MINING IN AFRICA NEW RISKS BRING NEW OPPORTUNITIES Updates on Quebec plan for critical and strategic minerals Canadian roadmap to net-zero DECEMBER 2022 | www.canadianminingjournal.com | PM # 40069240 +

Compact Mining Trailers Operates for less. Side dumps offer a compact footprint with lower operating costs From mines to quarries, SmithCo side dump mining trailers offer a smarter way to haul. These trailers can go the distance with payloads up to 100 tons and 200 tons when trained. Haul material more efficiently over distance than traditional haul trucks, making satellite mines more feasible. Dump over barriers, berms or into crusher chutes. Versatile SmithCo Side Dump Trailers will work for you. 800-779-8099 sales@sidedump.com

Rugged

FEATURES

ESG

Using a regeneration lens, mine waste becomes a resource.

Sustainable mine design starts with a cultural shift.

TECHNOLOGY

Mines of the future will run on data. MINING IN CANADA AND NORTH AMERICA

Updates on Quebec plan for critical and strategic minerals.

Opportunities for mining and critical minerals’ processing in North America.

Roadmap to net-zero.

Strong team: successful project.

Seabridge Gold: a Canadian icon of responsible operations.

ABB

12 LEARNINGS

Top 12 learnings mined from a year of all-electric and zero-emission exploration.

INDIGENOUS PEOPLES

Constructing lasting partnerships: team of Indigenous and non-Indigenous companies join forces on Giant mine remediation.

GREEN

ENERGY

New power integration center offers productivity and sustainability solutions.

MINING IN AFRICA

Mining in Mozambique: new risks bring new opportunities.

EQUIPMENT

Increasing efficiency with support equipment.

DEPARTMENTS

NEWS | Updates from across the mining ecosystem.

LAW | It is in the budget: new measures for mining companies and a new super flow-through financing tax credit for investors.

YEAR IN REVIEW | A year in review from EY center of excellence advisors.

ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

Coming in January 2022 Canadian Mining Journal’s January issue will look at all aspects of water management from tailings ponds, conservation and coping with the scarcity of water in certain locations.

For More Information

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

16

DECEMBER VOL. 143, N O .10

Front cover image provided by Petro-Canada Lubricants www.canadianminingjournal.com

18

10

20

14

16

18

32

37

38

24

26

28

30

35

4

6

DECEMBER 2022 CANADIAN MINING JOURNAL | 3 38

EDITORIAL | Critical mining was the highlight of 2022.

FAST

8

13

45

FROM

DECEMBER 2022 Vol. 143 – No . 10

225 Duncan Mill Rd. Suite 320, Toronto, Ontario M3B 3K9

Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief Dr. Tamer Elbokl TElbokl@CanadianMiningJournal.com

Tamer Elbokl, PhD

W

Developed in consultation with provincial, territorial, and industry experts, Canada now has a list of minerals it considers to be “critical.” Currently, it consists of 31 min erals; however, the list will be reviewed every three years and revised if needed.

Most recently, Canada strengthened its guidelines to protect its “critical mining” sector from foreign state-owned enterprises. The announcement of approximately $4.0 billion in support over eight years to implement its first critical minerals strat egy together with the federal government’s announcement for divesting owner ship of some Canadian mining companies held by foreign state-owned companies are both part of this trend.

In March 2022, the government of Ontario announced its first-ever critical minerals strategy, which aims to secure Ontario’s position as a global leader of responsibly sourced critical min erals. Turn over to page 8 where our law column discusses the new measures in the federal budget 2022 for mining companies and the new super flow-through financing tax credit for investors.

The next 12 months are expected to be chal lenging when it comes to inflation and supply chain constraints. Building eco nomic development opportunities with Indigenous partners and developing a skilled labour force should continue to be a priority, readers can get insight into a year in review from EY center of excellence advisors and Max Luedtke from ABB industries on pages 13 and 24, respectively.

We also shed some light on Quebec plan for critical and strategic minerals on page 16. Additionally, this issue features articles on mining in North America including two interviews with the CEOs of “responsible” Canadian mining compa nies on pages 32 and 38. Gordon Feller’s article about mining in Mozambique is on page 30.

Finally, as part of our ongoing discussion on rebranding mining, it is time to start using the term “critical mining” to refer to the mining of those critical miner als. Our readers are cordially invited to weigh in about the use of this term by sending letters to the editor at TElbokl@canadianminingjournal.com. CMJ

News Editor

Marilyn Scales mscales@canadianminingjournal.com editor@canadianaminingjournal.com

hile the world recovers from the Covid-19 pandemic, the year 2022 has been a good year for the “critical mining” sector in Canada supported by several announcements by the federal and provincial governments.Production Manager

Jessica Jubb jjubb@glacierbizinfo.com

Advisory Board

David Brown (Golder Associates) Michael Fox (Indigenous Community Engagement) Scott Hayne (Redpath Canada) Gary Poxleitner (SRK)

Manager of Product Distribution Allison Mein 403-209-3515 amein@glacierrig.com

Publisher & Sales Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published 10 times a year by Glacier Resource Innovation Group (GRIG). GRIG is located at 225 Duncan Mill Rd., Ste. 320, Toronto, ON, M3B 3K9 Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods:

Phone: 1-888-502-3456 ext 3; E-mail: amein@glacierrig.com

Mail to: Allison Mein, 225 Duncan Mill Rd., Ste 320, Toronto, ON M3B 3K9

We acknowledge the financial support of the Government of Canada.

CREDIT: ADOBE

4 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

President, The Northern Miner Group Anthony Vaccaro THE EDITOR

Critical mining was the highlight of 2022

OUR COMMITMENT RUNS DEEP

CAT® UNDERGROUND HARD ROCK MINING

Underground hard rock mining presents special challenges when it comes to safe, efficient, productive operation from environmental concerns and rising costs to communications and connectivity challenges. Cat ® underground loaders and trucks are designed to help you meet those challenges head-on.

We recently introduced our first zero emissions battery-electric machine, the R1700 XE underground loader, and a new AD63 underground truck that delivers high payload and can be configured to meet the strictest emissions regulations. And we’ll soon be launching a new diesel-electric R2900 XE built from the ground up for increased production and reduced emissions.

At Caterpillar, we never stop looking for new ways to innovate and optimize. We’re committed to listening to your challenges and collaborating with you to find new ways to improve the way you mine.

CAT.COM/UNDERGROUND

All Rights Reserved. CAT, CATERPILLAR, LET’S DO THE WORK, their respective logos, “Caterpillar

the “Power Edge” and Cat “Modern Hex” trade dress as well as corporate and product identity used herein, are trademarks of

and may not be used without permission.

©2022 Caterpillar.

Corporate Yellow”,

Caterpillar

• ENVIRONMENT

|

Updates from across the mining ecosystem

Newmont to spend $160M on water treatment plant at Porcupine

On Nov. 18, NEWMONT is mak ing a $160-million investment into a new, state-of-the-art water treatment plant at its Porcupine operations near Timmins, Ont.

The water plant is to be com pleted by the end of this year and become operational in 2023. It will return up to 13 mil lion m3 of treated, clean water to the Mattagami, Frederick house, and Upper Kapuskasing watersheds.

“Investments like the new water treatment plant that we are announcing today are only made possible by the steadfast commitments of our employees, all levels of government and our Indigenous communities and partners,” said Porcupine general manager Dawid Pretorius at the official announce ment. “I would like to thank all involved for their dedication to upholding our reputation as an industry leader in safe, sustain able and responsible mining.”

Since 1910, the Porcupine mining district has produced more

DECARBONIZE

Mine Sites and

on Energy

than 67 million oz. of gold. Newmont produces about 287,000 oz. of gold from its Porcupine mines in 2021. Proven and prob able reserves at the end of last year contained 6.2 million oz. gold in 42.8 million tonnes grading 1.89 g/t gold. The company is now the largest employer in Timmins, providing more than 1,200 jobs for employees and contractors.

The official announcement was attended by Ontario Premier Doug Ford, MPP for Timmins and Minister of Mines George Pirie, Newmont senior VP for North America, representatives of many nearby Indigenous nations, and local dignitaries.

| Sayona to expand NAL resources, production capacity

SAYONA MINING is making potential plans to increase the resources at its North American Lithium (NAL) project in La Corne, Que., with the acquisition from Jourdan Resources of the Vallée lithium project.

Sayona says this is a strategic acquisition which will posi tion the company to quickly expand resources and plan for increased production capacity. The newly acquired claims host pegmatite targets located close to and along strike for the NAL orebody.

Sayona will acquire 48 claims spanning about 1,997 ha, located adjacent to the NAL operation. Twenty of the leases are located within 500 metres of the mine boundary. The orig inal NAL property covers 19 claims over 582 hectares.

Twenty claims or 755.3 ha will be acquired outright, which will allow an immediate extension to the NAL operating area for future expansion. Sayona also has the right to earn up to a 51% stake in the remaining 28 claims by spending $4.0 million within a year and a further $6.0 million over two years at the property, raising its interest to 50%. The final 1% equity is available is Sayona prepares a feasibility study and arranges funding for mine development at Vallée.

Sayona will also acquire at 9.99% shareholding in Jourdan through a private placement of $1.5 million. The two compa nies plan to form a joint venture to develop Vallée. CMJ

6 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FAST NEWS

The Porcupine Hollinger gold mine in northern Ontario. CREDIT: NEWMONT

• LITHIUM

CMJ

Your

Save

The AgriPower clean safe Biomass and Waste-to-Energy Systems will be uniquely designed to provide the Electricity and Heat required at your Mine Sites across Canada and around the World. The AgriPower units are fueled by the mine’s waste of paper, cardboard, and wood of all types, some plastics, and biomass from dead-dying trees in the area. WE CAN PROVIDE PROJECT GREEN FUNDING. CONTACT: Garry Spence 1-519-631-6035 garryevergreenenergy@rogers.com

U.S. military may assess Canada critical minerals projects for funding

Canadian battery mineral miners and explorers are sniffing around hundreds of millions of dollars in potential funding from the United States military, but there are no firm deals yet to take advantage of an alliance dating back to World War II.

The concept of the U.S. funding projects in Canada to help sidestep China’s control over lithium and rare earth element (REE) processing broke into the open this month at a confer ence in Washington, D.C. However, some companies say they’ve been aware of the initiative for years.

There appears to be a new urgency under the Biden admin istration as it says it faces looming threats from China to national security through minerals needed for green energy and the wider economy. In March, it used the 1950 Defense Production Act (DPA) Title III to give the Department of Defense increased powers to help miners and explorers secure supplies of battery minerals such as lithium, nickel, cobalt, graphite and manganese. They’re also seeking REEs used in much modern technology, from weapons to mobile phones.

The DPA has US$750 million to fund projects after measures approved in a law passed in August for tax breaks on electric vehicles made in North America, and a Ukraine aid package in May. CMJ

DECEMBER 2022 CANADIAN MINING JOURNAL | 7

Mineral:

Particle Size: 800 x 150µm Mineral Expression: 1% of Surface Area Copper Recovery: >90% Coarse Particle Flotation... this changes everything. Call

or visit

for technical

to arrange

testing, or

>600µm particles recovered using HydroFloat CPF •Grind coarser at same recovery •Reduce coarse values lost to tailings •Increase throughput •Reduce primar y grinding power consumption •Generate coarser tailings

CRITICAL

|

The U.S. military has set aside funding that could possibly propel Canadian critical minerals projects. . CREDIT: COMMERCE RESOURCES

Chalcopyrite

1.604.952.2300

EriezFlotation.com

papers,

lab/pilot

complete flowsheet development.

•

MINERALS

Make sure to send your press releases to: editor@canadianminingjournal.com

By Michael Sabusco, Emmanuel Sala, and Matthew Imrie

It is in the budget: new measures for mining companies and a new super flow-through financing tax credit for investors

On April 7, 2022, the federal government of Canada delivered Budget 2022 (federal budget). As part of the government’s push for economic growth in areas like clean technology, health care, aerospace, and computing, industries in which crit ical minerals play an essential role, the federal budget proposes to provide up to $3.8 billion in support over eight years to imple ment Canada’s first critical minerals strategy, and introduces a new “super flow-through” 30% critical mineral exploration tax credit (CMETC) aimed at increasing investment for certain min ing companies exploring for specified critical minerals.

On Aug. 9, 2022, the department of finance released draft legislation to implement the CMETC, and on Nov. 3, 2022, in its fall economic statement, the federal government reiterated its commitment regarding the critical minerals’ strategy and CMETC.

The CMETC is a new 30% tax credit for specified mineral exploration expenses incurred in Canada and renounced to investors in flow-through shares (FTS) as part of FTS agree ments entered after April 7, 2022, and on or before March 31, 2027. It applies to certain exploration expenditures targeted at nickel, lithium, cobalt, graphite, copper, rare earth elements, vanadium, tellurium, gallium, scandium, titanium, magnesium, zinc, platinum group metals, or uranium, which tend to be used in solar panels, batteries, permanent magnets and other elec tric vehicle components (i.e., critical minerals).

This CMETC is a new tax incentive to be added to the existing federal FTS regime under the Income Tax Act (Canada), which already allows certain investors to benefit from (i) a deduction of 100% of the qualifying resource exploration expenditures renounced by an eligible corporation in its favour; and (ii) in certain cases, an additional 15% tax credit (15% federal tax credit) for individuals on certain grassroots qualifying resource exploration expenditures.

The new 30% CMETC follows the current rules for the 15% federal tax credit but applies only to projects targeting critical minerals. Taxpayers cannot claim both the 15% federal tax credit and the 30% CMETC with respect to the same qualifying

resource expenditure, and the 15% federal tax credit cannot be used as a “fallback” option.

To qualify for the 30% CMETC, a “qualified engineer or geo scientist” must certify that the expenditures will be incurred pursuant to an exploration plan that primarily targets critical minerals (i.e., targets deposits containing more than 50% criti cal minerals). The CMETC certification must be made in a pre scribed form up to 12 months before the time the FTS agree ment is entered into.

The Canada Revenue Agency (CRA) has not yet released the CMETC certification prescribed form, even though eligible issu ers have been able to enter FTS agreements targeting critical minerals since April 7, 2022. In the meantime, with respect to CMETC certifications made in advance of the prescribed form being released, the CRA will accept a letter signed by the “qual ified engineer or geoscientist” that includes certain informa tion, such as why it is expected that the mineral deposit(s) being explored will primarily contain critical minerals.

According to CRA guidance, issuers should keep in their records (in case requested by CRA) documents that support the certification, such as claim outline(s) and number(s), descrip tions of geological features of the property(ies), and proposed exploration activity(ies) and how they relate to the targeted critical minerals, as well as copies of exploration plan(s).

The introduction of the critical minerals’ strategy and the CMETC are anticipated to be a welcome relief for many mineral exploration companies in Canada, and an exciting opportunity for other market participants. Specifically, we expect that some of the benefits will include the following:

> Increasing interest in the Canadian critical minerals space. A recent World Bank Group report finds that the production of critical minerals could increase by 500% by 2050 to meet the surging demand for clean energy. We think that Canada, being recognized as a leading mining nation with enormous potential for discovery of mineral resources, is well-positioned to benefit from a rise in global demand for critical minerals, and that the

8 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

LAW

introduction of the CMETC will enable it to become a more attractive destination for critical minerals investment.

> Assisting companies advance exploration projects. The government’s financial commitment to the critical minerals’ strategy and introduction of the CMETC should assist explora tion companies in securing funding for critical minerals proj ects, and thereby reduce part of the risk profile associated with such early-stage projects. We think that these new measures may also prompt certain mining companies to reconsider their current focus and evaluate making changes, where possible, towards qualified resources with potential for critical minerals. In a working paper published in October 2021, the International Monetary Fund noted that it expects global demand for copper, nickel, cobalt, and lithium to increase over the next 20 years, with significant increases expected in both prices and demand in the event we transition to net-zero CO2 emissions in 2050, another trend we expect will assist in the advancement of proj ects with potential for critical minerals.

> Encouraging capital-raising activities. We expect to see a renewed interest and increase in FTS financings by Canadian issuers exploring for critical minerals. With the new CMETC dou bling the tax credit rate of the existing credit, the break-even point for investors is reduced significantly. The timing of the CMETC also coincides with recent new prospectus exemptions, aimed at providing a more efficient method for issuers listed on a Canadian stock exchange to raise capital from a broader base

of eligible investors, which could be a way for a broader group of investors to participate directly in these tax-efficient invest ments which have traditionally been available only to certain eli gible investors (typically “accredited investors”).

> Stimulating alternative investment vehicles. Flow-through funds play a significant role in the junior mining industry, rais ing significant amounts of capital for deployment to explora tion companies and providing investors with income tax sav ings via a deduction of 100% of the amount invested in the fund, as well as indirect exposure to a diversified portfolio of FTS acquired by the fund over time. Given the increased inter est in critical minerals exploration, the improved income tax incentives, and the anticipated uptick in flow-through financ ings by critical minerals mining companies, we also expect to see an uptick in the aggregate amount of capital raised by flowthrough funds, that will be deployed to critical minerals mining companies, while the CMETC is available.

For further information and insight on the topics discussed in this article, please refer to the Dentons Insight published by the authors and available at https://www.dentonsmininglaw.com/ CMJ

MICHAEL SABUSCO is a partner at Dentons Canada and practices in the corporate, securities, and M&A groups. He is also the Ontario lead for the firm’s national mining committee.

EMMANUEL SALA is a partner at Dentons Canada and practices in the corporate and tax groups. He is also the Québec lead for the firm’s national mining committee.

MATTHEW IMRIE is a senior associate in Dentons Canada’s corporate group.

DECEMBER 2022 CANADIAN MINING JOURNAL | 9

Using a regeneration lens, mine waste becomes a resource

Regeneration of previously mined sites presents opportunities to turn waste into a resource, create nature-based solutions and better closure outcomes. Waste from past mining contains met als like cobalt, lithium, copper, platinum, and tellurium. This mine waste can help fuel the energy transition and meet the responsible sourcing requirements of green tech and sustainable brands.

Leaders in industry, government, and civil society can now view impacted, brownfield sites differently. Not just as tailings, waste rock, and wastewater to be managed for risk, but as a potential source of metals and an opportunity for nature-based solutions; whether sites are abandoned, closed, and held as lia bilities by operating companies, or active operations.

There are three reasons the time is right to re-think mining waste and mine sites: 1 Demand linked to the energy transition. The World Bank projects that we will need over 3.0 billion tonnes of min erals and metals to deploy the wind, solar, and geothermal power, as well as energy storage, required to achieve a climate target of less than a 2°C increase.

2 Technology innovation. Innovation in mine waste processing is exploding, both tested and new technologies can be used to re-mine waste and address pollution.

3 The need to find more land for naturebased solutions to meet our biodiver sity and climate goals. The benefits that can accrue from restoring degraded sites is significant; we can create quanti fiable, green outcomes in the form of biodiversity and carbon credits.

New business models that put community first

In November 2021, we launched Regen eration, a start-up focused on re-mining and restoration, to seize this opportunity and put community first. To be success ful, re-mining projects will need to prove themselves commercially and, in addi tion to permits, they’ll need a community license to operate.

Because many of these brownfield sites are in areas that have experienced nega tive impacts from past mining activities, we see an opportunity to reset and improve community relationships. In this context, new business models, especially those that depend on both a community

and commercial bottom-line, are an asset. As a public benefit company, Regeneration is an example of such a model, the com pany itself is part of the innovation.

We blend NGO and commercial think ing, and we draw on experts from both sectors. We have a community and a commercial bottom line. We form inno vative partnerships with community organizations and businesses. We link upstream sites to downstream brands and consumers.

When we are assessing potential Regen eration sites, we focus first on restoration outcomes. When we identify a restoration opportunity, we then work together with the community to build a closure vision. With this approach, re-mining is a means to better community, conservation, and climate outcomes.

Our social impact business model can constructively disrupt the status quo, addressing liability risk and using reve nue generated from re-mining and other sources to support restoration and pro vide community benefits. While a pure commercial actor may require a corpo rate driven rate of return, we can proceed with a site if the total restoration and

10 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

By Stephen D’Esposito

ESG

CREDIT: DEEMERWHA STUDIO/ADOBE IMAGES

The time is right to transform legacy sites into ecological assets while producing critical minerals

re-mining potential pencils out, in some cases it may simply need to break even.

The Salmon Gold precedent

Before we launched Regeneration, we tested this model on a smaller scale with placer mining in Alaska and the Yukon. Based on this experience, Resolve (Regen eration’s sister NGO), launched Salmon Gold (a project to put biodiversity posi tive gold in the supply chains of Apple and Tiffany by re-mining placer tailings and restoring stream habitat for salmon and other anadromous species). Apple & Tiffany kick-started the project with ini tial funding for Resolve to develop the business model, scout and assess the sites, and help fund restoration at the first projects. They purchased Salmon Gold which is now in their products. We worked together to tell a story in the marketplace. From this experience we know that the market wants differenti ated mineral products where possible and restoration credits.

Full value mining for a healthier industry

The past impact of mining is an issue in many communities and the trend is for community leaders to seek solutions to these legacy issues before new mines advance. They want new mine develop ers to address past problems and support positive restoration outcomes. This is typically outside of the commercial pur pose of mining companies seeking to develop new projects, but it’s in the DNA of Regeneration.

Where we find community, restoration and remining solutions, the industry bal ance sheet also improves, both finan cially and reputationally. In this way, Regeneration is delivering a public good.

A concept that underpins Regeneration is full value mining – the idea that when we mine, given the impact and infrastruc ture costs, we should do our best to extract everything and ensure full use of the nat ural resource. When applied to past min ing, especially at older sites, where pro cessing was less efficient, the opportuni ties that can result from thinking this way are significant. Already, we see mining majors and others, including our equity partner Rio Tinto, advancing full value mining, essentially a circular economy concept, at operating sites. As an example, Rio Tinto is producing scandium from tita nium dioxide waste streams and tellu rium as a by-product of copper produc tion in two of its operations in North America. We encourage this.

“I am really excited … that we are partnering with Resolve to develop and launch Regeneration, a start-up that will use the re-mining and processing of waste from legacy mine sites to support rehabilitation activities and restore natural environments.

Regeneration wears its name well –its purpose will be to extract valuable minerals and metals from mine tailings, waste rock and water, and to reinvest the earnings from the sale of these responsibly sourced materials to help fund habitation restoration and closure activities, including at legacy and former mine sites.”

JAKOB STAUSHOLM, CEO, RIO TINTO

Regeneration is working with several other mining companies to assess these opportunities at closed sites and active mines.

Abandoned sites are strong candidates for full value mining (and full value re-mining) too. Abandoned and orphan

sites sometimes sit stagnant due to pro hibitive liability issues. Work at aban doned sites will take policy innovation and funding creativity, but the upside is significant. Together, these sites should be an early source of new critical miner als production and nature-based solu tions. This could also benefit govern ments that are looking to showcase prog ress on 30 x 30 commitments.

A new basket of mine site products

We see a future where closed mine sites contribute to a basket of sustainable prod ucts – differentiated minerals that fuel the energy transition; biodiversity and car bon credits; site liability reduction; and restored sites that support a community’s vision for post-remining land uses and values. CMJ

Stephen D’Esposito is the founder and CEO, Regeneration. He is also the president of Resolve.

This article has two parts. In part II, we will explore Regeneration’s approach to technology, site strategies, and policy innovation.

.com

45 offices worldwide and a global network of af liates. No matter where you are in the world, chances are we’ve got your project covered.

in review from EY center of excellence advisors

By THEO YAMENGO

Whether responding to rising costs and supply chain dis ruption or navigating digital crossroads and low-carbon targets, mining and metals companies looking to get an edge on competitors need to fundamentally shift their busi ness and operating models to meet changing demand and expectations.

Those that fail to reposition themselves for an evolving future, risk falling behind in the face of a powerful energy tran sition that will drive a sector renaissance in 2023. To help pro actively plan strategies for the coming year, EY polled its Americas Mining and Metals Centre of Excellence expert advi sors and technical mining professionals to better understand what the most impactful technological or geopolitical develop ments in the mining industry were in 2022 and what should companies be focusing on in 2023.

> Patricia Jaworski, maintenance and reliability advisor

The 2020s, from both technological and geopolitical standpoints, are pushing the mining industry to streamline more than ever before; we can no longer rely on the historical, cyclical trends that we have experienced.

To capitalize on tech developments, such as using AI to inform or even dictate decisions, I recommend a “back-to-ba sics” approach. Diligently adhering to business processes must be the first step in any journey where layering technology solu tions onto practices and systems is being considered. Without it, good data does not exist. And a tech solution built on bad data will result in failure. We need the knowledge to develop and introduce cutting-edge solutions and, more importantly, we need to leverage experience to ensure that the people, pro cess, and data foundations of a business, operation, or site are ready for those solutions.

> Doug Stretton, asset management and maintenance

The Russian invasion of Ukraine was the most significant geopolitical event of 2022, disrupting markets and completely changing the agenda of most mining companies. Those impacts will be felt for years to come.

For 2023, with a potential recession looming, mining companies should be

focussed on getting their operational costs down. As the busi ness cycle turns, cashflow and prices will fluctuate. The coming recession is an opportunity for acquisition and growth, if a min ing company can drop costs and build cash. It is important to note that asset management always does well at this part of the cycle as maintenance is one of the biggest costs for mining com panies to consider.

> Joseph Ashun, asset management specialist

One of the most impactful technological developments in the mining sector was the continuing introduction of the auton omous hauling fleet. This shows early signs of approximately 15% reduction in operational cost compared to vehicles with humans behind the wheels.

While the focus should continue to be on ESG and its surrounding elements, mining companies should also focus on ensuring the basics are done well. This is with regards to safety, business processes, training and devel opment of the new “workforce.” Also, a renewed focus on inno vation will always yield dividends.

Future proofing your mining and metals organization to pre pare for transformation will require vision and sophisticated orchestration. The next 12 months are expected to be challeng ing when it comes to inflation and supply chain shortages. Having a bold vision will empower companies to streamline investments today and chart a transformation roadmap for tomorrow. CMJ

THEO YAMENGO is the EY Americas and Canada mining and metals leader. For more information, visit www.ey.com/en_ca/mining-metals.

DECEMBER 2022 CANADIAN MINING JOURNAL | 13

YEAR IN

REVIEW

A year

The next 12 months are expected to be challenging when it comes to inflation and supply chain shortages. Having a bold vision will empower companies to streamline investments today and chart a transformation roadmap for tomorrow.

By Steve Gravel

MINES OF THE FUTURE

WILL RUN ON DATA

Ibegan studying the mining supply and services sector in Sudbury, Ont., at an economic development think tank in 2010. At the time, only a handful of com panies in the regional orbit had started to design products in anticipation of har nessing data insights in the mining sector. Some early examples that caught my eye were Symboticware, Maestro Mine Venti lation (now Maestro Digital Mine), and K4 Integration’s TopVu line of solutions.

Previously, meaningful data analytics and the business insights they provide

were out of reach to most mining end users due to a host of factors, including the prevalence of analog assets within the install base that could not capture data, patchy connectivity in underground oper ations and at-surface plants, and a lack of a clear return on investment (ROI) on data-driven decision making to induce large-scale adoption. Consequently, most downstream benefits of data analysis already being enjoyed by other sectors, such as manufacturing, were not accessi ble to mining at that time.

Either organically or by design, the mining technology community realized the untapped potential in data analytics in their sector. In a quick, 10-year period, several high-tech data capture compa nies started to pop up in the ecosystem. In effect, these ruggedized, purpose-de signed and built data capture solutions began to solve mining’s data problem.

14 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

TECHNOLOGY

CREDIT: CENTRE FOR SMART MINING

Above: Cambrian business developer and NSS Canada technician demo new data visualization tools underground.

So, now that there are solutions readily available to liberate data for mining companies, what do we do with it?

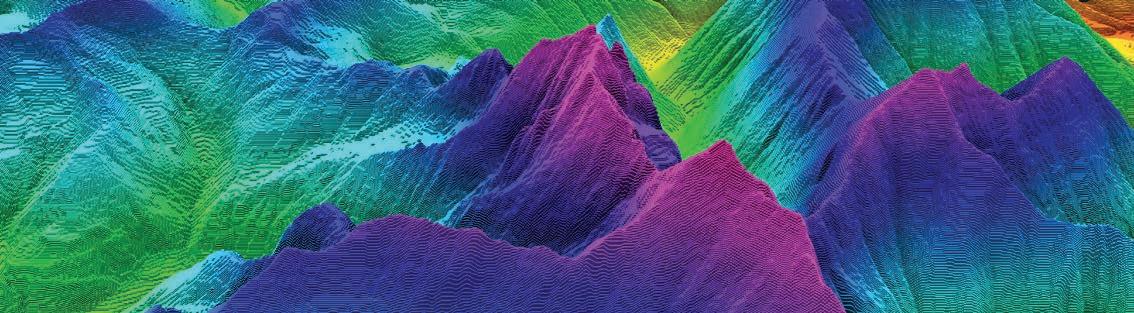

This is where the next, fast-moving trend in mining technology has begun to take shape: the true value of the data being expertly collected lies in the business insights they provide to decision makers. How this data is analyzed and displayed can be transformational to an operation. Now, insights related to equipment per formance, orebody and stockpile quality, plant operations, spatial and geological data, and environmental performance can be at one’s fingertips … more or less.

Many mines have implemented some form of daily and monthly reporting based on the deluge of data coming from this army of networked devices. Some mining operations are beginning to incorporate elements of machine learn ing and artificial intelligence to enhance predictive analytics and pattern recogni tion. Harnessing such next-generation technologies is currently difficult to scale beyond individual pilots and across enterprises, but such fits and starts are a necessary process of innovation.

What companies are often left with are proof-of-concepts that showed exciting potential but failed to launch. This is where the next opportunity lies. Tech vendors that take a structured approach, that take the time to integrate into estab lished practices, and that can show bene fit across several business units will start to see widespread adoption of their solu tions.

There are several questions that come to mind when I think about data analyt ics in mining. Why is it important to get this right? What are the benefits to hav ing operational data and insights avail able in real time? What downstream techniques and ways of doing things are unlocked if wider-scale adoption of data analytics is adopted? Some of the “white whales” in underground mining opera tions when it comes to highly desirable novel approaches include concepts like ventilation on demand (VOD), short in terval control (SIC), and data driven ESG (environmental, social, and governance).

Ventilation in underground mines is a well-studied subject area in part because it is so essential for safe operations. Air quality is often negatively impacted by vehicle emissions, heat and humidity, toxic gases, and even tool fog from pneu matic tool operation.

VOD technology enables mines to accu rately monitor air quality in underground

operations and adjust ventilation accord ing to activities going on in particular areas of the mine.

In addition to improving air quality and miner safety, VOD when paired with asset RFID tagging and tracking technol ogy can improve the mine’s energy effi ciency; thereby reducing environmental impacts. This approach to underground ventilation is now becoming more com

provide close to real-time operating data and status of all tasks in the mine. With the increasing availability of data, SIC, as well as other data-driven management techniques, will undoubtedly begin to gain prominence.

monplace as sensor technologies, IoT devices, and the resulting data analytics capabilities have now reached a level of maturity that mines have been able to adopt them.

Another approach that has been en abled by mass adoption of data collection and the nascent rise of data analytics in mining is short interval control. Simply put, SIC is a production management process whereby frontline workers pro vide progress feedback against an expec tation around allocated tasks per shift and advise managers of issues or devia tions in real-time. Applying SIC in the un derground mining setting has originated from the need for operations to be more efficient with work conducted on shifts and improving asset utilization. This ap proach to operations management is un derpinned by some of the technologies discussed above as SIC relies on the use of real-time production information to

NATURAL RESOURCES

Trusted. Independent. Committed.

Improving a company’s environmental performance, social license to operate, and accountability framework is becom ing increasingly important in mining dis tricts around the world. Accurate and up-to-date data capture and analysis are essential for meeting and exceeding key performance indicators and understand ing if a firm’s critical controls are per forming as projected. Some examples of how data analytics supports environmen tal and social performance range from air pollution reduction to water conserva tion, but there are also less obvious exam ples such as remote monitoring of popula tion-adjacent tailings dam seismicity. Incorporating streams of data from numerous disparate sources can place a company at the intersection of risk man agement, human factors, and data science to make ESG risk information accessible and useful for decision-makers.

For data analytics applications in min ing, the prize will be worth the struggle. More widespread adoption of the tech nologies mentioned above will lead to meaningful outcomes. Taking a calcu lated approach and trialing innovative technologies that make sense for individ ual mining operations have the potential to unlock significant return on invest ment. In the future, the difference between success and failure for mining companies may be determined by those who decided to embrace data analytics and those who did not. CMJ

DECEMBER 2022 CANADIAN MINING JOURNAL | 15

SGS IS THE WORLD’S LEADING TESTING, INSPECTION AND CERTIFICATION COMPANY WWW.SGS.COM/NATURALRESOURCES NAM.NATURALRESOURCES@SGS.COM

Delivering

fit-for-purpose solutions

across the entire mining life

cycle

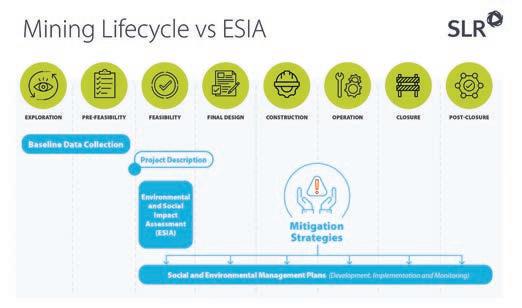

Our fit-for-purpose solutions encompass the skills of qualified geologists, geostaticians, analytical chemists, mineralogists, metallurgists, process engineers and mining engineers brought together to provide accurate and timely mineral and process evaluation services across the mining life cycle.

Steve Gravel is the manager of the Centre for Smart Mining at Cambrian College.

Technicians testing geological data capture and visualization tool. CREDIT: CENTRE FOR SMART MINING

MINING IN CANADA

Updates on Quebec plan for critical and strategic minerals

By Diane L.M. Cook

Global net-zero emissions by 2050 tar gets have Canada’s resource indus try re-thinking its long game. Quebec is ramping up mining of its key minerals required to manufacture electric vehicle batteries. The province plans to become a leader in the critical strategic minerals (CSM) mining sector and a leader in the electric vehicle battery manufacturing sector for the North American automo tive industry.

In its “Quebec Plan for the Development of Critical and Strategic Minerals 202025.” The province identified four policy pillars to promote the development of CSM to encourage investment in the prov ince, meet the growing demand for these mineral resources, and play an active role in the global energy transition.

Plan updates

Since the plan was released in October 2020, several new developments have occurred in the province’s mining indus try.

Eric de Montigny, a spokesperson for Quebec’s Ministry of Natural Resources and Forest (MNRF) says, “MNRF recently

announced the launch of a CSM-specific research network aimed at increasing synergies between organizations to develop concrete and accessible solu tions for the mining industry more rap idly … to increase geoscientific knowl edge in the province, several targeted work campaigns were carried out to better understand the potential of CSM in various regions, namely, Nord-duQuébec, Abitibi-Témiscamingue, CôteNord, Saguenay-Lac-St-Jean, Mauricie and Outaouais.”

Furthermore, de Montigny says since the CSM sector poses technical, environ mental, and technological challenges, a specific research focus has been created in the joint research program on sustain

Highlights of the plan include

able development to encourage MNRF researchers to develop expertise in the development of CSM in Quebec’s geologi cal context.

“To date, five promising projects have been supported under the first call for proposals and will receive funding over three years. The results of the second call for proposals will be announced shortly. Another project under the Quebec plan is the exploration support program which includes funding awarded for six CSM mining exploration projects.”

Quebec already has a well-established mining sector which includes major min ing companies that mine for five of the key minerals required in the manufac ture of electric vehicle batteries.

> exploring the province’s CSM potential through mapping and data collection;

> financially supporting projects in exploration, transformation, recycling, artificial intelligence, and research and development;

> recycling and reusing CSM; and

> promoting the province internationally as a responsible supplier of CSM.

16 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Aerial view of Nouveau Monde Graphite’s Matawinie mine under construction. CREDIT: NOUVEAU MONDE GRAPHITE

Top CSM mining companies in Quebec

Graphite, lithium, cobalt, nickel, and man ganese are the five key minerals required to manufacture electric vehicle batteries. Some of the top CSM mining companies in Quebec include Sayona Quebec’s North American Lithium (NAL) which is to restart production in the first half of 2023, Northern Graphite’s Lac-des-Iles graphite producing mine, Canadian Royalties’ Nunavik-Nickel, and Glencore Canada’s Raglan nickel producing mines. Since cobalt is a by-product of nickel mining, it can be produced at nickel mines.

de Montigny also says, “Several graph ite, lithium, and nickel mining projects have reached the development stage in the mineral development process.”

Advantages of mining CSM in Quebec

Quebec’s brochure, “Critical and strate gic minerals in Quebec: new wealth and business opportunities,” outlines the advantages of mining CSM in its prov ince: an attractive business environment that includes several tax incentives, exploration allowances, access to several types of capital, and technological, and scientific expertise; know-how; special ized equipment manufacturers and sup pliers; a skilled workforce; and several applied research centres. The province also has an advantageous geographic location, as it is close to industry and major population pools and access to deep water ports with access to the U.S., European, and Asian markets. Quebec also provides electricity at advantageous prices for mining companies that are connected to its Hydro-Quebec grid.

“The enthusiasm surrounding CSM in Quebec represents major business oppor tunities for investors as evidenced by the recent announcements made by the gov ernment in connection with the develop ment of the battery industry in Quebec. The arrival of GM, Posco Chemical, and BASF is a concrete achievement that shows Quebec has the resources to be come a major player in the development of CSM value chains,” says de Montigny.

How mining companies can benefit from the plan

Several government policies that comple ment each other include the 2030 Plan for a Green Economy, the Sustainable Mobil ity Plan, the 2030 Energy Policy, and the Battery Sector Development Strategy.

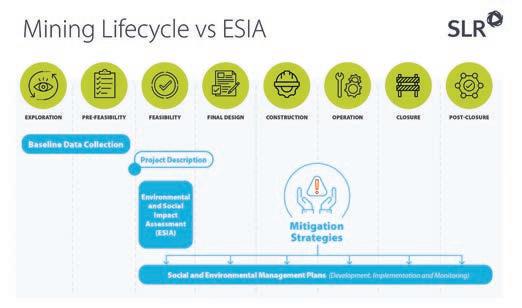

The plan provides targeted support to companies throughout the mineral devel opment cycle from exploration to mining to mineral recycling.

In addition to the launch of a CSMspecific research network that will benefit the entire industry, companies can bene fit from new CSM-specific programs such as the 2021-24 mineral exploration sup port program for CSM; the 2022 research and development support program for CSM extraction, processing, and recycling; the 2022 CSM circular economy research and development support program; and the launch of a CSM-specific focus under the joint research program on sustainable development of the mining sector to sup port the technological development of innovative processes for the responsible exploitation of CSM.

According to de Montigny, companies may also benefit from an allowance on the development of CSM in the mining tax regime that was announced in the 2021-22 Quebec budget, and an increase in sup port for the piloting, process demonstra tion, and transformation phases to develop CSM was also announced during the most recent budget and is expected to be implemented shortly.

Quebec has the largest lithium reserves in Canada and almost half of the lithium projects in the country with 86.34 million tonnes of proven and probable reserves (PPR). The province is the only graphite producer in the country with one active mine, two mine development projects, and eight advanced exploration projects targeting graphite deposits with 62.19 mil lion tonnes of PPR. Quebec currently has two active mines that produce cobalt as a by-product and one mine development project that includes cobalt as a by-prod uct with 1,037.4 million tonnes of PPR.

A recent forecast by Benchmark Mineral Intelligence says at least 384 new mines for graphite, lithium, nickel, and

cobalt are required by 2035 to meet the demand for electric vehicle and energy storage batteries, and the demand for lithium-ion batteries is set to grow sixfold by 2032.

The EV battery sector

Quebec’s strategy for the development of the battery sector includes a three-prong approach: leverage its mineral wealth which includes several CSM to produce batteries and strengthen the province’s position as a global supplier of batteries from mining to the manufacture of key components, invest in the local manufac ture of electric vehicles, and integrate Quebec into a North American battery recycling supply chain.

Jean-Pierre D’Auteuil is responsible for media relations at Quebec’s public affairs and digital communications department, and he confirmed that some projects have been announced. They include BASF’s intentions to set up a cathode active materials (CAM) plant on the site of the Société du parc industriel et portu aire de Bécancour (SPIPB); the intentions of the Ultium CAM joint venture, formed by General Motors Canada and Posco Chemical, to set up a CAM plant on the SPIPB site, where production will begin in 2025.

Quebec has announced its support for Nemaska Lithium’s project to build a lith ium spodumene mine and processing plant to supply a plant in Bécancour spe cializing in the commercial processing of lithium salt into lithium hydroxide, and Nouveau Monde Graphite will focus on developing anode materials needed in the battery industry. The company intends to operate a graphite mine and mill in SaintMichel-des-Saints, Lanaudière, as well as a primary processing plant in Bécancour.

Once Quebec establishes itself as a leader in the mining of CSM, it then plans to establish itself as a leader in Canada’s electric vehicle manufacturing sector for the nation’s automotive industry.

Looking forward

Quebec is already well-positioned to become a leader in the CSM mining space in terms of mineral resources, technolog ical and scientific expertise, skilled labour, hydroelectricity, and an attrac tive business environment for mining investment. Quebec plan will help the province become a leader in the mining of CSM and the electric battery sector in Canada and North America, which will help Canada meet global net-zero emis sions targets by 2050. CMJ

DECEMBER 2022 CANADIAN MINING JOURNAL | 17

Nouveau Monde Graphite’s commercial-scale coating unit completes the company’s Phase 1 modules for an integrated ore-to-batterymaterial value chain. CREDIT: NOUVEAU MONDE GRAPHITE

By Eric Wasmund, Asa Weber, and Jose Concha

Opportunities for mining and critical minerals’ processing in North America

As a response to the previous two de cades of expanding globalized trade, governments and businesses in North America are now beginning to pay more interest and concern to the sources of raw materials. This is especially true for strategic metals and minerals that are the necessary building blocks for the net-ze ro economy. Green materials like nick el, lithium, graphite, cobalt, and copper will be increasingly required for large format rechargeable batteries and infra structure in quantities that will be hard to achieve and will probably be a bottle neck in the mass acceptance of electric vehicles. It is forecasted that copper de mand will increase from about 25 million t/y today to 40 million t/y by 2030 as well as a 44% increase in nickel demand over the same period.

Over the last two decades, China has developed a dominant position in battery manufacturing technology which includes the mining and processing of battery pre cursor metals throughout the world, in places like the Democratic Republic of Congo for cobalt and Indonesia for nickel. Some of these sources are being newly

scrutinized because of a lack of govern ment transparency and regulations, and because some of the sources require much higher uses of energy to process, such as mining and processing nickel lat erites compared with nickel sulphides. Ottawa and Washington are both signal ing strong action to “on-shore” the mining and processing of green metals in North America. Executive orders from President Biden to support green metal projects in the U.S.A. and the recent federal govern ment announcement for divesting owner ship of some Canadian mining companies held by foreign state-owned companies are both part of this trend.

As a result, the mining industry in North America is already seeing a resur gence in activity and investment. This is driven by the drive to electrify energy infrastructure and increase energy self-sufficiency. Along with this, there will be an important driver to extract and process these materials in the most environmentally efficient and sustain able way. This is where companies like Eriez come into the story.

The first step in producing materials

after mining is the concentrator, and the basic concentrator flowsheet has not changed much in the last 50 years. Ore at or above the cut-off grade is identified by the mining operation, then it is crushed and ground to a suitable size to enable bulk froth flotation followed by an up grading cleaner step to produce final con centrate for smelting and/or refining. All this time, the grinding endpoint and con sumed energy are driven by the particle size required to float minerals based on conventional flotation. For a typical por phyry copper ore, conventional flotation is not practical for particles above 200 mi crons, sometimes significantly less, so the endpoint of the grinding operation must be in this range, resulting in excessive grinding and serious challenges for water recovery, since de-watering becomes more difficult as the solids become finer. In a conventional plant, the usual way to address this is to thicken the tails and then pump them to a water impoundment for settlement. In this scenario, a significant amount of the water is lost to evaporation. Water loss means that the water in a con centrator cannot be operated in a closed

18 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

MINING IN NORTH AMERICA

Eriez flotation industrial HydroFloat CrossFlow copper installation.

CREDIT: ERIEZ

loop and fresh water is always required. Other de-watering strategies exist, but they are energy and capital intensive.

Eriez has pioneered the commercial ization of coarse particle flotation (CPF) with its HydroFloat cell, which is a key disruptive technology that has a major impact on both water and energy, and it will be a key strategy to conserve both. By increasing the size where ores parti cles can be floated, typically 2-3 times, significantly less grinding energy is required, potentially 30% to 50% less. And because the flotation tail is much coarser, it is easier to de-water and has less retained water.

Eriez introduced their HydroFloat coarse particle flotation equipment about 10 years ago with major base metal pro ducers, such as Rio Tinto, Newcrest, and Anglo American. Early applications focused on recovering “lost” coarse metal units from conventional concentrator tailing streams. This typically repre sented at least 60% of coarse tails and 2% to 6% global recovery improvement.

Now, the focus is on including the HydroFloat inside the mill circuit as an ore sorter. The first application of this type was successfully demonstrated at Anglo American’s El Soldado during 2021 and is now in full operation. This config uration of CPF allows a significant reduc tion in grinding energy, conventional flo tation capacity, and it produces a coarse tail that can be easily de-watered or com bined with conventional tails. As part of their FutureSmartMining family of tech nologies, Anglo American is piloting a technology to co-mingle coarse and con ventional tails in unique ways to produce a waterless dry stacked tail. Eriez is excited about the recent technologies such as low energy water recovery and waterless impoundments that have become commercially possible because of coarse particle flotation.

Another Eriez technology that has been introduced to increase the effi ciency of concentrators is the StackCell, a high-rate mechanical cell that uses the two-stage principle. In the first stage, high shear mixing of bubbles and feed slurry occurs to optimize bubble-particle collecting. In the second stage, which is isolated from the first, the bubble-parti cle aggregates can float by buoyant forces in a fluidic environment with low turbu lence and a low energy convective flow that minimizes bubble particle detach ment and drop-back. The two-stage flota tion technology contrasts with conven tional mechanical tank cells where bub

ble-particle contacting and buoyant separation occur in the same fluidic envi ronment, which cannot be simultane ously optimized for both processes. The StackCell is now operating in commercial flotation applications in several coun tries. It has been verified that in many scenarios, StackCells can operate with one quarter or less of the residence time required for conventional technology and with 40% less impeller energy. This all means smaller concentrators with less

energy use.

Both products are positioned to have a key role in supporting the sustainable expansion in mining of critical and stra tegic minerals that is underway in North America. CMJ

Eric Wasmund is vice-president of global flotation business at Eriez, Asa Weber is global StackCell product manager at Eriez, and Jose Concha is global HydroFloat product manager at Eriez.

The Next Generation of Nickel

Canada Nickel is rapidly advancing its Crawford nickel-cobalt project – targeting production of NetZero Nickel™

We're working on it.

DECEMBER 2022 CANADIAN MINING JOURNAL | 19 canadanickel.com | TSX-V:CNC

Sustainable mine design starts with a cultural shift

The clock is ticking for many mining companies who have set ambitious sustainability goals. In overcoming negative historical perceptions, mine operators recognize that stakeholders want to see a positive return. This return is not just on financial performance, but also on what is called the triple bottom line: people, planet, and profit. The grow ing consensus is that companies with a strong triple bottomline are more resil ient and reliable investments.

It is now time to fulfill those promises,

which requires support from mine devel opment and expansion technical teams. This is because some of the greatest opportunities to improve environmental, social, and governance (ESG) perfor mance live within design innovation. To unlock the full potential of future mines and improve current operations, engi neers and designers must move beyond their technical disciplines and embrace the whole-system complexities posed by sustainability challenges. This does not mean forgetting our cornerstone design

By Nicolette Taylor

values of safety, reliability, and cost-ef fectiveness. Now, teams must also con sider ESG factors.

The good news is that these traditional values and new ESG considerations can exist in harmony with each other. For instance, improvements that benefit the environment, such as reduced energy use or material movement, also cut costs. With creative approaches, engineers can help mines achieve those win-win sce narios.

How do we close the gap between where we stand now and what has been promised? A good place to start is with company culture.

Understanding the risks

For design teams to align with ESG goals, we need a solid understanding of where we want to move the needle and why. A 2022 market sentiment survey conducted by White & Case shows that community impact, emissions, tailings management, and water usage are the top concerns the industry faces from investors and regula tors. While the ever-growing body of ESG frameworks and governing authorities can feel overwhelming and complex, this simplified data gives design teams practi cal direction. Focusing on those top con cerns is more digestible than becoming

20 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

ESG

Engineers play a unique role in meeting net-zero and ESG commitments

Left: While mines can develop infrastructure to generate their own energy, there are numerous partnership mechanisms for bringing renewable energy to mine sites.

an expert in all things ESG. Equipping design teams with the tools, knowledge, and resources for these focus areas fun nels creative energy into the places that will make the greatest positive impact.

even further into the future is vital. However, while longevity of company vision is essential to ESG performance, some of the more aspirational goals might feel far-fetched. To keep teams motivated, interim targets, such as prog ress goals every 5 or 10 years, provide a roadmap based on reality. Therefore, many of those same companies who have committed to achieve net-zero car bon emissions by 2050 also share prog ress goals, such as a 30% carbon reduc tion by 2030.

Motivating the workforce

mine plan advances. Plans for energy-ef ficient strategies for reprocessing legacy stockpiles unlock value while prioritizing early production. Finally, the mine design includes an offset to avoid exces sive water inflows to underground oper ations, naturally reducing dewatering requirements. These mitigation mea sures reduce both the financial and car bon costs of operation and closure.

We need to shift our mentality and demonstrate that green design does not need to cost more. Sharing success sto ries teaches others that sustainable solu tions can, and should, reduce costs.

Communicating measurable goals

Once these ESG risks are understood, measurable targets should be shared at all levels of the organization. Design teams need to know exactly what they are working toward. If you have read John Doerr’s “Measure What Matters,” you know that setting and communicat ing clear, measurable goals is key for driving performance. This is what we see among mining companies. For instance, all companies that belong to the International Council on Mining and Metals commit to achieve net-zero car bon by 2050 or sooner.

While decarbonization tends to be the most talked about subject within the world of sustainability, miners publish a wide array of other measurable targets. For example, take BHP’s goal to achieve gender balance by 2025, starting from a baseline of 17% in 2016. Welcoming more women into a male-dominated workforce means mines need to be inclu sive work environments. That kind of design shift all starts with setting and measuring the goal. It also means sharing that goal beyond the C-Suite boardroom. Strategizing based on where the indus try needs to be in 10 years, 20 years, or

Social capital can be hard to measure, and as such, it is often undervalued. Mines of the future will not arise on their own; they will be created by people. A culture of sus tainability increases employee retention and motivates output, which cost-effec tively maintains a company’s intangible intellectual capital. By engaging all levels of staff in sustainability and valuing sus tainable solutions, employers can help employees connect their work to a higher purpose. This is especially important to attract the incoming generation of engi neers that will position mining for a greener future. Considering how much of our modern society and the energy transi tion relies on mining, as an industry we have an amazing opportunity to meet this desire among team members.

Focusing on business optimization

Part of the cultural shift means helping leaders and employees recognize that sus tainability does not have to be a financial burden. In fact, the opposite can be true. If done right, systems with sustainable strat egies have the potential to drive costs down and improve mine recovery rates.

For example, an active copper mine in Arizona completed a debottlenecking study to review their operation. Through this exercise, they found they could save energy costs by modifying their grinding and crushing circuits. The modifications meant they could reduce the costs, energy use, and greenhouse gas (GHG) emissions while also increasing their recovery.

Even minor changes can benefit the triple bottom line. Another Arizona mine is leveraging simple solutions during its development phase. One strategy is selecting cemented rockfill (CRF) and unconsolidated rockfill (URF) to reduce the waste stockpile footprint while also lowering emissions by reducing haulage requirements. Optimizing sill locations further reduces the CRF cement content while maintaining stope stability as the

Working together as partners and collaborators

The broad nature of sustainable develop ment requires a multidisciplinary approach. Bringing diverse experience together will advance our methods. Partnerships between operators, engi neers, original equipment manufactur ers (OEMs), universities, and even utility providers create opportunities for inno vation. It also promotes whole system thinking and ways to achieve a more cir cular economy; both of which are vital for reducing waste.

When considering that up to 80% of mining’s emissions come from scope 3 activities (i.e., indirect activities outside of scope 2), the most notable change will rely on streamlining and improving these value-chain activities. Partnerships can open possibilities for mining compa nies to influence those responsible for upstream and downstream activities. Alternatively, mine operators can diver sify their own business model to control more of the value chain.

Moving forward with the right foundation

A skilled technical team provides solu tions for today and beyond. Soon, adopt ing a holistic, long-term approach of designing for the needs of the future will be the only option for mines to meet stakeholder demands. Shifting company sustainability culture with tactics, such as communicating risks and goals, focus ing on mine optimization, and exploring partnership mechanisms, is the first step toward meaningful change. A strong cul ture of sustainability is a crucial founda tion of this one-way trajectory. Building the right base from which technical teams can launch will help the industry keep its promises. CMJ

Nicolette Taylor is a project manager, mining, minerals, and metals at Stantec.

DECEMBER 2022 CANADIAN MINING JOURNAL | 21

Above: Technical teams have the power to transform top risks, such as water usage, into opportunities.

CREDIT: STANTEC

CREDIT: STANTEC

LUBRICANT TECHNICAL EXPERTISE CAN MAXIMISE THE PERFORMANCE AND RELIABILITY OF YOUR MINING EQUIPMENT

Mining operations encounter a wide range of lubrication challenges from operating a mixed fleet both above and below ground to equipment needing to run reliably 24 hours a day 7 days a week.

When looking to secure efficiencies and address problems as quickly as possible, it’s important to have a collaborative relationship with a lubricant technical expert.

Here we tackle the top four ways in which your lubricant advisor can help reduce maintenance costs and improve performance to help contribute to a lower total cost of ownership.

Lubricant selection

Managing a mixed fleet is a daily occurrence for many mining equipment managers. From a surface mine with equipment from several different Original Equipment Manufacturers (OEMs) to mines with both surface and underground operations with various equipment, the multiple OEM requirements can mean that selecting lubricants is a challenging process as there’s not necessarily a ‘one size fits all’ solution.

Lubricant technical expertise can provide invaluable advice and insight for this process, as manufacturers have a wealth of experience and real-world data to draw upon to make recommendations based on the equipment’s operational need.

However, it’s important that this collaborative approach is maintained beyond the initial specification period. For example, when purchasing a new piece of equipment, it may arrive factory filled with one specific oil. It’s

in these times that lubricant advisors can add value and support you with recommendations to help maximise equipment performance.

Product consolidation

For mining operations, the range of equipment on site and the number of different lubricants available means there is understandably a desire from operators to reduce the number of products on-site. Through effective consolidation, the oil storage area can be condensed and the risk of selecting the wrong lubricant for a given application reduced.

However, this is a complex process –especially for mixed fleets where there are several OEM lubricant specifications and recommendations to consider. Each piece of equipment will have an OEM manual, all of which will need to be digested and deliberated on before beginning to consider lubricant consolidation.

The specific operational needs of the mine also need to be factored into the process. For example, surface mines have a clear focus on equipment emissions, but below the surface this is even more important as the air is kept underground – even with ventilation. Added to this, underground you don’t have to deal with temperature variations as there’s air at a constant temperature, but environmental impact needs to be considered alongside occupational health and safety.

Due to the complexity of the process, seeking advice is crucial as while some level of consolidation can be beneficial, it’s important not to go too far by

sacrificing the benefits of what one lubricant can offer to reduce the number of products onsite.

This can often be the case with consolidation if it’s not carried out in collaboration with a lubricant expert. This could cause failure on a lubricated piece of equipment – resulting in increased maintenance costs and unplanned downtime that has a direct and negative impact on the mine’s operations.

Optimizing oil drain intervals

Optimizing oil drain intervals can give mining operators a range of benefits –from keeping equipment operational for longer to enabling oil drains to align with other scheduled maintenance to help decrease downtime. Safely extending oil drain intervals can also support a mine’s sustainability focus by reducing the amount of waste oil produced and the volume consumed across a given period.

With the potential to impact on equipment warranty and - if incorrectly extended – cause increased wear, oil drain intervals should only be extended in conjunction with a used oil analysis program and in collaboration with a technical service advisor. Incorporating used oil analysis is a key stage of the process and allows for close monitoring of the condition of the lubricant both before and during any changes to the drain interval.

Technical service advisors can also provide support for equipment managers reading used oil analysis reports. This can be challenging due to the number of data points and factors that need to be considered, but with expert support

SUPPLIED CONTENT

Gord Susinski, Senior Technical Advisor for Petro-Canada Lubricants, an HF Sinclair brand

you can learn how to easily identify where maintenance may be required and spot trends in wear metals that allow issues to be fixed before they become too expensive or serious. Over time this will allow you to become confident in interpreting the report and identifying issues that need to be addressed.

Problem solving

On any site, problems can arise at any time meaning that real time support and advice is needed to prevent costly unplanned downtime.

Providing guidance remotely or onsite, a technical expert can help support a smooth operation. For example, if there’s an issue such as a bearing failure, the starting point should always be a root cause failure analysis process to rework the calculations on the bearing. By starting at the beginning and collaborating with a specialist the issue can be identified and addressed –whether it’s the use of an incorrect lubricant, or over-consolidation resulting in an inadequate lubricant being used.

Additional advice, support and training

can also be provided such as insight into OEM recommendations for oil drain intervals to help protect warranties, how to take a quality oil sample and general maintenance advice.

Lubricants play a vital role in keeping a mining operation running smoothly. Optimizing oil drains, assisting in resolving issues before they become too severe to repair, or choosing the right oil for equipment are all items your technical services advisor can help you with, all to help you increase uptime and reliability. By seeking collaboration and working in partnership with a technical service advisor, you can be confident that your equipment will perform with the highest efficiency and reliability, and that you’re adopting the industry’s latest best practices. n

For more information, visit: https://lubricants.petro-canada.com/en-ca/ industries/mining

Top 12 learnings mined from a year of all-electric and zero-emission exploration

Afull year has passed since ABB launched it eMine framework of methods and solutions to make the all-electric mine possible. Their experts share 12 insights from 12 months of fruit ful learnings and most importantly how they see the journey moving forward.

A study by McKinsey, “Creating the zero-carbon mine,” reports that to achieve a 1.5°C climate-change target by 2050, the mining industry will need to reduce direct carbon dioxide emissions to zero.

Researchers from GlobalData inter viewed senior managers at 139 mining sites about emissions reduction plans. Over half of the respondents saw the greatest potential for electric vehicles. In the short term, their strategy mostly revolves around the use of renewable energy, assisted by diesel displacement efforts to equipment powered by electric batteries or fuel cells.

The mining sector is committed to ESG, but more action is needed. In this past year, ABB experts have garnered learn ings that they transformed into for ward-looking insights to accelerate the transformational drive across the mining sector.

1 More minds lead to better mines. To speed up the development of car bon-reducing technologies, ABB is con vinced that the solution lies in creating strategic pools of miners involving differ ent technology providers who can look at miners’ requirements and work together to bring forward the right solutions.

Strategic collaboration between miners having the same interest will help push

the technology development between technology providers and accelerate the adoption of carbon-reduced and finally carbon-free solutions.

By creating open and collaborative plat forms combining the industry stakehold ers and technology suppliers, miners can have access to a pool of solutions, which they can push into their conceptual stud ies. They can also collaborate with peers across the industry value chain and gain access to additional ideas and innovative solutions.

They can influence the supplier ecosys tem, shape policy and share their experi ence and learnings.

2 Made for you, works for all. Miners want to have an agnostic solution that is not bound to one technical, propri etary offering. We want to make it as easy as possible to integrate the interoperable systems for customers.

Thus, joint development and co-cre ation play a crucial role in leveraging the domain expertise of key partners to cre ate interoperable solutions, meeting a wider range of needs. Continuous align ment of key technical suppliers will favor the establishment of industry standards.

This calls for a more open working cul ture, a desire to change, embracing new technologies and widening the skill set to actively manage change and innovation.

3 A single journey is only a series of well-planned steps. It is becoming clear that the process of electrifying the entire mining ecosystem will not happen overnight and needs to

happen in phases. An electric mine looks different from a traditional mine. ABB is working with miners to break down this long-term roadmap into short-term actionable projects, piece by piece, to gradually transform their operations.

A phased approach enables mines to immediately lower carbon footprints with a limited up-front capital invest ment, while simultaneously advancing progressively as technology becomes more mature, scalable and cost effective.