MINING IN ONTARIO

UPDATES ON CRITICAL MINING IN NORTHERN ONTARIO

HOW TO IMPROVE THE COMPETITIVENESS OF ONTARIO’S MINING INDUSTRY

WOMEN IN MINING

Challenging the status quo

FEBRUARY/MARCH 2023 | www.canadianminingjournal.com | PM # 40069240

Ready for action? When the team of Hoffman Family Gold have to deal with harsh conditions deep in the wilderness of Alaska, they use Komatsu equipment designed for whatever reality (and reality TV) throws at them. Learn more about the equipment: komatsu.com/pc490lc

FEATURES

ESG

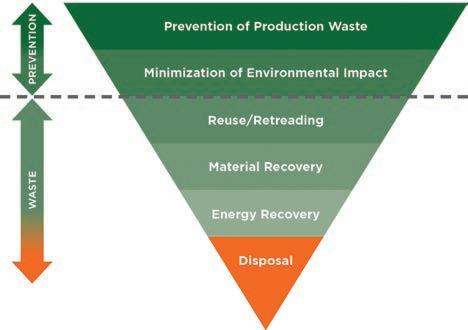

10 Using a regeneration lens, mine waste becomes a resource: Part 2.

12 How does innovation in mining accelerate ESG goals?

17 What’s all that noise?

WOMEN IN MINING

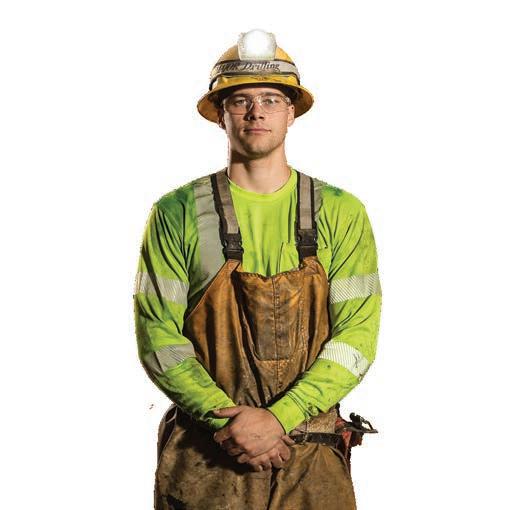

22 Challenging the status quo: An interview with Jamile Cruz.

28 The social impacts of mining on Indigenous women and communities .

TECHNOLOGY

33 The latest evolution in sealing technology.

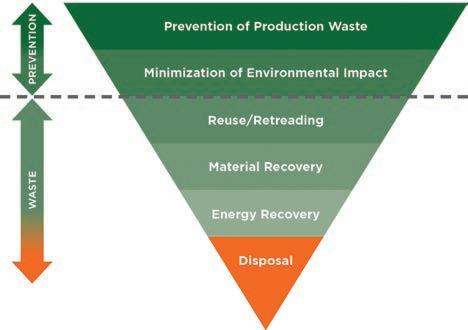

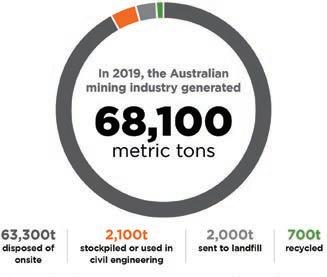

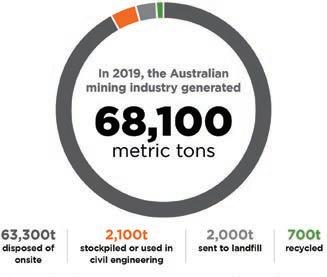

35 Building a business case for OTR recycling.

39 Put an end to the frequent replacement of capping boards in cell house refineries.

42 A mid-term look at critical mining in North America.

VENTILATION

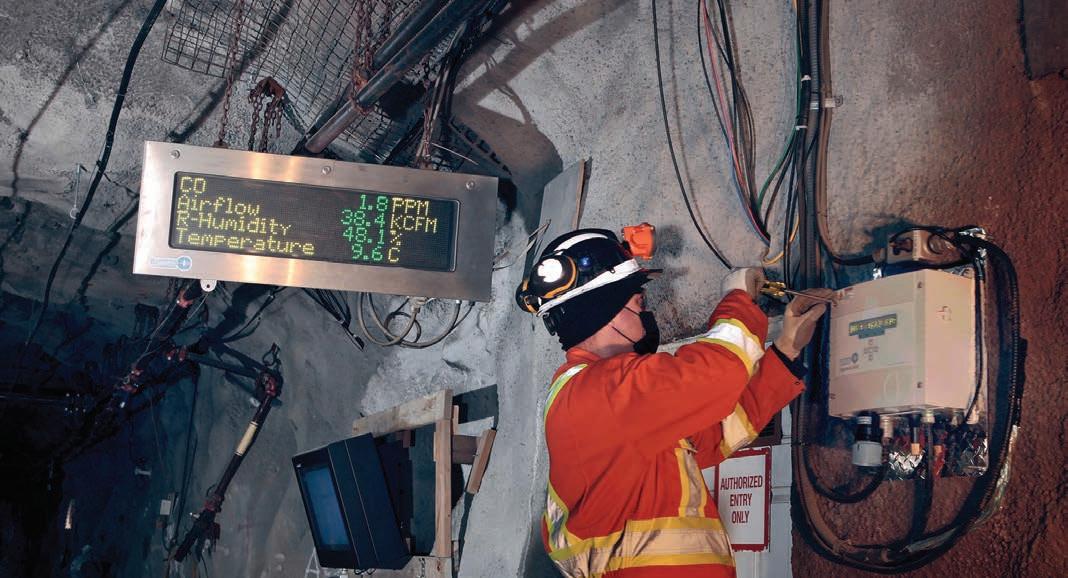

44 How ESG impacts the future of mine ventilation.

WATER MANAGEMENT

49 Unpacking mine water management: A cornerstone of long-term viability and mine value.

MINING IN ONTARIO

46 Updates on critical mining in northern Ontario.

52 How to improve the competitiveness of Ontario’s mining industry: Interview with Chris Hodgson.

56 Ontario is making a significant contribution to Canada’s net-zero target.

58 The EV supply chain in northern Ontario.

60 Making critical connections: The races for minerals and talent.

RECRUITMENT, TRAINING & CAREERS

62 Human centered approach to maximizing returns.

64 Losing the next generation of women in mining.

66 How to mitigate top mining business risks.

DEPARTMENTS

4 EDITORIAL | Mining in Ontario and the need for female talent.

6 FAST NEWS | Updates from across the mining ecosystem.

14 LAW | Green technologies and geopolitics are on a collision course.

20 COSTMINE | The cost of salt.

68 ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

www.canadianminingjournal.com

Coming in April 2023

Canadian Mining Journal’s April issue will tie-in BEVs, mine electrification, and the hunt for the resources to fuel de-carbonization. The issue will include a report on transportation and logistics.

For More Information

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

Front cover image: Portrait of a female worker in a mine in protective gear.

CREDIT: MESTOCK/ADOBE STOCK.

20 28 FEBRUARY/MARCH 2023 VOL. 144, N O .2

CANADIAN MINING JOURNAL | 3 46

Mining in Ontario and the need for female talent

Tamer Elbokl, PhD

Big restructuring and acquisition news will be the theme of 2023. Just before I started drafting this editorial, Teck Resources, Canada’s largest diversified miner, announced major changes including rebranding to Teck Metals Corp. as it spun off its steelmaking coal unit into a new company: Elk Valley Resources Ltd.

The Vancouver-based miner’s business separation will allow it to focus on critical metals that are crucial to the global energy transition, such as copper. Teck will seek shareholder approval of the separation at its annual and special shareholders meeting scheduled for Apr. 26.

Another big news was Canada’s B2Gold’s announcement that it is buying fellow precious metals miner Sabina Gold & Silver in an all-stock deal worth $1.1 billion (US$824 million).

The transaction hands B2Gold the Back River gold district property in Nunavut, which holds multiple high-potential mineralized zones. In my opinion, this is a strategic move for B2Gold as the company operates mines in Mali, Namibia, and The Philippines, so this would be their first property in Canada. Soon, I will be interviewing Clive T. Johnson, president and CEO of B2Gold, to speak on the Sabina transaction.

Just one week before B2Gold’s announcement, the world’s largest gold producer, Newmont, confirmed it had approached Australia’s biggest gold miner, Newcrest Mining, with a US$17-billion takeover offer.

If you are planning to attend the Prospectors and Developers Association of Canada (PDAC) 2023 convention in Toronto, Mar. 5-8, please visit our booth to pick up a hardcopy of this humungous issue, which is our biggest CMJ issue in a long time with 72 pages.

As the leading voice of the mineral exploration and development industry, PDAC recently provided the federal government with a list of recommendations that would help increase the competitiveness of Canada’s mineral exploration and development industry as part of the public consultation in advance of Budget 2023. PDAC’s recommendations focused on providing incentives to the industry to bolster exploration and development in Canada, including extending the Mineral Exploration Tax Credit (METC), expanding the eligibility of Canadian Development Expenses (CDE), reviewing the net benefit of flow-through share regime, increasing the METC for exploration within Canada’s territories, and expediting the development of a Pan-Canadian Geoscience Strategy (PGS).

With International Women’s Day (IWD) approaching on Mar. 8, we introduce our new “Women in Mining” section in this issue. Flip to page 22 for an exclusive interview with Jamile Cruz, founder of I&D 101 and currently director of joint ventures and Brazil country manager with Rio Tinto. On page 28, Kesiah Stoker highlights the social impacts of mining on Indigenous women and communities from PDAC’s recent social impact report.

Several articles in this issue highlight and provide updates on critical mining in Ontario with a focus section on careers and recruitment and the need for female talent in the mining sector (see pages 46-67).

Our April issue will tie-in BEVs, mine electrification, and the hunt for the resources to fuel de-carbonization. Editorial contributions will be accepted until Mar. 8, 2023, and should be sent to the Editor in Chief. CMJ

FEBRUARY/MARCH 2023 Vol. 144 – No . 02

225 Duncan Mill Rd. Suite 320, Toronto, Ontario M3B 3K9

Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief Dr. Tamer Elbokl TElbokl@CanadianMiningJournal.com

News Editors Marilyn Scales mscales@canadianminingjournal.com Moosa Imran mimran@canadianminingjournal.com

Production Manager

Jessica Jubb jjubb@glacierbizinfo.com

Advisory Board

David Brown (Golder Associates)

Michael Fox (Indigenous Community Engagement)

Scott Hayne (Redpath Canada)

Gary Poxleitner (SRK)

Manager of Product Distribution

Allison Mein 403-209-3515 amein@glacierrig.com

Publisher & Sales

Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos

416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.:

1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published 10 times a year by Glacier Resource Innovation Group (GRIG). GRIG is located at 225 Duncan Mill Rd., Ste. 320, Toronto, ON, M3B 3K9 Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891. Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods:

Phone: 1-888-502-3456 ext 3; E-mail: amein@glacierrig.com

Mail to: Allison Mein, 225 Duncan Mill Rd., Ste 320, Toronto, ON M3B 3K9

We acknowledge the financial support of the Government of Canada.

4 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FROM THE EDITOR

Join Our Monthly Mining Newsletter

Long-term solutions for sustainable mining

No spam here, just quality content to help your mining operations excel.

Get expert-level features covering in-depth topics that will answer some of your burning questions - emailed directly to your inbox.

Matching the dump body to the payload

Over the past 30 years, SMS Equipment has designed, fabricated, and assembled hundreds of custom dump bodies for off-road mining trucks.

Recruiting skilled workers in remote regions

A career in Heavy Equipment Maintenance provides benefits and growth opportunities that few industries can match.

Updates from across the mining ecosystem

• DECARBONIZATION | New Gold orders four more Sandvik BEVs for New Afton

New Gold has ordered four more Sandvik LH518B battery-electric loaders for its New Afton gold-copper mine in British Columbia.

The new battery-electric vehicles (BEVs) will join the first-ever Sandvik LH518B, which New Afton trialled in late 2020 before purchasing in February 2021, and two Sandvik Z50 BEV trucks also operating at the mine.

The Sandvik LH518B loader features the company’s patented self-swapping battery system, including the AutoSwap and AutoConnect functions, improving equipment safety and availability.

Located approximately 350 km northeast of Vancouver and 10 km from regional hub Kamloops in south-central British Columbia, the New Afton underground was among the industry’s earliest adopters of BEVs, which have contributed to the mine’s sustainability and productivity goals, the company says.

During more than two years in operation, the first Sandvik LH518B has helped

New Afton improve cycle times while reducing heat, noise, and greenhouse gas emissions.

Sandvik plans to deliver the first new LH518B in 2023, with the remaining units to be delivered by 2025.

“We’ve tested and proven battery-electric technology for larger scale adoption at New Afton and now we’re taking the

• MINERAL PROCESSING | Nicola to restart Merritt gold mill

Nicola Mining says the company is completing final preparations to commence gold mill near Merritt, B.C., by the end of the first quarter of 2023.

Nicola announced on Jan. 9 that it had signed a mining and milling profit share agreement with Osisko Development, and under the agreement, Osisko may transport material to Nicola’s mill site. It is the only facility in the province permitted to accept third party gold and silver mill feed from throughout the province.

Currently, the company has received more than 16,000 tonnes of ore from the Cariboo gold project. The company has also hired employees to fill key positions required for gold production.

On Jan. 3, Osisko shared results from a feasibility study done on Cariboo that indicated 163,695 oz. average annual gold production over a 12-year mine life, bulk tonnage and initial probable mineral reserves of 2 million oz. of gold (16.7 million tonnes at 3.78 g/t silver), an after-tax net present value at 5% discount of $502 million and 20.7% internal rate of return at $22.70/oz silver. CMJ

next step in our journey and growing our BEV fleet,” said Peter Prochotsky, New Afton mine manager.

“We’re looking forward to receiving the new loaders. We anticipate battery-electric and autonomous equipment will continue to play a vital role in improving safety and productivity in the years to come,” Prochotsky said. CMJ

• HEALTH | Teck funds copper for health care innovation at BCIT

Teck Resources has made a $1.75-million donation towards the new Teck Copper Innovation Hub at the British Columbia Institute of Technology (BCIT). Researchers and students at the facility will test the use of antimicrobial copper in a range of health care devices, including prosthetics and orthotics.

Copper has unique antimicrobial properties and is proven to eliminate up to 99.9% of harmful bacteria. This means copper can make such applications safe for both patients and health care professionals.

The Teck copper hub will be located inside the BCIT Centre for Applied Research and Innovation. New ways that copper can be used to enhance health and safety will be explored using 3D printing among other techniques.

Teck has a formal copper and health program through which it has funded many initiatives across a range of industries and public facilities. One such initiative involves the installation of copper in areas of high-traffic and high-touch surfaces such as hospitals, public transit, airports, museums, and post-secondary institutions. CMJ

6 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

NEWS

FAST

New Afton’s first Sandvik LH518B SANDVIK

Osisko’s Cariboo gold mine is providing ore to Nicola’s Merritt, B.C., mill OSISKO DEVELOPMENT

PRECISION, SIMPLICITY, COMPATIBILITY. THE 6X ®. OUT NOW!

The new 6X radar level sensor is so easy to use, it’s simply a pleasure. Because we know customers value not just ‘perfect technology’, but also making everyday life better and less complicated. We wouldn’t be VEGA if measurement technology was our only value.

VEGA. HOME OF VALUES.

GET TO KNOW THE 6X® www.vega.com/radar

FEBRUARY/MARCH 2023 CANADIAN MINING JOURNAL | 7

Updates from across the mining ecosystem

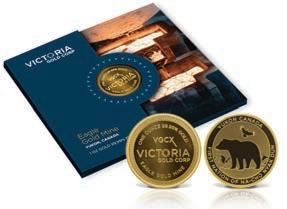

• MINING | Victoria Gold launches coins honouring the Eagle mine

Victoria Gold has launched one-ounce gold and silver coins to honour its Eagle gold mine, the largest in the history of the Yukon. The coins are presented in a commemorative package, which features photos of the mine and celebrates Victoria’s valued relationship with the First Nation of Na-Cho Nyak Dun, within whose traditional territory the mine is located.

The mine lies on Victoria’s 100%-owned Dublin Gulch property about 375 km north of Whitehorse, Yukon. Annual production is estimated to be at least 200,000 oz. of gold annually. The mine life was recently extended to 2040 based on proven and probable reserves of 148 million tonnes grading 0.64 g/t gold for 3.1 million contained oz. in the Eagle deposit. CMJ

Coins commemorating the Yukon’s largest gold mine are available in gold or silver VICTORIA GOLD

• CONSERVATION | Taku River Tlingit declare Taku watershed protected

Following a series of community meetings, this week, the Tak’hu (Taku) River Tlingit First Nation (TRTFN) declared the Taku watershed an Indigenous protected and conserved area (IPCA) within their traditional territory.

The Taku watershed covers 1.8 million hectares and is the largest watershed on the Pacific coast of North America that is inaccessible by road. It contains five species of salmon and supports large mammal predator-prey relationships.

The Taku IPCA protects 60% of the Taku watershed, in hopes of preserving salmon rivers and spawning areas, and landscapes needed for wildlife, for clean water, and Lingít Kusteeyí (Tlingit way of living).

The remaining 40% of the Taku watershed is identified as specially managed landscapes which include areas with high mineral potential, where the Taku IPCA provides opportunities for clean mineral extraction and other uses that support a low carbon economy.

“Taku River Tlingit have a sacred relationship with our territory, reflected in the concept of Lingít Kusteeyí, which encompasses caring for all life. The declaration of the IPCA is an extension of this commitment to forever care for the fish, wildlife, waters, and all other life and spirits within Taku River Tlingit Territory,” said Jìnìk (Charmaine Thom), spokesperson for the Taku.

“The new IPCA establishes a fair, responsible and respectful framework for Indigenous leadership, reconciliation, economic certainty, environmental protection, climate resilience, and wild salmon conservation and restoration,” said Jìnìk. CMJ

8 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FAST NEWS

DEEPLY INVESTED IN MINING.

By David Baker, Stephen D’Esposito, and John Thompson

By David Baker, Stephen D’Esposito, and John Thompson

Using a regeneration lens: mine waste becomes a resource

PART 2

Regeneration is an energy transition start-up that produces biodiversity, community, and climate positive minerals for the energy transition, green technology, and sustainable brands through re-mining, reprocessing, and restoration.

If the primary targets are legacy and historic mine and mill sites, there should be an emphasis on critical mineral production and the utilization of these sites for biodiversity restoration, renewable energy production, and carbon sequestration. Here, we explore the interdependence of site strategies, technologies, and policy innovation that contribute to our approach. We believe these have industry-wide relevance.

Legacy and historic mine sites, and mine and milling waste, can become environmental and community assets.

Start with a new vision for legacy mine sites

A nature positive development company would have two main functions: re-mining and restoration. Tailings, milling and processing residues, waste rock, and mine impacted waters represent oppor-

tunities to recover metals and minerals as well as create new products. With this in mind, people should take a fresh look at mining and milling waste.

A key objective is to finance restoration with revenue from minerals and, where possible, both renewable and nature-based products and outcomes. This is a different approach from the purely commercial re-mining and reprocessing of mine and milling wastes.

Achieving that objective requires assembling a portfolio of sites with the potential to create lasting value for communities and partners. For each site, work to create a coalition with a shared closure vision.

Characterizing the waste and identifying its potential value is one critical element.

An intensive focus on technology

helps us unlock residual value. Always seek the best recovery technologies (existing or new) that fit the challenges of the site and are scalable to a production rate not necessarily defined by traditional economic metrics.

Envision, design, and implement a clear path to a rehabilitated site that meets the needs of communities and governments.

Site assessment lens filters for net positive outcomes include the following:

> Improved post-mining environmental outcomes that effectively reduce site liabilities.

> Community support for and benefits from post-mining land use.

> Production of strategically important critical metals and minerals.

> Meeting the needs of downstream partners to source responsible metals and minerals.

For each site, the case presented to an investment committee should be unique and may include metal production, new products from waste, and other revenue streams aligned with our public benefit goals including value from biodiversity

10 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

ESG

From left to right: Initial restoration results at Sulphur Creek, Yukon, Canada; mine tailings in western U.S.; equipment from legacy placer mines, Alaska CREDIT: D’ESPOSITO/REGENERATION

and carbon credits, environmental and closure services fees, and liability reduction. Depending on the site, maximize value through the inclusion of renewable energy production, carbon sequestration, water management, agriculture, and other economic opportunities.

Good methodology, informed by sitebased learning, can be a catalyst for reducing the inventory of abandoned and legacy mine sites.

No longer will legacy sites suffer from minimum levels of compliance, nor will these sites simply be ‘managed.’

Legacy sites as technology incubators

There is a market gap. A rush of new technologies need access to mine sites for ground-truthing and testing. There are also proven technologies that can be re-applied to waste. However, access to sites is difficult.

The mining sector is not kind to innovation, where a “willing to test, fail, and try again” mentality is essential.

It is challenging for mining majors to support small scale trials, and potential liability issues can be prohibitive, creating an obstacle for technology innovators.

Mining juniors are trying to develop specific projects. Utilizing new, unproven technologies can lead to investor skepticism.

Proponents of new technologies can be viewed skeptically as trying to pitch one technology or system, even where an alternative may be better suited.

In fact, a focus on just one technology would narrow both market and impact because different sites require varied technology solutions. This can be solved by partnering with a range of technology providers, matching the right innovations with the right problems.

The use of proven and emerging technologies does not prevent the application of new technologies throughout the mineral extraction value chain, including those for waste characterization, material handling, processing and recovery, Products, waste management, reclamation, water treatment, and CO2 management.

Technology developers should have access to mining and milling sites to trial, verify, and validate their technologies.

For example, as a technology ecosystem partner, we are currently testing the application of an emerging technology, partnering with its developer to reduce the volume of bauxite residues.

An enabling policy environment

Working within the current regulatory context and seeking policy innovations will accelerate improved community and environmental outcomes while producing minerals for the energy transition. Policy, regulation, and voluntary standards can be modernized to support these goals.

Full value mining, optimizing the efficiency of extraction and production, at legacy, historic, and operating mine and mill sites should be incentivized.

Policies that support the use of proceeds from re-mining to restore and close abandoned mine sites are in the public interest. The community is better off and restored sites support the biodiversity goals of numerous governments.

Because these sites can produce carbon and biodiversity benefits, support for accessible credit and offset markets, including the development and use of transparent, credible tools to support these transactions, is essential. Tools and transparent markets will bring value for Indigenous governments and communities.

Communities can benefit from responsible sourcing and procurement standards that go beyond de-risking supply chains by rewarding minerals produced from re-mining and reprocessing, especially where restoration takes place. Through partnerships, new standards for restoration, re-mining, and Indigenous participation can be developed and tested.

To ignite a start-up culture and smart risk-taking, legacy sites can be treated as innovation and technology laboratories with tax incentives, grants, and funding for local and business partnerships. Some sites can be supported to test re-mining methods, develop biodiversity credits, and deploy renewables and green energy infrastructure.

This approach can support development efforts in countries with mineral resources. Sharing these strategies and tools with support from development agencies can strengthen and support development goals and enhance critical minerals supply chains.

Where governments are considering procurement policies and incentives that support the circular economy, definitions should include pre-consumer circularity, like products from metals extracted from mine waste.

Achieving an impact

This model requires us to build on mining’s traditions (the love of exploration, the value of discovery, and a hyper-focus on safety), ignite a start-up culture and thirst for innovation, and empower our restoration visionaries, whether in the profession or communities. CMJ

David Baker is the chief operating officer, Regeneration. Stephen D’Esposito is the founder and CEO, Regeneration. He is also the president of Resolve. John Thompson is the chief innovation officer, Regeneration.

FEBRUARY/MARCH 2023 CANADIAN MINING JOURNAL | 11

How does innovation in mining accelerate ESG goals?

While the global community of investors, political leaders, and regulators raise the bar for mining, the innovators and engineers are answering the challenge. An increased focus on mining means tremendous potential for transformational change from emerging and existing solutions. Mines can, and should, be designed with an energy transition profile in mind, meaning the construction and operation must be able to meet the future energy needs. The time for dreaming and waiting is over.

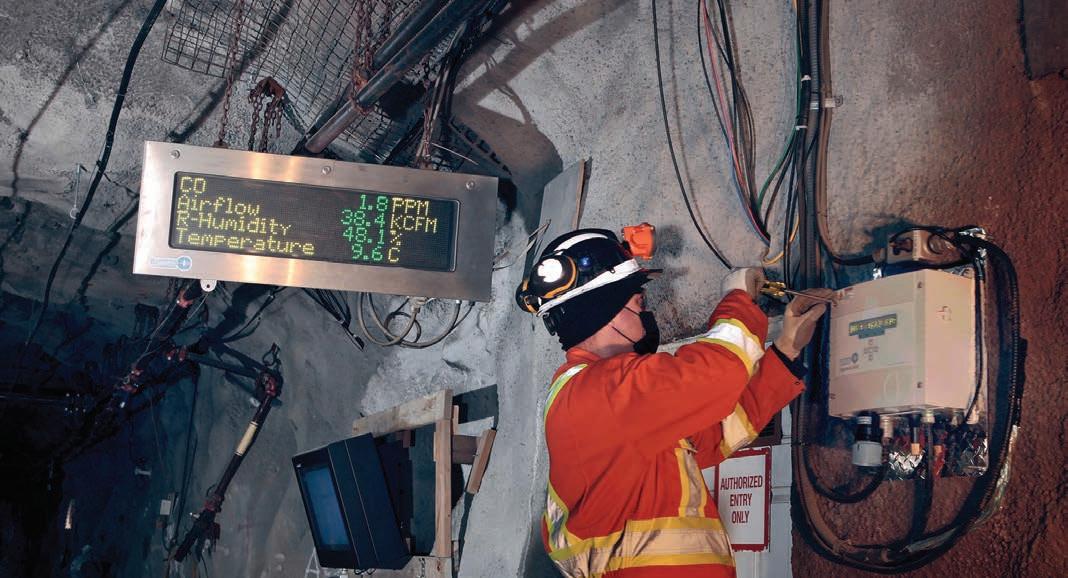

1. Leveraging remote operation

Remote technology already exists to be able to control loadhaul-dump machines from a surface control room or from an operating centre that is hundreds of kilometers away. Control rooms are often used for dewatering, hoisting, and material handling oversight. Beyond on-site control centres, we can also pair remote data collection and analytics within a business centre for globally distributed operations and facilities. This allows us to gain insight into an entire, integrated mining entity. Remote operation is used in all stages of the mining lifecycle,

not only for remotely driving trucks and LHDs at a mine site. At the milling and refining operations, there are opportunities to work virtually and monitor in real time. Remote operations allow site personnel to gather data for off-site specialist support, including use of augmented reality to troubleshoot and assist an operation from anywhere in the world. For example, we use a combination of photography, digital records, and location (geographical information system GIS) to remotely collect data and monitor conditions at a tailings pond site in Washington, U.S. This level of efficiency is a huge contributor for both safety and ESG in mining.

2. Utilizing real-time knowledge

Next generation operations must include cloud platforms, wireless communications, edge computing, artificial intelligence, and robotics capabilities. Real-time or near-real-time data for

12 | CANADIAN MINING JOURNAL www.canadianminingjournal.com ESG

Mine closure and rehabilitation is complex. Closure panning software, like PRAC, can help mining companies chart a closure plan and manage multiple sites across a portfolio CREDIT: STANTEC

process optimization, analytics, and autonomous decisions will come together. Plug and play capabilities will be the norm. Short interval control allows operations to pivot and manage resources in an integrated operation, maximizing safety in productive workplaces. Workers access virtual data and digital information to perform work and to capture new routines for continuous improvement. All ground response and process data are captured and analyzed with simulation and optimization tools to directly feedback into designs for future design improvements.

3. Learning from other industries

We are seeing more partnerships and collaborations with niche technology providers and original equipment manufacturers. This is powerful because we can provide an extended range of innovative solutions to mining clients. Last year, we entered collaborations with technology companies to benefit engineering designs. Auxilium offers unique solutions to transform tailings into carbon-sequestering building materials. Renix offers a continuous ion exchange process for wastewater treatment to produce clean water and recover new value-added products. Companies like Auxilium and Renix help save water and energy, getting us closer to net-zero. Partnerships and collaborations can be difficult to navigate and take time to put into place. But mining as an industry can benefit from leveraging solutions in other industries.

4. Modernizing software

Though it might seem easier to consider sustainable options when a mine is being built, opportunities abound for mines that have been operating for decades. A software upgrade could increase both yield and safety. For example, we can automate parts of the system to increase efficiency. Automation and tracking of people and equipment is widespread for use in ventilation controls, energy management, and safety. Tracking can be expanded for supplies delivery (like fuels and tools) to allow management and control of goods while minimizing idle and downtime. This, in turn, enables optimal planning and scheduling of work. All inventories are logged and tracked with advanced analytics to improve processes and reduce bottlenecks.

After more than 35 years of working in mine closure, Stantec engineers created a closure software tool, called PRAC, which stands for progressive rehabilitation and closure. This software provides a systematic approach to closure by capturing all closure-related data within one location.

5. Recruiting the next generation of miners

The mines of tomorrow need people for jobs that did not exist 20 years ago. Even today, many mines rely on computer programmers, AI developers, automation specialists, and data scientists. On top of that, mines need support in new areas such as greenhouse gas emission audits and community and Indigenous engage-

ment. It is exciting to see Engineers Canada and the Canadian Academy of Engineers considering adding a new engineering discipline – the energy engineer – to specialize in the critical energy transition in all sectors including mining.

Generation ESG is the sought-after mining employee who is tech savvy and values protection of the planet. These employees are equipped to manage future mining operations and leverage multi-trade skills. They will combine electrical, mechanical, and IT knowledge to maintain the evolving equipment and systems. A key message in recruiting new mining employees is the focus on mining and its essential contributions to society. We need critical minerals and metals not only for our daily lives, but to enable us to build renewable energy sources and work toward a more sustainable future.

The next phase of mining

Using technology to our advantage helps us become more sustainable and responsible stewards of earth’s finite resources. The word “innovation” might mean something different to everybody. But the truth is mining companies must act now to discover, assess, and implement leading-edge solutions not only in their mines, but also processing plants and infrastructure. This metamorphosis is supported by a progressive industry with its new-age concept of “fail fast.” This means we must safely learn and adjust quickly to try to use fresh solutions to get us to the future state of mining sooner rather than later. The mining industry needs speed to ESG to achieve its own net-zero aspirations while supporting the sustainability of the planet with metals and minerals used in climate change solutions. CMJ

FEBRUARY/MARCH 2023 CANADIAN MINING JOURNAL | 13

By Samantha Espley

CREDIT: STANTEC

Samantha Espley is a senior mining advisor at Stantec.

Gathering data remotely is efficient and can improve safety due to various alerts built into the system. These alerts help with immediate response to avoid site emergencies which could pose environmental risks to neighboring communities.

Green technologies and geopolitics are on a collision course

By Paul Triolo and Kevin Allison

By Paul Triolo and Kevin Allison

Technologies such as electric vehicles (EVs), wind power, and solar power are an important part of accelerating the transition to a low-carbon economy. However, these technologies are increasingly being drawn into geopolitical competition between the United States and China. Canada – with its abundance of natural resources, including critical minerals essential for making EV batteries, wind turbines, and solar systems work – is now applying a geopolitical lens to the sector in ways that will create risk and opportunity for Canadian firms and investors.

The latest evidence came on Nov. 2, 2022, when Canada’s federal innovation minister, François-Philippe Champagne, ordered three Chinese companies to divest their stakes in three Canadian mining companies. This was based on national security concerns. The companies are a Vancouver-based firm exploring for rare earth minerals in Ontario and two lithium mining companies with assets in Canada and Latin America. A few weeks later, the Canadian government published its new Indo-Pacific Strategy, in which it pledged to “[act] decisively when investments from stateowned enterprises and other foreign entities threaten our national security, including our critical minerals supply chains.”

To understand why critical minerals have become a geopolitical issue, it is important to understand their importance to the green transition and China’s role in this emerging technology ecosystem.

Supported by domestic policies designed to speed the electrification of China’s vehicle fleet, demand for EVs and EV batteries in China has soared. Domestic companies have capitalized on the opportunity. Today, 15 of the top 20 global suppliers of EV batteries are Chinese firms. Chinese companies have also built dominant positions in the global production of lithium used in lithium-ion batteries; graphite used in battery anodes; rare earth minerals such as neodymium, used in both EVs and wind turbines; and other critical materials for green technologies, including nickel, copper, and cobalt.

Chinese battery companies, led by global leader CATL, are rapidly expanding their presence in Europe and North America. Further upstream, Chinese-owned mining companies are extracting and processing critical minerals on a large scale across Latin America, Africa, and other regions of the world.

A decade ago, China’s increasing influence in critical minerals would have been seen as a natural outgrowth of its resource-intensive growth strategy. But as relations between China, the U.S., and other like-minded democracies have soured, China’s dominance of this strategic supply chain has sparked concern in Washington and, increasingly, in Ottawa. Beijing’s so-called “mask diplomacy” during the early days of the Covid-19 pandemic and the charge that Russia has used gas

supplies as an economic weapon in its war in Ukraine has fueled worries among some observers that China could use its dominance of critical minerals as an economic tool – or even withhold supplies in the event of a military conflict or other political dispute. The U.S. itself recently imposed export controls on semiconductor technology destined for China, and there is an ongoing debate about whether China might choose to retaliate via critical mineral exports.

Changing the footprint of the green-tech supply chain while also meeting soaring global demand for critical minerals will be difficult and expensive. Extracting and refining valuable resources like lithium and rare earths is capital-intensive. Mining and processing them can create toxic byproducts that must be carefully managed. Gaining buy-in from local communities and regional, national, and tribal governments for new mining projects is often difficult and politically fraught.

These are just some factors that will make it difficult for any one country – much less a group of like-minded allies – to attempt to re-shore large chunks of these complex supply chains. Without careful management, geopolitically driven efforts to reduce reliance on Chinese-origin inputs could create significant fissures across the supply chain, from mining to finished batteries, just as technology roadmaps are gaining traction and innovation is exploding across the industry.

Geopolitical shifts can create new costs, regulatory complexity, compliance burdens, and reputational issues for companies. The Canadian mining sector can play a significant role in encouraging and supporting geographical and supply chain diversity while urging governments to be clear-eyed about the costs and to avoid unintended consequences. The stakes for the planet are high.

CMJ

14 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

LAW

PAUL TRIOLO is senior vice-president for China and technology policy lead at the Albright Stonebridge Group, part of Dentons Global Advisors. KEVIN ALLISON is vice-president for Europe and Eurasia and technology policy at the Albright Stonebridge Group, part of Dentons Global Advisors.

PHOTO: PEACH/ADOBE IMAGES

Hand protection for mining hazards 800-265-7617 superiorglove.com/mining

SUPPORTING MINING EXPLORATION FOR MORE THAN 20 YEARS www.helicopterespanorama.com Business Development Director jcarrier@panoramahelico.com 418-321-2097 Québec (Alma) 418 668-3046 | Nunavut (Iqaluit) 888 288-3046 | Alberta (Grande Prairie) 888-288-3046 SERVICES Mineral Exploration Aerial Construction Drill Moves Airborne Survey Geophysics Lake Sampling Thermography Photogrammetry Terrain Analysis And much more... FLEET AS 350 Series (5-6 passengers) D, BA, BA+, B2, SD2, B3 Bell 212HP BLR (14 passengers) Multiple drone platforms Infrared and long range cameras

By Dan Clayton

Whether it is the distant sound of a highway, a busy street abuzz with people, or a river flowing through a park, we often do not think twice about the sounds we hear every day.

On the contrary, sounds of an industrial nature (like those produced by mining, manufacturing, and other heavy industries) have the tendency to command our attention and oftentimes, stir our frustration.

But why is that? It usually comes down to a few common characteristics that industrial facilities share.

Take, for example, a surface mine site. These sites often have intermittent sound sources that do not continuously operate but rather turn on and off with sound levels that vary. You will also hear many sounds designed to grab your attention in a busy mine environment, such as reverse safety beepers on equipment like loaders, trucks, and bulldozers. Other instances might include emergency blasting sirens and associated public address systems and loading facilities including rail yards and movements. Some sound sources also have irritating spectral characteristics, such as tones and strong low frequency components, which people can be sensitive to. Each of these factors makes it difficult for people to subconsciously block out the sound.

Historically in Canada, mining and industrial areas have been situated away from residential properties. However, that is changing year after year, as those areas expand and encroach on one another.

Here enters the noise clash. And no, that is not a new band name.

Are the regulations and bylaws ready?

The short answer is no, especially for mining sites.

For eastern Canada, in provinces such as Ontario and Quebec,

the regulations are more present for mining operations. But, as you head west, things get a bit sparse and unregulated for both sound and vibration.

In British Columbia and Manitoba, there are no requirements to assess sound or vibration from mining operations unless an Environmental Impact Assessment (EIA) is required. Even then, the methods to be used are outdated and inconsistent.

In Alberta, some mine types are regulated but many key types, such as sand and gravel pits, are not. Operations of both current and proposed pits have been increasingly contentious with neighboring residents in recent years.

Many mining operations do not trigger an EIA, but still have the potential to cause a disturbance due to sound and vibration. Especially those that are governed by municipalities with bylaws or policies with criteria that are too lenient or inappropriate for the location.

Mines that are assessed are often using outdated evaluation parameters like average sound as opposed to other metrics that more accurately account for time-varying sound sources.

Will the bylaws cover it?

Many bylaws are designed for the sound generated by residential activities and can often explicitly exclude any regulation of industrial sound. They will often have a statement that says something like, “No person shall make or cause, or permit to be made or caused, any noise in or on a street or elsewhere in the city that is liable to disturb the quiet, peace, rest, enjoyment, comfort, or convenience of individuals or the public.”

If you think about it, you could argue that most sounds we hear can disturb the quiet, peace, rest, enjoyment, comfort, or convenience of individuals or the public. So, this kind of bylaw has no practical application and is very hard to enforce.

FEBRUARY/MARCH 2023 CANADIAN MINING JOURNAL | 17

PHOTO: SLR CONSULTING ESG

»

WHAT’S ALL THIS

There are often no objective or quantifiable criteria to reference. Those that do exist typically only refer to absolute levels. However, annoyance is more closely linked to the difference between the sound level of the source in question compared to the ambient sound level without it at a receptor location. Evidently, whether sound is reaching that absolute threshold or not, residents are suffering.

Areas that have no regulation for mining operations will often rely on noise or vibration complaints to assess whether there is an issue or not. The “let’s deal with it later” approach.

The problem with this approach is that once someone has got to the point where they complain about or are irritated by a sound, the sound needs to be attenuated much more to be acceptable compared to a person who is not at that point. In this way, dealing with complaints from noise and vibration costs businesses time and money that they would not have needed to spend had they took a proactive approach to mitigation in the first place.

The need for mines is increasing, especially for key manufacturing metals for things like electric vehicles, solar panels, and consumer electronics, and infrastructure requiring sand and gravel.

With this pressure, mine sites are being situated nearer to residential properties, and areas where sensitive wildlife and Indigenous people’s land uses are located. So, noise and vibration clashes from these sites to these surrounding uses are

becoming more common, putting stops to important projects that are feasible in all other ways.

A lack of regulation is sometimes the preference. But if you live near a mine site that is not regulated for sound or vibration or has not got an effective management plan to control these emissions, then you will welcome new regulations. This works both ways. For mining operations, lack of regulation of sound and vibration leads to ambiguities and uncertainty, which causes time delays and additional costs to resolve, if they can be resolved at all. Municipalities are confused, residents are angry, and owners and operators are frustrated.

There are no goalposts, and that does not work.

How can we solve this problem? More proactivity, consistency, and clarity are needed. A sound and vibration assessment road map would be beneficial, including things like more consistency in the methodology, assessment criteria, and requirements for the management of sound and vibration from operations across the country.

The next step is for operators and regulations to consider noise and vibration at an early stage in feasibility and permitting stages of a project. If this is you, then consider involving an acoustics and vibration consultant in your project sooner than later. How does that sound? CMJ

18 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

ESG

SERVICING THE ABRASION RESISTANCE MARKET SINCE 1988 www.sprs.ca Technocore® GMAW wire field version of "brazing" rope Top Performing Tungsten Carbide "brazing" rope Field replaceable weld-on wear tiles for augers Multipurpose weld-on wear bars 1/2" thick rope overlay on 1" mild steel bars MEMBER OF EDMONTON, ALBERTA CANADA Contact Patrick@sprs.ca

Dan Clayton is the technical discipline manager of the acoustics and vibration team at SLR Consulting Ltd.

sidedump.com/ce 800-779-8099 Learn about our cost estimator Lower Cost, Higher Returns Moving more efficiently in the most challenging environments for 20 years.

Salt (NaCl), a nutrient vital to all animal life, is an important natural resource especially in southwestern Ontario. Canada is one of the world’s largest salt consumers thanks to its harsh winters, and Ontario provides substantially more of this salt than all other provinces combined. Most Canadian salt is commonly mined via underground room-and-pillar methods and is used to de-ice roadways. Table salt, chemical raw materials, and other end uses also represent major portions of overall consumption. The later products are most often produced via solution mining, where fresh water is injected via wells into buried salt deposits to recover a salt-saturated brine. Solution mining also yields valuable underground caverns, often used to store hydrocarbons after salt production ends.

As mineral resources, the development of salt deposits into new mines generally entails an iterative evaluation process like that of any other mineral deposit, beginning with discovery and scoping-level economic analysis. However, salt deposits are more widespread than most and relatively cheap to extract, a defining characteristic that salt shares with other ubiquitous minerals of economic interest. As with mining other common minerals, transportation costs often form a substantially larger portion of overall operating costs when compared to mineral commodities of higher value. But the mining costs associated with producing salt via room-and-pillar methods can often form a major portion of the overall operating cost, too. And the cost to process salt-saturated brines into table salt can be quite high. Not giving due consideration to these costs during the economic analysis of salt development projects brings with it the potential for poor decision making. To make more relevant investment and development decisions, salt mining and processing costs should be estimated realistically and included in all economic analyses from the first evaluation onward.

To demonstrate the relative magnitudes of these salt mining and processing costs relative to transportation costs, Costmine has modeled the cost of two 2,000-t/d salt mining scenarios. A representative room-and-pillar mine accessed via a 350-metre

The cost of

By Sam Blakely

shaft was modeled alongside a typical single-well solution mine of the same production rate. A 2,000-t/d vacuum pan evaporation plant, to produce table salt from salt-saturated brine, was also modeled to offer a more complete estimate of the cost to produce table salt via solution mining. The overall initial capital cost and average life-of-mine production costs from these models are presented below.

We can see that the transportation cost estimate is clearly our largest operating cost, but the estimated cost to process brine into table salt is also considerable and is within 20% of our transportation cost. While the estimated solution mining operating cost is small from almost any perspective, room-and-pillar mining costs represent about 20% of the overall operating cost in a scenario of mining and shipping rock salt.

The above cost does not include the initial capital expenditure nor the costs of marketing and packaging required before profitable production can be achieved. These costs are considerable and should always be considered before investment or development decisions are made. What has been presented above does demonstrate that, even when shipping costs are relatively high, the costs of production can still be substantial and must be duly considered during project evaluations. CMJ

20 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

COSTMINE

Sam Blakely is a senior mining engineer at Costmine, a division of The Northern Miner Group.

Item Average operating cost (US$/tonne salt) Room-and-pillar mining $ 61.44 Solution mining $ 6.05 Processing plant $ 211.37 Transportation* $ 255.00 *1,500 miles via rail ($0.17/tonne/mile) salt

Salt mining CREDIT: ALEXANDERKONSTA/ADOBE STOCK

Challenging the status quo

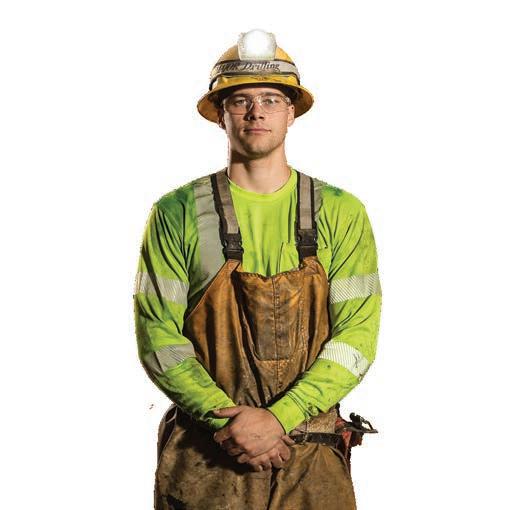

Jamile Cruz (JC) is a recognized, award-winning industry leader. Her passion for empowering people and driving equity and inclusion led her to create I&D 101, with the goal of creating inclusive spaces that support all talent.

Recently in 2022, Jamile has been recognized in Women in Mining UK’s “100 Global Inspirational Women in Mining (WIM100),” which is an initiative that celebrates women who have made inspiring contributions towards a stronger, safer, and more sustainable mining industry during her extensive volunteer experience including her roles as founding director of Women in Mining Brasil (WIM Brasil), as a former board member for Women in Mining Canada, as the board member of the Brazil-Canada Chamber of Commerce and D&I Committee Chair. With International Women’s Day (IWD) approaching on Mar. 8, I had the opportunity to discuss several issues related to the role of women in mining with Jamile Cruz.

CMJ: Tell us about your background; how did you start working on diversity and gender equality?

JC: I was born in a city called São José dos Campos in São Paulo, Brazil. My dad worked, through our childhood and adolescence, CONTINUED ON PAGE 24

Jamile Cruz, founder of I&D 101, holds a project management professional designation, a master’s certificate in project management, and a bachelor of engineering degree. Jamile is also the recipient of the 2021 Business Changemakers award by the Globe and Mail and the 2020 Canadian Institute of Mining distinguished lecturers award. She has 20 years of experience in transforming high-performing organizations through the creation and implementation of strategies to reduce operational costs and achieve business goals across multiple industries, including mining, design engineering, and management consulting, working directly for Hatch, Vale, and Accenture, and serving as a board member and chair of the ESG Committee for ATEX Resources, a Latin America-focused exploration company. Jamile has recently accepted a role as director of joint ventures and Brazil country manager with Rio Tinto.

22 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

WOMEN IN MINING

An interview with Jamile Cruz, founder of I&D 101

Founded in 2018, I&D 101 is a consultancy specialized in inclusion and diversity strategies. It was created to strengthen the performance of organizations by unlocking the potential and creating spaces that are inclusive to the participation of all talent, setting new trajectories for innovation and value creation. The company aligns the diversity strategy with business goals and works to activate organizational leaders to shape inclusive cultures that enable superior business results. Although Jamile has recently moved to a strategic role with Rio Tinto, I&D 101 continues to deliver its vision supporting multiple organizations under new leadership.

FEBRUARY/MARCH 2023 CANADIAN MINING JOURNAL | 23 ByTamer Elbokl, PhD

as a technician in the oil and gas industry in Brazil. So, my entry into the technical world, or refinery world, was through him. The company ran summer camps during which we always had the chance to visit the refinery in my city.

Growing up in a lower middle-class family, you see engineering as a way of building the structure you need in your life, so for my dad it was always important that we studied technical courses and then that we hopefully had the opportunity to do engineering or something similar.

I studied high school mixed with a technical degree (you would start at the age of 15 and by 18, you had a profession). I studied a telecommunications course sponsored by Ericsson. They built the laboratories at school and donated the equipment, and some of the technicians and teachers worked for Ericsson. I finished my degree in electrical engineering while working as a technician for Ericsson.

After I finished engineering, I signed up for an exchange program by Hatch Canada to bring engineers from Brazil to Canada and ended up getting into mining. In mining, you learn something new daily, and I am someone who needs that excitement and needs to be learning new things.

Then, I ended up joining a fertilizers group, so I moved to Regina, Sask. for a few years. Later, there was an opportunity for me to switch to management consulting. So, I joined Accenture to work on the issues of the mining world, capital projects, and investment reviews. It was 2014 when we started discussing the theme of diversity, equality, and inclusion (DE&I). So, we sent an abstract to the 2014 CIM meeting in Vancouver, and it was

accepted. From there, the conversation became part of my everyday life and soon enough I was dedicating all my time to figure out solutions to improve DE&I at organizations.

In 2020, I received the Canadian Institute of Mining Distinguished Lecturers Award in recognition of my work developing inclusive workplaces, especially in mining. In addition, I was a recipient of the 2021 Business Changemakers Awards by the Globe and Mail.

CMJ: When did you start becoming interested in inclusion and diversity training, and how did you start I&D 101?

JC: I left Accenture and started I&D 101 in the middle of 2018, so we just celebrated our fourth anniversary. I was with Accenture when I started talks around DE&I just because the topic needed to be addressed. So, I started participating more in conversations with clients and with other people to discover how they were approaching this, how they see this change, and whether they understand that this needs to be intentional, and investment needs to be there or not.

At the time, Accenture announced their goal to achieve gender balance by 2025. As a woman in a technical group at Accenture, my first question was “how?” So, we started working together on the model and how that would be possible. Meanwhile, I became close to the leadership in Canada and ended up getting the role of inclusion and diversity lead for Accenture Canada.

Traditional Water Management Is Eroding Project Value

You need passive, semi-passive, or enhanced passive treatment and source control strategies integrated to your traditional water treatment.

24 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

started with a free site

Get

assessment

Find out how Technology Readiness

(TRL)

with modernized Best Achievable

(BAT) assessments can reduce

expenditure. Simplify your water treatment strategy Streamline your permitting Decarbonize your mine

Levels

combined

Technology

operational

WOMEN IN MINING

1 Inclusive practices for career opportunities.

2 Respectful workplaces.

3 Ability to reconcile work with personal commitments.

4 Signs and symbols of gender inclusion in the workplace culture.

5 An industry that is a magnet for talent.

6 Supplier diversity buying from women-led companies.

7 Investing in women in the communities where companies operate.

8 Developing the talent of the future – Investing in STEM (science, technology, engineering, and math).

While doing that work for almost 1.5 years, several clients started asking questions on how we were achieving results. I proposed that we needed to do this for our clients. And it was a challenge to start a smaller market concept in a big organization. So, I decided to leave Accenture and start I&D 101. They were super supportive from the beginning. I think they understood this work needed to be done everywhere.

With a dynamic approach to mindset and behaviour change, the initial diagnostic identifies challenges, guides the co-creation of practical solutions with a focus on systems and process design, set to engage, empower, and improve organizational performance, from leadership to front-line employees.

CMJ: How did you get involved with other organizations such as Women in Mining Brasil (WIM Brasil)? Were you one of the founding members?

JC: I was one of the directors of Women in Mining (WIM) Canada for two years. WIM Canada has an amazing project in collaboration with the government of Canada outlining the action plan for inclusion of women in mining. Through Canadian Consul Eveline Coulombe, I was introduced to Andrea Rabetim, who is a leader on volunteering and intersectoral articulation at Vale, and Rinaldo Mancin, a director of sustainability at the Brazilian Mining Association (IBRAM), a national private nonprofit organization that represents the companies and institutions that operate in the mining sector (like MAC in Canada), and we had a conversation about how important it would be to start a defined structure in Brazil.

So, I&D 101 was hired by IBRAM to develop the Brazilian version of an action plan in 2019, and then we launched the plan in 2020. But then through this process of getting the women to discuss the challenges and what needed to change, a lot of the women started coming to us and saying, “the brand should be Women in Mining.” In 2019, we established Women in Mining Brasil (WIM Brasil).

CMJ: Now after more than three years, do you feel that WIM Brasil is making a difference or a positive change?

JC: Yes, I believe so. I think one of the key things for me as a director is that we have pushed hard, and everybody worked together to develop an engagement plan that defined commitment from the organizations.

WIM Brasil’s value proposal is to build a new way of looking

at the Brazilian mineral sector, with respect for women at all levels of the organization and in all areas of activity, encouraging inclusive and diverse work environments, and encouraging the participation of women as holders of technical expertise, operational excellence, and innovative spirit. So, the action plan is developed as eight strategies: we talk about the talent life cycle, recruitment, promotion, and retention. The plan also talks about the need for companies to invest in technical and training courses and invest in the community with the lenses of women, because that is where the growth of a community really happens. Companies need to think about innovation from the diversity perspective. The plan essentially gives the companies a framework to educate themselves on where to start. It is like, here you go; here is the step-by-step plan. We guide them through the implementation of this plan. On a yearly basis, with the support of the consulting company EY, we review the KPIs with the participating organizations and suggest changes for people to understand it better. We run a survey, and the last one had 34 companies. With the results, we are able to provide feedback on how they compare to the industry average and recommendations on the next steps. It helps to create awareness on actions that have real impact.

We are about 41 signatory companies. Women represent only 15% of the workforce in the Brazilian mining sector, according to the first WIM BRASIL Indicators report. Now, 69% of the signatories have a diversity and inclusion program and 13% of the signatories reported investing in the professionalizaCONTINUED ON PAGE 26

DECARBONIZE Your Mine Sites and Save on Energy

The AgriPower clean safe Biomass and Waste-to-Energy Systems will be uniquely designed to provide the Electricity and Heat required at your Mine Sites across Canada and around the World.

The AgriPower units are fueled by the mine’s waste of paper, cardboard, and wood of all types, some plastics, and biomass from dead-dying trees in the area.

WE CAN PROVIDE PROJECT GREEN FUNDING.

We do not have a website as our projects are unique and held confidentially for our clients. Please email or call:

Garry Spence 1-519-631-6035

garryevergreenenergy@rogers.com

FEBRUARY/MARCH 2023 CANADIAN MINING JOURNAL | 25

WIM Brasil has eight systematic strategies to advance the participation of women in the Brazilian mining industry

tion of this untapped talent group. I am quite proud of this project, and I do think it is making a difference.

On the website (www.wimbrasil.org), we have an annual program report (WIM Brasil Indicators), where you can see the changes applied and the type of programs that can make a difference. The WIM Brasil Indicators is the first progress report from our action plan for advancement of women in the mining industry.

The report presents performance and maturity indicators of the diversity, equity, and inclusion strategies detailed in the action plan, the results of the research carried out with the signatory companies who are implementing this plan, and good practices that demonstrate that we can indeed create a more inclusive industry. We went through the effort of searching and presenting best practices and stories that could showcase the growth and inspire other companies to take action.

I think there is an evolution. We are still talking about a group of companies that are on the top layer of mining organizations. Brazil has more than 2,000 mining corporations, and we are talking about those that have about 70% of the production. Those are large organizations with well-structured HR groups and sustainability groups that can run this kind of exercise. We keep telling them that by doing this and participating in this group, they can help the smaller organizations to figure out that they need to do and share the lessons learned and take just what works by sharing the lessons learned and applying what works based on experiences and results.

CMJ: In your opinion, what can be done to attract more women to study mining engineering and or geology and join the mining sector, and what can the mining sector do in general to attract more women?

JC: Mining tends to be a low-profile industry. Meaning, the investment in external communications can be in the lower range. We invest in sharing information with surrounding communities but not in a more global perspective. We hardly talk about mining outside of industry forums.

We could move from low to medium or high profile and be more present in the media and other multi-sector forums talking about our projects, how we operate, what mining really is/does, and inviting more people to participate instead of reacting only when something (bad) happens.

Then, unfortunately, the image associated with mining is often not the most positive. We need to reach out to the public. It is about sharing the reality. This is how many people are employed, this is how geology works, this is what the engineering work can be, these are the innovative initiatives being developed to make mining more sustainable, and these are all the other groups and professions that are part of this industry. In addition, these are all the elements in everyday life that are produced by mining.

As I mentioned before, WIM Brasil has eight systemic strategies to advance the participation of women in the Brazilian mining industry. In general, I think there are elements there that people are trying, but it needs to be a combined effort. We need to have respectful and safe workplaces. Women should be allowed to reconcile work with personal commitments. We need to start seeing signs and symbols of gender inclusion in the workplace culture. The industry should be a magnet for talent; the mining industry needs to create greater interest in the industry with women at an earlier stage in their careers, investing in women in the communities where companies operate, and investing in STEM.

Generally, mining needs rebranding. A lot of the work we do is associated with culture. You can bring more people in, you can convince them, and you can give them decent salaries. The question is “are they going to stay?” So, when we talk about women, when we talk about different underrepresented groups, they need to walk in knowing that they are safe, psychologically and physically safe, and they need to feel empowered to stay, work, and grow in one place.

Sustainable Designs Innovative Thinking Responsible Mining

wsp.com/mining

In Canada, Women in Mining Canada has local branches in in Toronto, Montreal, and Yukon. This offers not only the networking aspect, but the tools for people who want to join the industry and the access to understand the realities of these work environments, as well as a potential support system that will guide them though many milestones in their careers.

At a certain point, you propose that diversity and inclusion are not problems to be solved. Business can only unlock the performance potential of a more diverse workforce by intentionally addressing diversity and inclusion as critical pieces of their business and cultural strategies.

CMJ: Do you think that the mining industry is currently presenting itself well to women?

JC: I think based on your previous question, the answer is no. There is a challenge to be addressed around culture, around the

26 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

At WSP, pursuing a greener future inspires us to innovate and deliver impactful and sustainable solutions.

Be part of our team doing purposeful work in mining, solving the challenges of today, and tomorrow.

WOMEN IN MINING

mining brand, and the explanation of what it is. There is a lot of work to be done not just for the mining industry, but also for women who want to be in mining.

I would love to see a project where the industry comes together on the rebranding, for example, and not a rebranding just for the perspective of selling a better image, but with the commitment to do the internal work around culture. I think we can quantify the challenge that is ahead of us with new licenses to operate for the next big projects. Then, the question becomes what level of effort and investment is the industry willing to put in to changing the culture? If we are proactive towards these changes, we could move more effectively and achieve great results.

CMJ: Do you think the provincial and federal governments can do more to help?

JC: I think they can support everything we discussed from involvement in education to involvement of communities and consultation.

I think there is a role to be played by the governments in terms of facilitating or creating models where there is an opportunity for everybody to participate.

The challenge we have today is that the model is focused solely on financial outcomes. We need to adjust this model, and for many organizations and investors, this is what ESG standards and measures will help to address. The outcomes will need to be more balanced.

CMJ: Now, please talk to us about the recent recognition, WIM100 UK: 100 Global Inspirational Women in Mining, and what does it mean to you?

JC: WIM100 is an initiative that celebrates women who have made inspiring contributions towards a stronger, safer, and more sustainable mining industry. It is a recognition of the work many women in the mining industry have committed to execute. My name is there this year because it has been four years since we started I&D 101, six years in total with diversity and inclusion work, and almost 20 years in the mining sector being outspoken about the challenges and trying to fix it. I think I am not someone who is willing to complain without figuring out solutions.

I was one of 491 women nominated across 61 countries. The recognition is of the hard work I have been doing for more than 20 years with clients, transforming businesses into high-performing organizations, creating, and implementing strategies to reduce operational costs and achieve their business goals. It feels great to be recognized as an industry leader and for my passion for empowering people and driving equity and inclusion in the mining industry.

I believe that if you show up at a table with a challenge, then you should show up with ideas on how to deal with that challenge. I want to be someone who inspires people to come up with new ideas and to challenge the status quo. If I see something wrong, my brain starts working on how I would do that differently. What are the other alternatives? CMJ

FEBRUARY/MARCH 2023 CANADIAN MINING JOURNAL | 27 Eriez.com | 814.835.6000

1 2/17/23 9:40 AM Page 1

Stop DangerousTramp Metals ERIEZ_TrampMetal_1-2Pg_CMJ_3_23.qxp_Layout

Highlights from PDAC’s social impact report

social

The importance of respecting Indigenous Peoples and their traditional territories is widely recognized in the Canadian mining industry. Understanding the values and culture of an Indigenous community is crucial to a mutually beneficial partnership, but mining companies also have a duty to anticipate the social impacts of their operations on the host community, as well as mitigate negative effects.

The Prospectors and Developers Association of Canada (PDAC) recently published its social impact report titled “studying the social impacts of mineral development projects on indigenous communities.” PDAC used literature review, a case study, and interviews to analyze the effects of mining on the social infrastructure of the host Indigenous communities. This article highlights the findings and recommendations from the report.

A unique perspective

The mining industry tends to focus on social impacts at the community level, but men and women in the community

experience these impacts differently. Whereas men may benefit more from employment opportunities, Indigenous women (who typically focus on the household, family planning, and the broader community) are disproportionately affected by social disruption.

Drawing inspiration from the National Inquiry into Missing and Murdered Indigenous Women and Girls (MMIWG), PDAC’s study applied a gendered lens to analyze the impacts of mining projects on Indigenous women, and how these impacts can affect gender imbalances in Indigenous communities. All five interviewees in the study were women: four Indigenous community members and the mining company’s community relations manager.

According to PDAC’s report, starting a mining project with a gender-based analysis will help elucidate the roles of women, men, and gender diverse people in Indigenous society, and present a more complete understanding of the project’s social impacts. Several mineral resource companies already use

28 | CANADIAN MINING JOURNAL www.canadianminingjournal.com WOMEN IN MINING PHOTO: IKAVE102RUS/ADOBE IMAGES

The

impacts of mining on Indigenous women and communities

Gender-based Analysis Plus (GBA+) principles as part of their permitting process. The report suggests that a proactive approach to involving women and understanding their perspectives and values is a prerequisite to supporting an Indigenous community during a mining project.

Social impacts

1 | Indigenous women’s issues

Women in Indigenous host communities face a range of social impacts from mining projects. The MMIWG report states that when a mine brings in a transient, predominantly male workforce with little connection to the host community, it can exacerbate vulnerable situations that lead to increased crime (e.g., substance abuse, gambling, prostitution, violence, and harassment). When a mine hires Indigenous men from a host community, this can increase responsibilities for the women of the community (e.g., volunteer firefighting).

Women who work in mining camps often face social issues onsite. According to a recent study by Liard Aboriginal Women’s Society, high percentages of women have reported harassment, discrimination, assault, and abuse at camps in Yukon and northern B.C. Hypermasculinity, ineffective prevention strategies, lack of trust in grievance reporting, and denial of the existence of these issues perpetuate an unsafe environment for women.

Indigenous women may also experience limited opportunities and career development due to stereotypes. They often have lower paying jobs, and rotational shift work is difficult for mothers who are primary caregivers. This can result in demotivation to enter the workforce and can reinforce gender imbalances.

To address these issues, mining companies can

a create women’s support groups onsite;

b improve procedures for responding to harassment complaints;

c expand opportunities, education, and training for women to take on technical and managerial roles; and

d provide community-based programming and family support (e.g., daycare).

Indigenous women should be included in decision-making processes and the development of equality initiatives. PDAC advocates that mining projects should support, not undermine, the human rights of Indigenous women.

2 | Housing and cost of living

The remoteness of Indigenous communities, especially in northern Canada, results in an inflated cost of living. Transportation costs and complexity of distribution lead to soaring prices and food insecurity. Remote communities also experience housing issues such as overcrowding, shortages,

By Kesiah Stoker

and poor conditions. An influx of mining workers increases competition for food and housing, exacerbating these issues.

Providing employment and business opportunities for Indigenous community members can increase their income and improve quality of living. However, locals with mining jobs often leave the community for better opportunities, so their incomes may not contribute to the local economy. PDAC’s report suggests that mining companies conduct socio-economic assessments and develop programs to encourage people to stay in their communities. Mining companies should also build camp housing facilities to mitigate housing issues.

3 | Community infrastructure

Indigenous communities in remote areas can experience a lack of safe drinking water, poor road conditions, poor digital infrastructure, and gaps in education. Fortunately, mining companies can create mutually beneficial improvements to the infrastructure in host communities.

Due to regulatory requirements and environmental commitments, mining companies routinely monitor water quality for their operations. This can be expanded into the development of water management programs for nearby communities. Heavy mining equipment can further damage roads, so mining companies should be prepared to help maintain and/or build roads.

Mining companies can help address the lack of technical literacy and internet access in remote communities, which limit community development and access to healthcare, education, and banking. PDAC’s report suggests that computers with internet access should be provided for families to stay connected during rotational shifts.

Education and training for Indigenous community members builds resilience in the community and strengthens the workforce for the mining industry. Companies can also facilitate career growth and opportunities for Indigenous employees to reach management and executive levels. Of course, Indigenous knowledge should be integrated into these programs.

The report states that in addition to improving infrastructure, mining companies should support local social programs so that communities remain resilient after the closure of a project.

4| Traditional lifestyles and land

Traditional activities such as hunting, fishing, and harvesting are essential elements of Indigenous cultural identities. However, there has been a decline in participation in these activities, and the outflow of younger community members leaves elders with fewer opportunities to pass on traditional knowledge. Employment in mining can provide financial resources that enable the purchase of equipment and supplies for traditional activities, but rotational work schedules often

FEBRUARY/MARCH 2023 CANADIAN MINING JOURNAL | 29 CONTINUED ON PAGE 30

According to PDAC’s report, starting a mining project with a gender-based analysis will help elucidate the roles of women, men, and gender diverse people in Indigenous society, and present a more complete understanding of the project’s social impacts.

conflict with the timing of these activities (e.g., long hunting

To mitigate these issues, mining companies can provide time off for traditional activities and build generational support in the community. Companies should also consult with host communities regarding traditional land use and involve them in archaeological assessments and field mapping. There could be opportunities to expand traditional land use, for example, building roadways that follow harvesting routes.

Health and wellbeing

Health issues in Indigenous communities are exacerbated by extreme poverty rates, intergenerational trauma, and poor relationships with healthcare providers. The remoteness of many Indigenous communities also creates a lack of adequate health facilities and a shortage of healthcare workers. Mining camps often provide health services from basic first aid to trained first responders, and companies can expand these services to the host community and/or build new local facilities.

Connection with culture and language improves wellness in Indigenous communities. The ability to work on traditional territory can strengthen an Indigenous employee’s sense of belonging. Mining companies can invest in Indigenous cultural programs for all employees, designed and managed by Indigenous employees.