> Inspiring Ontario’s youth toward an exciting career in mining.

> Strolling down Ontario’s Electric Avenue.

> The Centre for Smart Mining turns five.

PASSING THROUGH THE RING OF FIRE

SUMMARY OF THE REPORT ON LABOUR TRENDS IN THE CANADIAN MINING SECTOR THE SIDE THAT LEARNS THE FASTEST WILL WIN

– Conquer steep inclines while minimizing spillage and haul road deterioration with the diesel-electric drivetrain’s constant application of power to ground

– Achieve decarbonization targets with trolley solution compatibility, available as both first fit and retrofit

– Unleash unmatched power with 895 kW of gross power – the highest in the 100-tonne class

– Reduce fuel consumption with optimized engine speed management

Liebherr-Canada

• Phone:

16 Inspiring Ontario’s youth toward an exciting career in mining.

19 Strolling down Ontario’s Electric Avenue.

25 The Centre for Smart Mining turns five.

27 Passing through the Ring of Fire.

30 From a quarry in Ireland to a gold mine in Ontario.

51 History of mining: Cobalt’s boomtown blues.

32 We must decarbonize mining to create clean energy.

35 The 2024 outlook of employee safety technology in the mining industry.

37 What is the correlation between transformational leadership and the profitability of Arizona copper mining companies?

40 Rebranding mining is necessary: Summary of the report on labour trends in the Canadian mining sector.

43 The side that learns the fastest will win.

45 Time is money: Why it pays to be strategic with mining tire service work.

47 A highly responsive conveyor belt tracker.

49 Reviewing the pros and cons of polyurethane and high-vibration screen media.

4EDITORIAL | Ontario: A place for mining to grow.

4LETTER TO THE EDITOR |

6FAST NEWS | Updates from across the mining ecosystem.

8 LAW | The federal and provincial governments’ initiatives to help the EV battery supply chain and critical minerals strategy.

10UNEARTHING TRENDS | British Columbia’s mineral exploration in 2023.

12MIN(E)D YOUR BUSINESS | Where is British Columbia going with mineral tenure reform following the Gitxaala decision?

53ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

www.canadianminingjournal.com

Front

Coming in April 2024

Canadian Mining Journal’s April issue will tie-in BEVs, mine electrification, and the hunt for the critical minerals to fuel de-carbonization. The issue will include a report on haulage and transportation.

For More Information

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

Tamer Elbokl, PhD

Tamer Elbokl, PhD

ccording to the annual BloombergNEF’s Global Lithium-Ion Battery Supply Chain Ranking, Canada has overtaken China for the top spot in the ranking, which rates 30 countries on their potential to build a secure, reliable, and sustainable lithium-ion battery supply chain. Also, in another good news this week, energy minister, Jonathan Wilkinson, announced that Canada plans to boost its energy security by slashing the time it takes to develop new critical mineral mines by nearly a decade with improved permitting processes.

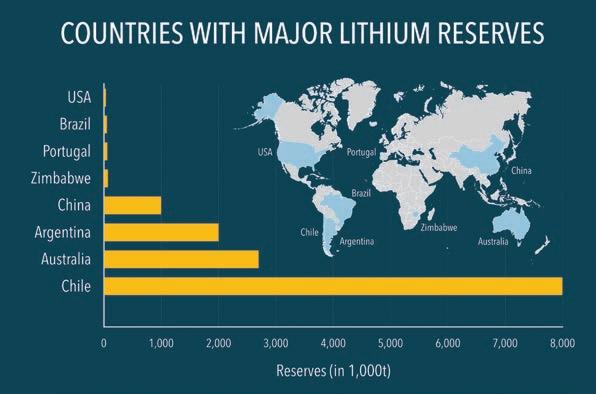

Canada’s position in the ranking is improving due to policy commitment at both the provincial and federal level. Obviously, lithium-ion batteries need lithium mining. The article on pages 19-24 offers updates on current lithium mining projects in Ontario and explains how there is a generational opportunity for Ontario to become a lithium exploration powerhouse. With an ongoing land acquisition fever by several junior mining companies, Ontario could soon emerge as a big player in lithium production, which could help reduce the global lithium market’s volatility.

Articles on pages 16-31 provide updates on mining in Ontario, which is the main topic in this issue. Additionally, our History of Mining article on page 51 discusses the story of Cobalt, Ont. Flip to pages 35-44 for articles that explore the latest topics and case studies on recruitment, training, and careers as well as health and safety in mining.

If you are planning to attend the Prospectors and Developers Association of Canada (PDAC) 2024 convention in Toronto, Mar. 3-6, please visit our booth to pick up a hardcopy of this issue; we will be in booth # 808.

Finally, our April issue will tie-in BEVs, mine electrification, and the hunt for the resources to fuel de-carbonization. Editorial contributions will be accepted until Mar. 8, 2024, and should be sent to the Editor in Chief. CMJ

In response to an article published in December 2023/January 2024 issue of the Canadian Mining Journal, entitled, “The rise of resource nationalism in the global critical minerals industry,” I would like to point out that the governments of Canada and British Columbia essentially nationalized a major cobalt-copper deposit in B.C. by incorporating it into a park in 1994. This deposit is Windy Craggy. This was done without any involvement or consultation with the First Nation on whose traditional territory this deposit is located. Now, both governments are promoting the development of critical minerals and planning to make sure to include Indigenous participation. If both governments are serious, then they would review their 1994 decision and allow this deposit to be developed.

Windy Craggy has a 1992 non-NI 43-101 compliant historical resource estimate of 297,400,000 tonnes: 1.38% Cu, 0.069% Co, 0.20 g/t Au, and 3.83 g/t Ag, using a 0.5% copper cut-off grade. This estimate should be considered a minimum, as a new zinc-rich zone was discovered at the end of latest drilling campaign in 1990. This deposit would be considered as the largest of the resources of cobalt and copper in North America that are listed under both British Columbia and Canada critical minerals designation.

I have been involved with the Windy Craggy project since 1975 and was project geologist from 1989 to 1992. I have been engaged with Mr. James Allen (former chief of Champagne Aishihik First Nation) since 2011 regarding this project, and together we have compiled a list of benefits for all stakeholders with a positive and innovative way forward.

— Bruce Downing, MSc, P Geo, FGC, FEC (hon)FEBRUARY/MARCH 2024

Vol. 145 – No . 1

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3

Tel. (416) 510-6789 Fax (416) 510-5138

www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl

telbokl@canadianminingjournal.com

News Editor

Marilyn Scales

mscales@canadianminingjournal.com

Production Manager

Jessica Jubb

jjubb@northernminer.com

Advisory Board

David Brown (Golder Associates)

Michael Fox (Indigenous Community Engagement)

Scott Hayne (Redpath Canada)

Gary Poxleitner (SRK)

Manager of Product Distribution

Allison Mein

416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales

Robert Seagraves

416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos

416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.:

1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group

Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry.

Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada.

All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods:

Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com

Mail to: Allison Mein,

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3

We acknowledge the financial support of the Government of Canada.

“RELENTLESS PURSUIT TO END OCCUPATIONAL HEALTH

AND IMPROVE WORKER SAFETY.”

The Vigilante AQS™ accurately measures airflow, worker heat stress, gas concentrations, and air particulate matter – reducing downtime and enabling miners to return to the face sooner and safer.

Every shift, every day, every miner – home safe. Everyone Safe – Guaranteed.

The process of devolution has been long time coming to the territory of Nunavut since it was founded in 1999. In a historic move last week, the Canadian government signed over responsibility for control over all the lands, resources, water, and wildlife to the territorial authorities.

Nunavut was the last of the three Canadian territories to take control of its resources – and there are many. The territory covers 2.1 million km2, roughly the size of Greenland. Agnico Eagle Mines mines gold at the Meadowbank-Amaruq complex near Baker Lake and the Meliadine mine in the Kivalliq District. Baffinland Iron Mines, which is 25% owned by ArcelorMittal, operates the Mary River iron ore mine near Pond Inlet.

Former producers include the Nanisivik zinc-lead mine, Polaris zinc-lead mine, Lupin gold mine, and Jericho diamond mine. The potential remains for new discoveries, even if there are virtually no roads or infrastructure in the territory. Nunavut covers 20% of Canada’s landmass (and only 40,000 of its citizens), making this the largest land transfer deal in Canadian history.

Royalties from natural resources will begin to flow to the territorial coffers rather than the federal government. There is a sliding scale of federal funds to be transferred. This year’s transfer is $2.1 billion, but it will be reduced as royalties begin to replace part of it.

Spanish Mountain Gold has begun a new metallurgical testing program to assess a coarser grind on samples from its Spanish Mountain project near Williams Lake, B.C.

“We are excited about this new program which may show that a coarser grind decreases power consumption, improves downstream processes such as tailings and water management, and favourably impacts costs and production,” said president and CEO Peter Mah.

The Spanish Mountain prefeasibility study was completed in 2021. It demonstrated annual production of 180,000 oz. of gold over the first six years and 150,000 oz. over the life-of-mine. Costs

were estimated at US$707/oz. over the first six years and US$801 over the mine life. Capex requirements were set at US$461 million ($607 million) for an open pit mine and 20,000 t/d mill.

The measured and indicated resource at the project is 294 million tonnes grading 0.50 g/t gold (4.7 million oz.) and 0.72 g/t silver (6.8 million oz.) using a cut-off of 0.15 g/t gold. The inferred resource is 18 million tonnes at 0.63 g/t gold and 0.76 g/t silver.

Within the resources are proven and probable reserves of 95.9 million tonnes grading 0.76 g/t gold (2.3 million oz.) and 0.71 g/t silver (2.2 million oz.) For reserves, a cut-off of 0.3% g/t gold was used. CMJ

The process of devolution will take three years. It is to be complete on April 1, 2027. The feds have pledged $15 million to the territory to make this happen. There are federal lands and buildings to be turned over, and the workers in those buildings will become territorial employees, for the most part. It is anticipated that Nunavut residents will have to train in fields such as land management, ecology, and sciences to replace all the work done in Ottawa on behalf of the territory. CMJ

The Windfall gold project is now powered by hydroelectricity. The 95-km-long, 69 kV power line built, owned, and operated by Waswanipi Cree First Nation has been connected to the project. The move away from diesel power generation for the camp and underground mine will reduce both power costs and greenhouse gas emissions at the site.

Windfall is a 50:50 joint venture of Osisko Mining and Gold Fields, with Osisko as the operator. The property is located in the Abitibi Greenstone Belt, Eeyou Istchee James Bay, Que., 700 km north-northwest of Montreal. The property lies within the traditional territory of the Waswanipi Cree First Nation.

Osisko says the Windfall environmental impact assessment review is ongoing, and the impact and benefits agreement is expected to be finalized this year with the Cree Nation government and Waswanipi Cree First Nation. CMJ

Seabridge Gold has updated the prefeasibility study (PFS) for its 100%-owned Courageous Lake open pit project in the Northwest Territories, creating a more sustainable and profitable operation than the earlier PFS done in 2012. The new PFS led by Ausenco demonstrates the production of 2.5 million oz. of gold over an initial 12.6-year mine life.

Everything that should go up is up, and that which should be lowered is lower. The study increased gold reserves in the measured and indicated resource by 39% to 11 million oz. Courageous Lake now has an after-tax net present value (NPV) with a 5% discount of US$523 million, an internal rate of return (IRR) of 20.6%, with a 2.8-year payback. Annual production will be 201,000 oz. of gold at

CREDIT: SEABRIDGE GOLD

CREDIT: SEABRIDGE GOLD

an all-in sustaining cost of US$999 per ounce, in the lowest quartile of the World Gold Council cost curve.

The PFS also highlights a 73% increase in the after-tax NPV 5% to US$523 million, a 50% reduction in initial capital to

New Found Gold has received the results of 16 diamond drill holes that tested the Honeypot zone, part of the Queensway gold project 15 km west of Gander, Nfld. The zone was discovered last year 230 metres north of the Jackpot zone and on the east side of the Appleton fault zone.

Here are highlights from Honeypot: 26.35 g/t gold over 7.65 metres, including 101.72 g/t over 1.8 metre and 24.06 g/t over 0.5 metre; 2.05 g/t gold over 14.7 metres; 6.70 g/t gold over 6.2 metres, including 16.93 g/t over 0.5 metre and including 17.24 g/t over 1.1 metre, and separately 1.5 g/t over 2 metres; and 23.05 g/t gold over 5.3 metres, including 71.42 g/t over 0.5 metre, 67.99 g/t over 1 metre, and 11.39 g/t over 1 metre.

Gold at Honeypot is hosted within a primary fault that has been defined by drilling over a strike length of 280 metres to a depth of 190 metres. The domain shows good continuity, and the grade appears higher at depth.

No NI 43-101 compliant resource estimate has been completed. CMJ

US$747 million, and an increased aftertax IRR to 20.6% from 7.3%. The average gold reserve grade increased 19% to 2.6 g/t, and the life of mine strip ratio was reduced 39% to 7.58. The increase for contained gold in measured and indicated resources rose to 11 million oz., up 38% from 8 million oz. in 2012.

Seabridge chair and CEO Rudi Fronk estimated that the PFS covers only 30% of the Courageous Lake resources identified. Therefore, the project has considerable potential to exceed the original 12.6year mine life.

The Courageous Lake property is located 240 km northeast of Yellowknife, NWT, and is situated within the Courageous Lake greenstone belt (CLGB) in the Slave Structural Province. CMJ

• INVESTMENT | Samsung SDI acquires 8.7% stake in Canada Nickel, has right to buy 10% of

Samsung SDI has become the latest company to invest in Canada Nickel, which is developing the Crawford nickel sulphide project in the Timmins-Cochrane mining camp of Ontario.

Samsung intends purchase US$18.5 million worth of Canada Nickel’s common shares at a price of C$1.57 per share. Upon closing, Samsung will own approximately 8.7% of the company’s outstanding share capital. The battery maker will also be granted the right to purchase a 10% equity interest in the Crawford project for US$100.5 million. This would give Samsung the right to 10% of the nickel-cobalt production from the Crawford project over the life of mine, and the right to an additional 20% of production for 15 years, extendable by mutual agreement.

Crawford is currently host to the world’s second-largest nickel resource, totalling 2.46 billion tonnes at 0.24% nickel for 13.3 billion lb. of contained nickel, according to a feasibility study issued in October.

Uniquely, the mine will be a net negative contributor to global carbon dioxide (CO2) emissions, thanks to its ability to geologically sequester 1.5 million tonnes of carbon per year. There will also be room to capture and store 30 million tonnes of carbon from third parties. CMJ

The federal government of Canada released its 2023 fall economic statement (the FES) in November 2023, reiterating key pillars of the 2023 federal budget, namely its ambitious plans to support and grow Canada’s electric vehicle (EV) battery supply chain and critical minerals industry. The FES outlines the government’s achievements and commitments in securing major investments, cutting red tape, and improving market access for these strategic sectors, with a view to create and protect middle-class jobs, spur innovation, and enhance Canada’s competitiveness and leadership in the clean economy.

The government’s formal push for growth in this area officially began in April 2022 with its 2022 federal budget, wherein the government committed to fund $3.8 billion over eight years to implement Canada’s first critical minerals strategy. A key part of the strategy is to accelerate project development through faster regulatory reviews and permitting decisions. Developing a mine in Canada can take a very long time (in the range of 10-15 years on average), as compared to other jurisdictions with similar legal systems that benefit from shorter timeframes. For example, Australia has focused on streamlining and consolidating its approval process over the last few years, a much-needed focus here in Canada. As most Canadian projects are in the early stages of development, most of the minerals required for North America’s energy transition may ultimately need to come from other countries if Canada and its provinces are not aligned on improving competitiveness in bringing critical minerals to market.

In 2022, the government committed to fund $3.8 billion over eight years to implement Canada’s first critical minerals strategy.

In response to this issue, provincial government initiatives like Ontario’s proposed changes to its mining regulation, aimed at speeding up mine approvals, are starting to take place. These proposed changes would make it easier to obtain permits and loosen some existing restrictions without compromising environmental standards. More recently, the Ontario Ministry of Mines launched two public consultation initiatives seeking input on proposals to improve the mineral exploration assessment work regime and the exploration plans and permits regime. These initiatives aim to streamline regulatory processes and ensure competitiveness in the global mining sector, but additional measures to accelerate exploration and development of Canadian critical minerals projects are necessary and should be expected as demand continues to grow.

Demand for critical minerals has grown exponentially in recent years, significantly outpacing the rate of supply, which has become a pressing concern. By some estimates, global demand for critical minerals for clean energy technologies will double by 2030. The federal government’s most recent update to its zero-emission schedule set out that auto manufacturers and importers must meet annual zero-emission vehicle regulated sales targets. The targets begin with a requirement that at least 20% of all new cars, SUVs, crossovers, and light-duty pickup trucks offered for sale in Canada in 2026 emit zero emis-

sions. The requirements increase annually towards 60% by 2030 and 100% by 2035.

In response to growing demand, governments, miners, and car manufacturers have started to form partnerships to secure reliable and sustainable critical mineral supply chains. Since 2020, the federal government has secured more than $34 billion in investments in the batteries and automotive supply chain, including landmark battery manufacturing facilities by Volkswagen and Stellantis-LGES in Ontario during the first and second quarters of 2023.

The federal government has placed a strong emphasis on developing domestic supply chains to reduce dependence on foreign sources and ensure a stable supply. However, the success of these supply chains will ultimately depend on the rate at which critical minerals can be extracted from the ground and supplied up the chain.

Canada has long been seen as a global mining leader, with an abundance of essential critical minerals. While Canada’s mining sector ranks second among Bloomberg NEF’s scoring of 10 leading critical mineral producers, it is essential that Canadian projects are able to move at a faster pace if we are to capitalize on what has been said to be a generational opportunity for

Canada to become a leader and global supplier of choice in the clean energy transition. Put simply, to compete in this race, Canada must pick up the pace.

To that end, the federal government has announced that, by the end of 2023, it will outline a concrete plan to further improve the efficiency of the permitting and impact assessment processes for major projects, which will include clarifying and reducing timelines, mitigating inefficiencies, and improving engagement and partnerships. In Ontario, the ministry began a similar process intended to improve the local regime to boost Ontario’s competitiveness. We already have the strategy and the budget and are now eagerly awaiting details of the plan that may help propel Canada towards becoming a leader in the global race to bring critical minerals to market. Our ability to implement at this stage will be critical considering the targets and impending deadlines that have been set. Time is of the essence. CMJ

Michael Sabusco is a partner in Dentons Canada’s Corporate, Securities, and M&A groups, and the Ontario lead of the firm’s National Mining group. Greg McNab is a partner in Dentons Canada’s Corporate group and the co-lead of the firm’s National Mining group. Jaskaran Grewal is an associate in Dentons Canada’s Corporate, Securities, and M&A groups.

Coming off the back of record interest rate hikes by the United States Federal Reserve and geopolitical tensions in 2022, significant economic turbulence was expected in 2023. As the year progressed and the effects of measures taken by central banks across the world set in, as well as increasing geopolitical strife and uncertain economic conditions in the world’s largest economies, commodity prices experienced wide-ranging effects. While the price of gold recorded historic gains throughout the year, 2023 left a lackluster mark on base metals. Copper prices closed the year at roughly the same level as it opened, while lead and zinc fell by around 10%.

With this global context in mind, the “British Columbia Mineral and Coal Exploration Survey” found that the province saw its first year-over-year decline in exploration budgets in nearly 10 years. Exploring the key trends and state of the industry, the survey shares three takeaways.

Despite exploration decreases, the industry achieved its third-highest expenditure in the past 10 years. The exploration spending for the year reached $643 million, marking a 13% decline from the record $740 million set last year. This year-over-year decrease is the first since 2015-2016 when exploration spending dropped by 25%. This dip aligns with the global trend in exploration spending for 2023, with a reported 3% year-over-year decrease from 2021.

The decline in exploration activity is further evident in the total metres drilled, which fell by 35%, dropping from 1,150,000 metres in 2022 to 748,000 metres in 2023. This continuation of decreasing drilling activity in the province mirrors the trend observed from 2021 to 2022, which saw a 20% year-overyear decrease. This aligns with global

By Iain Thompson

Exploration interest in copper within the province outpaced that of gold.

patterns, as reported at the time, indicating six consecutive quarters of declining projects drilled worldwide.

Despite this, B.C. demonstrated resilience by maintaining its third-highest expenditure over the past decade, highlighting the robust nature of the mineral exploration industry in the province.

Regionally, the northwest region, known for its abundance of porphyry and precious metal deposits, remains the focal point of exploration in B.C., contributing to 69% of the province’s exploration spending. This reinforces the ongoing trend of heightened attention in the region, with it representing 61% and 56% of provincial exploration spending in 2022 and 2021, respectively.

2 | Interest shift: copper thrives as precious metals falter

Although the price of copper did not enjoy the same highs throughout 2023 that the

price of gold did, exploration interest in copper within the province outpaced that of gold. Spending in the gold sector fell by 23% from $422 million in 2022 to $326 million in 2023. This follows three years of consecutive increases in provincial exploration spending in the sector.

The impact of this decreased overall exploration spending was softened by the continued interest in copper exploration, which saw a 4% increase in spending from $234 million in 2022 to $244 million in 2023. The surge in spending primarily targeted established deposits rather than grassroots opportunities. Specifically, 71% of the expenditure on copper exploration was directed towards projects in the later stages of the exploration lifecycle. In contrast, the percentage

of total copper exploration spending allocated to later-stage projects was 56% in 2021 and increased to 64% in 2022.

This continued interest in copper, largely channelled towards established deposits in later exploration stages, suc-

als essential for fulfilling national and corporate decarbonization commitments will remain steadfast.

These opposing forces may cause exploration budgets to hover around similar levels next year; however, the

cessfully mitigated the impact of the overall decrease in exploration spending, underscoring copper’s growing significance within the industry.

3 | Pivoting to established projects amidst rough financing waters

Global exploration budgets for grassroot projects fell 10% in 2023, hitting a recordlow share of global budgets at 23%, furthering a global shift away from grassroots exploration. This risk-averse behaviour displayed globally by explorers was also seen in B.C., where only 35% of overall exploration spending was for projects in the earlier stages of the exploration lifecycle (grassroots and early stage), which represents a 4% decrease from the share held in 2022 (39%).

The shift can be attributed to the increasingly difficult financing conditions confronting junior exploration firms due to stricter monetary controls. Meanwhile, junior companies with well-developed projects and major players are focused on expanding current deposits and addressing tasks such as permitting, environmental compliance, and consultation.

Looking ahead: Steadfast metal demand amidst storms of 2024

While various headwinds, such difficult financing conditions and geopolitical turbulence, may slow down the global economy in 2024, the demand for critical met-

eventual need for new resources with the appropriate pathways to production will result in the need for continued exploration. CMJ

Iain Thompson is the mining and metals consulting leader at EY Canada, based in Vancouver.

The British Columbia Mineral and Coal Exploration Survey is a joint initiative between the government of British Columbia’s Ministry of Energy, Mines, and Low Carbon Innovation (EMLI), the Association for Mineral Exploration (AME), and EY Canada. For more information visit www.ey.com/ ca/bcminingsurvey.

British Columbia’s mineral claims system is regulated under the “Mineral Tenure Act.” This act provides an electronic online registration system that allows the grant of mineral claims to “free miners.” The free miners can then acquire mineral claims by using the province’s “Mineral Titles Online Registry” to select cells on a map and pay a fee to obtain a claim.

Ever since the Yukon Court of Appeal’s 2013 decision in “Ross River Dena Council versus the government of Yukon, 2012 YKCA 14,” there has been debate about whether the B.C. mineral claims staking regime comported with the Crown’s duty to consult Indigenous groups.

That question has now been answered by Justice Ross of the B.C. Supreme Court, who concluded in “Gitxaala versus British Columbia (Chief Gold Commissioner), 2023 BCSC 1680,” that B.C.’s existing mineral staking regime was not consistent with the Crown’s duty to consult.

Justice Ross’ lengthy ruling can be summarized as follows:

> A duty to consult is triggered by B.C.’s mineral tenure staking system because it causes adverse impact on areas of significant cultural and spiritual importance to First Nations and the rights of First Nations to derive financial benefit from the minerals within their claimed territories.

> The Chief Gold Commissioner has the discretion to create a new structure for staking mineral claims that incorporates consultation with First Nations.

> The United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) and the subsequent Declaration on the Rights of Indigenous Peoples Act (DRIPA) do not have the effect of implementing UNDRIP as law, and DRIPA does not create an ability to take the government to court if any other laws are inconsistent with UNDRIP.

The province elected not to appeal the ruling.

Given the obvious consequences of the decision, the court suspended its declaration by 18 months to give B.C. government time to “allow the design and implementation of a program of consultation,” noting presciently, “I do not know what that program will look like, but it will not happen tomorrow.”

The court also appeared alive to the fact that any workable system will need to be developed in consultation with all interested parties – not in a backroom. Justice Ross concluded his judgment by noting the importance of negotiation and emphasizing that the province, First Nations, and the mineral exploration industry are all here to stay.

The purpose of this article is to assess the status of the gov-

ernment’s related engagements with affected parties, and to discuss some of the important issues that will have to be considered – many of which are not obvious from a reading of the Mineral Tenure Act or the Gitxaala decision. While important to any party planning mineral exploration in B.C., the decision also has the potential to affect the mineral tenure regimes in other provinces as well, if and as related litigation is brought forward.

Any discussion of how to reform the mineral staking system post Gitxaala must be understood in the context of discussions that had already started well before the decision was rendered. More specifically, the province has been examining some form of mineral tenure review for some time, though little information has been made publicly available.

Nothing of relevance can be readily found on the B.C. ministry of energy, mines, and low carbon innovation website; however, government officials have referred to such an exercise. For example, in a recent decision rejecting one of our clients’ exploration permit applications, the statutory decision-maker wrote:

“I also acknowledge that there is opposition by... First Nations with the mineral tenure regime in B.C. The decisions and engagement process for any future tenure applications fall outside the scope of this decision.”

In January 2022, the B.C. First Energy and Mining Council issued a report titled, “Indigenous sovereignty: Consent for mining on Indigenous lands.” It contained numerous recommendations to government regarding reform of the mineral tenure regime. These included the following:

> Indigenous Governing Bodies (IGBs) should exercise statutory powers under the Mineral Tenure Act;

> Crown free miner certificates should only be issued with IGBs consent;

> Registration of a mineral or placer claim should only grant the right to explore for minerals;

> IGBs could develop and administer their own claim staking processes; and

> IGBs should restrict the use of surface rights, regardless of who holds a mineral or placer claim.

The Association for Mineral Exploration (AME) has a webpage titled, “Mineral Tenure Act modernization: What you need to know.” It was posted before the Gitxaala decision –though it appears it has been updated since. It discusses various issues, but it provides no specific insight as to what, if any, consultations the government was undertaking with AME on this reform exercise.

In the Gitxaala decision, the court noted that B.C. had submitted certain evidence regarding its prior efforts toward modernizing the mineral tenure regime, and that consultations were undertaken between 2017 and 2019. None of the

evidence noted by the court appeared to go directly to the issue of consulting on the staking of claims, and the Court noted, “… the ministry decided to pause the process with the idea that the province would later incorporate the concepts into broader work being planned and undertaken pursuant to DRIPA.”

If it is difficult to find information about the Mineral Tenure Act modernization discussion that pre-dated Gitxaala, it is even harder to find any information about engagements being undertaken after the decision.

The sole statement found from the minister of energy, mines, and low-carbon innovation notes only that efforts related to reform of the Mineral Tenure Act are building on the collaboration with First Nations, industry, and communities. But the announcement gave no particulars about any consultations undertaken or planned. It also noted the process would be with an eye to reconciliation and “most importantly” aligning the act with UNDRIP. But the Court did not order the government to change the process to align with UNDRIP; in fact, the court expressly ruled the UNDRIP is not the law of B.C. What the Court did order is for B.C. to amend its staking process to better comport with the Crown’s duty to consult. Remarkably, there was no mention of that in the minister’s statement.

continued on page 14

While there can be no doubt that any reform of the mineral tenure regime will be complex, it is imperative that a fulsome and open dialogue takes place that involves all interested parties. Additionally, it is necessary to ensure that consideration is given to both legal and practical aspects of any changes to the claim staking system. Some of the key issues and questions that will need to be considered include the following (and there are surely many more than would come forward in a robust consultation):

1 Will large swaths of B.C. be closed to exploration entirely –either temporarily or permanently – based on planning level (i.e., not claim specific) consultations undertaken between Indigenous groups and government?

2 If a party seeks to register a claim and, during the Indigenous consultation process, another party seeks to do the same, will the first applicant receive priority even if its consultation process takes longer?

3 Will the Crown encourage companies to enter “staking agreements” with Indigenous groups, much like they presently encourage the use of exploration agreements? If so, will the absence of such an agreement have an adverse effect on the government’s willingness to conclude the duty to consult has been met in the absence of such an agreement?

4 If an Indigenous group is consulted in respect of a proposed claim staking, will it be told the name of the party seeking to stake the claim? And will it be required to keep the interest in those claims confidential from other parties?

5 Where a claim staking is proposed and is the subject of consultation, will other parties be able to file an application for a staking in the same area prior to the claim being registered? If so, will the consultation processes related to these staking applications be considered contemporaneously or consecutively? Will Indigenous groups be able to weigh one proposal against the other to determine which company is more prepared to accommodate their interests?

6 If a staking application is rejected on the basis that the Crown does not feel its duty to consult can be met in the circumstances, will the staking applicant have any opportunity to propose additional accommodation?

7 If a staking application is rejected on the basis that the Crown has determined it cannot register the claim consistent with its duty to consult (i.e., given the Supreme Court’s direction on “balancing of interests”), then will that area be foreclosed from staking by other parties? If so, for how long and under what circumstances might it again become available for potential staking?

8 Will future claims be registered “on conditions?” If so, what will the scope of those conditions be? Might they limit the type or extent of exploration and mining activity that could follow on those claims?

9 If the resulting reforms lead to certain designated areas

where claim staking will be permitted, and certain areas where it will be restricted or prohibited, will compensation be available to third parties that have already invested in the restricted or prohibited area?

10 If during consultation an Indigenous group expresses a preference to see staking only by one or more companies that it has a special relationship with, will government consider this as some form of “accommodation” that could potentially reduce the likelihood any other applicant company would be allowed to stake the claim?

11 Where claims are consulted upon and then registered, would a subsequent transfer of those claims to another party require another consultation process before the government registers the transfer? If so, would this same principle apply to transfers undertaken as a realization on security (i.e., claims pledged as security) or pursuant to various types of agreement commonly used in the exploration industry (such as earn-in agreements)?

12 If or to the extent Indigenous groups are given decision-making authority in respect of claim staking (i.e., not just being consulted), what safeguards will exist to ensure decision-making comports with relevant administrative law principles (e.g., independence, conflict of interest) as well as any applicable anti-corruption legislation?

13 Will any post-consultation decisions related to staking (approve or reject) be made publicly available? If so, will they contain information about the economic benefits the proponent has shared with the Indigenous group?

14 Will First Nations be able to seek damages from the government for past infringement of rights (prior to the Gitxaala decision, or during the 18-month interim period during which the court suspended its order)?

The answers to these questions have the potential to significantly impact the course of exploration activity in B.C. going forward. More specifically, they can affect the cost, timing, and certainty associated with mineral claim staking. They also have the potential for important secondary effects, such as impacting the use of claims to secure financial obligations (for example to lenders). All these matters will surely be considered by investors who have considerable ability to decide where and whether to deploy exploration capital.

Having said that, the purpose of raising these questions is not to suggest the issues cannot be tackled – it is more that they must be tackled through a fulsome, open, and inclusive engagement. Unfortunately, the relative silence following the Gitxaala decision is rather troubling. One can only hope the government will have more to say and that more robust engagement will commence soon – particularly since the 18-month window that the court provided in Gitxaala is moving rather fast. CMJ

Robin Junger is counsel, Indigenous law, environment; Sasa Jarvis is a partner, capital markets and securities; Cory Kent is a partner, capital markets and securities; and Joan Young is a partner, litigation and dispute resolution at McMillan LLP.

The Ontario mining industry stands at the forefront of a generational opportunity where the pursuit of valuable minerals intertwines with the high-tech and low-carbon demands of the 21st century. The global shift towards renewable energy and electric vehicles magnifies the significance of Ontario's mining potential, a geopolitically secure region with low-carbon energy supply and a long history of mining. The province’s abundance of critical minerals positions it as a key player in the clean technology supply chain, attracting investment interest across the entire supply chain spectrum – from players in the auto industry through to U.S. military. Through its critical minerals strategy released in 2022, Ontario has great ambition to be “the” global supplier of choice for a net-zero future.

Paramount to achieving this ambition is a skilled and diverse workforce. The lack of a robust pipeline of future works has been identified as a key challenge for the major producers in Ontario, who have given the Ontario Mining Association (OMA) a mandate to embark on a reputation-building campaign that dispels myths and misconceptions that are turning young people away from a career in mining.

The mining industry in Ontario faces a stark reality: one in four miners is set to retire and nearly 50% of skilled engineers are reaching retirement age in the next decade, just as the World Bank estimates a nearly 500% increase in supply of critical minerals – by 2050 – to specifically feed the clean energy transition. This juxtaposition has created a perfect storm.

In 2023, the OMA collaborated with the Ontario Labour Market Partnerships (OLMP) to better understand the situation through a “labour market assessment.” The study found that it is difficult to find candidates to fill critical skilled roles because of high retirement rates in senior positions and those with the most demanding requirements. This is further exacerbated by growth in the demand for certified occupations, but the supply of these certified workers has not kept up, and trade qualifications have been stable or declining. The availability and enrolment in mining-related courses at post-secondary institutions are also on the decline. Mining courses exist as a part of post-secondary education but are not available in all regions in the province, and enrollment has been declining, or the courses are no longer offered to the same degree as in the past. Post-secondary programs are also not seen to be catering to the industry’s evolving skill requirements driven by technological innovations, particu-

larly the increasing need for technical and automation skills.

The study also identified two challenges we are well-aware of in the industry. The geographic remoteness of mining operations complicates recruitment efforts, and outdated perceptions of mining are a significant impediment. To cultivate a next-generation skilled workforce, it reiterated the tremendous need to share information and have real conversations about modern mining and what it is like to live in the northern areas of our province.

At the OMA, we are active in our efforts to reshape perceptions of mining and help attract a diverse talent pool. Through collective action, public engagement, and a dynamic campaign, we hope to inspire the youth in Ontario today to consider an exciting career in mining. Our “This is Mine Life” campaign leverages our successful “This is Mining” brand, transitioning from a Millennial target audience to Gen Z – the next generation of the workforce. Recognizing that Gen Z is less trusting of traditional media and advertizing, the campaign aims to meet our audience where they live, study, and play. Our campaign has also shifted toward residents in central and northern Ontario, where polling data shows they are more likely to consider a career in mining.

To reach our audience where they live, study, and play inevitably means spending a great deal of time online. We are excited to be working with Edge Factor to produce and distribute “This

is Mine Life” content. Together, we have produced high-impact media that showcases the stories of people working in mining: their careers, the soft skills they need, and the technologies they use. Edge Factor uses the power of cinematic storytelling to take students and job seekers on a journey from “I have no idea what I want to do with my life” to discovering industries, careers, technical education, specialist high skills major and postsecondary programs, soft skills, STEAM (science, technology, engineering, art, and math) , and local opportunities. In collaboration with Mining Matters and Impala Canada, the Edge Factor film crew went behind the scenes at the LDI Mine in northwestern Ontario to film an Industry Tour, and episodes for their various streaming series: Launch Point, Career Profile videos, Skilled Responders, and Geek Out on Tools & Equipment.

President and founder, Jeremy Bout, expresses his enthusiasm about the collaboration, stating, “The team at Edge Factor is excited to partner with the mining industry in Ontario to connect in a new and exciting way that inspires the next generation of mining professionals to find passion in what they do.”

Young people, their families, and their educators are sharing this programming in classrooms, homes, and at events. Students and learners can create an account and complete the online

experiences to learn valuable skills that will move them forward in their career journey. We encourage you to check out the “This is Mine Life” section of the Edge Factor platform:

The first place students find jobs and connect with employers in Canada We are also excited to be partnering with Talent Egg to build the online “hub” of our “This is Mine Life campaign.” TalentEgg. ca is Canada’s most popular job site and online career resource for students and recent graduates. Since 2008, Talent Egg has helped millions of students and recent grads hatch their careers, and worked with hundreds of Canadian employers to successfully attract top talent to join their organizations. The “This Is Mine Life” website on Talent Egg provides users with a range of different resources to support their career journey. It educates users about the purpose of mining, tells real stories about mine life, links users to career opportunities from across OMA members, provides details on scholarships, and more! Please check out our hub on Talent Egg and we welcome all job postings to link up with us on this site.

A first trip underground!

One of the key goals of the “This is Mine Life” campaign is to address negative or false perceptions of mining in Ontario in the minds of the future potential workforce across the province. We know the biggest influencers in their lives are their parents and teachers. With this in mind, we launched the

fourth season of our award winning “This is Mining: The Podcast,” with a renewed focus on mine life.

“This is Mining: The Podcast” explores stories of human transformation connected to Ontario’s mining industry and how mining is tackling the most pressing challenges facing our generation. The podcast takes a deep dive into what mine life means: a life boldly driving our modern world forward, by delivering the metals and minerals that make everything possible. In partnership with Amber Mac, an entrepreneur, bestselling author, blogger, keynote speaker, and podcast/TV/radio host, the podcast offers a fresh perspective on the role of mining in our lives and in our province.

Throughout season four, we focus on the most important resource on Earth: people. In episode one, the modern economist, Todd Hirsh, helps us understand the current labour shortage in Canada and how we can talk to young people about their futures. And Veronica Knott, a young mining engineer, reflects on how she found her passion and home in Canada’s mining industry.

The second episode dives into how the perceptions and misperceptions of mining today reflect the realities on the ground (and underground). Amber Mac chats with Ryan Montpellier, the executive director of the Mining Industry Human Resources Council, and Cara Rockwood, an environmental scientist who is pursuing a career in mining and chal-

lenging her peers (and even professors!) to think of mining as an environmental field.

The third episode addresses the existing stigma around the skilled trades. Monte McNaughton, the former Minister of Labour, Immigration, Training, and Skills Development in Ontario, discusses how it is important for young people across Ontario to know that careers in the skilled trades are meaningful, well-paying, and in-demand. Kendra Liinamaa, a young millwright working at a nickel mine in Sudbury, reflects on how she personally overcame her own stigma to pursue her own career.

During episode four, Dawn Madahbee Leach, the chair of the National Indigenous Economic Development Board, talks about the power of resource development partnerships and careers as a route to prosperity and reconciliation for Indigenous Peoples. Clyde Moonias, a member of the Neskantaga First Nation, talks about how he is embarking on his career “close to home” as the health, safety and environment coordinator at Wyloo’s Esker site in northern Ontario.

Our final episode of the season sees Amber Mac take her first ever trip underground at a mine in Sudbury. Along this exciting visit underground, Amber connects with Shawn Sauve, a mobile equipment specialist; Alex Mulloy, a carbon specialist; and Christiane Gasteiger, an integrated remote operating centre superintendent – all at Vale Base Metals. NORCAT’s very own tech entrepreneur and mining futurist Don Duval makes a cameo in this episode too!

Last February, the OMA commissioned Ipsos to conduct an online omnibus poll which revealed that 37% of Ontario youth would consider a career in mining. When segmenting the data, there was increased interest in northern Ontario (46%); southwest Ontario (45%), and in central Ontario (38%). And almost two-thirds of youth polled agreed that the government of Ontario should do more to promote the role of mining in the province and the job opportunities that exist in the sector.

We are collaborating with the government and working hard to make sure those 1.1 million youth across our province are aware of the wide variety of occupations available in our sector –occupations that align with young people’s values, given that they are essential to produce low-carbon energy solutions. We are demonstrating how mining in Ontario meets and exceeds the highest environmental standards, how the industry is technologically advanced, and building a legacy a positive net benefit to host communities. An industry where representation matters, and where every voice is heard and respected.

Through the collaborative efforts of industry stakeholders, government support, and the enthusiasm of the next generation, Ontario’s mining sector will overcome the workforce challenges and emerge as a global leader in responsible, innovative, and modern practices. This is not just a campaign; it is a vision for a thriving and dynamic future for mining in Ontario. CMJ Chris Hodgson is president of the Ontario Mining Association (www.oma.on.ca).

The global demand for lithium is projected to reach 1.5 million tonnes of lithium carbonate equivalent (LCE) by 2025 and over three million tonnes by 2030. As the world moves away from fossil fuels, the world needs a stable supply of quality lithium to achieve a low-carbon future, and Canada needs lithium (among other critical minerals) to achieve its netzero target.

In 2022, the government of Ontario announced its first critical minerals strategy, aiming to secure the province’s position as a global leader of responsibly sourced critical minerals, including lithium. The provincial government plan is to work alongside all stakeholders including the federal government, the mining sector, manufacturing Indigenous Peoples, and local communities.

The strategy involves six pillars, or areas of government action, including the following:

i enhancing geoscience information and supporting critical minerals exploration;

ii growing domestic processing and creating resilient supply chains;

iii improving Ontario’s regulatory framework;

iv investing in innovation, research, and development;

v building economic development opportunities with Indigenous partners; and

vi growing labour supply and developing a skilled labour force.

The northern Ontario mining industry is destined to play an important role in the province’s critical minerals strategy as a

supplier of nickel, cobalt, and lithium to southern Ontario’s auto industry.

Several lithium junior miners operate in a different space than precious and base metal exploration companies, and their work led to the emerging premium lithium mineral district located in Ontario being dubbed the “Electric Avenue.” The area contains some of North America’s highest-grade lithium-bearing rocks.

Pegmatites form thick seams called dikes that intrude into other rocks and can measure anywhere from a few centimeters to hundreds of meters. Within Pegmatites is a lithium-bearing mineral known as Spodumene.

The two common methods for mining lithium are brine extraction (predominantly in South America, and it is water-intensive) and hard rock mining of spodumene, with subsequent lithium chemical conversion. Spodumene is a mineral that contains lithium. It is a proven source material for lithium chemicals and subsequent battery production. Hard rock/spodumene is usually extracted via conventional mining techniques. Blocks of mineralized pegmatite are then crushed, and sent to dense media separation and flotation tanks, where ore minerals are separated. Water and gravity are the primary means to separate the spodumene to form a “spodumene concentrate,” which is sent to chemical plants (lithium conversion plants) for conversion to lithium chemicals.

So far, northern Ontario has not seen any mining of lithium, but deposits of lithium bearing pegmatites in the northwest are now being targeted by several exploration companies. As a result, northwestern Ontario is now a rapidly emerging lithium exploration powerhouse, with an ongoing land acquisition fever by several junior mining companies. Ontario could soon emerge as a big player in lithium production, which could help reduce the global lithium market’s volatility, caused by the dependence on current leading suppliers, such as the “lithium triangle” stretching across Bolivia, Argentina, and Chile (recently, Indigenous communities in northern Chile agreed to lift roadblocks that have restricted access to the country’s giant lithium operations), and Australia, China, and Nevada in the U.S.

Sadly, none of the properties in Ontario is currently in the production stage or even close. Table 1 shows two properties (PAK and Georgia Lake) in feasibility and prefeasibility stages, respectively, 10 properties in advanced exploration, nine in exploration, five in preliminary economic assessment (PEA) or scoping, and finally, four prospects: Plaid and Whiteloon Lake, Wintering Lake, Borland, and Forester, with the last two 100owned by Patriot Lithium.

The properties are mostly owned by Canadian companies: 11 out of 17 companies have headquarters in Canada, as shown in Table 2. These Canadian companies own 24 properties in total, with Battery Mineral Resources owning or co-owning eight properties, all of them in advanced exploration. Australiabased miners also have sound presence on the list in Table 2, with three companies: Green Technology Metals, Critical Resources, and Patriot Lithium. The Aussies combined own nine properties at 100%, including only one property in advanced exploration (Wisa Lake, owned by Green Technology Metals). Finally, there are two companies from Belgium and one from South Africa.

Frontier Lithium is an exploration and development mining

Company

Headquarters country

Frontier Lithium Canada

Rock Tech Lithium Canada

Avalon Advanced Materials Canada

Green Technology Metals Australia

Power Metals Canada

Critical Resources Australia

Battery Mineral Resources Canada

Grid Metals Canada

Patriot Lithium Australia

Recharge Resources Canada

International Lithium Canada

Gossan Resources Canada

SCR-Sibelco Belgium

Sibanye-Stillwater South Africa

Sibelco Belgium

Spearmint Resources Canada

Strategic Minerals Europe Canada

> Ontario’s rise as a lithium powerhouse could stabilize current market volatility.

> The province’s push to develop “Electric Avenue” aligns with the global market’s increasing demand for battery metals, essential for electric vehicles (EVs) and renewable energy storage.

company with headquarters and assets in northern Ontario, a tier-one mining jurisdiction. The company’s PAK project represents the largest proven land position in the new, premium lithium mineral district, with a high-grade, large tonnage, and pure lithium resource. Strategically located near the United States border, Frontier is developing the first fully integrated lithium mining-and-processing operation in Ontario with an aim to become a significant supplier of spodumene concentrates and battery-grade lithium hydroxide to the growing electric vehicle and energy storage markets across North America.

Recently, Frontier has commenced a preliminary economic assessment study targeting the manufacturing of battery quality lithium hydroxide in the Great Lakes region to support electric vehicle and battery supply chains in North America. Frontier maintains a tight share structure with management ownership approximately 30% of the company.

Rock Tech is another Canadian cleantech company with a mission to produce lithium chemicals for EV batteries. The company aims to serve automotive customers with high-quality lithium hydroxide made in Germany.

Recently, Rock Tech Lithium announced that it is undertaking a non-brokered offering of approximately 7.7 million units of the company at C$1.30 per unit to raise aggregate gross proceeds of C$10 million ($7.3m). Half of the gross proceeds (C$5 million) are intended to finance the continued exploration and development of Rock Tech’s Georgia Lake lithium project in Ontario, including exploration drilling programs and planned

consolidation of adjacent properties.

Georgia Lake is a key part of Rock Tech’s integrated strategy. The project contains over 40% of the published Mineral Resources in the Thunder Bay District and the newly added Boston Lake mining claims offer another opportunity to further expand. In the last few months, the Georgia Lake project has advanced significantly.

So far, no lithium refineries exist in Canada to convert lithium oxide into an upgraded battery-grade material called lithium hydroxide, companies like Avalon Advanced Materials are working to bridge that gap and become mid-stream processors. The company’s 100%-owned Separation Rapids property is approximately 70 km by road north of Kenora, Ont. The property consists of 19 mineral claims and one mining lease covering a combined area of approximately 4,414 hectares in the Paterson Lake area, Kenora Mining Division, all of which are 100%-owned by Avalon. It is worth noting that Separation Rapids lithium project has the potential to produce high purity lithium compounds for two distinct markets: a specialty mineral product for high strength glass-ceramics and lithium battery materials, notably lithium hydroxide.

The Separation Rapids’ Big Whopper pegmatite deposit is one of the largest “complex-type” lithium-cesium-tantalum (LCT) pegmatite deposits in the world, unusual in its enrichment in the rare, high purity lithium alumino-silicate mineral petalite. Petalite is the preferred lithium mineral feedstock for several high strength glass-ceramic products for technical reasons, including its low level of impurities.

Last June, another junior player, Maverick Capital, announced that it has entered into a definitive mineral property acquisition agreement, pursuant to which it proposes to acquire the Northwind Lake property, a lithium pegmatite explo-

ration project located in the Electric Avenue lithium district, located approximately 10 km north-northwest of the Frontier Lithium PAK lithium deposit in the Red Lake mining division in Ontario.

The Aussies are here!

The recent expansion of Patriot Lithium’s footprint (Patriot Lithium fully owns Gorman and recently added two other prospects: Borland and Forester) and the ongoing development of Frontier Lithium’s PAK project are expected to inspire further investments and exploration within the corridor.

Earlier in Jan. 2024, Patriot Lithium secured rights over an additional 536 km2 in one of the largest and highest-grade lithium deposits in North America: the Electric Avenue. Patriot Lithium’s portfolio in Ontario comprises multiple highly prospective hard rock lithium projects.

Including Patriot’s Gorman project, the Aussie miner will own the largest claim in the “Electric Avenue,” with a regional claim package exceeding 890 km2.

Managing director, Nicholas Vickery, said that adding the Berens and Borland areas positioned Patriot as a major player in “one of the most exciting lithium regions in the world.”

In 2022, Australian Critical Resources secured 1,200 more hectares in Ontario’s “Electric Avenue” to expand its Plaid lithium project.

An aggressive works program is already well underway to identify drilling targets in the region, with pegmatite mineralisation observed across Plaid and Whiteloon Lake projects. The mapped pegmatites follow the same northwest/southeast trend of Frontier Lithium’s PAK, Spark, and Bolt battery mineral deposits.

Finally, another Australia-based junior miner, Green Technology Metals, hopes to begin producing lithium from its 100%-owned Seymour project near Armstrong, 250-km northeast of Thunder Bay, by the first quarter of 2024. The property has an estimated resource of 9.9 million tonnes of lithium oxide grading 1.04%. Other lithium properties in its portfolio include Root, 300-km northwest of Thunder Bay, and Wisa, 100-km east of Fort Frances.

The PAK lithium deposit contains some of North America’s largest and highest-grade lithium-bearing pegmatites in the form of

a rare low-iron spodumene and is the largest in Ontario by size. The deposit is located 175 km north of Red Lake, Ont. The deposit has a strike length of 500 metres and a depth of 300 metres with a true width varying between 10 metres and 125 metres.

The project is 100%-owned by Frontier Lithium, a Sudbury based, publicly listed, junior mining company with the largest land position in the Great Lakes region of northern Ontario known as the Electric Avenue. The Project has significant upside exploration potential.

The project encompasses close to 27,000 hectares and covers 65 km of the avenue’s length and remains largely unexplored. Since 2013, Frontier has delineated two premium spodumene-bearing lithium deposits (PAK and Spark), located 2.3 km apart. The project exploration continues through two other spodumene-bearing discoveries: the Bolt pegmatite (located between the PAK and Spark deposits), as well as the Pennock pegmatite (a further 30 km northwest of PAK deposit within the project claims just east of the Manitoba border). A 2023 pre-feasibility study: “National Instrument 43-101 (NI 43-101) Technical Report PFS PAK Lithium Project,” authored by BBA E&C Inc., delivered a 24-year project life, at a post-tax NPV (8%) of US$1.74 billion and internal rate of return of 24.1% as per the press release disseminated on May 31, 2023.

Several operators worked on different targets in the 1950s to discover strategic metals. A comprehensive drilling program was carried out in 1955 and 1956, investigating the spodumene pegmatites after these had been discovered during prospecting work, seeking a potential source of the lithium mineral.

nal return rate of 47.8% and a pre-tax net present value of US$ 223 million for the Georgia Lake project.

According to prefeasibility study, the project has an after-tax net present value of $146 million (at a discount rate of 8%) and an internal rate of return of 36%. The mine would cost $192.2 million to build, with sustaining capital costs of $98.5 million including closure after a nine-year mine life.

In May 2023, Rock Tech announced the expansion of its exploration potential in the Thunder Bay by entering into an option agreement to acquire a 100% undivided interest in the Boston Lake claims. Adding to the company’s Georgia Lake project, these claims will expand Rock Tech’s footprint in a region that is already well-known to the company.

“The Georgia Lake project contains over 50% of the published mineral resources in the Thunder Bay district and the Boston Lake mining claims offer an exciting opportunity to expand our exploration footprint,” said Robert Macdonald, general manager at Rock Tech’s mining entity.

The company asserted that the agreement and the Georgia Lake project demonstrate Rock Tech’s continued growth in the market. To further support this development, CIBC, a longstanding participant in the mining industry, is serving as Rock Tech’s strategic advisor that will help selecting a strategic partner to jointly advance Georgia Lake project by managing the process intended to identify partners for the development and further exploration of the mine project.

> The total resource (measured, indicated, and inferred) of the PAK deposit is 9.3 million tonnes grading 2.06% lithium oxide (Li2O). The deposit remains open at depth and along strike. The inferred resource is 2.8 million tonnes at 2.22% Li2O.

> Spark deposit is estimated to contain 14.4 million indicated tonnes at 1.40% Li2O and 18.1 million inferred tonnes at 1.37% Li2O.

> The Channel sampling in the two other pegmatite occurrences in the area (Bold and Pennock) returned grades of 1.51% and 1.96% Li2O, respectively.

The mine site is Located 160 km northeast of Thunder Bay. Georgia Lake is planned as an open-pit and underground mining project, anchored by indicated mineral resources of 10.6 million tonnes grading 0.88% Li2O and inferred resources of 4.2 million tonnes grading at 1% Li2O.

In November 2022, Rock Tech announced the results of a pre-feasibility study (PFS) completed for its 100% owned Georgia Lake spodumene project located in the Thunder Bay mining district of Ontario. The PFS strengthens previous engineering studies and supports an open pit and underground mine operation and the construction of a 1,000,000 t/y spodumene concentrator. The positive results indicate a pre-tax inter-

Moreover, after reaching a high level of engineering maturity for its Guben Converter in Germany, Rock Tech is now implementing its strategic vision to build several lithium converters in Canada. The company has decided to accelerate the planning for its Canadian converter, aiming for a start of production in 2027. Rock Tech has also relocated its Canadian headquarters to Toronto.

Australian miner, Critical Resources is developing critical metals projects in Canada. The company holds a suite of lithium prospects across Ontario, including Mavis Lake, Graphic Lake, Plaid, and Whiteloon Lake.

The company’s primary objective is the rapid development of its flagship Mavis Lake lithium project. The Mavis Lake Project area includes the primary claims area that was acquired by Critical Resources in January 2023 and new claims that were acquired in late 2023.

This major lithium project is located approximately 19 km east-northeast of Dryden in northwestern Ont., providing a logistics and support base for a low-cost operation during the exploration and development efforts, supported by local resources such as hospitals, airport, and a high quality, clean hydropower produced by Ontario Power Generation and deliv-

ered to the community through a robust distribution network managed by Hydro One Networks.

Critical Resources holds 1,097 individual claims that form a single, contiguous block covering approximately 22,984 hectares of land, with a geological setting, highly prospective for lithium. The First Nations in the area are Wabigoon Lake Ojibway Nation, Eagle Lake First Nation, Naotkamegwanning (Whitefish) Nation, Lac Seul First Nation, and Metis Nation of Ontario.

Critical Resources completed over 19,500 meters of drilling in 2022 that delivered some of the highest lithium assay results reported by any Australian hard-rock lithium company.

Mavis Lake has a mineral resource estimate of 8 million tonnes at 1.07% Li2O and has near-term development potential. Critical Resources has completed over 30,000 metres of drilling at Mavis Lake and continues exploration and drilling to increase the resource base. The company has also commenced technical studies and environmental monitoring programs that will lead to the transition from exploration to development.

make it a part of a supply chain that supports the North American and European Electric Vehicle industry.

Graphic Lake

Finally, the project has immediate road accessibility to TransCanada Highway 17 and the rail network that stretches across Canada and has links to the northern U.S., providing inbound and outbound logistics routes for major equipment, mining fleet, and other product logistics. Utilizing the deep-water port and shipping lanes from the nearby port of Thunder Bay will help to reach any number of downstream customers and will

Another project that is 100%-owned by Critical Resources. Located 55 km south-east of Kenora, Ont., Graphic Lake is situated in the Sioux Lookout Domain of the Wabigoon Terrane in north-west Ontario. The property hosts a pegmatite swarm trending NE/SW, over an estimated strike of 5.5 km controlled by the foliation of the metasedimentary host rock. These pegmatites exhibit elevated levels of Rare-Earth-Elements (REE) consistent with LCT pegmatites. LCT pegmatites account for roughly one quarter of all lithium production, most of the tantalum production and all caesium production globally.

Access to the property is favourable along gravel/dirt roads trending east/west from Highway 71. Further infrastructure to site such as electricity is also favourable with powerlines present across the property.

Seymour Lake, Root, and Wisa Lake

Australia-based company Green Technology Metals’ flagship Seymour project is located near the township of Armstrong and approximately 230 km north of the city and port of Thunder Bay. Seymour is rapidly moving from exploration to development to be construction ready by 2024. The project covers the Archean Green Stone belt, highly prospective for LCT pegmatites and hosts a mineral resource of 9.9 Mt at 1.04% Li20.

The project remains largely underexplored with focus on accelerated drilling and development activities on the Aubry deposits in the Southern Seymour tenement area to fast-track the project into production.

In addition to their lithium properties in Quebec, Patriot Lithium’s Gorman project (506 km2) covers 72 multi-cell mining claims for a total area of approximately 320 km2. The Electric Avenue lithium district contains several LCT pegmatites over a total strike length of at least 60 km with potential for additional discoveries along strike to the NW and SE. Patriot’s Gorman project is located approximately 60 to 65 km to the NW of Frontier Lithium’s PAK, Spark, and Bolt LCT pegmatites and about 39 km from Frontier Lithium’s Pennock Lake LCT pegmatite. Additional LCT and rare metals pegmatites, recently identified by Midex Resources occur within 2.5 to 23 km of PAT’s Gorman project. CMJ

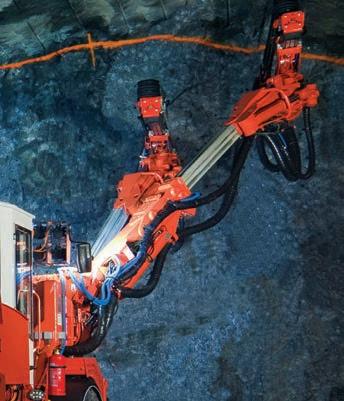

The Centre for Smart Mining (CSM) was established in 2019 as a federally funded research hub focused on helping to solve technology adoption challenges for the mining sector. I have had the pleasure of serving as the centre’s inaugural manager, and since taking the helm, I have had the opportunity to see some incredible things happening in the Canadian mining industry. Since the Canadian Mining Journal is focusing on mining in Ontario for this issue, I thought it would be interesting to look at some of the highlights of technological advancements the CSM has assisted with in mining technology in the province since 2019. Some of the technical themes the CSM noticed were automation and robotics technologies, advanced mobility solutions, and industrial software.

One of the areas that has been growing quickly in Ontario mining is the development and adoption of automated and autonomous systems. Unsurprisingly, some of the interesting projects the CSM has worked on focused on commercializing novel applications of automation technology. One solution the CSM’s mechatronics team worked on involved handling and manipulating drill rods using a robotics platform. Handling exploration drill rods can be laborious and potentially dangerous to workers. CSM student researchers conceived a system using a series of indexing controllers and encoders to locate and grip drill rods and manipulate them into place on the drill rig. The solution saves time and prevents injuries and is now being deployed at some Ontario-based exploration sites to gather feedback data. Open-source tools like Robot Operating

System (ROS) and platforms like Universal Robotics are making projects like this much more possible. In that way, it is very likely that robotic solutions to traditionally manual workflows will become more prevalent in Ontario mining.

The mining sector is one of the most promising industries for implementing advanced mobile equipment solutions. Technologies that contribute to simultaneous localization and mapping (SLAM) are starting to have a big impact on how mobile equipment interacts with the underground environment. Some of the critical technologies that make up systems like this include Lidar to scan the environment, high-powered image processing computers to digest the 3D point clouds and, in advanced systems, machine learning applications for navigation. The CSM has taken on some important projects in this space recently. For example, the CSM is currently engaged in a project that involves developing and testing a driver-assist solution for scoop trams. Much like the above ground solutions, such as lane assist or automated parallel parking car owners have enjoyed for years, this solution provides scoop operators with collision detection, auto-braking, and wayfinding support to help make operating the equipment safer and more productive. These systems should start to roll out in pilot studies in the latter part of 2024.

Software solutions in mining as a category is very broad. It can refer to scheduling, fleet management, asset health management, geological modelling, mine planning, and many other solutions. What is clear, however, is that software solutions that help mining companies organize, plan, and execute more effi-

ciently are becoming more and more numerous. As a corollary, according to recent forecasts, the mining-focused software market is expected to grow from $10 billion in 2023 to nearly $15 billion by 2028. Here at the CSM, we have also seen an increase in the demand for novel software solution development. So much so that in 2022, the centre hired a lead software researcher to manage that segment of our portfolio. Some of the projects this new team have worked on to date focused on software applications that managed and tracked mine material inventory, monitored occupancy and ventilation requirements, analyzed and predicted machine maintenance schedules, and even provided a solution for managing equipment-specific training records. The fact that this team is getting busier each month is evidence that software in mining is continuing to grow as the value of these platforms is proving out in the field.

While the mining industry has long been seen as a late adopter of new technologies, the innovative solutions the CSM has encountered over the last five years is showing that this tendency is starting to fade. Topics like AI (artificial intelligence), robotics, additive manufacturing, and many others are becoming increasingly commonplace in mining and not just in a tokenistic way at conferences but as part of operational decision making. This is further evidenced by the keen interest the tech industry has started to show in mining. Mining is no longer seen as a dead-end for high-tech solutions, but increasingly as a growth sector willing to partner on pilots and demos. For example, if you