MINING IN B.C. BLACKWATER AND YELLOW METAL SAFETY A MINER’S TRUE STORY JANUARY 2023 | www.canadianminingjournal.com | PM # 40069240 WATER MANAGEMENT FOR A GREENER FUTURE Teck’s water strategy and saturated rock fills technology

We’ve designed and built heap leach projects since heap leaching was first developed in the early 1970’s.

EVERY HEAP IS DIFFERENT.

There are still a lot of failures – due to permeability, heap stability, or lack of respect for the topography – KCA can ensure that your heap starts up quickly, and works as designed. We are not just design engineers – we acted as EPCM contractors on the heaps in these photos – if you want experience and innovation on your side, call us for your next project.

WWW.KCARENO.COM CALL CARL OR DAN (US) 775- 972-7575

MINING IN B.C.

SAFETY

SCREENS

CONVEYORS

DEPARTMENTS

Front cover: Abstract icon representing the ecological call to recycle and reuse in the form of a pond with a recycling symbol.

Coming in February/March 2023

Canadian Mining Journal’s February/March issue will look at the state of mining in Ontario, the issue will include a report on top development projects, the Ontario Mining Association’s annual address.

For More Information

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

www.canadianminingjournal.com 14 19 JANUARY 2023 VOL. 144, N O .1

CREDIT: MALP/ADOBE STOCK.

12 The

in mining and

14

17

FEATURES TECHNOLOGY

role of biotechnology

minerals. WATER MANAGEMENT SYMPOSIUM

Teck’s water strategy: Interview with Chris Kennedy, director of water, Teck Resources.

Water management for a greener future.

19

Artemis is developing its Blackwater gold mine for the first pour in Q3 2024.

21

23

A miner’s true story: Part 1.

Vehicle fire suppression: Assessing the latest evolution in fire safety solutions.

25 Three

vibrating

30

ways

screen diagnostics help your bottom line.

Beginning 2023 with spring start-up in mind.

27 Sandwich belt high

conveyors are

31 Water tank efficiency tips to kick off the new year.

angle

in harmony with the environment. MAINTENANCE

4 EDITORIAL | Ending 2022 on a high note is the best way to start 2023. 6 FAST NEWS | Updates from across the mining ecosystem. 9 COSTMINE | Yes, costs have risen. 11 LAW | One-half of the critical minerals story. 33 ON

|

JANUARY 2023 CANADIAN MINING JOURNAL | 3 21

THE MOVE

Tracking executive, management, and board changes in Canada’s mining sector.

FROM

T

Tamer Elbokl, PhD

The mining industry plays a significant role in water management and stewardship. How miners manage their wastewater is a significant point of focus for the sector. In Canada, gold, iron ore, copper, nickel, diamond, and other mines are allowed to release water (effluent) to an aquatic environment if it meets the regulatory requirements. Two articles in this issue highlight the most important discussions by industry experts during our recent water management symposium that took place on Oct. 12, 2022. Flip to page 14 for insights into Teck Resources water management strategies and policy and their SRF (saturated rock fills) technology. According to the experts in the panel discussion, the challenge today is not to merely treat water, but create effective water management beginning with development and through to post-closure. Canadians can take the lead in how we use water, how little we use, how much we recycle, and how well we treat it. We need to be building today the technologies that will be effective 10 or 20 years from now. See page 17 for more details on water management for a greener future.

Mining is the largest private sector employer of Indigenous people in Canada, especially in British Columbia. The mining sector is a major partner to Indigenous businesses in B.C., and Indigenous communities in B.C. share the benefits of mining with the mining companies to help achieve lasting, self-defined community objectives. An article on page 19 discusses how Artemis is developing its Blackwater gold mine for the first pour in Q3 2024. The Blackwater project sits on traditional lands belonging to the Lhoosk’uz Dené Nation and Ulkatcho First Nation. Artemis signed a trilateral project participation agreement in 2019 and works closely with Indigenous and local communities to support business development.

While safety is a major concern in the mining sector, some accidents are inevitable. Read a miner’s true accident story on page 21 of this issue.

Additionally, our law column features one half of the critical minerals story on page 11. There are also several articles featuring tips on how to prepare your equipment for the new year on pages 25-32.

Finally, we wish our readers a Happy New Year, 2023, and we hope that it will be a good year for the mining sector in Canada! CMJ

JANUARY 2023 Vol. 144 – No . 01

225 Duncan Mill Rd. Suite 320, Toronto, Ontario M3B 3K9

Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief Dr. Tamer Elbokl TElbokl@CanadianMiningJournal.com

News Editor

Marilyn Scales mscales@canadianminingjournal.com editor@canadianaminingjournal.com

he federal government ended 2022 year on a high note by unveiling a new critical minerals strategy eyeing a “generational opportunity.” Backed by $4 billion in the 2022 federal budget, the strategy will help create jobs across the country and grow the economy. The roadmap unveiled focuses on driving exploration and building sustainable infrastructure to avoid the economic risks that come from relying on international partners that do not share common values.Production Manager

Jessica Jubb jjubb@glacierbizinfo.com

Advisory Board

David Brown (Golder Associates) Michael Fox (Indigenous Community Engagement) Scott Hayne (Redpath Canada) Gary Poxleitner (SRK)

Manager of Product Distribution

Allison Mein 403-209-3515 amein@glacierrig.com

Publisher & Sales Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published 10 times a year by Glacier Resource Innovation Group (GRIG). GRIG is located at 225 Duncan Mill Rd., Ste. 320, Toronto, ON, M3B 3K9 Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods:

Phone: 1-888-502-3456 ext 3; E-mail: amein@glacierrig.com

Mail to: Allison Mein, 225 Duncan Mill Rd., Ste 320, Toronto, ON M3B 3K9

We acknowledge the financial support of the Government of Canada.

CREDIT: ADOBE

4 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

President, The Northern Miner Group Anthony Vaccaro THE EDITOR

Ending 2022 on a high note is the best way to start 2023

GET TO KNOW THE 6X® www.vega.com/radar THREE INTRINSIC VALUES: ACCURACY, RELIABILITY, AND EASE OF USE. THE 6X ®. OUT NOW! Admittedly, at first glance, you can’t tell what’s inside the new VEGAPULS 6X radar sensor: A high-precision level instrument that doesn’t care if its measuring liquids or bulk solids. Only its color gives you a hint that it’s going to be great to use. VEGA. HOME OF VALUES.

Updates from across the mining ecosystem

• DEVELOPMENT | Ascot arranges $200M financing package for construction of the Premier gold project

Ascot Resources has signed non-binding letters of intent for a total of approximately $200 million in project financing for construction of the Premier gold project, located on Nisga’a Nation Treaty Lands in the prolific Golden Triangle of northwestern British Columbia.

The proposed financing package will consist of a US$110 million gold and silver streaming agreement with Sprott Resource Streaming and Royalty and/or its affiliates and an equity investment by Ccori Apu S.A.C of $45 million, a portion of which will be structured as Canadian development expenditures flow-through shares, such that the total gross proceeds to the company is $50 million.

Ccori Apu’s shareholders are the majority shareholders of Compañía Minera Poderosa S.A., which owns and oper-

ates a high-grade gold mine in northern Peru and produces approximately 300,000 oz. of gold per year.

Ascot is also projected to provide an

update on the construction plans for Premier Gold project and the path towards production, which is anticipated in early 2024.

The Premier underground mine opened in 1918 and was the largest gold mine in North America until its closure in 1952, producing 2.0 million oz. of gold and 45 million oz. of silver. The current project covers 8,133 hectares with three key deposits and several exploration targets. The key deposits are Premier, Silver Coin and Big Missouri, which all had historical mining activities and underground access.

In 2020, Ascot released a feasibility studied that outlined an eight-year mine life producing an annual average of 151,000 oz. of gold equivalent at an all-in sustaining cost of US$769 oz gold. CMJ

Amex accepts exploration company of year at Mines and Money,

AWARD |

London

Montreal’s Amex Exploration has won the Exploration Company of the Year honour awarded on Dec. 1 at the Mines and Money annual dinner in London, U.K. The award acknowledges a company and its team for a significant new discovery made or advanced between Oct. 1, 2021, and Sept. 30, 2022.

Amex is advancing its Perron gold project 110 km north of Rouyn-Noranda, Que. By the end of this year, the company will have completed close to 375,000 metres of drilling. The program has outlined the volcanogenic massive sulphide (VMS) potential of the property over a 4-km strike.

The company discovered four new gold zones and two copper-rich VMS zones, while expanding and defining the HighGrade Gold zone (HGZ) (an underground mining target) and the adjacent Denise zone (a near surface bulk-tonnage target).

In addition, Amex qualified for EcoLogo certification as awarded by Underwriters Labs Canada for its environment, social and governance (ESG) efforts.

Victor Cantore, President and CEO of Amex Exploration, commented, “The Perron project is located in a greenstone belt of Quebec that was previously overlooked for gold. Our success has proven that perseverance leads to discoveries which will benefit the people of the area and the province of Quebec.

“I am very proud of the dedicated team and the quality of work we have produced. Exploration is at the core of Amex culture, and we continue to stay focused on delivering results for our shareholders and stakeholders.” CMJ

• SCHOLARSHIPS |

De Beers Group awards $45K in scholarships to women in STEM

De Beers Group has awarded $45,000 in scholarships to 10 Canadian women, as what the company says is a commitment to support women in science, technology, engineering and math (STEM) studies in Canada.

From the more than 475 applications, the winners are eight women from the Northwest Territories, one from northern Ontario and one from Nunavut. Each receives $4,500 as they enter year one of a program.

The 2022 scholarships represent a three-year $135,000 program launched earlier this year as part of De Beers’ Building Forever program in Canada. It builds on a partnership between De Beers Group and UN Women that provided US$408,000 in scholarships to support Canadian women in STEM programs between 2018 and 2021.

In addition, De Beers is funding four new $5,000 entrance scholarships annually over the next four years to support women in STEM at the University of Calgary, two in science and two in engineering.

Moses Madondo, managing director of De Beers Group, said, “It’s clear from the overwhelming response that there is still a need to accelerate opportunities for women in STEM. As a company committed to building forever, we remain focused on identifying and removing systemic barriers to social and economic inclusion because we recognize that equal opportunity will benefit us all.”

Individuals interested in applying for these scholarships need to apply directly through their university. CMJ

6 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FAST NEWS

The construction camp at Ascot Resources’ Premier gold project in B.C. CREDIT: ASCOT RESOURCES

•

• UNDERGROUND EQUIPMENT | Sandvik, Redpath sign 5-year equipment deal

Sandvik and Redpath have signed a five-year agreement to standardize the use of equipment, a move that will lead to cost reductions and safety enhancements underground. The goal will be reached through technology advancements, innovation, continuous improvement projects and standardized best practices.

The agreement will be guided by operational and relationship key performance indicators.

“Sandvik Mining and Rock Solutions has long been a valued supplier of underground mining solutions to our global operations,” said George Flumerfelt, CEO of The Redpath Group.

“This mutually beneficial co-operation will help ensure Sandvik provides the same service experience and quality, independently of the geographic location and size of Redpath operations.”

The agreement includes Sandvik commitments on local presence and support, as well as an annual technology summit and factory training sessions.

“Closer collaboration with Redpath’s busines will enable us to ... optimize product development,” said Sandvik president Mats Eriksson. CMJ

• HAULAGE | Railveyor hauls over 10M tonnes at Agnico’s Goldex

Rail-Veyor Technologies Global has announced that the company’s TrulyAutonomous haulage system operating at Agnico Eagle Mines’ Goldex mine in Val d’Or, Que., has hauled over 10 million tonnes of ore since installation and commissioning was completed in 2018.

Initially designed with a haul capacity of 6,000 t/d, the Railveyor system has consistently exceeded that number, according to Rail-Veyor and Agnico. The company also claims that the fully electric system helps reduce potential greenhouse gas emissions, especially when compared to traditional diesel truck haulage solutions.

“Since 2018, the implementation of the Railveyor system at Goldex has had a positive impact on our operations. This innovative project has had a unifying effect among our teams because all departments were able to participate in it. It also allowed us to raise the bar on our production, and it helped us achieve our environmental and health and safety goals,” said Christian Lessard, maintenance superintendent Agnico’s Goldex mine. CMJ

JANUARY 2023 CANADIAN MINING JOURNAL | 7

Updates from across the mining ecosystem

• MINE PLAN | New mine plan in updated feasibility for Marathon’s Valentine gold project

• HAULAGE | Caterpillar demonstrates first battery electric Cat 793 truck

Caterpillar is calling its demonstration of its first battery electric truck, the Cat 793, a success. The company debuted the truck at its Tucson, Arizona, proving ground earlier this month.

Caterpillar completed development of its first battery electric 793 prototype with support from mining customers participating in Caterpillar’s early learner program. Participants of the program with definitive electrification agreements include BHP, Freeport-McMoRan, Newmont, Rio Tinto, and Teck Resources.

Marathon Gold updated the feasibility study for its Valentine gold project in the central region of Newfoundland, including for the first time a three-pit mine plan.

The project will be based on the Marathon, Leprechaun and Berry deposits, using conventional open pit methods. The new study has increased reserves, a longer mine life, and higher gold production than the previous feasibility study of April 2021.

Proven and probable reserves contain 2.7 million oz. of gold in 51.6 million tonnes grading 1.62 g/t gold, up 31% in ounces, 10% in tonnes, and 20% in grade, compared to the previous feasibility study of April 2021.

Within the reserves is a high-grade portion (greater than 0.7 g/t gold) containing 2.4 million oz. of gold in 35.3 million tonnes at 2.21 g/t gold. These numbers represent increases of 38% in ounces, 29% in tonnes, and 7% in grade.

Total measured and indicated resources for all zones are 64.6 million tonnes grading 1.90 g/t gold for 3.96 million contained ounces. There are also 20.8 million tonnes of inferred resources grading 1.65 g/t gold for 1.1 million oz. of gold.

The project is planned in three phases over a total of 14.3 years using a gold price of $1,700 and an exchange rate of US$1.00 to C$0.75. During the first three years beginning in 2025, the mines will produce 200,000 oz. of gold, and with an increase in the milling rate and lower feed grade for the next nine years, output will be approximately 193,000 oz. per years. An accumulated low-grade stockpile will be processed for the last three years.

The Valentine gold project received provincial and federal environmental approval earlier this year based on mining Marathon and Leprechaun. Early works construction began in October.

During the event, Caterpillar monitored over 1,100 data channels, gathering 110,000 data points per second, to validate simulation and engineering modelling capabilities. Fully loaded to its rated capacity, the truck achieved a top speed of 60 km/h. The loaded truck travelled 1-km up a 10% grade at 12 km/h. The truck also performed a 1-km run on a 10% downhill grade, capturing the energy that would normally be lost to heat and regenerating that energy to the battery. Upon completing the entire run, the truck maintained enough battery energy to perform additional complete cycles.

Launched in 2021, the early learner program focuses on accelerating the development and validation of Caterpillar’s battery electric trucks at participating customers’ sites, with the aim to aid the individual commitments each early learner participant has made to reduce and eliminate greenhouse gas emissions from their operations.

The company says a primary objective of the program is for Caterpillar to collaborate more closely with its customers as the industry undergoes transformational change through the energy transition.

“Our global team came together to develop this battery truck at an accelerated pace to help our customers meet their sustainability commitments,” said resource industries group president Denise Johnson. “This demonstration is a significant milestone, and we are excited for these trucks to get to work at customers’ sites around the world in the near future.” CMJ

8 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FAST NEWS

CMJ

Canadian Mining Journal’s 2023 Media Kit and Editorial Calendar is now available. Contact Robert Seagraves at rseagraves@canadianminingjournal.com or George Agelopoulos at gagelopoulos@northernminer.com or call 1-416-510-6891 to request your copy. www.canadianminingjournal.com

Drilling at the Valentine Lake gold project in Newfoundland. CREDIT: MARATHON GOLD

Yes, costs have risen

Inflation in the U.S., for the 12 months ending October 2022, was 7.7%. For the same period, inflation in Canada was 6.9%. Australia saw a 7.3% increase. These are not the kinds of inflation figures that anyone wants to see, but they are our current reality, and we must deal with their effects. What do those effects look like for the mining industry? Without question, costs have risen, but how much have they escalated? Has it been a gradual climb or a dramatic shift?

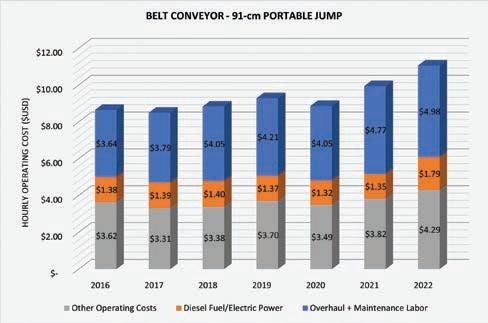

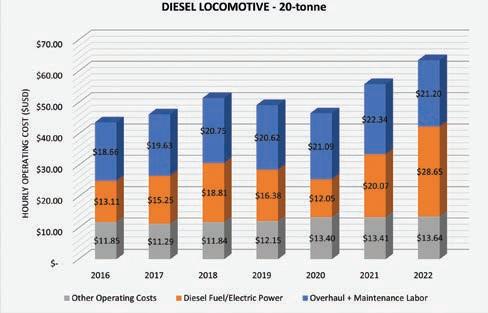

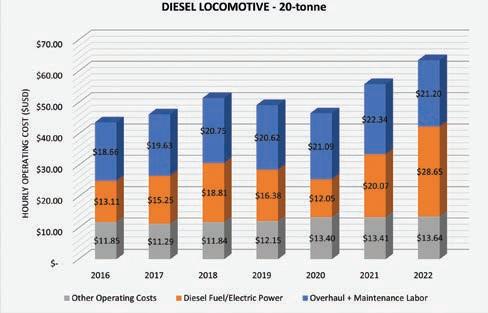

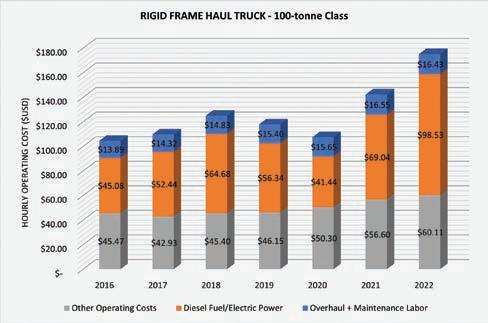

To dive into these questions a bit more, this brief article highlights the capital and operating costs for a sampling of mining equipment over the period 2016 through 2022. As the author, I thought it would be an interesting exercise to examine costs over this arbitrary period because it corresponds to the period for which I have overseen Costmine’s mine supplies and equipment cost databases. The costs were obtained for the study using Costmine’s online application, Equipment Cost Calculator, which is updated annually in the fall. All currency values are in U.S. dollars.

The pieces of equipment examined are as follows:

> Rigid frame haul truck: 100-tonne class

> 20-tonne diesel locomotive for underground haulage

> 91-cm wide portable jump belt conveyor, inclusive of motor and designed to 100 lb/cu ft material

> 150 to 300 t/h air separator, inclusive of motor and exclusive of liner (For the years 2016-19, the capital costs did not include motors. To bring the costs in line with later years, the author added a flat $50,000 to the cost of the machine for a 300 hp AC motor).

As you will note in the following charts, there are plots for capital costs on both a dollar basis as well as a per cent change basis. Several of the figures also represent operating costs broken into the following categories: overhaul plus maintenance labour, diesel fuel or electric power (as appropriate), and “other” operating costs. The “other” category comprises tires, wear parts, maintenance and repair parts, lube, and natural gas. This breakdown only highlights common categories of interest. It is important to note that operators are not included in hourly operating costs. These costs are for the machine only.

Observations

1. Capital costs

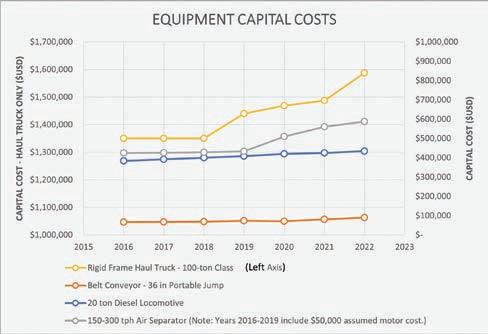

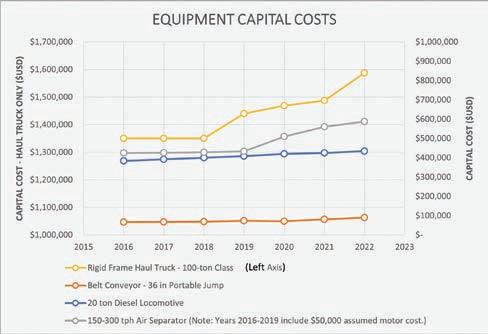

The capital costs for the selected equipment are illustrated in Figure 1 over the specified period. We can observe that costs remained flat for all but the diesel locomotive over the first three years of the study period. The locomotive during this time saw only a minor, but consistent, increase in cost. We can also see that the haul truck kicked off an upward trend in pricing in 2019, with the air separator and locomotive following suit in 2020.

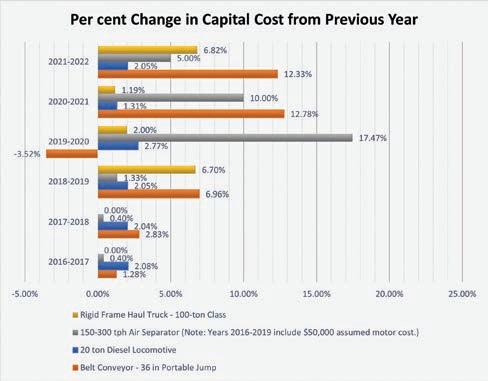

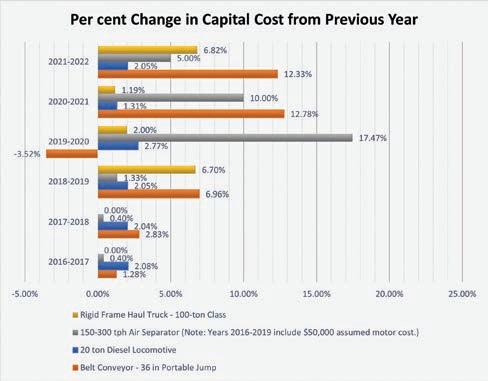

The capital cost trends may be better depicted by Figure 2, which represents the year-over-year per cent change in costs for the selected equipment. This figure shows an accelerated upward growth in prices in the latter half of the seven-year window for most items. There are two exceptions, with the first being a one-year drop in price for the conveyor going into 2020 and the second being a consistent annual increase for the locomotives across the full seven-year time frame. It is also notable

Figure 1: Equipment capital costs.

that the conveyor has seen the largest cost increases on a percentage basis over much of the 7-year time frame. It is eclipsed only by the locomotive in 2017 and by all pieces in 2020 due to it being the only item seeing a reduced cost that year.

Figure 2: Per cent change in capital cost from previous year.

Finally, while the cumulative tally for all equipment pieces in 2022 is $2,700,100 versus $2,224,555 in 2016, it is clear in both capital cost figures that costs did not change uniformly for all equipment types over the period studied. We will discuss more about this below.

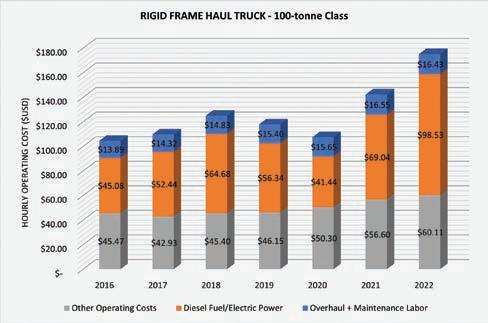

2. Operating costs

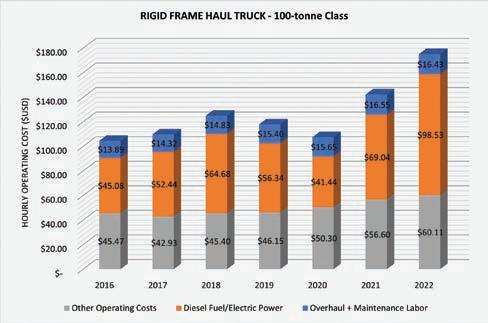

For the selected equipment and operating cost categories, diesel fuel is the most variable of costs for the 2016 to 2022 period. This is clearly demonstrated in Figures 3 and 4, where the total hourly operating cost fluctuations closely follow the rise and fall of the hourly diesel cost proportion. Moreover, we can see that the truck and locomotive have a similar pattern in their operating cost profiles.

JANUARY 2023 CANADIAN MINING JOURNAL | 9

COSTMINE > By Brad Terhune

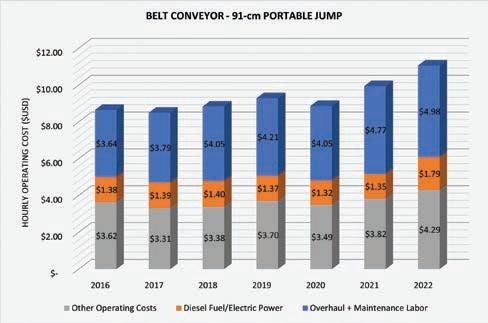

Figure 5: Hourly operating costs, belt conveyor; 91-cm portable jump. :

Conversely, electric power (grid sourced) is shown to be the most stable category for the selected equipment. For example, if we examine the belt conveyor chart in Figure 5, we see that the cost per hour for electricity from 2016 to 2021 did not change by more than $0.05/hour for any given year, or 3.7% from one year to the next. A similar scenario is observed in Figure 6, where the cost per hour for power required to operate the air separator deviated no more than $0.44/hour, or 3.2%. A significant increase in utility power for 2022 deviates from this trend at the end of the 7-year period.

The labour costs associated with overhauls and maintenance increased over the seven years ending in 2022. The average increase across the four equipment types is 31.6%.

Discussion and insights

1. Capital costs

As noted above, the capital costs for the selected equipment did not change uniformly over the study period. This, of course, is due in part to the disparate nature of the chosen equipment across both the mining and processing tasks, but it is also largely the result of manufacturer uncertainty regarding the global pandemic and other coincident issues related to transport logistics and raw material supplies. The culmination of these issues has made it difficult for manufacturers to set and maintain reliable pricing structures. The author has personally had many conversations with data contributors that highlighted an initial resistance to raise prices, with the thought that underlying cost pressures would ease. As we see from all the figures above, however, manufacturers can suffer reduced

Figure 6: Hourly operating costs, air separators; 150 to 300 t/h. :

margins for only so long before they must raise prices to bring them back in line with underlying costs.

As estimators in the mining industry, we all know that costs escalate over time and that it is best to avoid delays in development decisions. The data in this article drive this point home, with the costs for developing a project today being higher than it would have been just three to four years ago.

2. Operating costs

Global events and government policy can bring uncertainty to the diesel supply chain, resulting in prices that rise and fall as quickly as the tides. In turn, the costs to operate your mobile fleet (or to power your remote mine) can vary wildly. The data for the diesel-powered equipment in this study confirms this. At the other end of the spectrum, electric power costs can remain steady when serviced by the utility grid. Might the estimator view this as an additional argument for electrification beyond those arguments tied to ESG?

As one might expect, the labour costs associated with keeping the machines running increased over the study period. It is notable however that the proportion of labour costs relative to the total hourly operating cost did not change for any equipment item. This is because operating costs such as diesel, or items within the “other” category, offset the labour adjustments. Cost estimators should consider these types of relationships whenever they conduct trade-off studies focused on future operating cost expenditures. CMJ

Brad Terhune is a cost analyst and senior geologist with Costmine (www.costmine.com).

10 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Figure 3: Hourly operating costs, rigid frame haul truck; 100-tonne class.

Figure 4: Hourly operating costs, diesel locomotive; 20-tonne. :

COSTMINE

By

One-half of the critical minerals story

risks rising that a new investment provides a window to review and repudiate a history of investment.

While it is not clear the world has changed, a recent frenzy of activity demonstrates the way Ottawa sees the world has vastly changed. Observers of Canada have borne witness for many years to many foreign and state-owned enterprises (SOEs) sizing up middle powers like Canada with increasing appetite. The Government of Canada has come to the public revelation that critical minerals are, for lack of a better word, critical to economic growth, energy transition and transformation and the security of Canada and its allies.

New announcements, and new questions

On Oct. 28, 2022, the federal government published its policy update on SOE investments in critical minerals. This policy makes it clear that going forward, the government will closely scrutinize investments by foreign SOEs and foreign-influenced private investors in Canada’s critical minerals sectors, across all stages of the value chain. In particular, the policy states that significant transactions by foreign SOEs in Canada’s critical minerals sectors will only be approved (on the basis that they result in a net benefit to Canada) on an exceptional basis. More generally, all investments (irrespective of size) by foreign SOEs and foreign-influenced private investors involving a Canadian business or entity operating in the critical minerals sector in Canada are more likely to face scrutiny under the Investment Canada Act’s (ICA) national security regime.

On Nov. 2, 2022, the rubber hit the road with the announcement that divestiture orders had been issued for three investments by Chinese investors. Notably, the Canadian target businesses in all three cases are relatively small and engaged in exploration and development activities. In fact, one of these investments comprised a minority interest in exploration properties located exclusively outside of Canada. We view this as a signal from the government of the new standard that will be applied for these types of investments under the ICA.

What we do not know is how this will apply to different classes of what an observer might see as an SOE or a “foreign-influenced private investor.” There are many investors that presumably fall within this definition. We do not yet know the full extent of what entities need to be most concerned about this pivot.

We also presume, but do not have clarity on whether new investments may give rise to new risks. An SOE making a fresh investment that follows on prior commitments may result in

A welcome change

On top of additional constraints on capital, Canada’s mining industry has been held back by an inefficient federal impact assessment regime. Current permitting timelines under the federal regime are simply too long and deter investment. While the Impact Assessment Agency’s website says that a mine project is expected to take about five years to complete, the permitting process and recent experience shows that actual permitting times are much longer, easily surpassing eight to 10 years. In addition, there is significant uncertainty regarding the outcome of the process.

However, the industry received an early Christmas gift on Dec. 9, 2022, with an announcement that the federal government will initiate a review of permitting processes to attempt to speed up critical minerals’ projects in Canada. This is a welcome change after 10 years of reforms to the process that have resulted in regulatory timelines that frighten even the most optimistic of developers.

To the extent that Canada can refine the impact assessment process so as to materially shorten current permitting timelines and provide proponents with greater clarity regarding the applicable regulatory standards, this will be welcomed by project developers. In addition, the national benefits sharing framework announced by Canada in the 2022 fall economic statement, if done properly, may help Canada and proponents effectively address Indigenous concerns. If this framework runs in parallel to a more efficient permitting regime, this could add significant certainty to the regulatory process and materially shorten permitting timelines, without sacrificing environmental protection.

Looking ahead

New standards will clearly drive new scrutiny on investments into Canada. While the implications of these policies continue to develop, we watch hopefully for progress on permitting, approvals and replacement capital sources. All these issues need to be addressed if Canada is going to succeed in developing its significant natural resources, including critical minerals. CMJ

JANUARY 2023 CANADIAN MINING JOURNAL | 11

“The world has vastly changed in the last few years”

— INNOVATION MINISTER FRANCOIS-PHILIPPE CHAMPAGNE

LAW

Sander Grieve, Steven D. Bennett, Zirjan Derwa, and Martin Ignasiak

SANDER GRIEVE is a partner, head of mining at Bennett Jones LLP. STEVEN BENNETT is a partner, M&A, at Bennett Jones LLP. ZIRJAN DERWA is a partner, competition and foreign investment, at Bennett Jones LLP. MARTIN IGNASIAK, K.C. is co-head of regulatory practice at Bennett Jones LLP.

By

THE ROLE OF biotechnology IN MINING AND MINERALS

As the global demand for metals continues to grow year over year, the need for intensive mining is showing no signs of slowing down. In fact, some reports project that production of battery metals is expected to increase by 500% by 2050. This unprecedented demand is also being met by a two-fold supply problem; the slow speed of new mining operations coming on-line and the general problem of world-wide low ore grades that has surfaced over the last few decades.

The global market needs to grapple with these problems and producers need to find ways to extract metals quickly and cheaply while still adhering to environmental, social, and governance (ESG) responsibilities which have become critical guiding principles of late. One burgeoning area of technology that is potentially valuable in solving some of these issues is biotechnology.

Generally speaking, biotechnology involves the use of processes that are facilitated by cells or their components to achieve a specific end-goal. For the mining sector, biotechnologies have been proposed or established for a range of applications, but most notably the pre-treatment (bio-oxidation) with microbes of refractory gold- or copper-bearing materials prior to cyanidation, and the use of microbial surfactants to extract high mineral yields from low-quality ores.

In fact, variations of the former bioprocess have enjoyed commercial success since the 1960s. In situ bioleaching, for example, was used in Canada in the 1970s to recover uranium from deep mines, and at the Denison mine alone, an estimated 300 tonnes of additional uranium were extracted after the main phase of mining using bioleaching. Similarly, when used in stirred tank bioreactors that are set up as continuous feed systems, bio-oxidation can help process 40 to >8,000 tonnes of concentrate per day, as was first shown in Fairview mine of Barberton, South Africa, in 1986. Metso Outotec’s in-line BIOX bacterial oxidization process is perhaps the

most widely deployed biotech solution over the long-term with a presence in over 13 plants, and Toronto-based, BacTech Environmental’s BACOX analogue has also seen significant success in South American gold operations.

In all these cases, the use of microorganisms in mining initiatives is described as highly advantageous: they are considered cost-effective and environmentally benign, with lower carbon footprints and abilities to liberate (in some cases, selectively) valuable metals from complex materials that are otherwise recalcitrant to standard pyrolytic and hydrometallurgical techniques.

Accordingly, recent biotech developments seek to use micro-organisms to process solid wastes, extract metals from oxidized ores, and to selectively recover metals from process waters and waste streams. The recycling of electronic, urban waste respectively is of particular interest given its high metal content and accessibility. In one laboratory study out of Switzerland, the leaching of finegrained electronic scrap at concentrations of 5 and 10 g/L, respectively, with Thiobacilli (bacteria) allowed for recovery of 90% of the available aluminum, copper, nickel, and zinc at 30°C. While these results are undeniably micro-or-

12 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Madiha Khan and Steve Gravel

TECHNOLOGY

ganism and condition-dependent, they do show comparable recoveries to certain hydrometallurgical techniques in the patent literature (up to 92%) without the need for the strong acids and energy-intensive temperatures (>60°C) of the latter. Given that Canadians are generating around 725,000 tonnes of e-waste annually, in one of the fastest growing waste streams in the world, with roughly $10 billion worth of gold, platinum, and other precious as well as battery metals dumped globally as per a new UN report, the development of biorecycling techniques is required.

Despite the promise and success of bio-

technologies, however, there has been relatively little adoption of said technologies into industrial flowsheets. Various studies suggest that the issue is multifactorial, but is broadly linked to the sector’s problem-solving approach to innovation, since there is little room to enhance profitability via product differentiation. In other words, predominant innovation drivers include the push for improved processes that can reduce risk and costs (of current operations or developing new

mines) and increasing asset productivity.

Consequently, biotechnological innovations must be more than simply ecofriendly alternatives to conventional processes; they must outperform or match the efficacy of their chemical analogues, allow for incremental adoption to reduce risk of failure, and be highly cost-effective to scale and implement (with preference for “bolt-on” or “in-line” solutions). This requires spaces to prototype and evidence their efficacy through the capture of irrefutable data, but also requires knowledge brokers to champion and socialize candidate solutions that are viable across the sector.

These, incidentally, are key characteristics of applied research centers like Cambrian R&D and the Centre for Smart Mining at Cambrian College, which are poised to become vital pieces in the mining ecosystem for biotechnology adoption. As an example, in partnering with Dr. Nadia Mykytczuk, a world-leading researcher in biotech, at Laurentian University, Cambrian was able to facilitate the design and build of bench-scale bioreactors that removed 78-90% of problematic arsenic from tailings over the span of six months. This successful collaboration partly forms the basis of Mykytczuk’s ongoing work with BacTech, which recently filed a provisional patent on processes that can be used to extract critical battery metals from mine tailings in Sudbury.

Finally, what stands in the way of mass-adoption of promising biotechnological solutions in mining and mineral processing are barriers not unfamiliar to those in the sector. Solutions that have easily quantifiable returns on investment, manageable disruption to existing processes, and minimal investment in human capital and skills upgrading will tend to win out. Systems that are turnkey or that are provided “as a service” that show value early on may indeed pave the way for an influx of biology-based techniques that can unlock great benefit to the sector. CMJ

Dr. Madiha Kahn is an analytical research lead at Cambrian R&D.

Steve Gravel is the manager of the Centre for Smart Mining at Cambrian College.

JANUARY 2023 CANADIAN MINING JOURNAL | 13

Analytical Research Lead, Dr. Madiha Kahn, mentors a student researcher.

CREDIT: CENTRE FOR SMART MINING

Cambrian R&D research intern operating analytical equipment.

SMART MINING

CREDIT: CENTRE FOR

By Tamer Elbokl,

Responsible mining

Teck’s water strategy:

Interview with Chris Kennedy, director of water, Teck Resources

Building on the success of our first Reimagine Mining symposium, this year’s event connected delegates with industry leaders on the forefront of mining industry. The role of new technologies in water management was the main topic of the 2022 event. This article summarizes an interview with Chris Kennedy (CK), director of water, Teck Resources. He is a specialist who will shed light on how to implement new technology solutions in mine wastewater management.

TE: As a conversation starter, can you describe what a “director of water” does at a mining company?

CK: Water is an essential resource for people, communities, and the environment. It is also a critical input to the mining process. Water is one of Teck’s eight strategic themes along with health and safety, climate change, people, responsible production, tailings management, communities and Indigenous Peoples, and biodiversity and reclamation. Our sustainability strategy has long-term strategic priorities and shorter-term sustainability goals.

This role is an appreciation of the mining industry for the importance of water management to the business success and sustainability. There are three things that are key to my role at Teck (three pillars): The first one is leading our governance

Chris Kennedy is the director of water at Teck Resources. Kennedy is focused on water governance and water strategy, with a particular emphasis on identifying new water management approaches and technologies to enhance operational sustainability at Teck’s operations, development projects, and legacy sites. He has over 20 years of experience working in academia, mining finance, consulting, and another senior mining company. He is a registered professional geologist in B.C. and Ontario and graduated with a BSc in geology and zoology from the University of Toronto (2000) and a PhD in microbial geochemistry from the University of Toronto (2003).

14 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

PhD WATER MANAGEMENT SYMPOSIUM CREDIT: IOFOTO/ADOBE IMAGES

>

approach to ensure de-risking water usage operations and environmental risk is minimized and managed. Through this governance program, we try to bring in industry best practices, ensuring all the sites are operating as best as we can or figuring out ways to help them get there. The second one is driving our strategic priorities. There are two key strategic priorities, and part of my role is ensuring we have the right resources to help drive those forward and understand how they work in the business. The third pillar in my job is using my experience in the mining industry as a subject matter expert for all Teck’s new projects, ongoing projects, and closed sites.

TE: Can you please talk about Teck’s water strategic priorities and goals?

Teck’s strategic priorities: > Transition to seawater or low-quality water sources for all operations in waterscarce regions by 2040.

Implement innovative water management and water treatment solutions to protect water quality downstream of all our operation.

Short term goals: > By 2025, design all development projects in water-scarce regions with a seawater or low-quality water source. > By 2025, implement new source control or mine design strategies and water treatment systems to further advance efforts to manage water quality at our operations.

CK: There are two main strategies: The first one is utilizing either seawater or low-cost, low-quality water, especially in water stress regions, such as the copper mines in Chile where we made the decision to use desalinated water by treating seawater. The ocean is about 150 km from the mine site, and about 4,400 metres above the ocean. So, we are pumping it quite far and quite high which is not easy, but we have a massive copper resource. The second one is implementing innovative water treatment or water management. The other thing we are trying to do is distill it down before we send it to our process mill.

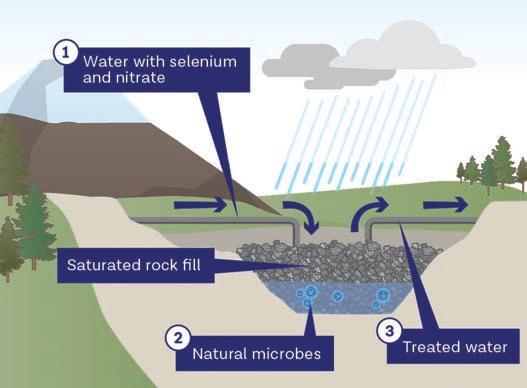

There are many water treatment technologies out there, and they continue to evolve, so we have an inhouse team that evaluates and develops new technologies, such as Teck’s saturated rock fills (SRF) technology.

This is effectively going beyond needing a treatment facility to building our mine waste facilities differently through a collaboration with the International Network for Acid Prevention.

Can we get away from water treatment by 2040? This won’t happen overnight, but we want to move away from having to build dedicated facilities, so it is an exciting time with a lot of work to do to keep mining sustainably.

TE: Can you touch on Teck’s water policy and its commitment to protect water and the life it sustains?

CK: It would be great if we could mine without water, but we cannot. We need it in the middle of the process, and it is a human right to have access to water. Everything that lives in our environment needs clean water. Our water policy is a public document, signed by our CEO and chair of the board and states a consistent and strong transparent water governance. We want to manage our water at our operations efficiently and effectively, then to collaborate to achieve responsible and sustainable water use both internally and with our stakeholders, such as governments, local communities, and First Nations, not just inward looking.

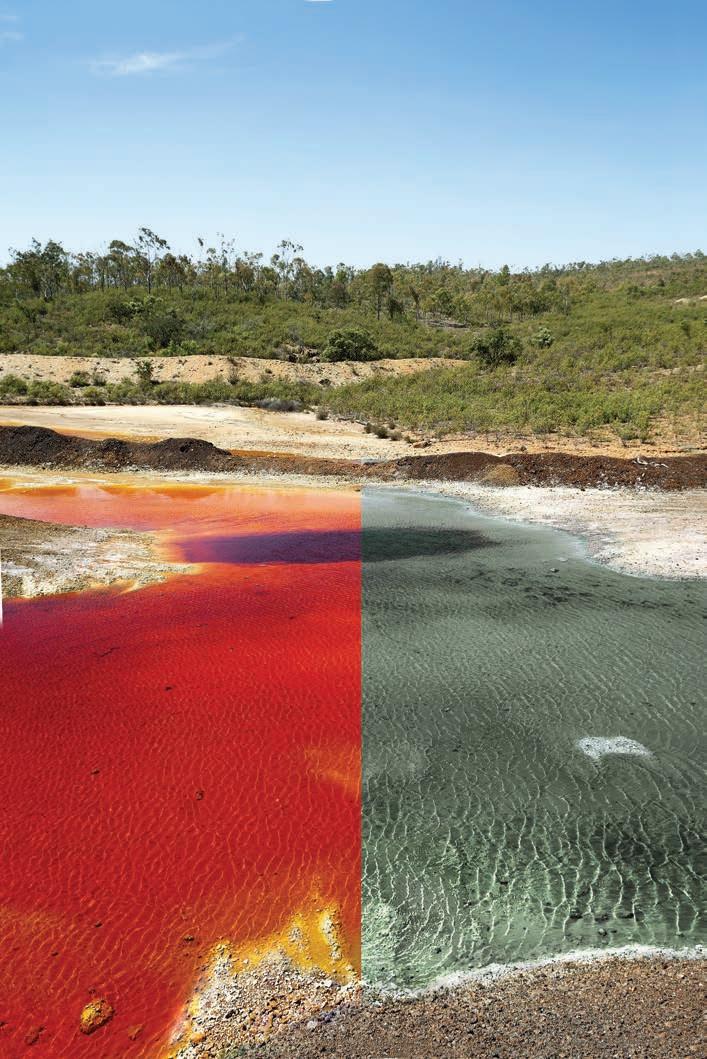

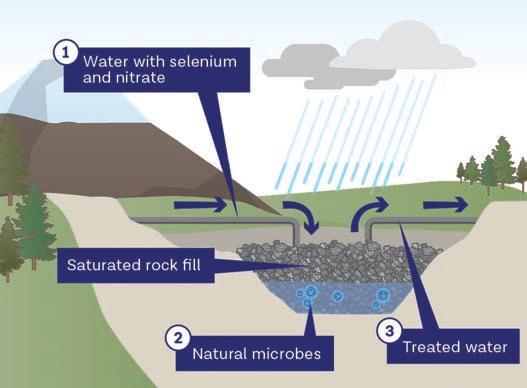

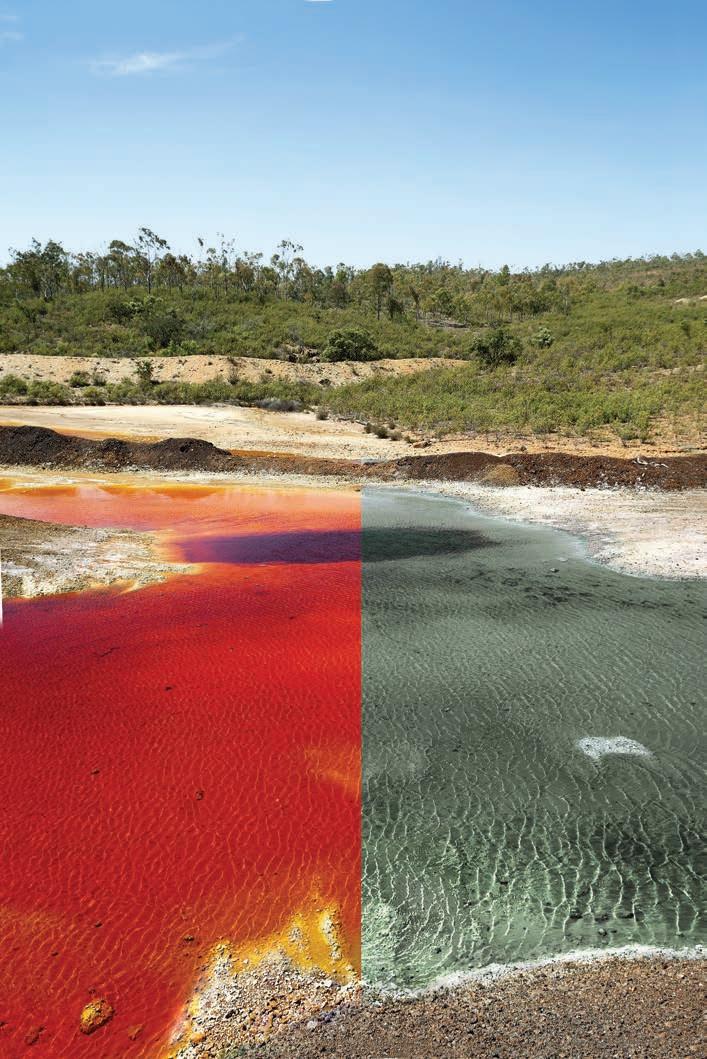

TE: Can you please talk about the technology behind the use of saturated rock fills (SRFs) to treat mine-affected water and the benefits of SRF over other forms of water treatment?

CK: Teck has collaborated with several research partners to develop and test the effectiveness of SRF technology to treat mineinfluenced water. SRFs use naturally occurring biological processes in mining areas that have been backfilled with rock and saturated with water to remove selenium and nitrate. In this case, imagine the situation where we had the coal and the rock around the coal, and we were left with an open pit. We are in a water surplus region, so the pit does fill back up with water. It is like an ice cream scoop where the water is halfway down the ice cream, so you do not see a lake of water because of the rocks on top of it. And natural microbes live within this water saturated with rock, that is the SRF part. Water for treatment is injected into the SRF, and natural bacteria convert dissolved forms of selenium into a solid form which remains securely stored in the SRF, and nitrate to inert nitrogen gas which is safely released. Finally, treated water is pumped out of the SRF and discharged.

The use of saturated rock fills to treat mine-affected water is a leading-edge sustainable technology. SRF is extremely effective at removing selenium and nitrate from mine affected water and improving water quality. SRF technology is quicker to build and less complex to operate. Other benefits of SRF over other forms of water treatment include lower capital and operating costs, the capacity to treat larger volumes of water, use of

JANUARY 2023 CANADIAN MINING JOURNAL | 15 CONTINUED ON PAGE 16

RecRuitment of qualified peRsonnel in engineeRing and geosciences

of the candidate Professionnal and background checks Recruitment process Language courses Immigration and arrival processes Integration

the company ... And many more services ! contact

:

www.hrhworkforce.com

Canada : +1 (514) 612-7172

South America : + 57 (601) 790-0072

info@hrhworkforce.com Selection

into

one of ouR RepResentatives

>

less energy, and a smaller environmental footprint.

This is one of those fantastic things in my career where many things about the bacteria that live there was part of my PhD work. When water leaves these facilities, 95% of the selenium and nitrate is gone. SRF is an amazing technology that did not exist five years ago, and it is going to be a key technology in wastewater treatment moving forward in Elk Valley.

TE: 2021 was a big year for water treatment in Elk Valley; how did Teck manage the expansion of Elkview SRF facility to double its capacity?

CK: One of the great things about SRFs is that they are in a huge mine pit. The reactions are happening quite close to where we inject the water and give them a carbon source, and we have a lot more capacity than we think we do. At Elkview, it started out at 10,000 m3 per day. Over the next few years, from 2018 to 2021, we tried to figure out how the water was moving in the pit, so hydrogeology aspects, microbial characterization aspects, geochemistry aspects, water management, and engineering. A dedicated, passionate team staged and focused on the science, R&D, and engineering studies, and moved it up to 20,000 m3 per day. And then again, through monitoring where the water is moving to understand risks and opportunities of what we could do, we think there is room for more. There is the basics of engineering and science study, there is also the passion of the people in the Elk Valley, and honestly, one of the most incredible teams I have

ever worked with, and I worked for a couple of different places. I think it comes down to the fact that for people who live there, this is their livelihood, their backyard, their families recreating these waters. So, I think it is people’s passion and engineering and science where we all came together to make that happen and are helping it move forward as well.

TE: Finally, are there any other plans that Teck is working on?

CK: We have a water quality plan that is moving forward and was developed with the government and First Nation groups to understand what the water quality is we need to get to and how do we get there.

Our first water treatment facility is successfully treating 7,500 m3 of water per day at our Line Creek operations, and we are seeing reductions in selenium and nitrate concentrations downstream.

The second water treatment facility, the Elkview SRF, has been achieving near complete removal of selenium and nitrate from up to 10,000 m3 of water per day since 2018. As I mentioned before, in 2020, this SRF was expanded and is now treating up to 20,000 m3 of water per day. Our third water treatment facility, the Fording River South water treatment facility, is now operating with capacity to treat up to 20,000 m3 of water per day. Finally, our fourth water treatment facility, the Fording River North SRF, is currently commissioning with expected initial capacity to treat up to 9,500 m3 of water per day. Construction is underway to expand this facility to 30,000 m3 of water per day by the end of 2022.

Teck’s water treatment facilities are achieving approximately 95% removal of selenium and nitrate from treated water. We expect further significant reductions of selenium and nitrate as additional facilities come online.

Following the start-up of the Fording River South water treatment facility, Teck now has up to 47,500 m3 per day of water treatment capacity in the Elk Valley. After completion of the FRO-N SRF water treatment facility by the end of this year, Teck will have capacity to treat up to 77,500 m3 of water per day, a four-fold increase from its treatment capacity in 2020. With the additional capacity, we expect to achieve one of the primary objectives of the Elk Valley water quality plan: stabilizing and reducing the selenium trend in the valley. CMJ

Visit our website for a full recording of the interview, including answers to several technical questions from the audience.

16 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

WATER MANAGEMENT

SYMPOSIUM

Saturated rock fill process. CREDIT: TECK RESOURCES

greener future Water management for a

The buzz words are out there – green, net-zero, ESG, decarbonization. But is our mining industry meeting the challenges? Canadian Mining Journal held its second Reimagine Mining virtual symposium on Oct. 12, 2022, to hear from experts on how far we have come and what lies in the future.

The regulatory landscape is changing quickly, as public opinion demands sustainability and environmental accountability of all industries – none faster than mining. But without mining, there will be no green future because the change cannot happen without lithium, nickel, copper, graphite, uranium, and critical minerals; fortunately, the Canadian mineral industry is poised to supply them. The sector is among the leaders in digital, sustainable production.

Among the fastest changing aspects of water management is the regulatory framework. How are Canadian miners responding to the evolving requirements for water management?

Provincial regulations, in particular, have had a significant impact on the mining community. Luckily, responsible miners already treat water to drinking water quality – if not better.

What is new more recently is the restriction of the amount of fresh water that can be pumped or diverted for a project. Canada is lucky in having abundant fresh water, but not all countries are. Moreover, many jurisdictions have strict limits on when and how much treated water can be released.

Many profitable Canadian miners already made water management a big part of their planning in the engineering phase of development. At this point, proper water plans start to save money. Amounts of both fresh and recycled water are reduced. Treatment costs are down for smaller volumes. Piping and storage requirements are less. Smaller tailings facilities are needed, and it is the same for closure bonds. These add up to lower initial capital requirements.

Those savings continue throughout the life of the project with technologies such as ore sorting, paste backfilling, and dry tailings stacking. That adds up to lower operating expenses.

Other mining companies with less forward thinking executives, continue to plan water use around the needs of the mine and mill. They are of a mindset to retrofit water management to existing operations and finding it extremely expensive. Sometimes, a retrofit is not successful (meaning more expense).

The ultimate goal of water management is not to rely on

PANEL MEMBERS:

mechanical or chemical treatment methods, but create natural filtration. Not every solution will suit every project.

Treatment methods can be loosely grouped in three types: active, semi-passive, and passive. Active treatment relies on the use of mechanical means and chemicals, and often a dedicated building. It is the most expensive of the three options. Semipassive falls in the middle, and carries a middle-sized price tag. Passive treatment, which exists in nature, should be the goal of every water management plan, and it is the least expensive over the long-run.

No single technology will work in every operation. It may even be necessary to combine technologies to suit a specific site. Liming systems, bioreactors and treatment wetlands can all have their place. Combining these methods will probably be the way to go for at least the next decade.

Using multiple technologies can be quite difficult and requires very specific skill sets. This is where collaboration between the mine planners and specialized engineering firms is so useful. It may be necessary to start with an active system, add semi-passive treatment to various streams over time, and transition to a passive system at closure.

What new techniques are on the horizon to help miners reach the ultimate goal of passive treatment?

Both metal and organic materials may make up the toxic portion of effluent streams. Metals can be removed or reduced by reducing the solubility of the metal. They might be transformed into salts or the pH manipulated to reduce solubility.

Twenty years ago, the major technology involved using lime or other chemicals to precipitate solids then dealing with the sludge. Today, technologies have advanced to using bioreactors to create sulphides that form metal sulphides minerals that then

JANUARY 2023 CANADIAN MINING JOURNAL | 17

CONTINUED ON PAGE 18 By CMJ staff

LEOWOLFERT/ADOBE

WATER MANAGEMENT SYMPOSIUM

DR. MONIQUE SIMAIR, CEO and principal scientist of Maven water and environment; AJ MACDONALD, VP of engineering with Integrated Sustainability; and DR. SYLVIE ST. JEAN, director for environment and reclamation with Osisko Development

Projects that hold water

Water – you can’t operate without it. As your partner, we enable you to secure, manage and utilize every single drop. That’s an approach that holds water.

Learn about our creative and custom water management solutions for every stage of your mine’s life.

stantec.com/mining

precipitate. A new plant has recently been permitted in British Columbia that uses both high pH with lime and sulphide.

There are other precipitation technologies that are being adapted from other industries or sectors. For example, a biological nitrification-denitrification system adapted from a domestic wastewater treatment plant can be used to remove nutrients. B.C. is also home to one of the first ion exchange plants to remove selenium, and it uses an electro-reduction process for the sludge management.

Software, too, is being adapted from other sectors. The willingness to adapt is key. The goal in many other sectors is to discourage precipitation and the scaling that results. For mining, the software has to be adapted to encourage precipitation and the removal of metals.

When the environmental, governance and social (ESG) team is involved in planning, they often consider water management. Such teams are involved in sustainability, and part of that is reducing the carbon footprint of an operation. Treating wastewater with lime can generate significant amounts of carbon dioxide (CO2), so other technologies are of interest. If even part of the water treatment can become semi-passive, total CO2 is reduced.

Decarbonization ties into the Technology Readiness Assessment for emerging technology proposed to control or treat effluent discharges from major mines. This is a nine-level scale where levels 8 and 9 are considered acceptable; level 7 is considered as R&D and may meet regulatory requirements; but level 6 and below lack the site specific confirmation to support their use. British Columbia has already issued guidelines to assess the application of new methods in water treatment.

Many semi-passive water management technologies are adapted to a specific mine site, and therefore fall in level 6 or below. For example, there is much variation in gravel beds or wetlands developed for a site-specific effluent that they can only be assessed at a low level. The opportunity comes when they are created on a small scale, probably paired with active treatment. Later, when closure is imminent, the data will be in hand for the passive system and it could meet the higher level requirements for sole use.

The panel offered their thoughts on what water management is going to look like a decade from now. There will be an influx of remote control, big data, and artificial intelligence (AI). Management systems will be increasingly site-specific, including the use of biochemical reactors, depending on the amount of water that needs treatment.

Incorporating different types of technology in different orders will be a trend as systems are individualized. Such systems are already being called treatment trains. Maybe one unit will treat for cyanide, the next for nitrate, perhaps several for the removal of various metals. Expect off-the-shelf solutions to be less appropriate.

The challenge today is not to merely treat water, but create effective water management beginning with development and through post closure. Canadians can take the lead in into how we use water, how little we use, how much we recycle, and how well we treat it. We need to be building today the technologies that will be effective 10 or 20 years from now. CMJ

18 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

WATER MANAGEMENT SYMPOSIUM

By Marilyn Scales

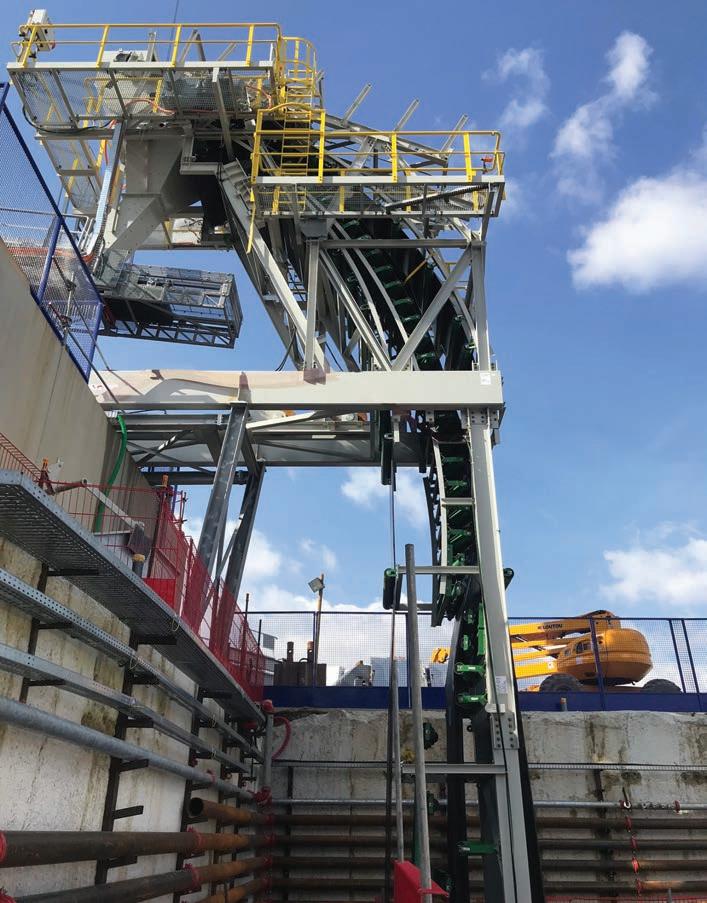

Blackwater AND YELLOW METAL

Artemis is developing its Blackwater gold mine for the first pour in Q3 2024

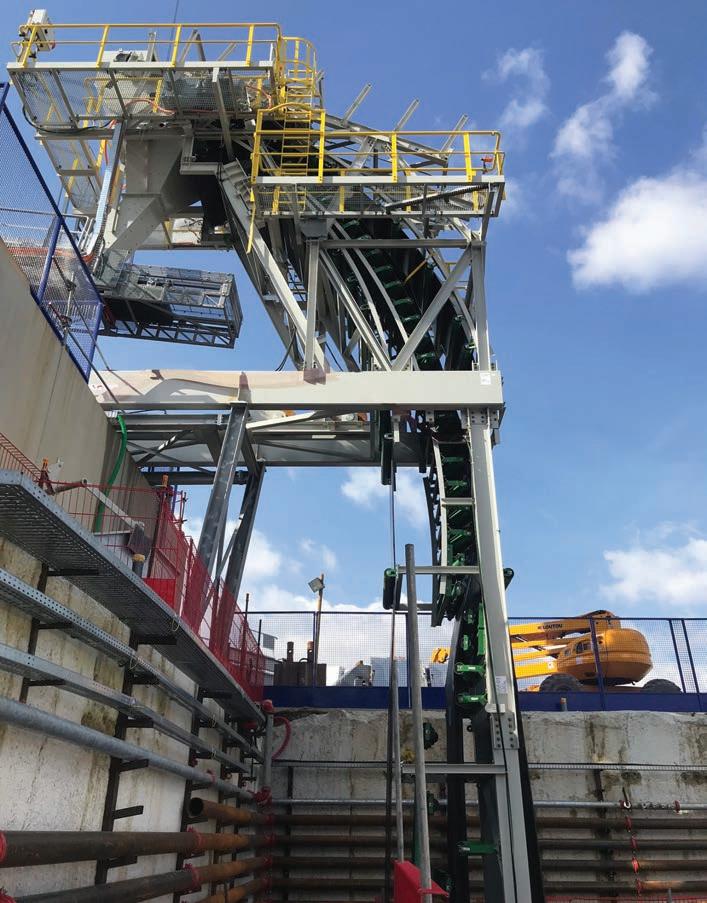

Tucked away in central British Columbia, the Blackwater gold project is the focus of intense activity 112 km southwest of Vanderhoof. Artemis Gold is prepared to spend $645 million to bring the mine into production, with the first gold pour planned for the third quarter of 2024.

Not only will this be the next major gold mine in the province, but it is also hailed by Artemis president and COO Jeremy Langford as one of the most exciting large scale, open pit gold developments in Canada. The goal is 400,000 oz. of gold in each of the first five years of operation.

There is every expectation that Langford and his team will succeed. This

is the team that successfully developed Atlantic Gold in Nova Scotia, then sold it to Australian miner St Barbara in 2019. Their track record speaks for itself.

In 2020, Artemis paid $190 million for Blackwater in cash and shares, plus an 8% gold stream to previous owner New Gold once commercial production begins. At that time, New Gold estimated that it had invested roughly $365 million in drilling, engineering, camp development, and permitting the project.

Between acquiring the project and the end of September 2022, Artemis has spent an additional $76.6 million on site preparation and equipment.

The start of major construction is imminent at the Blackwater gold project in B.C.

CREDIT: ARTEMIS GOLD

The prize is a disseminated gold-silver mineralization containing 8.0 million oz. of gold and 62.2 million oz. of silver in proven and probable reserves. The reserves are 334.3 million tonnes grading 0.75 g/t gold and 5.8 g/t silver, or 0.78 g/t gold-equivalent.

The reserves are included in the measured and indicated resource, which is 596.8 million tonnes grading 0.61 g/t gold and 6.4 g/t silver and containing 12.4 mil-

JANUARY 2023 CANADIAN MINING JOURNAL | 19

CONTINUED ON PAGE 20

MINING IN B.C.

lion oz. of gold-equivalent. There are also 16.9 million inferred tonnes at 0.45 g/t gold and 12.8 g/t silver.

The 2021 Blackwater feasibility study outlined a net present value (5% discount) of $2.15 billion with a levered after-tax internal rate of return of 43% with a payback period of 2.3 years. And those numbers were calculated on a gold price of US$1,600/oz. and a 0.79 Canadian/ US dollar exchange rate. The all-in sustaining cost is estimated to be C$850 (US$670) per ounce of gold recovered.

Artemis has had no problem raising money for the new mine, noted Langford.

“Artemis signed a credit approved term sheet with National Bank and Macquarie for a $360 million project loan facility, which includes an additional $25 million in capitalized interest during the construction period,” he said.

“Artemis has approximately $230 million in cash which has been raised through equity offerings in 2020, 2021 and most recently with the $175 million equity offering completed in October 2022. Finally, Artemis sold a US$141 million (about $190 million) silver stream to Wheaton Precious Metals in December 2021,” Langford added.

Indigenous support

The Blackwater project sits on traditional lands belonging to the Lhoosk’uz Dené Nation and Ulkatcho First Nation. With that in mind, Artemis signed a trilateral project participation agreement in 2019. Artemis has a business opportunities team that works closely with Indigenous and local communities to support business development.

“The input, traditional knowledge, and expertise that Lhoosk’uz Dené Nation and Ulkatcho First Nation bring to the table is critical to the success of our project and we are thankful for their support and partnership,” Langford said.

“For example, earlier this year, we were privileged to hold a land blessing ceremony at the Blackwater site, in anticipation of the start of site preparation work. The blessing was performed by the chiefs, elders and the younger people of the Lhoosk’uz Dené Nation and Ulkatcho First Nation.”

As soon as it could start early work at the site, Artemis hired Nechako Plateau Construction as on-site contractor for early site preparation activities including the camp, preparing the mill site,

and upgrading infrastructure and facilities. The contractor is a local Indigenous business.

The nuts and bolts

Before mining starts, Artemis will remove 1.9 million tonnes of overburden and rock with which to build the haul roads and 6.0 million tonnes for tailings dam construction. None of the waste rock is acid generating.

The mine will be a conventional truckand-shovel open pit extracted in nine phases over a mine life of 20 years, based on reserves currently outlined. The initial ore mining rate will be 6.0 million t/y for the first five years, 12 million t/y for the next five years, and then 20 million tonnes for the following five years.

Artemis has a $140 million lease agreement with Caterpillar to supply the mining fleet. The main haulage fleet will consist of 12 Cat 793, 230-t trucks. There will be two Cat 6040 backhoe hydraulic excavators and one Cat 6060 front-end loader.

Initially the fleet will be diesel-powered. But the company has an option to replace it with electric vehicles beginning in 2029. The technology is still in

development, but Artemis will have a pathway to eventually achieve net-zero.

“Our agreement clearly details the individual component scope and defines a schedule for the build. In this inflationary environment, this helps to insulate Artemis from capital cost and schedule overruns for a significant percentage of the initial capex,” explained Langford.

Notably, Artemis has further de-risked the project by signing a fixed-price EPC contract with Sedgman Canada for $318 million for the mineral processing plant.

“We have a vision to develop Blackwater mine to be one of the lowest carbon footprint mines in the world. A new transmission line will be built connecting and powering the site with BC Hydro’s renewable hydroelectricity. It will be one of the first fully electrified process plants in the gold mining sector with all traditional diesel and propane equipment replaced with electrical equipment,” Langford said.

Gold and silver are recoverable with both gravity and conventional cyanidation. Three-stage crushing of run-ofmine ore will be followed by a grinding circuit with a single ball mill followed by cyclone classification. A portion of the mill discharge will pass through a gravity concentrator. The cyclone overflow will be pre-aerated using oxygen and then enter a hybrid circuit with three stages of leaching and seven stages of CIL adsorption. A sulphur dioxide-oxygen circuit will destroy cyanide in the tails before discharge.

Various circuits in the mill will be expanded as throughput eventually increases to 20 million t/y.

The Blackwater tailings management facility will be a valley-fill design, which has a lower risk of failure than traditional paddock-style ponds. The natural topography will provide most of the containment and a single retaining wall will be established and raised annually. The facility is designed to hold 469 million m3 of tails and waste rock as well as 12 million m3 of pond storage under normal operating conditions.

What lies ahead

Artemis is looking forward to receipt of the B.C. Mining Act permit – the final permit – by the end of March. Once that is received, major construction will begin.

The goal of a new 400,000 oz./year gold producer will be within reach. CMJ

20 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

MINING IN B.C.

“We have a vision to develop Blackwater mine to be one of the lowest carbon footprint mines in the world. It will be one of the first fully electrified process plants in the gold mining sector.”

—JEREMY LANGFORD, PRESIDENT AND COO, ARTEMIS GOLD

THE empty chair

It was just another day at the mine. Little did I know that my trip to the mine, the morning lineup, the faces, the voices, the laughter, the steps taking me underground that day, were potentially my last memories.

Underground, I had finished a task earlier than expected and decided to walk down a drift to a quite spot I had in mind. I planned to call my buddy to pick me up from there. I grabbed my gear and started the journey along the drift. I was fully loaded. Both my hands were full, and I was carrying some other things as well. After turning a corner, I noticed there was mucking activity taking place ahead. A truck was waiting to be loaded and a scoop was in motion. It was dark out there, and it was hard to determine if the scoop was coming in my direction or moving away from me. As a safety precaution, I started to shine my headlamp light towards the cab of the scoop operator. Suddenly, the scoop stopped. Thinking that the operator had seen me, I continued walking. I passed by the draw point from where mucking was taking place. When I reached the second corner of the draw point, the scoop started to move forward. The investigation later showed that, while I was shining my light at the scoop, the operator was backing up, looking in the opposite direction from where I was. He did not see me coming towards the scoop.

I was not expecting the massive piece of equipment coming within inches of me. The worst nightmare in my life started to unfold. I was petrified, standing in the corner of the draw point. The side of the scoop hit me sending me down to the floor of the drift. Surrounded by a massive tire on one side, the wall of the draw point on the other side, and a pile of rock ahead, it appeared to me that my life was about to end. There was no chance to turn back time a minute or two and bring me back to that moment when the prospect of my life was still shining. Life has no rehearsal. There I was, on a cold floor, surrounded by rock, metal, and rubber, and the horrendous sound of rocks falling into the scoop bucket. I felt reduced to the minimum a human being can be reduced. I was hopeless, helpless, completely alone, scared, and about to depart from this world in a very tragic way.

JANUARY 2023 CANADIAN MINING JOURNAL | 21

CONTINUED ON PAGE 22 By J.G. FREEMAN83/ADOBE SAFETY A MINER’S TRUE STORY | PART 1

I did not realize the magnitude of what was about to happen until the image of my wife popped up in my head. Afraid of abandoning her and my kids in such a horrific way, I screamed a dreadful “noooo.”

I did not realize the magnitude of what was about to happen until the image of my wife popped up in my head. Afraid of abandoning her and my kids in such a horrific way, I screamed a dreadful “noooo.” It was my last hope that God will hear my voice and spare me this time. My wife was waiting for me to return home, just like every other time after work. I had miserably failed her, my kids, and my siblings. I failed my parents and friends as well. It is not fair to do that to the people we love the most. To the people who rely on us. To those who say goodbye to us when we leave for work and are certain that we will come back to them.

The scoop suddenly stopped. It gave me a moment of peace. But it did not last long as the scoop started to back up. There was a chance that the bucket will crush me against the floor or the wall. Death was still laughing at me. It seemed determined to take me away without any compassion.

Just when I was about to surrender my life, I looked up and saw the screen on the wall. A light of hope warmed me up again. I do not remember how I did it, but in a split second I was climbing up that wall. My mind and body were in survival mode. I did not feel the weight of my body. I did not feel any pain in my hands while holding up to the rigid metal. In an instant, I was up near the roof of the drift, watching the scoop backing up to the drift intersection.

Once the scoop stopped, I descended as fast as I climbed. I reached out for my hand flashlight to signal my location. The flashlight was gone, and my hard hat had been crushed under

the tires with the cap lamp on it. My radio disappeared leaving behind just the microphone hanging from my coveralls. I was in a state of shock, physically and mentally.

The scoop operator did not even know that I was there. I was in his blind spot, and chances are he was going to come back for more muck. There have been scoop accidents where the victim was cut into pieces by metal and rock. It was terrifying to think that in a few seconds I could be torn into pieces. Without being able to communicate with the scoop operator I had the feeling that I was about to become another statistic.

Thankfully, I remembered a little flashlight I always carry in my pocket for emergency situations. I always make sure that it is fully charged before heading underground. It paid off being diligent with that little flashlight. It literally saved my life because I was able to signal to the operator about my presence.

The scoop operator came out of his cab and was in shock. He was very disturbed, and feeling sorry for what had happened, but it clearly was not his fault. I had failed him as well. He was just doing his job and had no idea that a person was trapped in the draw point. As soon as he saw me, he wanted to go to call supervision. He was the only other person at the scene, and I asked him to stay near me for a moment as I needed another human being to hold to. The operator hugged me and comforted me. It was only then I started to realize that I was alive. What just happened was surreal. I had been cornered by death and miraculously escaped from its claws.

After supervision arrived, I witnessed firsthand my company’s emergency system in action. I felt blessed to work in a mining company where a distressed employee is treated with so much care. I was rapidly taken to the shaft, which was ready for me. I sat in a wheelchair and was taken to surface while receiving first aid and care the entire time. On surface, an ambulance was ready for me, and I was in a hospital within minutes. The attention from the doctor and nurses helped me restore my awareness and I was ready to keep rocking. Thankfully, I came out of this incident with only minor scratches.

After the incident I promised to myself that I will never tell the story to my wife and my kids. I already did enough by failing them that day. I do not want them ever to think about the horror I went through. I promised myself that I will always do everything in my power to come home safe after work. This promise is keeping me safe every day and is aligned with what my family and friends expect from me.

It is late in the afternoon after work and my wife, and I are enjoying supper. She is telling me what happened during the day while she was at work. I like listening to her stories, her complaints, her joys and all those little things that life is made of. Suddenly it hits me: what if I had died that day in the mine? What if the chair where I am sitting was empty? The thought of my wife sitting alone, overwhelmed by deep sadness, looking at that empty chair, almost makes me cry. But I need to stay strong for I promised myself that she will never know what happened to me that day at work. I just keep smiling and listening to her, pretending like nothing had happened. CMJ

article is Part 1 of this story. Part 2 will be published in February/March issue.

22 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

SAFETY

This

The Copper Journal, published since 1987 includes 52 weekly and 12 monthly reports, along with the Copper Price & Inventory Comparison chart that is updated monthly. An annual subscription is $295 www.jegross.com

SAFETY

By Alden Spencer

A NEW ERA IN ULTRA- AND MEGA-CLASS VEHICLE FIRE SUPPRESSION: Assessing the latest evolution in fire safety solutions

Technology around heavy industrial vehicles has evolved over the decades, as they have been called on to haul, dig, lift, and move ever greater quantities of material. This progressive demand for power led to the emergence of mega- and ultra-class mobile equipment. The giant size of these vehicles means everything is heightened - bigger parts, more complexity, larger engines, larger quantities of fuel, and consequently - a higher risk of fire. As the cost and danger associated with industrial vehicle fires increases, it is time to take a fresh look at the state of vehicle suppression solutions and how they can evolve even further.

Vehicle fire protection basics

Three commonly employed vehicle fire suppression systems are

1 Dry chemical systems: These systems use monoammonium phosphate, a dry chemical, to interrupt the chemical chain reaction of Class A, B, or C fires.

2 Liquid agent systems: Liquid agents suppress the fire by interrupting the chemical chain reaction and providing a cooling effect.

3 Twin-agent systems (i.e., dual-agent systems): Both dry chemical and liquid agents are incorporated in a single design, employing the firefighting properties of both agents.

The need for evolution in vehicle fire suppression systems

Dry chemical systems have been the go-to for fire protection on large, industrial vehicles since the 1950s. In the 1990s, dual-agent systems emerged, utilizing dry chemical for rapid flame knockdown and liquid agent to cool hot surfaces and minimize reflash potential.

The suppression benefits of these dualagent configurations are matched by their accompanying complexity from costly clean up and repairs after a dry chemical discharge to the careful planning required for side-by-side installations to the need to activate two separate systems simultaneously. These complexi-

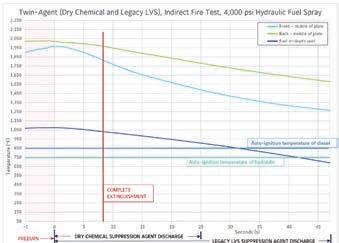

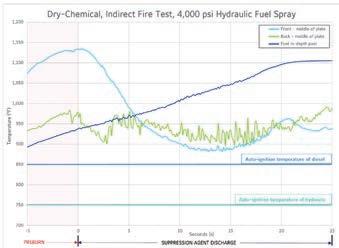

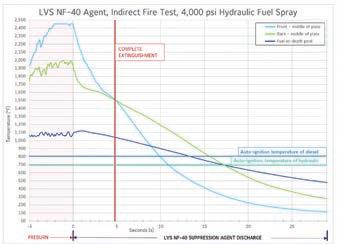

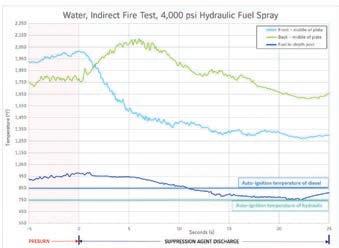

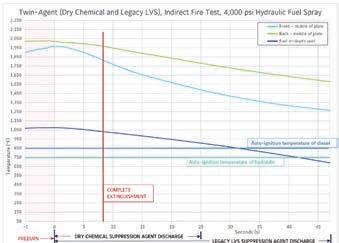

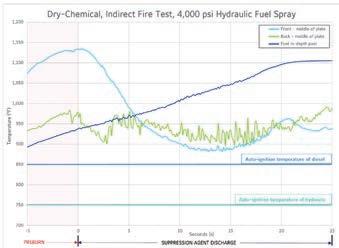

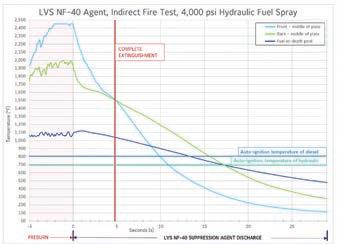

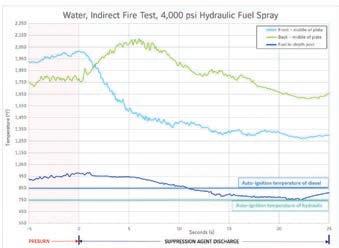

ties, in addition to shifting environmental regulations regarding the use of perand polyfluoroalkyl substances (PFAS), highlight the need for a new, non-fluorinated single-agent fire suppression solution that meets the needs of today’s heavy-duty industrial vehicle operations.