> Innovative paths for post-mining prosperity

> Planning for closure: Q & A

THE REEFTON RESTORATION PROJECT THE DIRTY SECRET OF THE EV INDUSTRY

During the fire season (Apr 1 – Oct 31), any industrial operation working in or near forested areas should follow the “Outdoor Fires” Regulation 207/96 – Part II and refer to the Industrial Operations Protocol to determine if these regulations apply to your operations.

Developing a Fire Prevention and Preparedness Plan.

Mitigating operations in a manner that helps prevent wildland fires from starting.

Modifying operations based on fire danger and the risk of operations starting a wildfire.

Training staff to use equipment to reduce the negative impact should a wildfire occur.

Detecting and reporting wildfires so they are responded to in a timely manner.

10 Reclaiming the future: Innovative paths for post-mining prosperity.

RECLAMATION AND CLOSURE

14 Planning for closure: Q & A.

21 Saskatchewan Research Council helps the Accelerated Site Closure Program achieve award-winning results.

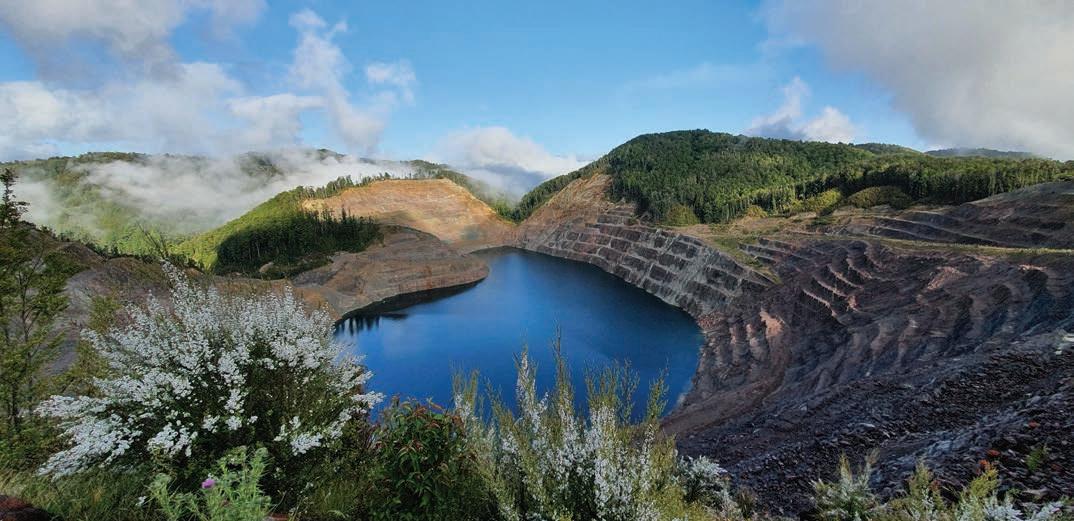

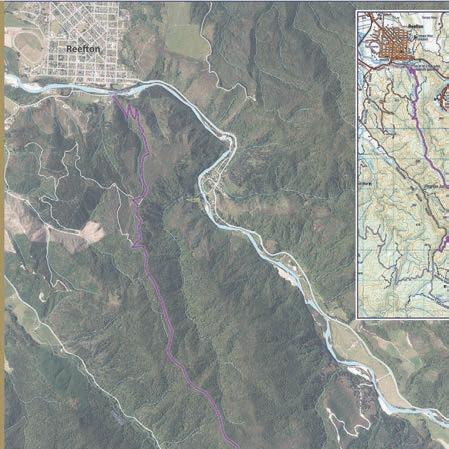

23 The Reefton restoration project.

WATER AND TAILINGS MANAGEMENT

16 The mining industry leads innovation in water treatment.

18 Underground tailings: Q & A.

CRITICAL MINERALS

29 The dirty secret of the EV industry.

HISTORY OF MINING

31 The big nickel scandal of 1916.

4EDITORIAL | Reclamation is an integral part of mine operations.

6OPINION-EDITORIAL | British Columbia celebrated Mining Month in May 2024.

7FAST NEWS | Updates from across the mining ecosystem.

8 LAW | Mine reclamation in Canada: Regulatory challenges and opportunities.

12MIN(E)D YOUR BUSINESS | Project approval: Managing the proponent target–reality gap.

53ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

Coming in August 2024

Canadian Mining Journal’s August (MINExpo) issue includes our annual ranking of the Top 40 Mining Companies in Canada by revenue. This will be supplemented with a look at some of the top development projects in Canada. And for MINExpo, we will preview trucks, heavy equipment, and material handling systems.

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

Tamer Elbokl, PhD

Tamer Elbokl, PhD

ttending Wyloo Canada’s announcement that it plans to build a battery materials plant in northern Ontario that may cost around $900 million was “the icing on the cake” for the media tour in Sudbury organized by MineConnect Supply and Services Association at the end of May. Wyloo has entered a memorandum of understanding with Sudbury to secure a parcel of land to build the plant. The company said it chose Sudbury, a nickel producer for more than a century, for its leadership in the mining sector, its shift to clean technologies, and its commitment to reconciliation with First Nation communities.

The plant would target an output of around 50,000 t/y of nickel sulfate and precursor cathode active material (pCAM), a battery component often containing nickel, cobalt, or other chemical elements. Eventually, the plant would produce enough material to power about 800,000 vehicles a year.

Marla Tremblay, executive director, and Heather Johnston, project manager, in cooperation with several other members of their team, hosted an inaugural Mining Media FAM tour from May 27 to 31 in Sudbury, Ont. that included attending the back-to-back Mining Transformed and BEV In Depth: Mines to Mobility conferences. Additionally, I toured several supplier and manufacturing locations in Sudbury and interviewed several executives and CEOs for articles to come in the next few issues of this journal.

According to our feature article by OceanaGold staff on page 23, OceanaGold is entering the final stages of rehabilitation of its Globe Progress mine. After the mine closed in 2016, the site became known as “the Reefton restoration project.” The restoration team made sure that concurrent restoration work, also known as parallel reclamation, was an integral part of OceanaGold’s operations throughout the working life of the mine.

Additionally, several articles in this issue discuss the status of mine closure and reclamation, tailings, and water management in the mining industry and highlight potential new technologies.

Flip to the interview on page 29 with Martin Turenne, president, CEO, and director of FPX Nickel who reveals the dirty secret of the EV industry.

Finally, on page 31, John Sandlos sheds some light on the big nickel scandal of 1916.

Our most anticipated August issue will feature our annual Top 40 ranking of Canadian miners based on total revenue in 2023. The MINExpo issue will also look at some of the top development projects in Canada, and we will preview trucks, heavy equipment, and material handling systems. Relevant articles can be submitted to the Editor in Chief until July 15, 2024. CMJ

JUNE/JULY 2024

Vol. 145 – No . 4

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Marilyn Scales mscales@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@northernminer.com

Advisory Board

David Brown (Golder Associates) Michael Fox (Indigenous Community Engagement) Scott Hayne (Redpath Canada) Gary Poxleitner (SRK)

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales

Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 We acknowledge the financial support of the Government of Canada.

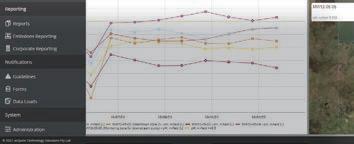

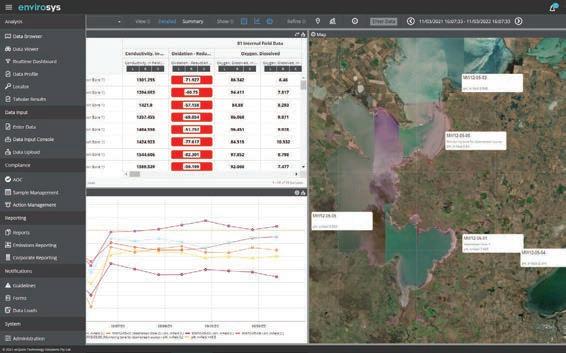

In today’s era of heightened investor and public scrutiny, maintaining an effective water management strategy is vital for a company’s environmental license to operate.

However, with companies collecting more environmental data than ever before and regulatory diversity across regions, Stuart van de Water, Environmental Leader at acQuire, says that the demand for better water stewardship is putting enormous pressure on environmental managers and scientists.

“Information is being collected from multiple sources and at differing frequencies. It’s time consuming to transform this raw data into business-ready reports,” Stuart says.

Without a data management system in place, it becomes difficult, if not impossible, for environmental teams to do their job efficiently and with certainty.

“Maintaining data integrity at the highest levels is crucial, but without a central repository to capture all water management data, this can be a daunting task,” Stuart says.

“Having auditable data that can be traced back to its original source is essential to water management governance, especially if it has been transformed in the time between capturing and reporting.”

Whether miners are tracking water consumption, monitoring water quality in creeks, rivers and dams, or taking grab samples from pits and dams, a single source of truth for all environmental information provides a competitive advantage – and peace of mind.

“Good environmental data management is invaluable for operational support and high-level modelling used in business decisions and policy making. Knowing you can easily report against your data is critical,” Stuart says.

acQuire’s environmental data management solution, EnviroSys, combines people, process and technology to help you manage a range of environmental data across your business.

EnviroSys provides you with complete transparency of your environmental data so you can always answer the crucial question, “are we compliant right now?” anytime, anywhere. Discover more about our environmental data management solution at

May is Mining Month in British Columbia, an ideal time to recognize and celebrate this cornerstone industry in our province. Mining moves us, connects us, and allows us to innovate. It drives and builds our technology and is the very foundation of almost everything around us, from the copper, gold, and silver used in electrical equipment, smartphones, and healthcare equipment to the critical minerals that build the batteries, wind turbines, and solar panels that are essential to fighting climate change.

Mining is one of B.C.’s largest industries and a foundational part of our economy, providing economic benefits in communities across the province. Last year, mineral exploration expenditures reached $643.5 million, 94% higher than this government’s first year in office, and mining production value is forecast to be up 57% since that time. In fact, looking over the past five years, exploration spending has totalled $2.8 billion with mining production at over $60 billion.

As minister responsible for mining, I take immense pride in our government’s accomplishments in supporting and growing the mining industry, but the industry’s successes are all possible because of the hard-working people at the heart of every aspect of mining. This industry is built by the determination of prospectors, expertise of geologists, support of suppliers, innovation of manufacturers, vision of investors and — most important of all — the dedication of tens of thousands of men and women who make mining their life’s work.

Step onto any mine site today, and many British Columbians might be surprised to find mining is not what they thought it was. Innovative, low-carbon practices like electric-powered machinery are creating cleaner and more efficient operations. Digital technologies are improving productivity and reducing waste. And diversity is helping to shape the future of mining, with women now making up over one in six workers and growing, something that was not even

imagined 35 or 40 years ago. Mining and mineral exploration is also the largest private-sector employer of Indigenous Peoples in remote communities in B.C., which is vitally important to recognize as First Nations have a critical role in the sector. First Nations’ cultural links to the land stretch across centuries, offering perspectives that are essential for driving progress in the industry, and their partnership and participation in the industry are essential for further growth.

Just as today’s miners can reflect on their work with pride, the next generation of miners and explorers can look forward to long and rewarding careers, as innovation and robust environmental, social, and governance (ESG) standards continue to strengthen B.C.’s mining sector. Men and women today have access to training to upgrade their skills to keep pace with an evolving industry that is committed to ongoing job security, the highest standards of health and safety, and a strong focus on remediation and environmental sustainability.

The year ahead promises to be marked by milestones, as we welcome two major mines starting or resuming operations: Premier gold, near Stewart, and Blackwater gold, southwest of Prince George. And we will continue to make progress on our B.C. Critical Minerals Strategy, guiding us to further boost critical minerals development, maintain sector com-

petitiveness, advance reconciliation, and attract new investment, while driving sustainable economic growth with jobs and opportunities for all British Columbians.

We are taking action to create more efficient processes and permitting while maintaining high environmental standards. B.C. has made significant progress on permitting timelines, including a 52% reduction in the backlog of exploration permits since 2022. Budget 2024 reaffirms our commitment to a low-carbon economy with $24 million to ensure that we continue to reduce permitting backlogs and enable access to the critical minerals we need for a low-carbon economy and future.

The success of the mining sector is founded on the hard work of people from across the province whose commitment to excellence and perseverance is truly inspiring. My ministry and I cannot express enough gratitude to explorers, miners and their families, and all those who support this vital industry.

Generations of British Columbia’s families have enjoyed security and a good life in mining, and in their names, I am proud to have proclaimed May 2024 Mining Month in British Columbia. CMJ

Honourable Josie Osborne is British Columbia’s minister of energy, mines, and low-carbon innovation.

Equinox Gold poured first gold on schedule at its 100% owned Greenstone gold project near Geraldton, Ont., the company’s flagship asset.

“We look forward to ramping up to commercial production in the third quarter of this year and delivering sustained value from the Greenstone mine for all our stakeholders,” president and CEO Greg Smith said in the statement.

Equinox is targeting 90% of the 27,000 tonne-per-day plant by the end of 2024. It has also increased mining rates ahead of this gold pour and has stockpiled 1.5 million tonnes of stockpiled ore at the end of the first quarter.

Production at Greenstone in 2025 is

expected to total 199,000 oz. at an all-in sustaining cost of US$879/oz. in the second half, matching guidance of approxi-

mately 175,000 to 210,000 oz. at US$840 to US$940/oz., BMO said in a note.

Greenstone is expected to produce approximately 400,000 oz. annually over its first five years, and 360,000 oz. per year over its 14-year mine life.

In April, Equinox acquired the remaining 40% interest in the mine from Orion Mine Finance for close to $1.4 billion (US$995 million) in cash and shares.

The purchase included $1.02 billion in cash and 42 million shares valued at $342.3 million . Equinox financed the acquisition through a new $684.7 million loan and a $356 million bought-deal equity financing. CMJ

In early January this year, Liebherr-Canada handed over an R 9150 mining excavator to new customer L. Fournier & Fils, a leading Canadian general contractor that works in the industrial, civil, and mining sectors.

This R 9150 is the first Liebherr excavator commissioned in eastern Canada and will go to work in the Abitibi-Temiskaming region at the North American Lithium (NAL) mine and mill, belonging to Sayona Mining, near Val d’Or, Que. The operation is part of the largest spodumenelithium ore reserve in North America.

Within seven months of meeting for the first time at the 2023 CIM Expo in Montreal, Fournier had become a Liebherr-Canada customer. Tom Juric, divisional director of mining for LiebherrCanada, credits this to the entire mining team at LiebherrCanada and their ability to demonstrate the company’s ability to not only supply world-class mining equipment but also to offer exceptional support services to their customers.

To experience Liebherr-Canada’s product and service offerings for themselves, representatives from Fournier were invited to Alberta to visit the Fort McKay service centre and the Acheson sales and Reman centre in October 2023. After a tour of the centre Gabriel Routhier, operations superintendent for Fournier who has been operating heavy equipment since he was a teenager, was given the opportunity to operate an R 9150 that Liebherr-Canada had on hand. After Routhier had experienced the R 9150 for himself, the whole group visited a nearby limestone

quarry to see one of the site’s R 9150s in action.

“As soon as I started digging, I felt the power of the machine. It had the speed of a 50-tonne construction excavator,” enthused Routhier. “When we were at the quarry, it only took three cycles to confirm the speed I experienced. At the time, I was wondering how it was possible for the machine to perform so effortlessly because I could barely hear the engine. Following discussions with the operator and the VP of operations, I was fully convinced the Liebherr R 9150 was the right tool for us.”

Besides highlighting the performance of the R 9150, Liebherr-Canada also wanted to showcase its ability to support customers across the entire lifecycle of their Liebherr equipment. So, during the same visit, members of Liebherr-Canada’s customer service team met with the Fournier delegation to discuss how they would support the customer with comprehensive machine inspections, troubleshooting, and problem resolution strategies to maximize uptime with the new R 9150. And to further understand how Liebherr-Canada helps its customers with parts planning, major component remanufacturing, and service support.

Once the R 9150 goes to work, it will be running round the clock. To ensure maximum uptime, one of Liebherr-Canada’s mining service technicians will provide full-time support to the customer and an inventory of consignment parts and components will be maintained at the NAL site. CMJ

The regulation of mine reclamation in Canada plays a vital role in ensuring the responsible development and utilization of the country’s abundant natural resources through the balance of economic development with environmental sustainability. As the mining industry evolves, alongside the evolution of environmental protection legislation and innovations in reclamation technologies, stakeholders are faced with a myriad of regulatory challenges and opportunities in implementing effective reclamation strategies.

One challenge stakeholders face is understanding the jurisdictional landscape which governs mine reclamation. The regulation of mine reclamation involves a sometimes-complex interaction between federal and provincial jurisdictions, often coupled with First Nations’ concerns. Provincial jurisdiction covers the ownership, administration, and control of public lands and minerals in Canada. However, the jurisdiction of the federal government can overlap with some aspects of mining-related activity, including the role it plays in regulating environmental assessments for certain mines, Indigenous rights and consultation, and other matters pertaining to federal lands and species under its jurisdiction.

effects of mining projects, including their impact on land, water, air, biodiversity, and ecosystem health, and these assessments set out the basis for the requirements for mine reclamation practices.

The key federal statutes include the Impact Assessment Act (IAA) and the Fisheries Act, while provincial legislation varies across jurisdictions. These regulations set standards for environmental assessments, permitting, reclamation plans, and post-closure monitoring, ensuring compliance with environmental reclamation standards. Stakeholders must be familiar with the various application statutes in their relevant jurisdiction which will govern their operations. Understanding the robust and sometimes overlapping frameworks can present a challenge for stakeholders in regulatory compliance, particularly as the regulatory framework governing mine reclamation continues to evolve. Consultation with impacted First Nations will include review of reclamation plans in the context of traditional treaty and rights holders.

The IAA serves as the legislation which sets out the framework by which the federal government assesses the environmental and Indigenous impacts of certain designated projects, including mining developments. Mining activities covered under the IAA are subject to rigorous government reviews and assessments. The IAA’s impact on mine reclamation, albeit indirect, is important, as the IAA evaluates the potential environmental

Mining project stakeholders previously affected by the IAA may now face uncertainty in the face of the decision of the Supreme Court of Canada (SCC) in October 2023, which found the federal IAA to be largely unconstitutional. The SCC found that the IAA’s regulation of “designated projects,” which include certain mining developments, was outside the legislative authority of the federal government. The federal government must redesign portions of the legislation to address these deficiencies. The approximately 20 mining projects currently undergoing federal impact assessment will continue to advance, but stakeholders may now have the opportunity to challenge these assessments in the event the provincial assessment process is sufficient for their operations. Until an amended IAA is enacted, no new projects will be designated for the purposes of the IAA.

The emergence of technological innovations in mine reclamation presents promising opportunities for enhancing environmental outcomes and regulatory compliance, while, at the same time, presenting new jurisdictional considerations for regulators and stakeholders. Innovations such as remote sensing used to monitor compliance with regulations requiring revegetation as part of mine reclamation, and phytoremediation of mine tailings to extract contaminants and rehabilitate

soil, present novel solutions for mitigating environmental impacts and achieving mine reclamation to the required standards.

However, questions arise as to what regulatory challenges such technologies may face — such as unclear legal frameworks leaving mine operators and regulators struggling to interpret how existing laws apply to emerging technologies. Additional regulatory challenges may arise through questions of data ownership, privacy rights, and security, when considering technological advancements such as remote sensing and data analytics. Additionally, effective governance of technological advancements in mine reclamation will be required to ensure sufficient collaboration between government agencies, industry, and Indigenous communities.

Mine reclamation is a complex process, for which managing liability is crucial to ensure that operators have the financial resources to reclaim mine sites adequately to the applicable regulatory standards. Key challenges in liability management in mine reclamation include the following: ensuring the financial assurance mechanisms put in place adequately cover the

costs of reclamation and closure activities; long-term liability planning; inconsistencies in regulatory enforcement and compliance depending on the resource or jurisdiction; and proper monitoring of the effectiveness of reclamation efforts and adaptive management programs.

Navigating the regulatory landscape governing mine reclamation in Canada presents both challenges and opportunities for stakeholders. Stakeholders must have a comprehensive understanding of the applicable legal frameworks, the opportunities presented through technological advancements, and how to legally incorporate such technologies in their projects. In addition, transparent and well-planned reclamation liability and security regulations will be critical to future sustainable development in the sector. CMJ

Alex MacWilliam is counsel at Dentons and leads the Canada region environment practice group. He advises Canadian and international clients on all legal and regulatory issues relating to the environment and sustainability. Kate Wiltse is an associate at Dentons’ Toronto office. In her practice, she assists Canadian and international clients on a wide variety of environmental and regulatory matters.

This KCA unit can produce 200 kg per hour of screened agglomerates of ore or other products, and is available for rental or sale. A two-deck screen and delumper allow complete control of final product size. The unit meets all safety standards, and has a dust collection system for healthy operation.

The mining and metals sector ranked lowest in the 2021 GlobeScan report of attitudes toward all major sectors in 31 countries. Some U.K. universities have banned mining companies from recruiting on campus, and the number of geology and mining engineering graduates continues to slide.

Much of the issue stems from some newsworthy poor historical performance, including the sector’s impact on land, air, water, and biodiversity, as well as a perceived inability to prepare communities to thrive after operations close. Environmental, social, and governance (ESG) concerns ranked #1 for a third year in a row in EY’s top ten business risks facing mining companies report for 2024, highlighting that local community impact, tailings, waste management, water management and mine closure are utmost concerns within the ESG focus.

This article will examine three of the key areas identified in the ESG topic: innovative mine closure projects that benefit local communities, pioneering design approaches for end-of-life mine planning, and advancements in water stewardship that contribute to sustainable industry practices.

Mine closure is extremely complex, impacting a wide range of stakeholders with different, and increasingly high, expectations. An inadequate closure creates a negative legacy that is extremely difficult and costly to remediate. Many mining companies are strengthening their focus on the issue, aiming to repurpose sites, establish secondary businesses, and create long-term value for communities.

The concept of waste-to-value is transforming waste as a liability, into as something beneficial, such as extracting additional minerals and metals from closed mines. An intriguing case is the potential to meet the demand for rare earth metals, by reprocessing tailings left from former or ongoing operations.

Creating long-term value for communities post-mining can be achieved through innovative approaches to mine closure. The closed Kidson mine in Australia is being transformed into a renewable energy power hub. With the implementation of pumped hydro storage systems within the old pits surrounded by solar panels and wind turbines, these sites capitalize on the existing topography to generate green electricity. By utilizing two water reservoirs situated at different elevations, water can flow from the higher to the lower reservoir, turning turbines and producing electricity. This is especially appealing where energy costs are high, offering a sustainable source of local power. Wind and solar installations complement this setup, further enhancing the renewable energy output.

Additionally, the principle of “design for closure” focuses on integrating landscape architects and mining companies in the early stages of a mine’s development. Their collaboration is aimed at utilizing the natural surroundings and landscape of the mine site efficiently, leading to a more effective production and closure plans. This forethought ensures that the environmental footprint is minimized, while also providing a sustainable, long-term legacy for the local community once mining operations cease.

The past 10 years have seen more tailings dams built than in any previous decade. Today, safe storage of tailings is a key focus for stakeholders who are demanding mining companies do more to prevent failures that can devastate local communities and the environment and cost billions of dollars to fix. With over 200 billion tonnes of existing tailings under management and an additional 40 billion to 50 billion tonnes expected in the next five years, this is a critical risk to manage.

Fifty-five per cent of respondents to a survey expected tailings to receive investor attention, compared with less than 5% last year. In August 2023, members of the International Council on Mining and Metals (ICMM) released tailings disclosures to demonstrate ongoing commitment and provide transparency on the Global Industry Standard on Tailings Management (GISTM). But Mining companies need more innovative solutions to design, build, monitor, and manage tailings, especially if we are going to also extract value from waste.

Another innovative approach involves employing mine tailings as a carbon sink through the process of carbon mineralization, which sequesters CO2 from the

atmosphere and stabilizes it within the mine waste. This technique, however, is applicable only to specific types of tailings. Studies have demonstrated that great potential exists in Canada and elsewhere to make this ambition a reality.

The Mining Microbiome Analytics Platform project is an exciting example of progress. This collaboration between the University of British Columbia, industry players, and other partners maps naturally occurring microbes at various mine sites to accelerate the development and application of microbial biotechnologies throughout the mining life cycle. For example, remediating slag containing residual copper could be made profitable by introducing microbes that bind with the copper and enable extraction.

Over half of the EY survey of the top ten business risks facing mining companies report for 2024 respondents said water stewardship was one of the top risks with significant increased scrutiny from investors. It is an issue top of mind for many governments as well. For example, the Chilean National Mining Policy 2050 mandates that continental water makes up no more than 10% of total water used in all copper production. Other drought-affected regions are likely to adopt similar restrictions, as it is critical that hydrology is managed end-to-end given water impacts soil composition and, therefore, the ability to regenerate land.

Many mining companies have set targets around their commitment to drive good water stewardship and improve disclosure to stakeholders.

In conclusion, the metals and mining sector, once viewed skeptically because of its environmental impacts and community disengagement, is actively seeking redemption and transformation. By focusing on innovative mine closure strategies, repurposing waste to value, and addressing water stewardship concerns, the sector is charting a course towards a sustainable and responsible future. Accelerating novel technologies commercialization and collaborations is proof of the industry’s commitment to improving its legacy and mitigating its footprint. As mining companies increasingly incorporate cutting-edge solutions to manage tailings, promote renewable energy, and engage in thoughtful design for closure, they are not only responding to investor and govern-

ment scrutiny but are also creating new opportunities and lasting benefits for the communities they have been a part of. This pivot toward responsible mining demonstrates the sector’s potential to be a driving force in the global transition to a greener and more sustainable economy. While challenges remain, the strides taken towards a positive closure legacy and improved water stewardship signify a forward-looking approach that may very well redefine the industry’s role in the world. CMJ

Chih-Ting Lo is a strategist, board member, and entrepreneur who’s committed to making a global net-zero carbon future a reality by focusing on industry decarbonization. A professional engineer with deep sector knowledge in ESG performance, Chih-Ting brings a data-driven approach to EY Americas Mining and Metals Centre of Excellence. To learn more, visit: https://www.ey.com/en_ca/mining-metals/ mining-and-metals-centre-of-excellence.

Radar sensor for harsh environmental and weather conditions

Long ranges and a wide temperature range

Reliable measurements even in precipitation, fog, dust and dirt

Simultaneous detection of distance and speed

Adaptable to specific applications thanks to various operating modes

Intuitive set-up and visualisation of the measured data using the ifm Vision Assistant Software

Canada has abundant reserves of cobalt, nickel, lithium, and rare earth minerals that are essential for the green economy. This has resulted in heightened interest and eagerness to mine these reserves. The exploration and development of these resources will require project-by-project government approval. The approval process requires compliance with environmental legislation at the provincial level and possibly at the federal level. It also involves interaction with the public to comply with regulatory requirements, and to gain a social license to operate. Increasingly, gaining project approval is an expensive and time-consuming process. Often, the project proponent is unfamiliar with the approval process in Canada, and the lack of harmonization between the federal and provincial regulatory jurisdictions. This leads to the proponent targeting an approval date based on economic or engineering requirements, rather than on an understanding of the realities of the timelines associated with the approval process.

A proponent’s decision to undertake a project is typically based upon predetermined benchmark financing, economic, and/or engineering considerations. Financing requires the generation of a return on investment in a timely manner. With economics, for example expansion of a petrochemical plant, the focus is on “hitting the market” at a specific time (month/ year) based on the predicted demand for the company’s product(s). Engineering, for example moving a project from pilot to full-scale operation, requires starting and completing construction consistent with the engineering design.

Unfortunately, in many cases, these approaches lead to the actual time available to undertake the regulatory requirements of the relevant environmental legislation being incompatible with the requirements (demands) of the proponent’s

financial, economic, and/or engineering driven schedule. This leads to a gap between the proponent’s target approval date and the timing demanded by the reality of the approval process. This target–reality gap must be managed by the proponent. Accordingly, a regulatory strategy is needed to navigate the complexities of a regulatory process that typically has no fixed timelines to complete the approval process. These parties usually comprise the consultant retained by the proponent to obtain the approval, and the proponent’s in-house project management team.

Bridging the target–reality gap poses challenges for both the proponent’s in-house team and the external consultant. The target date for approval has been established by senior levels of management in the proponent’s company and becomes a performance requirement of the in-house team and the consultant. Furthermore, the target date is often established without an understanding or appreciation of the complexities and open-ended nature of the approval process, or the political realities of the project area, for example, the possible need to collect multi-seasonal environmental data, and the time required to develop and secure agreement on mitigation measures with potentially impacted groups and regulators. In the case of the in-house team, advising senior management that the target approval date may not be achievable may be a career limiting experience. Consequently, the in-house team invariably tells senior management what they want to hear, that is the target date is achievable, not what they need to hear, that is the target date would be very challenging, if not impossible, to achieve given the on-the-ground realties. The result is that management of the target–reality gap is pushed down onto the consultant.

Often, in managing this situation, the consultant has some difficult decisions to make. Do they commit to achieving the target approval date, and then suffer the consequences of failing to “perform” later? Alternatively, do they have a difficult conversation with the proponent at the start of the project and be clear that the target approval date may not be achievable? The risk with this latter approach is that the proponent instead retains a consultant that will commit to achieving the target approval date. The root of this conundrum lies in the need to educate the proponent about the realities of the approval process and the achievability of the target approval schedule at the start of the project (i.e., beginning with the end in mind). The following case may provide some insight into the challenge of managing the target–reality approval gap and, with hindsight, offer some solutions for future consideration.

The case

Following the award of the contract to obtain approval for the expansion of a petrochemical plant, the consultant became increasingly concerned over the proponent’s project manager (PPM) continually stating “when (company) gets us our approval on (day/month/year).” To manage the PPM’s very specific target approval date, the consultant built a probabilistic model of the approval process. The model combined the provincial process and the potential for a federal review process. Simple triangular probability distribution functions (PDFs) specifying the shortest, most likely, and the longest times for each of the time elements that comprise the approval process were determined based on the consultant’s experience, through discussions with other practitioners, lawyers experienced with the process, and with the regulators. The model output was a probability function for approval dates. The model also indicated which elements of the approval process posed the greatest degree of uncertainty and risk to an approval date.

The model indicated that there was only a 25% probability of achieving the proponent’s target approval date. Furthermore, the model indicated that the greatest uncertainties in the approval process were in areas beyond the control of either the consultant or the proponent, for example, the public and government review processes, and need for a public hearing. The PPM was advised of the model and its output. The PPM immediately requested the approval dates for the 50% and 75% probability levels. Upon hearing these dates, the PPM requested that the consultant come to his office immediately with the model and instruct him how to use it. The PPM then used the model to educate senior executives and the board of directors of his company about the realities of the approval process, and the degree (or lack thereof) of control that the proponent and the consultant had over the process.

Subsequently, the project approval was obtained, without the need for a public hearing, on a timeline acceptable to the proponent.

A key learning from this success story is that the proponent and the consultant need to be open and honest with each other about the target approval timeline at the start of the project. The proponent needs to be educated about the legislative framework of the approval process in the jurisdiction in which the project is to be constructed. The proponent also needs to be educated about the political realities of gaining an approval in the

Bridging the target–reality gap poses challenges for both the proponent’s in-house team and the external consultant.

particular jurisdiction, for example, what are the government’s land use and development policies, how well-tested is the approval process, what is the political situation regarding development and the general public, and in some instances with Indigenous groups in the project area? Similarly, the consultant needs to be educated with regards to what is driving the proponent’s desire to meet the target approval timeline. The consultant must be honest with the proponent regarding the achievability of the target approval timeline, even if this could potentially be detrimental to the consultant. These actions by both the proponent and the consultant will lead to greater co-operation and understanding between the parties. It will also lead to an increased likelihood of obtaining approval.

Given the complexities and challenges of the approval process, many project proponents successfully obtain approval within an acceptable timeline. Success is usually founded on the proponent’s understanding and appreciation of the approval process, and in taking the time to discuss and agree on the terms of reference for the environmental impact assessment with the regulator. The proponent also needs to focus on taking the time to empathize with those stakeholders potentially impacted by the project, developing their trust, and establishing collaborative meaningful relationships with them. This leads to consultative decision-making around issues such as possible project options and mitigative measures. The result is a social license to operate that is acquired in addition to a government approval.

Finally, most, if not all critical metal and mineral reserves are located beneath Indigenous lands. Recently, certain Indigenous groups have expressed the view that they “own” these resources. Consequently, at a minimum, Indigenous groups see themselves as being partners with the proponent in a project, rather than simply being stakeholders impacted by the project. Therefore, Indigenous groups are focused on building collaborative and meaningful relationship with the proponent, rather than simply being informed of the proponent’s goals and objectives. Fully understanding and appreciating these Indigenous perspectives will help proponents and consultants manage the proponent target–reality gap in the exploration and development of these resources. “Beginning with the end in mind” benefits the proponent, not only in the short term through construction moving forward, but also in the long term throughout the operational life of the project and its subsequent decommissioning, reclamation, and sustainable post-closure land use. CMJ

Bryan Leach is a retired P.Eng. (Alberta), C. Eng. (U.K.) and a former principal with Golder Associates. He has managed environmental impact assessments for mining projects in the Northwestern Territories and Panama, petrochemical plant expansions in Alberta, and waste management projects in Alberta.

Ljililana Josic and Tim Joseph were interviewed on the topic of mine closure.

Ljiljana Josic is the senior director, tailings, water, and geotechnical engineering at SNC-Lavalin and has an M.E.Sc. degree in geotechnical/environmental engineering from Western University. She has over 25 years of experience in geo-environmental engineering, including geotechnical, environmental and hydrogeology. Her work has included dam design, design of tailings, waste rock, and sludge facilities on over 50 projects.

Ljiliana answered the following questions:

Q When should the closure plan be put in place?

AThe closure plan should be discussed and initiated at an early stage of the project. At the scoping level, different technologies for the tailings management should be evaluated and the best option should be selected based on selection criteria that include, social-economic, environmental, technical, and project economics. Closure of the facility definitively should be included in the tailing management design options evaluation criteria. The input from the community regarding post-mining is very important for developing the closure plan. Designing for the closure using the best design practices is currently adopted by many mining operations. The closure plan is usually initiated at the pre-feasibility stage of the project and updated during mine operation. An early closure plan is very important to understand the cost of the closure. Financial provisioning and estimation can commence at the conceptual closure planning stage and should be updated every three to five years during the operation phase of the project.

AQHow long will the closure plan take to be implemented?

The tailings storage facilities are unique structures designed for the specific environment, region, climate, ore type, geotechnical, physical, chemical properties, etc. The closure plan should ensure that tailings disposal area is left after operation as structurally stable, be resistant to deterioration through erosion, and be compatible with surrounding unmined landform. The closure plan implementation depends on the type of the tailing’s facility. For example, for the dry stack tailings, the closure can start earlier as a progressive reclamation.

Tailings dams are more difficult to close. Designing and planning for the closure during operation should ensure that the final state of the tailings mass will have high resistance to liquefaction and low risk of catastrophic failure. The tailings storage facility is closed when tailings deposition has ceased, and all closure activities have been completed.

Q Once the project enters closure and post-closure, water management and treatment can become the dominant carbon generator. What can be done to mitigate this?

ATo mitigate carbon generation in water management and treatment during project closure and post-closure, several solutions can be implemented. Early incorporation of mine waste management in planning and design stages, along with the implementation of passive treatment systems like wetlands, can significantly reduce long-term maintenance needs and environmental liabilities.

Additionally, water recovery and tailings dam footprints can be maximized and minimized, respectively, through high-performance filters, achieving up to 90% water recovery, and uti-

lizing compact and efficient designs that can reduce plant footprint substantially.

Further improvements can be achieved by enhancing filtration efficiency with technologies that separate fine and coarse streams, and by reducing reagent usage through the application of thickeners. These measures not only address environmental concerns but also enhance operational efficiency and sustainability in the long term.

Q What should happen after the mine is closed?

AWhile in the past, mine closure and reclamation may have often been an afterthought, modern guidelines and legislation require closure plans and financial assurance to be initiated from the earliest stages of mine development. Closure plans and financial assurance requirements are typically developed based on the removal of mine facilities and rehabilitation of landforms to a condition similar to the pre-mining conditions and surrounding natural landscapes.

Reclamation and closure plan requirements vary by jurisdiction, but typical elements include provisions for temporary as well as permanent closure, with consideration of all elements of the mine. Of particular importance is the physical stability of open pits, tailings disposal facilities, and waste rock piles. The closure plan must demonstrate that these structures are stable in the long-term regarding slope stability as well as geochemical stability.

Closure plans will generally include monitoring plans for the post-closure period (i.e., active closure) to ensure that the intent of the closure plan is met. Full passive closure (i.e., the walk away scenario) can only occur once monitoring in the active care phase has demonstrated that remaining structures are physically stable and environmental requirements are met over an extended period.

Tim Joseph holds a Ph.D. in mining engineering from the University of Alberta and the P. Eng., and FCIM designations. He is the president and CEO of JPI Mine Equipment and Engineering. He is a mining operations’ consultant, and his company provides mining operations, performance, and engineering solutions, as well as mining courses. He is also a professor emeritus in mining engineering at the University of Alberta and has been part of the faculty of engineering for 21 years.

Tim answered the next two questions.

AQHow important is engaging the local community in the closure process?

People talk about consultation. I do not think they really understand what consultation needs to be, and it is not about just informing a community group and it does not matter whether it is a community, or whether it is Indigenous or not. It is just bad informing, saying we plan to do this just so you are aware.

How can you properly or more appropriately engage local communities so that at the point that the mine basically ceases to exist as an operating functional entity and they need to start implementing the closure, you need to make sure you leave the land as you found it.

The question really should be “how can we better engage the community at all stages, so they become part of the process,

the workforce, and the group that gets training, information, and education out of that whole activity? At the end of mining, it is that community that becomes the custodian of the landscape and the water and the air and everything else.

So, the biggest conversation that comes up is when a community expresses concerns that if an exploration route comes into their area, it will taint their water and destroy the water quality. The companies are prepared to ensure that that water quality is maintained. Why not train the local people on how to maintain that water quality?

An exploration mission into an area can take five to 10 years before we even see a mine develop. So, that is years of activity when a community could be doing something. And you are giving self respect to the community members who are now actually working to support themselves. That is really the big win that I have seen in other countries where communities have become self-sustaining. They can do it themselves, and if the resources are attributed to the community, the community then pays taxation on those resources to the government.

AQWhat are some of the opportunities available after closure?

This is a beef I have had for many, many years. What are the opportunities for using the waste materials and does the waste have other uses other than just being waste? Are there products in there? I had an interesting conversation with a mineral processing designer in the uranium industry in Saskatoon recently. He said he really wants to write a paper next year about all the critical minerals that are missed that go out with the waste when they mine for uranium.

Companies mining oil sands are throwing titanium, vanadium, and other very valuable minerals away with the tailings. But processing that waste material can become an industry for the community beyond the mine as it stands today. Could the waste materials become the next generation of industry and employment for that community? Are there construction materials that can be utilized? We have seen this in Greece and Morocco where communities have latched onto the value of the waste materials, and they have used it to build roads in their region, and they became the go to road builder.

People are not thinking broadly enough about what the opportunities are in closure. We need to shut things down, green things up, and walk away. That is not the answer. I think the answer is what is the opportunity to make the community sustainable beyond the mining.

Particularly if it is a 20- to 30-year mine life and a whole generation will grow up knowing nothing else but mining. Otherwise, when the mine closes, the community dies.

More recently, they are all tied together because if we want to reduce emissions, there is a dollar value that you can sell to a mining company to say this is the value you will get. Do not just think in terms of dollars, think in terms of emissions reductions. If they could save hundreds of thousands of tonnes of CO2, does that not have value?

How do you put a dollar value to that? Companies get stuck there. So, they say this is just something we have been asked to do. They are expected to reduce emissions by the province as part of the closure requirement and as part of the operating requirement, but they struggle to find that dollar incentive to say yes, we really need to pay attention to this. CMJ

Catherine Hercus is a freelance technical writer.

“Why mining?” It is a question people often ask when they learn I am a water treatment expert focused on this sector. My response is often enthusiastically long, but the crux of my answer is this: The mining sector is as innovative as they come. In fact, this sector is typically at the leading edge of technological development. Mine water treatment is years — often even a decade or more — ahead of municipal water treatment or treatment in sectors such as agriculture and food production. This is, in part, because of the ever-increasing regulatory regime applied to mine water quality in Canada. The regulatory requirements mean the mining sector is always under pressure to develop and refine technologies to ensure compliance and to find new ways to bring existing contaminants to lower levels than currently possible. Additionally, as science progresses and knowledge around toxicology and bioaccumulation increases, there are new elements and compounds that enter scrutiny for treatment. Accordingly, we are continually assessing how existing technologies can work to treat “new” issues which they were not originally designed to address. The complex challenges this sector faces and the corresponding innovation with which it is always responding to those challenges make this a dynamic and fun sector to be part of.

So, what are some of the key aspects of mine water treatment that drive this innovation in technological advancement and development?

THE PROBLEM: Water contamination in mining Mining operations inevitably interact with water in multiple ways, leading to potential contamination. Here are the main sources:

> Process water: Water is used in grinding and extraction processes. This water typically ends up in a tailings pond before being treated and released. Mines often perform partial treatment on these waters before they enter a tailings pond, addressing contaminants like cyanide or sulfides.

> Rock storage facilities: Both ore and sub-economic rock storage can lead to contamination. Rain and snow leach minerals from these rocks, sometimes causing oxidation and acidification.

> Exposed pit and underground mine walls: Newly exposed rock surfaces in pits or underground mines can leach and oxidize, contributing to water contamination.

> Blasting activities: Explosives used in mining contain ammonia and nitrate, which can contaminate water when they interact with rock.

> Infrastructure runoff: Unlike municipalities, mines must treat all water runoff from roads, parking lots, and laydown areas.

> Mine camps and personnel infrastructure: Water used in camps, including potable water and sewage, also requires treatment.

In the simplest terms, treatment needs are determined by comparing the targeted water quality for discharge to the actual water quality. If any constituent is exceeding the target, then it is a candidate for treatment. In Canada, the Canadian Council of Ministers of the Environment (CCME) provides the Canadian Environmental Quality Guidelines (CEQG), which apply after a specified mixing zone. Additionally, guidelines like the Metal and Diamond Mining Effluent Regulations (MDMER) and Coal Mining Effluent Regulations (CMER) apply to the “end of pipe” discharge. Provincial criteria may also apply.

Mining typically occurs in highly mineralized places. If the mineralized area is close to surface, then the water quality can sometimes be naturally elevated in metals and other elements. It is common for water in mineralized areas to naturally exceed targeted federal and provincial guidelines. In such cases, we need to develop site-specific guidelines to protect the environment while considering natural concentrations.

In Canada, mining abides by stricter water quality regulations than most other sectors, including agriculture, forestry, and municipalities. For example, mines must treat contact water to much cleaner levels than municipalities treat sewage before discharging. They also often need to collect, test, and treat water from roadways and parking lots, which municipalities generally do not. This rigorous regulatory environment drives innovation, pushing mining companies to develop and implement advanced water treatment technologies.

Different jurisdictions use various guidance on how to develop site-specific targets and identify treatment candidates. For example, in British Columbia, if a constituent is predicted to surpass 80% of the target regulated concentration, it is flagged for screening by a “Best Achievable Technology (BAT)” pro-

cess. This process helps to identify appropriate treatment or mitigation approaches for the potential contaminant. There are two main methods for treating water: Transfers and transformations.

Transfers: Transfers move contaminants from one place to another without changing their form. Examples of commonly used transfers are membrane separation, ultrafiltration, and reverse osmosis. Transfers are effective but require a plan for disposing of the concentrated contaminants to prevent recontamination. Unless you can pair it with a transformation, you will need to manage the disposal. Constituents have not changed form, only changed their location, so a disposal plan is required to remove the risk of recontamination. Not all constituents behave the same way or can be treated with the same transformations. You need to know the properties of the constituent and the conditions necessary to undergo the transformation you are targeting.

Transformations: Transformations change the fundamental properties of contaminants through chemical or biological reactions. Transformations can make contaminants more stable and easier to manage. An example of a commonly used transformation is the biological oxidation of cyanide to ammonia to nitrate or reduction of nitrate to nitrogen gas (the most common gas in our atmosphere).

Transfers and transformations are often paired together in water treatment. For example, microbes can reduce sulfate to sulfide, which then bind with metals such as copper and zinc to form stable, insoluble compounds that can be filtered.

Leading the way in water treatment innovation

Mining must meet more stringent discharge criteria than other sectors, which drives innovation in water treatment. One would think that the amount of selenium coming off sewage treatment system into a river would have equally stringent regulations as selenium coming from a mine. This is not the case. However, this pressure is driving innovation in mine water treatment at a pace that is unparalleled. In some cases, such as the case of selenium, the mining sector is also advancing analytical detection methods for the contaminants because the available methods were not sufficiently sensitive and accurate to meet their guidelines reproducibly. This need for high precision and effective treatment has pushed mining to the forefront of water treatment technology.

How can we do better?

Mining is already leading the way in water treatment technology, but there is always room for improvement. Here are some ideas:

> Celebrate the wins: Publicize advanced practices and technologies to amplify the sector’s leadership, strengthen public trust, and allow other sectors to adopt them and improve to the standards we hold mines to in Canada.

> Share the science: Continue to distribute evidence-based information publicly.

> Improve source control: An ounce of prevention is worth a pound of cure. Treatment may seem more impressive as it “fixes’ a problem,” but prevention is even better. Mines continue to innovate in this area alongside water treatment.

> Decentralize treatment: Use co-management or segregation to enable more effective, localized treatment. This will

also help to transition mines into closure more easily.

> Decarbonize water treatment: Reduce greenhouse gas (GHG) emissions by using newer technologies that replace traditional methods, like lime treatment.

> Fast-track technology maturation: Technology readiness assessments and technology maturation plans streamline new technology development. They facilitate communication and permitting, bringing technologies to implementation more quickly and cost-effectively.

Innovation highlight: Gravel bed bioreactors

Gravel bed bioreactors (GBBRs) are a technology known by several different names. Sometimes they are called gravel bed reactors (GBRs), rock bed bioreactors (RBBRs), or a similar variation. The author developed North America’s first fullscale GBBRs for the treatment of metals and nitrate from mine water at a mine in Ontario. There are now two GBBRs operational, from 2019 and 2020, respectively. While many technologies get side-tracked by “interesting research” that does not align with getting technology to market, these systems went from technology readiness level (TRL) 6 through 8 in less than two years. Testing included trials at bench-scale (laboratory) and column-scale (off-site climate controlled and on-site using actual conditions). These tests were planned to specifically address risks and information gaps to advance the technology. This technology maturation plan (TMP) focused on the maturing of the technology for implementation and permitting, which was critical to its rapid success. These GBBRs each treat approximately 20,000 m3/day of water from either a tailings pond or neutralized water from a potentially acid-generating rock stockpile. Dissolved metals treated can be as high as 3 mg/L copper or 4 mg/L zinc, paired with 10 to 30 mg/L nitrate. The GBBR has been operated side by side with a conventional low-density sludge system (LDS). Not only did the GBBR outperform the LDS for metals treatment because of metal-cyanide complexes that only the GBBR could treat, but also performed nitrate treatment in the same step. These cost savings are significant but can also yield an approximately 2,000 t/y decrease in GHG emissions compared to the conventional LDS treatment. The mBio GBBRs are now at a TRL-8 for many constituents, such as nitrate, copper, and zinc. Maven Water & Environment is expanding the implementation of their mBio systems across Canada and for a wider range of constituents.

Water treatment is a complex and crucial part of the mining industry. It requires site-specific consideration, and there is no one-size-fits-all solution. This, and the stringent guidelines being imposed on the sector, have put mining at the forefront of water treatment leadership. Understanding the basics of contamination sources, treatment needs, and treatment methods can help us appreciate the innovation driving this sector. With ongoing advancements and a focus on continuous improvement, the mining industry has set a standard for water treatment that other sectors can follow. CMJ

Dr. Monique Simair is a globally recognized leader in passive and semi-passive water treatment for the mining sector, including bioreactors, constructed wetlands, in situ treatment, and contaminant source control methods. She is the founder and CEO of Maven Water & Environment (www.mavenwe.com) and can be contacted at monique@mavenwe.com.

Kristan Straub, Ljiliana Josic, and Dr. Shahid Azam were interviewed regarding the latest developments in tailings storage.

Kristan Straub is the CEO of Wyloo Canada and holds a B.Sc. in geology from Laurentian University. Kristan has more than 25 years of experience in the mining industry, including being the vice president of exploration at Glencore, and president of Koniambo Nickel SAS, New Caledonia. Kristan is a proud band member of Henvey Inlet and French River No.13.

Ljiljana Josic is the senior director, tailings, water, and geotechnical engineering at SNC-Lavalin and has an M.E.Sc. degree in geotechnical/environmental engineering from Western University. She has over 25 years of experience in geo-environmental engineering, including geotechnical, environmental, and hydrogeology. Her work has included dam design, design of tailings, waste rock, and sludge facilities on over 50 projects.

Dr. Shahid Azam is a professor of environmental systems engineering at the University of Regina and holds a Ph.D. degree from the University of Alberta. He is a geotechnical engineer with over 30 years of international experience. His work focuses on developing natural resources and civil infrastructure and using a multi-disciplinary approach to address mining and construction issues.

AQMany mines are now storing tailings underground. What is the process?

Kristan Straub: When ore is mined, a void is created. The purpose of underground tailings is to fill a void and prevent collapse. They are treated and upgraded, crushed, ground, and passed through a solution to leach the sulfides from the waste rock. The tailings are then dewatered and thickened into a concentrated paste. The treated tailings are taken back underground and used to fill the void spaces underground. Depending on the recipe used, binders are used to create a cement-like binder which gives the tailings strength. It is not concrete, but it is a hard material.

Regarding contaminants/toxic material in tailings, there will be a lot of work done beforehand. Whether they are sulfide ore, reactive based on the sulfur content in the tailings, the key associated risks is drainage. The tailings will not be exposed to water.

The chemicals associated with cleaning the tailings will be accepted ones, and no cyanide or arsenic will be used. Classic lime slaking changes the water pH, turns it into a sludge, and

then this is used in backfill and the water is brought back to pH neutral.

There are technologies available on the market today and extractive technologies which extract metals left over from the residue and allow it to be safely stored. Most Ontario and Manitoba underground mines are storing their tailings underground.

Ljiliana Josic: The tailings are generally mixed with a binder, usually cement, and then pumped underground to fill voids and help support an underground mine.

QWhat are the advantages and disadvantages of storing tailings underground as opposed to on the surface?

ALjiliana Josic: Underground tailings deposition or backfilling is considered one of the safest forms of tailings disposal. This technology has many advantages: The disposal of mine tailings in underground mine stopes results in an increase in their geotechnical stability, an increase in their geochemical stability, and a decrease in their leaching potential. Another benefit is a reduction of the footprint compared to land use on the surface by not having a dam and reservoir used as tailings storage facilities and the elimination of seepage that can reach aquifers in watersheds.

It reduces the risk of direct exposure and limits long-term monitoring. In addition, the underground tailings disposal can reduce tailings porosity and decrease their permeability, as well as provide an alkaline environment that can limit the potential for acid rock drainage (ARD) and metal leaching.

The disadvantage of this could be the higher cost and the location of the underground mine.

Kristan Straub: So far, there have been no failures of this type of tailings storage system. It is designed for use in underground environments. The binder added to the tailings helps it resist interaction with water. It is located under the water table, as opposed to above ground mines which are in contact with the water table and subsurface ground water. As this will be below the water table, there are limited potential risks, and the scale of the risk is mitigated.

Because of the way the tailings are stored underground, they lose their reactivity. The rock is processed, ground down, and put back in with cement binders. The risks are associated with interacting with surfaces, and we are limiting that interaction. Other extraction methods leach the sulfides out of the metals and mix it back into concentrates. This is not cheap but is good stewardship and is the right thing to do.

Dr. Shahid Azam: This approach is acceptable; failures have not been associated with this method. This is popular in Ontario and Quebec and is referred to as mine backfill. There can still be stability issues as they use different types of binders to improve backfill materials. The tailings should be fine if someone keeps an eye on them.

Dr. Shahid Azam: Failure is common in Canada. About four years ago in Brazil, there was a big one, and more have happened in China. It is not just happening in developing countries; it can be anywhere.

The main reasons for tailings failure are communication problems on the site. If the mine is big, the number of personnel working on the mine is big, with lots of employees. Who says what to who becomes important. Record keeping becomes important.

The dams can be big in size and are not always constructed using high quality materials. Often the storage container is made up of less than high-quality material, just whatever material is on hand at the site. So, storage is often made of marginal material, and physical and chemical stability is an issue.

The mining company is not an expert in dam construction. They are experts in getting the commodities out. Dams can be raised in height as more material has to be stored over time. These must be managed for a very long time. In one case in the U.S. at Questa, the mine is 100 years old. There was a classical tailings failure in Spain, where the people at the mine did not pay much attention to the geotechnical design.

Another problem is the rock formation. After it is blocked off, it becomes fragmented. Water comes through the tailings, and bacteria also comes through, and if it has residual chemicals, for example pyrite has iron, and when mixed with water you get sulfuric acid. When water and gas form round a material, it makes more chemicals, and contaminants are going out, and the physical stability is compromised.

Regarding tailings construction, how firms implement this on the mining site can be a problem. Sometimes they put new geological material in there, but how will it work in the long term? There can be major issues with this construction practice depending on the material installed.

One problem is the lack of storage capacity. One example is a uranium mine in Saskatchewan, they had to make sure it did not dewater too fast. You want to increase the tailings storage capacity gradually rather than too quickly.

In Chile, the biggest problem is the extreme aridity of the land. You must get the water out of the tailings. This is not such a big problem in places like Ontario.

Active earthquake zones are another issue. And there are always tremors at mine sites whenever they are blasting on site. Scale and comminution are site-specific. Innovations and technological improvements are not happening fast enough and cannot keep up with the pace that is required.

Kristan Straub: Regarding the tailings dam failure at Mount Polley, the upstream tailings dam contained both tailings and water in a reservoir, the dam failed, and the tailings leaked into the environment.

AQWhat are the important considerations in planning storage failures?

Ljiliana Josic: Achieving physical and chemical stability of the tailing’s storage facilities is paramount for the mining companies, designers, operators, and community. The primary goal is safe facilities, and operating companies must commit to making safety a primary consideration in the tailings dam design, construction, operation, closure, and post-closure monitoring.

The tailings facilities should be regularly inspected, and any potential risk must be reported and mitigated. The monitoring instrumentation must be placed strategically, and data must be collected regularly and analyzed to identify and mitigate any potential risk. The annual probability of failure must be periodically calculated and reported. The water management of the structure must be regularly inspected to prevent overtopping. Dam safety inspections and dam safety reviews must be completed and documented. The Canadian Dam Association provides guidelines of their procedures. In addition, independent tailings review boards should be engaged to promote safety and prevent potential failure.

An emergency action plan or emergency preparedness and response plans related to catastrophic failures of tailings facilities must be prepared and discussed with all potentially affected communities, workers on the site, operators, and other stakeholders.

The document must be regularly reviewed and updated. Emergency contact names and details must be included in the emergency preparedness and response plans.

The operating company is responsible for taking all steps necessary to save lives and provide appropriate humanitarian aid in case of a sudden failure. All necessary resources and support for local and national governments and first responders during and after a failure must be provided by the operating company.

At the scoping level, different technologies for the tailings management should be evaluated and the best option selected based on selection criteria that includes social, economic, environmental, technical, and project economics criteria.

Tailings storage facilities are unique structures designed for the specific environment, region, climate, ore type, geotechnical, physical, and chemical properties.

Dr. Shahid Azam: The rush for critical minerals — the government has expedited the process. How will it be ensured before digging, does the mine have everything in place, is it technically and chemically stable, and how will it be affected by climate change? There must be consideration of all the above. The public wants jobs, minerals, and metals.

The observation approach, which is well-established in our industry, means instruments are installed in critical sectors to make sure the tailings are fine. It means that someone keeps an eye on the tailings.

Now, Canadian mining companies extracting minerals must follow Canadian standards for environmental protection. They must be included in the mine site design, and the site must be compliant.

One new issue is climate change. If there is a major rainfall, are you ready for it? What if it happens?

Today’s critical minerals are the green energy of tomorrow.

As global mining consultants, we champion sustainable, responsible processes that see beyond profit to support people and the planet. rough our expertise across the mine life cycle, we meet the needs of now, and guide the industry to where it needs to go next.

wsp.com/mining

AQWhat is the approximate volume of the tailings which can be stored underground?

Ljiliana Josic: At best, about 60% of the tailings can be placed underground. Reducing the surface-disposal footprint, underground disposal of cemented tailings can provide ground support to minimize or prevent subsistence or surface collapses. CMJ

Catherine Hercus is a freelance technical writer.

During a time when a global pandemic brought industries across the world to a standstill, shuttering businesses, and stymieing job growth, the government of Saskatchewan initiated a program to help get people back to work.

On May 22, 2020, the government of Saskatchewan launched the Accelerated Site Closure Program (ASCP) with $400 million in federal stimulus funding through Ottawa’s Covid-19 Economic Response Plan.

The initiative was aimed at supporting Saskatchewan-based oil and gas service companies to conduct reclamation work on thousands of inactive oil and gas well sites across the province.

The ASCP was a collaborative effort between the Saskatchewan Ministry of Energy and Resources, the Saskatchewan Research Council (SRC), the Saskatchewan Ministry of SaskBuilds and Procurement, and the Saskatchewan First Nations Natural Resource Centre for Excellence.

to this team, but it still came with a bit of a learning curve.”

As program manager, the Ministry of Energy and Resources says it is proud of the way the team of government and industry stakeholders worked quickly and collaboratively to get people back to work and take advantage of this federal pandemicrelief fund.

“This work would not have been possible without the dedication of Saskatchewan’s oil and gas service sector, which stepped up to get the work done within a relatively short timeframe,” energy and resources minister Jim Reiter said.

Being the western oil and gas powerhouse it is, Saskatchewan currently has 50,000 active oil and gas wells — with 1,483 new wells drilled in 2022 alone. Between 1900 and 2022, Saskatchewan had amassed a backlog of inactive and orphaned oil and gas wells.

At the inception of the ASCP, Saskatchewan had over 35,000 inactive gas wells, over 46,000 abandoned wells and a little over 2,700 orphaned wells.

Tasked as program administrator, SRC leaned on its experience gained from previous reclamation projects and used a procurement-based model to allocate work and implement area-based cleanups.

Bundling work into packages drove efficiencies, generating more cleanup and reclamation work under the program, which kept more Saskatchewan people employed.

Jesse Merilees, vice-president of business integration at SRC, said, “the scope of this major project was not a foreign concept