 1,045 9,924 9,040 1,346 1,042 3,035 3,616 7,471 4,793 872 680 2,728 1,650 5,475 5,736 1,135 1,458 4,496 4,675 –788 277 1,367 1,423 3,958 4,173 555 977 1,141 1,861 2,255 2,209 329 526 775 908 1,945 2,047 –445 122 42 492 1,902 1,883 92 –306 635 481 1,868 1,475 89 –103 305 458 1,712 1,630 912 919 1,301 1,198 1,687 996 159 284 114 694 1,494 1,848 253 461 209 763 1,461 1,282 523 464 470 624 1,438 1,426 290 335 582 523 1,386 1,506 871 945 967 1,059 1,248 1,444 –91 –319 532 357 1,239 1,357 –138 695 74 402 1,134 1,179 –460 –170 275 454 1,130 1,073 246 190 531 414 1,106 1,128 –100 –478 –3 520 1,069 1,032 48 –84 388 447 1,061 919 96 277 555 524 887 752 –167 72 253 184 816 736 –149 –6 25 86 787 934 –87 176 248 406 741 804 47 263 302 317 555 614 133 252 187 457 525 411 56 73 126 132 520 480 1 233 100 101 505 548 –198 33 –5 164 392 433 –26 36 81 175 322 356 36 111 84 132 317 264 10 27 88 107 301 578 32 104 20 316 298 249 –2 28 5 50

Canada’s TOP 40 CANADIAN

All

in the tables are expressed in millions of Canadian dollars. -

Top 40 runner ups

THE FINE PRINT

> We recognize that revenues are an imperfect way of looking at companies, as they discount the value of near-term expansions and development projects. Since the cut-off for our Top 40 can be close, we have also included a runners-up table to highlight other Canadian companies that are generating strong revenues.

> Please see also the criteria for our Top 40 eligibility, which is unchanged from past years.

> Differences in reported revenue figures between this year and last are attributable to different exchange rates used to convert U.S. dollar figures for each year and to some companies having restated prior years’ revenue. Financial results are also impacted by commodity prices and exchange rates. For comparability purposes, note that cash flow from operations is calculated after changes in working capital.

> We use the Bank of Canada’s average exchange rate when converting U.S. to Canadian dollars: for 2022, the average was US$1.00 for C$1.301.

> This year, we also added a column displaying the number of operating mines in Canada for each company to the main table and displayed the full commodity exposure for each company.

> We are thankful to Katja Freitag, Manager of Mining Intelligence, for her help in generating the data for the tables using the Mining Intelligence database.

20 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Number of Total revenue in net income in Operating cash operating million C$ million C$ flow in million C$ Rank HQ Listed mines in 2021 2022 Company Country Industry at Symbol Canada Commodity exposure 2022 2021 2022 2021 2022 2021 41 SilverCorp Metals Canada Mining Company TSX SVM 0 Copper, Gold, Lead, Silver, Zinc 284 241 40 58 140 108 42 Endeavour Silver Canada Mining Company TSX EDR 0 Copper, Gold, Lead, Silver, Zinc 273 207 8 17 72 29 43 43 Wesdome Gold Mines Canada Mining Company TSX WDO 3 Copper, Gold, Silver, Zinc 265 263 –15 164 65 131 44 K92 Mining Canada Mining Company TSX-V KNT 0 Copper, Gold, Silver 245 193 46 34 95 77 45 Osisko Gold Royalties Canada Royalty & Streaming TSX OR 0 Gold-Silver-Copper 218 225 –119 –24 110 106

Sorted by total revenue (2022) C$ millions Total revenue net income Company TSX ticker 2022 2021 2022 2021 Cenovus Energy CVE 71,765 48,811 6,450 587 Suncor Ener gy SU 62,907 41,133 9,077 4,119 Canadian Natur al Resources CNQ 49,530 32,854 10,937 7,664 MEG Energy MEG 6,343 4,397 902 283 Imperial Oil IMO 37,508 2,479

Providing Safe, Simple & Secure fencing solutions for your boundary and security needs. We have the temporary fencing solution for your next project in stock and ready to deliver - fast! Call for a quote today! 1-855-993-0499 BROADFENCE.COM ANTICLIMB PANELS WATER-FILLED BARRIERS BARRICADE PANELS SLOT BLOCKS 6’ and 8’ panels available

Canadian oilsands producers

Net income

Net income change

C$ millions Rank Company Total Net Net income/ revenue income revenue 20 Wheaton Precious Metals 1,386 871 63 15 Franco–Nevada 1,712 912 53 18 Champion Iron 1,461 523 36 32 Ero Copper 555 133 24 5 Sumitomo Metal Mining 12,515 2,794 22 24 Torex Gold Resources 1,130 246 22 8 Newcrest Mining 5,475 1,135 21 1 Nutrien 49,298 9,968 20 19 China Gold International 1,438 290 20 17 SSR Mining 1,494 253 17 2 Teck Resources 22,533 3,317 15 11 B2Gold 2,255 329 15 10 Lundin Mining 3,958 555 14 6 First Quantum Minerals 9,924 1,346 14 7 Agnico Eagle 7,471 872 12 37 Victoria Gold 322 36 11 33 Calibre Mining 525 56 11 39 Copper Mountain 301 32 11 16 Capstone Copper 1,687 159 9 27 Lundin Gold 1,061 96 9 31 Dundee Precious Metals 741 47 6 13 Hudbay Minerals 1,902 92 5 14 Cameco 1,868 89 5 26 Alamos Gold 1,069 48 4 4 Barrick Gold 14,331 562 4 38 Karora Resources 317 10 3 34 Aris Mining 520 1 0 40 Largo 298 –2 –1 3 Newmont 15,505 –558 –4 36 Taseko Mines 392 –26 –7 21 Iamgold 1,248 –91 –7 25 Centerra Gold 1,106 –100 –9 30 New Gold 787 –87 –11 22 Equinox Gold 1,239 –138 –11 9 Kinross Gold 4,496 –788 –18 29 First Majestic Silver 816 –149 –18 28 Fortuna Silver Mines 887 –167 –19 12 Pan American Silver 1,945 –445 –23 35 Argonaut Gold 505 –198 –39 23 Eldorado Gold 1,134 –460 –41 AUGUST 2023 CANADIAN MINING JOURNAL | 21

Canada’s TOP 40

C$ millions Company 2022 2021 Income Change Nutrien 9,967.96 3,948.50 6,019.46 Sumitomo Metal Mining 2,793.51 940.36 1,853.14 Teck Resources 3,317.00 2,868.00 449.00 Hudbay Minerals 91.59 –306.01 397.60 Centerra Gold –100.47 –478.09 377.62 First Quantum Minerals 1,345.54 1,041.91 303.63 Iamgold –91.22 –318.59 227.36 Agnico Eagle 872.20 680.01 192.18 Cameco 89.38 –102.58 191.96 Alamos Gold 48.28 –83.53 131.81 Champion Iron 522.59 464.43 58.16 Torex Gold Resources 245.69 189.97 55.71 Franco-Nevada 911.69 918.81 –7.12 Calibre Mining 56.40 72.88 –16.49 Karora Resources 9.90 27.47 –17.57 Largo –1.89 28.26 –30.15 China Gold International 289.85 334.81 –44.96 Taseko Mines –25.97 36.47 –62.44 Copper Mountain 31.96 104.09 –72.13 Victoria Gold 36.47 110.72 –74.25 Wheaton Precious Metals 870.74 945.35 –74.61 Ero Copper 132.51 251.77 –119.26 Capstone Copper 159.02 284.06 –125.04 First Majestic Silver –148.71 –6.16 –142.55 Lundin Gold 95.72 277.30 –181.57 B2Gold 329.06 526.05 –196.99 SSR Mining 252.63 460.95 –208.31 Dundee Precious Metals 46.74 263.11 –216.37 Argonaut Gold –198.06 33.22 –231.28 Aris Mining 0.81 233.22 –232.41 Fortuna Silver Mines –166.74 72.48 –239.22 New Gold –86.93 176.07 –263.00 Eldorado Gold –460.43 –170.34 –290.09 Newcrest Mining 1,134.73 1,457.68 –322.94 Lundin Mining 555.46 977.23 –421.77 Pan American Silver –444.72 122.01 –566.73 Equinox Gold –137.98 694.89 –832.87 Kinross Gold –787.55 277.01 –1,064.56 Barrick Gold 562.16 2,532.15 –1,969.99 Newmont –558.26 1,460.18 –2,018.44

Operating cash flow

Revenue Change %

22 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

C$ millions Rank 2022 Company Revenue Revenue 2022 2021 Change 16 Capstone Copper 1,687 996 69% 2 Teck Resources 22,533 13,481 67% 7 Agnico Eagle 7,471 4,793 56% 1 Nutrien 49,298 34,737 42% 33 Calibre Mining 525 411 28% 14 Cameco 1,868 1,475 27% 38 Karora Resources 317 264 20% 40 Largo 298 249 20% 5 Sumitomo Metal Mining 12,515 10,576 18% 28 Fortuna Silver Mines 887 752 18% 27 Lundin Gold 1,061 919 15% 18 Champion Iron 1,461 1,282 14% 29 First Majestic Silver 816 736 11% 6 First Quantum Minerals 9,924 9,040 10% 34 Aris Mining 520 480 8% 24 Torex Gold Resources 1,130 1,073 5% 15 Franco-Nevada 1,712 1,630 5% 26 Alamos Gold 1,069 1,032 4% 11 B2Gold 2,255 2,209 2% 3 Newmont 15,505 15,320 1% 13 Hudbay Minerals 1,902 1,883 1% 19 China Gold International 1,438 1,426 1% 25 Centerra Gold 1,106 1,128 –2% 23 Eldorado Gold 1,134 1,179 –4% 9 Kinross Gold 4,496 4,675 –4% 8 Newcrest Mining 5,475 5,736 –5% 4 Barrick Gold 14,331 15,023 –5% 12 Pan American Silver 1,945 2,047 –5% 10 Lundin Mining 3,958 4,173 –5% 31 Dundee Precious Metals 741 804 –8% 35 Argonaut Gold 505 548 –8% 20 Wheaton Precious Metals 1,386 1,506 –8% 22 Equinox Gold 1,239 1,357 –9% 36 Taseko Mines 392 433 –9% 37 Victoria Gold 322 356 –10% 32 Ero Copper 555 614 –10% 21 Iamgold 1,248 1,444 –14% 30 New Gold 787 934 –16% 17 SSR Mining 1,494 1,848 –19% 39 Copper Mountain 301 578 –48%

(sorted by cash flow) Total Operating Operating revenue cash flow cash flow/ in million in million revenue Rank Company C$ C$ (%) 1 Nutrien 49,298 10,554 21 2 Teck Resources 22,533 7,983 35 3 Newmont 15,505 4,190 27 4 Barrick Gold 14,331 4,530 32 5 Sumitomo Metal Mining 12,515 1,585 13 6 First Quantum Minerals 9,924 3,035 31 7 Agnico Eagle 7,471 2,728 37 8 Newcrest Mining 5,475 N/A 9 Kinross Gold 4,496 1,367 30 10 Lundin Mining 3,958 1,141 29 11 B2Gold 2,255 775 34 12 Pan American Silver 1,945 42 2 13 Hudbay Minerals 1,902 635 33 14 Cameco 1,868 305 16 15 Franco-Nevada 1,712 1,301 76 16 Capstone Copper 1,687 114 7 17 SSR Mining 1,494 209 14 18 Champion Iron 1,461 470 32 19 China Gold International 1,438 582 40 20 Wheaton Precious Metals 1,386 967 70 21 Iamgold 1,248 532 43 22 Equinox Gold 1,239 74 6 23 Eldorado Gold 1,134 275 24 24 Torex Gold Resources 1,130 531 47 25 Centerra Gold 1,106 –3 –0.3 26 Alamos Gold 1,069 388 36 27 Lundin Gold 1,061 555 52 28 Fortuna Silver Mines 887 253 29 29 First Majestic Silver 816 25 3 30 New Gold 787 248 32 31 Dundee Precious Metals 741 302 41 32 Ero Copper 555 187 34 33 Calibre Mining 525 126 24 34 Aris Mining 520 100 19 35 Argonaut Gold 505 –5 –1 36 Taseko Mines 392 81 21 37 Victoria Gold 322 84 26 38 Karora Resources 317 88 28 39 Copper Mountain 301 20 7 40 Largo 298 5 2

TOP 40

Canada’s

By Steve Gravel

Is there a mining technology investment

LANDS CAPE?

One of the most frequent questions I get asked when working with mining technology companies is “how do I access capital?” These tech firms have all the hallmarks of other tech companies. They employ highly skilled people, they use disruptive technology like artificial intelligence, and they engage in world-class applied R&D. Traditionally, industrial technology companies have not used third party investment as an instrument to raise capital as much as other sectors like digital technologies and life sciences. Lacking a universally compelling story, consumer facing products, and having typically longer returns on investments, industrial tech companies have long struggled to attract venture capital interest. This, however, is starting to change.

While not typically seen as a bastion of new ways of doing things, the mining sector is undeniably an industry that consumes innovative technologies. There is much written on this topic regularly by industry insiders profiling the latest solu-

tion that will save money or make mines safer or more profitable. Many of these mining technology companies were formed on the basis of solving a specific challenge for the mines, and many of them are bootstrapped and grow through typical means like personal investment, patient capital (friends and family), or traditional bank loans.

In my experience, mining technology companies usually do not raise capital the way other technology sectors do. Quite often, I have heard from angel investors and venture capital fund managers that the mining technology sales cycle is too long and therefore too risky to invest in. What has become increasingly clear is that there is a nascent mining technology investment landscape that is starting to take shape and much of this important work is happening right here in Canada.

From a cursory look at the investments that have been made in mining technologies, the types of deals can be divided into a few categories; industry specific

corporate venture capital (VC), traditional venture capital funds with a focus on industrial technologies, and academic linked start-up programs.

Corporate VC is the direct investment of corporate funds into an external startup company. Typically, this is characterized by large companies recognizing a unique technology offering that can offer benefit within the large firm’s value chain or business process. Often, the corporate will invest through joint venture agreements, direct funding to R&D, and/ or taking an equity position in the start-up. The investing corporation may also provide the startup with management and marketing expertise, strategic direction, and/or a line of credit. Some interesting examples of corporate VCs that have invested in some mining tech start-ups that I have come across in recent years include ABB Technology Ventures and Caterpillar Ventures.

ABB Technology Ventures (ATV) is the venture capital arm of the well-known

AUGUST 2023 CANADIAN MINING JOURNAL | 23

TECHNOLOGY

PHOTO: ADOBE STOCK/CENDECED

CONTINUED ON PAGE 24

TECHNOLOGY

electrical and automation firm, the ABB Group. ATV looks for breakthrough technology companies aligned with ABB’s business goals and more altruistic vision for society. Some notable investments include the B.C.-based digital ore sorting solution company, MineSense, and the Sweden-based battery developer and manufacturer, NorthVolt, which is becoming a household name for those interested in the EV supply chain.

Caterpillar Ventures (CV) was founded in 2015, and it invests in early-stage startups focusing on the energy sector and the digital economy. While many of the firms’ investments have been in industrial technology companies with wide cross-sectoral appeal, several of them have mining as a key segment of focus. For example, CV has invested in Guardhat, an industrial IoT firm that facilitates lone worker scenarios through wearable tracking devices and other solutions. CV have also invested in Waterloo-based tech company, Clearpath Robotics. Clearpath has had several forays in the mining sector from intelligent inspection robots to autonomous mapping robots and fully

autonomous mine vehicles. In all, CV has invested in 17 firms to date and is actively recruiting new investment opportunities in energy, digital solutions, robotics, and advanced materials.

Furthermore, mining companies themselves have started to see the value in the technology ecosystem and have launched corporate VCs to accelerate new ventures towards commercialization. NEXA Resources, for example, launched its Mining Lab program in 2016, and Vale launched its corporate VC arm, Vale Ventures, in 2022 to invest in disruptive technological innovation projects for the mining and metallurgy industry.

When it comes to VC firms that have a focus on mining technology, it appears there are only a handful of firms zeroed in on mining from which to draw. The term commonly used in the investment community for these funds is “industrial innovation venture capital.” Far and away, the most prolific VC I have encountered in the space is the Vancouver-headquartered Chrysalix Venture Capital. While some of its 20+ portfolio companies focus on multiple sectors, the threads

that link them all are mining, metals, and energy. The portfolio companies are truly a great example of technological innovations in the industry as they range from utilizing AI in mineral exploration to advanced IoT sensors and even autonomous inspection robots.

In the angel investment space, there is momentum growing behind a few opportunities led by the Northern Ontario Angels (NOA), Archangel’s Axion fund, and the Sudbury-based Catalyst fund. These funds have a focus on investing in northern Ontario-based companies and have mobilized capital for several mining-based technology ventures such as the IoT firm, Symboticware, and the autonomous mining equipment venture, Fortai.

In addition to direct investment in start-ups, there are university-linked accelerators that have healthy numbers of portfolio companies focused on the mining sector. University of Toronto’s Creative Destruction Lab, for example, have had nearly a dozen companies targeting mining and mineral processing from AI geological solutions and tailings treatment technologies to advanced robotics and novel lithium extraction technologies. Involvement in academic linked accelerators provides early-stage companies access to mentors and introduction to the angel and venture investment community.

The mining sector has been a consumer and developer of innovation for over a century. The rise of the modern tech firm has occurred relatively recently over the last three decades. Mining and tech are now, more than ever, getting to know each other. With the recent re-focusing of attention on critical minerals, more technology ventures are starting to see the sector as an opportunity. Mines are now closer to the consumer with the advent of the electric vehicle supply chain, and they are more prevalent in the public consciousness. This, coupled with the sector’s recognition of the need to decarbonize, make it ripe for new technology adoption. While still in the early stages, the investment community is starting to consider mining-focused firms as viable ventures to invest in. Canada has an opportunity to lead in this space and become a destination for industrial tech start-ups. CMJ

www.canadianminingjournal.com

Steve Gravel is the manager of the Centre for Smart Mining at Cambrian College.

Is your mine design based on sound geology?

.com

By Tamer Elbokl, PhD

turnarounds Profitable

Interview with Lewis Black, CEO and president of Almonty Industries

Almonty Industries is a global mining company focused on tungsten mining and exploration. The company is listed on the Toronto Stock Exchange and its current portfolio includes operations in Spain, Portugal, and South Korea. Almonty specializes in acquiring distressed and underperforming tungsten operations and assets. The company’s operational experience and unrivaled expertise in the tungsten market help revitalize these operations.

The company’s acquisitions have been fast and very profitable turnarounds. Almonty continues to actively pursue other growth opportunities via acquisitions where it can apply its tungsten expertise to create additional value for all stakeholders.

Tungsten is an irreplaceable component in the production of much modern technology. For example, tungsten is an additive in the production of specialty alloys; filament wire for lighting (2%); and specialty uses for mobile phone handsets, military, ballistics (defense equipment) automotive parts, aerospace components, drilling, boring and cutting equipment, logging equipment, electrical

Tungsten is on the list of 31 minerals currently considers to be “critical” by the Canadian government. It is a chemical element with the symbol W and atomic number 74. Tungsten is a rare metal found naturally compounded with other elements. It was identified as a new element in 1781 and first isolated as a metal in 1783.

Fast facts about tungsten

> Tungsten is the heaviest engineering material with a density of 19.25 g/cm3.

> It has the highest melting point of all metals at 3,410°C with a boiling point of 5,700°C.

> It has the lowest vapour pressure of all metals.

> It has the highest modulus of elasticity of the metals (E = 400 GPa).

> It is the hardest pure metal.

> Excellent high-temperature strength characteristics.

> It has the highest tensile strength at temperatures above 1,650°C.

> It has a low thermal expansion co-efficient (4.4 x 10-6 m/m/C) like that of borosilicate glass, and therefore makes it useful for glass to metal seals.

> It does not oxidize in air and needs no protection from oxidation at elevated temperatures.

> Its corrosion resistance is excellent, and it is not attacked by nitric, hydrofluoric, or sulphuric acid solutions.

> Environmentally friendly; does not break down or decompose.

and electronics appliances, chemical applications, and many other end-uses. Recently, I had the opportunity to chat with Lewis Black (LB), CEO and president of Almonty Industries. Black talked about tungsten and the recent developments in the global markets and how it affects the company’s projects and investments.

CMJ: As a conversation starter, can you please talk to us briefly about the history of Almonty Industries and how you became the CEO and president of the company?

LB: Almonty Industries was created about 12 years ago by myself, which is how I

>

AUGUST 2023 CANADIAN MINING JOURNAL | 25 GLOBAL MINING

“Highly regarded as a hands-on, turnaround investor-operator, Almonty is an expert at overseeing projects regarded as too complex or difficult for the average, pure “financial investor.”

LEWIS BLACK, CEO AND PRESIDENT OF ALMONTY INDUSTRIES.

became CEO. I put about $9 million into the company when we made our first acquisition, which was the Los Santos mine in Spain. I was the founding partner back in 2011.

Previously, we had been under a ticker of PMI where we had had the Panca mine. We had bought that mine, turned it around, and sold it for 21 times earnings. So, after that event, we rebranded a few years later with Almonty

CMJ: In your opinion, how are political risks and defense implications affecting the industry now?

LB: Both these points have really taken front and center in the last four years. Everyone was very aware of certain jurisdictions and their dominance of certain commodities for the last 30 years.

We saw this in 2008 when most of the supply contracts out of China were canceled in the national interest. At that point, everyone in the economic meltdown and the thought was: we are going to diversify, and of course, the EU (European Union) pivoted towards Russia to diversify, which has not worked out quite as they planned. In the last four years, we have seen this geopolitical risk elevate dramatically. Also, one thing we have learned during the last three years of the pandemic is that governments have much more capacity to act than we all realized. Whether you are a corporation or a consumer, it does not really matter what jurisdiction you are in, because if a national emergency or a strategic reason is declared, the government can do whatever it wants. And there is really nothing you can do about it.

Things are no different with commodities. So, there has been a focus on tungsten which is extensively used in defense. One thing that has been highlighted in the first traditional land war that we have seen in a generation, which is in Ukraine, is that currently the West has an exceedingly small capacity for munitions production compared to what it had 30 years ago.

And in Ukraine, they are consuming every day more munitions than we could produce daily. So, you can see why it is problematic to have 90% of the world’s tungsten coming from China and Russia. Even if you can get the tungsten, which is exceedingly difficult right now, 90% of it

must come from the very people that you have to prepare yourself to defend against. It is an extraordinary predicament that we found ourselves in.

CMJ: Is the situation any different because we have a war going on? Did we not realize that problem before even the war?

LB: I think we must look at the concept of the democratic system. The democratic system is reliant on a popularity contest every few years. So, the focus is on the things that make you popular. During the Cold War, of course, defense was front and center, but since then, we have become a much more progressive society, and now we can solve our issues over croissants and coffee. The harsh reality is when one country plants 167,000 troops on the border of a sovereign nation that borders into Europe, and you call their bluff, they roll right across you.

When the war started, Germany said they have two days’ worth of munitions inventory, and they are sending tanks to Ukraine but no munitions. Also, the U.S. very generously, promised to give 31 Abrahams tanks to Ukraine, but they cannot ship them because they need to replace the existing armor with tungsten and webbing armor, which they cannot procure right now because there is no tungsten. Unfortunately, people knew but no one really cared.

The issue is that no politician was going to get elected in the last 30 years saying I am stockpiling munitions. And we have obviously seen what happens when someone calls our bluff.

CMJ: The global supply chain is facing many increasing challenges. Can you talk to us about that? What created the current situation in addition to the war?

LB: In the 1980s, there were 100 tungsten mines outside of China around the world. By the mid-nineties, only two were left, and this was not unique to tungsten.

What happened to several commodities is that pre-WTO membership of China, they arrived at the market, and bought market share by making certain commodities available at prices that we were in disbelief at. As a result, no one could compete.

We never really understood this market share dominance. And once you got a foot in the door, supplying raw materials would become supplying of downstream materials, and you would keep expanding your dominance. It was just business, and we dropped the ball. How we resolve it now is the $24,000 question.

What we saw during COVID was not just any typical global event. We saw enormous ripples of interference with a smooth-running global operation.

For example, shipping has been an absolute disaster for the last three years.

26 | CANADIAN MINING JOURNAL www.canadianminingjournal.com GLOBAL MINING

A surveyor takes topographic alignment readings as the development of supporting infrastructure for Almonty’s Sangdong mine continues CREDIT: ALMONTY INDUSTRIES

It has been hugely expensive, enormously unreliable, and chaotic. We have sanctions on Russia but not really. Sanctions only work if everyone signs up. So, Russian tungsten still finds its way to the market. It just does not go through the EU anymore. It goes through China.

Globalization conceptually is a fantastic and worthy ambition, but we do not really have a global supply chain. What we have is a supply chain that is dominated by certain jurisdictions. The fact that it crosses the world to get to you does not make it a global supply chain. A global supply chain implies that if you are not happy buying from place A, then you have options to buy in place B, C, D, and E; that is a global supply chain. We do not have that. Currently, you can buy it in place A, and that is it. And so, shipping has obviously been an issue.

We are talking about commodities that are dominated by two countries, Russia and China. We have no idea what they will do to defend that market share. Will they cut you off? Will they restrict supply? Will they crash pricing? We do not know how they will defend it. And that is the great unknown for governments. So, we need diversification.

CMJ: Outside of China and Russia, how can countries in conflict with those two countries secure their supply of tungsten?

LB: High level solutions include government offtake, loans, and subsidies. We know that countries would like to have a choice but want certain conditions with that choice. They want to know that the mines are ESG compliant and that they operate in transparency.

I know from first-hand experience that building and operating in democracies is not for the fainthearted. It is a journey and the countries where the journey to opening a mine is much smoother are less transparent democracies, and the level of ESG compliance is really starting to diminish. Now, they have no choice but to obtain tungsten that has a more spurious ESG background because there is no other option.